Being

VOL. 36 • NO. 5 • MAY 2023 THE AUTHORITY FOR THE DATA-DRIVEN BUSINESS PM40050803 ❱ 8 Data Clean RoomsPrivacy and Personalization ❱ 18 AI and Its Impact on Customer Service An Interview with Greg

North American Digital Product

Financial

Digital Banking:

data-driven is complicated. We can help.

Brown, VP

Management, BMO

Group

We’ll Help You Keep It Clean

Dealing with bad data is a task no marketer needs on their checklist. Inaccurate, outdated, and duplicate records can build up in your database, affecting business decisions, the customer experience, and your bottom line. As the Address Experts, Melissa helps our customers improve their direct marketing efforts with the best Address Veri cation, Identity Veri cation and Data Enrichment solutions available. We validated 30 billion records last year alone, which is why thousands of businesses worldwide have trusted us with their data quality needs for 37+ years.

BAD DATA BUILDUP

Returned Mail & Packages

Missed Opportunities

Decreased Customer Insight

DATA CLEANLINESS

Real-time Address Veri cation

Change of Address/NCOA Processing

Geographic & Demographic Data Appends

Contact us for a Free Proof of Concept and ask about our 120-day ROI Guarantee.

Trust the Address Experts to deliver high-quality address veri cation, identity resolution, and data hygiene solutions.

Melissa.com 800.MELISSA (635-4772)

Vol. 36 | No. 5 | May 2023

PRESIDENT Publisher & Editor-in-Chief

Steve Lloyd - steve@dmn.ca

ASSOCIATE EDITOR

Michael Brooke - michael@lloydmedia.ca

DESIGN / PRODUCTION

Jennifer O’Neill - jennifer@dmn.ca

ADVERTISING SALES

Steve Lloyd - steve@dmn.ca

CONTRIBUTING WRITERS

Arnie Guha

Tom Kaneshige

Scott Mitchell

William Skelly

Wesley Sparling

LLOYDMEDIA INC.

HEAD OFFICE / SUBSCRIPTIONS / PRODUCTION:

302-137 Main Street North Markham ON L3P 1Y2

Phone: 905.201.6600

Fax: 905.201.6601 • Toll-free: 800.668.1838 home@dmn.ca • www.dmn.ca

EDITORIAL CONTACT:

DM Magazine is published monthly by Lloydmedia Inc. DM Magazine may be obtained through paid subscription. Rates:

Canada 1 year (12 issues $48)

2 years (24 issues $70)

U.S. 1 year (12 issues $60)

2 years (24 issues $100)

DM Magazine is an independently-produced publication not affiliated in any way with any association or organized group nor with any publication produced either in Canada or the United States. Unsolicited manuscripts are welcome. However unused manuscripts will not be returned unless accompanied by sufficient postage. Occasionally DM Magazine provides its subscriber mailing list to other companies whose product or service may be of value to readers. If you do not want to receive information this way simply send your subscriber mailing label with this notice to: Lloydmedia Inc. 302-137 Main Street North Markham ON L3P 1Y2 Canada.

POSTMASTER:

// 3 MAY 2023 DMN.CA ❰

Please

undeliverable

to: Lloydmedia Inc. 302-137 Main Street North Markham ON L3P 1Y2 Canada Canada Post Canadian Publications Mail Sales Product Agreement No. 40050803 Twitter: @DMNewsCanada NEXT ISSUE: Staffing, Work and Workplace TECHNOLOGY ❯ 4 Talking Points

8 Data Clean Rooms - Privacy and Personalization

18 The Impact of AI on Customer Experience In Financial Institutions in North America ❯ 6 Collaboration Key to Customer Service talkingpoints INSIGHT STRATEGY

17 The Millennial Comeback -Effective Marketing Strategies For Stronger Reach and ROI

10 Personalization Pulse CheckHighlights from MoEngage 2023 Report

12 Digital Banking: An Interview with Greg Brown of BMO Financial Group ❯ 22 Using Data Models To Create Marketing Campaigns That Engage Every Age ISTOCK/ ANTON VIERIETIN ISTOCK/ TERO VESALAINEN ISTOCK/ GIUSEPPE LOMBARDO ISTOCK/ KAR-TR ISTOCK/ANDREYPOPOV

send all address changes and return all

copies

❯

❯

❯

❯

❯

talkingpoints

Google Cloud

Google Cloud announced a new global research that found that manufacturers who provide immersive and personalized customer experiences (CX) are outperforming their peers in terms of revenue, profits, and eCommerce sales. However, many manufacturers face challenges with data silos that stand in the way of creating the digital CX buyers are looking for today.

The research, titled Digital Customer Journey for Manufacturers, was sponsored by Google Cloud and conducted by the global analyst firm IDC. It was based on a worldwide survey of over 1,500 manufacturing leaders across nine countries and seven industries, including industrial machinery, automotive, electronics, consumer packaged goods, and more. The study examined the growing importance of CX in manufacturing for B2B and B2C buyers and the connection between the maturity level of manufacturers’ digital customer journeys and their growth, investment in and deployment of technology, and challenges they face in digitally transforming CX.

Robust customer journey boosts sales

According to the survey, manufacturers with the most mature digital customer journeys saw a 13.5 percent increase in revenue and a 14 percent increase in profit in the past 12 months. These manufacturers created personalized customer experiences incorporating the latest cloud technologies, such as artificial intelligence (AI), augmented reality (AR), and integration with consumer applications like smart home devices.

On the other hand, manufacturers identified the following challenges in transforming and improving the customer experience, such as:

❯ Different team priorities (31.1 percent)

❯ Lacking the talent needed (29.5 percent)

❯ Lacking the required infrastructure (27 percent)

❯ Customer data is siloed and difficult to access (22.4 percent)

“Manufacturers are realizing that their

current operating models need to evolve, and with growing competition and the commoditization of products, having a differentiated digital customer experience is a key component to staying competitive and driving revenue,” said Simon Floyd, Director of Manufacturing and Transportation Industries at Google Cloud. “Successful manufacturers are breaking down the silos within their workforces and data systems to unlock new ways to attract, engage, and satisfy today’s buyers who want smart recommendations and solutions so they can reduce the time spent researching, selecting, and ordering.”

Investment in predictive analytics, intelligent products, and AR will increase The research also found that manufacturers’ spending is expected to increase over the next 12 months on customer engagement applications in the following areas:

❯ 54.8 percent plan to invest in creating customer portals that include IoT sensors and predictive analytics.

❯ 43.3 percent plan to invest in developing integrated services that add value and open new revenue streams.

❯ 25.3 percent plan to invest in improving the omnichannel brand experience and providing personalized product configuration.

When it comes to creating personalized experiences, two-thirds of the most mature manufacturers are utilizing a real-time inventory ledger that provides a holistic view of inventory across the network using pre-built, AI and machine learning (ML)-based demand planning technology — a capability that has only become more important as disruption has become a constant across the industry. Manufacturers also plan to invest in AR and virtual reality (VR) to stay connected in real-time with customers. 41.8 percent stated they have already implemented AR/ VR, while another quarter (25.1 percent) plan to implement it within the next 12 months. Embedding rich 3D and AR directly into their search bars, websites, or mobile apps can help manufacturers improve search functionality by allowing search on the go using connected IoT devices — and incorporating inventory information with online searches.

CX and cloud maturity are strongly correlated

The use of data, digital platforms, and technology is a hallmark of a manufacturer’s customer experience. Increasingly, the amount of data that can be analyzed in the cloud is where value is generated, as manufacturers can now analyze large data sets and drive improvements across the enterprise. According to the research, more than 50 percent of the most mature cloud users stated they are highly effective at applying predictive

analytics and data-driven insights to inform experiences and operations vs. only 11 percent of the least mature cloud users.

“The whitepaper reinforces what we’ve seen for the past three years, which is that customer experience and cloud maturity are strongly correlated,” Floyd added. “As manufacturers become more market-driven and better prepared to pivot, a connected data cloud platform that unlocks real-time intelligence enables workplace collaboration, and creates an immersive, AI-driven personalized customer experience will become essential to long-term success.”

After record-breaking growth in 2021, internet advertising revenue has slowed but still delivered double-digit growth in 2022. That’s according to the newly released IAB Internet Advertising Revenue Report: Full Year 2022, conducted by PwC.

Between 2021 and 2022, internet advertising revenues grew 10.8 percent year-over-year (YoY) totalling $209.7 billion, and overall revenues increased by $20.4 billion YoY. Q1 saw the highest growth of 21.1 percent, followed by Q2 at 11.8 percent, resulting in ad revenues for the first half of the year surpassing $100 billion for the first time. Revenues slowed in Q3 (8.4 percent) and Q4 (4.4 percent).

Canada Data Center Market - Investment Analysis & Growth Opportunities 2023-2028

The Canada data center market size will reach $5.48 billion by 2028 from $3.32 billion in 2022, growing at a CAGR of 8.71 percent.

This report analyses the Canadian data center market share. It elaborately analyses the existing and upcoming facilities and investments in IT, electrical, mechanical infrastructure, general construction, and tier standards. It discusses market sizing and investment estimation for different segments.

The market is characterized by the presence of international and local players offering various services such as colocation, managedto-host and cloud services.

The industry is also supported by a favourable regulatory environment, stable political climate, reliable power grid, and cool climate, which are ideal conditions for data center operations. In terms of growth, the Internet of Things (IoT), cloud computing, and big data are driving demand for data storage and processing capabilities in Canada, leading to the construction of new facilities and the expansion of existing ones.

Major tech companies such as Amazon, Google, and Microsoft have established facilities in Canada, while local players are expanding their offerings. In Canada, several companies offer modular data center solutions, including global players like Schneider Electric.

// 4 ❱ DMN.CA MAY 2023

■ ■ ■ ■ ■ ■ ■ ■ ■ ■ ■ ■ ■ ■ ■ ■ ■ ■

The Canadian government has also supported the adoption of modular facilities, offering incentives for investment and development. The market will likely grow as demand for data storage and processing capabilities remain strong in the coming years. The industry is expected to attract increased investment, leading to the development of new facilities and the expansion of existing ones. Further, Toronto and Montreal are Canada’s primary locations for data center investment. The construction of Special Economic Zones (SEZs) & Free Trade Zones (FTZs) and the availability of infrastructure will attract investors to develop data center facilities in the coming years.

KEY HIGHLIGHTS

❯ Canada has around 115 operational colocation data centers. Most colocation facilities are being developed according to Tier III standards. The country also has the presence of global operators like Equinix, Digital Realty, and others.

❯ The Canadian data center market has witnessed significant growth in recent years due to rising demand for cloud computing, big data analytics, and IoT.

❯ The industry has seen new announcements from hyperscale operators, such as Microsoft Azure and Google Cloud, and colocation operators, like Urbacon Data Centre Solutions.

❯ Increasing priority on energy-efficient and sustainable facilities, driven by concerns about the carbon footprint of the data center industry.

❯ Many organizations opt for hybrid solutions combining on-premises data centers with cloud services to optimize cost and performance.

❯ Due to increased land prices and electricity, companies are moving to cities like Calgary, Kamloops, etc.

❯ Significant investment is being made in building new data centers and upgrading existing ones to meet growing demand and support emerging technologies.

Ads’, a first-of-its-kind AI tool that allows marketers to generate highly relevant ad copy for multiple platforms simply by inserting a URL from a website or landing page.

URL to Ads analyzes the content of a given website. It uses artificial intelligence to generate ad copy matched to the page and tailored for platforms including Google, Facebook, Twitter, LinkedIn and Bing. The tool is designed to give marketers back precious time, generating relevant, high-performing ad copy with a single click and helping them achieve better results from their campaigns.

“Creating tailored and effective ad copy from specific pages can save time for marketers. At Unbounce, we have always been keenly focused on pairing marketers with tools that can help them be more effective and ultimately more successful,“ says Darby Sieben, Chief Product Officer of Unbounce. “With our deep experience helping marketers to create high-impact, high-performing content, combined with our unique body of data on what has driven billions of conversions for our customers, we are immensely excited about the potential of this new tool and keen to get it in the hands of marketers across the globe.”

Marketers can easily try the new tool by visiting - https://unbounce.com/url-to-ads

Global Study: 70 percent of Business Leaders Would Prefer a Robot to Make Their Decisions

People feel overwhelmed and underqualified to use data to make decisions and this is hurting their quality of life and business performance, according to a new study – The Decision Dilemma – by Oracle and Seth Stephens-Davidowitz, New York Times bestselling author. The study of more than 14,000 employees and business leaders across 17 countries found that people are struggling to make decisions in their personal and professional lives at a time when they are being forced to make more decisions than ever before.

The number of decisions we are making is multiplying and more data is not helping People

are overwhelmed by the amount of data and this is damaging trust, making decisions much more complicated, and negatively impacting their quality of life.

Unbounce Debuts New AI-powered Marketing Tool Allowing Single-Click Ad Copy Generation from a URL

Unbounce, the global leader in landing page and AI-powered conversion optimization software, announced the launch of ‘URL to

❯ 74 percent of people say the number of decisions they make every day has increased 10x over the last three years and as they try to make these decisions, 78 percent are getting bombarded with more data from more sources than ever before.

❯ 86 percent say the volume of data is making decisions in their personal and professional

lives much more complicated and 59 percent admit they face a decision dilemma — not knowing what decision to make — more than once every single day.

❯ 35 percent don’t know which data or sources to trust and 70 percent have given up on making a decision because the data was overwhelming.

❯ 85 percent of people say this inability to make decisions is having a negative impact on their quality of life. It is causing spikes in anxiety (36 percent), missed opportunities (33 percent), and unnecessary spending (29 percent).

❯ As a result, 93 percent have changed the way they make decisions over the last three years. 39 percent now only listen to sources they trust and 29 percent rely solely on gut feelings.

Decision distress is creating organizational inertia

Business leaders want data to help and know it is critical to the success of their organizations, but don’t believe they have the tools to be successful which is eroding their confidence and ability to make timely decisions.

❯ 85 percent of business leaders have suffered from decision distress – regretting, feeling guilty about, or questioning a decision they made in the past year – and 93 percent believe having the right type of decision intelligence can make or break the success of an organization.

❯ 97 percent want help from data. In an ideal world, they want data to help them: make better decisions (44 percent), reduce risk (41 percent), make faster decisions (39 percent), make more money (37 percent), and plan for the unexpected (29 percent).

❯ In reality, 72 percent admit the sheer volume of data and their lack of trust in data has stopped them from making any decision at all and 89 percent believe the growing number of data sources has limited the success of their organizations.

❯ Managing different data sources has required additional resources to collect all the data (40 percent), made strategic decision making slower (36 percent), and introduced more opportunities for error (26 percent).

❯ Business leaders do not believe that the current approach to data and analytics is addressing these challenges. 77 percent say that the dashboards and charts they get do not always relate directly to the decisions they need to make and 72 percent believe most data available is only truly helpful for IT professionals or data scientists.

❯ Business leaders know this needs to change. They believe the right data and insights can help them make better HR (94 percent), finance (94 percent), supply chain (94 percent), and customer experience (93 percent) decisions.

// 5 DMN.CA ❰ MAY 2023

■ ■ ■ ■ ■ ■ ■ ■ ■ ■ ■ ■ ■ ■ ■ ■ ■ ■

■ ■ ■ ■ ■ ■ ■ ■ ■ ■ ■ ■ ■ ■ ■ ■ ■ ■

Collaboration Key To Customer Sales

BY TOM KANESHIGE

BY TOM KANESHIGE

The CMO Council’s new report Sales & Marketing: Driving Revenue Through Collaboration found that more than 70 percent of marketers don’t feel very confident in their sales and marketing model to sell effectively in the digitalized customer journey and to the self- reliant buyer. Here’s an excerpt of the report:

Once a clearly marked road from awareness to conversion, the customer journey has become chaotic. A B2B buying team now can consist of a dozen or more individuals, each with different roles in the buying process, and each conducting research online, and suddenly appearing at different buying stages.

“It’s no longer a sales process, marketing process or a sequential process but a simultaneous one with the customer experience at the center,” says Aditi Uppal, senior director of digital marketing at Teradata. “The ease with which customers find information has made the top of

STRATEGY ❱ DMN.CA MAY 2023 ISTOCK/ ANTON VIERIETIN

the funnel more relevant to sales, and the bottom of the funnel equally important for marketing.”

Traditionally, marketing would collect and send a bunch of MQLs to sales in a single handoff. Salespeople may or may not have followed up on them. Today, this isn’t good enough. Instead, there needs to be practically daily handoffs of data between marketing and sales, along with relevant insights.

“I strongly feel that the handoff is going away,” Uppal says. “The simultaneous availability of intelligence across stakeholders provides a better sense of what customers are, or might be, doing, and arms sellers with timely and actionable information.”

For instance, let’s say a seller sends information to an account and plans to wait for 5-10 days to hear back. With modern digital analytics, marketing, however, picks up buyer intent signals indicating that the account may be close to signing with a competitor. Sales needs this insight right away to take an action.

With marketing tracking numerous customer data points across first- party and third-party data sources, the ongoing flow of two-way information between sales and marketing requires a robust technology solution and customer data platform to make frequent orchestrations easier and to arm sellers and marketers with the most up-to-date and relevant information across the plethora of the buying team.

“It’s how you bring it all together to create that thread for seeing what’s happening at the account,” Uppal says. “This ensures that both sales and marketing are aware of where each account is in today’s complex buying cycle. It’s no longer a world of sales ops and marketing ops operating in siloes. Today’s dynamic environment requires a collaborative revenue ops partnership, and modern digital marketing technologies can make this a winning combination.”

Sales & Marketing: Driving Revenue Through Collaboration is based on a survey of over 300 marketing leaders across industries and geographies. Additionally, we conducted in-depth interviews with marketing and or sales executives from Teradata,

Schneider Electric, Valpak, Capital Group, Cox Business, Brunswick, and others. Download the full report: https://www.cmocouncil. org/thought-leadership/reports/ sales--marketing-driving-revenuethrough-collaboration

Expert commentary from KPMG

As part of this report, the CMO Council spoke with Jason Galloway, Customer Advisory Leader & Marketing Consulting

Lead with KPMG and Walt Becker Sales Transformation Lead at KPMG around some of the key findings. Below is an excerpt from that interview.

What is the sense of urgency for a sales-marketing relationship reset? What’s at stake?

Jason Galloway: The sense of urgency for a sales-marketing relationship is two- fold: customer needs and demands have been changing over the years at an exponential rate. These days, the traditional sales and marketing funnel stages are blurred, and customers are becoming more and more self-reliant across the stages of the buying journey. All the while, they’re expecting seamless interactions and experiences at every touchpoint. The bar has been set high, and in order to keep up, sales and marketing teams have to work together towards the same goals, they have to speak the same language, and they have to hold each other accountable.

Walt Becker: It often used to be said that “Marketing is Marketing and Sales is Sales”... One responsible for brand recognition, product awareness, and demand generation, while the other focused on building relationships, shaping opportunities, and closing deals. But, in today’s world with increasingly self-reliant buyers, marketing and sales must work together to better orchestrate investments to better align demand generation activities with sales priorities, improve both digital and analog customer interactions, and increase key performance metrics across an integrated pipeline. Companies who continue to operate marketing and sales in siloes will underperform peers who have “connected” front-offices.

What is the biggest hurdle from a sales or marketing point of view? How can they overcome it?

Jason Galloway: I think the biggest hurdle for marketers is the shift in mindset. Many marketers grow in their career with a one-track mind — leads. How many leads did this campaign generate? How much engagement did we evoke from the audience? But more and more marketers are being held accountable for business growth, and a stronger relationship with sales can open the door for them to put that value on the table. We are starting to see sales and marketing teams align on shared metrics and work towards common goals — for example, some marketing teams are taking accountability for sales qualified leads. And while they don’t have all of the control, ownership drives accountability.

Walt Becker: Simply put, performance metrics. Marketing and sales must share a common set of KPI’s that balance both shortterm sales results and longer-term revenue objectives. For too long marketing has been measured on a suite longer-term revenue or customer goals, while sales was focused on achieving daily, weekly, or quarterly sales targets. For the marketing and sales relationshipreset to work, both need to be measured on unified short and longer-term metrics.

What does a successful relationship reset look like?

Jason Galloway: It’s a two-way street. Both marketing and sales need to get aligned on short and long-term goals, and then play off their strengths to achieve results together. From a marketing perspective, this involves taking the time to understand how sales operates and how to speak their language. It can be difficult to develop cross- functional objectives when you are speaking different languages in terms of goals and metrics. After figuring out where marketing and sales want to go and what they can achieve together, they need to put the resources and tools in place to enable consistent collaboration and accountability.

Walt Becker: First, marketing and sales need to embrace a joint

strategic planning process that prioritizes growth objectives across customer segments, markets, and product areas. Both then need to reorient their investments to achieve growth goals. For marketing, this means aligning ad spend, lead gen campaigns, nurturing activities, and sales enablement investments. For sales, this means reorienting allocation of sales capacity, adjusting sales motions, and aligning incentive compensation. It also requires a regular management cadence between marketing and sales on things like campaign design and effectiveness, account planning and marketing, lead nurturing and opportunity management, and, if applicable, cross/up-sell and renewal processes. Both will still have their unique roles to play in driving top-line growth, but creating tighter coordination on key customer processes and increasing alignment of KPIs will unlock more leads, opportunities, and wins.

// 7 DMN.CA ❰ MAY 2023

TOM KANESHIGE is the chief content officer at CMO Council. He creates all forms of digital thought leadership content that helps chief marketers, line of business leaders, as well as growth and revenue officers succeed in their rapidly evolving roles.

Jason Galloway, Customer Advisory Leader & Marketing Consulting Lead with KPMG

Walt Becker Sales Transformation Lead at KPMG

STRATEGY

Data Clean Rooms:

Answering Advertisers’ Need for Privacy and Personalization

BY WILLIAM SKELLY

The stage is set for

“data clean rooms to become an indispensable privacy-preserving technology,” according to the Interactive Advertising Bureau (IAB). In the State of Data 2023 report, IAB reveals two-thirds of advertisers are using data clean rooms.

Data clean rooms enable advertisers, publishers, platforms and other parties to combine their first-party data “in compliance with privacy regulation while allowing each participant to maintain privacy and control of its data,” according to the IAB.

You’ve probably heard the term “clean room” for restricting contamination during scientific research or manufacturing. A data clean room is a technology or neutral space for data collaboration. Users can combine datasets without revealing personally identifiable information (PII). Each organization controls their own data, while being enriched with additional information from thirdparty data partners.

Walled gardens and data partners

Data clean rooms are available through walled gardens and data partners or software companies. Walled gardens include Google, Facebook and Amazon. Within the

walled gardens, advertisers can securely share their first-party data to enhance, target and measure campaigns on their platforms.

Data consultants and software companies can offer neutral thirdparty clean rooms. In addition to organizing, analyzing and measuring data, these partners can support discovery of new audiences. Working with the right data management consultant will support marketers with advertising messages that are more personalized and relevant across multiple media.

Data clean rooms secure privacy while opening doors

Here’s how data clean rooms are supporting advertisers to reach their audiences while protecting consumers’ privacy.

1Increasing first-party data privacy

With ongoing changes in privacy regulations that are necessary for consumer protection, marketers need help in managing first-party data. In a data clean room, their customers’ information remains anonymous. Meanwhile, data partners can finetune market segmentation based on purchase history, consumer habits, media preferences and more.

2Building better target audiences

Through data clean rooms, advertisers get help from data partners to access new target audiences. Especially when entering a new market, a data consultant specializing in new customer acquisition will provide insights into the industry vertical, offering predictive and prescriptive modelling and machine learning to identify new universes and attract more prospect customers.

3

Enhancing personalization and customer experience

The ability to integrate transaction data and other consumer behavior information allows marketers to create more personalized advertising messages. Consumers appreciate relevant communications on their preferred media and at the right time in the customer journey. Marketers benefit from greater consumer engagement and customer experience, while reducing wasted advertising dollars.

4Boosting performance and return on ad spend

Inside a data clean room, marketers can view attribution models, combining transaction data with the publisher or ad partner’s performance metrics. Visibility into impressions and

click rates for identifying the source of conversions allows data analysis into the reach and frequency of ad campaigns. Marketers can make more immediate adjustments to improve media performance and return on ad spend (ROAS).

Making data clean rooms more accessible

IAB’s report on the State of Data 2023 notes that some advertisers are still learning about the new technology, while others may not have the budget to invest in data clean rooms.

By partnering with a data consultant, marketers can gain the benefits of a data clean room without making major technology investments themselves. Advertisers will get the help they need to manage, organize and optimize the data they own. Collaborating with a data partner, marketers can enter a data clean room, level up their advertising strategies, increase awareness, attract new customers and deepen loyalty.

// 8 ❱ DMN.CA MAY 2023

WILLIAM SKELLY is CEO of Causeway Solutions, a leading provider of Acquisition Analytics and innovative data services. Causeway Solutions empowers clients to make smart, timely, datadriven decisions through real-time consumer insights to better reach target audiences.

TECHNOLOGY

ISTOCK/ TERO VESALAINEN

Personalization Pulse Check

Highlights from MoEngage 2023 Report

Personalization is not just a necessity anymore — it is imperative.

In this year’s Personalization Pulse Check Report, MoEngage helps brands understand customer sentiment on personalization. The data is clear: it is not just “nice to have”; customers now demand it.

However, only 30 percent of brands use deeper insights to personalize their experience. Brands still struggle to provide personalized, omnichannel experiences based on customers’ affinity, AHA moments, channel/ frequency preferences, and more.

Finding the solution to winning customer loyalty can appear daunting, but it isn’t an impossible feat. The key is to start with the basics: for example, how many channels you use to interact with customers, how often customer sentiment changes, how many channels your customers browse before making a purchase, and so on.

But who can give you the answer to these age-old questions? Your customers!

MoEngage spoke to 2,000 North American consumers to understand their customer engagement preferences and personalization needs. This report is meant to answer clear questions like what delights consumers, what frustrates them, how personal they want you to be, where they would like to read or see communication from you, and much more.

A look back at previous Personalization Pulse Check edition

In last year’s Personalization Pulse Check report, MoEngage found that the number one challenge for consumer brand marketers was consistent messaging across multiple channels.

This is the communication gap between brands and their end customers. Much data is available

to these marketers, but customer communication is not personalized on a relevant, human level.

Approximately 44.5 percent of marketers feel that using insights (customer, journey, and campaign

level) helps boost the overall ROI. However, adding personalization to customer engagement remains elusive.

So in this year’s report, MoEngage wanted to understand consumers’ current expectations toward brand communications and establish how these expectations have changed (or not) compared to their last edition of the report.

MoEngage surveyed 2,000 North American consumers from the US and Canada, aged 16-54 to:

1. understand their expectations from brands regarding personalizing their experiences.

2. know what delights, what frustrated customers, and how personal they want brands to be.

3. find out which channels they would like to read or see communication from brands on and much more

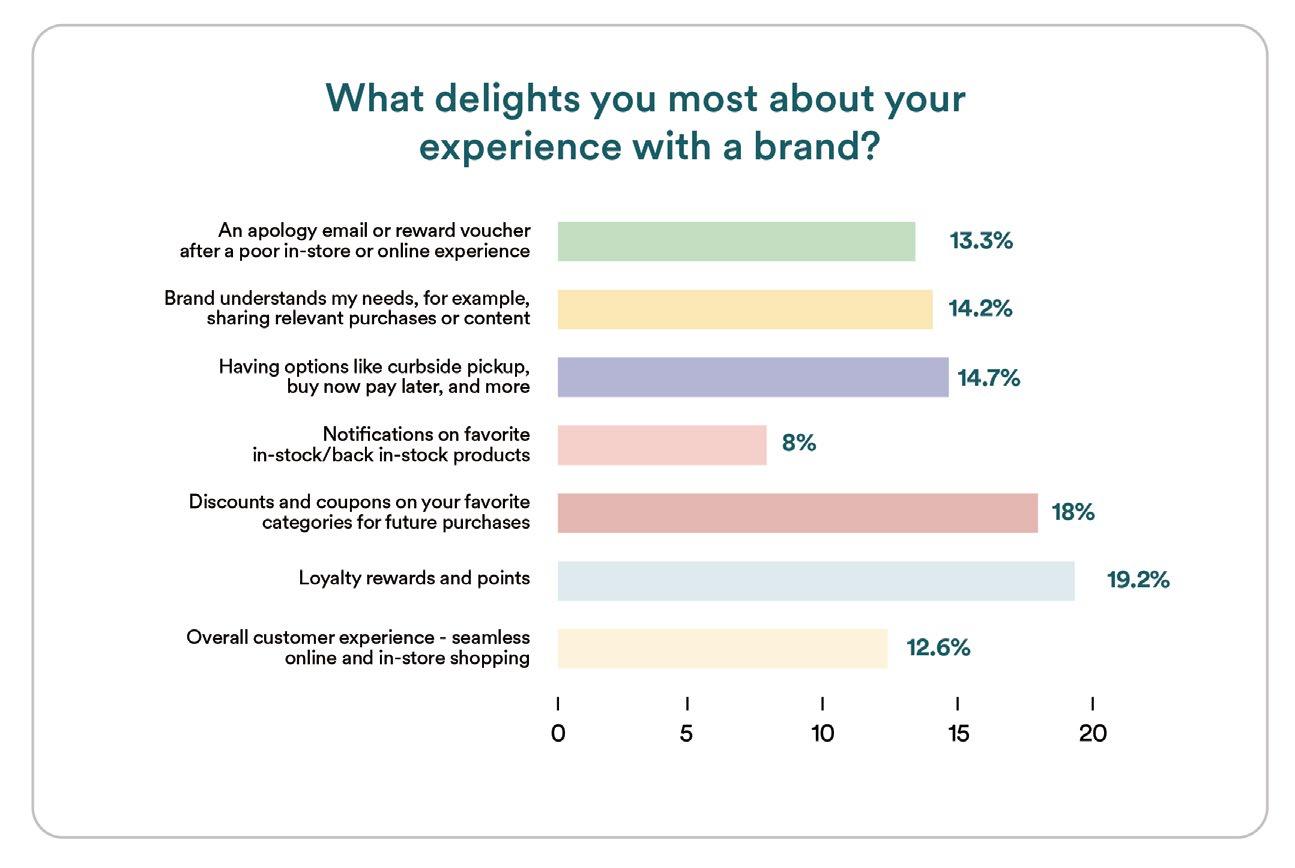

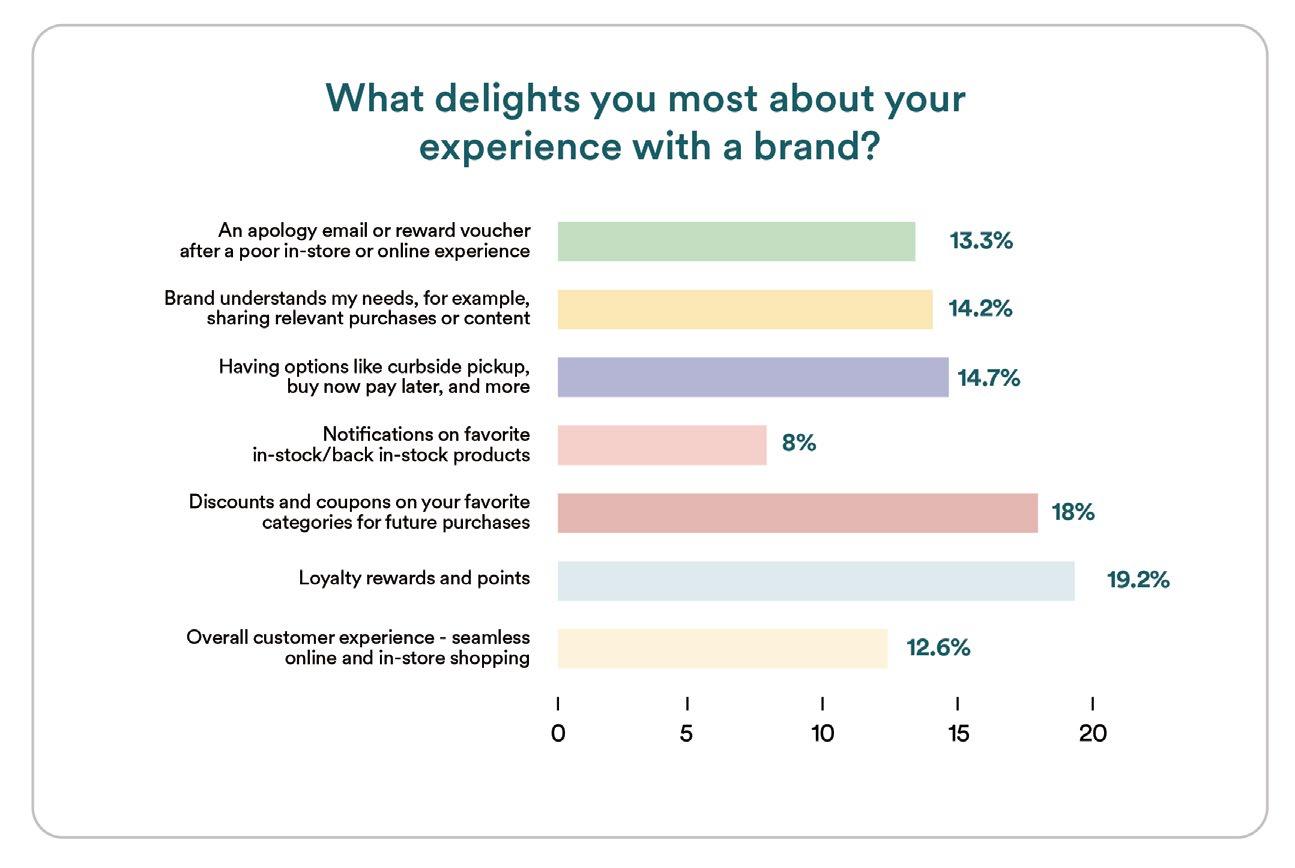

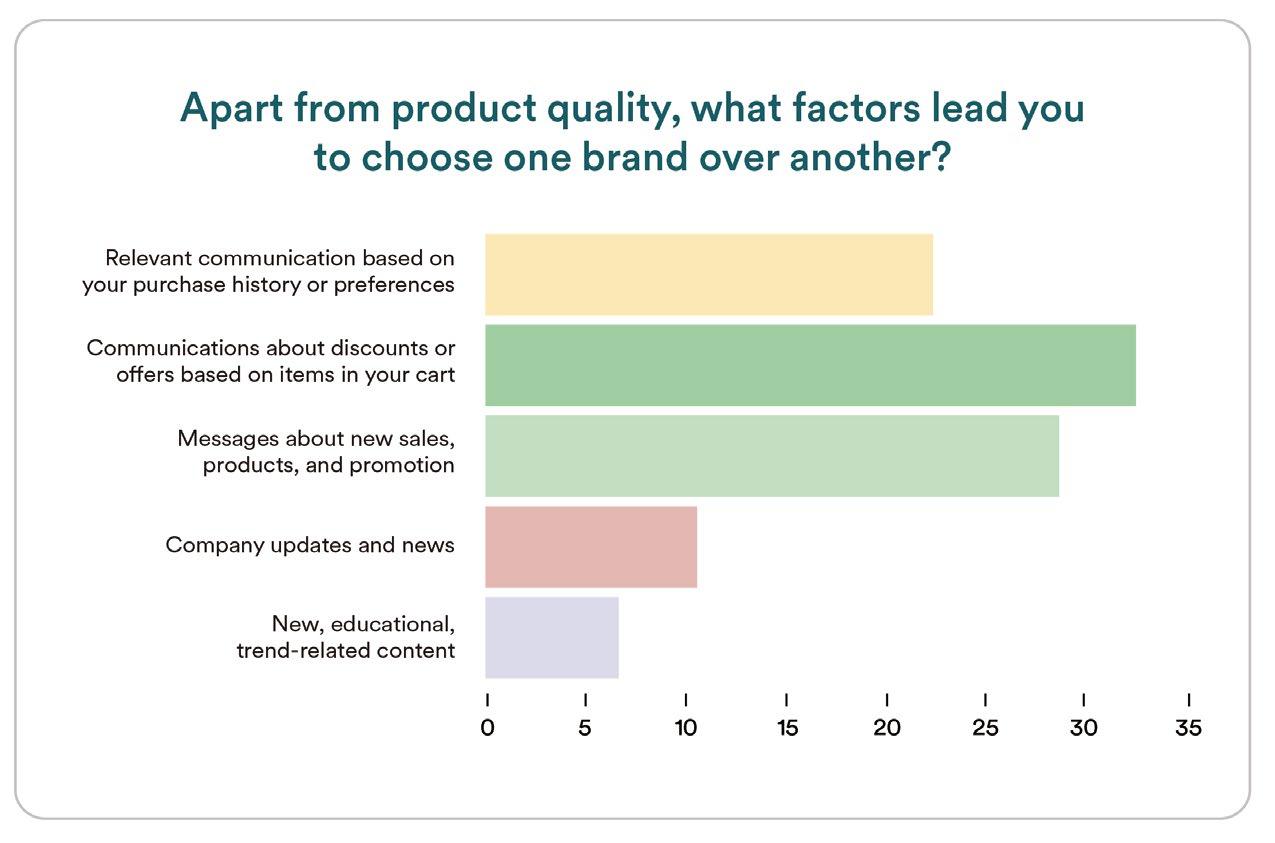

From a customer engagement perspective, around 14 percent of consumers are delighted when brands understand their purchase needs and improve their overall buying experience.

The broad majority of consumers want brands to understand their purchase needs, compensate them when they have a poor experience, and notify them about in-stock favourite products. Consumers also want brands to focus on a seamless customer experience that includes personalized communication based on their buying behaviour.

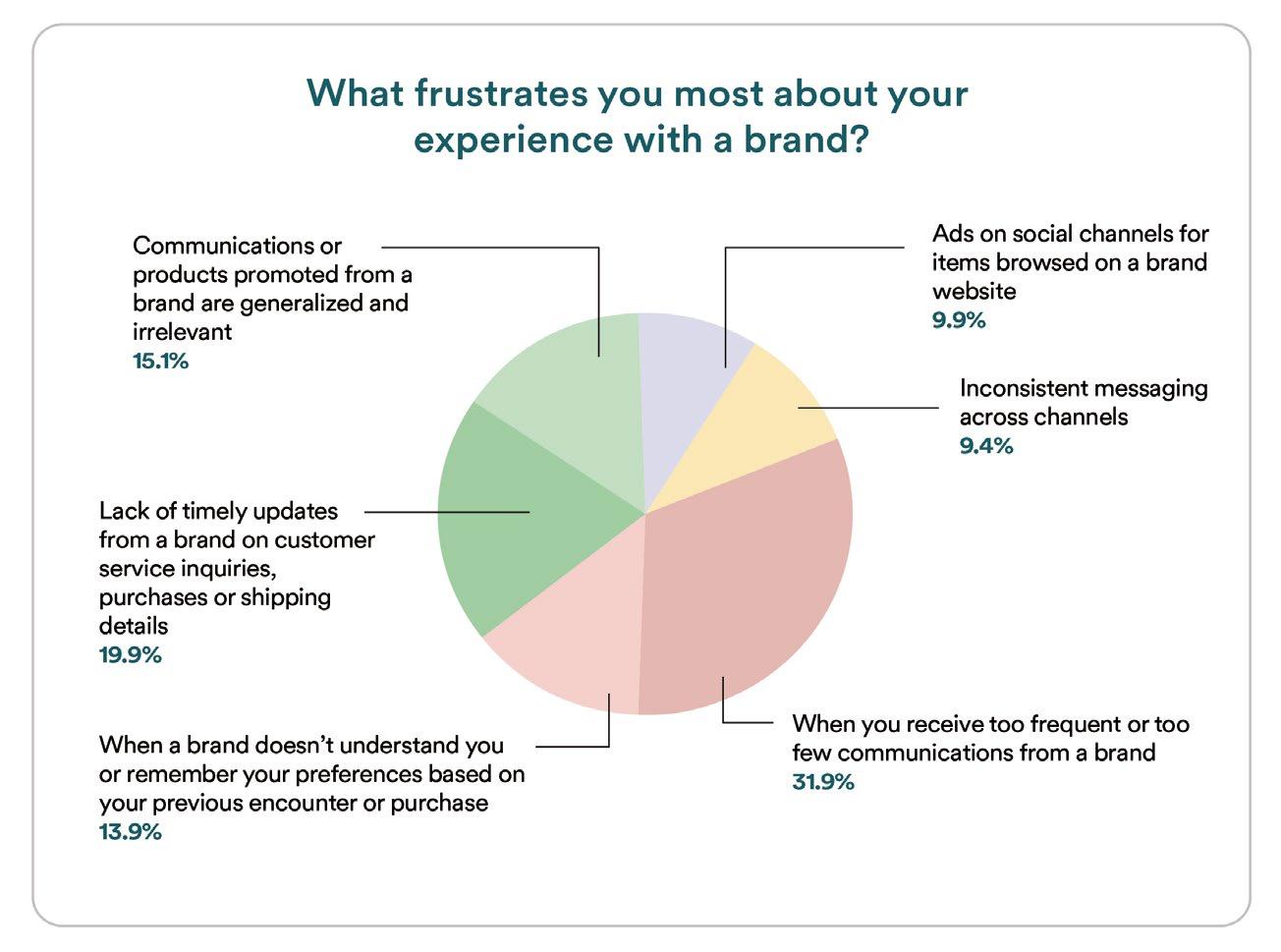

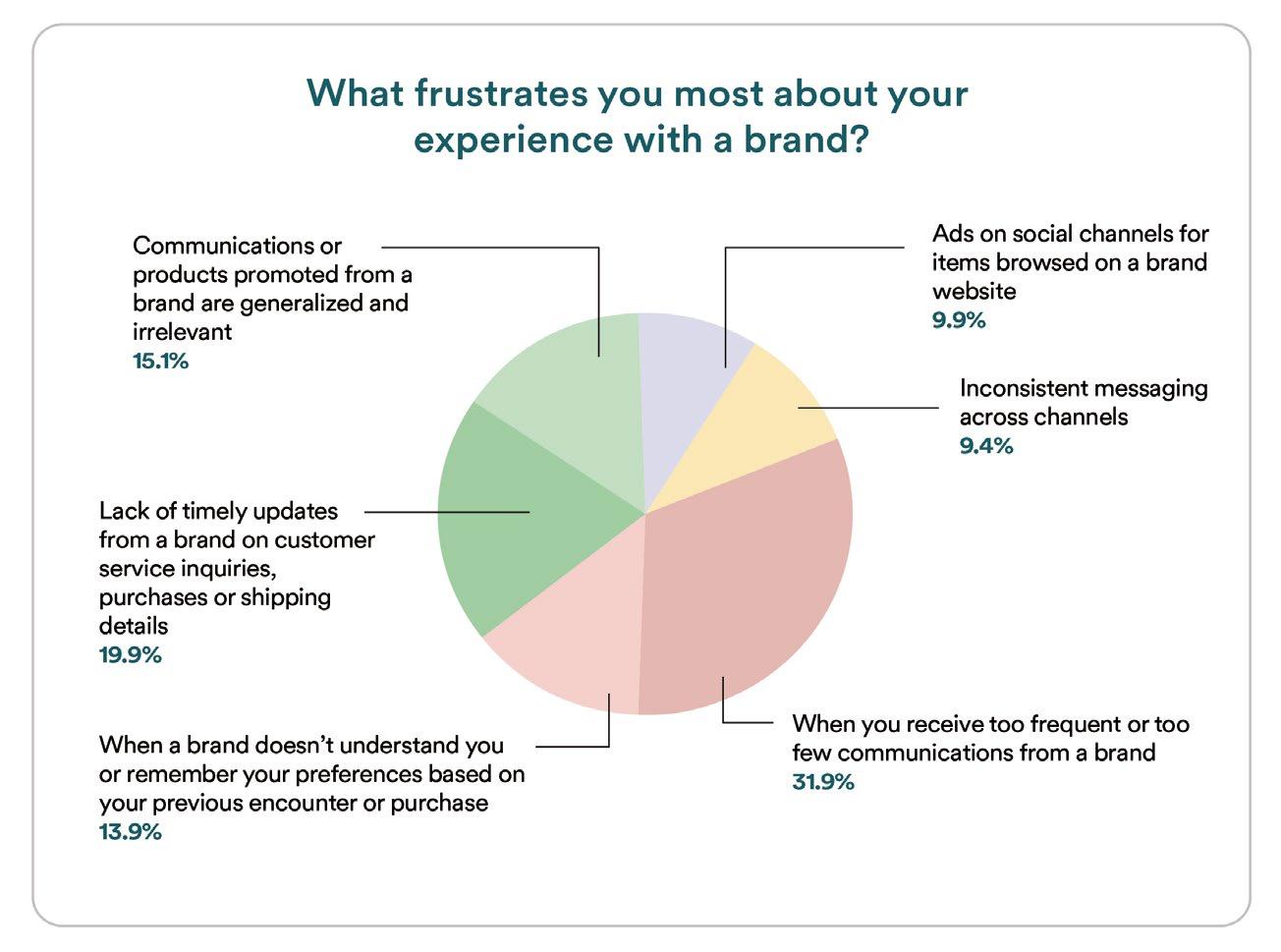

The majority of consumers’ frustration stems from a lack of strategic customer engagement. Furthermore, 31.9 percent of consumers are frustrated when brands send too frequent or too few communications. This clearly shows that consumers also demand relevant, timely, and customized communication apart from price and product-related benefits.

// 10 ❱ DMN.CA MAY 2023

INSIGHT

ISTOCK/ANDREYPOPOV

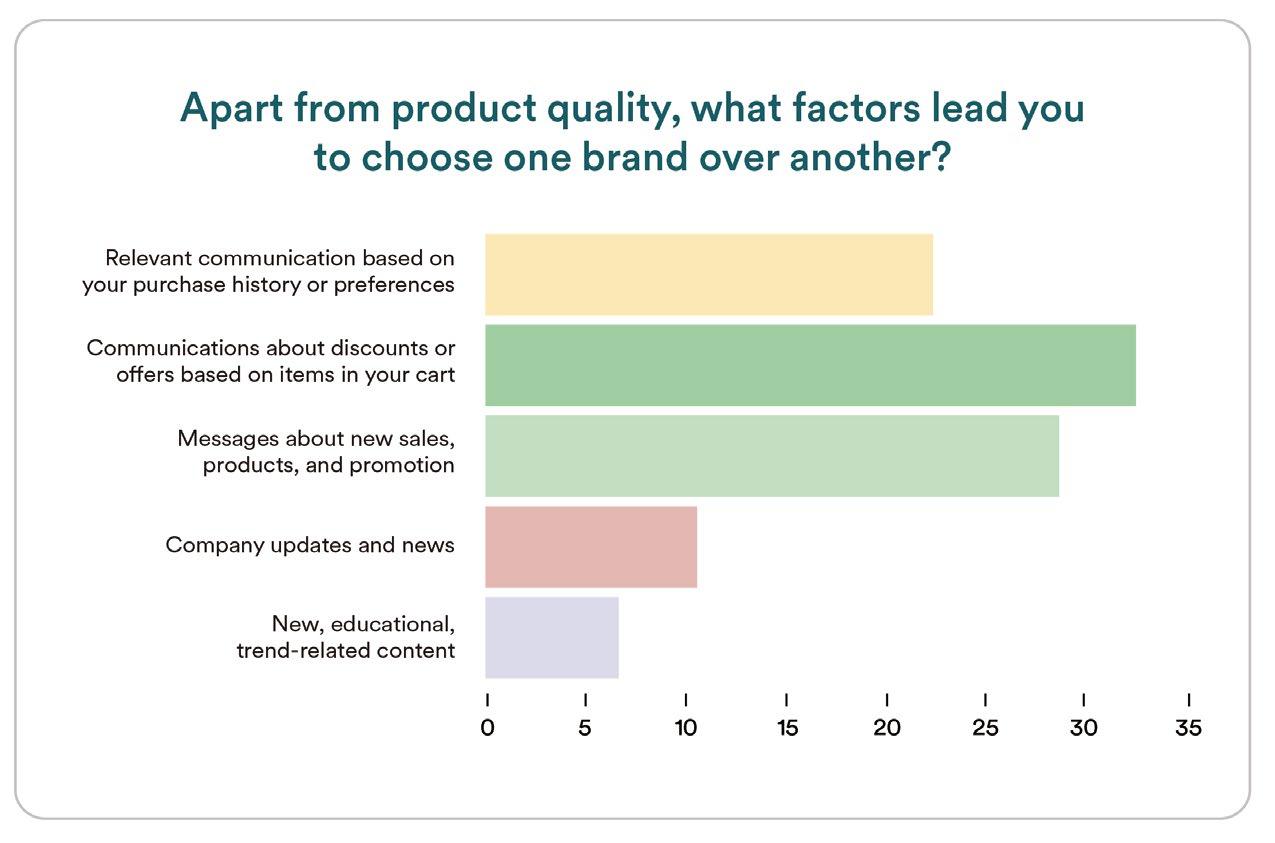

Based on the data, it is clear what delights and frustrates the consumers is mostly related to brand communication. It’s essential to understand consumers’ criteria when personalizing communication and engagement.

27.7 percent of consumers want their communication personalized using purchase history, and 22.7 percent prefer known interests such as favourite categories, repeat purchases, wishlist products, and more such insights.

The expectation in which brands use name, preferences, and location are still essential but represented as lesser importance compared to the other criteria, likely because brands have been focusing on these attributes for some time. Now, consumers are looking for deeper conversations that can only happen using deeper insights such as purchase history, app/website activity, affinity, and so on.

Interacting with brands through their website (22.5 percent) is consumers’ preferred channel, more so than even in-person interactions (18.8 percent). This shows a shift in the importance of digital communications compared to traditional channels. Moreover, 13 - 15 percent of consumers still prefer mobile apps and social media as engagement channels. Emails and SMS are on the consumers’ preferences list as well. Noticeably, chatbots seem to be last on the priority list; however, based on 2023 engagement trends, this channel will gain popularity soon.

We understand the preferred channels, so what comes next?

Frequency of interactions on these channels. 47.8 percent of consumers interact once or twice on their preferred channel(s) before making a purchase. Whereas an equally close 43.6 percent interact 3-4 channels before purchasing.

Balancing personalization and privacy

Personalization comes at a cost, i.e., sharing personal data. Hence it is essential to understand how consumers perceive sharing their data and letting brands use it for an enhanced experience.

Well, more than 66 percent of consumers are comfortable or slightly comfortable with sharing their data including name, location, and email. This acceptance of

data sharing shows personalized experience is expected from consumers. That’s how customercentric brands need to move to succeed in a high-competition, low-loyalty environment.

Once we understood that consumers are willing to share their data, the next thing to gauge was what type of data they wanted to utilize for this personalized shopping. So other than name and location, more than 50 percent of consumers want brands to use preferences, affinity, favourite products/categories, and purchase history as elements of personalization. Finding browsing and purchase history insights is straightforward, as brands can use the app and website data.

Prioritize personalization like your growth depends on it

Because it does! Where brands place their bets, how they prioritize their customers, and adapt to customer expectations will determine their growth trajectory for the year ahead.

Consumers have made it abundantly clear that they want a highly personalized experience over their favourite channels and seamless journeys from start to finish. Deliver on these expectations, and all brands, large

or small, have a chance to retain their growing customer base. Fall short, and brands might miss out on the opportunity to try again.

Future success depends on four emerging growth areas

Moving away from static segmentation towards dynamic, hyper-personalization

To get personalization right, brands need to understand what isn’t personalization. In many instances, personalization and segmentation are used interchangeably. While segmentation helps you categorize and label your customers into different cohorts based on their interests, preferences, locations, etc., personalization helps you treat them as individuals. Look at it this way, while segmentation allows you to divide thousands or millions of customers into different segments, personalization allows you to have individual moments with each customer.

Invest in scalable real-time messaging

Your consumers demand the opportunity to interact with a brand whenever they need to, without a moment’s delay. Giving consumers real-time transactional updates on value-added services like curbside

pick-up, BOPIS, order confirmation, returns, etc., sent at the right time, helps you as a brand have a proactive communication plan to build trust and loyalty. Using MoEngage

Inform, brands can deliver critical messages to customers in realtime. These include alerting customers when an ordered package arrives, sending OTPs to approve transactions or log in securely, cab arrival updates, or password reset requests, for example.

Explore channels to grow in the age of conversational commerce

Customers don’t want to wait hours on end to connect with your brand’s customer service on a call. They want an instant resolution. That’s where channels like SMS, chatbots, Facebook, and more come in handy and are gaining increasing popularity. Brands need to personalize their communication to suit these conversational channels.

Exploring channels like Chatbots and WhatsApp allows brands to establish a direct relationship with the consumer.

Leverage insight to succeed with first-party data

Zero-party data collected from loyalty/referral programs, buying intent, or other sources should now be used for product recommendations, building custom profiles, and improving customer service, which in turn will assist better strategic decisions. Similarly, brands can use first-party data gathered from owned digital channels — website/app, surveys, feedback, newsletter, WhatsApp opt-ins, etc. This will facilitate offering hyper-personalized experiences, reaching the right customers, and fostering customer relationships by understanding their preferences. By embracing new technologies and investing in both consumers and their journeys, brands can infuse a customer-first mindset into all levels of engagement. The window for action is small — and closing. But brands have the opportunity to drive bottomline growth and create better experiences just by letting their customers lead the way.

FOR MORE INSIGHTS from this report, please visit www.moengage.com

// 11 DMN.CA ❰ MAY 2023

INSIGHT

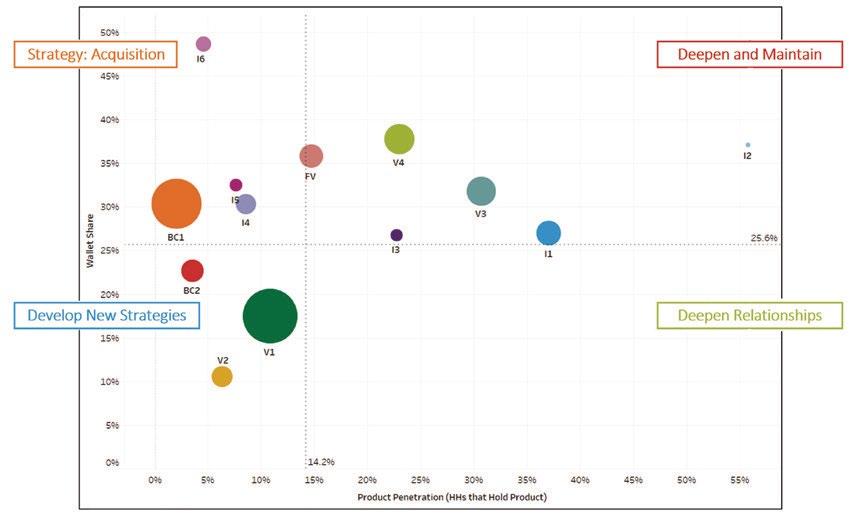

Digital Banking:

An Interview with Greg Brown, Vice President, North American Digital Product Management, BMO Financial Group

BY STEPHEN SHAW

BY STEPHEN SHAW

These days few people ever visit their local bank branch anymore. Certainly not to do their everyday banking. They prefer to do it online from the comfort of their home, or using their bank’s mobile app. Need to deposit a cheque? Just take a picture of it with your smartphone! Want a quick loan? A few clicks and presto! Your loan is magically approved.

Banking was not always this convenient. There was a time, not that long ago, when banks made you do business on their terms. Banker’s hours, they used to call it. Those were the days when you used a passbook to manage your account deposits and withdrawals – when you lined up to see a “teller” who would dispense your cash. And if you needed money on a weekend, you were out of luck. Then along came ATM machines. Debit cards. Telephone banking. Internet banking. One technology innovation after another. Banking became, as they say, something you do, not somewhere you go.

Today the financial services industry is going through the most disruptive period of innovation ever: the unbundling of banking services caused by the rise of fintech companies. The change is so sweeping that it threatens the hegemony of traditional banks whose customers are being lured away by a slew of upstart challengers — neobanks, non-bank lenders, payment specialists — providing frictionless, hassle-free experiences.

The fintech industry, now totaling 1,200 companies in Canada, has forced the normally cautious incumbent banks to speed up their efforts at digital transformation, anxious to halt or at least slow down the rate of silent attrition amongst their customers. But the big banks are starting that race from behind, weighed down by legacy processes and technologies that were designed for a service model based on branch visits. Their biggest handicap, however, may be their public image as monolithic, stodgy, and uncaring, especially amongst younger customers who are completely at ease with digital banking.

According to Bain and Company, just 29 percent of customers say they are loyal to their primary bank. People are simply fed up with being taken for granted. To win back their allegiance, banks must take their cue from the fintechs: help people take greater control of their financial lives through personalized digital tools and apps, relieving them of the stress involved in managing their money.

Instead of focusing on maximizing the total number of accounts, banks need to offer

their customers greater empowerment, peace of mind and financial wellness. The formula going forward: make it easy — make it intuitive — make it personalized. Above all, put the customer’s interests first.

The banks do have a few advantages as they battle this insurgency. Lots of historical customer data for one thing — information that can be harnessed to offer proactive advice based on a holistic picture of a customer’s financial health. Plus, their ability to team up with select fintech partners who can extend their value proposition with Personal Financial Management tools for budgeting, payments, and investments.

One Canadian bank making a determined effort to “digitize” is BMO Financial Services which now claims to be “digital first”. Recently Forrester named BMO the overall leader in Canadian mobile banking apps, crediting it for consistently offering useful features. Now the 8th largest bank in North America, BMO is committed to enhancing the digital experience of customers. Leading those efforts is Greg Brown who is in charge of BMO’s sales transformation strategy for the Personal, Business Banking and Wealth sides of the bank.

Stephen Shaw: You began your career working for your family’s furniture retail store. Did you ever imagine that one day you’d be heading up digital product management for one of the largest banks in North America?

Greg Brown: Definitely not. Growing up in a retail family business, you learn a lot, right? You learn how to wear a lot of hats. You learn how to be entrepreneurial, how to solve problems, how to manage finite resources, how to work hard, including every holiday, every Christmas. You learn how to build relationships, and you understand the importance of driving results. When I look back at that time, it really taught me how to wear many hats, how to be disciplined, how to run something end to end.

I also look at the time I spent at goeasy.1 I joined goeasy back in 2009 in a merchandising capacity. It was a great opportunity in a high-growth organization to really learn and develop as a young person. I remember back in 2011 when I first sat down with our CEO David Ingram: he could foresee where digital was going. His retail business was very much brick-and-mortar at the time, focused on driving traffic into our physical locations, over 200 of them in Canada, about 30 in the U.S. He said, “We need to start thinking about how we’re going to digitally transform our lease-to-own business. Can you do that?” And I said,

// 12 ❱ DMN.CA MAY 2023

STEPHEN SHAW is the Chief Strategy Officer of Kenna, a marketing solutions provider specializing in delivering a more unified customer experience. Stephen can be reached via e-mail at sshaw@kenna.ca

INSIGHT

Banking:

MAY 2023

“Well, I’ve been on Google before, so I’ll probably figure it out.” I had no experience, and I didn’t know what I was doing, but I knew how to solve problems. I knew I could figure it out.

In 2016 I decided to join BMO which like a lot of banks had been talking about digital transformation for a number of years. It appeared they were getting serious, a lot of buyin at the top, like “we need to do this now: we need to change our ways of working and build digital experiences for customers”. That was really appealing to me.

Shaw: That’s quite a cultural leap, going from a familyowned business to a midsize non-prime lender to a big bank. Tough transition?

Brown: Yeah, it’s a good question. Joining BMO, it wasn’t just the size. It was the fact that this is a highly regulated industry. So that whole experience of understanding how to work within that environment was something I had to adjust to, and obviously just the matrix structure of the organization, where there’s a lot of different stakeholders to work with as you get things done.

Shaw: Is your main responsibility retrofitting legacy banking processes, in other words, digitizing them, or making the online experience novel and different for customers? Are you adapting or reimagining?

Brown: I’m responsible for driving sales and growth for BMO across Personal, Business Banking, and Wealth. I have a team that runs the marketing and engineering function

of the public marketing site, bmo.com — bmoharris.com in the U.S. — and of course all of the self-serve tools and support functions. Then all of the onboarding experiences. So if you want to open up a bank account, you want a credit card, a lending product, my team owns the platform and the journeys for all three businesses.

Shaw: Is the emphasis on taking an existing process and making it less arduous for the customer, or is it starting with “first principles” and asking the question, “Do I actually have to even drag the customer through having this process?”. Brown: Yeah, it’s a good question. It’s why I hate the word “digitization” because it feels like you’re just taking an existing process and creating a digital way to do it. We’d be doing our customers a disservice if we didn’t reimagine it. When we launched our first self-serve “account open” experience, we asked ourselves how we make this seven minutes or less? How do we make it so foolproof you never need to go into a branch? The point of comparison is not the legacy process and how do we make it better? Our goal is to make the experience as seamless and simple and as intuitive as possible. And so that requires reimagining experiences, and figuring out how we can simplify them.

Shaw: When you agreed to take the job on, were there any challenges you faced that maybe you weren’t expecting? Certainly, the scale of change had to be quite

intimidating. Surely, you ran into pockets of resistance, inevitable on any change management project. Was there a “What have I got myself into?” moment for you?

Brown: I think my boss, who’s our Chief Digital Officer2, was pretty honest about the state of affairs when I joined. So I wouldn’t say I was particularly surprised with where we were in the transformation, or how much work was in front of us. We wanted to be a leading digital bank. We wanted to drastically improve our digital servicing experience. And so we created really clear journeys: Opening accounts, paying bills, transferring money — very clear journeys. And then we figured out the target outcomes we were looking to achieve. What is the proportion of sales that should be coming through this channel? What should be our ID verification success rate? How long should it take a customer to perform this task? There’s a series of KPIs and metrics that were related to each journey that would tell us, did we meet or exceed expectations? And then we made sure to bring stakeholders along for the ride. We explained what we were trying to build, and had them co-create changes to our processes to get us there.

Shaw: Banks finally recognize they have to play catch-up fast. I’m curious, are fintechs a genuine threat to you, or are they actually “frenemies”?

Brown: We have a very much a partner mentality when it comes to fintech. We want our customers to make real financial progress, and we need to be looking at the full set of available tools, some of which we’ll build ourselves, and some of which we’ll create through partnerships. And so we think there’s lots of opportunity with open banking3. We think it can be a lot more secure than screen scraping, which has existed for a number of years in Canada. But how do we make sure that the customer is in control? How do we make sure that privacy is paramount, that security is paramount, and that the exchange of data is done the right way?

Shaw: When you create your digital transformation roadmaps, there must be a lot of factors to consider. There’s what other banks are doing. There’s what the fintech companies are doing and will continue to do. There’s the shifting expectations of customers. When you look at all of those factors, do you build or buy? Lead or follow fast?

Brown: I think our partnerships need to be in service of our strategy. We need to partner for value. We’re not chasing partnerships just for the sake of it. And so, we’ve got really strong partnerships, and we’ll continue to build up more of those over the course of time.

// 14 ❱ DMN.CA MAY 2023

INSIGHT

How do we make sure privacy is paramount, that security is paramount, and the exchange of data is done the right way?

Shaw: I am intrigued about who you view as your competition. You have the incumbent banks trying to catch up, just like you — you have a bunch of natively digital fintechs popping up every day, trying to grab a piece of the action. Who are you in the ring against? And when all banking is digital, what are the differentiators? If the main distribution channel you’ve relied on for so long — the branches — is slowly fading away, what becomes your unique value proposition?

Brown: God, you’re painting the end of banking. I do believe the really impactful conversations still need to happen in person. We want to make more time for that. We really need to give the branches more time - the contact center more time - to have those really engaging, advice-based conversations. We know that’s a point of differentiation. We know that will lead to higher NPS [net promoter score]. But we’ve got more work to do there. And I would also say, on the digital side, that we are getting way better at delivering digital advice. We see how customers engage with us, with our BMO Insights platform, which shows them how they’re spending, how they’re saving, and forecasting where their cash flow will be, so arming customers with that information. And I think that’s the new frontier, especially with AI making those insights even more relevant and contextual.

Shaw: Are you building your digital experiences for the next banking generation, certainly Millennials, but Gen Z as well, who are completely at ease choosing alternative financial services providers?

Brown: I think about where we can position ourselves to really give younger people the tools and understanding of how to manage their financial life. I also think about their relative lack of financial literacy, which is not a new problem, but it’s not getting better either. I also look at the new-to-Canada segment — a huge one, right? We’ve got record levels of immigration coming into Canada. So that’s going to be a competitive battleground for sure. We just launched a new-to-Canada pre-arrival onboarding experience where we’re trying to make it easy for new Canadians even before they arrive here to get that account open, to get it funded, to just help them with the stress of a big family move to another country and how can we help them through that process. And then there’s the intra-generational wealth transfer that’s coming as well, helping boomers manage that. So, it’s not easy. It’s not easy managing competing priorities and adjusting to changes that happen, many of which you can’t always anticipate.

Shaw: If the next competitive battleground is the ability to offer fully personalized advice and recommendations through digital channels, is the end game contextual banking, that is, banking in real-time, at the moment, knowing the customer’s financial status and preferences?

Brown: I think you nailed it because most people don’t want to think about banking on a regular basis. People lead busy lives – they’re managing multiple priorities. “If I need to take action, tell me what I can do now about it.” We’re not trying to be the Google of banking –we’re not going to be that initial landing spot. But we’ve got a critical role to play in supporting customers when it comes to their finances. We want to do that in a way that’s more in context and in the moment, and to your point, personalized, that recognizes their unique situation and treats them accordingly.

Shaw: Is that ultimately AI that will pay off in automating that requirement?

Brown: Yep. I think so. If you think about customer expectations on a continuum, today we’re somewhere in between “know me” and “anticipate my needs”. That’s where I think the real opportunity is with AI — help customers see what’s around the corner and help them take steps to adjust if needed.

Shaw: You’ve won recognition from Forrester as the best mobile app amongst all the banks. What accounts for the success you’ve had?

Brown: I think there’s a lot to be proud of. But it’s taken years of work by an amazing crossfunctional team across design, digital, and technology, and the really strong partnerships we have with the marketing and product groups and our analytics group, along with a lot of corporate service areas like compliance, legal, and risk — about 17 or so groups altogether.

We started with this small collection of teams in a couple of urgent domains that needed attention. But we put really good people in place that understood how to build digital experiences and who have been intelligent, methodical, and diligent in their work. We’ve got a really strong results orientation, and so if we’re going to build something, we’re very specific about its value. We understand the trade-offs and why we selected a particular feature over something else. We understand what success looks like.

Digital experiences never end. There’s no end to the roadmap. The roadmap continuously evolves. And so it’s just persistence, I would say, moving forward and transforming and evolving and delivering on that next frontier of expectation and just doing it over and over again. And we’ve got a lot of support at the top levels of this bank because of that. Because our group has shown time and time again, we can produce and we can deliver.

Shaw: Are you guided by a unifying digitalfirst vision and strategy? Does that help you establish your priorities?

Brown: We’ve got an experience framework: Simple, intuitive, and personalized. We’ve got guiding principles around the type of experience we want to offer. It should say, “This is uniquely a BMO experience.” Regardless of whether you’re

// 15 DMN.CA ❰ MAY 2023

INSIGHT

We are getting way better at delivering digital advice.

sending money overseas, or opening a bank account, the experience should feel the same. It should feel very much like BMO. We’ve got design standards that guide us in terms of the look and feel of the experience. And a big part of the experiences we deliver are tied to customer feedback and research which involves talking to customers, getting feedback early and often through the process, prototyping, and staging design-thinking workshops, where we get customer and stakeholder feedback as we’re trying to redesign or redefine an experience. So being customerfocused and digital-first.

Shaw: How are you setting priorities and direction? Is that an annual effort where you create your roadmap for the year –decide on the priority projects you’re taking on, and the funding you’ll need? Are you working from a master plan of any kind with long-range goals?

Brown: Well, you couldn’t be asking that question at a more perfect time because we’re literally in the annual process right now, and I can tell you it’s painful. Yeah, it’s absolutely an annual planning process. There’s a whole integration and alignment process, where we’re asking, “Are there big business priorities or new priorities that we need to support and enable?” And so we try to get aligned on the three to four key things a team is going to work on for the next year. And then there’s all the business casing and management of that to help justify why we would invest in these things. So that’s the big process. And then, obviously, if there are really big plays that require more sizable investment levels, they require a different approach to get buy-in for those.

If we’re going to build something that’s a bit more greenfield where there aren’t really good examples of it in the market locally or globally, where there’s a lot more risk, we’ll do a deep research dive. But if we’re working on something that’s already in place, that’s where some of the journey analytics come into play, because our teams aren’t just building things, they’re managing and optimizing journeys: “Oh, we’ve got this new point of friction here. How are we going to solve that?”.

Shaw: Is there a steering committee of some kind populated by senior decision-makers who adjudicate, argue, debate, and settle on what the priority list looks like?

Brown: We have on my team 38 pods operating in all these different domains. Imagine if I had to be the decision-maker for 38 teams — I’d be on 38 steering committees! So that’s obviously not effective, right? So we have a decentralized model of decision-making where I have direct reports that run portfolios with similar stakeholders and they’ve got to work through the alignment and reprioritization. But that’s why we do this upfront annual planning — to decide the big investments we want to make — so the teams don’t have to continually align going forward.

Shaw: How does the funding part work exactly?

Brown: It’s very much business casing to justify what we’re asking to build. So there’s the initial, “Demonstrate the benefits you want, and we’ll give you the money,” but then there needs to be transparency in performance tracking: Whether that’s revenue, efficiency, loyalty, whatever the value measure was: “Can you point to the benefits that you’ve been able to deliver?”.

Shaw: What are the factors that are holding you back? The potential obstacles that keep you awake at night?

Brown: To be honest, I don’t lose sleep over those obstacles. When I’m thinking about where we want to go, I’m not looking locally, I’m looking globally. I’m looking for global upperquartile leaders who are doing this better than we are. And that’s what success looks like for me. And, you know, in many cases, whether it’s open banking or customer adoption of mobile, there’s a variety of reasons why those banks, global banks, are further along than we are.

Shaw: So, who would you put in that category of being further along?

Brown: There’s a number of banks in the UK and Scotland that are both full-service banks but also neobanks. Starling’s one that I look at — Bank of Scotland — there’s a number of global banks that I look to for inspiration. I hate to say this because it makes it seem like we’ve done the easy part — it wasn’t easy at the time — but if you compare it to the next tranche of transformation, we did the easy part,

right? We’ve transformed the ways of working. We’ve transformed the UI or the glass. We’ve gone just below the skin. We’re not at the real core yet of where the transformation gets really difficult, where you start touching those legacy platforms that have been around for decades — how you build for speed and efficiency and automation. And so that’s the stuff that I worry about. That’s where we need to go, and how do we get everyone organized around getting there? Because that is the burning platform. They need to be really bold moves for the bank. We need to take a pretty aggressive approach to getting there and doing that in a thoughtful way. And it’s hard because like everyone else we’re figuring it out as we go. Migration to the cloud is not easy.

Shaw: Talking about the next tranche of transformation, is the future of banking what’s going on in China today, which is mobile-first, cashless, cardless, embedded in everybody’s life, nobody’s thinking about it, it’s just a utility service, available at any time, on non-bank platforms?

Brown: Certainly, if I think about payments, in particular, they’re definitely at the forefront there. You look at India as well as another market where there’s a lot of innovation as it relates to payments. Embedded finance, which I think is really what you’re describing, is certainly the future. And if anyone’s used Apple Pay, you can just see where that’s going - moving away from passwords, moving away from having to verify yourself in a million different channels, moving away from having to enter your credit card details every time you want to pay something, that’s all friction, right? It’s all friction. And if it could be removed and avoided, you would just create a much better experience, and it still would be a very secure experience. So I like the future you’ve described. It sounds pretty cool.

Shaw: Ten years from now what does the banking experience look like for the average person?

Brown: The obstacles or pain points have all been removed. We’ve taken most of the friction out of the experience. I think customers are going to have a lot more choice. I think we’re going to give them better experiences. And generally, I think we’re going to be using our data in a more impactful way to guide them.

Shaw: Well, I’ve got through this interview without once asking about Bitcoin or cryptocurrency.

Brown: Well, thank you for that!

1. Goeasy is an alternative lender that provides non-prime leasing and lending services through its easyfinancial, easyhome and LendCare brands.

2. BMO’s Chief Digital Officer is Mathew Mehrotra.

3. Open banking is a regulatory framework that allows for the safe transmission of financial information, such as account and transaction data, between institutions and to authorized third parties. It is not yet available in Canada.

// 16 ❱ DMN.CA MAY 2023

INSIGHT

The Millennial Comeback – Effective Marketing Strategies for Stronger Reach and ROI

BY SCOTT MITCHELL

illennials –they were media and marketers’ favourite generation to talk about in the early 2010s; however, with the Gen Z population growing up and developing their own unique characteristics, millennials can sometimes be overlooked.

Despite the shiny appeal of the up-and-coming Gen Zs, now is the time to service your millennial audience as they account for the largest share of the working-age population and will one day overcome boomers in spending power.

By establishing an understanding of this audience’s priorities and behaviours, brands can effectively target millennial consumers and foster brand loyalty for years to come.

Millennials on the move: motivations and patterns

Understanding what drives a population is key to properly engaging with them. Recent headlines have prompted many discussions around what drives millennials, including the future of work, retirement and of course, the ongoing impacts of inflation. These concerns not only impact their spending habits but also their day-to-day patterns, which should in turn inform marketing efforts.

Jokes aside about the “lazy and entitled” millennials — research has found that younger generations, such as millennials, are more educated and diverse than their predecessors — they are also earning more money than baby boomers and Gen X-ers did at the same age. Why does this

Mmatter? Remember, millennials also make up the majority share of the working-age population — making them an extremely important audience to win over.

Further, studies have found that millennials are the most loyal generation, with around 50 percent saying they are extremely loyal or quite loyal to their favourite brands. On one hand, this is great, there is an opportunity to foster long-standing loyal customers. On the flip side, 50 percent of the population is also potentially primed to shift, meaning brands need to be consistently updating and catering marketing efforts to maintain their customer base.

So…what’s the best approach for targeting?

Similarly to other generations, authenticity and contextually relevant messaging should be a priority for brands looking to better engage with millennials. Especially in today’s current economic climate, Canadians may relate better to ads with price-conscious messaging. As data continues to drive audience targeting, brands have been able to execute more sophisticated marketing campaigns with advanced programmatic advertising capabilities including automation, privacy-safe data tactics, measurement solutions and cross-channel retargeting. Keeping that in mind, there are a few digital out-of-home (DOOH) tactics that are standouts for engaging with the millennial population.

Mobile extension and proximity targeting

It is probably no surprise that 9 out of 10 millennials have a

smartphone or that Canadian millennials use mobile to navigate nearly every aspect of their lives, from instant messaging to online shopping. With that, DOOH and mobile extensions can be powerful in reaching mass on-the-go audiences as they move throughout the day.

Proximity targeting is a key approach for brands working to gain market share and/or drive in-store purchases from nearby consumers. Geofencing the locations — whether that be brickand-mortar locations, competitor locations, etc. — enables marketers to re-engage audiences surrounding priority points of interest (POIs) on their mobile devices.

This approach can build additional touchpoints with target individuals who are likely to have already seen the ad. This extends the reach of a campaign while driving home a call-to-action that guides consumers through the purchase funnel.

Personalization with dynamic creative

As ad tech evolves, so do the expectations of consumers. More and more, consumers are not only enjoying but expecting to receive personalized ads. In fact, millennial brand loyalty increases by 28 percent if they receive personalized communication. How can marketers achieve this? Dynamic

creative optimization leverages data to inform specific elements and triggers, which can unlock a new way of engaging with customers. These capabilities enable brands to serve the most relevant ad content to DOOH viewers with no manual work or creative variations required. These activations can range from directions to a store to limited-time offers — all with a focus on hyper-relevant and localized messaging.

Evaluating successes to direct future campaigns

It is critical to set KPIs at the beginning of a campaign to measure its successes following the flight. By evaluating this data, and assessing which approach performed best, brands will have a guidepost for how they can pivot creative and tactics in future millennial-focused campaigns.

Taking the time to understand audience behaviours and leveraging the DOOH capabilities outlined here will enable marketers to create robust omnichannel strategies and enhance brand awareness, purchase intent and/or foot traffic with the millennial population.

SCOTT MITCHELL is the managing director, Canada of Vistar Media. They have built a complete end-to-end programmatic ecosystem to enable data-driven, automated, and measurable DOOH transactions.

// 17 DMN.CA ❰ MAY 2023

STRATEGY

ISTOCK/ KAR-TR

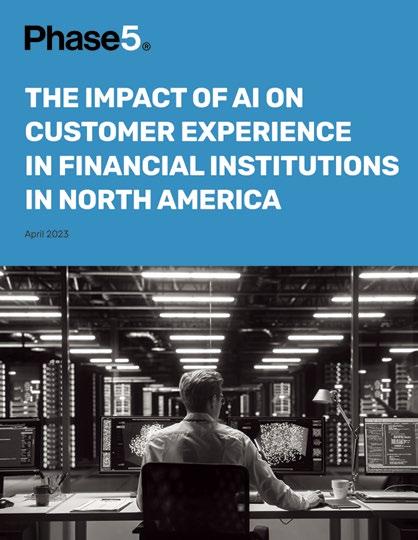

The Impact of AI on Customer Experience in Financial Institutions in North America

BY ARNIE GUHA

BY ARNIE GUHA

The rapid development of AI technology has significantly impacted various industries, including financial services. In the financial sector, AI has the potential to revolutionize customer experience by providing personalized, efficient, and costeffective services. The adoption of AI technology can also help financial institutions remain competitive and enhance their customer base. Through our work at Phase 5, we have seen several success stories as well as untapped opportunities.

One of the significant advantages of AI in the financial sector is providing personalized financial products and recommendations.

Financial institutions can analyze customer data and offer tailored solutions based on a customer’s specific needs, goals, and financial situation. For instance, banks can use AI-powered chatbots to

provide personalized financial advice and automate investment recommendations. This not only enhances the customer experience but also improves financial outcomes for customers. Moreover, AI can help to make financial products more accessible and affordable to customers. By automating certain processes, such as underwriting and risk assessment, financial institutions can reduce the costs associated with offering financial products, allowing them to offer products at a lower cost to customers. This can be particularly beneficial to underserved populations that may not have access to traditional banking services.

Intelligent automation, which includes artificial intelligence (AI), business process management (BPM), and robotic process automation (RPA) can significantly improve the efficiency of financial

institutions while reducing costs. By automating routine and repetitive tasks, such as data entry and customer service, staff can focus on higher-value tasks, such as analyzing data and providing personalized recommendations to customers. This results in a better customer experience as staff can provide more time and attention to customers. It also reduces operational costs for financial institutions. In addition, intelligent automation can help improve compliance and regulatory reporting, reducing the risk of non-compliance and associated penalties. AI can also help financial institutions identify and respond to potential issues and threats, such as fraud and security breaches, in real time, improving security and protecting customer data.

In addition to providing 24/7 customer support and reducing wait times, AI can also automate

loan and mortgage applications, reducing the time and effort required from both customers and bank staff. By using AI algorithms to analyze financial and personal data, financial institutions can make lending decisions in real time, providing customers with faster and more convenient loan approvals. During the COVID-19 pandemic, TD Bank deployed AI technology to assist customers by launching digital nudges to those who were more likely to be financially vulnerable. The AI system used more than 100 variables, including account balance and transaction patterns, to identify customers who could benefit from financial relief and support programs. These customers received nudges directing them to TD’s COVID-19 support page and government resources. The bank is now fully integrating AI within its app

// 18 ❱ DMN.CA MAY 2023

TECHNOLOGY

to provide customers with a personalized experience based on their transaction patterns.

The use of AI in financial services does raise important ethical considerations, particularly around issues of privacy and bias. Financial institutions must ensure that they are transparent in how they collect and use customer data and that they are not discriminating against certain groups of customers based on factors such as race, gender, or age. Additionally, financial institutions must ensure that AI algorithms are not perpetuating or amplifying existing biases in financial decision-making, such as systemic discrimination against certain groups. The potential risks associated with biased or discriminatory AI algorithms can have far-reaching consequences for a company’s reputation, regulatory compliance, and legal liabilities.

To address these risks, companies must develop and implement clear ethical guidelines for their AI systems, starting from the earliest stages of development. This includes implementing mechanisms for transparency and explainability of AI decisionmaking, as well as establishing independent oversight and accountability structures to ensure compliance with ethical standards. By prioritizing ethical AI practices, companies can not only mitigate risks but also build trust with customers, regulators, and the broader public.

AI has the potential to transform the customer experience in financial institutions in North America by providing personalized financial products, improving efficiency, enhancing security and fraud detection, and improving customer service. However, there are important ethical considerations that financial institutions must address to ensure that AI is used in a responsible and equitable manner. By addressing these considerations proactively, financial institutions can enhance customer trust and confidence in AI-powered financial services. Research can help define and assess your customers’ needs and pain points, enabling you to strategically prioritize technological enhancements and intelligently allocate scarce resources for

maximum impact. Contact us to discuss how Phase 5 can support your organization’s journey to customer-centricity through the informed and responsible application of AI capabilities.

For additional information, please visit www.phase-5.com

services and they don’t see any savings passed on to them,” says Arnie. As he sees it, the banks have not really explained the fact that technology costs money. Or how the same technical infrastructure might support transactions across multiple channels: for instance, when a customer visits

a branch, they deal with human agents who are all working off an online system; but many people don’t see the technology at work, which leads them to make false assumptions about the relative safety of bricks-andmortar transactions, compared to conducting the same transactions

Canadian Success Stories

The use of AI within Canadian financial institutions hovers around 30 to 35 percent. In the USA, it’s more than double this figure. There is no doubt that Canadian banks tend to be a bit more conservative than the US. However, there are some truly innovative things happening within Canadian banks that enhance CX.

Scotiabank was recognized as the Best AI Initiative globally by The Digital Banker‘s Global Retail Banking Innovation Awards 2021.

An Interview with Arnie Guha

- Author

BY MICHAEL BROOKE

The report that you’ve just read opens up an enormous amount of questions. I had the opportunity to interview its author, Arnie Guha. My first question surrounded the subject matter — “Why banks?”

As Arnie explains, “The reason I chose banks was that there are two types of institutions that touch almost everyone in modern society. One is the various levels of government and the other is financial institutions. No matter who you are or what you do, these two institutions will have some effect on your life.”

Most Canadians have a curious relationship with their banks.

“There really are very different perceptions about banks when we compare the US to Canada. The Schedule One banks in Canada have a very high level of trust.

The US is, of course, a different story. Even so, people in Canada do like to complain about banks. One of their biggest complaints is ‘Why are you charging me when you are keeping my money?’”

Customers are concerned when a branch shuts down because they perceive the bank is reducing costs by cutting staff. “They see the reduction in bricks-and-mortar costs but don’t see the cost of employing technology to provide