Wednesday, November 26, 2025

Wednesday, November 26, 2025

Format

Assumptions

Reserves

Capital projects

Expenditures

Assessment

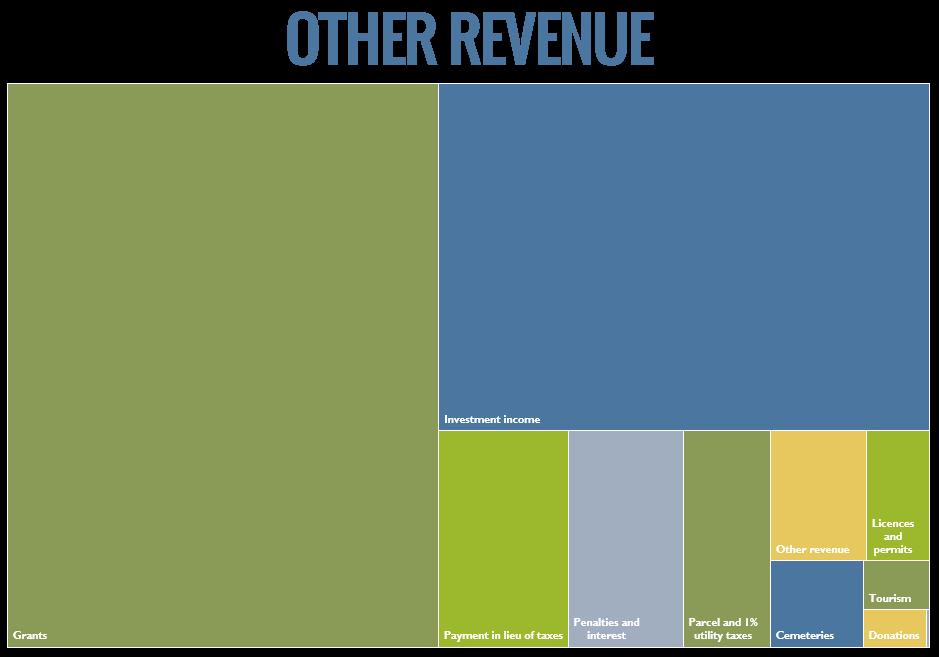

Revenue

Property tax impact

Wrap up

Any additional questions

Wages increase as per collective agreement

Construction inflation – 5%

Overall inflation rate for 2026 – 3%

Community Charter defines requirements

Must set out:

◦ Objectives and policies of the municipality

◦ Proposed expenditures funding sources and transfer of funds

◦ The total of the proposed expenditures and transfers to other funds for a year must not exceed the total of the proposed funding sources and transfers from other funds for the year

◦ To break out the revenue by source

◦ The Financial Plan must disclose the proposed expenditures for the year, and this must not exceed the proposed funding sources for the year

(a) The District will review fees/charges annually to ensure that they keep pace with changes in the cost-of-living as well as changes in the methods or levels of service delivery;

(b) The District will actively pursue alternative revenue sources to help minimize property taxes;

(c) The District will consider market rates and charges levied by other public and private organizations for similar services in establishing rates, fees and charges;

(d) The District will establish cost recovery policies for fee-supported services.The Policies will consider whether the benefits received from the service are public and/or private;

(e) The District will establish cost recovery policies for services provided for other levels of government;

(f) General Revenues will not be dedicated for specific purposes, unless required by law or Canadian Public Sector Accounting Standards; and

(g) The District will develop and pursue new and creative partnerships with government, community institutions (churches, schools), and community groups as well as private and non-profit organizations to reduce costs and enhance service to the community.

Accumulated Surplus funds above the 10% guideline shall be used to:

fund capital expenditures or to increase reserves;

pay off capital debt, including internal borrowings;

stabilize District property tax and utility rate increases;

fund other items as Council deems appropriate.

Reserve funds shall be set aside to:

◦ Provide sources of funds for future capital expenditures;

◦ Provide a source of funding for areas of expenditure that fluctuate significantly from year to year (equipment replacement, special building maintenance, etc.);

◦ Protect the District from uncontrollable or unexpected increases in expenditures or unforeseen reductions in revenues, or a combination of the two; and

◦ Provide for working capital to ensure sufficient cash flow to meet the District’s needs throughout the year.

Highlighted

balances in yellow are carried forward from 2025.

Current revenue Grants Gas Tax Reserve

Infrastructure Reserve Growing Communities Reserve Equipment Reserve

Campground Reserve Fire Reserve Other Funding

Long Term Borrowing

Replacement:

Replacement of 2012 CAT Backhoe

Replacement of 2006 Chevrolet 1500

Replacement of 2011 GMC 2500

Funded by -

Vehicle Reserve

Replacement of 20 picnic tables.

Design and planning for paving the entrance to the campground and around the sani-dump.

Funded by: Coquihalla Campground Reserve

RTU #5 was replaced in 2022 and RTU's #1-4 in 2024. At some point in time, ducting was disconnected and removed from the RTU #4 system which has left offices in the basement without climate control.

Funded by –Current Revenue

The District was alerted to periodic water staining on the building's ceiling.The roofing layers must be removed and a new roof installed to prevent further issues.

Funded by –Current Revenue

Convert Memorial Park washroom toilets and fixtures to "no touch" operation.

Funded by –

Current Revenue

Replace 60m2 of degraded concrete surfacing, repair gravel road and dismantle leaning lock block wall and rebuild.

Replace unsafe wooden staircase with new steel staircase.

Funded by –Infrastructure Reserve

ICBC funded an In-service Safety Review of the pedestrian and road infrastructure around the school.

From the report, several improvements have been suggested to increase accessibility and safety.

Funded by –

ICBC Road Safety Grant

Funded by –

Fire Reserve

Purpose –

Replace two Self Contained

Breathing Apparatus (SCBA) and purchase six 4500psi spare carbon-fiber cylinders.

Funded by –

Fire Reserve

The District of Hope Fire Department will undertake a project to provide for equipment growth and storage at Fire Hall 3 (located on Kawkawa Lake Rd.).

In 2026 the land will be cleared and services installed.

Funded by –Fire Reserve

The District of Hope Fire Department is looking to purchase a new washer & dryer that meet NFPA 1851 standards for cleaning and maintaining firefighting gear.

This upgrade is for Hall 1 (located on 3rd Ave in Downtown Hope)

Funded by –

Grant $30,000

Fire Reserve $10,000

SCADA (Supervisory Control and Data Acquisition) is the system that operates and monitors our water and sewer infrastructure. Over the past several years, we have expanded SCADA across the water network and 2026 marks the next phase: integrating our sewer infrastructure to enhance monitoring, data accuracy, and operational efficiency.

Funded by – Current Revenue

The Hope Fire Department will be undertaking standby rescue team duties as required by WorkSafeBC for confined space entry by Operations staff.

Funded by –

Current Revenue

SCADA improvements year on year to keep up with technology.

($100,000)

New Meter Reading Software. Our current software has become outdated and vendor support is no longer provided. ($10,000)

Well #10 Pump and motor failed in 2025 and the spare was used to replace. Well #10 is the only well to supply water to the 138 zone system, a new spare pump is required. ($30,000)

Funded by – Current Revenue

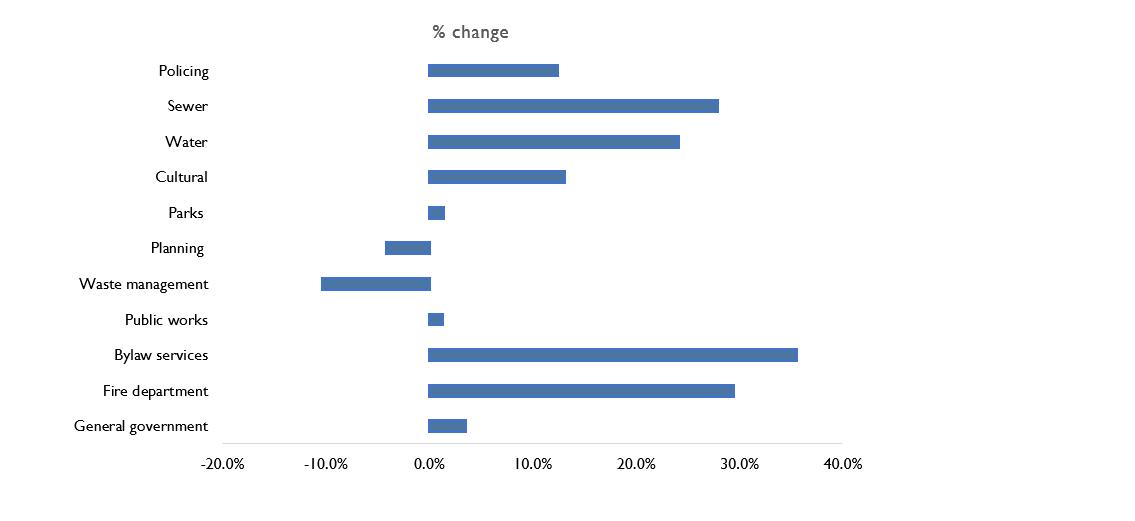

Expenditures

* based on 2025 roll preview (not revised roll totals)

2,500,000,000

2,000,000,000

1,500,000,000

1,000,000,000

500,000,000

DECREASED BY 19.2%

Act as a collector for the following:

◦ FVRD

◦ School Tax

◦ Regional Hospital District

◦ MFA

◦ BC Assessment

Overall property tax rate increase projected for residents is 3.39% excluding the above.

Commercial and industrial projected tax rate increase is 5.39% excluding the above

3.39% property tax rate increase residential

5.39% property tax rate increase commercial and industrial

Policing accounts

◦ for 31.5% of the property tax charged.

◦ Increased by 10.6% over the current year

Pipeline assessment valuation has had a substantial impact on the budget $640,000 (7.82%)

Potential for adjustment to light industrial due to zoning revisions and sales.

Capital budget

◦ Total budget for completion - $10,443,500

$555,500 to be funded from current revenue

Balance to be funded from various means.

◦ Expected expenditure for year - $6,863,500