Drowning in a tech habit?

Coming Soon! The

will test a

about a

to

(CGMA®)

Launching in January 2015, the

by making

and

Take advantage of your experience today. By qualifying as a

and

to advance your

goals. Get your CGMA

designation holder now, you can access CGMA resources immediately. Don’t miss this opportunity to influence business and show the world you have the

today.

this is you, you may have a problem. A tech problem. Learn why it’s important to turn off the tech and

you can create the right balance.

If you’ve ever used your smartphone in the bathroom (and you probably have), you need to take a tech break and reclaim your life.

Hackers use nine tools to access companies’ sensitive data. Learn about each one and how you can prevent an attack.

Plan sponsors are confused about the U.S. Department of Labor’s changing interpretations of the regulation to remit employee deferrals.

The process of paying employees comes with a fair share of emotional strain and financial costs to the business owner.

clients need you after tax season

Beth A. Berk, CPA

Benefit Advisors

Group Advisors

to

of the

the

of

VIRGINIA SOCIETY OF CPAs 4309 Cox Road Glen Allen, VA 23060 (800) 733-8272 Fax: (804) 273-1741 www.vscpa.com

Jill Edmonds

Managing Editor disclosures@vscpa.com

Chip Knighton Contributing Editor cknighton@vscpa.com

Jenny Chu, CAE Marketing & Communications Director jchu@vscpa.com

Joan D. Aaron, CPA

Lindsay S. Andrews, CPA

Adam G. Chaikin, CPA

David L. Cotton, CPA

Gary D. Dittmer, CPA

Elizabeth M. Helle, CPA

Clare K. Levison, CPA

Kevin S. Matthews, CPA David R. Peters, CPA George D. Strudgeon, CPA Barbara C. Sukramani, CPA Thomas L. Visotsky, CPA

Articles and advertising for future issues are due by 5 p.m. on the following dates:

March/April 2015 Jan. 5, 2015

July/Aug. 2015 March 2, 2015

Sept./Oct. 2015 July 6, 2015

Nov./Dec. 2015 Sept. 1, 2015

Jan./Feb. 2016 Nov. 2, 2015

March/April 2016 Jan. 4, 2016

Statements of fact and opinion are made by the authors alone and do not imply an opinion on the part of the officers, members or editorial staff.

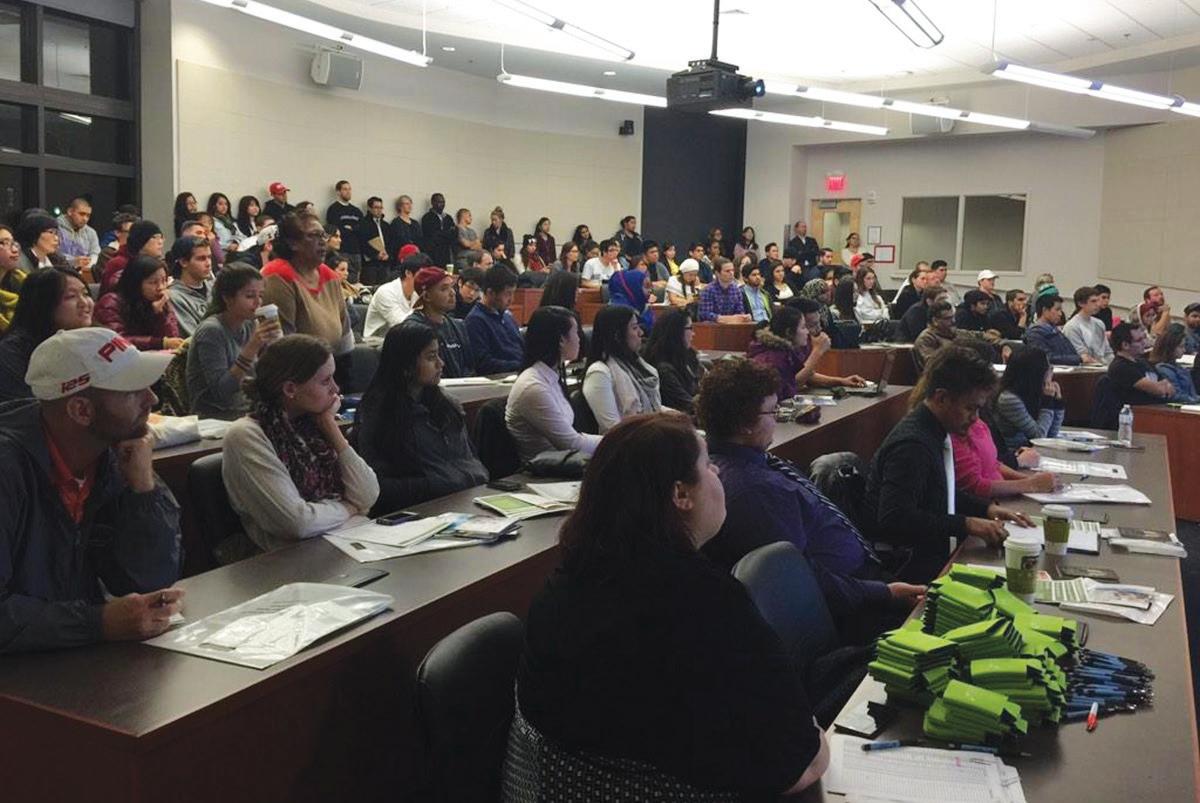

Northern Virginia Community College, Annandale

Loving the energy of this VSCPA Leadership Academy group with Tom Hood, Gretchen Pisano and Molly Walsh @tomhood @gretchenpisano @mwwash @DWSALTER1

Kicking off 2014 VSCPA Leadership Academy with @Colette_Wilson: Some leadership opportunities need to be sought out, others you say yes to. @EKIMOFFCPA

Thank you @ProfMitchell & @vscpa for hosting such an informative seminar. It was very helpful & gave great insight on future accounting! — @TAYBEWAYCRAY

VSCPA member, AICPA Board member & U of R Dean Nancy Bagranoff talks Future_of_Learning to @VBOANews. ow.ly/i/7zBPV — @VSCPAEMWALKER

@johnelder4 helping accountants understand Predictive Analytics pic.twitter.com/YUCLsSvSUt — @RPJOHNSTON

Can’t believe we did the wobble at the professional development conference. #vscpapdc14 #wow @HENRYDAVISCPA

BLOG: www.cpacafe.com

CONNECT: http://connect.vscpa.com

TWITTER: @VSCPANews, @FinancialFit

LINKEDIN: http://tinyurl.com/VSCPALinkedInGroup

FACEBOOK: www.facebook.com/VSCPA INSTAGRAM: www.instagram.com/VSCPA VSCPA ENDORSED PARTNERS

Get in touch At the Virginia Society of CPAs, we love to hear from you. Whether it’s a quick email to a staff member, chat on the phone, Disclosures letter to the editor, tweet, blog comment or something different altogether, let us know what you’re talking about, how you feel about different issues affecting CPAs and how we can help.

The VSCPA’s Accounting & Auditing (A&A) Advisory Committee has been hard at work protecting your interests and sifting through all the proposals coming from the major standard-setting bodies. The committee has issued eight comment letters since the fiscal year began May 1 and six since September, with most focusing on exposure drafts from the Financial Accounting Standards Board (FASB).

Since 2013, the Virginia Department of Taxation (TAX) has only issued state income tax refunds via direct deposit or on a prepaid debit card, eliminating the option of receiving a paper check. This mandate, intended as a cost savings measure for TAX, has proven unpopular, and the VSCPA is involved in the charge to repeal it in the 2015 Virginia General Assembly session, which begins Jan. 14.

Repealing the mandate would have positive effects for taxpayers, restoring the simpler paper check option for citizens. Some taxpayers have forgotten about their debit cards and incurred fees for inactivity. Some practitioners have advised their clients adjust their withholding to owe money on their return instead of taking a refund.

House Finance Committee Chair Lee Ware (R-Powhatan) introduced the bill, which has the VSCPA’s support. The bill would have a delayed effective date of Jan. 1, 2016, to allow TAX to adjust its systems without causing problems for the 2014 filing season.

In other issues, the annual tax conformity bill is in something of a holding pattern as Virginia waits for Congress to pass tax extenders legislation. If Congress passes an extenders bill during the lame-duck session, it’s likely that conformity legislation will be introduced in the General Assembly.

Stay tuned to the “Advocacy” section of www.vscpa.com for updates. n

Recent topics the A&A Committee has covered include:

>> The Governmental Accounting Standards Board’s proposals on accounting for non-trust administered pension plans and other post-employment benefits

>> FASB’s proposal to simplify inventory measurement

>> FASB’s proposal to eliminate extraordinary items from U.S. Generally Accepted Accounting Principles

>> FASB’s proposal on accounting for fees paid in a cloud computing arrangement

Visit www.vscpa.com/Standards to view all responses to proposals regarding professional issues from the A&A Committee and the VSCPA’s other technical committees, as well as comment letters from the VSCPA itself. n

Ensuring you are adequately complying with document retention policies is important as a CPA. Good thing there’s a quick guide from the American Institute of CPAs (AICPA) to help you develop and maintain your policies.

Developed by the AICPA Tax Practice Improvement Committee Working Group on Document Retention, the guide includes U.S. Internal Revenue Service requirements, a sample document retention policy, retention periods for different types of documents and more. Download it at www.vscpa.com/ DocumentRetention. n

The results are in from the AICPA PCPS/TSCPA 2014 National Management of an Accounting Practice (MAP) Survey, featuring input from 49 Virginia firms and 450 firms across the South. The survey was conducted by the American Institute of CPAs (AICPA) Private Companies Practice Section (PCPS) and the Texas Society of CPAs.

Virginia firms are ahead of the curve on succession planning, with 27 percent having either a written and approved succession plan or practice continuation agreement with another firm, compared to 13 percent regionally. Nearly one-third of Virginia firms reported a written partnership agreement.

Virginia firms also bill slightly higher than their regional counterparts at all levels of the org chart and offer health insurance at a slightly lower rate. And Virginia firms are much more likely to use cloud-based remote backups and servers than other firms in the South.

View a complete report on the survey results at www.vscpa.com/ 2014MAPSurvey. n

The Virginia Board of Accountancy (VBOA) has approved changes to its policy regarding the Virginia-specific Ethics course, a 2-hour annual CPE requirement.

At its April 30, 2014, meeting, the VBOA voted to name the VSCPA the provider of content for the Virginia-specific Ethics course. The decision was based on a recommendation from the VBOA’s Ethics committee, which is made up of VSCPA members and nonmembers. The VBOA believes it’s in the best interest of the profession and the public to ensure that all Virginia CPAs receive accurate, consistent and high-quality education. The VBOA cited the following factors in making the decision:

>> Failure to take a qualifying Ethics course is the most frequent CPE deficiency of Virginia CPAs.

>> By selecting a content provider, Virginia CPAs will have confidence knowing the Virginia-specific Ethics course will qualify for the VBOA requirement.

>> The Office of the Commonwealth’s Attorney General determined that it is within the VBOA’s authority to limit content providers of the ethics course.

>> As the largest provider of the Virginia-specific Ethics course, VSCPA Ethics content is already widely utilized and accessible.

>> The VSCPA has multiple member authors and staff involved in the development of the Ethics course content to ensure accuracy.

>> The VSCPA attends all VBOA meetings, is engaged in their processes and activities and is well versed and current on VBOA rules and regulations.

VSCPA leadership has been fully engaged with the VBOA during this process and will continue to do so to provide the best Ethics course to Virginia’s CPAs. The VSCPA is committed to continuing to provide a high-quality Ethics course with statewide reach and multiple delivery options, and to providing that course at a fair price in all delivery modes. The VSCPA’s content will also be available to other organizations, who may use an instructor of their choice that meets VBOA sponsor requirements. Visit www.vscpa.com/EthicsFAQ for more information on the VBOA’s decision, the VSCPA’s role and updates on the Ethics course.

If you have any questions about this decision or licensing requirements, please contact VBOA Director of Operations Mary Charity at (804) 367-0495 or mary.charity@boa.virginia.gov. You can reach the VSCPA Education Team at cpe@vscpa.com or (800) 341-8189. n

Change is constant for accounting firms, so Wolters Kluwer, CCH, conducted a survey to discern the most important trends over the next five years. Its 2014 Accounting Firm Preparedness Survey found that only one in five participants feel “very prepared” to take advantage of the most significant trends. Here’s what you should set your sights on in the near future:

1. Increased focus on client service — Wolters Kluwer says today’s model for client service is a “continuous loop of client engagement opportunities.” Survey participants that ranked very prepared for the future are planning to use technological advances to help them interact with clients.

2. Technology integration — Challenges related to technology integration “include making sound and strategic investments in technology that help the firm today, while providing a smooth migration and integration path to new and emerging technologies.”

3. Digital mobility — Very prepared firms are not only increasing their digital platforms, they are moving more of their business online, which can increase client service and also boost employee productivity.

4. Talent management and succession planning — Managing talent goes beyond hiring the right people; you must also leverage the skills of the people you already have. Additionally, “among smaller firms with less than 25 employees, roughly 70 percent do not have any type of succession plan in place.”

5. Social media as a business tool — Sixty-nine percent of very prepared firms are using social media for client service, collaboration or communication, which in turn increases client satisfaction.

Want more? Scan the QR code with your smartphone or visit www.cchgroup.com/ PreparednessSurvey to access the whitepaper. n

A co-worker of mine created a cool Excel file that he uses for the foundation of all his workpapers. It is great because it produces standardization across his documentation and he never has to worry about not including one of the required elements. So that he can quickly access this file, I recommended that he save it as a template. As a template saved in the right location, it will come up as an option each time he creates a new file. All files he creates from this template will start with the exact same content and formatting throughout. To set it up as a template, all he had to do was save a copy of his file as an Excel Template file with the .xltx extension at: C\Users\[HIS.NAME]\Documents\Custom Office Templates\. The next time he wants to start with his personalized template, he only needs to click on: File New PERSONAL. The same concept applies to Word and PowerPoint should your office want everyone to apply consistent formatting to support its branding efforts. n

GEORGE D. STRUDGEON, CPA, CGFM, is an audit director at the Virginia Auditor of Public Accounts in Richmond. He is a member of the Disclosures Editorial Task Force. Email him if you have Excel topics you want him to cover. george.strudgeon@gmail.com connect.vscpa.com/GeorgeStrudgeon

Active CPAs, listen up! If you are not yet aware of the changes to Virginia CPA license statuses, the Virginia Board of Accountancy (VBOA) has a new status for active CPAs: “Active — CPE Exempt.” Also, “Expired — Late Renewal” has been renamed “Active — Renewal Fee Delinquent.” What does this mean for you? Do you fall under one of these statuses? Find out now at http:// tinyurl.com/VBOALicenseStatuses. n

Between 2002 and 2007, Virginia lost more than 200,000 ACRES of forest, farm and other rural land to development. A conservation movement to protect land, which includes Land Preservation Tax Credits, has had results. As of August 2013, more than 3.84 MILLION ACRES of open space, parks, historic lands, natural areas, forests, farms and other lands have been preserved. The below chart is from the Virginia Department of Conservation and Recreation’s Conservation Lands Database.

Just how bad are phone scammers pretending to be the U.S. Internal Revenue Service (IRS) demanding payment? Believe it or not, the Treasury Inspector General for Tax Administration continues to receive complaints — 90,000 to date. So far, they have identified 1,100 VICTIMS who have lost an estimated $5 MILLION

The IRS repeats its warnings not to fall for these scams, so tell your clients: The first contact the IRS will make with you for payment is via official mail correspondence, not from a phone call. n

When it comes to margins, accounting is the most profitable, according to Sageworks. In a ranking of the financial data from private companies, Sageworks found that accounting, tax preparation, bookkeeping and payroll services had the highest profit margin of all industries — 19.8 PERCENT n

The record payout by the U.S. Securities & Exchange Commission (SEC) for a whistleblower tip, paid in 2014 to a whistleblower overseas who alerted the SEC to an ongoing fraud. Last year, the SEC received its highest number of tips since the program was implemented three years ago — 3,500. Nine whistleblowers received awards. n

The IRS does not make phone calls

The annual tax filing ritual is not the only time a client may interact with the U.S. Internal Revenue Service (IRS) — recent trends show that your clients are more likely than ever to have an issue come up after filing. And the truth is, clients often don’t call their tax professional right away when they have a post-filing tax issue or notice.

As your clients’ trusted advisor, it’s best to get ahead of this trend and communicate with your clients about tax compliance. Here are five reasons your clients may need you for more than just filing.

More clients are having trouble paying their taxes each year.

For 2011 returns, 23.7 million taxpayers filed a return with a balance due, and 3.7 million needed to make payment arrangements with the IRS. The U.S. Government Accountability Office reported in 2011 that 16.5 million taxpayers owe the IRS back taxes. Depending on how your clients fared in the economic slowdown, you may need to help someone who can’t pay the IRS.

The IRS is making a concerted effort to find and penalize inaccurate tax returns.

The IRS has a lot of potentially inaccurate returns to pursue. According to government data, 24 million of the 143 million individual tax returns filed for tax year 2010 did not match information statements on file with the IRS. That’s one out of six returns with potential underreporting that the IRS would like to see reconciled. However, in 2013, the IRS sent notices to only 4.1 million of these taxpayers. As the IRS moves to more automated compliance tools, expect your clients to receive more notices regarding discrepancies.

There could be many reasons for an underreporter notice, including IRS error. In

fact, many underreporter notices are resolved with no change to the return. One out of six individuals will face this potential issue, and even more small businesses. Your clients should understand that an underreporter notice may not always indicate an error, and that you can help get to the bottom of the issue.

You should also let your clients know that you can provide expert help to resolve any penalties resulting from an underreporter inquiry. This is important because the IRS is increasing its use of penalties to deter underreporting. From 2005 to 2013, the number of accuracy penalties the IRS assessed on inaccurate individual tax returns increased 1,154 percent.

The Affordable Care Act (ACA) will require non-filers to file.

In 2012, the IRS found 7.4 million potential non-filers for tax year 2010, and sent only 3.2 million notices to those taxpayers. In the past, the IRS had less incentive to pursue many of these non-filers, who potentially owed only a small balance. However, because the ACA will require taxpayers to reconcile premium subsidies and report insurance coverage, the IRS will question more of these non-filers. These taxpayers will be looking for expert help to file.

Clients need expert help in an audit, because the odds are in favor of the IRS. If your client gets audited, the IRS thinks the return needs an adjustment. Of the 1.56 million audits in 2013, the IRS made changes to almost 90 percent of the individual returns examined and 70 percent of the corporate returns examined. Overall, when the IRS completes an audit, individual taxpayers are left with an average bill of more than $16,000 per year examined in a field audit, and $8,000 per year examined in a mail audit.

The IRS will continue to develop better technology to reach more taxpayers — by mail.

Despite losing 18 days to employee furlough and $600 million in budget in 2013, the IRS slightly increased its compliance revenue from $50 billion in 2012 to $53 billion in 2013. With fewer people and reduced resources, the IRS has maintained its volume of compliance activity through correspondence. Scaling compliance activity by mail makes great business sense for the IRS. For example, document-matching audit notices have a 20-to-1 return on investment, compared with face-to-face audits, which have a 4-to-1 return on investment. Despite struggling with resource constraints, IRS compliance activity is still strong, because compliance by mail covers more taxpayers at less cost.

Helping your clients with tax compliance is about more than filing their required tax returns. Data shows that helping them after they file is significant, and that your clients will need your expertise in dealing with the IRS. Let your clients know that they are more likely than ever to get contacted by the IRS. And most importantly, let them know that you’re the first person they should call to get expert help. n

JIM BUTTONOW, CPA, CITP, of Greensboro, N.C., is an author and instructor in the field of tax controversy. He has 27 years of experience in IRS practice and procedure.

Reprinted from rwc360. This article originally appeared in the AICPA CPA Insider™ e-newsletter.

Few phrases have entered business speak that have been more overused than the term “work-life balance” (WLB). However, WLB sits at the core of our daily lives as a thing we strive for when approaching the self and family versus career.

The essence of WLB recognizes that individuals have needs in their personal and private lives that, when met, can increase employee satisfaction and productivity or, when unmet, increase burnout, resentment and workforce churn. How do we approach WLB so that it’s meaningful and not the punchline to a sordid joke?

I liken WLB to so many other things in life (food, alcohol, exercise) — when done in moderation, it can be fruitful, but in excess can be harmful. Striving to have a balance between what you give to an organization (your work) and what you get from the organization (your life outside the office) is crucial to your happiness and well-being.

Consider the attributes of work — it requires commitment, involves deadlines and challenges to your ability to multitask, work with different personalities and compete with those around you for achievement and advancement. These things all create a certain amount of stress. And while some stress can be productive, too much of it can be destructive to your career, personal relationships and health. The answer is moderation.

Despite our attempts to challenge the time continuum, there are only 24 hours in the day. At the start of a WLB initiative, we can consider the things we need in our lives. We need to work to support ourselves and our families, we need to spend time with our families and also have time to ourselves for enjoyment. And finally, we need to sleep. An idealistic scenario would be to split the day

in thirds: eight hours of work, eight hours of family time or enjoyment and eight hours of precious sleep. Idealistic is right! Hardly anyone actually experiences this in real life. If you do, consider yourself very lucky.

Realistic WLB needs to include commuting and traffic, cooking and cleaning, family schedules, exercise, volunteering, shopping, etc. So, a more realistic split of time looks something like 12–14 hours of doing things for other people, including family, and 8–10 hours for self — including sleep, exercise and enjoyment. Unfortunately, this is not a regimen that can keep you happy or healthy. Further, the presence of smartphones in our daily lives makes the balance tilt even more egregiously towards work and less for oneself.

Think of how remarkable that metric is. Most people have 10 hours or less per day to do things they enjoy and sleep. Considering that it is recommended that we get about eight hours of sleep a night, this is not set up for much fun in anyone’s life.

To encourage WLB, organizations have created flexible work schedules and provided all forms of mobile technology. However, most flexible workers do not know where to draw the line and create balance.

I have often asked people with flexible work schedules if they feel they work more or less than their colleagues in the office. In most of the cases, people say yes. I have heard a variety of reasons. “It’s important that my peers know that even though I am working from home, I am still working.” “I feel I need to over-

compensate for work to continue to earn the privilege to work remotely.” “I don’t want to lose a step to the competition.”

Fancy that! The organization gives us flexibility, however, the knee-jerk response is to work harder to maintain that flexibility.

I have also asked people if the provision of a smartphone has made them more productive. The answer is a resounding yes. However, if you listen closely to the answers, you hear the truth. “I am more productive because I can be reached wherever and whenever someone needs me.” “I can expeditiously resolve issues, even when I am away from my computer.”

“My people can find me anytime and get the answer they need!”

Again, a solution has been provided to make work better, but in practice, it undermines the boundaries you have between work and your outside life. Time for a reality check again. Carrying a smartphone is now a way of life in business and professional careers. It would be foolish to think that we can reject the notion of using smart devices and remain competitive in the workplace. Business is now rapidly moving on a global basis. If you manage staff in other time zones, it is important for them to reach you directly and a smart device is the best way to do that.

The question then becomes: How do you create realistic limits on devices so that you can strive for moderation? u

If you are like me, you have had situations when you have regretted not making boundaries with your smart device. Have you ever been:

>> In a house of worship when your phone rang?

>> In a movie theater when you had to text a response to a question?

>> At the breakfast table and asked your child to repeat a question because you were distracted by a message on your phone?

>> Interrupted a special family event, perhaps a dinner, to take an important business call?

>> Asked by your partner or child to put the device away?

These have all happened to me, and I sense that you too are grimacing and agreeing that this happens all too often. I have had these challenges for much of my professional career, having been required to always be accessible from an early point. Now the discomfort or the embarrassment has helped me try harder and do better.

>> Unless you are a surgeon, it’s likely not a life-or-death situation.

>> The times you need to focus on your partner or children should always take priority over work.

>> Only you can take control of this situation and it is important so you do not alienate those around you.

Smartphones are truly exceptional devices. Never in history have you been able to have such a concentrated source of breaking news and relevant information at your fingertips. And the thrill or excitement associated with being completely in the know, and current on all events, is addictive. After all, in the digital age, it is not what you know, but when you know it.

“An obsessive use of smartphones has yet to be formally recognized as a medical disorder, though psychiatrists in Singapore have been pushing for such a classification. But research has shown that people who do not have their smartphones with them become anxious not only because of their separation from online contacts but also out of a fear of losing the device.”1

The ability to have all of these data sources merged on a single platform is truly spectacular. It allows you to mainline data right into your central nervous system. However, like any addiction, it is not without a cost.

Consider the physiological response when managing your smart device. Your brain has to perpetually switch the contexts between

a huge number of items: text messages, instant messages, work email, personal email, breaking news, social media (Facebook, Twitter, Instagram, Pinterest, LinkedIn), realtime stock data, weather, etc. What a rush you can get knowing, in one minute, that there is a 60 percent chance of rain this afternoon, mom arrived home safely, David has new Facebook pictures posted, your last tweet was re-tweeted 15 times, your profile on LinkedIn was just looked at by a prospective client and you’re late for hockey practice! And what a physiological response it is, with adrenaline coursing through your veins, an elevated heart rate, extreme focus and concentration and even sweaty palms. But for what? What has elicited the fight-or-flight response? Nothing. This is life. And this is where the danger comes in.

When you think of this response each time you interact with the device, and in this case nothing serious needed to be dealt with, consider the body’s reaction to a real stressor. Then the response is an intense feeling of stress. And that prolonged stress on the body is not healthy for anyone.

Are you guilty of using your smartphone in the bathroom? Don’t lie. Of course you have. Has it really come down to the fact that we can’t spare two minutes to relieve ourselves? The one thing left in the world that should not require multi-tasking now does.

Are you someone who uses their smart device or tablet right up until bedtime? And then uses the device as an alarm clock?

Have you woken up in the middle of the night to check if you have received something during the night?

Is it clear to see that these devices are now permeating parts of our lives that should be left unmolested?

Are you guilty of using your smartphone in the bathroom? Don’t lie. Of course you have.

“Meetings and meals are social gatherings, not social media freefor-alls. Be present and aware of the people you are with physically. Just because your phone alerts you a message is waiting doesn't mean you have to interrupt a conversation to respond.”2

I recently was shopping in a home goods store and saw a special pillow made to prop up your tablet for in-bed reading. I grimaced and moved on. That is the last place that you need to use your tablet.

The best advice I have heard for dealing with boundary issues and not letting your smart device disrupt your WLB, is to set limits. There are two important parts to setting limits: letting people know what they are and adhering to them.

Limit your availability from 24/7 to something more reasonable. You may inform your coworkers that you are available from 8 a.m. – 8 p.m. each day and that any messages left after 8 p.m. will be responded to the next day. You should also tell your coworkers the types of things you need to be contacted about after hours. Widespread systems outage of your e-commerce system — urgent. Your coworker’s daughter has a slight fever and he needs to work from home — not as urgent. Your coworker just sent you the cutest cat video — no comment. Set realistic expectations of your response times within and outside of office hours. Use the quiettime or do-not-disturb setting to prevent interruptions after hours.

Adhering to your own limits is the only way for coworkers to understand you’re serious about having them. If you tell people not to

expect a callback after 8 p.m. and you respond to calls at 10 p.m. anyway, they won’t respect your boundaries. Also, letting people know that you appreciate you not being disturbed after hours reinforces good behavior.

Another way to enforce limits and resist temptation is to just put the device away. Try to wean yourself off the device slowly. Like other addictions, cold turkey is a hard way to go. So first, start putting the device away 30 minutes before bed, then an hour, and so on. Also, if possible, try not to use the device as an alarm clock or have it on the bedside table. Continue the smart device etiquette by not having that be the first thing you look at in the morning. It is surely a way to get off to a very stressful start. Give yourself 45 minutes to an hour of awake time before checking your email or phone messages.

If you have children, providing an example of good phone etiquette is important. When I received a hand-written message from my 10-year-old that was a simulated text message (Hola, IDK what’s for dinner, went to walk Daisy, BRB, TTYL), I knew we needed to talk. Don’t use your phone in the car, regardless of the urgency. It is important for kids to see you not text and drive. And most of all, have them see you put it away, so you can focus on them.

You can make a world of difference in your

life by recognizing the impact that your smart device has on your WLB. Start by making small changes. The rush associated with information all the time anywhere is very enticing. Recognize the impact it is having on your relationships and your health (i.e. sleep patterns). Set reasonable limits and stick to them. And finally, if not for yourself, do it for your partner or your children. They will enjoy having your undivided attention again. n

1. www.huffingtonpost.com/2014/10/17/smartphone-addiction-statistics_n_5996062.html

2. www.inc.com/kevin-daum/10-critical-rules-ofsmartphone-etiquette.html

ADAM CHAIKIN, CPA/CITP, CGMA, is founder and principal of Thought2 Execution LLC, a Virginiabased consulting firm specializing in finance, project management and ERP systems implementations.

Adam.Chaikin@Thought2Execution.com connect.vscpa.com/AdamChaikin linkedin.com/in/adamgchaikin @Thought2Execute

The theft of sensitive data at your company could cost you. How to Avoid a Hacker’s Attack

In 2013, the American Institute of CPAs (AICPA) listed theft of sensitive data as the fourth top cybercrime. Database security breaches have caused a huge amount of damage to companies across the United States. As companies rely more and more on the Internet to conduct business, company data is more and more susceptible to hackers. It is crucial for every company to prevent damage from data breaches.

Hackers use the following nine tools to access companies’ sensitive data.

This attack tool scans through large numbers of computer systems and searches for hosts that have a vulnerability or set of vulnerabilities. Once the mass rooter detects a vulnerable host, it will try to attack the system and later be notified on whether or not the attack was successful. Mass rooters are available within the public domain. To prevent this type of attack, make sure your computer systems are up to date. Also, do not leak important information like software versions, email addresses, names and positions of key personnel to the Internet. Also, try to prevent network devices from responding to scanning attempts.

Port scanners send client requests to a range of server port addresses on a host in order to find an active port and then exploit a known vulnerability of that service. According to IBM’s Cyber Security Intelligence Index, compiled in 2013, 28 percent of all attacks were done using a sustained probe or scan. This includes tools like port scanners, operating system enumeration tools, open ports and running services. To avoid such malicious scans, you can apply access control lists. Many sophisticated systems can monitor the number of ports scanned by one remote

source and block all requests from the source when the number of scans reaches a certain predefined interval.

This tool determines the operating system a target host is using, and it is widely available on various Internet sites. To prevent your system from being compromised, you must maintain proper path levels on endpoint and network systems, closely monitor system design, prevent direct external access to servers and shut down all unneeded ports and services.

Hackers use software exploits to take advantage of various classes of programmatic flaws in computer software. One of the most common types is an SQL injection, which fools the database system into running malicious code that will reveal important information from the compromised server.

According to the Cyber Security Intelligence Index, each company has 1,400 attacks on average within a week. As a result, there were 1.5 million monitored cyber-attacks in the United States in 2013. To reduce such attacks, companies must make sure their software is up to date and also encrypt sensitive data.

The denial of service attack tool allows hackers to run programs that continuously ask u

for information from the user’s computer until the computer is unable to answer any more requests. According to Microsoft,1 there are several ways to prevent denial of service attacks. One way is to “keep an audit trail that describes what was changed and why.” Another way is to “keep people aware of old configurations and their purpose.” Finally, you must “know the trade-offs between simplicity, cost and survivability.”

A DDoS tool allows hackers to install Trojan horse programs on the user’s computers throughout the network. These attacks are preventable. You must first acknowledge that you are vulnerable and that hackers attack organizations at random. As a result, you must implement the best and most current practices for network infrastructure, applications, critical supporting services and the domain name system (DNS).

Hackers use DNS spoofing to force a DNS server to accept and use wrong information from their server. Spoofing can cause lots of problems for vulnerable DNS servers, such as directing users to the wrong websites or directing email to non-authorized mail servers. If the hacker or competitor at another company is able to redirect email, they will be able to gain insight into the other company’s product designs and other confidential information, which can cause a huge loss for the original company. There are two main issues to worry about concerning DNS spoofing. First, a spoofing attack can go unnoticed until the competitor enters the market with a “copy” of the other company’s product. Second, many top-level business managers don’t realize that DNS spoofing can cause such tremendous financial and security risks. However, there are ways to prevent DNS spoofing. Companies responsible for a domain must check which type of server they are using and consult with its developer to

determine if the server is vulnerable to DNS spoofing. More importantly, companies must use the latest version of DNS Expert to check the vulnerability of all types of DNS servers to determine whether they are prone to DNS spoofing or other risks.

Cisco defines a Trojan horse as “a harmful piece of software that looks legitimate.” Users are commonly tricked into downloading and executing the file onto their computer. In reality, this file is disguised as a legitimate software or program. After it is activated, it will start to create numerous attacks on the host, which in turn gives the hacker access to the system through back doors. According to the Cyber Security Intelligence Index, 35 percent of cyber attacks were done using malicious code, such as third-party software using a Trojan horse. To prevent Trojan horse attacks, company employees must make sure they never open email attachments from unknown or suspicious users. They also should never download free software from unknown or sketchy websites.

Hackers use a virus to replicate itself to another file or document. A virus hidden inside a file could be spread to another person’s computer once they open that file. This is very similar to another kind of hacker tool called a worm. A worm, on the other hand, is a computer program that also replicates itself by sending itself to other systems, but it can spread much faster than a virus. To prevent hackers from using a virus or worm against your company, you must run virus detection software on your computer to scan and eliminate any viruses. You also need to make sure that your anti-virus software is up to date.

In the recent years, many companies suffered tremendously from security breaches. Here

There were 1.5 million monitored cyberattacks in the United States in 2013.

are four companies that have been negatively affected by data breaches.

In January 2007, TJX, the retail company that owns T. J. Maxx and Marshalls, suffered a severe data breach. Albert Gonzalez and his crew of hackers gained access to 45.6 million credit card and debit card numbers from the customer databases of TJX due to its poorly protected wireless local-area networks. He was able to do so by exploiting the holes in the SQL programming language. In other words, he used software exploits. This severe breach cost the company $256 million.

Hackers also used software exploits in the global payments breach in April 2012, as well as SQL injections that exploited holes in the SQL programming language. This severe data breach cost the company $93.9 million, which included $60 million for professional fees and other costs associated with investigation, remediation, incentive payments, credit card monitoring and identity protection insurance costs; $35.9 million for fraud losses, fines and other charges imposed by the card networks; and $2 million for insurance recoveries. This breach affected 1.5 million payment cards in North America.

In October 2013, 360 million personal account records and 1.25 billion email addresses were stolen from Adobe Systems Inc. These personal account records included encrypted passwords from the customers. This hack was considered the biggest breach in history.

Around November 2013, hackers installed malware into Target’s payment system. As a result, 40 million credit and debit card numbers were stolen from Target along with 70 million sets of customer information such as name, address and email address and phone number. This caused a 46 percent drop in Target’s profits in the fourth quarter of 2013.

1. Encrypt sensitive data. This adds an extra layer of protection to the data

that matters to you the most.

2. Educate your employees on data security. This is extremely crucial. According to Mentis Software Co., 69 percent of data breaches are caused by authorized users. Make sure to tell your employees to download applications from reliable websites and pay extra attention to attachments on emails. Also make sure to let employees sign and date an acknowledgement form showing that they participated in the training activity.

3. Create a written set of Internet policies. If possible, create handbooks that contain this set of policies and distribute them to your employees. This will help reinforce correct usage of the company’s internet.

4. Control Internet usage. Limit websites that employees can visit during work as well as lunch breaks. Use tools to block certain banned URLs if possible.

5. Do thorough background checks on your employees. Make sure to check if a prospective employee has a criminal record or a bad credit history. Also make sure to screen for hacker connections or unprosecuted hacker crimes.

6. Be extra aware of suspicious employees who show at-risk characteristics. Some common at-risk characteristics include, but are not limited to, a history of negative social and personal experiences, lack of social skills and a propensity for social isolation, a sense of entitlement and ethical flexibility.

7. Use a secure wireless connection to help prevent your company from encountering the same fate as TJX.

8. Use paper shredders to permanently dispose credit card information and Social Security Numbers.

9. Keep your company’s anti-virus software up to date. Outdated anti-virus software will open up vulnerability for a data breach.

As technology moves forward to help companies perform more efficiently, the risk of a data breach also increases. It is extremely important to understand common ways hackers get access to a company’s data as well as the ways to prevent data breaches. n

1. http://technet.microsoft.com/en-us/library/ cc750213.aspx

YANHUA BAI is a student at Virginia Tech majoring in accounting and information systems. JOHN BROZOVSKY, PH.D., is a Virginia Tech associate professor of accounting.

yanhua2@vt.edu jbrozovs@vt.edu

BY KERRI NORMENT, CPA

BY KERRI NORMENT, CPA

The original regulation provided a specific deadline for making sure employee deferrals were remitted in a timely fashion, but the new rule can, and has been, interpreted in many different ways. The new and changing interpretations of the regulation have muddied the waters for plan sponsors, leaving them confused, frustrated and in many instances noncompliant with the Employee Retirement Income Security Act of 1974 (ERISA).

DOL Regulation 29 CFR § 2510.3-102 states that plan sponsors should remit employee contributions on the earliest date the contributions can reasonably be segregated from the employer’s general assets, but no later than the 15th business day of the month following withholding. Most plan sponsors placed little importance on the “earliest date… reasonably be segregated” portion of the rule and believed that as long as employee deferrals were remitted by the 15th business day of the month following withholding, the contributions were timely remitted. This was an acceptable interpretation for many years.

In 1995, the DOL’s Employee Benefits Security Administration (EBSA) began investigating the timeliness of employee deferrals and created a national enforcement project known as the Employee Contribution Project, which eventually became a National Policy Priority. This project emphasized the importance of remitting employee contributions sooner than the 15th-day rule. As a result of the project, the DOL created a safe harbor rule that allowed small plans (those with less than 100 participants) to remit employee deferrals within seven days of withholding without threat of noncompliance with the regulation.

Similar guidance was not issued for large plans (those with more than 100 participants).

Despite the investigations and new guidance, the DOL did not revise the original regulation to reflect these changes. Instead, the regulation remained as originally stated, and the DOL only offered the interpretation as a suggestion or guideline. So began the confusion surrounding the timeliness of employee deferrals.

There are many reasons why the DOL changed its interpretation and enforcement of DOL Regulation 29 CFR § 2510.3-102. The most relevant reasons include advancements in technology, misappropriation or mismanagement of plan assets and the increase in the number of defined contribution plans and plan assets.

When the original regulation was implemented, there were few automated payroll processing systems, and even fewer that would allow for employee contributions to be easily segregated from general assets. This meant that plan sponsors needed time for the manual segregation of plan assets, and the rule accounted for this delay. In today’s world, nearly everything involves some automation, including payroll processing systems. With companies like ADP, Ceridian and Paychex processing payroll for companies, and their technological ability to distinguish between company assets and plan assets, plan sponsors now have the ability to remit employee deferrals simultaneously with payroll processing. Therefore, the original regulation

was determined to no longer be appropriate or necessary by the DOL’s standards. Instead, the DOL felt that if a plan sponsor had the capability to distinguish plan assets in conjunction with the processing of payroll, they should not be permitted to fall back on the 15th-day or safe harbor rules. Since this determination, there have been many cases in which employee deferrals remitted anywhere from three days to the 15th business day of the following month have been declared late by the DOL.

Through investigations, the DOL discovered that some plan sponsors were delaying the remittance of employee deferrals in order to use those funds for company obligations. Employee deferrals were often used by the plan sponsor to compensate for operational short falls that created cash-flow problems. The deferrals provided a temporary fix that many plan sponsors felt did not harm the employee because it was eventually repaid, and therefore sponsors believed it was an acceptable practice. In other instances, the DOL determined plan sponsors weren’t using the funds for company use but simply mismanaging the plan assets by not remitting them in a timely fashion. These findings resulted in the potential for significant lost earnings to plan participants and nonexempt prohibited transactions by the plan sponsor. Plan sponsors who caused lost earnings or participated in a nonexempt prohibited transaction were subject to significant restitution and penalties and, in the worst cases, disqualification of their plan’s taxexempt status. u

In recent years, the U.S. Department of Labor (DOL) has revised its guidance for remitting employee deferrals.

Over the past few decades, there has been a significant decline in the number of traditional defined benefit plans being offered by employers as a means of retirement savings for their employees. The decline is a direct result of the increased costs to the plan sponsors and a lack of control by the beneficiaries of these plans. Plan participants are living longer, resulting in longer payout periods, and the volatility of investment markets creates potential for underfunding or unpredictable funding requirements by plan sponsors. There has also been a recent determination that Social Security benefits will not be sufficient to sustain individuals after retirement. With an increase in retirees as a result of the Baby Boom and a contracted workforce, there is a disproportionate share of benefits being drawn as compared to amounts being contributed — so there is an increased need for employees to create and manage their own retirement savings through defined contribution plans and employee deferrals. While defined contribution plans allow for participants to have more control over investment options and deferral rates, the plan sponsor still plays a key role, remitting the employee deferrals.

These three circumstances paint a clear picture as to why the DOL has moved away from the original interpretation of the rule and developed a stricter, more punitive stance. The old interpretation only served to hinder, not help, participants reach their retirement savings goals.

Because the DOL changed its interpretation of Regulation 29, many plans may find themselves in noncompliance with ERISA. Consequences of noncompliance can range from being assessed penalties by the DOL, to prohibited transactions that could result in disqualification of a plan’s tax-exempt status. Penalties are minimal when the plan sponsor initiates corrections, because the penalty is based on the established Internal Revenue Service (IRS) underpayment interest rate, which in recent years has been 3 percent.

But penalties could amount to a significant level if a plan sponsor does not self-correct an error and it is instead discovered by the DOL. In such cases, the plan sponsor may be subject to a 20 percent excise tax in addition to 3 percent interest on late payments. The most severe consequence would be the disqualification of the plan’s tax-exempt status. By failing to remit employee deferrals in a timely manner, the plan sponsor’s inaction could be interpreted as a lack of fiduciary responsibility and possibly a prohibited transaction under ERISA.

If a plan were to lose its tax-exempt status, the disqualification would affect the employees, the employer, and the plan. The employees would have to include any employer contributions in which they were vested as income, and pay taxes on the amount. The employer could see a portion or all of its contributions disallowed as business deductions on its tax return. And finally, the plan would have to file Form 1041, U.S. Income Tax Return for Estates and Trusts, and pay any applicable taxes on the plan’s investment earnings.

The Self-Correction Program (SCP) provides for easiest way to correct late remittances and is the least costly. It simply involves identifying the late employee deferrals, using the IRS underpayment interest rate to compute amounts owed to benefit plan and submitting the payments to the plan. The calculation can be done using the DOL’s Online Calculator. However, this option is only available up until the second plan year after the error occurred.

Another correction method would include using the DOL’s Voluntary Fiduciary Correction Program (VFCP). Actions under the VFCP include paying the additional excise tax penalty, indicating on the plan’s Form 5500 Annual Return Compliance section the amount of employee deferrals that were remitted late and completing Form 5330, Return of Excise Taxes Related to Employee Benefit Plans. While some plan sponsors

believe filing Form 5330 only draws the attention of the DOL and IRS to further investigate a plan, most industry experts believe the filing will protect the plan sponsor against additional penalties from the DOL or IRS in the future, even if investigated.

So how should a plan sponsor apply the new interpretation by the DOL and avoid untimely remittances? Regardless of the number of participants, the best advice is for a plan sponsor to be consistent in the remittance of employee deferrals. If a plan sponsor demonstrates the ability to remit employee deferrals within one business day of each pay period, the plan sponsor needs to make sure all remittances happen within one day. The same holds true if the plan sponsor remits employee deferrals within 10 business days of each pay period. Consistency is critical to establishing the timeliness of employee remittances.

The second best advice is for plan sponsors not to rely on the small plan safe harbor rule to protect them from delinquent remittances. Except for rare circumstances, plan sponsors should not wait until the 15th business day of the month following withholding to remit the employee deferrals. n

CAROLYN K. “KERRI”CPA, is a manager in the Employee Benefits Practice at PBMares, LLP, a regional accounting and business consulting firm serving clients throughout the Mid-Atlantic. knorment@pbmares.com connect.vscpa.com/KerriNorment www.pbmares.com

Are you/your professional staff really at the right level where you should be/you need them to be?

Are you/your staff in a position that truly suits your/their personality, values, and professional and personal needs?

If you’re seriously interested in making the “right” move for your next hire, I can help you. I am an actively licensed CPA in Maryland and Virginia with over 20 years of experience including public accounting (E&Y) and consulting (KPMG), financial accounting (American Cancer Society), internal audit (Moneyline Tele rate), and recruiting (Acsys, formerly Don Richards). As a networker who truly enjoys helping others and sharing my career experiences to guide fellow professionals, here is how I can help you:

Ask you questions, and most likely ask many more questions than other recruiters about your company, duties involved, skills required, corporate culture and more

Work with you on finding the “right” professional that is the “right fit”

Provide you with valuable information about the professionals I work with, the marketplace, what your competitors pay, and more

Guide you on career paths available in public accounting and industry

Enable you to capitalize on your strengths

Coach you on how to put your best foot forwa rd to find the “right fit”

Advise you when to stay in your current position if that is the right move

If you’re interested in working with a recruiter who understand s your background, skills, and is genuinely interested in helping you find the

right fit

then I welcome meeting you!

BY ELI BOHEMOND

BY ELI BOHEMOND

Nothing makes a business owner cringe more than a discussion about payroll processing.

The process of paying employees comes with a fair share of emotional strain and financial costs to the business owner. Navigating payroll systems requires a deep knowledge of federal, state and local payroll taxes, employment regulations and labor laws. It requires the owner to understand the emotional attachments employees have with their paychecks — rendering payroll errors inexcusable and unacceptable.

In its 2012 Annual Taxation Survey, the National Small Business Association (NSBA) found that payroll taxes rank as a top financial and administrative burden to business owners. So it is certainly no surprise that business owners are constantly seeking out ways to remove themselves from that necessary, but unpleasant, business-payroll spectrum: payroll processing that mires them in management, aggravates them with administration and weaves them into a tangled web of waxingand-waning regulations.

Many business owners still believe they need to have a certain number of employees to justify payroll outsourcing. “I only have one or two employees,” followed by, “It really doesn’t take me that long to do payroll,” are commonly used rebuttals against outsourcing used by small business owners. And while these statements, and others like them, may seem true, they are not accurate or sensible given the incredible solutions available today.

Whether a business has one employee or 100, the employer is still responsible as the business owner to file and compensate payroll taxes. This requires complete compliance around the ever-shifting rules, regulations and timing requirements for how payroll tax is calculated and paid. Employers are also required to ensure they’re complying with all the federal, state and, in many cases, local municipalities’ payroll tax laws.

Minimum wage requirements, labor law postings, COBRA compliance, accurate tracking and precise payment for hours

worked are just some of the headaches associated with small business payroll processing.

According to the 2012 NSBA survey, the time and energy spent on just payroll processing is staggering:

>> The average business owner spends eight hours each month on payroll administration. This adds up to a total of nearly 100 hours per year.

>> More than two-thirds of all businesses spend anywhere from 40 to 80 hours per year keeping up to date on federal payroll taxes — time that doesn’t include issues with state or local taxes.

A 2012 study conducted by Business News Daily found that business owners highly value their time — no surprise there. One-third of business owners felt their time was worth $100 per hour and one-fourth felt it was worth at least $500 per hour.

With rates like these, it’s difficult to understand why so many businesses are still trying to do payroll on their own valuable time.

>> According to Business News Daily’s findings, it costs a typical business owner $10,102 per year just for payroll processing.

>> When adding in the time associated with maintaining a functional knowledge of all federal taxes, this cost balloons to somewhere between $14,000 and $18,000 annually.

The good news: With hundreds of payroll providers nationally, all focused on providing services to small businesses, the cost of outsourcing payroll, payroll tax filing and payments may only cost around $100 per month. Of course, this number is contingent on several factors, such as employee volume,

pay frequency and other variables based on services needed.

Not all providers are created equal. While many offer similar products and services, a business owner should take time to highlight the differences. They must know what to look for, and also which questions to ask a prospective payroll company. Here are seven ways to find the right company:

1. Ask a trusted advisor. Get insight into the company from a reliable accountant, broker, attorney or another business owner. Make sure it is someone whose opinion you trust.

2. Browse their website. First stop: their homepage. This hub provides that perfect knee-jerk assessment of corporate personality, culture and ethical standing. You should know within seconds what’s important to this company: their customers, their reputation and their employees — or their profit margins and shareholders. Who do you want to work with?

3. Get a sense of capability and credibility. This is a deeper, more difficult evaluation than that personality/culture/ethics assessment, but there are some tangible indications to gauge credibility. Are they certified in Statements on Standards for Attestation Engagement (SSAE) 16 Type II? Are they bonded? Who do they work with? Are these partners recognizable and respected?

4. Scope out LinkedIn. Do they have a LinkedIn profile? How many followers do they have? How active and engaging are they with these followers, or with reputable groups and related messaging forums? Is the messaging they use on this platform consistent with the language used on their website? u

5. Explore the value they offer, besides cost-based services. Do they provide value-added content in the form of whitepapers, reports, tip sheets, blog posts, videos, webinars and/or case studies to help educate and inform? The availability and existence of this content provides insight into how well the payroll company keeps up with a changing marketplace and how dedicated they are to providing added value at no cost to business owners like you.

6. Research the management team. What’s the depth and breadth of their experience? Do they possess a holistic understanding of critical business issues and needs or are they simply peddling payroll?

7. Examine the testimonials. Are testimonials readily available on their website and/or other social platforms from both past and current clients?

Statistics indicate that 40 percent of all businesses incur some sort of U.S. Internal Revenue Service (IRS) penalty in any given year. There are two major IRS penalties relative to payroll taxes: failure to file and failure to pay. Since the failure to file penalty costs more than failure to pay, it’s important to file, even if businesses are unable to pay the taxes owed. According to the IRS website, a plan will be developed to work with the taxpayer and satisfy the obligation.

Failure to file penalties are typically 5 percent of the unpaid taxes for each month, or part of a month that a return is late. This penalty does not exceed 25 percent of the unpaid

Do they post client testimonials that convey overall experience on a personal level and indicate the value of the payroll company’s services to business productivity and growth?

Let’s face it, finding a sales representative that has a business’s best interest at heart is an unrealistic expectation. Sales reps are paid by the sales they make and the revenue they generate. So, the higher the cost charged to the business owner, the larger the revenue credit and the higher the commissions paid to the representative.

The path to the best price is paved by inquiry.

1. Do they offer any discounts? Ask about any association or affinitygroup discounts that may be available to the business. Is the company part of a restaurant association or franchise

system? What bank does the business use? Oftentimes, payroll providers have relationships with organizations like these and provide preferred pricing for members or customers of these organizations. These littleknown opportunities could turn out to be quite beneficial!

2. What about incentives? Ask if the payroll company offers an incentive for clients who refer new clients to the company. Many payroll providers offer free or discounted services to loyal clients who bring them new business.

3. Just ask for it. Companies shouldn’t be afraid to simply ask for a better price. But, they shouldn’t ask unprepared: they must do the math first and know where they want to end up relative to their calculations. Also, if a discount is not granted, they should consider asking for a free service. It’s possible to negotiate a free month or two of service, which equates to 10 to 20 percent savings over the year.

taxes, according to the IRS. If the taxes are not paid by the due date, employers are generally hit with a failure to pay penalty of half of 1 percent of their unpaid taxes for each month, or part of a month after the due date that the taxes are not paid. This penalty may come out to 25 percent of your unpaid taxes.

Given the rapid pace of change in payroll tax laws, an increase in the percentage of businesses incurring these penalties is sure to materialize in the near future. Partnering with a reliable and reputable personalized payroll provider protects businesses and their employees from these highly unpalatable penalties.

Some business owners look at payroll purely as a business function — and an unpleasant one at that. They believe that as long as their employees have a paycheck in hand on payday, their job is done. But running a successful business is so much more than that.

Today’s employees expect more from their employers, and they have grown accustomed to evaluating their current employer against other employers based on ramped-up offerings. Employees are constantly assessing the employee-employer value relationship; that is, what each side actually receives versus what is actually provided. The moment this relationship goes off-kilter, the employee takes the reins and starts exploring other options to restore that balance they demand.

As this shift toward enhanced employee benefits continues, it’s imperative that business owners explore all available options to provide value-added benefits. Fortunately, if an employer knows where and how to look (i.e., you take advantage of a full-service payroll provider) these benefits come at little-to-no extra cost.

Employees today embrace do-it-yourself options. According to the American Payroll Association, approximately 60 percent of employees directly input or access key payroll data through self-service portals. Here’s why:

>> They want to obtain information, make changes and get answers to their questions on their own time — not only when a company HR representative is available.

>> Full-time and part-time employees are increasingly making use of direct deposit services and, in some cases, pay card options.

>> Businesses that employ a large population of scheduled employees working a number of different shifts should consider automated employee scheduling, which allows employees to take an active role in the creation and fulfillment of work schedules. This new technology improves the efficiency of the business, but (more importantly) puts an effective communication tool in the hands of that self-reliant employee.

Payroll is one of the most time-consuming, complex and legal-laden functions a business owner handles. According to the U.S. Department of Labor, there are more than 180 federal laws covering more than 10 million businesses and 125 million workers.

Of course, payroll taxes like Social Security, Medicare and federal unemployment make up some of the major taxes employers are responsible for calculating, collecting and paying. Beyond taxes, however, there are countless employee-focused regulations a business must comply with, including the Fair Labor Standards Act, Occupational Safety and Health Act, Employee Retirement Income Security Act and Family Medical Leave Act. Businesses are required by law to keep up with the changes within each of these taxes and regulations, as well as to implement them accordingly.

By using a reliable payroll provider, business owners can breathe easy knowing that a payroll company’s systems, processes, access to information and active involvement with lawmakers simplify the payroll process by taking the headaches and burdens off of employer’s head and shoulders.

A strong payroll company ensures a business’s compliance with dozens of tax laws, federal regulations and state employment acts. n

ELI BOHEMOND is an employee management solutions strategist at PrimePay, the largest privately held payroll company in the United States. He began his career as an accountant specializing in business process improvement.

ebohemond@primepay.com (610) 216-952 http://tinyurl.com/LinkedInEliB http://primepay.com/locations/virginia

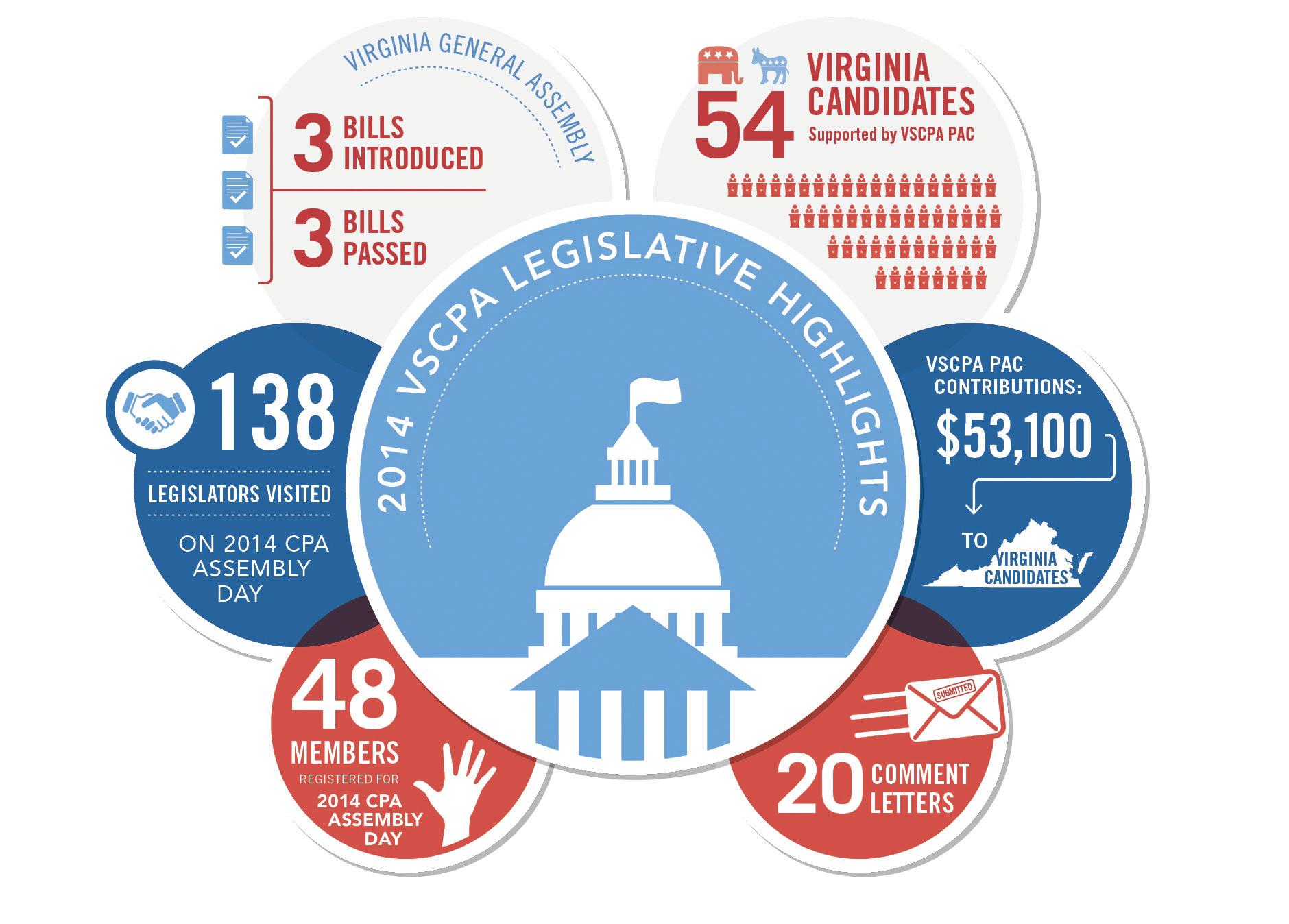

As a member of the VSCPA, you have access to some of the most powerful tools for doing business in Virginia — the VSCPA Government Affairs team and the VSCPA Political Action Committee (VSCPA PAC). With your guidance, these two programs are working to successfully ensure the protection of the CPA profession.

We will be tackling some major issues in the 2015 Session including, appealing the debit card refund mandate, CPA firm mobility, tax conformity and tax reform. As we gear up for the 2015 General Assembly Session, here’s how you can help.

>> Contribute to the VSCPA PAC

>> Join us at CPA Assembly Day on Jan. 20, 2015

• We’ll tackle issues like the debit card mandate repeal and technical updates to the accounting statutes.

• Members drive our advocacy by sharing their needs and concerns.

>> Lend your voice

• Join us in sending letters to your legislators. Visit www.vscpa.com/TakeAction to join us as we work to secure the continued success of the profession. You can also read more about our 2014 successes and to register for CPA Assembly Day on Jan. 20. Can’t come to Richmond but want to take part? There’s an online participation option too. n

Email disclosures@vscpa.com if you have exciting news to share. The VSCPA prints news of members’ awards, appointments and promotions as well as new hire and job change announcements. Firm news, such as mergers and acquisitions and community service activities, is also welcome. Feel free to send headshots, but please make sure they are high-quality, 300 dpi JPG files. Due to space constraints, we cannot print degrees or designations awarded to members. n

“Being a CPA is invaluable to have on an elected body. So much of my interactions with taxpayers or citizens are either about their taxes or their expenditures to provide the quality of life they want in their community. Having someone with the expertise to read financial statements or audits or budgets is helpful.”

— CAROLYN DULL, CPA, member since 2001, City of Staunton mayor

“VSCPA’s relationship building efforts via the VSCPA PAC enabled me to take important tax legislation to the appropriate channels to get introduced and passed. I could not have done this if I had to solely rely on myself.”

—

RYAN LOSI, CPA, member since 2000, IC-DISC Legislation, 2014

The 2014 legislative session was particularly productive and busy for the VSCPA Government Affairs team. For example, during the 2014 legislative session, VSCPA signed on as part of a coalition to support two bills that create recourse against “patent trolls,” an issue that was affecting VSCPA members. These “patent trolls” were using bad-faith patents to obtain licensing fees and then send threatening letters to Virginia businesses, including member firms, alleging patent infringement and demanding payment. The legislation that passed because of VSCPA support, HB 375 and SB 150, are combating these false assertions and saving our businesses money and time in court. Above you’ll find more 2014 highlights from the work of the VSCPA Government Affairs team and the VSCPA PAC. n

BOB MARTIN, CPA, has been named managing partner of Cherry Bekaert’s Richmond practice.

CHARRON MONTGOMERY, CPA, was named a shareholder in Charlottesville firm McCallum and Kudravetz.

Fredericksburg firm Robinson Farmer Cox Associates has promoted DIANE RIGSBY, CPA, to tax and accounting manager.

SHARON DAY, CPA, has joined Cherry Bekaert as a senior manager in the Virginia Beach office.

Mitchell Wiggins has hired CAITLIN DRUID, PATRICK GOODSELL, ROBYN PARLETT and MATTHEW ROCAWICH as staff accountants in the Richmond office.

NICK HARRISON, CPA, has joined Dixon Hughes Goodman as a tax advisory services partner in the Glen Allen office.

LISA BILSKI, CPA, has been named senior vice president at Richmond architecture and engineering firm Haskins & Anderson.

JAMIE FOWLER, CPA, has been named managing partner of Grant Thornton’s MidAtlantic practice.

Richmond firm Wells, Coleman & Co. has promoted TONYA FUTRELL, CPA, to senior manager and TAMMY HERLINGER, CPA, and KRISTIN WHITE, CPA, to manager.

HELEN MADORMA, CPA, has joined Fairfax firm Thompson Greenspon as an audit senior.

BOB ANDERSON, CPA, of Metro Sign & Design in Manassas Park, has been elected president of the Habitat for Humanity Prince William Board of Directors. SCOTT SILVESTAIN, CPA, of DuvallWheeler in Manassas, was also elected to the board.

CHRIS SUGGS, CPA, of Powell Valley National Bank in Jonesville, has been appointed to the Chief Financial Officer Committee for the Virginia Bankers Association.

MATTHEWS, CARTER & BOYCE has moved its office to 12500 Fair Lakes Circle, Suite 260, in Fairfax.

Fairfax firm MATTHEWS, CARTER & BOYCE has acquired Alexandria firm YATES, KLUTTZ & FRAZIER, CPAs

Fredericksburg firm ROBINSON FARMER COX ASSOCIATES has acquired Louisa practice ERROL R. FLYNN, CPA n

REBECCA ALTMEYER STEVEN AYERS

URANBILEG BATJARGAL KATHERINE BIGELOW CAROLINE BOULANGER RICKENA BOWMAN AMANDA BRELSFORD JEREMY BURGESS BRIAN CASASSA JODY DAVIS MICHELLE EDDY NICOLE EVANGER MAXIMO FIGUEROA JAMIE FLYNN SARAH GALLAGHER JAMES GIVENS FRANKLIN GORRELL MICHAEL GRADISHAR BRITTNEY GREGERSON DZEVAD HASANOVIC LAURIE IMPERATO BRANDON INGRAM ANNE JAVELLANA EDWARD JUDGE MONIQUE KIM NICOLE KOLMETZ EKATERINA LEASE VICTOR LEE GINA MASON CARINNE METTUS MICHAEL MONTANTI RICHARD MUTERSPAUGH CAITLIN MYERS KAITLYN PARRY MATTHEW PERMISON ADDIE PFEIFFER JEFFREY ROSTAND DORIS TERRY WILLIAM TETTERTON SARAH TRACY BENJAMIN VAUGHAN JANIEL YOUNGBLOOD XIAOJIE ZHENG

List from October and November. Compiled Dec. 1, 2014. n

VSCPA members BRANDON ATER of Virginia Tech and THOMAS LEWIS JR., CPA, of Virginia Commonwealth University were among 22 students selected to receive the American Institute of CPAs (AICPA) Minority Doctoral Fellowship.

The fellowship, funded by the AICPA Foundation, awards $12,000 each to full-time minority accounting scholars who are on their way to becoming accounting educators. n

MICHAEL HALL, CPA, a sole proprietor and professor from Richmond. He taught at Virginia Commonwealth University, Virginia Union University and Strayer University. He earned his bachelor’s and law degrees from Howard University and worked in the finance department with the Ethyl Corporation.

GERALD MARTIN, CPA, of Richmond. He began his career with Touche Ross and eventually became chief financial officer for Security Federal Savings Bank. He was active in church life and founded a Christian nonprofit, Preparing the Way, in Virginia Beach. n

VSCPA President & CEO STEPHANIE PETERS, CAE, was installed as president of the Board of Directors of the CPA Society Executives Association (CPA/SEA) on Oct. 18. CPA/SEA is made up of all state CPA society chief executive officers/executive directors throughout the United States.

Vice President of Strategy & Development AMY MAWYER celebrates her 21st anniversary with the VSCPA on Feb. 17.

Two employees celebrate their 15th anniversary with the VSCPA: Technology Director JEN SYER on Jan. 10 and Vice President of Member & Public Relations TINA LAMBERT, CAE, on Feb. 7.

Marketing & Communications Director JENNY CHU, CAE, celebrates nine years with the VSCPA on Jan. 9. Conference Manager VALERIE VAUGHN celebrates her fourth anniversary with the Society on Feb. 7.

Marketing Manager JENNIFER HARRIS has left the VSCPA. Good luck, Jennifer! n

The Self-Assessment Exam is available online for 1 CPE credit at www.vscpa.com/public/catalog. Choose the “On Demand” tab to find it and exams from previous Disclosures issues. n

CPA,

Stosch, CPA,

Nadia Rogers, CPA,

VSCPA

Virginia

with Sarah DeVoe, CPA,

Roanoke Country

the Roanoke Chapter’s

CPE

Scudder, CPA, Randy Best, CPA, and Joe O’Gorman, CPA, at the VSCPA’s Professional Development

at the Westfields Marriott Washington

VSCPA 100% Member Firms show their commitment to their employees, the profession and the association. A 100% Member Firm is simply a Virginia CPA firm or company that has all of its CPAs enrolled as members in the VSCPA.

Interested in being listed as a 100% Member Firm? Contact VSCPA Member Relations Director Brenda Fogg at bfogg@vscpa.com or (804) 612-9409.

A.F. Thomas & Associates, PC

Anderson & Anderson CPAs, PC

Anderson & Reed, LLP

Anderson, White & Company, PC, CPAs Andrews, Barwick & Lee, PC

Barnes, Brock, Cornwell & Heilman PLC

Beale & Curran, PC

Beck & Company, CPAs, PC Bennett, Atkinson & Associates, PC

Biegler & Associates, PC

BlackHeath Company, PLC

Bowling, Franklin, & Co., LLP

Boyce, Spady & Moore PLC

Britt & Peak, PC, CPAs

Bruce, Renner & Company, PLC Bullock & Associates, PC

Burdette Smith & Bish LLC

Burgess & Co., PC, CPAs

Cameron, Moberly & Hamrick, PC Charles H. McCoy Jr., Inc.

Charles S. Pearson Jr., CPA

Charles W. Snader, PC

Cherie A. James, CPA, PLC

Chesapeake Accounting Group PC

Christopher A. Enright, CPA, PLC

Cole & Associates CPAs, LLC

Coley, Eubank & Company, PC

Corbin & Company, PC

Craver, Green and Company, PLC

Creedle, Jones and Alga, PC

CST Group, CPAs, PC

Dalal & Company

David L. Zimmer CPA PC

Diane Y. Smith CPA PC

Didawick & Company, PC

Donald R. Pinkleton, CPA

Donald W. Coleman, CPA, Inc., PC

Douglas L. Thompson, CPA PLLC

Duvall Wheeler, LLP

Eggleston & Eggleston, PC

Elmore, Hupp & Company, PLC

Everett O. Winn, CPA, PLC

First Capital Bank Fritz & Company, PC

Garland & Garland, CPAs, PC

Garris and Company, PC

G.L. Roberson CPA, PLLC

Graham and Poirot, CPAs, LLC

Gregg & Bailey, PC

Gregory & Associates, PLLC

Gurman & Company, PLLC

Hantzmon Wiebel

Harris, Hardy, & Johnstone, PC Harris, Harvey, Neal & Co., LLP

Henley & Henley, PC

Henry R. Hortenstine III, CPA, PC

Hogan & Reed, PC, CPAs Holland & Brown LLP

Homes, Lowry, Horn & Johnson, Ltd.

Honeycutt & McGuire CPAs

Hottel & Willis, PC Hughes & Basye, PC Hunt & Calderone, PC, CPAs

J. Goddin & Associates, PC

Jay E. Reiner CPA PLLC

John M. Watkins, CPA Johnson, Equi & Co., PLC

Jones, Adams & Delp, PC Jones & Company CPA, LLC

Jones, Madden & Council, PLC

Jones & McIntyre, PLLC

Katherine L. Foley CPA, PC Keiter

Kositzka, Wicks & Company Kris McMackin CPA

L.P. Martin & Company, PC Lane & Associates, PC

Larry D. Greene CPA PC

Lauren V. Wolcott, CPA, PC Lent & Hawthorne, PC

M. Lee Winder & Associates, PC Maida Development Company

Mallard & Mallard CPAs, LLC

Malvin, Riggins & Company, PC Martin, Beachy & Arehart, PLLC McPhillips Roberts & Deans PLC

Michael B. Cooke, CPA, PC Michael R. Anliker, CPA, PC Mitchell, Wiggins & Company, LLP Moss & Riggs, PLLC Murray, Jonson, White & Associates, Ltd., PC Nicholas, Jones & Co., PLC

Norris & Associates, PC PBMares, LLP

R.P. Willis, PC

R.T. McCalpin & Associates

Renner & Company, CPAs, PC

Robb Scott Bradshaw & Rawls, PC Robinson Consulting Group

Roger L. Handy, PC Rubin, Koehmstedt & Nadler, PLC

Russell, Evans & Thompson, PLLC

Rutherford & Johnson, PC Salter & Associates, PC Saunders, Matthews & Pfitzner, PLLC