THE FINAL TANGIBLE PROPERTY REGULATIONS

To deduct or capitalize? Now, taxpayers can more easily answer that question with final IRS regulations.

Time is running out in the retirement plan restatement period. Plan sponsors need to prepare for Dec. 15, 2015.

There are a variety of tutoring options to help students succeed in accounting classes.

VIRGINIA SOCIETY OF CPAs

4309 Cox Road Glen Allen, VA 23060 (800) 733-8272 Fax: (804) 273-1741 www.vscpa.com

http://disclosures.vscpa.com

Jill Edmonds

Managing Editor disclosures@vscpa.com

Chip Knighton Contributing Editor

cknighton@vscpa.com

David Bass

Public Relations & Communications Director dbass@vscpa.com

Olaf Barthelmai, CPA

Adam Chaikin, CPA

Cheri David, CPA

Jennifer Duff, CPA

Keith Gray, CPA

Genevieve Hancock

Alesia Lewis, CPA

David Peters, CPA

Mark Plostock, CPA

Jeff Schroeder, CPA

George Strudgeon, CPA Barbara Sukramani, CPA

Articles and advertising for future issues are due by 5 p.m. on the following dates:

Jan./Feb. 2016 Nov. 2, 2015

March/April 2016 Jan. 4, 2016

May/June 2016 March 1, 2016

July/Aug. 2016 May 2, 2016

Sept./Oct. 2016 July 5, 2016

Nov./Dec. 2015 Sept. 1, 2016

Statements of fact and opinion are made by the authors alone and do not imply an opinion on the part of the officers, members or editorial staff.

FROM THE VSCPA’S LINKEDIN PAGE >>

It’s always interesting when people come in for a consultation about setting up a biz/entity selection, and they’re so hyped up about setting up an S corp, and they have no idea about reasonable comp issues. And they thought they were going to save SO MUCH money!

JAY REINER, CPA Arlington

What a great analogy the dashboard is for the financial information business leaders should be getting on a regular basis.

MELANIE LESKO, CPA Richmond

We appreciate the service! Wishing you both continued success!

ANNE HAGEN, CPA Richmond

@VSCPANews @FICPA Honored by your kind mentions — Thank you for all the value you bring for the community of CPAs + the Public. — @DCARSONCPA_MFC

Had a blast sharing the Young Member story — until next time! #INTCHG15 @YoungCPANetwork @VSCPANews — EKIMOFFCPA

Thanks again to our sponsors for making #VACFOAwards possible: @DHGLLP @VSCPANews @LumosNetworks @McGuireWoodsLLP @CapitalOne — @VIRGINIABIZ

@VSCPANews Can’t believe it’s been a year!. Wish I could go back to two of the best days of my Academic Career. — @KATIEOCON

CONNECT: connect.vscpa.com

TWITTER: @VSCPANews, @FinancialFit

LINKEDIN: tinyurl.com/VSCPALinkedInGroup

FACEBOOK: facebook.com/VSCPA INSTAGRAM: instagram.com/VSCPA

Get in touch At the Virginia Society of CPAs, we love to hear from you. Whether it’s a quick email to a staff member, chat on the phone, Disclosures letter to the editor, tweet, blog comment or something different altogether, let us know what you’re talking about, how you feel about different issues affecting CPAs and how we can help.

tweet or something different altogether, let us know what you’re talking about, how you feel about different issues affecting CPAs and how we can help.

As a professional society representing the accounting profession, the future health of the CPA credential is always an important topic for the VSCPA. A major part of that issue is the diversity — or lack thereof — of the profession, particularly at the highest levels.

According to our most recent membership report, 81.5 percent of the VSCPA members for whom we have ethnicity data are Caucasian. (Ethnicity is not a required field on the VSCPA membership application, and nearly a quarter of our current members left it blank.) That’s 12 percent higher than the general Virginia population.

The VSCPA isn’t alone in having this issue, and we’re not alone in attempting to solve it. (Visit vscpa.com/Diversity to learn more about initiatives aimed at diversifying the profession spearheaded by the Society and other industry groups.) But the fact that our membership is markedly less diverse than the rest of Virginia is a major problem.

Henry Davis III, CPA, is a director of finance and budget at Virginia Commonwealth University in Richmond, and the only ethnic minority on the current VSCPA Board of Directors. He recently wrote an insightful piece for the VSCPA on his own experiences as a minority in the profession — you can read it at vscpa.com/HenryDavis — and touched upon an issue that we’re currently trying to remedy:

“I believe one of the major factors in why minorities are not seeking the accounting profession is that the perception what a CPA does versus reality is not clear. At the high school level, there is not a lot of exposure to what accountants do. Usually there is an introductory class for accounting, but that’s it. It appears that high school students do not see the value of becoming an accountant and

obtaining a CPA license.”

One of Davis’s potential solutions is simply getting CPAs in front of minority students and letting them tell their stories. That’s the reasoning behind the VSCPA’s upcoming “You Can Attend College” events coming up this fall. With generous assistance from The Accountant’s Coalition (TAC), a group representing the Big Four accounting firms, the VSCPA is partnering with three minority Virginia legislators — Sens. Mamie Locke (D-Hampton), Louise Lucas (D-Portsmouth) and Donald McEachin (D-Henrico) — to hold workshops in their districts to educate students and parents on the financial issues that come with preparing for college.

While the financial planning aspects of the seminars are a major benefit to attendees, we’re hopeful that putting CPAs in front of these students will illustrate the benefits of the CPA credential and career path. In addition to the VSCPA members who will serve as discussion leaders, we’ll also have young professionals on hand to discuss their careers with interested students. The program builds on three established VSCPA programs in advocacy, financial literacy and student outreach and focuses our efforts in a different direction.

This is the first year of the VSCPA’s college workshops, and it’s only the beginning. We hope to expand the program across the Commonwealth in the next few years, with the goal of getting CPAs in front of as many students as possible to tell their stories. And as always, the VSCPA remains on the cutting edge of programming, and we think this program will serve as an example for other state societies to consider in their own diversity initiatives.

We hope our efforts, and those of the rest of the profession, will pay off in the future in

the form of a generation of young students taking the CPA Exam as a way to pursue their professional dreams.

As Henry Davis put it: “The avail ability of mentors for minorities has been significantly lacking. I believe that the VSCPA needs to have a greater presence with high school students, exposing them to the accounting profession and explain ing what accountants do as well as many different opportunities an accountant can choose from.

“I believe once minority students see the value in what accountant with a CPA license can do and all of the opportunities that exist, I believe you will see an increase in minorities joining the accounting profession.” n

STEPHANIE PETERS, CAE, has served as president and CEO of the Virginia Society of CPAs since 2007.

speters@vscpa.com connect.vscpa.com/StephaniePeters @StephPeters

CPA firms are doubling down on one of their most important assets: staff. The 2015 Private Companies Practice Section (PCPS) CPA Firm Top Issues Survey, from the American Institute of CPAs (AICPA), found that staffing is a significant challenge for firms — thanks to a steady demand for CPA services, workload compression issues and retiring Baby Boomers. Conducted every two years, the PCPS Top Issues Survey spotlights the main challenges facing practitioners. Key findings from the 2015 survey are:

RECRUITMENT & RETENTION: Staffing was always an issue in surveys prior to 2009, but after the 2008 economic recession, firms were more concerned with client retention. Now, staffing is once again top-of-mind for firms. Practice growth is still cited as an important issue, however, by both sole practitioners and firms with 11 or more professionals.

SUCCESSION PLANNING: Firms of all sizes, even sole practitioners, are concerned about succession planning. Larger firms are starting to transition to a new group of leaders, while smaller firms must find and groom staff members with leadership potential. Sole proprietors will focus on practice continuation agreements.

SEASONALITY: Firms of all sizes are grappling with seasonality and workload compression, perhaps because of challenges with frequent and/or late tax law changes and the late arrival of K-1s and Form 1099s. Service problems at the U.S. Internal Revenue Service have exacerbated the situation, and survey findings indicate that workload compression is a year-round challenge.

Check out the full report, including the top issues for more firm sizes, at tinyurl.com/Top-Issues-2015. n

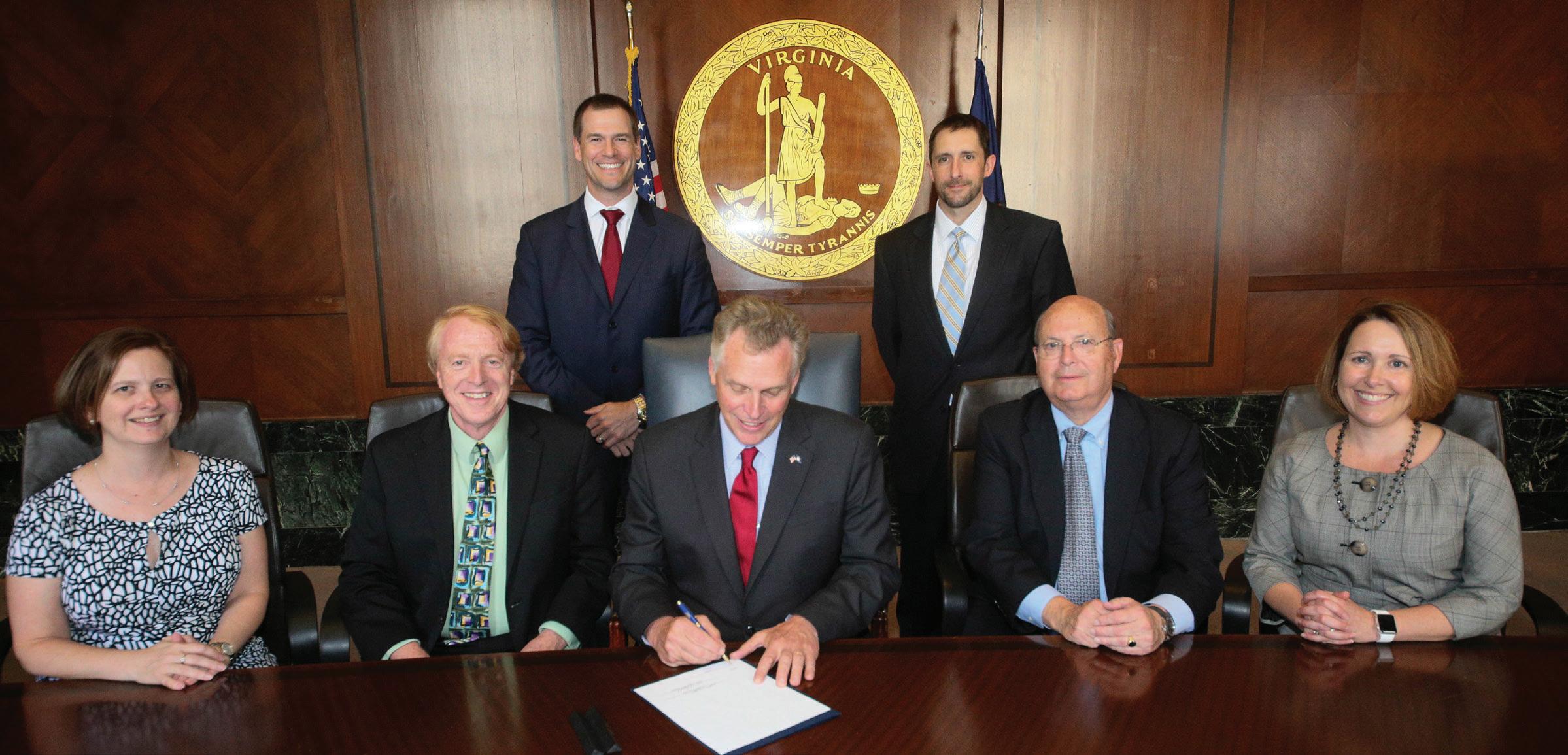

In July, Virginia Gov. Terry McAuliffe appointed VSCPA members BRIAN CARSON, CPA, and SUSAN FERGUSON, CPA , to fill the vacant positions on the Virginia Board of Accountancy (VBOA).

Carson is CFO at GoldKey/PHR Hotels & Resorts in Virginia Beach and a former partner with Dixon Hughes Goodman. Ferguson, an accounting professor at James Madison University in Harrisonburg, fills the educator seat on the VBOA. They replace fellow VSCPA members BARCLAY BRADSHAW, CPA, the outgoing VBOA chair, and BOB COCHRAN, CPA, who held the educator seat. VSCPA member STEPHANIE SAUNDERS, CPA, is the new chair.

Read an in-depth profile of the two newest VBOA members at vscpa.com/VBOAAppointments. n

The “State of the VSCPA” annual report is now online and better than ever! We’ve combined the State of the VSCPA report with the VSCPA Educational Foundation and advocacy reports into one comprehensive document. There’s never been an easier way to learn the what, how, who and why of VSCPA activities.

Visit www.vscpa.com/ StateoftheVSCPA to get the scoop on the VSCPA’s 2014–2015 efforts and the Society’s audited financial statements. n

Have you ever been given a large workbook with 60 tabs to review and you don’t know where to start or how to easily navigate it? If only Excel had an “Index” tab that had a hyperlink to each tab and each tab had a hyperlink* back to the “Index” without a lot of manual effort. No fear, I was able to find the coding below from tinyurl.com/o4facs4, which you can insert into your workbook that will magically make it happen.

To complete the process, create a new tab and rename it “Index.” Next, right-click on the tab’s new name, select “View Code” and then copy the code below into the large box. Then click on the Run button (which looks like a green play button). After it creates your index, you can exit the code window. Hopefully with this tip you will be able to quickly get your bearings and navigate that massive workbook like a pro.

Private Sub Worksheet_Activate()

Dim wSheet As Worksheet

Dim M As Long M = 1

With Me

.Columns(1).ClearContents

.Cells(1, 1) = "INDEX"

.Cells(1, 1).Name = "Index" End With

For Each wSheet In Worksheets

If wSheet.Name <> Me.Name Then M = M + 1

With wSheet

.Range("H1").Name = "Start" & wSheet.Index .Hyperlinks.Add Anchor:=.Range("H1"), Address:="", SubAddress:="Index", TextToDisplay:="Back to Index" End With Me.Hyperlinks.Add Anchor:=Me.Cells(M, 1), Address:="", SubAddress:="Start" & wSheet.Index, TextToDisplay:=wSheet.Name End If Next wSheet End Sub

*Warning: The code above will overwrite cell H1 in each of your tabs with a hyperlink “Back to Index.” n

GEORGE D. STRUDGEON, CPA, CGFM, is an audit director at the Virginia Auditor of Public Accounts in Richmond. Email him if you have Excel topics you want him to cover.

* george.strudgeon@gmail.com connect.vscpa.com/GeorgeStrudgeon

Click and learn: To watch this video, visit this page in the digital Disclosures issue at disclosures.vscpa.com and click on the play button. Or, check it out at tinyurl.com/q7yteg4.

If you’ve got questions about what it means to have an active CPA license in Virginia, but exempt from CPE, all you have to do is visit YouTube.

The Virginia Board of Accountancy (VBOA) has a short, easy-to-follow video available on its website (boa.virginia.gov) and YouTube (search for the Virginia Board of Accountancy channel). The VBOA plans to produce more videos this year explaining other hot-button CPA licensing issues. n

MORE LETTERS ARE COMING: Next year, the American Institute of CPAs (AICPA) will launch two new specialty credentials for CPAs in the area of fair value measurement: one covering fair value measurement for business and intangible assets and the other for financial instruments. The credentials will join the AICPA’s list of specialties: Accredited in Business Valuation (ABV), Certified in Financial Forensics (CFF), Certified Information Technology Professional (CITP), Chartered Global Management Accountant (CGMA) and Personal Financial Specialist (PFS). n

It’s no secret that states are offering tax incentives to large corporations to entice them to relocate their businesses. Tesla received $1.3 billion in incentives last year from Nevada to build the world’s largest lithium-ion battery plant. According to a survey from Bloomberg BNA, 84 PERCENT of the large corporations it interviewed have been offered incentives by a state or local official for a new development or relocation. In its study, Bloomberg BNA discovered:

>> The most competitive states have the best corporate income tax and overall tax structures, as well as the best approach to tax incentives. Texas, Nevada and Florida are the most successful in luring businesses to their states, while California, New York and Illinois are the least competitive.

>> When a company is being lured, their home states may not be doing enough to keep them. Only 33 PERCENT of respondents said their current state offered incentives for them to remain.

>> Corporations are actively trying to change policies at the state level. 56 PERCENT lobby state representatives to change tax policies. And among companies with more than $10 billion in revenue, that number jumps to 81 PERCENT

Read the full report from Bloomberg BNA at tinyurl.com/Bloomberg-Report. n

How confident are Americans in their finances? Are they satisfied? Prepared? Actually, it depends.

>>

HAPPINESS IS HIGH: The second quarter Personal Financial Satisfaction Index (PSFi) from the American Institute of CPAs (AICPA) found that Americans are the most happy with their finances since before the recession in 2007. Gains are attributed to increased job openings, rising home values and decreased loan delinquencies.

>> PREPAREDNESS IS LOW: Nearly a third of all Americans have no emergency savings, according to Bankrate.com, the highest number since the site started tracking it in 2010. Bankrate attributes the lack to a lag in income growth. And the U.S. Federal Reserve reports that almost a third of working adults have no retirement savings or pension. These workers, therefore, have no intention to retire or plan on working as long as possible.

>> DECISIONS ARE DELAYED: The majority of American adults (51 percent) have delayed a major life decision in the past year, such as getting married or retiring, due to financial reasons. A survey from the AICPA found this is an increase of 20 percentage points since the last time a similar survey was conducted in 2007.

The bottom line? Americans may not be making life decisions, nor are they well-prepared for the future. But hey, they’re happy! n

The number of taxpayers who paid a penalty last tax season for not having health insurance under the Patient Protection and Affordable Care Act. While that was 10 percent more than originally estimated by the U.S. Treasury Department, approximately 300,000 people overpaid the penalty. The average penalty was $190. n

“The Board shall establish by regulation a requirement for continuing professional education in ethics for CPAs.”

With that phrase and a stroke of then-Gov. Mark Warner’s pen, the Virginia Ethics CPE requirement was born March 24, 2003. The VSCPA developed its first Ethics course, written by member Jim Brackens Jr., CPA, and Michael Mares, CPA, the following year.

The requirement, one of the first major projects of the nascent Virginia Board of Accountancy (VBOA), was implemented in large part as a response to the high-profile accounting scandals around the turn of the century, which brought down numerous major companies and had a role in turning the Big Eight auditing firms into the Big Four.

“It came about as a result of Enron and WorldCom, and my understanding is that the administration got involved and demanded that there be an Ethics course for CPAs in Virginia,” said VBOA Executive Director Wade Jewell. “The administration initially wanted 8 hours, and the Society and the Board were able to convince them that 2 hours were sufficient for what we needed.”

“There wasn’t much debate about it,” said VSCPA member Larry Samuel, CPA, a former VBOA member and two-time chair who sat on the board’s Ethics committee and helped craft many of the outlines for

early versions of the course. “The governor said, ‘Thou shalt,’ and it was done. It was put in very quickly and implemented very quickly.”

Those 2 hours are perhaps the biggest, most important factor that hasn’t changed. Any Active CPA licensed in Virginia must fulfill that 2-hour requirement yearly, with the cutoff at Jan. 31 the following year. Ethics credit hours count toward the 120-hour CPE requirement per threeyear reporting cycle, meaning that 6 of those hours must come from Ethics. However, licensees holding the Active — CPE Exempt status are exempt from the Ethics requirement.

Furthermore, licensees who give up their licenses but want to resume their careers as CPAs must take the Ethics course as part of the 120 hours of CPE required to resume services. And the Virginia-specific Ethics course is “separate and distinct” from the one-time American Institute of CPAs (AICPA) ethics course required for initial licensure.

One issue with the requirement that was resolved quickly arose from CPAs who were licensed in multiple jurisdictions. This was before reciprocity and mobility were as widespread as they are today, and that meant some licensees had to hustle to fill the requirements of all their licenses.

“I had a partner who was licensed in lots of different states before reciprocity kicked in,” said Samuel, a partner at Deloitte’s Washington office at the time. ”He would have to take five different Ethics courses. He would say, ‘How ethical can I be?’”

Despite the name, there wasn’t much in the way of pure ethics instruction in early incarnations of the course. The initial course outline focused entirely on updates to the Virginia accounting regulations, with behavioral ethics coming into play in 2005, the second year of the requirement, in the form of a recommended 15-minute section on making ethical decisions.

“A lot of times, it didn’t end up in right or wrong. It was more about the ethical considerations and actions you could take,” Samuel said. “The struggle was, how much of that can you teach? If you’ve got the same requirement every year and essentially the same people taking it, how do you keep it fresh and how do you keep it going?”

That section remained the same (and even shrunk in recommended time allotment) until 2013, when the behavioral portion was expanded to focus on psychologist Lawrence Kohlberg’s stages of moral development.

“Early on, it was more of a focus on the Board’s statutes and regulations,” Jewell said. “While the course continues to highlight

the changes to statutes and regs, the course has evolved to also focus on CPE, CPE audit, and license renewal requirements. The Board recognizes that the annual Ethics Course is the one opportunity each year to have the full attention of its licensees.”

And the VBOA hit on a major element of the course very quickly — enforcement cases, which were introduced for the 2006 course. Each year since then, the board has selected several representative cases to include in the course as examples of how licensees often run afoul of regulations.

“If what we’re trying to do is prevent bad behavior by CPAs, we have to look at where the bad behavior is coming from,” Samuel said. “You look, naturally, at the enforcement areas. A big impetus was to show what cases are going through enforcement and showing bad behavior by CPAs.”

Recently, the VBOA’s changes have been more structural than contentrelated. As of 2015, the Ethics course must be instructor-led — although the VBOA recognizes several different course formats — and all

sponsors of the course must be pre-approved by the VBOA and posted on its website. And all Ethics instructors must hold an active Virginia CPA license in good standing.

But in the end, the Ethics course evolved into showing CPAs what they had to do and what they couldn’t do. It makes sense for a course that was created as a response to CPAs behaving badly and developed into a roadmap that every licensee can follow to make sure they’re doing the right thing. And isn’t that what ethics is really all about? n

CHIP KNIGHTON is communications manager at the VSCPA, as well as contributing editor at Disclosures magazine. cknighton@vscpa.com connect.vscpa.com/ChipKnighton @ChipKnighton

Whether you prefer to attend a class, participate in a webcast, work at your own pace or study at your office with your team, we have an option that fits your style.

Check out the variety of options from the VSCPA:

Group

In-house

Visit vscpa.com/Ethics to register today.

BY GIAN PAZZIA, CCSP, AND ALEX BAGNE, JD, MBA

BY GIAN PAZZIA, CCSP, AND ALEX BAGNE, JD, MBA

For expenditures related to residential or commercial buildings, the tax consequences between taking an immediate deduction versus capitalization and depreciation over a lengthy 27.5 or 39 years are staggering. In 2004, the IRS began drafting new rules to address this conflict and, after several iterations, yielded the final Tangible Property Regulations (TPR).

When the TPRs became fully effective for the 2014 tax year, CPAs and tax professionals scrambled to understand and implement the new rules. These regulations affect most businesses and many individual taxpayers. The TPRs apply to expenditures related to fixed assets and clarify rules applicable to the deductibility of materials, supplies and parts. They provide important new guidance on dispositions as well as optional elections that may yield tax savings. The TPRs may also impact previous years’ capitalized assets, which would then require filing IRS Form 3115, Application for Change in Accounting Method.

In response to public concerns, the IRS issued Rev. Proc. 2015-20 as relief for small businesses. Rev. Proc. 2015-20 provides a simplified method of compliance for small business taxpayers (i.e., less than $10 million in assets or less than $10 million in average annual gross receipts) to change a method of accounting under the final TPRs on a prospective basis for the first taxable year

beginning on or after Jan. 1, 2014. The IRS waived the requirement to complete and file Form 3115 for small business taxpayers that choose to use this simplified procedure. However, election statements are still required for the de minimis safe harbor and the small taxpayer safe harbor on a prospective basis.

For others not meeting the criteria of a small business, the implementation of the TPRs is a challenge that led many taxpayers to file extensions for 2014. Even though compliance with the TPRs can be time consuming, in many cases it can offer tremendous opportunities to claim faster tax deductions for various expenditures that were capitalized in prior years, even for those meeting the Rev. Proc. 2015-20 definition of a small business taxpayer. Below is a list of considerations under these new rules.

A new rule allows taxpayers to immediately deduct certain small-dollar expenditures that may have required capitalization under previous tax rules. This safe harbor allows taxpayers with Applicable Financial Statements (i.e., audited financial statements in most situations) to adopt depreciation policies requiring the immediate write-off of items costing up to $5,000. Taxpayers using this safe harbor must have a written accounting procedure in place as of the beginning of the tax year and consistently follow the policy for

both book and tax purposes. For taxpayers without Applicable Financial Statements, the threshold is $500, but a written policy is not necessary. This safe harbor requires a statement attached to a timely filed return.

The final regulations allow a taxpayer to immediately deduct certain building costs if the taxpayer expects to perform the activity more than once within a 10-year period. Examples may include repainting a hotel lobby or replacing an escalator handrail if expected to be performed at least twice within 10 years. An election statement is not necessary.

Taxpayers that meet the definition of a “small taxpayer” and own a building with an unadjusted basis of $1 million or less may be able to make elections that allow them to immediately deduct certain costs that would otherwise require capitalization. For this purpose, a small taxpayer is one whose average annual gross receipts for the three preceding years is $10 million or less. An eligible taxpayer can deduct expenditures up to the lesser of $10,000 or 2 percent of the unadjusted basis of the building. For corporations and partnerships, the election is made by the entity and not the shareholder or partner. u

For years, the U.S. Internal Revenue Service (IRS) and taxpayers disputed whether certain expenditures were required to be capitalized and depreciated or be immediately written off as repair and maintenance expenses.

PLANNING POINT: The $1 million building basis limit is only for building real property (not inclusive of land). For buildings over the $1 million threshold, consider a cost segregation study to reclassify personal property and land improvements from the basis of real property. For example, a $1.1 million building will not initially meet the safe harbor’s requirements but can qualify with a cost segregation study that reclassifies $200,000 into personal property, whereby the remaining real property basis is less than $1 million and qualify under this safe harbor in all future years.

Under prior law, taxpayers were required to capitalize removal costs into the basis of the replacement asset. Now, taxpayers can immediately deduct such costs as long as they claim a retirement loss deduction on the removed component.

PLANNING POINT: Taxpayers should request that contractors separately state demolition and removal costs on invoices so these expenditures can be immediately deducted (after carefully considering Code Section 280B).

The final regulations clarify the definition of supplies and when taxpayers can deduct them. For example, anything that costs less than $200 or is expected to be consumed within 12 months can be treated as a supply and immediately deducted.

The final regulations allow taxpayers to immediately deduct current or previously capitalized expenditures. Examples may include certain building costs such as electrical, plumbing or HVAC unit replacements. Conversely, taxpayers who were overly aggressive in immediately deducting capital expenditures should review their prior year repairs registers as well as their current year capitalization policies. Any corrections should be made in the 2014 tax return by filing IRS Form 3115.

Prior to the new rules, there was no clear guidance that allowed taxpayers to deduct costs of removed building components, such as an old roof, HVAC systems or windows. The final TPRs allow taxpayers to deduct any undepreciated basis of these removed components even if disposed in prior years, which may yield significant and immediate tax deductions. For example, a taxpayer that replaced a roof in 2010 can now deduct the undepreciated cost of that roof. However, taxpayers are only allowed to write off assets disposed in past years on the return for the tax year beginning Jan. 1, 2014.

PLANNING POINT: It is important to review all prior-year building improvements to determine if there were any partial dispositions of components. If this is not done for the 2014 tax year, the taxpayer must continue to depreciate these assets and forgo the opportunity to immediately write off any undepreciated basis as compliance with this provision may not be permitted future tax years.

The most significant portion of the TPRs focus on clarifying rules on what can be immediately deducted or must be capitalized. Examples of immediately deductible expenses include the installation of a new roof membrane, replacing three of 10 HVAC units in a building or remediating asbestos. Proper analysis requires careful consideration of the unit of property and of whether the expenditure results in a betterment, adapts the unit of property to a new or different use or results in a restoration. For buildings, each major building system must be analyzed as a unit of property.

RULE OF THUMB: For expenditures that are not considered a betterment or adaptation, the rule of thumb is that replacing one-third or less of a building component will be a repair expense as long as the taxpayer is not required to adjust the basis of the component disposed.

Cost segregation studies accelerate the timing of deductions by reclassifying personal property and land improvements, which have favorable tax attributes, from building costs, which do not. Quality cost segregation studies quantify the costs of removed components, which make it easy for taxpayers to take losses on them. Additionally, they can organize certain building information for proper repair analysis required by the TPRs. For buildings purchased and improved in prior years, a quality cost segregation firm employing TPR experts will analyze the new repair rules and provide information needed to claim missed deductions.

SUGGESTION: Only consider using a cost segregation firm that provides a final schedule clearly showing each building system stipulated by the TPRs along with other building categories that can be expected to be replaced (e.g., windows, doors, roof, lighting, interior finishes, etc.). For multi-tenant commercial buildings, make sure the study breaks out each tenant improvement in a clear schedule allowing the taxpayer to properly claim abandonment loss deductions in future years.

Even though the TPRs are extensive and complex, they do offer a number of taxpayer-favorable provisions. With careful implementation of the new regulations, many taxpayers are claiming missed deductions from prior tax years as well as opportunities to accelerate deductions in current and future tax years. n

GIAN PAZZIA, CCSP, is a principal with KBKG and is their national practice leader for cost segregation. He is an expert on repair versus capitalization issues and currently serves on the Board of Directors for the American Society of Cost Segregation Professionals, where he was president for the 2013–2015 term.

gian@kbkg.com

ALEX BAGNE, JD, MBA, is a director with KBKG and leads their tangible property repair regulation practice. He has more than 15 years of experience in public accounting, with most time spent at Big Four firms where he focused on providing specialized professional tax services related to accounting methods.

alex.bagne@kpkg.com

BY ANNA HUNTER, CPA, CPC, QPA

BY ANNA HUNTER, CPA, CPC, QPA

We are currently in the middle of a document restatement period, required by the U.S. Internal Revenue Service (IRS), which applies to a large number of plan sponsors with qualified retirement plans.

As trusted advisors, CPAs are in an excellent position to advise employers or clients who are sponsoring a retirement plan and help them meet retirement plan-related deadlines and avoid incurring any corresponding penalties. This article will outline the types of retirement plans subject to the latest deadline requirements, when it might be appropriate to move up those deadlines and how a plan restatement is generally completed.

Employers with a qualified retirement plan in place may already be familiar with the periodic plan document updates required whenever retirement plan legislation is made into law. These legislative changes are regularly added to current retirement plan document language through a plan amendment. The IRS requires all retirement plan documents to incorporate these specific plan amendments during certain cyclical remedial amendment periods in order to streamline the plan review process for the IRS and reduce the employer burden of maintaining a large number of amendments.

Revenue Procedure 2007-44 establishes a six-year document restatement requirement for pre-approved plans and a five-year requirement for individually designed plans. The cycle for certain pre-approved plans is currently open and runs through April 30, 2016. Failure to restate a plan document by the deadline could result in the employer being required to use the IRS Voluntary Correction Program or the Audit Closing Agreement Program to have the plan restated. These

programs require a non-amender submission to the IRS accompanied by a compliance fee that is determined by the number of plan participants. While April 30 is the final deadline for this current cycle, it is a good idea to restate certain plans by Dec. 31, 2015, to avoid some unnecessary scrutiny.

On May 1, 2014, the IRS opened the twoyear Pension Protection Act of 2006 (PPA) restatement period for all pre-approved 401(k), profit sharing, money purchase and target benefit plans. There are currently three types of defined contribution plan documents available:

1. Prototype (standardized or nonstandardized)

2. Volume submitter

3. Individually designed

The most commonly used documents use the pre-approved language. A prototype plan and a volume submitter plan are both considered pre-approved type plans because the plan language has already received IRS pre-approval in the form of either an “opinion letter” for a prototype plan or an “advisory letter” for a volume submitter plan. If no modification is made to the language in these pre-approved plans, an employer can rely on the IRS opinion or advisory letter for plan qualification. Plan qualification is very important to retain the tax benefits available in a qualified retirement plan. In addition, the document must contain language that meets

certain requirements of the tax law and the plan must be operated in accordance with the plan’s provisions.

An individually designed plan or modified prototype plan can obtain a special IRS “determination letter” by submitting Form 5300 and paying the full fee. If an employer wants to modify any language in a volume submitter document, they may apply to the IRS for a special determination letter by using Form 5307 instead and paying a reduced fee.

The different IRS letters protect the plan’s taxqualified status and are presented during an IRS examination of the plan as representation that the language in the plan has been reviewed and approved by the IRS.

Each restatement cycle, restated plan documents are given a name derived from the tax legislation responsible for the changes. The latest restated version of the document is referred to as the PPA restatement and will permanently incorporate the following list of legislative amendments into a single document:

Mandatory:

>> Pension Protection Act (PPA)

>> Heroes Earnings Assistance and Relief Tax Act (HEART)

>> Worker, Retiree, and Employer Recovery Act (WRERA)

>> Final 415 regulations u

Optional if the plan had participants affected by hurricane relief acts:

>> Katrina Emergency Tax Relief Act of 2005 (KETRA)

>> GULF Opportunity Zone Act of 2005 (GOZone)

The plan document language prior to the PPA restatement was called the EGTRRA restatement (from the Economic Growth and Tax Relief Reconciliation Act of 2001) and would have included these changes in legislation as tack-on amendments. No defined contribution plans listed above should be using an EGTRRA document after April 30, 2016, since the EGTRRA version of the IRS approval letter can no longer be relied upon to retain tax-qualified status.

Many 401(k) plan sponsors have made the decision to add a safe harbor contribution provision to their retirement plans in order to avoid certain annual contribution testing requirements. Employers sometimes have difficulty convincing employees to contribute a significant amount from their pay to the plan, which may have a detrimental effect on the amount the company’s highly compensated employees and owners can contribute to the plan from their own paychecks. An employer can choose to add a safe harbor contribution provision to their plan, either as a matching or nonelective contribution, at least 30 days prior to the start of a plan year, or in the case of a new 401(k) plan, immediately — as long as the plan year is at least three months long.1

To retain the safe harbor election and corresponding avoidance of certain testing requirements, special notification must be given to all plan participants each year, and the safe harbor contributions must be 100 percent vested at all times. This special notification language may not be modified during the plan year without jeopardizing the safe harbor status to avoid testing unless the modification is specifically permitted by the IRS. Treas. Reg. 1.401(k)-3(e)(1) says: “…

Except as provided in paragraph (g) of this section or in guidance of general applicability published in the Internal Revenue Bulletin… a plan which includes provisions that satisfy the rules of this section will not satisfy the requirements of §1.401(k)-1(b) if it is amended to change such provisions for that plan year."

The list of authorized mid-year amendments for this purpose is quite limited. Therefore, if a plan sponsor wants to make any other changes to the 401(k) safe harbor plan document during the restatement period, those changes should only take place at the beginning of a plan year. Otherwise, the safe harbor rules of 1.401(k)-(3) may be deemed to not be met and regular compliance testing will apply to the plan for the year.

While it is possible to restate a plan document mid-year in such a way that the new provisions are identical to the previous terminology found in the prior document, a plan sponsor will lose the ability to incorporate any additional changes in the restated 401(k) safe harbor plan document if they wait until the 2016 plan year to restate. Therefore, best practice would dictate that an employer using a safe harbor contribution provision will use the remainder of 2015 to review the current content of their plan document and make any desired modifications at the same time as the restatement to be effective Jan. 1, 2016.

So how does a plan sponsor go about restating a plan document to meet the PPA restatement requirements? Providers of plan documents can be found in a variety of places. Common providers include: the investment company holding the plan assets, a law firm specializing in Employee Retirement Income Security Act (ERISA) law, an investment advisory firm, a CPA firm, an actuarial firm or a boutique third-party administration firm. It is not unusual for an original document to be provided by the custodian of the plan assets when a retirement plan is first created. However, if the plan assets are ever moved

Plan restatement can provide an opportunity to analyze whether the plan is still working to benefit the plan sponsor and participants.

to a new investment platform, which is quite common over the life of a retirement plan, the former investment custodian might not notify the plan sponsor that the plan document is due for restatement. The current investment custodian may be able to provide a restated plan document. A local law firm with a practicing ERISA attorney will be able to provide a new document.

If the company offers both a defined contribution and a defined benefit plan, it is possible a relationship already exists between the employer and an actuarial firm. In this case, the actuary may be able to provide a restated defined contribution document in addition to the defined benefit document.

A third-party administration firm that specializes in retirement plan administration can also provide a restated plan document to meet PPA requirements.

Plan restatement can provide an opportunity to analyze whether the plan is still working to benefit the plan sponsor and participants. Over six years, many companies see changes to their business and workforce, such as a merger, reorganization, marriage or divorce, and the retirement plan should reflect those changes. CPAs can make their employer or clients aware of the plan restatement deadline and the opportunity to amend the plan document at the same time.

The earlier a plan sponsor is aware of the need to restate the plan document, the more flexibility they have in selecting a provider and the more time to customize the document. Year-end tax planning meetings can provide an excellent opportunity to address this topic. If the plan sponsor was not aware of the necessity to restate their document, they can now act on this advice and thank you for the timeliness of the information. n

Reg. 1.401(k)-3(e)(1) and

Reg.1.401(k)-3(e)(2)

ANNA HUNTER, CPA, CPC, QPA, is director of retirement services at PBMares, LLP, in Newport News,

retirement plan consulting and

businesses throughout Virginia.

BY GABRIELE LINGENFELTER, CPA, MBA, AND PHILIP H. UMANSKY, CPA, PH.D.

BY GABRIELE LINGENFELTER, CPA, MBA, AND PHILIP H. UMANSKY, CPA, PH.D.

Whether these students get confused during the introduction of debits and credits, during the discussion of adjusting entries or when preparing bond journal entries, classroom instruction may not be enough for some students to understand the material and to obtain the desired grade.

Elaina Ford, a tutor at Christopher Newport University (CNU) in spring 2015, said, “Most students struggled because they could not keep their debits and credits straight, which affected more advanced topics.” Tutoring is needed now more than ever due to larger sections of courses available; some students need a “high touch” environment to stay motivated in a difficult and, in what may seem an impersonal, course.

The word “tutor” comes from the Latin word “tueri,” which means to watch over or look after. In English and Irish secondary schools, tutors are teaching assistants. The term “tutoring,” as used in this article, refers to remedial or additional teaching to assist students who need extra help with their studies.

Tutoring can occur in various formats. There are online tutoring services, in-person private tutoring, tutoring that is provided through a central university department, tutoring provided by the respective department and peer tutoring. One online tutoring service for accounting can be found at accountingtutor.org/online-accountingtutoring. A quick Internet search will also find websites that let students search for private tutors in the subject with which they need help, such as wyzant.com. While online and private tutoring are always an option, this article focuses on tutoring services that two Virginia universities, CNU and Virginia Union University (VUU), provide for their students, as well as some general practices in the field.

At CNU, the Center for Academic Success (CAS) offers free tutoring for all currently enrolled CNU students in a wide variety of subjects, including accounting. Students can make 30-minute appointments or stop by the Center on a drop-in basis. The Center is run by Jeannine Leger, MS, NCC, director of Academic Success Services, and employs two coordinators (one for sophomores and one for upperclassmen) and two university fellows, who are recent CNU graduates and work mainly with freshmen and part-time subject area tutors who are current students. The CNU tutoring program assigns two tutors per academic topic and recommends approximately four sessions until grades improve. Sophomores primarily take advantage of tutoring in accounting.

Other schools prefer to keep tutoring for accounting students within the accounting department or the business school and use either students or faculty to provide services. At VUU, introductory accounting students are tutored by professors. VUU students are required to u

Teaching accounting entails that some students will eventually need help outside of class.

not only complete tutorials, which are part of their final course grade, but they must also go and pick up the tutorials from the professor/ tutor to review items that were incorrect. This method allows for the professor/tutor and student to form a bond that demonstrates a form of caring by both parties. The method has increased the passage rate in VUU introductory accounting courses, and works in part because accounting sections are small at VUU.

At some universities, departments hire seniors to tutor students enrolled in accounting principle courses. The CNU accounting department used student tutors for a number of years: accounting faculty would nominate a senior who had an A in both intermediate courses, and this tutor was hired as a student worker to tutor 2–4 hours a week. Faculty worked very closely with the departmental tutor, providing him/her with review guides, copies of assignments and access to graded student exams for review purposes.

Some students find help in informal peer tutoring. Friends may study together before an exam or work on homework assignments. We highly encourage students to form these informal study groups, as both the stronger and weaker student can benefit. Studying with someone their own age typically makes students feel more comfortable and relaxed and they may feel more willing to ask questions. Peer tutors can also explain which strategies they use to understand difficult concepts.

Tutors can receive benefits, too. According to the old adage, “to teach is to learn twice,” students enhance their own understanding of material through tutoring. Studies have shown that between two groups of students, one that simply reads information and another that must read and then teach the material to others, the teaching group performs better when tested. In addition, tutoring can be a form of practice for when a student advances in his or her profession and will need to explain certain areas of practice to both supervisors and those who report to him or her.

“Tutoring principles of accounting in particular was a great way to refresh material that I may have learned years ago,” said Matt Guendert, a CNU tutor during spring 2015 and the 2015–2016 Wall, Einhorn & Chernitzer Scholarship recipient. “Tutoring also acted as an introduction to the experience of teaching in a classroom, which would help to prepare me for a career in teaching if I choose to follow that path.”

Of course, the professor can also require more formal peer tutoring. While some schools have set up sophisticated peer tutoring programs, most of us have use a group assignment in our principles classes. Assigning a longer homework problem as a group project can lead to peer tutoring.

A good accounting tutor should have five characteristics:

Accounting knowledge: He or she should really “know” accounting. This can be measured via a national tutoring certification, but with respect to university

accounting tutors, knowledge is usually determined by the grade the tutor received in the two intermediate accounting courses and other upper-level accounting classes.

Professionalism and adherence to academic integrity: At CNU, tutors are not allowed to work on homework problems or other assignments with students unless the students have made an honest attempt at doing the work themselves. Also, the student needs to be assured that the tutor will not discuss his or her personal issues, such as learning disabilities and grades.

Common sense: Book knowledge is important, but the tutor needs to have the common sense to explain a difficult accounting topic with helpful tips and tricks.

At CNU’s Center for Academic Success, new tutors are trained in a one-on-one meeting with the coordinator in which the new tutor learns about the Center’s tutoring philosophy, which stresses independent learning, best tutoring strategies and academic integrity. Continuing tutors attend a group session each academic term during which the coordinator addresses issues that arose in the previous term and works through a few tutoring scenarios. However, CNU has an even loftier goal for the future. According to Leger, “Our goal in the next couple of years is to require all tutors to complete a national tutor certification course, which will teach them most, if not all, of these concepts in an actual course.” u

“Tutoring acted as an introduction to the experience of teaching in a classroom, which would help to prepare me for a career in teaching.”

— Matt Guendert

The smoothly. We’ve need on matter The Oct.

The surgery is nearly complete, and we’re checking to make sure it all went smoothly. On Oct. 1, the bandages come off!

We’ve spent 2015 analyzing the way you use vscpa.com and restructuring the site to put the information you need to enhance your professional success at your fingertips. The new vscpa.com is optimized to look good on whatever device you’re using, so you can easily access all the great news, information and resources, no matter where you are.

The same great content, but better looking and easier to access than ever. Join us Oct. 1 for the unveiling!

The Pathways Commission, a joint venture of the American Accounting Association and the American Institute of CPAs, has recommended ways to develop a national strategy to enhance the quality and integrity of accounting education and ensure a strong pipeline of accountants.

In its July 2012 report, “Charting a National Strategy for the Next Generation of Accountants,” the Commission named as an objective “to transform the first course of accounting,” and its related action item is to “build on previous efforts regarding how the first course in accounting is designed and delivered.” We know that not every student

pursuing accounting will have what it takes to make it through rigorous accounting courses. But we all likely had that one student who was struggling in accounting at first, but after additional help with a tutor grasped the concepts and successfully finished his or her accounting degree.

Having an effective tutoring program can help with the Pathways Commission’s objective to “transform the first course of accounting.” n

GABRIELE LINGENFELTER, CPA, MBA, teaches auditing, International Financial Reporting Standards (IFRS) and principles of accounting at Christopher Newport University in Newport News. She also is a frequent contributor to the Journal of Critical Incidents and a reviewer for the Society for Case Research. gabriele@cnu.edu connect.vscpa.com/GabrieleLingenfelter

PHILIP UMANSKY, CPA, PH.D., is an associate professor of business and chair of the Accounting and Finance Department in the Sydney Lewis School of Business at Virginia Union University in Richmond. pumansky@vuu.edu connect.vscpa.com/PhilUmansky

Virginia Society of Certified Public Accountants members are rewarded.

As a member of VSCPA, you can save with special discounts on Nationwide ® auto insurance. In addition, when you add rewards like Vanishing Deductible® , * you can take $100 off your deductible for every year of safe driving, for up to $500 in savings.

You wouldn’t be involved with VSCPA if you weren’t passionate about being part of a group that shares your values. We understand that feeling, because we treat customers like members. It’s one of the things that make us a different kind of insurance company.

Call Ronnie Shriner at (877) 683-3364 or visit nationwide.com/cps/pc-affinity-vscpa.htm for a quote today!

Are you/your professional staff really at the right level where you should be/you need them to be?

Are you/your staff in a position that truly suits your/their personality, values, and professional and personal needs?

If you’re seriously interested in making the “right” move for your next hire, I can help you. I am an actively licensed CPA in Maryland and Virginia with over 20 years of experience including public accounting (E&Y) and consulting (KPMG), financial accounting (American Cancer Society), internal audit (Moneyline Tele rate), and recruiting (Acsys, formerly Don Richards). As a networker who truly enjoys helping others and sharing my career experiences to guide fellow professionals, here is how I can help you:

Ask you questions, and most likely ask many more questions than other recruiters about your company, duties involved, skills required, corporate culture and more

Work with you on finding the “right” professional that is the “right fit”

Provide you with valuable information about the professionals I work with, the marketplace, what your competitors pay, and more

Guide you on career paths available in public accounting and industry

Enable you to capitalize on your strengths

Coach you on how to put your best foot forwa rd to find the “right fit”

Advise you when to stay in your current position if that is the right move

If you’re interested in working with a recruiter who understand s your background, skills, and is genuinely interested in helping you find the “right fit

then I welcome meeting you!

Success for the profession comes from getting and keeping the right people in office. We can only do that with your help. Now, more than ever, it is important for every CPA in the state to support the VSCPA PAC.

By contributing to the VSCPA PAC, you:

- Invest in candidates who protect and advocate for your business and clients

- Bring members and lawmakers together so the voice of CPAs remains strong

- Protect the trust, confidence and esteem the CPA certificate holds

The Virginia Society of Certified Public

Action Committee (VSCPA PAC) financially assists candidates and legislators who actively support CPA business issues.

today to protect

or (800)

at

VSCPA member LORI OVERHOLT, CPA, was honored with a Virginia CFO Award in a ceremony June 23 at the Jefferson Hotel in Richmond. The Virginia CFO Awards, co-sponsored by the VSCPA and Virginia Business magazine, recognize the state’s best chief financial officers (CFO) and those holding equivalent positions.

Overholt, the president and CFO of VSA Resorts, a vacation ownership company in Virginia Beach, won in the small private company category. Another VSCPA member, CYNTHIA JOYCE, CPA, of JoycePayne Partners in Richmond, was a finalist in the same category.

“I’m just honored to have been nominated, and I was honestly stunned to win,” Overholt said. “There were so many great nominees, and I’m so proud of Virginia as a state and what they do for business. I’m glad to own a business and be a CFO in Virginia.” n

Visit www.vscpa.com/public/catalog. Choose the “On Demand” tab to find the exam and others from previous Disclosures issues. n

Kirstyn St. Pierre of Christopher Newport University asks a question during Leaders’ Institute at the University of Richmond on June 19.

We’d like to thank all the sponsors, speakers, panelists and attendees who made the ninth annual Leaders’ Institute such a success. Sixty of Virginia’s most promising accounting students attended the event, held June 19–20 at the University of Richmond. The VSCPA would like to thank founding sponsor BAKER TILLY and the rest of the Leaders’ Institute sponsors:

BECKER BROWN EDWARDS CAPITAL GROUP CHERRY BEKAERT DELOITTE DIXON HUGHES GOODMAN ELLIOTT DAVIS DECOSIMO ERNST & YOUNG GRANT THORNTON JOHNSON LAMBERT KEARNEY & COMPANY KEITER KPMG

MEADOWS URQUHART ACREE & COOK MITCHELL WIGGINS & COMPANY PBMARES

PRICEWATERHOUSECOOPERS

ROGER CPA REVIEW

VIRGINIA AUDITOR OF PUBLIC ACCOUNTS VSCPA EDUCATIONAL FOUNDATION WELLSCOLEMAN

If you are interested in sponsoring the 2016 Leaders’ Institute to help us celebrate our 10th anniversary of this program, please contact Career & Leadership Development Director Molly Wash at mwash@vscpa.com or (804) 612-9417. n

The VSCPA and the Commonwealth take time that week to recognize everything CPAs do for Virginia’s taxpayers and businesses. All week long, the VSCPA is promoting the profession to media, businesses and consumers to get you the recognition you deserve for the vital role you play as a trusted advisor.

And you can still sign up for the centerpiece event of CPA Week: CPA Day of Service. Make a difference in your community with your CPA colleagues on FRIDAY, SEPT. 18. Register by Sept. 10 and you will be entered into a drawing for a $50 American Express gift card to put toward your activity.

Hundreds of CPAs and employees of accounting firms volunteer statewide each year as part of CPA Day of Service, working at volunteer locations for a variety of organizations and causes, including both indoor and outdoor projects.

CPAs care: Staff members from Elliott Davis Decosimo, from left, Rebecca Bourne, Becky Vaughan and Ryan Shipley, CPA, volunteered at the the Richmond SPCA during the 2014 CPA Day of Service.

Visit vscpa.com/DayofService or contact VSCPA Member Engagement Manager Laura Cobb at lcobb@vscpa.com or (804) 612-9441 to sign up. n

Attention Richmond CPAs! The VSCPA’s Richmond Chapter has two upcoming networking and education events to help fill your professional needs. On Oct. 22, the chapter will hold a networking event with fellow professionals including lawyers and bankers. That event will be held at the Highwood Property building atrium at 10900 Nuckols Road in Glen Allen from 5–7 p.m.

The chapter’s annual dinner, honoring past presidents and local college students, is set for Nov. 17 at The Place in Innsbrook. The event will start with 2 hours of CPE from 3–5 p.m., followed by a networking hour before dinner at 6 p.m. n

ASHLEY BAILY

JESSICA BAKER

JUSTIN BENNETT SAMANTHA BOYD MICHELLE CANN ANDREW COOK MATTHEW CUFF STEPHEN CUNNINGHAM JASON FAYORSEY NONNA GILANA JORDAN GRAVES MICHAEL HOLPE LUKE HOWARD ALEKSA HOWARD

BRANDON ISAACS MARGARET KIELY

JESSICA MURNIN TAYLOR MURRIN SARA PAGE

ANDREW PLAUGHER HUI QI JOEL RAPOSO JOHN RITENOUR DOUGLAS ROYALS

MATTHEW RYAN DUSTIN SAUNDERS NANCY SMIEGOWSKI MARY SWORD JEFFERY WALSTON

List from June and July. Compiled July 30, 2015. n

The following firms were named to Accounting Today’s Top 100 Firms list:

DELOITTE

PRICEWATERHOUSECOOPERS

ERNST & YOUNG KPMG

McGLADREY GRANT THORNTON

BDO

CLIFTONLARSONALLEN COHNREZNICK

BAKER TILLY VIRCHOW KRAUSE DIXON HUGHES GOODMAN

CHERRY BEKAERT

ELLIOTT DAVIS DECOSIMO

KEARNEY & COMPANY SC&H GROUP ARONSON RAFFA

HOWARD KRAMER, CPA, has joined Kositzka, Wicks & Co. in Alexandria as a tax manager in the Family Wealth Services group.

JAMES REAGAN, CPA, has joined Leidos Holdings in Reston as executive vice president and chief financial officer.

ELSIE ROSE, CPA, has joined Union Bank & Trust in Richmond as vice president and business development officer.

MELISSA STANLEY, CPA, has joined Brown Edwards & Co. as a partner in the firm’s Roanoke office.

Brown Edwards & Co. announced the following new partners: CHRIS BANTA, CPA, and JOHN HASH II, CPA, in Roanoke and BILLY ROBINSON, CPA, in Harrisonburg.

At Malvin Riggins & Company, PC, in Newport News, CRISTINA MUNIZ, CPA, has been named senior audit manager and

JAMISON W. BUEHLER, CPA, and BRYAN M. KING have been promoted to senior tax & accounting associates.

Councilor, Buchanan & Mitchell promoted VAL MIKHARAVA, CPA, to supervisor.

Grant Thornton named CARLOS OTAL, CPA, as managing partner of its Global Public Sector practice.

ALLISON PARSONS, CPA, has been promoted to senior manager at Homes, Lowry, Horn & Johnson, Ltd., in Fairfax.

BECKY STAHL, CPA, of Lightbridge Communications Corporation in McLean, was named Private Company CFO of the Year by the Northern Virginia Technology Council.

THERESA EMMERMAN, a student at Bridgewater College, received a $1,292 scholarship from the David E. Will Endowed Scholarship Fund for the Support of Public Accounting.

In addition to those listed above, the following firms were named as regional leaders in the Capital Region (Virginia, Delaware, Maryland, West Virginia and Washington, D.C.):

COTTON & COMPANY

JOHNSON LAMBERT YOUNT, HYDE & BARBOUR KEITER

GELMAN, ROSENBERG & FREEDMAN CALIBRE CPA GROUP

Fairfax firm BURDETTE SMITH & BISH was named as one of the 2015 “Best Places to Work” by Virginia Business and the Washington Business Journal.

Washington firm CBM was named CPA Firm of the Year 2015 by Washington SmartCEO

Fairfax firm THOMPSON GREENSPON was selected as one of The Washington Post’s Top Workplaces for 2015. The firm was ranked No. 26 out of 75 in the Small Employers category. n

Top: Jane Hayes, David Bass, Julia Henderson.

Bottom: Kathy Suddarth, Amanda Arnold.

Bethesda, Md., firms DEMBO JONES and ROMANO & MITCHELL, CHARTERED have merged effective July 1. The combined firm will operate under the Dembo Jones name.

MALVIN, RIGGINS & COMPANY, PC, in Newport News, has merged with T.R. KLEIN & COMPANY, PC, effective June 1. The company has an office in Baltimore, specializing in audits and a various range of tax and consulting services.

DIXON HUGHES GOODMAN wrapped up its fourth annual Count the Cans food drive, donating 270,875 pounds of food to communities across 12 states of the firm’s footprint.

Alexandria firm HALT, BUZAS & POWELL sponsored the Bethany House 4th Annual Garden of Light Gala, which raised more than $20,000, and volunteered at the Carpenter’s Shelter as part of the annual Spring for Alexandria community service day. n

Membership Services Coordinator JANE HAYES celebrates her 12th anniversary with the VSCPA on Sept. 22.

Public Relations & Communications Director DAVID BASS marks his third anniversary with the VSCPA on Oct. 2.

Membership Marketing Manager JULIA HENDERSON celebrates two years with the VSCPA on Oct. 29.

Education Coordinator KATHY SUDDARTH celebrates her first anniversary with the VSCPA on Sept. 22.

AMANDA ARNOLD has joined the VSCPA as a membership marketing specialist. Welcome to the team!

Conference Planner VERONICA BOYETT has left the VSCPA. Good luck, Veronica! n

JANE CALLISON, CPA, of Staunton. An employee of Hampton & Everett Accountants in Charlottesville, she was active at Foursquare Church on the Hill.

VAN HANTZMON, CPA, a VSCPA life member from Charlottesville. A longtime employee of Hantzmon Wiebel, he earned two degrees from the University of Virginia and was active at Wesley Memorial United Methodist Church, where he served as treasurer.

PEGGY HARDING, CPA, of Arlington. A former communications officer in the U.S. Navy, she graduated from Sweet Briar College and was active at Trinity Presbyterian Church in Arlington.

MAC LATHAN, CPA, of Wilson, N.C. A professor at East Carolina University, he served on numerous VSCPA committees, including the VSCPA Educational Foundation Board of Directors, the VSCPA Political Action Committee (VSCPA PAC) Board of Trustees, the Disclosures Editorial Task Force and the Educators’ Symposium Task Force. He graduated from Duke University and the University of North Carolina.

ASA SWART, CPA, a VSCPA life member from Fairfax. A graduate of Strayer College of Accountancy, he served in the U.S. Army during the Korean War and was a partner at two firms before starting his own firm. He was active at Fairfax United Methodist Church, where he served on the board of trustees.

CHARLES WALKER, CPA, a VSCPA life member from Mechanicsville. n

VSCPA 100% Member Firms show their commitment to their employees, the profession and the association. A 100% Member Firm is simply a Virginia CPA firm or company that has all of its CPAs enrolled as members in the VSCPA.

Interested in being listed as a 100% Member Firm? Contact VSCPA Member Relations Director Brenda Fogg at bfogg@vscpa.com or (804) 612-9409.

A.F. Thomas & Associates, PC

Anderson & Anderson CPAs, PC

Anderson & Reed, LLP

Anderson, White & Company, PC, CPAs Andrews, Barwick & Lee, PC

Barnes, Brock, Cornwell & Painter PLC

Beale & Curran, PC

Beck & Company, CPAs, PC Bennett, Atkinson & Associates, PC

Biegler & Associates, PC

Black Marlin CPA (Ann Black CPA PLC)

Bowling, Franklin, & Co., LLP

Boyce, Spady & Moore PLC

Britt & Peak, PC, CPAs

Bruce, Renner & Company, PLC

Bullock & Associates, PC

Burdette Smith & Bish LLC

Burgess & Co., PC, CPAs

Cameron, Moberly & Hamrick, PC

Charles H. McCoy Jr., Inc.

Charles W. Snader, PC

Chesapeake Accounting Group PC

Christopher A. Enright, CPA, PLC

Cole & Associates CPAs, LLC

Coley, Eubank & Company, PC Corbin & Company, PC

Craver, Green and Company, PLC

Creedle, Jones and Alga, PC

CST Group, CPAs, PC

Dalal & Company

David L. Zimmer CPA PC

Diane Y. Smith CPA PC

Didawick & Company, PC

Donald R. Pinkleton, CPA

Donald W. Coleman, CPA, Inc., PC

Douglas L. Thompson, CPA PLLC

Duvall Wheeler, LLP

Eggleston & Eggleston, PC

Elmore, Hupp & Company, PLC

Everett O. Winn, CPA, PLC

First Capital Bank

Fritz & Company, PC

G4 CPA Firm, Inc.

Garland & Garland, CPAs, PC Garris and Company, PC

G.L. Roberson CPA, PLLC

Graham and Poirot, CPAs, LLC

Gregg & Bailey, PC

Gregory & Associates, PLLC

Gurman & Company, PLLC

Hantzmon Wiebel

Harris, Hardy, & Johnstone, PC

Harris, Harvey, Neal & Co., LLP

Henley & Henley, PC

Hogan & Reed, PC, CPAs

Holland & Brown LLP

Homes, Lowry, Horn & Johnson, Ltd.

Honeycutt & McGuire CPAs

Hortenstine and McCown, CPAs, PC

Hottel & Willis, PC

Hughes & Basye, PC

Hunt & Calderone, PC, CPAs

J. Goddin & Associates, PC

Jay E. Reiner CPA PLLC

John M. Watkins, CPA

Johnson, Equi & Co., PLC

Jones, Adams & Delp, PC

Jones & Company CPA, LLC

Jones CPA Group, PC

Jones, Madden & Council, PLC

Jones & McIntyre, PLLC

JS Morlu, LLC

Katherine L. Foley CPA, PC Keiter

Kris McMackin CPA

L.P. Martin & Company, PC Lane & Associates, PC

Larry D. Greene CPA PC

Lauren V. Wolcott, CPA, PC Lent & Hawthorne, PC

M. Lee Winder & Associates, PC

Maida Development Company

Mallard & Mallard CPAs, LLC

Malvin, Riggins & Company, PC Martin, Beachy & Arehart, PLLC

McPhillips Roberts & Deans PLC

Meadows Urquhart Acree & Cook, LLP

Michael B. Cooke, CPA, PC Michael R. Anliker, CPA, PC Mitchell, Wiggins & Company, LLP

Moss & Riggs, PLLC

MJW

Mulkey & Co., PC

Nicholas, Jones & Co., PLC

PBMares, LLP

Pearson&Co., PC

R.P. Willis, PC

R.T. McCalpin & Associates

Renner & Company, CPAs, PC

Ritchie, Withers & Masincup PC

Robb Scott Bradshaw & Rawls, PC

Robinson Consulting Group

Roger L. Handy, PC Rubin, Koehmstedt & Nadler, PLC Russell, Evans & Thompson, PLLC

Rutherford & Johnson, PC Salter & Associates, PC Saunders, Matthews & Pfitzner, PLLC Saunders & Saunders, PC

Scheulen, Patchett & Edwards, PC

Sells Hogg & Associates CPAs, PC Sherman, Spero & Safarino, Ltd.

Spencer, Hager & Mosdell, PC

Spitler, Stephens & Associates PLLC

Stephen Merritt CPA, PC

Stephen F. Perry, PC

Stephen T. Shickel, CPA, PLC

Steve Guy & Associates, PC

Steve Walls & Associates, PLLC

Stokes Office Solutions LLC Sullivan, Andrews & Taylor PC

Terry L. Jones, CPA, LLC

The Cahill Group, LLC

The Davidson Group, PC

The Foley Group, Ltd.

Thomas E. Fraley, CPA Thompson Greenspon

Tongelidis Consulting, LLC Updegrove, Combs & McDaniel, PLC

Valderas Financial Solutions LLC

Verus Financial Partners

Wall, Einhorn & Chernitzer W.D. Sanders & Company, PC Wells Coleman

Wilkinson Consulting & CPA PLC

William B. May Jr., CPA, PC Wineholt & Associates, PC Yancey, Miller & Bowman, CPAs PLLC Yount, Hyde & Barbour, PC

Compiled July 31, 2015. Check vscpa.com/100Percent for a complete list. n

Gary Thomson, CPA, is the Mid-Atlantic regional managing partner for Dixon Hughes Goodman and serves on the firm’s Executive Committee. He’s married to his high school sweetheart, Janice, and has a daughter, Morgan, who is an athletic trainer and graduate student at Virginia Tech. In January, Gary completed a term as chairman of the Virginia Chamber of Commerce, where he continues to serve on the Executive Committee. He also serves on the VSCPA’s Board of Directors. He enjoys sports and is an avid golfer, a Pittsburgh Steelers season ticket holder and a Duke Blue Devils basketball fan.

I AM PASSIONATE ABOUT… This year has been all about my daughter's recent wedding. It's not possible my baby is married!!

PEOPLE DON’T KNOW THIS, BUT… I have been known to wear a Troy Polamalu wig to Pittsburgh Steelers games.

IF I WEREN’T AN ACCOUNTANT, I WOULD BE… A college professor or a basketball coach.

MY ADVICE TO FELLOW CPAs IS… Be well-rounded business leaders. We are trusted advisors and, as such, we have the opportunity to lead in many arenas, whether that be in our specific profession, in the community or in politics.

I NEVER LEAVE HOME WITHOUT… A little cash and my cell phone.

I WISH CPAs KNEW… How much we are trusted and needed beyond just the debits and credits or the Tax Code.

I’M A CPA BECAUSE… It’s a respected profession that allows us to help our staff and clients be more successful. n

ADVISOR AND LEADER >>

AM the vscpa

GARY THOMPSON, CPA >> Extending CPAs’ influence to the government arena.

SOLE PRACTITIONER SEEKS C.P.A. with partnership/buyout potential. Firm is located in rural Southside Virginia. Practice mainly accounting, payroll and taxation with some consulting work. Owner looking to retire within next 2 years. 5 years experience mandatory. Reply in confidence to #95, VSCPA, 4309 Cox Road, Glen Allen, VA 23060 or disclosures@vscpa.com.

TAX PRACTICE FOR SALE. Culpeper, VA. All client contact via phone, email, and snail mail only. $50K Gross. Average fee $900. Loyal, profitable, well trained clients. Most use Lacerte Tax Organizers. Some have been with me since Since 1979. Prior to downsizing 10 years ago I did about 190 returns. Currently 50. Have Lacerte files going back to the year 2000. $65K cash. Office building with apartment available also. info@danghazel.com

Classified ads are a great way to reach VSCPA members — 94 percent rate the information in Disclosures as excellent or good. What are you waiting for? Contact us at classifieds@vscpa. com or visit vscpa.com/Classifieds for rate information. Members receive a discount.

ARE YOU A YOUNG PROFESSIONAL looking to get the tools necessary to take the next step in your accounting career? The VSCPA’s third annual Leadership Academy will help you build on your innate talents and let your leadership abilities shine through.

The 2015 Leadership Academy is set for Nov. 16–18. Applications are due Friday, Sept. 18. Visit vscpa.com/LeadershipAcademy to apply! n

Selling? Download our FREE succession planning guide to getting your practice ready for market! Buying? When you buy an accounting practice from Poe Group Advisors, not only will you get a great practice, you’ll get insight. We take special care to thoroughly understand each practice we sell. That understanding — combined with our years of unmatched experience with successful transitions of accounting practices — helps you get the valuable insight to help you succeed.

Please visit www.PoeGroupAdvisors.com or email us at info@poegroupadvisors.com. 888-246-0974

VA1054 Virginia Beach, VA $425,000.00 VA1058 Virginia Beach, VA $895,000.00 VA2001 Williamsburg, VA $350,000.00 VA2002 Charlottesville, VA $175,000.00 NC1101 Outer Banks, NC $240,000.00 NC1103 Durham, NC $625,000.00 NC2001 Raleigh, NC $425,000.00 NC2004 Raleigh, NC $895,000.00 NC2003 Raleigh, NC $225,000.00

Thanks to all the VSCPA members who have already signed up to volunteer! Volunteer opportunities currently open are:

• Media Ambassadors (closes Sept. 30)

• Legislators’ Tax Guide Task Force (closes Sept. 30)

• Management of an Accounting Practice Task Force (closes Sept. 30)

• Educators’ Symposium Task Force (closes Sept. 30)

• VSCPA Board of Directors

• VSCPA Educational Foundation Board of Directors

• VSCPA PAC Board of Trustees

• Young Professionals Advisory Council

• VSCPA Accounting & Auditing Advisory Committee (opens Oct. 1)

• VSCPA Peer Review Committee (opens Oct. 1)

• VSCPA Professional Ethics Committee (opens Oct. 1)

• VSCPA Tax Advisory Committee (opens Oct. 1)

Visit vscpa.com/VolunteerSchedule to learn when you can sign up for your desired opportunity. n