Welcome to the special issue of Pickle focused on the CII Global M&E Investors Meet and the changing global media and entertainment landscape—a deep dive into India’s unprecedented rise as a creative powerhouse.

This year’s CII Big Picture Summit is more than an industry calendar highlight—it stands as a testimony to India’s M&E sector stepping confidently onto the world stage. The debut of the CII Global M&E Investors Meet, in strategic partnership with WAVES Bazaar, signals a bold new era of direct engagement between global capital and India’s most promising content creators, tech innovators, and entrepreneurs.

With curated deal-making sessions, investment matchmaking, and expert guidance from Elara Capital and Vitrina, the platform is purpose-built for investors and investees to forge partnerships that will reshape the future of media and entertainment in the AI era.

India’s “Advantage” has never been clearer: a unique blend of cultural diversity, a thriving creator economy, progressive policies, and world-class talent across AVGC-XR, digital, and traditional content verticals. The government’s focus on enabling infrastructure, supporting startups, and fostering innovation is fast-tracking India’s creative economy.

As the sector outpaces global growth, 2025 is set to be the year when

international collaboration and investment unlock new levels of innovation, scale, and global reach.

The momentum extends across India’s landmark events. The recently held IndiaJoy and the India Game Developer Conference (IGDC) , has catalyzed the digital entertainment and gaming boom, proving the commercial and cultural strength of Indian IP.

IFFI Goa is gearing up to set new standards in cinematic excellence, diversity, and inclusivity, while WAVES Film Bazaar continues to power South Asia’s narrative economy and drive cross-border co-productions. These platforms are not only showcasing Indian creativity on the world stage, but also cultivating vibrant ecosystems where ideas become global ventures and investment finds fertile ground. For investors, this is a rare opportunity to participate in India’s creative and technological leap. For creators and companies, it’s a chance to access mentorship, funding, and international partnerships like never before.

We hope this special issue of Pickle inspires you to explore new possibilities, connect with visionary leaders, and play a role in shaping the future of the global creative economy. Make plans to attend CII BIG Picture Summit and CII Global M&E Investor Meet (December 1 & 2, Mumbai). Contact us if you want to connect with the Indian M&E

n vidyasagar pickle media nat@pickle.co.in, www.pickle.co.in

Pickle Volume XVIII 7th Edition

Published by Pickle Media Private Limited

Email: natvid@gmail.com l Mumbai l Chennai No.2, Habib Complex Dr Durgabhai Deshmukh Road RA Puram CHENNAI 600 028

For advertising: natvid@gmail.com / pickle@pickle.co.in

Senior Editor : Vivek Ratnakar

Editorial Coordinators : Maitreyi Vidyasagar, Shruti Sundaranand

Design: Jose J Reegan, James, D Sharma, S Lakshmanan

Photo Editor : K K Laskar

Admin & Operations : B Rajalakshmi

Email: natvid@gmail.com

Pickle Business Guide 2025 Copyright 2025 by Pickle Media Pvt Ltd. All Rights Reserved. Pickle is an ad supported business guide tracking the filmed entertainment business in India.

SOUTH ASIA’S

SOUTH ASIA’S

SOUTH ASIA’S

SOUTH ASIA’S

TOP FILM MARKET FOR

TOP FILM MARKET FOR

TOP FILM MARKET FOR

TOP FILM MARKET FOR

GLOBAL COLLABORATIONS & CO-PRODUCTION

GLOBAL COLLABORATIONS & CO-PRODUCTION

GLOBAL COLLABORATIONS & CO-PRODUCTION

GLOBAL COLLABORATIONS & CO-PRODUCTION

20-24 November, 2025 | At Marriott, Panjim, Goa

20-24 November, 2025 | At Marriott, Panjim, Goa

20-24 November, 2025 | At Marriott, Panjim, Goa

20-24 November, 2025 | At Marriott, Panjim, Goa

Main verticals

Main verticals

Main verticals

Main verticals

CO PRODUCTION MARKET

CO PRODUCTION MARKET

CO PRODUCTION MARKET

CO PRODUCTION MARKET

SCREENWRITERS’ LAB

SCREENWRITERS’ LAB WORK IN PROGRESS LAB

SCREENWRITERS’ LAB WORK IN PROGRESS LAB

WORK IN PROGRESS LAB

SCREENWRITERS’ LAB WORK IN PROGRESS LAB

VIEWING ROOM

VIEWING ROOM

VIEWING ROOM

November 20-28,2025 | Goa, India

It is a converging point for South Asian & international film makers & film producers, sales agents & festival programmers for potential creative & financial collaboration For more info, Visit:

As

Access a curated deal pipeline across films, streaming, theme parks, gaming, virtual production, and AI driven ventures

Access a curated deal pipeline across films, streaming, theme parks, gaming, virtual production, and AI driven ventures

Access a curated deal pipeline across films, streaming, theme parks, gaming, virtual production, and AI driven ventures

Access a curated deal pipeline across films, streaming, theme parks, gaming, virtual production, and AI driven ventures

See sector-specific opportunities from top media houses, fast growing tech innovators, and state-backed infrastructure projects.

See sector-specific opportunities from top media houses, fast growing tech innovators, and state-backed infrastructure projects.

Hold

meetings

over 100+ companies seeking funding.

funding.

Talk directly to promoters who are already generating revenue and now ready to scale.

Talk directly to promoters who are already generating revenue and now ready to scale.

Talk directly to promoters who are already generating revenue and now ready to scale.

Talk directly to promoters who are already generating revenue and now ready to scale.

See sector-specific opportunities from top media houses, fast growing tech innovators, and state-backed infrastructure projects.

Explore co-investment structures under India’s 17 co-production treaties.

Explore co-investment structures under India’s 17 co-production treaties.

Explore co-investment structures under India’s 17 co-production treaties.

Explore co-investment structures under India’s 17 co-production treaties.

Spot ventures that are exitready, with commercialization strategies in place. Hold one-on-one meetings short listed from over 100+ companies seeking funding.

Spot ventures that are exitready, with commercialization strategies in place.

Spot ventures that are exitready, with commercialization strategies in place. Hold one-on-one meetings

See sector-specific opportunities from top media houses, fast growing tech innovators, and state-backed infrastructure projects. Spot ventures that are exitready, with commercialization strategies in place.

Hear from industry leaders who have already built successful positions in the sector.

Hear from industry leaders who have already built successful positions in the sector.

Hear from industry leaders who have already built successful positions in the sector.

Hear from industry leaders who have already built successful positions in the sector.

Hear from industry leaders who have already built successful positions in the sector.

Visit new studio hubs coming up in Mumbai, New Delhi, Bengaluru, and Chennai.

Visit new studio hubs coming up in Mumbai, New Delhi, Bengaluru, and

Visit new studio hubs coming up in Mumbai,

Visit new studio hubs coming up in Mumbai, New Delhi, Bengaluru, and

Visit new studio hubs coming up in Mumbai, New

and

Private Equity Funds Strategic Investors Venture Capital Funds

Private Equity Funds

Investors Venture Capital Funds

Capital Funds

HNIs (High-Net-Worth Individuals)

HNIs (High-Net-Worth Individuals)

HNIs (High-Net-Worth Individuals)

HNIs (High-Net-Worth Individuals)

HNIs (High-Net-Worth Individuals)

Be part of India’s expanding $30B+ M&E industry with CIIfiltered access to emerging opportunities.

CII-

Be part of India’s expanding $30B+ M&E industry with CIIfiltered access to emerging opportunities.

Be part of India’s expanding $30B+ M&E industry with CIIfiltered access to emerging opportunities.

Investee Participants

Investee Participants

Digital

Digital

Digital Platforms and service providers – OTT, Vertical Videos, FAST TV and AI services.

Digital Platforms and service providers – OTT, Vertical Videos, FAST TV and AI services.

Broadcasters, Broadband media providers and aggregators

Broadcasters, Broadband media providers and aggregators

Broadcasters, Broadband media providers and aggregators

Broadcasters, Broadband media providers and aggregators

Traditional Print brands/Integrated Trans media houses

Traditional Print brands/Integrated Trans media houses

Traditional Print brands/Integrated Trans media houses

Online gaming studios

Traditional Print brands/Integrated Trans media houses

Online gaming studios

Online gaming studios

Online gaming studios

Filmed entertainment studios, production companies and independent specialists

Filmed entertainment studios, production companies and independent specialists

Filmed entertainment studios, production companies and independent specialists

Filmed entertainment studios, production companies and independent specialists

Animation & VFX studios

Animation & VFX studios

Animation & VFX studios

Animation & VFX studios

Theme Parks, Exhibition and Venue services

Theme Parks, Exhibition and Venue services

Theme Parks, Exhibition and Venue services

Theme Parks, Exhibition and Venue services

Live Events & Music

Live Events & Music

Live Events & Music

Live Events & Music

OOH

OOH

OOH

OOH

Infrastructure companies

Infrastructure companies

Infrastructure companies

Infrastructure companies

Government Agencies

Government Agencies

Government Agencies

Government Agencies

Growth

Growth

Growth capital for expansion, technology upgrades, and new market entry.

Growth capital for expansion, technology upgrades, and new market entry.

Access to global networks and co-production opportunities.

Access to global networks and co-production opportunities.

Experienced

Experienced

High-potential

Regional

Curated Deal Flow

Curated Deal Flow

Curated Deal Flow

Ventures aren’t just listed — they’re handpicked. Each has been screened for funding readiness

Ventures aren’t just listed — they’re handpicked. Each has been screened for funding readiness

Ventures aren’t just listed — they’re handpicked. Each has been screened for funding readiness

Efficient Matchmaking

Efficient Matchmaking

Efficient Matchmaking

Expect introductions and pitch sessions with 80–100 vetted partners, designed to make every meeting count

Expect introductions and pitch sessions with 80–100 vetted partners, designed to make every meeting count

Expect introductions and pitch sessions with 80–100 vetted partners, designed to make every meeting count

Direct Access

Direct Access

Direct Access

Meet founders, C-suite executives, and senior government officials — the people who actually make decisions

Meet founders, C-suite executives, and senior government officials — the people who actually make decisions

Meet founders, C-suite executives, and senior government officials — the people who actually make decisions

One on One Opportunity collated, reviewed, and filtered by CII, the apex industry body for India’s media and entertainment sector

One on One Opportunity collated, reviewed, and filtered by CII, the apex industry body for India’s media and entertainment sector

One on One Opportunity collated, reviewed, and filtered by CII, the apex industry body for India’s media and entertainment sector

Focused Deal Environment

Focused Deal Environment

Focused Deal Environment

Networking is supported by dedicated deal rooms where conversations can move beyond introductions and into action.

Networking is supported by dedicated deal rooms where conversations can move beyond introductions and into action.

Networking is supported by dedicated deal rooms where conversations can move beyond introductions and into action.

LOS ANGELES I NOVEMBER 11-16, 2025

The Confederation of Indian Industry (CII) has announced the launch of the CII Global M&E Investor Meet at the 12th annual CII BIG Picture Summit, to be held on December 1-2, 2025, in Mumbai. This initiative, launched in collaboration with WAVES Bazaar, aims to unlock the full potential of India’s media and entertainment (M&E) sector by integrating investment with companies to fuel the next wave of growth.

CII has announced Elara Capital as the Investment Partner and Vitrina as the Global Financing Partner for the Investor Meet. WAVES Bazaar, a leading platform for business networking and project pitching in the M&E sector, will integrate its successful B2B meeting format and project showcases— featuring initiatives from its existing projects and WAVES Film Bazaar—into the CII Marketplace during the summit.

The CII Big Picture Summit, themed “The AI Era: Bridging Creativity & Commerce,” will bring together leaders from government and industry to chart a roadmap for the growth and transformation of India’s Media & Entertainment (M&E) sector. The Summit is being organized in collaboration with the Ministry of Information and Broadcasting, Government of India.

Sanjay Jaju, Secretary, Ministry of Information & Broadcasting and Gaurav Banerjee, MD &CEO, Sony Pictures

Network India are Charing the CII BIG Picture Summit along with Rajan Navani, CEO, Jet Synthesys, Gunjan Soni, Country Managing Director, YouTube India, (Office bearers of CII National Council of M&E).

The CII M&E Global Investor Meet will connect international investors with India’s most promising ventures through curated one-on-one meetings. The initiative is set to catalyze both global and domestic investment into India’s rapidly expanding M&E sector, covering film, streaming, gaming, animation, VFX, live entertainment, and more.

“India’s M&E industry, despite its rich history, has thrived largely on private passion and capital. CII’s Investor Meet is a major step to change that,” said Shibashish Sarkar, Chairman of the CII Global M&E Investor Summit, Group CEO of Reliance Entertainment, and President of the Producers Guild of India. “For the first time, we’re bringing global investors and Indian M&E enterprises together in a curated, one-on-one format. This summit is not just a generic expo but a true matchmaking event aimed at showcasing Indian companies as viable, exciting investments. I see this as the beginning of a journey.”

“Elara Capital is pleased to partner with the CII M&E Global Investor Summit. We look forward to bringing together the investor community and corporates

in the M&E space, driving synergies for both sectors in the best possible manner,” said Harendra Kumar, MD, Elara Capital.

“Vitrina is proud to partner with CII and the M&E Investor Meet on this landmark initiative,” said Atul Phadnis, CEO, Vitrina. “India’s M&E ecosystem is evolving rapidly, and our mission is to spotlight India’s potential on the global stage, connecting the right investors to the right opportunities.”

The CII BIG Picture Summit is the premier annual gathering of India’s media and entertainment industry, convening policymakers, industry pioneers, investors, and creative

leaders to drive the sector’s growth and innovation. As part of the Summit, CII Marketplace and WAVES Bazaar will jointly facilitate exclusive B2B meetings, bringing together industry leaders, buyers, sellers, and content creators for co-production opportunities.

The Summit will also feature participation from WAVEX and WAVES Creatosphere, contributing to a dynamic environment for start-up collaboration and business growth.

WAVES BAZAAR LINK:

Waves Bazaar: https://wavesbazaar. com/

From pioneering policy shifts to spearheading AI-powered innovation and global investment, the CII Big Picture Summit is not just charting the course for India’s M&E industry— it’s defining the blueprint for a creative economy that’s ready to lead on the world stage

The CII Big Picture Summit stands as the definitive annual marquee event for India’s dynamic Media & Entertainment (M&E) industry. Now approaching its 12th edition on December 1-2, 2025, in Mumbai, the Summit has grown from a mere industry gathering into a strategic fulcrum shaping policy, investment,

technology adoption, and international collaboration in the sector.

The 2025 theme, “The AI Era: Bridging Creativity & Commerce”, reflects a timely and transformative discourse on how artificial intelligence is revolutionizing creativity, content creation, and business models within Indian media.

Organized by the Confederation of Indian Industry (CII) in partnership with the Ministry of Information and Broadcasting, the Summit convenes an elite constellation of industry leaders, policymakers, investors, and visionaries spanning film, streaming, gaming, animation, VFX, and live entertainment.

This edition is poised to craft a collective roadmap for India’s M&E sector to scale new heights with global aspirations. Sanjay Jaju, Secretary, Ministry of Information & Broadcasting, chairs the event alongside key industry figures like Gaurav Banerjee, MD & CEO, Sony Pictures Networks India; Rajan Navani, CEO, Jet Synthesys; and Gunjan Soni, Country Managing Director, YouTube India. Their leadership reflects a strategic convergence of government policy, industry insight, and global commerce foresight.

The centerpiece for 2025 is the launch of the “CII Global M&E Investor Meet”, a first-ever initiative designed to channel global and domestic investments more directly into India’s burgeoning media and entertainment companies. Held in partnership with WAVES Bazaar—a vital platform for business networking and project pitching in the sector—the meet revolves around curated, one-onone investment matchmaking sessions that connect promising Indian ventures with capital and strategic partners. The initiative’s success is bolstered by strategic investors Elara Capital and Vitrina, adding financial muscle and market expertise to this ambitious platform.

India’s M&E industry traditionally thrived on powerful private passion and fragmented funding. The Big Picture Summit marks a watershed moment with an organized, large-scale investment construct driven by AIpowered content innovation.

By linking investors directly with companies and nurturing B2B collaborations, the Summit loudly signals India’s readiness for the global stage. This evolution unleashes a powerful industrial momentum— fusing creativity with commerce, expanding market reach, and integrating AI as a force multiplier in content creation, distribution, and monetization.

The Summit also conceives specialized forums such as the CII Marketplace and WAVES Bazaar collaborations that facilitate content deals, co-productions, and engagement with startups via WAVEX and WAVES Creatosphere programs. These synergistic platforms foster an environment ripe for entrepreneurship, innovation, and sustained cultural export growth.

The CII Big Picture Summit embodies India’s strategic push to position its M&E industry as a future-ready global creative economy powerhouse. Through AI integration, bespoke investor matchmaking, and collaborative international partnerships, the Summit unlocks new growth trajectories for Indian entertainment. It heralds a new chapter where creative ambition, technological prowess, and financial dynamism converge to amplify India’s cultural influence worldwide.

M&E in India is no longer a zero-sum game. Platform advantages and creative brilliance must co-evolve, underpinned by robust governance and transparent metrics. Only then can capital, content, and technology truly compound for mutual, sustainable gains.

By Dr S. Raghunath

In India’s rapidly evolving media and entertainment (M&E) landscape, success no longer depends on just creative brilliance or outstanding financial muscle. It depends on how platform power and creative excellence interlock and how investors’ strengths in distribution, ad-tech, and intellectual property (IP) compound the investee’s storytelling, cost discipline, and multilingual agility. When such partnerships are embedded in clean governance, transparent waterfalls, and shared dashboards, they transcend transactional funding. They create sustainable, data-driven ecosystems.

Investors today bring more than capital; they bring platform advantages. Distribution networks, connected TV (CTV) ecosystems, ad-tech analytics, and sports/IP rights serve as scalable levers that reduce risk and amplify reach. Meanwhile, investees such as the creators, studios, production houses, and digital platforms bring creative ingenuity, operational frugality, and

audience intuition. The alchemy lies in combining these two asymmetries of strength.

Take the Reliance–Disney India joint venture. Reliance’s Viacom18 provided distribution muscle, a domestic ad network, and a broadband base of 50 million+ subscribers through Jio. Disney contributed deep IP sports rights, global OTT expertise, and storytelling franchises. The outcome was not a mere merger of media houses but a compounding of scale. Reliance’s ad-tech stack elevated monetization efficiency across Disney+ Hotstar, while Disney’s creative slate found guaranteed reach across India’s tier2 and tier-3 geographies. Both sides had upsides. Disney offset the global subscriber slowdown. Reliance gained premium inventory and IP muscle.

In capital markets, ‘compounding’ refers to exponential growth through reinvested returns. In the M&E sector, it occurs when investor

Dr S. Raghunath

Professor of Strategy, Indian Institute of Management, Bangalore

infrastructure accelerates the velocity of creative outputs, and creative IP, in turn, enhances the valuation of the platform. Consider Zee Studios’ regional expansion model. Investors funded a multilingual slate across Marathi, Telugu, and Punjabi, ensuring diversified cash flows. The creative teams leveraged those funds not for scale alone but for adaptive dubbing, regional casting, and data-driven genre testing. ROI was not linear. It accelerated because each success improved the predictive accuracy of the next.

In OTT, Amazon Prime Video India moved from acquisition-heavy to coproduction models with Indian studios. The investor offered infrastructure. Global distribution, algorithmic promotion, and digital payment integration. The investees contributed local storytelling and cultural sensitivity. Transparent revenuesharing dashboards and performancelinked renewals created trust.

Governance quality has financial velocity. Clean contracts, transparent waterfalls of revenue, and rights documentation reduce frictional costs and creative disputes. The Sony–Zee merger collapse in 2024 underscores this: despite strategic synergies, failure to ensure leadership clarity and regulatory readiness eroded trust. In contrast, Balaji Telefilms’ partnership with Reliance Jio for ALTBalaji

distribution was anchored on preagreed data access, performance-based payouts, and transparent subscriber attribution.

Modern M&E partnerships thrive on shared analytics dashboards and live metrics on audience growth, churn, view-through rates, and revenue realization. These dashboards institutionalize transparency and depersonalize performance discussions. TVF (The Viral Fever) maintains a shared performance dashboard for its streaming partners, enabling agile creative pivots. In sports streaming, Disney Star and JioCinema used shared dashboards during IPL 2024 to optimize ad inventory across CTV and mobile, attracting incremental capital for subsequent seasons.

Info Edge invested in Pocket Aces, bringing data insights to refine audience segmentation. The Sun TV and MX Player partnership enabled dubbed and subtitled content across multiple Indian languages, monetizing existing IP and ad pricing and improving CPMs by 30%. Dream11 and Disney Hotstar’s collaboration during IPL 2024 linked gamified engagement with ad inventory performance, backed by automated dashboards.

For sustainable growth, incentives across the value chain must align. Investors should not seek short-term extraction but co-evolve with investees

through earn-outs, IP co-ownership, and performance-linked reinvestments. In the T-Series–Netflix partnership, renewal triggers were tied to viewership thresholds and soundtrack success, leading to mutual gains.

Timing the Inflection Point

India’s M&E market is projected to reach ₹3.1 trillion by 2027 (~7% CAGR). OTT viewers stand at 601 million, connected-TV users at 129 million (87% YoY growth), and digital ad spend now contributes 46% of India’s ₹1-lakh-crore advertising market. Rising disposable incomes and the global appeal of Indian IP make this the perfect moment for capital infusion.

When platform advantages compound creative excellence, the result is attractive value creation. But to sustain it, partners must institutionalize governance, transparency, and shared metrics. India’s M&E sector is not short of talent or technology; it is short of trust capital. Partnerships built on data, governance, and shared ethics will redefine value creation in this decade.

India’s macro environment is highly supportive. GDP growth of 6.8% (FY 2024-25), 850 million smartphone users, 5G rollout in 500 cities, and the world’s

lowest data cost. Regulatory clarity has improved 100%. FDI is allowed in OTT and digital news, and the AVGCXR sector has been recognized as a national growth engine. India exports over $1 billion annually in film, OTT, and music content, driven by diaspora and global OTT demand.

Challenges remain, such as piracy, fragmented regulation, and evolving censorship norms. Yet resilience is built in through diversification across language and medium, hybrid monetization (subscription + AVOD + brand integration), and AI-driven localization that cuts costs and expands market reach. The risk-adjusted return profile, therefore, remains favorable, especially for long-term investors.

The investment climate for India’s M&E industry in 2025 is strategically ripe. Audience scale (601M OTT users) meets monetization depth (digital ≈ 46% of ad spend; 15% ad-CAGR outlook), while theatrical business normalizes and regional hits diversify risk. Platform consolidation is unlocking bundled economics, and gaming’s 20% CAGR opens an adjacent growth curve. Investors who bring strategic patience and operational value will outpace those chasing quick returns. The real alpha lies in partnerships where investor platforms amplify creative innovation.

INVESTORS EYEING INDIA’S BOOMING MEDIA

The

Shibasish Sarkar, Group CEO of Reliance Entertainment, President of the Producers Guild of India, and Chair of the CII Global M&E Investor Meet 2025

As the Indian M&E sector stands at the crossroads of transformation, Shibasish Sarkar, Group CEO of Reliance Entertainment, President of the Producers Guild of India, and Chair of the CII Global M&E Investor Meet 2025, shares his nuanced perspective on the opportunities, headwinds, and the crucial role of institutional capital in shaping the industry’s future. Shibasish Sarkar chats with PICKLE

Few industries have experienced the intense evolution and disruption that Indian Media & Entertainment (M&E) has over the last decade and 2025 has turned out to be more than a statistical milestone for Indian M&E — it’s a year that will define the sector’s direction for the decade ahead. Whether it’s the digital tipping point, recovery in cinemas, animation breakthroughs, or the rise of live events, the industry is at an inflection point.

For the first time, digital streaming has overtaken traditional broadcasting, fundamentally reshaping India’s ₹2.5 lakh crore industry. Yet, this evolution is anything but uniform: while digital surges ahead,

television and print are finding new equilibrium, and live events are breaking records in communal entertainment. Cinema footfalls are rebounding to global-leading levels, but success increasingly hinges on quality storytelling and innovation.

At the heart of these changes stands Shibasish Sarkar, one of the most influential voices in the sector, wearing multiple hats — as Group CEO of Reliance Entertainment, President, Producers Guild of India, and Chair for the CII Global M&E Investor Meet 2025.

In a candid interview with Pickle, Sarkar delves into how the demand curve has shifted, as audiences

AUDIENCES ARE NO LONGER INTERESTED IN AVERAGE STORIES—IF THE CONTENT EXCITES THEM, THEY COME IN BIG NUMBERS. IF NOT, IT CRASHES. THAT’S A CLEAR MESSAGE TO ALL CREATORS: ORIGINALITY AND QUALITY ARE EVERYTHING

Shibasish Sarkar Group CEO of Reliance Entertainment, President of the Producers Guild of India, and Chair of the CII Global M&E Investor Meet 2025

reward originality and authenticity, leaving little room for mediocrity or formulaic repetition.

Crucially, Sarkar argues that the next phase of growth will require more than creative excellence. Systemic reforms in investment, infrastructure, and vocational education must take center stage.

The CII Global Media & Entertainment Investor Meet 2025 is positioned as a catalyst for this shift: an organized platform to attract institutional capital, foster international alliances, and advocate for policy changes that will shape the sector for the next decade.

Against this backdrop, Sarkar’s vision is clear: the future of Indian M&E hinges on balancing creativity with commerce, embracing technology, and building a globally competitive, resilient industry. The year ahead will test the sector’s adaptability—but it also offers an unprecedented opportunity to script a new chapter as a true global media powerhouse.

Following are the excerpts from the interview:

Pickle: How do you see the current scenario across the Indian M&E sector? What are the key signals from the film, digital, and other verticals?

Shibasish Sarkar: This year is truly unique for Indian M&E — both for its positives and its stark challenges. For starters, 2025 is the first time digital has overtaken broadcasting in market share within our ₹2.5 lakh crore sector. Traditional TV is under significant stress, with households declining from a peak of 140 million to a level where we’re asking, “Where will it stabilize — 80, 90, 100 million?”

But within these shifts, connected TV is growing rapidly, giving us hope that technology is not eroding

2025 IS THE FIRST TIME DIGITAL HAS OVERTAKEN BROADCASTING.

IT’S A WATERSHED MOMENT — NOT JUST A SHIFT, BUT A TRANSFORMATION IN HOW INDIAN AUDIENCES ENGAGE WITH CONTENT

Institutional Capital Imperative: Indian M&E is overdue for the kind of structured, long-term investment global peers enjoy. The CII Investor Meet aims to bridge this gap, connecting Indian enterprises to world-class investors.

Infrastructure Crisis: From 13,000 screens a decade ago to just 9,000–10,000 today—India’s exhibition infrastructure lags behind China’s 85,000. Sarkar calls for targeted government incentives, especially in underserved markets.

Sarkar advocates for regulatory reforms—including genuine single-window clearances and transparent permissions—to unlock faster growth and attract global productions.

Global Collaboration: Build robust ties with international content creators, investors, and policymakers.

DESPITE THE DIGITAL BOOM, THE BENEFITS ARE CONCENTRATED AMONG THE TOP GLOBAL PLATFORMS. FOR REAL, SUSTAINABLE GROWTH, WE NEED TO ENSURE VALUE CREATION IS MORE WIDELY SPREAD ACROSS INDIAN

the sector, but transforming it. In a country as vast and diverse as India, broadcasting will remain strong at a certain size. The question is, “What will that steady state look like?”

On the digital side, yes, the numbers are euphoric at first glance, but much of the ad revenue that’s migrated from TV is aggregating to just two players — Meta and Google. The growth in quick commerce and e-commerce advertising is real, but it’s important to ask how sustainable it will be long-term.

The Indian film industry has seen a post-pandemic resurgence. How do you compare its recovery to Hollywood and other global markets?

If you look at Hollywood, even after 3–4 years, they’ve recovered roughly to 70–75% of 2019’s footfalls. The Indian film industry is already at 85–86% on footfalls, and in value terms, we’ve crossed pre-COVID levels, thanks to increased ticket prices. What’s truly heartening about 2025 is that films of every size and genre

have succeeded. Gone is the myth that only big-budget spectacles or franchises work post-COVID. This year, Hindi, Tamil, Telugu, Malayalam — all have delivered successes, big and small. It’s clear: audiences are back, but only for compelling storytelling. Anything average simply crashes. That’s a wakeup call for creators — formulaic content won’t work; freshness, strong scripts, and originality are what draw crowds.

But there are challenges: the crash in satellite rights has hit non-theatrical

UNIQUE BALANCE OF CREATIVITY AND COMMERCE. BOTH ARE ESSENTIAL — AND NEITHER ALONE IS ENOUGH

revenues hard. Even OTT rights are under pressure, with platforms shifting focus to ad-driven models. This changes both pricing and the kind of content that gets commissioned, nudging OTTs away from niche, edgy fare towards more family-friendly programming.

Beyond films and TV, how are other verticals — like animation, gaming, and live events — shaping up?

Animation is in transition globally and in India. AI’s impact has been both positive and negative; we’ve seen some large companies fold, but also the historic success of an Indian IP like Narasimha crossing the ₹200–300 crore mark worldwide. This is unprecedented, shattering the myth that Indian animation can’t travel or succeed at scale. It’s energizing new creators and storytellers.

In gaming, the government’s stance on real money games has provided much-needed clarity. It’s a boost for both the core gaming and eSports communities — though it remains crucial to collaborate

WE MUST

with policymakers for sustainable growth.

Live events and concerts have exploded — a trend since 2023–24. BookMyShow’s ticket sales for live events will, for the first time, surpass those for cinema this year. There is huge pent-up demand, with global and Indian acts routinely selling out.

Print, contrary to past fears of complete cannibalization, has stabilized and even shown modest growth. Each vertical has mixed stories, but overall, the positives are outpacing the negatives.

There’s much talk of policy reform — particularly one-window clearances. What’s the ground reality, and what’s needed to truly enable ease of doing business?

“One-window clearance” has long been a buzzword, but on the ground, it’s still a work in progress. In a city like Mumbai, you’ll find one side of a street under one police station’s jurisdiction and the other side

INDIAN M&E HAS RUN ON PRIVATE PASSION FOR DECADES. THE CII GLOBAL M&E INVESTOR MEET IS OUR FIRST

Strategic Matchmaking: The summit offers curated, oneon-one meetings, giving Indian M&E companies unprecedented access to global institutional capital.

Sector-Wide Benefits: Beyond funding, the meet aims to raise the sector’s profile as a credible, investible asset class, catalyze policy advocacy, and build a roadmap for infrastructure and skill development.

Long-Term Vision: Sarkar sees the summit as the first organized effort to shift Indian M&E from passion-driven, fragmented growth to a model anchored in strategic investment, international collaboration, and scalable innovation.

under another — requiring two permissions for one location! Despite circulars and announcements, the process remains complex, buried in layers of bureaucracy.

The industry has thrived despite these hurdles, but meaningful change requires genuine involvement from authorities — understanding the real pain points and implementing solutions collaboratively. This applies to both film and the booming live events sector. If governments and municipal bodies engage more deeply, lay out clear SOPs, and work with industry stakeholders, it will unlock even greater potential.

You’ve been engaging with global leaders — Spain, UK, and more. Why is there growing international interest in Indian filmmakers?

In my role as Producers Guild President, I’ve focused on opening doors for global collaboration — from institutional capital to infrastructure and talent development. India is now respected as a market not just for consumption but for content creation and co-production.

Countries like Spain and the UK have shown remarkable commitment,

sending their top leaders to meet with Indian guild members, eager to attract Indian productions. They recognize that when Indian films shoot abroad, it’s not just about spending; it’s about projecting their countries as tourist destinations, creating a far larger economic impact.

We’ve signed over 25 MOUs with international commissions, and our partnerships with organizations like PACT (UK’s producers’ body) and the BFI are expanding. This is a twoway street: we champion India as a

destination, and also help Indian content go global. The momentum is real, and I see it only growing.

As Chair of the CII Global M&E Investor Meet 2025, why do you see this summit as crucial for the industry?

India’s M&E industry, despite being 150–200 years old (including print), has thrived largely on private passion and capital. Unlike the West or even Southeast Asia, we lack a

Vocational Training Revolution: As content production modernizes, traditional institutions (FTII, SRFTI) alone can’t meet demand. Sarkar urges new frameworks for upskilling in film, animation, gaming, and digital content, with an eye on emerging fields like AI and virtual production.

AI & Creative Disruption: From VFX to AI-driven dubbing and scriptwriting, technology is altering workflows, job profiles, and the creative process. The sector’s response must be proactive—reskilling and regulatory clarity are essential.

Producer’s Dilemma: With unpredictable box office and shrinking non-theatrical revenues, producers face unprecedented stress. Guilds advocate for fairer terms, better incentives, and sustainable business models.

tradition of institutional investment in content creation. Globally, banks and financial institutions have recognized M&E as an asset class for decades. In India, with a few exceptions, this hasn’t happened.

CII’s Investor Meet is a major step to change that. For the first time, we’re bringing global investors and Indian M&E enterprises together in a curated, one-on-one format — not a generic expo, but a matchmaking summit. We’re rigorously screening both sides, aiming to showcase Indian companies as viable, exciting investments.

For investors, it’s a chance to see the sector’s breadth, from sunrise verticals to mature businesses. For the industry, it’s about learning to present ourselves as investible, stable, and growth-oriented. I see this as the beginning of a journey — if it’s a decent start, we’ll only scale from here.

Pickle: From an investor’s perspective, what makes India and its M&E sector especially attractive today?

Shibasish Sarkar: When pitching to investors, I focus on three things — the country, the sector, and the specific opportunity. India is among the world’s fastest-growing economies, with a young, dynamic population and relatively stable governance. In a globally uncertain environment, India stands out as a bright spot.

The M&E sector itself has a track record of outpacing GDP growth, especially in digital, gaming, and live events. Some segments are mature; others are just taking off. There’s diversity, resilience, and immense room for value creation.

Of course, investors want ROI, stability, and certainty. The sector offers all three, provided we address structural gaps — like institutional funding and ease of doing business. The CII summit is a step in that direction.

Digital Dominance: Streaming platforms surpass traditional TV, with digital advertising revenue consolidating among giants like Meta and Google.

Cinematic Resurgence: Indian cinemas recoup up to 86% of pre-pandemic footfalls; theatre value bolstered by higher ticket prices and a return to diverse storytelling.

Live Events Surge: Concert and event ticket sales outpace cinema, reflecting a massive appetite for shared, real-world experiences post-pandemic.

Print’s Resilience: Despite digital cannibalization fears, print stabilizes, underlining India’s diverse consumption habits.

Evolving Consumer Tastes: Success hinges on fresh, innovative content—audiences reject mediocrity in favor of distinctive stories, talent, and genres.

Parameter India Western Europe/US

Clarity of Rules Often uncertain, bureaucratic Well-defined, transparent

Process Reliability Variable, sometimes ad hoc Predictable, structured

Permissions Multiple layers, face-to-face Mostly digital, minimal

Pickle: As a chartered accountant by training, how have you navigated — and led — such a creative, volatile industry?

Shibasish Sarkar: I began my career in FMCG and public sector roles before moving to media. Initially, I saw everything through the lens of commercial discipline — budgets, predictability, bottom lines. But over 20 years, I’ve learned that M&E needs a unique balance of creativity and commerce.

Creativity is the heart of our business, but if it isn’t balanced with financial discipline, the business risks being unsustainable. Conversely, a purely transactional approach stifles innovation. The best path is to surround yourself with great people, keep learning, and maintain an open mind.

Today’s industry leaders increasingly recognize this — hence the rise of co-CEO models and leadership teams that blend creative and commercial strengths. Success, especially in a sector as dynamic as ours, requires both.

As India’s top-ranked media and entertainment analyst, Karan Taurani, EVP of Elara Capital, shares his deep insights on the sector’s digital pivot, investment climate, and the road ahead for companies and investors. Karan Taurani chats with Pickle

The Indian Media and Entertainment (M&E) industry is in the midst of a profound transformation. With digital media now driving the lion’s share of growth and traditional segments facing mounting challenges, the sector’s future hinges on how quickly and effectively companies can adapt to new realities. At the forefront of this shift is Karan Taurani, Executive Vice President at Elara Capital, who has been recognized as India’s number one M&E analyst by the AsiaMoney Brokers Poll for three consecutive years. In this exclusive interview with Pickle, Taurani unpacks the latest trends shaping the industry in 2025, offers practical advice for founders and investors, and shares his perspective on where real value and opportunity lie in a rapidly evolving market.

Pickle: What’s your take on the Indian Media and Entertainment (M&E) industry’s growth in 2025 compared to previous years?

Karan Taurani: This year, the M&E industry is witnessing a strong extension towards digital. The shift from traditional to digital is continuing in 2025. The TV segment, in particular, is clearly struggling, while print has somewhat managed to sustain its market share. However, TV is losing significant share, and most of that is moving rapidly to digital, with some also going to connected TV.

By my assessment, due to the GST consumption push towards the end of

CY25, there will be some respite, and the industry might end up growing in the range of 8-10%. But, net-net, about 90% of this incremental growth is going to come from digital, especially as e-commerce and quick commerce have scaled up aggressively.

Elara Capital has collaborated with the CII Global M&E Investor Meet as part of the CII Big Picture Summit 2025. How do you see the M&E investment climate as we speak now?

The investment climate is a mixed bag right now. Traditional businesses need to reinvent themselves to scale up on digital; many still have less than 1015% of revenue coming from digital. This is precisely why the climate is mixed. Investors want to bet on digital models where digitization is mature. For instance, in the music industry, about 80-90% of revenue now comes from digital, making it the only media segment with such a high level of digitization.

As a result, valuation multiples are higher there. Traditional companies, even with healthy cash flows and premium EBITDA margins, are not able to command high valuations because their growth rates are stagnating, with overall market share converging. Thus, both investment and valuation challenges persist for traditional businesses.

What would convince institutional investors looking at the Indian M&E sector, with digital media now dominating the sector revenues?

Digital media is definitely driving growth. What will convince investors are, first, the growth rate in the specific digital segment—whether that’s OTT,

influencer marketing, gaming, or something else. Second is the path to profitability. Investors are especially interested in micro-segments of digital where there is consolidation and less fragmentation. Real money gaming, for example, is having a negative impact on overall advertising, though some of that is offset by the recent GST boost.

Overall, the media industry’s advertising growth rate won’t be more than 7-8%, with 90% of that coming from digital. Investors are now selective, avoiding OTT platforms in heavily fragmented markets without a clear path to profitability, especially as they lose ad revenue to e-commerce and quick commerce platforms.

You’re ranked #1 by AsiaMoney Brokers Poll for three consecutive years in Indian M&E coverage. Where do you see the biggest disconnect between how institutional investors view India’s M&E sector versus how you believe it should be valued?

The biggest disconnect is that investors are looking for companies that balance growth with profitability. In traditional media, growth is mostly absent, so all that’s left is premium margins. Investors want to see traditional companies scale up digital revenues—think 25-30% of their revenue from digital.

They also want to see how these companies can maintain profitability even as they expand into digital, since digital growth often comes with losses. If a company’s digital business is growing but isn’t profitable, valuations remain suppressed. Ideally, investors want M&E companies with scale in digital, better growth in the traditional segments they operate in, and margins that aren’t compromised by digital expansion.

Unfortunately, that perfect mix is rare, and most traditional businesses are declining. So, the major disconnect is that stable businesses with healthy profitability aren’t growing, and those aggressively pursuing digital see margins fall and valuations remain depressed.

Of the ₹2.5 trillion M&E market, listed companies represent approximately ₹1 trillion in market cap. This means 60% of the sector remains private and fragmented. What’s the thesis for professional investors to focus on private investments and consolidation plays in M&E versus buying listed names?

Listed companies haven’t seen much uplift in valuations. If you look at radio, print, and TV, their valuation multiples have actually gone down due to digital media scale losses, lower profitability, and fragmentation. Many market caps are significantly down—Zee, for example, has lost 70-80% of its market cap since pre-COVID, and Sun TV is down 30-40%.

Print has been more stable, maintaining 5-6% growth with healthy margins, so the erosion isn’t as steep. Digital isn’t scaling dramatically, but at least the growth rate is maintained at 6-7%

THE INVESTMENT CLIMATE IS A MIXED BAG—TRADITIONAL MEDIA STRUGGLES TO ATTRACT HIGH VALUATIONS, WHILE MATURE DIGITAL BUSINESSES, PARTICULARLY IN MUSIC AND SELECT MICRO-SEGMENTS, ARE COMMANDING PREMIUM MULTIPLES DUE TO THEIR SCALABILITY AND PROFITABILITY

because of regional strength. Radio has also seen major market cap erosion.

Clearly, listed companies have suffered for being unable to scale digitally and facing digital competition. So, the thesis for professional investors should be to focus on private investments, particularly in high-growth segments like gaming or niche OTT platforms with proven economics. For example, in India, the OTT business as a whole lacks unit economics, which is a problem.

More than 50% of India’s M&E sector remains unlisted, with thousands of independent production companies, regional players, and digital startups outside the listed universe. For aggressive investors seeking scale and differentiation, what’s the optimal approach: backing listed companies, acquiring unlisted producers, investing in new platforms, or co-investing in specific IP?

The market has a long tail, with many production houses and OTT platforms operating on a small scale. Aggregation is the future—bringing these players under one umbrella, partnering with larger OTT platforms like Amazon or Netflix to leverage and upsell to their subscriber base. We saw this with telecom, where direct-to-consumer acquisition was too costly, so platforms partnered with telecoms to scale subscribers. This needs to happen again.

Production houses should tie up with OTTs or big studios to scale content, as the ecosystem is about partnerships and aggregation. Producers alone can’t finance, distribute, and sell content at scale—they need partnerships for bargaining power and to leverage each other’s strengths.

What specific deal characteristics— revenue scale, profitability, growth rates, management pedigree—would institutional investors demand before deploying capital into Indian M&E at the same conviction levels as fintech, SaaS, or healthcare?

Investors look for revenue scale, the total addressable market (TAM), growth rates, positioning, execution, strategic differentiation, ability to scale market

WITH OVER HALF THE SECTOR UNLISTED AND HIGHLY FRAGMENTED, TAURANI SEES A MAJOR OPPORTUNITY FOR PRIVATE INVESTORS TO BACK AGGREGATION AND PARTNERSHIP

‘AGGREGATION IS THE WAY AHEAD; CONSOLIDATION AND COLLABORATION WITH LARGER PLATFORMS WILL DRIVE REAL VALUE

share, and track record. They want a blend of growth, profitability, and good execution. For instance, a company growing at 50% but burning ₹1,000 crore a year isn’t attractive. The focus is on companies with balanced growth and profitability and a proven track record.

Do you foresee a wave of M&E IPOs, similar to the early 2000s, with listings like JioStar, Applause Entertainment, Green Gold Animation, and others?

There could be a wave of IPOs, but for companies like JioStar, you can already play that exposure through Network18. Applause, Green Gold, and others could be candidates. Smaller content production houses might also list. However, getting the right valuations is a challenge because content is a highrisk business.

Most work on a cost-plus model with OTTs, so there’s limited margin upside. Also, the ability to create shows is constrained by creative bandwidth. Content is risky—only a small portion succeeds, while most does not.

Micro-dramas and short-form fiction are exploding globally (with companies like Rusk Media, Chai Bisket, and Flick TV raising over $20 million collectively). Is this a trend or fad? Should investors pursue this segment or wait for consolidation?

(Implied from overall comments on digital and fragmentation) The high growth and innovation in digital formats like micro-dramas are attracting attention, but investors should focus where there’s less fragmentation and clearer paths to profitability. Consolidation and partnership with larger platforms will likely be the path to sustainable growth.

The animation film “Mahavatar Narasimha” has seen phenomenal success, and over two dozen animation movies are now in the works. What’s your take?

(Implied from earlier comments on content and production) The success of animated content signals new hope, but scaling this model will require partnerships and a focus on quality, given the inherent risks in content creation and the need to appeal to broad, even global, audiences.

The film sector also saw a spurt in 2025?

The film sector has been volatile. There might have been a minor spurt in 2025, but the concerns remain; the industry is heavily reliant on large-budget films, making it risky. Small and mediumbudget films are not performing well, and the overall number of films has also come down. We aren’t making enough pan-India hits, which is a problem.

From Elara’s perspective as both a research house and investment banking platform, what ‘homework’ must M&E founders, producers, and studio heads complete before credibly approaching institutional capital? What separates companies that attract investment from those that don’t?

The thumb rule is that companies must be capable of scaling digitally, as digital is becoming mainstream. They must demonstrate great quality content

and a strong track record. Having the right people to execute and compete is crucial. Companies must be techfirst, with a digital approach, strong creative capabilities, and quality people behind them, because in M&E, you’re competing with global tech giants.

Do you see a connection between the Indian creator economy and mainstream media?

Absolutely. There is a strong connection, and it’s crucial for the industry to scale aggressively by creating content that appeals not only to one region but globally. Given India’s diversity in language and culture, content must resonate widely. Indian creators need to think differently and at a global scale.

Pickle: Finally, how does Elara Capital facilitate connections between global/ domestic institutional capital and India’s fragmented M&E ecosystem? Walk us through a typical engagement, such as how a regional production house or high-growth digital startup would engage through the CII M&E investor meet.

Karan Taurani: At Elara, we have a wide network of investors, from small to large, both Indian and international. Companies can access a broad spectrum of investors with varying appetites and criteria. Each company, whether a regional production house or a digital startup, can highlight its unique edge— be it in creativity, content, or scale. Through platforms like the CII M&E investor meet, these companies can connect with investors who are best aligned to their strengths and growth potential.

INVESTORS ARE LOOKING FOR THE SWEET SPOT: COMPANIES

Atul Phadnis Founder-CEO of Vitrina

Atul Phadnis, Founder-CEO of Vitrina, on the shifts transforming India’s film & TV landscape and how global funds can unlock new opportunities through data-driven partnerships. Atul Phadnis chats with Pickle

San Francisco Bay Area-based Vitrina is a leading global business intelligence and discovery platform for the video entertainment supply chain. It helps companies seeking to produce, finance, distribute, or service content find the right partners, projects, and decision-makers across 100+ countries.

With real-time tracking of film and TV projects and daily profiling of over 140,000 companies—including 90,000+ production houses and 10,000+ streamers and TV platforms—Vitrina empowers studios, producers, financiers, and vendors to identify credible collaborators, qualify opportunities, and close deals with speed and precision.

Vitrina is used by global streamers, studios, independents, content buyers, and service providers to bring datadriven clarity to partner discovery, co-production matchmaking, and international growth.

AtulPhadnis,FounderandCEOof Vitrina, describes it as a market network and intelligence platform that connects the global entertainment ecosystem across every stage—development, production, post, localization, distribution, and licensing. Vitrina AI was incubated at SRI International (Stanford Research) in Menlo Park, California.

Phadnis brings decades of expertise in content intelligence and global media supply chains. Previously Chief Content Officer at Gracenote and founder of What’s-ON, Atul has led large-scale media operations, high-value exits, and innovation in entertainment business networks. In this interview with Pickle, he shares his insights on the Indian investment climate, trends shaping 2025, and the keys to building successful crossborder content partnerships.

As Vitrina’s Global Financing Partner for the CII M&E Investor Summit, how do you assess the current investment climate for film and TV content in India? Vitrina tracks real-time production financing trends worldwide. What are the top three global trends shaping 2025, and where does India stand in this landscape?

2025 has been a year of recalibration, not retreat. Global production volumes are down 17%, but India has seen a steeper 30% drop—mainly due to a funding squeeze and higher selectivity in greenlighting. Yet, release volumes in India are down only 12.5% compared to the global average of 17%, indicating steady content momentum despite fewer project starts.

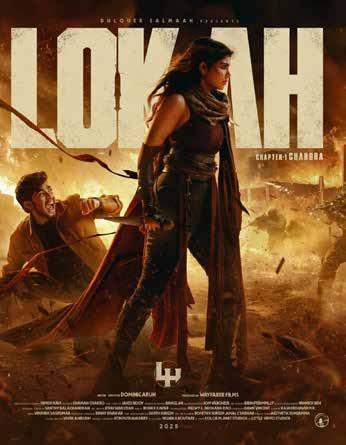

Importantly, the creative lens has sharpened. Investors are backing fewer but more thematically ambitious projects. In India, we’re seeing a pivot to identity and transformation stories, modern mythologies, and institutional critiques with mass appeal. Genre blending—action-fantasy-dramas, comedy-romances—and a renaissance in thrillers with morally complex characters are driving success. The rise of “Chapter 1” films signals a franchise and long-tail value mindset.

At Vitrina, we track this shift daily. While volume is down, quality, boldness, and IP-building potential are up. For investors, that’s a promising trade-off.

How does Vitrina help global funds identify and connect with credible Indian production partners for coproductions and financing?

Vitrina makes global co-production scouting faster, smarter, and more precise. We track every major film and TV project worldwide and enable our members to connect with matched projects, companies, financiers, and decision-makers. Funds, studios, and streamers use Vitrina not just to discover partners but to qualify them with real-time, verified credentials and connect directly with the right people.

We offer discovery by genre, scale, financing history, and collaboration profiles; live tracking of projects in

development and financing; verified contacts with specialization tags; and dedicated concierge outreach services. In a fragmented global market, we bring structure, speed, and reliability— helping funds move confidently from intent to conversation.

What should international investors know about India’s content market today? What are the biggest opportunities, and what advice would you give global funds considering Indian investments?

A: India’s content market is powered by a young, mobile-first population and a deep cultural connection to storytelling. Three opportunity zones stand out:

6 Cinematic scale with theatrical loyalty: India’s cinema-going culture remains strong, especially for high-emotion, high-entertainment films, offering durable value for well-positioned titles.

6 Regional cinema with high ROI: Low-to-mid-budget regional films deliver outsized returns, with highly engaged audiences across languages like Tamil, Telugu, Malayalam, Marathi, and Bengali.

6 Short-form & vertical drama: With 800M+ smartphone users, there’s exploding demand for mobile-first, snackable content— short dramas, clips, mini-series— that blend emotional impact and repeat value.

6 My advice: Treat India as a multimarket ecosystem, not a monolith. Deploy capital where there’s local depth, genre clarity, and audience alignment. Mapping the right regional collaborators and scalable IP is key to unlocking long-term value.

Vitrina tracks projects across 100+ countries from development to release. For a global fund evaluating an Indian web series or film, how does your platform reduce risk compared to traditional, networkbased approaches?

Vitrina replaces informal, relationshipdriven deal-making with a structured, data-first approach. We map every major film and series worldwide—

linking them to producers, financiers, partners, and decision-makers. Global funds can search partners by past deal history, regional focus, export success, genre, and project stage, plus access market intel on content demand and supply-chain.

We surface red flags early—lack of track record, incompatibility, or poor export appeal—so funds avoid wasting time. For high-potential projects, we help identify co-production fits, prebuy opportunities, and financeable gaps, along with verified contacts for outreach. This enables more confident, informed decisions—grounded in data, not just relationships.

Can you share examples of Vitrina’s successful collaborations with global production funds and companies?

We’re running multiple live mandates across feature and TV projects in

development and pre-production, helping projects reach financiers, commissioners, and studio heads, and unlocking pre-buy opportunities to close financing gaps. Some examples:

A large publishing house with 50+ book IPs is working with us to adapt selected titles into major features or series.

A Korean digital-first animation hit is being positioned for adaptation on a mainstream global platform, with connections to streamers and studios.

We support projects from Canada, the UK, Poland, India, Dubai, Japan, Australia, and Nigeria—identifying co-pro partners or financiers suited to their scale, genre, and market fit.

Using real-time project tracking and AI-led matching, we help creators find the right partners for co-production, financing, or pre-sales.

How does India’s talent ecosystem differentiate it from other markets when global investors evaluate production partnerships?

India offers several distinctive advantages:

6 Large, skilled workforce: Millions employed directly/ indirectly in the sector, with a robust ecosystem of studios, vendors, and post/CGI/VFX talent.

6 Diverse linguistic and cultural storytelling: With 100+ languages and a huge domestic market, Indian creative talent is adept at working across formats, genres, and sensibilities.

6 Emerging service-hub credentials: Indian post, VFX, animation, and localization support have increasingly global credits and cost advantages, with a strong reputation for skills and client relationships.

6 Creative supply-chain scale: The volume of annual content production offers depth and breadth of experience.

6 Cost-efficiency: High production values at lower budgets, when managed well, are attractive to investors.

Regional language content now dominates OTT platforms, with 86% of premium viewership for local stories. How does this diversity create unique opportunities for international funds?

Regional dominance is a strong positive for international funds:

6 Large addressable markets: Each regional audience (Tamil, Telugu, Malayalam, etc.) represents significant scale, producing domestic hits and attracting global interest.

6 High ROI potential: Many regional films are lower-budget but high-impact within their markets, opening up attractive economics for efficient capital deployment.

6 Risk diversification: Funds now have access to multiple regional “windows”, allowing diverse portfolios rather than a singlemarket bet.

In short, regional diversity leads to both volume and variety, enabling multi-bet portfolios across languages, regions, and formats.

While India has seen global hits like RRR, Pathaan, and Kantara, these remain exceptions. Based on Vitrina’s deal tracking, what shifts are needed for India to become a consistent content exporter like South Korea?

Achieving consistent export success requires key shifts:

6 More globally-oriented IP development: Projects need export/multi-territory potential, universal themes, and high production value—not just domestic commercialization.

6 Stronger early-stage support: Leading exporters have robust commissions, grants, and incentives for global-ready projects. India’s ecosystem is growing, but less coordinated.

6 Better infrastructure and incentive parity: Improving access, transparency, workflow integration, and quality benchmarks is needed.

6 Stronger export-story mindset: Successful exporters have robust

format industries; Indian TV/web series remain largely domestic.

6 Collaborative global coproductions: More structured partnerships with global studios/ streamers, embedding global standards and partners early.

India’s scale and talent make this feasible, but it needs ecosystem maturation, a shift in mindset, and investment in export-orientation.

If you were addressing Indian producers, directors, and studio heads at the CII M&E Investor Meet, what would be your core message about how global funds can become strategic partners—not just capital providers—for India’s next wave of content?

Global funds aren’t just capital— they’re connectors. They bring export pathways, scale, and IP monetization models. Indian creators should think beyond the domestic market—structure globally, develop exportable IP, and collaborate early with international partners.

If you were speaking to international production fund executives at the CII M&E Investor Meet, what would be your core message about India’s potential and readiness for global collaboration?

India is not just a high-volume market— it is a global production asset with rich supply-chain, world-class talent, cost efficiency, thriving domestic market, and rapidly growing audience ecosystems. For global funds willing to move beyond ‘one-off deals’, India offers a multilayered opportunity: invest in local production assets, co-productions, service-hub deals, IP-build for export, and adjacent monetisation.

Yes, there are structural gaps, but these are fixable risks. What matters is choosing the right partner, leveraging incentives, building export-ready formats early, and treating India as many markets, not one. The next phase of India-global collaboration is here—real, actionable and ready for investment.

Biren Ghose Co-Founder & CEO of Astra Studios

With India’s media and entertainment sector racing toward a new era of global leadership, Pickle sits down with industry visionary Biren Ghose to unlock the path ahead. In this interview, Biren Ghose shares why India is uniquely positioned to become the world’s next creative infrastructure hub—fusing the storytelling scale of Hollywood, the technological prowess of Silicon Valley, and the bold ambition of global destinations like Dubai. He discusses the major forces driving this convergence, the emergence of new asset classes, and how India is moving from “service chain” to “creator nation” status—offering fresh insights for investors, policymakers, and creators alike.

Biren, you say India will become the world’s next integrated media and entertainment hub, blending the creative scale of Hollywood, the tech muscle of Silicon Valley, and the grandscale vision of destinations like Dubai. What’s driving this convergence?

The convergence isn’t just aspirational— it’s structural. Global appetite for immersive content, cloud-driven production, and franchise IPs is at an all-time high. India possesses a unique advantage: it boasts world-class creative talent, a vast digital consumer base, and is rapidly investing in experience infrastructure.

But the magic lies in hybridizing these advantages. Imagine virtual production campuses that are both real estate assets and tech stacks; IP franchises that travel from mythology-based animation to blockchain-enabled games; and cultural venues that fuse physical and digital— think an “Indian Sphere” in every metro.

As capital, culture, and code blend, India is no longer just a production back office. It’s the laboratory for the world’s next creative infrastructure economy.

You view the coming wave as building new “asset classes” and not just media properties. Can you elaborate for institutional investors and policymakers?

Certainly. Traditionally, media investments were project-based: one film, series, or studio. Now, the ecosystem is delivering recurring, multiplatform returns.

For example, an AVGC-XR park is both a capital-intensive asset (like a tech campus or mall) and an ESG-positive one, driving local employment, tourism, and export revenue. A franchise like the India-origin mythology world is simultaneously an IP, a toy line, and a data-rich consumer brand.

A regional OTT platform is not just content—it’s also a data platform and a micro-audience marketplace. These new asset classes sit at the intersection of creative, technological, and consumer verticals, generating multiple streams of revenue—from licensing and digital distribution to live experiences and brand extensions.

What are your highest-conviction investment themes for 2025–2030, and what makes them resilient?

This decade is all about scalable, ESGfriendly, and tech-enabled plays. My top themes:

6 AVGC-XR Parks & Studios: Large campuses and experience zones that anchor the industry, blending production, community, and tourism.

6 IP-led Franchises: Games, animation, and mythology-rich stories that create hit entertainment and merchandise.

6 Experience Infrastructure: “Sphere-like” venues in Tier 1-3 cities, democratizing high-end entertainment.

6 Cloud & Rendering: Distributed AI-accelerated pipelines that make India the backbone of global media production.

6 Creator Economy Platforms: Blockchain-enabled marketplaces unlocking global monetization for Indian creativity.

6 Immersive Education & Museums: New models where storytelling meets learning—think “museum as experience.”

6 Sports & Live IPs: Next-gen “IPLstyle” leagues in esports and live media.

6 Rights Tech & AI Analytics: Systems to track, verify, and monetize global IP—driving trust and liquidity.

6 Tourism + Culture Integration: Venues that blend Indian heritage with immersive tech to boost both domestic and inbound tourism.

6 Regional OTT & Export Pipelines: Platforms that take India’s regional stories global.

Each theme delivers not only financial returns but also long-term systemic value—helping India move from “service provider” to “creator nation” status.

The rise of media-tech REITs, cityscale master assets, and securitized IP rights is mirroring what telcos, energy, and infrastructure did for the previous industrial eras. Whether you’re an infra fund seeking annuity-style returns, a hedge fund chasing yield, or a VC looking for quick exits, Indian media’s new asset classes offer diversified outcomes—including strategic and systemic impact.

Strategically, when India creates global cultural phenomena—mythology franchises, immersive venues, and new sports leagues—it moves up the value chain in soft power. Studios and experience hubs will become national assets, like Bollywood for cinema or IPL for sports, but spanning new creative frontiers like gaming, XR, and digital IP.

The integration of technologies like blockchain and AI analytics will also build transparency and trust, giving Indian IP global liquidity and legitimacy.

The idea of “Virtuous Cycles” keeps surfacing. How do these cycles benefit investors and Indian society?

You mention moving from a “service chain” to a “creator nation.” What will define success, both financially and in terms of national soft power?

Success is measured on multiple axes. Financially, India will see recurring revenues across new platforms—studio leases, SaaS production tools, IP royalties, and live event incomes. Critically, these generate cash flows and attract global capital, making investing in Indian M&E less speculative and more annuity-like.

Every capital asset—whether a virtual production campus, a franchise IP, or a streaming platform—triggers a chain reaction. They create jobs (direct and indirect), drive upskilling, attract tourism, and stimulate adjacent sectors like retail, F&B, and hospitality.

Exporting IPs attracts foreign investment and enhances India’s international recognition. The money flows back into the ecosystem—fueling education, technology investments, and new content creation. Investors benefit from recurring income and potential capital gains; society benefits through employment, inclusion, and national pride. It’s a flywheel that, once in motion, builds both profit and purpose.

For institutional capital entering the space, what vehicles and exit paths exist?

The spectrum of risk and returns is unique; here’s a framework for capital entry points and investor pathways:

Infra Fund PPP / REIT / long-term studio/venue leases

Brookfield, Macquarie, NIIF

Asset monetisation / REIT listing

Growth PE Equity in content + IP franchises Providence, TPG, KKR IPO / strategic acquisition

VC / Tech Early-stage immersive startups a16z, Sequoia, Lightspeed

Global M&A / tokenization

Slate / Hedge IP securitisation / rights funds Apollo, Silver Lake Royalty yield / streaming deals

Sovereign/ Hybrid City-scale ecosystem blending culture/ tourism ADIA, Temasek, GIC Transformational, long-horizon value

What new opportunities do you foresee for global investors, especially those seeking to partner or acquire in India’s media-tech sectors?

A new wave of global investors is seeking the edge of frontier assets—media cities, immersive campuses, IP libraries, and next-gen tech platforms. The maturity of Indian firms and their growing global ambitions set the stage for cross-border M&A, joint ventures, and strategic alliances.

For tech and venture funds, tokenizing IP and creating streaming-royalty instruments open up innovative portfolio opportunities. For sovereign and hybrid funds, city-scale developments combining tourism, culture, and media present a once-in-a-generation chance for transformational value capture.

Indian partners offer unmatched local insight, regulatory liaison, and access

to burgeoning regional markets—a compelling mix for global players.

As you look at the decade ahead, what note would you sound for stakeholders across the value chain—from entrepreneurs and content creators to policymakers and institutional investors?

The call to action is clear:

6 Entrepreneurs and Creators: Build for scale and the world; the next billion consumers are Indian but global in taste.

6 Investors: Think across asset classes; blend annuity-income REITs, IP royalty streams, and high-growth tech bets.

6 Policymakers: Prioritize infrastructure, IP protection, and export pipelines; India’s creative future hinges on seamless regulation and global connectivity.

India’s trajectory is to become not just an M&E “service hub,” but a creator—and owner—of global cultural and digital assets. The next decade belongs to those who can blend capital, culture, and code.

India is no longer just the world’s back office for media. We are the next creative infrastructure economy. The next decade belongs to those who blend capital, culture, and code—and build platforms, pipelines, and experiences for the next billion

WITH A STANDING OVATION FROM GLOBAL INVESTORS AND A NEW BREED OF INDIAN VISIONARIES, THE COUNTRY STANDS READY TO LEAD THE NEXT WAVE OF CREATIVE AND TECHNOLOGICAL DISRUPTION. FOR THOSE WHO ACT NOW, THE REWARDS ARE NOT ONLY FINANCIAL, BUT GENERATIONAL