IN MINUTES

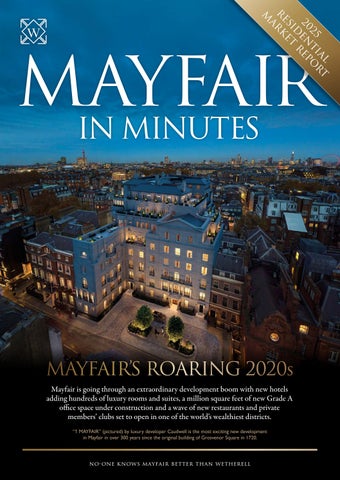

MAYFAIR’S ROARING 2020S

Mayfair is going through an extraordinary development boom with new hotels adding hundreds of luxury rooms and suites, a million square feet of new Grade A office space under construction and a wave of new restaurants and private members’ clubs set to open in one of the world’s wealthiest districts.

“ 1 MAYFAIR” (pictured) by luxury developer Caudwell is the most exciting new development in Mayfair in over 300 years since the original building of Grosvenor Square in 1720.

MAYFAIR’S DEVELOPMENT BOOM

NEW HOTELS, CLUBS, RESTAURANTS, OFFICES, RETAIL AND RESIDENTIAL

Reuben Brothers launch the first phase of its £1bn mixed-use regeneration project in South Mayfair. The 1.3-acre swathe of London’s most famous neighbourhood – acquired by the firm in 2011 – is being developed as The Piccadilly Estate.

The “anchor” is the development of Cambridge House, the former “In and Out” Club, into a luxury hotel with additional public realm improvements to Shepherd Market, plus an allnew boutique apartment scheme of 28 new residences.

The initial launch is One Carrington, 28 luxury units – due for completion later this year, styled in the form of a “modern Mayfair townhouse”. The mix will include one- to four-bed residences, as well as a penthouse. Prices start from £2.95M for a one-bed; the four-beds range from £12.95M. Facilities offered includes 24hr security and concierge, a lounge, library and secure underground parking. A landscaped courtyard will form the centrepiece of the development, and many of the apartments will come with terraces and balconies with views across Mayfair.

Directly opposite, The Carrington Club, the first business-focused private members’ club by Robin Birley (renowned proprietor of 5 Hertford Street and Oswald’s), is also being delivered as part of the regeneration. The Carrington Club will house a set of drawing rooms, boardrooms and workspaces, along with various dining options, and a large wellness centre with gym, treatment rooms, sauna/steam room and a 25-metre pool.

KEY DEVELOPMENTS INCLUDE:

n the West End’s largest mixed-use scheme, Grosvenor and Mitsui Fudosan’s 370,000 sq ft revitalisation of the South Molton triangle to create 267,000 sq ft of new office space and a five-star Oberoi hotel on Brook Street, as well as new shops and F&B outlets at street level.

n the opening of the 146 room Chancery Rosewood in the former US embassy in Grosvenor Square.

n the opening of the 102 room Cambridge House in the former Naval and Military Club (informally known as the In and Out Club) at 94 Piccadilly.

n Great Portland Estate’s 221,000 sq ft mixed-use development above the Elizabeth Line in Hanover Square includes 167,200 sq ft of new office space.

HOTELS

And there are more, including the launch of the 196-room St Regis London on the site of the former Westbury Hotel in Conduit Street later this year, and plans for Park Lane Mews – “The Shepherd”, a 82-key hotel with restaurant, bar, café and private members’ space alongside 16 luxurious apartments by Bain Capital Special Situations and Orka Investments.

These are just the latest in a wave of new schemes that have included the new Mandarin Oriental which opened in Hanover Square last summer - 50 guest rooms and suites plus 77 private residences - the opening of 1 Hotel Mayfair on the site of the former Berkeley Street Holiday Inn the year before, and recent refurbishments and renewals at the Park Lane Hilton, Claridge’s and The Beaumont.

Within walking distance of Mayfair central, The Peninsula Hotel opened its 199 rooms on the Belgravia side of Hyde Park Corner in 2023, the 150 room Montcalm Mayfair in Marylebone is opening after a renovation later this year, and The Ritz on Piccadilly is building a £300m extension, to include 53 new rooms.

Many of the new and emerging hotels feature wellness centres and spas as well as new restaurants. Richard Caring is to open Le Caprice - a famous name - at The Chancery Rosewood, which will also see the launch of Carbone, as the London outlet of the iconic New York Italian/American. Shanghai Me is opening at the top of the Park Lane Hilton in space vacated by Galvin at Windows, while steakhouse Mr Porter is to replace Trader Vics on the ground floor of the hotel.

Akira Back’s restaurant and Tom Sellers’ Dovetale are already up and running at the Mandarin Hotel and No 1 Hotel respectively.

17-22 South Audley Street is a mixed-use development by Artfarm and Hauser & Wirth and will house their new flagship 15,000 sq ft gallery. The Grade 11* Listed Victorian building will have residential on the upper floors with five long let residential apartments and eleven short let units around a new landscaped courtyard. Originally constructed in 1845 but rebuilt to designs by Ernest George and Peto architects between 1875 and 1876, the building was formerly home to retailer Thomas Goode, which vacated the space in 2021.

Claridge’s has undergone a remarkable transformation, blending heritage with modern luxury. The £800 million renovation included a five-storey basement, housing a spa, pool, and wine cellar, plus a four-storey vertical expansion, adding new penthouses with panoramic Mayfair views. The hotel also expanded into neighbouring buildings, increasing its room count from 203 to 269.

OFFICES

The Great Portland Estates scheme in Hanover Square is, in fact, several buildings: 18 Hanover Square, which is a new nine-storey property incorporating an entrance to the Elizabeth Line’s Bond Street station; 1 Medici Courtyard, a separate building containing 33,300 sq ft of offices above 31,300 sq ft of flagship retail units on New Bond Street; six residential units totalling 12,200 sq ft at the junction of New Bond Street and Brook Street; and 8,300 sq ft of restaurant space and 6,300 sq ft of offices above 20 Hanover Square.

Office tenants include New York’s Kohlberg Kravis Roberts & Co, a private equity fund manager; Glencore, one of the world’s largest globally diversified natural resource companies; UPL, a global provider of sustainable agricultural solutions; and Lexington Partners, one of the world’s largest managers of secondary private equity and co-investment funds. Lastly, the former headquarters of the publishers Conde Nast has been purchased by owner-occupier Global Holdings for the retrofit, refurbishment and extension of One Hanover Square as a new global headquarters building.

Over in Berkeley Square luxury goods brand Chanel is moving into 86,000 sq ft of new office space where Berger House once stood, and Blackstone - the world’s largest alternative asset manager - has signed a pre-let on 239,000 sq ft of new office space in a ten storey building on the south side of Berkeley Square.

Meanwhile, on the corner of New Bond Street and Grafton Street, O&H Properties has appointed McLaren Construction to build the 58,000 sq ft first phase of a mixeduse retail and office development designed by Foster & Partners.

CAMBRIDGE HOUSE, A GRADE I-LISTED 18TH-CENTURY MANSION AT 94 PICCADILLY, IS UNDERGOING A SIGNIFICANT TRANSFORMATION INTO A LUXURY HOTEL. REUBEN BROTHERS ARE INVESTING OVER £1 BILLION IN REGENERATING THE 1.3 ACRES OF THE PICCADILLY ESTATE. THE REDEVELOPMENT PLAN INCLUDES CONVERTING THE HISTORIC BUILDING INTO A 102-ROOM BOUTIQUE HOTEL, FEATURING NEW RESTAURANTS, BARS, LOUNGES, A SPA, AND SEVEN PRIVATE RESIDENCES. AUBERGE RESORTS COLLECTION HAS BEEN APPOINTED TO MANAGE THE HOTEL, WHICH IS SET TO OPEN IN 2026.

Mayfair has always been at the beating heart of clubland. White’s of St James’s - the oldest gentlemen’s club in London - began life in 1693 as Mrs White’s Chocolate House at 4 Chesterfield Street off Curzon Street, and didn’t move to St James’s for another 75 years. In that time, it made the transition from teashop to exclusive club.

Today, Mayfair is still home to traditional clubs like The Savile and Buck’s, but in recent decades a new breed of private members’ clubs has opened - initially following a pattern set by The Groucho, which opened in 1985, and Soho House, which opened a decade later.

In the past seven years, a flurry of new clubs have joined Annabel’s, George, Mark’s Club, 5 Hertford Street, a renewed Arts Club, Alfred’s and Oswald’s. They include:

2018 - The Conduit in Conduit Street. 2019 - AllBright in Maddox Street. 2021 - Nikita in Davies Street.

2021 - Studio 25 above Langan’s in Stratton Street.

2022 - The 22 in Grosvenor Square. 2022 - Maison Estelle in Grafton Street.

2023 - Apollo’s Muse, within Richard Caring’s Bacchanalia restaurant at 1 Mount Street.

2024 - Soho Mews House in Lancashire Court.

For the most part, they all offer something different. AllBright, for instance, was a women-only club, others are strictly invitation only. And more are planned.

Cambridge House on Piccadilly will be a luxury hotel run by Auberge Resorts, but it will also include a nine-room private members’ club. The Carrington is a new Robin Birley business-focused club opposite his already successful private members’ club at 5 Hertford Street. When it opens later this year it will offer meeting rooms, drawing rooms, individual work areas as well as a 25-metre swimming pool, a gym, spa and treatment rooms. It will be directly opposite One Carrington, a development of 28 contemporary residences.

“ The incredible wave of development across all property sectors in Mayfair is unusual, but unsurprising. London is a World City, and Mayfair - right at the heart of it - has always been a magnet for money.”

PETER WETHERELL

It may come in the form of wealthy tourists, innovative financial firms, luxury goods companies and tech firms looking for Grade A headquarters or multi-millionaires seeking a safe haven in a world that is changing unpredictably and fast, but Mayfair has always attracted wealth.

True, there is an unprecedented boom in new hotel developments across the capital - 757 new luxury hotel rooms are forecast to open in 2025, many of them in Mayfair - and there has been talk of a glut, but the major hoteliers seem confident.

The post-Covid tourist boom is still on track and VisitBritain says tourist numbers are almost back to 2019 levels, while visitor spending is up on the 2019 figures by 14 per cent. What’s more, a wave of new hotels will always lead to a reactive wave of refurbishment in existing hotels since they can’t afford to stand still.

The fact that office rents have risen to £150 per square foot in Mayfair and St James’s - the most expensive office space in London - and yet it continues to attract world-leading companies is testimony to the strength of the Mayfair brand, and the power of what the area has to offer.

A century ago - in the period we now know as The Roaring 20s - Mayfair

saw a similar wave of redevelopment, with the demolition of 25 grand mansions and smaller townhouses worth £2 billion at today’s values. They were replaced by hotels and modern apartment buildings.

2024 was a record year for residential in Mayfair, with 94 homes sold compared with 91 in 2023. The average over the last ten years was 75 sales, so it’s quite a leap. Of the 94 sales this year, 25 per cent were for homes priced over £5 million and 15 per cent were in excess of £10 million. Mayfair also saw more £20 million plus sales than any other district in Central London.

The best new homes in Mayfair now sell for £10,000 per sq ft and that figure is expected to rise to £12,000 per sq ft over the next few years. During 2024, 40 per cent of buyers were from the UK, and 60 per cent were from overseas. The biggest overseas buyer groups were American, Middle Eastern and Indian. Mayfair buyers are usually making generational purchases, and will hold their properties for ten to 20 years.

In 2025, we predict that the volume of Mayfair sales will rise by 30 per cent and values for the most sought after homes will rise by one to two per cent while the rest of the stock will stay stable.

SOLD IN 2024

FIRST TIME IN THE MARKET FOR 24 YEARS – THE ONLY “PAWSON” DESIGNED MAYFAIR HOME

SOLD FOR THE FIRST TIME IN 25 YEARS - A BLUE PLAQUE MAYFAIR MANSION

A palatial six-storey townhouse of 6,477 sq ft in South Street W1 (asking price £13.95M) overlooking Mount Street Gardens was once the home of Lord Ashfield (1874-1948), the celebrated First Chairman of London Transport and founder of London Underground.

A white stucco three-bedroom house of 2,845 sq ft (264.3 sq m) in Hay’s Mews behind Annabel’s.

In October 2000 the house was purchased by prominent Chicago financier Ralph I Goldenberg, a collector of contemporary art. He displayed works by artists including Willem de Kooning, Jackson Pollock, Robert Ryman, Andy Warhol, Robert Rauschenberg and Cy Twombly.

Americans have become a renewed force in London’s super-prime residential market. Five sectors - Hedge funds, IT, medical provision, logistics and media – see Mayfair as one of the few world-city locations to live, work and spend leisure time.

BUILT AND RECONFIGURED IN 1987 PROVIDING AN ARCHITECTURAL MASTERPIECE OF MINIMALIST DESIGN OFFERING COOL UNCLUTTERED LIVING SPACES WITH DARK-GREY STONE SLAB FLOORING, THE DRAMATIC INTERIORS ARE ILLUMINATED BY OVERSIZED FULL HEIGHT WINDOWS THE PLAQUE BEARING HIS NAME IS ALMOST

The plaque was erected in 1984 and he lived there between 1918 and 1940, overseeing what became the ‘golden age’ of the London Underground in 1919.

WE SELL SHELL IN GROSVENOR SQUARE

Sold on an asking price of £8.5 million, a 5th floor apartment in Grosvenor Square providing 2,145 sq ft (199.24 sq m) of

living space. As an empty shell, Casa e Progetti, the award-winning luxury design studio created art worked

floorplans and a portfolio of stunning CGI interior images to show buyers how the apartment could look once refurbished.

SOLD IN 2024

PARK STREET MANSION

For the marketing of this Park Street Mansion (asking price £25M) Wetherell digitally furnished after researching its illustrious history.

With its grand and beautiful reception rooms, with access to the Green Street gardens and spacious bedroom suites, this mansion just needed that extra step of “CGIs” to appeal to either an affluent discerning family wanting a London base or a successful tycoon wanting a trophy home in Mayfair.

CLARGES MAYFAIR IS SECURITY AT ITS BEST

This exclusive new-build apartment block has southerly views over the Royal Green Park and up to The Ritz. At £13,000 p.w. Wetherell achieved the 2nd highest £ / sq ft at £194 psf for a 3–4-bedroom flat in the building. (2nd only to the record achieved on a further flat by Wetherell at £216 sq ft).

This is Mayfair’s most exclusive new build development in a prime position to enjoy the natural surroundings of nearby Green Park and Hyde Park.

THE FLAT BENEFITS FROM RESIDENTS’ AMENITIES WITHIN THIS EXCLUSIVE DEVELOPMENT, COMPRISING SPA FACILITIES WHICH INCLUDE TREATMENT ROOMS, STATE OF THE ART GYM, 25-METRE SWIMMING POOL AND HYDRO-POOL, PRIVATE RESIDENT’S LOUNGE, CINEMA ROOM AND AN ALLOCATED PARKING SPACE.

COUNTESS RAINE SPENCER’S FORMER

£10.95M MAYFAIR HOME WHERE RAINE HOSTED PRINCESS DIANA

First time in the market in 22 years – Wetherell were instructed by the estate of Alan & Mary Hobart (prominent local art dealers and collectors). It was previously the former Mayfair residence of Countess Raine Spencer.

At 4,894 sq ft (454.71 sq m) this Georgian-style fivebedroom house had significant fame with an illustrious heritage and received a wave of enquiries from around the world. The house was effectively sold in less than a week of coming to the market, believed to be the fastest house sale in Mayfair during 2024.

AFTER DIANA’S DIVORCE IN 1996, RAINE AND DIANA GREW EXCEPTIONALLY CLOSE AND THE PRINCESS BECAME A FREQUENT VISITOR TO THE HOUSE ON FARM STREET.

FOR SALE IN 2025

WETHERELL DIGITALLY INTERIOR DESIGN A MAYFAIR PALACE ON PICCADILLY

A Grade II Listed mansion-townhouse providing 14,624 sq ft (1,358.6 sq m) of palatial accommodation, with full planning permission to convert back into a single family house offering circa 15,339 sq ft.

The provenance of this Piccadilly mansion building overlooking Green Park is outstanding. It was once the London home of poet Lord Byron and during the 1920s and 1930s was the private palace of French heiress Baroness Catherine d’Erlanger, one of the richest women in Europe. For sale with a guide price of £29,950,000.

WITH ITS GRAND LOUIS XVI NEO-CLASSICAL PORTLAND STONE FAÇADE, THE MANSION-TOWNHOUSE HAS GRAND PRINCIPAL ROOMS WITH TALL SASH WINDOWS AND GENEROUS CEILING HEIGHTS.

DESIGNED BY THE LATE RAFAEL VIÑOLY, WITH A CURVED ARCHITECTURAL FAÇADE THAT DELIVERS A BROAD, PANORAMIC ASPECT

FIRST TIME IN THE MARKET FOR 28 YEARS

An elegantly presented Grade II Listed four-bedroom townhouse in London’s St James’s Place, providing 3,176 sq ft of living space including a rare working gas lamp at the front. Believed to be the former home of original Spectator and Tatler editor Joseph Addison (1672-1719). For sale at £5 million freehold.

The home’s original late 17th century staircase is largely intact, with its wonderful closed-string dog-leg turned baluster, and there are swathes of original wooden panelling on walls and floors.

IT WAS IN 1716 THAT AN ACT OF PARLIAMENT REQUIRED HOUSES THAT COMBINED RESIDENTIAL AND BUSINESS USE TO HAVE AN OUTSIDE GAS LANTERN INSTALLED WHICH HAD TO BURN FROM 6PM TO 11PM NIGHTLY. IT IS BELIEVED THAT THIS IS WHEN THE GAS LANTERN ADJACENT TO THE FRONT DOOR WAS FIRST INSTALLED AT THE ST JAMES’S PLACE TOWNHOUSE, AND REMAINS FULLY OPERATIONAL TODAY.

THE PENTHOUSE AT THE BRYANSTON, HYDE PARK, COMBINES GLOBAL ARTISTS WITH WORLD-CLASS ARCHITECTURE

The tallest private residence overlooking Hyde Park, offering rare 360-degree views across London from sunrise to sunset. Situated above the West End at nearly 250 ft above the streets of London below.

The five-bedroom, triplex residence with a private internal lift, offers 7,763 sq ft of interior living space with an additional 1,403 sq ft of private rooftop terrace.

A truly tranquil oasis, connected to nature and yet right in the heart of the capital. Price: £70,000,000.

1 MAYFAIR: LONDON’S FINEST NEW RESIDENTIAL ADDRESS

1 Mayfair by luxury developer Caudwell is the most exciting new development in Mayfair in over 300 years since the original building of Grosvenor Square in 1720.

This highly anticipated new address is designed to be the finest residential scheme in London, and a leader in global luxury.

1 Mayfair has 24 principal residences including lateral apartments, penthouses and townhouses, five further pieds-à-terre and spectacular entertaining halls and lounges designed around a central garden.

Once complete it will offer 5-star deluxe amenities including the health spa, basement parking, 24-hour security, concierge, hotel style services and valet parking.

1 Mayfair has involved a world-renowned professional team, overseen by Caudwell, including architecture by New York based architect Robert A. M. Stern and the beautiful interiors of the halls and lounges devised by Paris based American-Chilean designer Juan Pablo Molyneux.

Located on the doorstep of Park Lane and Hyde Park, just moments from Mount Street, 1 Mayfair is a luxury destination occupying half of an entire city block with façades fronting onto South Audley Street, Hill Street and Waverton Street.

Inside the classical Portland stone façades the beautifully handcrafted interiors include a rotunda featuring a ceiling with hand-painted frescos, a grand reception room with a double height ceiling and 18ft (5.5m) high French windows overlooking the garden, a Crystal Gallery, The Library and a Garden Gallery, with seating areas opening directly onto the central courtyard garden.

With up to eight bedrooms, the townhouses, apartments and penthouses offer living spaces and a specification that is far above and beyond anything else that has been built in London. Unusually, Caudwell has curated a team of designers to create the product, ensuring a totally unique look and feel to the development.

Lars Christiaanse, Group Director of Sales at Caudwell says: “As a residential market Mayfair stands apart from the rest of the Central London property market and is globally recognised as one of the world’s most exclusive and desirable addresses.”

The apartments average an impressive three to ten thousand square feet, and due to the planning restrictions, there will never again be anything newly built of this scale available in Mayfair.

2025 will see the first reveal of part of the magnificent Portland stone Audley Square façade and over time the magnificence of the scheme will become revealed and billed as “a once in a lifetime unrepeatable opportunity”.

Completion set for Spring 2026 and prices are estimated to start at £35,000,000.

WETHERELL SPREADING BRAND “MAYFAIR” AROUND THE WORLD

Key public relations highlights: With Mayfair’s 300 years of history and Wetherell’s 44 years of specialising in the area – it is not surprising that we are the first port of call with journalists writing about the area. Wetherell featured in 215 articles in the 12 months of 2024, averaging 17 per month or 4 per week.

There have been 16 feature print articles on individual Mayfair properties with coverage published in 18 countries including The United States, The UAE, China, Italy, France, Spain, Portugal, Singapore and Australia, with key comment coverage placed in titles including Bloomberg, The National (UAE), Daily Telegraph, The Times.

Closer to home key consumer coverage has been regularly published in titles including Metro, The London Standard, plus daily and weekend editions of Daily Mail, The Times, Daily Telegraph, Financial Times and The Guardian.

As a market commentator Peter Wetherell and the team receive key industry coverage regularly published in titles including Prime Resi, Property Week, Estates Gazette, The Negotiator, Letting Agent Today, City AM, Property Industry Eye.

And lastly for “Trophy” properties there was key luxury coverage published in titles including Architectural Digest, Mansion Global (WSJ), Abode2, Luxury London, House Beautiful, Tatler, Vanity Fair, Mayfair Times, The London Magazine, Country & Townhouse, Cottages & Gardens (USA).

Wetherell broadcast to the world and the world comes to Mayfair.

BACK TO THE FUTURE

Mark Twain is attributed with saying that data is like garbage - you had better know what you are going to do with it before you collect it.

Every year Wetherell collects the previous year's data on residential Mayfair sales and lettings, turning data into knowledge and reporting on insights over years past and predictions for the future. Knowledge speaks but wisdom listens.

Mayfair has a small dataset however the main standouts are the 25% increase in sales for flats between £5 - 10 million and the convergence in values between Mayfair and PCL for the London townhouse at either side of £2,000 per square foot.

With values level with 2012 the London townhouse offers incredible space and

value combined with controlled outgoings. The reductions in values for the larger 3 & 4 bedroom flats might reflect the costs of service charges.

In the rental market there was a 25% reduction in the number of 1 bedroom flats let, reflecting the trend for "staying put" and renewing with a resulting shrinking of the gap in rental values compared to the rest of PCL.

With low stocks of rental property and a 50% increase in availability of property for sale (but currently with the same percentage under offer) we feel that there has never been a better time to purchase.

To stop "buyer's remorse" we would therefore not advocate Twain's most famous quote, "never put off until tomorrow what you can do the day after tomorrow".

MAYFAIR SALES AVERAGE £ PER SQUARE FOOT - 2024

MAYFAIR OUTPERFORMS REST OF PRIME CENTRAL LONDON

(Based on apartment sales excluding new developments. Leases 30 years+)

Mayfair value growth since 2007 (%)

Rest of Prime Central London value growth since 2007 (%)

Mayfair (Average £ per Sq ft)

Rest of PCL (Average £ per Sq ft)

© Wetherell Research using LonRes data (excludes leases of less than 30 years). Mayfair defined as W1J, W1K and W1S. Rest of Prime Central London: SW1A, SW3, SW7, SW10, SW1W, SW1X, W8. CHART SHOWS GROWTH SINCE 2007 FOR EACH YEAR E.G. 2022 BAR REPRESENTS GROWTH FROM 2007 TO 2024.

ANNUAL NUMBER OF MAYFAIR RESIDENTIAL SALES - JANUARY TO DECEMBER

(Excluding new developments)

Years 2007 to 2024.

Source: LonRes W1K / W1J / W1S postcode areas.

no-one knows mayfair better than wetherell

WEALTH PRESERVATION

For my entire career as a Mayfair estate agent, I have used the term “investment” when referring to residential property.

The phrase that you “cannot live in a share certificate” strengthened the view that “bricks & mortar” was THE tried and tested investment route.

When Margaret Thatcher came to power as the UK’s first female prime minister, one of her first fiscal actions was to raise stamp duty.

She doubled it from half a percent to one percent – a far cry from today’s top figure of 19% (basically 12% / +5% if 2nd home & +2% if an overseas buyer).

Both Conservative and Labour governments have piled on the increasing percentages for residential sales so that it has now become a sellers tax.

So buying is not now a “pop in and pop out” of the ownership market and now seen as a long-term hold, wealth preservation, a lifestyle choice and a generational family purchase.

SDLT / stamp duty is primarily a tax on prime central London and the South East. In the financial year 2023 to 2024 the total SDLT receipts amounted to £11.6 billion.

This was a 24% decrease from £15.3 billion in the previous year and London paid 39% of the total receipts £5.455 billion with the

South East accounting for another 19% at £2.195 billion.

First generation wealth is becoming younger, they are making it quicker and with global markets they are making considerably more than previous generations.

They are now making lifestyle choices.

Looking at the plethora of financial activities and economic activity in Mayfair and surrounds it is therefore not surprising that the world’s wealthy are gravitating to not just London but to Mayfair in particular.

This international oasis has had the patronage of wealth for over 300 years. Whereas in the past 90% of the inhabitants looked after the wealthy 10%, the Mayfair area now boasts 75% wealthy inhabitants.

As seen in our new report, Mayfair is reacting to these dynamics with new offices being the “home” of international brands, more private clubs and restaurant openings catering to prime central London.

There are more “7 star” hotel developments and refurbishments catering to “Brand Mayfair” across the globe.

Over the last 15 years, Mayfair has seen the boom in residential with new developments increasing the amount of residential addresses by 10% and achieving the new “super league” values up to £10,000 per square foot.

As these new developments come to the end of stock availability, the opportunity today is in the historic domestic market, more commonly known as the “second hand market” in historical buildings.

There has never been a better time to buy with values starting either side of £2,000 per square foot, comparable to 2012 values.

What’s more, the availability of stock is at an all-time high however it still has the same percentage under offer at between 7% to 10% of stock. Stable to strong foundations.

NOTE:

Wetherell see a potential rise in the volume of sales in 2025 for the Mayfair area but with values remaining stable. However “Trophy” properties will lead the market in rising values and as usual with those news stories going around the world.

This year’s catch phrase will be “buyers’ remorse” after missing out on a preferred home to another party.

From an estate agent’s point of view – “you have to lose a deal to know a deal”. 2025