Now that the stock market is back in record territory, it is interesting to compare where home prices are today compared with the peak values 10 years ago. The answer might surprise you. According to the Cromford Report, homes in the 85262 zip code are still 28% below the peak level pricing prior to the recession. Only parts of Old Town Scottsdale are almost back to pre-recession levels. (See chart below.) 1. Scottsdale 85251 2. Scottsdale 85257 3. Scottsdale 85250 4. Scottsdale 85255 5. Scottsdale 85258 6. Scottsdale 85254 7. Scottsdale 85260

-2% -8% -15% -15% -20% -21% -24%

9. Carefree 85377 10. Cave Creek 85331 11. Scottsdale 85259 12. Scottsdale 85262 13. Paradise Valley 14. Scottsdale 85266 15. Rio Verde 85263

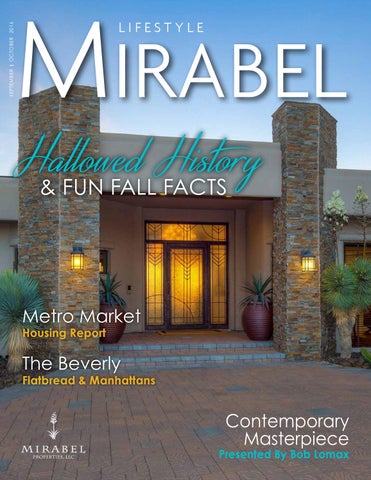

Coming This Fall | Contemporary Masterpiece 4 Beds | 4.5 Baths | Office & Home Theater $3,000,000

-26% -27% -27% -28% -29% -31% -36%

SEPTEMBER | OCTOBER 2016

MIRAB

MIRABEL FEATURED PROPERTY Featured Mirabel Cover Home

The Broker’s Corner

Mirabel LIFESTYLE

Hallowed History & FUN FALL FACTS

So why has the stock market fully recovered but not housing prices in our market? The answer may lie in the fact that during the boom 10 years ago, a good percentage of the buyers that were purchasing second homes probably didn’t have the financial resources to justify doing so. I estimate these buyers were as many as 30% of the total buyer pool back then. Their incomes were overly inflated because of a booming economy and home loans were easy to get and cheap. The thinking was they would buy a second home using leverage, enjoy them for a few years, and would make a profit as the housing values continued to increase. Unfortunately when the housing market crashed, these buyers did not have the staying power to make it through the recession and most of them lost the houses to short sales or foreclosures. These buyers are not likely to come back into the market. In addition to the aforementioned 30% of buyers being out of the second home market for good, another fairly large segment of the pre-recession potential buyers are choosing to rent to avoid subjecting themselves to the volatility in the real estate market. Add these two groups together and it could be as many as 40% or even 50% of the pre-recession potential second home buyer pool has evaporated. Given this drop in overall demand, it is not surprising that housing prices in our market are not back to the levels of 10 years ago. But the good news is, we shouldn’t see as dramatic of a correction next time there is a recession as the vast majority of second home buyers I work with today are paying cash for their homes and will have the staying power to weather the storm if there is one. The experts expect our market will see slight gains in home prices over the next several years and would call our market today healthy and the new “normal.

Metro Market Housing Report

Until next time ……………..

Bob Lomax

The Beverly

Owner/Designated Broker Mirabel Properties

Flatbread & Manhattans BOB LOMAX

OWNER/DESIGNATED BROKER MIRABEL PROPERTIES

480.595.2545 OFFICE 480.595.9503 FAX 602.920.7192 MOBILE

www.mirabel.com If your home is currently listed, this is not a solicitation for that listing.

Produced by DLP Marketing • (480)460-0996 • DLPmarketing.com

Contemporary Masterpiece

Presented By Bob Lomax