BUYER’S GUIDE TO REAL ESTATE

In the dynamic world of real estate, the journey to finding your dream home can be an exhilarating adventure, filled with excitement and opportunities. Whether you ' re a first-time buyer taking your initial step onto the property ladder or a seasoned investor seeking the next prime opportunity, this guide is your trusted companion.

BY DENISE RODRIGUEZ STEIDEL

BY DENISE RODRIGUEZ STEIDEL

I'm delighted to introduce myself as Denise Rodriguez Steidel, your dedicated local real estate agent As a proud member of our community, I'm fully committed to helping individuals from all walks of life navigate the real estate market with confidence and ease.

My primary objective is to deliver outstanding service to every client, whether they're embarking on their first home purchase, selling their current property, or seeking to make a wise real estate investment. With my expertise and a understanding of our local market, I am wellprepared to lead you through every phase of the process, ensuring the attainment of your real estate objectives.

In my role as your local real estate agent, I prioritize cultivating enduring relationships founded on trust, transparency, and mutual respect. My enthusiasm lies in helping you discover your dream home or securing the best possible price for your property, and I am unwavering in my efforts to ensure your real estate journey is a triumphant one.

Hence, whether you're in the market to buy, sell, or simply have inquiries about our local real estate landscape, please do not hesitate to contact me. I am eagerly looking forward to connecting with you and assisting you in accomplishing your real estate aspirations.

Hello 1218 Rosemont Drive Suite 108Indian Land,SC 29707 @denisencschomes https://deniserodriguezsteidel myrealtyonegroup com/ 702-672-9007 DeniseRodriguezRE@gmail com Denise Rodriguez Steidel Realtor®

Self Employment New Job Your Debt Credit Worthiness Are you prepared to own a home? TO-Do List (Printable) Saving for Down Payment Closing Costs Estimate your Mortgage 03 Types of Homes House Hunting Checklist for Home Buyers (Printable) Open Houses Etiquette Location, Location, Location Detective Work Private Showings New Construction PREPARING TO BUY A HOUSE FINDING YOUR NEXT HOME Benefits Duties Caution Online Who Pays the Agent? WORKING WITH AN AGENT 8 10 12 12 13 15 17 18 19 19 21 22 1 1 2 2 3 4 5 5 7 01 02 Buyer’s Guide to Real Estate - @denisencschomes

TABLE OF CONTENTS

TABLE OF CONTENTS 05 Common and Essential Contingencies Home Inspection After the Inspection Appraisal Low Appraisal Preparing for Closing Funding Recording CLEARING CONTINGENCIES CLOSING 33 34 34 Key Strategies for a Successful Home Purchase Contract Offer Acceptance MAKING AN OFFER 23 24 25 26 27 29 30 31 04 06 07 When Can I move How do I get the Keys Moving Out Utilities Moving In TAKING POSESSION 36 36 37 37 38 Buyer’s Guide to Real Estate - @denisencschomes

PREPARING TO BUY A HOUSE

This guide will help you assess your financial readiness for one of life's most significant decisions: buying a home. As you embark on this journey, anticipate answers to three pivotal questions that can shape your path to homeownership: Do I have a reliable source of income? Is my credit sufficient? Am I prepared to own a home?

Self-Employment

Prior to committing to the purchase of a home, it's essential to assess your ability to consistently meet its monthly financial obligations While it's impossible to predict every future change in your job or income, a careful and unbiased analysis is crucial.

For instance, if you ' re considering a transition from full-time employment to self-employment, be aware that this shift may present unexpected challenges. Mortgage lenders often require a minimum of one year, sometimes two, of income records in your new role due to the inherent risks associated with self-employment.

This precaution is taken because, similar to the uncertain fate of many new restaurants, numerous new businesses may fail. Furthermore, if this career change leads to a reduction in your guaranteed income, it can impact the overall financial stability of your household.

Even if your annual income is expected to rise in your new role, the loss of a consistent salary is a significant factor to consider, a point often overlooked by professionals like attorneys when they become partners in their firms

New Job

In summary, changing jobs can affect your mortgage approval process, but it largely depends on the specifics of your situation, such as the nature of the job change, income stability, and the lender's policies. It's advisable to consult with a mortgage advisor who can assess your unique circumstances and guide you through the application process

Section1

1

PREPARING TO BUY A HOUSE

Your Debt

Another crucial factor to consider in terms of income and job stability before applying for a mortgage is your debt-to-income ratio (DTI). Lenders often assess your ability to manage mortgage payments by evaluating your DTI, which is the percentage of your gross monthly income that goes toward paying debts like mortgages, car loans, credit card bills, and other financial obligations.

A high DTI can raise concerns for mortgage lenders, as it may indicate that you have limited financial flexibility to handle additional debt, such as a mortgage payment. Therefore, it's vital to have a manageable DTI to increase your chances of mortgage approval and to ensure that you can comfortably meet your monthly mortgage obligations while still addressing other financial responsibilities.

Credit Worthiness

Perfect credit isn't a requirement for buying a home; in fact, you don't even need great credit. Despite past financial setbacks like bankruptcy, foreclosure, or short sales, mortgage approval is possible, as long as your current credit history is reasonable Past blemishes, particularly those from five or ten years ago, are less relevant; what truly matters is how you manage your credit today.

Recent credit behavior holds the most weight in determining your credit score. Maintaining low credit card balances, timely payments to creditors, and avoiding new accounts in the last six to twelve months are indicators of responsible credit management, leading to a rise in your FICO credit scores.

It's crucial to get a grip on your existing debt before buying a home, as excessive bills can diminish the homeownership experience. So, focus on your current credit habits and debt management when preparing to purchase a home.

Section1

2 Buyer’s Guide to Real Estate - @denisencschomes

PREPARING TO BUY A HOUSE

Are you prepared to own a home?

When contemplating buying a home, it's crucial to consider your down payment, even if you intend to finance 100 percent of the purchase. This highlights the importance of savings, which extends beyond the down payment, as homeownership expenses go beyond monthly payments

These expenses include real estate taxes, homeowners' insurance, and the inevitable cost of maintenance and repairs, which can amount to about 1.5 percent of your home's value annually.

Additionally, it's wise to maintain savings equivalent to at least six months, preferably twelve months, of living expenses. This financial cushion safeguards against potential income disruptions due to job loss or illness, ensuring you can consistently meet your home-related financial obligations. Therefore, setting aside savings is a key aspect of responsible homeownership.

Tip

One essential tip for preparing to own a home is to get pre-approved for a mortgage before you start house hunting. This process involves a lender reviewing your financial situation and creditworthiness to determine the loan amount you qualify for. Pre-approval not only helps you understand your budget but also makes you a more attractive buyer to sellers because they know you ' re serious and financially capable of making the purchase. It can also speed up the closing process once you find the right home So, obtaining pre-approval is a smart initial step in your homebuying journey.

Section1

3

TO-DO LIST

By following these steps, you'll be well-prepared at every stage of your journey to becoming a homeowner. Starting early and methodically working through each task will enhance your chances of a successful and less stressful home buying experience.

Preparing to Buy a House

Check Your Credit and Improve Your Score

Obtain a copy of your credit report

Review it for errors and areas needing improvement

Take actions to enhance your credit score........................................................

Lower Your Debt-to-Income Ratio

Assess and reduce your existing debts..............................................................

Develop a plan to manage outstanding financial obligations effectively........

Save for a Down Payment

Establish a dedicated savings fund for your down payment

Research down payment requirements and set a savings goal.......................

Determine Your Home Buying Budget

Analyze your financial situation and establish a realistic budget....................

Consider factors like monthly expenses, future costs, and lifestyle.................

Research Loan Programs

Explore various mortgage options and understand their terms

Identify programs that align with your financial situation and goals...............

Get Pre-Approved

Contact a lender for pre-approval, which confirms your borrowing capacity..

Gather necessary financial documents for the pre-approval process..............

Find a Real Estate Agent

Begin searching for a reputable real estate agent in your desired area

Choose an agent who understands your needs and local market conditions...

Be Ready to Make a Deposit When Your Offer is Accepted

Ensure you have funds available for an earnest money deposit........................

Understand the role and significance of this deposit in the buying process......

Done @denisencschomes https://deniserodriguezsteidel myrealtyonegroup com/ 704-266-6553 DeniseRodriguezRE@gmail com

Fill out My Home Buyer’s Questionnaire to get started! Click Here

PREPARING TO BUY A HOUSE

Saving for Down Payment

It is likely you will need a down payment, unless you are applying for a VA or USDA loan. VA and USDA loans stand out as they often allow for zero down payments, making homeownership more accessible to eligible veterans and those purchasing homes in rural areas In contrast, FHA loans require a relatively modest 3 5% down payment, which has made them popular among a broad range of borrowers. Conventional loans offer greater flexibility but can have down payment requirements ranging from 3% to 20% or more, depending on factors like your creditworthiness and the lender's policies. It's essential to choose a loan type that aligns with your eligibility and financial resources, as well as the location of the property you intend to purchase.

To put this into perspective, if you ' re eyeing a first home with a $300,000 price tag, your down payment could range from $9,000 to $15,000. However, it's essential to keep in mind that your financial responsibilities don't end there.

Closing Costs

You'll also need to account for closing costs, which typically amount to approximately 2% to 5% of the loan amount On a $300,000 loan, for instance, these costs could total between $6,000 and $15,000. Lenders will scrutinize your bank statements during the mortgage application process to ensure you have the necessary cash reserves for both your down payment and closing costs.

If you find yourself short on cash, some mortgage programs do allow borrowers to utilize gift funds, either in full or in part, to cover their mortgage-related expenses.

Additionally, there are down payment assistance programs that provide grants or loans to eligible homebuyers seeking financial assistance with their down payments. If you ' re in need of extra support with your upfront expenses, consult with your loan officer to explore available options.

Section1

5 Buyer’s Guide to Real Estate - @denisencschomes

PREPARING TO BUY A HOUSE

Estimate your Mortgage Section1

Use this tool on my website to estimate your mortgage monthly payment. Consider the price of the property, down payment, interest rate, loan term, all property taxes, homeowners insurance, and any applicable HOA dues. If your down payment is less than 20 percent of the property price, you will need to include Private Mortgage Insurance (PMI) to the calculation.

https://deniserodriguezsteidel.myrealtyonegroup.com/mortgage-calculator

Tip

Research different types of loans before meeting with a lender. Beyond just comparing interest rates, take the time to explore the full range of terms, fees, and loan options available to you. Sometimes, a mortgage with a slightly higher interest rate but lower fees can be more cost-effective in the long run

Informed research helps you make the right decision for your financial situation, ensuring that you not only secure a mortgage but also one that aligns with your long-term goals.

WORKING WITH AN AGENT

Hiring a real estate agent when buying a home can provide numerous benefits and streamline the homebuying process. Here's an outline of how a real estate agent can be advantageous:

The Benefits

Expertise and Local Knowledge Real estate agents have a deep understanding of the local market, including neighborhood trends, property values, and upcoming developments. They can provide valuable insights into which areas align with your preferences and budget.

Time and Effort Savings Real estate agents take on the time-consuming task of searching for suitable properties, scheduling viewings, and researching listings They filter out homes that don't match your criteria, which minimizes wasted time.

Access to Listings Agents have access to a vast network of listings, including homes not yet publicly available, giving you an advantage in a competitive market. They can promptly notify you of new listings that meet your requirements.

Skilled Negotiation Real estate agents are experienced negotiators who work to get you the best possible deal. They can provide advice on pricing, contingencies, and concessions, protecting your interests throughout the negotiation process

Paperwork and Legalities Agents handle the complex paperwork and legal aspects of the transaction, reducing the risk of errors. They ensure that contracts, disclosures, and agreements are properly executed and in compliance with local regulations.

Network of Professionals Real estate agents have connections with a network of professionals, such as inspectors, appraisers, and mortgage brokers, simplifying the homebuying process. They can recommend trusted experts who can assist with various aspects of the transaction

Guidance and Support Agents provide guidance and support throughout the process, addressing questions and concerns that may arise. They offer advice on the right home for your needs, helping you make informed decisions.

Market Analysis Real estate agents can conduct a comparative market analysis to ensure you ' re making an offer in line with current market conditions and home values.

Handling Contingencies Agents assist in managing contingencies, such as inspections and financing, to ensure a smooth and secure closing process

Emotional Buffer Real estate agents can provide an objective viewpoint, helping you avoid emotional decisions that might not be in your best interest.

Section2

8

Section2

WORKING WITH AN AGENT

Choosing the right real estate agent is crucial when buying a home. Here are some steps to help you select the best agent for your needs:

Duties

Research and Recommendations:

Start by asking friends, family, and colleagues for recommendations. Real estate agents with a positive track record often come highly recommended.

Local Expertise:

Look for an agent who specializes in the area where you want to buy. They should have in-depth knowledge of the local market, including neighborhoods, schools, and amenities

Credentials and Licensing:

Ensure that the agent is licensed and in good standing. You can verify their credentials with your state's real estate regulatory authority.

Experience:

Consider an agent with a proven track record and several years of experience. Experienced agents have a better understanding of market dynamics and can handle complex situations

Communication Skills:

Effective communication is essential. Your agent should be responsive, prompt, and able to explain the process clearly. They should also be a good listener to understand your needs.

Negotiation Skills:

A strong negotiator can help you get the best deal. Inquire about the agent's negotiation strategies and success rate

Client Reviews and References:

Check online reviews and ask the agent for references from recent clients. This can provide insights into their performance and client satisfaction.

Marketing and Technology:

An agent should use modern marketing techniques and technology to maximize exposure for your property if you ' re selling, or to find the right homes if you ' re buying.

10

Buyer’s Guide to Real Estate - @denisencschomes

WORKING WITH AN AGENT

Availability:

Ensure that the agent's schedule aligns with yours. They should be available when you need them, especially for property showings and meetings.

Fee Structure:

Understand the agent's fee structure and how they get compensated. Most buyer's agents are paid by the seller, but it's important to discuss this upfront.

Compatibility and Trust:

Building a good working relationship is essential. Choose an agent you feel comfortable with and trust. You'll be working closely together during a significant financial transaction.

Clear Contract:

Review the agent's contract carefully. Ensure you understand the terms and the duration of your agreement.

Ask Questions:

Don't hesitate to ask questions about their experience, strategies, and the local market. An excellent agent will be open and transparent

Interview Multiple Agents:

It's a good idea to interview several agents to compare their qualifications and approaches. This can help you make an informed decision.

Remember that the right agent for you may not be the same as the right agent for someone else. Take your time to find an agent who aligns with your goals, communicates effectively, and has the experience and expertise to guide you through the homebuying process successfully.

Section2

Tip 11 Fill out My Home Buyer’s Questionnaire to get started! Click Here Buyer’s Guide to Real Estate - @denisencschomes

WORKING WITH AN AGENT

Caution Online

The majority of homebuyers initiate their property search online. When browsing real estate websites, you often encounter property listings with a clickable link for " more information." It's advisable to refrain from clicking this link if you wish to avoid receiving calls from multiple agents who may lack detailed knowledge of the property and have acquired your contact details by paying for lead acquisition through the website.

For more accurate and reliable information, consider reaching out your own trusted Realtor to facilitate the process.

Who Pays the Agent?

For decades, the standard practice in real estate has been for sellers to cover the buyer's agent commission, sparing buyers from out-of-pocket expenses. Buyer's agency agreements commonly include clauses guaranteeing agent compensation, even if the seller declines payment, with the agent first seeking payment from the seller. In For Sale by Owner (FSBO) homes, sellers may not want to pay buyer's agent fees, but experienced agents often navigate such situations effectively Additionally, in new construction home sales, builders typically compensate buyer's agents, ensuring that buyers represented by their own agents are not burdened with commission costs. Keep in mind that with this clause the buyer can ultimately be responsible for paying their buyer’s agent commission. It's essential for buyers to clarify the specifics of commission payments with their agent before entering into any agreements

Section2

FINDING YOUR NEXT HOME

The choice of the type of home to buy depends on individual preferences, lifestyle, budget, and location considerations. Weighing the pros and cons of each type will help you make an informed decision about your next home

Types of Homes

Single-Family Homes:

Pros: Privacy, outdoor space, potential for customization and expansion.

Cons: Higher maintenance, higher utility costs, often more expensive than other types.

Condominiums (Condos):

Pros: Lower maintenance, amenities (pool, gym), potentially more affordable, and often in urban locations

Cons: Shared walls and common areas, homeowners association (HOA) fees, limited outdoor space.

Townhouses:

Pros: Affordable, often larger than condos, shared maintenance with neighbors, usually in urban or suburban areas.

Cons: Shared walls, potential HOA fees, limited outdoor space.

Mobile Homes:

Pros: Affordability, mobility, often in communities with shared amenities.

Cons: Depreciation, potential restrictions on where you can place them, limited appreciation.

Duplexes and Multi-Family Homes:

Pros: Rental income potential, investment opportunity, often larger than single-family homes.

Cons: Management of multiple units, potential for vacancy, shared maintenance

Master-Planned Communities:

Pros: Comprehensive amenities (parks, schools, shopping centers), well-designed neighborhoods, sense of community, often in suburban areas.

Cons: Potential for higher HOA fees, limited individual customization, may be located farther from urban centers.

Section3

13

Buyer’s Guide to Real Estate - @denisencschomes

Section3

FINDING YOUR NEXT HOME

Cooperative Apartments (Co-ops):

Pros: Potentially more affordable, community living, cooperative ownership structure, often in urban areas.

Cons: Limited control over property, strict board approvals, potential for higher maintenance fees, resale restrictions

Tiny Homes:

Pros: Affordability, low maintenance, minimalistic living, mobility.

Cons: Limited space, potential zoning restrictions, challenges with storage.

Historic Homes:

Pros: Unique charm and character, potential for preservation grants, often located in desirable neighborhoods.

Cons: High maintenance, potential for costly renovations, limited modern amenities

Bungalows:

Pros: Single-level living, often more affordable, historic charm.

Cons: Limited space, potential for renovation needs, limited storage.

Ranch Homes:

Pros: Single-level living, open floor plans, suitable for all ages.

Cons: Limited privacy, maintenance challenges, less outdoor space.

Colonial Homes:

Pros: Classic design, spacious interiors, often in historic neighborhoods.

Cons: High maintenance, older plumbing and wiring, potential renovation needs

Contemporary Homes:

Pros: Modern design, energy-efficient features, often open and spacious.

Cons: Customization costs, may not fit in with traditional neighborhoods, potentially higher construction costs.

(not a complete list)

QuickFact

As of 2018, 67 percent of homes in the US were Single-family units.

House Hunting Checklist for Home Buyers

Address: Neighborhood: Year Build: Walk Score: Annual Taxes: Commute Time: Asking Price: # of Bedrooms: Hoa Fee: School District: # of Bathrooms: Sq Feet: rooms water shake n/a composite Y Y Y Y N N N N unknown Roofs Paint Bedroom 1 Garage door Kitchen Windows Driveway Walls Primary bedroom Front Porch Cabinet Space Furnace Gutters Ceiling Bedroom 2 Curb Appeal Counter Space HVAC Front Doors Moulding Doors Back deck Appliances Laundry Side yard Bathroom 1 Basement Fence Bathroom 2 Front Lawn Half bath Back lawn Closet Landscape cracked brick kitchen paint flooring roof electrical appliances blinds plumbing water/heater bath living room car chipped aluminum attached detached storage Y Y Y Y N N N N shop

Poor Poor Exterior Interior Foundation Flooring Repair Needs Repair Important notes/reminders Siding Garage Okay Okay Ideal Ideal Denise Rodriguez Steidel, REALTOR ® | 704-266-6553 | deniserodriguezre@gmail.com | @denisencschomes Paint Window Treatments Primary bathroom

Open Houses

Open houses are a common practice in the real estate market, providing potential buyers with the opportunity to visit a property without a prior appointment. The seller’s agent, or other associated agents will schedule, advertise, and allow access for anyone to view. Buyers can walk through the home, inspect its features, and get a feel for the layout.

A real estate agent representing the seller is often present during the open house to answer questions, provide information about the property, and potentially collect contact information from interested buyers

Note: You might be requested to take off your shoes, or wear shoe coverings that may be provided. The agent may also kindly request that you sign in and, in some cases, present a form of identification

Section3

YOUR NEXT HOME

FINDING

FINDING YOUR NEXT HOME

Etiquette

If you plan to attend an open house, consider the following: Most open houses request visitors to sign in. Providing your contact information is common and helps the seller and agent follow up with you, as well as to ensure the security of the property and its occupants during the event.

Treat the property with care, as if it were your own Avoid touching personal belongings, and be cautious with furniture and fixtures.

Feel free to ask the hosting agent about the property, its history, and any concerns you may have. They can provide valuable insights.

If you ' re not interested in the property, it's courteous to offer constructive feedback to the agent. This information can help the seller make improvements.

Stick to the scheduled open house hours. Arriving too early or staying too late may inconvenience the hosting agent.

Open houses can be an enjoyable and informative part of the homebuying process. They offer a glimpse into potential properties and provide a platform for questions and discussions with real estate professionals. Following proper etiquette ensures a positive experience for both buyers and sellers.

Tip

Your host will usually be the listing agent. The listing agent represents the seller. But that’s not always the case.

Section3

18 Fill out My Home Buyer’s Questionnaire to get started! Click Here Buyer’s Guide to Real Estate - @denisencschomes

FINDING YOUR NEXT HOME

Location, Location, Location Detective work

Before buying a new home, thorough neighborhood research is essential to make an informed decision.

There's no substitute for exploring the area on foot. Visit at different times of the day, allowing you to pick up on details that are often missed when driving or using online tools. Engage with neighbors and strike up conversations to gain insights.

Utilize online resources like Google Maps to identify nearby amenities such as schools, grocery stores, healthcare facilities, and transit stops You can also assess travel routes and times. Dive into further details by searching for specific services like hospitals and schools

Gather essential information about the neighborhood, including crime statistics, school quality, road conditions, future development plans, and more. This data will help you understand what to expect.

Schools: Use the U.S. Department of Education website to find local school information, including profiles and ratings

Healthcare: Consumer Reports offers hospital listings and performance ratings.

Crime: Search for recent incidents in your area using websites like CrimeReports. You can also locate registered sex offenders living nearby through the U.S. Department of Justice.

The Home: Access property records, deeds, and encumbrances through the local courthouse or city offices. Online databases are available, but visiting in person ensures access to the latest information

Remember that no neighborhood is flawless. Homebuying is about trade-offs, both in terms of properties and their surroundings. Have realistic expectations as you explore and assess the neighborhood, understanding that compromises are part of the process.

A well-researched neighborhood ensures a more informed homebuying decision, making it crucial to evaluate this aspect thoroughly.

Section3

19 Buyer’s Guide to Real Estate - @denisencschomes

Private Showings

Scheduling showings and managing listing notifications are integral element of an agent's role in assisting buyers. The goal is to simplify the home search process, save the buyer's time, and ensure that the properties they visit align with their preferences and budget.

1 Initial Consultation: During this meeting, the agent will gather important information about the buyer's preferences, budget, and any specific criteria for their future home. This helps the agent understand the buyer's needs and desires.

2. Setting Up Listing Notifications: These notifications are customized to the buyer's preferences and criteria. They provide automated updates about new properties that match the buyer's requirements, ensuring that the buyer is among the first to know about fresh listings hitting the market

3. Pre-Viewing Selection: When potential listings match the buyer's criteria and become available, the agent reviews and selects those that align most closely with the buyer's preferences. The goal is to present a curated list of properties for the buyer to view, saving time and effort.

4 Scheduling Showings: The real estate agent schedules showings with the listing agents or homeowners. The agent coordinates viewing appointments, taking into account the availability of the buyer and the sellers. To ensure efficient use of everyone ' s time, it's recommended that a typical showing day includes visits to approximately 4 to 5 properties.

While touring homes, the agent provides insights, answers questions, and offers a balanced perspective by highlighting both the positive and negative aspects of each property. Their role extends beyond simply opening doors; they are instrumental in facilitating well-informed decisions.

After each viewing, real estate agents diligently collect feedback from the buyer. They pay attention to which features of the property were appealing and which were not. This helps to refine the search criteria for subsequent showings, and ensures that each viewing aligns more closely with the buyer's evolving needs and desires.

Section3

FINDING YOUR NEXT HOME

21

FINDING YOUR NEXT HOME

New Construction

Buying a new construction home in a Planned community can be an excellent choice. It's important to emphasize that even when purchasing new construction, using a buyer agent is highly recommended:

Hire a Buyer Agent: As a buyer, it's crucial to have your own real estate agent, even when purchasing new construction. Your agent will represent your interests, help you navigate the process, and ensure you get the best deal.

Choosing the Right Development: Your agent will assist you in finding a community that suits your needs, budget, and lifestyle. You'll explore various builders, floor plans, and locations.

Select a Floor Plan: Once you ' ve chosen a community, you'll select a floor plan that fits your preferences. You might have options for customization and upgrades.

Negotiate the Contract: Your agent will help you negotiate the contract with the builder. This includes the purchase price, financing terms, upgrade options, inspections and repairs, and a timeline for construction.

Deposit and Financing: You'll typically need to provide an initial deposit, which may be held in an escrow account. Additionally, you'll secure financing through a mortgage lender

Construction and Inspections: As the home is being built, your agent will help schedule necessary inspections at key stages of construction to ensure the quality of work Even though it is a new home, your agent will highly recommend hiring a home inspector.

Final Walk-Through: Just before closing, you'll have a final walk-through to identify any issues that need to be addressed by the builder.

Closing: At the closing, you'll sign all the necessary paperwork and finalize the purchase. Your agent will ensure all the details are in order.

Warranty and Post-Closing Support: New construction homes typically come with warranties Your agent can help you navigate any warranty issues that may arise

Section3

Salespeople at a new construction developments are agents for the builder, and work in the best interest of the builder. Contact your real estate agent before visiting a new construction sales office or model homes, or let them know you are working with your agent. Tip

Section4

MAKING AN OFFER

In a competitive real estate market with multiple offers on properties, it's essential to strategize your offer wisely. To secure the house you desire without overpaying, consider the following guidelines:

Key Strategies for a Successful Home Purchase

Mortgage Pre-Approval: Begin your home-buying process with a mortgage pre-approval. This not only establishes your price range but also signals to sellers that you ' re a serious, financially sound buyer. It's a valuable step, especially in a competitive market.

Leave Room for Negotiation: Avoid offering the full amount you ' re pre-approved for.

Maxing out your pre-approval could hinder future negotiations and pose risks if interest rates rise. Remember, the pre-approval amount represents what you can afford, not necessarily what you should borrow.

Market and Seller Research: Investigate the market with the help of your buyer's agent.

Understand fair market values and gather insights into the seller's motivations. You agent will help you in crafting a compelling offer.

Make a Respectable Offer: Don't submit lowball offers that lack support from sales data. Consider the seller's perspective, understanding the hard work and emotional investment they've put into their home. A serious, market-backed offer enhances your chances.

Limit Contingencies: While some contingencies are necessary, minimize them in a competitive market. Essential contingencies include a home inspection and a finance contingency. Waiving non-essential contingencies can make your offer more appealing.

Hire Your Own Real Estate Agent: Avoid the seller's agent and hire a buyer's agent to represent your interests. A seller's agent prioritizes the seller's goals, so using them results in a dual agency situation where your interests are less protected.

Stay Rational and Objective: While it's easy to fall in love with a property, keep your emotions in check Don't let a dream home lead you to overspend Be prepared to walk away if the offer doesn't align with your budget.

By following these strategies, you can make a competitive and smart offer that increases your chances of securing your desired home without overextending yourself financially.

23

Section4

MAKING AN OFFER

Contract

A Purchase agreement is a binding contract once accepted by both the buyers and the sellers. A valid home purchase agreement or contract must be:

In Writing

Offered and Accepted

between parties that are legally competent

For a legal purpose

For an exchange of something of value

1. Earnest Money Deposit: The buyer usually accompanies the offer with an earnest money deposit, which is a sum of money that demonstrates their serious intent to buy the property. This deposit is held in an escrow account until the sale is completed.

Offer and Acceptance: The process begins when a buyer makes an offer to purchase a property. The offer includes details such as the purchase price, the earnest money deposit, the closing date, and any contingencies (conditions that must be met for the sale to proceed). The seller can either accept the offer as is, reject it, or present a counteroffer

2. Due Diligence Money: Due diligence money is distinct from earnest money. Earnest money demonstrates the buyer's good faith and is typically applied toward the purchase price at closing. Due diligence money, on the other hand, compensates the seller for holding the property off the market while the buyer investigates If the contract successfully proceeds to closing, the due diligence money may be credited toward the purchase price.

3. Negotiation: The buyer and seller may negotiate the terms and conditions of the contract until both parties reach an agreement and sign the contract. Negotiations may involve adjustments to the purchase price, contingencies, or other terms.

5.

4. Contingencies: Common contingencies in a purchase contract include a financing contingency (the buyer must secure a mortgage), an inspection contingency (the property must pass a home inspection), and an appraisal contingency (the property must appraise for at least the purchase price). If these conditions are not met, the contract may be terminated without penalties.

24 Buyer’s Guide to Real Estate - @denisencschomes

MAKING AN OFFER

Offer Acceptance

Your offer was accepted. Now what? This is an exciting step in the home buying process, but there are several crucial actions and steps to follow. Here's what you can expect:

1. Mortgage Application: Your next step is to complete your mortgage application promptly. You've likely been pre-approved, but this is when you'll formally apply for the loan.

3.

Provide Earnest Money: You'll need to submit your earnest money deposit, which is typically around 1 to 3 percent of the purchase price. This deposit demonstrates your commitment to buying the home.

2 Clear Contingencies: Most purchase agreements include contingencies such as financing, appraisal, and inspection. You'll need to work on fulfilling these contingencies in a timely manner.

Section4

CLEARING CONTINGENCIES

As the buyer and their real estate agent work to fulfill these contingencies, it ensures that the property is sound, the financing is secure, and the title is clear. Clearing contingencies helps build confidence in the transaction and allows the buyer to move forward with the closing process, marking a significant milestone on the path to homeownership

Common and Essential Contingencies

Home Inspection: The buyer typically has a specified period to conduct a home inspection. If significant issues are discovered, negotiations may take place regarding repairs or price reductions.

Appraisal: The lender usually requires an appraisal to ensure the property's value aligns with the purchase price. If the appraisal comes in lower than the purchase price, the buyer and seller may renegotiate the price, or the buyer may choose to make up the difference with additional funds.

Secure Homeowners Insurance: To secure your mortgage, you'll need to arrange homeowners insurance. This is a critical step to protect your investment.

Financing: The buyer's financing must be secured within the timeframe specified in the contract If the buyer fails to secure a mortgage, the contract may be voided, and the earnest money deposit returned.

Title Search and Insurance: A title search is conducted to ensure there are no legal claims or liens on the property's title. The buyer usually purchases title insurance to protect against any unforeseen issues.

Sale of Current Home: If you need to sell your current home before buying a new one, this contingency allows you to do so. If your home doesn't sell, you can withdraw your offer.

Radon, Mold, or Pest Inspection: In areas with known issues, you can include these specific inspections to ensure the property is free from these concerns

Easement or Boundary: If there are any encroachments or boundary disputes, you can include this contingency to address and resolve these issues before finalizing the purchase.

Section5

26

Section5

CLEARING CONTINGENCIES

Home Inspection

A licensed inspector will conduct the inspections to evaluate the property thoroughly. The inspector's role is to assess various factors, ensuring the property's condition is up to standard Here's what the licensed inspector will look for during a home inspection: Structural Integrity: The inspector will check for any signs of foundation issues, including wall or floor cracks and sloping or uneven surfaces.

1. Roof Condition: They will assess the roof's state, examining shingles, flashing, gutters, and looking for signs of water damage in the attic.

2. Plumbing Systems: The plumbing systems will be tested for functionality, looking for leaks and ensuring that faucets, toilets, and showers work as intended.

3. Electrical Systems: The inspector will examine the electrical panel, wiring, outlets, and switches for safety and functionality.

4. HVAC Systems: Heating and cooling systems will be tested for efficiency and any unusual noises or odors.

5 Appliances: Included appliances like stoves, dishwashers, refrigerators, washers, and dryers will be checked for their condition and functionality.

6. Windows and Doors: The inspector will look for proper sealing, functional locks, and any drafts in windows and doors.

7. Mold and Pest Issues: Any signs of mold or pest infestations will be identified, focusing on areas prone to moisture issues

8. Insulation and Ventilation: Attic and wall insulation will be examined to ensure it's adequate. Proper ventilation will also be verified to prevent moisture problems.

9. Safety Features: Smoke detectors, carbon monoxide detectors, and handrails on staircases will be checked for their presence and proper functioning.

10. Exterior: The exterior walls and siding will be inspected for damage or rot, and the drainage systems and water pooling will be evaluated.

12

11. Crawl Spaces and Basements: These areas will be examined for water intrusion, foundation cracks, and mold growth.

27 Buyer’s Guide to Real Estate - @denisencschomes

Insulation and Ventilation: Attic and wall insulation will be examined to ensure it's adequate. Proper ventilation will also be verified to prevent moisture problems.

10. Exterior: The exterior walls and siding will be inspected for damage or rot, and the drainage systems and water pooling will be evaluated.

Home Inspection

CLEARING CONTINGENCIES

11. Crawl Spaces and Basements: These areas will be examined for water intrusion, foundation cracks, and mold growth.

12 Garage: If there's a garage, the inspector will assess the functionality of the garage door, opener, and check for water damage and proper sealing.

13. Attic: The inspector will verify the attic's condition, assessing it for leaks, insulation, and proper ventilation.

14. Overall Maintenance: The overall maintenance of the property, including paint, flooring, and fixtures, will be considered

15. Environmental Hazards: The inspector will be vigilant about environmental hazards, such as lead paint or asbestos in older homes.

16. Documentation: They may request any available documentation, such as past inspection reports, warranties, or repair records.

Attending the home inspection as a buyer is a smart move It provides you with an opportunity to see the property firsthand, ask questions, and gain insights into its condition.

While you don't need to be an expert, being present during the inspection allows you to understand any potential issues and discuss them with your inspector. It's a valuable learning experience that can help you make an informed decision about the property. Make sure you communicate with your agent and the inspector your desire to attend the inspection. You must be accompanied by your agent when you enter the home.

9. Safety Features: Smoke detectors, carbon monoxide detectors, and handrails on staircases will be checked for their presence and proper functioning.

17. Section5

Tip

Section5

CLEARING CONTINGENCIES

After the Inspection

1.

Review the Inspection Report: Thoroughly examine the inspection report to understand the home's condition.

2

Discuss Findings with the Inspector: Discuss findings with the inspector to get insights and clarifications.

4.

3. Negotiate Repairs or Price: Depending on the severity of the issues found, you can negotiate with the seller. You may ask them to make repairs before closing or request a credit toward your closing costs to cover the repair expenses. Negotiations can be a sensitive phase, and your agent can guide you through this process.

5

Prioritize Concerns: Not every issue uncovered in the inspection may be a deal-breaker. Work with your real estate agent and the inspector to prioritize concerns based on their impact, cost of repairs, and your future plans for the property.

Request Additional Inspections: In some cases, you might want to bring in specialists for further inspections. This could include structural engineers, pest inspectors, or HVAC professionals if specific issues were highlighted in the general inspection. These additional inspections provide a deeper understanding of particular concerns.

6. Plan for Repairs: If you and the seller agree on repairs, plan for these Obtain quotes from contractors and ensure you have a clear timeline for the completion of the work before closing. Your agent can assist with coordinating these efforts.

8.

Consider the Big Picture: Keep the overall condition of the property in mind. It's common for an inspection report to list multiple issues, but not all are equally significant. Weigh the overall condition, the property's age, and its maintenance history.

7 Be Prepared to Walk Away: If the inspection reveals severe structural issues or a long list of costly repairs, it may be wise to consider walking away from the deal. While this decision can be challenging, it's crucial to prioritize your long-term satisfaction and financial well-being.

9

10.

Continue the Loan Process: Keep your loan process moving forward

Stay in Close Contact with Your Agent: Your real estate agent is your advocate throughout this process. Maintain open communication with them, as they can guide you through negotiations and help ensure that everything stays on track.

29 Buyer’s Guide to Real Estate - @denisencschomes

Appraisal

A home appraisal is a critical step in the home buying process. It is an unbiased assessment of a property's value conducted by a licensed appraiser to determine if the agreed-upon purchase price is fair and in line with current market conditions

The Appraisal Process and Cost

During the appraisal process, the appraiser inspects the property, considers comparable sales in the area, and factors in the property's condition and features to arrive at a valuation. The cost of a home appraisal typically ranges from $300 to $500 and is usually paid for by the buyer.

Should You Skip the Home Appraisal?

While it might be tempting to skip the appraisal to save costs, it's generally not recommended Appraisals provide reassurance to both buyers and lenders that they are not overpaying for a property.

Appraised Below Purchase Price

If the home appraises below the purchase price, it can pose challenges. The buyer, seller, and their agents will need to negotiate a solution, which could include renegotiating the price, the buyer making up the difference, or the deal falling through.

Appraisal Repair Requirements for FHA, VA, and USDA Loans

FHA, VA, and USDA loans often come with specific appraisal requirements For example, the property must meet certain safety and structural standards. If issues are identified during the appraisal, they may need to be resolved before the loan can move forward.

How an FHA Appraisal Works

FHA appraisals are particularly detailed, focusing on the property's safety, security, and structural integrity. If issues are found, they must be addressed before the loan is approved, ensuring that the home meets FHA standards.

Virtually all traditional mortgage lenders insist on an appraisal, even if it's not required by law. They do so to safeguard against potential losses in the event of a borrower's default.

Section5 CLEARING CONTINGENCIES

CLEARING CONTINGENCIES

Low Appraisal

When the appraisal comes in lower than the offer price, it can create a situation where the buyer, seller, and lender need to consider their options. For example, let's say You make an offer of $300,000 for a home, and your lender orders an appraisal However, the appraiser determines that the fair market value of the home is only $280,000.

Offer Price: $300,000

Appraised Value: $280,000

LTV Calculation for FHA Loan:

Maximum Loan Amount (96.5% LTV): $271,800 (0.965 x $280,000)

In this case, there are several potential outcomes:

1

Seller Reduces the Price: The seller agrees to lower the selling price to match the appraised value of $280,000. In this case, the new purchase price becomes $280,000.

3.

2. Negotiation: The buyer and seller engage in negotiation. They agree to a compromise where the seller reduces the price, and you contribute some funds to make up the difference For instance, the seller may lower the price to $290,000, and you would need to bring an additional $10,000 to closing.

5.

Buyer Pays the Difference: You, as the buyer, decide to pay the $20,000 difference between the appraised value and the original offer price out of your pocket. This means you would need to bring an additional $20,000 to the closing table to cover the gap.

Order a Re-Appraisal: In some cases, you may request a second appraisal if you believe the first one was inaccurate.

4. Walk Away: If a resolution cannot be reached, you have the option to cancel the deal, especially if you have an appraisal contingency clause in your purchase agreement.

It's important to note that the specific actions taken can vary based on the terms of the purchase contract and the willingness of both parties to negotiate. Additionally, some loan programs, like FHA and VA, have specific guidelines for handling low appraisals, which may impact the available options.

Section5

31 Buyer’s Guide to Real Estate - @denisencschomes

Section6

CLOSING

Home closing is the moment when the pages of your homeownership story finally come together in a harmonious conclusion It's not just about signing papers; it's about realizing your dreams, feeling the weight of responsibility, and celebrating your journey. As you sit at that table, pen in hand, surrounded by professionals who have guided you every step of the way, you'll reflect on the commitment you ' re making to a place that will soon be more than just a house it will be your sanctuary. It's a heartfelt moment where the hopes and aspirations of your family meet the sturdy foundation of your new home. Embrace it with gratitude, for in the final signatures, you'll find the key to a world filled with memories waiting to be made.

Preparing for Closing

In the final stages of closing on a home purchase, there are several crucial steps to ensure a smooth and successful transition. Here's what happens in the preparation leading up to closing:

1. Securing the Down Payment: Buyers should have their down payment ready in the form of a cashier's check or wire transfer.

Final Walkthrough: Just before closing, you'll have the chance to do a final walk-through of the property to ensure it's in the agreed-upon condition.

2. Reviewing Closing Documents: Buyers receive a Closing Disclosure (CD) at least three days before closing, outlining the final terms and costs of the mortgage It's essential to carefully review this document for any discrepancies.

3. Scheduling the Closing: Buyers agent will coordinate with all parties involved to communicate the closing date, time, and location. The closing usually takes place at the buyers attorney’s office.

4. Confirming Utilities and Services: Arrange for the transfer of utilities, services, and any ongoing maintenance agreements, making sure everything is set up for a smooth transition on the closing day

6.

5. Closing: Finally, you'll attend the closing meeting, where you'll sign all the necessary paperwork, including the mortgage documents. Once the deed is recorded with the county you will receive the keys to your new home, and it will officially become yours.

33

Buyer’s Guide to Real Estate - @denisencschomes

Funding

Funding involves the transfer or wiring of funds by your lender to the escrow company for the purpose of purchasing your home. Closing, on the other hand, takes place when the local government officially records the lien against your property, along with any necessary transfer of ownership.

To officially complete the loan process, all required documents must be submitted and approved by the closing date. Prior to the closing, the lender gets in touch with the attorney to verify the funding amount necessary for the transaction

Once this amount is confirmed, your lender will initiate the wire transfer in advance to ensure that the funds are disbursed on the closing date or within two days thereafter. This ensures a prompt payment to the seller and other involved parties. This is called wet funding.

The closing attorney will verify the receipt of loan funds and other cash, settling any outstanding balances on current mortgages, liens, or covering additional closing expenses. Any remaining funds will then be disbursed to the seller

Recording

Recording of the deed by the buyer’s attorney effectively marks the moment when the property officially changes hands from the seller to the buyer. This recording process ensures that the property's new owner is recognized by local authorities and legal system.

Once the deed is successfully recorded, the buyer gains the rightful and full possession of the property. This means that the property is no longer under the control or ownership of the seller. The buyer can now enjoy all the privileges and responsibilities that come with property ownership, including the ability to occupy, use, and manage the property as they see fit.

In essence, the recording of the deed is a vital step that not only symbolizes the completion of the sale but also serves as a cornerstone of property ownership, legally solidifying the buyer's right to the property and marking the end of the seller's connection to it.

Section6 CLOSING

34

Section7

TAKING POSSESSION

Buying a new home is an exciting journey, but it comes with several important questions, such as when you can move in and how to get your keys. Let's break down the process of moving into your new house and offer some tips on making it a smooth transition.

When Can I Move In?

The timing of your move-in depends on a few factors, including the terms of your purchase agreement and the specifics of your closing process. Typically, you can move in on the day of your closing, but it's essential to consult with your real estate agent or attorney for precise details.

During the closing process, the final paperwork and financial transactions are completed, and this often takes place at the sellers attorney's office. Once this process is finished, and the property's title is officially transferred to your name, you'll receive the keys to your new home. In some cases, the seller may agree to a possession date different from the closing date, but this should be clearly stipulated in the purchase agreement.

How Do I Get My Keys?

Getting your keys is the moment you ' ve been waiting for They are typically handed over at

TAKING POSSESSION

Moving Out

Moving can be a costly endeavor, but there are ways to make it more budget-friendly. Here are some tips to help you save money:

1. Get Multiple Quotes: If you ' re hiring professional movers, obtain quotes from several companies to find the best deal. Compare services, rates, and customer reviews.

3.

Declutter: Before you move, go through your belongings and declutter. Sell, donate, or discard items you no longer need The less you have to move, the cheaper and easier the process will be.

2. Move During Off-Peak Times: If possible, schedule your move during off-peak times, such as the middle of the month or during the week. This can lead to lower moving costs.

3. Utilities

When you move into a new home, setting up utilities is a priority Here are some tips:

1.

Contact Utility Providers: Reach out to local utility providers for electricity, gas, water, sewer, and trash collection. Schedule the activation of these services to coincide with your move-in date. Pay attention to business hours. You may need to activate some services prior to closing if the closing date falls outside of the business hours of the utilities company.

Internet and Cable: Contact internet and cable providers to set up these services in your new home. Research different packages to find the one that suits your needs and budget. Keep in mind that some companies may not have available services in your area.

2 Change of Address: Don't forget to update your mailing address with the post office, as well as with banks, insurance companies, and any other entities you receive mail from.

Section7

37 Buyer’s Guide to Real Estate - @denisencschomes

TAKING POSSESSION

Moving In

1.

Consider changing Your Locks: When you get the keys to your new home, make changing the locks your top priority. It's a security measure to ensure no unauthorized individuals can access your property. Re-keying is also important as there may be master keys in circulation.

2.

Smart Home Features: If your new home comes with smart features, ensure they're upto-date and secure Reset all devices to factory settings to remove old data and passwords. Install the latest software and firmware for security and functionality. Replace any malfunctioning devices that can compromise your smart home system.

3.

House Systems Check: Conduct a thorough check of the house's systems to identify any potential problems. Locate and check the main circuit breaker for tripped switches, inspect light bulbs and fixtures, and look for electrical defects. Find and test water shutoff valves, check gas, oil, or propane shutoffs, and ensure you know where they are located and how to operate them Also, inspect safety features like smoke and carbon monoxide detectors, and change their batteries if necessary.

4.

Cleaning Deeply: Before settling in, give your new home a thorough cleaning. Examine and change or clean filters in HVAC, appliances, and water filtration systems. Steam clean carpets, wash floors, cabinets, windows, and appliances. Scrub toilets, tubs, sinks, and wipe down closet shelves. Dust blinds, baseboards, ceiling fans, and light fixtures.

If you find the process overwhelming, consider hiring professional help to make your transition into your new home as smooth as possible. Your agent can recommend trusted local and licensed professionals for your new home needs.

Section7

Tip 38 Buyer’s Guide to Real Estate - @denisencschomes

CongratulationsTIME TO ENJOY YOUR HOME

I am absolutely delighted for you as you begin this wonderful journey of home ownership. Your new house isn't just a place; it's the beginning of a beautiful story.

As you look forward to this new chapter, remember that having the right buyer agent can make all the difference. I would be honored to be your guide in this exciting process. As your buyer agent I will offer you

A fresh Perspective: I bring a fresh and enthusiastic outlook to the process. By continuing educating myself in creative and effective negotiating techniques, as well as utilizing modern technology to streamline the process I will be able to meet your needs as stress free as possible. I will ensure that your interests are well represented.

Negotiation: Buying a home often involves negotiations. I am a skilled negotiator and will work tirelessly to secure the best deal for you

Personalized Service: Your journey is unique, and I will tailor my services to meet your specific needs and preferences. I'm here to make your home buying experience as smooth and stress-free as possible.

Dedication: Your satisfaction is my top priority. I'll be with you every step of the way, from the search to closing, ensuring that your transition into your new home is seamless.

Choosing the right buyer agent is as essential as choosing the right home I am committed to ensuring that your home buying experience is a positive and memorable one. If you decide to work with me, you'll not only be gaining a trusted ally but a partner who's dedicated to turning your homeownership dreams into reality.

Congratulations on taking the first step towards home ownership, and I look forward to the opportunity of assisting you on this exciting journey!

DeniseRodriguezSteidel REALTOR® Licensed in North Carolina and South Carolina 39

ThisGuide

DISCLOSURES AND GUIDANCE

Congratulations on taking the important step of obtaining this exclusive homebuyer's guide It is my intention to provide you with valuable insights and knowledge to assist you in your homebuying journey However, there are some important points and disclosures that you should be aware of before proceeding further

No Legal Advice: The information provided in this guide is not intended as legal advice Real estate agents are not qualified to offer legal advice Should you have questions about legal documents, contracts, or other legal matters, we strongly recommend that you consult with an attorney who specializes in real estate law I can offer recommendations of trusted local attorneys

Best of Knowledge: The information within this guide is accurate to the best of my knowledge up to the stated date Real estate laws and regulations are subject to change, so it is crucial to consult with professionals to ensure the information is current and applicable to your specific circumstances

Neighborhood Investigation: While this guide provides insights and factors to consider when selecting a home, it is essential to conduct thorough research and investigation of neighborhoods before submitting an offer This may include visiting the area at different times of day, speaking with neighbors, and accessing public resources to gather information relevant to your preferences

Existing Buyer-Agent Relationship: If you are already working with a real estate agent, this guide is not a solicitation to disrupt that relationship It is important to maintain open communication with your current agent and use the guide as supplementary information to enhance your understanding of the homebuying process

Consult Your Team: When purchasing a home, you have a team of professionals at your disposal, including your real estate agent, mortgage lender, and attorney We encourage you to consult with them regularly to address specific concerns, interpret legal documents, and ensure a smooth and successful transaction

Continued Support: My goal is to support you in making informed decisions throughout your homebuying journey If you have any questions or need further assistance, please do not hesitate to reach out to me or your real estate agent We are here to help you achieve your homeownership dreams

Remember, buying a home is a significant investment, and your understanding of the process is paramount Please consult with your professionals for personalized advice and guidance to ensure a smooth and successful home purchase We wish you the very best of luck in your upcoming real estate endeavors!

REFERENCES:

Bankrate (2023) How to buy a house in 2023 Accessed October, 2023 https://www bankrate com/realestate/how-to-buy-a-house/

Green Mistretta Law, PLLC. What to Expect When Selling Your Home: An Overview of the Closing Process for N.C. Sellers. Accessed October 2023. https://greenmistrettalaw.com/nc-real-estate-closing-guide/

Kaplan Real Estate Exam Prep, Accessed April 2023; September, 2023; (paid access) https://www.kaplanlearn.com/

South Carolina Code of Laws, Title 40, Chapter 57, Sections 05-810

DeniseRodriguezSteidel REALTOR® Licensed in North Carolina and South Carolina 40

notes

42 Buyer’s Guide to Real Estate - @denisencschomes

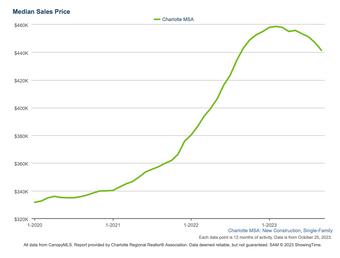

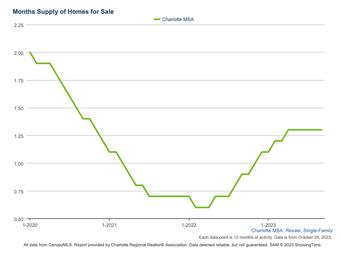

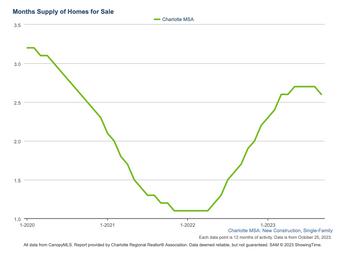

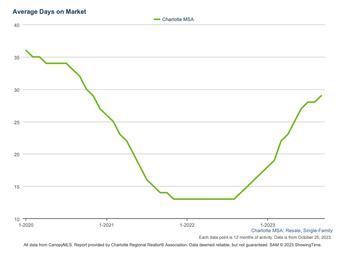

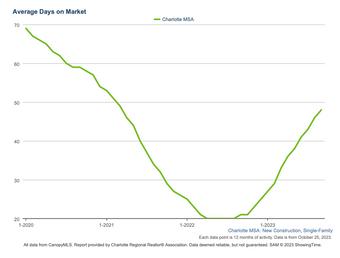

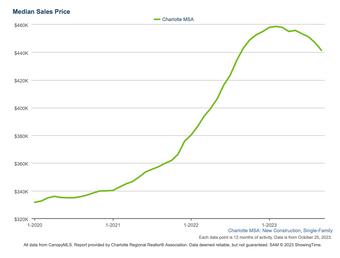

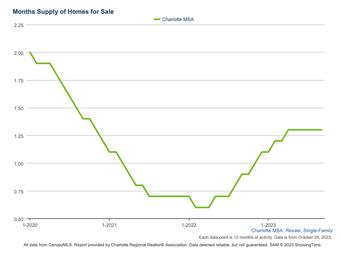

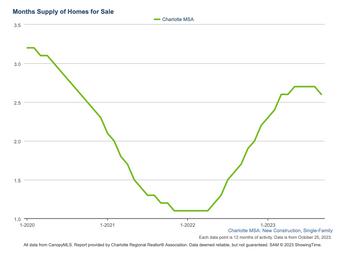

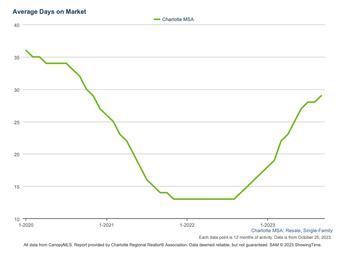

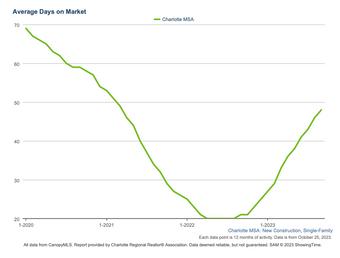

STATS CHARLOTTE METRO SINGLE FAMILY RESIDENTIAL RESALE MEDIAN SALES PRICE NEW CONSTRUCTION RESALE MONTHS SUPPLY NEW CONSTRUCTION RESALE DAYS ON MARKET NEW CONSTRUCTION UPDATES MONTHLY WITH THE LATEST DATA FILL OUT A CONTACT FORM FULL CHARLOTTE AREA MARKET REPORT FULL FORT MILL, SC MARKET REPORT MORE REPORTS Looking for a specific area Market Report? @denisencschomes https://deniserodriguezsteidel myrealtyonegroup com/ 704-266-6553 DeniseRodriguezRE@gmail com

Resources

About THE AUTHOR

I'm Denise Rodriguez Steidel, your dedicated partner in navigating the dynamic real estate market in both North and South Carolina. With a passion for organization and a genuine love for connecting with people, I'm here to guide you through every step of your real estate journey. Originally from the vibrant island of Puerto Rico, I bring a unique blend of cultural understanding and diverse experiences to the North and South Carolina real estate scene.

Having lived in both the welcoming communities of Michigan and the bustling cityscape of Las Vegas, I understand the complexity of different markets and the importance of finding the perfect place to call home As a licensed real estate professional, I bring knowledge about the local market trends, neighborhoods, and property values. My commitment to staying updated on the latest industry insights ensures that you receive the most accurate and up-to-date information to make informed decisions My approach is centered around you your dreams, your goals, and your unique preferences. Whether you ' re a first-time homebuyer, looking to sell your property, or searching for that perfect investment opportunity, I'm dedicated to understanding your needs and tailoring my services to exceed your expectations I believe that open and honest dialogue forms the foundation of a successful client-agent relationship. I'm not just here to help you buy or sell a property; I'm here to be your trusted advisor, your advocate, and your friend in the real estate process Let's embark on this exciting journey together!

https://deniserodriguezsteidel.myrealtyonegroup.com DeniseRodriguezRE@gmail.com

DO YOU NEED MORE HELP? SCHEDULE A MEETING (704) 266-6553 @DeniseNCSChomes 44

BY DENISE RODRIGUEZ STEIDEL

BY DENISE RODRIGUEZ STEIDEL