Fiscal Year 2022 (FY 2022) marked the District of Columbia Housing Finance Agency’s (DCHFA or “the Agency”) 43rd year serving the housing needs of Washington, D.C., residents. DCHFA was established on March 3, 1979, to stimulate and expand homeownership and rental housing opportunities in the District.

FY 2022 marked the return to a new normal. The Agency’s staff returned to work on a hybrid basis while continuing to create and administer homeownership programs and close deals to finance much-needed affordable rental housing. Through DCHFA’s flagship homeownership program, DC Open Doors, the return of the Mortgage Credit Certificate (MCC), co-administration of the Home Purchase Assistance Program (HPAP), and DC4ME, the Agency continued to create new D.C. homeowners, increasing the number of residents who could start building personal wealth.

DCHFA continues to look for opportunities to finance projects that will bring quality affordable housing to D.C. residents. While the Agency had a successful year in FY 2022, the goal heading into FY 2023 is to propel the City even closer to Mayor Muriel Bowser’s goal of 12,000 new affordable units in the District by 2025.

The Agency’s mission is to advance the District of Columbia’s housing priorities by investing in affordable housing and neighborhood development, which provides pathways for D.C. residents to transform their lives. DCHFA accomplishes its mission by delivering the most efficient and effective sources of capital available in the market to finance rental housing and to create homeownership opportunities.

In 2015, Mayor Muriel Bowser nominated me and the City Council approved my appointment to serve as a member of DCHFA’s Board of Directors. Each year of my tenure, my colleagues have graciously elected me to serve as vice chairman of the Board. As a director of development in the Williams administration and currently the chief operating officer and chief investment officer of The NHP Foundation, I have a unique perspective on affordable housing development in the District and the vital role DCHFA serves in providing pathways to homeownership and affordable rental housing.

During my seven years as a member of the Board, I have witnessed the Agency launch and expand programs to address the housing needs of District residents, and FY 2022 has been no exception. Throughout market fluctuations, DCHFA’s pipeline, portfolio and staff have remained steadfast and resilient.

On behalf of DCHFA’s entire Board of Directors, I commend the leadership and staff of the Agency and look forward to all of us continuing to collaborate on innovative solutions that bring even more affordable housing to District residents.

DCHFA would like to give a special thank you to Buwa Binitie, former board chairman. Mr. Binitie served as the board chairman for eight years before his term came to an end during FY 2022. During his tenure, DCHFA launched the Housing Investment Platform, ReMIT, DC MAP and several other initiatives that emboldened every division of the Agency.

In FY 2022, DCHFA’s Board, staff and I remained focused on providing the District’s residents with healthy, beautiful and affordable rental housing and opportunities to become homeowners. As a former community organizer and developer, I’ve witnessed the positive impact that housing security and homeownership has on families and the effect it has on the larger community.

This year, our approach has been to address the housing needs of our residents from several aspects of the housing ecosystem. We adopted a Diversity, Equity and Inclusion Policy (DEI Policy) to provide opportunities for historically excluded local developers to participate in Low Income Housing Tax Credit (LIHTC) deals in the District. Communities built by local developers and developers who look like the communities they’re serving creates greater synergy and inspires collaboration from existing residents.

During FY 2022, the U.S. Department of Housing and Urban Development (HUD) and the U.S. Department of the Treasury approved DCHFA to participate in the relaunch of the Federal Financing Bank (FFB) Risk-Sharing Initiative. Under this program, FFB provides predictable, stable and low-cost capital for multifamily loans to produce and maintain affordable housing insured under the Federal Housing Administration’s Risk-Sharing program. Participating in the FFB initiative gives the Agency another resource to address the critical need for affordable housing production and preservation.

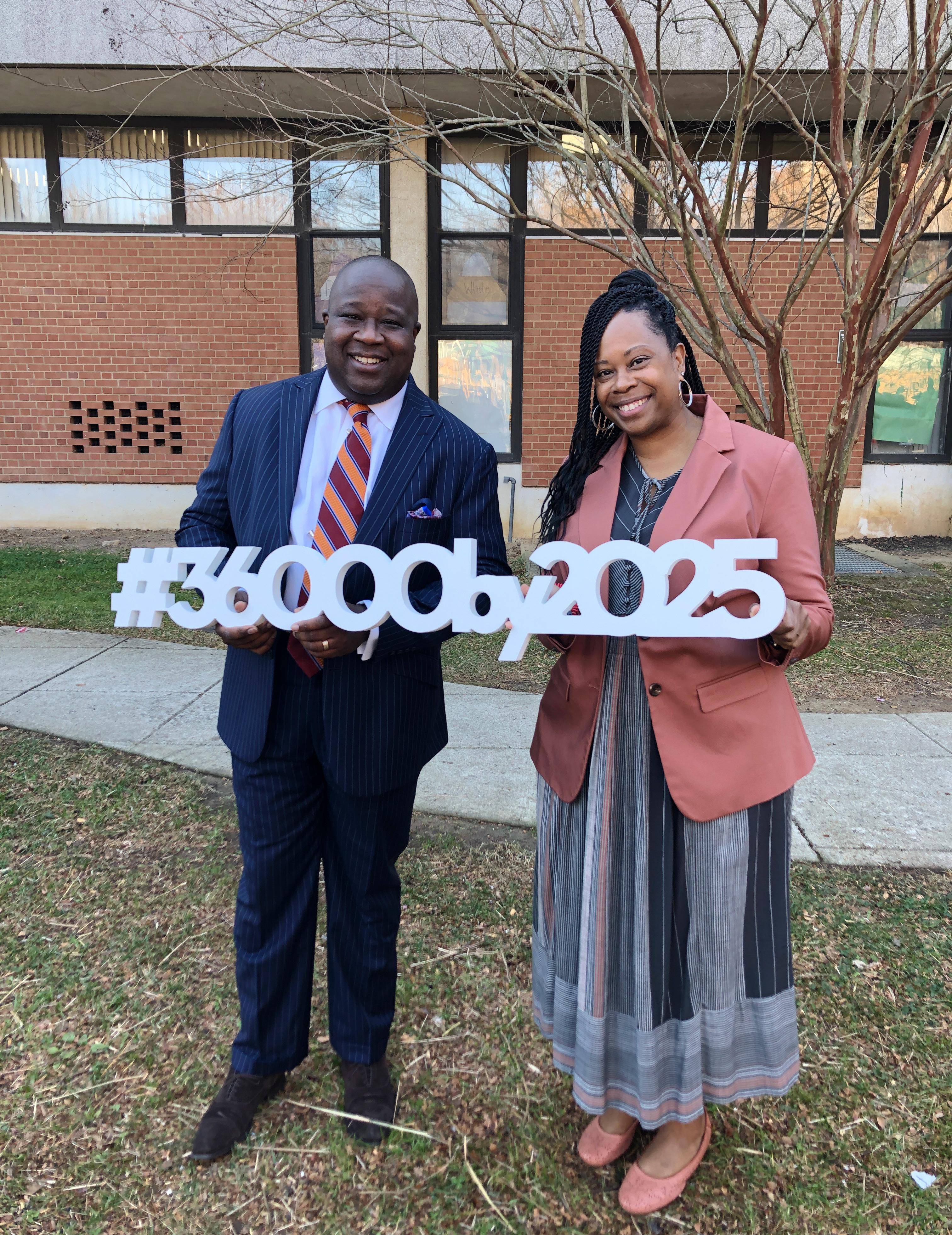

The Agency prides itself on being good stewards in our role as a part of Mayor Muriel Bowser’s city-wide housing coalition. I am very proud that the City has a mayor who not only is a national leader on her investments in affordable housing but also created the District’s first Racial Equity Plan and the Black Homeownership Strike Force, of which I am a member. The Single Family Programs division is eagerly assisting all of the new HPAP applicants who are now eligible due to the higher income limits and increased down payment assistance amounts recommended by the Strike Force.

On behalf of DCHFA’s stellar staff and Board of Directors, I thank Mayor Muriel Bowser and the Council for its visionary leadership and support of our Agency. I am also very grateful to our incredible Board for consistently supporting the staff and the work we do. It is with great enthusiasm that I present to you “The District Digest,” DCHFA’s Fiscal Year 2022 Annual Report.

All of DCHFA’s staff members contribute to forwarding the Agency’s mission of advancing the District of Columbia’s housing priorities. DCHFA’s Board of Directors provides leadership to the Agency’s staff in all of its endeavors.

Stephen M. Green Vice Chairman

Stanley Jackson Member

Bryan “Scottie” Irving Member

Stephen M. Green Vice Chairman

Stanley Jackson Member

Bryan “Scottie” Irving Member

Christopher E. Donald, Executive Director/CEO

Nikol Nabors-Jackson, Chief of Staff

Yolanda McCutchen, Vice President, Public Relations

Susan Ortiz, Public Relations Associate

Heather A. Hart, PHR, Vice President, Human Resources

Lindsey Smith, Human Resources Specialist

Thurston Ramey, Interim Senior Director, Business Intelligence

James Bowers, Director, Technology*

Gregory Graham, Manager, Technology

Eric Bunn II, Technology Coordinator

Charles Matiella, 365 System Administrator*

Keami Estep, Senior Manager, Procurement and Corporate Resources*

Marcus Thompson, Facilities Manager

Cheryl Roberts, Receptionist

Ashley Brown, Community and Stakeholder Engagement Manager

Karen Harris, Executive Assistant

Michael L. Hentrel, General Counsel

Tracy G. Parker, Senior Assistant General Counsel

Brittney Jordan, Assistant General Counsel

Jasmine Jackson, Assistant General Counsel

Lillian Johnson, Records Administrator

Ikeogu Imo, Senior Vice President*

Scott Hutter, Director

John Lawrence, Senior Multifamily Loan Underwriter*

Linda Hartman, Multifamily Loan Underwriter

Solomon Hughes, Multifamily Loan Underwriter

James Holley-Grisham, Multifamily Loan Underwriter

Jeff Cooper, Senior Vice President

Sidney Vass, Director

Clarence Watson, Senior Asset Manager

Fredericka Earle, Compliance Manager

Kyla Peck, Compliance Specialist

Birol Yilmaz, Senior Construction Engineer/Monitor

Sue Ghazi, Construction Engineer/Monitor

Seyoum Gizaw, CPA, Project Budget Analyst

Kelley Brown, Construction Coordinator

Steve Clinton, Chief Financial Officer

Essi Egbeto, Vice President Accounting/Controller*

Rosemarie Warren, Vice President Accounting/Controller

Henry Jones, Vice President, Treasury Operations

Matthew Pleasant, Director, Portfolio Operations

Rong Liu, Accounting Manager

Yan Ji, Financial Analyst

Jackie Langeluttig, Senior Loan Servicing Specialist

Adriana Dixon, Accounting Assistant

Wendi Redfern, Senior Vice President

Bill Milko, Business Development Manager

Zein B. Shukri, Single Family Operations Manager

Tracy Wright, Single Family Underwriter

Connie Smiley, Senior Loan Processor*

Tanisha Darden, Senior Loan Processor

Lisa Davis, Loan Closer/Post Closer

An asterisk (*) indicates someone who is no longer employed by the Agency but who was employed during FY 2022.

The Todd A. Lee Scholarship was established in January 2020 to commemorate the life and legacy of Todd A. Lee, DCHFA’s executive director/CEO from 2016 to 2020. During his life, Todd’s career focus was innovation, infrastructure/process and financing in real estate. He came to DCHFA because he wanted to have an impact in the city through the preservation and construction of affordable and workforce housing in the District of Columbia.

The Todd A. Lee Scholarship commemorates this outstanding D.C. legend and honors his commitment to both affordable housing and education. Todd was a mentor to countless individuals in the finance and housing industries. The scholarship benefits undergraduate and graduate students who aspire to be future contributors to the affordable housing industry.

Nina Askew University of Chicago, Master of Social Sciences

“After pursuing my master’s degree, I plan on continuing my studies of marginalized communities and reparative socioeconomic systems in a doctoral program. I am pursuing a career in affordable housing development where I intend to focus on holistic supportive services for impacted residents and urban revitalization projects. Everyone is entitled to a home, and my ultimate career goal is to protect this right for everyone, regardless of their socioeconomic status.”

Jimmie“Legacy is extremely important to me, which is why my primary career goal is to carry out my family’s legacy of serving others through ministry and community development. One of the first steps in accomplishing this goal would be to utilize my education and experience to support other faithbased institutions in developing affordable housing.”

Robinson Georgetown University, Master of Professional Studies, Real Estate Development

The Agency, the developments it finances and its staff members were recognized by the business and housing community in FY 2022.

Livingston Place at Southern Avenue

NALHFA 2022 Awards of Excellence, Multifamily Excellence

Susan Ortiz, Public Relations Associate

MarCom 2021 Gold Award, Annual Report - Government

Liberty Place Apartments

HAND Housing Achievement Awards, Best Small Affordable Housing Project

Through the Agency’s Community Engagement Initiative, DCHFA aims to support the community beyond its traditional role of financing affordable housing in the District. DCHFA supports activities for seniors, educational enrichment opportunities for youth, the arts and more. During FY 2022, the Agency supported and/or partnered with 31 community organizations.

During FY 2022, DCHFA adopted a Multifamily Diversity, Equity and Inclusion (DEI) Policy to address and alleviate disparities within the District’s affordable housing development sector and to create opportunities for current and legacy Certified Business Enterprises to thrive.

This policy not only encourages but incentivizes diverse participation. Development teams who meet the Agency’s eligibility requirements will receive preferred pricing for their transactions.

“The District of Columbia Housing Finance Agency is helping to bring a $101 million affordable housing development to Washington, D.C.’s Ward 7.”

Commercial Observer

Washington Business Journal

“The first step in the homebuying process should be finding a trusted lender and getting educated on all the available programs. This month, DCHFA brought back its in-person homeownership seminars.”

Washington Informer

“The District of Columbia Housing Finance Agency has closed on the $95 million in financing needed to redevelop Terrace Manor, a long-vacant complex in Ward 8 that developer WC Smith acquired after its former landlord, Bethesda-based Sanford Capital filed for bankruptcy.”

Washington Business Journal

“To assist first-time homebuyers, the District of Columbia Housing Finance Agency has a variety of affordable mortgage and down payment and closing cost assistance programs.”

Bankrate

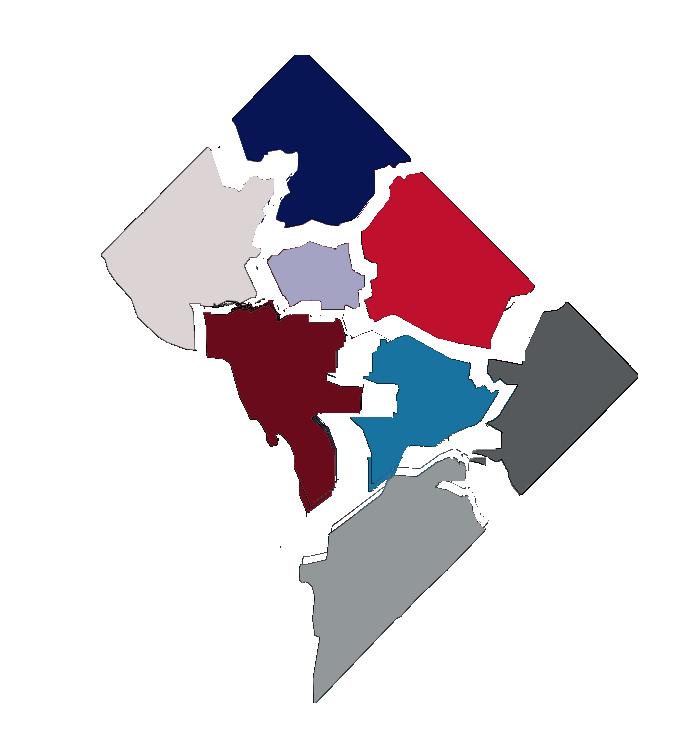

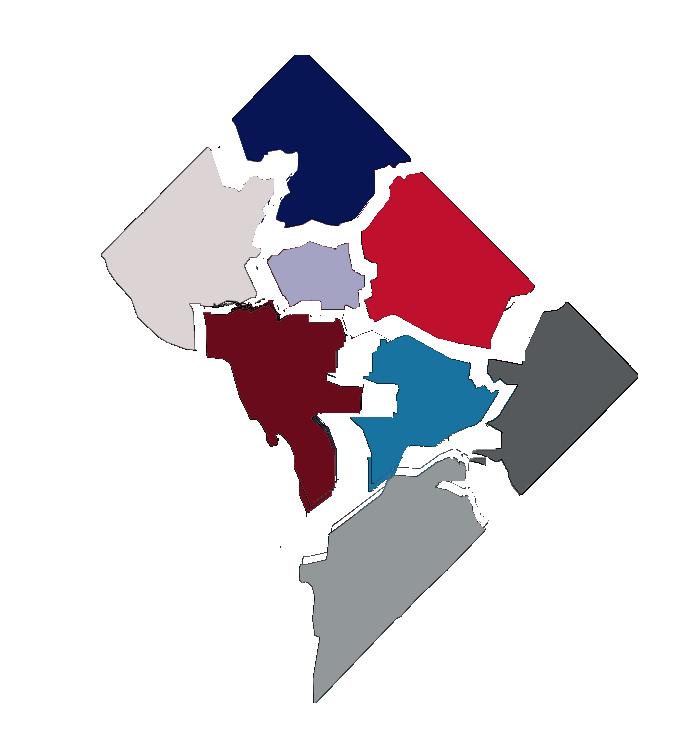

In FY 2022, DCHFA issued $285.9 million in bond financing for the development or redevelopment of 1,160 affordable housing units in Wards 2, 4, 5, 6, 7 and 8. In addition to the tax-exempt financing, DCHFA underwrote $216.5 million in federal Low Income Housing Tax Credit (LIHTC) equity and $27.5 million in D.C. LIHTC equity to finance these projects.

Ridgecrest Village Phase I

Ward 8 - Rehabilitation

Shepherd Park Apartments Ward

- New Construction

Terrace Manor

Ward 8 - New Construction

The Paxton

7 - New Construction

The Asberry (Barry Farm) Ward 8 - New Construction 4Cascade Park Apartments Ward 8 - Rehabilitation

Parcel 42 Ward 2 - New Construction

Waterfront Station II Ward 6 - New Construction

Kenilworth 166 Ward 7 - New Construction

1515 North Capitol Ward 5 - New Construction

Ward 2 - Preservation

• 42 affordable apartment homes

• 4 units at 80% or less AMI; 37 units at 60% or less AMI; 5 units at 30% or less AMI

• $30.5M total development costs

• $17.7M tax-exempt bond financing

• $7.7M LIHTC equity

• Tenant Opportunity to Purchase Act (TOPA)

• Developed by Standard Communities and Housing on Merit

Ward 8 - Rehabilitation

• 65 affordable apartment homes

• All units reserved for 60% or less AMI

• $30.5M total development costs

• $11.5M tax-exempt bond financing

• $7.2M LIHTC equity

• $9.2M HPTF loan

• TOPA Redevelopment

• Developed by National Housing TrustEnterprise Preservation Corporation

Ward 4 - New Construction

• 129 affordable apartment homes

• All units reserved for 60% or less AMI

• $41.7M total development costs

• $21.5M tax-exempt bond financing

• $9.8M LIHTC equity

• $13.0M HPTF loan

• Developed by Jair Lynch Real Estate Partners and Housing Up

• 87 apartment homes

• 58 units at 50% or less AMI; 29 market-rate, unrestricted units

• $41.9M total development costs

• $19.1M tax-exempt bond financing

• $8.0M LIHTC equity

• $10.4M HPTF loan

• Developed by Victory Housing, Brinshore Development and Bank of America Community Development Corporation

Ward 8 - Preservation

• 190 affordable apartment homes

• All units at 60% or less AMI

• $45.0M total development costs

• $21.5M tax-exempt bond financing

• $11.8M LIHTC equity

• Developed by Capital Realty Group

Ward 7 - New Construction

• 86 affordable apartment homes

• 58 units at 60% or less AMI; 28 units at 30% or less AMI

• $37.6M total development costs

• $19.5M tax-exempt bond financing

• $12.0M LIHTC equity

• New Communities Initiative

• Developed by The NHP Foundation, The Warrenton Group and WA Metropolitan CDC

Ward 7 - New Construction

• 93 affordable apartment homes

• 58 units at 60% or less AMI; 35 units at 30% or less AMI

• $40.0M total development costs

• $19.7M tax-exempt bond financing

• $13.5M LIHTC equity

• New Communities Initiative

• Developed by Atlantic Pacific Communities, LLC, Urban Matters

Development Partners and the Progressive National Baptist Convention CDC

• 47 affordable studios at Anna Cooper House (Ward 2); 47 efficiencies at Karin House (Ward 4)

• All units reserved for 30% or less AMI

• $33.8M total development costs

• $17.3M tax-exempt bond financing

• $10.2M LIHTC equity

• $11.4M HPTF loan

• Developed by So Others Might Eat (SOME)

Ward 6 - New Construction

• 76 affordable apartment homes

• 58 units at 60% or less AMI; 35 units at 30% or less AMI

• $43.7M total development costs

• $21.6M tax-exempt bond financing

• $14.3M LIHTC equity

• $13.8M HPTF loan

• Developed by TM Associates and UPO Community Development Corporation

Ward 7 - Rehabilitation

• 100 affordable apartment homes

• 91 units at 60% or less AMI; 9 units at 50% or less AMI

• $28.3M total development costs

• $13.8M tax-exempt bond financing

• $8.0M LIHTC equity

• $9.8M HPTF loan

• TOPA Redevelopment

• Developed by The NHP Foundation

The Department of Housing and Urban Development (HUD) Level I 50/50 Risk Share program provides an alternative financing option for developers who preserve affordable housing. DCHFA recognizes the importance of rehabilitating existing properties as much as creating new housing in the District of Columbia. The Federal Housing Administration assumes a portion of the risk and delegates loan processing and asset management functions to DCHFA, a qualified participating entity. FY 2022 was the Agency’s fifth year as a 50/50 Risk Share lender, and the Agency was able to celebrate the financing of Terrace Manor in Ward 8.

Terrace Manor Raze Event

June 30, 2022

McKinney Act Loans are short-term predevelopment “bridge” loans that can be used to finance the acquisition, predevelopment and rehabilitation costs associated with housing development. Nonprofit and for-profit developers building affordable housing in the District of Columbia are eligible to apply for McKinney Act Loans.

During FY 2022, DCHFA closed a McKinney Act Loan for The Rolark at Congress Heights Metro. The Agency issued $1 million to finance a portion of the project’s predevelopment costs. The developers of this 180-unit project are Banneker Communities, District Development Group and Congress Heights Community Training Development Corporation — together they form Congress Park Community Partners, LLC.

The unit mix at this property will consist of studios, one-, two- and three-bedroom units. The project is still in its preliminary phases, but the anticipated unit mix is 45 units at 30% or less AMI, 75 units at 50% or less AMI and 60 units at 60% or less AMI.

The Portfolio and Asset Management division of DCHFA is responsible for monitoring all multifamily developments financed by the Agency. As of the end of September 2022, DCHFA’s multifamily portfolio consists of 193 multifamily properties, totaling 26,711 units.

DCHFA established the Housing Investment Platform (HIP) as a resource for innovative investments that will increase the Agency’s support of the District of Columbia’s housing market outside of traditional bond and tax credit financing.

HIP’s Single Family Investment Fund provides joint venture capital to emerging developers for the creation of for-sale workforce housing in the District. In addition, the program fosters neighborhood stabilization and increases the tax base while the projects create employment opportunities through the construction of new homes.

An investment from HIP significantly reduces the amount of capital the developer needs to contribute to the project, but in return the developer agrees to restrict sales to households making workforce incomes, up to 120 percent of the Washington, D.C., median family income.

During FY 2022, DCHFA financed The Ana in Anacostia through HIP. The project will consist of two phases, each with 10 townhomes reserved for residents and families earning between 50 and 120 percent AMI. The homes will have three bedrooms, two bathrooms and single-car garages. The developer of this project is H2 DesignBuild.

DCHFA’s Single Family Programs division creates homeownership opportunities in the District by providing low-cost single family mortgages and down payment assistance (DPA), made possible through the issuance of mortgage-backed securities. The Agency offers a variety of programs for current and potential homeowners with the goal of expanding and retaining homeownership opportunities in the District.

• Created more than 170 new District homeowners through DC Open Doors and DC4ME

• DC Open Doors and the Home Purchase Assistance Program (HPAP) helped residents purchase homes across all eight wards of the District

• Re-launched the Mortgage Credit Certificate (MCC) program

• Brought back monthly in-person Homebuyer Information Sessions

Funded 157 mortgage loans amounting to $53.1 million with an additional $1.6 million in DPA.

• Average Purchase Price: $374,000

• Average First Trust Loan Amount: $336,000

• Average DPA Loan Amount: $11,867

• Average Age of Homebuyer: 36

• Average Number in Household: 1

• Average Borrower Income: $80,193

The Agency launched DC4ME during FY 2019 to bridge the gap between D.C. government employees who wanted to buy a home but did not qualify for the Employer-Assisted Housing Program, which is operated by the D.C. Department of Housing and Community Development.

DC4ME provides D.C. government employees mortgage assistance in the form of a zero percent deferred subordinate loan. Qualified District government employees can receive a reduced interest rate first trust mortgage, with optional DPA. DC4ME is offered to full-time District government employees, including employees of governmentbased instrumentalities, independent agencies, D.C. public charter schools and other organizations, provided the borrower’s employer falls under the oversight of the Council of the District of Columbia.

During FY 2022, DC4ME funded 19 mortgage loans totalling $6 million with an additional $94,230 in DPA. Borrowers purchased homes in Wards 1, 3, 4, 7 and 8.

Corliss Richardson is a native Washingtonian who combined assistance from DC Open Doors and HPAP to purchase her Ward 5 condominium.

“The reason I wanted to purchase a home in D.C. is because of its transportation, property taxes are lower than Prince George’s County and D.C. offers better grants than the surrounding areas,” said Richardson.

Richardson attended an orientation about District housing programs where she learned about DC Open Doors. She actually knew about HPAP because she had used it to purchase her first D.C. home, which she sold 28 years ago.

“Once I found out that HPAP was still in existence and was offering more money than in 1994, I knew then it was my time to use the program again. To become a homeowner once again,” she said.

Richardson received her HPAP certificate during the COVID-19 pandemic shutdown, so she ended up facing some delays. “I persevered in my search for another training through Lydia’s House so I could receive another certification. The only thing I needed to do was update my financials which made the process less stressful,” said Richardson.

When asked what advice she would give to other aspiring homebuyers, she said, “Be organized: make sure you have all of your documents so you can submit them at one time. Patience: it’s a virtue. Have confidence: know the people you are working with are looking out for your best interests. And communication: have a dialogue with your team so you may achieve your goal.”

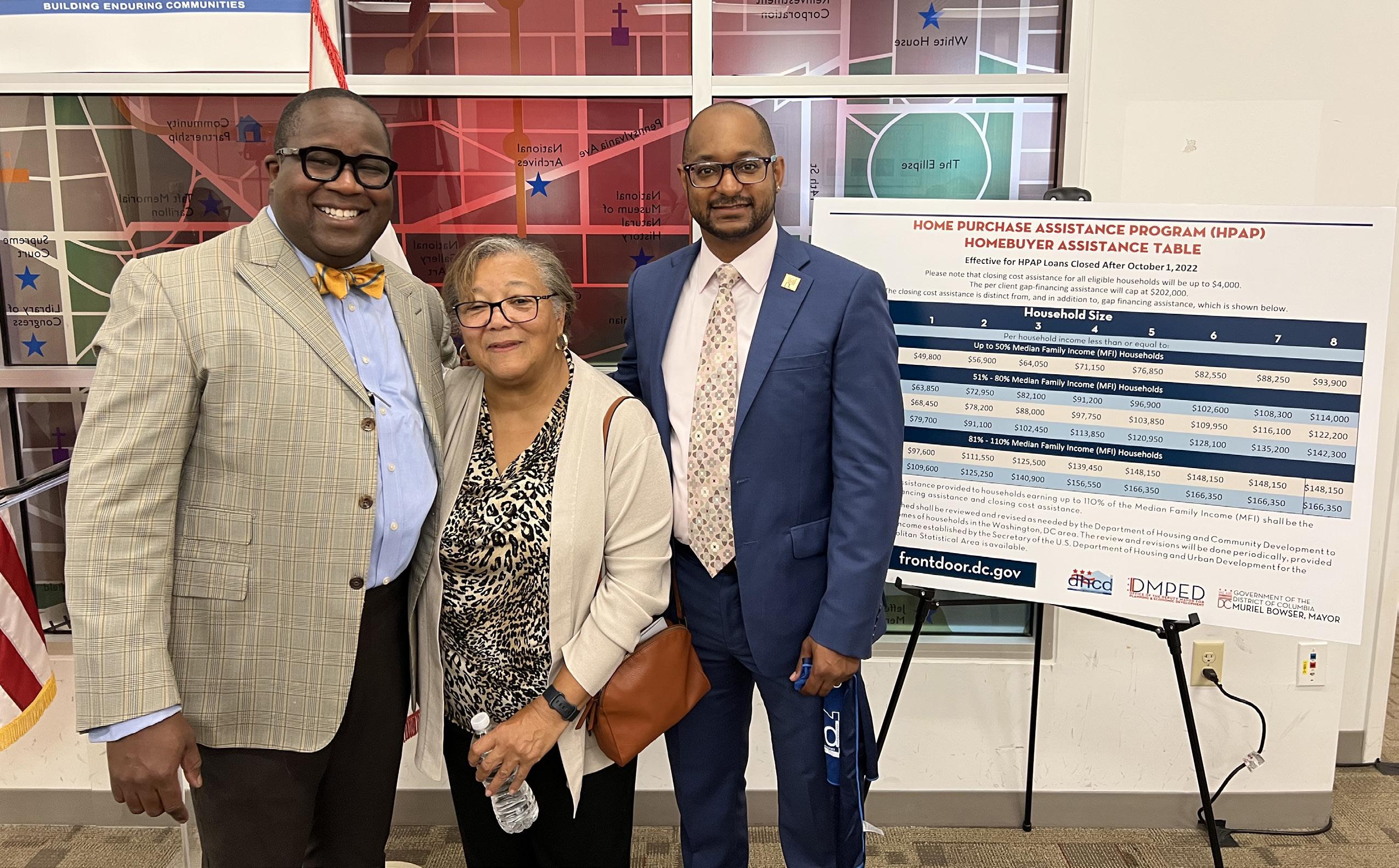

DCHFA is a co-administrator of the D.C. Department of Housing and Community Development’s HPAP. In FY 2022, DCHFA closed 125 HPAP loans for first-time homebuyers for a total of $6.9 million funded.

• Number of Notice of Eligibility (NOE) Applications Received: 602

• Number of NOEs Issued: 388

• Average Purchase Price: $341,976

• Average Loan Amount: $54,990

• Average Age of Homebuyer: 38

• Average Number in Household: 2

• Average Borrower Income: $68,763

DCHFA relaunched the MCC during Homeownership Month in June 2022. Originally created in 2016, the MCC is a powerful tool that allows homeowners to claim a federal tax credit of 20 percent of the mortgage interest paid during a calendar year. The remaining 80 percent of mortgage interest paid for that year may still be claimed as a tax deduction. The 20 percent credit allows homeowners to receive more cash back in their pockets each tax season.

From June until the end of FY 2022 in September, the Agency issued 80 MCCs on a total of $25.9 million first trust loans. Homebuyers can purchase an MCC at a discount if they combine it with DC Open Doors or HPAP, but they do not have to use one of these two programs in order to buy an MCC and take advantage of the tax benefits.

Jonathan Hogue purchased an MCC when he bought his Ward 4 Brightwood Park home. He has lived in the District for more than six years, five of which he spent working as a D.C. school teacher.

“My home is in the same neighborhood I taught in and keeps me connected to the family I have created in the District,” said Hogue.

He learned about the MCC from his mortgage broker. Working with a lender and realtor who know the local market and all of the assistance programs available is essential when looking to purchase a home.

“As a first-time homebuyer, I was unaware of all the tax implications buying and then paying for a home would entail. Thankfully, my mortgage broker, Melissa Rich, talked about short- and long-term tax situations and discussed the MCC’s benefits,” said Hogue. “Following the discussion, the brokerage helped me gather the right documents and complete the application process. Once I was up to speed about the program, it was easy to get approved.”

Hogue’s piece of advice to other first-time homebuyers is to “take your time when trying to figure out the right neighborhood and price range. Make sure you take very honest friends and family with you on home tours who you trust to call out things they know you will want in a home, and be very honest about how this will impact your short- and long-term budgetary goals.”

“As the grandson of sharecroppers and a first-time homebuyer doing the process alone, I would be remiss if I did not say the process is difficult,” Hogue said. “However, just be kind to yourself and be sure to surround yourself with only people you trust. I have no doubt you will be fine!”

Written & designed by Susan Ortiz, Public Relations Manager

Edited by Yolanda McCutchen, Vice President of Public Relations

Copyedited by Brandire

Photography by Chris Spielmann, Spielmann Studio

Printed by Global Print Masters