Projects Delivered in FY 2024: Terrace Manor

Projects Delivered in FY 2024: Paxton

Projects Delivered in FY 2024: Beech Tree Apartments / Shepherd Park Apartments

Projects Delivered in FY 2024: The Clara on MLK

Projects Delivered in FY 2024: 3450 Eads

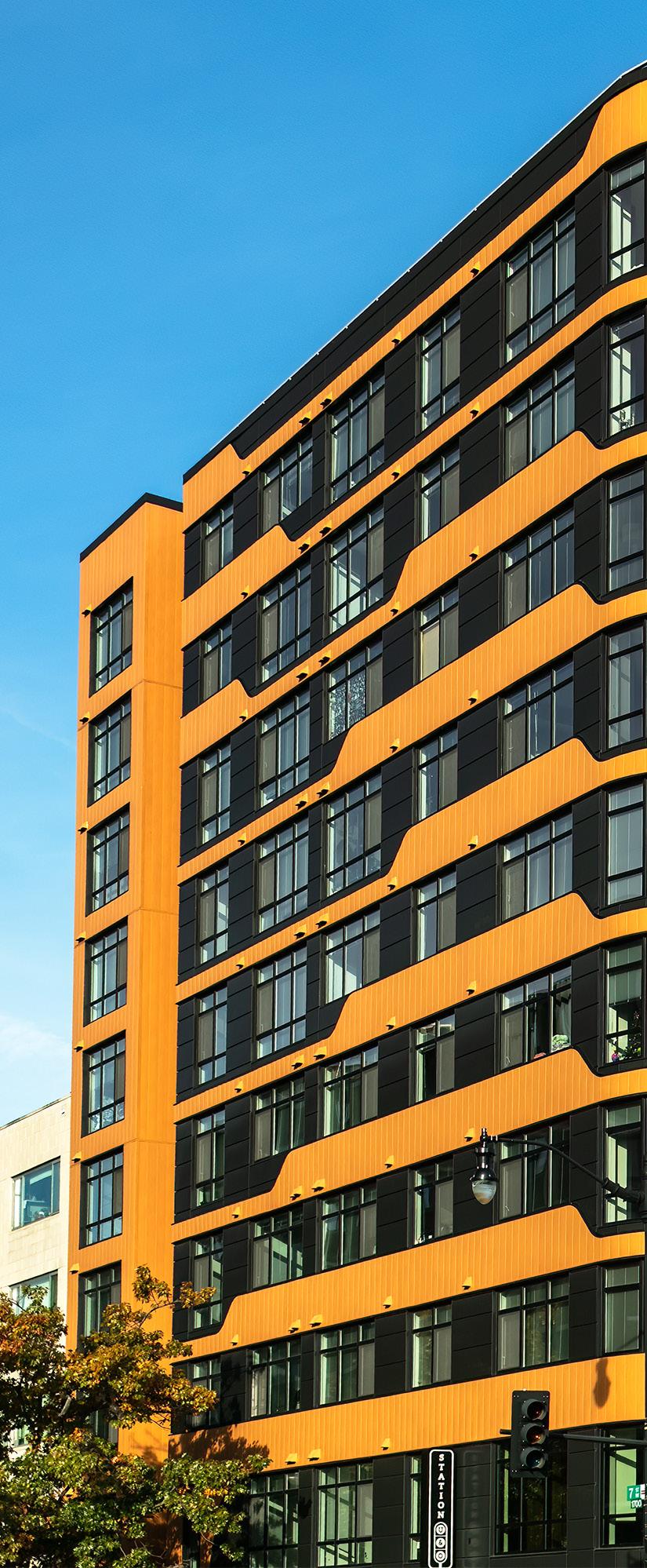

Projects Delivered in FY 2024: Station U & O Apartments

Projects Delivered in FY 2024: Ridgecrest Village Phase

Projects Delivered in FY 2024: 1530 First Street

Projects Delivered in FY 2024: Cascade Park

Projects Delivered in FY 2024: Villages at Parkland

Projects Delivered in FY 2024: Villages at Parkland

Fiscal Year 2024 (FY 2024) marked the District of Columbia Housing Finance Agency’s (DCHFA or “the Agency”) 45th year serving the housing needs of Washington, D.C. residents. DCHFA was established on March 3, 1979 to stimulate and expand homeownership and rental housing opportunities in the District.

Through DCHFA’s flagship homeownership program, DC Open Doors, DC4ME, and co-administration of the Home Purchase Assistance Program, the Agency continued to provide opportunities for renters to become D.C. homeowners.

Celebrating 45 years of service to the District , DCHFA continues to seek public, private financial and development partners to finance projects that will build and preserve existing quality affordable rental housing in the District.

The Agency’s mission is to advance the District of Columbia’s housing priorities by investing in affordable housing and neighborhood development, which provides pathways for D.C. residents to transform their lives. DCHFA accomplishes its mission by delivering the most efficient and effective sources of capital available in the market to finance rental housing and to create homeownership opportunities.

Throughout my career in affordable housing, development and the District government I have been a witness to and in some instances a part of DCFHA’s milestones throughout its 45 year history. My vantage point as chairman of the Board of Directors allows me to have an integral role in the service to District residents that the Agency’s staff works diligently to provide.

During Fiscal Year 2024 my colleagues on the board and I joined the Agency in celebrating its 45-year history as well as strategically charting DCHFA’s

path into the future. The board of directors and the Agency are partners in executing DCHFA’s mission, “To advance the District of Columbia’s housing priorities, the agency invests in affordable housing and neighborhood development, which provides pathways for DC residents to transform their lives.”

On behalf of the entire board, I congratulate DCHFA on its 45th anniversary and look forward to the Agency continuing to be impactful and solutions oriented in its approach to addressing the affordable housing needs in the District.

“ “

On behalf of the entire board, I congratulate DCHFA on its 45th anniversary and look forward to the Agency continuing to be impactful and solutions oriented ...

Throughout 2024, the Agency’s staff and I have been celebrating and commemorating DCHFA’s 45 years of service to the District’s residents. It is with great pride that I have been a part of DCHFA’s history for nearly a decade first as vice president of Multifamily Lending and Neighborhood Investments and in my current role for five years. During the Agency’s milestone year, we continued to make new milestones. As an installment of the Baldwin Du Bois Discussion Series, we launched As We Rise: Black Women in Affordable Housing, Finance

and Law in partnership with Women of Color in Community Development. The symposium will be an annual Women’s History Month event with a new theme each year. In June the Single Family Programs (SFP) division spearheaded DCHFA’s inaugural Homeownership Conference. In addition, SFP relaunched ReMIT (Reverse Mortgage Insurance & Tax Payment Program) to assist senior homeowners with reverse mortgages to emerge from delinquency. The Todd A. Lee Scholarship Program awarded 12 scholarships to D.C. residents matriculating in college and graduate schools throughout the country. This is the highest number of recipients since the scholarship launched in 2020. The Agency received the Great Place to Work Certification. This honor is a testament to DCHFA’s staff. The rating is based on employee’s feedback about their experience working at the Agency. Having a great work environment allows us to greater serve D.C.’s residents. DCHFA shared a major

milestone this year with the entire housing ecosystem as Mayor Bowser reached her goal of 12,000 new affordable units in the District by 2025. More beautiful, affordable, and healthy housing is always a cause for celebration. Our staff and I are immensely proud of DCHFA’s contributions to this goal through the issuance of bonds to construct and rehabilitate affordable rental housing.

Celebrating 45 years of service to the District was the tagline for the year, but it is more than a slogan. Service is a part of the DNA of the Agency and is an active component of the mission. This year’s annual report takes a look back at DCHFA’s 45-year history and highlights Fiscal Year 2024. We are reminiscent while also focused on the future of continuing to provide the best service to the District and its residents’ housing needs. On behalf of DCHFA’s staff and Board of Directors, I thank Mayor Bowser and the Council for its leadership, partnership and support of our Agency.

Stephen M. Green, Chairman

Heather Wellington, Vice Chairwoman

Stanley Jackson, Member

Bryan “Scottie” Irving, Member

Carri Robinson, Member

Christopher E. Donald, Secretary

OFFICE OF EXECUTIVE DIRECTOR

Christopher E. Donald

Executive Director/CEO

Nikol Nabors-Jackson

Chief of Staff

Yolanda McCutchen

Vice President, Public Relations

Keme Arigbe

Public Relations Associate

Heather A. Hart

SHRM-CP, PHR, Vice President, Human Resources

Lindsey Smith

Human Resources Specialist

Thurston Ramey

Vice President, Technology & Business Intelligence

Gregory Graham

Manager, Technology

Levent Arikok

IT Customer Support Manager

Jed Donkoh

IT Project Manager

Eric Bunn

IT Coordinator I

Tara Sigamoni

Vice President, Procurement &

Administrative Services

Marcus Thompson

Facilities Manager

Eric Jackson

Administrative Services Manager

Cheryl Roberts* Receptionist

Ashley Brown

Community and Stakeholder

Engagement Manager

Sia Sankoh

Executive Assistant

Michael L. Hentrel

General Counsel

Tracy G. Parker

Deputy General Counsel

Brittney Jordan*

Senior Counsel

Jasmine Jackson Counsel

Kayla Cruz

Associate Counsel

Lillian Johnson

Records Administrator

PORTFOLIO & ASSET MANAGEMENT

Jeff Cooper

Senior Vice President

Sidney Vass

Director

David Walker

Senior Asset Manager

Fredericka Earle

Asset Manager

Kyla Peck*

Compliance Specialist

Birol Yilmaz

Senior Construction Engineer/ Monitor

Sue Ghazi

Construction Engineer/Monitor

Seyoum Gizaw

CPA, Project Budget Analyst

Kelley Brown

Construction Coordinator

Marcus Ervin

Senior Vice President

Michael Durso

Director Business Development

Scott Hutter

Director

Linda Hartman*

Senior Multifamily Loan

Underwriter

James Holley-Grisham

Multifamily Loan Underwriter

Kadija Sow

Multifamily Loan Underwriter

Steve Clinton

Chief Financial Officer

Rosemarie Warren

Vice President, Accounting/ Controller

Henry Jones

Vice President, Treasury

Operations

Matthew Pleasant

Director, Portfolio Operations

Rong Liu

Accounting Manager

Yan Ji

Financial Analyst

Jackie Langeluttig

Senior Loan Servicing Specialist

Adriana Dixon

Accounting Assistant

Karen Harris, Finance Assistant

Wendi Redfern*

Senior Vice President

Tikisha Wilson Director

Carmellita Turner

Business Development and Outreach Manager

Zein B. Shukri

Lead Single-Family Underwriter

Tracy Wright

Single-Family Underwriter

Tanisha Darden

Single-Family Underwriter

Lisa Pugh*

Loan Closer/Post Closer

(formerly Lisa Davis)

Tahsin Bakar

Single-Family Underwriter

Jennifer Jones

Single Family Underwriter

Tiffany Ingram*

Senior Loan Processor

Alyshia Maith

Senior Loan Processor

Kim Norwood-Ellerson

Customer Service Administrator

*

An asterisk (*) indicates someone who is no longer employed by the Agency, but who was employed during FY 2024.

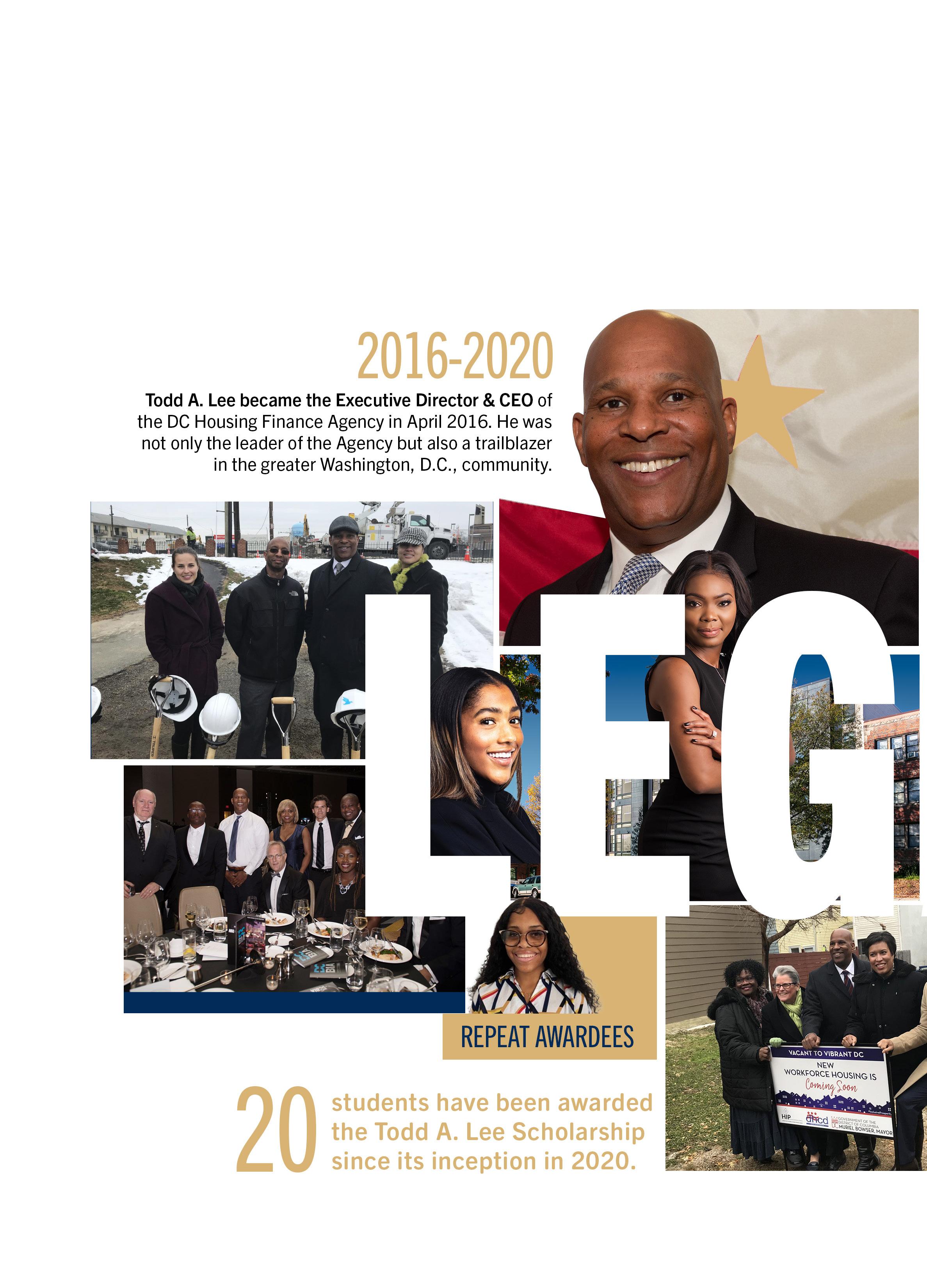

The Agency awarded the greatest number of applicants in FY 2024. The Todd A. Lee Scholarship was launched in 2020; since then, a total of 20 recipients (including repeat awardees) have received scholarships.

Public Policy Major at American University

“My field of study, a master of Public Policy, plays a critical role in developing our diverse communities, locally and globally.”

Public Health/Public Affairs Major at Brown University

“My goal is to leverage my education and experiences to advocate for urban environments that are designed with health and equity at their core, thereby addressing the pressing needs of underserved populations and creating models for sustainable development that can be replicated across the country and around the world.”

Civil Engineering Major at Howard University

“My passion lies In commercial real estate, where I aspire to combine my technical acumen and civil engineering background with my understanding of policy, politics, and community dynamics to enhance the livability of neighborhoods and underdeveloped areas.”

Computer Engineering Major at the University of the District of Columbia

“The field of computer engineering significantly impacts community development and affordable housing by leveraging technology to create smarter, more efficient, and sustainable living environments.“

Architecture Major at Florida A&M University

“I plan to further my education within architecture by obtaining my B.Arch degree this upcoming school year. While pursuing my degree, I will be participating in the UDream program at Carnegie Mellon University to network...”

Business Major at Liberty University

“I am passionate about helping people create an environment that’s comfortable enough for them to call home. I want to continue to be part of an organization that continues to provide affordable housing to economically challenged communities.”

Political Science/Community Development Major at Howard University

“I plan to co-own a commercial real estate agency, where I will serve as the in-house lawyer reviewing real estate contracts. In this role, I aim to ensure fairness and transparency in all transactions and to advocate for equitable practices within the industry.”

Towson University

“I would like to practice real estate and /or trust and estate law in order to ensure clear property ownership, and provide fair real estate practices. I want to help minorities be first-time homeowners and landowners.”

LIYA TAYLOR

Computer Science Major at Hampton University

“I would like to practice Real Estate and/or Trust & Estate law in order to ensure clear property ownership, and provide fair real estate practices. I want to help first time minorities be homeowners and landowners. “

MBA/Real Estate Development Major at the University of Maryland

“My love for real estate began during my undergraduate days at Howard University during the late ‘90s. While I was pursuing my finance degree, I observed in real time the physical transformation of the community surrounding the university and how real estate was integral to this change.”

Business Major at Louisiana State University

“One day, I aspire to own a commercial real estate firm that can positively impact impoverished communities while also achieving the goal of building generational wealth. This scholarship will provide the critical support needed to continue my education and development in this field, allowing me to turn my aspirations into reality.”

Business Major at the University of the District of Columbia

“Business and finance students can play a critical role in developing and managing affordable housing projects. Skills can be used to analyze market conditions, create financial models, and secure funding for housing developments.”

The 33rd Annual HAND Honors recognized Lee Goldstein, a 2020 Todd A. Lee scholar, with a Housing Achievement Award in the Emerging Leader category.

Liya Taylor started a new position as Student Ambassador at CGI.

Founded in 1976, CGI is among the largest IT and business consulting services firms in the world.

The DCHFA Charitable Contribution Program seeks to benefit District of Columbia residents in accordance with the following Target Themes: Academic or Vocational Enrichment, Resident Services, Youth Sports and Arts, Supporting Seniors, and Supporting Neighborhood Amenities and Events. The Agency provides funding via Charitable Contribution Program grants, sponsorships, scholarships, and donations. In FY 2024, DCHFA contributed to and/or supported 41 District organizations, programs, and Todd A. Lee scholars. Sixteen of those organizations and scholars received funding for the first time from DCHFA. The Agency supported District residents by contributing $556,000 in charitable funding to local organizations and students.

The majority of funding was allocated to the Charitable Contribution Program (46%) and scholarships (29%). The primary target themes supported in FY 2024 were Academic or Vocational Enrichment for both school-age students and adult learners and Supporting Neighborhood Amenities and Events.

As We Rise: Black Women in Affordable Housing, Finance, and Law was a symposium convened to highlight the unique and powerful presence of Black women in an industry where there is limited representation. The event was jointly organized by DCHFA and Women of Color in Community Development (WCCD) in celebration of Women’s

History Month. The event took place on March 28, 2024, in Washington, D.C.

Housing finance provided incredible professional opportunities to practitionersfrom ample remuneration to a wonderful balance of work and life. It was also a highly technical and complex field that had significant influence

over the built space through the annual issuance of multifamily tax-exempt housing bonds. The purpose of the symposium was to acknowledge that there were incredible women of color in this industry doing amazing work and to encourage even more to explore it. The goals were to increase awareness, educate, and invite the next generation of practitioners into the fold.

This event included several panelists and speakers within the industry.

The Honorable Sandra L. Thompson, director of the Federal Housing Finance Agency, and Alanna McCargo, president at Ginnie Mae, were featured in our Fireside Chat and discussed what it’s like to lead in high-demand and highprofile positions in the federal housing space.

Our Rare Air: A Legal Discussion panel featured dynamic women attorneys who are making significant strides in the field of housing and finance law. Each panelist shared their experiences navigating race and gender, present-day challenges, and important lessons on what it takes to emerge as leaders. The following speakers offered practical advice about sustaining success, making

an impact on society, and maintaining a healthy balance:

Brittney Jordan

Senior Counsel DCHFA, WCCD

Board Member* (Moderator)

Anitra Androh

Shareholder Polsinelli (Panelist)

Lauren Marcus

Esq. Partner Tiber Hudson (Panelist)

Keirston Woods

Shareholder Bryant Miller Olive (Panelist)

During this panel, we delved into the stories of diverse women whose experiences have led them down unique pathways in this industry – from non-linear career trajectories to strategic pivots into new opportunities. The following speakers shared their insights and strategies for developing new business, locating unique opportunities, and managing other people’s expectations:

Carri Cowan Robinson

Managing Principal and Founder of Bright Horizon Ventures, LLD (Moderator)

Winell Belfonte

Partner at CohnReznick (Panelist)

Patrice Mitchell

Affordable Housing

Investment Banker Wells Fargo (Panelist)

Maia Shanklin Roberts

Vice President of Real Estate

Development, Mid-Atlantic Preservation of Affordable Housing (Panelist)

Gina Nisbeth was the one of the keynote speakers at As We Rise. Nisbeth is the founder and president of 9th & Clinton, a national Black woman – owned firm that provides strategic advisory and investment structuring expertise to real estate developers, fund managers, nonprofits, and for-profit organizations investing in low-income communities for impact.

In 2019, Mayor Muriel Bowser set the goal of delivering 36,000 new housing units, including 12,000 affordable units.

The goal of producing 36,000 housing units in D.C. was achieved during fiscal year 2024! The Agency is excited to have been a part of this significant milestone for affordable housing in D.C.

DECEMBER

APRIL

OCTOBER

D.C. Housing Finance

Agency invests in senior and grandfamily housing

The Washington Informer

Affordable olumbia Heights senior apartment project will cater to ‘grandfamilies’ Washington Business Journal (bizjournals.com)

SOME Opens Roberts Residences, a new affordable housing building in Northeast Washington AP News

DCHFA appoints Marcus Ervin as Senior VP of multifamily lending

The Washington Informer

NOVEMBER

With Amazon backing, Northbridge and partners expand assisted living medicaid model in DC

Senior Housing News 2023

CRP, Manna start construction on D.C. property

Multi-Housing News (multihousingnews.com)

JANUARY

D.C. residents find dream home in new affordable housing development WTOP News

FEBRUARY

DC’s tools to create and preserve Affordable Housing (dcfpi.org)

MARCH

New affordable housing opens in Anacostia, America’s Islamic Heritage Musem gets new permanent home D.C. News Now

Affordable housing development in Anacostia impresses district native

The Washington Informer

TM associates opens $95M affordable community in DC Multi-Housing News (multihousingnews.com)

TM Associates announces opening of 177-Unit MDXL MultifamilyBiz.com

MAY (45) Season 4, Episode 54Older americans month Housing Discussion YouTube

JUNE Tikisha FOX5 Live Zone

Guy Lambert’s public affairs show WPGC

Taking to the Streets WHUR

The Morning Show WPGC

DCHFA celebrates 45 years of homeownership opportunities

The Washington Informer

DCHFA’s 2024 Todd A. Lee

Scholarship deadline extended to July 12

The Washington Informer

Homeownership Supplement

Washington Informer

Know your rights as a homebuyer and homeowner The Washington Informer

Tikisha Wilson; Director or Single-Family Housing/DCHFA Informer WIN tv (youtube.com)

D.C. affordable project lands $134M financing package Multi-Housing News (multihousingnews.com)

DC’s Barry Farm redevelopment clinches gov’t financing Commercial Observer

DCHFA Issues $61M for 139 affordable apartments in ward 8’s Barry Farm Connect CRE

Newpoint-sponsored fund provides $13.3M bond financing for affordable housing rehab in Southeast DC REBusinessOnline

AHC, Hoffman & Associates open 449-unit mixediIncome apartments in Southwest DC REBusinessOnline

This Week’s D.C. Deal Sheet (June 6, 2024) bisnow.com

Homeownership in DC WHUR 96.3 FM

D.C. ‘Flatiron’-style multifamily development Receives Full Funding Commercial Observer

A look at down payment assistance programs washingtonblade.com

NoMa’s ‘Flatiron’ apartment project lands construction financing bisnow.com

JULY

NRP Group, Marshall Heights break ground on 115-unit affordable housing project in D.C. REBusinessOnline

NoMa affordable housing apartments will have amenities that include personal finance classes WTOP News

Grand opening at The Westerly brings housing, retail to Waterfront Station thesouthwester.com

D.C. affordable housing property gets $59M in financing Multi-Housing News (multihousingnews.com)

How to buy a house with low income: tips and assistance programs msn.com

D.C. revives reverse mortgage assistance program for seniors facing foreclosure Mortgage Professional (mpamag.com)

D.C.’s ReMIT program relaunched to aid seniors in preserving homeownership

DCHFA awards scholarships to 12 students in honor of Todd A. Lee

How a D.C.-based reverse mortgage assistance program was revived

In FY 2024, DCHFA issued $200,079,000 in bond financing for the redevelopment of 475 affordable housing units in Wards 2, 3, and 4. In addition to this tax-exempt financing, DCHFA underwrote $29,802,685 in D.C. and $155,615,454 federal LowIncome Housing Tax Credit (LIHTC) equity to finance these projects.

DCHFA’s McKinney Act Loan Program is for shortterm predevelopment “bridge” loans that can be used to finance the acquisition, pre-development, construction, or rehabilitation of a development.

1515 N Capitol St NE

Ward 5, New Construction

139 apartment homes

reserved for those earning less than 50% and 30% of the Area Median Income (AMI).

$33,174,210 bond amount

$20,268,248 Low Income Housing Tax

Credits (LIHTC) equity

$68,070,758 Total Development Cost (TDC)

Developed by SOME (So Others Might Eat)

1000 4th Street SW

Ward 6, New Construction

136 affordable homes for 30% of the AMI those earning up to 50% of the AMI.

$15,650,000 in tax-exempt bond financing

$10,139,286 in LIHTCs

$32,328,258 TDC

Developed by Hoffman & Associates, Affordable Homes & Communities (AHC), City Partners, and Paramount Development.

The Westerly was honored at the 2024 HAND Honors with the Best Large Affordable Housing Project award.

3301 23rd St SE

Ward 8, New Construction

130 apartment homes

reserved for residents earning 60% or less of the AMI.

$36,990,000 in tax-exempt bond financing

$33,800,000 in LIHTCs

DCHFA’s Level I Risk Share Program

$24,500,000 loan from its HPTF

$81,411,959 TDC

Developed by WC Smith and the Anacostia Economic Development Corporation (AEDC)

reserved for residents earning 50% or less of the AMI.

$46,920,000 in tax-exempt bonds

$42,020,000 in D.C. and federal LIHTC equity

$29,020,000 HPTF

$101,062,331 TDC

Developed by Foulger Pratt and Enduring Affordable Housing Corporation

(Shepherd Park Apartments)

7428 Georgia Ave NW

Ward 4, New Construction

66 affordable apartments reserved for tenants at or below 30% of the AMI and households earning up to 60% of the AMI.

$16,300,000 in tax-exempt bonds

$9,023,367 in LIHTC

$11,700,000 HPTF

$33,792,756 TDC

Developed by Lock 7

3450 Eads

3450 Eads St NE

reserved for residents earning 30% or less, 50% or less, earning up to 60%, earning up to 80% of the AMI.

$2,500,000 in tax-exempt bonds

$14,100,000 in D.C. and federal LIHTC equity

$18,900,000 HPTF

$45,200,000 TDC

Developed by Neighborhood Development Company

1707 7th St NW

108 affordable homes

reserved for residents earning up to 80%, with the majority reserved for those earning 60% or less of the AMI.

$29,460,000 in tax-exempt bonds

$24,580,000 in federal LIHTC equity

$15,600,000 HPTF

$58,926,451 TDC

Developed by Dantes Partners and the H Street Community Development Corporation

1530 First Street SW

Ward 6, New Construction

reserved for residents earning 30% or less of the AMI and 80% reserved for those earning 50% or less of the AMI.

$33,400,000 in tax-exempt bonds

$28,300,000 in D.C. and federal LIHTC equity

DCHFA’s Level I Risk Share Program

$13,000,000 HPTF

$68,188,277 TDC

Developed by TM Associates, UPO Community Development Corporation, and Manna

2323 Martin Luther King Jr.

Ave SE

81 units reserved for residents earning 30% and 50% or less AMI.

$19,700,000 in tax-exempt bonds

$16,900,000 in D.C. and federal LIHTC equity

$14,000,000 HPTF

$43,277,665 TDC

Developed by Banneker Ventures and Medina Living Ideas for Family Excellence

Community Development Corporation

2000 Ridgecrest Ct SE

Ward 8, Rehabilitation

reserved for residents earning 80% or less of the AMI.

$21,900,000 in tax-exempt bonds

$16,830,000 in D.C. and federal LIHTC equity

$16,130,000 HPTF

$48,871,047 TDC

Developed by The NHP Foundation

reserved for residents earning up to 80% of the AMI.

$11,100,000 in tax-exempt bonds

$6,400,000 in LIHTC

$9,300,000 HPTF

$23,592,385 TDC

Developed by Dantes Partners and H Street Community Development Corporation

Huntington Village at 3526

Stanton Rd SE, Orchard Park at 3401-3629 22nd St SE

reserved for residents earning 30% and 60% of the AMI or less.

$59,200,000 in tax-exempt bonds and underwrote

$43,600,000 in D.C. and federal LIHTC equity

$29,020,000 HPTF

$39,000,000 Office of the Deputy Mayor for Planning and Economic Development (DMPED) New Communities Initiative (NCI) loan

$121,000,000 TDC

Developed by MidAtlantic Realty Partners, Taylor Adams Associates and CSG Urban Partners

DCHFA’s Portfolio and Asset Management (PAM) division is responsible for monitoring all multifamily developments financed by the Agency. As of the end of September 2024, DCHFA’s multifamily portfolio consists of 201 multifamily properties, totaling 28,279 units. DCHFA’s portfolio includes all active and inactive multifamily loans and LIHTC developments for which the Agency provides compliance and monitoring support.

The Department of Housing and Urban Development (HUD) Level I 50/50 Risk Share program provides an alternative financing option for developers who preserve affordable housing. DCHFA recognizes the importance of rehabilitating existing properties as much as creating new housing in the District of Columbia. The Federal Housing Administration (FHA) assumes a portion of the risk and delegates loan processing and asset management functions to DCHFA, a qualified participating entity (QPE). FY 2024 was the Agency’s seventh year as a 50/50 Risk Share lender.

The Emblem (NoMa Union Market) (HUD Risk Share transaction)

DELIVERED: 1530 First Street

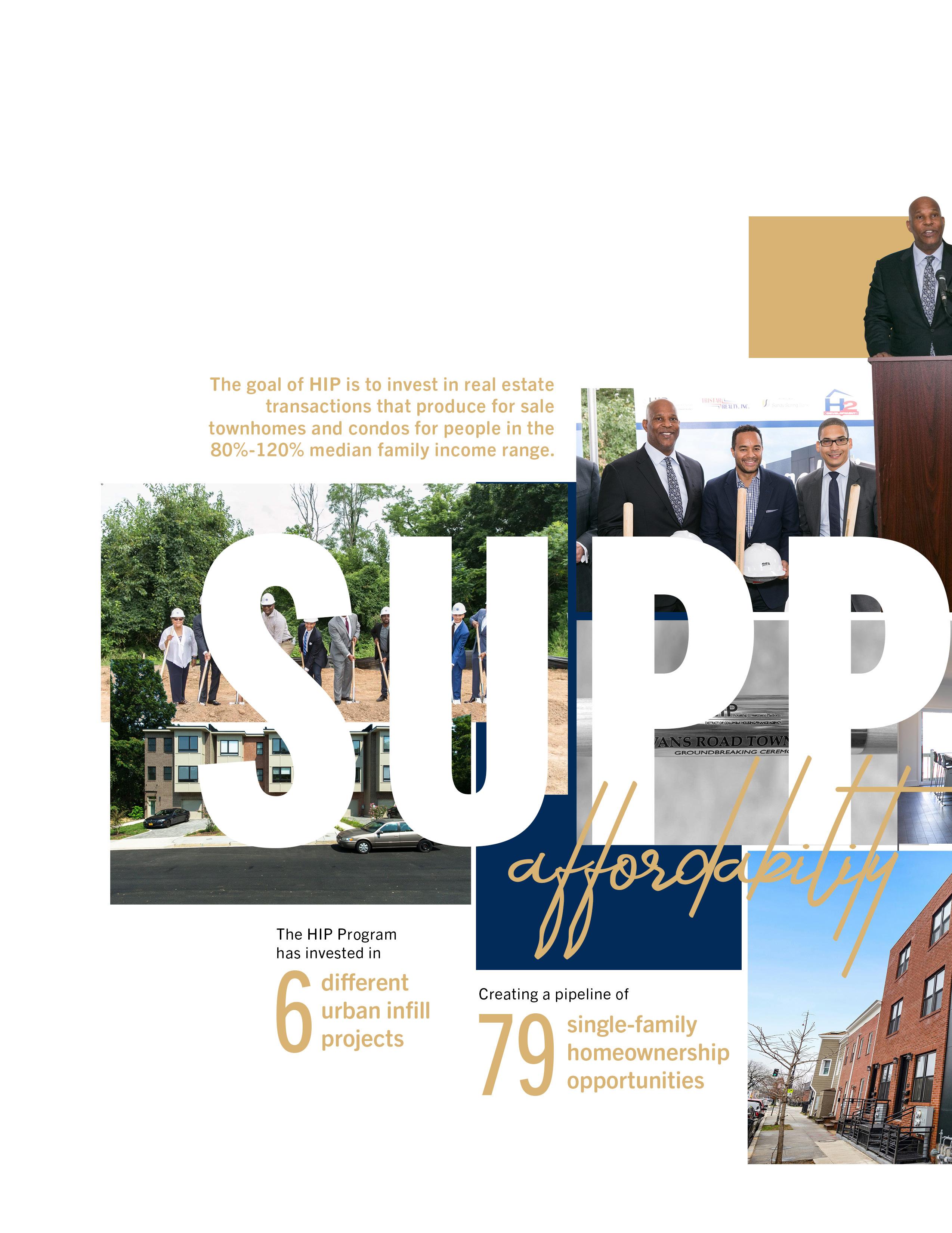

DCHFA established the Housing Investment Platform (HIP) as a resource for innovative investments that will increase the Agency’s support of the District of Columbia housing market outside of the traditional bond and tax credit financing.

HIP’s Single Family Investment Fund provides joint venture capital to emerging developers for the creation of forsale workforce housing in the District. In addition, HIP fosters neighborhood stabilization through homeownership opportunities while supporting developers with capacity-building-

opportunities.

An investment from HIP significantly reduces the amount of capital the developer needs to contribute to the project, but in return the developer agrees to market and sell the new single-family homes to households earning workforce incomes of 80%120% of the Washington, DC, median family income, also known as the “missing middle.”

To date, HIP investment has supported six different urban infill projects, creating a pipeline of 79 single-family homeownership opportunities. To date, 32 units have been completed and sold to

homebuyers. Another 20 units are scheduled for delivery throughout late FY 2024 and early 2025. The remaining 27 units will be delivered in late FY 2025.

Kelsi Pilcher is a first-time homebuyer that used DC Open Doors (DCOD) to purchase her Ward 6 home during the 2024 fiscal year.

““Being a homeowner means taking financial responsibility by creating an investment into myself and future financial planning… There’s a personal satisfaction in achieving ownership in what is likely the most expensive purchase an individual will make. Although owning a home is a huge responsibility, its opportunities for building wealth are boundless,” said Kelsi.

Kelsi is an attorney that relocated to D.C. in May 2024. She ran across the DC Open Doors program online and worked with a realtor soon after to secure her dream home with DCHFA’s down payment and closing cost assistance.

“She stated there is a stigma surrounding buying a home as a single woman; however, she embraced the power and independence of the process. “It was a quick process thanks to my realtor who was able to timely find a property that checked all of my boxes,” Kelsi stated.

With the use of DC Open Doors, Kelsi is increasing her financial stability through appreciation and building equity with her new home in the District.

DCHFA is a co-administrator of the District of Columbia Department of Housing and Community Development’s (DHCD) DC Home Purchase Assistance Program (HPAP). The Agency works in tandem with the Greater Washington Urban League and community-based organizations to get prospective homebuyers through the HPAP process and into the D.C. home of their dreams.

In FY 2024, DCHFA closed 193 HPAP loans for first-time homebuyers for a total of $21,660,038 funded.

Number of Notice of Eligibility (NOE) Applications Received: 611

NOEs issued: 453

Total closed loans: 193

Average purchase price: $401,250.00

Average loan amount: $112,235.00

Average age of homebuyer: 39

Average household size: 2

DCHFA launched DC4ME in 2019 to provide D.C. government employees mortgage assistance in the form of a 0% deferred subordinate loan. Qualified District government employees can receive a reduced interest rate first trust mortgage with optional down payment assistance.

DC4ME is offered to full-time District government employees, including those who may not meet the criteria for the Employer-Assisted Housing Program (EAHP) administered by DHCD. Under DC4ME, all D.C. government-based instrumentalities, independent agencies, D.C. public charter schools, and organizations that fall under the oversight of the Council of the District of Columbia qualify for the program.

Total closed loans: 10

Total loan amount: $2,963,361

Total down payment assistance amount: $17,655

The DC Open Doors and DC4ME 10% Down Payment Assistance Pilot Program is a resource for first-time and step-up homebuyers that are being squeezed out of the market by the dual causes of rising interest rates and low inventory of houses in the District.

This program aligns with DCHFA’s mission of providing homeownership opportunities and the Agency’s values of being innovative in its approach to provide capital needed to create new homeowners.

Capital Bank, the top-producing DC Open Doors, approached the Agency to partner with them on a pilot program that would relieve the pressure on first-time and step-up buyers by providing 10% down payment assistance. For these buyers, saving the downpayment is a top barrier to entering the home- buying process.

The maximum loan amount will be 10% of the purchase price. The average loan size right now is about $425,000, so that would equate to $42,500 in down payment assistance. This will vary depending on the purchase price of the home. The max loan amount is the 2024 conforming loan limit set by the Federal Housing Finance Agency.

The 10% down payment assistance loan will be a 0% interest, non-amortizing loan repayable upon refinance, payoff, or if the property ceases to be the borrower’s primary residence.

Homebuyers that participate in the program will also be eligible for Capital Bank’s $2,500.00 closing cost program simultaneously, only offered to recipients of the 10% Down Payment Assistance Loans Pilot Program.

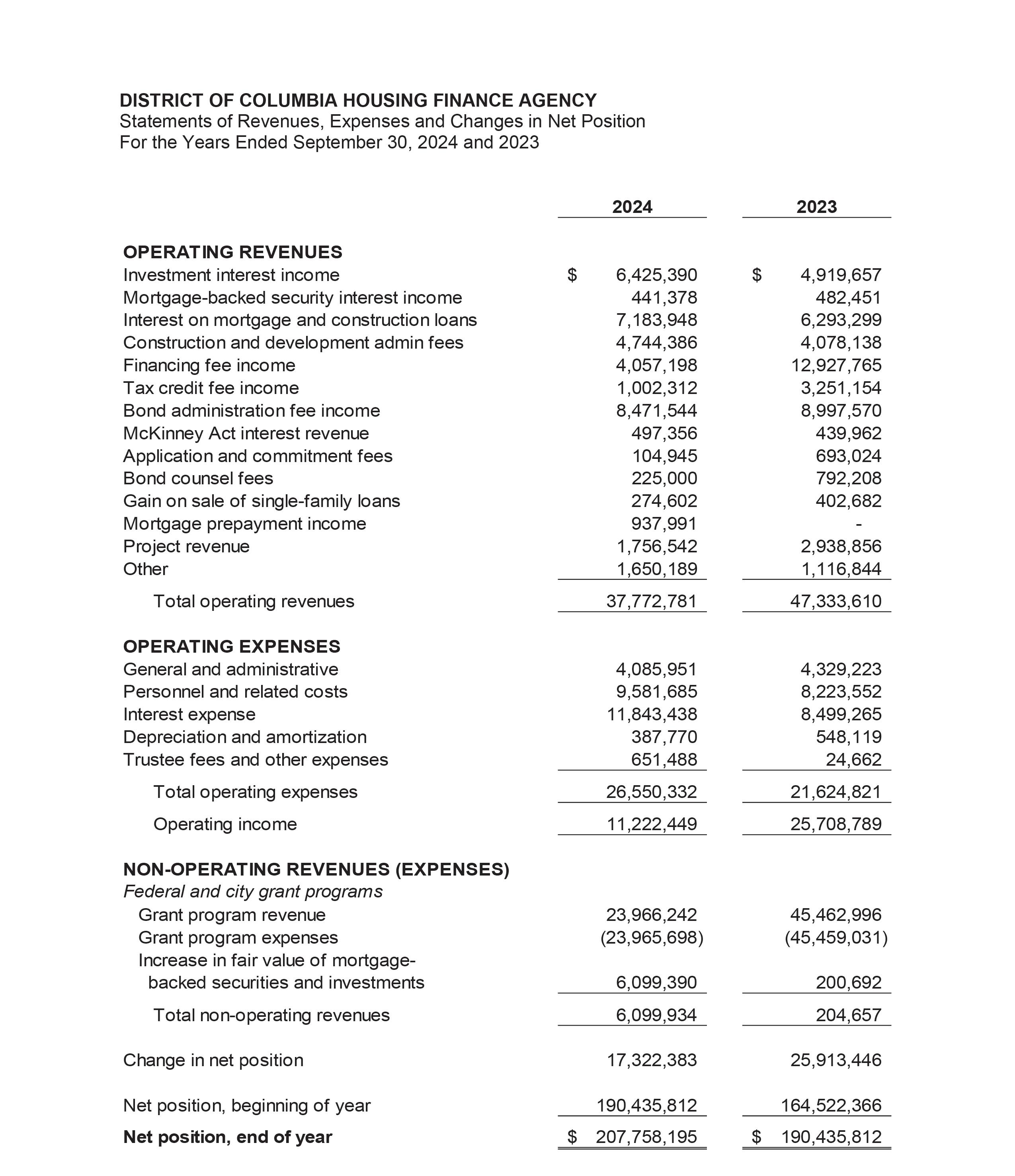

DISTRICTOF COLUMBIA HOUSING FINANCEAGENCY

Statements of Revenues, Expenses and Changes In Net Position For the Years Ended September 30, 2023and 2022

REVENUES

EXPENSES

NON-OPERATING REVENUES/(EXPENSES)

Statements of Revenues, Expenses and Changes In Net Position For the Years Ended September 30, 2023and 2022

REVENUES

EXPENSES

NON-OPERATING REVENUES/(EXPENSES)

DISTRICTOF COLUMBIA HOUSING FINANCEAGENCY The accompanying notes are an integral part of

8,125,894

DISTRICTOF COLUMBIA HOUSING FINANCEAGENCY

Statements of Revenues, Expenses and Changes In Net Position For the Years Ended September 30, 2023and 2022

REVENUES

EXPENSES

NON-OPERATING REVENUES/(EXPENSES) Federal and city grant programs Grant program revenue 45,462,996 8,125,894 Grant program expenses (45,459,031)(8,125,894) Increase (decrease) in fair value of mortgage-backed

(6,857,488)

non-operating (expenses)/revenues

(6,857,488) Change in net position 25,913,446 8,964,843 Net position, beginning of year 164,522,366155,557,523 Net position, end of year 190,435,812 $ 164,522,366 $

Statements of Revenues, Expenses and Changes In Net Position For the Years Ended September 30, 2023and 2022

REVENUES

NON-OPERATING REVENUES/(EXPENSES)

non-operating (expenses)/revenues

Written by Keme Arigbe, Public Relations Associate, DCHFA

Edited by DCHFA PR (Yolanda McCutchen, Vice President and Keme Arigbe)

Designed and Copyedited by Brandire

Photography by Chris Spielmann, Spielmann Studio

Printed by Global Print Master