Critical Power Supplement

Keeping power flowing

The nuclear option

> In search of steady power, will data centers have onsite reactors?

Rise of microgrids

> Local power could turn out to be the key to stability

Alternative fuel

> HVO is a low carbon energy source, but can you get it?

Sponsored by

INSIDE

Sponsored by

Contents

Holistic thinking

8.

10.

13.

Power is critical to any major infrastructure, and the provision of that power is a holistic issue extending from the racks, through the plantrooms past the backup power, and out into the grid.

Within the facility, data center builders are shifting towards modular constructions which are easier to plan and install. This pattern is repeated at higher levels, across the whole grid puzzle.

But at the same time, major problems such as climate change and the move to net-zero are demanding completely new ideas.

This supplement gives a look at the way existing thinking is developing to provide reliable power is provided and support the move to net-zero.

Nuclear possibilities

Atomic energy can provide a continuous steady supply of lowcarbon power, and the idea of using nuclear power for data centers has often been floated as a distant prospect.

Now, a combination of factors have brought it to the fore as a tangible possibility.

The move to net-zero requires fast adoption of low carbon energy, but sources like wind and solar are intermittent. This means that a steady alternative power supply is needed.

New proposals, for small modular reactors, seem to have bypassed the biggest problems facing nuclear in the past.

Nuclear power stations have traditionally been too big and too unwieldy for anyone without infinite patience and money.

Now that is changing (p4).

What is a microgrid?

When you have a local power source and power distribution at your facility, you have a microgrid - and that can be pretty useful.

Microgrids allow data centers to incorporate local power, and to become more independent of the local utility grid.

They also give data centers an opportunity to switch power to the grid when needed, making them a useful "prosumer," able to help out when needed (p10)

Can you get HVO?

As data centers have moved towards net zero, their backup generators have begun to be an issue.

Rarely used, they usually consumed diesel, making them visible sources of pollution. Swap the diesel for a vegetable product, and the problem is solved. The latest biofuel, hydrotreated vegetable oil (HVO) eliminates problems from earlier options, and has little or no net emissions.

But there's a new problem: where do you get it? We look at HVO supply chains (p13).

4 10 13 Critical Power Supplement | 3

4. Nuclear powered data centers Facilities are turning to all kinds of lowcarbon energy, but nuclear still has issues

Advertorial: modular revolution in the data center market Modular plantrooms are now the favorite way to construct data centers

Local power For stability, data center are turning to microgrids. What exactly are they?

Critical Power

Is there enough HVO to go round? Your backup is decarbonized. Can you keep it that way?

Finally - a nuclear powered data center?

Editor

Editor

Data centers are facing an energy crunch. They want to expand massively, while moving towards net-zero emissions. They need low-carbon electricity, and that’s not always available.

In Hong Kong, for instance, there simply isn’t enough renewable energy for the state, let alone proposed new data centers. Meanwhile in Ireland, there’s a limited amount of green power. If data centers guzzle it all, there’s not have enough left to decarbonize sectors like heating and transport, and the country misses its overall net-zero target.

Nuclear power could be part of the answer. It produces little or no greenhouse gas emissions, and could potentially deliver energy wherever it is needed.

More importantly, compared with truly renewable sources such as solar and wind energy, nuclear power delivers a steady dependable base load which doesn’t rely on the sun shining or the wind blowing That’s exactly the kind of power data centers need.

In the past nuclear power has suffered from poor delivery, with giant projects lumbering on amidst huge delays and cost over-runs, while environmental groups campaign vocally against them.

pplement • datacenterdynamics.com Critical Power

DCD Supplement

We’ve heard talk of nuclear-powered facilities for some years. Could the time have arrived?

Peter Judge, Global

Nuclear states in Europe, like France and Belgium, have succeeded in having nuclear energy classified as a clean technology, because it delivers steady base load electricity, without making greenhouse gas emissions.

However, those countries with existing nuclear power have a problem. As older plants come to the end of their life, governments are unwilling to commit to giant nuclear projects that may or may not succeed.

The alternative seems to be a different way to do nuclear, known as small modular reactors (SMRs). These are intended to overcome the past drawbacks of giant nuclear projects: they are a manageable size, and are built from pre-approved designs, with components made in factories.

In principle, they could be delivered quickly and repeatably. Permitting could be done once, for the design, which can be delivered to multiple places. Components can then be shipped from the factories for construction on site.

And since their power capacities are smaller than the older giant plants, they could be commissioned for individual projects, or anchored by data center customers.

Nuclear upgrades

The UK is one of the strongest backers of SMRs, with plans to spend up to £20 billion over 20 years, developing a fleet of power plants that could cover up to a quarter of the country's electricity consumption.

Rolls-Royce is one of the leaders, with SMRs that are at 470MW, at the top end of the range of “small” plants. Rolls-Royce plans to install 16 of its SMR generators in the UK

Meanwhile, with Government encouragement, a range of other potential builders are lining up. USbased developer Last Energy has announced a deal to sell 24 small modular nuclear reactors (SMRs) to UK customers.

Last is planning pressurized water reactors (PWRs) each of which will deliver 20MW of power each, and cost £100 million ($123m).

Other SMR companies pitching to build in the UK include Newcleo, a London-based startup that has announced plans to raise £900 million to build small lead-cooled fast reactors. Other firms pitching for money include GE Hitachi Nuclear Energy, GMET Nuclear, Holtec Britain, UK Atomics, and a partnership between Cavendish Nuclear and X-Energy.

Meanwhile, in the US, NuScale is the front runner, with the Voygr system, which has received government support in the form of $4.2 billion in subsidies, and now has approval from the Nuclear Regulatory Commission (NRC) for deployment in the US.

NuScale has published more information than some of the other systems, and earlier this year got some negative publicity. The company had promised to deliver power at $55 per MWh, which made it a good long term bet against other forms of energy. As details of the system have emerged, the expected cost has crept up to $90 per MWh, even when backed by further funding from the Inflation Reduction Act, the US program which includes measures to promote transition to lowcarbon power.

That’s more expensive than renewable sources such as solar and wind - although nuclear does provide a reliable, continuous energy supply.

Moving in

If nuclear continues to look like a valuable option, there’s a problem: with strong memories of Chernobyl and Fukushima, who wants a nuclear power station in their back yard?

It seems likely that the first SMR reactors will be installed on existing nuclear sites, where the infrastructure and permitting is already in place - and where there may soon be vacancies.

The older generations of nuclear power plants have been running for years. Some are coming to the end of their life.

Those sites already have permissions for nuclear plants, and all the apparatus to transfer the energy into the grid, and the local population have come to appreciate the jobs and energy they provide.

Rolls-Royce is starting the ball rolling with a decommissioned nuclear plant in Trawsfynydd in Wales, which could hold two 470MW systems.

In Canada, Ontario Power Generation is building up to four new SMRs in Darlington, Ontario where it currently has four forty-year-old CANDU reactors being refurbished.

OPG’s new SMRs are GEH's BWRX-300 models coming from GE Hitachi and they are due to start delivering power in 2028. They may actually provide power to data centers, as OPG has signed a Power Purchase Agreement (PPA) with Microsoft, most of which will be fulfilled by wind and solar - but nuclear may enter the mix if it arrives in time.

First nuclear data center?

The US has seen the first explicit plan for nuclear-powered data centersalbeit one which won’t come to fruition for more than ten years.

Building at Scale Supplement | 5

Nuclear power Critical Power Supplement | 5

The first SMR reactors will be installed on existing nuclear sites, where the infrastructure and permitting is already in place - and where there may soon be vacancies as older reactors shut down

Green Energy Partners (GEP) believes it has found the perfect location: an existing nuclear facility in Virginia run by the Virginia power utility Dominion, close to a hub where a massive expansion in data center capacity is straining the ability of the grid to provide any kind of energy - let alone clean power.

Westinghouse built two 800MW pressurized water reactors 50 years ago in Surry County, on the James River, near Jamestown. The company planned two more PWRs on the site, but they haven’t arrived, though the original reactors have had their licenses renewed to continue till 2052.

Surry is around 200 miles from the Northern Virginia data center hub where Loudoun County in particular is bursting at the seams, with data centers consuming around 20 percent of available power, and new builds frequently delayed by power distribution issues.

It’s on the route to the Virginia Beach cable landing station, so potentially a good place to tap national and international Internet trafficespecially given its potential for clean power.

GEP has bought 641 acres of land next to the site, and has proposed a lot of data centers there, which will eventually be powered by new SMRs, with green hydrogen for backup power.

Starting in 2024, the developer has plans to build 30 new data centers on the site (totaling 1 gigawatt) , which it has dubbed the Surry Green Energy Center (SGEC).

These will initially be powered by the available grid power, but since the site is next door to Surry, the data centers will actually get nuclear power from day one, GEP COO Mark Andrews told DCD

“The project is a 1-gigawatt hyperscale data center campus primarily powered by conventional nuclear out the door, so to speak,” said Andrews.

Using revenue from the data centers, GEP plans to develop on-site nuclear power with up to six 250MW SMRs.

With stringent permitting required, it could take 10 to 15 years for the SMR power to start flowing, GEP's VP of strategic development Bill Puckett told Virginia Business.

GEP plans to also produce green hydrogen on-site, using a combined system it calls a "green energy machine" or GEM.

There is actually a lot of synergy between nuclear and hydrogen. Pressurized water reactors use water heated well above boiling point, and can provide waste hot water above 400F. The most efficient electrolysis uses very hot water or steam, so the green hydrogen production plant would effectively use the SMRs’ waste heat as well as some of their zerocarbon electricity.

Some of the hydrogen produced can be blended with natural gas and shipped by existing pipelines outside the site, but a lot can be used on-site for generator backup at the data centers.

“As I am sure you are aware data centers require redundancy,” Andrews

told us. “Therefore, we have designed the project to utilize natural gas/ hydrogen generators running on approximately 10-15 percent hydrogen [for backup], fully convertible to 100 percent hydrogen within the next three to five years.”

When the SMRs are built, they will provide the primary power and the conventional nuclear power will become the secondary power source for backup if more than one SMR goes off-line.

The company is planning 35 acres of the SMRs, alongside 20 acres of hydrogen production

“We have just recently completed the feasibility study period and have gone hard on the Property,” said Andrews.

The SMR vendor is not yet determined, he explained: “We have just begun the next phase, whereby, we are now having discussions with various SMR and hydrogen manufacturing companies. As of this time we have not committed to any specific SMR partner."

However, GEP’s releases say it has been working with the Department of Energy's Idaho National Laboratory, which is also partnering with the US SMR firm NuScale whose Voygr design is built from 50MW modules.

Interestingly, NuScale is already working on a combined nuclear and green hydrogen system with Shell.

Andrews’ reticence may be partly because of the previously-mentioned setbacks at NuScale, whose projected power cost has recently increased, making its energy potentially less competitive.

Alternatively, it seems there are simply a range of possible partners available for nuclear pioneers.

6 DCD Supplement • datacenterdynamics.com Critical Power

Surry County could be the perfect location: an existing nuclear facility in Virginia, close to a hub where a massive expansion in data center capacity is straining the grid

High hopes for fusion?

Today’s nuclear power all comes from nuclear fission, in which the nuclei of heavy atoms are split, but science has a dream to one day create power from nuclear fusion, which combines lighter atoms such as hydrogen and helium, in the same reaction that powers the Sun.

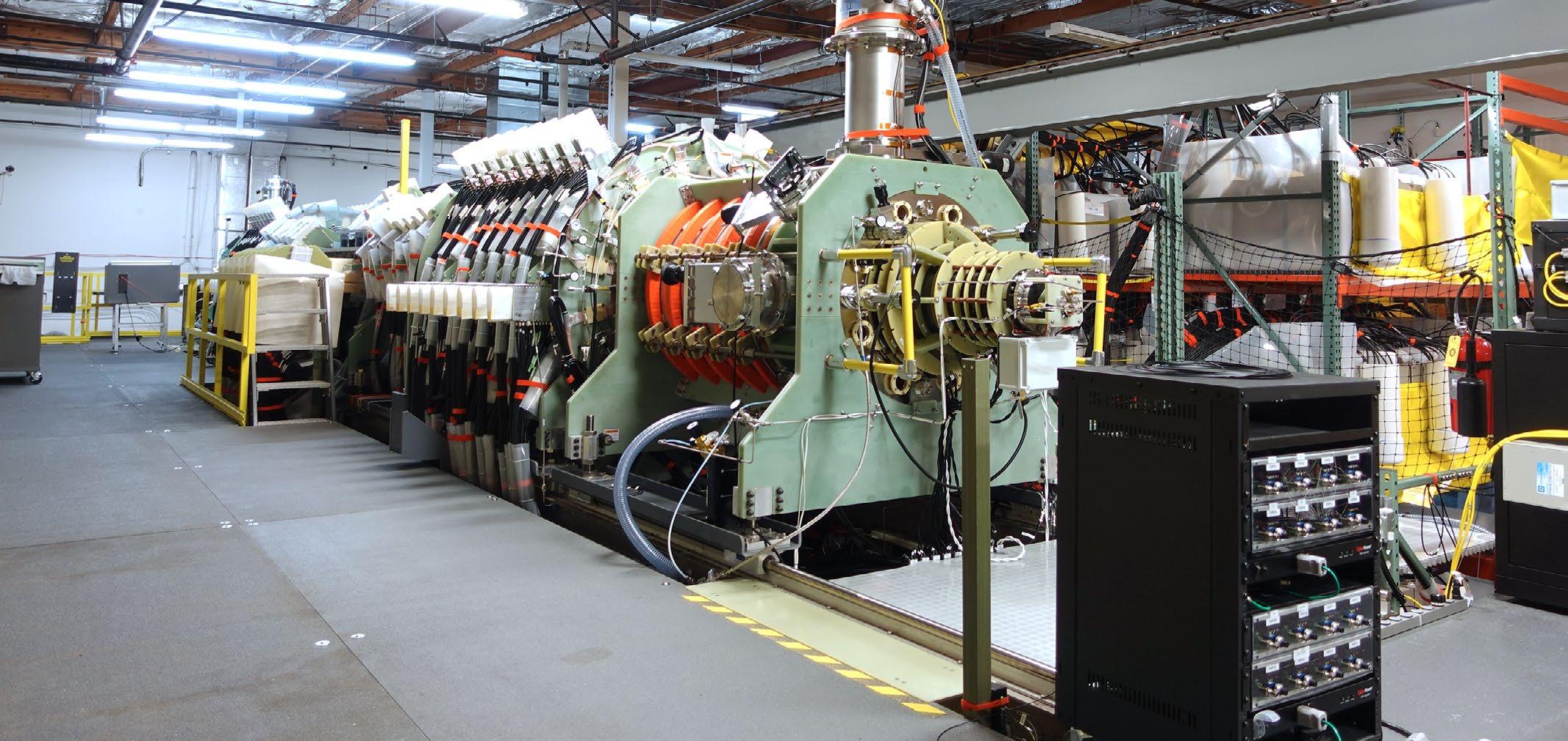

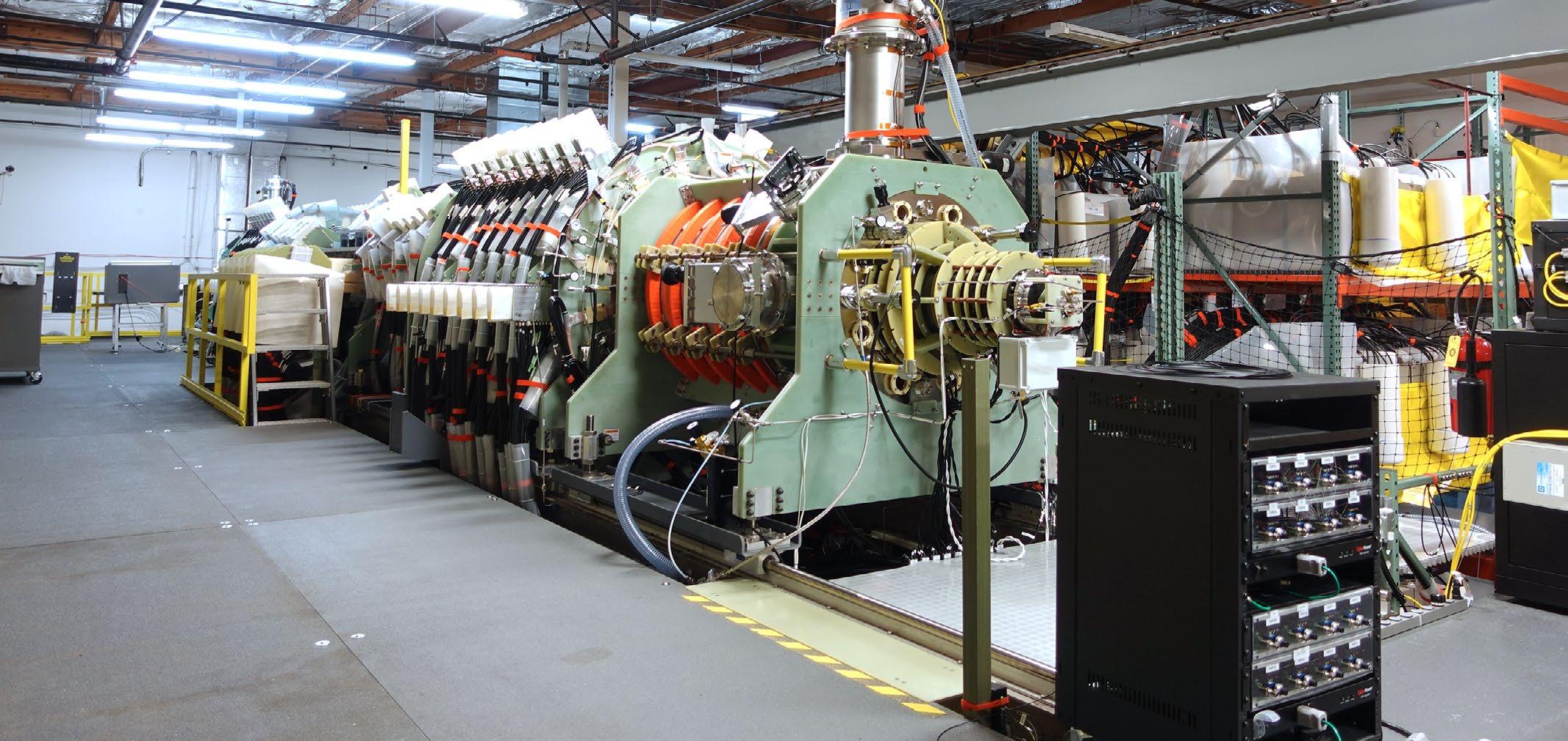

Fusion has been frustratingly out of reach for 80 years - understandably, as it requires a plasma (ionized gas) maintained at pressures and temperatures as high as those of the Sun.

The history has been one of repeated false dawns, where a “breakthrough” turns out to be just a small incremental step towards eventual fusion power.

For instance, in December, the Lawrence Livermore National Laboratory (LLNL) announced it had achieved “ignition”, by creating a fusion reaction that produced more energy than the laser energy used to drive it.

The experiment focused 192 laser beams on a fuel pellet in a target chamber, delivering more than 2 million joules of ultraviolet energy, creating a plasma which emitted more than 3 million Joules of energy.

This sounds like a major step, but the reaction pellet was tiny, and 2M Joules is in fact roughly the same amount of energy as 0.5 kiloWatt hours, or about five cents' worth of electrical energy.

Also, the energy bill broke even in scientific terms, not in commercial terms. The lasers used are very inefficient, so they consumed 300MJ of energy from the grid, to deliver the 2MJ to the reaction pellet.

But this year, prospects seemed to brighten, when Microsoft brought fusion power into the practical world of electricity contracts, with a deal which appears to promise the company will be using actual fusion power in 2028.

This date is sooner than many of the conventional nuclear power stations in this article will arrive, and has led to considerable doubt.

But Microsoft has signed an apparent power supply deal, in the form of a PPA with Helion Energy, a startup which claims its novel approach will deliver 50MW of fusion power to Microsoft by 2028.

Helion began as a project funded with a few million dollars of Nasa money, but got more than $500 million of billionaire venture capital funding, much of it from Sam Altman, best-known for Y Combinator and OpenAI.

There are other billionaire-funded fusion startups out there, including TAE, which had investment from the late Microsoft founder Paul Allen, and MIT spinout Commonwealth Fusion Systems is backed by former Microsoft CEO Bill Gates.

Most fusion approaches use the

two hydrogen isotopes deuterium and tritium, which produce a lot of potentially-harmful neutrons when they fuse. Helion plans to react deuterium with the helium-3 isotope, in a cleaner fusion reaction.

Sadly, this reaction requires higher pressures and temperatures than the best fusion experiments so far (and far beyond what Helion has demonstrated). And Helion hasn’t explained how it can mix helium-3 and deuterium, and prevent the deuterium ions from fusing with each other, in the reaction it is trying to avoid.

The company also has an untested system to extract electricity from the hot plasma, using electromagnetic induction, rather than the cumbersome steam generators used by most other fusion schemes.

But finally, if Helion successfully demonstrates fusion, it will have to spend several years getting approvals, before it can deliver any power to Microsoft.

So Microsoft’s fusion PPA could be a brave bid to support a potential winner, or a cynical effort to gather some green kudos without any actual risk. As the details of the PPA are being kept a closely-guarded secret, we can’t be sure which.

Most likely Helion has a get-out clause - and the rest of us should get on with more tested approaches to carbon-free energy.

Building at Scale Supplement | 7 Nuclear power

Critical Power Supplement | 7

Power Pods and Power Skids: Why Modular has Revolutionized the Data Center Market

The modular style of plantrooms is now the industry’s favorite way to construct data centers because of its speed of install, reduced costs, and overall efficiency. With data center market worth projected to reach $120bn by 2023, it is obvious that data center construction and install must continue to keep up with the ever-increasing demand.

To satisfy such substantial market growth, modular builds are the market’s favorite way to construct critical power solutions. This is because they crucially deliver on four key cornerstones: reduced lead time, cost, build efficiency and project safety.

Lead Time Reduction

A modular build is primarily known for its ability to reduce project lead times and result in overall project time-savings. The modular pod can take place simultaneously to the infrastructure build, which will be powered by the modular plantroom upon project completion, radically reducing the overall project duration.

Advertorial 8 | DCD Magazine • datacenterdynamics.com

Compared to a traditional build, modular plantrooms offer:

• 84% reduction in on-site an hour during installation phase

• 75% reduction in on-site program from delivery to Factory Witness Test

• 75% reduction in on site assembly and testing, saving time and labor costs

Cost Reduction

Modular designs are cost-saving solutions, often because of their ability to reduce the labor required on-site throughout a plantroom installation. Most of the work is completed within a factory-controlled environment, eradicating the need for onsite duplication.

Because less time is required to install the modular pod, the travel and accommodation costs for a team of fitting engineers become irrelevant as the majority of the installation work is completed prior to the pod’s delivery.

Lastly, using interconnecting busbar to power a modular plantroom, as opposed to using cable significantly reduces installation and lifetime maintenance cost.

Build Efficiency

As well as saving the project time, modular plantrooms are also extremely efficient in comparison to a traditional site build.

Modular plantrooms are easily replicated, therefore if a project should need to upscale in the future to keep up with demand, then the modular design of the plantrooms would facilitate this.

Post installation, the usual ‘deep clean’, a prerequisite to completing a site build, is no longer required. In a traditional-style build, cleaning all switchgear to remove contractor install debris before going live is essential to ensure that all equipment is functioning as it should. But, because the modular plantroom would arrive on-site in factory condition, cleaned, and ready to go, the level of site interconnection is significantly reduced when compared to traditional modular builds.

Safety Considerations

Prefabricated modular plantrooms are exactly that; fully constructed, tested and integrated plantrooms that are built off-site

in factory settings, shipped to location, and arrive ready for installation.

When built off-site, these pods usually have a higher quality install due to the clean conditions within a factory, and lead to a significant reduction in installation issues –as they are fully tested and ready to be used.

The impact on safety is a key motivator for implementing a modular design, as it significantly reduces the need for lifting large electrical products (such as PDUs, switchgear, busbars etc.) which poses obvious risks to the on-site team. With a 77% reduction in lifting operations on site, this has a positive impact on project safety and the time to complete installation.

These four parameters are a prerequisite for a satisfied client come project completion, which is yet another reason why modular builds are now so popular.

Modular plantrooms (or Power Skids as we call them) and Power Pods (also known as E-houses) are the epitome of streamlined operations, which is why we at Anord Mardix love them so much. They are also extremely versatile, in so far as each Skid or Pod can be altered to specific size and equipment specification according to the project’s needs.

A Deep Dive into Modular

Anord Mardix has the capability for a full end-to-end solution, which means that we have the opportunity to work with our clients from the beginning. That includes everything from design and fabrication to product install and continued service and support post-installation.

We recently completed a project in EMEA that was a huge success, owing to the modular aspect of the build that incorporated Anord Mardix’s quality design and products.

The initial brief was for a 2MW IT Power Pod with integral critical and non-critical LV Switchgear, 2MVA UPS with VRLA Batteries and integrated data center cabling.

The project scope also required mixed mode cooling with fire dampers, 2 zone fire suppression, 1 hour complete Pod fire integrity and integration of client BMS Cabinets along with full internal power, lighting and local code compliance installation.

Transportation through Europe, with delivery to site, needed expert coordination with local requirements to ensure that the 18m long x 3.9m wide x 4m high Pods (weighing approximately 45 tonnes) were delivered on schedule and commissioned with minimal disruption. The comprehensive engineering excellence from our team, across all departments, was integral to ensuring ensure the successful project handover to the client.

If you are looking for expert support and engineering excellence throughout your project, be sure to contact the Anord Mardix team: www.anordmardix.com/contact/

VERTIV | Advertorial

Critical Power Supplement | 9

All you need to know about microgrids

The local power landscape can give you autonomy, save money, and maybe provide you with better backup

Reliable power delivery remains one of the greatest engineering challenges we face, and the solutions to this challenge have driven advances in computing performance and capability.

This applies to both the phone in your pocket and the cloud services you are using today. Cloud services are delivered from data centers, where there have been continuous improvements in the delivery of constant reliable and uninterrupted power to swathes of computing devices housed tightly in a building.

All this is a direct response to our need as a society for more and more computing and digital services.

Every technological wave has a direct impact on the capacity demand seen by data centers. The latest numbers from the Uptime Institute show that average per chip power draw has shot up considerably in the last five years going from 300W to 800W at full load.

This is mostly due to technology we are already familiar with - cloud computing, 5G, the Internet of Things, and so on. These figures barely take into account the rising tidal wave of demand which

Generative AI is already ushering into the industry.

Data centers have a power problem now, and they will have a power problem 20 years from now. Their proliferation means that they will be a participant in pretty much any wider electric grid. But a new way of looking at power infrastructure called microgrids paints the picture of turning them into ethical prosumers rather than just simple power hungry buildings.

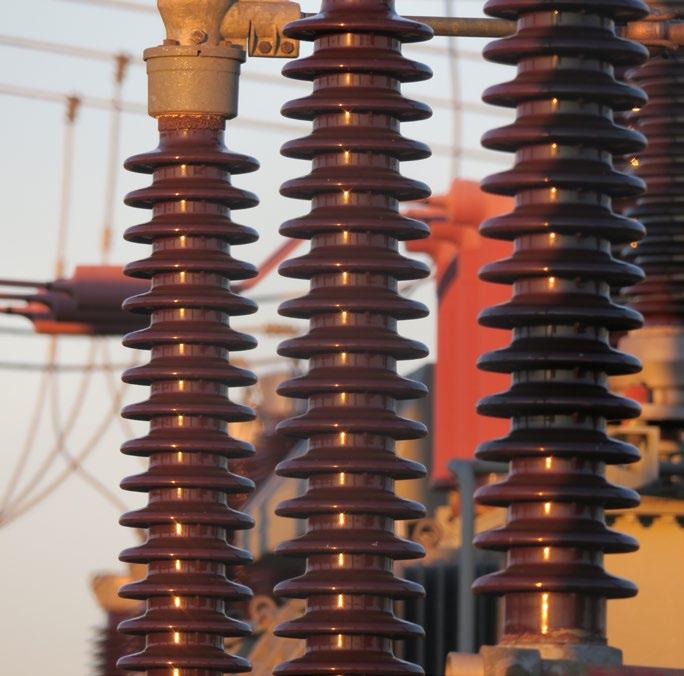

Grids and Power Delivery

To understand what microgrids are we first need to understand what is meant by a grid. The electrical grid is essentially the network that is required to bring energy from the producers to the consumers. Towards this there are 4 stages - Generation - Transmission - Distribution and Consumption.

The Generation stage is represented by the producer - this can be anything from a nuclear power plant to a wind turbine or a solar farm. The transmission stage is where electricity needs to be sent over long distances and for this its voltage is raised considerably to minimize losses.

The Distribution stage is where electricity is stepped down to levels appropriate for use in the home, office or enterprise.

A grid encompasses all these stages, their relevant hardware and functions.

A microgrid on the other hand locates all of these assets in very close proximity, on a single site. Within that site, there is a local power source, such as a solar farm or wind turbine, along with local distribution and local consumption. The microgrid is connected to the main grid but, because

A microgrid locates all components of a grid on a single site, including a local power source, local distribution and consumption. It is connected to the main grid but can operate independently

10 DCD Supplement • datacenterdynamics.com Critical Power

Vlad-Gabriel Anghel Head of Product at DCD>Academy

of its tight integration, it can also operate independently.

Depending on the economic conditions or the availability of power, a microgrid can operate entirely on the grid, using a mix of its own resources and the wider grid, or else go off-grid and operate entirely on its own.

If the local power source generates more power than is needed locally, the microgrid can even feed surplus generated capacity back to the larger grid, or as it is sometimes called, the macrogrid.

All data center facilities today have some form of backup power generation onsite. For most it's a diesel generator with an uninterruptible power supply (UPS) that is sized to the facility’s load.

Could this be considered a microgrid? After all it has all elements of a grid present in very close proximity, with power generated on-site. It is not considered a microgrid because it is not designed to run all the time: the diesel only runs in an emergency.

But what about more novel on-site power generation approaches? This is where microgrid technology comes in.

Harmonizing the Grid

Before we dive deeper into microgrids, we need to understand how and why a grid needs to be “harmonized” in order for it to allow for a smooth, quick and efficient interchange of electricity across different regions, or even different countries. The harmonization of the grid requires several different mechanisms.

The most important ones represent synchronization - ensuring the system works at the same frequency across its constituent parts - this can be either 50Hz or 60Hz depending on the region. Another important mechanism is voltage and phase balancing - every part of the grid needs to be matched in terms of voltage and phases.

There are other aspects behind the harmonization of the grid, like controllers and switching infrastructure, but these are the most important ones - if a component part is misaligned in voltage, phase or frequency, electrical energy transfer is difficult or impossible.

Renewable energy sources are desirable because they provide power without creating emissions. However, most

renewable sources carry a challenge when attempting to use them for an application that requires continuous, reliable powerand that is their intermittency.

Wind can blow at high speeds one day, low speeds the next day; the sun shines with varied intensity each day, and not at all during the night. Even hydropower, for most purposes the most stable renewable source, will vary as the ebb and flow of water creates different pressure in the reservoir.

Because of this intermittency it is difficult for renewable energy sources to be directly connected to the wider grid - simply because they would de-harmonize it.

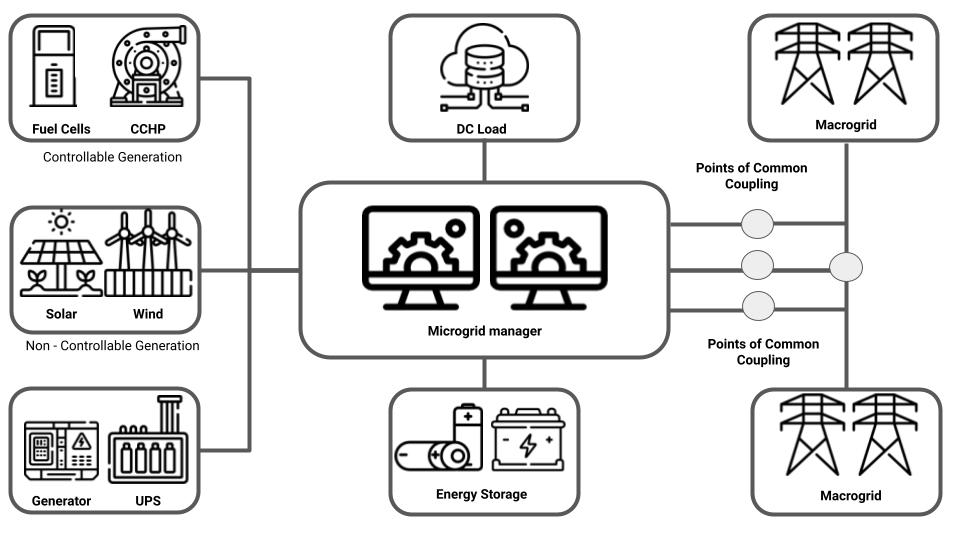

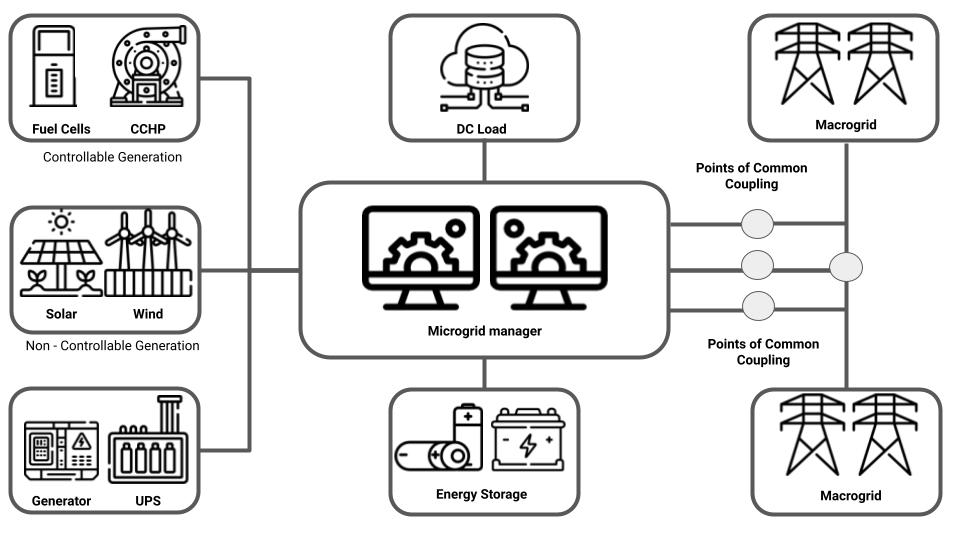

Campuses, business centers or other sites may install renewable sources as part of a drive towards net-zero. They end up with a mix of uncontrollable sources of energy generation, such as solar, coupled with more controllable sources like fuel cells or cogeneration such as CCHP (Combined Cooling Heat and Power), which can be switched on at will.

These sources of electrical energy have to be combined and brought into sync in order to connect to the macrogrid.

Microgrids

Critical Power Supplement | 11

Image by Erich Westendarp from Pixabay

Microgrids

This is where the need for microgrids comes from. As stated above, a microgrid is essentially a mini version of the main electric grid with all its component parts located in close proximity.

Microgrids are electrical networks designed to remain in operation at all time and they can work proactively. As seen in the diagram, the central piece of technology within a microgrid is represented by the microgrid controller and this can be either a piece of hardware or software.

This controller harmonizes all the electrical loads within the microgrid and further harmonizes them with the macrogrid if needed. The controller also is the mechanism through which utility power is transferred to the microgrid in the event of an outage, or for microgrid power to be activated in a utility outage.

In microgrids, islanding, or operating independently of the main grid is a near instantaneous operation ensuring a seamless transition from the macrogrid power to microgrid generation. This goes a level beyond the traditional backup generator found on a data center site. While the backup generator can take up the slack and keep the site up for a time, the microgrid can operate indefinitely in this “island mode”. The switch back to the utility happens in the same seamless way once the utility outage ends.

Another key factor of microgrids is they operate in parallel with the macrogrid and this can enable the owner/operator

to program certain metrics into the controller. For example if a data center is on a microgrid, and the owner wants to meet an annual average price per kWh target, the microgrid can switch the data center to utility or microgrid power at will, when price fluctuations for utility power drive the per kWh price above that threshold.

Once the surge in pricing has calmed down and values are back to manageable levels the owner/operator can switch back to utility power.

The same applies to sustainability targets in terms of energy mix and carbon intensity. The controller will leverage the generation resources that best match these targets. If the utility energy mix is mostly driven by coal and the microgrid has, for example, a wind farm on site - the controller would skew the power use to take power from the wind farm whenever it is available, picking the source to achieve the targets.

From consumer to prosumer

The microgrid controller also brings to the fore the notion of data centers acting as prosumers instead of just huge consumers. With enough generation sources, surplus

capacity can be sold back to the macrogrid when it's economically feasible.

Arguably microgrids can deliver a higher level of trust than traditional backup generators which are only fired up when necessary.

Because microgrids are in constant operation, any malfunction or defect is quickly identified and fixed, while the utility power is available to keep the site live. Many data center outages are caused by latent defects in the classic generator and UPS system emergency backup generation, which only become apparent when they are switched on - precisely at the point when they are vitally needed.

As with data center infrastructure management (DCIM) inside the data center, the microgrid controller can deliver a plethora of benefits from continuous data gathering, logging and analytics. Taking it a step further and applying AI on these data sets can lead towards a proactive management of the whole microgrid.

For example, drawing in local weather data can inform the microgrid controller what wind speeds will occur for the next 72 hours. This will give an estimate of the amount of power that will be generated over this time period, and allow the facility to plan when and how much utility power to use. This will improve the data center facility’s TCO.

A novel approach to backup

Microgrid technology is now mature enough to be adopted by wider industries and data center owners/operators should consider if such a solution is fit for purpose at their facilities.

As we already know, the largest chunk of data center outages are traced back to the loss of power. This risk is traditionally addressed by generators and UPS systems. However, as discussed previously, latent defects can and will affect the reliability and availability of the facility’s backup provision.

Microgrids go a step further and act as a more reliable way of avoiding utility outages. Not only that, they can also provide more benefits like additional energy management tools, cost reduction methods and help with achieving sustainability targets.

12 DCD Supplement • datacenterdynamics.com Critical Power

Image by H. Hach from Pixabay

HVO supply chains: is there enough to go around?

Dan Swinhoe News Editor

Biofuels are as old as the diesel engine: Rudolf Diesel designed his engine for petroleum, but ran his first tests in 1893 using peanut oil. They are only now coming into their own.

To reduce carbon emissions, companies are looking to do away with using fossil fuels such as diesel and swapping back to biofuels that are as readily available as their polluting counterparts and on par in terms of performance.

Hydrotreated vegetable oil (HVO) is a recentlydeveloped low-emission biofuel that promises high performance without the need to replace or customize diesel gen-sets.

Data centers are looking at HVO as a way to green their backup diesel operations. But are the supply chains for this new biofuel ready to keep the world online if there’s a blackout?

What is HVO?

HVO is a synthetic paraffinic diesel, made from vegetable oils or waste, reprocessed with added hydrogen. Unlike previous biofuels, It is a drop-in replacement fuel that can be used without modifications to existing engines. It offers a similar energy content, density, viscosity, and flash point. It also performs very well from start up in cold climates.

It can also be blended with diesel, and can be held for much longer without degrading.

HVO emits CO2, but most of this was recently captured by plants, so the “net” emissions are much less. Crown Oil reckons 1,000 liters of HVO releases 195kg of net C02, compared to 3,600kg for the same amount of regular diesel. It also reduces the nitrogen oxide emission by around five percent.

Last year Kohler announced that all its missioncritical diesel generators could run on HVO with no modifications. Likewise, Rolls Royce has said its mtu Series 1600 and Series 4000 gensets are also HVO certified.

“HVO has a higher stability and lower tendency to oxidize compared to biodiesel, which can lead to fuel degradation over time,” explains Nazmi Atalay, global general manager (Production – R&D) at generator provider AKSA Power Generation. “The stability of HVO is due to the hydrotreating process, which removes impurities and saturates the double bonds in the

HVO supply chains Critical Power Supplement | 13

As more operators adopt HVO, are the supply chains ready?

vegetable oil, resulting in a more stable and uniform fuel.”

Price can be a blocker on adoption; the cost of HVO is currently around 15 percent more than diesel in some markets. But the longer lifespan of HVO – up to 10 years –can offset some of the costs associated with fuel polishing and even scrapping of fuel if microbes gain a foothold in a fuel tank.

“One of the big issues with data centers of course, is that the fuel just sits there forever and a day,” says Simon Lawford, technical sales manager at supplier Crown Oil. “[With HVO] the husbandry of the fuel is a lot simpler and easier. And there's the benefit that you can use it to attract those environmentally conscious clients.”

Lawford notes there’s still confusion with biodiesel, alongside “concern and conservatism” from data center engineers around the performance of HVO. Once companies conduct trials, however, most are happy with the performance.

Who is adopting HVO?

UK operators Kao and Datum, Compass in the US, as well as Belgium's LCL, and Latvia’s DEAC are all looking to adopt HVO as fuel for their backup generators.

Most haven’t shared exactly how much fuel they are procuring, but Kao said it would be replacing 45,000 liters of diesel, and be procuring more than 750,000 liters when its 35MW Harlow campus is fully developed.

Amazon Web Services (AWS) is also switching to HVO in Europe, beginning with its Irish and Swedish facilities.

Digital Realty's French unit has adopted HVO for its new PAR8 site in Paris. The company is also deploying HVO in Madrid, Spain, and plans to expand its use across the continent in the near future.

Equinix is piloting HVO, but its 2022 environmental, social, and governance (ESG) report doesn’t give details beyond the CO2 savings. Equinix says its HVO generated 30 metric tons of carbon dioxide equivalent (mtCO2e) net, while the equivalent diesel would have generated 40,300 mtCO2e. Using Crown Oil’s 195kg per 1,000 liters benchmark, that comes out at around 150,000 liters of HVO, a fairly significant amount.

Kohler recently swapped diesel for HVO at its Brest generator manufacturing plant in France, totaling some 325,000 liters.

Outside of the data center industry, the transportation, construction, aviation, marine, and off-road equipment sectors are all users of HVO.

Crown Oil’s Lawford tells DCD the HS2 rail system uses HVO in the UK, and the Glastonbury music festival has also been using HVO since 2019. It is also approved for use in aviation if upgraded to sustainable aviation fuel (SAF).

Is there enough HVO to go around?

If you want HVO, you can get it, but questions remain around whether an operator would be able to ensure ample ongoing refueling supply during prolonged grid outages.

Production is increasing in tandem with supply, but HVO is still a drop in the ocean compared to other fuels.

For example, some 2.26 billion liters of renewable fuel were supplied in the UK in 2022, according to government data. Around seven percent of that is HVO, with biodiesel and bioethanol making up most of the rest.

However the total of renewable fuel is small compared to overall fuel use. Around 30 billion liters of diesel and 18 billion liters of petrol are consumed in the UK each year in total. Those 2.26 billion liters represent around seven percent of total road and nonroad mobile machinery.

“HVO has been quite a hockey stick,” says Crown Oil’s Lawford. “Back in 2019, there was maybe 5 million liters imported [into the UK] and it's grown pretty exponentially since then, and continues to grow as people switch.”

The feedstock supply is generally good. Some first-generation biofuels are synthesized using oil from purpose-grown produce – palm, sugarcane, soybeans etc. The treated oil in HVO – known as a secondgeneration biofuel – is usually sourced from the likes of tall oil [a by-product of wood pulp manufacture], rapeseed oil, waste cooking oil, and animal fats. Existing biodiesels and HVO use largely the same feedstock, meaning the wider raw materials supply chains for the production of HVO are by and large as secure as the wider biodiesel market. B100, a common biofuel, uses rapeseed as a feedstock, for example.

Neste is a major producer of HVO and launched its first European refinery in 2007. It has previously told DCD it is actively seeking firms that can supply it with feedstock, including used cooking oil, waste animal fat, and other renewable raw materials.

Neste is building a second refinery at Rotterdam. Total, ENI, Cepsa, and Shell are all either producing or building refineries in Europe.

However, some companies DCD spoke to for this article have noted supply chain issues for large orders at short notice.

“There are ongoing supply chain problems with some existing engine suppliers, some companies are in better condition than others in the supply side with well-planned bulk orders,” says AKSA’s Atalay.

Adopting HVO with a diesel fallback

Colo giant Digital Realty has hundreds of facilities worldwide and more than 120 in Europe and Africa. The company is starting with HVO in Paris, France, and Madrid, Spain, but intends to roll it out continent-wide in the future.

“We did the tests. I witnessed the tests to make absolutely sure that the fuel would comply with all the security measures and SLAs that we had in place,” says Lex Coors, chief data center technology and engineering officer at Digital Realty. “And I recommended to our VP of operations of EMEA that I am 100 percent behind it and recommend HVO 100 [100 percent HVO] for all countries.”

14 DCD Supplement • datacenterdynamics.com

Critical Power

If you want HVO, you can get it, but questions remain around ensuring ongoing refueling supply during prolonged grid outages

How a company adopts HVO is largely up to them. Crown Oil’s Lawford says the company always recommends a full lift and shift of existing fuel to HVO,but some clients would rather bleed HVO into the system in stages.

“You can mix HVO 100 in any percentage with the existing diesel,” adds Coors. “You don’t have to empty your tank. You can simply top it up. In two, three top-ups, I will be at full 100 percent HVO 100,” says Coors.

The fact that HVO can be blended with diesel also means that in an emergency, companies can fall back on diesel in their generators if the HVO supply lines do run dry.

“I think the supply chain is ready for it,” says Lawford. “But the crucial point here is that unlike biodiesel, you're not wedded to HVO. You can switch straight back; so if the world were to end and there was no HVO available, then you can just use diesel.”

In France, Kohler’s product manager for large diesel generators and clean energies, Pierre Adrien Bel, said the company was able to swap its Brest plant fairly easily in partnership with Total.

“From the first of January we are at 100 percent with HVO100,” he explains. “We did a large cleaning of all our pipes and fuel tanks and then we put HVO 100 inside.”

Can you get HVO in a pinch?

Given enough lead time and willingness to pay, a company can procure almost any amount of HVO. But the fact that the fuel is there as a backup to power generators during potential blackouts means companies need to be sure of steady supply lines at short notice.

“It's always easy to have one or two sites with tanks filled up,” says Digital’s Coors. “The issue is more in the refuel contracts, where you need to have your follow-up fuel within so many hours if you lose the grid.”

Data centers traditionally rely on two fuel suppliers for redundancy during emergencies. The lack of multiple suppliers, combined with a potential shortfall in shortnotice fuel deliveries means Digital Realty still has diesel contracts for backup.

“Maybe in two or three years from now there will be multiple HVO 100 suppliers from different factories across Europe, that is the time where we may recommend to our diesel suppliers to go into HVO 100 and stop the fossil fuels,” says Coors.

However, the availability of HVO may depend on location: “Our lead times for HVO [in the UK] are the same as diesel, two

working days, or emergency next day,” says Crown’s Lawford, who began with Neste but now has multiple providers. “Crown Oil has nine tanks around the country filled with HVO and it just feeds into our standard lead time in our standard operations.”

Chicken and egg of HVO supply

Europe is currently the largest producer of HVO. Neste has facilities in Rotterdam in the Netherlands and Porvoo in Finland. ENI has HVO production facilities in Venice and Gela and it’s even possible to get HVO at roadside fuel stops in Italy.

In France, Total’s La Mède refinery can produce 500,000 tonnes of HVO-type biofuels per year. In Spain, Cepsa recent converted its La Rábida Energy Park in Huelva to produce HVO. Shell is set to build a new refinery in Rotterdam.

US HVO production has grown around 500 percent in the last five to six years, and it's due to double again in the next two years and expected to reach six billion gallons by 2024. In a paper on HVO, Kohler notes Chevron, Phillips 66, Diamond Green Diesel, and Global Clean Energy have all made announcements to increase the capacity of HVO, with a Neste plant in California recently coming online.

However, some parts of the country are much further away from production facilities, meaning cost, embedded carbon, and potential logistics issues are greater. The environmental benefits of adopting HVO may be negated if the fuel has to be transported to a facility thousands of miles away, usually in diesel-fueled trucks.

“For our Brest plant, Total has installed a large local HVO storage so that they are able to supply us at a lower price, next to the facility,” says Kohler’s Bel.

But in the US, the company is still working to make the switch: “In California, it will be quite easy to find HVO, whereas with our plant in Wisconsin, it is more difficult to find. And the cost to transport HVO from California to Wisconsin make no sense.”

The UK doesn’t produce its own HVO, but can import from Europe and US. The UK last year lifted some EU anti-dumping duties and countervailing measures on HVO

imported from the US. The lift means importing HVO from the US is more feasible in the UK than mainland Europe.

Outside of Europe and the US, Neste has an HVO plant in Singapore, but Shell recently scrapped plans for an HVO plant there.

In China, state-owned energy provider Beijing Sanju Environmental Protection & New Materials launched a large refinery in Shandong province in 2021 – its third in total – and plans more, including in Malaysia.

There are no HVO production plants in Africa, South America, Canada, the Middle East, or Australasia – though plants are set to come online in South America and the Middle East in the coming years.

While much more storage infrastructure is dedicated to other biofuels and/or fossil fuel diesel, more HVO customers could see more storage infrastructure reassigned.

Digital Realty says by "taking as much as you can put it in the tanks" production will inevitably increase alongside demand.

“If no one is doing this, then the production will not increase. But [higher demand] will increase the production and increase the confidence by those factories to say there is a need, let’s increase production.”

A stepping stone to fuel cells

Kao says one of its MTU 1965kW output diesel generators will consume around 450-500 liters per hour at full load. Two-hour monthly test runs are standard, resulting in 9001,000 liters of mineral diesel producing an average of 3.6 tons of carbon dioxide (CO2) per month. A single diesel generator can create around 43 tons of CO2 per year; the equivalent HVO fuel would produce around 2.3 tons per year (net).

Compared to a Power Purchase Agreement, on-site renewables, or fuel cells, the CapEx of HVO is low - and it makes use of existing generators.

Coors sees it as merely a temporary stepping stone towards better fuels and then onto fuel cells and hydrogen: “HVO will be definitely a very good solution for the first five to seven years. By 2030 I expect green hydrogen to become more available.“

HVO supply chains Critical Power Supplement | 15

The environmental benefits of adopting HVO may be negated if the fuel has to be transported thousands of miles in diesel-fueled trucks

Editor

Editor