SYNOPSIS

2026

2026

DBank is a modern investment bank that caters to Latin American entrepreneurs, sophisticated investors, and family offices. We provide strategic wealth management, international structuring, and long-term capital growth by integrating investment banking, corporate finance, and global advisory services into a single platform.

Founded in 2002, DBank holds an International Banking License registered under the laws of Antigua and Barbuda. With over twenty years of experience, we specialize in delivering tailored banking and investment solutions.

Our approach combines financial engineering, wealth planning, access to global markets, and specialized banking services, all within a robust framework of compliance, confidentiality, and operational efficiency.

In 1993, Mrs. Isabel Montiel de Osio, a lawyer with a background in corporate and financial banking, decided to invest in the financial sector and establish a multifamily office in Latin America. With over 40 years of experience providing legal services to a wide range of financial institutions and multinational companies in Venezuela, she recognized an opportunity in the market.

At that time, her firm had approximately $80 million in assets under management and maintained intermediary agreements with major banks in Europe. This scenario led to the idea of expanding their financial services by incorporating an international bank.

By 2002, Mrs. Osio, in collaboration with a group of professionals with significant experience in the banking sector, acquired D Bank, LTD., an offshore bank located in Antigua and Barbuda. The goal was to create a high-end financial boutique tailored to high-net-worth clients.

Following the passing of Mrs. Isabel, her son David Osio assumed institutional leadership, ensuring strategic continuity, model evolution, and international expansion.

Under his leadership, DBank has transitioned from a traditional financial boutique into a fully integrated modern investment banking platform.

David Osio is a prominent banking executive, financial strategist, and entrepreneur with over 30 years of experience in international banking, wealth management, and multifamily office platforms.

Average annual growth in assets under management during the last 10 years %

Estimated Assets Under Management among our affiliated companies USD MM

More than 20 years among the first offshore banks with major recognition of Antigua. Supervised by the Regulatory Commission of Financial Services (FSRC)

Recognized 2 consecutive years as the first bank in the Caribbean to comply 100% with the standards for the prevention of money laundering and financing of terrorism

More than 80% of our clients are from Latin America, mainly businessman , top level professionals and companies from the private sector (retailers, suppliers, industrial, technology, among others ) with recognized experience and proved track record of their wealth and assets. Main countries:

Brazil Argentina

Caribbean Venezuela Colombia

Monitoring of the risk management practices and anti-money laundering administration to ensure a thorough due diligence and compliance with AML/CFT measures not only at the local regulation level but also with international frameworks

to the market average, a significant reduction in high-risk investments, as well as excellent management of third party portfolios

Corporate Governance

Audit Committee

Compliance Commitee

Credit committee

Technology Committee

Investment & Assets and Liabilities financial Committee (ALCO)

Ethic Committee

Today’s Latin American entrepreneur operates in a highly complex and demanding global financial environment. Key structural challenges include:

Traditional commercial banks, especially in the U.S. and Europe, have reduced their exposure to international clients. This has led to lengthy onboarding processes, unexpected account closures, and limited support for complex corporate structures, creating operational friction and capital flow risks for cross-border businesses.

3

Automatic information exchange, stricter compliance frameworks, and frequent regulatory changes require entrepreneurs to implement more sophisticated structures, clearly separate personal and corporate assets, and proactively anticipate tax and legal risks.

Entrepreneurs often make the bold choice to concentrate their wealth in a single jurisdiction, a single operating business, and a single currency. However, this approach inherently increases their exposure to political, currency, legal, and succession risks.

Rapid business growth can outpace financial structuring, leading to tax inefficiencies, legal exposure, limited financing access, and reduced investor appeal. Addressing these challenges is essential for sustained growth and enhanced business value.

In an environment where traditional commercial banks are imposing increasingly stringent barriers to international investors, DBank serves as an international financial hub, integrating investment banking, wealth management, and cross-border corporate structures into a single platform.

International

Continuous

DBank transforms entrepreneurs from mere bank clients into well-structured financial entities by aligning their operating businesses, investments, and family wealth.

We design structures that are: Properly integrated onshore and offshore, Tax-efficient and compliant, Robust under banking and regulatory scrutiny, Prepared for growth, succession, or liquidity events

DBank allows USD-based investments with a focus on life-cycle portfolio design. We provide true diversification across assets, geographies, and currencies, prioritizing capital preservation, income, and sustainable growth.

We provide long-term advisory services, offering strategic guidance, structural adjustments to comply with evolving regulations, and support for key decisions like expansion, exit, and restructuring.

USD personal accounts linked to international structures

Efficient management of personal income from dividends, fees, or exits

Liquidity solutions for a global lifestyle

Digital platforms, international payments, and consolidated reporting

Corporate and investment accounts

Cash management and international payments

Cross-border operational support

Executive financial reporting

Customized USD-denominated portfolios

Fixed income, equities, and alternative assets

Discretionary and advisory mandates

Personal and corporate liquidity management

Holding companies, LLCs, and offshore/onshore structures

Estate and succession planning

Structures for operating entrepreneurs and family offices

International legal and tax coordination

Financial & Accounting

International Tax Planning

Fiduciary Services

Corporate Services

Business Consulting

Tailoredtoyourneeds

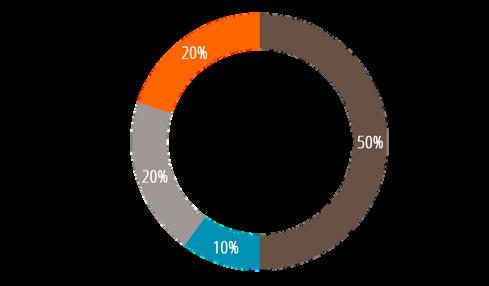

Portfolio

Models

Capital Preservation

6th Month Time Horizon

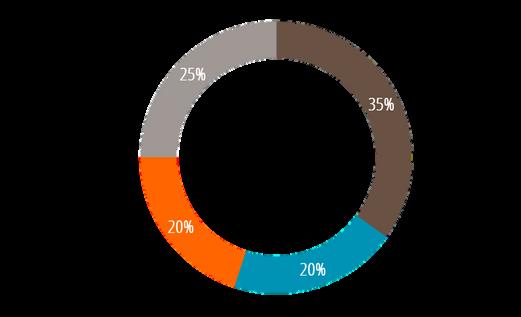

Moderate Income

+3 Years Time Horizon

Aggressive Allocation

Return over the long term

Major Regions

Major Sectors

Technology and Innovation

Energy and Decarbonization

Healthcare

Private Credit Markets & Financials

Sustainable Investments

The conservative model portfolio’s objective is to achieve capital preservation with a 6-month investment time horizon while providing incremental income above that of money market strategies.

The portfolio assets are allocated across a combination of fixed-income products according to a static asset allocation strategy. It maintains a neutral mix over time of Treasuries and Money Markets.

Annualized Return Between 5.7% - 7.55%

Our Moderate portfolio seeks to provide investors with long‐term growth and current income. The portfolio is designed to keep investors ahead of inflation while maintaining the stability of principal. This model may be appropriate for investors with longer time horizons who can tolerate some volatility.

This model portfolio’s objective is to provide projected cash flows and income above those of money market strategies, while conservatively managing drawdown and negative absolute performance risk, consistent with a 3+ year investment horizon.

Annualized Return Superior 9%

An aggressive portfolio may fit investors who seek to maximize total return over the long term. This portfolio has a targeted 40% allocation in equities and alternative investments, with a higher level of risk than the others.

Annualized Return Between Superior 10%

Defining your value proposition

Understanding your market and target habits

Understanding your strengths, skills, and time available

Creating a growth story behind your idea

Developing your business plan

Understanding your numbers & financing

Getting the legal structure to protect your idea

Defining SMART goals

Identifying new opportunities

Building a sales funnel

Improving your management and structure

Containing your cost structure

Diversifying your offer

Leverage your business

Identifying your pain points

Adapting to market changes

Developing strategic leadership

Creating a proper marketing strategy

Converting your finances from red to black

DBankismorethananinvestmentbank: itisyourstrategicpartnerforstructuring, protecting,andgrowingwealthglobally