INVESTMENT OUTLOOK

BONDS ATTRACTIVE AFTER RISE IN YIELDS

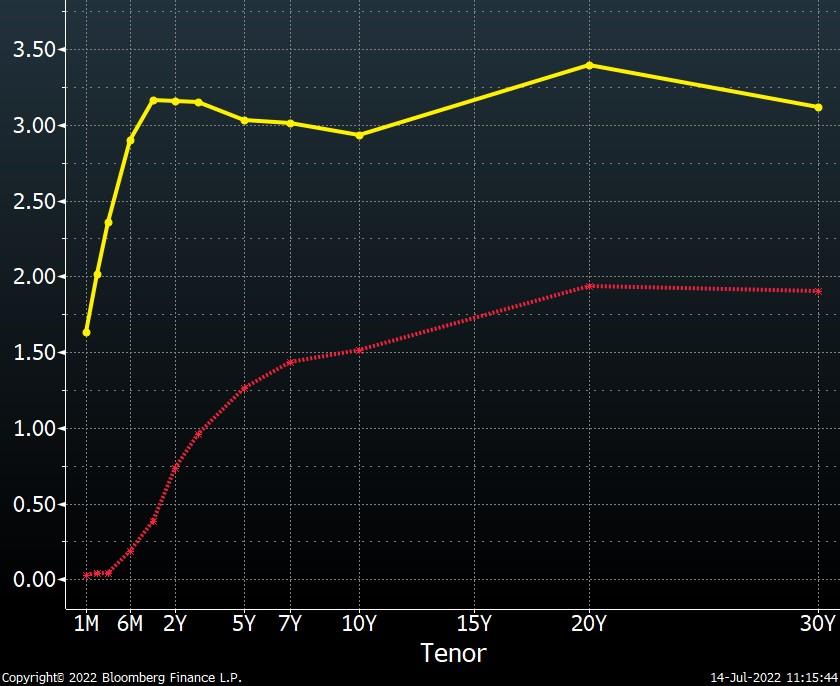

The high inflation figures of the last several months have forced policymakers at the U.S. Federal Reserve (Fed) to begin tightening monetary policy. The Fed began this process in March and through early July had raised its key policy rate 1.50%, while indicating that further hikes will come later this summer and fall. As a result of this policy change, the U.S. Treasury yield curve has risen sharply this year. The 2-year U.S. Treasury bond yield is up 243 basis points year-to-date through July 14th to 3.16%, while the 10year Treasury yield has risen 143 basis points to 2.94%.

Elevated inflation is still a serious concern for the markets, but at the end of the second quarter there was a change in investor sentiment, with inflation fears beginning to give way to fears that an economic slowdown will occur during the next 12 months. Inflation breakeven rates, what investors expect inflation to be in

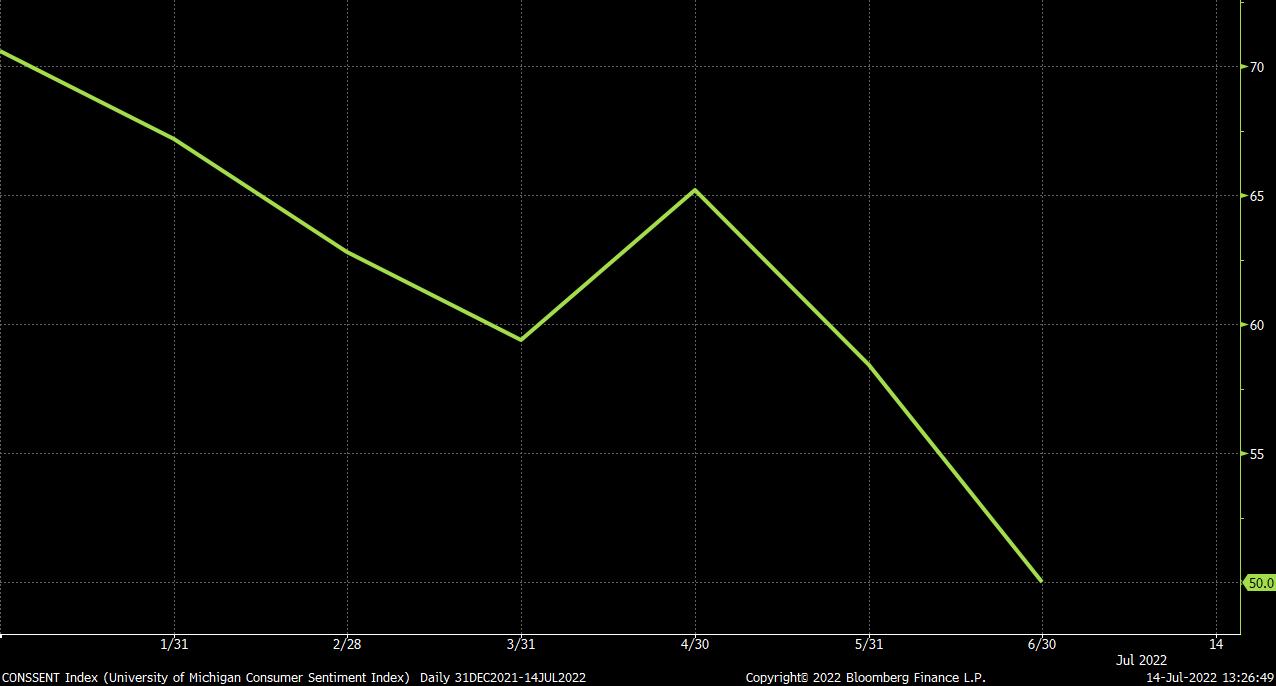

the future, fell sharply in June, while the U.S. Treasury yield curve inverted (longer-term yields fell beneath short-term yields). It’s likely that recent Fed actions will soon begin to have an impact on

broad economic growth data, with signs that the U.S. housing market has already begun to weaken. Consumer confidence in the U.S. has also fallen this year.

7/14/2022

12/31/2021

U.S. Inflation Breakeven Rates

U.S. Treasury Yield Curve

Source: Bloomberg Source: Bloomberg

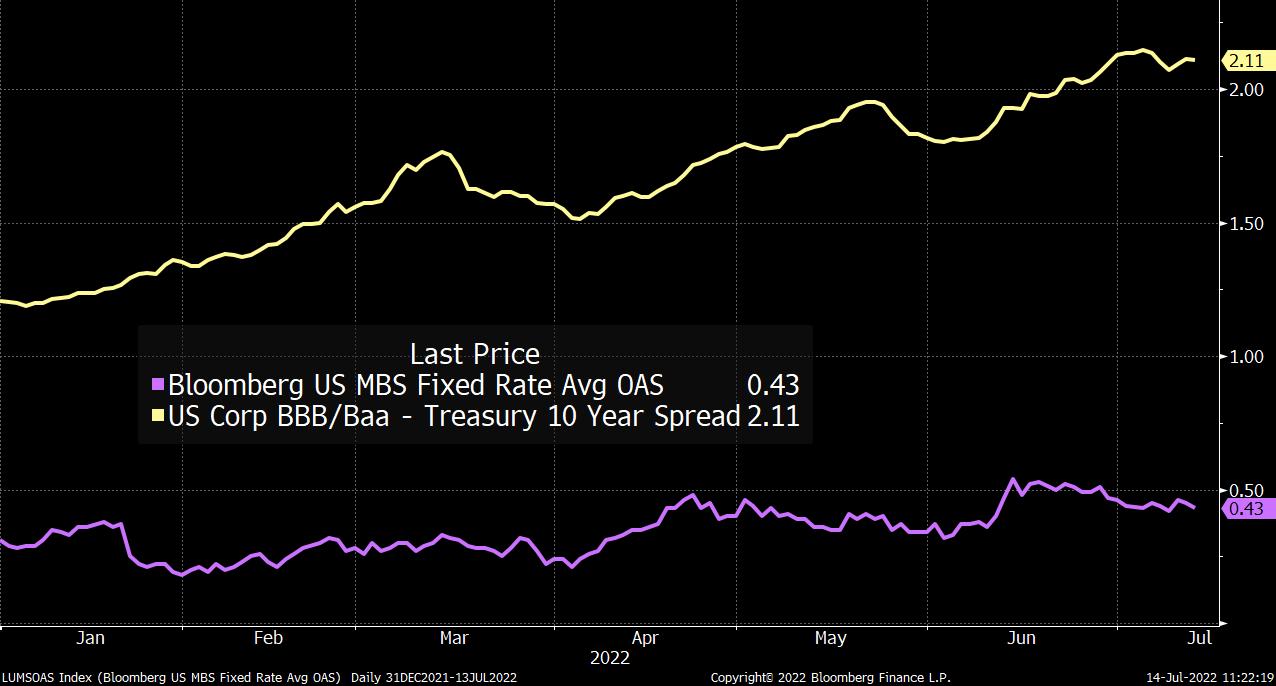

Consistent with this increased nervousness in the markets, corporate bond spreads rose in the second quarter. This widening appears a bit disproportionate to the risk, however, and we are beginning to see attractive opportunities in the high-quality corporate bond space. Agency mortgagebacked security (MBS) bond spreads also rose slightly in the second quarter, with this asset class also looking increasingly attractive vis -à-vis U.S. Treasury bonds. Most of the MBS market is trading at a discount to par today, meaning that prepayment risk is limited. This, combined with higher option-adjusted spreads for MBS, makes the asset class especially attractive for bond investors seeking to minimize credit risk while realizing additional yield.

Bond Option-Adjusted Spreads

Source: Bloomberg

University of Michigan Consumer Sentiment Index

Source: Bloomberg

After this year’s interest rate moves, yields in the fixed income market are near decade highs and the

asset class is quite attractive at today’s prices. The Bloomberg U.S. Aggregate Bond Index, which measures the investment-grade bond market in the U.S., has a yield-to-maturity of 3.75% today, near its highs of the last 10 years. Interest rate moves are very difficult to predict in the short run, of course, but yields like this are attractive and we suspect that U.S. Treasury yields won’t approach the highs seen in March for some time.

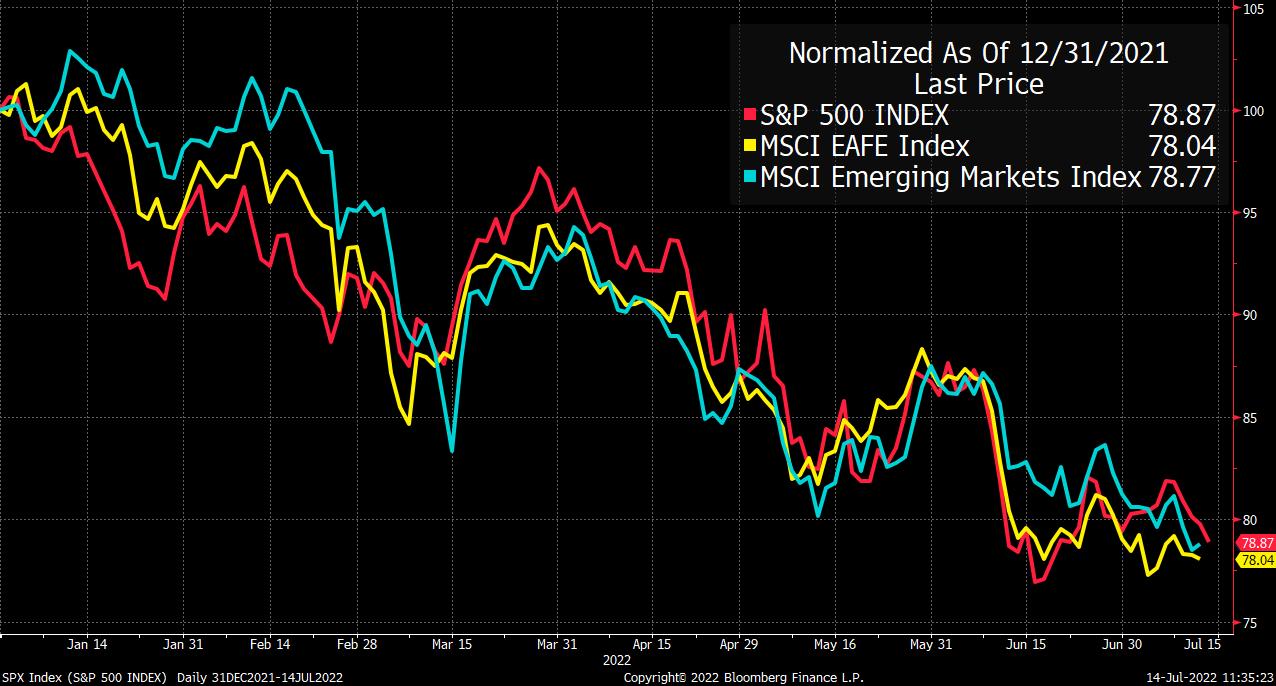

OUTLOOK FOR EQUITIES LIKELY TO IMPROVE

Higher interest rates this year have been hard on stocks as well as bonds, with the MSCI All Country World Index, a measure of the global stock market, returning -20.2% year-to-date through July 14th. Interest rates have especially impacted growth stocks (defined as companies with higher perceived longterm growth prospects), with concerns regarding the health of the broader economy also weighing down industrial, consumer discretionary, and other more cyclical sectors late in the second quarter. International stocks often underperform during bear markets, but this year their performance has been in-line with domestic stocks.

Year-to-Date

with pandemic-related constrained supply) would likely lead to further aggressive monetary tightening and possibly a more severe recession next year. If, on the other hand, it appears that global demand and supply will begin moving more into balance in the coming quarters, with demand ebbing and supply constraints gradually easing as the aftereffects of the pandemic gradually wear off around the world, the

Investors’ views of the timing and potential severity of a coming slowdown are in flux, with much depending on how the current global demand and supply imbalance evolves in the near term. Continued imbalance (meaning excess global demand combined

Source: Bloomberg Equity Returns

Source: Bloomberg

risk of a sharper recession will decrease. We believe the second scenario is the most likely, with inflation decreasing and Fed policymakers spared from having to take more draconian action than investors already anticipate today. If this were to occur, it would be positive for both the stock and bond markets.

Our equity portfolios have overweight positions to the healthcare, industrial, and materials sectors, and underweight positions to energy, financials, and consumer staples. Heightened volatility in the stock market usually creates opportunities, and in the coming weeks we will manage our equity strategies with this in mind.

— Brandon Fitzpatrick, CFA

THIS PUBLICATION IS FOR INFORMATIONAL PURPOSES ONLY. THIS PUBLICATION IS IN NO WAY A SOLICITATION OR OFFER TO SELL SECURITIES OR INVESTMENT ADVISORY SERVICES, EXCEPT WHERE APPLICABLE, IN STATES WHERE DB FITZPATRICK IS REGISTERED OR WHERE AN EXEMPTION OR EXCLUSION FROM SUCH REGISTRATION EXISTS.

INFORMATION THROUGHOUT THIS PUBLICATION, WHETHER STOCK QUOTES, CHARTS, ARTICLES, OR ANY OTHER STATEMENT OR STATEMENTS REGARDING MARKET OR OTHER FINANCIAL INFORMATION, IS OBTAINED FROM SOURCES WHICH WE AND OUR SUPPLIERS BELIEVE RELIABLE, BUT WE DO NOT WARRANT OR GUARANTEE THE TIMELINESS OR ACCURACY OF THIS INFORMATION.

BLOOMBERG FINANCE L.P. IS THE SOURCE UTILIZED FOR GRAPHS THROUGHOUT THIS PUBLICATION. THE GRAPHS ARE USED WITH PERMISSION OF BLOOMBERG FINANCE L.P. NEITHER WE NOR OUR INFORMATION PROVIDERS SHALL BE LIABLE FOR ANY ERRORS OR INACCURACIES, REGARDLESS OF CAUSE, OR THE LACK OF TIMELINESS OF, OR FOR ANY DELAY OR INTERRUPTION IN THE TRANSMISSION THEREOF TO THE USER. THERE ARE NO WARRANTIES, EXPRESSED OR IMPLIED, AS TO ACCURACY, COMPLETENESS, OR RESULTS OBTAINED FROM ANY INFORMATION CONTAINED IN THIS PUBLICATION.

NOTHING IN THIS PUBLICATION SHOULD BE INTERPRETED TO STATE OR IMPLY THAT PAST RESULTS ARE AN INDICATION OF FUTURE PERFORMANCE.