EXPLORE A NEW OPPORTUNITY TO INVEST - REITS

101

Financial Advice

A Real Estate Investment Trust (REIT) is a security that trades like a stock on the major exchanges and owns and in most cases operates income-producing real estate or related assets. Investors can buy and sell them like stocks throughout the trading session, since many of them are registered with the SEC. Properties in a REIT portfolio may include residential, commercial , industrial or even infrastructure projects .

YOU CAN INVEST ON REAL ESTATE WITHOUT HAVING TO BUY, MANAGE, OR FINANCE ANY PROPERTIES THEMSELVES. TAKE A BRIEF LOOK OF THE ADVANTAGES REITS OFFERED TO INVESTORS

1

WHY IS A GOOD OPTION?

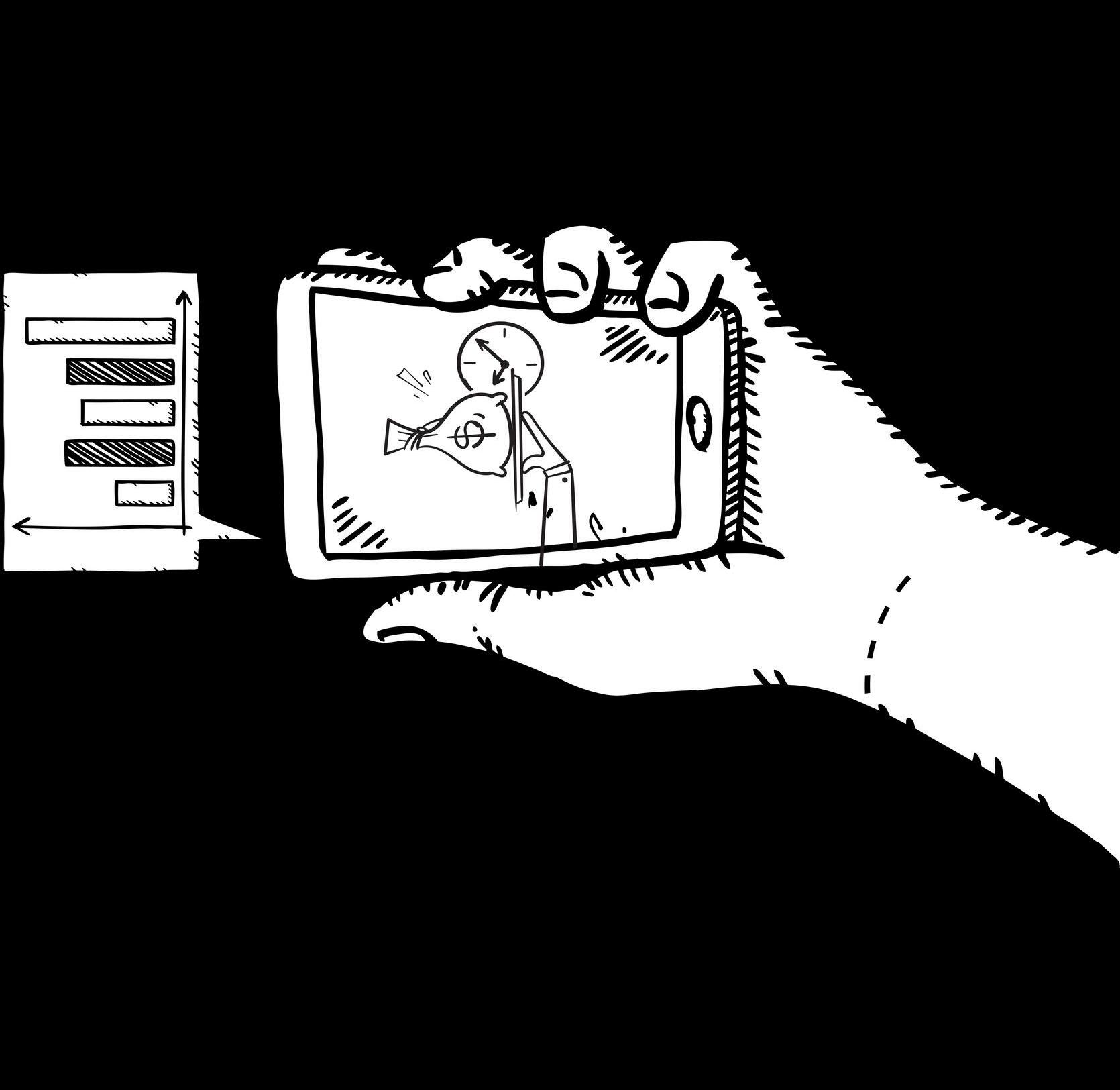

Diversification

Higher Yield more Liquidity

SinceREITsreceivespecialtax considerations theytypically payoutahigherrateof dividendsthanequitiesor manyfixedincome investments.REITs sharescan beredeemforcashatany moment.

Asaconsequenceof diversification,riskisminimized. Buildingdiversifiedportfolioof one'sownrentalpropertiesisto riskyandrequireabigger investment.

Long-term performance

4

attractive risk-adjusted returns and stable cash flow

REITshavehistoricallyproduced solidreturns. Theyalsocan serveasaneffectivehedge againstrisinginflationrates

Transparency

They'realsorequiredtoreport theirfinancialresultstotheSEC

earn income from the real estate market, without having to buy or manage properties themselves

2 1 2

3

WHAT ARE THE TYPES OF REITS? AND WHICH ONE BEST SUITS YOUR NEEDS

The investor will be able to choose from a wide variety of REITs

Equity REITs Retail REITs Residential REITs

Ownandmanagepropertiesand collectpaymentsfromtenants. Revenuesaregeneratedprimarily throughrents

Ownandoperateavarietyof commercialpropertiessuchas shoppingmalls,officebuildings, anddatawarehouses.They generateincomefromrents receivedfromtenants.

Ownandoperateavarietyof residentialhousingproperties. Theseincludemulti family apartments,studenthousing,and evensingle familyhomes.

Healthcare REITs

Investintherealestateof hospitals,medicalcenters,nursing facilities,andretirementhomes

Mortgage REITs

Investinmortgagesandderive theirincomefrominterest payments.

3

WHAT COULD BE THE ASSOCIATED RISKS? HOW TO AVOID THEM?

Understand those risks that investors needs to mitigate when they invest in REITs

Real Estate Risk

Fluctuationsinpropertyvalue,leasingoccupancy, andgeographicdemand

Interest Rate

Interestrates, canaffectpropertyvaluesand occupancydemand

Occupancy rate

REITsmustmaintaincertainoccupancylevels

Real Estate Risk

REITscanhaveanarrowgeographicfocuswhere themajorityofthepropertyislocatedinaparticular areaorregion

Low Growth

REITsdon'toffermuchintermsofcapital appreciation.Aspartoftheirstructure,theymust pay90%ofincomebacktoinvestors

404 oops!

AVOID THESE MISTAKES

SELLINGATTHEBOTTOM NOTANALYZINGAREITCAREFULLY

LETTINGFEARKEEPYOUFROMBUYINGGOODREITS

ONLYCONCENTRATINGPOSITIONS,NOTDIVERSIFYING

SSUMINGTHINGSWILLRETURNTONORMALQUICKLY

4

andisnot

containedinthisdocument

offer

notbe

withrespecttothepurchaseorsale

Theinformation

isprovidedtoyouforinformationalpurposesonly

intendedtobean

orsolicitationofanoffer

ofanysecurityandshould

relieduponbyyouinevaluatingthemeritsofinvestingin securities. info@davosfinancial.com