In January, I accepted the opportunity to serve as the 10th president of the University of Virginia. This honor brings to mind so much of what has made the preceding years satisfying and rewarding — professionally and personally — while serving as Darden’s dean.

Gratitude doesn’t nearly cover the emotion, but I remain eternally grateful to you. I’m also grateful to Professor Mike Lenox, who selflessly and enthusiastically agreed to serve as Interim Dean while a search for Darden’s 10th dean is conducted this year.

Darden is in very good hands with Mike. He’s an incredible teacher, leader and innovator, and an even more extraordinary person. Mike is action-oriented and will continue to build on the School’s hard-earned reputation as the best business school in the country.

For these and so many other reasons, I enter the new year with boundless gratitude and optimism.

Darden’s past has provided the foundation for the world’s best student experience, delivered by our unmatched faculty. Our present demonstrates a moment of strength, with an earned reputation for excellence (Page 7) supported and strengthened by our recently concluded — and record-setting — Powered by Purpose campaign (Page 4).

And the future? That is the most inspiring of all. Darden holds immeasurable promise, defined by our ability to continue building on core strengths and values. That means investing in program and curricular innovations as well as a new generation of faculty and faculty research so that Darden remains on the cutting edge of business leadership. On Page 5, we explore the next generation of philanthropic support for Darden. On Page 24, we highlight the LaCross Institute’s thought leadership reflecting the urgency of the moment to ensure ethics are embedded in AI so that it serves the greater good.

In our cover story (Page 12), we look behind the curtain at the boom in data centers required to support AI’s growth. Darden professors and alumni help us answer how data centers can be better, more ethical neighbors to communities that are understandably skeptical of facilities that can strain local electricity and water supplies. With expert insights from our professors, Darden Executive Education & Lifelong Learning shares strategies for future-proofing supply chains amid global disruption (Page 18). The Darden community has invested meaningfully in lifelong learning, and I

“My boundless gratitude and excitement comes with zero doubt that the Darden community will continue to drive the School to great heights, and that the School’s mission to develop responsible leaders has never been more relevant or needed.

invite all alumni to engage with us to continue their professional and personal growth (Page 34).

To help empower us to enter 2026 with a positive mindset and practical tools, Professors Sean Martin and Bobby Parmar explore why imposter syndrome (Page 30) and persistent doubt (Page 11) might not be as threatening as we think, if we can reframe them as cues for learning, growth and problem-solving.

My boundless gratitude and excitement comes with zero doubt that the Darden community will continue to drive the School to great heights, and that the School’s mission to develop responsible leaders has never been more relevant or needed. I thank you for allowing me to be part of this wonderful place.

SCOTT C. BEARDSLEY President, University of Virginia, and Charles C. Abbott Professor of Business Administration, Darden School of Business

18

GLOBAL SUPPLY CHAINS ARE SHIFTING. HERE’S HOW COMPANIES CAN BE FUTURE READY.

Rapid changes are affecting supply chains. Darden experts provide four strategies for leaders to future-proof organizations facing supply chain disruption.

With a global data center building boom putting new strains on communities and local resources, Darden experts offer insights on how data centers can achieve business goals and be good corporate citizens.

The world is running out of time to embed ethics into AI’s foundations. The time is now to secure a future of ethical AI.

What if we’ve misunderstood the concept? And what if having thoughts that one might be an impostor isn’t entirely negative?

The Darden Report is published twice a year with private donations to the University of Virginia Darden School Foundation.

© 2026 Darden School Foundation Winter 2026, Volume 53, No. 1

University of Virginia Darden School of Business Office of Communication & Marketing P. O. Box 7225 Charlottesville, Virginia 22906-7225 USA communication@darden.virginia.edu

Mike Lenox

Interim Dean, University Professor and Tayloe Murphy Professor of Business Administration

Robert Weiler President, Darden School Foundation

Juliet K. Daum (TEP ’22) Chief Marketing and Communications Officer

EDITORS

Jay Hodgkins

McGregor McCance

ART DIRECTION & DESIGN

Hyphen

WRITERS

David Buie-Moltz

Lauren Foster

Dave Hendrick

Caroline Mackey

Molly Mitchell

Sally Parker

CLASS NOTES EDITOR

Egidijus Paurys

PHOTOGRAPHY

Tom Daly

Ali Johnson

Jack Looney

Caroline Mackey

Andrew Shurtleff

Sanjay Suchak

ILLUSTRATION

James Gilleard

Hyphen

Fien Jorissen

Daniel Liévano

Sébastien Plassard

ANSWER. John Fowler (MBA/JD ’84)

DARDEN THIS SUMMER announced the successful close of the Powered by Purpose campaign, with a total impact of $632 million including gifts, pledges, UVA matching funds and funds held outside Darden but designated for its exclusive benefit. The campaign galvanized support from more than 70 percent of Darden alumni.

“This campaign has been extraordinary in every sense,” said UVA President and former Darden Dean Scott Beardsley. “It’s a story of generosity, vision and trust in Darden’s mission. I’m deeply grateful to our alumni, donors, volunteers, faculty, staff, students, foundation and friends — this success

belongs to all of you.”

Launched publicly in October 2019, Powered by Purpose set an ambitious goal to secure $400 million in support for the people, programs and spaces that define the Darden experience. That first milestone was surpassed in April 2023 — well ahead of schedule. Milestone I delivered transformational investments in professorships, scholarships, the student experience, learning environments and key capital projects.

“The first milestone was about laying the foundation — and building belief,” said Jim Cooper (MBA ’84), Milestone I chair of the Powered by Purpose

campaign. “We set a bold goal and exceeded it by focusing on what matters most: students, faculty and the long-term vitality of the School. It was inspiring to see how the Darden community rose to meet the moment.”

Building on that success, the campaign entered Milestone II — Faculty Forward — a focused effort to strengthen faculty excellence. This phase increased support for research and teaching and elevated Darden’s faculty as global thought leaders. Milestone II proved especially successful, with the campaign ultimately achieving $200 million in total faculty support — the largest area of investment across both milestones.

→⃝ 29 endowed professorships and more than 100 scholarships created over the course of the campaign

→⃝ Batten Foundation Darden Worldwide Scholarship Program, established in March 2018

→⃝ Sands Family Grounds of UVA Darden DC Metro, opened in March 2018

→⃝ Sands Institute for Lifelong Learning, launched in October 2020

→⃝ The Forum Hotel, opened in April 2023

→⃝ C. Ray Smith Alumni Hall, rededicated in April 2023

→⃝ Tahija Arboretum & LaCross Botanical Gardens, fully dedicated in June 2024

→⃝ LaCross Institute for Ethical Artificial Intelligence in Business, launched in September 2024

→⃝ On-Grounds student housing, groundbreaking in October 2024

With the Powered by Purpose campaign complete, Darden is already looking ahead. The fall 2025 Powered by Purpose Campaign Final Report closed with a forward-looking section titled “The Unfinished Case” — a glimpse at the priorities shaping the School’s next chapter. The following excerpt from that report outlines how Darden will continue to invest in the people, programs and places that ensure the School’s enduring impact.

[Q] How do we create an environment where faculty thrive?

We’re fueling the ideas that change business and society by:

➀ Building the Initiative for Transformational Capitalism — uniting the Institute for Business in Society and the Olsson Center for Applied Ethics — to scale Darden’s leadership in ethics, sustainability and stakeholder capitalism.

➁ Building on the momentum of the Mayo Center for Asset Management to expand into areas such as private equity and venture capital — reflecting students’ growing interests and preparing them to navigate the future of finance.

➂ Growing the Bruner Fund for Faculty Excellence to attract and retain the world’s best teachers and scholars.

➃ Refreshing the Faculty Office Building to foster collaboration, spark innovation and give faculty room to grow. Because great teaching is what makes everything else possible.

[Q] How do we make a Darden education possible for every talented student?

Cost of attendance for the Full-Time MBA now tops $240,000. That’s a potential deal-breaker for far too many.

A fund for student excellence would provide flexible, need-based financial aid — unlocking potential and leveling the playing field for future MBAs. We’ve started. But we need to go further.

[Q] What happens when students don’t just attend Darden — they live it?

New on-Grounds housing will transform student life, learning and connection.

Construction continues, and there are still meaningful ways to invest in its future. Supporting this project isn’t just about buildings — it’s about community, competition and long-term sustainability.

Nearly nine out of 10 Darden Full-Time MBA Class of 2025 graduates who were seeking employment accepted a full-time job offer within three months of graduation.

The class also maintained a high median compensation of $175,000 base salary and $30,000 signing bonus for the fifth year in a row.

This year’s graduating class secured positions in top industries with 37.3% of graduates entering consulting, 26% entering financial services and 16.1% entering the technology industry. The number of students entering tech nearly doubled, from 26 students in the Class of 2024 to 47 students in the Class of 2025.

Darden’s most recent alumni can be found across the U.S. in the mid-Atlantic (25.3%), Northeast (25%), South (14.4%), West (13.4%), Southwest (12.3%) and Midwest (7.9%).

They will be joining leading global companies, including Amazon, Barclays, Bank of America, Boston Consulting Group, Capital One, Emerson, McKinsey, JP Morgan Chase, Bain, Visa and more.

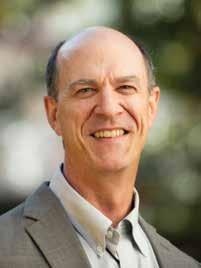

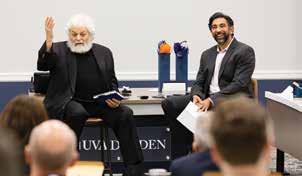

FOLLOWING THE APPOINTMENT of former Darden Dean Scott Beardsley as 10th president of the University of Virginia, the University in January named longtime Darden Professor Michael Lenox as interim dean of the School.

Darden is conducting a global search for a successor to Beardsley, whose term as UVA president began 1 January.

UVA Interim Executive Vice President and Provost Brie Gertler announced the selection of Lenox, outlining the veteran professor’s significant and varied roles serving both Darden and the greater UVA community.

“Mike has the experience, acumen, integrity, and deep familiarity with Darden’s values and programs to propel Darden forward,” Gertler said, adding that Lenox advised her that he will not apply for the role of Darden dean.

Darden’s 10th dean likely will be in place by fall 2026, Gertler said, adding that the Provost’s Office soon will provide additional information on the search and ways the School and UVA communities can contribute to the process.

Lenox joined the Darden faculty in 2008. He has served as senior associate dean and chief strategy officer, senior advisor to the dean, associate dean of innovation programs and executive director of the Batten Institute. He has served UVA more broadly by leading UVA Innovates, the University’s entrepreneurship initiative, and co-leading the development of the University’s strategic plan. He also serves as special advisor to the provost.

He holds a Ph.D. from MIT in technology management and policy and bachelor’s and master’s degrees in systems engineering from UVA.

Darden welcomed nearly 600 students to Grounds in Charlottesville in August at an “all-Darden” event, including members of the Full-Time MBA, Executive MBA, Part-Time MBA and Ph.D. programs. The Full-Time MBA and Executive MBA students will be part of the Class of 2027, while Part-Time MBA and Ph.D. students will earn their degrees at different paces.

STUDENTS

32 24 21 3.5 18 countries represented industries represented percent hold an advanced degree percent served in the military average undergraduate GPA Future Year Scholars

Darden also welcomed the Master of Science in business analytics (MSBA) Class of 2026 in August. The MSBA is presented jointly by Darden and the UVA McIntire School of Commerce.

28

Darden came out on top in The Princeton Review’s ranking.

Darden is ranked in the Top 5 in nine of 18 categories, the best the School has ever performed. The accolades include No. 1 in the country for Best Professors and No. 1 for Best MBA for Management. Overall, UVA Darden has 10 rankings in the Top 10 across all categories this year, tied with Northwestern University for the most among business schools. Over the last three years, no business school has had more Top 10 rankings than Darden.

Ten scholars joined Darden to start the academic year, bringing valuable knowledge in key areas such as finance, data analytics, decision sciences, strategy, entrepreneurship, communications, ethics, accounting and more.

Chen was on the business school faculty at Purdue University, and he earned a Ph.D. in finance from the University of Rochester. His research interests include empirical asset pricing, asset management, and short selling and securities lending. He will teach First Year finance and “Quantitative Portfolio Management.”

Before Darden, Delarue was an assistant professor at Georgia Tech in industrial engineering. He completed his Ph.D. in operations research, and his research focuses on marketplace and public sector operations. He will teach First Year core decision sciences courses.

Freed earned his Ph.D. in finance from the University of South Carolina. His research agenda focuses on household and behavioral finance, and he will teach First Year core finance courses.

Kathawalla was a visiting assistant professor at Georgetown University. She holds a Ph.D. from Harvard University, and she is an expert on the unconscious dynamics and defensive behaviors that impact learning, growth and change in organizations. She will be based at UVA Darden DC Metro, where she will teach negotiations in the professional format programs.

An expert in predictive analytics, AI and data science, McCormick joins Darden as a visiting scholar for the academic year. He will focus his attention on writing, industry research and curriculum development. He studied computer science at Worcester Polytechnic Institute.

Palley joins Darden from the faculty at Indiana University. He completed his Ph.D. in decision sciences from Duke University. His research uses tools from various decision sciences fields to help individuals and organizations make better decisions. He will arrive at Darden in January and teach core decision sciences courses.

McKean was most recently a post-doctoral fellow at the University of Utah. She completed her Ph.D. in management and organizations at Northwestern University. Her research interests focus on interactions between corporations, the state and stakeholders. She will teach the First Year core strategy course and “Strategic Analysis and Consulting.”

Before Darden, Phillips taught business ethics at York University. He received his Ph.D. from UVA. His research interests include stakeholder theory, network ethics and historic corporate responsibility. He will teach in the doctoral program and the First Year core ethics course.

Miller has been a research assistant professor at UVA’s Miller Center, and he earned his Ph.D. at UVA. He is an economic historian, and he examines the development of modern economic systems during periods of instability and volatility. Now in a full-time role at Darden, he will continue to teach business history electives on financial crises.

Shaffer comes to Darden from the faculty at the University of Southern California. He earned his doctorate from Harvard Business School. His research interests focus on valuation and corporate governance. At Darden, he will teach First Year core accounting courses.

TIME ‘MOST INFLUENTIAL PEOPLE IN AI’ AWARD HIGHLIGHTS FACULTY ACCOLADES

Gabe Adams won UVA’s All University Research Award.

“The Discount Rate for Investment Analysis Applying Expected Utility” by Manel Baucells and Sam Bodily was named co-winner of the 2024 best paper award by the Decision Analysis Journal

Peter Belmi won the UVA All University Teaching Award.

Rich Evans and co-authors won four awards for their paper “Cross-border Impact on Asset Managers”: the SFA Conference Best Investments Paper Award, 2025 FMA Asset Management Consortium Best Paper Award, Bolsas y Mercados Españoles-Six Research Grant and Antonio Dionis Soler Research Award.

Anton Korinek was named to TIME’s third-annual TIME100 AI list recognizing the 100 most influential people in artificial intelligence. Earlier in 2025, he was one of a handful of international experts selected to deliver a report to the G7 nations on how AI might affect the world’s leading economies.

Mike Lenox was awarded the Organizations & Natural Environment (ONE) Distinguished Scholar Award for 2025, given annually to distinguished scholars who have had a foundational impact on sustainability scholarship and leadership.

Panos Markou received the M&SOM Meritorious Service Award, recognizing excellent work by volunteer reviewers in service to the M&SOM journal.

Anthony Palomba was named to the 2025 Best 40-Under-40 MBA Professors list by Poets & Quants.

Saras Sarasvathy was awarded the Schumpeter School Prize for her outstanding academic achievements and pioneering contributions to entrepreneurship research.

From artificial intelligence to timeless wisdom from Confucius and lessons from Alexander Hamilton, new courses introduced in the 2025–26 academic year reflect Darden’s commitment to cutting-edge knowledge and enduring leadership principles.

ARTIFICIAL INTELLIGENCE FOR CUSTOMER GROWTH

This Marketing area course equips future business leaders with the tools to harness AI for customer acquisition, engagement and retention. Students will explore how advanced AI methods can transform traditional approaches through rapid experimentation, real-time optimization and hyper-personalized campaigns.

THE ANALECTS: TIMELESS WISDOM, CONFUCIAN THOUGHTS BECOMING GLOBAL STRATEGIST

Drawing from the deep traditions of Confucian philosophy, the course explores personal ethics in leadership, cross-cultural negotiations and sustainable development. Students will apply classical concepts to modern business challenges, developing a framework for ethical and effective global leadership.

DISRUPTIVE INNOVATION: WINNING IN NEW MARKETS AND PRODUCT CATEGORIES

This course examines how companies

succeed or fail when entering new-to-theworld markets. Students will learn to identify patterns of innovation and organizational behavior that determine whether strategies thrive in uncertain market conditions.

ALEXANDER HAMILTON: LESSONS IN MANAGEMENT, STRATEGY AND LEADERSHIP

Exploring the legacy of one of America’s most influential historical figures, the course examines Hamilton’s career and contributions through the lenses of finance, leadership, political economy and strategy. Students will gain insights into the intersection of history and management practice.

Students will engage deeply with the seminal works of entrepreneurship, learning to approach research as producers of knowledge. The course emphasizes developing complex arguments and contributing to impactful intellectual conversations in the field.

oubt is pervasive. So, too, is our reluctance to tackle it head-on, according to research and insights revealed in a new book by Professor Bobby Parmar.

Running away from uncomfortable moments of doubt and uncertainty exacts a price in our personal and professional lives, according to Parmar. In Radical Doubt: Turning Uncertainty Into Surefire Success, Parmar suggests this doesn’t have to be the case. Doubt can be an opportunity, rather than a threat. Parmar recently shared his thoughts on Radical Doubt with The Darden Report.

How is Radical Doubt different from other books about decision-making?

Most decision-making books try to get the reader to act like a machine. This is a decision-making book that tries to help you unleash your human talents and skills. That means

Bobby Parmar

Shannon G. Smith Bicentennial Professor of Business Administration

trying to understand multiple conflicting goals rather than trying to optimize a single goal, dealing with both quantitative and qualitative information instead of trying to get human beings to act like a robot and only deal with information that you can quantify. Your values, your beliefs, your perceptions, all of those are deeply human things that are sometimes discounted in traditional decision-making books.

Where’d you get the idea for this book and topic?

This is my 18th year at Darden, and I’ve taught leadership, innovation and design thinking, and business ethics. I’ve noticed that my students are really good at the technical problems, but they struggle with more complex decisions with multiple competing criteria and multiple interpretations. That got me really interested in how to help them.

Leaders can lack the skills for making these difficult decisions, but they need those skills. The more they move up in an organization, the more they have to deal with problems that cut across finance and accounting and operations and strategy, when there isn’t a simple, clear answer. There’s demand for people who are good at addressing these moments of doubt and a clear gap in the fact that there isn’t curriculum or research on how to do it.

You write that “the goal is to proceed wisely by training you to experience doubt as a catalyst

for learning.” Could you explain?

When we experience doubt, it’s because we have these conflicting perspectives about what we see in front of us and what we should do. Most of us experience doubt as a weakness, not as a signal for getting more curious or a signal for starting to learn more effectively. The book tries to make the case and to provide opportunities for the reader to experience the feeling of these multiple conflicting interpretations. Typically, because we associate the experience of doubt with feeling inferior or feeling weak, we give up too early in our decision-making process. We don’t frame the problem effectively. We don’t spend enough time generating alternatives or testing potential alternatives to learn about what would be effective. All kinds of counterproductive things happen when we experience doubt as a red flag rather than a green flag.

What do you mean when you suggest that we can get better at dealing with doubt?

When you’re doing a set of bicep curls or squats at the gym, the first couple of reps feel great, but you’re not actually getting any stronger. You’re just warming up. By rep eight and by rep nine, it hurts. It’s uncomfortable, but those are the reps where we’re actually building strength. And when we see doubt as, ‘I might be uncomfortable, but this is the part where I’m improving the way I think about something. This is the part where I’m learning some-

thing new,’ then it’s easier to lean into it rather than running from it.

What’s the cost of intentionally avoiding uncertainty and doubt?

You forgo the opportunity of improving the way that you think about the world. You rely on incomplete assumptions and beliefs to navigate the world, so you might end up wasting time and money and making decisions that you regret because they’re much more reactive.

How can a leader in an organization help their teams in the workplace?

The first is to be really careful to reward effort and learning versus only rewarding outcomes. Setting the expectation that we’re all going to grow and get better is important. Giving them some grace when they stumble is important.

The second thing is making sure that there are systems in place that promote learning. Before launching a product or a new process improvement or a change initiative, have a structured premortem where we think about the things that could go wrong. Then use that to improve plans. Conduct postmortems. What did we learn? What are we going to do differently next time? Finally, doubt is a lot scarier when our choices are irreversible, when we’re taking big risks. When leaders find small ways, experiments, small bets for people to learn with minimal investment and minimal cost, that makes doubt a lot easier to deal with.

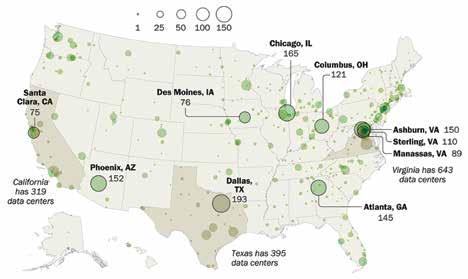

When several large data centers were proposed in Loudoun County, Virginia, a couple of years ago, residents learned the projects would be allowed “by right.” That means, they wouldn’t require public hearings or local government approval. Home to what is known as Data Center Alley, the county already has nearly 200 data centers with dozens more in the pipeline.

Public backlash was strong. Residents organized petitions and packed county planning meetings to protest the facilities’ scale, noise, water and electricity use, and architecture. As a result, the county board voted in March 2025 to end by-right zoning for data centers, requiring public review and special exceptions for future projects.

To Byrne Murphy (MBA ’86), who grew up in Northern Virginia and pioneered sustainable data centers in Europe, the conflict could have been avoided.

“Demand exploded so much and so fast, the industry struggled to catch up. These operators were under massive pressure to produce — so they did,” he says. “It’s the story of the product life cycle for most every explosive new product or industry. But the operators — and public officials — should have understood the implications of what was to come.” They did not take into account the wider context: the communities in which they operate.

Loudoun County is not alone. The growth of data centers is a global story, but developing them the right way has to start at the local level, says Murphy, owner of Kitebrook Partners. Murphy co-founded DigiPlex, one of the original data center operators in Europe, in 2001 and sold the company in 2021. Murphy launched Kitebrook

☀ There are somewhere between 5,000 and 5,500 data centers in the United States, according to various sources.

Exact totals are challenging to pin down.

☀ More than 2,200 additional data centers have been announced.

Source: Aterio

↓⃞ With booming demand for computing power, larger and louder data centers are coming to more communities around the world, where they are using more power and more water than prior generations of data centers.

Infrastructure, a developer of AI-enabled data centers, in 2023.

“Local is king. Context is key. Even in America, what happens in Texas doesn’t happen in Massachusetts doesn’t happen in Oregon. For water, power, zoning, architecture — context matters a lot.”

Data centers have been around since the 1950s, but they gained traction with the growth of the internet and were boosted again by the rise of cloud computing in the last decade. Since OpenAI’s public release of ChatGPT in November 2022, the exploding use of artificial intelligence has driven a new data center building boom.

Northern Virginia, Texas, Northern Illinois, Arizona and the Pacific Northwest are considered development hotbeds, but data center developers have proven they will go wherever they can successfully build a facility.

As the building boom advances, constraints in public resources are emerging. Disadvantaged communities that are dependent on electricity and water utilities are especially vulnerable, says Professor Vidya Mani, a supply chain expert. “If you want to create a data center, you have to be very careful to make sure that it doesn’t disadvantage a section of society that’s already suffering. It’s not a new societal problem or new ethical problem. It’s a new technology.”

Despite a fiercely competitive environment, operators can

find ways to align their goals with local needs, Murphy says.

“Let’s not be naive: The speed with which everything is happening is affecting how these projects roll out,” Murphy says. “If they roll out too big and too fast, and with zero consideration for the wider community, then bad outcomes result.”

One such outcome is that those communities are pushing back — with dramatic effect. Darden professors are focused on two critical resource constraints that businesses must navigate with communities and policymakers to align interests: electricity and water.

Electricity demand in the United States was relatively flat for more than 20 years, starting at the turn of the century, thanks to technology advances that improved energy efficiency. However, that has started to change rapidly in the last two years. AI and cloud computing are dramatically increasing electricity demand, and it’s only going to keep rising, says Professor Mike Lenox.

The problem isn’t just limited to finding enough energy supply to meet demand. The growth of data center-driven demand is expected to stretch some electricity transmission and distribution systems to — or past — the breaking point in the near future. Massive electric grid investments will be required to serve data centers, and local communities are increasingly protesting a cost-sharing system that can saddle residents with the cost of grid upgrades needed to serve a large corporation’s data center.

To find ways to responsibly develop data centers without harming the reliable, affordable electricity service communities depend on, stakeholders can embrace new ways to generate power, says Lenox.

Lenox believes one viable path forward leads to more reliance on renewable energy sources. The majority of new generation added to the electric grid in recent years has been solar, wind and battery storage systems. Even in the current policy environment, Lenox says, the economics of renewables are strong, and battery storage is addressing issues around the inability for renewables to provide energy when, for example, the wind is not blowing or the sun is not shining.

The way forward may include a new business model for utilities — a more distributed electric

↑⃞ Data centers consumed about 4.4% of total U.S. electricity in 2023, but are expected to use between 6.7% and 12% by 2028. Source: U.S. Department of Energy

☀ U.S. electricity demand is expected to grow 25% by 2030 from 2023 levels.

Source: ICF

☀ Almost all forecast electricity demand growth in the U.S. is attributable to data centers powering AI, cloud computing and other services.

Source: U.S. Department of Energy

grid with democratized participation by “prosumers” who both produce and consume electricity, Lenox says. This would be good news for individuals and businesses alike: Utilities orchestrate a system in which community solar, microgrids, and prosumers with rooftop solar and home batteries can buy and sell.

“This is a much more resilient, distributed, networked electrical system,” Lenox says. “All of this would be working in a very coordinated and complex system, which, ironically, will probably require AI solutions to manage.”

A growing number of data centers are also beginning to build or source their own energy from solar farms, wind turbines and natural gas turbines. Some are actively considering options not yet commercially available in the U.S., such as small nuclear reactors.

In 2001, DigiPlex chose Norway for its first data center in large part because of abundant hydroelectric potential. Early on, few cared that its data centers ran on 100% sustainable energy, Murphy says, but it was 30 or 40 percent less expensive to power than with fossil fuels. Word spread.

With today’s 100- to 500-megawatt centers, he says, companies can realize billions in savings over time and support corporate sustainability goals at the same time.

“My point is, you can do very well while you also do a lot of good,” he says.

Water use in the United States has actually decreased since 1975, says Professor Peter Debaere, an expert in water economics. In general, water is being used much more productively, he says.

↑⃞ Data centers are increasingly located throughout the United States, but Northern Virginia remains the largest hub for data centers in the world with many new facilities in the development pipeline. Source: Pew Research

☀ U.S. data centers withdraw 449 million gallons of water per day and 163.7 billion gallons annually, as of 2021. ↓⃞

☀ Large data centers can withdraw up to 5 million gallons per day, equivalent to the water use of a town populated by 10,000 to 50,000 people. ↓⃞

However, water issues are local. Data centers have recently been linked to water shortages and quality issues in places like Newton County, Georgia, and Goose Creek, South Carolina. In dry western states, agriculture is by far the largest water user, but data center growth in hubs like Phoenix, Arizona, and Southern California is adding stress to an already challenging situation. Debaere notes that data center water use will create more value per gallon used than many agricultural uses of limited value, so the conversation about water’s best uses is a complicated one, but the bottom line is still new demand for an already limited resource in the desert.

Large data centers can use up to 5 million gallons per day, depending on the cooling technology they withdraw, according to the Environmental and Energy Study Institute. What’s more, the latest high-power chips being developed for AI use cases require liquid cooling systems, which means data center water withdrawl could surge in the coming years. While much of this water can be preserved in closed-loop systems or returned to water sources through open-loop systems, the reality is that many data centers purchase water from public utilities and allow it to evaporate into the atmosphere after use.

☀ A medium-sized data center can withdraw up to roughly 110 million gallons of water per year for cooling purposes, equivalent to the annual usage of 1,000 households.

Source: Environmental and Energy Study Institute

Debaere urges companies to be more transparent about water. Though some data is publicly available, data center companies aren’t required to disclose how much water they use to cool their facilities and equipment.

“Getting data on the actual water use is not so easy,” he says. “But if you want to manage water, you’ve got to know what you can expect — and also, whether there are plans to expand and

whether the water use would increase.”

Operators are exploring and using new cooling and energy technologies that conserve water: Closedloop systems continuously recycle and reuse chilled water. Liquid and immersion cooling and gray water systems that use municipally treated wastewater don’t require as much fresh water. Renewable energy sources like solar, wind and batteries also don’t use water, whereas nuclear, natural gas and other steam turbine-based sources of generation do.

Water needs to be more than an afterthought for both the community and the developer, Debaere says. Before a project is greenlit, the right policies need to be ironed out, including cost-sharing agreements for infrastructure upgrades.

“Upfront cost-sharing for specific investments these companies need for their water can be a way of ensuring that, whatever happens in this uncertain environment, communities are not left holding the bag.”

Big tech firms have a responsibility to invest in the communities in which they operate, and this is often folded into their sustainability goals, Mani says. Developers can help innovate new ways of partnering with policymakers, utilities and municipalities to help prevent surprises down the road.

“We can get all of this done. It just requires that initial thought to make this work,” she says.

It’s a tall order for the data center operators moving at warp speed in this space, Murphy says. “The pressure is unbelievably intense. There is a firstand second-mover advantage, but the sentiment is that if you’re a distant third or fourth mover, you may be out of business.”

However, Murphy believes they don’t have a choice when it comes to aligning interests with communities over the use of resources as critical as electricity and water.

“Change is coming, whether the data center operators embrace it or whether it’s forced upon them,” he says. “There will be those who adapt faster, more efficiently, and thereby offer a more palatable product locally. In turn, by taking into consideration all the stakeholders, they are offering a more viable long-term solution. Those that implement such a delivery model will become the disruptors, and they shall reap their just rewards.”

WRITTEN BY DAVE HENDRICK

HERE’S HOW COMPANIES CAN BE ‘FUTURE READY.’

In early 2025, the Trump administration’s plans for wide-ranging tariffs on all imported goods both altered traditional supply chains and put new emphasis on reshoring efforts in the United States. Dramatically altering global supply chains built on free trade principles became not just an aspiration but an imperative for many organizations.

Yet rethinking and, in many cases, reversing longstanding logistics practices is no easy task. According to Darden Professors Doug Thomas and Vidya Mani, issues at the heart of the latest instances of supply chain tumult are unlikely to become less complicated.

The two Darden Operations area professors believe today’s organizations can expect greater changes in global supply chains than at

any time in the past 30 years.

The rapidly shifting terrain can lead to decision paralysis, but forward-thinking organizations are moving ahead despite the uncertainty and ambiguity. The professors’ research suggests organizations can remain future-ready by both fully understanding the key factors driving global supply chain changes and, once the landscape is understood, committing to key elements in organizational transformation.

While tariffs attract outsized attention in the current supply chain discussion, trade and economic policy is just one of the four key factors that make the current moment more dynamic than at any time in the past 30 years. Also driving shifts: consumer and investor preferences, emerging technology, and instilling resilience. Before making strategic decisions or revamping an organization for the future, leaders must be aware of the forces impacting supply chains across four key factors, according to Thomas and Mani.

Economic policies are created to protect countries’ national interests and reflect the relative bargaining power in the global supply chain. They include trade agreements, import and export controls, subsidies, sanctions and more. Today’s policies are unprecedented in scale, scope and the intricacies of their details — with complex rules related to products, components, and manufacturing and labor practices. While specific tariff pressures remained in flux in late 2025, it has become clear that a new era of uncertainty with highly detailed policies will continue to lead to a tactical reshaping of supply chains.

There is an increase in consumer concern for fair trade and ethical sourcing, which can be seen in purchasing decisions when an economy is considered strong. Affordability concerns dominate during inflationary and recessionary periods. Evolving consumer preferences and continued capital flows into environmental, social and governance (ESG) funds suggest transparency in supply chains and sourcing will continue to be a major factor.

Increased automation and advances such as artificial intelligence, blockchain and 3-D printing are reducing the importance of inexpensive labor and potentially making it more economical to manufacture closer to points of consumption. Additionally, the ability to capture more data than ever has a range of implications for potential enhancement.

Resilience has been a popular and elusive goal for those working in supply chains for generations. Shocks to the system are routinely deemed to be a “wake-up call” that will lead to diversified, resilient supply chains, only for organizations to fall back on the familiar.

Given the unprecedented shifts taking place, as noted in the preceding three factors, true resilience has never been more urgent. Organizations that succeed will increasingly understand that resilience is a strategy, not a contingency.

Once fully conversant in the forces buffeting global supply chains, leaders can turn toward ensuring long-term competitiveness. According to Thomas and Mani, organizations interested in leading on futureready supply chains should commit to four principles.

Every organization aspires to peak operational performance, but how is that defined? Are leaders laser-focused on operational excellence or is the door open to inertia? Perhaps more importantly, how is operational excellence measured? Organizations prepared for the rapidly shifting production terrain create key performance indicators and organizational structures with end-to-end views.

Business fundamentals still apply, which means retaining and promoting good people is critical. Organizations with the desire to lead must prioritize talent development, and end-to-end coordination must be ensured through roles and structures. There are opportunities to use AI to automate simple tasks, opening new windows for talented employees.

While processes and roles are formalized, they are not rigid. Resilient organizations have learned to instill a culture of experimentation and even risk-taking. Encouraging this mindset allows teams to find opportunities and solve messy problems, particularly around segmentation and end-to-end analysis.

WHAT IF, INSTEAD OF WAITING FOR THE NEXT MANUFACTURING CRISIS, ORGANIZATIONS EFFECTIVELY STRESS TESTED THEIR GLOBAL SUPPLY CHAINS TO ENSURE READINESS?

New technologies and data capabilities have opened new pathways for enterprising organizations. Data-backed inventory planning has changed many previously standardized practices. Organizations embracing data-driven capabilities have new opportunities to set safety stock levels and can use bootstrapping techniques — essentially, resampling from historical data — to anticipate complex demand patterns. Organizations embracing these techniques are gaining supply chain flexibility and accuracy not available to many of their peers.

What if, instead of waiting for the next manufacturing crisis, organizations effectively stress tested their supply chains to ensure readiness?

Financial institutions must show evidence of adequate liquidity and their ability to manage through a crisis. No such imperative exists for supply chains. In the absence of industry-wide measures intended to protect vulnerable supply chains, savvy organizations can consider their sourcing capabilities through a heightened strategic lens, working through the needs of today while anticipating challenges of tomorrow. As leaders become aware of vulnerabilities and chokepoints, stress testing may lead to significant revamping while other organizations may proceed with a clearer understanding of the road ahead.

Darden Executive Education & Lifelong Learning (EELL) celebrated its fifth consecutive year of being recognized by the Brandon Hall Group Human Capital Management Excellence Awards. EELL brought home eight awards for its custom client programs, bringing its total to 26 awards since 2021.

The awards are a testament to the strong partnerships EELL has built with its clients and highlight best practices across categories including learning and development, leadership development and the future of work. The awards, shared with EELL’s valued client partners, include:

Kohler Capability Accelerator — GOLD for Best Custom Content

Executive IQ by Money Management Institute —

GOLD for Best Executive Development Program, SILVER for Best Unique or Innovative Leadership Program, SILVER for Best Association Professional Development Program and SILVER for Best Leadership Development Program

AARP LeadUP — Bold Leadership for AARP’s Future — SILVER for Best Executive Development Program

PBS Executive Leadership Program — SILVER for Best Hybrid Learning Program

FanDuel Executive Leadership — BRONZE for Best Competencies and Skill Development

To design a custom client program with Darden EELL, reach out at darden.virginia. edu/executive-education/ contact.

RESILIENT ORGANIZATIONS HAVE LEARNED TO INSTILL A CULTURE OF EXPERIMENTATION AND EVEN RISK-TAKING. ENCOURAGING THIS MINDSET ALLOWS TEAMS TO FIND OPPORTUNITIES AND SOLVE MESSY PROBLEMS, PARTICULARLY AROUND SEGMENTATION AND ENDTO-END ANALYSIS.

Organizations taking the time to learn how to take strategic supply chain action in the new landscape have a map, meaning ambiguity will not lead to paralysis.

While the challenges are immense, they are not insurmountable, and solutions are available for those willing to put in the time and effort to learn the landscape and make strategic and sustainable sourcing, production and distribution decisions across the supply chain.

To support the development of leaders who understand today’s supply chain challenges and have the tools to manage through the uncertainty, contact Darden Executive Education & Lifelong Learning at www.darden.virginia.edu/executive-education.

As investment in artificial intelligence (AI) continues to surge, a critical element is not getting enough consideration, increasing risks to people, businesses and society.

University of Virginia President Scott Beardsley believes significantly more attention must be focused on ethics as it applies to AI, in theory and in practice.

“What’s going well is that the tools, frameworks and conceptual clarity for ethical AI exist and are advancing rapidly,” said Beardsley, former dean of Darden. “What’s going poorly is implementation. Many companies still treat ethics as optional, while structural risks like bias, opacity and concentration of power remain entrenched.”

Time is running short to make a meaningful difference.

The next five years, Beardsley said, will determine whether ethics are embedded as infrastructure — or patched in too late at greater cost.

Darden is leading in the effort to implement ethical AI. The subject also has emerged as a core focus for Darden in the classroom, in research and in thought leadership that helps businesses thrive.

Darden’s LaCross Institute for Ethical Artificial Intelligence in Business, launched in 2024, provides a nexus for AI-related knowledge creation and instruction across Darden and the University of Virginia.

Here are several key issues framing the urgency of the ethical AI challenge, identified from research and scholarship conducted by the LaCross Institute. Learn more at darden.virginia.edu/ lacross-ai-institute.

The technology is scaling faster than governance or safeguards can keep up. AI is already shaping people’s lives, the harms are real, regulation is behind and adoption is accelerating. Decisions made now will shape how AI is embedded into society for decades.

Ethics cannot be bolted on later. Waiting until AI is fully woven into critical systems to correct bias, opacity or governance failures will be like retrofitting seatbelts after cars are already on the road. The next five years represent a window of opportunity to embed ethical frameworks — before risks become locked in and irreversible.

The United Nations’ Ethical AI Agenda 2030 frames the next five years as a window of opportunity: close enough to demand immediate action but long enough to implement structural safeguards.

A “move fast and fix later” culture may work in consumer tech, but it is dangerous when applied to AI systems that determine creditworthiness or medical treatment. Once these systems are deployed, adding ethics after the fact is slower, costlier and harder to enforce. By 2030, AI will be so embedded in business and government infrastructure that retrofitting ethical standards may be nearly impossible.

Regulatory frameworks are fragmented and lagging. The EU AI Act, which comes fully into force in 2026, represents the first comprehensive regulatory regime. Elsewhere, the landscape is patchy: the U.S. has only partial guidance, while countries like Brazil, South Africa and Indonesia are still developing policies. AI is global, yet rules are national.

AI ethics is the academic and philosophical study of the moral, social and political issues raised by artificial intelligence. It is concerned with principles, frameworks and normative debates. It addresses the question: What should we do?

While they are related, they describe two perspectives: one theoretical, the other practical.

AI ethics is the academic and philosophical study of the moral, social and political issues raised by artificial intelligence. It is concerned with principles, frameworks and normative debates. It addresses the question: What should we do?

Ethical AI, by contrast, refers to the practical implementation of those principles in the design, development and deployment of AI systems. It is about ensuring that AI behaves in ways that are helpful, honest and harmless — not just in outputs but throughout the development lifecycle. It addresses the question: How do we actually do it?

AI ethics without ethical AI is toothless. Ethical AI without

AI ethics is aimless. Both are required. The current imbalance — heavy rhetoric on ethics, lighter focus on practice — is what makes this moment particularly risky.

The LaCross Institute frames ethical AI as a value chain — a set of end-to-end activities where ethics must be designed in and continuously verified. In this model, there are five interconnected stages:

• Infrastructure — compute, cloud, networks and their environmental footprint

• Measurement & Data — sourcing, preparing and governing data

• Models & Training — architecture, tuning and optimization choices

• Applications & Implementation — deployment into real workflows

• Management & Monitoring Outcomes — ongoing oversight and impact assessment

Each stage creates opportunities for value and distinct ethical risks that need controls and accountability built in from the start.

The value chain operationalizes ethics. It turns “be ethical” into who does what, when and with what evidence. It’s the difference between aspirational principles and repeatable management practice — and it’s how leaders make ethics part of AI’s ROI, not a bolt-on cost. cost. LaCross Institute Director Marc Ruggiono is the lead author of an institute white paper on the value chain of ethical AI that will be published in early 2026.

Too often, AI ethics have been treated as an afterthought rather than a core design principle. Organizations may sign on to broad “ethical principles,” but when it comes to building or deploying AI, ethics is bolted on late in the process, if at all.

Too often, AI ethics have been treated as an afterthought rather than a core design principle. Organizations may sign on to broad “ethical principles,” but when it comes to building or deploying AI, ethics is bolted on late in the process, if at all.

When ethics is left until the end, it is always the weakest link. Companies find themselves reacting to scandals instead of building trust and resilience.

Organizations often feel pressure from investors, boards or competitors to roll out AI products quickly. When AI is rushed, small errors can scale into systemic harms. For example, biased datasets may lead to discriminatory lending or hiring practices, which can then ripple across markets. Tesla’s Autopilot illustrates how pressure to launch quickly created gaps between what the system could do and how users perceived it — resulting in accidents and regulatory scrutiny.

Speed may provide a temporary competitive edge, but it often backfires. Flawed launches damage consumer trust, attract lawsuits and invite regulatory crackdowns. This creates reputational harm that outweighs early gains. Companies that chase speed without safeguards are gambling with trust, compliance and long-term sustainability.

Companies that are transparent and fair build stronger trust and brand loyalty. As the LaCross Institute emphasizes, “Helpful, Honest and Harmless” AI is not a brake on innovation but a foundation for sustainable growth.

Companies that build ethics into their AI strategy gain a dual advantage: They mitigate risks while building trust as a growth engine. Ethical AI is shifting from a cost center to a strategic asset. The companies that understand this early will be better positioned for the next decade.

From the actors who design, buy, deploy, insure and audit AI — especially large enterprises, standards bodies, multistakeholder consortia,

AI automates some analysis, but it elevates the need for leaders who can design systems that are reliable, fair and auditable in production. The MBA stays relevant by becoming the degree that teaches how to run the business of AI.

universities and civil society. In the near term, these players can move faster than legislation and shape norms through procurement, standards adoption and market discipline.

AI is automating pieces of analysis and content creation, but the managerial work that MBAs are trained to do — framing problems, balancing tradeoffs, governing risk and orchestrating crossfunctional execution — grows more important as AI scales. Rather than displacing MBAs, AI is creating management roles: AI product owner, model risk manager, AI procurement lead, responsible AI officer and data governance director. These roles reward graduates who can connect technical teams, legal and compliance functions, and profit and loss owners using shared frameworks and measurable controls.

AI automates some analysis, but it elevates the need for leaders who can design systems that are reliable, fair and auditable in production. The MBA stays relevant by becoming the degree that teaches how to run the business of AI or manage AI as a business function.

Companies that are transparent and fair build stronger trust and brand loyalty. As the LaCross Institute emphasizes, “Helpful, Honest and Harmless” AI is not a brake on innovation but a foundation for sustainable growth.

The LaCross Institute stands out through its operational, managerial focus — distinct from both theoretical ethics centers and purely technical AI labs.

It treats AI ethics as an operational, leadership-driven discipline embedded in research, education and practitioner engagement. Through robust funding, a value-chain management framework, ambitious academic programming and university-wide collaboration, it equips business leaders with real-world tools to govern AI ethically and effectively.

HOW MANAGERS CAN USE 4 DEBUNKED MYTHS TO HELP EMPLOYEES THRIVE

Impostor syndrome — more accurately called the impostor phenomenon — is often used to explain why capable people doubt themselves at work, despite clear evidence of their success. But what if we’ve misunderstood key parts of the story, including its definition? And what if having thoughts that one might be an impostor isn’t entirely negative?

A new integrative review, recently published in the Academy of Management Annals, challenges long-held assumptions and offers a more constructive perspective on impostor phenomenon.

Professor Sean Martin co-authored the paper with Basima Tewfik of MIT Sloan and Jeremy Yip of Georgetown. Drawing on nearly 50 years of research, the authors argue it’s time to reframe the conversation.

“When we dug into the literature it became incredibly clear, incredibly quickly, that the definition of the term ‘impostor syndrome’ was all over the place, and so were a lot of the findings,” says Martin. “A lot of people who were using the term were not talking about the same thing and were not using it correctly. They were using ‘impostor syndrome’ to mean things like cultural fit, or a sense of belonging or feeling like an underdog. And they were assuming that if you felt like an impostor, it must be a bad thing.”

The paper argues that the core of the impostor phenomenon has drifted from its original definition. At its heart, it’s a belief that others overestimate one’s abilities. But researchers and popular discourse have increasingly focused on emotions or feelings, such as fear, shame and not belonging.

IMPOSTOR THOUGHTS MIGHT BE LESS A WARNING SIGN — AND MORE A SIGN THAT YOU’RE GROWING.

To restore clarity, the authors call for a “course correction” that recenters the concept on the phenomenon’s cognitive origins. They propose a new term: “workplace impostor thoughts,” which Tewfik coined in an earlier paper.

The authors note these thoughts are often temporary, shaped by context and, in some cases, may even offer unexpected interpersonal benefits.

HOW IMPOSTOR SYNDROME WENT MAINSTREAM — AND GOT TWISTED

Interest in impostor syndrome has exploded in the past decade, thanks to media fascination with the idea that some famous and successful people think they’re faking it.

For example, Stephen Curry, the Golden State Warriors star considered the greatest shooter in the history of basketball, said he suf-

fers from impostor syndrome.

“I’m human,” Curry told CNBC during an interview. “Like everybody, you have doubts about yourself, you have impostor syndrome at times.”

Although impostor syndrome seems to be everywhere today, the concept dates back to the 1970s. Psychologists Pauline Clance and Suzanne Imes first introduced it as “impostor phenomenon” after noticing that many high-achieving women struggled with persistent feelings of intellectual fraudulence. They described it as an “internal experience of intellectual phoniness in people who believe that they are not intelligent, capable or creative despite evidence of high achievement.”

The concept gained traction with the rise of social media, which helped spawn a micro-industry of self-help books aimed at addressing impostor syndrome. It also became a popular topic at women’s leadership conferences.

While Clance and Imes described the phenomenon as an experience, rather than a pathology, over time the word “phenomenon” gave way to “syndrome” in the popular press. The definition also grew to encompass a range of feelings related to inauthenticity and a lack of belonging or feeling like an outsider. This, the authors say, “muddied the conceptual waters, especially because this affective influx is relatively recent.”

After examining 316 articles and books on impostor phenomenon, the authors found many of the assumptions about the concept to be “ill-founded or inadequate.” They identify four misconceptions about the impostor phenomenon and offer a counter-narrative for each.

sented groups, the evidence is mixed. The review notes that gender differences do sometimes emerge in specific settings, such as medical school students. But working professionals, in particular, don’t exhibit clear gender differences. This suggests that context plays a significant role in triggering impostor thoughts.

3.

Much of the existing research assumed that the impostor phenomenon is correlated with negative outcomes, such as stress or decreased self-esteem. But newer studies, including the authors’, show the effects are more nuanced. In fact, Tewfik’s research shows workplace impostor thoughts can have advantages. In her 2022 paper, “The Impostor Phenomenon Revisited: Examining the Relationship Between Workplace Impostor Thoughts and Interpersonal Effectiveness at Work,” she found that employees with more frequent workplace impostor thoughts may also be seen as more interpersonally effective at work and no less competent than those with fewer such thoughts.

4.

Many assume that impostor thoughts cause people to spiral into shame or avoidant behavior, but the research doesn’t clearly explain exactly why impostor thoughts cause outcomes, whether bad or good. The authors’ review of research finds that most studies fail to directly test the psychological mechanisms behind the phenomenon. Where they are tested, findings are mixed.

For Martin, who teaches and studies topics such as psychological safety, speaking truth to power and social class mobility, the paper has two big takeaways.

The trio argue that many scholars treat impostor phenomenon as stable and trait-like when, in reality, workplace impostor thoughts are more accurately viewed as transient and situational. This is why lead author Tewfik, who has researched the topic for more than a decade, started using the term “workplace impostor thoughts” to more accurately describe the experience.

1. 2.

THE IMPOSTOR PHENOMENON IS MORE PREVALENT AMONG WOMEN OR THOSE WITH MARGINALIZED IDENTITIES.

While many assume the impostor phenomenon is more prevalent among women or underrepre-

First, workplace culture. “If employees say they are experiencing impostor thoughts and are associating the feeling with negativity, that suggests they don’t feel safe,” he says. “What I hope is that managers think about whether they have created safe conditions for employees to grow.”

Second, an opportunity for reframing. “People who are experiencing workplace impostor thoughts should recognize that this is not something that is going to last forever. It can pass,” Martin says. “It’s also a sign that others think highly of you.”

In other words, impostor thoughts might be less a warning sign — and more a sign that you’re growing.

Professor Sean Martin is co-author of “Workplace Impostor Thoughts, Impostor Feelings, and Impostorism: An Integrative, Multidisciplinary Review of Research on the Impostor Phenomenon” (2025), with lead author Basima Tewfik of MIT Sloan and Jeremy Yip of Georgetown.

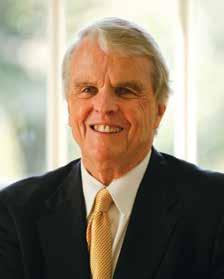

With over 40 years of affiliation with the Darden School, it’s more than fair to describe John Fowler Jr. (MBA/JD ’84) as an ambassador for the institution. His connection as a student in the 1980s sparked a passion that evolved into a feeling of responsibility to Darden across his lengthy career in investment banking (during which he hired many Darden graduates), his service as a member of the Darden School Foundation Board of Trustees, and even the ultimate insider view as a visiting lecturer using the case method to teach mergers and acquisitions.

After all that involvement, you could understand if Fowler decided to dial things back. But that’s not about to happen. In July, he began a two-year term as chair of the Board of Trustees.

“The School gave so much to me, and I had a transformational experience,” said Fowler, a “Triple Hoo” with an undergraduate history degree and a law degree from UVA to go along with his Darden MBA.

Fowler broadly defines his role as chair as helping the Board of Trustees, the Foundation and Darden leadership secure the resources to allow Darden to protect its hard-earned place among the world’s top business schools and to enable it to keep executing on the ambitious strategies that will define the future of a school approaching its 75th anniversary.

Darden is completely self-funded. It receives no operational support from UVA or the Commonwealth of Virginia. As such, it relies on philanthropy, tuition and revenues generated by the Foundation and the School’s own programs and initiatives. Fowler said part of his responsibility is to work with his fellow trustees and leadership to continue supporting the tremendous momentum the School has established through that model.

“We can’t take our foot off the gas pedal. We need to continue to play offense versus defense and ensure we have the resources and vision to

retain our well-earned reputation,” he said. “We have the best faculty, the best facilities and the best experience here. It’s a challenge, but my approach is to focus on how to keep doing what we’re doing, just even better.”

However Fowler fulfills that key leadership responsibility, it almost certainly will not be with fanfare. Across his years leading major investment banking operations, Fowler always preferred to do so without seeking attention. The approach was intentional.

“I’ve kept a lower profile as self-promotion is not my style. Plus, I was also working in a highly regulated industry,” he said. “Don’t be mistaken — surviving in the business that I did for 40 years, I am very competitive and outspoken. But I live by the mantra of ‘results count,’ so I don’t feel a need to blow my horn. To me, results speak for themselves.”

Fowler currently serves as executive chairman of Aonis Therapeutics, a drug discovery company that deploys artificial intelligence to investigate potential opportunities to reposition FDA-approved drugs for other unknown therapeutic indications. He retired in 2024 from Wells Fargo, where he served in a variety of roles, including most recently as vice chairman of corporate and investment banking. Previously, he held leadership and executive positions in investment banking at Deutsche Bank, JP Morgan & Co. and Salomon Brothers. He began his banking career in 1979 with Jefferson National Bank (now Wells Fargo) in Charlottesville after earning his undergraduate degree and before attending Darden.

Through the years, Fowler hired many MBAs from schools across the country. Even recognizing his potential inherent bias, the Darden graduates typically impressed him.

“The differentiation with Darden people is they work harder. They’re thoughtful and respectful. They’re doers,” he said. “They also tend to speak up more and ask questions and challenge you, which is something I look for in people.”

Martina Hund-Mejean (MBA ’88), former chair of the Foundation board and former CFO of Mastercard, described Fowler as a “down-toearth strategic thinker who works well across many different stakeholders.” She noted his success “quietly but effectively adding terrific new trustees” to the Board of Trustees over the years.

She said when she thinks of Fowler, she thinks of a phrase coined by John Strangfeld

THE

WITH DARDEN PEOPLE IS THEY WORK HARDER. THEY’RE THOUGHTFUL AND RESPECTFUL. THEY’RE DOERS.

(MBA ’77), former chairman and CEO of Prudential: “High impact, low ego and no drama. He truly represents the Darden way,” Hund-Mejean said of Fowler.

Jim Cooper (MBA ’84) is a member of the same Darden class as Fowler, and the two have shared time on the board over the years. Cooper said he’s confident that Fowler will have a successful term as chair, building on the success of strong chairs before him.

“He’s a problem-solver with a keen eye for the issues, both obvious and not so. And frankly, he just gets the job done,” Cooper said. “Darden has been on such an upward trajectory the past decade or so, and we all want to keep that momentum going. John will no doubt achieve that and more in his term.”

Now living in Charlottesville after retiring from Wells Fargo, Fowler laughed when asked why he returned. “Doesn’t every UVA grad want to come back to Charlottesville?” he asked.

The town’s allure for Wahoo alumni is unmistakable. And it’s got ahold of the Fowler family.

His wife, Corey Phillips Fowler, grew up in Charlottesville and also graduated from UVA. She is a photographic artist who enters juried shows and has had solo shows in Havana, Cuba, and Brooklyn, New York. John’s father, John Sr., is a UVA School of Law alumnus who also lives in town. One of Fowler’s two sons and the son’s wife are UVA grads who also moved back to Charlottesville. His other son and his daughter live, respectively, in Los Angeles, California, and Minneapolis, Minnesota, with their families. Fowler’s backyard backs up to the backyard of his brother Ed Fowler (MBA ’93).

Away from professional pursuits, Fowler enjoys gardening and raising vegetables, and in years past has home-brewed more than 100 bottles of hot pepper sauce annually for friends and family. Naturally, he also enjoys cooking and discovering new foods with his wife.

A voracious reader of history, spy and crime novels; nonfiction; news; and classics alike, Fowler rarely travels without his Kindle, filling any downtime with as many chapters as he can squeeze in. Recently, he re-read George Orwell’s classic dystopian novel 1984

Maybe something about reading widely and frequently — constantly gathering different stories, different perspectives — feeds back into why Fowler recalls his Darden experience so fondly and remains dedicated to the School thriving.

“Darden teaches you how to work with other people. It teaches you how to look at a problem, come up with solutions and recognize that there isn’t one answer,” he said. “You want people to be part of a team and community, to learn and be open, and to have, hopefully, a civil dialogue, which I’m all for, especially these days.”

Now, with the Powered by Purpose campaign over but much yet to be accomplished, Fowler said he’s excited to keep helping the Darden School in his new Foundation board role and any other way he can. It’s the same approach he favored during his years of leadership in business.

“Let’s go!” he said. “Let’s just get things done.”

Taught by the nation’s #1 ranked faculty, UVA Darden Executive Education equips you with the tools, confidence and network to deliver impact from day one. Sharpen your influence. Strengthen financial acumen. Unlock your team’s full potential. Rise higher — and bring others with you.

Darden alumni receive 20 percent discount.

SPRING 2026 PROGRAMS:

• Collaboration & Influence (Online, Self-Paced)

• Finance for Non-Financial Executives (Charlottesville, VA)

• Women in Leadership (Washington, D.C. Area, Hybrid)

• Leading Teams for Growth & Change (Charlottesville, VA)

BY MOLLY MITCHELL

When Kelly Thomson (MBA ’99) first stepped into an introductory microeconomics class in college, it wasn’t her idea. It was her father’s ultimatum. “He told me if I didn’t take an econ class, I’d have to pay him back for my college education,” she jokes. During her undergrad education, “that was the extent of anything quantitative.”

That one economics class was a small step that would ultimately lead Thomson down an unexpected path from a Russian language major in New Jersey to the boardroom of a sovereign wealth fund in Abu Dhabi.

Thomson fell in love with the Russian language in high school, and her interest grew in college, where she majored in Russian language and minored in political science and women’s studies.

“My dad thought I’d grow up to be a spy,” she says. “It was the mid-’80s, the height of the Cold War.”

But Russian language jobs were thin on the ground when she graduated, so she took a job at a nonprofit in Washington, D.C., funded by the U.S. State Department. While there, she read Banker to the Poor: Micro-lending and the Battle Against World Poverty by Muhammad Yunus, about the establishment of Grameen bank in Bangladesh, which makes very small loans to people who can’t access traditional banking. “I thought, this is it. This is what I want to do with my life. I want to go and do micro-lending in former Soviet countries.”

There was just one problem. She didn’t have any finance or economics experience, except for that one class in college. So she decided to go back to school and ended up at Darden, where she graduated in 1999, and today serves on the Darden School Foundation Board of Trustees.

Darden wasn’t easy at first as a student.

“I was terrified,” Thomson says. “In my first week, I realized that debit doesn’t always mean ‘minus’ and credit doesn’t always mean ‘plus’ in the world of accounting. It really rocked my world, and I thought, ‘I have made the biggest mistake of my life. I’m not going to get through this.’” But she credits “Learning Team Six, the most amazing learning team in the entire world,” for helping her succeed. “They kind of carried me through that first semester.”

Kelly’s plan was clear: learn finance, work in a bank and then go do micro-lending. Everything went to plan, except that the middle step — work in a bank — became her ultimate career. After a summer internship with Citi in New York City, New York, she was offered a full-time role and soon found herself climbing the ranks in investment banking. She moved to London, United Kingdom, with Citi and discovered a niche that appealed to her in project finance.

“You can actually go and kick the tires and see what it is that the money is being spent on,” she said. “I got really interested in that.”

One of her clients was Mubadala, a relatively new investment company owned by the government of Abu Dhabi. Eventually, they offered her a job. Thomson took the leap and moved her young family to the United Arab Emirates, where she would stay for the next decade of her life. At Mubadala, she found an environment full of possibility. “It was like the world was their oyster, and they exploded onto the scene and were just doing so many different things in so many different parts of the world. It was exciting and fun, and everyone was a little bit unconventional.”

She stayed at Mubadala when she moved back to the U.S. in 2017 and helped form its subsidiary Mubadala Capital a few years later,

“

I’M VERY PASSIONATE ABOUT THE PLACE.

I WOULDN’T HAVE THE LIFE I HAVE IF I HADN’T BEEN AT DARDEN.

where she is back to building things in a more entrepreneurial mode. “I’ve now been in finance for 27 years, and I’m still doing new things. I think it’s really cool,” she says.

Darden helped her along the way with more than the quantitative skills she needed to break into banking. “Darden teaches you the value of collaboration and partnership,” she says. “From Day One with your learning team, it creates people who are comfortable with collective recognition and collective responsibility.”

She links that skill to her success in Abu Dhabi, where consultation and collaboration are more important culturally. “It’s not a place where you get rewarded for being the standout individual; it’s a place where you get rewarded for what your team says about you, or how the firm as a whole does.”

While it was hard to stay connected to Darden in Abu Dhabi, Thomson was eager to get involved when she got back to the United States. She now serves on the Board of Trustees and previously served on the Darden Alumni Association Board of Directors.

“I’m very passionate about the place. I wouldn’t have the life I have if I hadn’t been at Darden,” she says.

As much as things have changed at Darden since Thomson graduated, the important things remain the same. “I think at its core, Darden is still doing all of the amazing things that it did when I was there,” she said. “And there’s always stuff to do to make things better. I’m excited about just being one single voice in that discussion.”

BY CAROLINE MACKEY

SkinnyPop Popcorn. C4 Energy. Waterloo Spar kling Water.

If you’ve heard of these brands, you’ve seen the impact of Brian Goldberg (MBA ’02), whose career has spanned building, investing and advising some of the most recognizable names in consumer-packaged goods.

“I spent my 20s on a more traditional big-company track,” Goldberg said. “But as I was approaching my 30s, I wanted to pursue a more entrepreneurial career path.”

He enrolled at Darden to open new doors. After earning his MBA, Goldberg joined Pfizer, then moved to New Capital Partners, an investment firm where he discovered a defining opportunity.

“I was looking at investing in a startup beverage company based in Austin, Texas, called Sweet Leaf Tea,” he said. “I ended up moving into that company as CFO and COO to partner with the founder, and we built that company over about a five-year period and sold the business to Nestlé in 2011.”

Leaving behind a stable career for Sweet Leaf was a risk. “I took an 80 percent pay cut and did it for the equity upside,” Goldberg said. “I bet on myself and bet on the company.”

Not long after Sweet Leaf, Goldberg took on one of his most high-profile ventures: SkinnyPop Popcorn.

“When we acquired it in 2014 in partnership with private equity firm TA Associates, it only had four employees,” he said. “It was a real business, but it didn’t have the basics. Within one year, we took the company public.”

In 2018, Amplify Snack Brands, SkinnyPop’s parent company, was sold to Hershey for $1.6 billion, one of the bigger exits of Goldberg’s career. His next move was to invest in and join the board of a startup called Waterloo Sparkling Water, which had a sizable exit to

“

AS LONG AS YOU HAVE VALUES-BASED LEADERSHIP AND STRONG BUSINESS FUNDAMENTALS, YOU CAN TACKLE AN EXTRAORDINARY RANGE OF CHALLENGES.

private equity in 2020.

In 2020, Goldberg launched Redbud Brands, a venture studio and holding company focused on creating and scaling early-stage consumer businesses. That same year, he began building an institutional investment strategy to back later-stage brands, which became Asto Consumer Partners, a $350 million private equity fund. Via this strategy, Goldberg has invested in brands such as Nutrabolt (C4 Energy), Kitsch, Torani, BeatBox, Physician’s Choice, Clean Skin Club and Overnight Oats.

Goldberg said his time at Darden reshaped how he viewed leadership.

“I came in as an accounting major, so I was already very analytical and finance focused,” he said. “What I didn’t fully appreciate until Darden was the importance of soft skills. I thought finance and quantitative stuff were what made people stand out in their careers. In reality, it’s the relationships and how you manage and work with people.”