By the numbers: A year in sneaker resale with power seller Mustafa Hamed

Danny Parisi Jan 3, 2024 • 4 min read

Sneaker resale is big business. The market is currently worth around $2 billion globally, and it’s expected to grow to $30 billion by 2030.

But for the individual sellers who make their living from the business of buying and selling sneakers, it can be a risky vocation even as the market sees continued growth. Mustafa Hamed, a reseller who sells millions of dollars worth of sneakers through StockX every year, said the business has grown increasingly cutthroat as more people see the opportunity and enter the market.

“I’m lucky in that I got into it before Covid so I had to learn what sells,” Hamed said. He noted that the boom in sneaker resale during the pandemic meant new sellers could flip things easily, despite never having learned the skill of identifying a hot-selling item before

it blows up. A former minor league baseball player, Hamed took to sneaker reselling in 2017 when he sold a pair of Nike Bearbrick SB Dunks and made a $70 profit.

Hamed agreed to walk Glossy through some of the numbers of his most recent year of reselling sneakers to give a glimpse into what the business looks like from the perspective of an established seller.

In 2023, Hamed sold more than 50,000 pairs of sneakers with a total product value of over $6 million. He can process as many as 1,000 orders in a single day, though he typically sells about 1,500 pairs a week and 5,000-8,000 per month. He attributes his efficiency to StockX Pro, a dashboard of features on the StockX platform that is geared toward power sellers. It lets them edit and update listings at a rate of 1,000 items in an hour. Processing an order involves accepting a payment and beginning the shipping process, which is completed by StockX.

“One day, I got home from the gym at 11:30 and finished 200 orders by 11:55,” Hamed said.

Early on in his career as a reseller, Hamed ran the operation alone, but in the last year, he was able to expand the business. His girlfriend helps co-manage the business, plus, ahead of Black Friday, he hired three full-time permanent employees to fulfill orders. While he used to house stacks of shoeboxes in his house, he now uses a StockXowned warehouse in New Jersey. Black Friday is a particularly big time of the year for sneakers. In October, Hamed stored 6,000 pairs of shoes in the New Jersey warehouse, and after Black Friday, only a thousand remained.

Sellers on StockX are anonymous, and Hamed doesn’t advertise his business anywhere. Instead, success on the platform is simply a matter of anticipating what’s going to be popular and stocking up

accordingly. Hamed said choosing shoes that eventually have a high resale value is based on a mix of art and science.

“You have to be 100% in; you have to pick up on trends before anyone else if you want to make some money,” Hamed said. “Like the [Adidas] Samba trend that was big [in 2022.] It’s a $100 shoe, but they were selling at 250% of retail, like $250. That’s an insane markup if you can be ahead enough to buy them up at the retail price.”

Hamed said the profit margin on Sambas was exceptionally high. He sources his sneakers from a variety of places and typically pays close to retail price for them. The biggest challenge with sourcing, Hamed said, is outpacing the bots that some sellers use to automatically buy hyped sneakers the moment they drop. Brands like Nike have taken steps to inhibit the bots, but the problem still persists throughout the industry.

He cited Uggs as another big seller last year. He sold 4,000 pairs of them in 2023. Other major sellers were the Nike SB Dunk Panda and white-on-white Air Force 1s. Considering the brand’s dominance in the industry, it should come as no surprise that Nike was, by far, the best-selling brand in Hamed’s portfolio. Adidas and New Balance were also big sellers, along with Crocs.

But despite the positive growth, the business of reselling sneakers requires risk-taking. Hamed said he can spend up to $200,000 when buying up a sneaker’s inventory in bulk, but if the shoe doesn’t sell through, he sees a loss. One sneaker he took a $200,000 bet on last year was the Nike Air Max 1 Ironstone, which ended up being his biggest selling product of the year. But not every risk pays off. While he declined to offer specific numbers, Hamed made a similarly big bet on the viral MSCHF Big Red Boots, which resulted in a “fat loss”,

My Notes:

Jan 3, 2024

$30 billion by 2030

Page 1

more people see the opportunity and enter the market

Page 2

In 2023, Hamed sold more than 50,000 pairs of sneakers with a total product value of over $6 million. He can process as many as 1,000 orders in a single day, though he typically sells about 1,500 pairs a week and 5,000-8,000 per month.

Sellers on StockX are anonymous,

Page 3

choosing shoes that eventually have a high resale value is based on a mix of art and science.

“You have to be 100% in; you have to pick up on trends before anyone else if you want to make some money,”

sources his sneakers from a variety of places and typically pays close to retail price for them.

bots that some sellers use to automatically buy hyped sneakers not every risk pays off.

Kicks for the Planet: How Sneakers are Going Green

Sustainability is becoming increasingly important in the fashion industry, and the sneaker industry is no exception. Sneaker production has a significant environmental impact, from the sourcing of materials to manufacturing and distribution. However, many sneaker brands are taking steps to address sustainability issues in their production processes.

The Environmental Impact of Sneaker Production

Sneaker production has a significant environmental impact. The production of sneakers contributes 1.4% of global greenhouse gas emissions. To put that in perspective – aviation industry is responsible for the 1.9% of global green house gas emissions. However, the use of synthetic, fossil fuel-based materials and toxic glues make sneaker manufacturing energy-intensive and polluting. Moreover, the limited recycling of sneakers adds to the pollution in landfills. As athleisure trend continues, it is crucial for retailers to prioritize sustainability in the ever-growing sneaker market to reduce its impact on the environment.

Sustainable Sneaker – A growing trend

According to projections, the sustainable footwear industry is anticipated to achieve a market worth of $11.8 billion by 2027, registering a compound annual growth rate of 5.8% from 2020 to 2027. This trend is corroborated by Google data, which reveals a global surge in searches for “sustainable sneakers” over the last five years. The results reflect consumer expectations for greater

accountability from retailers and a shift towards sustainable innovation, especially in the athletic shoe segment. Veja, Adidas, and Nike are the most popular brands for eco-friendly sneaker designs, placing them in direct competition in this sector

Sourcing from India for Sustainable Materials

India is a leading producer of sustainable materials used in the fashion industry. According to a 2018 report by the Textile Exchange, India is the largest producer of organic cotton in the world, with a 51% share of global production. Organic cotton is a sustainable material commonly used in sneaker production.

In addition, India has a growing bio-based materials industry, including pineapple leather and other plant-based alternatives to traditional leather. These materials are more sustainable and environmentally friendly than traditional leather, which is often produced using toxic chemicals and has a significant environmental impact.

Sourcing sustainable materials from India can also benefit local communities and economies. For instance, PUMA sources organic cotton from Indian farmers and works with them to promote sustainable farming practices. By supporting local communities and promoting sustainability, sneaker brands can make a positive impact on the environment and society.

Waste Reduction in Sneaker Production

Waste reduction is another important aspect of sustainable sneaker production. Circular design, closed-loop manufacturing, and recycling programs are just a few examples of waste reduction strategies being used by sneaker brands.

For instance, Adidas has introduced the Futurecraft Loop, a sneaker made entirely from recycled materials that can be returned to the company to be recycled into new sneakers. Nike has also launched a sneaker recycling program that turns old sneakers into new products.

Consumer Awareness and Responsibility

Consumer awareness and responsibility are crucial in promoting sustainable practices in the sneaker industry. Consumers can support sustainable sneaker production by buying from sustainable brands, repairing and reselling sneakers, and recycling old sneakers.

For instance, the resale market for sneakers is growing rapidly. According to a 2021 report by the resale platform StockX, the global sneaker resale market is projected to reach $30 billion by 2030. Buying and reselling sneakers promotes sustainability by extending the lifespan of products and reducing waste.

Future is brightest

The sneaker industry is taking steps to address sustainability issues, such as the use of sustainable materials and waste reduction. Sourcing sustainable materials from India can be particularly beneficial, as India is a leading producer of organic cotton and biobased materials. By promoting sustainability and supporting local communities. When exploring sourcing from India its best to have a reliable partner who has deep rooted understanding of the Indian market. Moglix, has been working with 15000+ reliable and compliant Indian suppliers across multiple industries in the manufacturing and procurement landscape for almost a decade. Zoglix which is part of the Moglix group is dedicated towards developing an ecosystem of frictionless sourcing from India for procurement leaders in the USA. Know more.

My Notes:

Page 1

Sneaker production has a significant environmental impact. The production of sneakers contributes 1.4% of global greenhouse gas emissions.

the use of synthetic, fossil fuel-based materials and toxic glues make sneaker manufacturing energy-intensive and polluting

limited recycling of sneakers adds to the pollution in landfills.

sustainable footwear industry is anticipated to achieve a market worth of $11.8 billion by 2027, registering a compound annual growth rate of 5.8% from 2020 to 2027.

global surge in searches for “sustainable sneakers”

Page 2

India is the largest producer of organic cotton in the world, with a 51% share of global production

India has a growing bio-based materials industry, including pineapple leather and other plant-based alternatives to traditional leather.

Further research the production processes of these materials.

PUMA sources organic cotton from Indian farmers and works with them to promote sustainable farming practices. By supporting local communities and promoting sustainability, sneaker brands can make a positive impact on the environment and society.

Circular design, closed-loop manufacturing, and recycling programs

Page 3

Adidas has introduced the Futurecraft Loop, a sneaker made entirely from recycled materials that can be returned to the company to be recycled into new sneakers

repairing and reselling sneakers, global sneaker resale market is projected to reach $30 billion by 2030.

Buying and reselling sneakers promotes sustainability by extending the lifespan of products and reducing waste.

Zoglix which is part of the Moglix group is dedicated towards developing an ecosystem of frictionless sourcing from India for procurement leaders in the USA.

The sneaker resale market in 2023

Limited editions

One major factor is the increasing consumer demand for limited edition and exclusive sneakers. Many sneaker enthusiasts, particularly those who are considered "sneakerheads," are willing to pay a premium for rare and hard-to-find sneakers, which has led to a thriving market for reselling these types of shoes.

This demand for limited edition and exclusive sneakers has led to a number of major brands and retailers releasing limited runs of their most popular shoe models. These releases are often highly sought after by sneaker enthusiasts and can sell out quickly, leading to a scarcity of the shoes on the secondary market. This scarcity, in turn, drives up the prices of the shoes, making them more valuable to resellers.

In addition to the scarcity of limited edition and exclusive sneakers, another major factor driving the sneaker reselling market is the cultural significance of certain shoes. Many sneakers have become cultural icons, with certain models and collaborations being highly sought after by collectors and enthusiasts. This has led to a market in which certain shoes can command extremely high prices, even years after their initial release. The most valuable sneakers are from collaborations and limited-edition releases. Brands such as Nike, Adidas, and Jordan continue to dominate the market, but there is also a growing demand for lesser-known brands and

Unique Nike Dunk Low Pro SB ‘Paris’ (2005) - @elie costa & @hichem.og

independent designers. These collaborations and limited-edition releases have created hype and exclusivity, making them more valuable in the secondary market.

Marketplaces

Another key factor that has contributed to the growth of the sneaker reselling market is the rise of online marketplaces and social media platforms that make it easier for buyers and sellers to connect. These platforms have revolutionised the way people buy and sell sneakers, making it easier for people to find and purchase the sneakers they want, as well as for sellers to reach a wider audience and sell their sneakers at a higher price.

Online marketplaces such as eBay, StockX, GOAT and other similar sites have become go-to destinations for sneaker enthusiasts looking to buy and sell limited edition and exclusive sneakers. These platforms offer a wide variety of sneakers and make it easy for buyers to search for and purchase the shoes they want. They also provide a safe and secure way for sellers to list their sneakers and reach a large audience of potential buyers.

Social media platforms such as Instagram, Twitter, and Facebook have also played a major role in the sneaker reselling market by providing a platform for sneaker enthusiasts to connect, share information about upcoming releases, and sell their sneakers. These platforms have made it easier for sellers to reach a wider audience and have also helped to create a sense of community and culture around sneaker collecting and reselling.

Overall, the rise of online marketplaces and social media

StockX website (as of January 2023)

platforms has made it easier for buyers and sellers to connect and has played a major role in the growth of the sneaker reselling market. These platforms have made it easier for people to find and purchase the sneakers they want and for sellers to reach a wider audience and sell their sneakers at a higher price, which has led to a thriving market for reselling sneakers.

A worldwide phenomenon

In terms of geography, the North American market is currently the largest for sneaker reselling, with the United States being the biggest contributor. This can be attributed to several factors, including the fact that the US has a large population and a strong culture of sneaker collecting and reselling. The US sneaker market is driven by a combination of factors, including the popularity of athletic shoes, the influence of hip-hop culture, and the rise of sneakerheads.

In the United States, the sneaker reselling market is primarily driven by a group of dedicated enthusiasts, known as "sneakerheads," who are willing to pay a premium for rare and exclusive sneakers. These enthusiasts often purchase multiple pairs of the same sneaker, with the goal of reselling them at a higher price. This has led to a thriving market for reselling sneakers in the US, with many sellers making a significant profit by flipping limited edition and exclusive sneakers.

In addition to the North American market, Asia and Europe are also significant markets for sneaker reselling. In Asia, the Chinese market is particularly notable, driven by the increasing purchasing power of the middle class. In recent years, China has become one of the largest sneaker markets in the world, and its middle class population has become increasingly interested in luxury fashion items, including sneakers.

The United Kingdom is also a major player in the European market, driven by its strong fashion industry. The UK has a long history of fashion innovation and has become a center for sneaker culture in Europe. The UK has a large population of sneaker enthusiasts and a strong market for reselling sneakers, making it an important market for sneaker reselling.

Overall, the sneaker reselling market is a global phenomenon, with significant markets in North America, Europe, and Asia. The North American market, led by the United States, is currently the largest, but the market in Asia, particularly China is growing fast. Also, Europe, with countries like the United Kingdom, is also an important market for sneaker reselling, driven by strong fashion industry and culture.

If you haven't already, we highly recommend to watch this great documentary made by the Financial Times talking about the sneaker resale market:

My Notes:

Page 1

One major factor is the increasing consumer demand for limited edition and exclusive sneakers.

willing to pay a premium for rare and hard-to-find releasing limited runs sell out quickly, scarcity of the shoes on the secondary market. This scarcity, in turn, drives up the prices of the shoes, making them more valuable to resellers.

another major factor driving the sneaker reselling market is the cultural significance of certain shoes

T shirts should have a cultural significance if they want to be considered as valuable and be sought after.

cultural icons

extremely high prices, even years after their initial release

Page 2

hype and exclusivity

Social media platforms such as Instagram, Twitter, and Facebook have also played a major role in the sneaker reselling market by providing a platform for sneaker enthusiasts to connect

Page 3

North American market is currently the largest for sneaker reselling dedicated enthusiasts, known as "sneakerheads," willing to pay a premium for rare and exclusive sneakers purchase multiple pairs of the same sneaker, with the goal of reselling them at a higher price.

Asia and Europe are also significant markets for sneaker reselling.

The United Kingdom is also a major player in the European market, driven by its strong fashion industry. The UK has a long history of fashion innovation and has become a center for sneaker culture in Europe. The UK has a large population of sneaker enthusiasts and a strong market for reselling sneakers, making it an important market for sneaker reselling.

global phenomenon, watch this great documentary

Watch this documentary to take notes from.

Page 4

Sneaker Resale Statistics

Posted on 08 August, 2023 by Sheena

This report includes the latest facts, Dgures, and future projections on the sneaker resale industry.

Top sneaker resale statistics

By the end of 2023, the entire sneaker resale industry will accumulate $11.5 billion in revenue, equivalent to 15.3% of the primary sneaker market.

The used sneaker market will enjoy a compound annual growth rate of 16.4%, reaching $53.2 billion in total sales to cap 2032.

The United States will continue as the major player in global secondary sneaker sales by ending 2023 with a $2 billion total revenue.

Air Jordan and Nike dominate the sneaker resale market with a 71.3% combined market share in 2020.

Adidas experienced a 27,800% growth in its secondary sneaker sales between 2014 and 2020.

In 2020, online marketplaces are the most used channel for reselling trainers, raking up 50% of all transactions and a $3 billion revenue.

The women's sneaker resale segment experienced a 41.1% spike from 1.6% in 2014 to 42.7% in 2022.

The majority of secondary sneaker shoppers belong to the millennial age group (27-42), taking up approximately 80% of sneaker resale purchases.

Balenciaga trainers are the most expensive trainers to resale with an average price tag of $699. Vans is the cheapest at $121.

StockX will stay as the top sneaker resale platform with a $540.9 million revenue by 2023. Fight Club, on the other hand, is the fastest-growing reselling site after registering a 494% increase in annual sales in 2021.

To date, Michael Jordan’s 1998 NBA Finals Air Jordan 13 is the most expensive sneaker ever to be resold. It fetched $2.2 million in an April 2023 Sotheby auction.

Sneaker resale market overview

The entire sneaker resale market is expected to cross the $11.5 billion mark by the end of 2023.

In 2023, the used sneaker market will rise by 8.55% compared to the $10.6 billion revenue in the previous year.

As of 2022, the secondhand sneaker market is equivalent to 14.6% of the global sneaker industry. By 2023 it will be relatively 15.3% of the primary sneaker market.

The sneaker resale market is approximately 6% of the global secondhand apparel and resale industry which is valued at $177 billion in 2022.

By 2032, the secondary sneaker revenue is projected to reach $51.2 billion, signifying a 16.4% CAGR.

With a 10-year gap between 2022 and 2032, the sneaker resale market is projected to register a whopping 401.9% growth.

In the United States, the total secondary sneaker market is expected to generate $2 billion worth of sales by the end of 2023.

The US secondhand sneaker industry is also projected to balloon by $30 billion in 2030 with a 47.2% CAGR.

The used sneaker industry in the US is expected to register a 1,400% growth by the end of 2030.

Sneaker resale revenue by year

Popular Articles

Why cutting running shoes in

The role of heel counters in ru

A runner's guide to choosing t

The deDnitive guide to runnin

All you need to know about ro

See all articles (/uk/news)

Articles (/uk/news) / Statistics (/uk/news/statistics) / Sneaker Resale Statistics

Year Revenue in billion 2019 $6 2020 $10

Best rated shoes

Running shoes

Salomon Genesis (/uk/salomon-genesis)

Skechers GO RUN Ride (/uk/skechers-go-run-ride-11)

Sneaker resale revenue by region

In the United States, the sneaker resale value is $2 billion in 2019, taking up more than a third of the entire reselling market in North America.

By the end of 2023, the United States will rake up another $2 billion in revenue in the secondhand sneaker market.

This will be equivalent to a 17.4% US share of the global sneaker resale revenue of 2023.

China, on the other hand, reportedly reached $1 billion in secondary sneaker sales in 2019.

The combined US and China sneaker resale market took up 28.3% of the global secondhand sneaker revenues in 2019.

Mathematical models predict that the US used sneaker industry alone will generate $6 billion by the end of 2025, prompting the country to stay ahead of its competitors.

According to StockX, 6 out of the 10 fastest-growing sneaker resale markets were from Europe.

These countries are France, Italy, the United Kingdom, Spain, Germany, and the Netherlands. France experienced a 281% increase in buyer gross merchandise value (GMV) in 2019.

Meanwhile, Italy showed an 830% rise in seller GMV in the same year.

Germany also reported a +274% growth in the number of sneaker resellers in 2019.

In 2022, North America tallied $5.4 billion in revenue from secondhand trainers.

It is followed by Europe and Asia PaciDc with $2.4 billion and $1.9 billion, respectively.

The combined revenues of the Middle East, Africa, and Latin America in sneaker reselling totaled $1 billion.

In terms of market share, North America occupied 50.5% of the sneaker reselling industry in 2022.

Europe trails at 22.7% market share in 2022.

China-led Asia PaciDc region took 17.5% of the entire secondary sneaker market.

During this time, South Korea is the second fastest-growing resale market, registering a 210% increase in Nike sales.

Middle East and Africa have a 5.6% of the 2022 sneaker resale industry. Qatar shone with a +1,486% Adidas sales.

Latin America had the least share with 3.7%.

On Cloudultra 2 (/uk/on-cloudultra-2)

Salomon Thundercross (/uk/salomon-thundercross)

ASICS Superblast (/uk/asics-superblast)

See all running shoes (/uk/catalog/running-shoes)

2021 $10 2022 $10.6 2023 $11.5 2032 $51.2

Sneaker resale revenue by region in 2022

Sneaker resale revenue by brand

Figures from 2020 secondary sneaker revenues show that the combined sales from Air Jordan and Nike amounted to $7.1 billion.

Compared to the sales accumulated in 2014, the revenue has increased by a whopping 642.7%.

This is also equal to a compound annual growth rate of 39.7%.

Adidas is the second biggest sneaker resale brand with $2.8 billion in revenues.

From 2014-2020, the company has grown its secondary market by a staggering 27,800%.

Based on the calculation, the CAGR of Adidas resale is 155.6%. If this trend continues, Adidas will rake in $4.7 billion in secondhand sneaker revenues by the end of 2023.

In 2020, the combined used sneaker revenues of all other shoe companies amounted to $80 million.

This is equivalent to a 166.7% increase from 2014 to 2020.

Sneaker resale revenue by brand Brand

million

million

Region Sneaker resale market revenue in billions Market share North America $5.4 50.5% Europe $2.4 22.7% Asia PaciDc $1.9 17.5% Middle East and Africa $0.6 5.6% Latin America $0.4 3.7%

Jordan and Nike $960

Adidas $10

$2,790

Others $30

$80

2014 2020 Air

million $7,130 million

million

million

Nike and Air Jordan comprise the majority of the resale market with a 71.3% share in 2020.

This is a 5.7% dip compared to the 77% performance in 2018.

Back in 2014, Nike and Air Jordan is 96% of the entire sneaker resale industry. This means their share has gone down by 24.7% by the end of 2020.

Adidas capped 2020 with a 27.9% sneaker resale portion.

A 5.9% increase from its 2018’s 22% market share.

Adidas recorded its biggest slice in 2016, registering 30% of the entire secondhand sneaker market.

Comparing the Dgures from 2014 to 2020, Adidas has grown its secondary sneaker market share by 26.9%.

From 2014-2018, other sneaker brands are at a steady 2-3% share of the resale market. The Dgure dropped to 0.8% in 2020.

Year Air Jordan and Nike Adidas Others 2014 96% 1% 3% 2016 67% 30% 3% 2018 77% 22% 2% 2020 71.3% 27.9% 0.8%

Sneaker resale market share by brand

Sneaker resale channels

Data on the 2020 secondary sneaker market reveals that online marketplaces take up 50% of the total revenues, amounting to $3 billion in revenues.

This Dgure is expected to increase to $6.3 billion by 2027 and $12.9 billion by 2031. From 2022-2032, revenues from selling used trainers through online sites will experience a 330% growth.

Consignments are the source of 25% of the entire secondhand sneaker revenues in 2022. By mathematical models, the entire revenue through resale consignments will be $3.4 billion by 2027.

With $1.1 billion in sales, sneaker events cut an 18.3% slice of the secondary sneaker market. It is estimated to grow to $4.8 billion by 2032 but will only be occupying a 17.5% market share.

Social media as a sneaker resale channel takes the least market share of 6.67% in 2020.

Projections say that the total sales of used trainers through social media outlets will reach $1.2 billion in 2027 and $3.1 billion in 2032.

Sneaker resale by channel

Year Online market Consignment Social Media Sneaker events 2022 $5.3 $2.7 $0.7 $1.9 2027 $11.2 $6.0 $2.1 $3.9 2032 $24.1 $12.3 $5.8 $9.0

Sneaker resale consumer proDle

The used sneaker market in 2022 is dominated by men with a 57.1% share.

Consequently, the women’s market portion is 42.2%.

Back in 2014, the resale market is 98.4% for men generating $984 million in revenue.

Meaning, between 2014 and 2022, the percentage of men in the sneaker market decreased by 41.1%.

Meanwhile, the women end-user segment has grown by 41.1%.

According to StockX, the current women’s resale is 1500 times greater than when the company started in 2015.

Back in 2014, the women-generated sneaker resale revenue is worth $16 million.

Sneaker resale by gender

Year %Men %Women 2014 98.4 1.6 2022 57.3 42.7

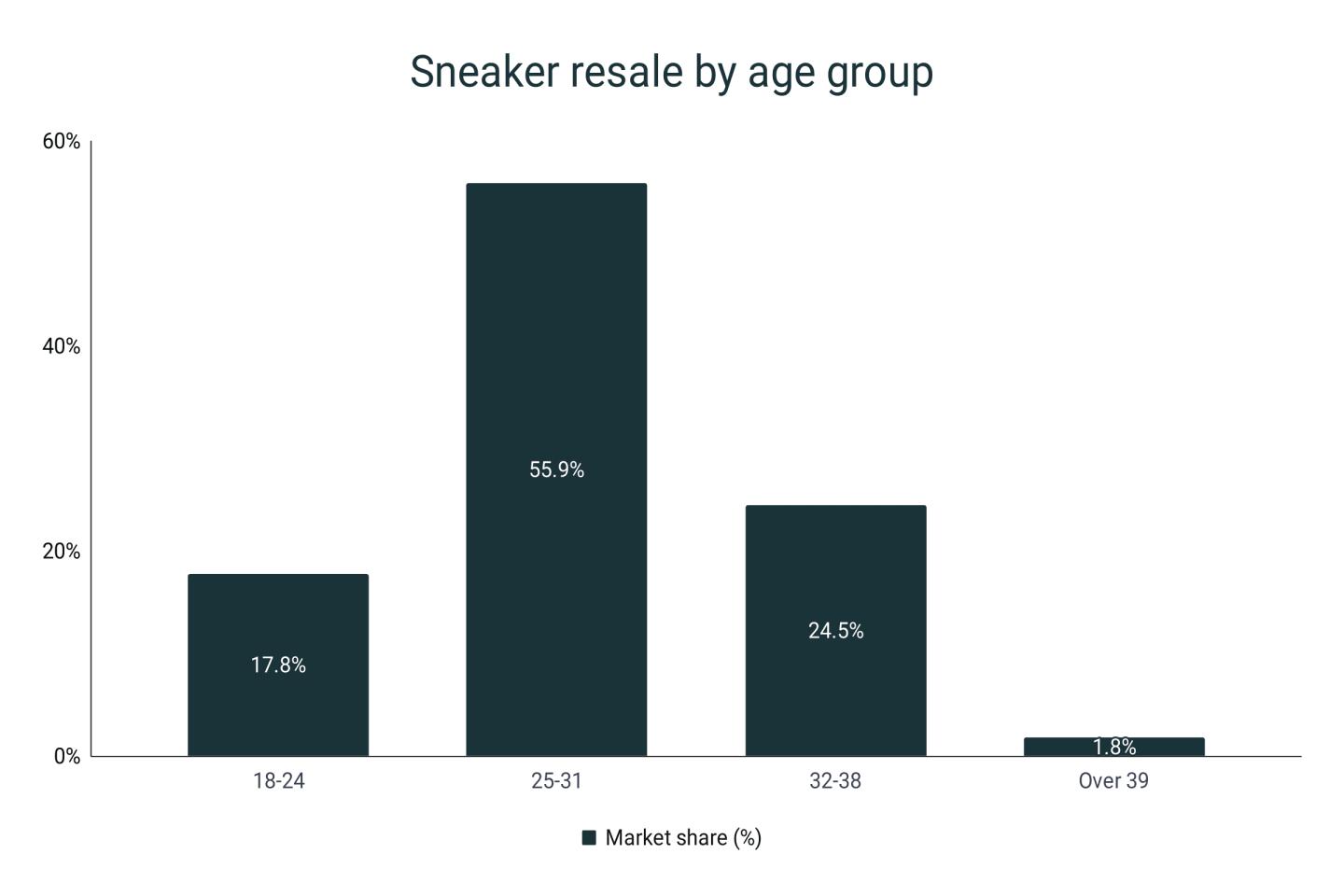

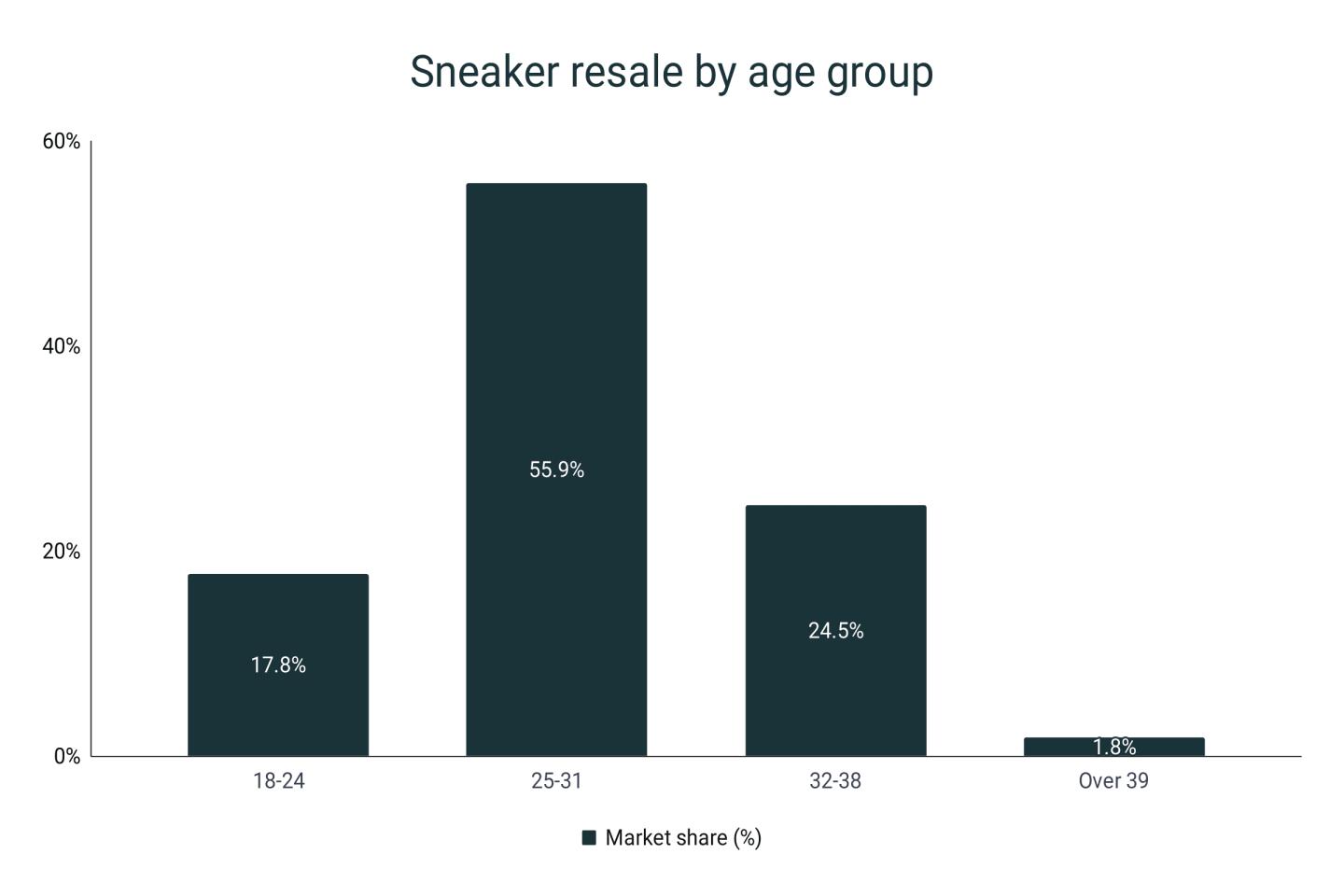

In terms of age, about 55.9% of secondhand sneaker consumers are in the 25-31 age group.

The 32-38 age group recorded a 24.5% share while ages 18-24 have a 17.8% share of the used sneaker market.

Ages 39 and up accounted for 1.8% of the resale consumers.

The majority of secondary sneaker shoppers belong to the millennial age group (27-42), taking up approximately 80% of the market.

This is rekected in a report by thredUp, noting that 35% of millennial consumers prefer thrift shopping due to environmental reasons.

Of the Gen Z (ages 9-24) population, 33% of the Gen Z men consider themselves “sneakerheads.”

For Gen Z women, the Dgure is 26%.

Sneaker resale by age group

Age Market share (%) 18-24 17.8 25-31 55.9 32-38 24.5 Over 39 1.8

Sneaker resale prices

Balenciaga trainers with a $699 price tag are the most expensive in terms of average reselling price.

Adidas is the next with an average resale price of $295.

In the third and fourth spots are Air Jordan and Nike with $266 and $230, respectively.

Secondary New Balance trainers, on the other hand, have a mean cost of approximately $223.

Vans and Converse, relatively, have the cheapest reselling price at $121 and $183, respectively.

Brand Average resale price Air Jordan $266 Adidas $295 Nike $230 Converse $183 Balenciaga $699 Vans $121 New Balance $223

Average sneaker resale prices

In terms of resale premium or the percent of markup from the retail price, Air Jordan leads the pack with an average of 54%. This means that a Jordan DNA shoe, for example, which has a retail price of $100 will sell at $154 on resale sites.

Nike, which accounted for 50% of all resold trainers on StockX in 2020, registered an average premium of 46%.

Adidas and Converse resold trainers, on the other hand, have an average of 32% and 30% markup, respectively.

The New Balance, which showed an average annual resale value growth of 61%, has a price premium of 39% on average.

Sneaker resale premium by brand

Brand Resale premium Air Jordan 54% Nike 46% New Balance 39% Adidas 32% Converse 30%

Air Jordan 1 is the most resold sneaker at $260 and has a market share of 23%.

On average, the retail value of Jordan 1 trainers is $140. Meaning, it generates an 85.7% premium when resold.

In Japan, Jordan 1 Retro High OG DeDant SB LA to Chicago is the most bought secondary sneaker. It sells for $391 on average, 50.4% more than the mean reselling price of Air Jordan worldwide.

The Adidas Yeezy 350 is the second most bought second-hand sneaker globally, accumulating an 18% share of the entire resale market.

When resold, it costs 27.3% more than its mean retail price of $220.

In China, 10,000+ pairs of Yeezy Boost 350 V2 Clay were resold in 2019 alone.

The Nike Air Force 1 holds a 6% cut of the entire sneaker resale market. On average, it costs $274 in resale value.

Compared to the $120 retail price, Air Force 1 kicks earn a 128.3% premium on average on resale.

Most bought secondary trainers

Sneaker resale platforms

According to reports, StockX will lead the online sneaker resale market with $540.9 million. GOAT will total $80.8 million in revenues by the end of 2023.

Fight Club and Stadium Goods will reach $46.1 million and $34.2 million in revenues, respectively.

In terms of company value, StockX is estimated to be worth $3.8 billion before 2023 ends.

With a $3.7 billion net worth, GOAT is the second biggest sneaker resale company.

Fight Club will see a $250 million valuation by the end of 2023.

Stadium Goods was bought for $250 million by FarFetch in 2018.

Sneaker resale sites revenue (2023)

Sneaker Market share Ave. retail Price Ave. resale price Premium Jordan 1 23% $140 $260 85.7% Yeezy 350 18% $220 $280 27.3% Air Force 1 6% $120 $274 128.3%

Resale site Revenue (in $ million) Valuation (in $ million) Fight Club $46.1 $250

*valuation before the acquisition by FarFetch in 2018.

In 2021, Fight Club experienced a 494% one-year sales increase compared to its sales by the end of 2020.

Previously, it scored a 40.6% one-year growth in sales.

With a 453.4% difference, Fight Club became the fastest-growing reselling platform in 2021.

Stadium Goods registered the second-highest on-year sales growth in 2021 with a 276.8% rise.

StockX remains to grab a steady third spot in terms of yearly sales growth. It reported a 190.9% and 102.6% increase in 2021 and 2020, respectively.

Meanwhile, GOAT suffered an 86.8% dip in its sales growth from 2020 to 2021.

Sneaker resale site sales growth

Stadium goods $34.2 $250* StockX $540.9 $3,800 GOAT $80.8 $3,700

Resale site 2020 2021 Fight Club 40.6% 494% Stadium goods 52.5% 276.8% StockX 102.6% 190.9% GOAT 146.8% 101.4% Overview

Most expensive trainers on the resale market

To date, Michael Jordan’s 1998 NBA Finals Air Jordan 13 is the most expensive sneaker ever to be resold. It fetched $2.2 million in an April 2023 Sotheby auction.

In April 2021, Sotheby closed the most expensive private sale of the Nike Air Yeezy Grammy Prototype which Kanye West wore at the 2008 Grammy Awards. The sneaker sold for a Guinness world record price of $1.8 million.

Sold at $1,472,000, Michael Jordan's game-worn Nike Air Ships sneaker is now the most expensive secondhand sneaker sold at an auction.

At third place sits the $615 thousand price tag of the Nike Air Jordan 1 High Sneaker that Michael Jordan wore in an exhibition game of the Chicago Bulls in 1985. It is dubbed the “rarest of the rare” sneaker and was sold in August 2020.

Another game-worn sneaker by Michael Jordan, the autographed Air Jordan 1 kicks fetched $560 thousand in a 2020 Sotheby’s auction in New York.

Most expensive secondhand sneaker purchases

Sneaker Resale price Michael Jordan’s 1998 NBA Finals Air Jordan 13 $2,200,000 Kanye West Nike Air Yeezy Grammy Prototype $1,800,000 Michael Jordan's Nike Air Ships $1,472,000 Nike Air Jordan 1 High “Shattered Backboard” $615,000 Chicago Game-worn Air Jordan 1 $560,000

On the other hand, StockX's list of the most proDtable secondhand trainers on the market is led by Nike Dunk SB Low Paris with a minimum asking price of $89,691.

This is equivalent to a 149,385% premium from its $60 original retail price.

In 2021, shoe reselling site Proxyeed sold one pair of the SB Low Paris fetched over $130,000.

The 1985-released Jordan 1OG Bred holds the second-highest price premium at 145,554% of its original price. Its lowest bidding price is $94,675 in 2021.

Nike SB Dunk Low London and Nike SB Dunk Low Tokyo both have a retail price of $60 when Drst released. Today, the lowest asking price for the models are $24,900 and $23,415, respectively.

The percent markup for the two trainers is 41,400% and 38,925%, respectively.

Another 1985 silhouette, the Jordan 1OG Chicago (1985) completes the list of most proDtable resale trainers. In 2021, it has an asking price of $22,224, about 34,091% price premium when resold.

Most valuable trainers to resell

Sneaker Retail price Lowest asking price Premium Nike Dunk SB Low Paris $60 $89,691 149,385% Jordan 1OG Bred (1985) $65 $94,675 145,554% Nike SB Dunk Low London $60 $24,900 41,400% Nike SB Dunk Low Tokyo $60 $23,415 38,925% Jordan 1OG Chicago (1985) $65 $22,224 34,091%

In the secondary sneaker market, Nike x Off-White collabs generate an average of 296% premium when resold.

At 112%, Adidas x Bape sneaker collaborations are the second most proDtable.

Nike’s collaborations with Fear of God and Travis Scott register a 101% and 93% increase from its retail price when sold in the resale market.

Meanwhile, the Yeezy and Pharell Williams silhouettes with Adidas accumulate 65% and 38% price premiums.

Sneaker price premium by collaboration

Collaboration Premium Nike x Off-White 296% Adidas x Bape 112% Nike x Fear of God 101% Nike x Travis Scott 93% Adidas x Yeezy 65% Adidas x Pharell 38%

My Notes:

August, 2023

Page 1

The used sneaker market will enjoy a compound annual growth rate of 16.4%, reaching $53.2 billion in total sales to cap 2032.

The majority of secondary sneaker shoppers belong to the millennial age group (27-42), taking up approximately 80% of sneaker resale purchases.

To date, Michael Jordan’s 1998 NBA Finals Air Jordan 13 is the most expensive sneaker ever to be resold. It fetched $2.2 million in an April 2023 Sotheby auction.

With a 10-year gap between 2022 and 2032, the sneaker resale market is projected to register a whopping 401.9% growth.

The used sneaker industry in the US is expected to register a 1,400% growth by the end of 2030.

Page 2

2023 $11.5

2032 $51.2

Mathematical models predict that the US used sneaker industry alone will generate $6 billion by the end of 2025,

According to StockX, 6 out of the 10 fastest-growing sneaker resale markets were from Europe.

Page 3

Europe

$2.4 22.7%

Figures from 2020 secondary sneaker revenues show that the combined sales from Air Jordan and Nike amounted to $7.1 billion.

Adidas is the second biggest sneaker resale brand with $2.8 billion in revenues.

166.7% increase from 2014 to 2020. Page 5

online marketplaces take up 50% of the total revenues, amounting to $3 billion in revenues.

Projections say that the total sales of used trainers through social media outlets will reach $1.2 billion in 2027 and $3.1 billion in 2032.

Page 6

men with a 57.1% share.

Meaning, between 2014 and 2022, the percentage of men in the sneaker market decreased by 41.1%. Meanwhile, the women end-user segment has grown by 41.1%. Page 7

55.9% of secondhand sneaker consumers are in the 25-31 age group.

18-24 have a 17.8% share of the used sneaker market.

Lower disposable incomes ?

Gen Z (ages 9-24) population, 33% of the Gen Z men consider themselves “sneakerheads.” For Gen Z women, the Dgure is 26%. Page 8

Balenciaga trainers with a $699 price tag are the most expensive in terms of average reselling price.

Page 9

In terms of resale premium or the percent of markup from the retail price, Air Jordan leads the pack with an average of 54%. This means that a Jordan DNA shoe, for example, which has a retail price of $100 will sell at $154 on resale sites.

Page 10

Air Jordan 1 is the most resold sneaker at $260 and has a market share of 23%.

The Adidas Yeezy 350 is the second most bought second-hand sneaker globally, accumulating an 18% share of the entire resale market. When resold, it costs 27.3% more than its mean retail price of $220.

StockX will lead the online sneaker resale market with $540.9 million. Page 12

In April 2021, Sotheby closed the most expensive private sale of the Nike Air Yeezy Grammy Prototype which Kanye West wore at the 2008 Grammy Awards. The sneaker sold for a Guinness world record price of $1.8 million.

Sold at $1,472,000, Michael Jordan's game-worn Nike Air Ships sneaker is now the most expensive secondhand sneaker sold at an auction.

At third place sits the $615 thousand price tag of the Nike Air Jordan 1 High Sneaker that Michael Jordan wore in an exhibition game of the Chicago Bulls in 1985. It is dubbed the “rarest of the rare” sneaker and was sold in August 2020.

Another game-worn sneaker by Michael Jordan, the autographed Air Jordan 1 kicks fetched $560 thousand in a 2020 Sotheby’s auction in New York. Page 13

StockX's list of the most proDtable secondhand trainers on the market is led by Nike Dunk SB Low Paris with a minimum asking price of $89,691. This is equivalent to a 149,385% premium from its $60 original retail price.

1985 silhouette, the Jordan 1OG Chicago (1985) completes the list of most proDtable resale trainers. In 2021, it has an asking price of $22,224, about 34,091% price premium when resold. Page 14

Nike x Off-White collabs generate an average of 296% premium when resold.

At 112%, Adidas x Bape sneaker collaborations are the second most proDtable.

In collaboration with our friends at sneakerhead data resource Campless, we breakdown the innovative ways Nike uses to manipulate the sneaker resell market.

It's no secret that Nike and Jordan Brand dominate the sneaker resell game - just ask any of the bleary-eyed campers outside your local sneaker store at 7 a.m. on a Saturday. The Oregon sportswear giant's clout in the game is so considerable that the sneaker data experts over at Campless estimate that 96% of shoes on the resell market are adorned with the Swoosh or the Jumpman.

What's often overlooked, however, is the extent that Nike actually controls the market for deadstock kicks. While ASICS, New Balance and adidas shoes will pop up from time to time in the hands of resellers, the conditions that the resell market thrives on - namely exclusivity and hype - have been expertly manipulated by Nike to create a unique ecosystem that ensures sneakerheads will continually go to extraordinary lengths to acquire the sportswear giant's product.

It's obvious both Nike and resellers thrive off limited releases, but the Swoosh is so adept at forecasting demand that the volume for big drops (like the ever-popular Jordan Retro series) is so expertly

© HIGHSNOBIETY / MICHAEL KUSUMADJAJA

big drops (like the ever-popular Jordan Retro series) is so expertly calculated that only a fraction of the release hits the resell market roughly 4%, Campless estimate. Drops may sell out instantly keeping Nike and Jordan at the forefront of the sneakerhead conversation - but without being so limited that resellers can charge huge premiums where Nike could have been making retail sales.

© FLIGHTCLUB

For example, 2013's Air Jordan V "Oreo" and Air Jordan X "Steel" were both released in 2013 at a retail price of $170. 505,000 pairs of the "Oreo" hit retailers, while the "Steel" was limited to 151,000 units. While the logic of exclusivity would dictate that the "Steel" would command a much higher resell price, both hit the market at an average price of $225 as the "Oreo" was in much higher demand and Nike adjusted its production run accordingly, keeping the hype machine thirsty while still shipping over half a million shoes in a single weekend.

That's not to say that each release perfectly balances exclusivity and availability; Nike will occasionally choose to reassert its position at the top of the game by causing pandemonium with an extraordinarily limited release. This hype can then be leveraged to drive huge sales for future releases, as was the case with 2013's What The LeBron X. Nike produced a tiny run of the shoe, which unsurprisingly sold out instantly. When it came to the 2014 release, the What The LeBron XI, Nike dropped the sneaker in far greater quantities, and built off the previous release's hype to shift a large volume of retail sales as customers thought the drop was highly limited just like the year before.

This tactic is sometimes used on a much grander scale, as highvolume restocks can be used several months after a big release to turn unsatisfied customers into sales dollars. Spontaneous restocking (like the 13 Jordan models that were re-upped on May 18, or the huge Retro re-release the year before) allows the brand to satisfy Jordan-hungry customers who missed out the first time, while using the hysteria surrounding the restock to persuade previously-undecided customers to pull the trigger too.

All this trickery provides an answer to the sneaker community's million-dollar question - "Why don't they just make more sneakers or raise the price?" Put simply, by expertly balancing limited supply and heightened demand Nike can have its cake and eat it. Producing a greater volume of shoes would discourage the 4% of customers who fuel the resell market, while raising prices would deter the other 96% from copping for themselves. By ensuring supply never quite meets demand, Nike creates a market that nets the resell community millions of dollars a year, while cultivating the sort of rabid following that keeps the Swoosh at the forefront of consumer culture - right up there with Apple and Starbucks. Not to mention allowing the brand to sell millions of 20year-old sneakers a year without advertising, PR, discounts or sales.

The secondary market Nike has built for itself is a strange one, and very similar to the trade in illegal drugs in many ways. Supply is highly limited and controlled by one agent - in this case Nike, but Latin America's cocaine cartels do much the same - and at the other end of the market there are no barriers for entry. Like your local dealer, no overheads or qualifications are required for budding resellers to enter the market; just purchase some stock, line up a few potential customers and you're in business. And much like the trade in narcotics, prices for deadstock kicks are not officially set (although Campless's price guide does a good job) and people will go to extraordinary lengths to feed their purchasing addiction.

Nike's cult of devoted followers has cemented its position as one of the world's foremost megabrands, one whose products cause riots (Air Jordan XI "Concord"), force people to queue over a week before release (the Air Yeezy 2), and even offer up their car in exchange (Air Foamposite One "Galaxy"). This sort of manic following would never have been possible had the Oregon brand not so ingeniously observed, experimented with, and ultimately manipulated the bizarre dynamics that take place in the marketplace for deadstock sneakers.

Thanks to Josh Luber at Campless for his cooperation and help with this piece. For more analysis of the sneaker resell market, check out The Most Valuable Sneakers of 2015 Q1, as well as our piece Tracking the Resell Price of the adidas Yeezy 750 Boost.

Nike Jordan Brand

My Notes:

Page 2

Campless estimate that 96% of shoes on the resell market are adorned with the Swoosh or the Jumpman.

Nike actually controls the market for deadstock kicks unique ecosystem that ensures sneakerheads will continually go to extraordinary lengths to acquire the sportswear giant's product.

adept at forecasting demand

Page 3

505,000 pairs of the "Oreo"

"Steel" was limited to 151,000 units.

market at an average price of $225 as the "Oreo" was in much higher demand and Nike adjusted its production run accordingly, keeping the hype machine thirsty while still shipping over half a million shoes in a single weekend.

Page 4

extraordinarily limited release.

leveraged to drive huge sales for future releases

built off the previous release's hype to shift a large volume of retail sales as customers thought the drop was highly limited just like the year before.

high- volume restocks can be used several months after a big release to turn unsatisfied customers into sales dollars

hysteria surrounding the restock Page 5

expertly balancing limited supply and heightened demand

By ensuring supply never quite meets demand, Nike creates a market that nets the resell community millions of dollars a year, while cultivating the sort of rabid following that keeps the Swoosh at the forefront of consumer culture

allowing the brand to sell millions of 20- year-old sneakers a year without

advertising, PR, discounts or sales.

Page 7

Supply is highly limited and controlled by one agent prices for deadstock kicks are not officially set (although Campless's price guide does a good job) and people will go to extraordinary lengths to feed their purchasing addiction.

cult of devoted followers products cause riots force people to queue over a week before release (the Air Yeezy 2), offer up their car in exchange (Air Foamposite One "Galaxy").

ingeniously observed, experimented with, and ultimately manipulated the bizarre dynamics that take place in the marketplace for deadstock sneakers.

References

Parisi, D. (2024, January 3). By the numbers: A year in sneaker resale with power seller Mustafa Hamed. Glossy. https://www.glossy.co/fashion/by-the-numbers-ayear-in-sneaker-resale-with-power-seller-mustafa-hamed/

The sneaker resale market in 2023. (n.d.). Www.retailed.io. https://www.retailed.io/blog/sneaker-resale-market admin. (2023, March 20). Sustainable Sneakers: Addressing Environmental Impact and Trends in the Industry. Zoglix. https://blog.zoglix.com/kicks-for-the-planet-howsneakers-are-going-green/#:~:text=According%20to%20a%202021%20report

Sneaker Resale Statistics. (n.d.). RunRepeat - Athletic Shoe Reviews. https://runrepeat.com/uk/sneaker-resale-statistics

Leach, A. (2018, August 7). How Nike Controls the Sneaker Resell Market. Highsnobiety. https://www.highsnobiety.com/p/sneaker-resell-market/