20 minute read

WC’s Healthcare Industry

Wilson County’s Healthcare Industry

Healthcare Industry Defined In this article, we present and analyze data for Wilson County TN’s healthcare and social assistance industry, as defined under NAICS code 62. Specifically, we consider WC data as compiled by the U.S. Department of Labor data7 through year 2019 (and for some cases, including 2Q2020) for the following industry subsectors:

❼ Ambulatory (Outpatient) Care (621)

❼ Hospitals (622)

❼ Nursing and Residential Care Facilities (623)

❼ Social Assistance (624), and

❼ Healthcare Equipment Manufacturing and Wholesaling.

Corresponding 3-digit NAICS codes for each industry subsector studied in this report are noted above in parentheses. Each industry subsector8 can be further subdivided into specific industry groups, as identified by 4 to 6 digital NAICS codes. The healthcare industry groups classified under each industry subsector are listed in Table 1. In select instances, Wilson County data for certain healthcare industry categories are not available due to US DOL disclosure guidelines. Providence West Medical Center, Mt. Juliet, TN

In 2019, there were 261 private healthcare and

7 Only privately-owned healthcare establishments and services are considered in this analysis. Besides the NAICS 62 industry subsectors, this analysis also includes a review of healthcare equipment manufacturing and wholesaling which are classified under other NAICS subsectors. 8 The 3-digit NAICS healthcare industry subsector codes are defined as follows. Industries in Ambulatory Healthcare Services (subsector 621) provide health care services directly or indirectly to ambulatory patients and do not usually provide inpatient services. Health practitioners in this subsector provide outpatient services, with the facilities and equipment not usually being the most significant part of the production process. Industries in Hospitals (subsector 622) provide medical, diagnostic, and treatment services that include physician, nursing, and other health services to inpatients and the specialized accommodation services required by inpatients. Hospitals may also provide outpatient services as a secondary activity. Establishments in the Hospitals subsector provide inpatient health services, many of which can only be provided using the specialized facilities and equipment that form a significant and integral part of the production process. Industries in Nursing and Residential Care Facilities (subsector 623) provide residential care combined with either nursing, supervisory, or other types of care as required by the residents. In this subsector, the facilities are a significant part of the production process and the care provided is a mix of health and social services with the health services being largely some level of nursing services. Industries in Social Assistance (subsector 624) provide a wide variety of social assistance services directly to their clients. These services do not include residential or accommodation services, except on a short stay basis. In addition to NAICS 62, other healthcare related industry groups included in this study are Medical Equipment and Supplies Manufacturing (3391) and Medical Equipment Merchant Wholesalers (42345). Examples of products made by NAICS 3391 medical equipment manufacturers are surgical and medical instruments, surgical appliances and supplies, dental equipment and supplies, orthodontic goods, ophthalmic goods, dentures, and orthodontic appliances. NAICS 42345 is comprised of medical equipment wholesalers primarily engaged in the merchant wholesale distribution of professional medical equipment, instruments, and supplies (except ophthalmic equipment and instruments and goods used by ophthalmologists, optometrists, and opticians). Source: see https://classcodes.com/naics-3-digit-subsector-code-list/ or https://www.naics.com/ .

social assistance establishments9 operating in Wilson County TN, employing 3,799 people who were earning on average a weekly wage of ✩841. Compared to a decade earlier (2009), these numbers indicate a healthy 10 year growth trend in terms of the total number of healthcare and private community assistance workers employed in Wilson County (+13%), the number of establishments (+32%), and the average weekly wage (+23%)10 .

Hartmann 920 Medical Complex, Lebanon, TN

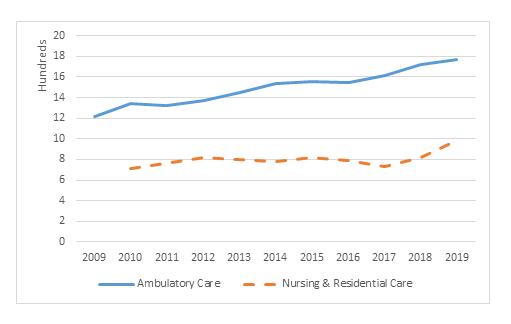

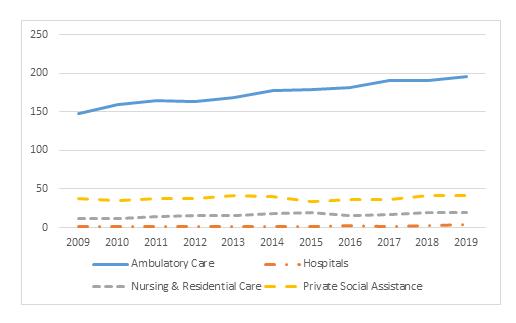

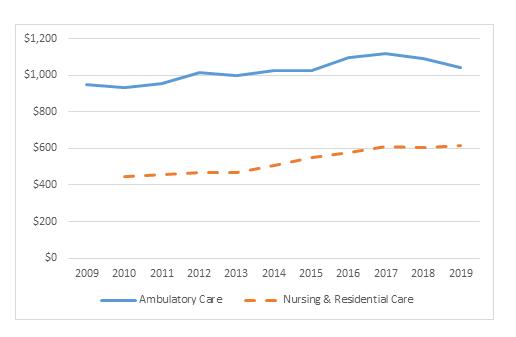

The largest healthcare industry subsectors represented in Wilson County are ambulatory services and nursing/residential care facilities. During the period12 2010 to 2019, the employment growth rate of both of these subsectors in WC was steady yet modest, with the ambulatory care subsector gaining a net of about 47 employees per year and nursing/residential care adding about 30 annually. For the same nine year time period, a relatively constant average weekly wage differential ranging from ✩488 (2010) to ✩428 (2019) existed between the higher paid wages in ambulatory care vs lower paid wages in nursing/residential care. In regard to the total number of establishments, ambulatory care providers were clearly dominant in Wilson County representing a fairly constant 75% of the entire healthcare industry subsector from 2009 to 2019, adding about 5 new ambulatory centers annually. See Figures H1, H2 and H3.

Ambulatory (Outpatient) Care In 2019, there were 196 ambulatory service establishments operating in Wilson County TN, employing some 1,765 people who were earning on average a weekly wage of ✩1,045. These WC economic indicators point to a very robust 10 year county growth rate for ambulatory care in Wilson County, in terms of the number of workers (+45%), number of establishments (+32%) and average weekly wage (+10%).

Physicians Plaza, Lebanon, TN

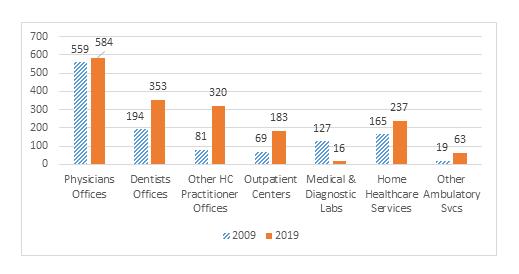

As shown in Table 1, ambulatory care (NAICS 621) can be divided into seven (7) industry groups. In terms of the number of ambulatory workers in Wilson County, the top three ambulatory categories in 2019 were physician’s offices (584 employees), den-

9 The 2019 total of NAICS 62 WC establishments consists of 220 healthcare groups and 41 social assistance organizations, or 84% vs. 16%, respectively. In 2009, the number of private social assistance organizations in WC was slightly higher at 19% of the NAICS 62 total. NAICS 62 separation of healthcare vs social assistance groups is not available for employee or wage numbers due to US DOL disclosure guidelines. 10 According to US Bureau of Labor Statistics, the purchasing power of ✩1 in 2009 would require ✩1.19 in 2019, a cumulative price increase of 19.17%. For the purpose of wage comparisons then, we can conclude that any 10 year (2009-2019) average weekly wage increase cited in this report that exceeds 20% can mostly be attributed to real wage growth instead of a simple nominal wage increase. 11 NAICS 6219 can be further sub-categorized into Ambulance Services (62191) and Blood & Organ Banks (621991). 12 2009 nursing/residential care data in Wilson County is unavailable due to US DOL disclosure guidelines. 13 This industry group comprises establishments of independent health practitioners (except physicians and dentists) and includes the offices of chiropractors (621310), optometrists (621320), mental health practitioners (621330), physical, occupational & speech therapists, and audiologists (621340), podiatrists (621391), and miscellaneous health practitioners (621399).

Ambulatory (Outpatient) Care (Subsector 621) : Offices of Physicians (6211) Offices of Dentists (6212) Offices of Other Health Practitioners (6213) Outpatient Care Centers (6214) Medical and Diagnostic Laboratories (6215) Home Health Care Services (6216) Other Ambulatory Health Care Services11 (6219)

Hospitals (Subsector 622): General Medical and Surgical Hospitals (6221) Psychiatric and Substance Abuse Hospitals (6222) Other Specialty Hospitals (6223) Nursing and Residential Care Facilities (Subsector 623): Nursing Care Facilities (6231) Residential Mental Retardation, Mental Health and Substance Abuse Facilities (6232) Community Care, Assisted Living Facilities for the Elderly (6233) Other Residential Care Facilities (6239)

Private Social Assistance (Subsector 624): Individual and Family Services (6241) Community Food and Housing, and Emergency and Other Relief Services (6242) Vocational Rehabilitation Services (6243) Child Day Care Services (6244)

Other Healthcare Related: Medical Equipment and Supplies Manufacturers (3391) Medical Equipment Merchant Wholesalers (42345)

Table 1: Healthcare Industry Groups by NAICS Code

Tennessee Sports Medicine Complex, Mt. Juliet, TN

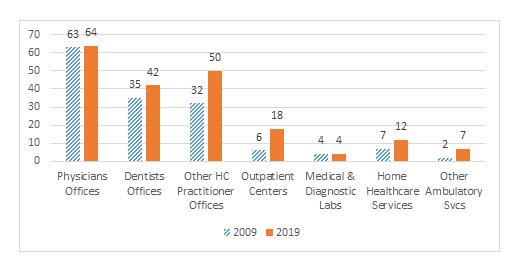

tist’s offices (353), and the offices of other healthcare practitioners13 (320). In terms of a ten year change in the number of county ambulatory workers (2009-2019), the most significant employment changes occurred in dentist’s offices (+13%), other health practitioner’s offices (+20%), outpatient care centers (+9%) and medical/diagnostic labs (-9%). The total of WC physician’s office workers increased a modest 2%. In terms of the number of ambulatory establishments in WC, the number of physician’s and dentist’s offices were relatively stable over the past decade. The number of other healthcare practitioners, however, increased by a significant 56%. We also note that the number of outpatient centers in WC tripled, from 6 centers in 2009 to 18 in 2019.

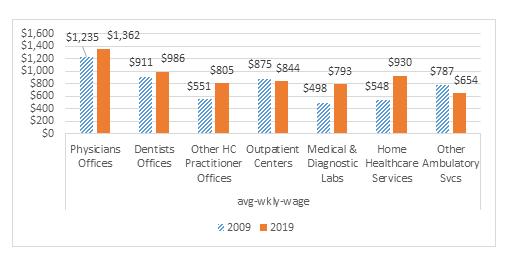

A review of WC’s ambulatory wages for the past decade 2009-2019 suggests some interesting healthcare industry stabilities as well as changes. First, we note that the average weekly wages for workers in physicians and dentist offices remain first and second in rank among all WC ambulatory categories (✩1362 and ✩986, respectively in 2019). A change is observed, however, in WC’s home healthcare services14 (NAICS 6216) category, however, where its ambulatory care average weekly wage ranking flips from 6th place in 2009 (✩548) to 3rd place (✩930) in 2019 (behind physician’s and dentist’s offices). This noted change in WC’s healthcare industry portends structural healthcare industry transitions in the years ahead, factoring in such considerations as a growing senior population, changes in national healthcare insurance policy and, of course, the recent global pandemic. As one healthcare industry expert recently stated, COVID-19 has also helped to catalyze a number of trends that we have been talking about for years, including: Seniors’ desire, now greater than ever, to be cared for in the home; flexibility from CMS for the utilization of telemedicine in care planning; and reimbursement for higher acuity care provided in the home. We believe these trends will stick well beyond the pandemic and will only continue to highlight just how important and impactful care in the home is to health care costs but also, most importantly, to patient outcomes, quality and safety.15

We note that the number of WC employees working in medical and diagnostic labs (NAICS 6215) fell from 127 employees in 2009 to 16 in 2019. We would attribute this drop in personnel at dedicated medical and lab testing facilities either to other types of medical service facilities which incorporated on-site testing (e.g., hospitals) or else transferring such activities to facilities located outside of the county. Technological improvements in testing and diagnostic procedures may be another reason for reduced personnel. The 59% jump in average weekly wage in this industry category (✩498 in 2009, rising to ✩793 in 2019) may also indicate the need for a higher skill set to work in medical testing and diagnosis. We note that there was a constant four medical and diagnostic labs operating in WC during the entire 2009-2019 period. See Figures H4, H5 and H6.

TriStar Summit Imaging Center, Mt. Juliet, TN

14 The home healthcare industry (NAICS 6216) comprises establishments primarily engaged in providing skilled nursing services in the home, along with a range of the following: personal care services; homemaker and companion services; physical therapy; medical social services; medications; medical equipment and supplies; counseling; 24-hour home care; occupation and vocational therapy; dietary and nutritional services; speech therapy; audiology; and high-tech care, such as intravenous therapy. Source: https://secure.industriuscfo.com/industry-metrics/naics/6216-home-health-care-services 15 “Home Health Executive Forecast for 2021: Reserving a Seat at the Big Kids’ Table” by Robert Holly, Home Healthcare News , December 14, 2020 retrieved from https://homehealthcarenews.com/2020/12/home-health-executive-forecast-for-2021-reservinga-seat-at-the-big-kids-table/

Figure H1

All WC Healthcare Employees, Ambulatory Care vs Nursing & Residential Care, 2009 - 2019

Source: US Department of Labor

Figure H2

Number of WC Healthcare Establishments by Industry Group, 2009 - 2019 Source: US Department of Labor

Figure H3

Average Weekly Wage in WC’s Ambulatory Care vs Nursing & Residential Care, 2009 – 2019

Source: US Department of Labor

Nursing and Residential Care Facilities

In 2019, there were 20 nursing and residential care establishments operating in Wilson County TN, employing some 982 people who were earning on average a weekly wage of ✩617. These WC economic indicators point to a very robust 9 year16 county growth rate in terms of the number of nursing/residential care establishment workers (+39%), number of establishments (+67%) and average weekly wage17 (+38%).

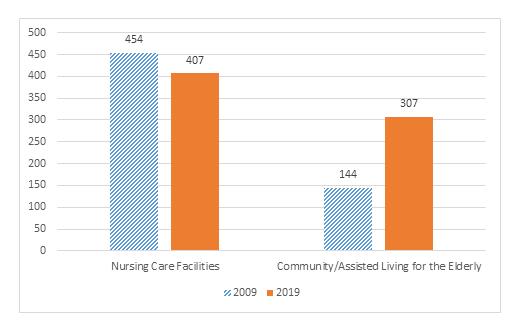

As shown in Table 1, nursing and residential care facilities (NAICS 623) can be divided into four (4) industry groups18 . In terms of number of workers in 2019, the largest nursing/residential care employment categories in WC were nursing care facilities (407 employees) and community & assisted living facilities for the elderly (307 employees). During 20092019, it is interesting to note a slight drop in the number of workers employed in WC’s nursing care facilities but more than a doubling in the number of workers employed in WC’s community/assisted living centers for the elderly.

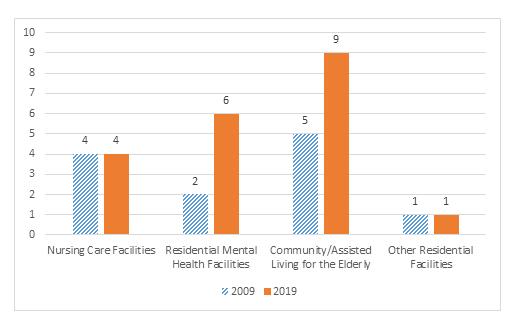

In terms of a ten year change in the number of nursing and residential care establishments, we observe that the number of nursing care facilities (NAICS 6231) and other residential facilities19 (NAICS 6239) remained stable at 4 and 1 facilities, respectively. However, we also note that during 20092019 the number of residential mental health facilities in WC tripled (going from 2 to 6 facilities) while the number of eldercare assisted living facilities almost doubled (going from 5 to 9 facilities).

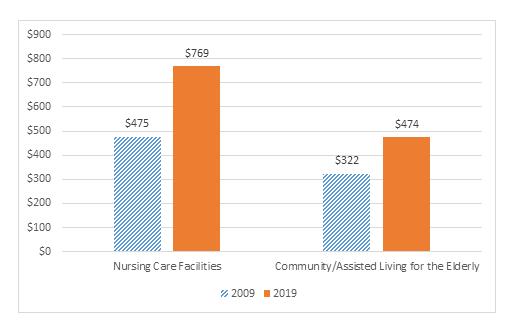

A review of WC’s rapidly growing nursing and residential care wages during the past decade 20092019 confirms the national trend of increasing demand for these healthcare professions. The average weekly wages for those employed in WC’s nursing care facilities jumped 62%, earning ✩475 in 2009 and rising to ✩769 in 2019. Similarly, the wages of those employed in WC’s eldercare facilities increased 47%, earning ✩322 in 2009 and increasing to ✩474 in 2019. See Figures H7, H8 and H9.

Hospitals Recent moves and developments among major area hospital systems in WC are clear testimonials to the county’s rapid growth in population and in the local economy. Over the recent past decade, the number of hospitals operating in Wilson County has grown from one in 2009 to four in 2019.

Centennial Pediatrics Plaza, Mt. Juliet, TN

The most notable recent change in the hospitals operating in Wilson County has to do with a formal large expansion of Nashville’s Vanderbilt University Medical Center (VUMC) into Wilson County. On August 1st, 2019, VUMC acquired the Lebanon TN hospital system owned by Tennova Healthcare, a statewide private medical sys-

16 2010 NAICS 623 employment and wage statistics are used in growth rate calculations here as corresponding 2009 NAICS 623 numbers are unavailable due to US DOL disclosure guidelines. 17 According to the US Bureau of Labor Statistics, the purchasing power of ✩1 in 2009 would require ✩1.19 in 2019, a cumulative price increase of 19.17%. Thus, any 10 year (2009-2019) average weekly wage increase in this report that exceeds 20% can roughly be attributed to real wage growth instead of a simple nominal wage increase. 18 Wage and employment data for certain NAICS 623 industry subsectors are unavailable due to US DOL disclosure guidelines. 19 This industry group comprises establishments of residential care facilities (except residential mental retardation, mental health, and substance abuse facilities and community care facilities for the elderly). Source: https://secure.industriuscfo.com/industrymetrics/naics/6239-other-residential-care-facilities 20 Tennova Healthcare’s divestiture of its Lebanon hospital facilities to VUMC should not suggest that the two hospital networks will always operate separately from each another. For example, it was announced in fall 2020 that VUMC agreed to acquire a minority interest in Tennova Healthcare’s 270-bed hospital in Clarksville. Specifically, VUMC signed an agreement with Tennova minority partner, GHS Holdings LLC, a wholly owned subsidiary of Clarksville Volunteer Health, Inc., to acquire its 20% minority interest in Tennova Healthcare-Clarksville and related physician practices. This action is consistent with a recent spate of hospital partnerships,

tem of hospitals and other healthcare service facilities20 . Rebranded as Vanderbilt Wilson County Hospital (VWCH), VUMC’s Tennova purchase consisted of a 2-campus medical facility, including a general inpatient services hospital at 1411 West Baddour Parkway, and a second facility, now called VWCH McFarland, at 500 Park Avenue. VWCH McFarland provides specialized behavioral health and physician rehabilitation services21 . Notably, the VWCH McFarland facility is co-located with Cumberland University’s School of Nursing. The 2019 addition of VWCH significantly expanded VUMC’s local presence in WC, joining about a dozen or so other existing VUMC-affiliated clinics and medical practices. VWCH provides a full service hospital facility for Wilson County residents as well as for those living in the surrounding eastern rural counties and beyond. 22

West Lebanon Professional Medical Center, Lebanon, TN

Other hospital systems operating with a physical presence in Wilson County include TriStar Summit and Ascension Saint Thomas Heart. A division of HCA Health, TriStar Health is middle Tennessee’s largest, most comprehensive healthcare provider. TriStar Health offers imaging and urgent care services at TriStar locations in Mt Juliet and Lebanon, as well as primary care services in Lebanon23 . Ascension Saint Thomas Heart, a Catholic health ministry and the nation’s second largest private healthcare service provider, offers a variety of primary and specialty care services in Mt. Juliet and Lebanon24 .

Private Social Assistance Services

In 2019, there were 41 private social assistance establishments in Wilson County TN, an 11% increase over the 37 establishments operating in the county in 2009. We also note in 2009 that there were 702 people employed in WC private social assistance establishments25 earning an average weekly wage of ✩345.

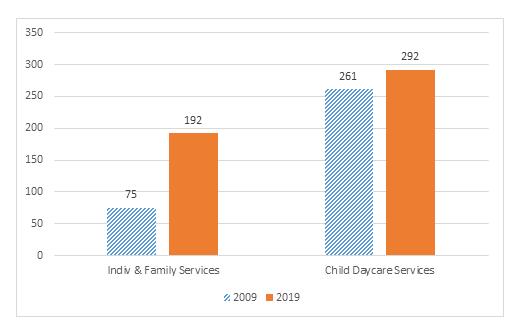

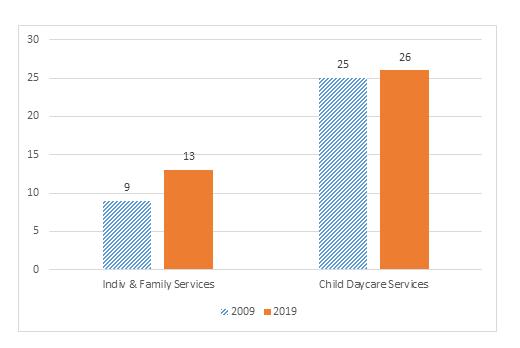

As shown in Table 1, social assistance (NAICS 624) can be divided into four (4) industry groups26 . In terms of number of WC workers in 2019, the largest social assistance categories were individual and family services (NAICS 6241) and child daycare services (NAICS 6244). For the decade 2009-2019, we note a rather large 156% increase in the number of WC workers employed in individual/family services (75 workers in 2009 rising to 192 workers in 2019), accompanied by a moderate 12% increase in the number of documented child daycare facilities. We also note that while individual and family service facilities increased by 44% (going from 9 to 13 during the 10 year period), the number of registered child daycare facilities experienced only a slight 4%

acquisitions, mergers, etc. taking place within Wilson County, as well as in the state of Tennessee, and nationally. Source: Tennova Healthcare - Clarksville May Soon Partner with Vanderbilt University Medical Center — Newsroom (tennovaclarksville.com) 21 “Introducing Vanderbilt Wilson County Hospital: VUMC takes over Tennova Healthcare – Lebanon” by Andy Humbles, The Tennessean, August 01, 2019, retrieved at https://www.tennessean.com/story/news/local/wilson/2019/08/01/tennova-lebanonbecomes-vanderbilt-hospital/1869272001/ . 22 Also in this issue, see the companion article on VWCH as well as WCT’s Who’s Who section for a list of specific VUMC healthcare groups operating in WC. 23 See https://tristarhealth.com/locations/ for healthcare services by WC location. 24 See https://healthcare.ascension.org/locations?page=1&facility=&location=mt%20juliet&distance=50&filter= for healthcare services by WC location. 25 2019 WC employee and wage statistics are unavailable in the NAICS 624 industry subsector. 26 Only privately owned social assistance establishments in NAICS 624 are considered in this analysis. Government social assistance agencies are excluded from consideration. Wage and employment data for certain NAICS 624 industry subsectors are unavailable due to US DOL disclosure guidelines.

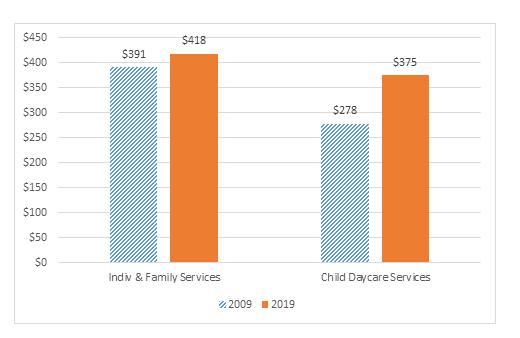

increase (going from 25 in 2009 to 26 in 2019). Interestingly, while the average weekly wages for those employed in WC’s individual/family service facilities increased by a slight 7%, earning ✩391 in 2009 and rising to ✩418 in 2019, the wages of those employed by WC child daycare facilities27 increased 35%, earning ✩278 in 2009 and increasing to ✩375 in 2019. See Figures H10, H11, and H12.

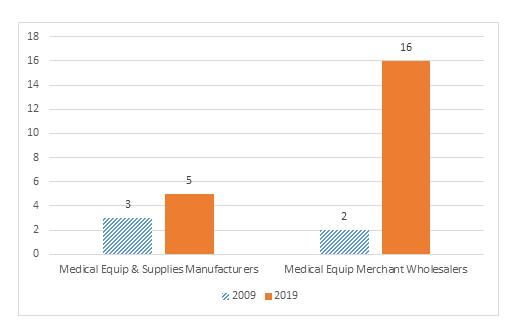

Other Healthcare Industry Groups Two other notable healthcare industry groups operating in Wilson County in recent years are medical equipment & supplies manufacturers (NAICS 3391) and medical equipment merchant wholesalers (NAICS 42345). In 2019, WC’s medical equipment manufacturing industry was dominated by small enterprises consisting of 5 establishments, employing 10 people in total who earned an average weekly wage of ✩978. For the same period, WC’s medical equipment merchant wholesaler industry consisted of 16 establishments, employing 325 people who earned an average weekly wage of ✩1271. While economic indicators are generally positive for the county’s fledgling medical manufacturing industry, its overall size is too small at present to predict whether the industry group will have much impact on the county economy in the near future. On the other hand, WC’s medical merchant wholesaler industry shows much economic promise for the county, noting a near term 28% growth spurt in workforce size (2017 to 2019), an 8-fold increase in the number of new establishments (from 2009 to 2019), and an industry-high wage rate. Given WC’s national strengths in supply chain logistics, it is not surprising to observe recent strong local business activity in medical equipment wholesaling. See Figure H13. Future Outlook

Recent healthcare Industry developments in Wilson County have provided both a microcosm and an affirmation of national healthcare trends. As WC’s population has undergone unprecedented growth during the past decade, a variety of both small and large size healthcare providers are establishing or expanding their local presence in the county to meet a growing diversified demand for health and medical services. Developments in WC over the past decade have included new healthcare service models, such as increases in health provider services targeted at home-based patient care and new forms of ambulatory services. We also note increases in the number specialized and independent health practitioners, as well as integrated healthcare services (e.g., in-house diagnosis and testing) offered by area hospitals. We observe increases in the number of residential healthcare facilities that offer specialized care to special needs groups, including seniors (eldercare via assisted living centers) and residential-based mental health treatment programs.

Future challenges to adequate healthcare service delivery is somewhat atypical in WC from that of other counties, in that WC county includes sizable urban and rural populations. Hence we note in WC a proliferation of small community-based healthcare clinics as well as a growing local interest in telehealth28 (mostly Internet-based) solutions. A the national healthcare scene continues to undergo transitions, we may expect WC’s healthcare changes of the past decade to not only continue but in some cases intensify, driven by both local and external factors, such as the global pandemic, and industry restructurings among large healthcare providers.

27 While the general topic of illegal and/or unlicensed daycare facilities is outside the scope of this report, in addition to child safety concerns, one also cannot ignore the economic significance of the child daycare industry itself nor its economic impact on other industries, including healthcare. Tennessee, for example, does not require a childcare provider to be licensed to provide care for fewer than five unrelated children. Such industrial nuances as this makes a comprehensive analysis of this WC industry subsector a difficult challenge. (https://www.tn.gov/humanservices/for-families/child-care-services/child-care-types-of-regulated-care.html) 28 See the survey article on Telehealth Trends in this issue.

Figure H4

Number of WC Employees in Ambulatory Services, 2009 vs 2019

Source: US Department of Labor

Figure H5

Number of WC Establishments in Ambulatory Services, 2009 vs 2019

Source: US Department of Labor

Figure H6

Average Weekly Wage in WC Ambulatory Services, 2009 vs 2019

Source: US Department of Labor

Figure H7

Number of WC Employees in Nursing & Residential Care, 2009 vs 2019

Source: US Department of Labor

Figure H8

Number of WC Establishments in Nursing & Residential Care, 2009 vs 2019

Source: US Department of Labor

Figure H9

Average Weekly Wage in WC Nursing & Residential Care, 2009 vs 2019

Source: US Department of Labor

Figure H10

Number of WC Employees in Private Social Assistance, 2009 vs 2019

Source: US Department of Labor

Figure H11

Number of WC Establishments in Private Social Assistance, 2009 vs 2019

Source: US Department of Labor

Figure H12

Average Weekly Wage in WC Private Social Assistance, 2009 vs 2019

Source: US Department of Labor

Figure H13

Number of WC Establishments in Other Healthcare Industry Groups, 2009 vs 2019

Source: US Department of Labor

Cumberland University’s Rudy School of Nursing and Health Professions, Lebanon, TN