YOUTUBE DIAMOND CREATOR AWARD

Only sporting organisation in Australia to have achieved 10M subscribers.

400TH TEST WICKET

Mitchell Starc became the second Australian fast bowler to take 400 Test wickets.

DOUBLE CENTURY

Annabel Sutherland scored 210 runs at the WACA against South Africa.

BORDER-GAVASKAR TROPHY

373,691 attended the NRMA Insurance Boxing Day Test, the most for any Test match in Australia.

Most-watched Test series on Foxtel and 7 since acquiring the rights.

Record 3.2M users on our digital platforms for a single-day session.

10,000 RUNS

Steve Smith became the fourth Australian to reach the milestone.

WOMEN’S ASHES

87% more people watched the Women’s Ashes than in 2021-22.

MCGRATH

FOUNDATION

$9,053,360 raised.

BIG BASH

Largest KFC BBL Crowd at the Gabba since 2008.

103,232 registered participants from SouthAsian backgrounds – achieving goal of 100,000 participants two years early.

WOMEN’S BIG BASH

A 46% increase in average audiences per game across Seven, Foxtel, 7plus and Kayo Sports.

We are pleased to report on a year when cricket truly brought people together across Australia.

Last summer, the NRMA Insurance Border-Gavaskar Trophy, the Women’s Ashes, Big Bash Leagues and white ball internationals filled stadiums, kept millions of fans across the world glued to screens and dominated national conversation.

Cricket’s place as Australia’s national sport was clear, underpinned by a strong, ongoing focus on producing inspirational players and teams and creating brilliant experiences for fans in our stadiums and on our digital platforms.

We have attracted more registered participants, especially children aged 5-12 and players from South Asian communities, and we continue to unlock new commercial opportunities as the game grows.

We have continued to use our position in world cricket to advocate for and protect the game’s heritage, especially Test cricket, and ensure that Australia’s voice is heard on the challenges and opportunities created by the proliferation of franchise T20 cricket. We are working collaboratively across Australian Cricket as we continue to grow the game through this period of change to the benefit of all participants, fans and partners.

INSPIRATIONAL PLAYERS AND TEAMS

Australian Cricket’s global reputation is significantly enhanced by our continued ability to produce world-class players and successful teams.

Australia’s 3-1 victory in the Border-Gavaskar Trophy series was testament to Pat Cummins’ team’s skill and resilience. Congratulations to Steve Smith (10,000 Test runs), Mitchell Starc (400 Test wickets) and Pat Cummins (300 Test wickets). The Australian men’s team’s long-term success was highlighted by the display of every bilateral series trophy at the MCG in January.

Alyssa Healy’s Australian team made history with a 16-0 whitewash in the multiformat Women’s Ashes. The series culminated with a historic first Day-Night Test at the MCG, marking the 90 th Anniversary of the first women’s Test Series. It was particularly pleasing to see Annabel Sutherland, Alana King and Beth Mooney’s names added to the MCG’s honour board as the strong investment in women and girls’ cricket continues to yield positive results.

Our domestic competitions and pathways continue to provide a world-leading nursery for player talent with the elite level of competition exemplified by South Australia’s much celebrated drought-breaking Sheffield Shield victory.

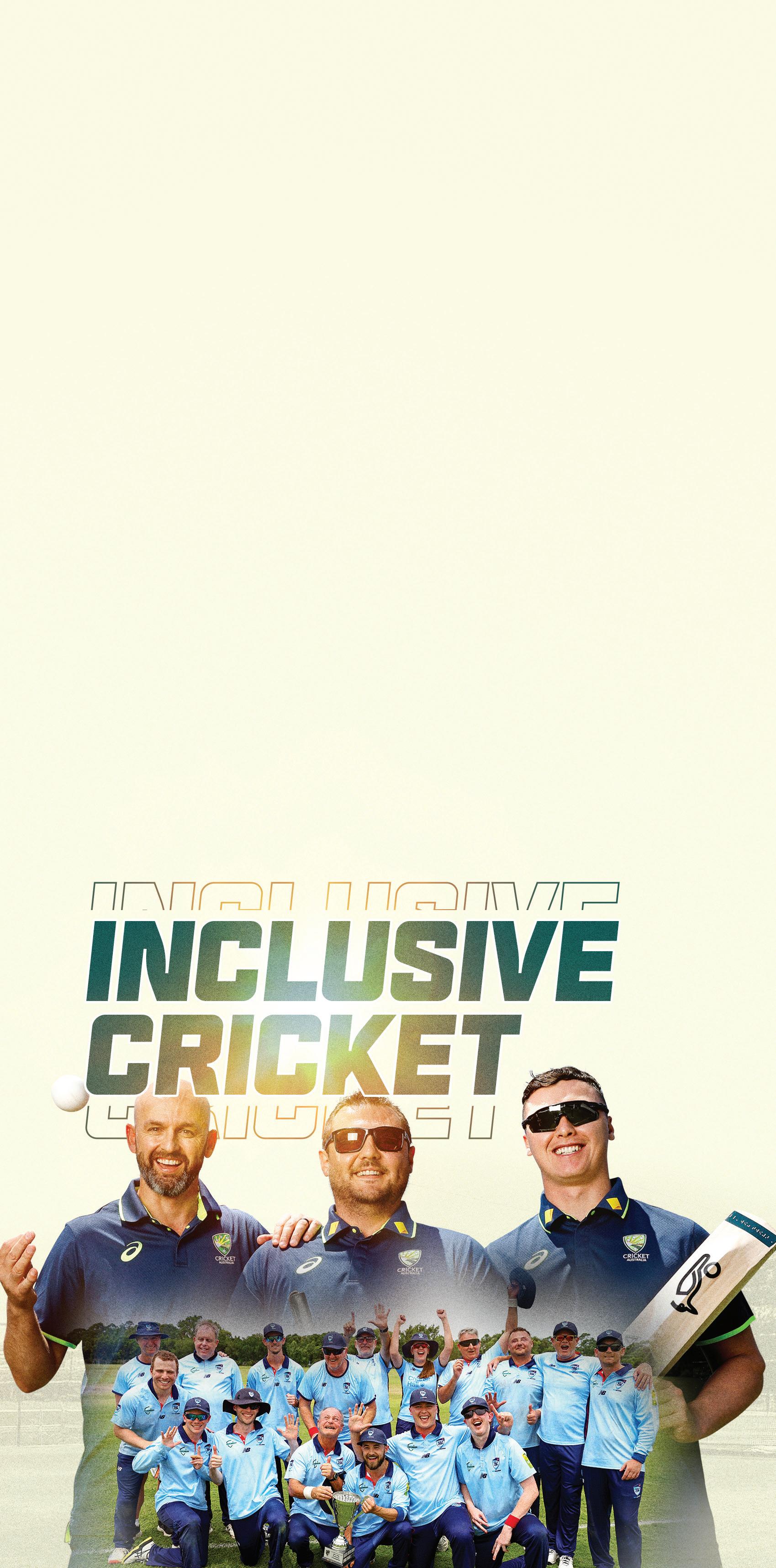

The National Indigenous Championships, the Australian men’s team’s victory in the Blind Ashes, the men’s National and Deaf and Hard of Hearing team’s tour of India and the National Inclusion Championships helped broaden participation opportunities for many Australians.

BRILLIANT EXPERIENCES

Records were set at every venue for the Border-Gavaskar Trophy as more than 2M fans attended cricket matches.

This included the 74,362 fans who attended the decisive fifth day of the NRMA Insurance Boxing Day Test, with the total match attendance of 373,691 breaking the Boxing Day Test record.

This interest was reflected in broadcast. Of the 17 sports events in 2024 that attracted an average audience of more than 2M viewers, 10 involved cricket.

The Big Bash Leagues continue their upward growth trajectories. The Hobart Hurricanes’ victory in the KFC BBL final played before a sold-out Bellerive Oval crowd, and with viewing audience of 1.64M, was a fitting conclusion to a season where the league’s world class entertainment was again on show. The competitive nature of the WBBL was exemplified by the Melbourne Renegades going from last place in 2023 to winners in 2024.

PARTICIPATION GROWTH

Registered participation in cricket grew to 669,642, with a 6% increase in women and girls’ registrations.

OUR FINANCIAL PERFORMANCE

Surplus from Operations for the year ended 30 June 2025 is $109.6M, an improvement of $21.4M on the previous year. The net deficit for the year ended 30 June 2025, after funding to members, is $11.3M, an improvement of $20.6M on the previous year.

The improved financial performance and net deficit were anticipated and largely driven by the delivery of a successful cricket season and record attendance at the Border-Gavaskar Trophy Series. Funding to members increased $0.8M compared to the prior year to $120.9M.

Strong growth was achieved in targeted areas such as children aged 5-12 and South-Asian participation. This followed a strategic investment in areas of participation that will have a sustained positive impact on cricket’s long-term future.

The goal of having 100,000 registered participants from South-Asian backgrounds was achieved two years ahead of the goal set in our Multicultural Action Plan. This demonstrated the enormous opportunity cricket has to connect with these growing communities.

CA closed the year with cash and deposits of $22.1M, and a further $70M in funding available through a renewed five-year secured banking facility. CA remains in the enhance phase of our five-year strategy which focuses on further growing the game and providing financial stability as it recovers from the impact of COVID.

Looking ahead, FY26 presents both the Ashes and high value Indian white ball content that will generate strong profit, while CA remains focussed on managing costs and driving revenue opportunities.

PURPOSE-LED PARTNERSHIPS

Our purpose-led partnerships are built on shared values and a commitment to delivering meaningful outcomes.

This included a new partnership with UNICEF Australia, anchored by the ‘Until Every Girl Can Play’ campaign, while our partnership with the Shane Warne Legacy continued to drive awareness for heart health during the NRMA Insurance Boxing Day Test and the McGrath Foundation’s Sydney Pink Test again set the standard for sports charity activations globally.

CA’s contribution to the organisation of a match between an Afghanistan Women’s XI and a Cricket Without Borders XI created a strong focus on efforts to support members of the Afghanistan women’s team now resident in Australia.

CRICKET’S BIGGEST SEASON

Early ticket sales indicate the 202526 international season – featuring the India white ball tour, The Ashes and the women’s multiformat series against India – will be the most watched in history.

Together with the Big Bash Leagues, this will provide an enormous opportunity to promote cricket to new fans and participants and demonstrate the game’s commercial value.

We continue to work closely with our state and territories, our broadcaster partners Fox and Seven, our new Principal Partner Westpac, with whom we signed our biggest ever commercial partnership, Platinum Partners NRMA Insurance, KFC and Toyota and all our Gold and Silver partners.

THANK YOU

Maintaining the prosperity of Australian Cricket is dependent on the hard work and collaboration of those working in the interests of the game including State and Territory Associations, the Australian Cricketers’ Association, local associations and community clubs.

We thank former CEO Nick Hockley who navigated the unprecedented challenge of the pandemic and delivered a period of significant growth and prosperity for our game. We also thank all players, officials, volunteers, administrators, employees, and commercial, media, government and charity partners who have played an instrumental role in keeping cricket at the heart of Australian communities.

Australian Cricket is now in the fourth year of our five-year strategic plan and commencing the exciting ‘Thrive’ Phase of Where the Game Grows.

The third and final phase is focused on taking the game to new heights at home and abroad, with a thriving Australian Cricket system operating at its full potential. This requires bold thinking and action to drive new growth in all areas of the sport.

Throughout the year, strategic decisions taken laid the groundwork to succeed in the final years of the strategic plan, with the following key highlights demonstrating the successes achieved on and off the field.

Australia’s women’s team’s record-breaking Ashes summer saw the first ever 16-0 whitewash in a multiformat series against England, as well as huge crowds across the series, culminating in the world record attendance for a women’s Test match in the first women’s Test held at the MCG since 1949 and first day-night Test at the venue.

Australia’s men’s Test team triumphed over India as more attendance records fell, with the series ensuring Australia held every available bilateral Test series trophy at the same time.

Launched our Stretch Reconciliation Action Plan.

Continued focus on fan experience led to new innovations and activations at matches, in conjunction with our valued venue partners, resulted in the highest ever average fan Net Promoter Score across the summer, +54.

Launched the Spring Challenge as part of our revisions to optimise the WBBL, which also allowed us to increase the average women’s state player’s salary to over $163k a year, the highest of all women’s team

Released the first ever National Community Cricket Infrastructure Strategy, helping to direct almost $5.6M on 208 projects worth around $144M through the Australian Cricket Infrastructure Fund.

Launched Project Inspire to empower women in cricket leadership, a key initiative under our 10-year Women & Girls Action Plan, which aims to increase the presence and impact of women in leadership roles at all levels of the game.

Record multicultural participation in cricket, with 103k participants from South Asia last season, alongside a record 29k 5-12 year old girls playing the sport.

Further enhanced CA’s commercial program, with the addition of iconic Australian brand Aussie Broadband, and the continued long-term support of Qantas, Weber, KFC and Gatorade for Australia’s national sport.

The Big Bash continued to grow with a 7% increase in attendance from the previous year, and the new Big Bash app driving an 81% increase in digital sessions and growing social media following by 569k.

Australia opened its international season with a tour of Scotland and England, sweeping the three T20 Internationals in Edinburgh. The team then began the English leg by winning the deciding T20 match to draw that series 1-1.

Australia won the first two matches in the ODI series against England, who came back in the third and won the fourth match under DLS. The final match was abandoned due to rain; with Australia ahead on DLS they won the series 3-2.

Back at home Australia and Pakistan shared the first two ODIs in low scoring affairs to head to Perth with the series level. Pakistan won the final match.

Onto the much-anticipated Border-Gavaskar Trophy, where India defeated Australia in Perth before we took out the

Steve Smith reached 10,000 Test runs

Steve Smith became the highest scoring visiting batter (591) at Lord’s during the World Test Championships Final, surpassing Australian Warren Bardsley’s 575, and Sir Donald Bradman’s 551

win in Adelaide on the back of a century by Travis Head and an eight-wicket haul by Mitchell Starc.

Despite a rain affected draw in Brisbane, Australia won in Melbourne and Sydney to take back the Border-Gavaskar Trophy 3-1. Pat Cummins won the coveted Johnny Mullagh Medal in Melbourne and Scott Boland finished with player of the match in Sydney. The series victory meant Australia held every available bilateral Test series trophy.

To close out the World Test Championship cycle Australia headed to Sri Lanka. Led by Usman Khawaja (232), Steve Smith (141), Josh Inglis (102) and Matt

Kuhnemann (nine wickets) we dominated the opening Test.

Smith (131) scored back-to-back centuries in the second Test along with Alex Carey’s second Test century (156) as Australia again dominated, winning by nine wickets. Kuhnemann finished with 16 wickets for the series.

Swapping for ODIs Sri Lanka then hit back to win the ODI Series.

The WTC final against South Africa at Lord’s was bowler dominated including 6-28 by Pat Cummins before South Africa’s Aiden Markram (136) guided South Africa to victory.

Australia performed credibly in the return of the ICC Champions Trophy with a semi-final result.

Pat Cummins snared his 300th Test wicket and equalled Ritchie Benaud’s most Test five-wicket hauls as Captain

MARSH SHEFFIELD SHIELD

South Australia chased a record total (270) to win the 2024-25 Sheffield Shield, breaking a 29-year title drought. Brendan Doggett was named Player of the Match for taking the best ever match figures in a Shield Final (11-140).

MARSH ONE-DAY CUP

South Australia became the first team to lift the newly named Dean Jones Trophy, defeating Victoria at Adelaide Oval. After a match-winning bowling performance, Henry Thornton (4-27) was named the inaugural Michael Bevan Medalist.

During the year CA was delighted to extend Australian men’s team Head Coach Andrew McDonald’s contract through to the end of 2027.

Beth Mooney has now scored a century in each format of the game

The women’s international season began with Australia’s 3-0 series sweep of New Zealand after a six-wicket win in the final T20I in Brisbane, with an expert display from allrounder Ashleigh Gardner, who was named player of the series.

The team missed out on taking a historic fourth consecutive T20 World Cup title in the UAE, falling to South Africa in the semi-final in October.

A second series whitewash followed with Australia defeating India on home soil in December, which included a record-breaking innings of 105 (75) by Ellyse Perry, Georgia Voll’s maiden international century, and some

all-round Annabel Sutherland brilliance, which saw her named player of the series.

Our reigning One-Day International world champions retained the Rose Bowl, travelling to New Zealand for the ODI competition. The first match was washed out and Australia won the next two matches to continue their winning streak. Allrounder Annabel Sutherland was named player of the series.

In a successful and well-attended Women’s Ashes Series, Australia completed an historic clean sweep of the seven game multiformat series. This included a comprehensive innings and 122 run victory in the first DayNight Test to be played at MCG. Proudly celebrating the 90 th anniversary of the first women’s Test match in 1934-35, the Ashes was a celebration of the progress of women’s cricket, and Australian women’s cricket particularly.

Closing out the international season, Australia held off a fast-finishing New Zealand to seal a T20I sweep with a tense eight-run win in the series finale in Wellington.

2024-25 RESULTS

2024-25 DEBUTANTS

TEST, ODI AND T20I

MCG HONOUR BOARD

Individual brilliance from Annabel Sutherland (163), Beth Mooney (106) and Alana King (5-53) earned the trio a place on the MCG Honour Boards alongside Peggy Antonio; the only other female player to etch her name in history at the iconic venue.

T20 SPRING CHALLENGE

Hobart Hurricanes won the inaugural T20 Spring Challenge Final in October, defeating Brisbane Heat by five wickets in a thrilling final-ball run chase at Cricket Central in Sydney.

New South Wales wicket-keeper batter Tahlia Wilson was named the inaugural T20 Spring Challenge Player of the Tournament and the WNCL Player of the Year, following a stellar 2024-25 season.

WOMEN’S NATIONAL CRICKET LEAGUE (WNCL)

New South Wales Breakers defeated Queensland by 21 runs at Allan Border Field to win

KFC BBL|14 Final achieves second largest audience

Glenn Maxwell

Hobart Hurricanes were crowned champions for the first time after an epic KFC BBL|14 Final against Sydney Thunder, highlighted by Mitchell Owen’s unforgettable, record-equalling century from just 39 balls, contributing to the highest run chase in a BBL Final.

The KFC BBL|14 Final showcased thrilling cricket action and attracted record viewership nationwide, cementing the League’s status as the most-loved premier T20 competition in its window, with unforgettable moments and nationwide audience engagement.

There were plenty of highlights during the season. Glenn Maxwell amazed the crowd with a onehanded boundary line catch for the Melbourne Stars on New Year’s Day. Matt Short’s record-breaking century helped the Strikers defeat Brisbane at the Adelaide Oval. Steve Smith smashed a magical 121* from 64 balls to lead the Sydney Sixers to a 14-run victory over Perth. Sam Konstas made a stunning BBL debut for the Sydney Thunder, hitting the fastest half-century in team history off just 20 balls.

A national average audience of 1.6M watched the Hurricanes secure their first Big Bash League title, defeating the Thunder by

seven wickets. This marked a 43% increase from the BBL|13 Final, becoming the most-watched BBL match across Seven, Foxtel, 7plus, and Kayo Sports. Held at Ninja Stadium, the thrilling game drew a sold-out crowd of 15,706, the venue’s highest since BBL|06.

The season averaged 770,000 viewers nationally, growing 20% year-on-year, with the Finals series drawing 1.145M per game. Seven achieved its highest average audience since BBL|10, while Foxtel recorded its most-watched season ever.

Digital engagement soared during BBL|14, with the League’s social media followers growing by 569,000 and the Big Bash app driving an 81% increase in sessions. The newly launched Big Bash YouTube channel acquired 191,000 followers, with match highlights averaging 577,000 views.

BBL|14 also excelled in attendance figures, with total attendance for the season reaching 971,346, a 7% increase from the previous year. The average attendance of 22,076 per match was the highest since BBL|07. The Finals series witnessed the one millionth fan across WBBL and BBL attend The Knockout at ENGIE Stadium, while the total attendance across both competitions was 1,051,178.

Melbourne Renegades claimed their first WBBL title

Hayley Matthews was the hero for the Melbourne Renegades as they defeated Brisbane Heat by seven runs to be crowned Weber WBBL champions for the first time. Named the Player of the Final, Matthews smashed 69 off 61 balls – the highest individual score ever in a WBBL Final.

significant stream of engaging content from our world class competition. WBBL social media consumption increased by 56%, along with a 55% increase in engagement and more than 80,000 new followers during the tournament.

Star of the season-opener at Adelaide Oval, 15-year-old debutant Caoimhe Bray claimed a crucial wicket and scored the winning runs for the Sydney Sixers. Hobart Hurricane Lizelle Lee rewrote the record books at the SCG with the highest ever score of 150* (75) as well as the most sixes in an innings. Georgia Voll hammered a careerhigh 97* (56) to win the match between Sydney Thunder and Perth Scorchers and Brisbane Heat’s Lucy Hamilton became the youngest player in WBBL history to take a five-wicket haul, bowling her side to a six-wicket win over the Melbourne Stars at Drummoyne Oval.

The WBBL continues to reinforce its status as the world’s best cricket league for women, exemplified by the viewership, attendance and engagement

Australian DJ duo Kinder lit up the Weber WBBL|10 Stadium Series, with the dance sensations performing an electrifying show in four of our largest venues, for families and event seekers alike.

A 46% increase in average audiences per game across Seven, Foxtel, 7plus and Kayo Sports, alongside 23% growth in average attendance, demonstrates both the passion of our core fan base and the League’s mass appeal to wide national audiences.

Total registered participation continued its upward trend increasing to 669,642. There was an encouraging 6% increase in women and girls registrations as well as growth in Woolworths Cricket Blast (+8%) and social cricket (+11%). This was offset somewhat by a 7% decline in indoor cricket.

We maintained our focus on building registered participation among 5 to 12-Year-olds during the year and we continued to see increases across the board.

Girls’ participation growth remains strong increasing by 8% and a 4% increase in boys resulted in 143,098 5 to 12-year-olds registering to play during the 2024-25 season. The additional 5 to 12-year-old girls registered to play across Junior Cricket, Woolworths Cricket Blast, and Social Cricket programs.

The popularity of Woolworths Cricket Blast continues with 89,684 girls and boys registering to play this year, reflecting an 8% increase on last season. Girls made up 29% of registrations having grown 11% on last year.

Junior Cricket recorded a 6% increase in registrations on last year, directly resulting from three years of growth in Woolworths Cricket Blast leading to more participants continuing to the next step in the Junior Cricket experience.

More than 108,000 participants registered, surpassing prepandemic numbers for the first time. Overall boys’ Junior Cricket is 2% up on last year with growth coming in 12 and under segment demonstrating the impact of the focus on transition and retention. With a national retention average at 71%, when moving into Junior Cricket, two out of three girls and seven out of 10 boys stay in the game.

Record numbers of girls playing

JUNIOR CRICKET EXPERIENCE

In early 2025 we completed an extensive review of the junior cricket pathway, which included a pilot and development of a new social cricket product. It’s a social cricket offering for the whole family that will engage new participants, increase likelihood of retaining current players and bring lapsed participants back to the game. The new Junior Cricket Experience will be launched in season 25-26, that will include the launch of Smash Series Cricket.

represent 13% of registrations. In CA’s Multicultural Action Plan, our target of 100,000 South Asian Registered Participants was achieved. A healthy increase of 11% to 103,232 participants included a 19% increase in women and girls signing up.

NSW Metro took out three of the four Championships on offer this year

NATIONAL CHAMPIONSHIPS

West Australia won the Under 19 Male Championships

NSW Metro won the Under 17 Male Championships

NSW Metro won the Under 16 Female Championships

NSW Metro won the Under 19 Female Championships

CA, through the network of State and Local Cricket Associations, provides the system for umpires from Grassroots level to the International stage.

Sam Nogajski officiated his first ICC Men’s World Cup in the West Indies and the United States this year. He was also recently added to the ICC’s Emerging Umpire Panel, the first male Australian Umpire in 10 years.

2024-25 DEBUTANTS

Lisa McCabe

Men’s T20 International Umpiring Debut (Aug 2024)

Kent Hannam – (Match Referee)

• Men’s T20 International Debut (Aug 2024)

Men’s One Day International Debut (Sep 2024) Women’s Test Match Debut (Jan 2025)

Andrew Crozier

Women’s T20 International Umpiring Debut (Sep 2024)

Troy Penman

Women’s T20 International Umpiring Debut (Sep 2024)

David Gilbert (Match Referee) Men’s One Day International Debut (Nov 2024)

INTERNATIONAL

Australia won all six of their matches during the U19 International Women’s Tri Series against Sri Lanka and New Zealand in Queensland.

ICC U19 Women’s World Cup in Malaysia was played in January 2025, when Australia lost a semifinal against South Africa.

NATIONAL INDIGENOUS CRICKET CHAMPIONSHIPS (NICC)

The NICC showcases exceptional cricket talent and widens the pathway for Aboriginal and Torres Strait Islander cricketers to participate at the highest levels of our sport.

Western Australia claimed their first women’s NICC title in April, while Queensland won the men’s division on Yuwibara Country in Mackay.

NATIONAL INDIGENOUS TRAINING CAMP

The Training Camp hosted by the MCC Foundation was held at the MCG again after the success of last year’s camp. We remain committed to reconciliation and sustainably strengthening opportunities for First Nations Peoples to play, attend and follow cricket.

We thank our partners, the Melbourne Cricket Club Foundation and National Indigenous Television (NITV) for showcasing the Championships to all Australians through live broadcast for the first time.

AUSTRALIA WOMEN’S INDIGENOUS TEAM

The Women’s National Indigenous Team competed in the PacificAus Sports Cricket Invitational between Papua New Guinea (PNG), Fiji, Samoa and Australia, in June.

This was the first-ever Women’s T20 International tournament held in Port Moresby and was a fantastic opportunity to continue to strengthen the ties between Australia and the pacific region, build relationships and share culture through cricket.

Australia won four matches against Vanuatu and Samoa and shared one win each with PNG. PNG were the eventual winners, finishing higher in percentage.

We thank the Australian Government and Papua New Guinea Cricket for their support.

AUSTRALIAN TEAMS

The Australian Men’s Blind team retained the Blind Ashes after securing a commanding 3-0 series victory against England in the 2024 Blind Ashes series.

This victory marked a significant moment for Australian Blind and Low Vision cricket, as it was the first Blind Ashes series played in Australia in eight years and the 20 th anniversary of the event itself.

The Men’s National Deaf and Hard of Hearing Team toured New Delhi in February for a T20I Tri-Series with India and South Africa before an ODI Series with India. Although Australia won a T20I match against India for the first time in 20 years, they were defeated by India in both Series.

NATIONAL CRICKET INCLUSION CHAMPIONSHIPS (NCIC)

The 2025 NCIC were held in Brisbane in January, with Victoria retaining multiple titles.

Victoria once again claimed the national titles in the Men’s Deaf and Hard of Hearing, Women’s Deaf and Hard of Hearing and Cricketers with an Intellectual Disability divisions, while NSW took home their sixth consecutive national title in the Blind and Low Vision division.

The new Women’s Blind and Low Vision division comprising two teams of players from around the nation, played exhibition matches for the first time, at the NCIC, with two wins apiece.

We thank CommBank and Taverners Australia for their support for this event.

NOMINATED FOR AFR AWARD

CA and partner AI Enterprises were finalists in the Creativity and Entertainment category of the Australian Financial Review AI Awards.

Collaboration between CA, Insight Enterprises, Microsoft and HCL Tech, has produced a new AI driven feature to uncover stories and deliver personalized experiences. This new feature, AI Insights, aggregates millions of data points to deliver information about the game and players, while the match unfolds. Launching just before the Women’s Ashes in January, we attracted more than 250,000 unique users in its first month.

Cricket fans engaged with our digital channels in record numbers during the 2024-25 season, which included four billion social media impressions on CA social channels from November to February – up 88% year-on-year.

The fantastic content showcasing our players, as well as exciting international and Big Bash match coverage, made for rich and engaging digital experiences for fans from around the world.

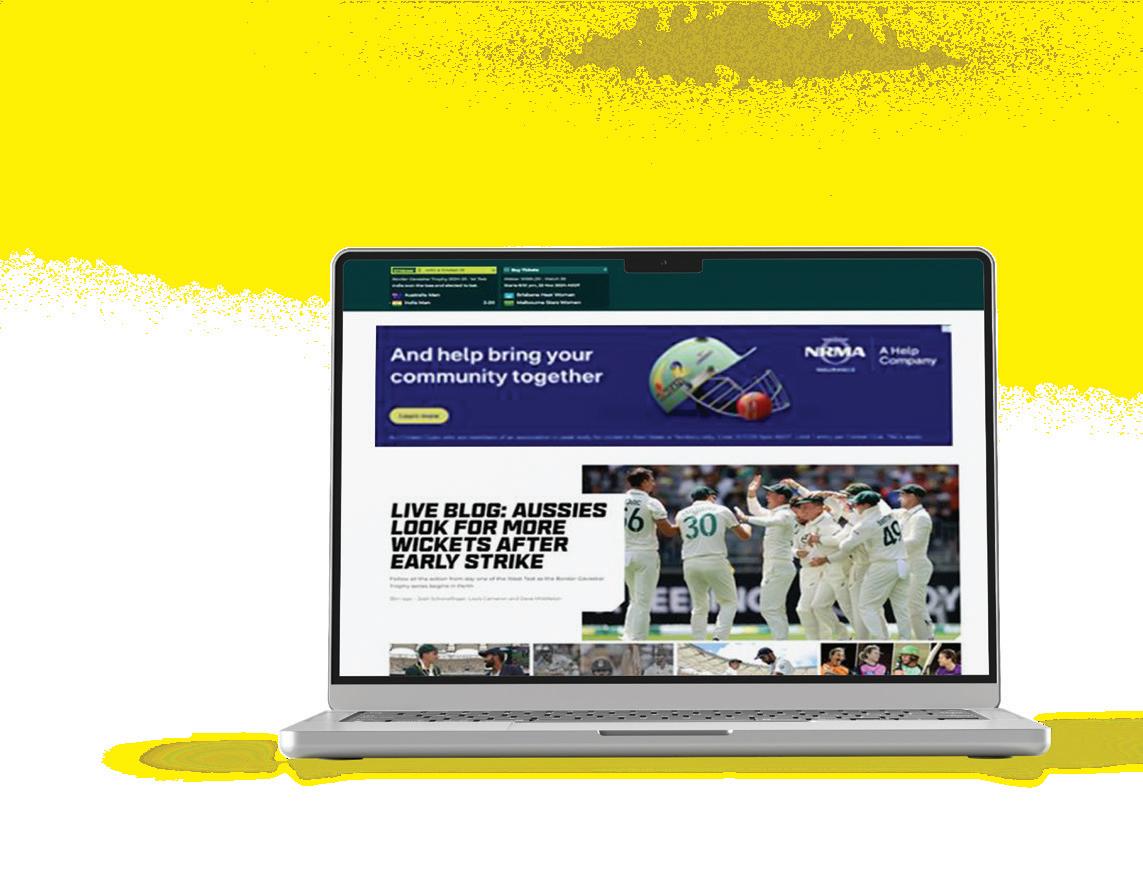

Increasing engagement on our owned platforms – cricket.com.au, CA Live app, Play Cricket app and the Big Bash app – was a major focus for the 2024-25 season. Day two of the Sydney Test saw our biggest day ever for Australian sessions on our platforms, where fans kept coming back to enjoy our content including the introduction of vertical video in the CA Live app to deliver a new content experience. One in six Australians have downloaded the CA Live app.

This season we also focused our resources on key platforms to engage new and existing audiences. With India touring Australia, and the huge cricketloving audience in the subcontinent, we were thrilled to reach 10M subscribers on the cricket.com.au YouTube channel. Well ahead of other sporting organisations in Australia, CA is the only one to have achieved this milestone and receive the coveted Diamond Creator Award. This achievement also places CA in the top bracket of sports organisations world-wide.

BIG BASH SCHOOLS CHALLENGE

The digitisation of our Big Bash Schools challenge program offers a fun and engaging platform for young kids to learn confidence, teamwork and basic ball skills, helping to prepare them for our entry level programs. CA can also engage online with them directly.

Thanks to the Australian Sports Commission for their support through their Play Well Participation grant.

CA’s commercial partnerships continue to play a key role in uniting and inspiring Australians to love and play the game, while powering the long-term success of Australian Cricket.

In 2024-25, sponsors capitalised on cricket’s extensive national reach and record broadcast audiences to achieve measurable brand outcomes, with innovative activations across the NRMA Insurance Men’s Test Series, Weber WBBL, and KFC BBL delivering strong fan engagement and memorable experiences.

This year, partnerships were strengthened through a focus on digital innovation, enabling deeper and more targeted connections with fans. Last season, CA invested in Partnerbrite, an ad-tech platform designed to monetise known audiences and deliver

outcome-driven digital solutions for commercial partners. Building on this capability, we launched our own productised version of the platform, branded CrowdCatch.

As part of a pilot program, NRMA Insurance became the first partner to activate a CrowdCatch campaign over the summer, leveraging CA’s first-party data audiences. This enabled NRMA Insurance to target highly relevant audience groups across its own paid social channels with cricketled creative, supported by an integrated CA Digital package.

The campaign delivered outstanding results, achieving a 38% improvement compared to NRMA Insurance’s existing paid social benchmarks. This success demonstrated the strength of engaging a rich, cricket-aligned audience base and reinforced the value of providing innovative, outcome-led solutions for our partners.

Strategic and collaborative relationships with partners continued to drive sponsorship growth while also contributing to the broader success of cricket.

Through the Woolworths Cricket Blast program, we reached 89,684 kids, bringing total participation to over 453,000 since Woolworths began its support in 2018

Toyota continues to be a passionate supporter of community cricket through their Good for Cricket Raffle, which has raised over $8M for grassroots cricket over the past seven years. Each year, Toyota donates over $250,000 in prizes, giving participants the chance to win brand-new vehicles or unforgettable experiences, including star players visiting their own clubs.

We acknowledge the conclusion of our long-standing partnership with CommBank at the end of the 2024-25 season.

For more than two decades, CommBank has been a driving force in the growth of cricket, championing grassroots participation, community initiatives, and most notably, the rise of women’s cricket. Their support has left an enduring legacy of inclusivity, accessibility, and inspiration for generations of players and fans, and we are deeply grateful for their significant contribution to the game. The commitment of all of our partners highlights the powerful role sport plays in fostering connection and driving impact. Their continued support also reinforces cricket’s standing as one of the most valuable and commercially sustainable properties in Australian sport

Cricket continued to unite Australians with domestic and international audiences tuning in at record levels. Standout moments included a 48% year-on-year increase in Men’s Test viewing audiences that peaked when it mattered, with the final session of the SCG Test averaging 2.6M viewers.

MEN’S INTERNATIONAL

Australia’s successful bid to regain the Border-Gavaskar Trophy was the most-watched Test series under the current Fox Sports and Channel Seven broadcast partnership:

A 48% YoY increase in Test viewing audiences, with an average daily audience of 1.47M viewers across the entire day –eclipsing the 2021-22 Ashes Series as the most watched Test series in the Foxtel and Seven era.

40 sessions of play averaging more than 1M viewers, with 10 sessions averaging more than 2M viewers.

• The Sydney Test was the highest rating Test in the history of Seven and Foxtel, averaging 2.03M viewers across the entire Test –up 84% YoY. The final session of the SCG Test was the highest rating session of the summer, averaging 2.6M viewers.

• The Boxing Day Test averaged 1.9M viewers, with the thrilling final session watched by an average audience of 2.3M – the highest rating Boxing Day Test in the past decade.

RECORD-BREAKING AUDIENCE IN INDIA

The Border-Gavaskar Trophy delivered unprecedented viewing figures on the Jio Star network, which produced coverage in five-languages for fans in India. Branded by Jio Star as The Toughest Rivalry, the series broke Indian viewership records.

192.5M TV viewers watched the Border-Gavaskar Trophy across the Jio Star network with 52Bn minutes of viewing time – the second greatest audience ever for a BGT series.

• This was also the second most watched series ever on Indian television, including India’s home and away series.

The vast audience represented a 74% increase on the previous Border-Gavaskar Trophy series played in Australia.

WOMEN’S INTERNATIONAL

Culminating in the Women’s Ashes clean sweep, this was the most watched Women’s International season in history:

A cumulative average audience of 4M viewers across the Ashes series, an increase of 87% on the 2021-22 Ashes – the most-watched Women’s Ashes in Australia.

• The Day/Night Ashes Test was the highest-rating women’s Test in Australia, with daily average audiences up 27% on the 2021-22 Ashes. Day two averaged 539,000, including 803,000 viewers for the final session, both records for women’s Tests.

The three Ashes T20Is were up 74% on the 2021-22 Ashes and the ODI series audiences were up 86% on 2021-22. The first ODI was the highest-rating women’s ODI ever in Australia with 498,000 tuning in.

• Audiences for the ODI series against India across Seven and Foxtel were up 60% on the most recent (2021-22) series between these two teams and the highest average audience for a nonAshes ODI series.

BIG BASH LEAGUES

A pulsating BBL|14 ensured this was collectively the most watched BBL season broadcast by the current rights-holders and the most watched ever on Foxtel Group. WBBL|10 also recorded significant increases in viewing audiences:

The BBL confirmed its status as Australia’s most watched sports league on a per-game basis with average audiences for BBL|14 growing 20% year-on-year.

The KFC BBL|14 Final was the second highest rating BBL game ever and the most watched in nine years, reaching a national average audience of 1.6M.

This was 43% greater than the BBL|13 Final, and the most watched BBL game ever across each of Seven, Foxtel, 7plus Sport and Kayo Sports.

• The BBL|14 Finals drew an average audience of 1.145M per game, the most for a Finals series of four or more games and of any length since BBL|07.

The average audience per match for WBBL|10 increased 38% YoY and was the largest since WBBL|07.

ABC, SEN AND SOUTHERN CROSS AUSTEREO REMAIN THE SOUND OF CRICKET

CA was pleased to extend its audio partnerships with the ABC, SEN and Southern Cross Austereo for the next seven seasons (2024-25 to 2030-31). The extension will ensure cricket fans continue to enjoy a broad and comprehensive range of coverage across AM and FM radio, DAB+ and digital platforms.

DIVERSITY & INCLUSION

We continued our focus on diversity and inclusion throughout FY25. Our gender pay gap of 8.8% in favour of men is the lowest in the industry.

We launched our South Asian Mentoring & Leadership Program for employees across Australian Cricket who come from a South Asian background. This is a key commitment made in our Multicultural Action Plan to connect our people with multicultural ambassadors who have shared insights and advice on career progression and growing a personal brand through networking.

Our continued focus on ensuring cricket is a sport for all was recognised in April when CA was awarded the highly prestigious Gold status in the annual Pride in Sport Awards, exceeding our target of Bronze status.

EMPLOYEE ENGAGEMENT

Employee engagement continued to increase, with our employees noting the most favourable engagement score since the pandemic. We continued our focus on career and development through Hello Monday and SHK career sessions for people leaders and a strong focus on resilience and mental health. We also launched Mental Health training with our partner Converge.

60 JOLIMONT STREET REFURBISHMENT

A highlight for our people in FY25 was the refurbishment of our 60 Jolimont Street head office. The new meeting rooms, collaborations spaces and shared social facilities were designed to foster teamwork, leadership, and high performance, and reusing of existing pieces and incorporating recycled and sustainable materials was a priority. The changes reflect the culture and professionalism of our sport which also showcase trophies and imagery that pay tribute to past and present cricket legends who have helped to make the game what it is today.

“As an Aboriginal cricketer, I’ve been fortunate to progress through the ranks and reach this level, but I recognise the barriers that many Aboriginal and Torres Strait Islander people face in accessing opportunities within the sport. By being a RAP Ambassador, I hope to contribute to actionable solutions that foster understanding and inclusivity.”

Kamilaroi woman Hannah Darlington

CA launched its third Reconciliation Action Plan (RAP), and second ‘Stretch’ RAP, outlining a comprehensive strategy to achieve its vision for reconciliation – where cricket is renowned as an inclusive sport where everyone belongs.

This ‘Stretch’ RAP, focusing on high impact commitments, marks a significant milestone in CA’s decade-long journey towards reconciliation.

Our RAP aims to deepen engagement with Aboriginal and Torres Strait Islander communities, creating opportunities across all facets of cricket. Key initiatives include dedicated First Nations matches, cultural learning for employees, increased investment in Indigenous activities, and celebrating Indigenous excellence in cricket. They aim to boost

representation of Aboriginal and Torres Strait Islander peoples to 3% of employees and increase spending with Indigenous businesses by 5% annually.

We acknowledge our complex history and will celebrate ongoing contributions of Aboriginal and Torres Strait Islander peoples to our game and representing equality and equity.

Thank you to Aboriginal and Torres Strait Islander players, coaches, mentors, and employees for their candid and invaluable feedback, Reconciliation Australia for their guidance, CA’s National Aboriginal and Torres Strait Islander Cricket Advisory Group for their leadership and CA’s RAP Working Group for their dedication to identifying and prioritising impactful actions to deliver meaningful reconciliation outcomes.

Artist Ky-ya Nicholson Ward (Wurundjeri, Dja Dja Wurrung, Ngurai Illum Wurrung) was commissioned to create an original artwork for CA’s RAP.

MCGRATH FOUNDATION –$9,053,360 RAISED

The McGrath Foundation sold a record-breaking 425,000 Virtual Pink Seats during the NRMA Insurance Pink Test, to raise funds for McGrath Foundation to provide care to those impacted by all cancers (their new, broader mission). Six thousand families were supported by 60 McGrath Cancer Care Nurses. We are extremely proud to partner with the McGrath Foundation and very grateful to cricket fans for supporting Australians experiencing cancer.

SHANE WARNE LEGACY – 13,416 HEALTH CHECKS ON BOXING DAY

CA and the Shane Warne Legacy (SWL) raised awareness for heart health during the NRMA Insurance Boxing Day Test Match. With 52 stations at the MCG, fans underwent screenings for heart disease and diabetes. A clinicianled blood glucose and cholesterol check was introduced for high-risk individuals. 15.6% of participants had high blood pressure, with 115 requiring urgent medical referral, highlighting the initiative’s impact on preventive healthcare. CA and the SWL will continue to raise awareness together for the next two years.

UNICEF AUSTRALIA

Millions of girls globally face barriers to education, health, and safety. CA partnered with UNICEF Australia during the CommBank Women’s Ashes Test in the ‘Appeal Appeal’ campaign, reaching 6.8M Australians and generating $1.5M in pro-bono media to raise awareness of this important cause. Funds raised will provide empowerment packs for 2,791 girls and transformation packs for 113,000 girls, helping them to stay in school.

SUSTAINABILITY

As custodians of the sport, we know we must take steps to play our part in reducing the impacts of climate change and adapt and prepare our infrastructure to thrive under new conditions.

During the year, we engaged with experts and the cricket community to begin the development of our Environmental and Sustainability Action Plan. Our core objectives are to create positive impact; reduce emissions; improve governance practices; inspire others.

We continued to reduce our environmental footprint through initiatives like donating to charity 128 pallets of cricket gear decommissioned over the past five years; keeping 1321kg of CA’s end-of-life technology out of landfill to be recycled or refurbished; and, using more eco-friendly materials in our KFC Bucket Heads and 21,000 eco flags for the Women’s Big Bash.

INVESTMENT IN CRICKET

Government investment in cricket is fundamental to ensuring Australia’s national and state teams continue to produce amazing performances in great venues, local and travelling fans enjoy brilliant experiences at our matches and host cities and communities benefit economically and socially.

CA, along with state and territory associations, successfully advocated through federal and state elections for investment in a range of cricket projects and programs.

The awarding of hosting rights for select international matches out to 2030-31 was the culmination of

a series of strategic partnerships between CA and State and Territory Governments to provide greater certainty for fans and communities, and to ensure investment in cricket at all levels across the country.

CA continues to work closely with relevant governments and other stakeholders on the development of key stadia projects in line with the future opportunities presented by Australia co-hosting the ICC 2028 Men’s T20 World Cup and returning to the program in the 2028 Olympics in Los Angeles.

The Australian Cricket Infrastructure Fund (ACIF) continued to deliver funding for community cricket facilities around the nation driving participation growth. In 2024-25, the ACIF facilitated almost $5.6M to contribute to 208 projects worth around $144M. This investment was guided by cricket’s first ever National Community Cricket Infrastructure Strategy developed to guide and support sustainable infrastructure investment.

The ICC Men’s T20 World Cup Multicultural Legacy Program, supported by a $4.4M contribution from the Australian Government, saw a 29% increase in participation in entry-level cricket programs among culturally and linguistically diverse communities, with 26,000 participants over the past two years

The inaugural PacificAus Sports Cricket Invitational held in Papua New Guinea was thanks to our partnership with the Australian Government through the PacificAus Sports program and delivered on CA’s strategic priority to ‘grow the game globally’ and is a key commitment under our Stretch Reconciliation Action Plan 2024-2027.

The Afghan Women’s XI featured in a match against a Cricket Without Borders XI in Melbourne, a celebration of the team and the players and was the first time the team had played together.

Annabel Sutherland and Travis Head took top honours at the Australian Cricket Awards in February, winning the prestigious Belinda Clark Award and Allan Border Medal respectively.

Annabel won her first Belinda Clark Award in a year that saw her named in the ICC ODI Team of the Year. It was also the first time that Travis won the Allan Border Medal, having played a crucial role in Australia’s successful year.

WOOLWORTHS CRICKET BLASTER OF THE YEAR

Frankie Mountney (Tasmania)

UMPIRE OF THE YEAR

Sam Nogajski received the CA Umpire Award for the third consecutive year after another exceptional season at both international and domestic levels.

VOLUNTEER OF THE YEAR

Chrissie Ponter, Federal Cricket Club, NT

TOYOTA COMMUNITY CRICKET CLUB OF THE YEAR

Coromandel Valley Ramblers Cricket Club, SA

AWARD

AUSTRALIAN CRICKET AWARDS

Belinda Clark Award

Allan Border Medal

Women’s ODI Player of the Year

Women’s T20I Player of the Year

Shane Warne Men’s Test Player of the Year

Men’s ODI Player of the Year

Men’s T20I Player of the Year

Weber WBBL | 10 Player of the Tournament

KFC BBL | 14 Player of the Tournament

Women’s Domestic Player of the Year

Men’s Domestic Player of the Year

Betty Wilson Young Cricketer of the Year

Bradman Young Cricketer of the Year

Community Impact Award

Hall of Fame Inductees

2024-25 STATE CRICKET AWARDS

Sheffield Shield Player of the Year

Women’s National Cricket League Player of the Year

One-Day Cup Player of the Year

RECIPIENT

Annabel Sutherland

Travis Head

Ashleigh Gardner

Beth Mooney

Josh Hazlewood

Travis Head

Adam Zampa

Ellyse Perry and Jess Jonassen

Glenn Maxwell and Cooper Connolly

Georgia Voll

Beau Webster

Chloe Ainsworth

Sam Konstas

Cameron Green

Christina Matthews, Michael Clarke and Michael Bevan

Fergus O’Neill (Victoria)

Tahlia Wilson (New South Wales)

Liam Scott (South Australia)

Benaud Spirit of Cricket Award (Men’s) Victoria

Benaud Spirit of Cricket Award (Women’s) New South Wales

Indigenous Cricketer of the Year

T20 Spring Challenge Player of the Year

Anika Learoyd (New South Wales and Sydney Thunder)

Tahlia Wilson (New South Wales)

2025 NATIONAL COMMUNITY AWARD WINNERS

Young Leader of the Year

Community Cricket Coach of the Year

Community Match Official of the Year

Cricket Blast Coordinator of the Year

Women and Girls Initiative of the Year

Inclusion & Diversity Initiative of the Year

Celebrating Cricket in Schools

Community Cricket Association of the Year

Henry Land, Cunnamulla Emus Cricket Club, QLD

Dave Neil, Orange CYMS Cricket Club, NSW

Amey Jambeka, Huon Channel Cricket Association, TAS

Shane Wilson, Kiama Cavaliers Cricket Club, NSW

Mel Nixon, Tracy Village Cricket Club, NT

Priya Rajendra, North Balwyn Cricket Club and Melbourne Deaf Cricket Club, VIC

St Andrews Catholic College, Redlynch, QLD

Metropolitan Junior Community Cricket Inc., WA

Community Cricket Partnership of the Year Swan Valley Cricket Club, WA

Community Facility Project of the Year (Major Category – $1M+)

Community Facility Project of the Year (Minor Category – < $1M)

Indoor Facility of the Year

Junior Initiative of the Year

Technology & Media Initiative of the Year

Community Facility Project of the Year

Shoalhaven City Council, Artie Smith Oval, NSW

Community Facility Project of the Year Eastlake Junior Cricket Club/ACT Government, Deakin West Oval, ACT

Charmhaven Indoor Sports, NSW

Warringah Cricket Club, NSW

Warwick Greenwood Cricket Club, WA

BOB COWPER OAM

Having played for Victoria and Western Australia from 1960 to 1970, Bob also represented Australia from 1964 to 1968. The left-handed batter played in 27 Tests, scoring 2,061 at an average of 46.84. He scored the first Test cricket triple century on Australian soil (307), taking 12-hours at the MCG against England in February 1966.

KEITH STACKPOLE, MBE

After a First Class career with Victoria, scoring 10,100 runs, Keith represented Australia during 1966-1974 as a middle order batter. He played 43 Tests and six ODIs, scoring 3031 runs, and went onto to become a respected commentator.

FRANK DUCKWORTH MBE

An English statistician who consulted to the ICC, Frank co-developed the Duckworth–Lewis method for adjusting cricket scores in rain-affected matches.

IAN REDPATH MBE

Australian opening batter and member of the Australian Cricket Hall of Fame. Ian played 66 Tests and made 4737 runs at 43.45 including eight centuries and 31 half centuries with a top score of 171. In 1975, Ian was made a Member of the Civil Division of the Most Excellent Order of the British Empire for services to cricket.

CREAGH O’CONNOR AM

Former CA Chair Creagh O’Connor AM served on the VCA Board for 11 years from 1999 and was Chair from 2005-2008. He joined the South Australia Cricket Association board in 1991 where he served for 19 years.

FRANK MISSON

Having represented New South Wales, Frank was a right-arm opening bowler for Australia in five Tests from 1960 to 1961. He had a bowling average of 38.5 (best of 4/58) and scored 38 runs.

PATRICIA THOMSON

After playing for Victoria, Patricia represented Australia in four Tests, including the 1963 Ashes tour. Patricia scored 107 runs at 26.75 and claimed two wickets at 73.5.

JANICE PARKER (NEE WADY)

Janice played cricket for Australia from 1963 to 1969 after playing for Victoria. A right hand batter and medium-pace bowler, Janice scored 172 runs (2 x 50s, top score of 60) and took three wickets (best of 2/13) during five Tests.