STATES PULL OUT ALL THE STOPS IN RACE FOR EV INVESTMENTS

Midwestern states fell behind early in the race to secure EV

Midwestern states fell behind early in the race to secure EV

As developer Bedrock prepares to start moving dirt for a longterm project to remake a stretch of downtown Cleveland’s riverfront, city o cials are proposing a novel way to fund part of the public infrastructure work. A master development agreement hashed out over many months between Bedrock and the city shows that Cleveland plans to create a large tax-increment nancing overlay district that would span much of down-

town and parts of the near-West Side. e district will allow the city to capture, and borrow against, the growth in property values over several decades.

go

public infrastructure projects on

Part of that money, in turn, will go toward public spaces, roads, riverfront bulkheads and other infrastructure on Bedrock’s property, a largely barren slice of the east bank behind Tower City. But additional revenues will ow to public infrastructure projects on the lakefront; to other parts of

See RIVERFRONT on Page 16

A prevailing strategy for many marijuana companies has always been to plant operations in new medical markets in anticipation of capitalizing when those states allow for general adult use.

With Ohioans poised to vote Nov. 7 on recreational marijuana via Issue 2 — a measure that polling suggests is highly popular with voters — that long-awaited opportunity in the Buckeye State maynally be around the corner.

If passed, it is expected that Issue 2 could provide a huge boost to Ohio’s current medical-only marijuana industry.

It couldn’t come at a much better time for a business segment that’s been struggling more than many stakeholders had anticipated.

“Competition is erce for market share. Many of these businesses are in survival mode,” said Kevin Murphy, a veteran cannabis attorney at Walter Haver eld who’s on the board of Gibsonburg-based multistate operator Standard Wellness Co. “I think for business owners in Ohio, having rec pass is the most important thing for their businesses long-term. It even trumps SAFE Banking and getting rid of (IRS Code) 280E (limitations).”

As in many parts of the country, Ohio’s marijuana industry has been grappling with a downturn amid rising in ation. But Ohio has already proven to be a challenging market for companies to operate in regardless of economic factors.

A two-tiered regulatory regime — which will nally atten to one agency under the department of commerce at the end of this year — has been cumbersome and costly for many operators to navigate.

An oversupply of product, which has built up amid soft demand and a stagnant medical patient population, has contributed to falling retail prices but also slimmer margins for suppliers.

“While not everyone is struggling, everyone who is an operator is happy to see states like Ohio go rec because of the increased sales that it will bring,” said Stephen Lenn, a Phoenix-based lawyer with Brennan Manna & Diamond who works with the cannabis industry, particularly in nancing and M&A deals. “But whether you can take advantage depends on how your operations are.”

e expectation among many industry stakeholders is that annual sales volumes of legal cannabis could double or triple in short order with an adult-use program in place.

“We expect an adult-use market to double demand in its rst year,” said Andy Rayburn, CEO of Buckeye Relief, a vertically integrated marijuana company based in Eastlake. “We expect a signi cant part of that new demand to come from two areas: the Ohio illegal market and tens of thousands of Ohio residents who drive to Michigan to purchase products every month.”

lectors could be hopeful that there will be tra c from those states to purchase in Ohio, which will help with revenue and tax receipts,” said Douglas Berman, executive director of Ohio State University’s Drug Enforcement and Policy Center.

rent regulations unused.

But the expectation is that grow space will ll up and be built out further as demand increases with adult-use laws in place.

“Many companies like us are more than likely going to wait and see that the law passed before they start investing more capital,” Maloof said. “If you are nancing expansions, lenders will want certainty that the program is actually going to launch before they underwrite loans. And for those of us who are equity- nancing stu , we also don’t want to deploy capital until we are reasonably certain it will yield an e ective return.”

ere are also tight restrictions on advertising and additional competition from Michigan’s rec market, Ohio’s potentially $2.8 billion illicit market (as estimated by New Frontier Data) and unregulated, hemp-derived delta-8 THC products that are commonly available at corner stores and gas stations.

All of those factors play a role in the pace of legal marijuana sales, which have been hovering around an average of approximately $40 million a month in the state since 2022.

If Ohio legalizes adult use, said Standard Wellness CEO Jared Maloof, the state also should benet from the lack of rec states surrounding it — excluding Michigan, of course.

“I expect a signi cant amount of tra c from Kentucky, Indiana, Pennsylvania and West Virginia,” Maloof said. “I think we will see either medical patients or consumers in general coming from those border cities into Ohio to buy products. And that’s why I’m thinking that three times our current revenue will be a conservative estimate.”

“I do suspect that market folks running the industry and tax col-

According to DEPC, as of this March, taxes and fees related to the medical marijuana program have generated an estimated $183.33 million for Ohio’s state government and local government entities since sales began in 2019.

Ohio medical marijuana products are only subject to sales tax. Under the laws proposed by Issue 2, adult-use sales would be subject to a 10% excise tax as well as sales tax.

According to estimates from DEPC, Ohio could see approximately $276 million to $404 million in additional annual tax revenues in the fth year of an adult-use program.

Companies also say that if Issue 2 passes, they will need to hire more employees to serve a larger market.

How many more workers are needed could vary a lot among companies and would, naturally,

be shaped by the actual demand the market sees.

Nonetheless, Maloof said Standard Wellness, which has roughly 135 employees in the state today across all operations, may “more than likely double” its Ohio workforce with a rec program in place. Other large marijuana companies have expressed similar expectations.

Additional capital expenditures are in the o ng as well, so long as the nancing is available.

Out of 34 large (Level 1) and small (Level 2) cultivators in operation in the state today, regulators have approved expansions for 13 growers, four large and nine small, according to state records. Not everyone is growing in their full capacity allowed, and some have taken grow areas o ine temporarily amid the oversupply.

According to state records, just 25% of a maximum 1.85 million square feet of combined marijuana cultivation space permitted by current law is in use. Another 15% of that has been authorized for use but is not operational. at leaves somewhere between 60% to 75% of total industry cultivation space permitted under cur-

If voters ratify Issue 2, stakeholders surmise, it might be close to a year before consumers have access to rec products. at’s because of the additional licensing and regulations that will need to be managed and will take time to sort out.

at timeline also could get thrown o by unforeseen setbacks with the rollout of an adult-use program.

ere’s also the possibility of an outright repeal of the laws established by Issue 2 by anti-marijuana lawmakers, though many observers are skeptical that GOP o cials would follow through with such a move. After all, Ohio could be the 24th state in the country with an adult-use program. And there haven’t been serious repeal movements underway in any of the markets with rec laws in place.

“ e immediate optics (of repealing a law passed by voters) may be enough to keep people from wanting to push back that much,” Berman said. “Some lawmakers thinking in longer terms might say, in a sense, let’s cut our losses. If the state wanted to tweak aspects of the law or regulate (the industry) to death, so to speak, it could have the means to do that. And that may seem less politically misguided than a complete repeal.”

Recreational sales would provide a massive jolt for marijuana companiesProjections from cannabis research rm New Frontier Data show the potential for recreational sales to grow quickly in Ohio should voters pass Issue 2 this November.

“While not everyone is struggling, everyone who is an operator is happy to see states like Ohio go rec because of the increased sales that it will bring.”

Stephen Lenn, a lawyer who works with the cannabis industry

By Paige Bennett

By Paige Bennett

Like many in today’s workforce, Jamir Taylor wants a work schedule that offers flexibility.

Taylor has been a licensed practical nurse for eight years. About a year ago, the Garfield Heights resident discovered Gale Healthcare Solutions — a platform that connects available nurses with health care facilities with open shifts via an app.

Intrigued by the concept, Taylor signed up for Gale.

Now, the LPN uses the platform one to three times a week to pick up shifts at assisted-living centers and long-term care facilities in Greater Cleveland.

Taylor is one of roughly 600 nurses in the Cleveland area who use Gale Healthcare Solutions.

well said. “They love being a nurse, but they just physically can’t be and mentally can’t be a nurse for much longer.”

His goal with Gale — named after Florence Nightingale — is to give nurses more control over their schedules, preventing burnout and keeping them working in the industry.

“People today more than ever want flexibility in their lives,” Braswell said. “They want to work when they want to work. They want to get paid when they want to get paid . . . our technology, being a two-sided marketplace, allows us to have flexibility.”

on-demand service platforms like Uber and Amazon could be applied to staffing in the health care sphere.

Less than six months later, he launched Gale. The platform has since grown to 68,000 nurses in the U.S. — and nearly 8,000 in Ohio.

In the Cleveland area, Gale works mainly with post-acute care facilities and nursing homes, rehab centers and assisted-living facilities, said Gale vice president of corporate affairs Sandra Germann in an email.

Tony Braswell, the company’s founder and president, said the platform’s goal is to give nurses the ability to work flexibly while also helping health care systems decimated by staffing shortages fill critical roles. Nurse shortages are affecting hospitals and facilities across the U.S., including in Ohio.

In May, the Ohio Nurses Association issued a “code red” warning in light of the ongoing labor shortage. At the time, the agency reported that thousands had left the industry because of difficult working conditions and that many who remained felt burned out.

Sixty-four percent of nurses reported feeling stressed, and 57% reported feeling exhausted, according to a 2023 survey of nurses from the American Nurses Foundation.

“Nurses are quitting,” Bras-

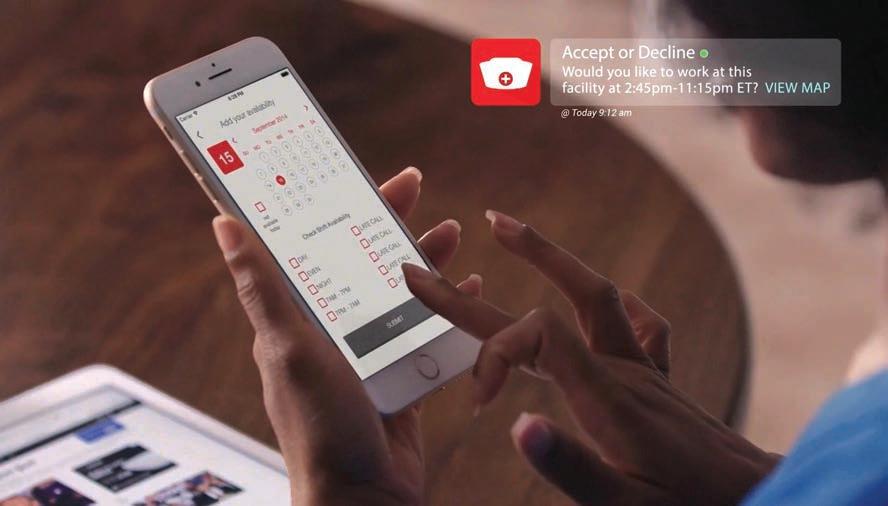

The Gale app functions similar to an Amber Alert. Using the company’s app, facility managers post their staffing needs, and available nurses in the local area receive a notification. Nurses set their availability and can accept or decline shifts. Once a nurse takes a shift, it appears on the health care facility’s schedule.

Braswell has worked in the health care staffing industry for 32 years. He has first-hand experience fielding phone calls from nurses and facilities, trying to find nurses to fill open shifts. He also understood the challenges health care systems faced with the payroll process and keeping up to date with staff credentials to ensure compliance.

Gale offers benefits and a same-day pay option to nurses. It also lets them store and manage their credentials within the app, making it easy for facility managers to access them.

Taylor, the LPN, said Gale’s instant pay and benefits were big attractions of the platform. Both Taylor and Braswell said they expect more nurses to become interested in this type of opportunity as they look for more freedom when it comes to their work life.

“Technology is changing the whole work environment, where people work remote now,” Braswell said. “That nurse, unfortunately, can’t work remotely because the patient can’t come to her house,

tient can’t come to her house, but she can work flexible.”

He was working one day in 2016, when he got a notification from Amazon, informing him that his college-aged son had ordered a bottle of ketchup to his dorm room.

a bottle of ketchup to his

At first, Braswell couldn’t believe his son had used a delivery service for such a small purchase. But then, he realized the idea behind

believe his son had used a

“People today more than ever want exibility in their lives.”

TonyBraswell, Gale Healthcare Solutions

founderThe Gale Healthcare Solutions app allows nurses to nd open shifts at health care facilities. | GALE HEALTHCARE SOLUTIONS PHOTOS

By Stan Bullard

By Stan Bullard

George Davis, president of ProBuilt Homes of Mentor, is preparing to seek city approvals to build for the rst time in the western suburbs with a 68-unit property in North Olmsted.

However, it won’t be ProBuilt’s typical for-sale property. Instead, he wants to build a rental townhouse community. ProBuilt also has 28 ranch-style units going up in Concord Township, and it recently nished e Standard on Lake Shore, 28 units of ranch and two-story units in Willoughby that are fully rented.

Davis is not alone. Other builders are adding projects in the builtto-rent category, one best known through Redwood Living, which has spread from Cleveland to multiple states and has more than 14,000 units.

e developments allow builders to participate in the growing market for rental properties, and increasing rents, that has developed the past few years. at trend is exempli ed in downtown Cleveland by e Lumen and e Beacon, and by Intro to e Quarter and others in Ohio City and Tremont.

ose are multistory buildings that are complicated and take two years to build. Build-to-rent projects, by contrast, are either one or two stories and no more di cult to build than a home or townhouse and take less than a halfyear to construct.

Davis said he gravitated to the properties in 2019 because he thought they o ered a growth opportunity. ey’re also similar to single-family and townhouse properties he’s familiar with building and selling.

“ ere are similar designs and similar contractors,” Davis said, in contrast to going into a multistory building that’s more complicated,

WANT

LOOKING FOR YOUR OWN

more costly and takes longer to build.

e properties also solve an existential problem for successful homebuilders who focus on selling what they build and not getting stuck with houses at the end of the day.

“ ere’s an eat-what-you kill aspect to the homebuilding business,” Davis said. ey also o er the chance for builders to put themselves in the apartment market and enjoy the growth in demand and increasing rents of the past few years.

e other attraction is the demographics.

“ ere’s a psychological shift,” Davis said. “Some young people want to live where they want without being tied down with their own home and seek the ability to move easily when their lease expires. Snowbirds also rent suites year-round even though they leave during the winter months. And they give young families saddled with student debt a chance to live in newer properties.”

Sam Petros, founder of Petros Homes in Rich eld, also is in the market through several ventures with various partners as well as multifamily projects such as One University Circle, the high-rise apartment in University Circle.

“What’s not to like about these?” Petros said of build-torent properties, which generally are single-story unless they have bedrooms on the second oor.

“You don’t smell your neighbor cooking curry or hear anyone above or below you.”

Davis said the site of the proposed “ e Enclave” in North Olmsted already is multifamily, and he recently won approval for variances in building setbacks that will allow him to put the townhouses on the Grace Road site.

“It takes more explaining (to

the city) because they aren’t your typical apartments,” Davis said. “But it’s an appealing alternative to another three-story garden apartment building.”

Among Petros’ ventures are Princeton Place in Cuyahoga Falls, 160 units in either one or two-story layouts. Construction of the last 10 units and the clubhouse is underway, and the property already is 85% leased. An additional 176 units are under construction at Riverwood in Akron and 78 at Villas at Maplewood in Parma Heights. His partners include Pride One, the Medina-based builder, and Grey Fox, a Cleveland-based realty investing concern.

“I learned a long time ago,” Petros said, “You can take someone out of a three-story walk-up apartment to a new rental easier than you can convert homeowners to renters.”

Plus, he said, rising rents make the $2,000 monthly rent typical for the properties competitive with traditional multifamily properties. Petros also has invested in similar projects in other markets, where he worries about the volume of projects driven by institutional investors. He’s condent Northeast Ohio won’t face the overbuilding he sees in more active markets.

Although Petros is continuing to pursue more build-to-rent projects in the region, he said he’s increasingly cautious because of rising interest rates and construction costs.

“I’m tapping the brakes,” he said. A di erent take on the build-torent market comes from Bo Knez, CEO of Knez Homes of Concord Township. He said investors have been seeking to buy single-family

homes and multiple units in townhouses. e pace was quicker a few years ago, he said, though there still are groups that seek to buy a half-dozen houses to rent them out.

“It’s dissipating now with the exception of new homes near the eds and meds,” Knez said, referring to Cleveland neighborhoods near University Circle such as Glenville. “ e farther away from there now, the less we’re seeing it.”

the 56-unit Concord Station in Painesville, to an a liate of Paci c Oak Residential of Jacksonville, Florida, for $9 million. Paci c Oak has a portfolio of about 3,000 such rentals.

Davis said that after he leased up the Concord Station property, he just “had a sense” it was a good time to sell it. at’s not a bad outcome for a failed condo project with one, two-unit building he bought in 2019 from a lender.

e housing downturn in 2008 prompted Bucky Kopf, president of Kopf Homes of Avon Lake, to pivot to renting the condominium and townhouse community he planned after acquiring the old Aquamarine resort complex.

“We built 57 condominiums,” Kopf said. “ en the market changed. We never stopped the project. We may have slowed or sped up but we just kept building and renting them out.” Today there are 459 rentals at Aquamarine in a complex that is 99% leased.

e build-to-rent communities, as new projects with strong rent rolls, also attract investors if the builder wants to shed a property.

For example, in 2021, Davis sold his rst build-to-rent community,

Michael Barron, executive managing director at Marcus & Millichap’s Independence o ce, said investors like projects such as Concord Station, a sale he handled for Davis, because they often have the highest rents in the neighborhood. He said renter interest in them “amped up” after COVID-19 because there is more space for working at home and less density in the communities.

e minus of selling such projects, he said, is that because they often are in areas that don’t have similar properties that fetch high rents, it can be di cult to nd meaningful, comparable sale prices that experienced investors seek.

But not all builders want to sell them. Petros said matter-of-factly that he is in the build-to-rent sector so he can build a portfolio for his family’s nancial future.

Kopf said he gets an inquiry almost every week to buy the Aquamarine rentals.

“We have exceptional nancing and equity,” Kopf said. “ ey’ll be with us as long as there is a Kopf family.”

HEALTHY CAREER GROWTH?

“What’s not to like about these? You don’t smell your neighbor cooking curry or hear anyone above or below you.”Sam Petros, founder of Petros Homes in Rich eld

e city of Cleveland is proposing sweeping code changes that will impact rental housing and empty buildings, with the goal of putting neglectful property owners on notice.

A legislative package introduced to the Cleveland City Council on Sept. 18 will overhaul the existing residential rental registry and create a separate registration mandate for vacant structures — including commercial and industrial properties. e language a ects two dozen or so sections of the city’s code, involving zoning, building, re and health issues.

e legislation is sure to spark vigorous discussion at City Council — and resistance from some landlords, property managers and real estate organizations.

Sally Martin O’Toole, the city’s building and housing director, acknowledged the potential for pushback and litigation. But, she said, Cleveland must do more to protect its residents and neighborhoods.

“We want to take a more aggressive approach,” she said during a recent interview. “We just don’t want to let the market run over us the way that it has for so long.”

Dubbed the “Residents First Legislative Package,” the proposed changes are the result of more than six months’ worth of discussions among lawyers, council members, building o cials and members of the Vacant and Abandoned Property Action Council, a local group that formed on the precipice of the foreclosure crisis in 2005.

e legislation draws on O’Toole’s past work as the housing director for South Euclid, a suburb with a more robust rental-registration program and a pre-sale inspection requirement for vacant properties. South Euclid, home to just over 21,000 people, saw significant reductions in delinquent property taxes on rental homes and overall vacancy when it imposed new rules.

Cleveland, a city of about 361,600 people and nearly 163,000 real estate parcels, poses a much bigger challenge. Surveyors who took an inventory of those parcels in late 2022 and early 2023 found about 9,800 vacant structures, ranging from single-family homes to abandoned factories.

ey also saw that the overall condition of buildings in Cleveland is declining. e share of top-graded properties fell to 54% from 78% in 2015, the last time the survey was conducted. More than half of vacant structures earned grades of “D,” for deteriorated, or “F,” for hazardous.

e legislative proposal re ects those ndings. And it comes as O’Toole is revamping her entire code-enforcement operation and

preparing to hire more inspectors, with hopes of taking a more proactive approach. at will include door-to-door visits and sending letters to property owners in speci c neighborhoods — a shift from the longtime model of reacting to complaints.

“Doing those things that the city has not done wakes the market up to what’s possible,” she said. “We’re not going to roll over and let you buy this building and just exploit your tenants and not take action. We are de nitely taking action.”

e legislative package has a few key planks.

First, it expands the rental registry to include any residential property that is not owner-occupied. Today, that registry is comprised of about 62,000 properties, but ofcials believe tens of thousands more are noncompliant or slipping through loopholes in the existing code.

e proposed ordinance also requires non-owner-occupants to identify a local agent in charge — an individual responsible for the condition of the property. If the owner does not live in Cuyahoga County or a neighboring county, the local agent must reside in Cuyahoga County. at means buyers can’t just direct the city to a P.O. Box, for example.

“If you’re the local landlord who owns properties in your name, we already know about you. is is not about you. We can talk to you if we need to talk to you,” said Kris Harsh, a councilman who represents parts of the Old Brooklyn and Stockyards neighborhoods.

“ is is speci cally about the outof-state investors who are using property managers who hide.”

Landlords then will have to apply for a certi cate for rental occupancy. And the city will have the ability to block rentals or revoke certi cates if owners aren’t complying with local laws. Rentals must have an up-to-date lead-safe

certi cate, without open lead-hazard control orders. And they can’t have outstanding code violations. Landlords also cannot be behind on property taxes, unless they’ve agreed to a payment plan with Cuyahoga County. Collectively, rental properties in Cleveland are responsible for about $18 million in delinquent taxes, O’Toole said.

e legislation also includes a new requirement that larger multifamily properties, with at least four units, get an annual heating and cooling inspection and provide documentation to the city. And the owners of those buildings must be current on their utility bills.

O’Toole said the city was inundated last winter with calls from tenants whose apartment buildings had no heat. Some residents were using space heaters to stay

owners of all sorts of empty buildings to le annual paperwork with the city.

And it will establish, for the rst time, something akin to a pointof-sale program — a pre-sale city inspection requirement for oneto-three-family homes.

Point-of-sale programs are common in the Cleveland suburbs, but they’re controversial — championed by public o cials, loathed by the real estate lobby and divisive among consumers. ey typically require the buyer or seller to put money in escrow to repair code violations.

Cleveland is not trying to implement a broad point-of-sale program, which would require presale inspections of every home. Instead, o cials are targeting vacant residential properties.

If a city inspector nds violations, the buyer or seller will have to deposit $5,000 into an escrow account. And the buyer will have to commit to making repairs within six months.

Harsh, a former real estate agent and community-development practitioner, has mixed feelings about that aspect of the plan. “I worry about its ability to be e ective in Cleveland with the sheer number of properties we have,” he said, predicting that the pre-sale inspection idea will prompt the most contentious discussions among council members.

“We do still have xer-uppers,” he said. “I don’t want to discourage people from buying those houses because the day they pick it up, there’s a bill of goods that comes due.”

Vacant commercial and industrial buildings won’t be subject to a pre-sale inspection. But when owners register those properties, they will have to post a cash bond that the city can draw on to pay for nuisance abatement and other maintenance.

warm.

Councilwoman Rebecca Maurer, whose ward spans parts of Old Brooklyn, Slavic Village, Brooklyn Centre and Tremont, believes the legislation will bring transparency and accountability to an opaque investment landscape. She and Harsh, along with council members Joe Jones and Jenny Spencer, were part of a working group that shaped the code changes.

“It’s going to take some titrating, and it’s going to take a lot of balance,” Maurer said of the package, which will be the subject of public hearings this fall.

But, she added, “I don’t think we have seen that level of engagement and collaboration to tackle our housing issues in the city in over a decade.”

e second major change is the creation of a vacant property registry. at program will require

at bond will be $5,000 for buildings of up to 10,000 square feet and $15,000 for larger structures, though the legislation gives the city leeway to require additional money. If cash is left over when the property is reoccupied or sold, the owner can seek a refund from the city.

“It’s hopefully not a barrier to sales and not a big barrier to deals,” O’Toole said of the bond requirement. “ at’s the thing we didn’t want, to create a chilling effect in the market. … We just wanted to create some better oversight.”

e legislation also includes a new inspection requirement for parking garages. Owners would have to get a third-party evaluation every ve years and provide a report to the city.

e idea is similar to Cleveland’s façade-inspection program for certain older buildings — a requirement the city imposed after a parapet wall collapsed at a historic building downtown. e process puts the onus on the property owner to pay for and le the inspection report.

But other parts of the legislation

will require more manpower and resources from a city department that is short-sta ed, and that has long struggled with e ciency and follow-through.

“We still need to do more,” Harsh said. “ e building and housing department has been one of the most chronically underfunded departments in the city of Cleveland.”

Frank Ford, a member of the legislative working group and a senior policy adviser at the Fair Housing Center for Rights and Research, agreed. It’s essential to make sure the building department and law department have the funding and sta to implement new laws, he said.

“Over the past two decades,” Ford added, “we’ve seen more than 100,000 foreclosures, a massive in ux of investors converting homes for rental and a documented decline in housing conditions. ese ordinances are an important step to protecting the health and safety of renters, as well as the property value of Cleveland homeowners.”

In tandem with altering and creating programs, the language outlines new registration fees and penalties for noncompliance. And it gives city inspectors the ability to issue civil tickets for nuisances, such as piles of garbage bags on a porch, gra ti or infestations of rats or insects.

Today, the building department issues minor misdemeanor tickets that require a court process. Civil

tickets are an additional, simple tool. If an owner does not pay, the ticket becomes an assessment on the property-tax bill. Inspectors would issue $200 tickets for each infraction.

Maurer cheered that provision.

“Really, our biggest issue is lack of action entirely,” she said. “It’s lack of landlords feeling any consequences. It’s lack of property owners feeling like there’s anyone looking.”

is year, the city has led nuisance lawsuits against the owners of multiple apartment buildings in the Shaker Square area, with the aim of shifting control from the landlords to court-appointed receivers. While those court battles play out, the building department is seeking the authority to use its demolition funds for repairs at nuisance properties — not just for teardowns.

e increased exibility would let the city clean up crumbling porches, collapsing roofs and other problems, in hopes of preventing buildings from deteriorating to the point where it doesn’t make structural or nancial sense to save them. at proposal is outlined in a separate, but related, piece of legislation introduction to the City Council last week.

“Every property in Cleveland should be on a track,” Maurer said. “Is it on a track toward rehabilitation? Is it on a track toward demolition? Is it being mothballed? … We want things to be in

one of those slots. And what we don’t want is for a huge percentage of our properties to be in this Never Never Land where there are all carrots and no sticks for them to be addressed.”

e legislative package also would give the city the authority to cut tall grass, weeds and brush on private property for the entire growing season after sending out a single notice at least 72 hours in advance. Cleveland then would bill the property owner for that work.

Lastly, the language seeks to streamline aspects of the code and clear up confusion.

For example, the city currently has two di erent forms available for sellers to complete when they transfer a property — one for small residential structures and another for apartment buildings and other commercial real estate.

e new plan is to require the same documents for every property transfer, with consistent disclosures about building conditions and zoning.

O’Toole is prepared for aspects of the proposal to change during City Council hearings. But she hopes most of the language survives intact.

“We wanted consensus around these pieces,” she said. “We wanted it to be a bit of a think-tank process, as opposed to just cutting and pasting, because we know our market has some unique challenges. I think we were able to do that successfully.”

“Over the past two decades, we’ve seen more than 100,000 foreclosures, a massive in ux of investors converting homes for rental and a documented decline in housing conditions. These ordinances are an important step to protecting the health and safety of renters, as well as the property value of Cleveland homeowners.”

Frank Ford, a member of the legislative working group and a senior policy adviser at the Fair Housing Center for Rights and Research

By Kim Palmer

By Kim Palmer

In July, the federal government published new de nitions and borders expanding the Cleveland Metropolitan Statistical Area (MSA) and the Cleveland-Akron-Canton Combined Statistical Area (CSA) with little fanfare.

e new Cleveland MSA (formerly the Cleveland-Elyria MSA) added Ashtabula County and about 97,000 people to the existing grouping of Cuyahoga, Geauga, Lake, Lorain and Medina Counties.

And the new CSA now encompasses a total of 17 counties, including most of the counties on the southern shore of Lake Erie, with the recent addition of Coshocton and Sandusky counties.

An MSA is de ned as a region that consists of a city and surrounding communities within commuting distance linked by social and economic factors as determined by the O ce of Management and Budget (OMB).

e new MSA is signi cant because it’s used to calculate an area’s employment rates, poverty rank-

ings and funding program eligibility.

While most businesses or workers within the Cleveland MSA are not a ected at all by the change in a somewhat obscure governmental designation, incorporating Ashtabula into the Cleveland MSA shows a region with a larger workforce and more diverse industry, according to Jacob Duritsky, vice

president of strategy and research at Team NEO.

“Adding Ashtabula to our MSA makes a di erence to our overall population number by about 97,000. It’s not a big change structurally but for things that we deal with at Team NEO — economic development and site selection — bigger is always better,” Duritsky said.

Businesses looking to expand or move use the MSA to determine whether a region has an adequate available workforce.

“Companies, when comparing places to relocate, often ask for or look at this type of metro-level data and if Cleveland can point to having more workers and more industry, we can show more economic power,” Duritsky said.

Recent data show that with the addition of Ashtabula, the region has a labor force of more than 1.1 million with a participation rate of 63.4%. e new Cleveland MSA also shows that 34% of workers between the ages of 25 to 64 years have a bachelor’s degree or higher, just under the national average of 35%.

A larger MSA and Cleveland-Akron-Canton CSA designations also is consistent with

the fact that Northeast Ohio is the economic engine of Ohio, Duritsky noted.

“We are the biggest economic unit in the state and the CSA de nition re ects that in the region we make up 35-40% of the state gross domestic product,” he said.

Baiju Shah, CEO and president of the Greater Cleveland Partnership, points out that the new MSA is a reminder that the region, with about 3.8 million people, ranks in the top 20 nationally.

“We’re a top 20 region, the third-largest region in the Midwest behind Chicago and Detroit,” Shaw said.

He said a larger MSA means a more diverse set of companies to include when selling the region to businesses. “It is important to have the MSA designation to let businesses know about access to talent, access to amenities, access to more diverse companies where partners or spouses can work,” Shah said.

A city’s MSA also is a determining factor when it comes to certain federal funding and competitive grants focused on regional impacts, according to Shah.

“ ere are programs that we have been watching and tracking through the U.S. Department of Commerce and the National Science Foundation focused on larger metro and CSA areas,” he said. e MSA expansion also means more partners at the table when competing for that federal money.

e electric vehicle arms race is on, and it’s still anybody’s game.

Southern U.S. states have captured the lion’s share of more than $100 billion in North American EV investments announced by automakers in the past three years, data from the Ann Arbor, Mich.-based Center for Automotive Research shows. At the same time, Midwestern states have regained some ground.

Michigan went on a spending spree to get back in the mix. Ohio

and most recently Illinois also opened up their pocketbooks to claim a piece of the automotive future. Even Canada, once predicted to be left behind in the EV transition, is holding its own thanks to a federally funded leveling of the playing eld.

In short, the battle for EV supremacy is still in the beginning stages, said Mark Barrott, head of South eld, Mich.-based Plante Moran’s automotive practice.

“We’re probably at the end of the rst quarter,” Barrott said.

“We will need two to three times more battery capacity than what

Michigan leads states in automaker announced EV and battery-related investment since 2018 with more than $23 billion. Ohio is in the top 5 with nearly $9B while Illinois has only $200 million.

we have or what’s been announced if we are to meet the projected North American demand.”

That means more than a dozen megaprojects (each at least $1 billion in capital expenditures and $75 million in annual payroll) are still on the table, according to a number of economic development officials around the U.S. and Canada who were interviewed for this story and say they are watching those projects like hawks.

Announced automaker EV and battery-related investments by year

Some are more desperate to land them than others, and not all projects are created equal. While the strategies and prizes may vary, incentives packages in the hundreds of millions of dollars have become table stakes.

Here’s why: To compete with China and the rest of the world on EVs, the U.S. ooded the domestic market with subsidies, from the In ation Reduction Act’s $370 billion for clean energy — including a consumer credit up to $7,500 for eligible vehicles — to tens of billions of dollars in grants and loans from the U.S. Department of Energy. e incentives-fueled, win-at-all-costs attitude is contagious, it seems.

The industry’s more than $500 billion transition to battery power over the next few years — as research firm AlixPartners estimates the investment to be — sparked a bidding war across North America for factories representing the future of manufacturing and economic security. Skeptics, though, have criticized the massive taxpayer subsidies and questioned the ROI of the projects, which remains to be seen.

It all started in 2021, or at least that’s when many states were put on alert. at year, Ford Motor Co. announced $11 billion of investments in Tennessee and Kentucky, which sent shockwaves through the Dearborn, Mich.based automaker’s home state and made it clear: e Rust Belt wouldn’t simply be entitled to the spoils of resurgent domestic manufacturing.

“It was a game changer and a state changer for us. It’s the largest project ever in our history, even if you account for inflation,” Kentucky Gov. Andy Beshear said in an interview with Crain’s. The same could be said for Tennessee.

Ford’s electri cation overhaul, like those of other automakers, revealed how much states are willing to pay for a project. e

$5.8 billion BlueOval SK Battery

Park some 50 miles south of Louisville, Ky., is expected to launch in 2025 and create 5,000 new jobs with starting annual pay of $55,000. e twin battery factories are being subsidized by $250 million in taxpayer cash, plus $27 million worth of land provided at no cost.

The cost per job works out to $50,000 when factoring in just state cash incentives. The cost of losing the project, though, would have been immeasurable, as Beshear sees it. “For us, this battle wasn’t just about having the new jobs of the future. It was about making sure we didn’t have displaced workers. . . .To land these facilities means we will not go through the displacement that we saw in the energy sector.”

Losing that Ford project was a major blow to Michigan, and it paid a premium to make sure it didn’t happen again. e state approved an incentives package valued at $1.7 billion — the largest subsidy approved by any state this year — to land the Ford-CATL battery plant in Marshall, about 100 miles west of Detroit.

per job. In Ohio, the new $3.5 billion Honda-LG plant being constructed east of Dayton is in line for more than $2 million of all-in subsidies for each of 2,200 jobs promised.

Those price tags invite plenty of criticism. “These deals are less about business and more like giant publicly funded campaign advertisements,” said John Mozena, president of the Center for Economic Accountability, a Michigan-based think tank. Companies are far more concerned about other factors such as labor availability, energy costs, infrastructure and tax structure than subsidies, he argues.

After coming up short in a bid to win Chinese battery manufacturer Gotion Inc.’s rst plant, which went to Michigan, Illinois followed its neighbor’s lead and created a $400 million deal-closing fund to go along with legislation that added new tools to the state’s economic-development program specically tailored to EV and battery projects.

e EV battery race began in earnest a couple of years ago with the rst tranche of investments from Ford, General Motors Co., Stellantis NV and other foreign and startup automakers looking to cash in on North American incentives. Even if unwittingly, Southern states had a head start before battery electric cars in the mainstream were even a consideration.

Southern states were decades ahead in site readiness, but other factors including market dynamics and business climate have in uenced the auto migration south, Barrott said. It’s become more important for automakers to produce batteries and vehicles nearer to where they sell them, for one. Cheaper labor, as plants are largely nonunionized, lower energy costs and taxes, faster permitting and the lack of United Auto Workers in uence are all major bonuses in the South, too.

“ e art of economic development was really perfected in the Sun Belt, the Southeast primarily, to lure industry away from the Rust Belt and the Northeast,” said John Boyd, principal of e Boyd Co. Inc., a Florida-based rm that consults on site selection for companies including Honda, Boeing and Dell. “We call economic development in 2023 the second war between the states.”

It’s a war the South was winning handily on the EV front before the Rust Belt started making moves. It’s been a costly one for both sides.

Slated to launch in 2026, the $3.5 billion plant promises 2,500 new jobs with starting annual pay of $45,000. That comes out to $384,000 per job when including just cash in the deal.

Factor in federal incentives, and the math is even more staggering. Ford’s plant in Michigan will be eligible for about $6.7 billion in federal tax credits, according to an analysis by Good Jobs First, which tracks corporate subsidies. That works out to $3.4 million worth of subsidies

Josh Hundt, executive vice president and chief projects officer for the Michigan Economic Development Corp., said the state had to inject so much cash into the deal because of how far behind it was in prepping mega sites for development. The subsidy included $750 million for building out infrastructure and utilities on the farmland.

“It was necessary for us to be more competitive with these other states that were securing these projects, frankly, when we were not,” Hundt said.

Among the incentives are tax credits of up to 75% of payroll taxes for new or retained jobs for up to 30 years, and 10% to 25% of employee-training costs. Other incentives include tax credits on 0.5% of a company’s property investment; income taxes connected to construction wages; and exemptions from taxes on building materials as well as electricity and natural gas. e e orts paid o . Armed with more than a half-billion in assorted tax breaks, including $125 million from the deal-closing fund, Illinois Gov. J.B. Pritzker beat out Ohio and Alabama to land a Gotion battery-assembly plant announced earlier this month.

It’s not quite the bargain deal that Illinois got several years earlier when it lured startup EV maker Rivian to take over a shuttered Mitsubishi assembly plant in Normal for about $50 million.

Since 2021, southern states have captured nearly 70 percent of automaker EV investment in the U.S., with Georgia leading the way at $20 billion, according to CAR data. Michigan had the second-largest chunk of $14.7 billion. Deal ow peaked in 2022 with nearly $50 billion committed in the states. Less than half that amount has been announced this year.

e southern states that have won the most EV projects in the past three years — Georgia, North Carolina and Tennessee — have netted $38 billion of investment and shelled out $6.7 billion worth of incentives to close those deals.

e winningest states in the Midwest — Michigan, Indiana and Ohio — have secured $28.6 billion of EV investment, greased by $5.6 billion in subsidies.

e level of incentives is unlike anything in the 120-year history of the automotive industry, Barrott said. “It’s not really coming with many strings. If the OEMs and the supply base weren’t driving toward an electric future, it would be a problem, but the OEMs are doing this anyway. What the federal government is doing is speeding it up.”

States like Tennessee were regularly investing in the infrastructure of sites they hoped would eventually house some sort of transformational manufacturing project.

“Tennessee has been in a position to attract these types of projects for reasons that date back decades,” Stuart McWhorter, commissioner of the state’s department of economic and community development, said of the $8 billion

“These deals are less about business and more like giant publicly funded campaign advertisements.”

John Mozena, president of the Center for Economic AccountabilityKentucky Gov. Andy Beshear speaks during a Ford Motor Co. event in Frankfort, Ky., in 2021. Ford announced a BlueOval SK Battery Park to be built in Kentucky. | BLOOMBERG

of recent EV-related investments in that state. “It’s organically happening. We’ve created a business environment that is attractive not only to the automotive industry but a lot of industries.”

Tennessee did approve $884 million of incentives for Ford’s $5.6-billion, 6,000-job EV investment announced in tandem with its Kentucky plant, but the prize was more valuable than just a battery plant. In addition to battery manufacturing, the project includes an assembly plant and supplier park, making for a far larger job multiplier and economic impact. “What that has meant to that community is generational,” McWhorter said. “It’ll impact families for generations.”

For now, the industry is calm before another wave of investment, Barrott said. “We always projected a bit of a lull at this point in future announcements of battery facilities,” he said. “Just like any manufacturing operation, you have to build your facility in advance of the actual demand.”

About 850 gigawatt hours of capacity has been announced, is under construction or is in operation, which is enough to ful ll the market through 2029, by Plante

Moran’s estimation. If automakers are to meet ambitious EV sales goals — half of all new car sales in the U.S. could be electric by 2035, according to an S&P Global Mobility projection — they will need to build at least twice as many plants. us, the break in announcements is crunch time for economic developers eyeing those projects still out for bid.

In Indiana, site readiness is also top of mind for economic devel-

opers. e state lured a $2.5 billion Stellantis-Samsung SDI battery plant last year and is on the prowl for more. “ e incentives are still key and king, but the type of incentive is ipped,” said Brock Herr, senior vice president of business development for the Indiana Economic Development Corp. “No longer is nancial incentive the rst priority. Speed is the new best incentive.”

e same goes for Ohio, whose

automotive manufacturing prowess is second only to the Motor City state. JobsOhio, the state’s business attraction arm, has more than doubled annual spending on business attraction and expansion in the past three years. e state has also dedicated $750 million for site readiness, with an eye on EVs, said J.P. Nauseef, president and CEO of JobsOhio. “It’s one of our highest priorities,” he said. “We’re sourcing these deals all over the world.”

Like Michigan, Ohio’s exposure to manufacturing raises the stakes of the EV transition, said Jonathan Bridges, managing director, automotive, at JobsOhio. “Being the largest producer of engines and second-largest producer of transmissions, particularly as we talk about how the industry is in transition, that puts us at risk. We’re actively supporting the transition by diversifying away from ICE (internal combustion engine) technology as well as supporting those investments that are still in that space.”

U.S. states are also feeling pressure from their neighbor to the north. Canada has won about $20 billion of EV investment in the past three years, or more than 14 percent of overall investment. The incentive-rich Inflation Reduction Act legislation

blindsided Canada and forced the government to open its coffers to stay competitive, said Vic Fedeli, Ontario’s minister of economic development, job creation and trade.

“It certainly was not in the spirit of the free trade agreement (USMCA), so the IRA would have certainly come as a complete surprise to everyone else in North America,” Fedeli said. “Our federal government announced that we would develop a tax structure that was competitive to the IRA.”

That was only after Stellantis forced its hand. In May, the automaker halted construction of its Nextstar battery plant with LG Energy in Ontario, demanding an incentive package as lucrative as those offered up by the U.S. After a monthslong standoff, the Canadian federal government conceded by approving $7.5 billion in tax incentives to match the provincial government’s $3.7 billion.

Fedeli said Canada plans to keep beefed-up tax breaks to win future projects. “ is is our go-forward strategy,” he said. “We don’t think you can make an o er that is competitive without it.”

this report.

Working to advance racial equity and economic mobility for the next generation in the Great Lakes region.

e Lubrizol Corp., a maker of specialty chemicals based in Wickli e, just east of Cleveland, has since its founding in 1928 made lubricants for automobiles. Its rst product, Lubri-Graph, lubricated the leaf springs of early automobiles. Over time, the company built a line of additives for engine oils and other transportation-related uids, as well as uids for other industries.

As the electric vehicle market began to blossom, the company evaluated its product line. It learned, perhaps most importantly, that electric vehicles required di erent kinds of uids.

“I think the more we understood it, and the more we looked into it, we realized pretty quickly that there’s a pretty signi cant opportunity here to apply what has made our reputation in the chemical industry,” said Shawn Jareck, the company’s global director of eMobility, in a recent interview.

Lubrizol is but one Northeast Ohio business that was built around, and continues to serve, the auto industry, and that now is pursuing opportunities in the electric vehicle economy as EVs comprise a growing segment of the industry.

Now, Lubrizol has EVOGEN, a line of uids and greases for electric vehicles. Its EVOGEN 4006, a solution that lubricates EV axle devices, last year was designated product of the year by Fuels & Lubes Asia, a Hong Kong publisher that publishes F&L Magazine. e award recognizes innovation in the fuels and lubricants industry.

Northeast Ohio has been an auto manufacturing center since 1897, birthing 83 car makers before the last one failed in 1931. at number included a handful of electric vehicle makers, foremost among them the Baker, a product of Walter Baker’s Baker Motor Vehicle Co. Baker sold his rst electric to omas Edison, a native of nearby Milan, Ohio. By 1906 he was selling 800 cars, electrics that could go 80 miles on a charge.

Today, the depth and breadth of businesses in the transportation manufacturing supply chain is wide and deep.

At the top end are assembly and metal stamping operations of the major vehicle makers — Ford Motor Co. has a truck assembly plant in Lorain County west of Cleveland and an engine plant in suburban Parma. Also in Parma is General Motors Corp.’s Parma Metal Center, where $46 million was invested in 2021 to upgrade stamping operations for parts of parts for SUVs and

midsize trucks, including aluminum stamping operations for the lighter electric vehicles of the future.

Beyond the automakers, the Cleveland region has nearly 200 business operations that make auto parts or, like Lubrizol, make materials and bits and pieces that go into vehicles.

e region is home to Cleveland-Cli s Inc., a steelmaker whose Cleveland Works is a major sheet metal supplier to the auto industry. Not far from Ford’s engine plant and GM’s metal center is Buckeye Fasteners Co., a nut and bolt maker whose weld screws were part of Model A Fords nearly 100 years ago. In Lorain County west of Cleveland, Bendix Commercial Vehicle Systems LLC, makes braking systems for trucks and other commercial vehicles.

e region is also home to major operations of Swagelok, a company that makes tubing and ttings for everything from NASA’s Artemis lunar program to fuel cell electric vehicles, which use hydrogen gas and oxygen to power an electric motor. SARTA, the Stark Area Regional Transit Authority in the Canton area, now has 20 buses powered by hydrogen and both the Toyota Mirai and Hyundai Nexo operate on hydrogen. e region’s transportation businesses employ 26,000 people, according to the state’s latest count in 2016. e area’s civic leaders and economic development organizations, the leaders of those 200 businesses, as well as the state of Ohio’s development leaders, believe that the region has a strong base on which to grow existing operations and attract new businesses as the vehicle industry looks to the future beyond the internal combustion engine to the broad spectrum of new products that electric vehicles will need.

“What we recognize is the growth opportunity in EVs, and it’s both companies that are currently participating in automotive and companies that are not,” said Baiju Shah, president of the Greater Cleveland Partnership, the regional chamber of commerce. “It’s everything from the body to the batteries to the tires — Goodyear (the Goodyear Tire & Rubber Co. based in Akron) has a whole di erent set of tires that they’re supplying to the EV market because there is a di erent set of performance requirements.”

Mindy McLaughlin, managing director of global business development at Team NEO, a regional economic development nonpro t, said that about 50% of the region’s current auto industry suppliers are making something for electric vehi-

cles, in part because their product line is what McLaughlin called agnostic to whether it’s an internal combustion or EV battery car.

“ ey could be a company that, maybe, they have to change something to make it lighter, like the fastener companies we have,” she said.

“We already have a ton of those kind of suppliers that are poised to really grow” in the EV market.

Another piece of the puzzle is a new state workforce e ort, unveiled in July. In a report called “Supercharging Our Electric Vehicle Workforce,” the state outlines a program to expand the EV workforce by establishing new training programs and increasing awareness of the future demand for workers. e report anticipates that growth of the EV industry will create more than 25,000 new jobs across the state – and 12,700 in Northeast Ohio -- in businesses that serve EV manufacturers, battery development and manufacturing and charging station installation and operations.

e region is already home to several key recent EV investments.

Ford Motor Co. is investing $1.5 billion in its Ohio Assembly Plant in Lorain County west of Cleveland to build a new commercial electric vehicle. e plant currently assembles larger trucks like the F-350, 450 and 550 series. e state put together a $205 million package of incentives to attract the new construction, which is expected to add 1,800 jobs to the plant, which currently employs 1,600 workers.

On the brighter side in Lordstown there is Ultium Cells, a $2.3 billion joint venture between General Motors and LG Energy Solution. e 2.8 million-square-foot plant employs 1,300 workers and began shipping product a year ago to General Motors. It’s one of three battery plants the consortium is building. e other two are in Michigan and Tennessee.

Some in Northeast Ohio see the Ultium Cells plant as a cornerstone of what they hope will become the “Voltage Valley” — loosely de ned as the region surrounding the cities of Warren and Youngstown in the Mahoning River valley — a landing site for electric vehicle equipment manufacturers, in particular energy storage rms.

Sara Daugherty, chief of sta of Brite Energy Innovators, a nonpro t energy incubator in Warren, said the motto has been kicked around since Lordstown Motors rst came on the scene after the closure of the GM plant in 2020 and the coming of Ultium.

en, in 2022, JobsOhio released a report, “Ohio Battery Supply Chain Opportunities,” that argued that Ohio has the potential to become a major regional hub for battery manufacturing in the United States and to build its role in the EV supply chain the state should seek to attract investments in cathode active materials (CAM), one of the main components of lithium-ion batteries.

e new assembly line is expected to open mid-decade.

e region is also hoping a solution can be found that will have electric trucks produced at the former General Motors plant in Lordstown. GM ended production of the Chevy Cruze there in 2019 but, a year later, a willing buyer, Lordstown Motors Corp., came along. e newly formed company planned to invest $424 million to retool the factory, with the grand hope its Endurance electric trucks would become what Tesla was for electric cars. e Ohio Tax Credit Authority agreed to a tax credit that would save Lordstown Motors $20 million over 15 years.

Along the way, Lordstown Motors connected with Taiwan’s Foxconn, formally Hon Hai Precision Industry Co. Ltd., the iPhone maker. Foxconn agreed to buy the plant with a plan to become a contract manufacturer for the Endurance or other Lordstown Motors vehicles that came along. It’s already connected with Fisker Inc., which plans to have Foxconn build its PEAR: Personal Electric Automotive Revolution. It’s a small SUV that, if the project goes through, will come o the Foxconn assembly line in Lordstown sometime in 2025 with a price tag of around $30,000.

But earlier this month, Lordstown Motors led a chapter 11 bankruptcy petition, put itself up for sale and accused Foxconn of setting out to destroy its business.

While much of the regional vehicle industry growth will be in the pieces and parts that go into the vehicles Northeast Ohio also has several companies that are making electric vehicles.

Battle Motors of New Philadelphia has been making vehicles for the refuse and recycling, readymix concrete and other markets for 75 years under the Crane Carrier name. Last year it unveiled two electric models. e company believes that clean and quiet electric garbage trucks make sense for the waste management industry as states rules that require the adoption of zero emission goals for medium and heavy duty trucks, such as California’s Advanced Clean Truck Regulation.

And in Cleveland a young motorcycle maker, LAND Energy, has added a line of electric cycles. Evolved from a gasoline-powered motorcycle business, LAND makes tow electric models – the District and the District Scrambler, an o -road cycle.

“Our whole energy infrastructure, it’s in the midst of a change like we have never, ever seen before,” said LAND president Scott Colosimo, who plans to build production in Northeast Ohio, because of its history with auto makers and the supply chain that has built up around them. “It’s important that we do it here.”

LAND is using a $7 million Series A funding round to upgrade its production facility, including a state-of-the-art assembly line and adding to its workforce.

I grew up within an hour drive of the auto assembly plants in Toledo, Ohio, and Wayne, Mich., that went on strike earlier this month for fair wages, the elimination of an unjust tier system and a union-built electric vehicle future. For families and communities like mine — as is true throughout Michigan, Ohio and much of the country — the outcomes of the strike and UAW’s contract negotiations matter on two levels: they impact my community directly and materially, and they are a bellwether for how the clean economy will look for the workers who comprise it.

e auto industry isn’t new to transformative innovations — it’s built on it. e shift to EVs is no di erent. New technologies to reduce emissions, improve fuel economy, protect drivers and make production lines safer and more e cient are constantly rolling out and transforming auto production. Innovation after innovation, autoworkers take it all in stride. Now, to meet the climate moment, they are ready to build EVs.

at’s part of the reason the United Auto Workers union has gone on strike. e members believe, rightly, that the shift to EVs must not incite a race to the bottom for the quality of auto jobs in the United States. ere is no good reason that EVs cannot be made in the United States by union workers who are paid family-supporting wages.

Auto workers and climate advocates agree: e transition to EVs is a crucial part of efforts to drive down emissions from transportation and meet climate goals. at’s why the Biden administration put the force of the In-

ation Reduction Act behind it. e law includes incentives for automakers to build EVs and their parts here. It also provides billions in grants and loans to keep at-risk or recently closed facilities running, by transforming production lines that were building internal combustion engine vehicles and their parts into production lines building the

Routinely being hit by a waft of fumes that smell of paint upon opening a door or window at home would concern any reasonable person. For Robert Shobe, a longtime resident of Beniteau Street on Detroit’s East side, exposure to potentially hazardous pollutants makes him more than concerned.

He is genuinely afraid.

Having already fought cancer to remission once, Shobe’s health status makes him particularly vulnerable to the adverse impacts of environmental contaminants. As he takes a breath and his burning throat kicks o a persistent cough, he isn’t thinking much about the type of vehicles rolling through Stellantis’ paint booths a mere 300 feet from his back door. He just wants to be able to breathe.

ere is no question that, over their lifetime of use, most EVs emit far less in greenhouse gases than internal combustion vehicles. Sadly, at all levels of government, those long-term bene ts are being pursued at the expense of plant-side communities already

bearing the disproportionate burden of our societal pollution. Communities much like Shobe’s. at’s because the production of an electric vehicle emits far more pollution than a comparable fossil fuel vehicle.

First, the major sources of emissions that exist during the manufacturing of gas-powered vehicles remain unchanged for EVs. For example, the painting process is the same no matter how the vehicle is fueled — the paint booth alone accounts for nearly all volatile organic compound emissions at a plant and 65% of its CO2 emissions. Similarly, the steel composition of EVs is generally comparable to traditional internal combustion vehicles. Primary steel production in U.S. plants remains reliant on coal and its byproducts, making them some of the worst sources of toxic heavy metal air pollution in the United States.

ose industry impacts are not equally shared. Communities supporting steel facilities are among the country’s most socioeconomically and environmentally disadvantaged.

en there are the batteries. Lithium-ion battery production requires enormous amounts of energy and resources. Materials like lithium, nickel and cobalt are also in limited supply. at means more emissions from diesel trucks traveling through low-in-

clean vehicles of the future. ose funds could be used at recently closed facilities like those in Belvidere, Ill., Lordstown, Ohio, and Romeo, Mich.

ese federal investments are working to boost other investments and create jobs. Demand for EVs is exploding and they are selling at record high rates, while investment in

EV manufacturing domestically is skyrocketing as well. Since the In ation Reduction Act was signed into law last August, there has been approximately $66 billion of investments announced supporting 60,000 EV manufacturing jobs in 117 facilities around the country. Many of those announcements and jobs are popping up here in the Midwest. In fact, historically, Michigan ranks second for both the total number of announced EV jobs and amount of EV investment, and it leads the nation by a large margin for state and local subsidies supporting EV manufacturing.

come neighborhoods and communities of color already exposed to nearly 30% more diesel pollution than higher-income majority-white neighborhoods.

Suppose manufacturers and our policymakers genuinely care about reducing both the long-term impacts of greenhouse gas emissions and the health of plant-side communities. If that is the case, they must combine the necessity to eliminate tailpipe emissions with a commitment to reducing both the number of vehicles on our roads and the impact of their production on plantside communities. at demands prioritizing investment in mass transit systems, focusing consumer incentives on the least resource-intensive electri ed vehicles and

It’s a good time to be in the automaking business. But is it a good time to be an autoworker? When it comes to job quality — fair wages and bene ts, job security, predictable hours, a safe work environment, and the free and fair choice to join a union — there is certainly room to improve. ese are the people creating the record pro ts that auto manufacturers are enjoying, and they should be treated with dignity and get their fair share; that is what the UAW is ghting for.

Simply put, we cannot take advantage of the technologies of the future at the expense of the workers today. We all have a moral responsibility to workers and the communities they work and live in. e times and technology may be changing, but what must stay the same is our expectation that opportunities for working families come before executives’ pro ts.

requiring manufacturers to use cleaner materials, like carbon-free steel and low VOC coatings.

Across the United States, a person’s race is the best predictor of whether they are exposed to elevated levels of industrial pollution. Unchanged, the drive to replace every car on the road with an EV of comparable size will further expand the already enormous discriminatory chasms in health and environmental outcomes in communities already overburdened by pollution.

If we don’t address this now, policymakers and manufacturers will further entrench current inequalities. Sadly, that seems to be the route we’re headed, but it’s not too late for us to do this right.

The shift to EVs must not incite a race to the bottom for the quality of auto jobs in the United States.

Ranked by base salary for current or upcoming season

1.

guresofteninclude onlyaportionofsigningbonuses,whicharetypicallyamortizedovermultipleyearswhencalculatingsalarycaps.

Sources:spotrac.com,espn.comandleaguewebsites;additionalresearchbyCrain's

3. ForGuardians players,theyearrepresentswhentheymadetheirmajorleaguedebut.Forotherplayers,ittypicallyrepresentswhentheyjoinedtheNFLorNBA,eveniftheyspenttimeindevelopmentalleagues,unlessotherwisenoted. 4. Includes$18,400,000 guaranteed option bonus for 2023. 5. Includes $10,985,000 guaranteed option bonus for 2023.

2. Representstheplayer's nalseasonundercontract.NFLcontractstechnicallydon'texpireuntilthefollowingyear.

Includes $8,000,000 guaranteed option bonus for 2023.

Age: 27

Year entered league: 2017

Base salary: $46 million

2023 cash: $46 million

Contract: Five years, $230 million (2022-26)

Here’s the deal: While Watson’s contract still has the most guaranteed money in NFL history — just ahead of Bengals quarterback Joe Burrow ($219 million) — his annual salary ranks just eighth among league quarterbacks.

Age: 23

Year entered league: 2019

Base salary: $34,005,250

2023 cash: $34,005,250

Contract: Five years, $197,230,450 (2023-28)

Here’s the deal: Garland moves up four spots on this list thanks to his extension kicking in this season, but his annual salary still only ranks 29th among NBA players.

Age: 27

Year entered league: 2017

Base salary: $32,600,600

2023 cash: $33,162,030

Contract: Five years, $163,000,300 (2021-26)

Here’s the deal: Mitchell topped this list last year but is now just 36th among NBA players, salary-wise. All anyone in Cleveland can think about is his next contract. Mitchell’s player option for 2025-26 looms large.

Age: 26

Year entered

league: 2018

Base salary: $22,441,100

2023 cash: $23,041,000

Contract: Five years, $100,500,000 (2023-27)

Here’s the deal: Ward is one of the league’s best cornerbacks when healthy, but he’s missed 16 games since 2018 and has already had four concussions. Ward is due more than $51 million in guaranteed money through 2025.

Myles Garrett

Defensive end, Browns

Age: 27

Year entered league: 2017

Base salary: $17,250,000 2023 cash: $17,250,000

Contract: Five years, $125 million (2022-26)

Here’s the deal: Garrett became the NFL’s highest-paid defensive player when he signed the extension in 2020, but he now ranks fth in average salary among defenders. He’s earned All-Pro honors in four of the last ve seasons.

Max Strus Guard, Cavaliers

Age: 27

Year entered league: 2019

Base salary: $14,487,684

2023 cash: $14,487,684

Contract: Four years, $62,297,040

Here’s the deal: The Cavaliers paid a heavy price to lure Strus from Miami, both in money and players (forwards Cedi Osman and Lamar Stevens). But the Knicks series exposed Cleveland’s shooting woes and Strus was the best available solution.

Jose Ramirez

Third baseman, Guardians

Age: 31

Year entered league: 2013

Base salary: $14 million

2023 cash: $14 million

Contract: Seven years, $141 million (2021-28)

Age: 29

Year entered league: 2015

Base salary: $20 million

2023 cash: $20 million

Contract: Five years, $100 million (2020-24)

Here’s the deal: Cooper caught a career-high nine TD passes in 2022 and his other numbers (78 catches, 1,160 yards) were in line with his Pro Bowl seasons. His salary is tied for 11th among NFL wideouts.

Jarrett Allen Center, Cavaliers

Age: 25

Year entered

league: 2017

Base salary: $20 million 2023 cash: $20 million

Contract: Five years, $100 million (2021-26)

Here’s the deal: Allen’s scoring and rebounding average both dipped in 2022-23 and he struggled in the rst round playoff loss to the Knicks. But his contract is reasonable by NBA standards, even if he plays a position that’s been devalued.

Caris LeVert

Guard, Cavaliers

Age: 29

Year entered league: 2016

Base salary: $15,384,616 2023 cash: $15,384,616

Contract: Two years, $32 million (2023-25)

Here’s the deal: LeVert took a pay cut to re-sign with the Cavs, but it was a sensible deal for both sides, one that gave Cleveland the exibility to sign Max Strus and Georges Niang this summer.

Here’s the deal: Ramirez is the best bargain on this list, and maybe the best bargain in baseball. After signing a belowmarket extension last year, he’s continued to produce on the eld, making his fth All-Star appearance in July.

One of the most helpful aspects of Crain’s Cleveland’s annual “Highest-paid athletes” list is that it allows Northeast Ohio’s dads to more accurately criticize professional athletes.

For instance, instead of yelling, “Deshaun Watson gets paid millions and can’t navigate a pocket to save his life!” they can yell, “Deshaun Watson gets paid $46 million and can’t navigate a pocket to save his life! Although, in fairness, only a portion of that total counts against the salary cap because the team converted much of this year’s salary into a signing bonus, which gets amortized over the length of his contract!”

Clunkier, but more accurate, which is the same phrase Cleveland’s dads use to describe Bernie Kosar.

Of course, even that last complaint isn’t quite accurate because Watson only makes $46 million a year on paper. Once you add in federal taxes, state taxes, municipal taxes (Berea during the week, Cleveland on Sunday), Medicare, Social Security, agent fees (about 3-5%, unless you negotiate the contract yourself), “jock taxes” (i.e. taxes the athlete pays while playing in road cities, which can di er wildly based on the city), NFL players association dues and the like, Watson might “only” net about $20 million a year to not navigate a pocket.

ose expenses aren’t a big issue for Watson, who CAN navigate a pocketbook after signing the largest fully guaranteed contract in NFL history ( ve years, $230 million). But taxes and fees can be a big deal for players further down on the list such as guard Drew Forbes (who ranks 64th, with a salary of $1.01 million).

Cavaliers guard Darius Garland moves into the No. 2 spot thanks to his ve-year, $197,230,450 extension kicking in. He’ll make $34,005,250 this season, moving him past the king of last year’s list, Cavs guard Donovan Mitchell.

Mitchell now ranks third, with a $32,600,060 salary.

e rest of the top 10 looks like this: Browns cornerback Denzel Ward ($22,441,000), Browns wide receiver Amari Cooper ($20 million), Cavs center Jarrett Allen ($20 million), Browns defensive end Myles Garrett ($17,250,000), Cavs guard Caris LeVert ($15,384,616), Cavs guard Max Strus ($14,487,684) and the lone Guardians player on the list, third baseman Jose Ramirez ($14 million).

ry,” Catanese said. “Teams think of them more as a commodity. Running backs and linebackers have kind of gone by the wayside, since teams are more about the passing game now. When it comes to the really big contracts, quarterbacks, o ensive tackles and pass rushers are the three positions that come to mind for me.”

e Browns are no di erent. Before his season-ending knee injury, running back Nick Chubb was arguably the team’s best player — or second-best, depending on where you rank Garrett — but he’s just 14th on this list, with a $10,850,000 base salary.

at’s actually the highest base salary of any running back in the NFL, and his $14,850 cap hit

From Page 1

downtown; and to other city neighborhoods, for better parks and recreation facilities.

Tax increment nancing, or TIF, draws on new property-tax revenues generated by projects. Communities and developers can borrow against that revenue stream. e typical deal involves issuing bonds and pledging the reallocated tax revenues to repay them over 30 years.

TIF isn’t new in Cleveland. But the city has never used the tool this way, or on this scale.

Columbus has created TIF overlay districts in its downtown and at Easton, a large project northeast of the city. Similar structures are common in other states. But Cleveland has used tax-increment nancing for individual projects, instead, for both public and private improvements.

Now the city needs to make “generational infrastructure investments” in its waterfronts — the riverfront and lakefront alike — and improve public access, said Je Epstein, the chief of integrated development, during an interview. And the city must position itself to compete for talent, companies and residents.

“ is,” he said, “is a tool that will help us achieve that.”

Any tax increment nancing agreement will require approval by the Cleveland City Council. None of the enabling legislation has been introduced yet.

At this point, council members are considering legislation to allow Mayor Justin Bibb’s administration to sign a master development agreement with Bedrock, the Detroit-based real estate arm of billionaire Dan Gilbert’s Rock family of companies.

A council committee held the rst public hearing on that agreement Tuesday, Sept. 19.

“