City Council rolls out strategy for ARPA spending

Plans detail using $15 million to jump-start redevelopment in ve struggling communities

BY KIM PALMER

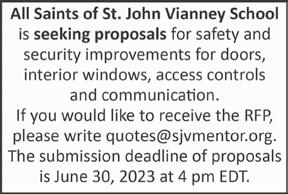

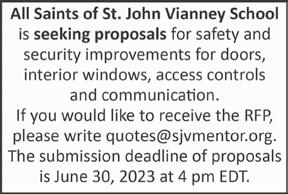

Cleveland City Council members heard plans around the use of American Rescue Plan Act funding to address blight and deterioration in neighborhoods where disinvestment has left communities struggling to keep both residents and businesses.

e three pieces of ARPA legislation presented by members of Mayor Justin Bibb’s administration on Tuesday, May 23, to members of the Development, Planning and Sustainability Committee detailed a comprehensive strategy to use $15 million to jump-start redevelopment in ve micro geographies within the Mount Pleasant, Harvard-Lee and Union Miles communities.

e southeast neighborhoods investment plan calls for $5 million in

house rehabilitation and repair, $5 million in catalytic site remediation, and $5 million for commercial and storefront redevelopment. e spending mirrors other citywide ARPA programs, including a $50 million fund for site development and $10 million for citywide home repair and rehabilitation already approved by council.

“We have to start somewhere,” said Bibb’s chief of sta , Bradford Davy, referring to the historic disinvestment that has left the southeastern neighborhoods struggling. “We will mobilize the power and full support of the city administration behind this plan and want to focus resources on small areas to have a greater impact.”

See ARPA on Page 16

Guardians boost sales, attendance, TV ratings

BY JOE SCALZO

Playhouse Square plans next o ce-to-apartments project

BY STAN BULLARD

BY STAN BULLARD

More changes are in the wings for Playhouse Square Foundation’s e Bulkley Building, at 1501 Euclid Ave., than the addition of a golden marquee that is going in at the attached Allen eatre.

e operator of the city’s restored

theaters and its theater district development corporation plans to add 84 apartments in the nine- oor Bulkley Building. It’s another example of vacant o ce space getting new use serving the growing downtown residential market.

Craig Hassall, Playhouse Square president and CEO, said in an in-

terview he is excited that the project, which has an estimated cost of $22 million, will support the organization nancially and artistically while also advancing Cleveland Mayor Justin Bibb’s goal of increasing downtown’s population.

SPORTS BUSINESS

is spring, the only place the Cleveland Guardians are struggling is at the plate.

anks to some o season momentum, better-than-average weather and timely promotions, the Guardians have seen increases in pretty much every key business metric through the season’s rst two months.

e biggest boost has been at the box o ce, since that category helps drive increases in other areas like merchandise sales and concessions. e Guardians are averaging 18,910 fans per game through the season’s rst 26 games, a 20% increase over 2022’s rst 26 games. But that’s not quite an apples-to-apples comparison, since Cleveland only played 13 home games

in April and May last season due to the lockout and rainouts. If you make a pure year-to-date comparison, home attendance is up 32%.

“One of our goals coming o such a great season (in 2022) was to increase attendance,” said Curtis Danburg, the Guardians’ VP of communications and community impact. “ at’s a goal every year, but we de nitely wanted to be strategic about it this year.”

To that end, the Guardians introduced the Ballpark Pass in March. e $49-per-month standing room only ticket sold out in April and May and is expected to sell out in June as well. e pass has been particularly successful with rst-time customers, “which is the goal,” Danburg said.

See GUARDIANS on Page 17

VOL. 44, NO. 21 l COPYRIGHT 2023 CRAIN COMMUNICATIONS INC. l ALL RIGHTS RESERVED CRAINSCLEVELAND.COM I JUNE 5, 2023

Superior Avenue warehouse, church may be reborn as a new entertainment complex.

REAL ESTATE

PAGE 2

Columbus-based

and

to

in

Pickle

Chill

open new pickleball facility

Beachwood. PAGE 4

Four oors of the Bulkley Building will be converted to apartments in a venture led by Playhouse Square Foundation. | ALAMY

BULKLEY on Page 16 Momentum, weather and promotions give the team a spring upswing compared with last year

See

Old Cleveland warehouse-church eyed for entertainment complex

e former Superior Street Baptist Church, dating from 1892, may be converted to a place to let the good times roll on Superior Avenue just east of downtown Cleveland.

e church, at 2445 Superior Ave., is the oldest surviving structure in the Superior Avenue Historic District. With the attached former State Chemical o ce, manufacturing and warehouse building at 2435 Superior, which dates from 1926, the building may be converted to an entertainment complex that would incorporate a food hall, live entertainment and multiple indoor games.

at’s the plan if real estate developer GBX Group of Cleveland, which owns the property near its headquarters, assembles the nancing to rebuild the place to accommodate operators of an entertainment complex called Roar, in Winston-Salem, North Carolina.

Like other undertakings completed by GBX in the Superior Avenue Historic District, the proposed project would be an adaptive reuse of the property that would qualify for federal historic tax credits and, if it succeeds in securing them, Ohio Historic Preservation Tax Credits.

“We’re lucky that Ohio has state historic preservation tax credits because of the amount of restoration we have to do here,” said Rachael Price, a GBX senior associate who provided Crain’s Cleveland Business a tour of the boarded-up church and adjoining two-story warehouse. Also providing the tour were Yuliya Litvak, GBX project manager for the complex, and Phil Winton, vice president of strategic messaging.

GBX proposes installing a food hall on the rst oor of the buildings, surrounded by “beer walls” with taps for multiple beers. e complex also would feature live music, ax-throwing, duckpin bowling, an arcade, an esports venue and electronically juiced-up mini-golf. e backyard of the property would become home to a beer garden under the plan.

e operation would provide jobs for an estimated 80 to 100 people, Litvak said.

No cost estimates or timeline are available.

e district’s zoning permits the operation. However, on May 15, GBX won variances from the Cleveland Board of Zoning Appeals allowing it to go in because it would be within 50 feet of nearby homes, and the sound it generates might be heard within 50 feet of the property.

Winton said approval of the variances allows GBX to begin rming up its plans and to secure nancing.

e proposal is the latest example of GBX Group’s vision to establish a mixed-use historic district on Superior east of downtown.

GBX has installed its own headquarters and has opened a shortterm rental apartment building and other lofts in the neighborhood. e district also has become home to CrossCountry Mortgage’s new headquarters in a renovated building. e new Cleveland police headquarters is proposed for the ArtCraft Building across the street.

GBX settled on the entertainment complex because it would be able to occupy the 30,000-square-foot complex.

“Originally, we thought it could be

an o ce property,” Price said. However, that idea was dropped as the future of the o ce market became uncertain during the pandemic. e other factor is that the property has substantial parking on its north side, and GBX owns a parking lot on the west side of the structures.

During the tour, Litvak showed how GBX had to decipher how some of the spaces originally were used. For instance, in the church, the removal of boards showed a sloped oor, likely where the choir sang.

e irony is that in this case, it is not the old church that provides the basis for the historic designation. Instead, its industrial period provides the historic interest. e State Chemical building west of the church is part of the district’s history as a location where the city’s commercial and manufacturing businesses expanded

in the 1920s and operated for years in Cleveland’s heyday as a home for factories.

Tom Yablonsky, a high-pro le landmarks expert and special adviser to the nonpro t Downtown Cleveland Alliance, emphasized the commercial use rather than the age of the

church, which was converted to part of the State complex in 1941, as more important historically.

“An entertainment complex would help create a more dynamic neighborhood,” Yablonsky said.

However, Cleveland City Councilwoman Stephanie Howse, who represents the area as part of Cleveland’s Ward 7, is less convinced.

“We always welcome opportunities for development that enrich our communities,” Howse said in a phone interview. “ e Campus District (the local community development corporation) is working to get feedback from the community, and we want to hear their voice. We want to get it together with input from community partnerships, so it does not become a place of agitation.”

State Chemical moved further east and in the 2010s moved its head-

quarters to Monarch Centre in Mayeld Heights, which an a liate of the company acquired. e minister of the former Baptist church moved to another, undetermined, church in Hough in 1941 as State Chemical bought the house of worship, according to state historic documents led by GBX.

GBX bought the complex in 2017 for a price undisclosed in Cuyahoga County property records. However, the county values the building and land at $410,000.

Although GBX has paid a total of more than $80,000 in property taxes on the building since then, that has not been the greatest cost of being the steward of a landmark.

Price said brick walls on top of the State Chemical building were water-damaged, so they were replaced. On that building’s second oor, oorto-ceiling jacks provide support for the south side until the renovation project begins in earnest.

Multiple windows that were beyond saving also have been replaced. However, glass blocks that replaced the church’s tall clerestory windows on its south side will remain. Price said that’s because they date from the industrial use of the building, its most historic period.

More ravages over time than water damage have been weathered by the church. In 1901, the bell tower was hit by lightning, and the church burned. It was rebuilt in 1902. However, the bell tower was never replaced, Price pointed out.

Operators of Roar, which is in an old car dealership restored by GBX in Winston-Salem, did not return three calls by Crain’s Cleveland Business about the proposed entertainment center.

Winton said Roar’s operators would not comment on whether they would pursue the Cleveland location until GBX gets funds for the job.

Stan Bullard: sbullard@crain.com, (216) 771-5228, @CrainRltywriter

2 CRAIN’S CLEVELAND BUSINESS | J UNE 5, 2023

REAL ESTATE

BULLARD

STAN

Superior Street Baptist Church dates from 1892. The church and the attached building could become a food hall-focused entertainment center. | STAN BULLARD/CRAIN’S CLEVELAND BUSINESS

GBX sta working on the project include, from left, Yuliya Litvak, Phil Winton and Rachael Price.

A time-worn cornerstone at Superior Street Baptist Church.

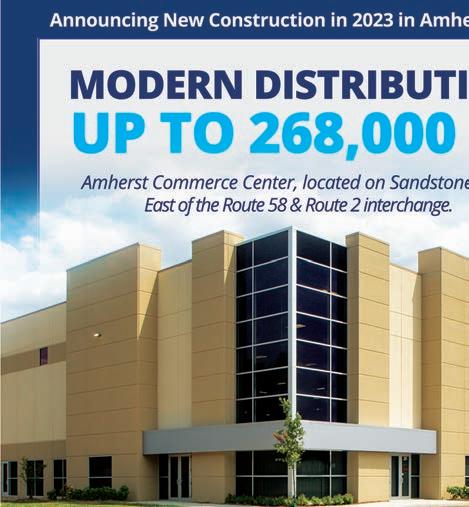

Columbus-based Pickle and Chill to open pickleball facility in Beachwood

BY JOE SCALZO

When Columbus-based Pickle and Chill decided to open a second indoor/outdoor pickleball facility, the owners were looking for a location with the right climate, business-wise and weather-wise.

Beachwood o ered both.

Pickle and Chill plans to open a new facility at the Pavilion Shopping center in the former Stein Mart building at 23949 Chagrin Blvd. in Beachwood. Stein Mart led for bankruptcy in 2020, closing all of its 274 stores, including three in the Cleveland area.

Once it opens, Pickle and Chill will house 12 indoor and six outdoor courts, along with a bar and lounge and multiple event spaces.

e current plan is to build the outdoor courts in front of the building, with six courts roughly equating to two full-sized tennis courts.

pretty similar climate to Cleveland. We’re both in Ohio. We know a lot of the players in Cleveland. And we know that markets that don’t have an indoor facility like Cleveland are going to respond really well to one that’s being built right now. It’s one of the better-situated spots (in Cleveland), between all those communities.”

Pickle and Chill opened its Columbus facility with nine indoor courts in November 2022, on the former site of Ohio State’s varsity tennis courts. Ten outdoor courts will open in mid-June.

The facility has been especially attractive to newcomers, Milligan said, with more than 1,200 players taking an introductory course since its opening.

all-weather climate to have an indoor/outdoor dedicated pickleball facility,” Pickle and Chill owner David Kass said in a news release. “We are uniquely situated down I-71 to bring the same knowledge and experience to the Cleveland market who we believe will embrace this concept as much or more than Columbus has.”

Although the Cleveland and Columbus buildings have a very different footprint — both in size and former function (retail versus tennis) — Milligan said the Cleveland location will be modeled on the Columbus facility, which features two indoor murals and has plans for a third.

The facility will be open to players of all skill levels and allow for members and non-members to participate in open play, leagues, clinics, lessons, tournaments and more.

Pickleball has exploded in popularity in Cleveland in recent years, with 180 available indoor and outdoor sites as of December, 2022.

“The pickleball craze in general is really exploding everywhere, but it made the most sense for us to (add a location) up the street,” said Ruth Milligan, a strategy partner for Pickle and Chill. “We’re a

“I would have been happy if we had taught 300 people,” she said. “So, from that standpoint, we know there’s a lot of growth in the learner category. We’ve also been able to serve stronger players who want more time at their level. So there’s a top-down, bottom-up thing that’s happening and that growth informed us that we’d be able to add another location.”

Pickle and Chill runs seven leagues a week and several clinic series and has six active instructors, hosting more than 120 hours of open play, special events and other programming each month.

The ownership group also owns the only Ohio-based Major League Pickleball team, the Columbus Pickleball Club. Pickle and Chill hosted the second MLP event in October 2022.

“We’re one of the very few locations in the United States in an

The Columbus location has a full liquor license, but doesn’t have a full-service kitchen (at least not yet), with the ownership looking to split the difference between, say, a rec center and Top Golf.

“It’s a place where you can learn to play and where you can play competitively, but it’s also a really lovely event space,” she said. “We’re not trying to be Top Golf. We’re not trying to be a place with comprehensive dining. We’re cutting in the middle and it’s working for us so far.”

As for Pickle and Chill’s future growth plans? Milligan said they’re not looking to be a franchise player, calling the Cleveland expansion “organic growth.”

“We have a model that we think would work anywhere,” she said. “But we’re announcing Cleveland today; we’re not announcing anywhere else. We’re very excited to be coming to Cleveland (and) we’re looking forward to bringing the same spirit that we’ve seen down here.”

Joe Scalzo: joe.scalzo@crain.com, (216) 771-5256, @JoeScalzo0

4 CRAIN’S CLEVELAND BUSINESS | JUNE 5, 2023 Specializing in commercial real estate investment strategy, asset management, and valuation and disposition services. Your SVN Summit Investment Advisors Nichole Booker, PhD. Senior Advisor 330.475.5500 nichole.booker@svn.com Aaron Davis Senior Advisor 330.221.7297 aaron.davis@svn.com JERRY FIUME, SIOR, CCIM Managing Director 330.416.0501 jerry.fiume@svn.com FOR LEASE Industrial Flex Space •6,480 SF Available •3,044 SF Office •3,436 SF Warehouse •Two Docks •Two Drive-In Doors •18’ Clear Height Fully Sprinkled 216.861.5684 kevinkuczynski@hannacre.com Kevin Kuczynski 6930 Engle Road Middleburg Heights, OH 44130 PROPERTY OVERVIEW 1/30/2017 BingMaps - Directions, trip planning, traffic & https://www.bing.com/maps/ Straight Talk. Smart Deals ® CONTACT JONATHAN A. MOKRI 440.526.8700 • jmokri@cbscuso.com www.cbscuso.com Providing Commercial Real Estate Loans Throughout Northeast Ohio and 15 Other States MAKE A SPLASH WITH YOUR COMMERCIAL REAL ESTATE INVESTMENTS WITH A LOAN FROM CBS Personalized Service • Loans up to $30 Million • No Prepayment Penalties • Investment & Owner-Occupied Commercial Real Estate

SPORTS BUSINESS

The Columbus Pickle and Chill has nine indoor courts. The owners will open a new location, in Beachwood, in October. | CONTRIBUTED

“THE PICKLEBALL CRAZE IN GENERAL IS REALLY EXPLODING EVERYWHERE, BUT IT MADE THE MOST SENSE FOR US TO (ADD A LOCATION) UP THE STREET.” —Ruth Milligan, a strategy partner for Pickle and Chill

Trio of industry veterans launch Birchway Title Agency

BY STAN BULLARD

With a combination of business backgrounds to cover key aspects of growing a Cleveland company, three women have launched Birchway Title Agency.

e founders are Sonya Rarey, who had a business analysis background before venturing into the land title agency business two years ago, as president; Amy Medinger as vice president of commercial sales; and Billie Finkler as commercial escrow o cer.

Medinger and Finkler have decades of experience in the title insurance business.

Rarey said the three teamed up to launch Birchway not only because their skills complemented each other, but their vision did, too.

“We want to take a fresh approach to the title business,” Rarey said. “Who grows up to want to be in the title industry as an escrow o cer or title examiner? We want to provide opportunities and mentorship to make it a career for young people, young bright people like our kids.”

Rarey said she believes the indus-

try needs to take advantage of mainstream data analysis to identify and build business, particularly on the residential side.

Finkler, who has owned stakes in title companies in the past, said she had hoped to nd like-minded people to start a company with when she met Rarey.

“Otherwise, I was ready to retire,” Finkler said.

e company will do residential work but has its focus on commercial work. at’s where Medinger comes in.

“I want to be the person looking over title documents,” Finkler said, while Medinger has a large list of commercial real estate contacts.

Rarey agreed.

“Amy is the person who knows everyone’s birthday,” Rarey said. “She knows where they went for vacation and how many kids they have.”

For her part, Medinger said title insurance remains a relationship-oriented business, but she believes that newer forms of marketing will help it grow. During summers, Medinger can be readily spotted at real estate trade events by her signature straw hat.

MRN’s redo of Voss property seeks Cleveland aid on taxes

BY STAN BULLARD

e scope of MRN Ltd. of Cleveland’s proposed renovation of the former Voss Industrial complex, at 2168 West 25th St. south of the West Side Market, is starting to come into focus.

Legislation for the city to provide tax increment nancing (TIF) for redeveloping the old factory, introduced Monday, May 22, indicates it will be a $62 million project. e measures also point to the use of the property before Voss began operations there in the 1950s, as the property rst served as a producer for carriages and electric cars.

A letter from the city’s economic development department accompanying the measure provides a little more color on the retail component of the mixed-use project, including pickleball and indoor mini-golf use, as well as a food and beverage operation occupying about 50,000 square feet.

Another 25,000 square feet will be devoted to restaurant and retail use, and 24,000 square feet to o ce or co-working space.

e project will include 92 apartments.

e brie ng document by economic development indicates the completed operation will create 125 jobs with a total estimated annual payroll of $3.75 million.

MRN has requested the typical 100% abatement for the non-school portion of property taxes for 15 years in the TIF package. e developer will provide payments to the Cleveland Municipal School District for lost taxes. e TIF also would go into e ect after the standard — at least for now — 15-year tax abatement expires.

e TIF will help the developer

handle debt payments on the project’s nancing. Although taxes on improvements to restore the property to active use will be abated, the developer will have to continue to pay existing taxes on the land.

Cleveland City Council assigned the measure to the Bibb administration for review.

MRN also has applied to the Ohio Department of Development for a $5 million allocation of State Historic Preservation Tax Credits in the program’s 30th round, according to state records. e state has said it will announce which projects win an award at or near the end of June.

Ari Maron, spokesperson for MRN, did not reply to an email or phone call from Crain’s by 2:20 p.m. Friday, May 26.

MRN paid $7.5 million for the Voss property in 2021. It incorporates multiple interconnected buildings. e property was available after Voss moved to a single-story industrial building in Berea in 2019. Voss had created parts for aircraft since taking over the complex in the 1950s.

e complex served for years from the 1860s to the 1920s as the home of Rauch & Lang Carriage Co.

e company switched to building electric cars in 1904 from horsedrawn carriages, according to e Encyclopedia of Cleveland History.

After merging with Baker Motor Vehicle Co. to become Baker-Raulang in 1915, it made trucks for the U.S. in World War I.

After gas-powered cars won the auto market, the plant was put to use to become a maker of airplane parts.

Stan Bullard: sbullard@crain.com, (216) 771-5228, @CrainRltywriter

e founders also believe that despite declines in residential and commercial sales volumes, 2023 is not a tough time to start a real estate service business. at’s because they share a belief that the business will grow as volume returns with better times.

“ at’s the perspective you get from having been through past downturns,” Rarey said. “I’ve worked for several companies through the years where the owners felt a recession was a ne time to start a busi-

ness, because it prompts people to nd opportunities.” However, Medinger noted that several companies have given them signi cant real estate transactions already that she considers a vote of con dence, as well as assignments. e rm has multiple title insurance underwriters it can place business with. en there is the knowledge side of being able to nd problems with a piece of property that might prevent

a title insurer from guaranteeing what is referred to as clean title.

“I get calls from people who want to know how to handle or locate an easement (a right to access property),” Finkler said. “Generally, that turns into business.”

Although the business is new, the trio say they can handle land deals across the continental U.S.

All three were previously employed with Everest Title Land Agency of Cleveland.

Stephen J. Crawford, Everest Land Title owner and managing partner of realty law rm Crawford Law LLC, said in a phone interview he wished the three the best of luck in their new endeavor.

He pointed out that the women are exiting a rm with o ces at Key Tower in Cleveland, Canton and Poland, Ohio, which has been in operation since 2006.

Birchway also shows it’s a post-pandemic startup. So far, it has been operating virtually. Medinger said the company is looking at multiple locations to set up shop.

“We all need a place to land, even if not every day,” Finkler said.

JUNE 5, 2023 | CRAIN’S CLEVELAND BUSINESS 5

Cindy Dunne President ECS Solutions

has joined

Brandon Miller, CPA, CGMA CEO, HW&Co.

Conversations That Change Everything

“ECS Solutions, becoming a division of HW&Co., enhances our ability to deliver comprehensive services nationally to senior living providers as their billing and financial management challenges become ever more complex.”

Brandon Miller, President & CEO, HW&Co.

www.hwco.com 216-831-1200 SM

Barbara Cole, CPA Principal HW Healthcare Advisors

REAL ESTATE

REAL ESTATE

Business partners who have launched the new land title company called Birchway Title Agency are (from left) Sonya Rarey, Amy Medinger and Billie Finkler. The company is virtual for now but plans to settle into a suburban Cleveland o ce soon. CONTRIBUTED PHOTO

Of raiders and Wingfoots: What’s ahead for Goodyear?

Sir James Goldsmith.

Chances are, if you play a game of word association in the Rubber City using the name of the late European nancier, well, the responses won’t be printable in a family publication.

Bright summer

“What are you doing this summer?”

If you’re someone who’s established in life, your thoughts when asked that question might turn to vacation plans, or a strategy for home renovations.

But if you’re a high school or college student, and especially a new graduate at either level, the question might provoke some anxiety about a basic subject: short-term work prospects and longer-term career goals.

Fortunately, summer 2023 is shaping up as the best season for work in a few years. e summer job, after a down period, is back.

e Associated Press noted, for instance, that the still-tight labor market “is increasing demand for teenage workers and boosting their wages to higher-than-usual levels as many teens look for jobs during their summer breaks.” As a result, the proportion of Americans between the ages of 16 and 19 who have jobs “has trended up in recent years, as nearly 34% of Americans in that age group had jobs in April compared to 30% in 2019, the last pre-pandemic summer, according to government data.”

Jobs generally remain hot, even as the economy looks a little i y. e U.S. Bureau of Labor Statistics reported on Friday, June 2, that total nonfarm payroll employment increased by 339,000 in May, well above estimates, and that job creation in March and April was revised up by a total of 93,000.

More numbers: Average hourly earnings have risen at a 4% percent annual rate over the last three months, and a 3.9% rate over the last six months. Hourly pay has trended up even higher, around 5%, in industries that typically employ teens, such as retailers and amusement parks. ere are, according to the U.S. Department of Labor, about 1.6 jobs open for every person that is unemployed. Getting past the pandemic is helping.

Of course, there’s no guarantee that the good times on the labor front will keep rolling, and for some industries — think tech and nance, in particular — things are already tough. But for teens and young people looking to work this summer, opportunities abound.

Craig Dorn, president & CEO of Youth Opportunities Unlimited, a Cleveland nonpro t focused on workforce development for teens and young adults, recently told cleveland.com, “ e

youth are back with a vengeance with a desire to work during the summer,” noting that the organization also is seeing increased interest from employers in students across the board. Two big traditional summer employers of young people, Cedar Fair and Cleveland Metroparks, also report greater success in nding young workers, though the Ohio Restaurant Association says its members still face some challenges.

e strong jobs market for new workers is good for everyone. Companies in many industries still need workers, and having a more plentiful workforce of young people is a good answer to that problem. And young people bene t from learning the value of work at an early age. It instills discipline that is valuable when they hit the workforce full time, and gives them an opportunity to start making and saving money to put them on a stronger life path for success.

Summer work by your teen creates teachable moments.

e Ohio Department of Commerce suggests, for instance, that as your teen begins earning money, you should spend time talking with them about handling it responsibly — and showing how you do the same. “Kids, including teens, model adult behavior, and what better way to set the tone than to implement healthy nancial habits right before their eyes,” the department says.

Another solid piece of advice from the department: If your kids ask questions you can’t answer, or if you’re looking for more information about a nancial concept, ask them to help you look for information and talk about it together. “ is is where you can open their eyes to basic budgeting and saving techniques,” it notes.

Ohio is among several states where legislators are considering proposals to relax child labor laws to address worker shortages. e current evidence suggests that the market might be working itself out, as it tends to do over time, but we’re open to a responsible easing of some of the current standards to make work more available to more young people.

Final thought: Anyone who’s in a position to hire a young person this summer would be doing a valuable service to make the hire, whether it’s a seasonal position or helping someone get started in a new career. It works out for all in the long run.

For those of you too young to remember (or old enough to forget), Goldsmith launched a takeover attempt of Akron-based Goodyear Tire & Rubber Co. in the fall of 1986. Goldsmith was part of a group of emerging corporate raiders that included T. Boone Pickens and Carl Icahn, who identi ed companies they believed had grown fat, happy and inefcient, as well as negligent of its core business.

Goodyear, which at the time had divested funds into varied entities such as an oil pipeline, became a prime takeover target. And with that, so did its 132,000 global workers, including 12,000 at company headquarters in Akron.

We are reminded of that tumultuous industry event today, nearly 37 years later, in the wake of an industry-rattling letter Elliott Investment Management LP sent to Goodyear chairman, president and CEO Rich Kramer and the board of directors in early May.

e West Palm Beach, Florida-based investment rm, which claims to own a 10% “economic interest” in Goodyear, is calling for the company to make major changes in order to “strengthen Goodyear’s nancial position, bolster its competitiveness globally and create sustainable value.”

Elliott Investment’s “path to value creation” includes three recommendations: divest its corporate stores (roughly 715 locations worldwide, according to Elliott) and use the resultant injection of capital to pay down debt; appoint ve new members to the board to spearhead change; and begin a comprehensive operational review.

In a broad sense, this move mirrors Goldsmith’s actions nearly four decades ago. Just as Goldsmith had aimed to create more value for shareholders and himself — he said at the time he owned more than 12.5 million shares of Goodyear, or about 11.5% of the company’s stock — Elliott Investment is doing just that.

By implementing these changes, Elliott Investment said it believes Goodyear’s stock price would increase — trading at around $11 per share at the time of the letter — to $16 per share by selling the retail stores, and to $32 per share with operating improvements.

Contrast that to 1986: According to news accounts, Goldsmith bought his rst 88,000 shares of Goodyear that fall for $31.75 each. A month later, the price per share jumped to $41.

Elliott Investment’s letter also prompted Goodyear’s stock to surge, to $14.91 on May 15 from $11.42 on May 11. ere’s no doubt investors like hearing ideas that will make them even more money. at’s about where the similarities end.

6 CRAIN’S CLEVELAND BUSINESS | J UNE 5, 2023

EDITORIAL

Executive Editor:

McIntyre (emcintyre@crain.com) Managing Editor: Scott Suttell (ssuttell@crain.com) Contact Crain’s: 216-522-1383 Read Crain’s online: crainscleveland.com Write us: Crain’s welcomes responses from readers. Letters should be as brief as possible and may be edited. Send letters to Crain’s Cleveland Business, 700 West St. Clair Ave., Suite 310, Cleveland, OH

or by emailing ClevEdit@crain.com. Please include your complete name and city from which you are writing, and a telephone number for fact-checking purposes.

o : Send a Personal View for the opinion page to emcintyre@crain.com. Please include a telephone number for veri cation purposes.

Elizabeth

44113,

Sound

Detore is editor of Tire Business, a sister publication of Crain’s Cleveland Business.

DON DETORE/TIRE BUSINESS

PERSONAL VIEW

See GOODYEAR, on Page 7

RICH WILLIAMS FOR CRAIN’S CLEVELAND BUSINESS

GOODYEAR

From Page 6

While Goldsmith initially aimed to secure control of the tire maker, backed by $5 billion from a Britishnance company, it appears as if no other major Goodyear stakeholders are supporting the move, at least publicly. We contacted two major shareholders — BlackRock Holding, which owns 12.3% of company shares, and Vanguard Group, which has 10.1% — and both declined to comment on Elliott Investment’s proposal.

In its letter, Elliott Investment asked for a meeting with Goodyear. e tire maker, to its credit, immediately agreed.

If and when such a meeting will take place is unclear. Unlike the Goldsmith episode, however, it appears as if both sides are willing to listen to each other.

Don’t, however, think any agreed settlement will be without tumult.

Goodyear has a long, proud history of operating retail locations. It was less than ve years ago when the tire maker launched its “Roll by Goodyear” retail tire concept — bringing a retail tire showroom minus service bays to vibrant lifestyle areas.

Elliott Investment also questions Goodyear’s move to partner with Bridgestone Corp. and create the 50/50 joint wholesale venture TireHub LLC. e rm said that Goodyear “hastily redirected the entirety of its ATD (American Tire Distributors Inc.) volume to TireHub.”

TireHub, Elliott Investment wrote, “faced signi cant challenges” because, among other reasons, it operated fewer distribution centers than ATD, had technological issues and lacked selling prowess as a newcomer to the market.

“Goodyear’s go-to-market strategy has damaged its brand, market share and pricing,” Elliott Investment wrote.

Adding new board members, too, will be dicey. Elliott Investment said it has identi ed ve executives, either currently or formerly employed, who have relevant ex-

perience in strategy and operations. It’s clear that these hand-picked execs would take the role on only if signicant change would result.

Elliott Investment, unlike Goldsmith’s takeover bid, made a point in its documents to praise Goodyear, the Goodyear brand and its legacy as “an iconic U.S. manufacturing leader.”

It lauds the company for its robust original equipment business, especially for electric vehicles, and said it is not calling for any reduction in workforce or capacity at Goodyear’s tire plants across the globe. e group, however, did not o er an opinion on Goodyear’s corporate workforce.

In addition, Elliott Investment did not weigh in on Goodyear’s acquisition of Cooper Tire & Rubber Co., which was nalized two years ago. e jury still seems to be deliberating on that one.

“We want to reiterate our deep respect for Goodyear,” Elliott Investment wrote.

In 1986, some believed it was a forgone conclusion that Goldsmith would successfully take over and pillage Goodyear. Employees, stakeholders and government o cials — including U.S. Rep. John Seiberling, whose paternal grandfather, Frank Seiberling, co-founded Goodyear — rallied behind the company, and the result was somewhat di erent.

Goldsmith, who died in 1997 at age 64 from pancreatic cancer, sold his stake in the company for $620.7 million — making a pro t of around $93 million, according to e New York Times — while also agreeing not to purchase any Goodyear stock for ve years.

e tire maker o ered to buy 40 million shares from stockholders, at $50 a share. at move alone cost Goodyear $2.6 billion, forcing it to divest assets and reduce sta .

“Our ship is a little lower in the water now, and it’s a little shorter,’’ Robert E. Mercer, Goodyear’s chairman at the time, told the Times. “We’re lean and mean, but it would be wrong to say that we haven’t been wounded.’’

Some say Goodyear emerged a much di erent company.

No matter how this latest investment unrest shakes out, it is clear that Goodyear is an important brand, both today and in the future.

A strong Goodyear is not only good for the tire industry and the thousands of tire dealers who sell its products, but also for Northeast Ohio, where Goodyear is revered arguably more than any other Ohio entity.

is latest episode comes as Goodyear prepares to celebrate its 125th anniversary in August. It will be interesting to see how the rubber meets the road in the months ahead.

JUNE 5, 2023 | CRAIN’S CLEVELAND BUSINESS 7

OPINION HOW TO FLY WITH SKY QUEST: » On-Demand Charter » Jet Club Memberships » Aircraft Ownership Opportunities 216-362-9904 Charter@FlySkyQuest.com FlySkyQuest.com From takeoff to touchdown, trust Sky Quest for a seamless private travel experience. Family Owned & Operated Since 1976 AKRON | 330 535 2661 CLEVELAND | 216 831 3310 MEDINA | 330 239 0176 PLEASANTVALLEYCORPORATION.COM | NAIPVC.COM CONSTRUCTION, REAL ESTATE, FACILITY AND PROPERTY MANAGEMENT

Tires are stacked in front of a Goodyear auto service location in South San Francisco, California. | BLOOMBERG

NO MATTER HOW THIS LATEST INVESTMENT UNREST SHAKES OUT, IT IS CLEAR THAT GOODYEAR IS AN IMPORTANT BRAND, BOTH TODAY AND IN THE FUTURE.

New name, focus for Industrious Group

BY RACHEL ABBEY MCCAFFERTY

President and CEO Chris Pascarella is excited about Industrious Group Inc.’s recent name change, but he’s even more excited about its new tagline: “Champion of the Trades.”

Industrious Group in Cuyahoga Heights o ers maintenance, repair and rebuild services for customers in a variety of markets.

And, more and more, Pascarella said, those customers have been relying on Industrious Group’s maintenance sta , instead of having those services in-house.

“Our customers, I don’t think want just a product anymore,” Pascarella said. “ ey want a solution.” at’s what Industrious tries to offer. And it’s working to add relevant skills to its portfolio to make that approach even stronger.

Earlier this spring, Enprotech Corp. changed its name to Industrious Group Inc. Industrious means “diligent,” Pascarella said; it means “hard-working,” “persistence” and more.

e new name gives the larger holding company some separation from its subsidiary, Enprotech Industrial Technologies. And it was a good time to rebrand, Pascarella said, as the company has been changing its focus.

Industrious Group has been honing its focus to the heavy industrial and skilled trades, Pascarella said, divesting businesses that don’t t its current vision, like those it sold in the beverage packaging and tool-anddie space.

At the same time, it’s diversifying in a di erent way, and looking to put its repair and rebuild expertise to

work in the renewables sector.

Industrious Group is owned by Japanese company ITOCHU Corp. Pascarella said ITOCHU has an interest in the renewables sector and wanted Industrious to grow in that space as well, particularly by using its strength of repairing and modernizing equipment. Enprotech has a focus on maintaining, repairing and rebuilding machinery and equipment for its customers in heavy industrial spaces like automotive and steel.

In early May, Industrious Group acquired American Hydro from Wärtsilä Corp. for an undisclosed amount. e company does custom hydropower refurbishment work for its customers, which helps Industrious with its expansion into the renewable energy sector. Pascarella said he expects this acquisition to

Universal Metal Products using technology to make its plants more e cient

BY RACHEL ABBEY MCCAFFERTY

It’s safe to say that people outside of manufacturing might underestimate the work that goes into the products they use everyday.

Take, for example, a particular refrigeration hinge assembled by Universal Metal Products. Right now, putting that product together involves a lot of steps, and it’s more physically demanding than one may think. One of those steps includes an operator putting two parts together and kicking a foot-operated press to preassemble them.

Stergios designed two new machines for this work, and the team built them in-house. Operators can now place two parts on a table at a time, and they’re automatically removed by the machine at the end of the operation by what Stergios called a “pick and place unit.” It sounds like a small change, but Rossman said it’s one that allows the company to almost double the output on those parts and halve the amount of labor needed for them.

e next phase will be to add a way to automate the placing of the products on the table, Stergios said.

just be the rst for the company in the hydro space. In fact, Industrious is looking to grow through acquisitions in a variety of related markets, like wastewater or pulp and paper, he said.

Pascarella also said the company is currently working to combine the metalforming and steel entities under the Enprotech umbrella into one. And it’s looking to grow that side of the business through acquisitions as well, either adding to the Enprotech subsidiary, or as a standalone in the heavy industrial space.

Currently, Industrious employs about 500, Pascarella said. He declined to share annual revenue. Enprotech has facilities in Ohio, Indiana, Michigan, Kentucky and Mexico, while American Hydro has two in Pennsylvania, with a sales o ce in Canada.

Universal Metal nishes together almost 1 million of these parts every year, said director of manufacturing Matt Rossman. It’s labor-intensive, and it’s a job that a lot of operators dislike because of the physical work involved.

So Universal Metal is looking to change how the process is done, eliminating that step with automation. In our Modernizing Manufacturing series, Crain’s is exploring how local manufacturers are using technology to make their work safer, more e cient and more appealing.

Universal Metal Products has three facilities. One in Wickli e, where the company is headquartered, one in Pemberville, Ohio, near Toledo, and one in Texas. e company o ers metal stamping services, but also other value-added processes like assembly to its customers in the automotive, appliance and industrial markets.

Mechanical engineer Nick Stergios has been focused on “improvements” and new machine designs and builds for the company, Rossman said, looking for ways to increase productivity and reduce labor needs. In the case of the hinge above, the company is looking to create a tool that puts the part together all in one process, eliminating the pre-assembly currently done on a kick-press.

In general, Universal Metal is looking for ways to update its technology to make the process more “hands-o ,” Stergios said. e company has created a list of all the particularly time-consuming jobs at the company, identifying potential machine-based solutions. is work looks at the cost and time differences between having a particular operation done by hand by an employee or automated by a machine.

ABOUT TALL OAKS FEATURES

Experience the magic of 14 gorgeous, wooded acres in the heart of beautiful historic Kirtland, OH (less than 25 miles east of Downtown Cleveland).

Family-owned and operated, Tall Oaks offers beautiful and unparalleled indoor and outdoor rustic-chic spaces, State-of-the-Art A/V equipment, overnight accommodations, Event Management, Best-in-Cleveland Culinary Team and so much more!

The Tall Oaks Team is professionally trained and experienced in handling all aspects of your event. From the creation of a tantalizing menu to breathtaking customer service to execution of last details, come experience unparalleled excellence at Tall Oaks. Our staff is equipped and empowered to make your next corporate event like nothing your Team has ever experienced before!

Extensive Oversized Windows, Glass Doors, and Transom Lights to Let the Beautiful Outside in!

Expansive Heated Rear Covered 2,000 sq. ft. Veranda with Fire Tables.

Gorgeous Open-Air, Timber-Formed Bourbon & Cigar Cabin featuring Oversized Wood-Burning Fireplace.

A Wide Variety of Beautiful, Themed Breakout Meeting Areas.

Renowned & Award-Winning Culinary Team to Design and Serve Unique Menus, Sure to Impress your Guests.

Covered and Accent-Lit Walkways, Gazebos and Porches.

Professionally trained On-Site Event Planners/Managers. Valet Parking Service.

“We’re trying to break free from the guy sitting there, putting one part on a machine at a time,” he said.

For example, at Universal Metal’s Toledo-area plant, a set of new machines are simplifying the process for an appliance component. Previously, an operator would take each individual part, put it in a machine to get a thread placed and then remove the part.

e company runs about 1.5 million of one of these threaded parts every year, Rossman said; the other is run about 800,000 times a year.

at added up to almost 3,000 hours of labor per year, Rossman said.

Universal Metal is able to make these machine solutions in-house, as it did in the example above, or they can bring in outside assistance, Stergios said.

A lot of the technology available today to manufacturers has been around for a while, Stergios said, but it’s “better now.” It’s easier to operate. And it’s more cost-e ective, Rossman said, which is particularly important for companies like Universal Metal that might be making a lot of lower-cost parts. e math on how much the machine costs has to make sense against the cost of making the parts as-is.

Ultimately, the need for this kind of transformation became apparent during the pandemic, Rossman said.

e company’s Toledo-area plant in particular saw labor shortages.

“It became very hard to nd staing for a couple months at our Toledo facility,” he said.

e work was still there, Rossman said, but the labor available to hire often wasn’t. And the next generation isn’t going into manufacturing in big numbers, and those that are, are tech-savvy, he said.

By reducing the hands-on labor needed on some operations, Universal Metal can redeploy employees to other areas of the plant, Rossman said. e goal isn’t layo s — in fact, Rossman said he’d hire more if he could — but to e ciently use the labor the company does have.

Universal Metal Products currently employs about 265, with the majority located in Wickli e. Its 2022 sales were about $80 million, Rossman said.

Rachel Abbey McCa erty: (216) 771-5379, rmcca erty@crain.com

8 CRAIN’S CLEVELAND BUSINESS | JUNE 5, 2023

On-site Carriage House Inn with 14 Deluxe Suites. Up to 100 additional Suites Offered in Partnership with Other Local Hotels. And So Much More! Ohio's Newest & Most Unique Corporate Event Center Has An Exclusive Offer For Your Next OffSite/Outing! RECEIVE $2000 OFF YOUR FIRST CORPORATE EVENT WITH TALL OAKS!* * Terms and Restrictions apply. This offer must be redeemed before 4/1/2024 and is to be used for corporate events only. This offer may only be redeemed on an organization's first corporate event. Minimum spend $10,000 required. www.tall-oaks.com | 9199 Chillicothe Rd. Kirtland, OH 44094 | 440.497.6790 -- VOTED BEST NEW EVENT VENUE BY NATIONAL MAGAZINE IN 2022 -MANUFACTURING

This

to make production at Universal

Products more e cient. | CONTRIBUTED

Dalton Thomas, an Industrious Group employee, works on a semi-truck bed. | PJ MOZINGO

pick and place machine is helping

Metal

Nonpro t fundraising to renovate new home for job training programs

BY LYDIA COUTRÉ

BY LYDIA COUTRÉ

In the decade since it was founded to o er work experience to individuals with exceptionalities, the Two Foundation has expanded from a cafe to now include a boutique in the space next door and is expanding its support services and work training opportunities.

e nonpro t has long outgrown its leased space (at 8578 E. Washington St. in Chagrin Falls), and in January, it purchased a new home in Chagrin Falls for $1.6 million. e building at 177 E. Washington St., formerly a luxury automobile shop, will o er 6,800 square feet after renovations, doubling the nonpro t’s space, which has been its biggest limitation in growing the number of individuals served.

e Two is in the midst of a $4 million capital campaign to raise money needed for the renovations, which will cost $2.3 million in total. ey need to raise $1.3 million of that in order to start site work and hope to break ground in June.

Shari Hunter founded the nonprofit in 2013 and opened the cafe two years later. Her goal was to get people a job they could succeed and thrive in, but her grander vision was to change people’s perceptions of individuals with exceptionalities. And she’s seen it work.

“We’ve broken down the walls, we’ve lost the stigmas, we’ve opened the doors,” she said. “So they don’t see Derek as Down syndrome; they just see Derek as Derek. ey don’t see Andy as autism; they see Andy as Andy. And it’s amazing what happens. You don’t see the label anymore with our individuals.”

Hunter’s son Derek, now 30, is the inspiration behind the Two Foundation. From the time Derek was born, she was committed to raising him without labels, without separating him — the same way she raised her two other children.

Frustrated by the ways that certain systems are set up for individuals with cognitive diagnoses, Hunter envisioned a di erent way to “create opportunities for individuals of every ability,” as is now the mission statement of the Two.

Derek was already successful in nding work by the time she started the foundation, but Hunter wanted to

make sure others had more opportunities and support and removed barriers. Derek now works at the Two, alongside both of his siblings, Ti any and Christian.

As of a recent rebranding, the Two Foundation is now doing business as Two and Company, a new name reecting the importance of community support from partners, such as businesses and schools.

“My mom says all the time, ‘We’re not a place; we’re a movement,’” said Christian Hunter, vice president of operations. “It’s our customers; it’s our schools, our business partners, our donors that are our company that are furthering our movement forward.”

Shari Hunter always saw a cafe as the best model for her workplace training vision, because it gives help to break through misconceptions and stigmas and builds connections while training individuals.

“It brings in CEOs and other business leaders, and they come here to eat, and then they end up hiring from us,” she said, “because they go, ‘Oh, that’s a kind of scary idea.’ But then when they come in here, they go, ‘Oh, I can do this. I want to do this.’ So it takes the fear out, I think, for many businesses.”

e foundation has more than 80 business partners — from large companies to small businesses — that have hired its graduates. Last year, they placed 30 job seekers, up from 12 in 2018. Between 2018 and 2022, the Two’s sta grew from 12 to 32 employees (including full and part time), and its total revenue more than doubled from $775,000 to $1.7 million.

e new building will include the cafe and shops, training space and business o ces, and it will enable the organization to double the number of job seekers it trains and places annually.

e Two is still deciding how it will use a house next door that was included in the sale, but options include residential space for the individuals it serves or a hospitality training rotation.

e new location will add a lot of visibility for the cafe and boutique, compared with its current space, which is tucked back from the road.

e foundation is certi ed by the state as a Ohio Department of Developmental Disabilities (DODD) and

Opportunities for Ohioans with Disabilities (OOD) provider. It partners with local schools, DODD and OOD on job readiness training, job development and follow-along support.

Continuing to grow the high school program is a major focus for the organization.

“We can be that bridge from school to community employment, and remain in the picture to support these individuals and support these families long term,” Christian Hunter said. A couple of years after it opened, the cafe added a garden out front, and in 2019, the Two expanded into the space next door, doubling to 3,600 square feet of space and adding retail experience to job training opportunities. e foundation also o ers job-related social and educational programs, as well as transportation services.

When individuals come to the Two, they can explore career options through various rotations to see what might be a good t: kitchen, o ce tasks, computer work, manufacturing (they make and assemble some of the items sold in the boutique), pricing and merchandising, gardening and landscaping, etc.

“And all the while, our teachers are assessing, you know, what are the things that each individual really likes, and what are the things that they’re really good at?” Christian Hunter said. “So by the time their training time is done here, we’ve really narrowed our focus, and we’ve eliminated a few of the rotations. And those individuals are spending more time in the speci c rotations that we feel like (they’ll) end up in after they leave here at the Two. So we’re really able at that point to identify what’s going to be the right match and then move into job development and progress from there.”

Derek, who graduated from Kent State University, is now the Two’s administrative assistant, a title he’s opted for over Christian’s suggestion of director of community relations.

“I enjoy seeing the growth to this point, going from the current place and blossoming and coming down to this new location as well,” Derek said. “It’s just amazing how well we’re doing.”

Lydia Coutré: lcoutre@crain.com, (216) 771-5479, @LydiaCoutre

JUNE 5, 2023 | CRAIN’S CLEVELAND BUSINESS 9 CrainsCleveland.com/CareerCenter

Talent with Opportunity. From top talent to top employers, Crain’s Career Center is the next step in your hiring process or job search. Get started today APPLEGROWTH.COM/CAREERS WANT BALANCE WITHOUT THE ACT? LOOKING FOR YOUR OWN HEALTHY CAREER GROWTH? FIND A MODERN WORKPLACE THAT WORKS FOR YOU Ideal Multi-Tenant/Office Building LAND FOR SALE: Beacon West, Westlake CONTACT US Charles Marshall 330-659-2040 3457 Granger Road, Akron, OH 44333 beaconmarshall.com Property Features * Price for 7.22 lot is $600,000 * Price for 6.59 lot is $580,000 * “Army Core Wetland Approval on Both Sites” NONPROFIT

Connecting

CONTRIBUTED

Private jet companies, hot o pandemic surge, face new hurdles

BY BLOOMBERG

Jim Segrave has provided private jet services to wealthy clients for decades. He chartered ights through the nancial woes of 2008 and through hurricanes that slammed his home state of North Carolina, forcing him to salvage equipment from his ooded o ce building using a canoe.

But Segrave’s biggest test yet may come this summer as he pushes forward with a public listing of yExclusive Inc., which operates more than 90 private jets, through a special purpose acquisition company that values his business at $900 million. Private ights in the U.S. have declined from their pandemic highs, with takeo s and landings dropping 4.5% in the rst quarter from a year earlier.

e drop accelerated to 9.3% in April compared with an 8.6% decrease in March.

Besides the demand decline, the industry is also grappling with in ation, especially around a lack of maintenance technicians and pilots.

e aircraft market remains tight as a lingering supply-chain shortage impedes planemakers from ramping up production faster. Over the long term, the industry is under growing pressure to mitigate or o set its greenhouse gas emissions.

Richmond Heights-based Flexjet, the second-largest U.S. operator of

private jets behind NetJets Inc., shelved its SPAC listing last month, paying $30 million to call o the deal. Wheels Up Experience Inc., which went public in 2021 via SPAC, has struggled to turn a pro t even as sales have grown.

The descent Segrave said he isn’t worried. FlyExclusive does its own work on airplanes except for engine maintenance, and is investing in simulators to train its own pilots.

“Our customer base is fairly insulated,” said Segrave, who founded yExclusive in 2015 after selling his rst private-jet business to Delta Air Lines Inc. in 2010. “ ey generally are going to continue to travel.”

Private ying is still more popular than in 2019, according to U.S. Federal Aviation Administration data. While many rst-time private iers return to commercial airlines, others are sticking around as they get a taste of the speed and convenience of private travel. ose new customers, often described as the frugal wealthy who before never had motivation to try private aviation, will result in a slight increase of private iers compared with the pre-pandemic market, said Brian Foley, an industry consultant.

ere’s also evidence of stable demand for private aviation. Aircraft makers, which underpin the health

of the industry, have raised prices ahead of in ation and deliveries are expected to increase to 722 business jets this year, up from 614 in 2022, according to JPMorgan Chase & Co. Next year, those deliveries are expected to rise to 750, the highest level since the 2008-2009 nancial crisis, according to JPMorgan data.

MAYBE

Still, the mood at the annual European corporate jet conference in Geneva, which begins May 23, may be tinged with trepidation that the industry could be rocked by a recession. Planemakers continue to face production delays, and a deep recession could throw the whole market o kilter, Foley said.

Segrave, who is an active pilot, said yExclusive wants to buy more of Textron Inc.’s Cessna planes, but the wait time is three years or so from order to delivery.

Flexjet, a larger competitor, is also seeking to increase its aircraft orders from Embraer SA and Bombardier Inc., but production is being held up by jet engine supplies.

Changing winds

e end of the ying frenzy is a major headwind for charter companies that match available aircraft to passengers in the spot market. But for companies like Flexjet, which own their own eets and cater to more stable customers who buy chunks of ight hours, the surge during the pandemic brought new problems, including having to purchase expensive aircraft capacity from other operators to meet clients’ needs, said Kenn Ricci, chairman of Flexjet.

“ ank God it’s not what it was last year,” said Ricci, whose company saw annual ight hours under management jump to 145,000 from 90,000 before the pandemic. “It’s hard for me to see anything bad in the market right now because I’m so looking forward to it slowing down.”

at surge tightened inventories and sent used-aircraft prices soaring. Less than 3% of pre-owned aircraft were up for sale during the height of the pandemic. e market has loosened up but is still tight by historical standards, with about 4% of the eet up for sale, less than half the rate before 2020.

e average asking price for used aircraft fell 1.2% in March from February to $12.8 million, according to a JPMorgan Chase report, showing some

easing of the tight pre-owned market. Still, that average asking price was 7% higher from a year earlier.

Companies, especially smaller ones, are slower to pull the trigger on plane deals now, said Janine Iannarelli, who helps clients buy and sell planes.

“ e winds of change in our economic and political environment are making people maybe step back a little bit,” she said. “We’re in this period where people are wait-and-see.”

Investors may be wary after private-jet operator Wheels Up reported rising net losses in 2022 even as sales have grown. e stock has plummeted more than 95% since going public in July 2021 through a SPAC and company founder Kenny Dichter stepped down as CEO on May 9.

Kinston, North Carolina-based yExclusive is expected to have operating cash ow of about $64 million this year and sees that doubling to $130 million next year, according to a May proxy ling. e company’s sales jumped to $320 million last year, almost triple its sales in 2019. Segrave expects to double last year’s sales to almost $730 million in 2024. FlyExclusive plans to begin trading as early as this summer.

“We’ve grown it in a very methodical, smart, disciplined way and now we’re taking this company public,” Segrave said. “We’re going to continue being disciplined.”

10 | CRAIN’S CLEVELAND BUSINESS | JUNE 5, 2023

TRANSPORTATION

“THE WINDS OF CHANGE IN OUR ECONOMIC AND POLITICAL ENVIRONMENT ARE MAKING PEOPLE

STEP BACK A LITTLE BIT,”

—Janine Iannarelli, aircraft broker

Pure Hockey to enter Ohio market with May eld Heights store

STAN BULLARD

e lights will be going back on at the former Danny Vegh Home Entertainment store in May eld Heights after the Boston-based Pure Hockey retail chain leased it for the company’s rst Ohio store.

Pure Hockey, as the name suggests, is devoted to a wide range of hockey equipment and paraphernalia, from skates and sticks to uniforms.

e company has leased about 7,000 square feet at the former Danny Vegh store, 6505 May eld Road, according to a notice on the Construction Journal online building data site.

Pure Hockey also has received a permit to redo the space, according to the May eld Heights building department.

e company operates more than 60 stores and two e-commerce websites. It was launched in 2002 when principals David Nectow and Sal Tiano acquired three sporting goods stores. Pure Hockey has three stores in Pittsburgh, as well as stores in Novi and Troy, Michigan, near Detroit.

When Pure Hockey opens, the May eld Heights building will be far di erent than when Danny Vegh shut

down in 2018. Michael Occhionero, a senior vice president at Hanna Commercial, said the building is now owned by an a liate of My SALON Suite, which leases individual workstations to hair stylists.

e company replaced a mezzanine in the Danny Vegh building with a second oor containing salon suites.

Startup Syrup launches with $3M in seed nancing

SCOTT SUTTELL

e worlds of AI, SaaS and email marketing collide in Syrup, a startup with a Cleveland team that just announced its launch and the raising of more than $3 million in seed funding.

Syrup describes itself as “bringing an innovative approach to email marketing that harnesses the power of product usage data coupled with AI to create hyper-personalized experiences for users.” It’s co-founded by Brad Owen, the Cleveland-based founder of NeverBounce, a Beachwood company that provided email veri cation and list cleansing services that was acquired by ZoomInfo in 2019, and his half-brother, Michael Classen, former executive o cer at Greenspring Associates. (With Syrup, Classen is based in Brooklyn, New York.)

Owen said in a phone interview that the company has spent the last year in stealth mode, developing its technology and planning for a commercial launch. Syrup now has an 11-member team, including three people in Cleveland. Everyone at the company works remotely.

He said the company’s email marketing platform is “ready to go to market,” and that Syrup is working with design partners and preparing to add customers in the coming weeks. (Visitors to its website can sign up for a waitlist to test the product.)

Syrup’s goal is to enable businesses to communicate with customers as individuals, Owen said, rather than as a mass. It’s using generative arti cial intelligence technology to enable a level of personalization that will help companies boost retention, loyalty and revenue. Owen also said Syrup aims to make its platform easy to use, more on the level of con-

sumer email products (think Gmail, for instance) than more complicated business email products.

e technology is built to engage with customers based on “predictive insights,” Owen said, including activity level, likelihood to convert or churn, and potential for expansion.

Bolstering the company is $3.3 million in seed funding, led by High Alpha Capital, a venture rm specializing in B2B SaaS companies. High Alpha Capital says it has raised $250 million across three funds and has launched or invested in more than 70 startups.

Mike Fitzgerald, a partner at High Alpha Capital, said in a statement, “Drawing on our marketing tech experience we recognize the critical role of personalization in the email space. Syrup’s disruptive approach to email marketing can transform how SaaS companies engage with their customers; we’re excited to partner with Brad and Michael on their journey.”

Owen, who has bootstrapped previous companies, said he expects to raise more outside money for Syrup.

One more thing: about that name. Asked how he and Classen came up with “Syrup,” Owen said he wanted a brand “that was sophisticated, delightful and memorable. Syrup pays homage to the marketing automation drip; the moment in time responsible for your customer relationships in an email-centric world.”

Owen noted, too, that he and Classen “grew up on a farm that produces maple syrup. We’ve both grown to appreciate the balance of simplicity and sophistication surrounding the process. It’s safe to say we have an a nity for the term.”

Scott Suttell: ssuttell@crain.com, (216) 771-5227, @ssuttell

However, Occhionero declined to comment on the status of Pure Hockey as a potential occupant of the building. Nectow, Pure Hockey’s chief operating o cer, did not return three calls from Crain’s Cleveland Business by 4:40 p.m. ursday, May 25. Pure Hockey also did not return three emails to its company website or the

email address for its marketing unit by the same time. e Cleveland-Akron market is served by multiple small hockey shops, including some in Northeast Ohio municipal ice rinks, as well as sporting goods chains such as Dick’s Sporting Goods.

Another hockey equipment retailer serving the Cleveland-Akron market is Perani’s Hockey World of Flint, Michigan. Perani’s Hockey World has a store in North Olmsted, as well as in Columbus and Cincinnati among its total of 17 locations.

Robert Perani, vice president of Perani’s Hockey World, said in a phone interview that the company’s North Olmsted store was the family-owned rm’s second or third location when it opened in 1992.

“It’s been like a second home to us,” Perani said. “We have employees who bought their hockey equipment there as kids. We have parents who bring their kids to the same store where they got their rst skates at as kids.” e company, he said, has frequently discussed adding an east suburban location in the Cleveland area. But it has chosen not to add a second store across town because it did not

want to operate two stores within such a short drive time, as well as the logistics of nding employees who play or played hockey.

“Hockey families are used to driving,” Perani added. “I will say our Columbus and Cincinnati stores are there because of the success of our Cleveland store. Rather than add another store there, we’ve chosen to expand our North Olmsted store.” e company in August plans to expand to 8,000 square feet from its current 6,000 square feet, Perani said. e shop has been in Lauren Hill Plaza since the company opened here. e hockey market is growing, Perani said, but at a slow rate. He takes the long view of a multistore competitor entering the Northeast Ohio market.

“We don’t have concerns,” Perani said. “We hope they don’t steal business but help grow hockey.”

Perani’s Hockey World was launched in 1978 by his late father, Bob Perani, who opened his rst store in Flint after a semipro and pro hockey career.

Stan Bullard: sbullard@crain.com, (216) 771-5228, @CrainRltywriter

JUNE 5, 2023 | CRAI N’S CL EVE LA N D B U SINE SS | 11 LYMAN CAMPUS One Lyman Circle, Shaker Heights BUTLER CAMPUS 7420 Fairmount Road, Russell Twp. Girls Kindergarten - Grade 12 and Coed Early Childhood 216 46 4. 0 946 LaurelSchool.org l l College choices as of May 30, 202 3. Congratulations to the Laurel School Class of 2023! Forever green and white. No matter what colors come next. 63% $5.4 million 2023_Grad_Ad_Crains.qxp_Layout 1 5/30/23 10:52 AM Page 1

REAL ESTATE

TECHNOLOGY

Pure Hockey, a purveyor of equipment for all things hockey, plans to set up shop in this building on May eld Road near Costco in May eld Heights. | COSTAR

HIGHEST-PAID CEOS CRAIN'S LIST |

Ranked by 2022 total compensation

Source:S&PGlobalMarketIntelligence(spglobal/marketintelligence);additionalresearchbyChuckSoderandLydiaCoutré(researcher@crainscleveland.com) |Netincomeisincomeattributabletoordinary shareholders.Pensionvaluechange guresincludenonquali eddeferredcompensation.ToappearonthislistanexecutivemusthaveservedasCEOofalocalpubliccompanyatsomepointduring2022.NOTES:

1. JenniferParmentierbecameCEOof ParkerHanni nCorp.onJan.1,2023,replacingWilliams,whoisnowexecutivechairman.

2. StrahservedasactingCEOfromOctober2020toMarch2021.

3. Parmentierpreviouslyservedaschiefoperatingo cer.

4. Carestiopreviouslyservedassenior vice president and chief operating o cer.

5. Marquez previously served as executive vice president of global banking Get all 62 CEOs and historical compensation data in Excel. Become a Data Member: CrainsCleveland.com/data

12 | CRAIN’S CLEVELAND BUSINESS | J UNE 5, 2023 RANK EXECUTIVE TENURE AS CEO 2022 TOTAL COMPENSATION/ 1-YEAR CHANGE SALARY/ BONUS STOCK AWARDS/ OPTION AWARDS NON-EQUITY INCENTIVES/ PENSION VALUE CHANGEOTHER COMPANY NET INCOME (MILLIONS)/ 1-YEAR CHANGE 1 KEVINM.STEIN TransDigm Group Inc. April 2018 - present $18,709,996 -12.9% $1,273,750 $376,375 $12,486,796 $1,886,625 $2,686,450 $866.0 27.35% 2 LOURENCOGONCALVES Cleveland-Cli s Inc. August 2014 - present $18,457,351 -24.6% $2,035,000 $9,260,335 $6,924,868 $573 $236,575 $1,335.0 -55.32% 3 THOMASL.WILLIAMS Parker Hanni n Corp. February 2015 - December 2022 1 $18,448,169 8.3% $1,387,500 $5,800,687 $4,282,828 $3,780,697 $3,044,860 $151,597 $1,315.6 -24.65% 4 MICHAELB.PETRASJR. Sotera Health Co. June 2016 - present $16,659,858 658.1% $1,038,462 $3,749,997 $10,712,705 $1,142,308 $16,386 ($233.6) 5 CRAIGARNOLD Eaton June 2016 - present $14,066,041 -27.4% $1,400,000 $588,000 $8,058,926 $2,443,490 $1,364,160 $211,465 $2,462.0 14.83% 6 VIRGINIAC.DROSOS Signet Jewelers August 2017 - present $12,953,460 6.3% $1,500,000 $0 $6,814,324 $4,500,000 $139,136 $769.9 7 JOHNG.MORIKIS The Sherwin-Williams Co. January 2018 - present $12,749,910 -19.5% $1,408,962 $0 $5,357,573 $4,248,445 $947,000 $787,930 $2,020.1 8.35% 8 TRICIAGRIFFITH Progressive Corp. July 2016 - present $12,748,826 -11.9% $950,000 $9,500,203 $2,042,501 $256,122 $721.5 -78.47% 9 CHRISTOPHERM.GORMAN KeyCorp May 2020 - present $10,463,627 20.9% $1,150,000 $6,479,961 $719,997 $2,025,000 $14,895 $73,774 $1,917.0 -26.97% 10 RICHARDJ.KRAMER Goodyear Tire & Rubber Co. April 2010 - present $10,317,348 -51.8% $1,366,667 $0 $5,658,051 $0 $3,109,500 $0 $183,130 $202.0 -73.56% 11 CHRISTOPHERL.MAPES Lincoln Electric Holdings December 2012 - present $10,096,478 9.6% $1,065,000 $3,672,156 $1,833,338 $3,088,500 $185,377 $252,107 $472.2 70.78% 12 DANIELA.CAMARDO Athersys Inc. February 2022 - present $9,894,813 $525,385 $250,000 $498,000 $8,600,000 $21,428 ($72.5) 13 STEVENE.STRAH FirstEnergy Corp. October 2020 - September 2022 2 $9,268,371 -13.5% $863,984 $6,601,055 $995,388 $715,074 $92,870 $406.0 -68.36% 14 MITCHELLR.BUTIER Avery Dennison May 2016 - present $9,107,739 -26.7% $1,176,923 $6,769,541 $974,400 $186,875 $757.1 2.3% 15 FRANKC.SULLIVAN RPM International Inc. October 2002 - present $9,053,579 -24.1% $995,000 $0 $3,219,192 $3,618,000 $995,000 $0 $226,387 $491.5 -2.21% 16 ROBERTM.PATTERSON Avient Corp. May 2014 - present $9,046,852 -3.6% $1,156,154 $2,008,216 $2,006,642 $3,676,524 $199,316 $703.1 204.64% 17 MARKT.SMUCKER The J.M. Smucker Co. May 2016 - present $8,511,639 -31.6% $1,100,385 $22,100 $4,143,838 $1,381,245 $1,748,110 $115,961 $631.7 -27.91% 18 SUNDARAMNAGARAJAN Nordson Corp. August 2019 - present $8,432,113 -18.2% $900,000 $2,997,098 $2,475,660 $1,670,400 $327,553 $61,402 $513.1 12.92% 19 RICHARDG.KYLE The Timken Co. May 2014 - present $8,237,530 -14.8% $1,067,072 $4,876,769 $1,873,405 $0 $420,284 $407.4 10.38% 20 RICHARDA.ZIMMERMAN Cedar Fair LP January 2018 - present $7,285,782 -27.1% $908,400 $4,375,035 $1,986,671 $15,676 $307.7 21 JENNIFERA.PARMENTIER Parker Hanni n Corp. January 2023 - present 3 $7,106,874 $765,423 $3,304,641 $1,229,346 $1,373,446 $434,018 $1,315.6 -24.65% 22 DAVIDR.LUKES Site Centers Corp. March 2017 - present $6,799,485 -1.6% $900,000 $3,606,484 $2,250,000 $43,001 $168.7 35.07% 23 DANIELA.CARESTIO STERIS July 2021 - present 4 $5,903,168 102.7% $767,280 $1,397,772 $2,870,787 $854,729 $12,600 $243.9 24 NEILA.SCHRIMSHER Applied Industrial Technologies October 2011 - present $5,840,834 -4.0% $930,000 $2,389,762 $608,682 $1,640,520 $0 $271,870 $257.4 77.76% 25 OCTAVIOMARQUEZ Diebold Nixdorf Inc. March 2022 - present 5 $5,660,334 $779,755 $4,343,685 $536,894 ($581.4)

Be the CEO of your own success with Weatherhead Executive Education

From a world innovator in leadership development comes the world’s most ambitious leadership program. Weatherhead School of Management’s Leadership Deep Dive TM is ideal for senior executives seeking ways to advance their organizations through innovative leadership strategies.

Enroll today and learn to inspire and lead at four levels: self, team, organization and society.

With a curriculum built on appreciative inquiry and emotional intelligence—the revolutionary leadership principles that originated at Weatherhead—you’ll finish the program well equipped to foster innovation, inspire and lead your team to success.

For information about our upcoming cohort, call 216.368.1503, email signatureprograms@case.edu or visit us online at weatherhead.case.edu/deepdive by scanning the QR code.

HIGHEST-PAID NON-CEOS CRAIN'S LIST |

Ranked by 2022 total compensation

Source:S&PGlobalMarketIntelligence(spglobal/marketintelligence);additionalresearchbyChuckSoderandLydiaCoutré(researcher@crainscleveland.com) |Thislistincludespubliccompanyexecutiveswhose 2022compensationwasreportedinpublic lings.Netincomeisincomeattributabletoordinaryshareholders.Pensionvaluechangecolumnalsoincludesnonquali eddeferredcompensation.NOTES: 1. BankspreviouslyservedaspresidentandCOO.

SmithpreviouslyservedasexecutivevicepresidentandCOO. 3. KocipreviouslyservedasexecutivevicepresidentandCFO. 4. Pattersonpreviouslyservedasseniorvicepresidentofbusinessintegration. 5. WellspreviouslyservedasCFO. 6. Coughlin previously served as executive vice president and group president. 7. Petz served as president of The Americas Group from March 2021 to March 2022, and before that she was senior vice president of sales and marketing. Get 180 executives and more data in Excel format. Become a Data Member: CrainsCleveland.com/data