EACH WEEK DON’T MISS OUT ON CRAIN’S SPECIAL REPORT!

BROUGHT TO YOU BY:

WEEKLY FOCUS: SMALL BUSINESS, Page 10 VOL. 40, NO. 2

JANUARY 14 - 20, 2019

Source Lunch

Akron Entrepreneurs’ craft lighting business has bright future. Page 16

Excel Soccer Skills Development founder Tibi Regele Page 19

CLEVELAND BUSINESS

The List Northern Ohio’s top SBA lenders Page 15

MANUFACTURING

AlexLMX via Getty Images

Tariffs a drag on Ohio manufacturing growth

By JEREMY NOBILE

The international impact of tariffs

jnobile@crain.com @JeremyNobile

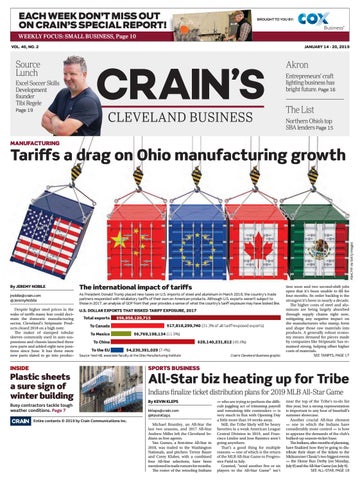

As President Donald Trump placed new taxes on U.S. imports of steel and aluminum in March 2018, the country’s trade partners responded with retaliatory tariffs of their own on American products. Although U.S. exports weren’t subject to those in 2017, an analysis of GDP from that year provides a sense of what the country’s tariff exposure may have looked like.

Despite higher steel prices in the wake of tariffs many fear could decimate the domestic manufacturing sector, Cleveland’s Stripmatic Products closed 2018 on a high note. The maker of stamped tubular sleeves commonly used in auto suspensions and chassis launched three new parts and added eight new positions since June. It has three more new parts slated to go into produc-

U.S. DOLLAR EXPORTS THAT RISKED TARIFF EXPOSURE, 2017 Total exports

$56,958,120,715 $17,818,299,740 (31.3% of all tariff-exposed exports)

To Canada To Mexico

$6,769,198,134 (11.9%)

To China To the EU

$28,140,231,812 (49.4%) $4,230,391,029 (7.4%)

Source: Ned Hill, associate faculty at the Ohio Manufacturing Institute

INSIDE

Plastic sheets a sure sign of winter building Busy contractors tackle tough weather conditions. Page 7 Entire contents © 2019 by Crain Communications Inc.

P001_CL_20190114.indd 1

Crain’s Cleveland Business graphic

tion soon and two second-shift jobs open that it’s been unable to fill for four months. Its order backlog is the strongest it’s been in nearly a decade. The higher costs of steel and aluminum are being largely absorbed through supply chains right now, mitigating any negative impact on the manufacturers who stamp, form and shape those raw materials into products. A generally robust economy means demand for pieces made by companies like Stripmatic has remained strong, helping offset higher costs of materials. SEE TARIFFS, PAGE 17

SPORTS BUSINESS

All-Star biz heating up for Tribe

Indians finalize ticket distribution plans for 2019 MLB All-Star Game By KEVIN KLEPS kkleps@crain.com @KevinKleps

Michael Brantley, an All-Star the last two seasons, and 2017 All-Star Andrew Miller left the Cleveland Indians as free agents. Yan Gomes, a first-time All-Star in 2018, was traded to the Washington Nationals, and pitchers Trevor Bauer and Corey Kluber, with a combined four All-Star selections, have been mentioned in trade rumors for months. The roster of the retooling Indians

— who are trying to perform the difficult juggling act of trimming payroll and remaining title contenders — is very much in flux with Opening Day a little more than 10 weeks away. Still, the Tribe likely will be heavy favorites in a weak American League Central Division in 2019, and Francisco Lindor and Jose Ramirez aren’t going anywhere. That’s a good thing for multiple reasons — one of which is the return of the MLB All-Star Game to Progressive Field in July. Granted, “send another five or six players to the All-Star Game” isn’t

near the top of the Tribe’s to-do list this year, but a strong representation is important to any host of baseball’s summer showcase. Another crucial All-Star element — one in which the Indians have considerably more control — is how to appease the demands of the club’s bulked-up season-ticket base. The Indians, after months of planning, have finalized how they’re going to distribute their share of the tickets to the Midsummer Classic’s two biggest events — the Home Run Derby (on Monday, July 8) and the All-Star Game (on July 9). SEE ALL-STAR, PAGE 18

1/11/19 2:40 PM