The Cook County assessor says public sentiment about plummeting values over the past couple of years is worse than his of ce sees it

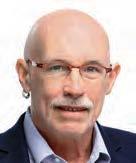

Danny EckerDowntown commercial property owners fearing Fritz Kaegi’s latest estimates of what their buildings are worth might have good reason to worry, based on new comments from the Cook County assessor.

Taking a generally positive outlook on the downtown commercial real estate market as e ects of the COVID-19 pandemic subside, Kaegi told local property owners on April 24 that overall public sentiment about plummeting property values in Chicago’s urban core over the past couple of years is worse than his o ce sees it.

When it comes to the fallout that the struggling downtown ofce and retail market may unleash on other taxpayers, “generally the perception is that the impact will be greater than what we think it actually will be,” Kaegi said in an interview with Crain’s

during an event his o ce held to discuss assessments with local real estate stakeholders. at may be nauseating for many landlords to hear as they brace for Kaegi to release assessments in the next few weeks for West Chicago Township, which includes a big chunk of down-

Chicago felt rich with restaurant openings over the last year. We’re focusing on downtown options for the business diner, sampling four dinner spots and three lunch locales. We also scope out a cocktail bar and a wine tasting counter. | PAGE 14 See

town west of the Chicago River. Kaegi is reassessing all of downtown this year for the rst time since 2021, and the West Loop numbers will signal his broader opinion on how rising interest rates and weak demand for

The trendy grocery chains were an important marketing engine for many of today’s up-and-coming direct-to-consumer brands

e sudden closure of trendy grocery chain Foxtrot Market is a blow to many up-and-coming direct-to-consumer brands that used distribution in the upscale stores as a key marketing engine. As Crain’s rst reported, Outfox Hospitality, the Chicago-based parent of Foxtrot Market and Dom’s Kitchen & Market, shut both chains down on April 23, six months after the two brands merged. “We explored many avenues to continue the business but found no viable option despite good faith and exhaustive e orts,” Dom’s Chicago stated on its Facebook page.

GREG HINZ

Bigger hurdles await as Mayor Johnson tries to put the start-up blues behind him.

e chains were small — Foxtrot operated 33 stores in cities such as Chicago, Washington, D.C., and Austin, Texas, while Dom’s only had two stores in Chi-

cago. Foxtrot, in particular, provided a demonstration ground for many DTCs that had goals of entering bigger chains such as Target and Whole Foods, helping them gain momentum.

“ ere are very few retailers willing to roll the dice on a new brand with unproven sales, track record, margins etc. Foxtrot was an incredible hub for innovation and an amazing partner to bright-eyed entrepreneurs,” Paul Voge, CEO and co-founder of DTC sparkling water brand Aura Bora, wrote in an email. Aura Bora drinks were sold in Foxtrot stores.

Southwest is reducing its schedule at O’Hare Airport by more than one-third this summer.

PAGE 3

For both fans and critics of Mayor Brandon Johnson, the last half of April has been revealing.

Johnson won City Council approval of a $1.2 billion bond issue to fund housing and economic development projects of his choice with minimal council controls, but so far has been unable to kill a plan allowing individual aldermen to keep the controversial ShotSpotter program in their wards.

He patched up a dispute with U.S. Sens. Dick Durbin and Tammy Duckworth over how to revitalize a critical terminal modernization and expansion project at O’Hare International Airport, but Gov. J.B. Pritzker and legislative leaders soundly dissed his plan to keep the Bears in Chicago with billions in taxpayer subsidies.

Meanwhile, on the crime front, Johnson had to nd the right tone in dealing with both the murder of a popular young cop and the 96bullet police shooting of a motorist who shot at them after being stopped for failing to use a seat belt.

So it has gone for Chicago’s rookie mayor as the anniversary of his rst year in o ce rolls by in mid-May. e record is mixed — very mixed.

e question now: Will he get through his start-up blues and successfully handle the even bigger challenges that face him and the city in his sophomore year?

Despite some nasty ghts and the unexpected in ux of tens of thousands of refugees from the southern border, Johnson has pretty much had his progressive way with the City Council. Allies such as Chicago Teachers Union President Stacy Davis Gates and Chicago Federation of Labor President Bob Reiter say they are pleased with his performance. Notably, so does anti-violence crusader Arne Duncan, who almost ran for mayor against Johnson. Beyond that, Johnson has shown signs of at least soothing some wounds with an irate business community, beginning to recognize that focusing on jobs and economic development is a win-win proposition, as Chicagoland Chamber of Commerce chief Jack Lavin puts it.

But Johnson su ered a humiliating defeat when voters rejected his vaunted “Bring Chicago Home” plan to hike real estate transfer taxes to fund a ordable housing programs. He fumbled the ShotSpotter issue, canceling and then temporarily renewing the program. And though some of his appointments have drawn wide praise — Chicago Police Department Superintendent Larry Snelling and city Planning Commissioner Ciere Boatright, in particular — there is a sense among

friends and foes alike that the administration of a mayor whose previous public service was limited to holding a seat on the Cook County Board of Commissioners has been too slow to sta up, too reliant on a tiny core of advisers, and too much in political debt to the CTU to survive and thrive in a diverse city with enormous needs.

“It’s like the dog who caught the re truck,” says one City Council ally who asked not to be named.

“You have to have a fast learning curve in this job. He’s got to step up his game.”

‘More

One of those key insiders, senior adviser Jason Lee, rejects such criticism and says better times are on the way. (Johnson himself was unavailable for comment for this column. Former Mayor Lori Lightfoot declined comment, and Johnson electoral foe Paul Vallas released a statement terming him “a failed teacher turned union organizer with no management skills.”) Given that Johnson had to and did deal with an unexpected in ux of migrants that stressed the city’s resources, “I’m encouraged at what we’ve accomplished,” Lee says. “Of course, there’s more work to do.”

Lee points to successful approval of key progressive items, including mandatory time o , shifting priorities in the city budget and the abolition of the sub-minimum wage for tipped restaurant workers — so do key allies, such as Reiter and Gates. e latter declares Johnson has done “an amazing job,“ and denies frequent rumors that she’s a near-daily presence at City Hall. Gates even shrugs o gripes from others that there is nothing progressive about subsidizing billionaires like the Chicago Bearsowning McCaskeys, quipping, “A lot of people work in stadiums.”

Some, perhaps, unexpected applause — full-throated applause — comes from Duncan, a former Chicago Public Schools chief and U.S. Education secretary whom many business leaders strongly pushed to run for mayor in the 2023 election. Johnson’s decision to shift from a police-heavy anti-crime strategy and better fund preventative antiviolence programs has made Duncan “more hopeful than I’ve ever been” that Chicago has turned a key public safety corner. “We’re in the ballgame in a way we’ve never been. But we have to keep at it. ere’s no guarantee of success.”

Such sentiment does not appear to have sifted down to voters — at least not yet. e latest opinion poll, taken for a group headed by strategist Greg Goldner as part of the campaign against Johnson’s “Bring Chicago Home” referendum in March, found the mayor’s ratings well underwater, with just 26% of Chicagoans approving of his job performance and 54% dissatis ed. “It’s clear (Johnson) is doubling down on an agenda I’m

not sure he ever had a mandate to pursue,” says Goldner.

Lee says the mayor is doing better in his own polls. He declines to release gures. However, interviews with key gures who say they want Johnson to succeed but have their own power bases, indeed, are mixed. One of those gures is Near South Side Ald. Pat Dowell, 3rd, a veteran o cial and former city planner whom Johnson made chairwoman of the powerful City Council Finance Committee, once the longtime power base of former Ald. Ed Burke.

“I think the mayor has done a better job than his predecessors of engaging aldermen” in decision making, Dowell says. But sta ng up the administration has been “a little slow,” she added. Asked whether Johnson fully realizes that as mayor he now has to represent the entire city and not just his progressive base, Dowell replies, “No,” pointing to the tax referendum and

Johnson’s decision to cast a tiebreaking vote in favor of a Gaza cease- re resolution that was bitterly called unfair by the city’s only Jewish City Council member, Deborah Silverstein, 50th.

An equally nuanced appraisal of Johnson’s rst year comes from Derek Douglas, president of the Commercial Club of Chicago and its Civic Committee, which has served as the voice of the city’s big-business community for more than a century.

“It is in all of our interest for the mayor to be successful, and it is in that spirit that we have looked for areas of alignment where we can partner with the city. A good example is public safety,” Douglas says in a written statement. “We also have been pleased to see some of his recent moves to revitalize the downtown area through the LaSalle Street (Reimagined) project and to streamline city processes for business like the ‘Cut the Tape’ initiative.”

“At the same time,” Douglas continues, “we spoke out against his decision to cancel ShotSpotter and have deep concerns about the CPS Board’s guidance to shift away from selective enrollment schools. But the lines of communication with the mayor are open.”

Says Johnson ally Ald. Andre Vasquez, 40th, co-chair of the Council’s Progressive Caucus: “ ere’s room for improvement.” His advice: “Focus on the things that aren’t going well” and spend less time pushing stadium plans that are “de nitely concerning” to progressives. Indeed, how the Bears stadium plays out — as well as related efforts by the White Sox to get city help in building a new stadium in the South Loop — will say much about whether Johnson really is turning a corner as a leader. So will successfully delivering on an O’Hare gates deal that does not trade the city’s long-term economic future for short-term political gain, assuring the upcoming Democratic National Convention does not give the city a 1968-style black eye, and not burdening Chicago home and o ce owners with an una ordable new CTU contract. If Johnson can do that — land a good O’Hare deal, keep the Bears and Sox in town at a reasonable cost to taxpayers, deliver a successful convention for President Joe Biden and promote a CTU contract that recognizes Chicago’s scal realities — his mixed start will be forgotten. It might help if he went public more often to make his own case.

If not, Chicago will have to buckle up for a bumpy next three years.

“In business, relationships are everything. Wintrust gave us that personal touch.”

LOLLINO — PRESIDENT | ALAMODE FOODS

Prosecutors say expressionist drawing was stolen during the Holocaust

Brandon DupréIn a legal response led April 23, the Art Institute of Chicago defended its ownership of an artwork that the Manhattan District Attorney’s O ce believes was stolen during the Holocaust, setting up a legal showdown that has the art world watching. e museum’s 132-page legal ling is the latest in a dispute over the ownership of a watercolor-and-pencil drawing by Austrian expressionist Egon Schiele that is believed to have

been stolen during the Holocaust from Fritz Grünbaum, a Jewish cabaret entertainer from Vienna who was murdered in a Nazi concentration camp and whose art collection was looted, according to New York o cials.

In its response to a motion by New York o cials to turn over the artwork, the museum defended its ownership, calling the district attorney’s claims “factually unsupported and wrong.”

“ e core allegations raised . . . have been the subject of decades of extensive civil litigation

and government investigation, in this country and abroad, which has generally reached the opposite conclusion: that ‘Russian War Prisoner’ was not looted during World War II but was, instead, lawfully sold by surviving family members after World War II,” the legal response reads. e museum in particular is relying on conclusions drawn in Bakalar v. Vavra, a case that also dealt with the Grünbaum collection. e Art Institute’s legal

See ART on Page 20

cutting more than a third of its ights

The airline says the reduction is largely due to delays in getting new planes from Boeing

John Pletz

Southwest Airlines is reducing its schedule at O’Hare International Airport by more than one-third this summer, in large part because it is getting fewer planes than expected from Boeing.

e airline will operate 37% fewer ights from O’Hare in June than it did a year earlier, according to schedule information compiled by data provider Cirium. Southwest’s much larger schedule at Midway Airport, where it’s the dominant carrier, will be down about 1%.

“ e issues related to the delays from Boeing are the driving factor with our schedule reoptimization,” a Southwest spokesman said after the airline published its summer schedule recently. e airline reported worse-than-expected rst quarter results on April 25.

It’s just one more example of the wide-ranging impact of production and regulatory problems at Boeing — which date back to fatal crashes of two 737 Max planes in 2019 and 2020 and continued after a more recent incident in January, when a door insert blew out of a 737 Max in mid-air. United Airlines also encountered challenges, from routes to sta ng, because of Boeing’s production woes, which also have delayed certi cation of new versions of the 737 Max. Southwest, which only ies 737s, will operate about 18 ights a day from O’Hare in June, down from 30 daily ights, according to Cirium data. It’s temporarily dropping service from O’Hare to Tampa Bay.

“We’re continuing to work with Chicago-area travelers to let them know about our service from O’Hare,” the spokesman said. “With the summer schedule from O’Hare, we continue serving the majority of our nonstop destinations, though with fewer frequencies.”

e reduction will make it harder

for O’Hare to return to pre-pandemic levels of ying. In January, the number of passengers was about 13% below pre-pandemic levels.

Southwest began serving O’Hare two years ago in an e ort to attract travelers in the northern part of the city and suburbs, and it quickly added destinations.

“ e (Chicago Department of Aviation) is looking forward to a robust summer schedule from many of our airline partners,” the department said in a statement, noting that United is scheduled to y 3% to 4% more seats in July and August from O’Hare than it did in 2019. “In the long run, air travel demand and

The reduction will make it harder for O’Hare to return to pre-pandemic levels of ying.

airline capacity track the underlying economic growth of a metropolitan area. We are bullish on Chicago’s economic future and continue to invest in infrastructure projects that will continue to increase O’Hare’s economic impact for decades to come for the overall bene t of residents of the metropolitan area.”

“While we don’t have a timeline to share, we have long-term growth plans that we want to pursue from O’Hare,” the Southwest spokesman said. “We look forward to adding new service from Chicago’s north side as traveler demand and eet plans align.”

It’s not the only supply-chain related problem impacting O’Hare. Air New Zealand suspended its Chicago-to-Auckland ight into the second half of next year because the airline is having di culty getting spare Rolls-Royce engines for its Boeing 787s for required maintenance.

A group of local developers has taken a key step forward in a $90 million plan to turn an o ce complex near Old Orchard mall into 245 apartments, buying the property for 88% less than it sold for 17 years ago.

A venture led by Evergreen Park-based DIR Development paid just under $7.9 million in March for the Old Orchard Towers o ce property at 5202 and 5250 Old Orchard Road in Skokie, according to Cook County records. DIR is working in partner-

ship with Chicago-based GW Properties and Glenview-based Drake Group on an ambitious conversion of the seven-story buildings into a mixed-use residential complex.

e sale price underscores the property’s staggering loss of value from what it was worth before the COVID-19 pandemic. e seller, Chicago-based real estate rm Zeller, bought the 355,195-squarefoot complex for $64 million in 2007 and re nanced it in 2018 with a $59.6 million mortgage, property records show.

But the rise of remote work has

driven up o ce vacancy to record highs, and higher interest rates have played a key role in battering o ce property values, setting o rampant distress and pushing developers to consider ways to repurpose outmoded ofces as something else.

GW Properties and e Drake Group saw such an opportunity at Old Orchard Towers, where Zeller’s loan matured last summer with roughly one-third of the property vacant and the

Homes in Chicago were less a ordable in March than they’ve been at any time in the past 17 years, and probably longer.

It’s the result of a rare two- sted punch of prices and interest rates both going up.

A monthly index of a ordability that the Chicago Association of Realtors released recently for March shows the a ordability of houses in the city hitting the lowest point in the group’s data, which stretches back to January 2007.

For condos and townhouses, aka attached housing, the index showed a ordability was at its second-lowest on record. But combined with a dip of several points in the a ordability of houses, it brought the city’s housing market overall to a 17-year low.

It’s likely that the March gure is also lower than a ordability was in the years before CAR’s data, because mortgage interest rates, a key component of a ordability, have been higher in recent months than any other time since early 2000.

Comparable data for the suburbs is not available.

CAR’s index tracks the relationship between median household income and the median-priced home under prevailing interest rates. If the index is at 100%, it means the median household income would fully qualify for the

median-priced home. A higher gure means homes are more affordable.

In March, the a ordability index was 73, the lowest it has been in the 17 years and a few months CAR has been making the calculation.

It was 10 percentage points below the index for March 2023, a steep drop precipitated by in-

spokesperson said in an email.

Raising Cane’s Chicken Fingers is working on a deal to occupy a prime corner in Chicago’s Fulton Market District.

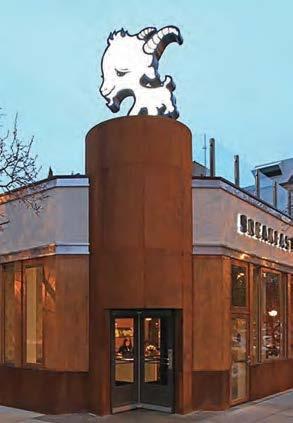

e Baton Rouge, La.-based fast-casual restaurant chain is in talks to lease the space at 820 W. Randolph St., formerly home to the Little Goat Diner, according to people familiar with the negotiations.

The fast-casual chain would be a shift from the trendy, upscale restaurants like Nobu, Au Cheval and Girl & the Goat that the neighborhood’s Restaurant Row is known for.

A Raising Cane’s spokesperson con rmed that the chain has “a deal moving through our process, but it is still very early to share timeline or anything involving the lease.”

“Should the deal continue to move forward in our process as we hope, we’d be happy to provide additional information as conrmed and available,” the chain’s

With little more than chicken ngers, fries and Texas toast on the menu, Raising Cane’s would be a shift from the trendy, upscale restaurants like Nobu, Au Cheval and Girl & the Goat that Fulton Market’s Restaurant Row — a stretch of Randolph Street from Halsted Street to Ogden Avenue — is known for. But it would come as the district, primarily an o ce and entertainment destination, has thousands of apartments in the development pipeline and would add to the variety of food options available to those new residents.

Boka Restaurant Group co-CEOs Rob Katz and Kevin Boehm own the 8,780-squarefoot property. Little Goat, a Boka Group restaurant, moved to Lakeview in 2023 after a decade at 820 W. Randolph St. A spokeswoman for the restaurant group declined to comment on the potential Raising Cane’s deal. e Fulton Market location would be Raising Cane’s fourth in Chicago, after its agship at Madison Street and Michigan Avenue

creases in the two major components. e median price of homes sold in the city in March was up 7.3% from the same time a year earlier. And interest rates, though they have been uctuating, were generally about a half-percentage point higher in March than in March 2023.

e phenomenon of rising prices coming hand in hand with

across from Millennium Park and its restaurants in Wrigleyville and Rogers Park, and its 19th in the metro area, according to the chain’s website.

e chain is in expansion mode, with co-CEO AJ Kumaran telling Crain’s in 2022 that Raising Cane’s plans to “very quickly” be on “every corner of Main and Main.” e chain has more than 750 locations worldwide and reported $3.3 billion in sales for the year ending in June 2023, according to Bloomberg.

Canvas Real Estate’s Michael Wexler, who did not respond to a request for comment, Andrew Becker and John Bassi are marketing the property for lease on behalf of the owner, according to a brochure.

recent highs in interest rates is confounding the Federal Reserve’s e ort to get in ation under control by increasing the cost of borrowing.

“ e Fed keeps trying to tame in ation with rate increases,” Glenn Kelman, CEO of online real estate marketplace Red n told Fortune magazine, “but at least one sector is untamable, and that

is housing.” e inventory of homes for sale is epochally low, but households that have to buy — because of a growing family or a job relocation, as examples — are doing it, despite having to pay a premium to get a house and having to pay an interest rate that is more than twice what they would have paid three years ago.

Chicago-area banks are still grappling with the fallout of the year-ago meltdowns of Silicon Valley Bank and Signature Bank as a U.S. regulator’s requirement that bigger financial institutions replenish a depleted insurance fund bit into their most recent earnings reports.

“It is kind of the gift that keeps on giving as the poor decisionsof a small handful of banks . . . is now unfortunately causing banks to experience higher expenses for the second quarter in a row,” said Terry McEvoy, banking industry analyst with Little Rock, Ark.based financial services firm Stephens.

Following the bank failures in the spring of 2023, the U.S. Federal Deposit Insurance Corp. instituted a special assessment on the country’s biggest banks to replenish a fund designed to protect depositors. e past two quarters have seen banks including JPMorgan Chase, Wintrust, BMO Harris, Fifth ird and Northern Trust report hefty expenses related to the assessment, but the worst is

likely behind them as the bulk of their requirements have now been met.

During the first quarter of 2024, 10 of Chicago’s biggest banks incurred an average expense of $226.2 million each for the assessment. That was down from $923.5 million. in the fourth quarter of 2023.

So far, the Chicago banks have paid about $10.6 billion in total to meet the new FDIC requirements, which were adopted late last year and gave banks two years to pay the fund a 0.125% levy on total uninsured deposits.

The rule, which excluded the first $5 billion of each bank’s uninsured deposits, was expected to impact 113 of the country’s biggest banks.

The FDIC estimated that $15.8 billion of the losses from the failures of Silicon Valley Bank and Signature Bank came from covering the uninsured exposure of depositors in those banks.

The good news is that banks had telegraphed their exposure well in advance so their quarterly earnings did not contain any surprises on the assessment front.

As America’s #1 business lender, we’re invested in local economies with over $40 billion in business loans. Our commitment includes providing funding to under-resourced business owners and supporting entrepreneurs with the tools and resources to help them make every move matter.

Rita Sola Cook President, Bank of America Chicago

Rita Sola Cook President, Bank of America Chicago

When the township of New Buffalo, Mich., decided to allow recreational marijuana dispensaries in areas surrounding the city, they gured there’d be strong interest. What they hadn’t banked on was how much.

e township opened the application process for licenses in April 2023 and, as of March 18, received 50 applicants — some partial — with plans to open dispensaries near the Interstate 94 exit and on U.S. 12 south of New Bu alo’s downtown.

“Yes, it took us by surprise,” said Bu alo Township Supervisor Michelle Heit.

In a special emergency meeting on March 14, Heit and other township o cials attempted to slow the roll, placing a moratorium on new applicants. It is in effect for at least 12 months and could be extended an additional six months on a board vote. Anyone who had led a partial application by the March 18 deadline was given until June 3 to complete their applications.

“ e Planning Commission wanted to make revisions to the current ordinance while we discuss making changes,” Heit said. Such changes might involve creating bu ers between businesses, she said. ey could also include a cap on the number of permitted facilities.

She said 27 applicants have preliminary approval.

King of Budz, e Bloomery, Rolling Embers and URB Cannabis dispensaries recently opened o of Exit 1 on Interstate 94 just past the Indiana-Michigan state line.

house, said New Bu alo was an easy choice for his second location. He bought the land that his dispensary now sits on even before New Bu alo approved dispensaries.

“It’s close to the Indiana border and metro Chicago. It’s also a lakeshore community with Four Winds Casino, which brings seasonal tra c,” he said.

e township of New Bu alo had a population of 2,455 in 2020; the city had 1,708. at’s a lot of dispensaries per capita, but New Bu alo’s population swells in the summer months with vacationers.

In May 2023, the city of New Bu alo voted to keep the town free of dispensaries.

Excise taxes collected from each dispensary are estimated to be about $59,000 per business annually, Heit said. If, say, 20 dispensaries end up opening, that would mean $1.2 million to the state, which then distributes funds across municipalities. In 2023, Michigan had 751 cannabis retailers reporting more than $3 billion in sales.

New Bu alo is late to the pot party. Since 2019, when Michigan legalized recreational marijuana, ve dispensaries have opened in Buchanan, about 20 miles from New Bu alo.

e New Bu alo dispensaries are hoping to grab some of those

“It all comes down to demand. But I won’t be surprised if 30 are operating within two years.”

Casey Kornoelje, owner, Pharmhouse

customers, especially those who live close to the border in Indiana.

Joining them on U.S. 12 just across the state line with Indiana, where all cannabis sales are illegal, are JARS Cannabis and Pharmhouse Wellness, which is slated to open in midMay. JARS is about 50 feet from the Michigan-Indiana border.

Casey Kornoelje, who owns Grand Rapids-based Pharm-

e moratorium announcement took Kornoelie by surprise. He said the town at rst had a “let the free market decide” attitude. at obviously changed. How many dispensaries can the area support? “ at’s the milliondollar question,” Kornoelje said. “It all comes down to demand. But I won’t be surprised if 30 are operating within two years.”

Royal Oak Realty Trust of Rochester, New York, is the new owner of Des Plaines-based Riddell Sports Group’s plant where football helmets are made and refurbished — a facility so huge it could put six football elds under its roof.

Royal Oak on April 18 paid $36.5 million for the 347,205-squarefoot factory at 7501 Performance Lane in the western part of North Ridgeville, Ohio, a western suburb of Cleveland, according to the Lorain County auditor’s o ce.

LCN had paid $30.65 million to buy the plant from its original developer — an a liate of Indianapolis-based Scannell Properties, an industrial realty developer and operator — shortly after it was completed in 2017, according to county data.

Royal Oak is a private Real Estate Investment Trust, a designation that gives investors preferential tax treatment. However, it operates with direct investments rather than being publicly traded.

Royal Oak, which holds the property in the name 7501 Performance La Ridgeville Ohio LLC, had paid $18.25 million cash for

the property and assumed an $18.25 million loan on the property, according to Lorain County land records.

On its website, Royal Oak said the loan will expire in 2027 and has what it called an attractive 4.04% interest rate and amortizes as if it had a 25-year term. A long amortization period makes for lower monthly payments than a shorter one.

Royal Oak already owns industrial properties in Eastlake and Solon as well as ve other locations in Ohio. e REIT has a total of 69 investments in industrial and ofce properties it describes as “mission critical” and a portfolio of 7.4 million square feet, according to its website.

Stan Bullard writes for Crain’s sister site Crain’s Cleveland Business.

Furniture and home goods e-commerce giant Wayfair will open its rst-ever brick-andmortar store this month in the North Shore.

e 150,000-square-foot store in Wilmette — about half the size of an average Ikea — will be located in Edens Plaza at 3232 Lake Ave. and will feature an on-site

restaurant called e Porch, the company announced. e space will also include a design studio, where customers can get home design advice, according to the company’s website.

In an emailed statement to Crain’s, a Wayfair spokesperson said the company selected Wilmette for its rst physical store

“based on a variety of factors, including convenience and acces-

sibility for our customers.” Financial details behind the store’s opening were not disclosed. e company started as an e-commerce business o ering everything in home goods, from interior furnishings like couches and mattresses to outdoor decor such as hot tubs and grills. e retailer generated $12 billion in revenue in 2023, according to the company’s website.

Here’s what made CEO Timothy Crane pull the trigger on the bank’s biggest deal yet

Mark Weinraub

Wintrust Financial President and Chief Executive O cer Timothy Crane said he viewed the company as a buyer, not a seller, when he took over the Rosemont-based bank nearly a year ago, but he later found his options limited while sifting through potential takeover targets. Most of those rms were saddled with what he viewed as overextended balance sheets.

just a very nancially sound bank both from the standpoint of their balance sheet and the interest rate risk they have taken, but also a good cultural t because they are a good community bank.”

Crane viewed Macatawa’s approach as a sign that it would be a good fit with the similarly positioned Wintrust.

“Macatawa, as Wintrust did, avoided a lot of those potholes,” Crane said. “ ey stayed pretty short (and) were very thoughtful about the investments they made.”

“This is just a way for us to accelerate our progress in these adjacent geographies.”

Timothy Crane, Wintrust Financial’s president and CEO

He finally pulled the trigger on a $510 million deal for Macatawa Bank, impressed by the conservative approach the western Michigan bank took with its loan portfolio when interest rates were near zero.

“ e population of attractive candidates right now, particularly with the interest rate marks at a lot of banks, was very limited,” Crane said in an interview. “Macatawa is

Deals in the nancial sector have been slow this year as the Federal Reserve’s decisions to hold interest rates steady has left many banks with unpro table loans on their balance sheets.

Macatawa also fit in with Wintrust’s long-term strategy of expanding in locations close to its current base of operations.

“ is is just a way for us to accelerate our progress in these adjacent geographies,” said Crane, who added that Wintrust already has business in those areas but not much of a physical footprint

Discover Financial Services, which in the process of being acquired by Capital One, plans to meet its goal of bringing 1,000 jobs to its call center in Chatham.

“When we opened our center in this vibrant Black community on Chicago’s South Side, we set out to help people achieve brighternancial futures by providing jobs and having direct and long-term involvement with the city,” Dan Capozzi, executive vice president and president of U.S. cards at Discover, said in a ling April 22 with the U.S. Securities & Exchange Commission. “Capital One’s commitment will ensure what we started continues into the future.”

Capital One unveiled in February its $35 billion plan to buy Riverwoods-based Discover, which employs about 6,000 people in two o ces in the Chicago area. Rich Fairbank, CEO of Virginia-based

beyond its recently opened Crown Point, Ind., branch.

Investors approve e Macatawa deal, Wintrust’s largest, was cheered by investors.

“We view Macatawa as an excellent strategic partner for Wintrust as it gives the bank a solid foothold in an attractive high-quality market where Wintrust can continue to grow,” David Long, analyst at Raymond James, said in a research note. “We believe Win-

trust stands out among its peers given its superior balance sheet growth and a lower-risk loan portfolio.”

Long has a rating of “strong buy” on Wintrust’s stock. He reiterated that after the deal was announced.

Shares of Wintrust have risen 3.2% since the deal was announced. Macatawa’s stock was up 4.4% during the same period.

Following the close of the deal, expected in the second half of 2024, Wintrust will have around

$60 billion in assets.

Wintrust, which has built itself into the largest Chicagoheadquartered bank through a series of acquisitions over the years, did not feel any pressure to close on the deal even as multiple suitors circled Macatawa.

“We have been looking at acquisitions, and we always are, because we think we are good at it.” Crane said. “We are always disciplined about this. e nancials had to work. Culture has to work.”

Every week on e Dining Table podcast, host David Manilow shares his own experiences from some of Chicago’s best places to eat, drink and shop. Crain’s reporters bring expert insight into all aspects of the city’s restaurant and food scene. And we welcome chefs, culinary experts, cookbook authors, bartenders, business owners and more to discover what makes them tick.

Capital One, said at the time that the company will maintain a “signi cant presence” in the Chicago area after the deal closes.

Discover announced in March 2021 it would be opening the call center at the site of a vacant Target store at 8560 S. Cottage Grove Ave., holding a news conference with the company’s CEO and thenMayor Lori Lightfoot on the site.

Discover launched operations from temporary space at the site a few months later. At a grand opening in August 2022, Discover trumpeted that it awarded 47% of its business to minority-owned suppliers and 28% to women-owned suppliers as the center was built out, with a quarter of construction costs totaling nearly $4 million going to Black-owned contractors.

e company has said that it expected to employ more than 1,000 people at the center by 2024, with the majority living within ve miles of the site.

Here’s what happened in the April 22 episode:

Sujan Sarkar has had an eventful few weeks. On April 3, the already-highly decorated chef was named a James Beard Award nalist in the 2024 Best Chef in the Great Lakes Region category for his work at Indienne in River North, which earned a Michelin star last year. Seven days prior, Sarkar was busy opening the doors of Swadesi, a new Indian cafe on the Near West Side.

Located at 328 S. Je erson St., Swadesi — pronounced “swuhdeh-shee” — serves pastries, sandwiches, co ee and chai, all with prominent Indian avors. ink menu items like a butter chicken croissant with burrata and pickled onions, a breakfast

egg sandwich with avocado and potato rosti, and masala chai made in-house daily.

Sarkar joined the podcast to talk about the new spot, discuss the success of Indienne and unpack why he’s narrowing in on Chicago for future growth.

“Traditional Indian food is gold, and you don’t tamper with gold too much,” Sarkar said on the show, speaking about his approach to making his menus.

“Traditional Indian food should be traditional, you shouldn’t mix anything.”

Manilow describes Sarkar’s cooking as genuine. e chef has worked in kitchens everywhere from Delhi to London to Dubai to San Francisco to New York. He’s not setting things on re to manufacture a show. e food is simply beautiful on the plate and familiar in taste. ere’s a wow factor, he says, but it’s still subtle in a good way.

“ e top restaurant in the world today, they are not only talking about the food,” Sarkar said. “It’s about the service standard, the people. First thing is the people.”

Sarkar recognizes the need for ingenuity. Conscious that he does not want to always serve the same menu items, his restaurants are constantly looking to switch things up. “When you run a business, you are always thinking about the people who are with you, how long business can sustain, and at the same time you have to be creative,” he said. “Nowadays, everyone is looking for something new. You don’t want to serve them something again and again.”

Listen to Manilow and Sarkar’s full conversation on e Dining Table podcast. Never miss a show — subscribe to e Dining Table on Apple Podcasts, Spotify or wherever you listen to podcasts.

Mark Weinraub A rendering of Discover’s customer care center in Chatham. JONES LANG LASALLE Crain’s Staff 2024 James Beard nalist Sujan Sarkar joined The Dining Table podcast to talk about his new Indian-inspired cafe in the West Loop. | NEIL JOHN BURGER

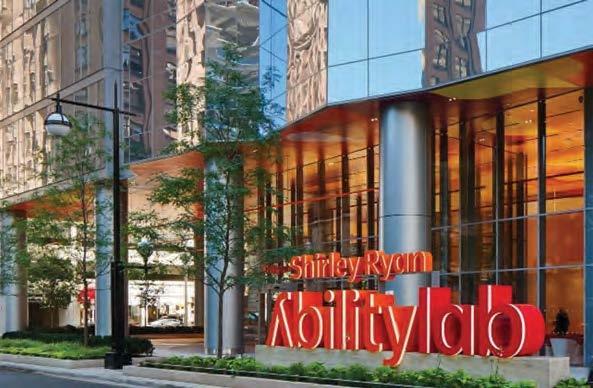

When the head of facilities at Shirley Ryan AbilityLab heard that a major health care organization was recognizing hospitals’ sustainability e orts, he wanted to get that feather in his hospital’s cap.

Sustainability, primarily e orts around decarbonization to combat climate change, had been part and parcel of the work being done at the Streeterville rehab hospital for years, said Lamar Davis, AbilityLab’s executive director of facilities, engineering and support services.

“We’d already been doing this, recycling, energy savings, looking to reduce our waste stream,” Davis said. “So when the Joint Commission launched the program, I was interested.”

After an introductory meeting, he thought: “We can do this. We are already doing this and we should get credit,” he said. “We’ve been the No. 1 rehabilitation hospital in the world for 33 years running, we’re a nursing magnet hospital, we should we go for national recognition in sustainability.”

Davis is planning to apply for the Joint Commission’s new Sustainability Certi cation in the coming months.

e Oakbrook Terrace-based national accreditation organization for hospitals and health care facilities launched the voluntary certi cation last year to acknowledge hospitals’ e orts and guide them toward improvement in reduction of greenhouse gases and other sustainability measures.

e Joint Commission says its certi cation brings health care a common framework for setting priorities, creating baselines, and measuring and documenting greenhouse gas reductions across the industry.

ronmental responsibility, with a host of state and federal regulations and requirements by the U.S. Centers for Medicare & Medicaid Services coming to bear on hospitals. Sustainability plans also help hospitals take advantage of a growing number of tax incentives and utility rebates, he said. ough much of the work is established at the AbilityLab, Davis says the certi cation gives more than just a rmation. Its structure requires setting, and reporting, meaningful sustainability goals.

For example, the hospital is committing to recycling 10% to 15% of its waste stream, annually. It also seeks to reduce annual energy use by 2% to 5%.

e fruits of energy reduction are already apparent, Davis said, as rebates from two utilities, Commonwealth Edison and Peoples Gas have added up “to the tune, over six years, of more than $100,000.”

“ e CFO loves it when I bring in those checks,” he said. “Normally, we’re a department that just spends money.”

Beyond rebates, cost savings can be found in energy-e cient lighting, which eventually pays for itself, and programs that turn o lights and equipment when not in use.

Davis added that patient care is also improved. “By using materials without (volatile organic compounds) and being mercury-free, we’re protecting people who are

“We’d already been doing this, recycling, energy savings, looking to reduce our waste system.”

Lamar Davis, executive director or facilities, engineering and support services, AbilityLab

Dr. Jonathan B. Perlin, president and CEO of the Joint Commission, points out the goals of the program aren’t just “doing what’s right” by the environment, but also focus on the bottom line, patient outcomes, reputation and compliance.

e certi cation, he notes, isn’t the only set of standards for envi-

sensitive to some organic compounds,” he said. “We try to buy all low-VOC materials, and, sure, we may pay a little premium, but I think the health care bene ts make it worthwhile.”

Perlin also notes that reducing the carbon footprint of a hospital is good health care. He said sustainable practices in the hospital improved health outcomes for patients, sta and the community.

Could it be Illinois is nally learning to compete in the intrastate economic development game?

In an ideal world, Illinois — or any state, for that matter — could draw investment based on its natural attributes. In this state’s case, those would be a strong, centrally located transportation network, a well-educated workforce with access to world-class universities, abundant natural resources like, say, Lake Michigan, reliable electricity service, relatively a ordable housing and amenities such as upscale restaurants and cultural institutions that make living here attractive to high-level talent.

Of course, we don’t live in an ideal world, and thus the ability to go the extra mile to attract and incentivize investment is and has been a factor as states jockey for prizes such as corporate headquarters, big manufacturing opportunities and next-generation research facilities.

Taking o ce following an administration that seemed intent on running down Illinois’ reputation, Gov. J.B. Pritzker has made competing on the economic development front a top priority. e strategy is paying o . e governor and Rivian CEO R.J. Scaringe announced on May 2 the electricvehicle maker will expand its assembly plant in Normal in order to produce its new line of small SUVs — a deal struck after Rivian’s plan to build a plant for that purpose in Georgia hit some serious speed bumps.

To make the Normal expansion happen, the state will provide Rivian with $75 million from a newly formed deal-closing fund as well as $634 million in tax incentives over 30 years. In return, Rivian will add at least 550 jobs over the next ve years and invest $1.5 billion in its manufacturing operations. As

Bloomington-Normal economy. Since Rivian bought a shuttered Mitsubishi plant there in 2017 for $16 million, the Irvine, Calif.based company has hired more than 8,000 workers in Illinois. Rivian has invested more than $2 billion and produced more than 100,000 vehicles, including trucks, SUVs and delivery vans.

Meanwhile, Rivian has become an anchor of a nascent electric-vehicle ecosystem in Illinois, which Pritzker has leveraged to attract

Two massive industrial sites symbolizing Chicago’s manufacturing decline — the former U.S. Steel South Works site on the Far South Side and the former Texaco re nery in Lockport — could get new life in the race to build cutting-edge quantum technology.

part of the just-announced plan, the state also is funding a second manufacturing-job training academy in Normal. e total value of the incentive package is $827 million and requires Rivian to maintain at least 6,000 jobs in Illinois.

Some critics will no doubt question the wisdom of these incentives, worrying the state is spending more than the resulting jobs are worth, but those arguments pale against real-world evidence that suggests encouraging this kind of manufacturing and technological investment pays greater dividends not just for the companies involved but for the communities they employ. Rivian’s presence has turbocharged the

more jobs, including Rivian supplier Gotion, which is building a battery-assembly plant in Manteno that’s expected to employ 2,600 people after the state o ered up $536 million in incentives. Stellantis, the parent company of Dodge and Chrysler, is converting its Belvidere assembly plant to make an electric truck and adding a battery plant in an expansion that’s expected to create 5,000 jobs in the Rockford area, a decision helped along by interventions from Pritzker as well as President Joe Biden.

In Rivian’s case, Illinois moved quickly to capitalize on the stumble in Georgia. at state had o ered $5 billion in incentives to lure Rivian to build its second assembly

plant near Atlanta, a project that was slated to bring 7,500 jobs. Production was expected to begin this year, but the plant ran into delays and construction was ultimately put on hold — creating an opening for the Pritzker administration to swoop in and talk with Rivian about doubling down on its investment in Illinois. Rivian says it’s still committed to the Georgia project but, in the meantime, its new line of more compact, more a ordable SUVs will be rolling out of the Normal factory.

Another sign Illinois is getting nimbler in the race for the technology jobs of the future comes in the realm of quantum computing. As Crain’s reported last month, two massive industrial sites symbolizing Chicago’s manufacturing decline — the former U.S. Steel South Works site on the Far South Side and the former Texaco re nery in Lockport — could get new life in the race to build cutting-edge quantum technology.

PsiQuantum of Palo Alto, Calif., is considering both sites for a facility to build and operate quantum computers, which could result in more than 1,000 jobs — and the company’s site-selection decision is expected to come down any day now.

PsiQuantum is among a handful of companies building quantum computers, which are radically di erent from existing technology. It’s looking for a site to be home to a cryogenic facility to consistently create temperatures near absolute zero, which is required to operate the computers. e project would result in 250 to 1,000 jobs to start and eventually grow well beyond that, said a source familiar

with the plans.

Landing the company would go a long way to ful lling Pritzker’s vision of turning Illinois into “the Silicon Valley of quantum development,” adding to a streak of economic development wins over the past two years. It also would bring a long-awaited revitalization to one of two industrial sites in the Chicago area that had been left for dead. You might wonder why a company based in Palo Alto would be looking anywhere beyond Silicon Valley for a place to build out this kind of facility. Many factors stand in Illinois’ favor, including the presence of the state’s two federal research labs, Fermi and Argonne, as well as the proximity of top research universities such as the University of Chicago and the University of Illinois. But another key is an investment in quantum that Pritzker made in his rst term, with a $200 million pledge to the Chicago Quantum Exchange, a research partnership that includes those universities, the federal labs, as well as several Fortune 500 companies. And the state’s investment already helped land $230 million in federal research grants at Argonne, Fermilab and the University of Illinois. Illinois is competing with Colorado for another $70 million in federal research money for quantum, which will go a long way to create the nation’s hub for the industry. e quantum action as well as the Rivian win con rm investment can beget more investment. It’s a lesson Illinois may have learned a little later than some other states — but it’s an important lesson nevertheless.

It should be clear by now that articial intelligence is both everywhere and unstoppable.

Speech recognition, image processing and sensor interpretation have given us personal assistants, semiautomatic medical diagnosis and self-driving vehicles. is isn't new. e decades-old technology of behavior-based recommendation systems helps guide us on Amazon, LinkedIn and Net ix. And these are only the most visible systems.

Predictive engines and optimization technologies have been improving business processes and logistics behind the scenes for years. e truth is that you interact with AI systems in one form or another about a dozen times a day.

And that was in the world before Nov. 30, 2022, the launch day of ChatGPT.

Since that launch, we have seen a massive shift toward AI — generative AI in particular — as a transformational technology. Sure, there are problems. Issues related to facts, AI hallucinations, privacy, data security, reliability, etc. But the world has made its decision: We are going to use these technologies to transform our lives, work and businesses.

And what is Chicago's role in all this?

For years, Chicago has been working to get over the "second city" label regarding technology, and particularly the technologies of computation. We quote numbers touting levels of investment and the students we train, tech jobs and companies, all with the goal of arguing that we are already a massive technology hub. Unfortunately, sometimes it sounds like we are arguing that we are more famous than people think we are, not understanding that this is not how fame works.

As the world moves forward with generative AI — machine-learning models trained to create new content — we are faced with interesting questions. How do we compete? How do we win? How do we lead?

Do we enter the competition by trying to build the next massive language model and ght for the next increment in uency, training time, response time, reasoning or any other metric you might choose? Do we want to spend our time and focus competing in a race de ned by Open AI, Google, Microsoft, IBM and Meta? It's a race that is absorbing astounding levels of thought and money in a ght toward the best language model that will be eclipsed in a week.

Or do we decide that we should embrace who we are and de ne a new race, a new competition — a race for which we start with an unfair advantage?

What is that advantage? For good or for bad, we are a Midwestern city that believes in substance over style. Even more Midwest, we believe in steak over sizzle.

It is still harder to raise money in Chicago than in the Bay Area. A startup there is two guys with a drawing on a napkin. In Chicago, it's a team of 10 that has two products and three customers and is on the verge of pro tability.

It can be annoying, but it is because we are focused on the real, substantial impact of the technologies that surround us, rather than how incredibly shiny they are.

We are the City at Works, and we want technology that works. is attitude is what gave us P33, the Discovery Partners Institute, the University of Chicago's Data Science Institute and Northwestern University's Data Science & AI initiative, projects aimed at going beyond the technologies and making them useful.

From a personal perspective,

this was the strategy behind Narrative Science. e company innovated, but innovated by focusing on the task and the genuine business need, rather than the technology. Our innovation wasn't just in the space of ideas. It was in the space of product and impact.

As we consider how Chicago should respond to the rise of AI, we need to embrace this notion.

We need to go beyond the question of how to improve on the science of AI, and have every CEO, product manager and developer in the city work on how to make it use-

ful. We need to ask four questions as we look at these new technologies: What do they do? Tell me what these technologies do in clear and certain terms.

What can they do for me? Tell me the tasks they can do better or make easier.

What do they need? Tell me the data, people and systems I need to make them work.

What are the risks? Tell me what can go wrong and who it will harm. at is, tell me how to make these technologies real. Tell me

how to make them work. Chicago is special because we make things real. Everyone else can spend the day dazzled by the shiny and new. We can lead the world by getting the shiny things a little dirty, because we gured out how to give them honest jobs.

Kristian Hammond is the Bill and Cathy Osborn professor of computer science at Northwestern University and co-founder of Narrative Science, an AI startup acquired by Salesforce in 2022.

In the 1920s, actress Colleen Moore became a queen of the silent screen as the rst to portray a new kind of woman, the lively, short-haired apper, beginning with her 1923 hit “Flaming Youth.” By the late 1930s, after sound movies and some personal setbacks dimmed her career, Moore was living regally in a Chicago penthouse alongside her third husband, stockbroker Homer Hargrave.

e North State Parkway home was the epitome of grandeur and glamour for the day, with a twostory living room wrapped in carved wood paneling and stacks of windows, a plaster-ornamented barrel vault ceiling across the top and, in another room a glittering, a mirrored speakeasy-style bar concealed behind movable bookcases.

ose features and many others are still in place, while the kitchen, bathrooms and spaces for casual family use have been updated in a brighter, more relaxed style.

“My wife and I loved its old style” upon buying the home in 1997, says Je Louis, “but we needed to get behind those walls and bring it up to date, and make some spaces for the way all of us live now with our families.”

With his wife, Elizabeth, Louis put the penthouse, on parts of two oors, on the market April 22. e price is $4.35 million, and the listing agent is Jenny Ames of Engel & Volkers.

Lake Michigan and Lincoln Park are in view from the Louis terrace. e terrace is on the 14th oor, while the home is on both the 14th and 15th.

Windows seen face east, but there are also windows on the home’s north side, the only ones in the building.

Je Louis, a fth-generation member of the family that founded SC Johnson, the Racine, Wis.based consumer products giant, is on the boards of that rm and the Gannett media company. His father, John Louis, was U.S. ambassador to the United Kingdom from 1981 to 1983. Je and Elizabeth Louis moved to England with their four kids in 2007.

“We kept the (co-op) because we thought we would be back in a year,” he says, “but now it’s been 17 years, our kids are grown and we’re not using it.”

Built in 1926, 1320 N. State Parkway was designed by Robert DeGolyer, the architect of many of the most stylish residential buildings of the era, including several on Lake Shore Drive and in the Gold Coast. His most visually stunning work is the Powhatan, an art deco landmark on the lakefront in Kenwood.

Local legend says the penthouse at 1320 N. State Parkway was designed expressly for Colleen Moore, who in 1949 gave her charming “Fairy Castle” dollhouse to the Museum of Science & Industry and in 1964 joined Michael Kutza in launching the Chicago International Film Festival. Moore also published a book in 1969 called

“How Women Can Make Money in the Stock Market.”

But it seems more likely that Horace Hargrave was its rst owner, and she joined him there after they married in 1937. She was still in Hollywood and making movies and married to her rst husband when the building went up. One of her most famous lms, “Ella Cinders,” came out the same year the building was completed.

In the co-op’s wood-paneled study, some of the built-in bookcases fold open to reveal a mirror-lined bar. At the opposite end of the room, more bookcases ank a stone replace. It was all intact when the Louises bought the co-op from its second owners 27 years ago.

e couple tapped architect

Chip von Wiese and interior designer Alessandra Branca to undertake a rehab project that lasted nearly two years. In this room, other than upgrades to utilities, the only change was re nishing the wood in an oxblood red.

seats 22, and the darkness of the millwork gets relief from a row of windows.

e room “is almost exactly how it would have been” when Moore hosted Christmas parties here after her guests arrived in the horsedrawn sleighs she sent to pick them up, Louis says.

e home’s second bar may look historical, but it’s a 21st-century design that Louis drew up to replace the old silver safe.

Padded leather doors and bar bumper, a midnight blue ceiling and dark wood trim give it the “look of a pub” he was after. “If you get 100 people into the (home) for a party,” he says, “80 of them will be in that room.”

Louis says he liked the result so much he later designed others for the family’s homes in England and Florida.

ere was an intentional shift to “lighter and more contemporary” in the design of a new suite of rooms for family use, Louis says.

Containing the breakfast room, family room and kitchen, the space was made from some former spaces for servants, including a small kitchen, and by enclosing a small outdoor terrace.

“We thought it would be nice to have a more casual ‘back of the house,’” Louis says. e roughedged hickory oors and pine beams above provide some continuity with the grand formal rooms. ere’s more of the modern look in the kitchen, but with nods to the historical look in its heavy cabinet latches and drawer pulls.

Upholstered walls keep the primary bedroom “absolutely silent,” Louis says, and the bed is placed to capture a direct view of Lake Michigan, a little more than two blocks east.

e barrel ceiling in the primary bathroom echoes the more dramatic one in the living room, and mirrored cabinets are a reminder of the mirrored bar hidden in the library.

e primary suite also includes a pair of dressing rooms and a round entry hall with pillared

Local legend says the penthouse was designed for Colleen Moore, who in 1949 gave her “Fairy Castle” dollhouse to the Museum of Science & Industry.

“It’s a super-cozy, warm room that I’ve used as my o ce and for reading,” Louis says. During the COVID-19 pandemic the room turned out to be “a great background for Zoom,” he says.

A closer look at the bar shows its vintage elegance, complete with images of gazelles emblazoned on the mirror and side panels.

Nobody had altered the bar in its decades of existence, and the Louises were delighted to follow suit, Je Louis says.

ere is also a replace at the opposite end of the room.

e wood-paneled dining room has all the grandeur that high society would have expected at mealtime in the 1920s. e table

walls and a chandelier, an appropriately elegant complement to the grandeur of the preserved original rooms downstairs.

ere are three more bedrooms here on the 15th oor and one on the 14th. Each one has an en suite bathroom.

Two of the 15th- oor bedrooms open onto this playroom with a tented fabric ceiling. It’s space added by the Louises when they enclosed some outdoor space on the 14th oor while building out the family section of that level. Adjacent to it is another outdoor terrace.

Wintrust Financial Corporation, Naperville

School of the Art Institute of Chicago, Chicago

Croke Fairchild Duarte & Beres LLC, Chicago

Greenberg Traurig, Chicago

Leadership Greater Chicago (LGC), Chicago

Wintrust is proud to announce the promotion of Grant Cowen to Market President for Naperville Bank & Trust, a branch of Wheaton Bank and Trust Company, N.A., a Wintrust Community Bank. In his role, he will work with a team of over 20 banking professionals to offer personal and commercial banking services, full trust, investment services, and mortgages. Grant has spent over 40 years in banking and had a 24+ year career with West Suburban Bank (acquired by Old Second National Bank) in Naperville.

Willis Tower, Chicago

Todd Hartman has joined Willis Tower as Vice President, General Manager. He will oversee the property management team and ensure the building continues to deliver best-in-class service for tenants. He has over 20 years of experience, most recently serving as Executive Vice President and Chief Operating Of cer at Corporate Of ce Properties Trust. Todd will succeed Gary Michon who is retiring after 15 years in the role. The iconic Tower recently underwent a street-to-sky transformation.

Construction, Chicago

Seth Erlich joined Leopardo as vice president of tenant interiors. Seth brings with him nearly 30 years of experience working in construction management. In his new role, Seth will oversee all aspects of Leopardo’s tenant interiors market. He will be responsible for strategy and operations, as well as developing new business relationships while working closely with existing clients and project teams to consistently deliver a quality-driven and clientfocused approach.

Cameron Martin will join the School of the Art Institute of Chicago as the new F.H. Sellers Professor in Painting. In this role, Martin will take a leadership role in advising, committee work, curricular development, and advancing the legacy of leadership and scholarship in the Painting and Drawing Department. An internationally renowned painter, Martin comes to SAIC from Hunter College, where he is the interim head of the BFA program.

Wintrust Financial Corporation, Rosemont

Wintrust Financial Corp., a nancial services holding company based in Rosemont, Illinois, with more than 170 locations across Illinois, Indiana, and Wisconsin, is pleased to announce two promotions. Dana French assumed the role of EVP, Strategic Initiatives at First Insurance Funding. Dana joined Wintrust 19 years ago. Joshua Tomei was promoted to EVP, Senior Strategy Of cer at First Insurance Funding. Joshua joined Wintrust two years ago.

Amundsen Davis, LLC, Chicago

Amundsen Davis is thrilled to welcome back Tanya Petermann as the rm’s Chief Administrative Of cer. Tanya is an attorney by trade and has practiced in both the law rm and in-house general counsel setting. Tanya will work closely with rm leadership on day-to-day operations, as well as long term strategic planning.

Amundsen Davis’s Managing Partner, Lew Bricker, said “We are thrilled to welcome Tanya back to our ever growing and evolving rm in this role.”

Croke Fairchild Duarte & Beres welcomes Eric Greenberg as chair and Kerry Rost as of counsel to the rm’s new Food and Drug Law practice group. A recognized leader in the industries he serves, Eric draws on his deep experience to advise clients on a range of product development and compliance matters involving the FDA and state agencies, including labeling issues and projects relating to food and food packaging materials.

An accomplished commercial litigator and legal advisor, Kerry concentrates her practice on food and drug law, packaging law and commercial litigation. In addition, Kerry is also trained as a doctor of podiatric medicine, bringing her insights into the scienti c, health and safety issues facing FDA-regulated businesses.

Lance Tyson has joined Greenberg Traurig as of counsel in its Public Finance & Infrastructure Practice. With more than two decades of experience representing local governments, government authorities, and nancial institutions, he provides practical, strategic advice to clients on governmental and business matters. He works across several practices with emphasis in the areas of public nance, real estate, banking, tax credits, public investment funds, and government affairs.

LGC, the region’s premier civic leadership development organization, welcomes Damion Heron (LGC Fellow since 2018) to its Board of Directors. Heron serves as Midwest Region Executive, Corporate Responsibility, JPMorgan Chase. He will support LGC’s mission to develop a strong pipeline of civic leaders who will shape the future of greater Chicago and the region. Heron brings to the Board his extensive experience in philanthropy, civic engagement, and commitment to creating a better Chicago for all.

ML Realty Partners, Itasca

Croke Fairchild Duarte & Beres welcomes Eugene Schoon as senior counsel in the rm’s Litigation practice group. In more than 35 years of practice, Eugene has counseled hundreds of corporate and individual clients on a variety of issues, including liability insurance issues and claims, risk management, and product liability defense matters with particular emphasis on mass torts, cross-border litigation and class actions. The rm also welcomes Charles (Chuck) Reiter III as senior counsel in the Outside General Counsel practice group. Having served in a wide range of roles, Chuck brings a wealth of experience in healthcare law to the rm, including in risk management, compliance and quality improvement programs in the healthcare industry.

Taft welcomes partner Isaac Colunga to the rm’s Litigation practice. Isaac defends consumer class actions led across the country, with a particular focus on the Telephone Consumer Protection Act, the Fair Credit Reporting Act, and other federal consumer protection statutes. He is highly sought-after in these areas. Isaac also prosecutes and defends clients in a variety of business disputes. Outside of the courtroom, he helps his clients comply with the TCPA and other telemarketing laws.

Taft Law, Chicago

Sophie Honeyman has joined Taft as an associate attorney in the Litigation practice. Prior to joining the rm, Sophie served as a judicial law clerk for the Hon. Mark J. Dinsmore in the U.S. District Court of the Southern District of Indiana, where she managed internal case les, honed her legal research skills, and drafted numerous orders regarding civil motions and disputes and social security appeals.

Matt Lamers joined ML Realty Partners as Asset Manager. He will focus on Chicagoland and Dallas-Fort Worth portfolio management for ML Realty Partners. Mr. Lamers comes from Lincoln Advisors and holds a Bachelor of Business Administration degree from the University of Wisconsin-Madison. He is an active member of the Wisconsin Real Estate Alumni Association.

CORE, Chicago / Providence Government payment solutions leader CORE hires Mike Duffy as CEO, aiming to rede ne the GovTech landscape by emphasizing high-touch client service models and unmatched subject matter expertise. Duffy is the founder and former CEO of CityBase headquartered in Chicago. He received his B.A. from Purdue University and M.B.A. from the University of Chicago Booth School of Business.

Chicago felt rich with restaurant openings over the last year. We're focusing on downtown options for the business diner, sampling four dinner spots and three lunch locales. For those getting creative with their entertainment budgets as restaurant prices continue to rise, we also scope out a cocktail bar and wine tasting counter. |

By Ally Marotti

243 S. Franklin St.

Dining at Seville is a colorful experience. e chairs are orange, the wall is turquoise, plants hang from the ceiling. Tiles on the wall depict birds and tropical foliage. It’s a nice departure from Chicago’s many earth-toned restaurants and provided just the energy my dining partner and I needed on a gray, snowy March day.

Among the Loop’s newest lunch spots, the Mediterranean restaurant from celebrity chef Fabio Viviani sits on the 16th oor of e Canopy by Hilton, just across the street from Willis Tower. e 5,900-square-foot dining room is airy, with windows o ering Loop views and an atrium-style skylight overhead. e restaurant opened in January and started serving lunch in early March.

But lunch in the Loop, it seems, is still a gamble for restaurant operators. We went on a Monday

at 1 p.m. and, save for two women sitting at the bar, were the only patrons in the joint. Downtown restaurant operators have said that business has been slow on Mondays and Fridays since the pandemic, as many Loop o ce employees work hybrid schedules.

No matter. As a diner, it felt special to have the place to ourselves, and we did not have to talk over the din of a crowded room. Service was also prompt. We were in and out in just under an hour.

ere’s a shared plates section on the menu that tempted me to throw the rest of the day’s productivity to the wind and turn the lunch into a grand tapas-style experience, but my curiosity about the other parts of the menu kept me in check. We stuck with one dish from that section: the Iberico and sa ron crispy rice ($18). It

404 S. Wells St.

ere’s a lunch deal at Italian restaurant Terra e Mare that makes the trek to the far southwest corner of the Loop worth it. For $20, diners can get a three-course prix xe meal. It feels European. It feels special. It feels fun. And it feels like it’s begging to be paired with a little lunch wine.

I ordered a glass of the 2021 Trovati Grillo ($13), a fruity and lively white from Sicily that I knew would not a ect my afternoon productivity. My dining partner had a glass of Aransat ($14), a blend of pinot grigio and sauvignon blanc from Friuli that had a little skin contact, giving it the color of a dessert wine but the perfect light sip for lunch.

Terra e Mare is open for lunch from 11 a.m. to 2:30 p.m. e restaurant, the latest from the team behind North Center’s Irene’s Finer Diner and helmed by chef Noah Zamler, opened in November. e blue scalloped tile on the

167 N. Green St.

e lunch crowd in Fulton Market is alive and well, and that is evident at Yokocho.

e Japanese spot is tucked into an alley o Green Street. It does not take lunch reservations, and on a Wednesday at 12:30, it felt like a triumph to nd three seats at the bar. Turns out, those seats were front row to the food prep. One of my dining partners ordered a negi hamachi hand roll ($8), which is only available for those dining in.

e chef rolled the crispy nori and sushi rice and set it right in front of her on the counter. It felt authentic, and brought the Japanese alley bar vibe to life.

e lunch menu is simple in a way that feels e cient, a prerequisite for the business diner. All three

was a taste sensation. e rice was crispy and the sa ron was not overwhelming. A dollop of unctuous Manchego cream was hidden beneath the melt-in-your-mouth Spanish ham. A delightful glutenfree option.

Next up was an apple and Manchego salad ($15) with sliced apples, chunks of cheese and sherry vinaigrette. We added chicken for an extra $7. e server told us this was one of several salads added to the menu for lunch. Indeed, the lunch o erings were expansive.

We also split a prosciutto pinsa ($26), a kind of pillowy atbread with arugula, stracciatella, Parmesan creme and tru e honey. Delicious, but messy.

Before we got in the elevator to leave, we stopped to look at the vast outdoor area. When the akes aren’t ying, I imagine it will be a great draw.

restaurant’s long bar evokes the seaside, and the lighting brings warmth.

e lunch o erings seem to be a draw, too. e restaurant was far from full during the noon hour on a ursday, but a steady stream of diners did lter in, most dressed in business attire.

e options available under the $20 deal are narrower than the full lunch menu’s o erings, but frankly, the deal was so good, we didn’t even discuss going another way.

My dining partner started out with a cup of ribolita soup. in slices of what tasted like rye bread swam in a cozy broth with tomato, cannellini beans and olive oil. I opted for the second starter option: polpettine, slow-cooked beef meatballs topped with tomato agrodolce and gremolata (a green sauce often made with parsley, lemon zest and garlic). e meatballs were piping hot, and the avor pro le was not too garlic-heavy — smart for the

lunch crowd, who undoubtedly don’t want to go back to the o ce with garlic breath. ere are six options for the main course, including a couple of pastas, sandwiches and a salad. I went with the chopped salad with grilled chicken thigh. It came with salami slices that were crisped like bacon, mixed greens, a few garbanzo beans and a red wine vinaigrette. My dining partner ordered the orecchiette agnello. It was made with spelt our, giving it a nice heartiness and texture, and served with lamb ragu, Castelvetrano olives, semidried tomato, fennel pollen and ricotta. Delicious, but my dining partner decided it was perhaps a bit too heavy to encourage a productive afternoon. We both went home with leftovers.

But we did, of course, make room for the dessert: a chocolate chip cookie for each of us, served on a warm plate.

of us ordered various avors of a Donburi bowl, a heaping serving of sushi rice topped with crispy shallots, cucumber, kyukappa (preserved Japanese vegetables) and pickled ginger. I got tru e hamachi ($17) with yellowtail, spicy mayo and tru e sauce, and my dining partners opted for spicy salmon ($16) and unagi, or barbecued eel ($16). ough the bowls were substantial enough for lunch, do not skip the chicken katsu sando ($12). It’s served on Japanese-style milk bread with katsu sauce, red onions and kyukappa, and cut in half, making it perfect for sharing. e milk bread is soft and pillowy, the chicken was warm and crispy and the various textures made the whole thing a delight to eat. After

the rst bite, my dining partners — who work in the Loop — started scheming about whether they could order the sandwich for delivery. Ordering delivery is not a bad idea if you’ve got a group larger than three. ere are a coupledozen seats around the bar and a few two-tops, but we only spotted one table that sat more than that.

Yokocho, sister to Sushi Dokku from restaurant operator Susan ompson, relaunched in its new spot last summer after a four-year closure and relocation from Wicker Park. It’s open for lunch Tuesday through ursday from 11:30 a.m. to 2 p.m. e day we were there, it had cleared out by about 1:15 p.m.

318 N. Sangamon St.

Dinner at Fioretta comes with just the right amount of pomp.

e roughly one-year-old Fulton Market restaurant from DineAmic Hospitality has an atmosphere attuned to business entertaining. Its large and plush purple velvet booths o er some coziness; there’s room enough between tables; the servers are attentive. e music was perhaps too loud for a discrete business meeting, but the playlist — we caught Frankie Valli — was endearing.

e menu is stacked with the classics you’d expect at an Italian steakhouse: salads, steaks, pasta options and sides. We came out of the gate strong with a Caesar salad ($16). e Baby Gem lettuce was fresh, the dressing tangy and the brioche croutons crisp without tearing up the roof of your mouth. e service was stellar. Since we were a group of four and planned to share, the server carefully divvied up the salad onto our plates. It saved us from ghting over the last few bites.

e server also divided up the Prosciutto di San Daniele ($18) with added burrata ($12). e prosciutto, arugula, ParmigianoReggiano and paper-thin slices of Honeycrisp apple would’ve been awkward to serve ourselves, and it was a relief to watch her adeptly deposit it onto our plates. e cacio e pepe ($22) received the same treatment, as did the roasted mushrooms ($15).

As our server fussed over por-

tions, another employee came by with a box of focaccia. He plated some slices and poured olive oil for the table. e mystery boxes that servers carried throughout the room became a fun bit of intrigue for the evening. “What was in that box?” we’d wonder. When it came time to choose dessert, of course we had to try the cannoli box ($18), which contained four avors. Before that, though, we had a 16-ounce New York strip steak, cooked medium ($69) and sliced — again, for sharing purposes — and Parmesan tru e fries with garlic aioli ($15).

e cocktails also left an impression. My dining partners tried the Dark Manhattan ($18) and Fioretta Old Fashioned ($17). Both came with a large ice cube stamped with the restaurant’s ower logo: "Fioretta" means “little ower” in Italian.

It could be my insatiable sweet tooth talking, but my favorite part of the meal was the decadent chocolate cake ($19). It was served on a cake platter, its chocolatey layers of hazelnut praline, Nutella and caramela on full display. We had watched surrounding tables ordering the cake, each towering slice accompanied by a aming sparkler. Were all these people celebrating something, or did every dessert here come with a sparkler? We had to nd out. Our dessert was served sans sparkler, but those layers of decadence were celebration enough.

431 N. Dearborn St.

ere was a time in Chicago when the restaurants were grandiose. eir ceilings were high, their oors were vast and every day they fed the masses.