Exhibit B CITIES

oRDTNANCE NO.2024-08

AN ORDINANCE FIXING THE ESTIMATED AMOUNTTO 8E RAISED 8Y AD VALOREM TAXES FOR THE 2025 BUDGET OF THE CITY OF CASTLE ROCX, WASHINGTON IN ACCORDANCE WITH REVISED CODE OF WASHtNGTON 84.55.120

WHEREAS, the Castle Rock City Council of the City of Gstle Rock has met and considered it5 budget for the calendaryear ending December 31, 2025; and

WHtREAS, the di5trict's actual levy amount from the previous year was 5433,535; and WHEREAS, the population ofthis district is le5s than 10,000.

NOW, THEREfORE BE lT RESOLVED by the governing body of the taxing district that an increase in the regular property tax lew and a special ercess tax lew are both hereby authori?ed to be colhcted in the 2025 tax year.

The dollar amount ofthe increase overthe actual lew amount from the ptevious year shallbe 54,336 which is a percentage increase of 1.0m% from the previous year. The increase i5 exclusive of additional revenue resulting from new construction, improvements to property, newly constructed wind turbines, solat biomass, and geothermal tacilities, and anY increase in the value of state assessed property, any annexations that have occurred and refunds made.

ADoPTED by the city council and signed by the tv'tayor on this ;{]d .v ot OC-bbe.f zozq.

Councilmember lohn Wha len

Attest

Councilmem r PaulSimonsen

ncilmember Ellen Rose

Approved as to form

Treasurer

Publication Date City Attorney

Ordinance No. 2024-08

Mavor Paul Helenberg Counci mber Art Lee Councilmembe. Lee (essler

REr.,6,irE @ Levy Certification

Submil ihis documetrt to the coudq legislslive .uthorirJ.. on or before November 30 oflhe year preccdirg the yesr i[ $hich lhe ler] amou[ls ere lo be collected and fonisrd r cop]" to lhe assessor.

ln accordance with RCW 84.52.020. l. Paul Helenberg

\laror {Namel of Castle Rock

rhc (Tidel Co\r1itz tirr ( do herebl cenifi to lDi$riq Name) Counq legislative authority th8t dre Council (*&me ofcounB ) {CommissioNtr Council. Board- arc.)

ofsaid disrria reque$s that th€ following levl amouns be collected in 2025 as pmvided in the district's { Y.sr of Colkc-tioo ) budget. shich sas adopted follo*ing a public hearing held on l0nt/2t lDate of tublic Heariog )

Regular l-er1 ($417.E71.00)

I Slare rhe aotrl dollar amounr lo cs ler i€dt

Excess Levl: rsrare fie lot l dollar amounr k) ht lerirdl

Refund t-ev!:

Date: l019 l0ll

Signature

To ask abofl rhe availabiliry offiis publicarion in an altemate format for the visually impaired, pleas€ call (360) 7056715. Teletlpe(TTY) us€rs. please call(160) ?05{71E. For ta\ assist nce. call (160) 514- 1400. REv 6l oloor r$r r2:1,l2r

RESOLUTION NO. 745

A RESOLUTION OF THE CITY OF KALAMA REPLACING TAX LEVY RESOLUTION NO 743 AND ESTABLISHING THE DOLLAR AMOUNT OF TAX REVENUE FOR AD VALOREM TAXES WHICH wlLL BE NECESSARY TO MEET THE FINANCIAL REQUIREMENTS OF THE 2025 BUDGET OF THE CITY OF KALAMA.

WHEREAS the Kalama City Council certifies that the population of the City of Kalama is less than 10,000; and

VVI-IEREAS the City of Kalama received notice of the final assessed value of property within the City on November 14,2024 wllh an increase in the assessed value of over $2,000,000 showing the current assessed valuation of property within the City of Kalama is estimated at $549,013,367.00;

WHEREAS the City of Kalama believes it is important the assessed value of property within the City should be correctly stated and an accurate levy rate be set:

WHEREAS the Kalama City Council has properly given notice of the public hearing held on October '17, 2024, to consider the City of Kalama's revenue sources for the budget for calendar year 2025, pursuant to RCW 84.55.120,

WHEREAS the Kalama City Council, after hearing, and after duly considering all relevant evidence and testimony presented, has determined that the City of Kalama requires an increase in property tax revenue from the previous year. in addition to the increase resulting from the addition of new construction and improvements to property and any increase in the value of state-assessed property, in order to discharge the expected expenses and obligations ofthe City of Kalama and in its best interest.

NOW. THEREFORE, BE lT RESOLVED by the Kalama City Council of the CITY OF KALAMA, Tax Levy Resolution No. 743 is replaced by Resolution 745 establishing a levy of approximately $1.06643305 per thousand on 100% assessed valuation and utilaties, as adiusted, is required to meet the budgeted obligation and expenditures of the City of Kalama for the year of 2025 and produces the sum of 5585,486.00 plus the refund evy of $ 293 for a total certified levy of $585,779.00.

This resolution shall take effect upon passage

PASSED BY THE CITY COUNCIL OF THE CITY OF KALAMA and approved by the Mayor at a regular meeting on the 21st day of Novembe?, 024..,

II/IAYOR.

RESOLUTION NO. 746

A RESOLUTION OF TTIE CITY OF KALAMA REPLACING RESOULTION NO 744 AND ESTABLISHING THE CORRECT AMOUNT OF THE PROPERW TAX INCREASE TO MEET THE REQUIREMENTS OF THE 2025 BUDGET

WHEREAS. the City Council of the City of Kalama attesb that the population of City of Kalama is less than ten thousand:

WHEREAS, the City's actual levy amountfrom the previous yearwas $565,838 without any refund levy and was mis-stated in Resolution No. 7rg to include the refund levy;

WHEREAS, the City Council of the City ot Kalama has properly given notice of the public hearing held on October 17,2024 lo consider the City of Kalama cunent expense budget for the 2025 calendar year, pursuant to RCW 84.55.120:

WHEREAS, the City Council of the City of Kalama, after hearing and after duly considering all relevant evidence and testimony presented, determined that the City of Kalama requires an increase in property tax revenue from the previous year, in addition to that resulting from the addition of new construction and improvements to property and any increase in the value of state-assessed property, in order to discharge the expected expenses and obligations of the City of Kalama and in its best interest:

NOW THEREFORE, BE lT RESOLVED, by the City Council of the City of Kalama:

Resolulion No. 744 is replaced by Resolution No. 746 esiablishing an incrsase in the regular property tax levy, in addition to the increase resulting from the addition of new construction and improvements to property and any increase in the value of state-assessed property, is hereby authorized for the 2025 levy in the amount of $5970.00 which is a percentage increase of 1.0550723 percent from the previous year.

ADOPTED, at the regular meeting of the Crty Council of the City of Kalama, this 21st day of November, 2024, il Position 1

Scotl Moon, Council Position 2

t- ---,<?- , '--1--r-

Wendy C Council Position 3

Steve Kallio, Council Position 4 nc

ArrEsr: /)rr; l-/

Jon Coni McMaster, CleruTreasurer by a majority of its members. /1

Raffi'ilffir4

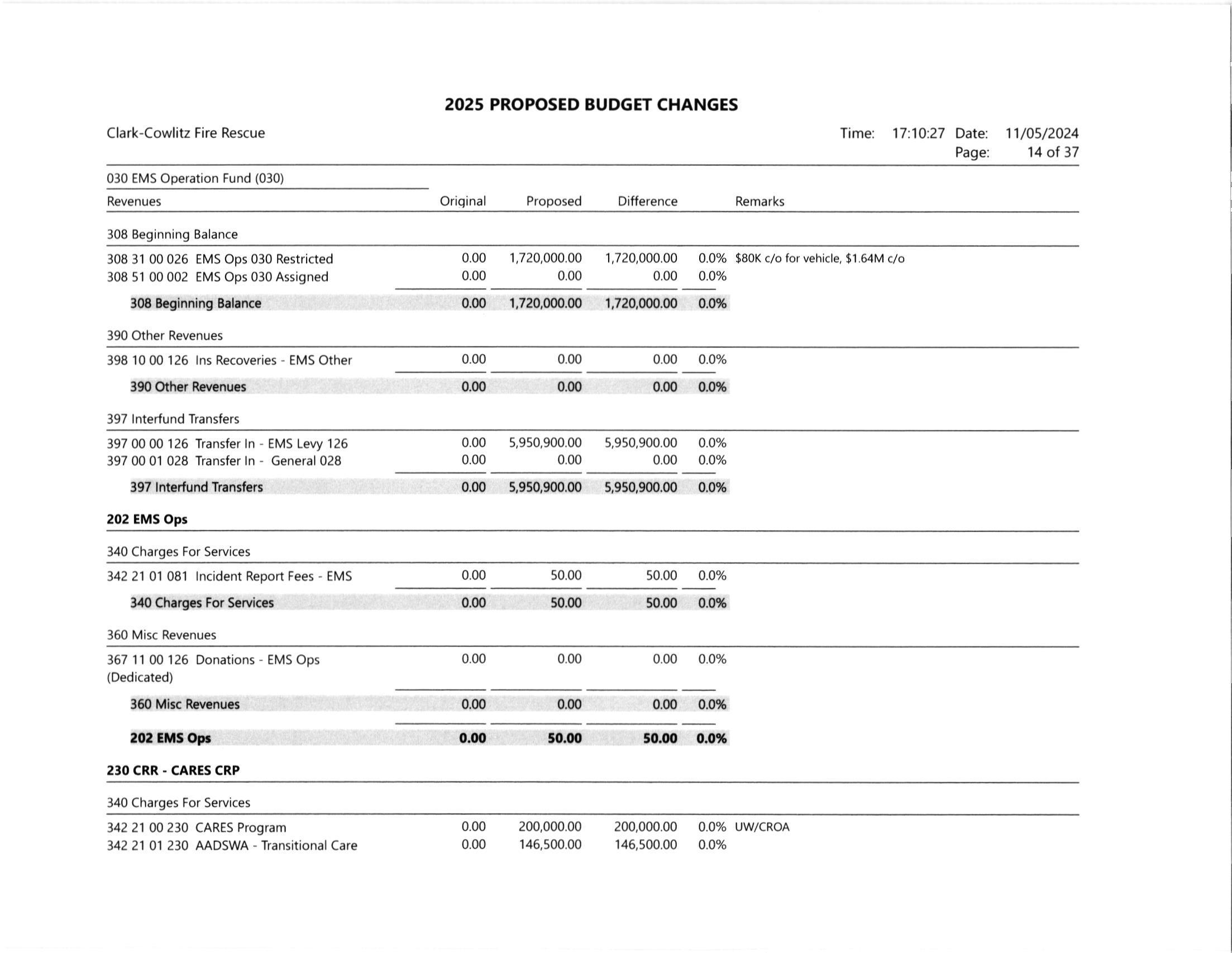

Wdshin8lon Saore

Form 64 O10O

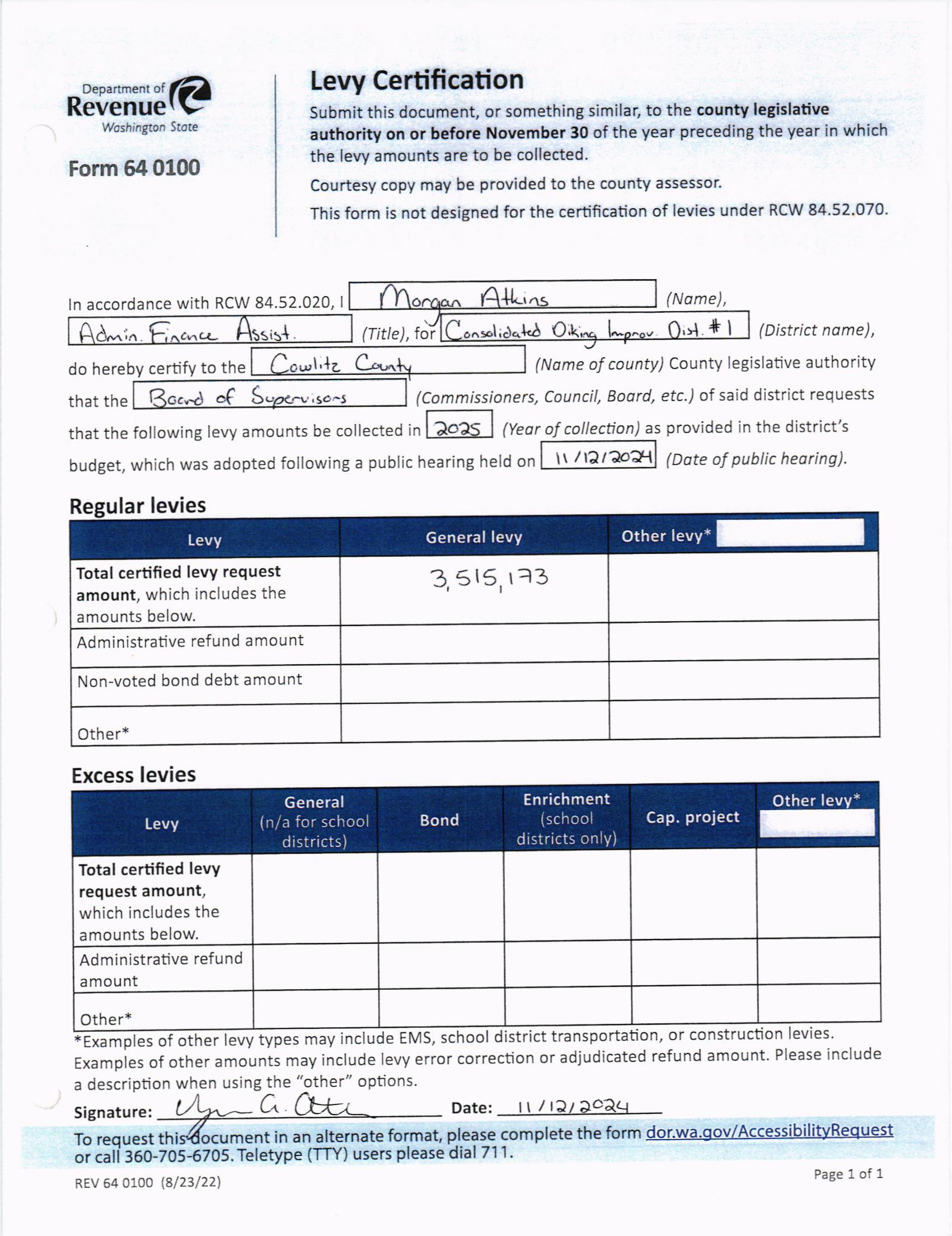

Levy Certification

Submit this document, or something similar, to the county legislatiye authority on or before November 30 of the year preceding the year in which the levy amounts are to be collected. Courtesy copy may be provided to the county assessor.

This form is not designed for the certification of levies under RCW 84.52.070.

ln accordance with RCW 84.52.020, I Clerkfireasurer (Title), fo(

Coni McMaster (Ndme), (District no,ne),

do hereby certify to the that the Kalama City Council that the following levy amounts be collected in

(Nome of county) County legisladve authority (Commissioners, Council, Boord, etc.) of said district requests 2025 (Yeor of collection) as provided in the district's budget, which was adopted following a public hearing held on 7tlt7lzo24 (Dote of public heorinq) lar levies

*Examples of other levy types may include EMS, school district transportation, or construction levies. Examples of other amounts may include levy error correction or adjudicated refund amount. Please include a description n using the " her " Signaturei

To request this document in an alternate format, please complete the form dor.wa.gov/AccessibilitvRequest or call 360-7055705. Teletype (TTY) users please dial 7'l 1.

Cowlitr

()RI'INANCE No a4'lotT

AN ORDINANCE OF THE CITY OF KELSO FIXING THE ESTIMATED AMOUNT TO Bf, RAISED BY AD VALOREM TAXf,S AT $I,786,224 OR MAXIMUM ALLOWf,D BY LAW FOR THE 2025 BT]DGET OF THE CITY.

THE CITY COUNCIL OF THE CITY OF KELSO DO ORDAIN AS FOLLOWS:

SECTION l. 'fhe estimated dollar amount to be raised upon real and personal property in Cowlitz County, Washington, to raise said dollar amount to cover the estimated budget needs of the City of Kelso for calendar year 2025 are as follows:

DOLLARAMOUNT

General Levy

Refund Levy

$ 1,779,615 or maximum allowed by law

$ 6,609 or maximum allowed by law

SECTION 2, This Ordinance shall be in full force and effect five (5) days from and after its passage and publication of summary as required by law.

ADOPTED by the City Councit and SIGNED by the Mayor this l?fltday of

CI CLERK APPR0VFI) O FORM

ATTO C PUBLISHED: i 2lo 2'l

RESOLUTION NO. .q1- LPA

A RUSOLT TtO\ OF THI] ('tT\' ( Ot \('lL OF THE ( tTl', ()F KT]t,So . I'THORIZl\(; A\ I:i('RF,ASE I\ THE RE(;I'I,AR PRoPERT}' TAX LE\'}'I}- ADDITIO\ To A\} A\IOI'IIT R},SI.'LTI\(; FRo}I \E\l ( ()\sI'Rt ("l lO\ Ar*D IllPROvUllEITs To PRoPERTI' r\D A\\ I\('REASE Ir.' THf \.ALT'E OT ST.{TE ASSESSED T.TILIT\. PRoPERT}.

WHEREAS. the City Courcil of the City of Kelso. Washington. a city of more than 10.000 population. has properly given notice of the public hearing held on October I 5. 2024. to consider the City's current expense budget for the 2025 calendar year. pursuant to RC\l' 8.1.55.120: and

WHEREAS. the City Council. after hearing and alier duly considering all rclerant evidence and teslimony presentd, determined that the City rcquires an incrcase in pmpen) ta\ reYenue from the previous year in addition to that resulting from new constnrclion and improvements and any increase in the value of state-assess€d utiliq- propert): in order to discharge lhe expected expenses and obligations of the Cit-v and in is best inlerest: norv. fierelbre.

T}IE CII'Y COIJNCIL OT THE CITY OF KELSO DO RESOLVE AS FOLLOWS:

SECTION l. Thal an increase in the regular pmpeny tax levy is hereby authorized lbr lhe lery to be collected in the 2025 talt year. The dollar amount of the increase over the acturl lery amount from the previous year shall b€ $17.323 which is a percentage incrcase of l.0lo/o from the previous year. This increase is inclusive of addition l revenue resulting t'rom neu construction and impmvements to property. refund levies and any increase in the value of state assessed propen]-.

EST/AL It: I('AT ON Y CLE K

APPRoVF.D ,\ ITOR\trY

Corrur AQTO FORM: rfc^0u T "t l\

ADOPTED b\ thc Cill ( ouncil and Sl(i\ED b1 the \lu1or this 1 Jar ,'t

Ra'{,tfilill@

,,^/osl:hglon Slore

Form 64 0100

Levy Certification

submit this document, or something similar, to the county legislative authority on or before November 30 of the year precedinB the year in which the levy amounts are to be collected. Courtesy copy may be provided to the county assessor. This form is not designed for the certification of levies under RCW 84.52.o7o.

do hereby certify to the Cowlitz coun.il

that the following levy amounts be collected in budget, which was adopted following a public hearing held on Regular levies

70lrsl2024 (Date oJ public heoring)

certified levy request amount, which includes the amounts

ln accordance with RCW 84.52.020, I that the Brian Butterfield her tions (District nome), (Commissioners, Council, Boord, etc.,l of said district requests (Yeor of col!ection)as provided in the district's (Nome), City clerk (Title), fot the city of Kelso, WA

of other levy types may include EMs, school district transportation, or construction levies. Examples of other amounts may include levy error correction or adjudicated refund amount, Please include a descripti

Signature: on en usin

Date: L

To request this document in an alternate format, please complete the form dor.wa.oov/AccessibilityRequest or call 360-705-6705. Teletype (TTY) users please dial 71 '1.

RhSOI.t I lO\ \O. Iilt)

A RESOI.I IIO\ of the Cit) Council of the Citl of Long\ ie$. \\'ashington. pursuant to RC\\ Chapter 8-1.55 ofthe State ol\\.ashington. providing fbr a 0.0% increase in the regular prop€n) ta\ lcr1. in addition to an) amount resulting tiom ne\! constmction. improrements. anne\ations. anl increase in the ralue ol snte-assessed propenl and amounts eligible tbr relund lerr liom the amount that \!as lericd in lOf.l to an amount uhich is l00.00ouir thereot.

\\'HEREAS. RCW Chapter 84.55.120 ot the Statc ol Washington- provides tbr and requires the enactment of an ordinance or resolution ofthe Citl Council. after a public hearing. to ler'1 ad ralorem taxes in an amount and'or percentage higher than that levied in the prer ious l ear: and

\\'HERE..\S. the Cit) Council of the Citl of Longvier'r- acitl of more than 10.000 population. has properll given notice ofthe public hearing held on October 24. 201'1. to consider the C it) of t.ongviet! 'r c urrent expense budget fbr rhe 1025 calendar l ear- puEuant to RC \l' 8-l.5i.ll0: and

fvtlERF-,{S. the Citl Council. after hearing- and after dull considering all relerant eridence and tesrimon] presented- has determined rhat the citl ofl-ongr ie* shall provide for a 0 0o,o increase in the regular propen) ta\ l('\] tiom the prerious 1ear. Additions to the increase resulting t'rom rhe addition of net construction and impror ements to prope6 anne\ation and an1 increase in the value ol slate-assessed propenl- and amounts eligible lbr retund lerl shall also be pror iderl lor in order to discharge the expected expenses and obligations ofthc Citl of [-ongr iew and in its best interests:

\O\\'. THEREFORE. Bt-- IT RL-SOI.!'ED b1 the Ciry'Council olthe Citl ol'Longrie* a.s tbllous:

l-hat an increase in the regular propenl ras levy. in addition to an! nes construction and impro\ements to propert!. annexalion and an1 increase in the value of state-assessed propertl and amounts eligible for retund lerl arc herebl authorized for the 2025 le!] in the amount or 50.00 rvhich is a percentage increase of 0.0o''o from the prerious year.

An1 unused general propert) ta\ le\) capacit) tbr the 202i tax lear is resened tbr turure lerl a^s prorided Lry RC\l' 8-1.55.092.

Passed by the Cit) Council thts hbL da,\ ol\ovember- l0l{'

,\pprored b} the \1a1or this Z/ da1 oi'\orember. l0ll'

\la\ ()r

Attest:

Citr lerk

Revenue @

Levy Certification

Submit this document, or something similar, to the countY legislatlve authority on or before Nov€mber ,o of the year preceding the year in which the levy amounts are to be collected.

Courtesy copy maY be provided to the county asses5or

This form is not designed for the certification of levies under RCw U 52'o7O'

QReset form

ln accordance with RCW 84.52.020, lnterim Ci rlan er

do here

that the

Jim Duscha (Nome), (Title).lor Citv of Lonoview (Disttict nome), by certfy to the Cowlitz (Nome ol county) County legislative authoritY itv Council (Commissioners, Council, goord, erc.,l of said district requests that the following levY amounts be collected in (Yeot ol collection) as budget, which was adopted following a publtc hearing held on 10t24t2024

Regular levies

Total certified levy request amount, which rncludes the amounts below.

Non-voted bond debt amount

Other'

Total certifi€d levY request amount, which includes the amounts below. Administratrve refund a mount

Other'

'Examples of other lew tYpes may irrclude EM5, school district transportation, or construcnon levies

Examples of other amounts may include levy error correctlon or adludic ated refund amoLlnt. Please include a descriPhon n using th€'

'other" opion

Signature

To request t rs document in an alternate format, or call 360-7O5-6705 Teletype (TTY) users please provided in the district's (Oote ol public heoring). complete the form dor.wa.gov/AccessibilitvReosest L

Date: please dial 7l

Exhibit G PORTS

A RESOLLIION OF TIIE PORT OF KALAr\,IA BOABr) OF COI{MISSIO\ERS ADOPTING TI{E BIJ'DGET FOR FISCAL YEAR 2025

WHEREAS, the Board of Commissionsrs has met and considered its budget for calendar year 2025; nd

WHEREAS, the hearing on the final budget was set for the Port Offce, Kalam4 Cowliu Counqv, Washington, at 5:00 p.m. on November l3t 2024; and

l!?{EREAS- notice of said hearing was published in the Longview Daily News, legal newspaper ofgeoeral circulation on November 2nd and November 9t ,2024; end

S1{EREAS. the hearing u'as held aad all persons desidng to be heard were in fact heard;

\IIIEREAS, the Board of Commissioners has considered the requiremens of the Port District and the financing thereof;

NOW. TTIEREFORE, BE IT RESOLYED by the Port of Kdama's Board of Commissioners as follows:

1. That the folloufug budget for 2025 is hereby adopted:

Sources ofFunds:

Operating and Nonoperating Revenues

Property Taxes Grants

Retained Eamings

Total Resources

Uses ofFrmds:

Operating and Nonoperating Expenses

(Includes Promotional Hosting of $50,000)

Debt Serrice Principal & hterest

Capital / Project Expendirures

Total Uses

$ 19,661,428 0 1,518.000 t+-J 7 5,92'7 s 35,555,3s5 $ t7,124,731

2. That a cenified copy hereof be filed with the Cou'litz County Offce of Financial Management for submission to the Cowlie County Board of Commissioners.

PASSED this 136 &y ofNovember 2024.

PORT OF BOARD OF CON{VISSIO\ERS

PRESIDENT CE PRESIDE\T

SECRET

A RESOLL'TION OF THE PORT OF KALAMA BOARD OF COMMISSIONERS AUTHORZING A}i INCREASE N TAX LEVY CAPACITY FOR TA)GS COLLECTED IN 2025

WHEREAS, the final msximum tax levy capacity for uxes collectable in 2024 urs $323,0j4; and

trTIEREAS, the Port District's population is less than '10,000; and

trTIEREAS. the highes regular tat which can be levied, beginning with the Port's 1985 teq-, occurs for taxes collectable in 2025 is equal to 5326,554 as ofNovember 13,2OZ4: atd

IV'HEREAS, the increase in the maximum lery capacity is $3,520 taking into accounr new construction:

NOW, THEREFORE, BE IT RESOL\,'ED by the Board of Commissioners of the port of Kalama as follo*'s:

1 . The Board of Commissioners hereby authorizes its maximurn tax lely capacity for taxes collectable in 2025 at $326,554.

2. The dollar amormt of tJrc increase over *re actual levy amomt from previous year shall be 53,520 which is a percentage increase of I % fiom the previous year.

3. Tlis Resolution shall become effective immediately upon its adoption.

PASSED this 13h day of\ovember 2024.

PORT OF KALA.VA BOARD OF COMMISSIO\'ERS

CE PRESIDE\T

SECRET

,A RESOLUTION OF Tl{E PORT OF KALA\4A BOARD OF COMMISSIONERS NOT TO LEVY A PROPERry TAX FOR COLLECTION IN 2025

WHEREAS, the Port of Kalama's Board of Commissioners has expressed its intent not to lev-v a prop€rty tax in 2025;

NOW, THEREFORE, BE IT RESOLVED by the Pon of Kalama's Board of Commissioners as follows:

1. That no propertv mxes be leried for collection in 2025; and

2. That a certified copy of this resolution be filed with the Cowlitz Couty, 1!'ashington, Legislative Authority and Assessor.

PASSED this 136 day ofNovember 2024

PORT OF BO,{RD OF CO\f\{TS SIO\ERS PRESIDE\-T

Levy Certification

Ra"$"6fi[3(?

Wdshrnfror 5t6l€

Form 54 0100

ln accordance with RcW 84.52.020, I Melinda H€uer (Nome), Director ot Accountint & Flnance ffitle), lor Port of ]6lama (District nome), do hereby certify to the cowlitt county fiome oI county) County legislative authority thatthe Commfssioners (Commissioners, Council, Boord, etc., ofsaid district requests that the following levy amounts be co;1g61g6;n 2025 (Yeor of collection)as provided in the district's budget, which was adopted following a public hearing held on L,/Blmz4 Pqte of public heoring).

Regular levies

submit this document, or something similar, to the county ledslative authorlty on or before November 30 of the year preceding the year in which the levy amounts are to be collected. Courtesy copy may be provided to the county assessor. This form is not designed for the c€rtification of levies under RCW 84.52'070. er" options

*Examples of other levy types may include EMS, school district transporta tion, or construction levies Examples of other amounts may include levy error correction or adjudicated refund amount. Please include a descri Signatu p on when usin he "oth

To request this document in an alternate format, please complete the form dor.wa.gov/AccessibilityRequest or cali 360-705-6705. Teletype (TTY) users please dial 71 '1.

PORT OF LONGVIEW COMMISSION

RESOLUTION NO.2024.05

A RESOLUTION OF THE BOARD OF COIvIMISSIONERS OF THE PORT OF LONGVIEW APPROVING AND ADOPTING THE FINAL BUDGET FOR CALENDAR YEAR 2025,

WHEREAS, the Board of Commissioners of the Port of Longview properly noticed and conducted a public hearing on November 13,2024 for the purpose ofa hearing on the budget pursuant to RCW 53.35.030; and

WHEREAS, the Board of Commissioners has further deliberated the adoption of the budget at its November 13, 2024 meeting;

NOW, THEREFORE, BE lT RESOLVEO by the Board of Commissioners of the Port of Longview that the budget for calendar year 2025 is hereby approved and adopted as presented.

ADOPTED by the Port of Longview Board of Commissioners this l3th day of November, 2024.

PORT OF LONGVIEW COMMISSION

Port of Longview

Resolution No. 2024-05

PaBe 1 of 1

By: Je n By

Evan Jones

Commissioner, District 2

By: tsstone District 1

Allan Erickson Commissioner, District 3

PORT OF LONGVIEW COMMISSION

RESOLUTTON NO.2024-06

A RESOLUTION OF THE BOARD OF COMMISSIONERS OF THE PORT OF LONGVIEW AUTHORIZNG AN INCREASE IN THE REGULAR PROPERTY TAX LEVY AND FINDING SUBSTANTIAL NEED TO BANK THE HIGHEST ALLOWABLE LEVY FOR FUTURE BUDGET NEEDS.

WHEREAS, the Board of Commissioners of the Port of Longview, after hearing and duly considering all relevant evidence and testimony presented, determined that the Port of Longview requires an increase in property tax revenue from the previous year, in addition to that resulting from the addilion of new construction and improvements to property, newly constructed wind turbines, and any increase in the value of state-assessed property, in order to discharge the expected expense and obligations of the Port district and in its best interest:

NOW THEREFORE, BE lT RESOLVED by the Board of Commissioners of the Port of Longview that an increase in the regular property tax levy, in addition to the increase resulting from the addition of new construction and improvements to property, newly crnstrucled wind turbines, and any increase in the value of state assessed property, is hereby authorized for the 2025 levy in the amount of $9,972 which is a percentage increase of 1.40o/o from the previous year. The highest lawful levy lor 2025, as calculated by the Cowlitz County Assessor, is $3,689,079.

ADOPTEO by the Port of Longview Board of Commissioners this 13th day of November,

PORT OF LONGVIEW COMMISSION

By

a*r:

Pursuant to Section 204 of Chapter 3, Laws of 1997, codified in RCW E4.55.0101, the Port Commission hereby finds that there is a demonstrated need in accordance with the Port's budget. Accordingly, this Port Commrssion hereby established a limit factor of 1 % for purposes of the Port's 2024 l€W collected in 2025. The Port Commission chooses to levy a tax that is less than the levy capacity for 2025 but desires to protect that capacity by passage of this resolution. 2024. District 1

By By:

J son Commis Evan Commissioner,

District 2

Allan Erickson

Commissioner,

District 3

Port of Longview

Resolution No. 2024{6 Pagp 1 ol 2

PORT OF LONGVIEW COMMISSION

RESOLUTTON NO.2024.07

A RESOLUTION OF THE BOARD OF COMUISSIONERS OF THE PORT OF LONGVIEW FILING THE FINAL BUDGET AND SUBMITTING A REQUEST FOR TAX LEVIES FOR CALENDAR YEAR 2025 wlTH THE CLERK OF THE BOARD OF COWLITZ COUNw COMIIIISSIONERS.

WHEREAS, the Board of Commissioners of the Port of Longview, by Resolution 2O24-OS dated November 13, 2O24, approved and adopted the Final Budget for calendar year 2025, it was ordered ard directed there be a tax levy upon all of the property within the Port of Longview District for Willow Grove Park expenses and savings for future property acquisition in the sum of seven hundred thifi'three thousand, four hundred sixty six dollars and no cents ($733,166). The total tax levy rate for collection in 2025 is $.04996 per $1,000 of assessed valuation.

lT lS ORDEREO AND DTRECTEO that the Counly Treasurer place all property tax receipts into the Port's Property Tax Fund.

NOW THEREFORE, the Board of Commissioners of the Port of Longview in the County of CowliE, State of Washington, are hereby directed to have said laxes extended upon the tax rolls of the Port of Longview District for the year 2025.

ADOPTED by the Board of Commissioners of the Port of Longview this 13th day of November, 2024.

PORT OF LONGVIEW COMMISSION

Port of l-ongview Resolution No. 2024{7 Page 1 of 1

By'

By Jeff o , District 1 vanJ nes Commissioner, District 2

By Allan Erickson Commissioner, District 3

Re"ffiffii[@

Wosh,ngton Stote

Form 54 0100

Levy Certification

Submit this document, or something similar, to the county leglslative authority on or before November 30 of the year preceding the year in which the levy amounts are to be collected. courtesy copy may be provided to the county assessor. This form is not designed for the certification of levies under RCW 84.52.070.

ln accordance with RCW 84.52.020, I President of Commission

do hereby certify to the Board of Commlssioners

Allan Erickson (Nome), (Title), fot Port of longyiew (District nome),

CowliU (Nome of counry) County legislative authority (commissioners, council, Bootd, etc./ of said district requests 2025 that the following levy amounts be collected in (Yeor of collection/ as provided in the district's budget, which was adopted following a public hearing held on Lut3l2o24 (Dote of public hedring).

Re lar levies

Excess

*Examples of other levy types may include EMS, school district transportation, or construction levies. Examples of other amounts may include levy error correction or adjudicated refund amount. Please include a description w using the "oth o ptions. e

Signature: Date: I I -

MESSAGE FROM THE CHIEF EXECUTIVE OFFICER

On behalf ofyour team here at the Port of Longview, lam pleased to present our adopted 2025 budget. 2025 will be a transition year for us as we move from planning to construction on the largest proiect in Port history. The long-awaited expansion of our rail corridor, supported and enhanced with complimentary projects, described below, are targeted to generate the best return on investment in terms of both local jobs and dollars to benefit of our communities.

lndustrial Rail Corridor Expansion (the "lRCE"l: This multi-year expansion project builds a new six-track rail bed adjacent to our existing rail corridorand addstwo additional rail tracks. The magnitude ofthe project requiresthe Port to seekfundingfrom multiple outside sources. To date we have received S15 million from a federal Rebuilding America's lnfrastructure with Sustainability and Equity (RAISE) grant, S2.5 million from Congressionally Directed Spending, 52 million National Highway Freight Program grant, and 54 million from state and local grants. As a critical Dan stahl step in the process, the Port will obtain the remaining funds with a combination of bonds and loans to round out our local match to comply with the RAISE grant requirements. The rail corridor expansion is vitalto our existing customers and their long-term Erowth, and is also the cornerstone for attracting a new customer to the newly prepared Berth 4.

Wlllow Grove Wetlands - Planning & Plantlng: The Port owns 92 acres of property used for wetland miti8ation in association with the construction of the IRCE project. Since 2018, the Port has monitored the site and planted over 20,000 willows to offset the impact of Port development projects. lf the port hadn't purchased and enhanced these wetlands, we would have had to purchase wetland bank'credits'from private developers, at higher cost to the Port. ln 2025, the Port expects to use a vast ma.iority of its wetland credits for the IRCE.

Rall lmprovements - Consistent with the Port's adopted development plans, a suite of rail improvements will begin in 2025 to separate berths 1 through 4rail traffic from berths5through8 railtraffic. These rail additions sign if icantly a lte r the ra il traffic patternsofthe Port, creating efficiencies and enhancing safety for Berth 2 operations and allowing the development of Berth 4.

With the self-mitigated IRCE ready to begin construction, and other rail improvements to enhance both the efficiency & safety of our rail network, we will start ramping up our efforts to market the new Berth 4 Terminal to outside cargo interests. On behalf of all of our team, we thank you for the continued support of your Port of Longview.

Sincerely,

Dan Stahl, Chief Executive Officer

ABOUT YOUR PORT

The port of Lonwiew is a premiere West Coast cargo handling facility serving as the transfer point for cargos moving across the tlobe. The Port is the first full-service operating port on the deep-draft Columbia River, 66 miles from the Pacific Ocean in Southwest Washington State. As the Gateway to the Pacific, the Port provides direct connections to all major modes of transportation - rail, roadway, river and runway.

With eight marine terminals, warehouses, rolling stock and waterfront industrial property spanning 835 acres, the Port's portfolio offers cargo handling services second-to-none. Foresight and strategic investments have readied the Port to meet diverse cargo needs and expanding international markets.

The Port is a regional economic engine driving economic development and job creation for the benefit of our community.

Governance

The Port is governed by a board of three, non-partisan elected commissioners. The Port Commission establishes the overall goals and direction for the Port through policy, which drives development, growth and cargo operations across the Port's facilities.

The Chief Executive Officer is the sole employee of the Commission, whose role is to execute Commission policy and manage overall Port operations.

Formation of the Port of Lonwiew

. 1911 - Port district allows geographical areas to form ports for the economic benefit of their communitY

. 1921- Established as Port of Kelso on the Cowlitz river by vote of citizens

. 1925 - Relocated to the current location at the end of Oregon Way

. 1925 - First grain elevator began construction, which closed in 1989

o 7929 - Renamed Port of Longview

Jelf wllson, Dlst. 1

Evan Jones, Dlst.

Allan Erickson, Dist. 3

BUDGET PROCESS

The Port of Longview's budget process began in earnest in June. The first step in the process involved a series of meetings with management staff to identify and prioritize the Port's needs for the next five years as outlined in the Port's Strategic Business Plan and the adopted financial policies. Each department was also required to identify its primary initiatives for the coming year. From this process, the draft operating and capital budgets were prepared.

The Strategic Business Plan identified the Port's various lines of business and developed specific goals for each. For 2025, the budget is reported by business line as well as by fund with the goal of providing the Commission and the community with a more complete picture of the Port's financial condition. Each department within the organization prepared its budget with the strategic goals in mind.

The Board of Commissioners held special budget meetings on October 21st and 22nd to review budget requests and provide direction to staff on preparing the proposed budget. A public hearing was conducted on November 13th for the purpose of reviewing the proposed budget. On November 13th, the Commission adopted the final budget.

2025 BUDGET FORMAT

Outlined below is a description of each budget section and the order in which each is presented

EUDGET IN BRIE F

The Budget in Brief section of the budget includes the following summary budget documents:

2025 BUDGET SUMMARY BY BUSINESS LINE

Page 8 of the Budget document summarizes the 2025 Net Operating lncome (Loss) Before Depreciation by business line. This presentation is designed to meet the Port's StrateSic Business Plan recommendation to reflect the Port's net profit or loss for its leased terminals, nonJeased terminals, non-marine industrial properties, and community (Willow Grove Park). The budget for 2025 anticipates that the leased terminal business line will have a net operating income of 53.0 million before depreciation. The non-leased terminal business line is expected to have a net operating income of 5200,133 before depreciation. Willow Grove Park will require a subsidy from the Property Tax Fund to cover the costs of its operations. Combined, the bud8et by business line reflects a net operating income before depreciation of S4.2 million. Page 9 is a graphic depiction of the results of each business line.

2025 GENERAL FUND SUMMARY BUDGET

This fund accounts for all non-restricted revenue and expenses of the Port. All the Port's operatinS activities from its marine and non-marine industrial properties are accounted for in the General Fund. Page 10of the Budget document summarizes the 2025 Net lncome (Loss) Before Depreciation. The budget for 2025 is projecting net income before depreciation from operations of 55.1 million. Page 11 is a su mmary of the transfers from the General Fund to the other Port funds which are further described below.

3. SPECIAL FUNDS SUMMARY BUDGETS

Page 12 and 13 of the Budget document provides summary budgets for the Port's special funds. For more detail see theSpecial Funds section of the budget wh ich begins on page 39. TheSpecial FundsSummary Budgets includesthe following funds:

a. WIILOW GROVE PARK FUND SUMMARY BUDGET

This fund accounts for the revenue and expenses of Willow Grove Park. For 2OZS, all ofthe fund resources comes in the form of a subsidy of 5445,250 from the Property Tax Fund.

2025 BUDGET FORMAT

b, PROPERTY TAX FUND

The Property Tax fund was created to allow the Commission and the public to see how property tax revenues are used by the Port. The property tax revenue in 2025 will be used to fund Willow Grove Park maintenance expenses, Willow Grove Park capitalexpenditures and the general reserve fund for future property acqu isitions.

2O2O LTGO BOND DEBT SERVICE FUND

The Port has one outstanding limited tax general obligation bond issue. The Debt Service Fund shows the annual principal and interest payments on these outstanding bonds for 2025. The debt service on the outstanding limited tax Seneral obligation bonds is funded through a transfer of 5542,170 from the general fu nd.

d. GENERAL RESERVE FUND

ln 2013, the Commission established this fund by resolution to set aside funds for capital projects and other lawful purposes. ln 2025, the Port will transfer S1.8 million from the General Fund to the General Reserve Fu nd.

4. CAPITAL BUDGET FUND SUMMARY

This fund accounts for the Port's capital expenditures. This fund is designed to separately capture capital outlays and show the funding mechanisms for these projects. For 2025, the capital budget is s38,571,200 which includes 55,762,059 in carryforward projects from 2074. lh.e capital projects fund is funded by transfers from the General Fund, the Property Tax Fund, customer contributions, bond proceeds and from Srant revenue.

SUMMARY BUDGET BY FUND

Page 15 of the Port's budget document summarizes the six separate funds highlighted above and estimates the ending working capital ofeachfund. The 2025 Budget by Fund incorporates all the changesthe Commission has made during its budget workshops. After inclusion of these changes, the General Fund's ending working capital will be above the targeted level established in the financial policies.

2025 BUDGET FORMAT

GENERAL FUND BU DG EI

page 16 of this document is the 2025 General Fund Operating Budget Summary. Beginning on page 17, detailed budgets for each of the Port's departments are shown. Each department budget includes a narrative explanation ofthe department's purpose and identifies significant initiatives that the department plans to achieve during 2025.

SPECIAI. FUND BUDGETS

The itemized budgets for the Willow Grove, Property Tax, Debt Service and General Reserve Funds begin on page 39. For 2025, the Commission has decided to levy property taxes at an amount substantially below the highest lawful level. The amount to be levied is 5733,455 representing a rate of approximately $0.05 per S1,000 of assessed valuation.

CAPITAL BUDGET

The 2025 Capital Budget begins on page 43. The Capital Budget is presented in four separate categories including: Safety and Administrative Equipment, Equipment and Vehicles, Facilities, lndustrial Rail Corridor Expansion and Community. For 2025, the capital budget is 538.5 million which includes 55.8 million in carryforward projects from 2023.

PROPERTY TAX

page 49 of this document is a history of the Port's Tax Levy for the last six years. Page 50 is a brief summary of the Port's tax collection, tax usage and the estimated tax on an average priced home. This is followed by a graphical depiction of the historical tax usageand on how property taxes are being. Page 52 is a graphical depiction ofthe tax lew revenue compared to operatin8 revenue and the uses of the tax levy.

IONG TERM DEBT

Page 53 of this document is a description of the Port's funding options of Limited Tax General Obligation (LTGO) Bonds and Revenue Bonds. This section also includes a schedule of the Port's current outstanding long-term debt and a graphical depiction of historic debt.

2025 BUDGET SUMMARY BY BUSINESS LINE

10,733,514 7,405,434

2025 GENERAL FUND SUMMARY BUDGET

ss0,882,659 s3,050,746 s149,105

2,los,992 309,175 4,730,515 L,370,200 1,186,511 28,442,L44 1,853,508 229,207 9,r21,000

2025 GENERAL FUND SUMMARY BUDGET

2025 SPECIAL FUNDS SUMMARY BUDGETS

2025 SPECIAL FUNDS SUMMARY BUDGETS

CAPITAL BUDGET FUND SUMMARY

2025 BUDGET BY FUND

2,000,000 (14,414,816) (18,139,32s1 (2ss,000) 15,762.059)

4,s13,797 2,000,000 3,572,5m 4,029, 7 2,000,000 (14,414,816) (18,139,325) (2Ss,000)

2025 GENERAL FUND BUDGET: SUMMARY

2025 GENERAL FUND BUDGET: NON-DEPARTMENTAL

Description

This cost center is designed to capture the General Fund costs that are not specific to a particular department and are not controllable by an individual department. The ma.ior costs included in non-depa rtmental are the anticipated costs of legalexpense relating to special projects, the Port's organization wide memberships and insurance costs.

There are no staff costs included in the non-departmenta I budget Port's an nual budget.

ln total, the Non-Departmental Budget represents 4.3% of the

Budget Highlights

No new programs or initiatives are anticipated in the non-departmental budget.

2025 GENERAL FUND BUDGET:

NON-DEPARTMENTAL

*Listing of Membership Dues and Fees are included on the following page.

2025 GENERAL FUND BUDGET: NON.DEPARTMENTAL

Washington Public Ports Association

Pacific Northwest Waterways Association

Pacific Northwest Waterways - River Values

lnland Ports & NaviBation Group

American Association of Port Authorities (AAPA)

Green Marine

Cowlitz Economic Development Council

Cowlitz-Wahkiakum Council of Governments

cowlit?-wahkiakum Council of Governments - SwEDD

Cowlitz-Wahkiakum Council of GovernmentsRelocation (One-Time Fee Request)

Merchants Exchange of Portland

Northwest Marine Terminal Association

Association of Washington Business

lnstitute for lnternational Steel Washington Council on lnternational Trade

Columbia River Steamship Operators Assoc.

Kelso Longview Chamber of Commerce Castle Rock Chamber of Commerce

Commerce Club

2025 GENERAL FUND BUDGET: BOARD OF COMMISSIONERS

Description

This budget accounts for the costs relating to the Board of Commissioners including their compensation, travel and miscellaneous expenses. The general counsel portion of the Port's outside law firm expense is also budgeted here.

Commassioner compensation expense includes a monthly stipend of S899 and a S151 per diem rate for attendance at official meetings of the port district or in performance of other service on behalf of the district. The per diem compensation is subject to an annual maximum amount of S19,320 (120 meetings) for each commissioner. Commissioners and their dependents are eligible for medical, dental, vision and life insurance benefits.

As part of their governance role, the Commissioners attend training events and other functions offered by organizations devoted to the Port industry including the Washington Public Ports Association, Pacific Northwest Waterways Association, American Association of port Authorities and others. The anticipated costs of attendance at these event functions are budgeted under the Conferences/Travel line item. A budget of S18,000 has been included for miscellaneous expenses that may be incurred over the course of the budget year.

ln total, the Commissioners Budget represents 0.6% of the Port's annual budget.

2025 GENERAL FUND BUDGET: BOARD OF COMMISSIONERS

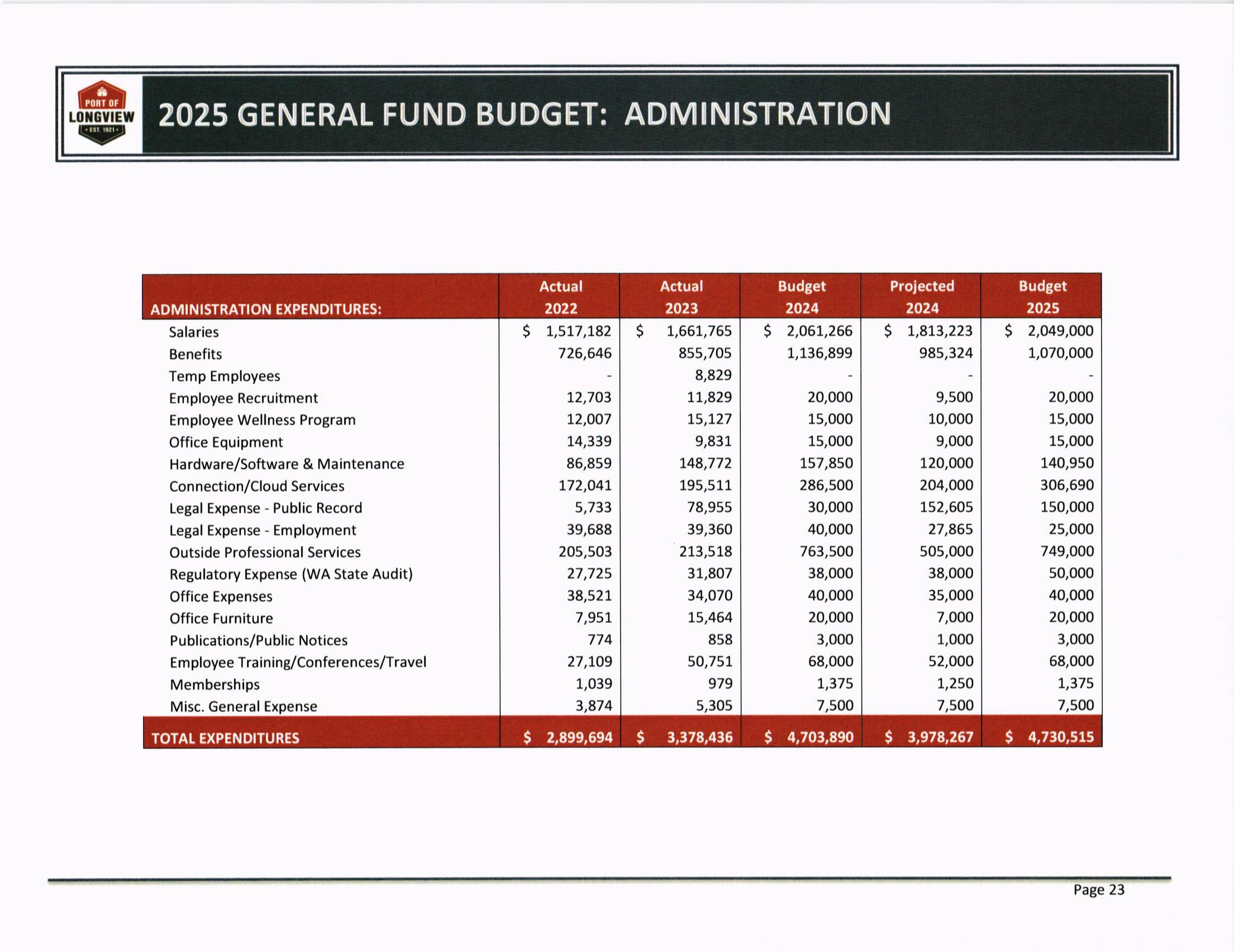

2025 GENERAL FUND BUDGET: ADMINISTRATION

oescription

The Administration Budget captures the costs of the Port's internal support services. The departments and functions in this budget include the following: the Office of the Chief Executive Officer, Finance/Accounting, Procurement, Human Resources, lnformation Technology and General Administrative services.

For 2O25, the Administration Budget includes funding for 17 full-time employees. ln total, the Administration Budget represents approximately 9.6% of the total operating budget.

Budget Highlights

The 2025 Administration Budget includes funding to allow the Executive direction of Port operations and administration; lT Department to work on lT projects including addressing network security and stability; Procurement to work on grant tracking and reporting; HR to focus on employee engagement and the finance department to contlnue work on the Port's long-term capital pla nning/fund ing.

2025 Budget lnitiatives

The 2025 initiatives for the Administration department align with the Commission's adopted Strategic Business Plan. The initiatlves include:

. lmplementation of Financial Software (Enterprise Resource Planning-ERP-system) upgrade to the cloud.

. lmplementation (tracking and reporting) of federal and state grants for the lndustrial Rail Corridor Expansion (IRCE) project.

. Development of the procurement department into an efficient partner for the organization through identifying areas for collaboration and cost savings.

. Continue the development of funding strategies for future large capital projects.

. Continue to strengthen the Port's cyber security program and network stability.

. Continual development of human resource tools to help create a productive environment for employees.

2025 GENERAL FUND BUDGET: ADMINISTRATION

TOTAT EXPENDITURES

2025 GENERAL FUND BUDGET: BUSINESS DEVELOPMENT

Description

The Business Development Budget is a comprehensive financial plan that encompasses the expenditures related to the Port's strategic marketing and business development initiatives aligned with the objectives outlined in the 2022 Strategic Plans. This budget plays a pivotal role in facilitating the growth and success of the Port across all lines of business.

The Business Development Budget is not merely an allocation of funds but a strategic roadmap that guides the Port's efforts to expand its market reach, secure valuable partnerships, and drive growth. lt ensures that the Port remains competitive and adaptable in a dynamic business environment, ultimately contributing to its continued success and the prosperity of the communities it serves. The budget includes funding for 4 full-time employees. ln total, the Business Development Budget represents approximately 2.8/o of the total operatinS budSet.

Budget Hithlights

1. Strategic Focus on Key Projects

2. Customer Growth and Acquisition

3. Revenue Exceeds Operating Expenses

4. Diversification Beyond Marine

2025 Budtet lnitlatives

The 2025 initiatives for the Business Development department align with the Commission's adopted Strategic Business Plan. The initiatives include:

. Berth 4 redevelopment and marketin8 efforts

. New customer acquisition

. lndustrial Rail corridor Expansion project support

. Overpass financing and construction

. Barlow Point development

o lncreased job creation

. Steady customers for operating berths to meet or exceed operating costs

o Real estate development

o Tariff management and market-based pricing

. customerrelationshipmanagement

2025 GENERAL FUND BUDGET: BUSINESS DEVELOPMENT

Note: The Business Development Department's budget does not include any trade advertising. The External Affairs Department is responsible for all Trade Advertising which includes all marketing materials and advertising in various publications.

2025 GENERAL FUND BUDGET: EXTERNAL AFFAIRS

Description

The External Affairs department acts as the conduit between the Port of Longview and many of our stakeholders. Functions in this department include public education/ community relations, business development communications and government affairs.

For zO2S, the External Affa irs budget includes funding for 3 full-time employees. ln total, the External Affairs Budget represents approximately 2.4% of the total operating budget.

Budget HighliShts

ln 2025, the ExternalAffairs department will maintain momentum on major community outreach projects such as its summer Tour Series and participating in numerous local events around the entire Port District. The Department will also look to expand its efforts by focusing on educational opportunities in schools as well as other speaking engagements within the local community.

Additionally, the department will work to fulfill communications needs of other departments and Port-wide projects, such as materaals for the historical preservation of the Berth 4 grain silos, develop new materials and increase communications efforts for Business Development and continue to produce a bi-annual newsletter for households within the Port District.

2025 Budget lnitlatlves

The 2025 initiatives for the External Affairs department aliSn with the Commission's adopted Strategic Business Plan. The initiatives include:

. Continue government and community outreach and education in 2024'

. Continue to advocate and educate for the lndustrial Rail Corridor Expansion project which includes work with federal and state lobbyists to promote the project for Srant fundinS.

o Pursue other state and federal grant funding as they arise'

o Prioritize educational opportunities in schools wathin the Port District

. lmprove Business Development communications and advertisinS.

. Create displays and historical preservation materials for the demolition of the berth 4 Srain silos.

o Develop a new three-year advertisinS promotion.

2025 GENERAL FUND BUDGET: EXTERNAL AFFAIRS

2025 GENERAL FUND BUDGET: OPERATIONS

Description

The Operations Department is responsible for managing all cargo activity for the Port's operating berths and certain leased berths.

The Operations Department manages all maintenance and repair of all equipment and vehicles at the Port, including equipment used by Facllities and Engineering tradesmen. Nearly every category in the Operations Budget is commodity driven, including longshore wages and benefits, cargo handling expenses, equipment rental, safety supplies, fuel, and security costs.

The budget includes funding for the Department's nine full time administrative employees and for the approximately 27 steady longshore positions that provide mechanic, millwright, crane maintenance, warehouse, and utility duties under Port management on a full-time basis.

ln total, the Operations Department represents approximately 57.7% of the operating bud8et.

Budget Highlights

For 2025, the Operations Budget is based on a cargo projection that assumes 170,000 metric tons of import activity and 7,853,500 million metric tons of export activity.

2025 Budget lnitiatives

The 2025 initiatives for the Operations Department align with the Commission's Strategic Business Plan. The initiatives include:

o ldentify and improve operating and production efficiencies.

. ldentify strategies to implement Climate Action Plan and reduce greenhouse gases.

. Continue to improve labor relations with the lnternational Lon8shore and Warehouse Union (ILWU) to aliSn strategic interests with our workforce.

. Continue to work with Business Development and the ILWU to identify new cargo handling opportunities.

2025 GENERAL FUND BUDGET: OPERATIONS

Longshoremen

Contract Stevedoring

Bulk Handling Equipment - Materials

Other Equipment and Vehicles - Materials

Cargo Handling Exp

Demurrage

Equipment Rental - Cargo Related

Equipment Expense - Fuel

Equip. Expense - Stock Supplies, Oil, Filters, etc.

Truck (licensed) Expense - Fuel, etc.

MFSA First Arrival Fee (Pass Through)

Outside

Outside

2025 GENERAL FUND BUDGET: OPERATIONS

2025 GENERAL FUND BUDGET: PLANNING & ENVIRONMENTAL

Description

The Planning and Environmental (P&E) Budget captures the costs of the Port's P&E support services. The department's functions included in this budget are associated with short and long term planning efforts, environmental program development, permits, contamination investigation, grants, and local, state, and federal agency permit coordination.

Environmental functions of the port are related to environmental stewardship, wastewater treatment, stormwater management, spill response, air emissions, site contamination cleanup, permittinS, and hazardous waste management.

For 2025, the P&E Budget includes funding for five full-time employees. ln total, the P&E Bud8et represents approximately 3.8%of the total operating budget.

Budget Highlights

The 2025 P&E Budget continues to make measured progress in planning efforts to ready the Port for future development, advance environmental programs to ensure the Port is consistent with regulatory requirements and continuing the Port's efforts regarding environmental stewardship. ln all other respects, the bud8et maintains the current level of support services as in past years.

2025 Budget lnitiatives

The 2025 initiatives for the Planning and Environmental department aliBn with the Commission's adopted Strate8ic Business Plan. The initiatives include:

. Continuation of planning efforts to prepare properties and infrastructure for new economic opportunities.

. lnvest in our stormwater, wastewater, and air emission infrastructure to ensure regulatory compliance.

. Partnership with local, state, and federal agencies to ensure the Port's freight network (road, rail, and waterway) is optimal for commerce.

. Continuation of developing the environmental program and Climate Action Strategy implementation.

2025 GENERAL FUND BUDGET:

PLANNING & ENVIRONMENTAL

2025 GENERAL FUND BUDGET: SAFETY

Description

The safety Bud8et captures the costs of the Port's safety support services. The department's health and safety functions included in this budget are: policy and procedure development, continued implementation ofthe Accident Prevention Program (APP), training and education, and continued improvement and progress of safety culture.

For 2025, the Safety Budget includes funding for one full time employee. ln total, the safety Budget represents approximately 0.5% of the total operating budget.

Budget Hlghlights

The 2025 Safety Budget will continue to develop a robust proSram to enhance and promote safety throughout the Port.

2025 Budtet lnltlatlves

The 2025 initiatives for the Safety department align with the Commission's adopted Strategic Business Plan. The initiatives include:

. Promote a safe and healthy work environment.

2025 GENERAL FUND BUDGET: SAFETY

TOTAT EXPENDITURES

2025 GENERAL FUND BUDGET: FACILITIES & ENGINEERING

Description

The Department of Facilities and Engineering is responsible for maintainlng the Port's infrastructure which includes docks, buildings, roadways, railroad tracks and utilities (including water, electrical, communications, wastewater, storm sewer, sanitary sewer and natural gas). This department is staffed by five full-time administrative positions. Total costs for these positions is the sum of two budget line items, Administrative Salaries and Administrative Employee Benefits. The Department also maintains a steady maintenance crew of 33 employees, which includes pilebucks, carpenters, laborers, equipment operators, electricians, plumbers, a painter and a sprinkler fitter. Costs for the steady maintenance crew is budgeted under the Wages and Benefits line item.

ln total, the Department of Facilities and Engineering represents 18.5% of the operating budget.

Budtet HiShliShts

ln 2025, the Department of Facilities and Engineering will undertake several major maintenance and capital improvement projects that will support the Port's lines of business. These projects include but are not limited to dock maintenance, maintenance dredging, rail improvements and maintenance, water main improvements and maintenance, storm sewer, sanitary sewer and wastewater treatment facility improvements and maintenance, electrical and communication improvements and maintenance, fire sprin kler maintenance and paving.

2025 Budget lnitiatives

The 2025 initiatives for the Department of Facilities and Engineering align with the Commission's adopted Strategic Business Plan The initiatives include:

. Maintenance and repair to the Port's docks, including dredging

. Maintenance and improvement to the Port's utility systems

. Maintenance and improvements to the Port's rail system

. Maintenance and repair to the Port's paved structures

. Assessment the Port's existing electrical grid

. lmprovements to Berths 5 and 6 stormwater and wastewater systems

. Construction of new rail adjacent to the 'S-Curves' rail

. Continue construction of a new fender system at Berth 2

. Continue design and construction of the lndustrial Rail Corridor Expansion project

. lmprovements to the waterlines at Willow Grove Park

2025 GENERAL FUND BUDGET: FACILITIES & ENGINEERING

2025 GENERAL FUND BUDGET: NON-OPERATING

Description

The Non-Operating Budget accounts for the Port's costs that are not directly attributable to the Port's business lines. These costs include the Port's contribution to the Southwest Washington Regional Airport, the Port's share of costs associated with the Lower Columbia River Maintenance pro.iect, its loan payments assoclated with the Port's equipment leases as well as its transfers to support the Port's other funds.

Budget Highlights

The 2025 budget includes the Port's share of the Lower Columbia River Channel Maintenance Plan and the Port's contribution to the Southwest Washington Regional Airport. This years budget also includes contributions toward the Columbia River Gauge project.

2025 GENERAL FUND BUDGET: NON-OPERATING

Southwest Washington Regional Airport

Special Projects - Lower Columbia River Operations & Maintenance

Special Projects - Lower Columbia River Channel Maintenance Plan

Special Projects - Lower Columbia River O&M Vik Prop Site Construction

Special Projects - Columbia River Turning Basin

special Projects - columbia River Gauge

Special Projects - Environmental Remediation

Special Proiects - Cowlitz County Fire Dept Underwater Sonar Project

Diking Assessment Election Expense Misc.

2024 WILLOW GROVE PARK FUND BUDGET

TOTAT

2025 PROPERTY TAX FUND BUDGET

2O2O LTGO BOND FUND

GENERAL RESERVE FUND

2025 CAPITAL BUDGET

2025 CAPITAL BUDGET

2025 CAPITAT BUDGET

2025 CAPITAL BUDGET

2025 CAPITAL BUDGET

TAX LEVY HISTORY

TAXES AT A GLANCE

2025 PROPERTY TAX LEVY

PORT PORTION OF TAX BILL:

Total estimated annual Port tax for a 5380,000 assessed value home for 2025 will be S18.99 - a increase of 50.00 from 2024.

MILLAGE RATE:

S0.04995-cents per assessed 51,000 (This is less than the legally allowable of 50.45 per S1,000)

TOTAL TAX COLLECTION:

Total tax levy for 2025 is 5733,466

2025 TAX LEVY USES

HOW ARE THE TAXES USED:

Willow Grove Park Maintenance Expenses (5445,250)

Willow Grove Park capital Expenditures (5255,000)

General Reserve Fund for Property Acquisitions (S33,216)

HOW ARE THE TAXES NOT USED:

Any operating costs, includang salaries and benefits.

Cowlitz County

of Taxes 2024

2025 TAXES AND THEIR USE

r Taxes

I Operating Revenue

r Gra nts/Contributions

r Other lncome

r Willow Grove Park Maintenance

r Willow Grove Park Capital

r General Reserve Fund

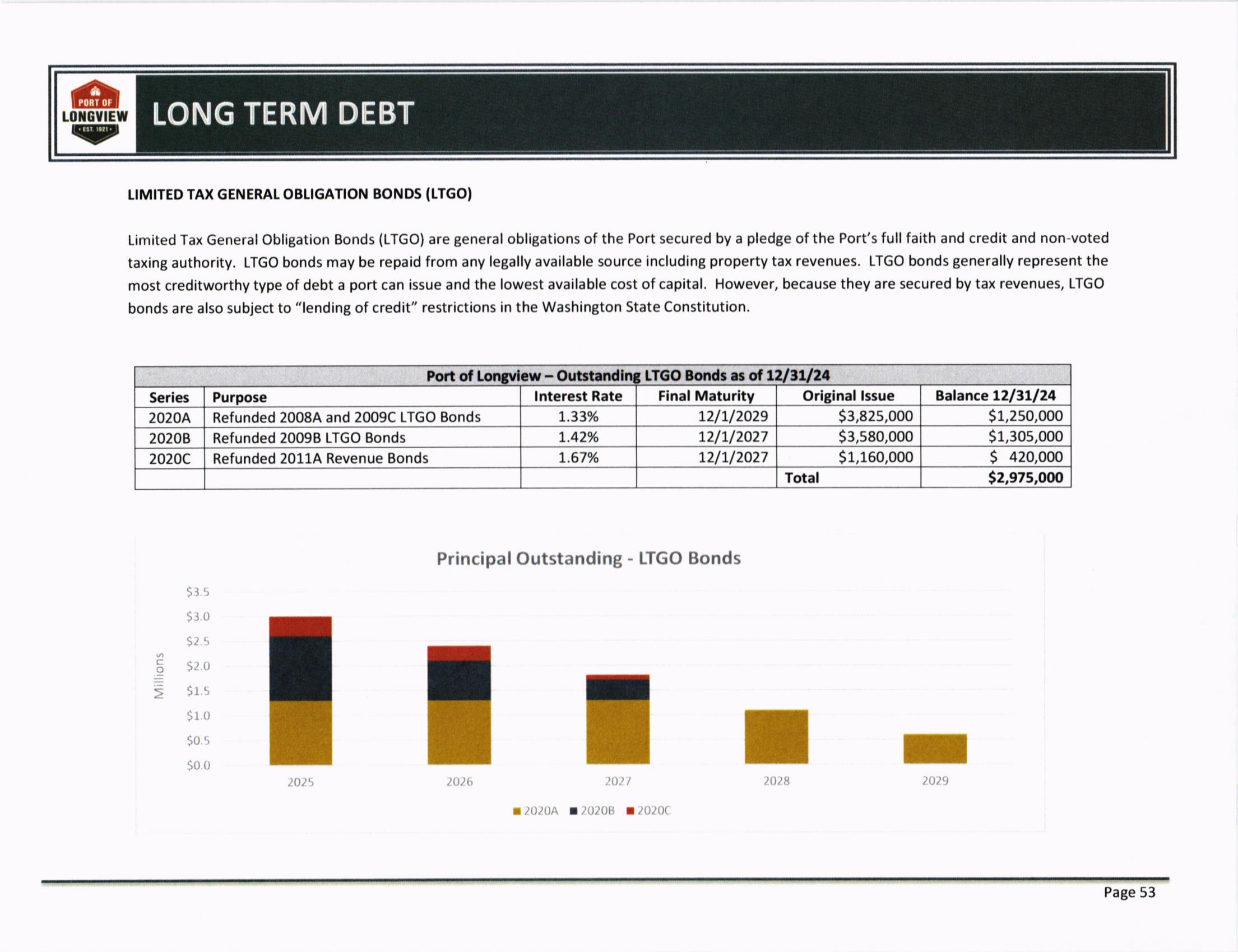

LONG TERM DEBT

uMrrED TAX GENERAT OBLTGATION BONDS (trcO)

Limited Tax General Obligation Bonds (LTGO) are general obligations of the Port secured by a pledge of the Port's full faith and credit and non-voted taxing authority. l-TGO bonds may be repaid from any legally available source including property tax revenues. LTGO bonds generally represent the most creditworthy type of debt a port can issue and the lowest available cost of capital. However, because they are secured by tax revenues, LTGO bonds are also subiect to "lending of credit" restrictions in the Washington State Constitution.

Port of Lontylew - Outstandlry LTGO Bonds as ol L2l31l24

Principal Outstanding - LTGO Bonds

LONG TERM DEBT

STATUTORY TTGO DEBT CAPACITY

Under Washington State law, port districts may issue LTGO debt up to 0.25% of the assessed value (AV) of their respective taxing district. The preliminary 2024AVofthe Port's taxing district is S14,680,108,521, resulting in total LTGO debt capacity of 536,700,271. As of 7213712024, the Port has

S3,470,843 of LTGO debt outstanding, leavings32,229,428 in remaining debt capacity. This remaininB capacity will generally increase over time, as 1.) the AV of the Port's taxing district increases, and 2.) existing LTGO debt is amortized.

Llmlted Tar Gcneral oblltatlon Debt

2024 Assessed Value for 2025 Tax Year

LTGO Debt Capacity (0.25% of AV)

Less: Outstanding LTGO Debt las of 72/37/2411

Remaining tTGO Oebt Capacity (Non-voted)

lllncludes outstanding LTGo Bonds and cERB Loans)

REVENUE BONOS

s 14,680,108,521

S 36,700,277 (S3,470,843)

53t,229,428

Revenue bonds are obligations of the Port secured by a pledge of the Port's operating revenues, net of operating expenses. Theyare not secured by property taxes, however for purposes of determining net operating revenues, property taxes may be applied to offset operating expenses. Thus,an increase or decrease in property tax revenue will have implications for both LTGO and Revenue bond debt capacity. Currently, the Port does not have any outstanding Revenue Bonds.

REVENUE BOND DEBT CAPACITY

ln contrast to LTGO bonds, there is no statutory limit on the amount of revenue bonds a port may issue. Rather, ports covenant with revenue bondholders to maintain revenues available for debt service at or above a certain level (typically 1.25 times annual debt service) in each year. Thisisknown asthe "debt service coverage" level. ln order to issue additional debt, a port must demonstrate that historical revenues, together with incremental revenues expected to be generated from the assets being financed, are sufficient to cover maximum annual debt service by this same level.

LONG TERM DEBT

DEBT MANAGEMENT POTICY

The Port had developed a debt management policy to set forth the criteria for issuance and repayment of debt. The primary objective ofthe Debt Policy is to establish criteria that will protect the Port's financial integrity while providing a funding mechanism to meet the Port's capital needs. The underlying approach ofthe Port is to borrow only forcapital improvements that cannot be funded on a pay-as you-go basis.

2025

SCHEDULE OF LONG TERM DEBT

HISTORIC DEBT SCHEDULE

RESOLUTION #536

PORT OF WOODLAND

A RESOLUTION OFTHE WOODI',1\NIT PORT COMMTSSION ADOTNNG THE BUTTCET FOR THE YEAR 2O!5 AND PROVIITTNG FOR A IJVY OF S''ff35() ACAINST THE ASSESSED VALUATION OF THE X)RT LISTRICT IN ACCoRDANCE To Rciw t''J2'o20'

WHER-EAS rhc Woodland Port Commission did adopt a kcliminary Budgct' tnd

WHEREAS noticc of rh. port's 2025 prclinioary Budga lr8s duly slld regllatly Dublishcd in Thc Rcflcctor' ' lc8!l ocwspaper ofganeral clrqufntion *itrtin Oc pon Distriit on Scptcmbcr 4' 2024 rnd' Scptctrbct I l ' 2024 foB and

WHEREAS tte h€ring or ssid Preliminlry Budger wss duly and- tltularly 3't for thc Pon of Woodland Commistion of'c€ located at t608cuitd n*a, w#i"ialw-i,.-iinEon, io*lirzEounty, st 9:00 A.M. on septembd l9' 202'l: lt'd

I,YHEREAS, notice of fiml budget wss duly and rrgularly publishcd h Thc Rcftcclor' a l'8al ncwlp'Pq of gcncrrl circularioB within flc Pon Distsicq on Octobcr 30,2024; and

WHEREAS, the find budgel hctritrg \'vss duly held on Novrmbcr 7' 2024: md

WHEREAS'th€ Po Commission considcr'd thc Equircme s of thc Pon Dirtrid fo' thc v"r 2025 and thc firsncing fiercot

NOW THER-EFORE BE IT RESOLVED BY THE WOODLAND FORT COMMISSTON AS FOLLOWS:

Ttat schedule A atbched her.to which by refcrencc is incoporatcd hcrcin, be rnd lhe same herGby ii adoptcd as thc budget lor the Pon of Woodland for thc yc'r 2025 '

That herc is levied a totll collcctcd amoutrt of$'l8t'350 againsr thc asscssed valuation oftbe woodl'nd Port Disricr' for the Maintenance Fund of the Woodunj poi Oitti"t *tjot to the highcst lawtul lcvv tl lOlTo and lh' Pott is nol i*i". *or"",iit ftianest lawful levy with tubstatrtisl ne'd that would incrcrse to l0l9i''

.BE IT RESOLVED by th. govemitrg body of(rhe taxirg dishict) $at an .incrcssc in the reSuht ProPcrty tax lcvy is hcreby aurhorized for rhe levy to be cottciiciln trtt zoZio* ""t fie dolltr amounl of6' ircreat€ over the tctual lew arnount tum ttt" p*riou, y"ot 'tt"ll iitOJoO *t'i"ft lt " ptt""ntagc incrc6c of tolo/o plus new coostructioo ;;lT;."';:.;;'ij'it tnit"l* rt "*r'sive of additional revcnuc Esuhins fiom trcw construction' improvernents to proPcray' n.*ty "on'ruc; wind turbincs' solat' biomas!' and gcoth'rmal feciliti's' and eny increase in thc valuc of sEtc asscssed p.opo*r' ony "nnt*otions thet hrvc occurrcd snd rcfunds mad''"

The Pon ofwoodland will continuc to bank thc diffcrcncc from previous yea6 by thc Pon of Woodland for pol€ntial use if it is determincd in tbc futue to utiiizc i" u-rta ""p"tity for Pon n'cds bas'd oo Pon policica ard Rcw ."qri.".""". Th. t"" b nor ldding to lhc banled capacity for lhc 2025 y"r'

That a Cenificd Copy hercby filed wilh the Auditor ofcowlilz County' Wsshington in hcr capacity i! Clerk of thc Bodrd of County Commissioners'

ADoPTI:D. this 7h da! of Novemb.r l0l.l

S I.,\ I E OF WASHINCION)

C(ll.;NIY OF ( t '\i LI tZ )

Paul Cline. President

wooDLAN D PORT Colvtlvl lssloN ,t

ohcn ile. Commissioner ( I I{ I II ICATE

l. Robert D. Rich. Commijrione. tirr the Pon ol Woodland. Corvlitz County. Washington' do heteby certity thal lhe anirch(d Budget for:025 \as dull and regularl] pasred and ad(tpted b) thc woodland Portcommission at a regularl:i :ichc.luled mc.tin3 held on 7i day of November. l0l'1.

lN WITN ESS THI Rli(,t. Ihavehereuntoi.tmlhandaffi\cdherc('thc\calof\!idPonDistrictthis]6da]-,ofNovcmber 201r.

r '.rll

RESOLUTION

f537

PORT OF WOODLAND

A RESOLUTION OFTHE WOODLAND PORT COIIIMISSION TNCREASINC THE PORT'S ACTUAL LEVY RATE tl6-s45 or tot7" WHICH IS AN INCREASE FROM 2024'

wHEREAS, norice ofsaid finalbudger was duly and regula.l-v published in The Rellector. a legal ne$spaper ofgeneral circulation uiihin the Port Disrict. on October 30. 2024: and

wHEREAS the final budgel hearing were dulJ- hcld on November 7' 202'l: atld

wHEREAS the Pon ofwoodland commission received no public comment rrgarding the finalbudget: and

WHEREAS the pon Commission considered the requirernems ofthe Pon District lbt the tcar 1025 and the finalrcing thcreof:

NOW THEREFORE BE IT RESOLVED BY THE WOODLAND PORT COMI}IISSION AS FOLLOIVS:

l. rhat lhetotalamount being levied in 2o2J is s.l88.i5o which .epresenls a s 16.5{6 increasc and a l0l 9'o incrcase over the actual amount levied last !ear.

2,l.hataCenifiedCopyhereb;.filerlrviththeAuditorofcowtitzCountt.washingtoninhercapacitlasclerkoflhe Boifd oI Counry Commissioners.

ADOP f ED- rhis +da! t,f \or rmbcr l()l'1.

WOODLAND PORT COIVIMISSION

t(-/-/ L PaulCline. Presidenl

D

Wile. Comm

Woshrnl1on Saote

Form 54 0100

Levy Certification

Submit this document, or something similar, to the county legislative authority on or before November lto of the year preceding the year in which the levy amounts are to be collectedCourtesy copy may be provided to the county assessor. This form is not designed for the certification of l€vies under RCw E4.52.070.

ln accordance with RCw 84.52.020, I Jennifer Wray-Keene (Nome),

Executive Director (Title), tot Port of Woodland (District nome), do hereby certify to the CowliE (Nome of county) County legislative authority that the Commission (Commissionets, council, Boord, etc.,) of said district requests that the following levy amounts be collected in (Yeor of collection) as provided in the district's 11tO712024

budget, which was adopted following a public hearint held on

Regular levies

(Date ol public heoring)-

of other levy types may include EMS, school district transportation, or construction levies. Examples of other amounts may incl lew error correction or adjudicated refund amount. Please include a description wh options. e

Date: 11t25t2025 in an alternate format, please complete the form dor.wa.oov/AccessibilityRequest dial 71 1.

2o25 trlNAL

Portof Woodland

trINAL BIJDCET

OVEAVIEW

TAAN,/PAQENCY TL]AOUCU

DUDCETINC

ODEAATION,/- DEVINUE,/ AND EXPENDITUAE,/

Port of Woodland

The Port of Woodland has prepared the final budget information for the Port District. The Commission's effort is to engage the public and provide a transparent budgeting process. This is key to communicating with the Port District good stewardship and leadership towards their mission:

"To suppont job cneotion thnough economic gnowth ond r-ecr-eotlonol oppontunities [n o dlvense onnoy of businesses, industnles, ond senvices thot enhonce the Distnict."

The Port of Woodland set the 2O25 Budget Calendar at the August 15,2024 regular meeting. The Commission may, at their discretion, add additional workshops for their discussion of the Operations Budget and/or the Capital Budget. The Port of Woodland Commission is required to hold one public hearing for the preliminary budget but encourages the public to provide comments and question to the Port Executive Director during Port business hours of 8 AM to 5 PM Monday through Friday or at any Port Commission meeting. Please be advised the following calendar may alter from an established meeting schedule of first and third Thursdys at 9 AM.

The final 2O25 Budget includes a final public hearing to be held on November 17, 2024 at 9 AM during the Port of Woodland Commission regular meeting. After which, the Commission will review any and all statements, and take action on the final budget for the operation and capital activities. This is recorded with CowliE County via resolutions.

For more information regarding Port Commission meetings, agendas, minutes, and other relevant plans, visit the Port of Woodland website at www.portofwoodland.com or our Facebook page at f acebook.com/portofwoodland

TPAN/DAPENCY TL--]POUCL-] DUDCETINC

The Port of Woodland general budget is broken into two categories: Operations and Capital. Operations refers to the day-to-day operations of the Port of Woodland to maintain current properties and projects. Capital refers to incoming or potential projects and future development on the horizon for the PorL The 2025 budget reflects the priorities, strategies and goals of the Comprehensive Scheme of Harbor lmprovements (CSHI).

The Executive Director prepares the Operations Budget for the Commission. This year's Operations Budget was prepared in coordination with the Commission due to the restructuring of the Port's business lines. ln August 2O24, the Port acquired an existing commercial business- Columbia Riverfront RV Park at 1881 Dike Road. This fall, the Port will complete the fiber optic construction that will allow for hte lnternet providers to begin services, starting a new business line of utility provider. ln June, the Rose Way lndustrial Park completed two buildings and will be under lease adding to the revenue lines. Finally, two leases were executed for two future terminals at the Martin Bar industrial properties that will be another business line for the port with marine terminals.

The Port Commission oversees the Capital Budget. This is formulated based on projects, plans and maintenance generated from the CSHI and maintaining existing assets. Currently, the 2022 list of CSHI prolects and plans have iether been completed, underway or removed. Main projects are improvements to the RV Park to renovate existing assets. There are several planning projects subject to funding, also. Matching funds are subject ot Port Commission priorities.

The public is encouraged to review the Comprehensive Scheme of Harbor lmprovements along with the Budget for a holistic management effort.

The Port holds a rainy dayl emergency fund balance of at least six months of revenue for expenditures. This fund is reviewed annually as part of the budget process to ensure the fund balance mets this schedule.

2025 Operations Budget

5?29,195.87

576^5OO.0O

$rJ98,755.60

CADITAL EUDCET

The Port has several capital projects identified under the 2025 budget subject to funding. These include:

. Austin Point Recreation Park -$2.5 million pending WA State Legisture funding of Recreation and Conservation Offr ce (RCO) requests;

. Austin Point Terminal $1.4 million pending MARAD Port lnfrastructure Development funding; Applications to be submitted for state and federal requests:

. Rose Way extension construction,

. Cougar to Skamania Fiber,

. Yale Bridge Fiber,

. Buildings 3,4, 5 and 6 at Rose Way lndustrial Park

All other capital projects, plans and maintenance would be funded through either reserves or property taxes. ln addtion, property taxes or the Port's "millage rate" are utilized for capital debt services first, followed by projects, plans and maintenance. The Port has current debt services on the following properties or proiects:

. 1670 Schurman Way building Construction

. 2O2O LTGO (Financed matching funds for Rose Way lndustrial Park)

. Howard Way Extension Construction

. Fiber Optic Utilities

. Rose Way Horizontal, Road and Building Construction & Centennial Horizontal Construction

. Rose Way Building E Construction

Currently, the preliminary assessed value and millage rate has the Port's millage revenues at $488,350 and will be finalized by the County in early January 2025. This equates to $O.17I$1,0OO of Assessed Value with an additional $187,564,534va|ue in the Port District.

Copitol Dnojects & Dtons

Prol€ct Propelty rype

RoseWay Extensron hdtrslnalzone

Rose way Extension lndustnalzone

Rose Way E{teGron lnduslflalZone

A&E-To0o. survey. ROw

A&E-Design

A&E

RoseWay Erlensron lndustriatZone Construclron

Ev Charging Stations

Brildrng 3, 4. 5 & 6

Euitding6

Eurlding5

Auilding3&4

Rose Way Burlding E & F Conslruclion

a&€

Constructon

Constructrcn

Construcllon

A3,E

Cowlit2 Slamanu Fiber Frber

Yale Bridge Frber Frbe,

RecreatronaYPubtc Access

30% l&f Terninal Development

A&E/Con$ructron

A&E/ Constructron

A&E

100 DaMdson Cty Fire Sration PtennrnS

Copitot Molntenonce

Club House Reno/Bathroom

Entry Sign age and Lrghtrng tandscaprng/Arbonsl

Club House Deck Replacement

Club House ADA lmprovemenls

FencedDogPark

FenceTraaler Parting

Seal Coat noadways

Patio ljpgades

Otfice upgrades

Pool Fitler &Dect upgrade

Rproof 1395 Do*arivet

IRV Park

lnvpart

lRv Park

RV Park

RVPaIk

lRvPa.r

lnv parr

DolYn River Dflve

Construclron

Construclron

Conslruction

Conslruction

Constructron

Constructron

Constructlon

Conslrudion

Construolon

Coflsttuction

Construdaon

Construclron

ST:\IE OF WASFIINGTON )

CERTIFIC;\TE )ss

COUNTYOFCOWLITZ )

I.R.rbcnD.Rich-CommissionerforthePortofwoodland,CowlitzCount]..'washington'doherebycertifythatthe

a$ached Budget for 2025 *asduly and regularlJ- passed and adopted by lhe Woodland Port Commission at a regularly scheduled meeting held on ?d day ofNovembet 2024'

IN WITN ESS THE REOF. I have hereunro ser my hand affixed hereto the seal of said Pon Districl this 2day of November 202J.

Exhibit D LIBRARY DISTRICTS

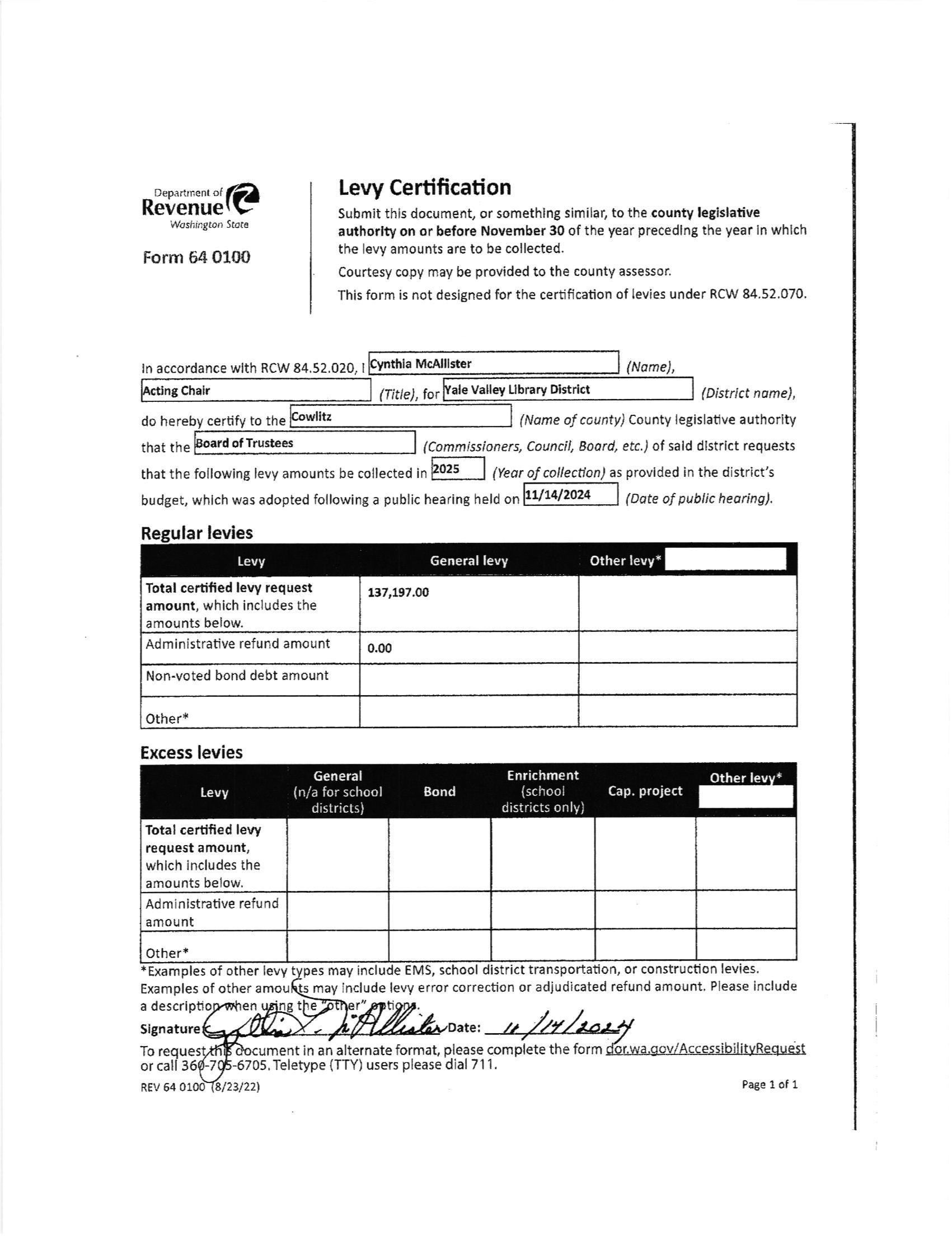

Yale Valley library Districr Resolution 2024{13

2025 Levy Resolution

The regular meeting of the Yale Valley Library District Board of Trustees was held November 14, 2024, attended by a quorum ofthe Board for the conduct of such business, including a public hearing for the purpose of providing comments on district revenue sources and budSet; and, after due consideration and deliberation, the following resolution was duly passed by a majority vote for all Trustees then attending.

WHEREAS, the Yale Valley Library District Board of Trustees, after duly considering all relevant evidence and testimony presented, determined that the Yale Valley Library District requires an increase in properw tax Tevenue from the previous year, in order to discharge the anticipated expenses and obligation ofthe district and in its best interest; and

WHERAS, the population of this district is less than 10,000; and

WHEREAS, the increase factor for the 2025 levy sh a ll be 101% over the prio r year's actual levy of S133,134, resulting in a dollar amount increase of S1,331. This increase is exclusive of propeny tax revenues resulting from the addition of new construction and improvements to property, newly constructed wind turbines, solar, biomass, and geothermal facilities and any increase in the value of state-assessed property, and aoy additional amounts resulting from annexations or refunds that have occurred.

NOW, THEREFORE, BE lT RESOTVED that the Yale Valley Library District Board of Trustees adopts the 2024 Lew certifications for Cowlilz county.

Adopted this 144 day of November, 2024

ta McAllister, Acting air

i

Wheeler, sec

@miii*'

'talEb ltE

Levy C ertification

strbDlt thl8 docueetrt to thE couty legkl4dve suthorlfy otr or bcfort Novembcr 30 of the yesr pr.c€dlng tte ye.r ln lrhhh the l6v, Euour& Bre to be c{llected lrd for{ltrd r copy to lte r$e!sor.

In accoldanco with RCW 84.52,020, I, Cynthie MoAUi$€r

,A.cting Chair for Yale Valley Diltriot Gidc) (Dlstict Nsmc) Can litz Couoty legjsiative &rtLority tlat lho (Nim6 ofcounty)

Rogular Le\.'lr tx1,)9]

(Star€ [x. t6ad dollnr ulorrrll to be lsvi3d)

Excess Irvy:

(StBlo dle .old do liar smoll[l b t lcr.iod)

Refund Levy: (Sr{b tho totd dollar amo'rrt to bc lcvicd)

SiFature: (NDlno) do herby cortify to Bosrd ofTluc,cer the ofsaid di6hict reqqests tllst tho fotlowitrg leyy aooqnts be colleotsd io at provided in rhe districr's (Y€6r of Coll€.'tion) budget, yrhiot was adopted btlowi4 a public hodog held m lW--t (Dab of Publlc H..ri6g) (Coml[ilsioftrr, Courq Boai4 etc.)

Dete, 17i74!2024

Fortal ,ssiluncq vidt bltr://dd,wa.soy/contcntlax6Joroq+"tv,/+fa: t,asg ot call (360) 5?G5900. To ibqut! a'oo{t I1o i*:jatmty ofruii ao.t ffi in an-at"t *" t"t""t fortf" vizuittv lnpairo4 ptme oall (360) 70s67t5' Toletype (mY) us€ro !flay csll 1-80H51-7985, mv 540l0oc(v) (10.I,[l)

Re?E'fiil[re

Woshdglon Saote

Form 64 Olfi)

Levy Certification

Submit thls document, or somethlng similar, to the county le8lslative authorlty on or belore November 30 of the year precedlng the year in whlch the levy amounts are to be collected.

Courtesy copy may be provided to the county assessor This form is not designed for the certiflcation of levies under RcW 84.52.070.