Power Shines Through Corn Belt Power Cooperative 2022 Annual Report

A natural diamond is formed when carbon atoms bond together under pressure and create crystals. The diamondformed under intense heat and pressure over many years - is considered the strongest and one of the rarest, most beautiful gems on the planet.

In 2022, Corn Belt Power Cooperative celebrated our 75th year of operation, also known as the diamond anniversary.

Over the last 75 years, we’ve faced numerous challenges, threats and pressures. Our circumstances and resilience have formed us into a strong organization. Working together with our member cooperatives, Corn Belt Power Cooperative impacts and enhances the lives of many.

Like light through a diamond, our Power Shines

Through.

of Directors

Kenneth H. Kuyper

Executive Vice President and General Manager

Executive Vice President and General Manager

Power Shines Through

David Onken

President, Corn Belt Power Cooperative Board

Executive Report

Corn Belt Power celebrated its 75th year of operation in 2022 and this report and annual meeting mark the 75th time we’ve gathered to participate in the democratic process of membership.

4 Power

Through

Shines

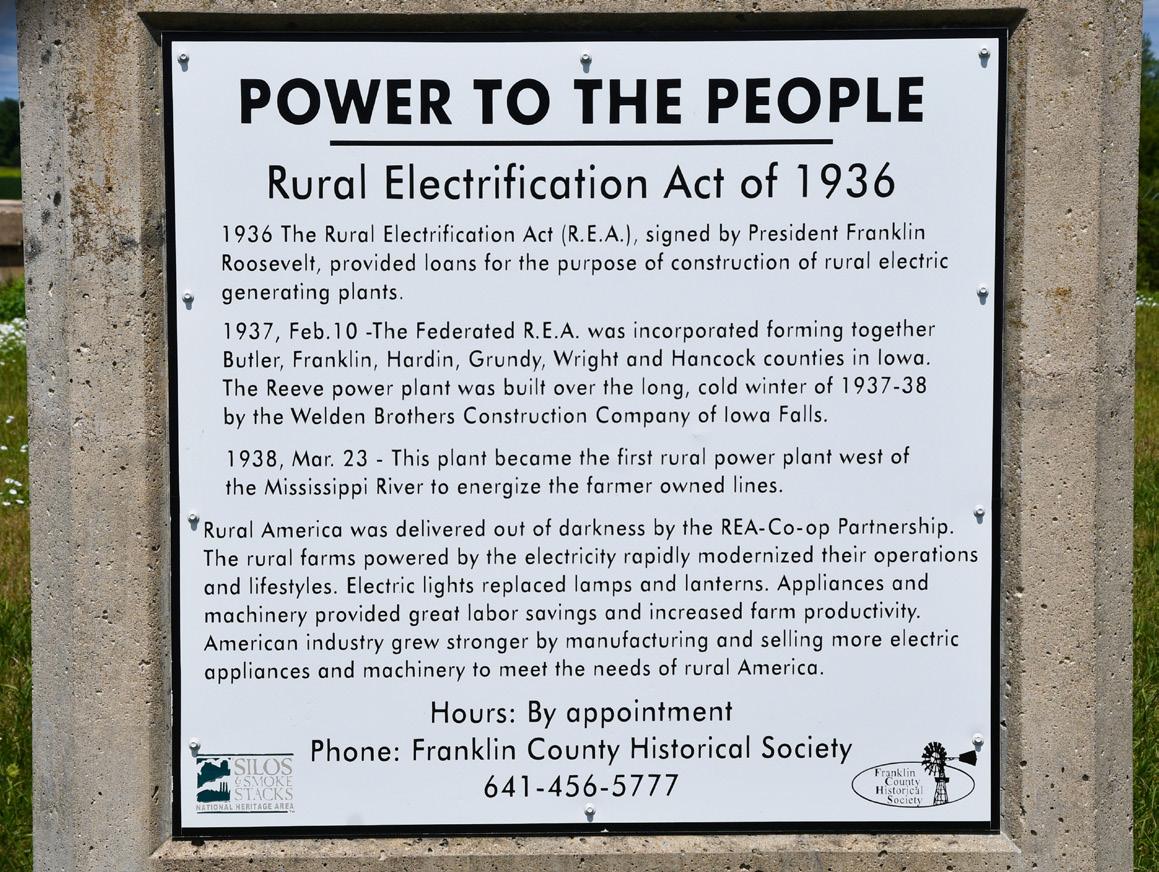

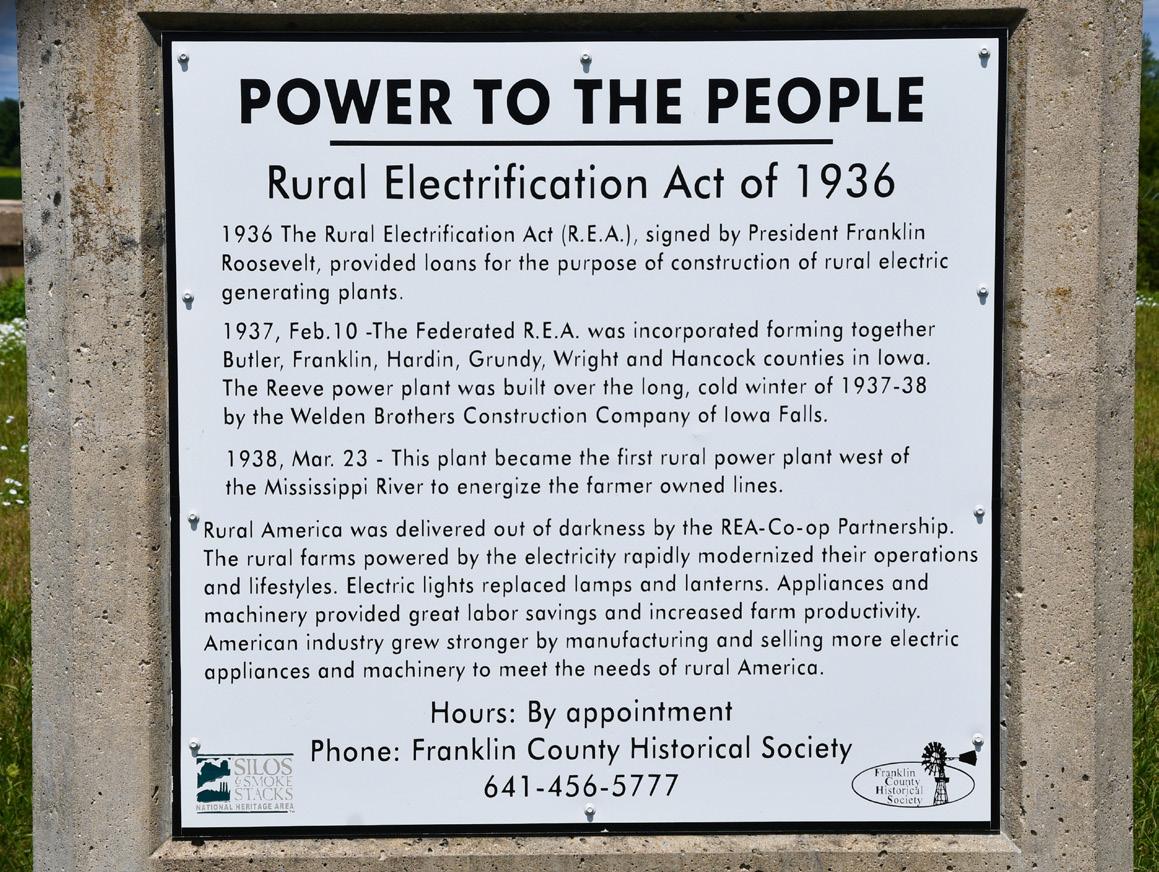

Rural Electrification Administration representative John Carmody announced Feb. 10, 1937 at the Hotel Wahkonsa, Fort Dodge, Iowa, that the REA had allotted funds for two generating plants to serve the nine RECs in north central Iowa.

With Carmody’s announcement, two generation and transmission cooperatives were the first in the nation to receive REA funds for electric generation.

Central Electric Federated Cooperative Association — more commonly called Central — was formed by the partnership of four western cooperatives that decided to locate their headquarters and generating plant in Pocahontas. Those co-ops were Calhoun County Electrical Cooperative Association, Pocahontas REC, Humboldt County REC and Buena Vista County REC. Sac County REC joined Central in 1939.

The five cooperatives from the eastern area formed Federated Cooperative Power Association — known as Federated — with its generating plant near Hampton. Federated consisted of Hardin County REC, Franklin REC, Butler County REC, Grundy County REC and Wright County REC. Hancock County REC became a member in November of 1937.

These two organizations — central and federated — would later merge and become what we know today as Corn Belt Power Cooperative.

Our mission to provide safe, reliable and affordable electricity to our membercooperatives remains the same. We also face what some might consider mounting challenges.

Corn Belt Power Cooperative 2022 Annual Report 5

This placard sits outside the Rural Electrification Administration Museum near Hampton which is also the location of the first REA-financed generating plant to go on line on March 15, 1938.

The 1950 board of directors serving Corn Belt Power Cooperative included (front row from left) Herman Reinicke, Grundy County REC: Cloyd Hass, Calhoun County Electric Cooperative Association; Omar Maland, Hancock County REC; W.T. Roche, Sac County REC; Max Soeth, D.E.K. REC; and George Kirstein, Wright County REC; (back row from left): A.G. Rust, Franklin REC; H.G. Dokken, Buena Vista County REC; Ben Jaspers, Hardin County REC; Cecil Laydon, Butler County REC; Arthur Strachan, Humboldt County REC; and Henry Hope, general manager.

What we know as Corn Belt Power Cooperative today was formed back in 1937 inside the Wahkonsa Hotel in Fort Dodge.

6 Power Shines Through

Steve Curry, retired meter technician, Corn Belt Power Cooperative shares a sign of peace at the 75th anniversary celebration in Humboldt Aug. 25.

Ken Kuyper, right, executive vice president and general manager, Corn Belt Power Cooperative reminisces about co-op memories with more than 200 employees, directors, retirees, member system managers and special guests at Corn Belt Power Cooperative’s 75th anniversary celebration Aug. 25. The cooperative’s articles of incorporation were established August 28, 1947.

Bill Fort, retired journeyman electrician, Corn Belt Power Cooperative soaks in co-op memorabilia that Sarah Dornath, administrative assistant, put on display for the co-op’s 75th anniversary celebration at the Humboldt County Fairgrounds Aug. 25.

7 Corn Belt Power Cooperative 2022 Annual Report MWH MWH Annual Capacity Factor Location Fuel 2021 2022 2022 WISDOM 1 Spencer, Iowa Natural Gas/Fuel Oil 0 642 0.20% WISDOM 2 Spencer, Iowa Natural Gas/Fuel Oil 5,268 447 0.13% WALTER SCOTT 3 Council Bluffs, Iowa Coal 129,390 133,546 58.14% WALTER SCOTT 4 Council Bluffs, Iowa Coal 157,204 170,477 43.44% NEAL 4 Sioux City, Iowa Coal 153,048 110,786 17.38% CROSSWIND Ayrshire, Iowa Wind 66,992 73,901 40.17% HANCOCK Hancock County, Iowa Wind 27,030 34,956 35.57% ILEC WIND Superior/Lakota, Iowa Wind 69,877 83,410 45.34% ILEC WIND Superior/Lakota, Iowa Wind 75,204 69,877 37.98% 2022 ENERGY SUPPLIED

by Corn Belt Power to Basin Electric and NIMECA 2022 DEEMED KWH SAVINGS FROM ENERGY EFFICIENCY PROGRAMS Residential Rebates Geothermal Heat Pumps Air Source Heat Pumps Residential Lighting High Efficiency Water Heaters Insulation & Weatherization ENERGY STAR Appliances Low Income Kits Air Conditioning and Other C&I/Agriculture Rebates Lighting Motors Ag and Other 0 100,000 200,000 300,000 400,000 500,000 0 500,000 1,000,000 1,500,000 2,000,000 2,500,000 3,000,000

Supplied

Member Cooperative Rates

Average member system cost, including substation charge; calculated average member co-op rate reflects power sold to municipals and others served by the cooperatives.

8 Power Shines Through

80 70 60 50 40 30 20 10 Mills/kWh 1980 1985 1990 1995 2000 2005 2010 2015 2022

Corn Belt Power Cooperative’s control center employees practice shedding load as part of the Southwest Power Pool’s load shed test Feb. 16. The drills are conducted multiple times each year to prepare for a load-shed situation.

Cody Montgomery, control operator, Corn Belt Power Cooperative, controls Wisdom Unit 2. Although in reliability mode, both units were called on throughout the year to provide power within the SPP footprint.

In 2022, the North American Electric Reliability Corporation (NERC) released a report outlining their 2022 Summer Reliability Assessment, and later a winter assessment. In the reports, NERC raised concerns regarding several regional transmission organizations (RTOs) and their challenges related to electric generation and transmission this summer. One of those RTOs is the Southwest Power Pool (SPP) whose system experienced energy emergency alerts (EEAs) just before Christmas. These alerts further reinforce what we already know: the energy transition must consider all forms of generation.

More renewable energy sources like wind and solar power are coming online, while traditional sources like coal, nuclear and natural gas are retiring. While there are benefits to renewable energy, Corn Belt Power believes and advocates for an all-of-the-above energy approach. All-of-the-above promotes the idea that the United States depends on a reliable and sustainable fuel supply that includes developing and incorporating domestically produced renewable energy resources to supplement baseload generation that includes biofuels, natural gas, nuclear, hydropower and coal.

Corn Belt Power continues to work with policymakers and regulators on the state and federal level for a sensible all-of-theabove generation approach. The ongoing energy transition must recognize the need for time and technology development, while including all energy sources to maintain reliability and affordability. A resilient and reliable electric grid that affordably keeps the lights on is the cornerstone of our rural economy.

Corn Belt Power Cooperative 2022 Annual Report 9

Minnesota North Dakota South Dakota Iowa Nebraska Kansas Oklahoma Missouri Arkansas Texas New Mexico Wyoming Montana Louisiana Colorado 14-state regional map

North

Iowa

Corn

Belt Power Cooperative Service Territory:

central

Tyler Herrig, electronics technician and John Naber, electrical/control, calibrate pressure switches on Wisdom Unit 2 as part of routine maintenance Nov. 1.

Corn Belt Power Cooperative’s Wisdom Station power plant in Spencer is a peaking generation resource. In 2022, when grid conditions tightened, the plant produced power for consumers across the SPP footprint.

Corn Belt Power Cooperative’s Wisdom Station power plant in Spencer is a peaking generation resource. In 2022, when grid conditions tightened, the plant produced power for consumers across the SPP footprint.

While the challenges may seem steep, Corn Belt Power continues to endure. Our membership in the SPP regional market continues to produce positive economic results. We are able to upgrade and rebuild our electric system as a byproduct of that relationship. In 2022, crews completed more than 63 miles in transmission line rebuilds. With another 92 miles in progress, 2023 shapes up to be another busy year. Crews completed the Algona to Hancock to Klemme 41.5-mile line rebuild that began in 2021. Crews set poles for the 14.4-mile Humboldt Station to Weaver Station rebuild. Line will be strung in 2023.

Across the system, electrical maintenance and meter crews electrified and/or built new substations and switching stations

and replaced aging infrastructure where needed.

On the power supply side, Corn Belt Power commissioned its first battery project at its Hampton Substation location in December. The 1.425-megawatt battery will help manage load in times of peak demand and will pay for itself in 12 years.

Wisdom Station continued to stay on alert throughout 2022. In reliability mode, the plant isn’t called upon as much as it once was. However, in December, when grid conditions tightened during the EEAs, Wisdom Station Unit 2 answered the call and provided power within the SPP footprint. Both units also ran in July during an SPP resource advisory.

Corn Belt Power Cooperative 2022 Annual Report 11

2500 2000 1500 1000 500 0 Million kWh 1963 1973 1983 1993 2003 2013 2022

Total Sales

We began construction of a new vehicle storage facility in 2022. Our existing vehicle storage and warehouse facilities were built in the 1950s. At the time, line trucks were much smaller and digger derrick trucks weren’t very common. In the past 75 years, equipment has become much larger and additional space is needed to safely store equipment.

Corn Belt Power continues to harden its cybersecurity infrastructure. The cooperative’s information technology and electrical maintenance departments installed a new uninterruptible power supply (UPS) system inside the cooperative’s server room in November. The new system will help the cooperative run its critical systems during a power outage until the organization’s generator turns on.

In addition to the UPS system, Corn Belt Power installed a new ransomware prevention tool called Rubrik; introduced a new Skyhelm security operations center; instituted a multifactor authentication program; and began phase two of NRECA’s RC3 program, which included updates to the cooperative’s disaster recovery and cyber incident plan.

As our first 75 years end, Corn Belt Power Cooperative looks to the next 75. We stand strong as a power supplier and committed partner to more than 34,000 homes, farms, industries and 20,000 municipal customers. This achievement can be attributed to individuals with a far-reaching vision who created the cooperative 75 years ago and to the dedicated people who have worked to make it strong since that time.

David Onken President, Corn Belt Power Cooperative Board of Directors

Kenneth H. Kuyper Executive Vice President and General Manager

12 Power Shines Through

Corn Belt Power began construction of a new vehicle storage facility in 2022. The facility will be used by the Humboldt transmission crew when complete. It is located directly across the new concrete pad, to the north of the cooperative’s headquarters.

Jon Myer, left, IT administrator and Jon Behounek, chief system operator, Corn Belt Power Cooperative, discuss installing the cooperative’s new uninterruptible power system. The system will help operate critical systems during a power outage.

Power Shines Through

13 Corn Belt Power Cooperative 2022 Annual Report

Adam Bird, journeyman lineman, strings new conductor four miles west of Pocahontas along the Pocahontas to Dover line June 21.

Year In Review

Fighting supply chain issues, Corn Belt Power moves system maintenance forward

Despite supply chain issues, 2022 proved busy for the Corn Belt Power crews that completed several system maintenance and improvement projects.

In June, crews electrified the new Whalen Substation inside the Butler Logistics Park. The substation powers Shell Rock Soy Processing.

Electrical maintenance crews replaced arresters and 69 kilo-volt insulators at the following substations: Templeton, Hanover, Gar, Breda, Pioneer, Graettinger, Linn Grove, Boone Valley and Heartland. Elsewhere across the system, electrical maintenance crews upgraded transformers, and replaced switches and regulators.

The cooperative’s meter crew replaced meters at Round Lake, Ayrshire, Klemme, Galbraith, Estherville Municipal One and Two and Eagle Grove.

14 Power Shines Through

Corn Belt Power Cooperative’s Justin Hesnard, left, journeyman electrician, and Shawn Ruberg, meter technician, install a meter at the new Whalen Substation inside the Butler Logistics Park May 18.

Corn Belt Power Cooperative 2022 Annual Report 15

The Whalen Substation (bottom left) powers Shell Rock Soy Processing inside the Butler Logistics Park.

Crews begin Humboldt to Weaver upgrade

Corn Belt Power’s transmission crews set 243 new poles along the Humboldt to Weaver Switching Stations line section in 2022.

This major system improvement will see more than 14 miles of line rebuilt when complete. One of those miles is a brand new line that extends from the old Humboldt-Sherwood line section to Humboldt-Pocahontas. The existing stretches of line travel west from the Humboldt Switching Station to Pocahontas. When the new Humboldt to Weaver line is complete, the cooperative will retire 10 miles of old line that is considered its Humboldt to Pocahontas path.

Ampacity ratings and having a fiber path from Humboldt towards the west is a major reason for rebuilding this line section, but the addition of ties to the new Weaver Switching Station will increase our system reliability to our members.

16 Power Shines Through

As part of the Humboldt to Weaver system upgrade, Corn Belt Power electrical maintenance crews build the new Weaver Switching Station three miles south of Gilmore City Oct. 31.

2022 TRANSMISSION PROJECTS

NEW LINES:

Coon Rapids Bitcoin Tap 0.32 miles

RECONDUCTORED LINE:

Pocahontas-Dover 10.7 miles

REBUILT LINE:

Algona-Hancock-Klemme 41.5 total miles

• 28.53 miles complete (2021)

• 12.97 miles complete (2022)

Sherwood-Manson: 29.1 miles of rebuild; 1.72 miles new construction

• 191 poles set (2021)

• 298 poles set; 29.1 miles of new conductor strung (2022)

• 34 poles to set; 1.72 miles of new conductor to string (2023)

PROJECTS IN PROGRESS:

Humboldt-Weaver: 14.4 miles

Parkersburg-Aplington Junction: 10.9 miles

Aplington Junction-Wellsburg: 11.4 miles

Buckeye-Wellsburg: 30.5 miles

Pocahontas-Weaver: 13.2 miles

Coon Rapids Tap: 6.37 miles

Weaver-Manson: 14.61 miles

TOTAL COMPLETE: 63.99 MILES

TOTAL IN PROGRESS: 92.2 MILES

Corn Belt Power Cooperative 2022 Annual Report 17

Humboldt transmission crews set new poles along the new Humboldt to Weaver line Nov. 2. This is part of the 2022 Humboldt to Weaver system upgrade. When complete, more than 14 miles of transmission line will be rebuilt.

Corn Belt Power completes battery project

Thanks to the cooperative principle of “Cooperation Among Cooperatives,” Corn Belt Power’s service territory now has a fully functioning battery energy storage system as of Nov. 18, 2022.

Basin Electric Power Cooperative introduced a member-owned Trial Battery Rate into its rate book in 2019. The rate allocates up to 150 kilowatts per Class C distribution cooperative.

Corn Belt Power collaborated with its membership to develop a plan that allows each member-cooperative to pool its individual allocation and create one large battery energy storage system. This system is a 1.425 megawatt Tesla® Megapack which Corn Belt Power integrated into the Hampton Substation.

The total project cost nearly $3.5 million, which includes the battery pack, engineering, site preparation and labor. The stored power from the battery will allow Corn Belt Power to avoid purchasing 1.425 megawatts of power during peak use times for up to six hours. This is enough energy to power roughly 145 homes for six hours at a time. Once the battery’s energy is depleted, it will recharge during off-peak times in preparation for its next disbursement.

Corn Belt Power Generation Mix*

*Estimated percentages for 2021 comprise Basin Electric Power Cooperative’s and Western Area Power Administration’s generation supplies. Numbers for 2022 were not available at the time this report was published.

This information does not allow any cooperative member to claim environmental attributes of power supply since some renewable energy certificates are sold to improve the economics of the renewable generation.

For more information, contact Ryan Cornelius, vice president, corporate relations, Corn Belt Power Cooperative, 1300 13th St. North, Humboldt, IA 50548, (515) 332-7726; ryan.cornelius@cbpower.coop

18 Power Shines Through

to member systems COAL 42.0% PURCHASE 25.5% RENEWABLE OTHER ...... 19.5% NATURAL GAS .................. 6.6% RENEWABLE HYDRO 6.3% NUCLEAR 0.0% OIL/DIESEL ........................ 0.1%

Delivered

Corn Belt Power Cooperative’s new battery energy storage system sits inside the Hampton Substation, next to the Rural Electrification Administration Historical Museum.

The 1.425-megawatt battery system installed Aug. 29 will discharge energy during times of peak demand. It is used as a load management tool.

Clothing design inspired by historical REC logo

Each year Marena Fritzler, marketing director, and Jennifer Arndorfer, human resources specialist, create a Corn Belt Power Cooperative clothing item that employees may choose to order.

In January, Corn Belt Power Cooperative released a throwback t-shirt design that gave a 50-yearanniversary nod to the Rural Electric Cooperative logo originally developed by Corn Belt Power and officially adopted by the National Rural Electric Cooperative Association at NRECA’s 1971 Dallas annual meeting.

Decades ago, Corn Belt Power spearheaded the design of this common REC logo and color scheme for use on cooperative vehicles, equipment and uniforms to enhance the image and recognition of RECs in Iowa. It was the first of its kind in the United States.

Harold Severson, author, “Corn Belt: Enthusiasm Made the Difference” noted that Corn Belt Power’s common identification program originated in a carefully planned survey conducted by Corn Belt Power to determine the degree of familiarity of REC members with REC personnel in Corn Belt Power territory. Among other discoveries, the survey stressed the need to identify vehicles so they were instantly identifiable as belonging to an Iowa REC belonging to the Corn Belt Power system.

The Corn Belt Power member service committee who studied and accepted the proposal, settled on yellow as the prime color with green and white stripes to provide contrast. Experts knew that yellow was a strong color and easily recognizable.

19

Cooperative 2022 Annual Report

Corn Belt Power

Member Cooperative Business Name Business Type Load Size (kW) Butler County REC Shell Rock Soy Processing C&I 3,687 Iowa Lakes Electric Cooperative Jones Dairy C&I 300 City of Webster City Karl Chevrolet C&I 208 City of Webster City Edgewood Apartments Residential 208 City of Webster City Pleasant View Elementary School School 218 TOTAL 4,621 2022 New and Expanding Load 2022 New Agricultural Load 500 400 300 200 100 0 2014 2015 2016 2017 2018 2019 2020 2021 2022 Hours WISDOM STATION ANNUAL OPERATING HOURS 20 Power Shines Through Wisdom 1 Wisdom 2 Member Cooperative Business Type Load Size (kW) Butler County REC Agriculture, C&I, Communications, Grain Storage & Residential 415 Calhoun County ECA Agriculture & Grain Storage 15 Franklin REC Agriculture, Manufacturing & Residential 525 Grundy County REC Grain Facilities 75 Iowa Lakes Electric Cooperative Agriculture, C&I, Residential, Grain Storage 3,535 Midland Power Cooperative Agriculture, Grain Storage & Residential 650 Prairie Energy Cooperative Agriculture, C&I, Grain Bins 447.5 Raccoon Valley Electric Cooperative Grain Bins, Livestock & Housing 314 City of Webster City C&I 146 TOTAL 6,122.50 LOAD REDUCTION* Poultry & Municipal 10,800 * Avian influenza caused several poultry facilities to shut down.

Cooperative begins construction of vehicle storage facility

In August, Corn Belt Power Cooperative broke ground on a new vehicle storage facility to the north of its Humboldt headquarters. In 2020, Corn Belt Power purchased an existing storage facility and land surrounding it with plans for future expansion.

The 14,000-square-foot building features eight overhead doors and a truck wash bay. It will also have offices for the Humboldt transmission crew, a breakroom, locker room and shower room. A concrete parking lot now connects the new facility and Corn Belt Power’s existing headquarters building. Among other critical materials, the building will house the Humboldt transmission crew’s 19 vehicles, trailers and line tensioners.

April 12 storms cause damage to co-op’s system

Tornadic activity and strong winds broke 24 poles in the Corn Belt Power Cooperative service territory the evening of April 12. The heaviest damage occurred on the Renwick Tap, impacting Boone Valley Electric Cooperative.

The Iowa Association of Electric Cooperative’s statewide outage map recorded 2,781 outages at the 1 a.m., April 13 peak. Most outages were restored by 6 a.m., April 13.

Corn Belt Power Cooperative 2022 Annual Report 21

Corn Belt Power crews repair line damage near the Renwick Tap following tornadic activity that broke 24 poles within the cooperative’s service territory April 12.

The new vehicle storage facility will house the Humboldt transmission crew across the parking lot to the north of headquarters.

Construction crews continue shaping the inside of the new vehicle storage facility that will hold 19 vehicles, trailers and line tensioners.

Truck accident at Neal Substation causes damage

A semi-truck traveling northbound on Sinclair Avenue south of 290th Street in Butler County, ran off the road and into Corn Belt Power Cooperative’s Neal Substation at 9:40 a.m., Oct. 10. The truck broke through the chain link fence and continued into the substation, causing hundreds of thousands of dollars of damage.

The truck struck and damaged two 833 kilovolt-ampere transformers, the station service transformer, a meter cabinet and tore down the 69 and 12.5 kilovolt unregulated bus.

22 Power Shines Through

The semi-truck came to rest on its side, inside the Neal Substation. No serious injuries were reported in the Oct. 10 crash.

A semi-truck crashed into the Neal Substation Oct. 10. The truck damaged two transformers, a meter cabinet and tore down a bussing system.

UNBLEMISHED FINANCES

S&P Global affirms ‘A’ Rating

S&P Global Ratings affirmed its ‘A’ issuer credit rating for Corn Belt Power Cooperative. The rating reflects S&P’s view of the general creditworthiness of Corn Belt Power under criteria for rating U.S. Cooperative Utilities.

The rating further reflects Corn Belt Power’s strengths, including:

• Strong membership base with nine RECs that have longterm contracts through 2075 that match Corn Belt Power’s contract with Basin Electric Power Cooperative

• Broad service area economy that is heavily agricultural, with member co-ops serving farms and rural residences across 41 counties in northern Iowa, which has historically exhibited an unemployment rate below the national average

• Rate-setting autonomy, annual review of member rates, and a discretionary power cost adjustment (PCA) mechanism, which offers timely cost recovery

Partly offsetting the aforementioned strengths, in S&P’s view, includes Corn Belt Power’s:

• High reliance on coal-fired generation for 42 percent of total power supply in 2021

• Concentrated customer base, with about 20 percent of revenue in 2021 attributable to the REC’s top 10 customers, six of which are ethanol refineries, which have more volatile operations and revenue due to the price nature of ethanol and corn in addition to price variations in grains and energy sources

• Decline in debt service coverage to an adequate level at 1.1x in fiscal 2021, which S&P Global projects will stay between about 1.06x and 1.1x during the next five fiscal years

The stable outlook reflects S&P Global’s view that Corn Belt Power’s liquidity will provide the cooperative with financial flexibility to meet obligations, while the contract with Basin

2022 Annual Report 23

Corn Belt Power Cooperative transmission crews string new conductor along the Pocahontas to Dover line June 16.

Corn Belt Power Cooperative

Record sales realized in 2022

In 2022, Corn Belt Power sold 2.062 billion kilowatt hours, marking another record year in sales, up from 2.059 billion in 2021.

While sales marked a record in 2022, it fell shy of Corn Belt Power’s projected increase. This is due in part to mild temperatures throughout the year and large loads offline for maintenance and avian influenza.

Heating and cooling degree days remained on par with record sales years in 2018 and 2021. However, loads continue to grow across Corn Belt Power’s system, something that isn’t projected to change in the coming years.

With record sales, Corn Belt Power also saw demand reach record levels in five of 12 months.

Corn Belt Power was able to use its load management program to reduce load during peak times. We recorded a 6,806 kilowatt reduction over the course of the year and cycled load 61 days in 2022. Corn Belt Power’s load management program saved member systems a combined $1.66 million in 2022.

Corn Belt Power returns money to members in the form of bill credit

Corn Belt Power’s board of directors made decisions that impacted the bottom line of the organization’s member-cooperatives.

Basin Electric Power Cooperative took advantage of high 2021 and 2022 commodity prices with fertilizer and by-product sales from its wholly owned subsidiary, Dakota Gasification Company and continued operational efficiencies to post strong operating margins.

The Corn Belt Power board of directors voted to return more than $9.7 million in bill credits in calendar year 2022.

Estimated Demand Reduction

24 Power Shines Through

14 12 10 8 6 4 2 0 MW JAN FEB MAR APR MAY JUN JUL AUG SEP OCT NOV DEC

REFINING SKILLS AND SHARING KNOWLEDGE

Co-ops meet with legislators

On December 20, Corn Belt Power Cooperative, Midland Power Cooperative, Calhoun County Electric Cooperative Association, Raccoon Valley Electric Cooperative and Prairie Energy Cooperative hosted the annual Fort Dodge area Legislator Breakfast. The group met with Senator Jesse Green, Senator Dennis Guth, Senator Tim Kraayenbrink, State Representative Mike Sexton and Mark Thompson. The group discussed a wide variety of issues, including rural tax equity.

Also in 2022, more than 200 rural electric cooperative employees and directors, representing 36 co-ops, traveled to the Iowa State Capitol Tuesday, March 22 to advocate on behalf of their memberowners during the annual REC Day on the Hill event.

Corn Belt Power Cooperative 2022 Annual Report 25

Jim Gossett, chief executive officer, Raccoon Valley Electric Cooperative, speaks to legislators and cooperative representatives during the annual Fort Dodge area Legislative Breakfast at the Starlite Best Western Dec. 20.

More than 200 electric cooperative employees visit with legislators during the annual REC Day on the Hill event at Iowa’s state capitol building March 22.

Corn Belt Power hosts Orientation Days

Corn Belt Power Cooperative welcomed more than 40 new directors and employees across two days at its Orientation Days Jan. 13 and 19. Those present learned about Corn Belt Power’s power supply, relationship with Basin Electric Power Cooperative, engineering and operations, corporate relations, finance and administration and business development departments.

2022 Load Management Statistics

26 Power Shines Through

40 35 30 25 20 15 10 5 0 JAN FEB MAR APR MAY JUN JUL AUG SEP OCT NOV DEC Approaching Peak Hours Peak Alert Hours Control Days

Jon Behounek, chief system operator, explains the Corn Belt Power Cooperative system map to Orientation Day attendees during a Jan. 13 control center tour in Humboldt.

Momentum is Building returns

After taking 2021 off due to safety precautions, the Momentum is Building Conference was back in session in 2022. Sponsored by the Touchstone Energy Cooperatives of Iowa, the annual twoday conference provides education and training opportunities for Iowa contractors, electricians, plumbers, HVAC professionals and builders.

Nearly 200 industry professionals and electric co-op employees attended the 2022 conference in Altoona.

16-17, 2023

Momentum building is Februar y

Corn Belt Power Cooperative 2022 Annual Report 27

Instructor Dave Sullivan teaches attendees electrical code at the Feb. 2022 Momentum is Building Conference. Sullivan provided six continuing education units to more than 70 electricians during the conference.

Nearly 200 industry professionals and electric co-op employees attended the 2022 Momentum is Building conference in Altoona.

Corn Belt Power, Basin Electric hold training session

Education, information and training is one of the seven cooperative principles and on Feb. 16, more than 10 energy services employees from across the Corn Belt Power service territory exercised that principle. Chad Reisenauer, director of community and member relations, Basin Electric Power Cooperative, trained the group of employees on how to use a blower door and how to conduct a blower door test at a residence. The group performed the test and training at a home in the new IGL housing development in Spencer.

LEAD alumni tour WAPA site

Alumni from Corn Belt Power’s Leadership Exploration and Development program (LEAD) toured Gavins Point Dam June 21. The dam, located on the Missouri River near Yankton, SD, is home to three, 44 mega-watt turbines and is operated by the U.S. Army Corps of Engineers. The power generated at the station is marketed by the Western Area Power Administration (WAPA). Corn Belt Power has a 22 megawatt WAPA allotment in its power supply.

28 Power Shines Through

Chad Reisenauer, director of community and member relations, Basin Electric Power Cooperative, provided home energy audit training for energy advisors in Spencer Feb. 16.

A group of Corn Belt Power Cooperative LEAD alumni snap a group photo June 21 following a tour of the Gavins Point Dam located in Yankton, S.D. Employees photographed from left are: Sam Moore, accountant III; Patrick Connor, plant manager; Rod Stephas, assistant plant manager; Tyler Herrig, electronics technician; Jim Mertz, electrical maintenance foreman; Eric Hankey, SCADA technician; Matt Donald, electrical maintenance foreman; John Naber, electrical/control; Brittany Dickey, vice president, business development; and Courtney Christensen, administrative assistant.

Gilbert retires, Thompson and Boedecker join board

Corn Belt Power Cooperative honored Charlie Gilbert, longtime Midland Power Cooperative and Corn Belt Power Cooperative director, following its April 6 annual meeting. Gilbert served as a Corn Belt Power director for 22 years. In addition, he served as the cooperative’s Basin Electric board representative since 2009.

Corn Belt Power’s membership elected Rick Thompson to replace Gilbert on the co-op’s board of directors. Thompson lives in LuVerne in Kossuth County. He farms soybeans and corn and is a hog and cow-calf producer. He was elected to Midland Power Cooperative’s board of directors in 2008.

At the same time, the board elected Jerry Beck to serve as Corn Belt Power Cooperative’s Basin Electric Power Cooperative board delegate. Also in 2022, Steve Boedecker replaced LaVerne Arndt as Calhoun County Electric Cooperative Association’s board delegate.

Corn Belt Power Cooperative’s board president, Dave Onken, left, and Kerri Mertz, executive assistant, honor Charlie Gilbert, longtime Midland Power Cooperative and Corn Belt Power Cooperative director, following the G&T’s April 6 annual meeting.

Corn Belt Power Cooperative 2022 Annual Report 29

Steve Boedecker, left, director, Corn Belt Power Cooperative and Calhoun County ECA; Keaton Hildreth, CEO, Calhoun County ECA; Mike Sexton, State Representative; and Jim Miller, director, Calhoun County ECA, talk cooperative issues at the annual REC Day on the Hill March 22.

Volunteer contest returns

Shine the Light, the statewide contest that highlights community volunteers, returned for its second year in 2022. Nicole Low, Eldora, won one of the $2,000 community grants for her work with Eldora’s Community Garden.

The garden is predominately a donation garden, but also offers leased plots for community members. In 2021, the garden donated more than 9,000 pounds of produce to the local food pantry.

Low and a friend created the garden several years ago when she noticed food insecurity in her community and in Midland Power Cooperative’s service territory.

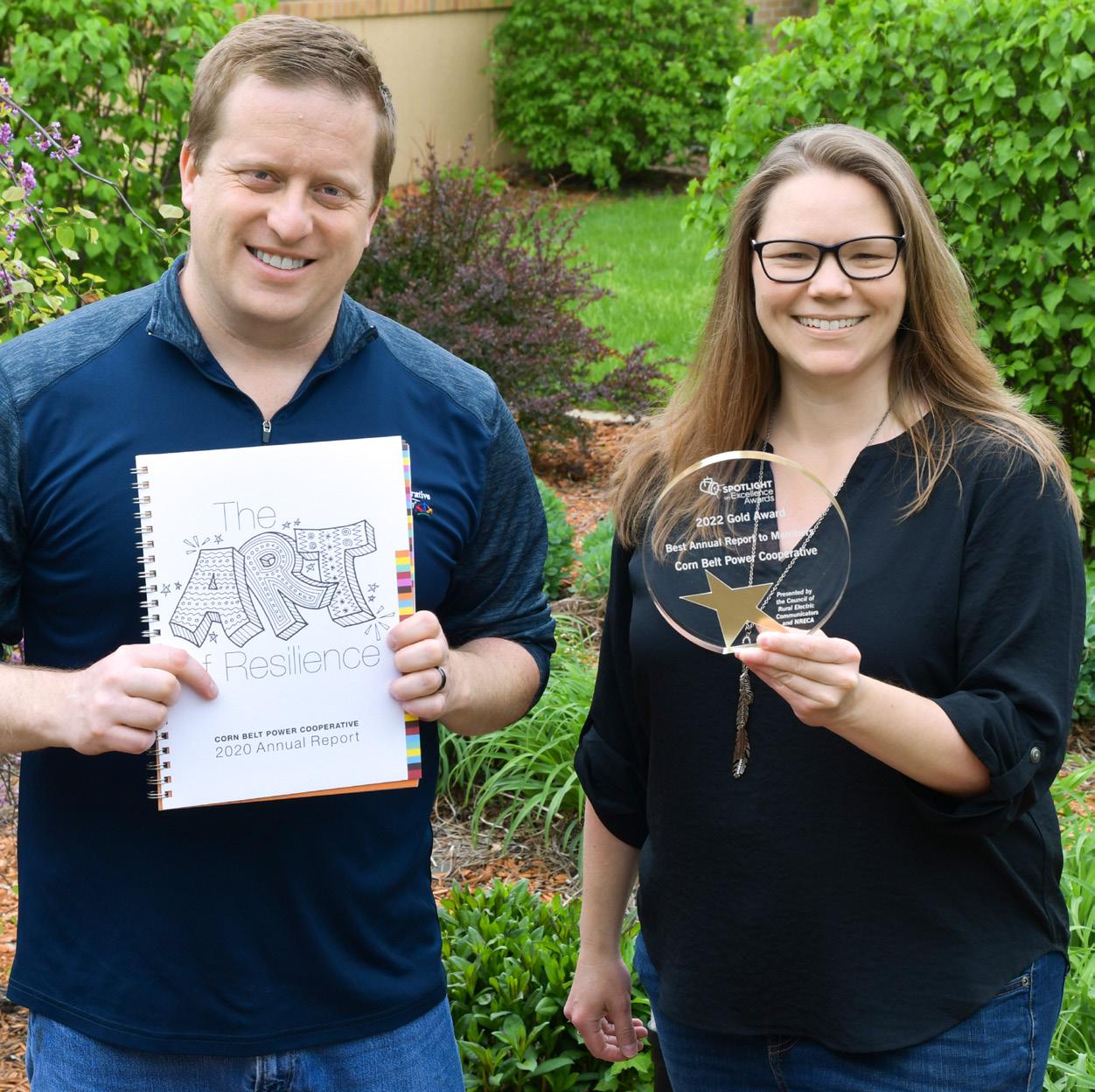

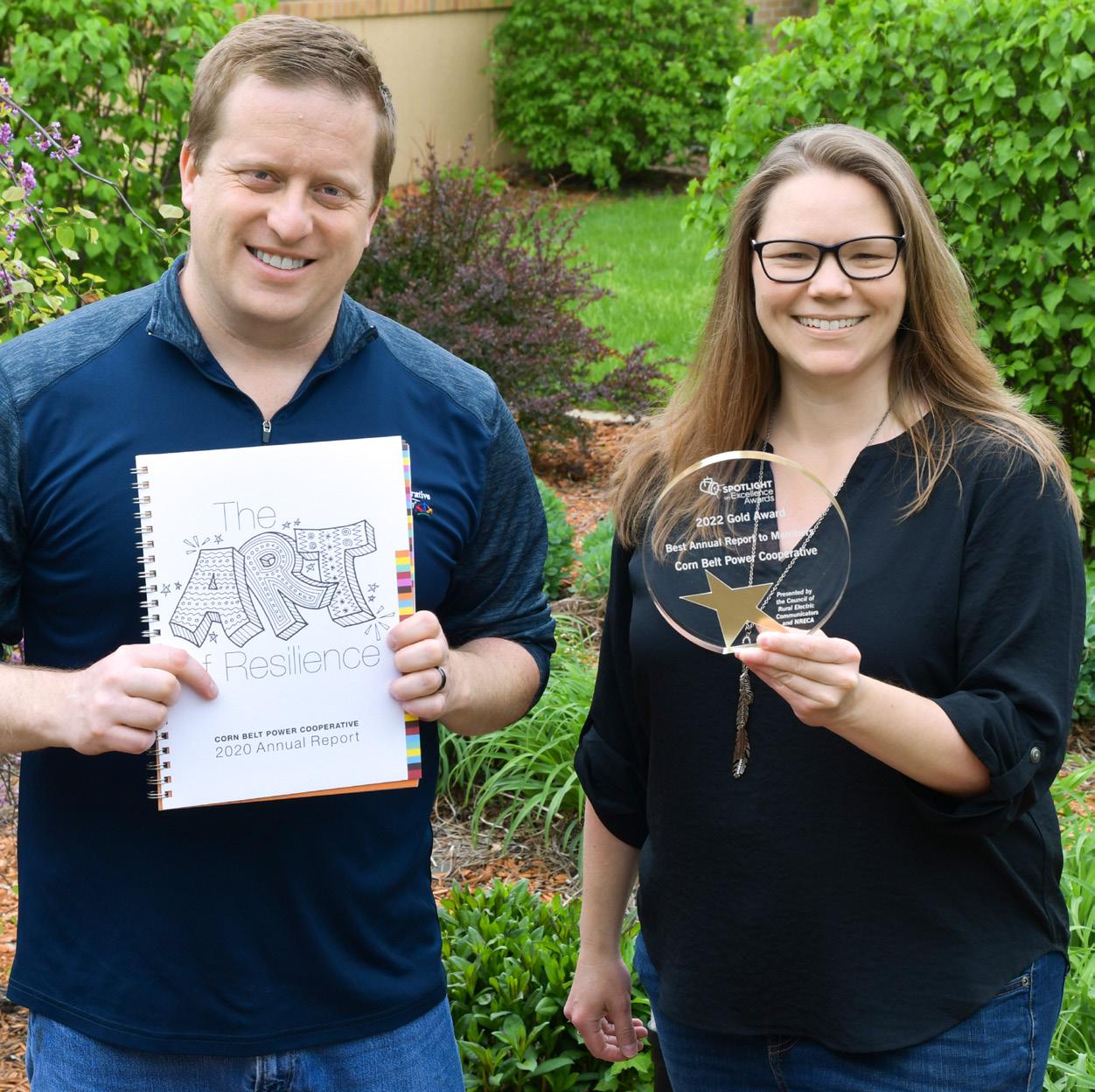

Annual Report earns Gold

In the 2022 “Spotlight on Excellence” national awards program, Corn Belt Power Cooperative received the firstplace Gold Award in the Best Annual Report to Members category for its 2020 annual report “The Art of Resilience.”

In addition, the cooperative also shared a Gold Award for Best Total Communication Program with NIPCO, CIPCO and the Iowa Association of Electric Cooperatives. The group won the award for its inaugural Shine the Light volunteer program.

30 Power Shines Through

Corn Belt Power Cooperative’s Corporate Relations team, Ryan Cornelius, left, vice president, corporate relations and Marena Fritzler, marketing director, display the first-place Gold Spotlight on Excellence Award for Corn Belt Power Cooperative’s 2020 annual report “The Art of Resilience.”

Nicole Low, 2022 winner, Shine the Light volunteer contest, is responsible for creating the Eldora Community Garden that produced more than 9,000 pounds of produce for the local food pantry in 2021.

Infrastructure dedications honor cooperative leaders

Corn Belt Power Cooperative and Butler County REC honored three longtime cooperative leaders at the Waverly Area Veterans Post April 11. Donald Feldman, former Corn Belt Power board president, now has a switching station in his name. Feldman dedicated 29 years-of-service to Corn Belt Power’s board of directors. Butler County REC chose to name two new substations after Robert Bauman, former CEO/general manager, and Rick Whalen, former economic development director. Bauman worked at the cooperative for 41 years, while Whalen spent 25 years helping develop the rural economy in Butler County REC’s footprint. The substations and switching station are located inside the Butler County Logistics Park.

The new infrastructure serves TrinityRail and the new Shell Rock Soy Processing facility.

Businesses receive awards

The Iowa Area Development Group (IADG) and its Rural Electric Cooperative partners honored seven distinguished Iowa companies with the Iowa Venture Award at a luncheon held in conjunction with the Iowa Association of Electric Cooperatives’ annual meeting, Dec. 1. Of those receiving awards, four businesses on Corn Belt Power Cooperative’s system were honored.

Shell Rock Soy Processing (Butler County REC) received Business of the Year, while Marker 126 (Prairie Energy Cooperative and Midland Power Cooperative), G Metal (Iowa Lakes Electric Cooperative) and CNI (Midland Power Cooperative) each won Venture Awards.

Corn Belt Power Cooperative 2022 Annual Report 31

Butler County REC and Corn Belt Power Cooperative honored from left, Bob Bauman, Don Feldman and Rick Whalen for their years of dedicated cooperative service with substations and switching station namesake dedications April 11 in Waverly.

Iowa Area Development Group awarded Shell Rock Soy Processing with the Outstanding Business of the Year award at the 2022 Venture Awards Luncheon Dec. 1. Shell Rock Soy Processing is located in the Butler Logistics Park, served by Butler County REC. The processing facility will employ 50-60 people once fully operational and crush 40 million bushels of soybeans annually.

ADDING BRILLIANCE TO THE COMMUNITIES WE SERVE

Joining a worthy cause

In 2022, Corn Belt Power joined a statewide coalition to end human trafficking in Iowa. The Iowa Secretary of State’s office launched the Iowa Businesses Against Trafficking (IBAT) initiative January 2022, with the goal to have Iowa’s business community raise awareness and help prevent human trafficking.

IBAT membership is open to any business or nonprofit organization that operates in the State of Iowa and shares a commitment to taking steps to promote awareness of human trafficking and the Iowa Safe at Home program. Safe at Home is an address confidentiality program for survivors of human trafficking and other violent crimes.

Join today and help make Iowa a traffic-free state: https://ibat.iowa.gov

Power Shines Through 32

Cooperation among cooperatives results in large donation

Grundy County REC, Corn Belt Power Cooperative, Basin Electric Power Cooperative and CoBank teamed up to donate $9,000 to Maroon & White Inc., the nonprofit organization funding the Uncky Daylo Kids Campus, a new childhood development center in Grundy Center.

The center is located inside the 33,000-square-foot former Upper Elementary building in Grundy Center. The existing two-story brick building, built in 1939, is undergoing major renovation. The local daycare will expand from 41 to 72 children inside the renovated space. Also, the YMCA before and after school program will accommodate a 50 percent increase in enrollment.

North Central Iowa Research Farm receives donation

Corn Belt Power, Prairie Energy Cooperative, Basin Electric Power Cooperative and CoBank teamed up to donate $6,000 to the North Central Iowa Research Farm in Kanawha. The research farm sought funding to build a new shop/office/meeting room adjacent to their existing building.

The research farm is used for educational purposes for all ages. The farm totals 92 acres, 80 of which are dedicated to research. Researchers study corn, soybeans, fertility, tillage, cropping systems, cover crops, insects, disease, weed management and tile. The farm is run by the Iowa State University Extension Office.

Through its Commitment to Community initiative, Corn Belt Power donated more than $20,000 to local charities, causes and organizations in 2022.

Corn Belt Power Cooperative 2022 Annual Report 33

Todd Foss, third from left, Prairie Energy Cooperative, presents donation check to North Central Iowa Research Farm representatives to help build a new shop. Pictured from left: Mark Grundmeier and Blake Smith, North Iowa Research Association; Todd Foss; Mervin Krauss, North Iowa Research Association; and Brandon Zwiefel, agriculture specialist, North Iowa Research Farm.

Mike Geerdes, left, CEO and Allyson Miller, executive assistant and human resources, right, Grundy County REC, present a $9,000 donation check to Melody Hoy and Jan Onnen of Maroon and White, Inc. Nov. 10. Coordinated donations from Grundy County REC, Corn Belt Power Cooperative, Basin Electric Power Cooperative and CoBank to Maroon and White, Inc. will help renovate an old school building into a new child development center in Grundy Center.

Golf event proves popular again

Area business representatives networked with cooperative system employees at the Touchstone Energy Cooperatives of Iowa Golf Outing at Spring Valley Golf Course, Livermore, June 7.

The event included more than 70 cooperative employees and key commercial and industrial account representatives from across Corn Belt Power’s system.

Employees contribute to community building project

Corn Belt Power Cooperative joined businesses and individuals across the community to contribute a donation and employee volunteer time to help construct the new Humboldt Wildcat Wonderland Aug. 16-19. The community finished playground construction just in time for the start of a new school year.

34 Power Shines Through

Kevin Bornhoft, vice president, engineering and system operations, Corn Belt Power Cooperative contributes his woodworking skills to build Wildcat Wonderland.

Natalie Brown, accounts payable/ general accountant, Iowa Lakes Electric Cooperative, chips onto the green at Spring Valley Golf Course.

Travis Grouge, Superior Ethanol, preps for a drive at the Touchstone Energy Cooperatives of Iowa golf outing June 7.

Ashly Zinnel, accountant III, Corn Belt Power Cooperative routes playground boards.

35 Corn Belt Power Cooperative 2022 Annual Report

Ryan Conlon, line foreman, Corn Belt Power Cooperative uses pole tongs to change a reel of conductor off the stringing trailer during the Pocahontas to Dover reconductoring project June 21.

Local hospital receives funds through REDL&G program

Prairie Energy Cooperative and Corn Belt Power Cooperative passed through $2.36 million in federal loans to help Iowa Specialty Hospital boost services for Labor, Delivery, Recovery and Postpartum (LDRP) care.

Through the Rural Economic Development Loan and Grant (REDL&G) program, Corn Belt Power sponsored a $1 million loan. Corn Belt Power also sponsored a grant for $300,000 with a $60,000 match from Corn Belt Power to loan a total of $1,360,000 to the hospital for the renovation of its existing footprint to make room for three new LDRP rooms.

CORN BELT POWER COOPERATIVE SYSTEM MAP

Prairie Energy also sponsored a loan of $1 million toward this project. The loans and grant come as a record number of births strain an alreadybusy hospital system, where five of 25 beds are dedicated to labor, delivery, recovery and postpartum care. In 2021, doctors delivered a record 568 babies, compared to 485 in 2020. 1 2 3 4 5 6 2 7 9 8

36 Power Shines Through

1. Iowa Lakes Electric Cooperative 2. Midland Power Cooperative 3. Boone Valley Electric Cooperative 4. Prairie Energy Cooperative 5. Franklin REC 6. Butler County REC

7. Raccoon Valley Electric Cooperative 8. Calhoun County Electric Cooperative Association 9. Grundy County REC North Iowa Municipal Electric Cooperative Association

(NIMECA)

(Serving municipal utilities of Algona, Alta, Bancroft, Coon Rapids, Graettinger, Grundy Center, Laurens, Milford, New Hampton, Spencer, Sumner, Webster City and West Bend)

Prairie Energy Cooperative and Corn Belt Power Cooperative present loan funds totaling more than $2 million to representatives from the Iowa Specialty Hospital in Clarion June 27. These funds help finance a much-needed maternity center expansion. Pictured from left at the check presentation are Steve Simonin, President & CEO, Iowa Specialty Hospitals & Clinics; Todd Foss and Sarah Olson, Prairie Energy; Cindy Hunter, chief quality officer, Iowa Specialty Hospitals & Clinics; Brittany Dickey, vice president, business development, and Stacy Cirks, development finance director, Corn Belt Power Cooperative; and Greg Polzin, chief financial officer, Iowa Specialty Hospitals & Clinics.

2022 Revolving Loan Fund Activity

REDG: Rural Economic Development Grant

REDL: Rural Economic Development Loan

RLF: Revolving Loan Fund

Marker 126, LLC - Duncombe

• Constructed 9,400+ sq. ft. new travel center outside of Fort Dodge along Highway 20.

• Plan to hire 5-8 management positions, 8-10 full-time staff and 12-17 part-time staff.

• Corn Belt Power Cooperative loaned $250,000 from RLF.

• Prairie Energy Cooperative loaned $250,000 from RLF.

• Midland Power Cooperative loaned $250,000 from RLF.

Graettinger Economic Development Council

• Homes for Iowa house purchased and brought into Graettinger.

• Corn Belt Power Cooperative loaned $50,000 from RLF.

• Iowa Lakes Electric Cooperative loaned $50,000 from RLF.

• Homeward Inc. loaned $50,000.

Corn LP - Goldfield

• Equipment expansion to produce higher protein DDG and enhance ethanol output by 5-10 percent.

• Will create 3-4 new full-time positions.

• Corn Belt Power Cooperative loaned $1,500,000 from a REDL.

• Prairie Energy Cooperative loaned $1,500,000 from a REDL.

PSI 2 Go, LLC – Belmond

• Equipment purchase to maximize commercial printing capabilities with a focus on laser personalization, bindery, lettershop and mailing/ distribution capabilities.

• Corn Belt Power Cooperative loaned $250,000 from RLF.

• Prairie Energy Cooperative loaned $250,000 from RLF.

Iowa Specialty Hospital-Clarion

• Building renovation of existing hospital to make room for additional labor, delivery, recovery, and postpartum rooms.

• In 2021 the hospital delivered a record 568 babies. They projected 600+ by the end of 2022.

• Corn Belt Power Cooperative loaned $1,000,000 from a REDL.

• Corn Belt Power Cooperative loaned $360,000 from a REDG.

• Prairie Energy Cooperative loaned $1,000,000 from a REDL.

Western Iowa Energy – Wall Lake

• Equipment expansion to increase production through specialized pre-treatment process.

• Will create four new jobs.

• Corn Belt Power Cooperative loaned $1,500,000 from a REDL.

• Raccoon Valley Electric Cooperative loaned $1,500,000 from a REDL.

Graettinger Economic Development RLF

Marker 126, LLC RLF

PSI 2 Go, LLC RLF

2022 Annual Report 37

Corn Belt Power Cooperative

Human Resources Update

NEW EMPLOYEES

Shane Braun apprentice electrician

Stacy Cirks development finance director

Sam Jacobson ROW technician

Brian Ver Mulm control operator

RETIREMENT

Denny Evans foreman, field engineering

PROMOTIONS

Brittany Dickey manager to vice president, business development

Justin Hesnard apprentice to journeyman electrician

Ethan Petersen apprentice to journeyman lineman

38 Power Shines Through

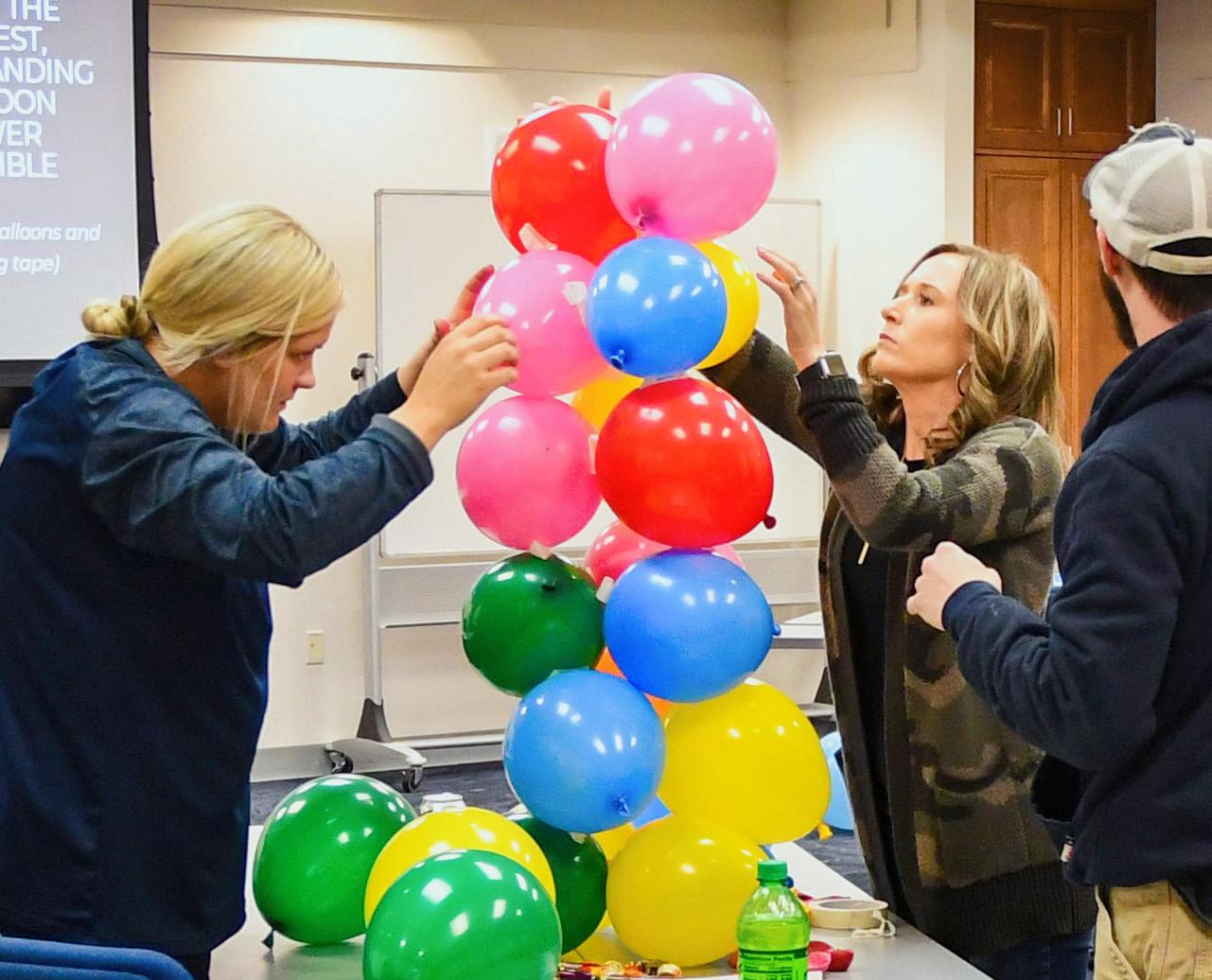

Jena Blackett, left, building custodian and Stacy Cirks, development finance director, Corn Belt Power Cooperative build a balloon tower during an iACT team building exercise for new employees.

Corn Belt Power Cooperative employees, Karen Berte, left, vice president, finance and administration; Jacob Olberding, vice president, power supply; Jacob Howey, communications technician; and Shawn Ruberg, meter technician, practice teamwork in a cup stacking challenge during the “Being Resilient” iACT University training in Humboldt March 30.

Board of Directors

Department Heads

Corn Belt Power Cooperative 2022 Annual Report 39

Ryan Cornelius Vice President, Corporate Relations

Jacob Olberding Vice President, Power Supply

Brittany Dickey Vice President, Business Development

Ken Kuyper Executive Vice President and General Manager

Karen Berte Senior Vice President, Finance and Administration

Kevin Bornhoft Vice President, Engineering and System Operations

Dale Schaefer Vice President, Franklin REC

Gary Poppe Assistant Secretary/Treasurer, Butler County REC

Rick Thompson Midland Power Cooperative

Steve Boedecker Calhoun County ECA

Brad Honold North Iowa Municipal Electric Cooperative Association

Ted Hall Prairie Energy Cooperative

Jerry Beck Secretary, Basin Electric Power Cooperative Representative Iowa Lakes Electric Cooperative

David Onken President, Raccoon Valley Electric Cooperative

Larry Rohach Treasurer, Grundy County REC

Corn Belt Power Cooperative

is a generation and transmission electric cooperative owned by its member systems. Corn Belt Power provides electricity to nine member cooperatives and one member municipal cooperative that serve farms, rural residences, small towns and commercial and industrial members in 41 counties in northern Iowa.

40 Power Shines Through

Purpose:

Mission:

Corn Belt Power Cooperative enhances the quality of life for members, employees and communities.

Responsibly provide reliable, safe and affordable electricity. Support member cooperatives’ success. Enhance employees’ effectiveness. Improve communities’ vitality.

Integrity, Accountability, Commitment, Teamwork www.cbpower.coop 515.332.2571 1300 13th Street North P.O. Box 508 Humboldt, IA 50548 This institution is an equal opportunity provider and employer. Corn Belt Power Cooperative 42 Power Shines Through

Values:

Financials Corn Belt Power Cooperative 2022 Annual Report

CORN BELT POWER COOPERATIVE Financial Statements

December 31, 2022 and 2021

(With Independent Auditors’ Report Thereon)

Independent Auditor’s Report

Independent Auditor’s Report

To the Board of Directors

Corn Belt Power Cooperative Humboldt, Iowa

To the Board of Directors

Corn Belt Power Cooperative

Humboldt, Iowa

Report on the Audit of the Financial Statements

Report on the Audit of the Financial Statements

Opinion

Opinion

We have audited the financial statements of Corn Belt Power Cooperative, which comprise the balance sheets as of December 31, 2022 and 2021, and the related statements of revenue and expenses, comprehensive income, membership capital, and cash flows for the years then ended, and the related notes to the financial statements.

We have audited the financial statements of Corn Belt Power Cooperative, which comprise the balance sheets as of December 31, 2022 and 2021, and the related statements of revenue and expenses, comprehensive income, membership capital, and cash flows for the years then ended, and the related notes to the financial statements.

In our opinion, the accompanying financial statements referred to above present fairly, in all material respects, the financial position of Corn Belt Power Cooperative as of December 31, 2022 and 2021, and the results of its operations and its cash flows for the years then ended in accordance with accounting principles generally accepted in the United States of America.

In our opinion, the accompanying financial statements referred to above present fairly, in all material respects, the financial position of Corn Belt Power Cooperative as of December 31, 2022 and 2021, and the results of its operations and its cash flows for the years then ended in accordance with accounting principles generally accepted in the United States of America.

Basis for Opinion

Basis for Opinion

We conducted our audits in accordance with auditing standards generally accepted in the United States of America (GAAS) and the standards applicable to financial audits contained in Government Auditing Standards, issued by the Comptroller General of the United States. Our responsibilities under those standards are further described in the Auditor’s Responsibilities for the Audit of the Financial Statements section of our report. We are required to be independent of Corn Belt Power Cooperative and to meet our other ethical responsibilities, in accordance with the relevant ethical requirements relating to our audits. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion.

We conducted our audits in accordance with auditing standards generally accepted in the United States of America (GAAS) and the standards applicable to financial audits contained in Government Auditing Standards, issued by the Comptroller General of the United States. Our responsibilities under those standards are further described in the Auditor’s Responsibilities for the Audit of the Financial Statements section of our report. We are required to be independent of Corn Belt Power Cooperative and to meet our other ethical responsibilities, in accordance with the relevant ethical requirements relating to our audits. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion.

Responsibilities of Management for the Financial Statements

Responsibilities of Management for the Financial Statements

Management is responsible for the preparation and fair presentation of these financial statements in accordance with accounting principles generally accepted in the United States of America; and for the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of financial statements that are free from material misstatement, whether due to fraud or error.

Management is responsible for the preparation and fair presentation of these financial statements in accordance with accounting principles generally accepted in the United States of America; and for the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of financial statements that are free from material misstatement, whether due to fraud or error. What inspires you, inspires us.

eidebailly.com 1

|

In preparing the financial statements, management is required to evaluate whether there are conditions or events, considered in the aggregate, that raise substantial doubt about Corn Belt Power Cooperative’s ability to continue as a going concern for one year after the date that the financial statements are available to be issued.

Auditor’s Responsibilities for the Audit of the Financial Statements

Our objectives are to obtain reasonable assurance about whether the financial statements as a whole are free from material misstatement, whether due to fraud or error, and to issue an auditor’s report that includes our opinion. Reasonable assurance is a high level of assurance but is not absolute assurance and therefore is not a guarantee that an audit conducted in accordance with GAAS and Government Auditing Standards will always detect a material misstatement when it exists. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control. Misstatements are considered material if there is a substantial likelihood that, individually or in the aggregate, they would influence the judgment made by a reasonable user based on the financial statements.

In performing an audit in accordance with GAAS and Government Auditing Standards, we:

• Exercise professional judgment and maintain professional skepticism throughout the audit.

• Identify and assess the risks of material misstatement of the financial statements, whether due to fraud or error, and design and perform audit procedures responsive to those risks. Such procedures include examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements.

• Obtain an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of Corn Belt Power Cooperative’s internal control. Accordingly, no such opinion is expressed.

• Evaluate the appropriateness of accounting policies used and the reasonableness of significant accounting estimates made by management, as well as evaluate the overall presentation of the financial statements.

• Conclude whether, in our judgment, there are conditions or events, considered in the aggregate, that raise substantial doubt about Corn Belt Power Cooperative’s ability to continue as a going concern for a reasonable period of time.

We are required to communicate with those charged with governance regarding, among other matters, the planned scope and timing of the audit, significant audit findings, and certain internal control–related matters that we identified during the audit.

2

Other Reporting Required by Government Auditing Standards

In accordance with Government Auditing Standards, we have also issued a report dated March 2, 2023 on our consideration of Corn Belt Power Cooperative’s internal control over financial reporting and on our tests of its compliance with certain provisions of laws, regulations, contracts, grant agreements, and other matters. The purpose of that report is to describe the scope of our testing of internal control over financial reporting and compliance and the results of that testing, and not to provide an opinion on the internal control over financial reporting or on compliance. That report is an integral part of an audit performed in accordance with Government Auditing Standards in considering Corn Belt Power Cooperative’s internal control over financial reporting and compliance.

Report on Other Legal and Regulatory Requirements

In accordance with the Rural Utility Service’s requirements set forth in 7 CFR Part 1773, we have also issued a report dated March 2, 2023, on our consideration of Corn Belt Power Cooperative’s compliance with aspects of contractual agreements and regulatory requirements for electric borrowers. The purpose of that report is to describe the scope of our testing of compliance and the results of that testing, and not directed primarily toward obtaining knowledge of noncompliance. That report is an integral part of procedures performed in accordance with Rural Utility Service’s requirements in considering Corn Belt Power Cooperative’s compliance with certain regulatory requirements.

Sioux Falls, South Dakota

March 2, 2023

3

CORN BELT POWER COOPERATIVE Balance Sheets

CORN BELT POWER COOPERATIVE Balance Sheets

ASSETS

ASSETS

December 31, 2022 and 2021

December 31, 2022 and 2021 See

2022 2021 ELECTRIC PLANT: In service 598,965,397 $ 582,783,702 Less, accumulated depreciation (331,618,755) (322,929,026) 267,346,642 259,854,676 Construction work in progress 10,342,185 8,212,171 277,688,827 268,066,847 OTHER PROPERTY AND INVESTMENTS: Nonutility property 158,958 158,958 Investment in the National Rural Utilities Cooperative Finance Corporation (NRUCFC) 4,999,510 4,926,793 Decommissioning funds 57,914,769 72,779,925 Other investments 106,221,736 90,147,128 Special funds 1,301,736 1,313,848 Notes receivable 11,826,763 8,462,044 Other assets 2,498,057 1,845,477 184,921,529 179,634,173 DEFERRED CHARGES: Decommissioning regulatory asset 10,677,070Bond refinancing regulatory asset 929,256 996,431 11,606,326 996,431 CURRENT ASSETS: Cash and cash equivalents 6,211,578 2,688,894 Special funds 3,700,000 3,700,000 Member accounts receivable 13,071,425 10,295,412 Other receivables 2,293,760 2,215,438 Inventories: Fuel 3,717,767 4,204,601 Materials and supplies 12,388,509 9,426,557 Prepayments 9,024 317,221 41,392,063 32,848,123 515,608,745 $ 481,545,574 (continued)

See accompanying notes to financial statements. 4 2022 2021 ELECTRIC PLANT: In service 598,965,397 $ 582,783,702 Less, accumulated depreciation (331,618,755) (322,929,026) 267,346,642 259,854,676 Construction work in progress 10,342,185 8,212,171 277,688,827 268,066,847 OTHER PROPERTY AND INVESTMENTS: Nonutility property 158,958 158,958 Investment in the National Rural Utilities Cooperative Finance Corporation (NRUCFC) 4,999,510 4,926,793 Decommissioning funds 57,914,769 72,779,925 Other investments 106,221,736 90,147,128 Special funds 1,301,736 1,313,848 Notes receivable 11,826,763 8,462,044 Other assets 2,498,057 1,845,477 184,921,529 179,634,173 DEFERRED CHARGES: Decommissioning regulatory asset 10,677,070Bond refinancing regulatory asset 929,256 996,431 11,606,326 996,431 CURRENT ASSETS: Cash and cash equivalents 6,211,578 2,688,894 Special funds 3,700,000 3,700,000 Member accounts receivable 13,071,425 10,295,412 Other receivables 2,293,760 2,215,438 Inventories: Fuel 3,717,767 4,204,601 Materials and supplies 12,388,509 9,426,557 Prepayments 9,024 317,221 41,392,063 32,848,123 515,608,745 $ 481,545,574 (continued)

4

accompanying notes to financial statements.

CORN BELT POWER COOPERATIVE Balance Sheets

CORN BELT POWER COOPERATIVE Balance Sheets

ASSETS

December 31, 2022 and 2021

31, 2022 and 2021

MEMBERSHIP CAPITAL AND LIABILITIES

2022 2021 MEMBERSHIP CAPITAL: Memberships, at $100 per membership 1,100 $ 1,100 Deferred patronage dividends, restricted 120,385,728 102,892,420 Other equities 64,652,953 63,366,513 185,039,781 166,260,033 LONG-TERM DEBT: Federal Financing Bank 123,943,829 99,091,389 Revenue bonds 11,370,833 12,009,167 NRUCFC 82,809,032 86,452,865 CoBank 962,500 1,732,500 USDA Intermediary Relending Program 11,151,042 7,190,839 230,237,236 206,476,760 Less, current maturities of long-term debt 14,002,290 13,940,086 216,234,946 192,536,674 OTHER LONG-TERM LIABILITIES: DAEC decommissioning liability 68,759,339 68,621,789 Ash landfill retirement obligation 4,095,595 3,785,333 Decommissioning regulatory liability - 4,325,636 Deferred compensation plan 203,061 212,601 73,057,995 76,945,359 CURRENT LIABILITIES: Current maturities of long-term debt 14,002,290 13,940,086 Short-term debt 9,000,000 14,500,000 Accounts payable 11,501,903 10,541,020 Accrued property and other taxes 2,292,561 2,387,644 Deferred credits 3,709,390 3,708,027 Accrued interest and other 769,879 726,731 41,276,023 45,803,508 515,608,745 $ 481,545,574

See accompanying notes to financial statements. 5 2022 2021 ELECTRIC PLANT: In service 598,965,397 $ 582,783,702 Less, accumulated depreciation (331,618,755) (322,929,026) 267,346,642 259,854,676 Construction work in progress 10,342,185 8,212,171 277,688,827 268,066,847 OTHER PROPERTY AND INVESTMENTS: Nonutility property 158,958 158,958 Investment in the National Rural Utilities Cooperative Finance Corporation (NRUCFC) 4,999,510 4,926,793 Decommissioning funds 72,779,925 Other investments 106,221,736 90,147,128 Special funds 1,301,736 1,313,848 Notes receivable 11,826,763 8,462,044 Other assets 2,498,057 1,845,477 184,921,529 179,634,173 DEFERRED CHARGES: Decommissioning regulatory asset 10,677,070Bond refinancing regulatory asset 929,256 996,431 11,606,326 996,431 CURRENT ASSETS: Cash and cash equivalents 6,211,578 2,688,894 Special funds 3,700,000 3,700,000 Member accounts receivable 13,071,425 10,295,412 Other receivables 2,293,760 2,215,438 Inventories: Fuel 3,717,767 4,204,601 Materials and supplies 12,388,509 9,426,557 Prepayments 9,024 317,221 41,392,063 32,848,123 515,608,745 $ 481,545,574 (continued)

December

See accompanying notes to financial statements. 4

CORN BELT POWER COOPERATIVE Balance Sheets

CORN BELT POWER COOPERATIVE

ASSETS

December 31, 2022 and 2021

Statements of Revenue and Expenses Years

2022 2021 OPERATING REVENUE: Sale of electric energy 133,281,213 $ 138,515,889 Other 19,328,961 16,037,257 Total operating revenue 152,610,174 154,553,146 OPERATING EXPENSES: Operation: Steam and other power generation 14,431,998 13,605,816 Purchased power, net 89,261,192 96,694,367 Transmission 5,389,449 5,041,890 Sales 2,649,037 2,496,472 Administrative and general 4,005,176 3,969,856 Maintenance: Steam and other power generation 3,978,030 3,766,409 Transmission 2,093,039 1,898,016 General plant 98,553 96,568 Depreciation and decommissioning 13,817,596 12,258,070 Gain on the disposition of property (2) (1) Total operating expenses 135,724,068 139,827,463 Net operating revenue 16,886,106 14,725,683 INTEREST AND OTHER DEDUCTIONS: Interest on long-term debt 7,614,061 7,620,244 Interest during construction (61,588) (20,339) Other interest and deductions 476,276 246,459 Total interest and other deductions 8,028,749 7,846,364 Net operating margin 8,857,357 6,879,319 NONOPERATING MARGIN: Interest and dividend income 350,347 296,442 Patronage income 14,968,534 4,605,604 Other, net 956,856 498,979 Total nonoperating margin 16,275,737 5,401,025 Net margin 25,133,094 $ 12,280,344

See accompanying notes to financial statements. 6 2022 2021 ELECTRIC PLANT: In service 598,965,397 $ 582,783,702 Less, accumulated depreciation (331,618,755) (322,929,026) 267,346,642 259,854,676 Construction work in progress 10,342,185 8,212,171 268,066,847 OTHER PROPERTY AND INVESTMENTS: Nonutility property 158,958 158,958 Investment in the National Rural Utilities Cooperative Finance Corporation (NRUCFC) 4,999,510 4,926,793 Decommissioning funds 57,914,769 72,779,925 Other investments 106,221,736 90,147,128 Special funds 1,301,736 1,313,848 Notes receivable 11,826,763 8,462,044 Other assets 2,498,057 184,921,529 179,634,173 DEFERRED CHARGES: Decommissioning regulatory asset 10,677,070Bond refinancing regulatory asset 929,256 996,431 11,606,326 996,431 CURRENT ASSETS: Cash and cash equivalents 6,211,578 2,688,894 Special funds 3,700,000 3,700,000 Member accounts receivable 13,071,425 10,295,412 Other receivables 2,293,760 2,215,438 Inventories: Fuel 3,717,767 4,204,601 Materials and supplies 12,388,509 9,426,557 Prepayments 9,024 317,221 41,392,063 32,848,123 515,608,745 $ 481,545,574 (continued)

ended December 31, 2022 and 2021

See accompanying notes to financial statements. 4

CORN BELT POWER COOPERATIVE

Balance Sheets

December 31, 2022 and 2021

Statements of Comprehensive Income Years ended December 31, 2022 and 2021

2022 2021 Net margin 25,133,094 $ 12,280,344 Change in unrealized gain in fair value of debt securities - (386,456) Comprehensive income 25,133,094 $ 11,893,888

See accompanying notes to financial statements. 7 2022 2021 ELECTRIC PLANT: In service 598,965,397 $ 582,783,702 Less, accumulated depreciation (331,618,755) (322,929,026) 267,346,642 259,854,676 Construction work in progress 10,342,185 8,212,171 277,688,827 268,066,847 OTHER PROPERTY AND INVESTMENTS: Nonutility property 158,958 158,958 Investment in the National Rural Utilities Cooperative Finance Corporation (NRUCFC) 4,999,510 4,926,793 Decommissioning funds 57,914,769 72,779,925 Other investments 106,221,736 90,147,128 Special funds 1,301,736 1,313,848 Notes receivable 11,826,763 8,462,044 Other assets 2,498,057 1,845,477 184,921,529 179,634,173 DEFERRED CHARGES: Decommissioning regulatory asset 10,677,070Bond refinancing regulatory asset 929,256 996,431 11,606,326 996,431 CURRENT ASSETS: Cash and cash equivalents 6,211,578 2,688,894 Special funds 3,700,000 3,700,000 Member accounts receivable 13,071,425 10,295,412 Other receivables 2,293,760 2,215,438 Inventories: Fuel 3,717,767 4,204,601 Materials and supplies 12,388,509 9,426,557 Prepayments 9,024 317,221 41,392,063 32,848,123 515,608,745 $ 481,545,574 (continued)

CORN BELT POWER COOPERATIVE

ASSETS

See accompanying notes to financial statements. 4

CORN BELT POWER COOPERATIVE

Balance Sheets

CORN BELT POWER COOPERATIVE Statements of Cash Flows

ASSETS

December 31, 2022 and 2021

Years ended December 31, 2022 and 2021

Adjustments to reconcile net margin to net cash provided by

2022 2021

FLOWS FROM OPERATING ACTIVITIES: Net margin 25,133,094 $ 12,280,344

CASH

operating activities: Depreciation and decommissioning 13,817,596 12,258,070 Undistributed patronage earnings from other investments (14,654,714) (4,602,381) Changes in current assets and liabilities: Receivables (4,490,697) 2,748,807 Inventories (2,475,118) 1,910,115 Prepayments 308,197 (103,781) Other - deferred charges 57,635 144,672 Accounts payable (86,911) (1,858,101) Accrued property and other taxes (95,083) (291,178) Deferred credits 1,363 (9,117,804) Accrued interest and other 43,148 27,481 Net cash provided by operating activities 17,558,510 13,396,244 CASH FLOWS FROM INVESTING ACTIVITIES: Additions to electric plant, net (22,081,520) 1,155,655 Distributions from special funds 65,262 (13,846,211) Additions to special funds (53,150) (6,935,927) Additions to other investments, other assets, investments in NRUCFC, and notes receivable (5,192,184) 15,000,000 Deductions to other investments, other assets, investments in NRUCFC, and notes receivable 1,934,562 (500,000) Net cash used in investing activities (25,327,030) (5,126,483) CASH FLOWS FROM FINANCING ACTIVITIES: Proceeds from issuance of long-term debt 37,751,000 (15,628,721) Repayment of long-term debt (13,990,524) 14,307 Funds advanced short-term borrowings 15,500,000 (81,273) Funds repaid short-term borrowings (21,000,000) (2,659,419) Patronage dividends paid (6,316,692) 1,831,300 11,943,784 (16,523,806) Net cash provided by (used in) financing activities Net increase/(decrease) in cash, cash equivalents, and restricted cash 4,175,264 (8,254,045) (continued)

See accompanying notes to financial statements. 8 2022 2021

PLANT: In service 598,965,397 $ 582,783,702 Less, accumulated depreciation (331,618,755) (322,929,026) 267,346,642 259,854,676 Construction work in progress 10,342,185 8,212,171 277,688,827 268,066,847

PROPERTY AND INVESTMENTS: Nonutility property 158,958 158,958 Investment in the National Rural Utilities Cooperative Finance Corporation (NRUCFC) 4,999,510 4,926,793 Decommissioning funds 57,914,769 72,779,925 Other investments 106,221,736 90,147,128 Special funds 1,301,736 1,313,848 Notes receivable 11,826,763 8,462,044 Other assets 2,498,057 1,845,477 184,921,529 179,634,173 DEFERRED CHARGES: Decommissioning regulatory asset 10,677,070Bond refinancing regulatory asset 929,256 996,431 11,606,326 996,431 CURRENT ASSETS: Cash and cash equivalents 6,211,578 2,688,894 Special funds 3,700,000 3,700,000 Member accounts receivable 13,071,425 10,295,412 Other receivables 2,293,760 2,215,438 Inventories: Fuel 3,717,767 4,204,601 Materials and supplies 12,388,509 9,426,557 Prepayments 9,024 317,221 41,392,063 32,848,123 515,608,745 $ 481,545,574 (continued)

ELECTRIC

OTHER

See accompanying notes to financial statements. 4

CORN BELT POWER COOPERATIVE Balance Sheets

December 31, 2022 and 2021

CORN BELT POWER COOPERATIVE Statements of

ASSETS

2022 2021 CASH, CASH EQUIVALENTS, AND RESTRICTED CASH AT: Beginning of year 8,234,371 16,488,416 End of year 12,409,635 $ 8,234,371 RECONCILIATION TO CASH, CASH EQUIVALENTS AND RESTRICTED CASH: Cash and cash equivalents 6,211,578 $ 2,688,894 Special funds/commercial paper 3,700,000 3,700,000 Revolving loan funds 2,498,057 1,845,477 12,409,635 $ 8,234,371 NONCASH INVESTING AND FINANCING ACTIVITY: Construction work in progress included in accounts payable 1,047,794 $ 1,751,217 SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION: Cash paid during the year for interest 8,048,304 $ 7,696,798

Years ended December 31, 2022 and 2021 See accompanying notes to financial statements. 9 2022 2021 ELECTRIC PLANT: In service 598,965,397 $ 582,783,702 Less, accumulated depreciation (331,618,755) (322,929,026) 267,346,642 259,854,676 Construction work in progress 277,688,827 268,066,847 OTHER PROPERTY AND INVESTMENTS: Nonutility property 158,958 158,958 Investment in the National Rural Utilities Cooperative Finance Corporation (NRUCFC) 4,999,510 4,926,793 Decommissioning funds 57,914,769 72,779,925 Other investments 106,221,736 90,147,128 Special funds 1,301,736 1,313,848 Notes receivable 11,826,763 8,462,044 Other assets 2,498,057 1,845,477 184,921,529 179,634,173 DEFERRED CHARGES: Decommissioning regulatory asset 10,677,070Bond refinancing regulatory asset 929,256 996,431 11,606,326 996,431 CURRENT ASSETS: Cash and cash equivalents 6,211,578 2,688,894 Special funds 3,700,000 3,700,000 Member accounts receivable 13,071,425 10,295,412 Other receivables 2,293,760 2,215,438 Inventories: Fuel 3,717,767 4,204,601 Materials and supplies 12,388,509 9,426,557 Prepayments 9,024 317,221 41,392,063 32,848,123 515,608,745 $ 481,545,574 (continued)

Cash Flows

See accompanying notes to financial statements. 4

CORN BELT POWER COOPERATIVE Balance Sheets

Statements of Membership Capital CORN

ASSETS

December 31, 2022 and 2021

Years ended December 31, 2022 and 2021

Deferred Reserve for patronage Statutory contingent Total Membership dividends surplus losses Balance, December 31, 2020 161,225,309 $ 1,100 98,887,347 20,354,992 41,595,414 386,456 2021 net margin 12,280,344 - 10,864,237 1,416,107 -Revenue deferred patronage dividends 76,763 - 76,763 - -Change in net unrealized gain in fair value of debt securities (386,456) - - - - (386,456) Patronage dividends paid (6,935,927) - (6,935,927) - -Balance, December 31, 2021 166,260,033 1,100 102,892,420 21,771,099 41,595,4142022 net margin 25,133,094 - 23,702,903 1,430,191 -Revenue deferred patronage dividends 107,097 - 107,097 - -Change in deferred patronage (143,751) - - (143,751) -Patronage dividends paid (6,316,692) - (6,316,692) - -Balance, December 31, 2022 185,039,781 $ 1,100 120,385,728 23,057,539 41,595,414income (loss)

Equities

Other

BELT POWER COOPERATIVE Accumulated other comprehensive See accompanying notes to financial statements. 10 2022 2021 ELECTRIC PLANT: In service 598,965,397 $ 582,783,702 Less, accumulated depreciation (331,618,755) (322,929,026) 267,346,642 259,854,676 Construction work in progress 10,342,185 8,212,171 277,688,827 268,066,847 OTHER PROPERTY AND INVESTMENTS: Nonutility property 158,958 158,958 Investment in the National Rural Utilities Cooperative Finance Corporation (NRUCFC) 4,999,510 4,926,793 Decommissioning funds 57,914,769 72,779,925 Other investments 106,221,736 90,147,128 Special funds 1,301,736 1,313,848 Notes receivable 11,826,763 8,462,044 Other assets 2,498,057 1,845,477 184,921,529 179,634,173 DEFERRED CHARGES: Decommissioning regulatory asset 10,677,070Bond refinancing regulatory asset 929,256 996,431 11,606,326 996,431 CURRENT ASSETS: Cash and cash equivalents 6,211,578 2,688,894 Special funds 3,700,000 3,700,000 Member accounts receivable 13,071,425 10,295,412 Other receivables 2,293,760 2,215,438 Inventories: Fuel 3,717,767 4,204,601 Materials and supplies 12,388,509 9,426,557 Prepayments 9,024 317,221 41,392,063 32,848,123 515,608,745 $ 481,545,574 (continued)

See accompanying notes to financial statements. 4

CORN BELT POWER COOPERATIVE

Notes to Financial Statements

December 31, 2022 and 2021

(1) Organization

Corn Belt Power Cooperative (the Cooperative) is a Rural Utilities Service (RUS) financed generation and transmission cooperative created and owned by nine distribution cooperatives and one municipal cooperative association. Electricity supplied by the Cooperative serves farms, small towns, and commercial and industrial businesses in northern Iowa.

The Cooperative's Board of Directors (Board of Directors) is composed of one representative from each member cooperative and is responsible for, among other things, establishing rates charged to the member cooperatives.

(2) Significant Accounting Policies

The Cooperative maintains its accounting records in accordance with the Uniform System of Accounts as prescribed by the RUS. The financial statements and the accompanying notes to the financial statements have been prepared in conformity with U.S. generally accepted accounting principles (GAAP). GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenue and expenses during the reporting period. Actual results could differ from those estimates. The significant accounting policies are as follows:

(a) Cash and Cash Equivalents

For the purpose of reporting the statements of cash flows, the Cooperative considers investments purchased with an original maturity of three months or less to be cash equivalents, except for cash held for investing as part of the decommissioning fund, relending program, and special funds which are restricted for use. These restricted cash and cash equivalents are included in footnotes 2(c), 2(d) and 2(g).

(b) Inventories

Inventories consist of fuel (primarily coal), emission allowances, and materials and supplies carried at cost. The cost for inventories is determined on a weighted-average cost basis.

The 1990 Clean Air Act (the Act) established the requirement for fossil fuel electric generating plants to hold sulfur dioxide (SO2) emission allowances under the Acid Rain Program (ARP). In 2015, the Cross-State Air Pollution Rule (CSAPR) established an additional SO2 allowance requirement along with adding nitrogen oxide (NOx) annual and seasonal allowances. The Act and CSAPR allocate a certain number of emission allowances to owners of fossil fuel generating plants that are affected by the rules and established corresponding ARP SO2, CSAPR SO2, CSAPR NOx annual, and CSAPR NOx seasonal emission allowance trading programs. Emission allowances that have been granted to the Cooperative as a result of the Act and CSAPR do not have any cost, and therefore, the use of these emission allowances does not result in expense. From time to time, the Cooperative will purchase a quantity of each type of emission allowance to ensure an adequate number of allowances are held. The purchased allowances are combined with the allocated allowances to derive an average allowance cost each year for each type of emission allowance. Emission allowances purchased are capitalized in inventory and are charged to fuel expense as they are used in operations.

(c) Other Investments