Report & Financial Statements

Representing Promoting Developing

Report & Financial Statements

Representing Promoting Developing

Co-operative Housing Ireland (CHI) is an Approved Housing Body providing almost 5187 high quality homes to low-income households. As a representative body, CHI champions co-operative principles in delivering homes and supporting communities. Co-operative Housing Ireland has been a leader in providing truly affordable homes across Ireland since 1973. CHI was formed under the Industrial and Provident Societies Acts (Reg. No. 3174R) and is a registered charity (RCN 20012182) As an Approved Housing Body (AHB) it is regulated by the Approved Housing Bodies Regulatory Authority (AHBRA)

Co-operative Housing Ireland works closely with various stakeholders in the housing sector, including Local Authorities, Government, and developers, to provide high quality social-rented homes across the country In addition to the 5187 homes provided, CHI has supported owneroccupier housing co-operatives to deliver 3,000 affordable homes

Our vision is of an Ireland where everyone has the option to participate fully in their own and the wider community’s social, economic and environmental development through co-operation

Our mission is to lead the development of social, economic and environmental sustainability in Ireland through co-operative effort and the provision of co-operative housing in particular

Definition

A co-operative is an autonomous association of persons united voluntarily to meet their common economic, social, and cultural needs and aspirations through a jointly owned and democratically-controlled enterprise

Values

Co-operatives are based on the values of self-help, self-responsibility, democracy, equality, equity and solidarity In the tradition of their founders, Co-operative members believe in the ethical values of honesty, openness, social responsibility and caring for others

1 Voluntary and Open Membership

Co-operatives are voluntary organisations open to all persons able to use their services and willing to accept the responsibilities of membership, without gender, social, racial, political or religious discrimination

2 Democratic Member Control

Co-operatives are democratic organisations controlled by their members, who actively participate in setting their policies and making decisions Men and women serving as elected representatives are accountable to the membership In primary co-operatives, members have equal voting rights (one member, one vote) and co-operatives at other levels are also organised in a democratic manner

3 Member Economic Participation

Members allocate surpluses for any or all of the following purposes:

• Developing their co-operative,

• Benefiting members in proportion to their transactions with the co-operative

5 Education, Training and Information

Co-operatives provide education and training for their members elected representatives managers and employees so they can contribute effectively to the development of their co-operatives They inform the general public – particularly young people and opinion leaders – about the nature and benefits of co-operation possibly by setting up reserves, part of which at least would be indivisible;

• And supporting other activities approved by the membership

4 Autonomy and Independence

Co-operatives are autonomous, selfhelp organisations controlled by their members If they enter into agreements with other organisations, including governments, or raise capital from external sources, they do so on terms that ensure democratic control by their members and maintain their cooperative autonomy

6 Co-operation among Co-operatives

Co-operatives serve their members most effectively and strengthen the co-operative movement by working together through local national regional and international structures

7. Concern for Community Co-operatives work for the sustainable development of their communities through policies approved by their members

Representing, Promoting, Developing Since 1973

1980s – Working with organisations within housing provision

Co-operative Housing Ireland (CHI), formerly NABCo, was formed in 1973 to support the growing housing co-operative movement that emerged in the late 1960s and 1970s.

A typical co-operative housing scheme during this period focused on home ownership, and involved between 8-20 homes, although in a few cases, between 130-150 homes were built by local co-ops over a number of years

From 1979 and throughout the 1980s, CHI worked with other organisations involved in housing provision or those that were widening the scope of housing services

In the 1980s, CHI’s focus shifted from private home-ownership to social-rented co-operatives.

This shift was largely as a result of a review of housing policy (Report No. 87) which recommended the recognition of the role of housing co-operatives in the provision of social-rented homes for low-income households The review acknowledged that co-operatives have a distinct form of membership and organisational structure emphasising their potential for providing and managing housing with both ownership and rental forms of tenure

In 1984, the Department of the Environment introduced the Capital Assistance Scheme (CAS) This allowed for grant transfers for financing mortgage loans to Approved Housing Bodies (AHBs) toward the cost of providing rental accommodation

CAS led to CHI supporting Ireland’s first co-operative rental scheme, the 13-home ‘Greenlawns’ project in Coolock, with rents linked to household income rather than market rates

The launch of the CAS scheme coincided with an increased focus by CHI on the provision of co-operative rental homes to new members allocated directly from local authority waiting lists.

1979 – Irish Co-ops - the ‘Third Arm’ of Housing

By the late 1970s, Irish housing co-operatives were catering to about 5% of the Irish housing market and were hailed as the ‘Third Arm’ of Irish housing, alongside local authorities and private developers. CHI established a full-time staffed office in 1979 to provide information and guidance on a wider scale.

In that same year the new Housing (Miscellaneous Provisions) Act allowed the Department of the Environment to pay a grant-in-aid to CHI as the representative body for housing co-operatives

The Department of Local Government encouraged local authorities to assist co-operative housing by allocating building sites, liaising with co-operatives, and assisting promptly with applications for mortgages.

A range of sites were provided by local authorities in Dublin for this purpose, leading to 276 houses and apartments at seven locations throughout the 1990s

During the 1980s and 1990s, over 20 co-operative housing projects were completed by CHI In 1991, a new Capital Loan and Subsidy Scheme allowed advance loans to Approved Housing Bodies of up to 100%. This enabled the expansion of CHI in Swords, Parlickstown, Ballyogan, Clondalkin, Lucan, Balbriggan and Killinarden until the end of the 1990s.

In 2000, through Part V of the Planning and Development Act, CHI began working with private sector developers and completed an apartment block at Rockfield, Dundrum, and Cardy Rock, Balbriggan

CHI continued to grow its foothold within Dublin throughout the 2000s and 2010s, the largest project of which was Avondale, a development of 200 dwellings completed in 2012

Newtown Court, developed in partnership with Dublin City Council, was the largest development in Ireland in 2004 with 193 apartments and duplex apartments The homes comprise a mix of social rented and shared-equity ownership purchase dwellings.

CHI expanded its reach by delivering homes in Galway and Kildare initially, and then in Munster with housing being developed in Kerry and Waterford To further this expansion, a new office was established, the staff of which helped to establish a foothold in the southern region

In 2023, CHI marked fifty years in operation and delivered an all-time high housing delivery of 849 homes serving more than 14,000 member tenants across the country.

2 0 2 3

‘Housing for All - a New Housing Plan for Ireland’ is the government’s housing delivery strategy to 2030 which was launched in September 2021. This multiannual, multi-billion-euro plan will improve Ireland’s housing system and deliver more homes of all types for people with different housing needs ‘Housing for All’ points to a growing role for AHBs in housing delivery

2011 saw the withdrawal of the Capital Loan and Subsidy Scheme (CLSS), primarily as a response to the 2008 economic crisis The majority of social-rented housing would no longer be funded through capital grants, AHBs and others would be expected to manage loans from both the Department of the Environment (now Housing) and from other sources (e.g. the Housing Finance Agency and banks).

CHI responded to this new reality by developing stronger relationships with the Department of Housing and key stakeholders in order to maintain and improve on its housing output

In 2020, Co-operative Housing Ireland delivered the largest social-rented housing development in Ireland that year with 144 homes in Rathnew, Co Wicklow The organisation moved its HQ from Baggot Street to Warrington Place In that same year, CHI delivered a record number of 454 homes across the island of Ireland. This growth marks a continuous trend, as from 2016, CHI’s delivery of homes has increased dramatically, from 194 to 592 in 2021

New homes delivered in 2023

849 homes delivered 381 houses delivered 468 apartments delivered 52 14,257 €319,837,413 Deep Energy Retrofits delivered people living in CHI homes + 1,795 since 2021 (+14%) 91% occupancy rate loan funding drawn down in 2023 for developments

Co-operative Housing Ireland Annual Report & Financial Statements 2023

Co-operative Housing Ireland enjoyed a year of many successes and many milestones in 2023 Not only did we celebrate fifty years in operation, but we also saw a record delivery of 849 homes added to our CHI portfolio and we reached an all-time high of more than 14,000 member tenants across the country now supported by CHI This is a tremendous achievement against the backdrop of continuing inflation, high interest rates, war and other economic and social challenges impacting Ireland and the housing sector.

CHI’s last half century is a tale of transformation as we ’ ve grown from supporting individual self-build home-ownership projects to an organisation that delivers large-scale developments, providing hundreds of truly affordable homes each year to lower income families As a result of this effort, thousands of people receive the keys of their forever home each year, giving them a safe, secure place to live from where they can work towards achieving their goals Affordability and access to a home has been the driving force for the housing cooperative movement By the late 1970s five percent of all homes built in Ireland were by co-operative efforts A desire to expand co-operative housing – coinciding with funding opportunities – led CHI, then the National Association of Build Co-operatives (NABCo) – to provide housing to families on local authority housing waiting lists

Today CHI is a unique Approved Housing Body (AHB) as we champion and promote the co-operative values of self-help self-responsibility democracy, equality, equity and solidarity as it has done since its inception in the delivery of social-rental housing This co-operative ethos permeates the communities the organisation supports both new and old People living in homes provided by CHI are members of their local housing co-operative These local co-operatives, typically made up of households within a region have the power to raise collective housing concerns, undertake and promote community activities, address local housing and other needs, and are responsible for nominating the voluntary members of CHI’s Board of Management

In more recent years, CHI has grown its capacity rapidly to support its burgeoning output and adapted to new regulations for AHBs as well as an ever-challenging building climate Our staff have exhibited great collaboration flexibility and planning skills as they ushered in the achievements over the last year Staffing will continue to be an area of focus for CHI as we seek to manage our growth to align with the increasing support required for our portfolio and also to align with the growth outlined in Housing for All Imperative to our continued success is an ongoing focus on growing at the right speed and scale to deliver and maintain over 5 000+ homes and support further delivery in the future

Another focus in 2023 was both reinforcing our existing partnerships as well as growing new partnerships and working closely with local and national government, state bodies, finance, industry, and community partners to seek to deliver on the targets set out each year While Leinster will always have a high social housing need we have strategically expanded our geographical footprint in order to provide a greater number of homes across the country Our increased delivery reflects our dedication to constantly exploring ways in which we can provide more social-rented homes throughout Ireland

Sustainability is also at the forefront of our ambitions We were delighted to win the ‘Net Zero’ award at the Chartered Institute of

Housing All Ireland Housing Awards 2023 for our ‘Improving Warmth and Wellbeing’ retrofit programme The programme involved retrofitting 216 of CHI s lowest energy performing homes receive deepenergy upgrades Retrofit works were completed with CHI Members in situ and in phases to ensure minimum disruption Retrofitting homes and buildings is key to decreasing use of fossil fuels and reaching netzero carbon emission targets

CHI is also working to support member tenants in other endeavours outside of housing provision to strengthen the fabric of the communities they live in Our longer-term projects are focused on areas with lasting social impact, for example, initiatives to support people to advance further in their education The excellence of our community engagement efforts was recognised in 2023 at the Irish Council for Social Housing Allianz Community Housing Awards where CHI won the Building Communities awards for its community development at the Halliday Mills apartment scheme in Dundalk Halliday Mills was met with significant obstacles over recent years but the team’s ongoing focus on the community resulted in a very positive level of member engagement garnering the top award for the sector Other 2023 programmes included a celebration of the first ‘Neighbours Day’ at Amharc Muileann and International Women s Day events around the country as well as ongoing initiatives such as gardening groups book clubs and community clean-ups

Looking ahead to the next 50 years, addressing the housing need is an area that will require continuous adaptation to an ever-changing environment It is sad and very unfortunate that the housing needs of so many go unmet Increasingly the co-operative model will be key to helping address the growing demand for housing CHI is putting more emphasis on building communities and on community development which are core tenets to the co-operative movement In seeding these core values, there are opportunities within CHI’s structure to support younger adult residents to work towards a future housing solution with a co-operative model

Finally I would like to thank our CEO Kieron Brennan and the commitment of the full CHI team for their hard work, dedication, energy and passion this past year They are an invaluable asset to our organisation and key to CHI’s success I also wish to recognise the voluntary commitment of my colleagues on the Board and to thank them for their support We look forward to the next chapter of Co-operative Housing Ireland and building on the last fifty years with continued success

Pearse O’Shiel

Chairperson, Co-operative Housing Ireland

The committee of management, (“the board of management” or “the board”), present their report and the audited financial statements for Co-operative Housing Ireland Society Limited (“Co-operative Housing Ireland”) for the year ended 31 December 2023.

Co-operative Housing Ireland

The Society was formed in 1973 under the Industrial and Provident Societies Acts (Reg No 3174R) and is the national organisation representing, promoting, and developing the co-operative housing movement in Ireland The Society is jointly owned by its affiliated cooperative housing member societies It is a not-for-profit organisation whose objectives are charitable in nature and has charitable status (CHY 6522) The Society’s Registered Charity Number is 20012182 The Society is an Approved Housing Body (AHB) as regulated by the Approved Housing Bodies Regulatory Authority (AHBRA)

The Society, in addition to its national representative role, is actively involved in the organisation, planning and financing of new co-operative housing developments, the promotion of good governance in the management of co-operative housing societies and the delivery of quality housing and associated services for members and their communities

Total housing stock at the end of 2023 amounted to 5,187 units (2022 4,338 units) The growth in units resulted in increased Payment and Availability Agreement income amounting to €39,304,011 (2022: €27,914,238) being the principal source of operational income for CHI activities and Rental Income and other charges to tenants amounted to €15,735,049 (2022 €13,377,695) These income streams are vital to the ongoing viability of CHI in funding the operational costs of CHI’s activities The Government supported Payment and Availability Agreements are provided to CHI under contractual agreements with certain Local Authorities Certain older originally grant funded CLSS properties are funded by a ‘differential’ income-based rent supplemented by a management and maintenance allowance from relevant Local Authorities The management and maintenance allowance continues to be flat lined at €647,946 The maintenance and life cycle costs of those properties is under funded by the State and remains a challenge to CHI operations

Results and operational review for the year

The results for the year as set out on page 45 There was an operating surplus for the year of €15 662 520 (2022: €17,729,596) and a net surplus of €293,945 (2022: €7,479,601) The increase in the operating surplus arose due to the increase in income through housing growth with an increase in Payment & Availability income of €11,389,773 Operational expenditure was in line with expectation and required for organisational capacity building CHI acquired 849 units in 2023 The corresponding figure for 2022 was 463 units

The impact of the invasion of Ukraine combined with the energy crisis continued into 2023, this remained challenging for operational costs, mainly due to high inflation rates, rising interest rates, continuing high uncertainty CHI expenditure increased to €48,110,618 in 2023 (2022 €32,725,873)

The income of CHI included a non recurring income item from the transfer of assets from Munster Co operative society in the amount of €692,143

A specific asset impairment charge has been included in the financial statements in relation to a current development site in the amount of €4,593,702

CHI’s strategy is reviewed annually, and a yearly Business Plan is developed to support the operational implementation of the Strategy.

The CEO reports regularly to the Board on progress being made in achieving organisational objectives Co-operative Housing Ireland’s leading role in housing delivery was reconfirmed during the year by recertification for lending from the Housing Finance Agency

Our five-year strategic plan commits the organisation to making progress on five key goals Our current strategy covers the period 2023-2027

Some of our main achievements in 2023 in relation to each goal are outlined on the following page

Given the ongoing challenges faced by the construction industry, including supply chain issues and inflation, and labour shortages we believe that we have made significant progress realising these goals and that 2023 was a very successful year for Co-operative Housing Ireland CHI was re-certified for lending from the Housing Finance Agency

We continue to develop funding relationships and will continue to look at diversification of our funding sources

See CHI Strategy 2023-2027

Goal 1

Growing cooperative housing

• CHI delivered 849 homes in 2023

• At the end of 2023

CHI owns and manages over 5 187 homes in addition to the 3 000 it supported through homeowner co-operatives

• Providing homes to an additional 14 000 people

• Celebrated its 50th year of delivering truly affordable housing with the official launch of its largest development ever of 208 homes at Kilruddery Glen, Bray, Wicklow

• The majority of our new homes are sustainable BER A-rated homes

• Prudent financial management and recertification for lending from the Housing Finance Agency

Goal 2

Building sustainable co-operative communities

Goal 3

Developing co-operative leadership

•

• • • • •

Production of a Member Association Event resource guide to complement the Member Association Handbook

Communal Artwork unveiled at Halliday Mills, Dundalk

CHI wins ‘Building Community’ at ICSH Allianz Community Housing Awards 2023 for Halliday Mills Member Association

Additional 57 homes at Newcourt, Dublin 8, received energy efficient upgrades as part of ‘Improving Warmth and Wellbeing’ bringing the total number to circa 110

CHI wins ‘Net Zero in Housing’ at the CIH All Ireland Housing Awards for its commitment to retrofitting homes

Targeted support to households on a number of issues including fire safety training, being a good neighbour, and paying rent

• 8 Members took part in our Board Skills Training Programme

• CHI established 20 Member Associations and finished 2023 with 10 in progress

• Community Leadership Wheel designed and disseminated to assist Member Associations in their leadership development

• CHI runs its inaugural International Women s Day campaign with an event Inspiring Women in Leadership an in-person panel discussion including the voices of women Member Tenants

• CHI now operates in 24 counties and delivered homes in Westmeath and Monaghan for the first time in 2023

• Continual improvement in how CHI operates to meet needs and improve efficiencies

• Rent arrears at 3 03% in December 2023

Goal 4

Raising our own capacity

Goal 5

Leading the co-operative movement

•

•

• Further growth in staff to 102 by December 2023, up 17% from 87 staff in January 2022 (excluding childcare)

• Evolve – Transforming Co-operative Housing Ireland

CHI s business transformation programme – Evolve – was launched in March 2023 The business has continued to grow exponentially, adding more homes and more people to the organisation year after year

Restructuring to Evolve

The Housing Services and Community Engagement division was restructured as part of CHI’s Evolve Business Transformation Programme

• CHI wins ‘Residential: Social and Affordable up to 5m’ in the Irish Construction Excellence (ICE) awards 2023

Participated in national and international forums on co-operatives housing and community issues

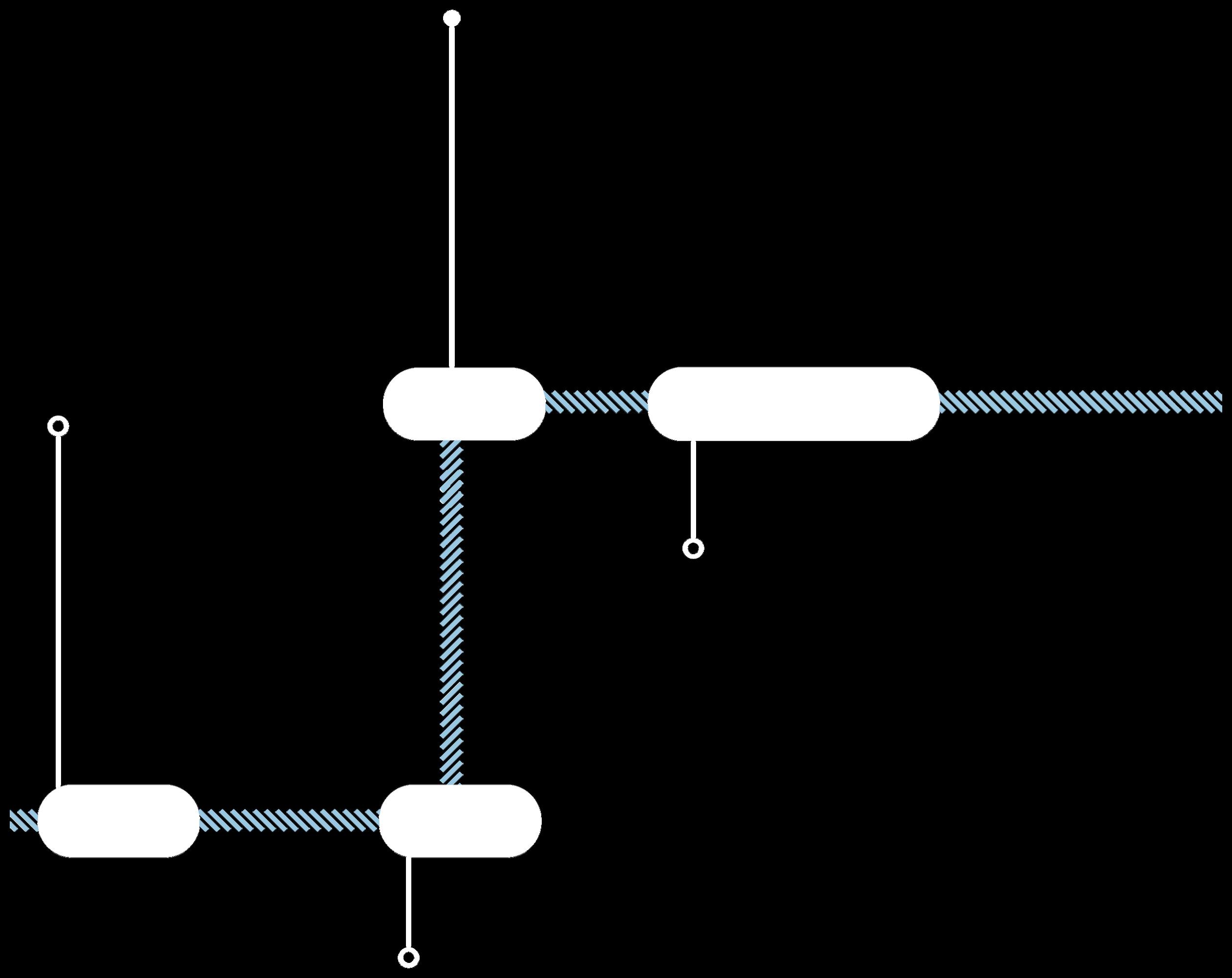

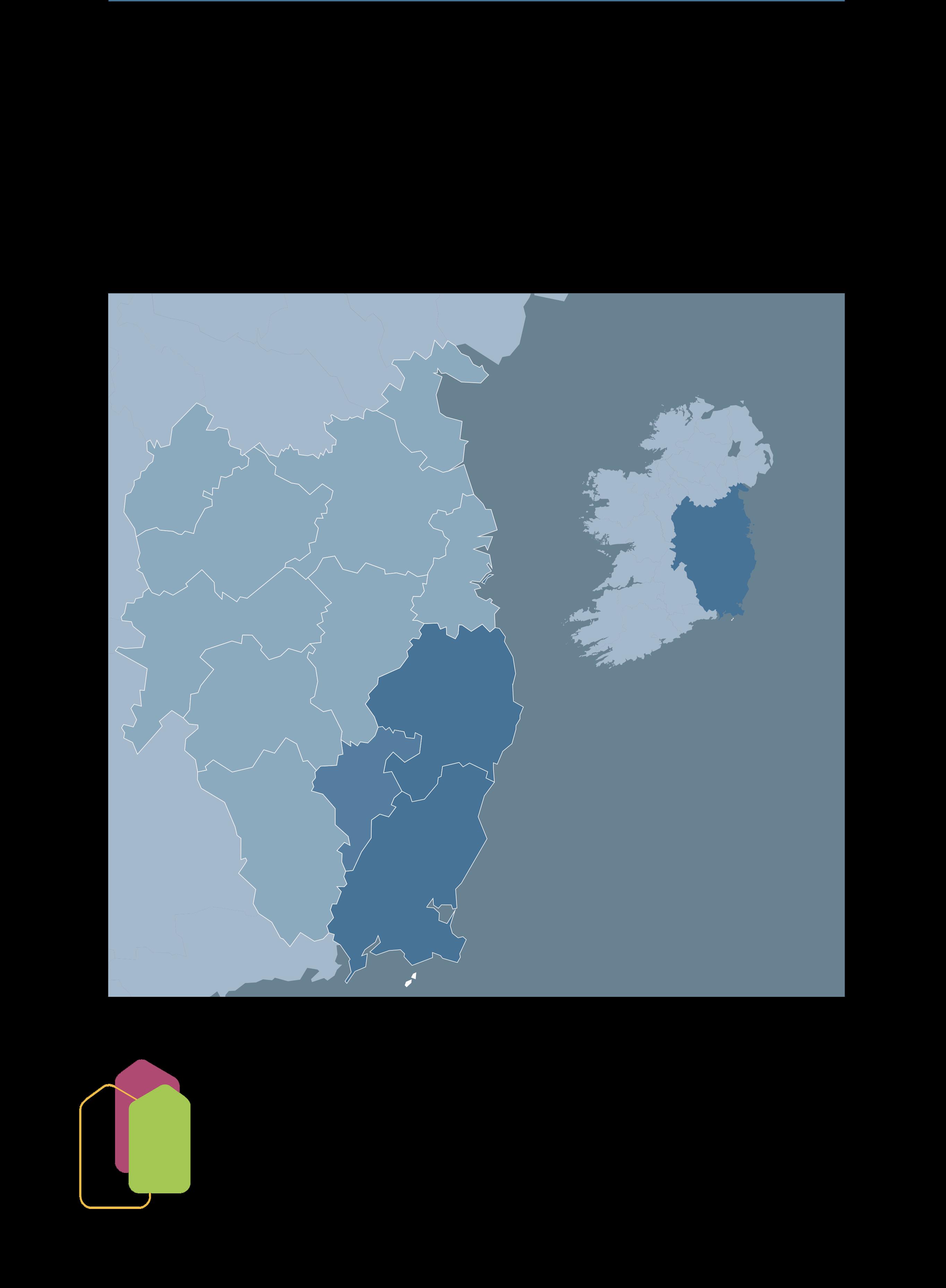

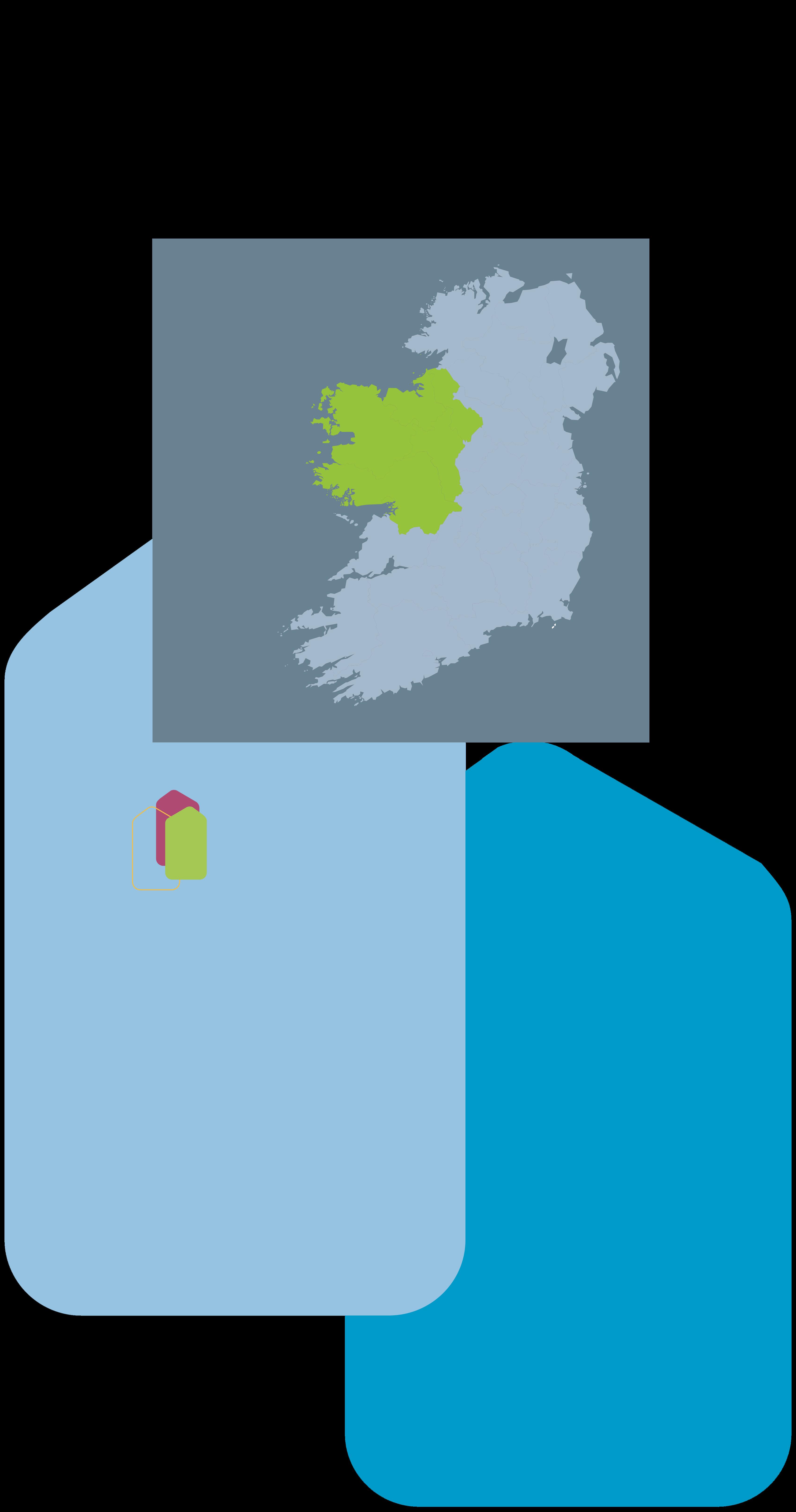

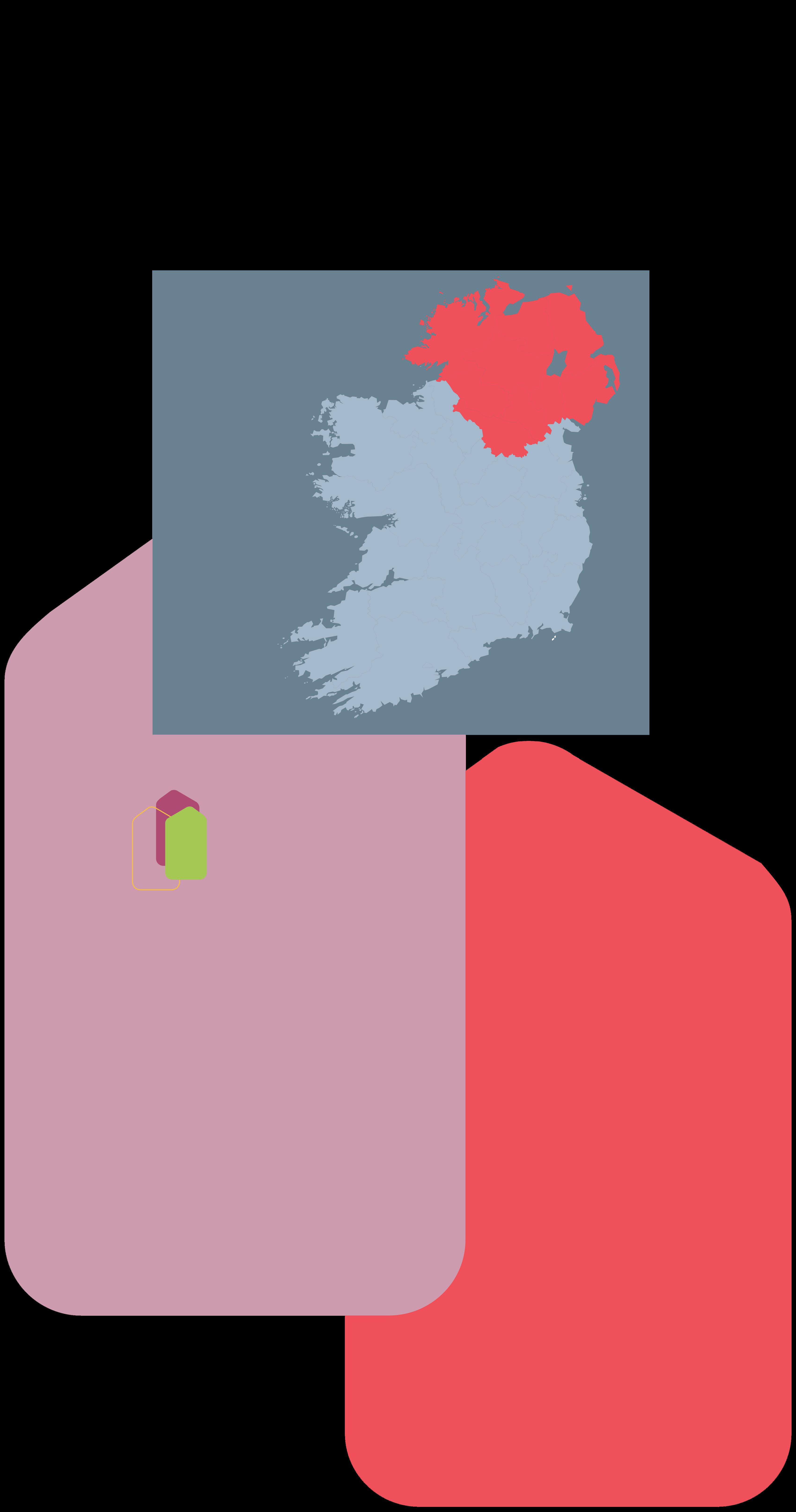

Ulster 22 849 homes delivered in 2023

Connacht

Munster

Leinster

Co-operative Housing Ireland delivered 849 homes during 2023. The largest delivery of homes was in Leinster with 624 homes, followed by Munster at 147 homes, and Connacht with 56 and Ulster with 22 homes. Homes were delivered across sixteen counties: Carlow, Cavan, Clare, Cork, Galway, Kerry, County Dublin, Kildare, Laois, Limerick, Mayo, Monaghan, Sligo, Wexford, Westmeath and Wicklow. At the end of 2023, CHI managed over 5,187 homes nationwide with over 14,257 people calling a CHI dwelling ‘home’.

The last number of years have been a particularly challenging time for the housing sector CHI aimed for another record-breaking year in 2023, with a target of 700 homes. 2023 was a landmark year for the organisation, with its highest housing yield to date of 849 homes

This accounted for an 87% increase in delivery versus 2020 The impact of uncontrollable delays in construction prevented CHI exceeding the success of 2021 and reaching its 2022 target, as the residual impact of the Covid-19 pandemic was surpassed by the war in Ukraine Despite challenges presented by the pandemic, CHI’s housing output grew exponentially in the years that preceded 2023, with a delivery of 190 homes in 2017 to 849 homes in 2023, and a 347% increase over a six-year period The sustainability of quality housing stock for future generations will require a dedicated and steady contribution from organisations like CHI Under Housing for All, 90,000 new social houses are

to be provided from now until 2030, and AHBs will be central to this This ramping up of output is testament to the important role AHBs must play in social housing provision CHI is adapting to the difficulties presented by today’s building climate by seeking out larger schemes in a tighter pipeline This enables CHI to consolidate its workload while keeping delivery high CHI is focusing its delivery where it has a strong foothold, for example, where it has housing teams in operation and strong relationships with local authorities The organisation promotes the continued expansion of the co-operative housing sector as a solution to housing need

CHI is strongly influenced by its members Several of its 12 Board members are elected by the Membership households that live in CHI homes The inclusion of the Member voice at all levels ensures that CHI not only provides housing units, but homes where people can thrive

Leinster accounted for 624 new homes, or 73% of CHI’s output for 2023. These homes were provided primarily in Wicklow and the greater Dublin region

624 Homes delivered in 2023

“They thought I couldn’t live alone with autism, but look at me now”

Joseph McGoldrick, Moongate, Wexford

Joseph McGoldrick had a difficult childhood having moved into foster care at the age of fifteen. Originally, from Limerick, he was moved to Rosslare where he lived until the age of 18 Joseph has high-functioning autism and he struggled in school despite his hard work and efforts to study. Although he didn’t complete his junior or leaving certificate, Joseph was able to complete a QQI level 3 in the National Learning Network. Joseph is very proud of this achievement after suffering much doubt and negativity from his family.

Joseph is also extremely proud of his independence and positivity He has worked hard to protect his personal health and wellbeing and to keep the negative people at bay He cites part of his success to the support he received from his foster mother who encouraged his independence

Part of Joseph’s independence came from applying for housing and he was delighted to move into his new home in Moongate, Co Wexford in September 2023

Always cautious about money, Joseph was happy to receive such an energy efficient home which is well connected and convenient for his commute to Waterford where he is studying catering and hospitality

His future interest lies in a career in the restaurant business and in travel Joseph travelled on his own to Turkey at the age of 19 and he has a long list of places he would like to visit including France and Italy

“I felt ready to live alone, I was enthusiastic about it.”

– CHI Member Joseph McGoldrick

The launch of 208 homes in Kilruddery Glen, Bray, Co Wicklow was a landmark event in the history of Co-operative Housing Ireland. Coinciding with CHI’s 50th anniversary year, the delivery of the homes in Kilruddery Glen toward the close of 2023 put the year-end closing figure at 849 homes delivered – trebling CHI’s annual output in five years.

An official opening was held at the estate on November 15th, 2023, led by Minister for Housing, Local Government and Heritage, Darragh O’Brien, TD, and Cathaoirleach of Wicklow County Council, Cllr Aoife Flynn-Kennedy. Other notable attendees at the event were Wicklow TDs, Minister for Health, Stephen Donnelly, and our current Taoiseach, Simon Harris, who attended in his capacity at the time as Minister for Further and Higher Education, Research, Innovation and Science

Speaking at the event, Co-operative Housing Ireland

Chairperson, Pearse O’Shiel said, “208 homes is a significant development for Co-operative Housing Ireland, our largest to date It is equivalent to the annual social housing delivery of a county the size of Wicklow It is fitting that we mark our 50th anniversary with this achievement We are a national organisation currently with 5,000 homes, community building in 24 counties and on target for a record delivery of over 700 homes this year ”

Minister O’Brien said, “Co-operative Housing Ireland and others are key to achieving our housing delivery targets as set out under Housing for All. The organisation has grown, sustainably, to meet the challenge of delivering more homes. Approved Housing Bodies like Co-operative Housing Ireland have a critical role, as they will deliver approximately half of all social homes this year working in tandem with my Department. I want to wish all of the new residents here the very best of luck as they begin a new

chapter of their lives in these magnificent homes ”

Cathaoirleach of Wicklow County Council, Cllr Aoife Flynn-Kennedy stated “It’s a pleasure to be here today to celebrate the official opening of Kilruddery Glen Developments like this help us to achieve the quality of housing that we hope for, for all of our citizens, and will contribute to the economic and social diversity of Bray and County Wicklow by creating both a more stable and more vibrant community ”

Also speaking at the event was member tenant, Kasha Byrne, who said “For the first time in our lives, we’re finally putting down roots We have a home for life, we’re not isolated, we’re part of something and we’re emotionally invested in making it a happy and thriving community now and in the future.”

Bray Poet Laureate, Kayssie K , a poet and singersongwriter, who was born in Zimbabwe and raised in Bray recited a poem, commissioned by CHI, at the event called ‘Memories in Hallways’

The delivery of the A-rated, sustainable homes was achieved through a partnership with the Wicklow County Council, the Department of Housing, Local Government and Heritage, the Housing Finance Agency, the Housing Agency, and the estate was built by residential developer, Lioncor Construction, Townmore and designed by BHA Architecture

“My son used to get a lot of stares in the community, here we get waves and hellos and the children make a huge effort to interact. Being part of a community is great.”

Kasha Byrne, Bray, Co. Wicklow

CHI member tenant, Kasha Byrne was among the first to move into the new estate, Kilruddery Glen, in Bray, Co. Wicklow. The estate signifies the largest single delivery of homes in CHI’s history which is fitting for the same year in which CHI celebrates fifty years in operation. Kasha moved into her home with her partner, Martin, who is a chef, and their three children, two of whom are on the ASD spectrum. The children all now have their own room and her girls have their own bathroom.

Karen felt very isolated in her previous home There were no other kids in the community and no road for the kids to play on Kilruddery Glen has been a completely different experience for them all with neighbours and children calling in regularly and a much greater sense of community There is a wealth of schools in the area and Kasha’s family have been able to make choices for their children based on each child and what suits their educational needs best There are so many choices they don’t have in other secondary schools It depends on the child what suits them

The transfer from the local authority house where Kasha and her family had been living took four years after nominations were put forward Kasha felt their last house didn’t meet their needs at all, as her children grew older Being settled and having security has given them much more structure to work from and has resulted in a more positive mindset for everyone in the family

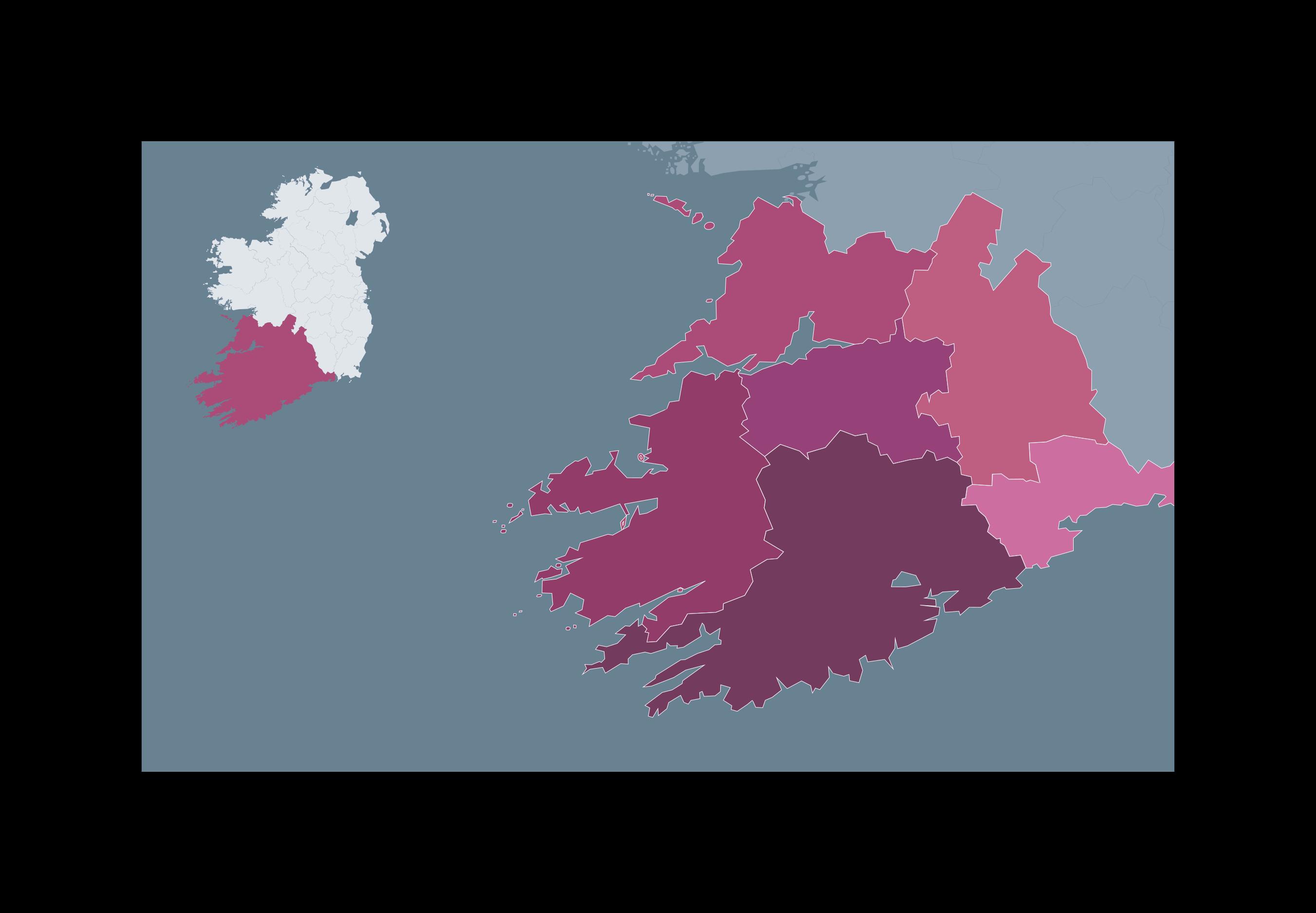

Munster accounted for 147 homes, or approximately 17% of CHI’s output for 2023. The majority of these homes were delivered in Kerry

Sharon Malupande, her pastor husband Themba, and their daughters, 15-year-old Natasha and 9-year-old Shekinah, moved into their new home in Amharc Muileann in Limerick in December of 2021.

Before being offered their CHI home at Amharc Muileann, Sharon’s family had been living in private accommodation which the landlord decided to sell As a result, they found themselves without secure tenure which really took its toll on the family The family qualified for inclusion on the local authority housing list but there were no houses available and a lot of families ahead of them so there followed a very unsettling time in emergency accommodation

“The landlord wanted to sell and a lot of landlords were doing that at the time We loved the area we lived in and our children were in school there But even if we rented somewhere else privately, there was no guarantee that we would not be asked to move again ”

A representative from the local council introduced them to the possibility of a home at the Amharc Muileann development which is how the family came to be one of the first residents of the estate on Bloodmill Road which was officially opened by Darragh O’Brien Minister for Housing Local Government and Heritage of Ireland in June 2023

“We were so excited when we were offered the home in Amharc Muileann, we knew we wouldn’t have to worry about moving again. We felt very relieved. My family love it.”

– CHI Member Sharon

“The house is lovely, and we have great neighbours,” Sharon said of the three-bed home

“Our children didn’t have to change school I can walk into work from here and my husband, who’s a minister and works part-time for Amazon is near to work as well ”

“Having all the kids with me in my own home is what I’m looking forward to the most this Christmas It’s been a nightmare getting here and life threw curveballs at us [but] we’re in our new home now and we love it.” Karen said. Karen and her children were waiting 11 years for a permanent home before taking up residence in her brand new ‘forever’ home in Lawlor’s Hill, Ardfert During that inordinate wait, they endured frequent insecurity amid eviction notices and difficult challenges of often cramped rented spaces In June 2023, on Karen’s birthday, she received a welcome call from CHI to notify her that she was in line for a new home Karen and her family moved in three weeks before Christmas

“It feels like life is starting over again” as she can finally put down roots and has the security and peace of mind that comes with a home of her own

The past few years have been tough for Karen and her family, as it was for many people, during the pandemic. In the two-bedroom apartment where she lived previously, Karen found her living situation very stressful with her two older boys sharing one bedroom, an apartment that was cold and damp and a landlord who was very difficult.

Moving into her new home at Lawlor’s Hill was a seamless process Her ready-to-move-in home was the perfect canvas for her to make her own and add her own personality

“It’s been a few years since I’ve had my whole family around the table sharing a meal and having a laugh That’s my dream ”

Connacht accounted for 56 homes or approximately 7% of CHI’s output for 2023.

“To have the comfort and security of my own home now makes such a difference.”

Mary Gormley, Vicar’s Choral, Tuam

Mary and her family moved into Vicar’s Choral in Tuam, Co. Galway, in August 2023. Mary moved in with her 17-year-old son and her 23-year-old daughter. Mary’s family had spent the previous 23 years living in privately rented accommodation in a nearby estate which was a lot larger and much more hectic. “With renting, you are on tenterhooks every day because the landlord could decide to sell at any moment. To have the comfort and security of my own home now makes such a difference.”

Mary’s family are enjoying their new home which they say is very peaceful and quiet yet only a few minutes from the town centre “The houses are beautiful It’s great to put our own stamp on it To move into a brand new, sparkling house, I felt like I won the lotto! I was delighted with the fine big kitchen Another thing I love about the house is that the heating is air-to-water, there’s no need for firelighters, turf, coals, and there are no ashes to clean In the previous place, we had a stove that heated the house and the water, but you would have wanted a bag of coal a day to heat the place! Now, it’s constantly warm ”

The pandemic had a big impact on the wellbeing of Mary’s children and having a secure and safe place to live has had a very positive impact

“My kids love the place, especially my daughter. Sure, you know boys -- my son would sleep in a tent, but it was really important for my daughter to have a stable place. She has settled well. She’s in great form and the house has made such a difference. And my son loves being beside the stadium.”

Ulster accounted for 22 homes, approximately 3% of CHI’s output for 2023. The organisation delivered its first homes in Monaghan; Drumbear Wood is a development of 17 homes located outside Monaghan Town.

“I don’t know how CHI managed to find the right community [for us]; it’s like CHI almost have a magic remedy. It’s important to me that we sustain what we’ve been given here, as we grow as a community and the next generation is coming up.”Olivia Johnson, Drumbear Wood, Co. Mo

Olivia Johnson and her four teenagers (two girls and two boys) were living in rented accommodation in Emyvale for over seven years before moving into their forever home in Drumbear Wood, Monaghan. While their landlords were lovely people, the home they rented in Emyvale was quite antiquated and Olivia felt like she was always living with a low-grade concern that the landlords would give notice and ask them to move.

Since moving to Drumbear Wood, Olivia feels like she finally has a connected community. “There is such an interesting selection of people living here. I’ve spoken to them all and they all call over and our kids have become friends It’s interesting that we are all similar in age, and we have had a lot of different life experiences We’re all in a place where we don’t have time for drama ”

Sustainability and the environment are very important to Olivia, and she wants to encourage biodiversity so working with the community on some growing projects is a high priority for her “We’re lucky there’s a forest nearby, and the oxygen supply from that is great to offset in a built-up area I want to get a Member’s Association set up so we can put things in place and run some activities ”

Olivia is an art teacher and she studied design in the IT in Galway and then went on to do fine arts degree

in DIT, followed by library management in UCD. She’s also completed other diplomas in ceramics, art, and horticulture. She volunteers in youth work with LGBT+ teens. “Working with art, people, and in nature, it’s amazing the positive release of chemicals that brought about in people I’m not an indoors person, so if I can work outside, I will ”

Olivia is looking forward to watching her children grow and making her new home in Drumbear Wood her own with gifts of art which she gets for her kids each year She’s happy to have a home where she and her children can inject their own sense of style She’s also looking forward to the real sense of security that comes with growing and being a part of a community

2023 has seen continued growth for Co-operative Housing Ireland where we delivered a record 849 homes (21% of AHB housing delivery in 2023), despite challenges facing housing delivery. Our Pipeline for 2024/25/26 is very strong and we expect to deliver 10,000 homes by 2030 Last year due to supply chain issues and inflation housing delivery was immensely challenging. The new CALF model has been very challenging as there are delays in obtaining CALF approvals over the old model and this also has delayed projects completing within their planned timelines Housing prices and construction inflation continues to rise resulting in increased costs to deliver new homes.

Despite these obstacles, CHI is confident of reaching our goals and delivering substantial numbers of new homes over the coming years.

With the emphasis on delivering new and much-needed social housing, our early contact with new Members before they moved into their new homes was a key part of our engagement throughout the year This communication phase is crucial for establishing clear roles and responsibilities for both tenants and CHI as the landlord Communication was carried out through letters, messages, website posts, social media updates (Facebook and Twitter), and SMS text messaging Our quarterly Member newsletter was produced and delivered by post to each household and emailed in electronic format The Housing Team has relied on ICT to communicate with new and existing Members

Reflecting the growth in our housing stock, the Asset Management and Property Services (AMPS) Division continued to expand across 2023 A key area of this growth has been the Contact Centre Team, which as of September 2023, assumed responsibility for managing all incoming calls to CHI including the Repairs and Customer Services lines This centralisation aims to enhance service efficiency and ensure we deliver an excellent customer service while achieving value for money

Our Capital Works programme and the Improving Warmth & Wellbeing project also continued throughout 2023 At our Newtown Court Scheme in Dublin, 57 additional homes received energy efficiency upgrades, improving their BER to a minimum of B2 and in most instances achieving even better ratings Phase 2 of our Window Replacement Programme at Newtown Court was also completed, along with several other smaller component replacement projects across the country

In the second year of our rolling Stock Condition Survey, CHI conducted over 900 detailed inspections of individual properties and 89 blocks This detailed data will enable CHI to plan and forecast future capital lifecycle component replacement works with greater accuracy and efficiency

Total Calls answered: Answer Rate: 97% Average wait time: 27 seconds

29,933

Fire Alarms Serviced: 600

Average daily calls per agent: 62

Compliant Repairs orders raised: 11,000+ Lifts Serviced: 196

Spend on Responsive Repairs: €2m

Total Spend on Capital Works: €4. 5m

Chimneys Cleaned: 842

Total number of Stock Condition Surveys completed in 2023 as part of our rolling Stock Condition Survey:

990 homes 89 blocks and

In 2023, The Member Engagement team changed their title to Community Engagement as it represents more clearly what the team are trying to achieve In CHI the word community can be understood in a number of different ways be it;

• Communities of place.

• Communities of interest.

• Identity-based communities.

• Communities of need.

The Community Engagement team have grown this year through the addition of colleagues to the team, as well as its ambition and visibility across the CHI network

This annual report provides the reader with a taste of what the Community Engagement team have achieved but does not take a deep dive into the amount of time and creativity it has taken to achieve the actions set out in the annual report

This year the Community Engagement team alongside their colleagues in CHI were recognised by the ICSH for their efforts by winning the category ‘Building Communities’ at the ICSH award 2024 will bring about the next step in the approach of Community Engagement within CHI through creative opportunities to increase the involvement and influence of our member tenants in decision making processes that impact their lived experience

The Community Engagement Team have completed the year with 30-member association (resident groups) set up in CHI communities There are 20 member associations that have been fully set up (with bank accounts) They have availed of the community fund that is made available through CHI The remaining 10 are in a process of development Throughout the year the community engagement team have had 466 interactions with each of the committees through calls emails and in person meetings

The benefits of the established member associations can be seen throughout CHI as well as the wider communities that they are situated in They help Members to:

• Create a sense of belonging within the

• Run events and activities that benefit the community as a whole

• Share advice and information with other people in the community

• Campaign on issues that relate to all the members in the community

Locations of CHI community Member Associations in Ireland

This year Member Associations have been invited to participate in the Community Leadership Wheel which is a confidence and capacity programme The intent of the programme is to support the Member Associations in their development so that they have the confidence and capacity to grow as a member association and community Sessions are tailored to the needs of the group and are bespoke to each community

CHI’s Member Engagement team invited Member Associations to apply for €400 funding, separate to the Community Fund, to hold an event that brought neighbours together to celebrate diversity in the community. The aim was to enhance community spirit and connection. Eight communities from across the CHI network took part in Neighbours Day, this coincided with International Diversity Day The celebration is an opportunity to reconnect with the values of solidarity, conviviality and friendship that should be at the forefront of neighbourly relations. The communities held family days, had food sharing initiatives, and played games from their youth, and communities that they originated from

Sarah Power of Móinéir Clonmacken Member Association shares her experience of Neighbours Day: “My name is Sarah Power; I am a second year student in CWELL and I truly enjoy working within communities Last year I moved into the newly built housing estate on the northside of Limerick city After two months of settling into our home CHI invited the residents to a meeting to talk about forming a committee I was delighted to attend and was voted in as secretary As I grew up in a disadvantaged area, I had seen firsthand how deprived some communities are and how this leads to anti-social behaviour, criminality, violence, negativity and so on I was eager to get involved in my Member Association to prevent this from happening in our community I have 4 children ranging in ages from 3 up to 10 years old and I only want what’s best for them growing up just like any mother does I want to lead by example and teach them to do nice things for others and get involved I feel that when children are involved in anything, be it helping to clean up our estate or give out leaflets of information,

they will respect it more, as they see the work they put into it Móinéir is a multi-cultural community I along with others on the association felt it would be great to hold a Neighbours Day event on August 12th We also had an official opening day for Móinéir This date suited everyone as the final phase of houses had been completed and all the Members had moved in It was our hope that all the families living here would come out to meet their neighbours, we also suggested some households bring a dish, this gave everyone a chance to meet each other and show others what skills they have We had a marquee set up with all different types of foods which were delicious! There was a kid’s entertainer ice cream van face painting and a soccer tournament for the kids The turnout for our event was spectacular Everyone enjoyed it It gave everyone a sense of belonging to their community and the kids made friendships During the day of our event a lot of members wanted to join our association which was absolutely brilliant! We were delighted to get new people on board ”

Each year the Community Engagement team in consultation with the entire Housing Service and Community Engagement division select a number of communities that they will work with throughout the year using the community development approach. The community engagement team work alongside the community to support them to understand their needs and requirements to shape a sustainable flourishing community.

This community of 85 homes is based in an apartment complex in Dundalk The community is a diverse one that faced several challenges in the early stages Even through the challenges many of the member tenants wanted to ensure that it was an active vibrant community With the support of CHI they established a member association and ran a number of activities

For the larger community development project an initial consultation took place to invite the residents to engage with the process The outcome of the consultation was to put more colour and life into Halliday Mills Working with the repairs team colour was introduced in the doorways and the lift shaft Through community consultation with a street artist, an original art piece was developed A launch was held inviting community partners

The community of residents living in houses and apartments are based in Blackrock in Cork Through a consultation with residents, it was identified that many residents do not know each other, and they felt it was important to bring the community together in a shared experience The community engagement team organised a sports day event with The Junction using a local amenity, Blackrock Hurling club, as the venue for the event It was a major success bringing many residents

together This led to the member association being reestablished with fresh enthusiasm and a meeting with CHI colleagues to also bring about trust between CHI and the community

Aisling Estate has 23 homes based in Clare Like the other community development projects the community members took part in a consultation There were several items in the consultation that the community felt like they would benefit from, but most importantly that they wanted to get to know each other a bit more This community development project started in 2022 In 2022 the community were invited to take part in a community crafts day In 2023 the community were invited to participate in a Halloween Fun Day This was an effective event as residents were able to mix with each other and start sustainable conversations

Communities can be defined in many ways. Either through geography, interest, position in the world, belief system etc. It is important to recognise that we are not just in one community but many and the positions that we take in each of the communities are different depending on the familiarity, distance or engagement with the community. In CHI we are aware of this and understand that our member tenants are not just in a community based upon the home that they live in.

There are three communities of interest that are facilitated by CHI

Book Club

This has been running for three years By the end of the year it is a member led group with the hope that it will sustain itself In 2023 there were eight consistent members

ALMAS Story:

‘I shouldn’t have been so apprehensive of joining an online Book Club on Zoom for it turned out to be quite uncomplicated.

Living away, I’d just returned to live with my daughter and grandson to find that Co-operative Housing have an on-line book club which I cautiously joined; I had little expectations as I don’t belong to any social media platforms like Facebook Nonetheless, my daughter pressed all the right buttons, and I was in!

As in all books you enter into a different dimension and one of which was ‘In Order to Live’ by Neomny Parks in North Korea It is a most extraordinary description of escaping terror and hunger through China and finally to freedom in South Korea by way of Mafias! The book ended so incredibly well after real, life-threatening episodes, thus showing in our own lives having no way out, we end up utilising our own weaknesses to become our strengths

Though I am a slow reader, I read through our last book quite quickly ‘The Ladies’ Midnight Swimming Club’, which I enjoyed a lot at first, until my fellow readers pointed out many inconsistencies which I partly agreed with, so, I was glad I had read it all continuously

Seeing you all my fellow readers in your homes is very comforting and I have taken enjoyment from being part of our Book club!’

CHI is aware of the knowledge and interest that our member tenants have in horticulture, and it was through this that the growing community stemmed The group have introduced the growing corner in the member newsletter and have an active role in the community engagement Facebook Page

From a request of the member tenants CHI have launched a creative writing group with the aspiration of developing a self-published book of short stories

This year we have seen the growth and development of the training that we have been able to provide to our member tenants. The online training has been most effective during the dark nights, while in person training works best during the summer months.

Workshops that are designed to support individuals to participate fully on a board of their choice Eight people fully completed the board skills training in 2023

In collaboration with Inner City Enterprise the Community Engagement team hosted a set of workshops to support individual member tenants who want to be their own boss and go on the journey of entrepreneurship First Aid

The Community Engagement team with the expertise of a number of First aid providers hosted a pilot programme of first aid training in three regions in 2023 Dublin Carlow and Limerick This has been a success and will be repeated in 2024

Laptops for Member Tenants entering third level education

In 2023, with the support of the CHI National Board the Community Engagement team embarked on a social investment project supporting residents in CHI homes who were entering a degree level programme for the first time by gifting them a laptop These laptops support these individuals so that they can actively participate in their course and engage with the course material 46 residents applied with 23 residents fulfilling the eligibility criteria

The Community Engagement team set up a Community Engagement closed Facebook group for residents of CHI homes back in 2021 The aim of the group is to share community activities that are going on throughout the country, to share ideas and to generate discussion The group has gone from strength to strength in 2023 There are now 959 members on the Facebook group the engagement between member tenants has increased and to this day there has been no negative interaction on the page This is a good-natured sharing group which shows the spirit of the national community

Over the past year, the Community Engagement team have developed two member resources.

The first is a ‘next steps’ booklet that supports Member Associations to organise and develop community actions and initiatives This booklet will be given to Member Associations that are trying to find their feet, follow good practice and generate ideas that they can participate in with their communities

The next is a co-created booklet with the Community Engagement team, Income team and member tenants The booklet is titled ‘Cost Saving Tips and Tricks’ The narrative of the document comes from the voice of the member tenants through their participation in two engaging focus groups The booklet was designed due to the active cost of living crisis that we are all living in

Two thirds of the residents living in CHI homes are female and CHI believe that it is important to raise awareness of International Women’s Day every year.

The first panel focused on Inspiring CHI leaders and comprised of CHI Members who have contributed significantly to their communities, been active Members of the CHI board, or grown their own businesses Joining the discussion were CHI members Mamy Nzema Nkoy, Caoimhe McCarthy and Marianne Ward-O’Leary Maughan

CHI Member Mamy Nzema Nkoy shared her experiences of supporting people in education, academia, and finding her feet as a leader in her community Last year, Mamy was presented with a Leader in the Community award by the BallyfermotChapelizod partnership for promoting education in her area At the Women in Leadership Forum, Mamy said

the most important thing a leader needs to have is a “clear vision that others can get behind and support”

Women who have inspired Mamy include her own mother and Julia Gillard, the first female prime minister of Australia, whom she admires for having risen to a role in leadership after settling in a new country

Member Caoimhe McCarthy discussed the steps she took when setting up family-run business, Sitto Z, who make their own signature artisan chilli sauces, dry rubs and juices Discussing the business, Caoimhe described how in 2016 her husband, a chef by profession, suffered life altering injuries which rendered his chef days over Sitto Z was created to bring the skills of the family together into a viable business

During the discussion, Caoimhe emphasised the importance of teaching her teenage girls practical interpersonal skills to be successful, especially in business These skills included “engaging with the public at marketing events, offering samples, and being wellversed in explaining a product ” When asked about women leaders who inspired her, Caoimhe said she always looked to her own mam, who was “constantly reinventing herself”

“Women have a lot of life education to bring to the table, which should not be overlooked by others or by women themselves.”

She emphasised that women have a lot of “life education” to bring to the table, which should not be overlooked by others or by women themselves She described her move from the halting site to her forever home in Kilcronan Court in 1996 She said that she was “ very proud” of her “traveller heritage and traditions” and that her move was something she did so that her children would have “ a better chance” at pursuing their goals Speaking about women who inspired her, Marianne said her mother was a “strong woman ” and a huge inspiration for her, having lived “most of her life by the roadside which presented many challenges for her and her family

CHI Member and Board Member Marianne WardO’Leary Maughan joined the discussion to talk about the importance of encouraging women to take on leadership roles Marianne was recently voted onto the national board of CHI and is the chair of the Members Association in Kilcronan Court Marianne described a good leader as someone who has “support, empathy, passion and drive”

Co-operative Housing Ireland’s ambitious plans for growth in housing delivery and services to Members required a necessary growth in the organisation’s team and their professional development. At the end of 2023, CHI operated across 24 counties and the number of people working for CHI, across all areas of the organisation, excluding childcare, increased to 102 An increase of 17% since 2022

Evolve – Transforming Co-operative Housing Ireland

CHI’s business transformation programme – Evolve – was launched in March 2023 The business has continued to grow exponentially, adding more homes and more people to the organisation year after year This trajectory of growth would see us reaching around 10k properties by the end of the decade Becoming an effective larger business, however, is about much more than adding properties and people

To remain fit for purpose CHI needs to change the way it does things, and in some cases change the things it does Or to put it another way, we need to do things better and do better things During 2023 a series of ‘visioning’ sessions were held with the Executive Management Team, colleagues across CHI and a group of interested tenants. From these sessions several themes emerged which provided the framework for the business transformation programme, these were:

• CHI the organisation

• People

• Acquiring and maintaining our homes • Tenancy and Neighbourhood Management services • Performance management –KPIs and targets

We then prepared to move into 2024, recognising that the next steps in the Evolve programme were to develop these themes into a programme of work which will help shape the business as we move forward.

As an initial next step (following on from the Housing Services restructure, which was, effectively, the first project to be delivered under the Evolve programme)

an internationally recognised customer service training organisation, the Mary Gober Institute (MGI) was engaged to provide training across the organisation. Before the year came to an end, MGI held introductory sessions with managers across the business to prepare us for the work to come in 2024

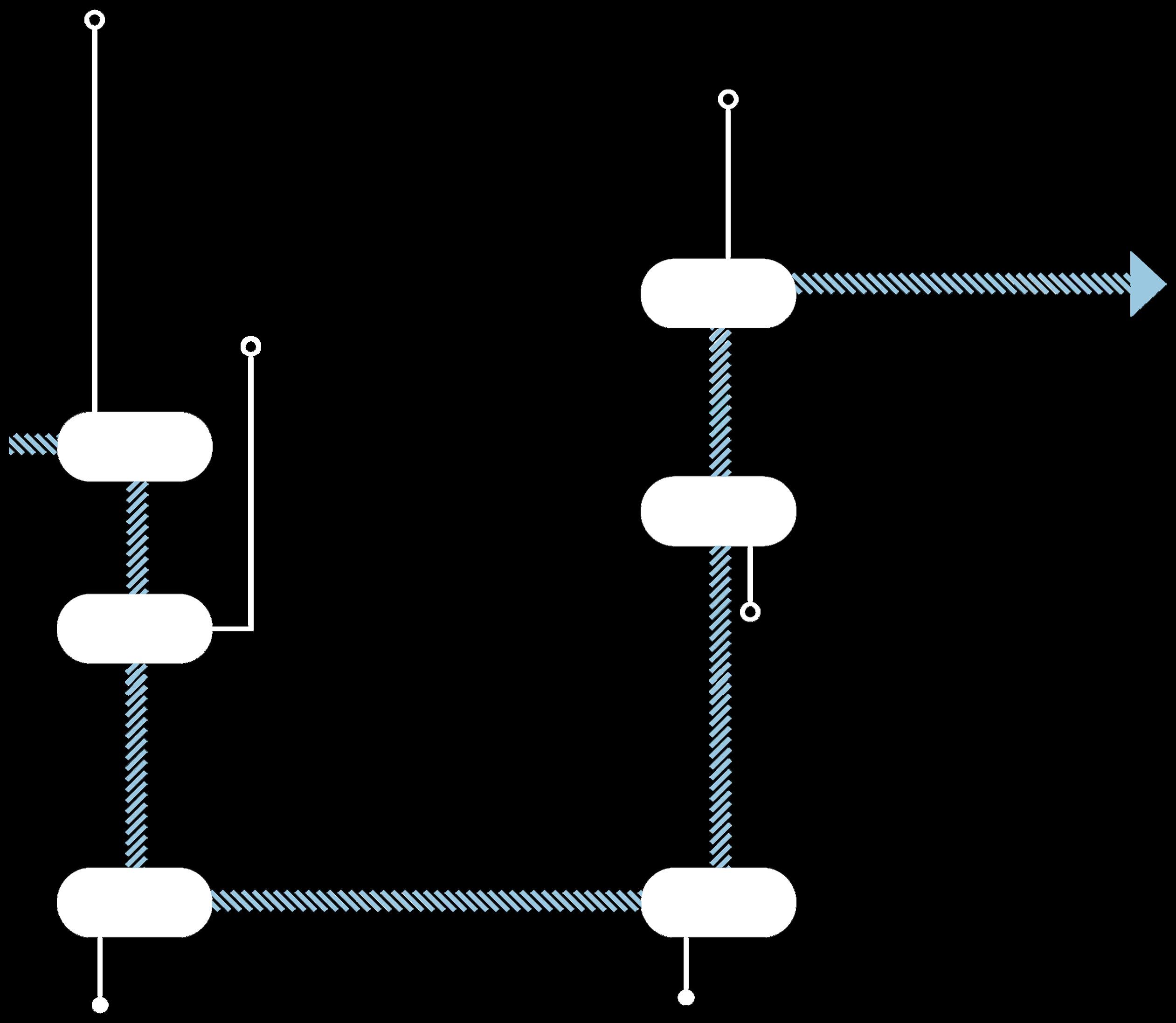

The Housing Services and Community Engagement division was restructured as part of CHI’s Evolve Business Transformation Programme. This restructure primarily focused on moving from a geographic model to a functional model.

One benefit of a functional model is that it provides the strongest opportunity to achieve both service consistency and high levels of performance It also allows room for the division to scale up within a growing organisation Colleagues can develop specialist skills in one clear area of focus Two new Heads of Housing Services roles were created to bring clarity on the management structure and provide single points of management accountability for individual services across the entire country

It is important for the new teams to work together in a spirit of collaboration and partnership This cultural aspect was central to the restructure It is lead from the top by the Director of Housing Services and Community Engagement, and re-enforced at all levels of the division, to ensure that the functional arrangements don’t result in silos, but that joint-working is the hallmark of how services are delivered

The new teams and their roles/responsibilities are as follows:

• Neighbourhood Team (Allocations & Lettings / Tenancy & Estate Management)

• Income and Financial Inclusion Team (arrears / other debt management / rent collection / financial inclusion)

• Safer Neighbourhoods Team (Anti-social behaviour / domestic abuse)

2023 proved to be a challenging year for the Income Team. In July and August there were significant issues with the Tenancy Management system, these hampered the income collection process, there were also further issues during the year with the system which impacted on the arrears recovery process. Thankfully with the assistance of the IT team many of the issues have been resolved. Although arrears did increase for CHI in 2023, the arrears percentage compares favourably against those reported by other AHB’s.

Co-operative Housing Ireland continues to provide quality early years education and school-aged childcare programmes to our CHI members and the wider community of East Wall, Dublin 3.

Nationally, the demand for childcare is increasing and this is evident particularly with the schoolaged Childcare programme By the end of 2023, our registration status was at 89% for our early years and school-aged programmes

The early learning and childcare sector saw a substantial package of €403 million in the Budget 2023 hitting the First 5 investment target of €1 billion This funding has been greatly appreciated by the sector nationally

From January 2023, funding of €121 million was allocated to reduce the parental co-payments for those registered on the NCS This funding saw an increases from €0 50 per

hour to €1 40 per hour for those accessing the universal subsidy With a major investment injected into the early learning and childcare sector this resulted in all our families signing up and benefiting from the reduced fees with some parental co-payments dropping by 21% making access to childcare more affordable for the families we work with

In August 2023, Co-operative Childcare Island Key renewed their contract with the Core Funding for the 2023/2024 academic year guaranteeing affordable childcare to our families by continuing to operate a fee freeze and ensuring the quality care provided remained high for both children and staff members

Co-operative childcare Island Key were successful in obtaining capital funding for the ‘Building Blocks Improvement Grant’ under the National Development Plan This funding was used to redesign and upgrade the existing kitchen and children’s sanitation spaces These works were completed in August 2023 and have provided more storage space, additional toileting and washing facilities and better accessibility

Co-operative Childcare strive to ensure we provide the best quality of care to our children and families We continued to work closely with Better Start throughout 2023 in delivering positive outcomes for children by working with the Siolta and Aistear Frameworks

Upon completion of the programme, all staff remained focused on developing the ‘Parent Partnership’ and ‘Curriculum’ pillars as well as implementing new ones

One staff member completed and graduated from the LINC programme in October 2023 at Mary Immaculate College, Limerick

The LINC programme is a Level 6 Special Purpose Award (Higher Education) that is designed to support the inclusion of children with additional needs in the early years

We also continued to work in partnership with several childcare organisations throughout 2023 Island Key worked closely with the National College of Ireland in delivering the Early Learning Initiative to the early years and school-aged childcare programmes to improve their literacy and numeracy understanding

Other organisations that we worked with regularly included Dublin City Childcare Committee, Early Childhood Ireland, POBAL, Tusla, National Childcare Scheme, Better Start and other local organisations

Co-operative Housing Ireland Society Limited (“the Society”) was formed in 1973 under the Industrial and Provident Societies Acts (Reg No 3174R) and is the national organisation representing, promoting, and developing the co-operative housing movement in Ireland The Society is jointly owned by its affiliated co-operative housing societies It is a not-for-profit organisation whose objectives are charitable in nature and has charitable status (CHY 6522) The Society’s Registered Charity Number (RCN) is 2001218

Co-operative Housing Ireland is Governed by its Rules, which were last amended at a Special General Meeting on 23 September 2023

Co-operative Housing Ireland’s Board comprises twelve non-executive members Up to seven Members of the Board are elected by the Members of Co-operative Housing Ireland and up to five are co-opted, by the Board, through a competitive, publicly advertised, process Prospective co-opted members apply by submitting their CV and a letter outlining how their skillset meets the needs of the organisation This is followed by an interview process

Board members serve for a two-year term which may be renewed up to a maximum tenure of ten years The Chairperson is elected, yearly, by the Board after the AGM up to a maximum of six years The CEO is not a member of the Board

Co-operative Housing Ireland’s Rules stipulate that an Election takes place every two years; 2023 was not an election year Outside of election years, when vacancies arise – for example, upon a resignation – Board members can be co-opted

The Board give their time to Co-operative Housing Ireland on a voluntary basis and receive no remuneration Out-of-pocket expenses may be reimbursed

The Board met 9 times in 2023 (10 times in 2022) with an attendance of 79% (2022, 69%) Some meetings were held virtually, and some meetings were a blend of inperson and virtual attendance

During the year between the approval of the 31 December 2022 financial statements and the approval of the 31 December 2023 financial statements, there were no new appointments or resignations to the Board of Management The board members who served throughout the 2023 financial year were Pearse O’Shiel, Enda Egan, Frances Kawala, Derek Maher, Cinnamon Blackmore, Regina Coakley, Nuala Savage, Marianne Ward-O’Leary Maughan, Michael Heaney, Eugene McLoughlin, Gerard McDonagh, and Ken Burke The Board remains steadfast in its commitment to maintaining the highest standards of corporate governance, ensuring continuity and stability in its oversight and strategic direction

Pearse O’Shiel (Chairperson)

Pearse O’Shiel is the chairperson of the CHI Board. He is a Ph D researcher and lecturer in the philosophy of education He was raised in a home built by the New Homes Housing Co- operative in Dublin Pearse lives in Co Clare and is married with three adult children

Enda Egan (Vice Chairperson)

Enda Egan is a serving civil servant since 1983. He has been volunteering for many years with the Richard Pampuri Social Club which is a social club for young adults with learning disabilities and special needs

Cinnamon Blackmore

Cinnamon Blackmore is the chairperson of the Slaney Co-operative She came to social activism to campaign for support and services for parents of special needs children, affordable housing and increased mental health services for young people in Wexford. She lives in Gorey and is a full-time carer to her son

Regina Coakley

Regina works full time in manufacturing and has held positions as Training Instructor, Health and Safety Co-ordinator and is currently Production Supervisor and Planner Regina lives in a Co-operative Housing scheme in Graiguecullen, Co. Laois.

Frances Kawala

Frances Kawala, although now retired, uses her arts background to find creative ways to encourage community involvement working with several local organisations to promote the needs of seniors, including their housing needs. She lives in a CHI home in Birr, Co Offaly

Derek Maher

Derek Maher is the Chairman of Downview Residents’ Association and is currently Chairman of Munster Co-operative He is married with four children and two grandchildren.

Nuala Savage

Nuala grew up in Bray, Co Wicklow, and is the mother of one son She works as a nurse, and previously owned and ran a creche in Leopardstown. Her son has special needs, and she actively engages in courses to support his care Nuala describes herself as a ‘people person’, with a lot to offer and to learn She loves putting her knowledge to good use in the community and getting things done.

Ken Burke

Ken lives in Dublin and has over 25 years’ experience leading financial services businesses He holds board positions in regulated firms in Ireland and the UK and was previously CEO of AIB Mortgage Bank and Head of AIB Business Banking He runs a successful strategic advisory business and has extensive property, commercial and risk skills. Ken is a Certified Director and holds a Masters in Business Administration from Trinity College Michael Heaney

From 2017 to 2022, Michael Heaney served as CEO of Údarás na Gaeltachta, the state agency with responsibility for economic, social and cultural development in Ireland’s Gaeltacht regions Prior to this, he was Director of Planning, Economic Development, Community and Cultural Services with Donegal County Council. He also served as Chief Executive of the Donegal County Development Board. He has worked in other roles within the state, local development, community development and development of education sectors Michael is a Board Member of the Irish College Leuven, of Asia Matters and of Donegal Tourism. At present, he is Vice-President of the Assembly of European Regions (AER) Gerard McDonogh

Gerry is a Chartered Accountant and experienced Finance professional having spent his early career working with PwC and subsequently spent 28 years with Musgrave Group in senior finance leadership positions before retiring in 2021 He has extensive experience in financial risk management, Corporate Governance and regulatory compliance Gerry is a director of Douglas Credit Union, a not-for-profit regulated financial institution and lives in Cork with his family.

Eugene McLoughlin

Eugene has over 40 years’ experience in the financial services industry and has held senior positions in Ulster Bank Group and The National Asset Management Agency He is a Fellow of The Institute of Bankers in Ireland and holds a Diploma in Company Direction from The Institute of Directors in Ireland. Eugene lives in Dublin and is married with three adult children

Marianne Ward-O’Leary Maughan

Marianne is a CHI Member, married with five kids and two grandchildren who are her heart and soul. Marianne loves music, cars, animals, and working in the community to help improve the area She’s proud of where she lives, the progress the community has made in the past few years, and the neighbours and friendships she has made along the way. Marianne looks forward to being part of a team of strong people and working towards more improvements across the board for all CHI Members

The attendance of members was as follows:

Name Present Absent Length of Service (years)

Pearse O Shiel

Derek Maher

Frances Kawala

Cinnamon Blackmore

Regina Coakley

Marianne Ward O’Leary Maughan

Nuala Savage

Enda Egan

Michael Heaney

Eugene McLoughlin

Gerry McDonogh

Ken Burke

Co-operative Housing Ireland Committees

The Board also has four standing sub-committees that meet on a regular basis: the Audit Assurance and Finance Committee Housing Services & Community Engagement Committee, Asset Management & Property Services Committee, and Development and Growth Committee The membership of these sub-committees includes Board Members, as well as others who are not members of the Board who, in a voluntary capacity, provide their expertise

There are also Ad Hoc Officer, Co-operative Structures, and Remuneration Committees

Details of the standing sub-committees are outlined below:

Name Length of Service (years)

Meeting Attendance/ No. of elligible meetings 2024 (up to 30th June) Representing, Promoting, Developing Since 1973

Eugene McLoughlin

Gerry McDonogh

Brian Heffernan

Aleksandra

The Audit, Assurance, and Finance (AAF) Committee is comprised of voluntary membership and met formally seven times during 2023 This was supplemented with various ad hoc work undertaken by the Committee, and its working groups, and provided individually by its members during the year

The workings of the AAF Committee are subject to terms of reference stipulated by the Board The Committee gives assurance to the Board in giving objective advice on the adequacy of the systems of governance internal control and risk management in the Society including oversight of the work of the internal audit function The role of the AAF Committee is therefore advisory rather than supervisory In summary it provides oversight of the financial reporting process, risk management systems, governance, internal controls and audit functions of the Society and provides assurance on the adequacy of and compliance with these systems On the basis of its considerations during the financial year, the AAF Committee is satisfied that the controls in place in CHI have been developed in a manner which addresses the range of risks for the Society and that these controls are operating satisfactorily

The Committee is also satisfied that the Internal Audit function and the external auditors are making a valuable contribution to the overall control environment through their evaluation and recommendations for improvement of controls across the activities of CHI

Kim Olin

Angela Shafer

Tracy Tuffin

Derek Maher

Coakley

The role of the Housing Services and Community Engagement 2023 Committee, is to provide direction and oversight on the Society’s work in engaging customers, including their wider community, to provide services that meet their needs and improve the customer experience In addition, the committee has oversight of the collection of rental income, asset management and the operation of the Childcare business The sub-committee helps to ensure that efficient and effective services are provided to meet agreed strategic and corporate outcomes, objectives and values, and that mitigation action is taken to address under performance where necessary It has a particular focus on customer and community insight and ensuring that the Society learns from and is responsive to customer and community feedback

Asset Management and Property Services Committee

Sub-committee - Asset Management and Property Services

Name Meeting Attendance/ No. of elligible meetings

Michael Heaney

Stephen Branigan

David Cullen

Alan Gallagher

Luke Howard

Ciaran King

O’Shaughnessy

of Service (years)

The Asset Management and Property Services Committee sub-committee provides oversight on all aspects of the maintenance and protection of the assets of the business, giving advice and making recommendations to the Board with specific focus on CHI’s Asset Management Strategy including consideration of the multi-annual capital component replacement programme, Deep Energy Retrofit Programme, and priorities for planned maintenance and asset improvements

Representing, Promoting, Developing Since 1973

Name Meeting Attendance/ No. of elligible meetings Length of Service (years)

Ken Burke

Frances Kawala

Peter Carroll

Martin Hanratty

Catherine Sturgeon