Legal Battle Concludes

Advanced Care Health Systems, LLC Dissolved, Michelle MacGregor Found in Contempt

By: John Oliver

A CONTENTIOUS LEGAL BATTLE

over the ownership and control of Medford-based Advanced Care Health Systems, LLC (ACHS) has finally come to a conclusion, with the once-promising health care business now dissolved. The case, which involved Lakiesha Sheaffer, a licensed Nurse Practitioner, and Michelle MacGregor, a registered nurse, drew significant attention due to the highstakes nature of their dispute.

The conflict began in March 2023 when Sheaffer and MacGregor co-founded ACHS to operate a health care clinic in Medford. However, disagreements quickly surfaced regarding the business’s ownership structure and day-to-day operations. Tensions between the two partners escalated, leading Sheaffer to seek legal action and file for a temporary restraining order to prevent MacGregor from making decisions that might destabilize the clinic.

Central to Sheaffer’s argument was Oregon law (ORS 58.376), which requires that licensed health care practitioners maintain majority control over health care businesses. Sheaffer, who holds such a license, contended that MacGregor, a registered nurse, did not meet the legal criteria to independently control the company. Court documents detailed MacGregor’s alleged overreach, including interference with staff, unauthorized access to confidential information, and the improper withdrawal of business funds.

The rift deepened in November 2023, when MacGregor’s attorney sent a letter demanding that Sheaffer stop receiving salary distributions, further intensifying their already strained relationship. Adding a significant legal twist, MacGregor was found in contempt of

court on July 7, 2024, for violating a Stipulated Order of Temporary Restraint issued earlier in March. The order, designed to protect the business from unilateral actions by either party, was reportedly disregarded by MacGregor, prompting Sheaffer’s legal team to seek remedial action. The court found that MacGregor’s failure to comply with the order led to her wrongful termination and played a key role in ACHS’s dissolution.

In the months following the court’s contempt ruling, ACHS officially ceased operations, leaving its employees and approximately 2,000 patients in a precarious situation as the business wound down. The Jackson County Circuit Court ultimately ruled in favor of Sheaffer’s request to dissolve the business, citing irreconcilable differences between the partners and ongoing legal violations by MacGregor.

This case highlights the complexities of business partnerships in the health care industry, where legal obligations, professional licensing, and regulatory compliance intersect. The dissolution of ACHS marks the end of a tumultuous chapter for Sheaffer and MacGregor, but the contempt finding against MacGregor underscores the serious legal consequences of failing to comply with court orders.

For now, the clinic that once held promise to serve Medford’s health care needs no longer exists, and both former partners must navigate the aftermath of their dissolved business and fractured relationship.

SEPTEMBER 2024

Veteran’s

Struggle

Life After the 1st Gulf War Amidst VA Challenges

By: John Oliver

AS THE YEARS ROLL ON and societal norms shift, veterans from past conflicts are finding themselves increasingly at odds with the systems meant to support them. For those who served in the 1st Gulf War, the transition from military life to civilian life has never been easy, but today’s environment of bureaucratic red tape and insufficient support from the Veterans Affairs (VA) system has only compounded their struggles. The disconnect between national policies and local VA services has left many veterans grappling with inadequate care and support.

John Miller, my brother, a veteran of the 1st Gulf War, epitomizes the challenges faced by many former soldiers. In 1991, he was among the troops sent to the Middle East to liberate Kuwait from Iraqi forces. The experiences and sacrifices he made during that time have shaped his life, but the aftermath of his service has been marred by the struggle to access adequate care and support.

Miller, now in his early fifties, reflects on his military service with a sense of pride but also frustration. “I did my duty, and I did it well,” he says. “But now, dealing with the VA has become a full-time job in itself. It’s like the

Continued on page 3

Veteran’s Struggle

From page 1

system was designed to make things as difficult as possible.”

At the national level, the VA has made strides in addressing veterans’ issues, including increased funding and new initiatives aimed at improving healthcare and services. However, the reality on the ground often falls short of these promises. The disconnect between national policies and local implementation has resulted in significant challenges for many veterans.

Local VA offices, including the one in Miller’s area, are facing severe budget constraints and staffing shortages. The mismatch between the expectations set by national policies and the resources available at the local level has led to a host of problems, including long wait times, reduced services, and low morale among staff.

“The VA has great intentions, but the execution is often lacking,” says Dr. Linda Thompson, a healthcare provider at a local VA clinic. “We’re dealing with a limited budget and an overwhelming number of veterans needing care. It’s a constant struggle to balance the needs of our patients with the resources available.”

One of the most pressing issues facing local VA facilities is budget shortfalls. Many VA centers operate under tight financial constraints, which impact their ability to provide comprehensive care. Staffing shortages exacerbate these problems, leading to longer wait times for appointments and reduced access to essential services.

Veterans like Miller are often caught in this system of scarcity. “I’ve had to wait months for an appointment that should have been addressed much sooner,” he says. “It’s frustrating and disheartening to see how the system is failing those who served.” The lack of adequate staffing has also led to increased stress and burnout among VA employees. “We’re doing the best we can with what we have,” Dr. Thompson explains. “But the constant pressure and high caseloads take a toll on everyone. It’s not just the veterans who are suffering—our staff is too.”

In addition to budget and staffing issues, veterans face significant bureaucratic hurdles when dealing with the VA. The process of filing claims, appealing decisions, and navigating the various channels within the VA system can be overwhelming and discouraging.

Miller describes his experience with the VA claims process as a “nightmare.” “I had to file multiple appeals just to get the benefits I’m entitled to,” he says. “It feels like you’re fighting against a wall of red tape that’s determined to keep you from getting what you need.”

The bureaucratic maze of the VA can be particularly daunting for older veterans who may not be as familiar with the intricacies of the system. The complexity of the claims process and the lack of clear guidance can lead to delays and denials, further compounding the frustrations experienced by veterans.

Despite these challenges, there are ongoing efforts to improve the VA system and provide better care for veterans. Local VA offices are working to address staffing shortages, streamline processes, and enhance the quality of care provided. Additionally, various veteran advocacy groups and organizations are pushing for policy changes and increased funding to support veterans’ needs.

For John Miller and other veterans, these efforts offer some hope, but there is still much work to be done. “We need more than just promises,” he says. “We need real changes that will make a difference in our lives.”

In the face of these systemic challenges, many veterans are finding strength in personal resilience and community support. Miller is actively involved in local veteran organizations and support groups, where he connects with others who understand his struggles. “It’s important to have that sense of community and support,” he says. “It helps you cope with the frustrations and find ways to advocate for yourself.”

Community organizations and veteran support groups play a crucial role in bridging the gap between the services provided by the VA and the needs of veterans. These groups offer resources, advocacy, and a sense of camaraderie that can be invaluable in navigating the complexities of life after military service.

As the nation reflects on its commitment to veterans, there is a growing need for systemic change within the VA to address the disparities between national policies and local realities. Ensuring that veterans receive the care and support they deserve requires a concerted effort from policymakers, VA officials, and the community at large.

For veterans like John Miller, the journey to secure adequate care is ongoing. The hope is that by shining a light on these issues, meaningful changes can be made to improve the VA system and better serve those who have sacrificed so much for their country. In the end, the goal is clear: to create a system that honors the service of veterans with the respect and support they have earned. As the challenges persist, it is up to all of us to advocate for the changes needed to ensure that veterans receive the care and recognition they so rightfully deserve.

Understanding Reverse Mortgages in Today’s Oregon Economy

By: Pamela Boatsman

AS THE HOUSING MARKET in Oregon continues to fluctuate, many seniors are exploring financial options to secure their retirement. One such option that has garnered attention is the reverse mortgage. A reverse mortgage can be a valuable tool for older homeowners looking to tap into their home equity to support their financial needs. However, it’s crucial to weigh the benefits and drawbacks, especially in today’s evolving economic landscape.

WHAT IS A REVERSE MORTGAGE?

A reverse mortgage is a type of loan available to homeowners aged 62 and older that allows them to convert part of their home equity into cash. Unlike a traditional mortgage where the borrower makes monthly payments to the lender, in a reverse mortgage, the lender makes payments to the borrower. The loan is repaid only when the homeowner sells the home, moves out, or passes away.

PROS OF REVERSE MORTGAGES

Supplemental Income: For many retirees, a reverse mortgage provides a much-needed source of supplemental income. This can be particularly beneficial in today’s economy, where inflation and rising costs of living have put a strain on fixed incomes. With the cash from a reverse mortgage, seniors can cover everyday expenses, healthcare costs, or other financial needs.

No Monthly Payments: One of the biggest advantages of a reverse mortgage is that it does not require monthly mortgage payments. The homeowner is not obligated to make payments on the loan, which can free up funds for other uses. This can be particularly appealing for retirees who may have limited income and prefer not to manage additional monthly expenses.

Flexibility in Payout Options: Reverse mortgages offer several payout options, including lump-sum payments, monthly installments, or a line of credit. This flexibility allows homeowners to choose a payout structure that best fits their financial situation and goals. In a volatile economy, having access to a line of credit can be especially useful, providing a safety net for unexpected expenses.

Home Ownership Retained: Unlike selling a home or taking out a traditional home equity loan, a reverse mortgage allows homeowners to retain ownership of their property. As long as they continue to meet the obligations of the loan, such as paying property taxes and maintaining the home, they can live in their house for as long as they wish.

Tax-Free Funds: The funds received from a reverse mortgage are generally not considered taxable income. This can be a significant advantage for retirees, as it means they won’t face additional tax burdens on the money they receive from the loan. High Costs and Fees: Reverse mortgages come with various fees and costs, including origination fees, closing costs, and servicing fees. These costs can be substantial and may reduce the amount of cash available to the borrower. In today’s economy, with rising costs and financial uncertainties, these fees can be a significant downside for many seniors.

Impact on Home Equity: While a reverse mortgage allows homeowners to access their home equity, it also reduces the equity left in the home. Over time, as interest accrues and the loan balance increases, the amount of equity in the home decreases. This can affect the financial legacy left to heirs and may limit options if the homeowner needs to sell the property or move in the future.

Complexity and Requirements: Reverse mortgages can be complex and may involve various requirements and conditions. Homeowners must continue to pay property taxes, maintain homeowner’s insurance, and keep the home in good condition. Failure to meet these requirements can lead to the loan being called due, potentially resulting in foreclosure. The complexity of the reverse mortgage process may also make it challenging for some seniors to fully understand the terms and implications. Potential for Reduced Benefits: The amount of money a homeowner can receive from a reverse mortgage depends on various factors, including the value of the home, the borrower’s age, and current interest rates. In a fluctuating market, the benefits of a reverse mortgage may be reduced, and homeowners may find that they don’t receive as much cash as they anticipated. Additionally, changes in the value of the home can affect the loan amount and terms.

Effect on Government Benefits: While reverse mortgage funds are generally not taxable, they can impact eligibility for certain government benefits. For example, receiving a lumpsum payment from a reverse mortgage may affect eligibility for Medicaid or Supplemental Security Income (SSI). Seniors should carefully consider how a reverse mortgage might impact their overall financial situation and government benefits.

It’s essential for homeowners in Oregon to thoroughly research and consider their options, consult with financial advisors, and fully understand the terms and implications of a reverse mortgage before making a decision.

REVERSE MORTGAGES IN OREGON

In Oregon, the real estate market has seen significant fluctuations in recent years, and the state’s economic conditions play a role in the reverse mortgage landscape. Oregon’s housing market has experienced periods of both high home values and affordability challenges. As a result, the pros and cons of reverse mortgages can vary based on individual circumstances and regional market conditions.

For many Oregonians, a reverse mortgage can be an effective way to access home equity, especially in areas with high property values. However, the high costs and complex nature of reverse mortgages mean that homeowners must carefully consider their financial situation and future plans before proceeding.

Reverse mortgages offer a potential solution for seniors looking to tap into their home equity to support their retirement. With benefits such as supplemental income, no monthly payments, and retained home ownership, they can provide valuable financial support. However, the high costs, impact on home equity, and complexity of the loan must be weighed carefully.

In today’s economic climate, where inflation and rising living costs are significant concerns, reverse mortgages can be a viable option for some. Nonetheless, it’s essential for homeowners in Oregon to thoroughly research and consider their options, consult with financial advisors, and fully understand the terms and implications of a reverse mortgage before making a decision.

Celebrating 105 Years

The Life and Legacy of Bell Pepper

By: John Oliver

ONE WEEK AGO, Grants Pass celebrated an extraordinary milestone: Bell Pepper, a beloved member of the community, turned 105. Born in 1919, Bell has lived through more than a century of history, seeing the world transform in ways many of us can only imagine. Though Bell is now legally deaf, her niece, Bonnie Lynam, sat down with Senior Planner to share stories from her remarkable life.

Bell’s journey began in Newtown, Pennsylvania, where she spent her early years before eventually settling in Grants Pass 45 years ago. Her niece described her as a vibrant figure in the community, still known to dance down the hallway with her walker always full of life and laughter. “She’s got that feisty spirit,” Bonnie chuckled, noting that Bell’s longevity is likely tied to her healthy habits. “She never smoked, never drank, and always believed in moderation.”

Throughout her life, Bell witnessed profound changes, from the invention of the refrigerator to the rise of the internet. “I remember when people used iceboxes to keep things cold,” Bonnie recounted on her aunt’s behalf. “Now, everything’s automated refrigerators, delivery services it’s amazing how much has changed.” Though Bell hails from the East Coast, Grants Pass has been her home for decades, and she’s seen the town evolve and grow.

One of Bell’s great passions was raising Pomeranian show dogs, a hobby that kept her active and connected to the local community. But it wasn’t just the dogs that brought Bell joy she shared a particularly strong bond with her twin sister, Donna. “They were inseparable,” Bonnie said. “Some of her best memories were camping and fishing with Donna, who passed away at 85.” Those outdoor adventures were among the highlights of Bell’s life, reflecting her love for nature and family.

At 105, Bell still enjoys life’s simple pleasures. Her favorite treats? “Ice cream, potato chips, and Pepsi,” Bonnie revealed with a smile. “She’s always had a sweet tooth.”

As we reflect on Bell’s life, one thing is clear: her story is one of resilience, joy, and a love for the small things that make life sweet. Her legacy is an inspiration, reminding us all to live with moderation, embrace our loved ones, and enjoy every day ice cream in hand.

Happy 105th birthday, Bell Pepper here’s to many more!

RECIPE

Sponsored by

Spooky Stuffed Pumpkin Dip

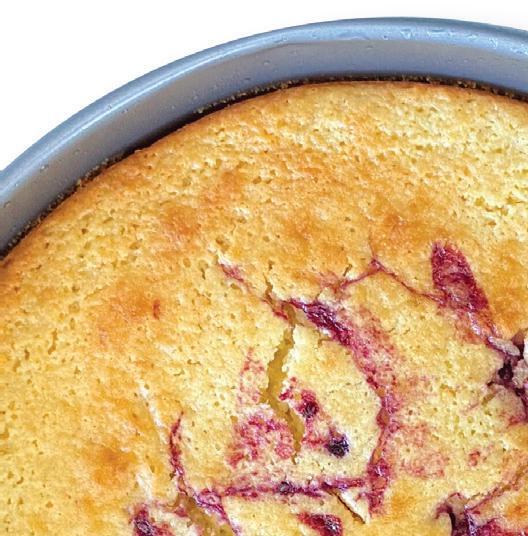

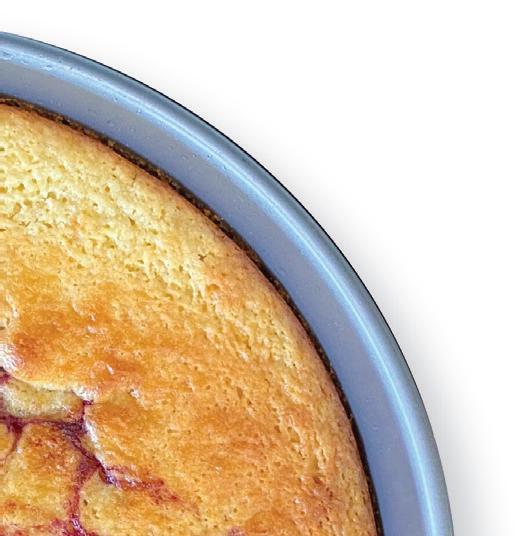

Gluten-Free Pacific Northwest Marionberry Cake

As Halloween approaches, it’s time to summon the spirit of the season with a recipe that’s both spooky and scrumptiously delicious. Picture this: a plump pumpkin, fresh from the patch, ready to be transformed into the ultimate fall party dip!

INGREDIENTS:

• 1 medium pumpkin (about 4–5 pounds)

For those of you with restrictive diets, or those that simply just prefer to cut gluten we have a delectable solution! Indulge in the vibrant flavors of the Pacific Northwest with our Gluten-Free Marionberry Cake recipe. Bursting with the sweet essence of locally harvested Marionberries, this delightful treat is not only a celebration of the region’s iconic fruit but also a gluten-free delight for those with dietary preferences. Crafted with a tender gluten-free batter and generously studded with plump Marionberries, each bite of this cake offers a taste of the lush landscapes and bountiful orchards of the Pacific Northwest. Follow along as we guide you through creating a moist, flavorful cake crowned with a homemade Marionberry sauce – a dessert that embodies the essence of the region while accommodating a gluten-free lifestyle.

• 1 tbsp olive oil

• 1 cup shredded mozzarella cheese

• 1 cup shredded cheddar cheese

• 1 cup cream cheese, softened

• 1/2 cup sour cream

• 1/2 cup mayonnaise

• 1 clove garlic, minced

• 1/2 tsp dried thyme

• 1/2 tsp dried rosemary

• 1/2 tsp smoked paprika

• 1/4 tsp black pepper

• 1/4 tsp salt

• 1/4 cup grated Parmesan cheese

• Fresh parsley, chopped (for garnish)

• Fresh veggies and crackers (for serving)

INSTRUCTIONS:

INSTRUCTIONS:

using frozen, thaw and drain excess liquid) 2 tablespoons gluten-free all-purpose flour

For the Marionberry Sauce:

• 1½ cups Marionberries

• ¼ cup granulated sugar

• 1 tablespoon lemon juice

• 1 tablespoon water

1) Preheat the Oven: Preheat your oven to 375°F (190°C). 2) Prepare the Pumpkin: Wash the pumpkin and cut off the top, creating a lid. Scoop out the seeds and stringy insides using a spoon or ice cream scoop. Lightly brush the inside and outside of the pumpkin with olive oil. 3) Roast the Pumpkin: Place the pumpkin (with the lid) on a baking sheet and roast in the preheated oven for 25-30 minutes, or until the flesh is tender but still firm enough to hold its shape. Remove from the oven and let cool slightly. 4) Make the Dip Filling: While the pumpkin is roasting, in a medium bowl, combine the shredded mozzarella cheese, shredded cheddar cheese, cream cheese, sour cream, mayonnaise, minced garlic, dried thyme, dried rosemary, smoked paprika, black pepper, and salt. Mix until well combined. 5) Fill the Pumpkin: Spoon the cheese mixture into the roasted pumpkin, spreading it evenly. Sprinkle the grated Parmesan cheese over the top. 6) Bake the Dip: Return the filled pumpkin to the oven and bake for an additional 20-25 minutes, or until the cheese is bubbly and golden brown. 7) Garnish and Serve: Remove from the oven and let cool slightly. Garnish with chopped fresh parsley. Serve the spooky stuffed pumpkin dip with fresh veggies and crackers for dipping.

TIPS:

• For a fun Halloween touch, you can carve a spooky face into the pumpkin before roasting. Just be sure to do this carefully and avoid carving too deep, as it may affect the structural integrity of the pumpkin.

• Adjust the seasoning and cheese types according to your taste preferences.

1) Preheat your oven to 350°F (175°C). Grease and flour a 9-inch round cake pan. 2) In a medium bowl, whisk together the gluten-free all-purpose flour, baking powder, baking soda, and salt. Set aside. 3) In a large mixing bowl, cream together the softened butter and granulated sugar until light and fluffy. 4) Add the eggs one at a time, beating well after each addition. Stir in the vanilla extract. 5) Gradually add the dry ingredients to the wet ingredients, alternating with buttermilk. Begin and end with the dry ingredients. Mix until just combined. 6) Toss the Marionberries in 2 tablespoons of gluten-free all-purpose flour to coat them. This helps prevent them from sinking to the bottom of the cake. 7) Gently fold the floured Marionberries into the batter. 8) Pour the batter into the prepared cake pan, spreading it evenly. 9) Bake in the preheated oven for 40-45 minutes, or until a toothpick inserted into the center comes out clean. 10) While the cake is baking, prepare the Marionberry sauce. In a saucepan over medium heat, combine Marionberries, granulated sugar, lemon juice, and water. Simmer for about 10-15 minutes, stirring occasionally, until the berries break down and the sauce thickens. Remove from heat and let it cool. 11) Once the cake is done, remove it from the oven and let it cool in the pan for 10 minutes before transferring it to a wire rack to cool completely. 12) Drizzle the Marionberry sauce over the cooled cake before serving. Slice and enjoy the delicious taste of the Pacific Northwest in this gluten-free Marionberry cake!

• This spooky stuffed pumpkin dip is sure to be a hit at your fall Halloween potluck party, offering a delicious and festive treat for all your guests!

“At the Grants Pass Gospel Rescue Mission, we are bound to proclaim Jesus Christ to the homeless and needy of Josephine County in a spirit of care by assisting with clothing, spiritual counseling, education, food, healthcare and shelter. We accomplish all this with an attitude of commitment.”

“At the Grants Pass Gospel Rescue Mission, we are bound to proclaim Jesus Christ to the homeless and needy of Josephine County in a spirit of care by assisting with clothing, spiritual counseling, education, food, healthcare and shelter. We accomplish all this with an attitude of commitment.”

540 SW Foundry