With over 100 years of experience, BITCO Insurance provides personalized services for contractors in all aspects of construction

Written by Dawn Killough

Produced by Stephen Marino

personalized

With roots in the coal mining industry, BITCO Insurance Companies provides business insurance coverage for construction, forestry, and oil and gas companies. Underwriters and agents are proactive in building relationships with insureds, providing regular communication and site visits, and being active in industry associations.

“We rely heavily on longstanding relationships with our agents, some of which have been around for over 50 years,” said Matt Kane, VP of Underwriting for the Western Region. “We place a lot of trust in their specialized knowledge of our products and the niche markets we serve.”

Longevity is the key to building great relationships, as many of BITCO’s underwriters

and senior management have decades of experience with the firm. “One of our mantras is, ‘if you get with BITCO, more than likely you’ll stay with BITCO,’” said Mark Wendell, VP of Underwriting, Oil and Gas, who’s been with the company for 36 years. And that mantra applies to both employees and customers. Underwriters, who decide whether to offer

coverage to specific customers, provide services like risk assessment and claims assistance. Local agents are usually the face of the company to customers, although that isn’t always the case. “We’re a little unique in that the underwriter wears all the hats,” explained Wendell. “They’re the marketing rep, underwriter, and the first person you contact. They’re the single point of contact.”

Developing close relationships with customers helps BITCO better serve its customers, as well as helping to reduce claims.

BITCO has a robust suite of programs for

“One of our mantras is, ‘if you get with BITCO, more than likely you’ll stay with BITCO.”

Mark Wendell, VP of Underwriting, Oil and Gas

construction contractors, from generals to excavation and utility contractors. There are five construction programs split by the type of work performed: builders (general and trade contractors), transportation (bridges, culverts, streets, roads), land improvement (site work, grading, excavation), materials producer (quarries, sand, gravel, ready mix), and utilities (water, sewer).

Their general contractor program offers several types of coverage, including workers’ compensation, general liability, automobile, umbrella, equipment, builders risk, and installation floaters. Additional protections are available, such as additional insureds and project general aggregate limits. Under their trade contractor program, they cover concrete construction, carpentry, plumbing, HVAC, drywall, painting, and electrical contractors with the same coverage as general contractors, including additional insureds and aggregate limits.

The transportation program is for contractors that work on streets, roads, bridges, and culverts. Specialized coverages, such as inland marine for equipment, including rentals, builders risk and installation floaters, and railroad protective liability coverage, are

included. Other options are available, including extended liability coverages and accounts receivable protection.

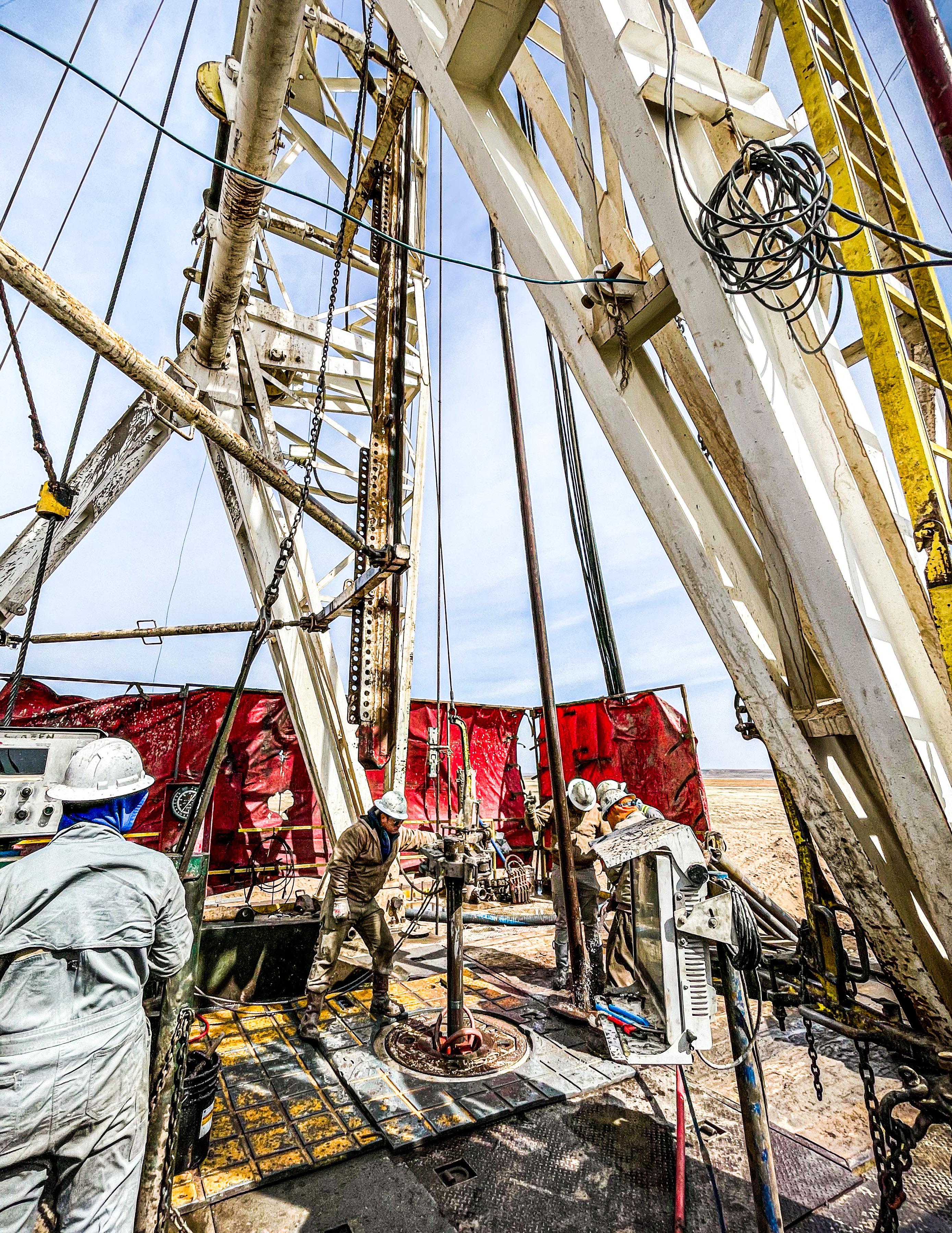

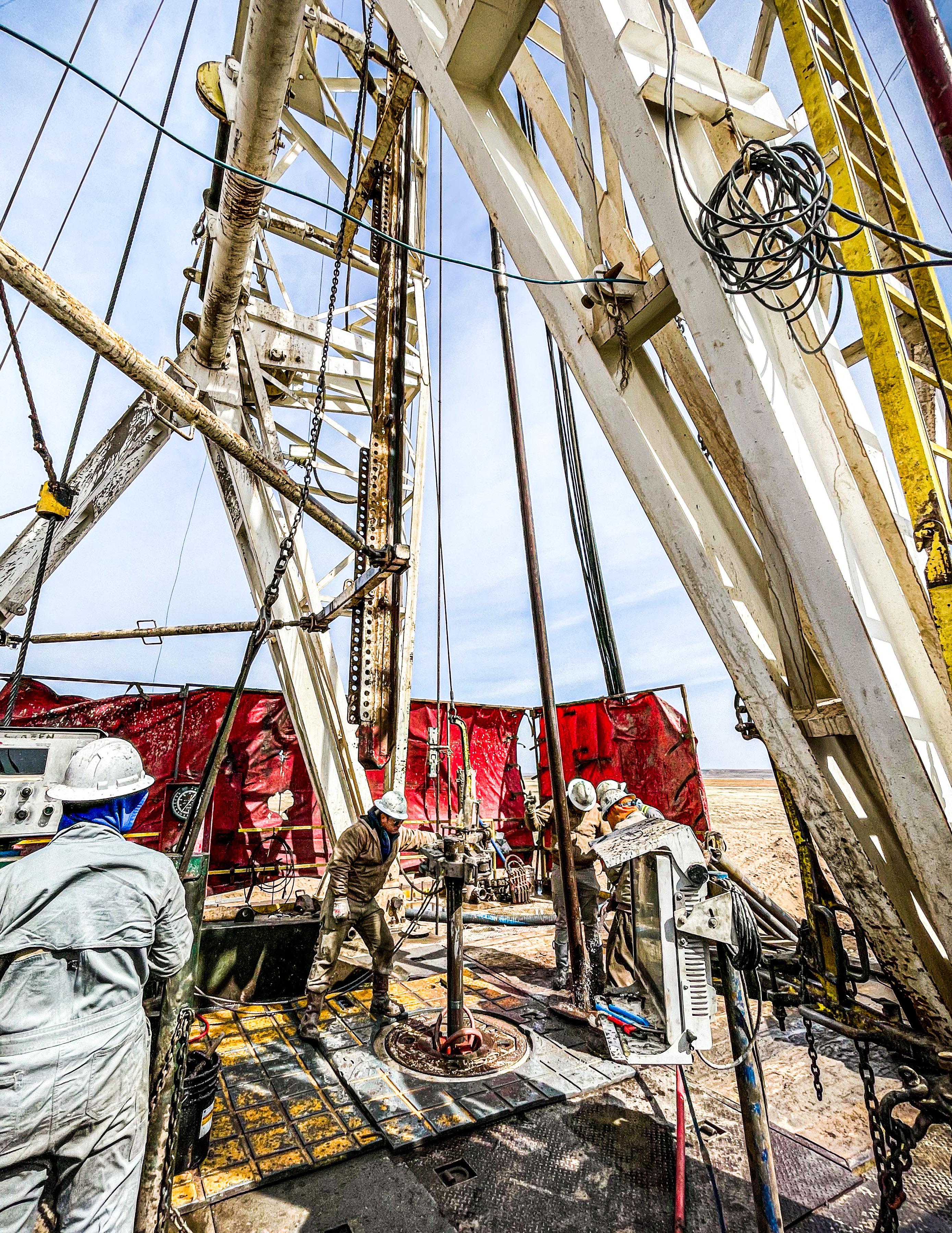

Land improvement contractors who provide grading, landscaping, or excavating services are covered under BITCO’s land improvement program. Sand and gravel producers, quarries, and ready-mix suppliers and producers can purchase coverage under their materials producers program, with options for extended liability endorsements, motor truck cargo coverage, and business income insurance. Utility contractors who work on water and sewer line projects can purchase standard insurance coverage under BITCO’s utilities program. Additional options include utility contractors extended liability coverage, connector equipment, and installation floaters. Oil and gas industry contractors working on

onshore petroleum and natural gas production, including operators and drillers, can purchase standard coverages, with options for pollution coverage, oil spill clean-up insurance, welldrilling equipment, and oil rigs.

BITCO’s underwriters and agents leverage the relationships they have built in the industry to assist insureds in identifying and mitigating risks on job sites. They provide resources and training to help companies reduce liability, save on costs, and improve the safety of their operations.

Their customer portal offers insureds a wealth of resources to help educate workers and provide guidance on best practices. Offerings include accident investigation procedures, driver training, management and supervisor training, and programs for fall protection, confined space entry, hazard communication, lockout/tagout, and vehicle accident prevention.

“We’ve got a very positive and welcoming culture nationwide throughout all of our offices.”

Matt Kane, VP of Underwriting, West Region

Underwriters perform site visits regularly with customers to help them assess the risks and provide insight on mitigating them. Should an incident occur that requires a claim, local agencies are the first line of communication, helping customers proactively respond to reduce costs and delays as much as possible. They also assist with workers’ compensation claim management, providing tools and resources to reduce their impact.

As part of the Old Republic General Insurance Group, one of the nation’s 50 largest publicly held insurance organizations, BITCO’s vast resources allow them to respond quickly and provide support and services for contractors in commercial or transportation construction.

Protecting assets is what we do, making a difference is who we are.

As an employer, BITCO offers many benefits, including a positive work culture, growth opportunities, and training and internships. “We’ve got a very positive and welcoming culture nationwide throughout all of our offices,” said Kane. There are many underwriters and agents that have been with the company for decades. “We’ve been doing something right to have that longstanding retention,” Kane continued.

Continued education for accreditation is offered to employees, either through a college program or for the chartered property casualty underwriter (CPCU) program. The CPCU accreditation shows the employee has received training and been tested on insurance, risk management, claims, and underwriting. The

course and tests are administered by The Institutes.

BITCO also has its own underwriter training program for college graduates. “We’ve had a lot of success over the past five or six years with new college grads that were a finance major or a risk management insurance major,” said Kane. “We bring them to our home office for about six months, and then they go to our branch offices to continue their careers. We’ve had close to 90% retention over the past few years.”

“We’ve been doing something right to have that longstanding retention.”

Matt Kane, VP of Underwriting, West Region

Summer internship opportunities include working with their underwriting, accounting, or IT departments.