Annual Report

Annual Report

Connexus Credit Union experienced significant progress and transformation throughout 2024.

Backed by the unwavering support of our member-owners and employees, the Board of Directors and Senior Leadership Team (SLT) navigated headwinds, embraced change, and launched strategic plans designed to bolster our legacy as your strong, trusted credit union.

Throughout the year, we gained momentum in places where it mattered and scaled back in others. With deliberation and care, we strengthened our foundation and remained committed to Our Vision, ensuring we continue to serve the needs of our members and employees.

As we moved into the current year, Connexus was grateful to celebrate a monumental milestone: 90 years of serving members.

Your credit union was founded by nine original members on April 9, 1935, in Wausau, Wisconsin. In the decades since, Connexus has expanded its membership criteria, merged with other credit unions, navigated the advent and adoption of technology, and, most importantly, earned a reputation as a trusted, award-winning credit union proudly serving members nationwide.

As we celebrate this moment, it’s important for Connexus to recognize and honor the people who have made this journey possible. Reaching the milestone of 90 years of service

was achieved through the dedicated support and loyalty of our members, employees, and leadership. Since our founding, it’s the people who have impacted Connexus in unique and important ways, allowing the organization to succeed. There is a deep sense of confidence in the current Connexus leadership and the outstanding experience and capabilities each of them bring to the organization.

Although the Connexus legacy is important, so is the future. We can state with conviction that the current leadership has the expertise to ensure our efforts are focused, our priorities are aligned, our decisions are strategic, and, ultimately, that Connexus will continue to be the exceptional credit union you know and trust, tomorrow and many years from now.

Connexus made significant strides in technological advancements across the organization, underscoring our commitment to innovation and continuous improvement. Modernization of applications throughout the institution, the implementation of better data reporting software, the launch of a new intranet, and the adoption of Cloudflare for enhanced account security underscored the ways in which Connexus values and continually improves technology and security.

Additionally, the credit union’s Digital Banking platform, powered by Alkami, earned the J.D. Power Mobile App Platform Certification—Banking SM for offering an exceptional mobile app experience. This is the first time J.D. Power has awarded this distinction.

Connexus employees lived up to the credit union motto of “people helping people,” volunteering over 4,200 hours of their time in 2024 through our Volunteer Time Off (VTO) program. The Board and leadership are continually humbled by and grateful for the ways our teams selflessly

give time and resources back to their communities and to the programs for which they are passionate.

Additionally, the credit union’s philanthropic program, Connexus Cares, provided support throughout the year. Resources are prioritized for nonprofit organizations providing basic humanitarian needs and those working with at-risk youth, seniors, and veterans. Connexus remains committed to driving positive change and looks forward to the ways we can enhance our giveback in the years to come.

The year also saw Connexus earning accolades for our collaborative, innovative culture. For the second year in a row, we were honored to receive recognition from Gallagher as we earned a spot on their Best-inClass Employers list. Additionally, Computerworld ranked Connexus #14 among small organizations on their “Best Places to Work in IT” list.

At Connexus, we understand that success is grounded in the talent and

dedication of our employees, and we deeply value their wellbeing. As a remote-first organization, we made intentional, thoughtful enhancements to our employee wellbeing programs throughout the year. These new offerings were designed to grow relationships, foster a positive culture, and increase meaningful engagement. Our teams also hosted numerous in-person and virtual events that allowed collaboration and connection.

A new intranet was unveiled in August. The site acts as a central hub for information sharing and offers streamlined document management, allowing for improved internal communication and collaboration. Additionally, leadership made enhancements to internal communication channels and content based on employee feedback, as part of our commitment to ensuring transparency across every level of the organization.

As we enter a new chapter, Connexus remains guided by the principles that have defined our organization for the past 90 years, and a commitment to innovation and member satisfaction ensures a prosperous future.

Despite facing headwinds in 2024, Connexus demonstrated discipline and resilience.

Slowed economic and loan growth, inflationary pressures, and high interest rates impacted financial institutions nationwide. With the foresight and the experience gained from our long history, Connexus launched comprehensive, strategic initiatives designed to address market challenges and ensure the organization continues standing on a strong foundation. Our robust, well-diversified balance sheet and strategic asset-liability management mean we remain well-capitalized and able to deliver the products and services our members need.

In spite of a challenging economic environment, Connexus sharpened its focus and made purposeful plans for a strong future. An understanding of societal changes and the evolving financial needs of our members positions the organization for sustainable, long-term growth. Our innovative financial products and dedication to exceptional member service will continue to set us apart in the industry.

Infrastructure investments, disciplined growth management, strengthened lending partnerships, and expanded product and service offerings are ways Connexus will continue to sustain long-term financial security for the benefit of our members.

As our team prepared the 2024 Annual Report, we discovered an apt note that appeared in our 2009 Annual Report:

“In 1935, the country was in the midst of the Great Depression. In 2009, we were in the midst of the Great Recession. Our founders created the credit union to be a light in the storm. Through the skilled leadership of our Board and management, our employees’ dedication to our members and our community, and our members’ commitment to the success of our credit union, Connexus proved how strong our ability is to keep that light shining — and shining brightly.”

With a history as long as ours, there are bound to be chapters of growth, chapters of reflection, and chapters of renewal. We know from experience that Connexus Credit Union has skillfully navigated challenges and embraced change in the past — and

we have always emerged strong, well-capitalized, and still resolutely focused on you.

As we enter a new chapter, Connexus remains guided by the principles that have defined our organization for the past 90 years, and a commitment to innovation and member satisfaction ensures a prosperous future.

On behalf of the Connexus Board of Directors and Senior Leadership Team, we extend our heartfelt gratitude for your unwavering support. We invite you to explore the 2024 Connexus Annual Report, showcasing our history, achievements, and aspirations.

With gratitude,

Alita Lobner, Board Chair

Chad Rogers, President & CEO

Here’s a look at our history.

See how we grew from a Wisconsin organization with just nine members to the renowned, nationwide credit union we are today.

1935

The credit union is founded by nine employees of Employers Mutual with a mission to serve their employees, retirees, and families. Members are allowed to deposit 50 cents until they reach their first $5 share.

1980

Employers Mutual is renamed to Wausau Insurance Companies. The credit union’s name changes to Wausau Insurance Employees Credit Union.

1994

The Pine Ridge corporate office opens in Wausau, WI.

1999

The credit union launches the first website to offer members “advances in electronic services that cross all geographic boundaries.”

2005

The Connexus Association is formed, opening membership to anyone in the U.S. who makes a $5 donation to the Association.

Connexus reaches $200 million in assets.

2010

Connexus celebrates its 75th anniversary.

2023

Our flagship branch opens in Rib Mountain, WI.

1949

The credit union membership reaches 1,000 members.

Our merger partners are an important part of our journey. Learn more about past mergers on page 10.

1989

A “new major service” launches: the Automated Teller Machine (ATM) card.

1998 Liberty Mutual acquires Wausau Insurance. Credit union membership is extended to Liberty Mutual employees, retirees, and families nationwide.

2003

The credit union officially rebrands to Connexus Credit Union to better reflect the growing field of membership.

Membership is extended to staff, students, and alumni of Northcentral Technical College.

2009

Our high-yield Xtraordinary Checking Account launches, garnering media accolades.

2019

Our philanthropic program, Connexus Cares, launches to support organizations that provide humanitarian aid and serve youth, seniors and veterans.

2025

Connexus Credit Union proudly celebrates 90 years of member service.

Despite the changes necessitated by a 90-year history, Connexus has remained consistent in one vital way: staying focused on you. Your needs, your experiences, and your expectations are our priority. When we do make changes, they are thoughtful. We strive to meet higher benchmarks, offer even better products and services, and continue delivering relevant, important, seamless service in every interaction.

No matter where you are, you can feel confident that whether you call, visit a branch, log in to our highly rated App, or visit us online, your experience managing your finances with Connexus will be convenient, safe, and reliable.

As part of the Co-op Shared Branch network , Connexus members have access to over 5,000 shared branch locations and thousands of fee-free ATMs nationwide. This service offers you the opportunity to make select transactions in-person at participating branches and access your accounts through our ATM network — no matter where you live.

Our roots may be in Wausau, but thanks to Digital Banking, a network of shared branches, and nationwide ATMs, our service spans all 50 states.

Digital Banking always works well for me. The features I most appreciate are the “at-a-glance” account balances, savings goals, mobile check deposit, and internal transfers.

- Margaret, Connexus member since 2013

An improved Help Center was rolled out in Digital Banking, making it easier for members to find answers and assistance when needed. Several of our helpful financial calculators were added to Digital Banking, too, providing tools for members “crunching the numbers” as they explored products offered by Connexus.

The nationwide recognition we garnered in 2024 spoke for itself, as our products and services received powerful media mentions and accolades. J.D. Power, the global insight and data leader, announced that our Digital Banking platform, powered by Alkami, earned the first J.D. Power Mobile App Platform Certification—Banking SM . The certification recognizes mobile app platform providers that offer exceptional mobile app experiences. This recognition was based on overall customer satisfaction and a rigorous evaluation of 146 operational and mobile app best practices as conducted by J.D. Power.

This distinction is an exciting example of the ways Connexus has adapted and innovated throughout the decades in order to provide you with industry-leading financial management tools and seamless, user-friendly, relevant service.

4.7/5.0

Connexus Credit Union App rating on Google Play™ and Apple App Store®

11.2M+

Total Digital Banking logins

25,800+ Total App downloads

2024 Accolades

Best Places to Work in IT, Computerworld

2024 Best-in-Class Employer, Gallagher

Best Credit Unions 2024, Kiplinger

Best Credit Unions of 2024 , NerdWallet

Best Credit Unions of 2024 , Business Insider

2024 Best Credit Union , Bankrate

Best Credit Union Personal Loans for 2024 , CNN Underscored 16 Credit Unions in the United States That Anyone Can Join , Business Insider

Best Credit Unions Gold Award , CommunityVotes Rockford

Visit our Media Center to see more 2024 accolades

J.D. Power recognized our Banking App platform provider for their Outstanding Mobile Banking Platform Experience, basing their selection on overall customer satisfaction, product design and development, end-user understanding, and overall performance.

Being your trusted credit union is one of the most important tenets of Our Vision. You trust us to keep your financial resources safe and to make decisions on your behalf in order to remain a secure, strong institution.

Through our nine-decade history, Connexus has grown from nine members to nearly half a million. But no matter how large that number may get, earning — and keeping — the trust of every individual member is a responsibility we will never take lightly. Whether it’s using Voice ID biometric technology to confirm a caller’s identity or offering two-factor authentication to protect your accounts from unauthorized access, we continue to look for innovative ways to safeguard your accounts and data.

In 2024, Connexus enhanced our security and fraud technology by implementing Cloudflare, a leading cybersecurity software program. When used as part of our Digital Banking platform, Cloudflare confirms whether login attempts are real and blocks fraudulent bot attempts. This enhancement provides an additional layer of security to keep your accounts protected.

464x

Increase in membership from 1949 until today

48%

Year-over-year increase in members using VoiceID biometric authentication

9

Valued merger partners since 2008

90

Years of serving members

Introduced in 2024, Cloudflare offers additional account security by recognizing and stopping automated, fraudulent Digital Banking login attempts.

Celebrating the credit unions that became part of the Connexus story.

The Connexus story isn’t complete without acknowledging the valued credit unions and their loyal and diverse members that merged with us along the way. Each merger partner who joined Connexus brought with them a goal of fostering a better financial future for their unique member groups. And, when the members voted to join our credit union, we took their vote of confidence seriously.

We understand the trust that’s been placed in us to uphold the work our credit union merger partners started, and we’re honored that their legacies are now a part of our shared story.

2008: Ohio Casualty Employees Credit Union, Fairfield, Ohio

2010: Wausau City Employees Credit Union, Wausau, Wisconsin

2012: Maple Hill Credit Union, Wausau, Wisconsin

2012: Tower Credit Union, Wausau, Wisconsin

2014: Cintel Federal Credit Union, Cincinnati, Ohio

2014: Endura Financial Federal Credit Union, Minneapolis, Minnesota

2015: Air Line Pilots Association Federal Credit Union, Burr Ridge, Illinois

2018: Bull’s Eye Credit Union, Wisconsin Rapids, Wisconsin

2022: Heritage Credit Union, DeForest, Wisconsin

We have been with this credit union since Endura, and now Connexus. We have been extremely pleased with our experiences.

- Cathy, Connexus member since 2014

As part of our commitment to providing exceptional experiences, we created welcome videos during past mergers to demonstrate our commitment to earning the trust of members who came to us through a merger. We assembled a showcase of these historical welcome videos. Watch now.

Whether we look at our past, our present, or our future, one piece of the Connexus Vision carries an especially important weight: our commitment to exceptional experiences. Regardless of how you choose to interact with us, we go to lengths to ensure we exceed your expectations and deliver a positive interaction. Every time.

And, while “exceptional experiences” are an inextricable element of our member service philosophy, this facet of Our Vision extends well beyond that. Our successful history and excellent reputation are possible due to the support and dedication of our

employees and the communities we serve. As such, we remain dedicated to providing exceptional experiences for these important groups, too.

We offer employees an annual allotment of compensated volunteer time off, host in-person and virtual engagement events throughout the year, and provide a robust Total Wellbeing benefits package. But

don’t take it from us; for the second consecutive year, Gallagher named Connexus a Best-in-Class Employer in part due to our exceptional health plan enrollment, generous 401(k) and Health Savings Account contributions, and comprehensive Total Wellbeing program.

In my 19-year career at Connexus Credit Union, I’ve loved learning about our members and employees — and witnessing the positive generational change we can bring to their lives. The remarkable culture we’ve cultivated allows us to seamlessly integrate cutting-edge technology with a warm, relationship-driven approach to serving our members.

- Christian, Connexus employee since 2006

Overall member satisfaction ranking as determined by a Net Promoter Score (NPS) of 59.2

Average wait time when calling our Member Contact Center

97%

Member calls answered within 30 seconds 94%

Number of employees active on our internal recognition platform

Branch Experience satisfaction ranking as determined by a Net Promoter Score (NPS) of 80.4

$146,605

Total dollar amount equivalent of 2024 volunteer time *

4,214

Hours volunteered by employees in 2024

150 Organizations supported in 2024

Connexus Cares sat down with several of our nonprofit community partners to learn more about their meaningful initiatives. We’re excited to share a glimpse into these organizations’ remarkable work and hear more about how our giveback has helped to support such impactful efforts. Watch now.

I was able to go to the credit union and get a loan right away. Cars move quickly around here! I’ve had an account at the credit union since I was seven years old, so it made sense — I already had a relationship with them.”

- When long-time member Gabrielle needed a new car, she trusted Connexus to help with the financing. Watch her story.

*According to Independent Sector research

We have been a member for a very long time and will never work with any other business. Thanks for all you have done over the years.

- Jack, Connexus member since 1998

At the end of the day (and the end of the year — 90 of them, to be precise), what matters most is whether we have impacted your life in a positive way. Each Connexus member has unique financial circumstances, concerns, values, and goals. As your credit union, it is our duty to work alongside you to offer the products, services, and guidance that align with your needs and allow you to foster prosperity.

In 2024, we continued to offer industry-leading products that allowed you to reduce expenses or consolidate debts. Our Home and Auto Refinancing options lowered rates and payments for countless members. Our debt consolidation options helped many get out from under the burden of expensive credit card balances. Our high-yield Certificates provided a path for safely growing wealth. And our myriad other lending and deposit products provided smart, safe ways to borrow and save — improving lives and offering something we can’t quite quantify: peace of mind.

2009

The year our acclaimed, high-yield Xtraordinary Checking Account launched

21,500+

Number of Xtraordinary Checking Accounts held by members

Lending Experience satisfaction ranking as determined by a Net Promoter Score (NPS) of 80.2

12

Number of years we have partnered with GreenPath to provide debt counseling to members

$178,661

Total debt paid off in 2024 by members on a GreenPath Debt Management Plan $157,025,694

Total amount of direct member loans funded

Deposit Product Experience satisfaction ranking as determined by a Net Promoter Score (NPS) of 77.3

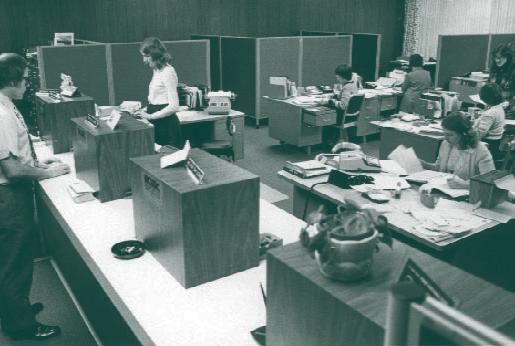

In preparation for creating this important yearly document, we revisited Connexus Annual Reports from years past. Reaching our milestone 90th year felt like a fitting time to flip through the pages of history and reflect on change and growth.

The reports made it clear: Connexus has changed in the past 90 years. Since our founding, Connexus has seen incredible transformation in nearly every quantifiable facet: membership growth, number of employees, locations, asset size, product offerings, technology, and overall reach (not as quantifiable are the noticeable changes in hairstyles and fashion choices, as evidenced by historic report photography).

Through all the changes and all the decades, the focus has always been on you. As a Connexus memberowner, you are an integral part of a collective effort undertaken by those nine founders, 90 years ago.

However, while paging through past reports, a theme emerged like a thread, connecting each member and each new decade. Yes — of course, much has changed from 1935 until today. But the theme that became evident from the pages of these reports is that despite the decades, the most important facet of Connexus has always

been you: the loyal, diverse, confident member who made this journey possible and worthwhile.

The 1989 Annual Report noted, “We will remember the confidence and support of membership that permitted your credit union to offer a wide range of new services. We thank you.”

In 2002 , the report stated, “Whether you’ve been with the credit union for decades, or recently began your financial journey with us, your trust in the credit union spirit strengthened our growing family.”

The 2003 pages read, “While we’re certainly proud of the financial milestones we’ve reached, we know our true success is defined in greater terms. That success is in realizing we have had a part in making your family’s life richer by helping you reach your goals and dreams, and that kind of pride can’t be measured in numbers.”

That is just a small sample from years of reports, yet the remarks speak volumes: Through all the changes and all the decades, the focus has always been on you . As a Connexus member-owner, you are an integral part of a collective effort undertaken by those nine founders, 90 years ago.

The credit union philosophy is “people helping people,” and that is exactly what Connexus will continue to do for you. Today, tomorrow, and for the next 90 years.

Alita Lobner, Board Chair

Kelsi Seubert , Vice Chair

Timothy C. Mulloy, Secretary & Treasurer

Michael Atkins , Director

Mary Nelson , Director

Michael Parker, Director

Michael Prestileo, Director

Chad Rogers , President & Chief Executive Officer

Claire Meney, Chief Operating Officer

Akin Agar, Chief Technology Officer

Eric Huseby, Chief Lending Officer

Adam Keer, Chief Revenue Officer

Casey Nichols , Chief Human Resources Officer

Karl Pagel, Chief Financial Officer

Michael Plaia , Chief Risk Officer

Brian Gourlay, Senior Vice President, Credit Risk Management

Laura Huggins , Senior Vice President, Marketing

Michael Stueland , Senior Vice President, General Counsel

To learn more about our Board of Directors and Senior Leadership Team, please visit our website.

Committee:

800.845.5025

ConnexusCU.org info@connexuscu.org PO Box 8026 Wausau, WI 54402-8026

Connect with us on LinkedIn Follow us on Facebook