CCM INSIGHTS

A Newsletter by Compass Capital Management

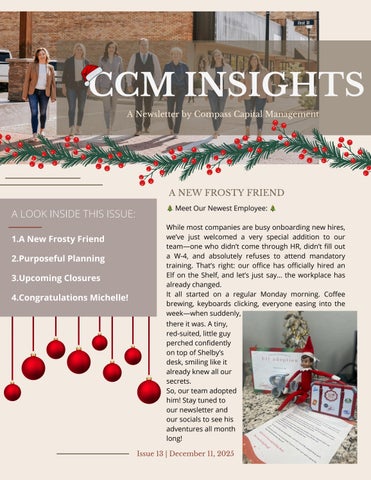

A NEW FROSTY FRIEND

�� Meet Our Newest Employee: ��

A LOOK INSIDE THIS ISSUE:

1.A New Frosty Friend

2.Purposeful Planning

3.Upcoming Closures

4.Congratulations Michelle!

While most companies are busy onboarding new hires, we’ve just welcomed a very special addition to our team—one who didn’t come through HR, didn’t fill out a W-4, and absolutely refuses to attend mandatory training. That’s right: our office has officially hired an Elf on the Shelf, and let’s just say… the workplace has already changed.

It all started on a regular Monday morning. Coffee brewing, keyboards clicking, everyone easing into the week when suddenly, there it was. A tiny, red-suited, little guy perched confidently on top of Shelby’s desk, smiling like it already knew all our secrets.

So, our team adopted him! Stay tuned to our newsletter and our socials to see his adventures all month long!

13 | December 11, 2025

PURPOSEFUL PLANNING

BY: JIMMY J. WILLIAMS, CPA/PFS, CFP , CRPC ® ™

Uncertainties may be an unpleasant fact of life. However, if you could control more of the activities that affect your family, wouldn’t you feel more confident? One of the attributes we consider when performing financial and retirement planning for clients is risk To many people, risk is a word they wish to avoid Remember, without risk there can be no return

Risk is not the most impactful attribute of planning The most powerful negative that can impact a family’s security is uncertainty Consider the fact that you cannot control what a foreign government leader may do to cause worldwide disruption Will the leader create an untenable situation that will bring upheaval to his and other trading partners? What decisions can you influence by this leader? The answers have to be indecisive. Human beings are the most unpredictable of all elements in the economy.

Often people who are retail investors make decisions based on their fears instead of analytical data I know this sounds common; however, if a person could strengthen their ability to see further in the future and analyze the past with an objective mindset, fewer people would buy high and sell low in the market Risk is the presence of factors that are not within your control and other factors that may be influenced by your actions but you cannot predict the ultimate outcome to be your desired result Professional institutional investors such as Warren Buffett understand the markets, risks involved in investing and the management of cash flow to the benefit. He is attributed with the quote, “Risk comes from not knowing what you’re doing.”

Over the past few months of 2025, the United States has experienced near record levels of volatility. The Chicago Board Options Exchange created an index, called “VIX,” to assist investors with anticipated levels of market volatility Its purpose is to measure the 30-day expected volatility of the U S stock market Sometime this index is referred to as the “fear index ” The VIX is based on the prices of options on the S&P 500 Index and is calculated by aggregating weighted prices of the index’s call and put options over a wide range of strike prices All this means, in simpler terms, is that call options are written to buy a certain position (stock) at a certain price within a certain time. The inverse is what a put option would perform for the writer of the option.

How would such an index be helpful to an investor? When an investor anticipates large upswings or downswings in the market, the person will want to hedge their positions with options. This type of investment requires significant skill or an investment advisor due to the inherent risk in options trading

The key to countering the impact of uncertainty is to maintain a well-diversified portfolio It is critical that you understand that diversification is not a means of assuring you that losses will not prevail in a portfolio However, over longer periods of time, a diversified portfolio manages your acceptable level of risk, allowing you to enjoy the potential for overall better returns. One of the methods we utilize for testing risk within a portfolio is to analyze the underlying sector of the economy and management of the particular company you desire to purchase shares of compared to other companies within the same sector of the economy. There are inherent risks within all industries Knowing the risks and your ability to mentally convert uncertainty to opportunity will serve you well

An extensive review of your current portfolio may help you understand the current risk contained within your investments. Many people fail to fully understand the underlying investments of their portfolio until they experience a downturn. The fear of loss is much greater than the expectation for gain. To mitigate your bias and your lack of available research material, it would be helpful to work with a CERTIFIED FINANCIAL PLANNER® practitioner. Financial and investment planning professionals understand your risk tolerance and time horizon until you require funds from the portfolio and your objectives for the use of the portfolio Your family has unique needs and goals. Do not allow your future to be less than you desire by attempting to invest in disruptive market cycles. Seek out a professional who can give you valuable and independent advice that may help you experience the future you desire. Your future awaits your presence. As stated by Charles F. Kettering, “You can’t have a better tomorrow if you are thinking about yesterday all the time ” Regret nothing Take charge of your future.

REGISTEREDPRINCIPALSECURITIESOFFEREDTHROUGHCAMBRIDGEINVESTMENTRESEARCH, INC,ABROKER/DEALER,MEMBERFINRA/SIPCJIMMYJWILLIAMSISANINVESTMENT ADVISORREPRESENTATIVEOFCOMPASSCAPITALMANAGEMENTLLC,AREGISTERED INVESTMENTADVISORCAMBRIDGEANDCOMPASSCAPITALMANAGEMENTLLCARENOT AFFILIATED215ECHOCTAW,SUITE101,MCALESTER,OK74501CAMBRIDGEDOESNOT OFFERLEGALANDTAXADVICEPLEASECONSULTYOURLEGALANDTAXADVISORFOR SPECIFICESTATEANDINCOMETAXPLANNINGSTRATEGIES THEINFORMATIONINTHISARTICLEISFOREDUCATIONALPURPOSESONLYANDISNOT INTENDEDTOBETAXADVICEFURTHERYOUSHOULDNOTRELYONTHISINFORMATIONTO MAKEINVESTMENTDECISIONS

UPCOMING CLOSURES

December 24 t h

December 25 t h

January 1 s t

CONGRATULATIONS MICHELLLE!

We are sending a HUGE congratulations to our Client Relationship Manager, Michelle!!!

Michelle recently passed a Financial Paraplanner Qualified Professional Certification Test and will be receiving her new official certification soon.

This course advances Michelle in her knowledge of the financial planning process to better our clients' experiences. Michelle has worked diligently since September to obtain her certification. We are beyond proud of the extra mile she goes for our CCM family