fifty plus advocate

Take advantage of spring skiing deals

CONCORD – Clint Conley, a senior producer for WCVB Boston’s award-winning “Chronicle” newsmagazine television program, has had not one, but two stints as a member of an acclaimed alternative rock band.

Clint Conley’s early 1980s Boston rock band Mission of Burma had a second incarnation in the 2000s that had the band touring widely abroad and playing large music festivals.

The 67-year-old Concord resident played bass, sang, and wrote songs for Mission of Burma, a Boston band that came to prominence in the city’s eclectic rock music scene in 1979. Mission of Burma gigged relentlessly in nightclubs and became wellknown for its frenetic live performances and highly original style, mostly in the Boston area but also in New York City. College radio stations like MIT’s WMBR and Emerson College’s WERS played its music regularly, as did some commercial stations.

Clint Conley | 10

‘Chronicle’ producer has balanced second career as alternative rock musician

Get to know us at aarp.org/ma.

Witha new year and tax season upon us, a lot of us start to think about money matters and how to make our finances work better. There is good reason money issues are a source of anxiety. It’s been a rough few months, trying to make sense of inflation, the rollercoaster of gas prices and a stock market that lost money in 2022. This can get a lot more stressful if you’re living on a fixed income.

think, how to safeguard against identity theft and fraud. Also, what to do if you or someone you know has been a victim. Join us March 2, at noon.

Social Security: Understanding Your Benefits is March 9 at 6 p.m. If you are approaching or starting to prepare for retirement, you need to know how Social Security works. At this workshop, we’ll focus on building an understanding of when to claim Social Security and what implications that will have on your finances. You will also learn how to secure your benefits.

Mike FestaThat’s why your AARP is working to ensure you have a brighter and more secure financial future. We’re fighting to protect and strengthen the Social Security benefits you’ve earned. And, we provide free tools and resources to help you plan, work and save for retirement.

A great starting point is the AARP Money Map™. With just a few simple steps, the Money Map provides a clear plan of action and resources to help with unexpected bills and debt management. You don’t even need to be a member; AARP membership is not required to use it.

Here in Massachusetts, we have our “Thrifty Thursday” series this March—webinars every Thursday this month to help you better understand and manage your finances. These events are free to attend; you need only sign up.

Our first webinar is How to Protect Yourself against Fraud and Identity Theft

The AARP Fraud Watch Network will share an inside look at how scammers

Making Every Cent Count: Everyday Habits to be Financially Resilient is slated for March 16 from noon to 1 p.m. Join us for a conversation about how our everyday habits can shape how financially resilient we are and how we can adopt good habits. Hear about daily ways to save, manage debt and budget.

We’ll dive into Retirement Planning: Strategies for Today and Tomorrow on March 23 at noon. It’s never too early or too late to take charge of your financial future. If you’re anxious about retirement, you can still build your stash—with the right moves. Learn tips for determining if you are on track and learn practical strategies to help you achieve retirement peace of mind.

Finally, Making Cents of Caregiving Costs is March 30 at noon. Caring for a loved one can come with a financial cost. We’ll introduce you to the AARP Financial Workbook for Family Caregivers. It provides essential financial information caregivers need to manage more easily some of the complexities of caregiving.

If you’d like to attend any of these, log on to AARP.org/MA.

AARP can help make sure your money, health and happiness live as long as you do by helping you save money and pay down debt.

Learn how you can put your time, knowledge and talent to use volunteering with AARP in Massachusetts. Help make the communities where you live, work and play the best they can be while engaging with others who share your passion for service.

READY TO VOLUNTEER? WE ARE READY FOR YOU.

/aarpma @aarpmaBy deBBie sPingarn contriButing Writer

REGION – Like the world in general, buying and maintaining over-thecounter (OTC) hearing aids is a journey in navigating an ever-complex digital world. Locally, CVS and Walgreens pharmacies offer hearing aids for consumers to purchase, but it varies from store to store as to the ease of finding them, getting information, and making sure the hearing aid is the right type and works well for each individual’s kind of hearing loss. Big-box club stores like Costco sell hearing aids and have since well before the federal OTC hearing aids law was passed in October 2022.

What’s the first step? Get a hearing assessment. You can schedule an appointment with your audiologist through a referral from a PCP or take an online assessment like one given at Costco. There, you log onto a website which asks general questions about your hearing. Be prepared with earbuds and the ability to connect them to a desktop computer, laptop or phone. For many, this is a difficult task. If you chose the Costco store, its hearing test

is given in a soundproof booth, but the assessment is not done by a certified audiologist. Ask questions: Who is giving the assessment, what are their credentials, education and certification for doing the test? Often, the assessor is a salesperson for Costco, skilled in selling hearing aids but not in diagnosing hearing loss.

Many drugstores only offer hearing aids on their online sites, or keep the hearing aids in the pharmacy section side-by-side with pills and drugs. At Walgreens on Wilson and Walpole Streets in Norwood, the only hearing

aid available sits alone in the pharmacy, a Lexie Lumen brand, retailing for over $800. It features a one-year warranty and ongoing customer support, which in today’s world means virtual customer service and possible long hold times.

Walmart, if it has a vision center, sells hearing aids alongside eyeglasses. However, the Walpole store only sells four types of hearing aids. The brand name is Hearing Assist and they are priced from $399 to $699. There is no audiologist on staff. No prescription is needed, but the consumer is on his or her own in selecting the type of aid. If issues arise with the device, there is no support or help within Walmart.

Product support is especially important to consumers like Dorothea Juno-Johnston, 82, of Somerville. She likes Hear USA, which has an audiologist available to help with adjustments and issues. Juno-Johnston likes their top-of-the-line hearing aids, despite no insurance coverage for the costs, which

run considerably more than over-thecounter aids.

Customer support for over-thecounter hearing aids is an 800 number of the equipment manufacturer. Though costs are less, the support received is not in person, and may be much harder to access than an in-person audiologist. However, if you can navigate getting an assessment either online or with an audiologist and then seek hearing aids on your own, the savings may be worth it. Concerns arise with older individuals who are not able to seek out online customer service help.

Despite the issues, the law allows increased access to consumers to much less-expensive OTC hearing aids for adults with mild to moderate hearing loss. No prescription is now needed, just information and possibly help in securing the right hearing aid. For more information, contact the National Institute on Deafness and other Communication Disorders, part of the National Institutes of Health (NIH) at 1-800-2411044 or visit https://www.fda.gov/medical-devices/consumer-products/hearing-aids.

By sharon Longo contriButing Writer

By sharon Longo contriButing Writer

REGION – Whether it’s a memory of a class, a crowded nightclub, or a relative’s wedding, we’ve probably all danced at one time or another. It may have been with hesitant trepidation, moving to the back of the dance floor to follow along with the Electric Slide, or with the confidence and charisma of Travolta in “Saturday Night Fever.” In either scenario, dancing is a great way to get the blood flowing, raise your spirits, and also enjoy the social aspects.

While swaying to a classical composition or gyrating to a reggae rhythm or disco beat, research has shown that dance has a number of benefits.

For obvious reasons, keeping the body moving can help to improve fitness. Depending on the type of dance, some genres provide more of an aerobic workout than others. Hip-hop can burn more calories than doing the fox-trot or tango, and ballet, jazz, tap, polka, and disco are somewhere in between.

Dance has been shown to improve

physical fitness, while it may also help to lower blood glucose and cholesterol levels.

According to the Department of Health and Human Services’ Physical Activity Fact Sheet for Older Adults, anything that gets your heart beating faster counts as moderate-intensity aerobic activity. This should be done for at least 150 minutes per week with at least two days per week of muscle-strengthening activities that make the muscles work harder.

There are specific dance classes for people with Parkinson’s, and studies done in regard to the tango showed the dance targeted impairments such as walking backward and starting/ stopping gait. While comparing the Argentine tango with the waltz and foxtrot, improvements were shown in locomotion, motor control, balance, and freezing of gait in both groups, but more significantly in the tango group.

Dancing has been shown to improve physical fitness, may also help to lower blood glucose and cholesterol levels, and the social aspect can lead to better emotional well-being.

structor who teaches classes each Monday at the Agawam Senior Center. “Keeping your mind and body active while having a good time is what it is about. The friendships we make continue to let us socialize in later years and combat isolation and loneliness,” she noted. “We support one another and look forward to staying active together. We laugh, smile, and just have fun!”

According to Psychology

Today magazine, dance therapy or dance/movement therapy may be used for people of all ages to help treat various conditions, mental health disorders, and other challenges including depression, PTSD, and anxiety. Even without the treatment component, the movement and expression alone can help reduce stress, possibly lead to better sleep, and improve one’s mood and energy level.

Dance is said to utilize the three planes of the body: the coronal or frontal, separating the front from the back; the sagittal or longitudinal, separating the right from the left; and the transverse or axial, separating the upper half from the lower half. This leads to better balance and strength, which could possibly prevent a fall.

Because we join others on the dance floor or dance with a single partner, the social aspect of dancing is positive and can lead to better emotional well-being. That opportunity to socialize while enjoying some good music has been shown to reduce depression symptoms in older adults.

Who hasn’t enjoyed the camaraderie and laughing along with others on the dance floor? Whether it’s participating in a line dance, or joining hands to circle around the married couple or clapping for the solo dancer as they take their turn to show off their moves?

Dance doesn’t exclude anyone; if someone were unable to walk, they could still use their upper body to move to the music.

“Dancing is more than just fun,” said Clara Sanborn, a line dance in-

The brain and body connection in learning and remembering the various dance movements helps with cognitive aspects. Some studies have shown that the areas of the brain such as the frontal lobe, which helps with organizing and planning, as well as the hippocampus, which contributes to learning and memory, both improve with exercise. Having to focus on the moves and patterns in each dance is a great mental workout.

Always check with a doctor who knows your health history before starting any exercise or new physical activity.

Decide what type of dance you enjoy. Are you looking to join a hip-hop, Zumba, or cardio dance class for more of an aerobic benefit? Have you always dreamed of twirling to Tchaikovsky or tapping to a great swing beat? Maybe you prefer to learn ballroom style, working with a partner? Check for local dance schools or adult schools, as well as senior centers to see what they have to offer. Many senior centers and town programs offer a variety of dance classes.

Check out YouTube for various how-to videos if you feel a bit self-conscious at first. Once you have practiced a bit and feel a little more confident in your moves, you can venture out to show off what you’ve learned.

Whatever your style or level of experience, dance is a great way to get out and meet others, stay in shape and enjoy some favorite music, move your body in an active way, and just have a good time.

“Keeping your mind and body active while having a good time is what it is about,” says Clara Sanborn, a line dancing instructor at the Agawam Senior Center.

REGION – There are many adult day centers throughout the state of Massachusetts. These day programs offer their participants the opportunity to join in chosen activities, socialize, get physical exercise and be mentally stimulated while still living at home. In addition, the caregiver is able to take a break from caring for their loved one, which can often be emotionally and physically challenging.

Home healthcare is simply a continuation of care that a parent or loved one might get but they can remain in their home. Assisted living facilities can be extremely costly and many older adults are simply not able to afford this type of full-time living arrangement. In many instances, it is much cheaper to simply have a Certified Nursing Assistant (CNA), physical or occupational therapist, speech therapist, visiting nurse and other providers simply offer their services based on what the needs are of the patient.

Some adult day centers offer those with physical or cognitive issues the

ability to still sleep at home while giving them a safe and stimulating environment to be in during the day. This option is often a better solution for someone who is still somewhat independent and is a lot less costly than a nursing home.

An adult day care program differs

Your service deserves our reward. Are you one of our community heroes, law enforcement, firefighter, healthcare worker/EMS, military or teacher? Let us help you buy or sell a home and we’ll be honored to present you with a reward check. Call for details.

With over 50 years experience in the real estate industry, Jo-Ann and Diane are your winning team to help you “make the next move”.

Let’s discuss how we are helping baby boomers find their retirement niche and get rewarded at the same time.

Diane Casey-Luong www.dianesmybroker.com774-239-2937

diane@dianesmybroker.com

774-230-5044

joannszymczak@gmail.com

from a community senior center in several ways. While a senior center can be a terrific place for relatively healthy adults to take an exercise class, hear a lecture and even go on a field trip, this might not be the right environment for someone with physical or cognitive issues or someone who requires additional support and/or supervision.

According to a 2021 study published in the journal Aging and Mental Health, “Both dementia patients and caregivers slept better, with few disturbances, on the nights before the patient’s attended adult day care. Other research shows that using adult day care has a positive impact on dementia caregivers’ mood, health and relationships and reduces their sense of ‘role overload.”

It is important to visit an adult day center before making the decision to have a loved one attend. Asking questions is imperative to finding the right fit and understanding both the needs of the senior who will be attending the center as well as the programs and services being offered. Many facilities provide meals/snacks, transportation, therapies, exercise, socialization, supervision, physical therapy and more. Some of the adult day centers are more social centers while others provide more intensive health and therapeutic services.

Some of the questions to ask when visiting a center might include how long they have been operating, the types of licenses/accreditations, staff/ attendee ratio, days and hours of operation and services offered.

Being the primary caregiver can be a stressful job. Burnout can happen quickly, and feelings of frustration can easily occur. The adult day center can

be a terrific tool for the caregiver to recharge. They can work or get things done knowing that their family member is in a safe environment.

Families benefit

“I love that we are able to help family members reconnect with their loved ones,” said Audrey Monroe, Director of Day Services at the Center for Human Development/Hawthorn Elder Care in West Springfield. “Many of the caregivers come to us in tears. They don’t know how to help their family member and they are burned out.”

“Our center offers so much support and we have nurses, social workers, nutritionists and more on staff,” she explained. “Our programs are covered 99% of the time by Mass Health. Those that attend at both at our Springfield and West Springfield locations all seem to be happy to be here.”

One participant, Gloria, said, “I love the nurses and staff. The people are friendly, and I look forward to seeing them. I have made friends and the staff takes care of me.”

“While my dad attends the ‘club’ as we refer to his time spent at an adult day center, it has allowed him to have a schedule, which has been really important, especially with his Alzheimer’s,” said Lisa Hughes of Burlington. “It has also brought a richness to his life that he would not have if he were in a nursing home or home with his adult children. When you attend the day centers, you make friends. He gets love from the caregivers, and he feels safe in this type of nurturing environment.”

The National Adult Day Services Association is a professional organization that represents the adult day services industry. Its website, www. nadsa.org, offers information about how to locate and choose an adult day center.

REGION - The ski season is winding down and all skiers are hoping to find that one last stash of powder, or at least a not-so-frozen granular run. Senior skiers can find reduced price lift tickets at resorts across New England. All it takes is a little web time to find good, great, and amazing deals.

Below is a list scouted across Massachusetts, Vermont, New Hampshire, and Maine. There will be other great deals out there as the weather warms up and the snow gets sticky.

Maine

• Sunday River in Newry has great deals for seniors ages 65-79 years young. Super Seniors who are 80plus ski for a small fee.

• Sugarloaf in Carrabassett Valley has discounted tickets for skiers 65-79 years old. Super Senior tickets are available for a nominal fee.

Massachusetts

• Jiminy Peak Mountain Resort in Hancock offers a slightly discounted senior ticket price for skiers 65 and up.

• Berkshire East Mountain Resort in Charlemont offers a slightly discounted day lift ticket for guests 60-79. Super Seniors (80-plus) ski for free.

• Catamount Mountain Resort in Egremont has free tickets for 80-plus skiers and a slight discount for the 60–79-year-old skier.

• Otis Ridge in Otis welcomes skiers 70-plus to ski for free.

New Hampshire

• Gunstock Mountain Resort in Gilford offers a free Golden Pass for skiers 70-plus years young and discounted lift tickets for the 60-plus crowd. The discounted tickets are also valid on weekends.

• King Pine in Madison has three senior rates broken down into the Senior 65-59, Senior 70-plus, and Senior 80-plus. All three groups have considerable discounts with the 80-plus skiing free on non-holiday mid-week runs.

• Loon Mountain in Lincoln offers seniors ages 80plus a complimentary ticket at any resort ticket window.

• Ragged Mountain in Danbury offers a senior ticket aged 65-79 at a discounted price and a free lift ticket for Super Seniors aged 80-plus.

• Cochoran’s Ski Area in Richmond is free for 72plus, a great value for the senior skier.

• If you want to ski one of Killington’s 155 trails and are 80-plus you can ski for free. Tickets must be picked up on site at a ticket window. They also offer decent discounts for the 65–79-year young downhillers.

• Pico, also in Killington, offers free lift tickets for the 80-plus skier. Tickets must be picked up on site at a ticket window. They discount lift tickets for se-

| 13

Resort Lifestyle CommunitiesMarlborough

REGION – Being audited by the IRS is high on the list of things that many Americans dread.

It’s a fearsome possibility because of the tax agency’s reputation as a dogged collector of income taxes. That possibly exaggerated image was reinforced with the federal government’s passage last year of the Inflation Reduction Act, which gave the IRS another $80 billion―most of it supposedly for greater enforcement of higher income individuals.

It was admittedly a bipartisan political issue. Democrats said the money would go to the undermanned enforcement branch of the tax collector. Republicans said it would lead to drastically higher audit rates for all Americans, claiming the move would double the chances of being audited.

Low odds for most people

But even if that’s the case, so what? If you’re a senior citizen or a retiree, in all probability, you should continue to sleep soundly. For one thing, your chances statistically of being audited are not likely. The vast majority of more

than approximately 150 million taxpayers who file yearly don’t have to face it. Less than one percent of taxpayers get one sort of audit or another. Your overall odds of being audited are roughly 0.3% or 3 in 1,000. And what you can do to even reduce your audit chances is very simple. And may sur-

prise you. If worse comes to worst, as the old saying goes―even if you are audited, it might be far less unpleasant than you believed.

Still, the IRS’s ruthless reputation lingers. A recent Lexington Law survey found 25% or one in four were afraid of getting an IRS audit. For background, the tax agency in the past has been criticized for targeting low-income taxpayers earning less than $25,000 a year who presumably are easier to audit because they generally don’t have armies of accountants and tax lawyers. But the agency agrees with some others involved in the process that higher incomes raise the chances of an audit.

But the IRS maintains it is misunderstood―that higher reported incomes lead to more scrutiny. And they have evidence to support it. “Few things can generate as much taxpayer concern, confusion and controversy as an IRS audit,” admitted Deputy Commissioner Sunita Lough on the IRS website. She calls it a “critical compliance tool” and refutes the critics who charge it with targeting poorer payers. “Despite common misperceptions about IRS examination rates, the reality is that the likelihood of an audit significantly increases as income grows.” Lough cit-

ed a study that shows taxpayers with incomes of $10 million and above had substantially higher audit rates than taxpayers in every other income category for each calendar year from 2010 through 2015. Those with incomes above $1 million also had higher exam rates than all other groups earning less.

Advice from tax preparers

So area tax preparers say there is some truth to the IRS contention that taxpayers who earn more have a higher chance of being audited. The reason for the misperception is that taxes are complicated. One major reason is that they are not just based on income but have other factors. And for that reason and others are not easily measured, she said.

So what would get you flagged by the IRS? Among their various publications are “Tips for Seniors in Preparing Taxes.” Here’s one of the tips for avoiding a common error:

“When preparing your return, be especially careful when you calculate the taxable amount of your Social Security.”

So what else can you do to avoid an audit? There’s a short answer from Nassar Torres, CEO and owner of Tor-

“It sounds very simplistic, but the short answer is to be honest with the information that goes into your tax returns,” says Nassar Torres, CEO and owner of Torres Tax Services in Lynn.

res Tax Services based in Lynn. He has 22 years of experience in financial matters starting when he was a teenager working for his father’s company.

“It sounds very simplistic, but the short answer is to be honest with the information that goes into your tax returns,” he said. “In particular, this applies to those who are self-employed or have passive income, such as rents, royalties, or investment income.”

“I do agree the most critical thing is to be honest,” suggested attorney Nelson J. Costa at the Wellesley-based firm of The Costa Group. “Report all items of taxable income and take all available deductions to get the best tax result possible.”

Both highly experienced tax experts stress making sure all numbers are correct. A factor that is not so often cited as a potential problem: If you are hiring a professional, make sure he or she is an honest one.

Naturally enough, tax preparers suggest using professional services. “Unless you know your way well around the relevant tax forms and applicable laws for your income tax situation,” Torres advised, “try to avoid doing your taxes on your own and seek the help of a professional. Either a CPA, Enrolled Agent, or other experienced tax preparer. This will ensure that you’re correctly reporting your income to the IRS and that you’re claiming the

right deductions/credits to ensure that you’re getting the highest refund/tax savings possible.”

If you don’t use a professional, Torres is among those who recommend that individuals re-check results. “In those cases where a taxpayer has some experience preparing their own returns, it’s never a bad idea to occasionally run their returns past a tax professional before submitting them to the IRS,” he said, “to ensure that they’re accurately filling out their return. Tax laws change often and the limits on income and deductions/credits can change from year to year as well,” Torres warned. A seasoned tax professional will have their finger on the pulse regarding these changes and will be able to help you avoid any potential tax pitfalls and not miss newer credits/deductions that be-

come available from year to year.

Costa agrees that re-checking your own or a preparer’s results is a good idea. So is meeting all necessary deadlines set by the IRS.

More reasons not to be fearful

There are two key facts to remember about an audit. First, correspondence audits conducted by mail accounted for just over 70 percent of the 2017 audits. Less than 30 percent of audits were the traditional face-to-face field audits that most taxpayers equate with audits―and fear the most.

Secondly, audits don’t always have negative outcomes, either. In 2017, there were 24,999 taxpayers who disagreed with IRS auditor findings― some came out ahead, though the odds were against them. The IRS said 24,000

taxpayers ended up forking over almost $11.5 billion in extra taxes. But almost 34,000 others received refunds for $3 billion dollars.

If you do get an audit report, the first thing to do to get over the shock. Don’t panic―if you’ve been honest. You’ll need to get your records of income, claimed business expenses, deductions and others. To be sure you have all you evidence you need, you will need to have proof of the past three years, which is a general time period for the IRS. If you’re still worried, you can hire someone to be your representative. And there are procedures for appeals if the ruling is against you.

“When I was a teenager working part-time in my dad’s tax practice, I once heard the IRS be referred to as the most brutal collection agency on the face of the planet,” Torres said. “That remark made a lasting impression on me, especially because it was made in the context of the IRS being even more brutal than the Mafia!”

He thinks the IRS based on his present observations has made its fair share of mistakes in the past but is shifting towards a more “cooperative and gentler” agency, as shown by recent reports of taxpayer refunds.

“For now, I think taxpayers are still justified in having a healthy fear of the IRS. And that may not be a bad thing,” he said.

in historic downtown Gardner!

Heywood Wakefield Commons offers worry-free living at affordable rates in private apartments with services available such as:

• Daily social activities & programs

• Three chef-prepared meals daily

• Assistance with personal care needs

• Medication reminders

• Laundry & housekeeping services

• Safety checks

• Dedicated, caring staff 24/7

For more information or to schedule a tour, call Kristy Livingston at (978) 632-8292 or email info@hwcommons.com .

Your chances statistically of being audited by the IRS are not likely—roughly 0.3% or 3 in 1,000.

The first breakup

Four years later, with several highly-rated records to its credit and a strong fan base and seemingly at its peak, the band broke up due to the tinnitus that had damaged the hearing of Roger Miller, the band’s guitarist.

“Rock is evanescent and fleeting,” said Conley. “I’m not sure anything big would have happened if we continued beating our heads against the wall.”

Conley earned a graduate degree in broadcast journalism from Boston University and got his start at WCVB as an intern on “Chronicle,” later becoming a full-time employee. He got married, started a family, focused on his career, and thought his life as a rocker was behind him.

A long television career

“I started working on ‘Chronicle’ around 1990 and never left,” Conley explained. “It’s challenging, fun, and engaging. As a senior producer, I come up with story ideas, write the script, and

Clint Conley has traveled New England for over 30 years as a senior producer for WCVB’s television newsmagazine “Chronicle.”

• We are very experienced licensed audiologists who have been in business for over 30 years. We actually care about your hearing. We care about you hearing better.

• Before you purchase hearing aids on line, over the counter, from a big box store, or a TV ad, that may end up in a bedroom drawer give us a call and make an appointment for a consultation.

• You may just discover you can get hearing care, AND hearing aids from LOCAL professionals for reasonable or comparable pricing.

• Give us a call at one of our three locations before you commit.

“When you can’t hear, we listen.”

go out and shoot the stories.”

For Conley, working on “Chronicle,” which features stories about the many aspects of life in New England, is a dream job. “I get to do things, go places, and meet people,” he said enthusiastically. “I’m madly in love with New England. I love doing things like exploring the deep woods in Maine. ‘Chronicle’ has been a great place to pursue all that. We tell positive, happy stories for the most part.”

Around 2000, Conley got bit by the music bug again. “I was astonished at the music coming out of me,” he recalled. He started a new band called Consonant and began writing, recording, and performing again.

In the years since Mission of Burma broke up, the band had become legendary in the independent rock music scene. It was cited as inspiration by rockers ranging from the Foo Fighters to Pearl Jam, The Replacements, and Husker Du. REM performed a cover version of Conley’s song “Academy Fight Song,” and both Moby and the Catherine Wheel recorded cover versions of “That’s When I Reach for My Revolver,” another song Conley wrote and sang. Its sole full-length album, “Vs.,” appeared on lists of the best albums of the 1980s and best punk albums of all time in publications like Rolling Stone. And in 2001, Mission of Burma was featured in the book “Our Band Could Be Your Life,” writer Michael Azerrad’s chronicle of the most influential bands of the 1980s that pioneered the underground/independent rock music scene in the United States.

“It’s astonishing,” said Conley. “I’m honored and pleased. We were four serious music listeners at our essence.”

Around the time of the Azerrad book release, a promoter in New York City made the members of Mission of Burma an offer to do a show, and the band’s second phase began. And Conley and the other band members quickly learned that Mission of Burma’s sta-

tus in the alternative rock world had soared since the band broke up.

“We did sellout gigs in Boston and New York, and played a festival in England,” Conley recalled. “It was joyous. We had opportunities to play places we never had the first time around. The United Kingdom, Europe, big festivals in the United States and overseas, including South By Southwest, Pitchfork, and All Tomorrow’s Parties.” In a grand homecoming of sorts, Mission of Burma opened for the Foo Fighters at Fenway Park in 2015.

Juggling his television career with being in a touring band was difficult, Conley, admitted, but he made it work. “I’ve been very fortunate with my bosses,” he noted. “They’ve been super kind and were very flexible during the second Burma incarnation.”

The second phase of the band would last much longer than its initial four-year run, over ten years in its most active period, but Burma didn’t officially call it quits again until 2020. In addition to its numerous live performances, the band also released four more critically acclaimed albums, and was the subject of a documentary film.

With a life that’s been dedicated to two entertainment mediums, Conley does see some parallels between his television and music careers. “TV is creative, but not as purely creative as making music,” he said. “Music is unbounded. TV is more strategic at engaging audience attention.”

Conley shrugged off any plans for retiring in the near future. “It’s certainly in the picture somewhere, but I’m enjoying my job as much as ever,” he said. “I don’t have a craving for more time off than I get. I wake up enthusiastic about my work.”

And is the idea of Mission of Burma reuniting again a possibility? “It’s not an impossibility, but also not likely,” he conceded. “Everything in its time and place. We had a beautiful and successful second incarnation.”

A reverse mortgage gives qualified borrowers the option to receive cash as a lump sum, a monthly check, or a line of credit with NO minimum required monthly mortgage payments. The homeowner is, of course, required to pay ongoing real estate taxes, insurance and meet other loan guidelines. By not having a monthly mortgage payment, thousands of eligible homeowners have utilized a reverse mortgage to:

• Increase monthly cash flow

• Pay off a current mortgage or home equity line

• Payoff credit cards

• Pay real estate taxes & property insurance

• Complete needed home repairs or desired improvements

• Ability to pay for at home care or nursing home expenses

• Finalize divorce situations (buyout ex & keep your home)

• Pay IRS obligations

• Settle legal matters

• Use a reverse to purchase a new home

• Purchase a second home or condo in warmer weather

• Install a new septic system

• Purchase a new or used car

• Buy an RV

• Support grandchildren’s educational needs

• Gift to adult children for their home purchase dreams

• Prepay funeral expenses

• Estate & financial planning purposes

• Cash reserves for unforeseen emergency life events

• Estate planning

• Lifestyle improvement options

• Travel

• Home accessibility improvements

• Cash received is all income tax free

• Peace of mind knowing that cash is available

• And the list goes on! What are your needs and desires?

A reverse mortgage might not be the magic wand to solve all the above life challenges, but it very well could be the next best thing. Take the first step and get informed. I would enjoy the opportunity of having that conversation!

Take Action!

A great place to start is get your free “How to Use Your Home to Stay at Home” 36-page book. This is the official reverse mortgage consumer booklet approved by the U.S. Department of Housing & Urban Development and published by the National Council on Aging. To receive your free copy, please call me at (781) 724-6221 or email me at av@powhse.com

Alain Valles Reverse Mortgage Specialist

781-724-6221

I am also available to evaluate your specific situation, answer your questions, and calculate how much money is available to you.

Alain Valles was the first designated Certified Reverse Mortgage Professional in New England. He obtained a Master of Science from the M.I.T. Center for Real Estate, an MBA from the Wharton School, and graduated summa cum laude from UMass Amherst. He is the senior reverse mortgage loan officer MLO#7946 at Powerhouse Funding Corp. NMLS #1740551. He can arrange but does not make loans. Alain can be reached directly at (781) 724-6221 or by email at av@powhse.com

REGION – Inflation is on the minds of just about everyone these days. But could it get even worse? Is a recession the next nightmare of 2023?

And while economic predictors are mixed on whether the sequence of events will happen this year, what does it mean for older people? And more importantly, what can they do about it?

Hard to predict

Brad M. Weafer, Chief Investment Officer for Boston Financial Management, is among those who appreciate how difficult it is to predict recessions.

“It’s very hard to predict the timing, magnitude and whether or not we’ll have a recession or not,” he admitted. But on the other hand, there are many hints and even predictions of the next negative economic development.

“Almost 70 percent of economists predicted a recession at some point in 2023,” he said. He was referring to a Bloomberg study finding last year that the likelihood of a U.S. recession had increased this year. It blamed the increased probability to a series of Federal Reserve interest rate hikes that

escalated the “ongoing fears of a stagnating economy,” according to polled economists.

The recession probability had more than doubled over the last six months, the survey showed.

So what can you do when it’s not just inflation but a recession as well?

Staying the course

For those with investments, Weafer’s advice applies to both older and younger investors: Stick to a long-term plan.

“When we see the odds of a recession rise, we tend to be extra vigilant in our stock selection, choosing companies we expect will have resilient prof-

its,” said Weafer. “These kinds of ‘high quality’ companies carry a number of similar characteristics including strong profitability, low debt levels, less cyclicality, and strong and durable cash flow.”

And there are other considerations specifically for older people.

“I might add this thought specifically for seniors. Many older clients may have less ability or desire to withstand the stock market volatility that generally corresponds with economic recessions,” Weafer explained. “This lower risk tolerance and lower exposure to risk assets is likely prudent. It may suggest a higher allocation to fixed income assets or alternative asset classes and investment strategies like trend following, as an example.”

The ominous word “recession” has various meanings but the National Bureau of Economic Research (NBER) defines it as a significant decline in economic activity that’s spread across the economy and that lasts more than a few months.

In everyday terms, a recession is when the economy goes down in the dumps for six months to a year. This usually means the stock market tanks, companies lose money (or go bankrupt), and people lose jobs. Key takeaways to keep in mind during all recessions (from Investopedia):

• Riskier assets like stocks and highyield bonds tend to lose value in a

recession, while gold and U.S. Treasuries appreciate.

• Shares of large companies with ample, steady cash flows and dividends tend to outperform economically sensitive stocks in downturns.

• Investors can’t hope to time a recession reliably, but diversification and measured steps to control risk can help preserve capital and position portfolios to profit from a recovery.

If you want to continue to invest in the stock market, do so intelligently. That means less volatile and usually sailing a safer course―even if it means less risk will equal lower investment returns.

If you’re looking for relatively safe investments, Weafer and others recommend government bonds―particularly for long-term investments.

Many advisors echo his contention that investments like the stock market should be viewed as long-term, pointing out that setbacks are usually temporary with comebacks in the future.

“The worst thing people can do is they get nervous and pull money out of the market,” said Jordan Rippy, a personal finance expert and accounting professor at Johns Hopkins Carey Business School. “Most people should be invested in the market for the long term.”

But a less conventional and often less recognized option: blue-chip art. Yes, it’s generally seen as a hobby of wealthy art patrons. That changed in 2012 with new regulations that gave flexibility for art work to be seen as real assets and opened up a new mass market. It now has the lowest correlation to equities of any major asset class, according to Citi. This means if the market dips, this asset doesn’t necessarily go down with it. It’s been increasingly recognized by mainstream outlets like the Wall Street Journal as one of the latest “hot” investments.

What you can do | 15

in the stock market during a recession are usually temporary, so investors should stick to their long-term plans and not pull money out of the market.

Ireadthe other day about an experiment done by a pottery teacher that simplified the notion of prioritizing quality versus quantity. The students were separated into two groups. The first group was told to make one pot. They were told they would be graded on the quality of one pot so they should spend all their time perfecting their technique. The second group was told to make as many pots as they could. They would be graded on number, not quality, and it did not matter how good the pots were. They could be good, bad, big, small, ugly, or perfect.

At the end of their time together, they looked at the pots that were done by both groups. The first group created a near perfect pot. It was functional and pleasing. But the best pots were unquestioningly from the second group. Most of what they created was junk, for sure, but the best of them were even better than the one from the first group.

Obviously, the second group got to make mistakes and fail over and over again. But each time, they failed forward. Each mistake helped them make the next pots even better.

I like to think that this is true not only of tactile skills like pottery but with person-centered skills like kindness and empathy. The more you practice

~ Yodathese soft skills, the better you become at seeing the world through someone else’s point of view.

I see a lot of people in our communities who are very kind, even when their neighbors are not able to focus on anything other than their own needs. I see people who go out of their way to include people and think about how they can be helpful. I think aging helps that. Older people may have their own problems, but they are better at understanding the limitations of their neighbors and accepting of their foibles.

Since the murder of George Floyd, many companies have started focusing or refocusing their commitment to Diversity, Equity, and Inclusion (DEI) initiatives. One company I recently encountered added “Justice” to their list of priorities, making their acronym “JEDI.” I think this abbreviation is singularly apt because as Yoda notes, “The greatest teacher, failure is.”

And these initiatives, JEDI, are best thought of like the pots created by the second group of pottery students. It is not about creating a perfect society or even one singular perfect policy. The purpose of JEDI initiatives is to build thoughtfulness into every day. We will not always be the best person we can be. We will make mistakes. We will be unfair, and we will exclude people, sometimes intentionally. The point is to keep trying. The point is to keep these issues and ideals at the center of everything we do so we do not slip into doing things the easy way or doing things that cause harm. The point is to practice our kindness muscle so we continue to improve how we interact with others.

Perfection is not possible. But imagine what we can do if we are all pulling our oars in the same direction.

Ski deals | from page 7 niors 65-79 years young.

• Mount Snow in Somerset offers a discounted one, two, and threeday ticket for the 65-plus crowd.

• Jay Peak in Jay is another great option for day passes for the 65-plus skier, offering a good discount over a regular day pass holder.

Season Passes

Spring is also the best time to find season pass deals for the 2023-2024 ski season. Many ski resorts limit the number of senior season passes. In general, the earlier you commit to the season pass, the better the value. Check your favorite ski resort for their pre-season senior passes.

Across northern New England ski resorts, you can find good, great, and

amazing deals for ski enthusiasts aged 60-plus. With a little investigative work, you can be schussing down the mountain slopes without spending a ton of cash.

Restrictions

Many resorts have limits on the number of ticket deals and have blackout dates for some deals. Online reservations are also required at many mountains. Check with the resort before loading up your gear and heading to the slopes.

For Spacious 2 BR Apts.

Subsidized through HUD’s Section 8 Program for the elderly and handicapped. Rents are based on 30% of adjusted monthly income. Conveniently situated in downtown Gardner, Binnall House features air conditioning, wall-towall carpeting, and modern applianced kitchens. Other features include solarium, activity rooms and an active senior population.

Acolorful Work of Art sat on my desk, a piece I created myself, that turned out to be quite effective.

I had just bought a package of five ballpoint pens with purple, green, red, blue, and black inks. They had covers, not push-buttons.

Confession:

I’m a pen freak. I love writing by hand. I’m always on the lookout for a new pen experience. I’ve been engaged in a lifelong pursuit of the perfect pen.

I was about to enjoy a new pen experience. These pens were narrow and comfortable in my smallish hand. They would make my daily journal writing interesting and fun.

I wasn’t surprised that I had to scribble a bit to jumpstart the ink flow. That’s common with new ballpoints. I began with purple, scribbling on the back of an old business card. Scribbled. And scribbled. Harder and faster, faster and harder. Produced only a weak occasional line, an embossed business card, and a purple pen begging me to leave it alone and let it die. Red, green, and blue were equally comatose. I rubbed and rubbed, ran out of room, moved to the front of the business card. Only black was fully alive. What to do? On the package, the pen company said if I wasn’t satisfied, I should return the pens. Was it worth the postage to make a fuss over pens that weren’t that expensive in the first place? Heck, yes! For a pen freak, who was now a frustrated consumer.

I wrote a letter to the pen company by hand, using the offending pens, which is why the letter was a colorful Work of Art. I began in purple saying I bought the pens the day before. Purple ink ran out. Continued in green saying

I had hoped these would write. Green ran out. Explained in red that I was enclosing the business card with my scribblings trying to start the ink flow. (That card was a second Work of Art, with vigorous lines and circles crisscrossing.) I wrote, “It’s a good thing that I have strong arms! But I didn’t think strong muscles would be required for writing with a ballpoint pen.”

I continued in black, asking them to please send me some pens that were capable of writing.

I signed my name with a blue ballpoint which wrote perfectly and which, I explained, I had received at my bank for free.

I added a PS in very faint purple then sharp black. “Also, the covers fall off.”

I mailed my letter and the pens to the pen company with a copy of the sales slip. I didn’t expect much, but I felt righteous, striking a blow on behalf of innocent disappointed consumers everywhere.

Pen company responded! A Consumer Affairs Associate sent me a gracious letter, with a package of new pens. She thanked me for taking the time to write; they’re concerned when a product causes a complaint; she forwarded my letter and pens to the Quality Assurance Team; because of my help they can identify quality and distribution problems in a timely manner. I was a hero.

The replacement pens were “from current production” so they were fresh off the assembly line. Apparently pens need an expiration date.

The new pens were acceptable, if a bit boring. They were not, and would never be, the perfect pens I long for. And the covers still fell off.

But I had learned that it pays to complain.

And I will always have the copy of my Work of Art letter for inspiration.

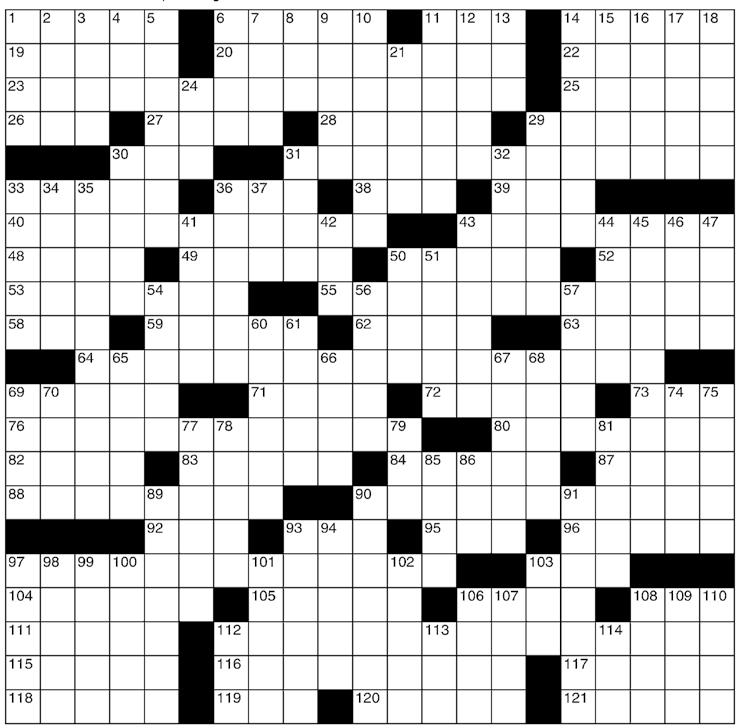

Answers on page 19

REGION - Choices, choices. Everything from toothpaste to smartphones―the choices are dizzying. Same goes for watching TV. If you want to keep it simple and don’t mind the expense, choosing to use cable or satellite service may make sense to you. There are also good reasons to “cut the cord” and eliminate your cable TV bill.

Getting started

For specific details on cancelling your cable service for something else, there are multiple websites (see two below) that’ll lead you through those details―there are too many to cover it all here. If you aren’t daunted by a bit of techno-speak, it should be fairly easy. If you don’t know a smartphone from a laptop, you may want to stay with cable services.

Or maybe you’re like Paula Kirk, a massage therapist from Westborough, who’d cancelled cable for a while and had a digital antenna for broadcast TV. “But then the antenna stopped working, so we subscribed to cable again.”

“I stay with it. Complete inertia!” admitted Joe Sternfeld, a retired actu-

ary in Cambridge. “It works and I have enough money to pay for it.”

Probably the biggest advantage to cutting the cord is cutting costs. A cable bill can easily cost upwards of around $200 or more a month. That may not be a problem for some. Sternfeld’s bill is about $150 for internet and cable TV, but he feels there are not enough savings for him to cut the cord. However, choosing more specifically what you want can cost you less.

So, to begin with, assess what you’re getting. A thousand channels? Wow! But if you only watch five of them, why pay for the other 995 of them?

If you want to cut the cord, it’ll help to have a smart TV—it’s like a TV with a built-in computer. These can be very, very expensive, or very cheap.

You’ll also need an internet connection. That service probably comes from your cable company, like Comcast. If you drop cable, you might need to shop around for a new internet provider.

Want to continue to watch network TV? You can do that for free with a digital antenna, mounted inside or

What you can do | from page 12

Advice for non-investors

But what to do if you have no investments and are living off Social Security and/or pensions and other generally fixed incomes?

Some experts say one of the areas you might capitalize on is an asset common to seniors: Home equity, either for a loan or even a sale. The housing market nationally has been on a roll, with year-to-year prices up almost 20 percent nationally, according to S&P CoreLogic Case Shiller. Mortgage rates are also on the rise, which has dampened demand. But on the other hand, cash investors are still buying.

Another down-to-earth suggestion: full or part-time work. Recessions unfortunately mean layoffs, so there’s a new market for many different skills. For retirees, that means brushing off old skills or perhaps learning similar or even new ones.

Reducing spending is another tactic. Experts suggest areas to look for first include what might usually be called discretionary spending. Try regulars such as entertainment services such as cable and cell phones. Also, look for discounts on cable, cell phone and other bills.

“Bill negotiation services are a way to reduce your costs, which is a simple way to combat inflation,” said Sam Zimmerman, CEO of Sagewell Financial, a Cambridge-based banking company geared toward seniors.

Another common suggestion: you want to pay off credit card debt, or any kind of debt with a variable interest rate―right away. That’s because those interest rates will rise and add more debt.

“There is no benefit at all to carrying credit card debt―it is a perpetual drain on your personal economy,” Rippy said.

A rule-of-thumb if you are living on a fixed income that does not change: Get creative.

Often, that is nothing more than looking for common everyday savings. Take advantage of senior discounts, for example. They’re everywhere but you often have to be aware of them to take advantage.

Here’s something else to keep in mind. Since 1854, the US has had 35 recessions. If there’s a new one, investors and the rest of us can only hope it lasts for the average time of 17 months or less.

outside. Depending on what works in your location, (see website below) you can get ABC, CBS, NBC, and so on.

Buying only the services you want

Cable services often include internet, TV and phone together. “Bundles” might save money, but not always. But it can be complicated to cut the cord. Some stick with cable for just that reason.

If you cut the cord you needn’t “bundle” anything. You can buy internet services from one company, and TV streaming services from others, such as Netflix, Hulu, or HBO. If you’re an Amazon Prime member, you can get a good number of movies and TV shows for free from that service. And lastly, if you still have a landline, you can buy a connection to that service from a third company.

“I enjoy the freedom of choosing my streaming services and know that if I want to, I can save money or spend more if I order multiple services,” said Diana Moon of Somerville, a former cable subscriber. “I also really disliked watching commercials. Sometimes there were more commercials than programming! The only time I miss having cable is not being able to watch the Academy Awards!”

(That problem can be solved by having a subscription to a streaming service that’ll air the Oscars or having an antenna.)

Have to watch sports? Some streaming services, such as Sling TV let you buy packages that including sports channels, such as ESPN and the Tennis Channel. Cut the cord? Stay with cable? The choice is up to you.

To see if you can successfully use a digital antenna, check out this website: https://www.antennaweb.org/

Learn more about how to cut the cord: https://www.pcmag.com/news/the-ultimate-cord-cutters-guide https://stayingfrugal.com/how-to-cut-the-cable/

WORCESTER – When it comes time to make a move that requires buying or selling a home, real estate experts Jo-Ann Szymczak and Diane Luong of RE/MAX Advantage 1 serve their clients with education and careful decision-making guidance.

Having earned the Senior Real Estate Specialist designation, Szymczak and Luong are prepared to address the specific concerns of mature clients. “Seniors have different needs than other sectors of the population,” said Szymczak. “They are frequently moving from a home in which they have lived for decades. We guide them through what can feel like an overwhelming process.”

Where younger families think about moving every five years or so, people in their senior years have homes full of belongings and memories. When they are moving to a different dwelling, getting organized is an enormous task. Szymczak and Luong are commit-

ted to educating their clients about the entire real estate process.

“We hold classes and coffee hours to educate seniors. Whether they are selling, buying, downsizing, considering a condo, or a 55-plus community, we help them figure out what they need and how to achieve it,” said Luong.

Selling a home is just one step in the complex process of moving. “It’s important for an agent to ask, ‘Where are you going? Do you have a next step?,’” said Szymczak. “We help our clients see the entire picture. We explain the whole process and provide resources for each phase,” she explained. “This can include getting the home staged, having photos taken, discussing how we’ll handle showings and offers, and also how to prepare for moving after the closing has occurred. Newer agents frequently overlook this important last step.”

After an initial consultation with Szymczak and Luong, the entire picture begins to take shape, and a careful plan is put into place. “We do more than sell the house; we provide a stress-free home-selling sys-

•

tem,” said Szymczak. “We are very client-based and want our clients to feel comfortable. We have found that an informed client is a happy client.”

In addition to focusing on senior citizens, Luong and Szymczak support clients who work in public service fields through the national Homes for Heroes program. “The Homes for Heroes program was established after 9/11 by a real estate brokerage firm in New York that wanted to recognize the contributions that first responders make to the community,” said Luong. “The program benefits first responders, teachers, military, and healthcare workers.”

Luong has been the top Homes for Heroes real estate affiliate in Massachusetts for the past three years. Her husband works in law enforcement, and she has given back over $110,000 through the program. “I give 30% of my commission to the program. Twenty-five percent goes to the buyer, and the other five percent goes to heroes in need,” said Luong. “It is so rewarding to be able to provide a tangible means of saying thank you.” Szymczak added, “We discovered during the pandemic how important these fields are to the com munity, and we are glad to give back.”

Diane Luong has been the top real estate affiliate in Massachusetts for the past three years for Homes for Heroes, a program that benefits first responders, teachers, military, and healthcare workers.

Talking about the current real estate market, Szymczak and Luong agree that real estate agents need to be more specialized in order to serve their clients. “We continually improve our credentials. And we are back to doing what we did 40 years ago, which is educating people on how to get ready for the market,” said Szymczak. “The primary skill set needed for this profession is communication, so that you can advise and protect your clients. Sometimes our advice is that they are not yet ready to move.”

Szymczak and Luong view themselves as problem solvers. “Real estate is a field where you need to be prepared to do whatever it takes to overcome obstacles and meet your clients’ needs,” said Luong. Szymczak concluded by saying, “We are service-oriented. We are with our clients every step of the way, all the way to closing. Ultimately, we help our clients get to the next phase of their lives.”

Jo-Ann Szymczak can be reached

Let them know you saw their ad.

Many thanks!

from your friends at

Please support our advertisers fifty

REGION – There are many strategies that can help with your digestion and regularity. To keep things moving, it is important to move your body in whatever form of exercise you are able to do and enjoy, drink plenty of water, and eat enough fiber-rich foods, including fruits and vegetables and more.

Whether you choose to take a daily walk, participate in an exercise class, or ride your bicycle, there is a correlation between moving your body and encouraging a bowel movement. Exercise helps with your digestion.

Water is another important tool to help keep you regular. Drinking six to eight glasses of water helps to flush out toxins, keep you hydrated and help give a feeling of fullness. Dehydration is a common cause of constipation. Staying hydrated helps things move. Some people like to add fruit slices, berries or even cucumber to their water to enhance the flavor and encourage them to drink more. Others choose to carry a water bottle with them and sip from it throughout the day.

Fiber has many benefits

Adding fiber promotes gut health and has many benefits. Although it is the part of our food that is not digestible, it’s still very important. Fruits, nuts, grains, beans and legumes and

vegetables all contain fiber, some more than others. Processed foods and those with added sugar tend to be lower in fiber and can contribute to constipation.

“By going through the body un-

digested, fiber can help move stuff along in your digestive tract, relieving constipation, a common occurrence as we age,” said Sangeeta Pradhan, a registered clinical dietician at Charles River Medical Associates in Framingham. “Many of you may have heard that fiber can help lower cholesterol and stabilize high blood sugars. But did you know that fiber can actually feed the beneficial bacteria in your digestive tract? Turns out that these little critters can actually reduce inflammation (the basis of all chronic disease) in the body, so having a thriving population of these ‘good guys’ translates to good health.”

“So, go ahead and load up on those fresh fruits, veggies, whole grains, nuts and beans,” she added. “The fiber in these foods can help you in more ways than one.”

Several specific foods have been referenced to aid in regularity. Foods like apples, avocados (which contain a large amount of magnesium which acts as a laxative), and kiwi, which stimulates your digestive track and speeds up intestinal tract time to help relieve constipation. Probiotics like

•

•

Legumes like beans, lentils and chickpeas are good high-fiber foods that promote gut health and regularity.

kefir can also help to soften stool. This fermented milk beverage adds good bacteria to the gut. Many people add this liquid to smoothies and really enjoy the creaminess and benefits it holds.

In an article in Runner’s World by Allison Young, she references ten foods that make you go. These include oranges, water, leafy greens, black beans, prunes, almonds, coffee, kefir, wheat bran and raspberries. These berries contain eight grams of fiber in one cup and are a popular choice for many runners.

What about coffee?

Many people swear by the fact that, in the morning when they drink their cup of coffee, this hot beverage works like a charm. Coffee does contain caffeine, which is a diuretic. It can activate your colon. However, some people add cream or milk to their morning cup of Joe, which can also stimulate the activity of the colon.

The timing can also play a role and not the coffee itself. The activity of the colon increases after waking up. Even if you drank a decaffeinated coffee, the result might be the same. Consuming coffee might work for some; however, it becomes questionable if you consume more than four cups each day.

“Despite being touted as ‘healthy,’ low-fat diets can actually contribute greatly to constipation,” said Sarah Neumann Haske, a registered dietician specializing in digestive health. “Consuming adequate amounts of fat in your diet will actually help normalize intestinal motility and aid in lubrication of the bowels.”

“Be sure you’re choosing healthier fats, she emphasized, “like olives or olive oil, avocados or avocado oil, nuts, seeds and nut butters, coconut oil, grass-fed ghee, organic eggs with the yolk and wild caught fatty fish.”