HOMELESSNESS

FACING FINANCIAL EXCLUSION

EVEN BEFORE THE PANDEMIC, CASH TRANSACTIONS IN AUSTRALIA WERE ON THE DECLINE. AS CHRISTOPHER KELLY REPORTS, POST-COVID, THERE ARE CONCERNS WE COULD BECOME A COMPLETELY CASHLESS SOCIETY.

T

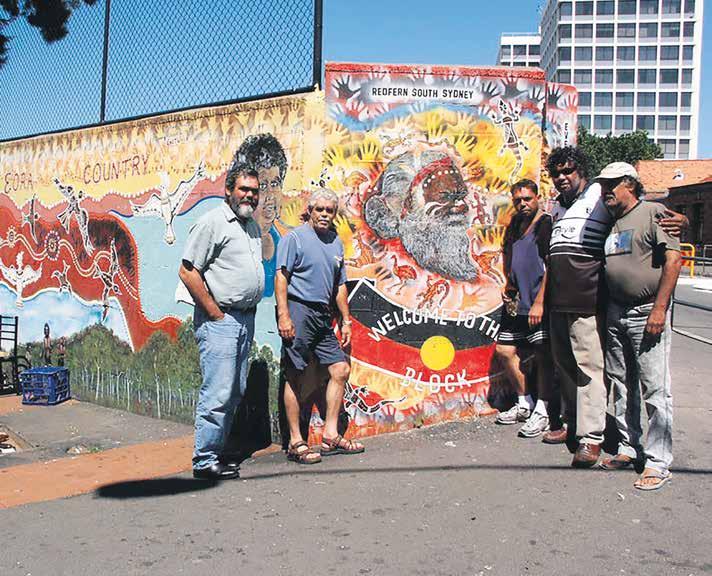

he thought hadn’t occurred to me before. It was only when the chap outside Woolies in Redfern asked for spare change that I realised that I rarely carried coins anymore. All I could offer the guy was a “Sorry, mate” as I passed him by. Ever since COVID hit, supermarkets and other businesses have encouraged us to forgo cash for tap ’n’ go. Even pre-pandemic, our use of physical currency was on the slide. A study commissioned by the Reserve Bank of Australia found that — since 2008 — ATM withdrawals have fallen almost 50 percent. And a Commonwealth Bank study showed a 35 percent drop in cash withdrawals over the past year. Meanwhile, chief executive of the Royal Australian Mint, Ross MacDiarmid, has reported “virtually no sales for coins since the start of the year”. By now, 15 million coins would have been produced. But as stores were forced to shutter up and people shopped online, demand from banks dried up. Speaking to the Guardian Australia, MacDiarmid added: “During COVID, what has unquestionably occurred is that people have stopped using currency entirely or reduced it significantly.” If the trend continues, the Mint will consider stopping producing coins altogether. All this has fuelled speculation that COVID-19 will precipitate a shift towards a cash-free economy. One report — from Research and Markets — forecasts Australia could become cashless in as little as two years (the Commonwealth Bank gives it six). But a move toward a cash-free economy would prove devastating to the most vulnerable in society including the poor, the elderly, and the homeless. According to the last Census in 2016, Australia’s homeless population stood at 116,000. The Census also recorded a 35 percent increase of people sleeping rough in NSW, making the state the homeless capital of Australia. For these people, a cashless system would make a difficult life even harder. “This

is a real issue,” said Justine Humphry, a lecturer in digital cultures at the University of Sydney, “and a potential point of financial and social exclusion for people who are homeless.” It isn’t just Australia’s homeless affected by a lack of cash. It’s a worldwide problem. And one that has led to some interesting solutions. In the UK, an Oxford University-backed initiative supplies homeless people with barcodes to wear around their necks so that they’re able to accept mobile payments. Another UK project — called Greater Change — provides the homeless with a QR code. Passers-by can then scan the code using their smartphone and make an online donation. In New York City, council member

has discovered that a cashless economy comes with societal costs. Studies show Sweden’s hasty embrace of a cashless society has left marginalised populations behind. Most notably, the homeless, immigrants, people with disabilities, and those living in rural regions. A UK report — called the Access to Cash Review — found that Sweden’s experience “outlines the dangers of sleepwalking into a cashless society” with millions of people potentially ejected out of the economy. If Australia were to adopt the Swedish model, the poorest in society — due to their inability to afford devices capable of making electronic payments — would find themselves, not only locked out of the economy, but excluded from

“Sweden’s hasty embrace of a cashless society has left marginalised populations behind ... the homeless, immigrants, people with disabilities, and those living in rural regions” Ritchie Torres successfully pushed a bill to ban cashless stores. “I started coming across coffee shops and cafes that were exclusively cashless and I thought, ‘But what if I was a New Yorker who has no access to a card?’” said Torres. “I thought about it more and realised that even if a policy seems neutral, in theory, it can be exclusionary in practice.” If Australia is to learn anything from how a cashless society would impact the vulnerable, it need only look at Sweden. Regarded as the most cashless society in the world, since the pandemic took hold, cash — at the behest of the banks — has all but disappeared in the Scandinavian nation. Indeed, 85 percent of transactions in Sweden are now electronic. And while there are many benefits of going digital — such as speed and convenience — Sweden

accessing essential services. “I’ve found in my research,” said Humphry, “that essential services are increasingly centred on and require access to smartphones — using mobile apps and text services for example.” Should Australia go cashless, government needs to make sure that disadvantaged communities are protected and not precluded. According to the Access to Cash Review, “the consequences to society and individuals of not having a viable way of paying for goods and services are potentially severe”. But, “If we act now,” conclude the authors, “we can take steps to stop harm happening, and prepare for a world of lower cash, without societal and economic damage. If we take action now, we can shape a future which is both economically viable and in which no one gets left behind.”

www.innersydneyvoice.org.au • Spring 2020• Inner Sydney Voice

17