Planning Ahead

The pros and cons of using revocable trusts to protect your assets and your privacy.

By Tim Feran

Shakespeare wrote, “The evil that men do lives after them; The good is oft interred with their bones.”

But those who create revocable trusts may put the lie to that statement.

Revocable trusts are “almost a will substitute,” says Kelly Green, chief magistrate of Franklin County Probate Court. But they have many advantages over a will.

“They’re a lot easier to change than a will,” she says. “A will has all sorts of requirements in order to change—most notably, two people witnessing it.”

And, “you can control stuff from beyond the grave,” says Fred Berkemer, a veteran Columbus attorney. Wills merely transfer assets to specified beneficiaries at the time of death with no strings attached, he says.

While revocable trusts are often seen as something used by people with sizable assets, Green says, a trust is “essentially setting up a rule book or playbook” for anyone who wants to protect some assets and dictate how they will be distributed.

For those who substitute revocable trusts in the place of wills, one key advantage is: Trusts can avoid the cost of probate court, “filing fees and legal costs,” says Robert Dunn, an attorney at Bailey Cavalieri LLC who focuses on estate planning and probate issues.

Avoiding probate court also means that the terms of the trust and the amount of assets are not put into the public record—they remain private.

“When you go through probate, you have to list an inventory. That is public record,” Green says.

“The key, though, is you’ve got to be sure that, at least during your life, you put the assets in the trust,” Dunn says. “You fund the trust, or you have a beneficiary designation that will send it to the trust on death.”

How can a revocable trust work be-

Wealth Management

yond the grave? One example: Funds can be paid out over a period of years and in increments.

That’s an especially useful point for parents of young children, says Berkemer, who has set up some revocable trusts—and not just for high earners. “I represent blue collar people primarily. I don’t get involved in the high-end income trusts.”

Even if the parents aren’t especially wealthy, payments can be made for supporting children as they grow up, and then for things like college expenses, marriage, or just to kick in at an age of maturity, Green says, “typically at age 18, 21 or 25, or it can go well past that.”

Another “beyond the grave” example: “I just did a trust for a lady on the Hilltop who owns a piece of land that the family has had since 1947,” Berkemer says. “There are two houses on this place, so we put it in a trust that controls the property so that a son can live there, a grandson can live there, until someone doesn’t

want to live there. Then the trustee can sell it and split the money. You can’t do that with wills.”

As probate court magistrate, Green speaks “a lot to elderly communities, and I tell them that [a revocable trust’s]

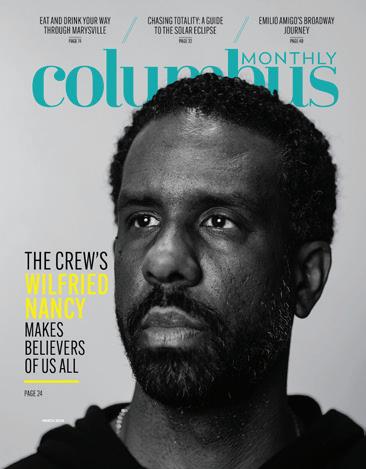

Robert Dunn

Kelly Green, chief magistrate, Franklin County Probate Court

greatest use is as an estate planning tool and a will substitute,” she says. “And one of the great things is its flexibility and your ability to change it at any time. You are making the guidelines. You don’t have to default to the oldest son to be the trustee, for example.”

Dunn notes that a revocable trust also can be used “to help an elderly person, a widow, say, to have a house, a bank ac count, all assets titled in the trust. If that person then becomes incapacitated, the trustee can simply pay the bills without a need for guardianship.

“But it doesn’t necessarily need to be incapacity. A person may just be tired of doing it,” he says. “I’ve seen it quite often. I saw it with my own mother.”

The downside of revocable trusts? “It takes a little more effort to prepare the trust as opposed to a will,” Dunn says. “I don’t know if I would recommend it for everybody. There’s really no one size fits all solution. Many small estates may work with a simple beneficiary. On the other hand, I could have a modest estate and have a revocable trust if I’m on a second marriage but want to provide for children from a first marriage.”

Berkemer agrees that many people don’t necessarily need a revocable trust.

“By using transfer on death affidavits, real estate can be transferred without probate,” he says, “and if financial ac counts have listed beneficiaries, probate may be avoided entirely without the ex pense of a trust.”

Ultimately, Green says: “People should talk to a qualified estate planner about this. There are tax implications to all of this. Don’t just pull information off the internet.” ◆