DAVID HELLER DAN BURNETT MARIE RAMSTETTER MINDY STONE DAN BURNETT–A LEGACY OF RESCUE ANNOUNCING COLORADO’S HEART AWARD 2024 WINNER Metro District Finalist Southeast District Finalist Statewide Winner Western District Finalist Northeast District Finalist CEO Update: CAR Survey Says Page 6 1031 Exchanges: A Practical Guide for Real Estate Agents and Their Clients Page 16 NAR Settlement Special Supplement Page 35 Official Magazine of the Colorado Association of REALTORS® c o l or a d o RE ALTOR® MAGAZINE MAY 2024 PLUS: Page 8

2 Simplify the transaction lifecycle and

Be in the know Sign up to receive updates on the next generation solution View Press Release › MRI announces next generation CTM eContracts™ solution

is now part of the MRI So ware family. from MRI Software

contract management process

eGent

The COLORADO REALTOR® is published by the Colorado Association of REALTORS®, 309 Inverness Way South, Englewood, CO 80112 (303) 790-7099

EDITOR: Lisa Dryer-Hansmeier, VP of Member Engagement & Public Relations: lhansmeier@coloradorealtors.com

ASSISTANT EDITOR: Adela Taylor: ataylor@coloradorealtors.com

DESIGNER: Monica Panczer, Creative Marketing Specialist: monica@coloradorealtors.com

ADVERTISING: Angelika Jones: ajones@ coloradorealtors.com

The Colorado Association of REALTORS® (CAR) assumes no responsibility for return of unsolicited manuscripts, photographs or art. The acceptance of advertising by the Colorado REALTOR® does not indicate approval or endorsement of the advertiser or their product by CAR. CAR makes no warranties and assumes no responsibility for the accuracy or completeness of the information contained herein. The opinions expressed in articles are not necessarily the opinions of CAR.

This is a copyrighted issue. Permission to reprint or quote any material from this issue is hereby granted provided the Colorado REALTOR ® is given proper credit in all articles or commentaries, and the Colorado Association of REALTORS® is given proper credit with two copies of any reprints.

The term “REALTOR ®” is a national registered trademark for members of the National Association of REALTORS® The term denotes both business competence and a pledge to observe and abide by a strict Code of Ethics. To reach a CAR director who represents you, call your local association/board.

3 CAR MEMBERSHIP MAXIMIZE YOUR The ultimate guide to exclusive perks UNLOCK THE POWER OF MEMBERSHIP BENEFITS TODAY! • CTM ECONTRACTS • VAULT HEALTH INSURANCE • LIVEPAD • PITCHHUB VIDEOS • RENTSPREE • WILLIAMS UNDERWRITING GROUP • IXACT CRM • LENOVO • HOTEL ENGINE • CAREFREE PET Discover a world of exclusive perks and privileges! As a valued REALTOR® member, you gain access to a wealth of benefits designed to enhance your life and business in ways you never imagined. BENEFITS LIKE... 20 MAXIMIZE YOUR CAR BENEFITS MAY 2024: What We Have Learned So Far This Year .............. 4 CEO Update: CAR Survey Says ............................... 6 Colorado's Heart Award Winner for 2024 8 Leadership Academy Graduates 14 RPAC Update .......................................................... 15 1031 Exchanges: A Practical Guide for Real Estate Agents and Their Clients 16 Maximize Your CAR Membership 20 Customer Service and What it Means to You 22 Apply Now to Serve on a CAR Committee .......... 24 Market Trends: New Listings Jump in April Giving Buyers a Few More Options 26 Free ABR Course Online 34 NAR Special Settlement Supplement 35 Leadership Spotlight on Aline Pitney.................. 36 AE Spotlight on Maria Cook ................................. 38 Free Virtual ABR Course........................................ 39

MAGAZINE c o l o r a d o RE ALTOR® 24 APPLY NOW TO SERVE ON A CAR COMMITTEE c o l o r a d o RE ALTOR® MAGAZINE

FROM THE PRESIDENT

What We Have Learned So Far This Year

We are already about halfway way through 2024.Your state leadership and staff have been busy visiting local associations and brokerage offices, in addition to attending the Region Xl Summit and hosting the CAR Spring Summit. Between the hallway talk and the sessions we attended, here’s we have learned so far this year.

The Region XI conference, held in Jackson Hole, Wyoming, was an incredible experience and an opportunity to connect with other members in the Region to discuss the issues facing our associations collectively. The conference consisted of many amazing speakers such as: Marki Lemon, discussing how to use AI to enhance your business; Elizabeth Mendenhall, an NAR Past President, who taught us the importance of “Getting Your Mind Right” through visualizing success; and finally, NAR’s current President, Kevin Sears, who took the time to present a current update from NAR in regards to the settlement and what it means for members.

Here are some additional takeaways from Region Xl:

• Members need to focus on things in their business that need to be done, differently, but the sky is not falling.

• NAR will not be increasing membership dues in 2024 or 2025.

• How to use AI for real estate sales: 100% of real estate now involves the internet. Embrace and utilize virtual tools to help market yourselves and your properties.

• The Region Xl conference serves as a wonderful opportunity to learn what is happening in the rest of the region and potentially help Colorado with similar challenges.

• 2022 was the worst year for home sales since 1995 according to NAR Economist Dr. Lawrence Yun.

• It was suggested there will be a huge pent-up demand from homebuyers and sellers which presents opportunities to impress our value and help consumers understand what it is we do as REALTORS®.

At our annual Spring Summit, we offered a more accessible and cost-effective opportunity for CAR to connect with the members across Colorado by hosting the Summit in the Denver Metro area. This location was well received by our members. The Summit was very interactive where participants got a chance to share their thoughts,

4

Jason Witt 2024 President of the Colorado Association of REALTORS®

continued on next page

ideas, and concerns with each other and CAR Leadership. Let’s keep remembering why we all do what we do and that it is our members we are working for!

Here are some of the association leaders’ takeaways from Spring Summit:

• There is a lot of misinformation regarding the NAR Lawsuits and Settlement. The best place to get the facts about them is at Facts.REALTOR.

• Members need to realize the lifetime value of a client.

• Clients need to have Top of Mind Awareness when it comes to our business.

• RPAC is a crucial investment in your business and helps support legislators that align themselves with what is important to Colorado REALTORS®’ careers. There was so much more gained by members attending the Spring Summit and I encourage you to take the time to attend a national, regional, or state conference, and more importantly, your local meetings, even if you can only spare one day. It is worth it.

As a closing reminder, I invited all CAR Committees to a 100% RPAC Participation Challenge. We are 30% of the way to our goal of 100% participation, with some committees falling short by only a few members’ participation. Therefore, I extend this challenge to you all as well. Let us strive for 100% participation in the RPAC, not out of obligation, but out of a genuine belief in the value it brings to our industry and our community.

Thank you to all the CAR staff, without whom these events would not take place. Thank you to the members for providing us your valuable feedback on these events so we can continue to improve in the future. And a final thank you to all of our members who make up this amazing association: I value you all, I appreciate you, and I thank you for your participation in these events – See you in October for the Leadership Symposium!

5

Jason at RPAC Auction with his wife Carolyn

Jason at Spring Summit with Scott Peterson

Members at the recent NAR Hill Visits in DC

CAR Leadership Academy Training

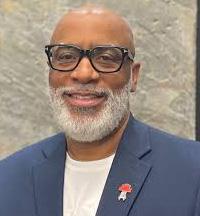

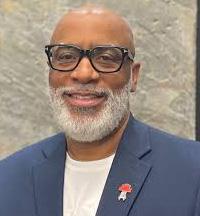

FROM THE CEO

CAR SURVEY SAYS

We conduct membership surveys every two years to see if we are getting better than the last time we surveyed the membership, and to make sure we stay relevant for Colorado REALTORS® across our beautiful state. While some members find great value in the advocacy, resources, support, and networking opportunities we provide, others feel we fall short in certain areas.

Your dedicated and passionate leadership and professional staff recognize that our members have varying opinions on the value CAR brings to their businesses. We also recognize these same members have different needs to help make their career more successful, which is a large part of why we exist in the first place.

During our survey in early 2024, it was evident that members were feeling confused, frustrated, and upset about the negative publicity surrounding the REALTOR® brand. While much of the negativity was aimed at NAR, it inevitably led to questioning the value of state and local associations as well. Some of this perception is influenced by misinformation from the media, member and public views, and let’s face it, selfinflicted challenges.

Despite the challenges we were facing, we believed it was crucial to gauge how CAR is performing in delivering relevant benefits and features for Colorado REALTORS®. This feedback is key to measuring our effectiveness, understanding member sentiments towards the association, and identifying areas for improvement.

Here’s a snapshot of what we learned from the survey results: Colorado REALTORS® highly value these programs provided by CAR: Legal tools and resources (72 percent very valuable), advocacy efforts (69 percent), ethics enforcement (67 percent), continuing education classes (63 percent), and market updates (57 percent). Most members feel like the Association is moving in the right direction (67 percent) and have a high level of confidence in the Board of Directors (60 percent). An overwhelming majority take pride in being a REALTOR® (85 percent).

However, there are areas where members feel improvement is needed. Some members believe their community does not have a positive view of REALTORS® (33%), and a quarter feel their professional reputation is not enhanced by their CAR membership. Additionally, there are concerns about a perceived decline in confidence in the Board of Directors and certain services and programs we provide, such as the REALTOR®

6

Tyrone Adams CEO of the Colorado Association of REALTORS®

continued on next page

Foundation, Project Wildfire, member discounts on services and vendors, and networking events. Low grades in these areas could be due to lack of awareness.

Ok, so what are we going to do with the information? Glad you asked. The next step is to analyze the data to identify key trends and patterns, which will help us better understand member needs, preferences, and concerns. This will also enable us to tailor our benefits and features, develop targeted initiatives, and align the

results with the CAR strategic plan to make necessary adjustments.

If you have additional comments or suggestions, please don’t hesitate to reach out to me at tadams@ ColoradoREALTORS.com or 303-785-7112.

A heartfelt thank you to all members who participated in the survey. Your feedback is invaluable to shaping the future of CAR and enhancing your real estate career.

Colorado Association of REALTORS®

Member Survey Report Card

7

DIRECTION OF THE ASSOCIATION ® 2.2 MEAN SCORE OVERALL ASSOCIATION GRADE ® B GRADE GPA: 3.0 2.3 MEAN SCORE CONFIDENCE IN THE CAR® BOARD OF DIRECTORS ® A F 2024 Don’t know 35% 5% 17% 2024 2021 2024 Don’t know 30% 1 5 2021 Don’t know 1 5 1 5 Don’t know 1 5 Don’t know

OVERALL ASSOCIATION GRADE A F 2021 Don’t know 37% 32% 10% 3% 1% 19% 37% 22% 15% 3% 3% 21% 27% 14% 2% 28% 21% 18% 7% 5% 22% 28% 26% 13% 4% 1% 28% 20% 24% 15% 7% 4%

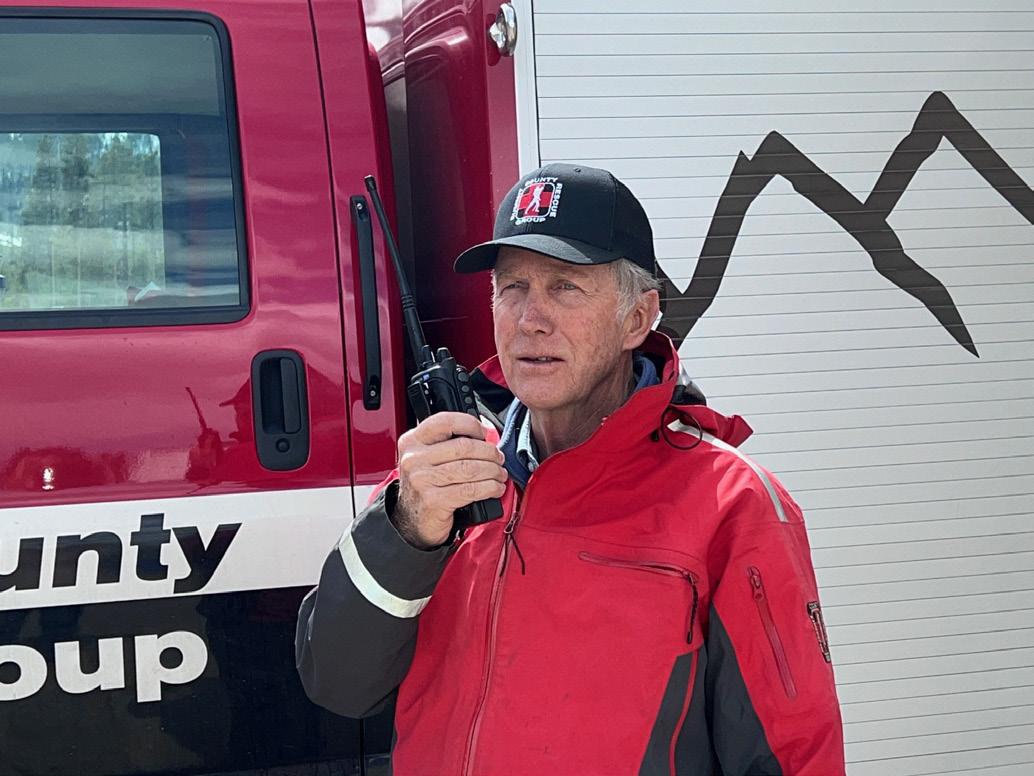

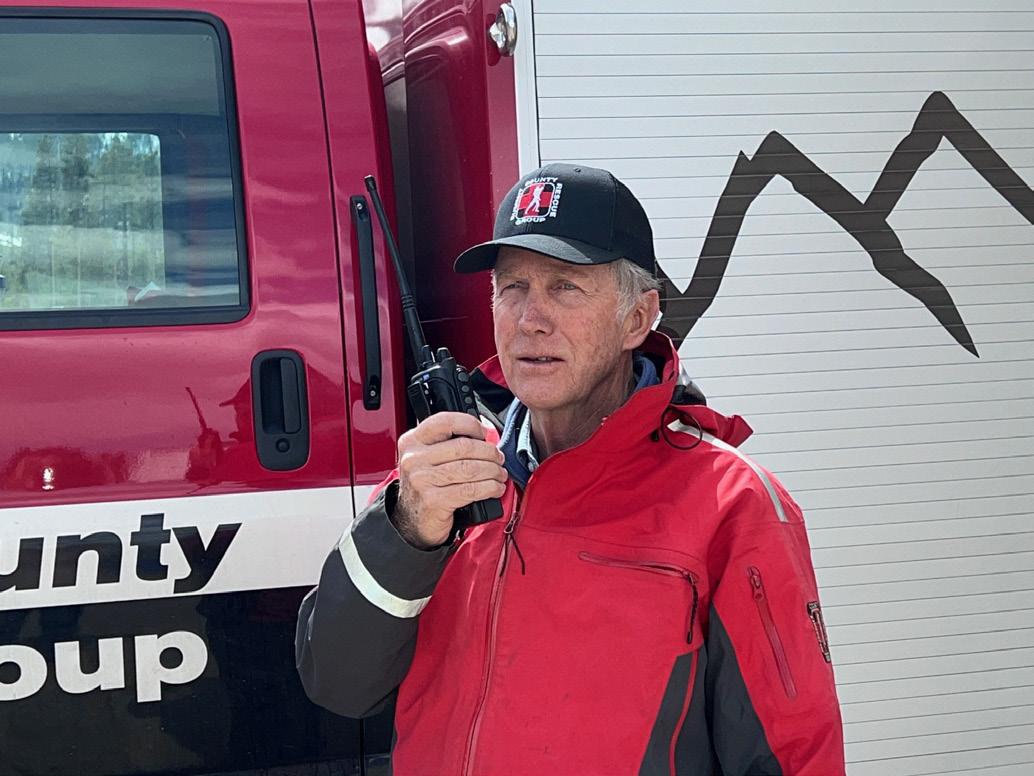

DAN BURNETT

2024 Statewide Winner

A Legacy of Rescue

“Dan has worked plane crashes, searched for lost hikers, skiers, hunters and children [and] he has helped bring out injured people from the deep backcountry.”

Contact Burnett at dburnett@ srgsummit.com and learn more about Summit County Rescue Group at https://www.scrg.org/.

REALTOR® Dan Burnett has been saving lives in the Colorado backcountry for decades.

DAN BURNETT STATEWIDE WINNER – COLORADO’S HEART AWARD SUMMIT COUNTY RESCUE GROUP

The Colorado mountains are home to some of the most breathtaking scenery and heartpounding outdoor recreation opportunities in the world. Year round, millions of locals and visitors alike venture out into Colorado’s backcountry to ski, snowboard, climb, fish, hike and more. Most will return with an adventure story and some incredible pictures, but occasionally the adventure turns into an emergency. When that happens, REALTOR® Dan Burnett and the team of highly-trained backcountry rescue experts that serve on the Summit County Rescue Group mobilize to help.

“Being a REALTOR®, and having a flexible schedule, has allowed me the freedom to be available at a moment’s notice when emergency calls come through,” said Burnett. “It is very rewarding to explain to clients the situation and have their understanding and support as well, especially when I have to leave them with sirens wailing.” When Burnett says, “at a moment’s notice,” he means it: the Summit County Rescue Group is available 24 hours per day, 365 days per year, and has responded to more than 4,500 missions since its inception in 1972.

Burnett serves as one of ten Mission Coordinators who lead 65 active Summit County Rescue Group members. He is the longest serving team member. “Dan has saved countless lives over the years by being part of the teams: organizing and running the search teams and coordinating search operations in the field to bring the injured and lost home safely,” said colleague Samantha Meister, who has worked alongside Burnett at Summit Resort Group for 13 years. “He has worked plane crashes, searched for lost hikers, skiers, hunters and children [and] he has helped bring out injured people from the deep backcountry.”

The work is fulfilling, but difficult. “It is rewarding to save multiple lives in a year [and] to bring closure and help to families of people who have died in mountain accidents,” shared Burnett. However, “Post-Traumatic Stress is a real factor,” Burnett said. “Having great support

continued on next page

8

from Patti, my wife; my family; rescue team members and mental health professionals helps a lot. Being allowed to hang out and participate with real-life superheroes (mountain rescue volunteers) is giant motivation and keeps me coming back year after year.”

It's not just the schedule that can be challenging. Summit County Rescue Group members are required to have current CPR and First Aid certifications, and a large portion of the team is EMT certified. The team trains extensively and must recertify in multiple search and rescue disciplines every five years. “One of the biggest challenges is always to keep up on skills, equipment maintenance and prep, and simply being physically ready,” Burnett said, adding, “It is funny…people expect a better than average looking person to arrive on the scene to save them, and then I walk out of the woods, or drop down from a helicopter. In the end, they are very happy to be safe and get the immediate care they need from our amazing team.”

That team spends countless hours each year performing outreach in the community: teaching avalanche rescue skills, environmental sustainability practices, emergency medical skills classes and backcountry preparation classes. They also host the premier avalanche rescue seminar for rescue teams across the state – and have for 45 years.

For all the teaching that Burnett has done in the community, he’s learned some important lessons as well:

“Storms can be weathered and survived,” he advised, “even in times of crushing scrutiny or when retired team members pass away because of old age. Through my faith and my family…these storms, too, will pass.”

9

continued on next page

DAVID HELLER -

2024 Metro District

Finalist

Team Linda Lou has raised over $250,000 to date and Heller expects the 2024 team to be the largest yet.

An Adventure With Purpose

Driven by a devastating diagnosis,

REALTOR®

Contact Heller at dheller@ irisrealtygroup.com and learn more about the National MS Society’s Colorado and Wyoming Chapter at https://www.nationalmssociety.org/ resources/get-connected/in-yourarea/coc.

David Heller rallied a community.

DAVID HELLER

METRO DISTRICT FINALIST

NATIONAL

MULTIPLE SCLEROSIS SOCIETY COLORADO/WYOMING CHAPTER

Some moments in life can be defined as Before and After. So it was for REALTOR® David Heller when his mother, Linda Lou Heller, was diagnosed with Multiple Sclerosis in 2010. “She’s been a constant source of support and inspiration throughout my life,” Heller shared. “She is the only inspiration I need to fight the good fight against MS each day!”

An avid cyclist and ultra-runner, Heller founded Team Linda Lou within the National Multiple Sclerosis Society’s Colorado and Wyoming branch. The team of cyclists has been riding in the Colorado MS-150, a grueling but scenic 150-mile bike ride through the Colorado Rockies, for more than a decade. Fundraising generated by the teams of cyclists that participate in the event has powered breakthroughs in research for the more than 1 million people living with multiple sclerosis. In fact, Team Linda Lou has raised over $250,000 to date and Heller expects the 2024 team to be the largest yet.

In 2022, Heller was asked to participate in the MS Run The US, an annual Ultra Relay which breaks up the nation into 21 segments and challenges runners to complete a segment of the 3,260 miles

across America in support of fundraising for MS research. Heller ran Segment 7, stretching from Steamboat Springs to Denver, so that his mother could be there to watch him run. “I’ll call it an adventure, an adventure with purpose,” he said of the experience. “To take on something like this - with so many miles and so much adversity every single day that you have to overcome - that is the perfect tribute to the people who are battling MS.”

Of his 18+ years as a REALTOR®, he said, “The relationships I've developed with clients and industry contemporaries over the past two decades has served as an incredible base with both fundraising and volunteer participation. The philanthropic philosophy demonstrated by both the Colorado Association of REALTORS® and NAR perfectly aligns with my communitybased values.”

10 continued on next page

JERRY CLARK2024 Southeast DIstrict Finalist

Mission Possible

REALTOR® Jerry Clark feels called to help community members find homes of their own.

JERRY CLARK

SOUTHEAST DISTRICT FINALIST

SPRINGS RESCUE MISSION

Jerry volunteers with the Springs Rescue Mission, which offers a person-first approach to overcoming homelessness in the local Colorado Springs community.

Every year the housing crisis in Colorado deepens and the city of Colorado Springs is not immune to the struggle to help Coloradans keep a roof over their heads. REALTOR® Jerry Clark, who operates his business, The Jerry Clark Real Estate Team with RE/MAX Integrity, in Colorado Springs, has been a steady presence in the fight against homelessness for more than 10 years.

He volunteers with the Springs Rescue Mission, which offers a person-first approach to overcoming homelessness in the local Colorado Springs community. It’s a programmatic model that takes a holistic approach to self-sufficiency through three pillars of life: housing, health, and work. The program provides supports in each pillar to teach participants the tools they need to live independently. The Mission also runs a three-tiered shelter system designed to create steps out of homelessness into independent living.

known for leading successful clothing and food drives which bring in thousands of dollars in donated goods for the Rescue Mission.

Clark’s community loves him right back, and he was honored with the Pikes Peak Association of REALTORS® Good Neighbor Award in 2023 for his service. When preparing for a lung transplant last year, he says, he learned just how good the human spirit is. “People really stepped up to help me and help keep the charities going,” he said. He was challenged to learn how to balance personal life with volunteer life but says he has no plans to slow down. “I am now even more inspired to help others because you never know when the day will come when you are unable to.”

Contact Clark at Jerry@ JerryClarkTeam.com and learn more about Springs Rescue Mission at http://www.springsrescuemission. org/.

“I love being involved with the community whether it be with my church or doing volunteer work,” Clark said. “Being a REALTOR® for 19 years, I have been blessed to have been given the opportunity to meet a lot of people and to get involved with volunteer groups to help those people that are in need. The Rescue Mission is a great avenue for this.” Clark is

His passion and dedication to his service work continue to impact the lives of those around them, and Clark wouldn’t have it any other way. “I feel that God put me on the Earth to help others,” he said. “My goal is to inspire others as well and always remain positive.”

continued on next page

11

“It is such a gift to [help] sick or wounded animals come back to a healthy life – it warms your heart [and] heals your soul.”

Love For Every Creature

REALTOR® Marie Ramstetter gives her time and treasure to save homeless cats and help them find new homes.

MARIE RAMSTETTER

WESTERN DISTRICT FINALIST

LOMA CAT HOUSE INC.

Most are aware of the struggles that animal shelters face in the United States: overcrowding, disease, lack of funds, lack of proper vaccines or medicines, and worst of all, not enough homes for all the animals in need. A longtime animal lover, Grand Junction REALTOR® Marie Ramstetter stepped in to help the Loma Cat House. Founded in 2005 by Barbra Brown to care for homeless cats in the Grand Valley, Loma Cat House quickly outgrew its first facility and reached out to the community for help. Ramstetter was one of two women to offer unconditional support.

“I grew up on a farm and loved every creature,” Ramstetter said. “It is such a gift to [help] sick or wounded animals come back to a healthy life – it warms your heart [and] heals your soul.”

tireless basis. She does all of this with a giving heart.”

Ramstetter’s passion for helping animals brings her great joy. “Cats have always been special to me,” she said. “Their purring does feel like it heals. Animals can teach you so many lessons [if] you just pay attention.” One such lesson, she says, is the ability to adapt to changing circumstances.

Contact Ramstetter at ramstet@ gmail.com and learn more about Loma Cat House at http://www. cathousegj.org/.

For almost 20 years, Ramstetter has played a pivotal role in expanding and stabilizing Loma Cat House, helping it grow into a sustainable organization. She fundraised and oversaw construction of new buildings on a friend’s horse ranch to establish a larger facility. She has since devoted over 1,000 hours of her time to trapping, caring for, and arranging vet care and adoptions of countless feral cats and kittens.

“She tends to inspire people to help,” said friend Betty Fulton. “She’s taken on this massive job on a purely volunteer and

“As a REALTOR®, we all find situations that hinder the sale of our listings,” she said. “When everything goes well, there is a lot of satisfaction and joy. But there is also heartbreak, one needs to get used to bearing that.”

While Ramstetter’s supporters say she will likely never retire from either real estate or her service to homeless animals, Ramstetter considers the passage of time a way to deepen her impact. “At age 78, I will not live that many more years,” she said. “I want to leave a legacy to animal rescue that will enhance their lives and help protect the earth.”

12 continued on next page

google com/mail/u/1/?ogbl# nbox/FMfcgzGxTFRbwPHhZFjFsjCZdPHdNdvg?projector=1&messagePartId=0 11 1/1 5/4 24 8 56 PM MG 4280 jpg https //ma l goog e com/ma l/u/1 ?ogbl#inbox FM cgzGxTFRbnJSVVFNnnnjpWSd RnvZ?projec or 1&messagePartId 0 1

2024 Western District Finalist

MARIE RAMSTETTER -

MINDY STONE2024 Northeast District Finalist

A View of Community

Growing need during COVID inspired REALTOR® Mindy Stone to volunteer in her tight-knit community.

MINDY STONE

NORTHEAST DISTRICT FINALIST CROSSROADS MINISTRY OF ESTES PARK

Her service has been recognized by her community: in 2023 she was honored by the Estes Nonprofit Network with their prestigious Katie Speer Philanthropist of the Year Award.

It was 1994 when REALTOR® Mindy Stone, CMAS, moved from Illinois to the mountains of Estes Park, Colorado – a town she calls the most beautiful place on Earth. “I absolutely love my community,” she said. “We come together in times of need no matter what.”

It is this devotion to her community which inspired Stone to volunteer with Crossroads Ministry, having begun her service with the organization just before COVID hit. Crossroads Ministry helps to support the community through a resident food bank and provides clothing, financial assistance, and literacy training.

“Being a REALTOR® has encouraged me to get involved in the community and the flexible schedule allows me to really participate,” Stone said.

Historically, when the community need has grown, so has the support offered by Crossroads Ministry. Stone shares that the number of clients needing assistance in the food bank has nearly doubled in the last year and they are doing all they can to keep up with the demand. To help with that need, Stone volunteers every single week. “Someone wise once said you will make time for what is important to you,” said friend Stacy Huyler-Fisher. “Mindy is dedicated to Crossroads Ministry. She never misses a week at the food pantry [and] she will not schedule anything over the time she has reserved for her volunteer duties.”

Contact Stone at mindystone99@ gmail.com and learn more about Crossroads Ministry at http://www. crossroadsep.org/.

Crossroads Ministry began its efforts to help low-income residents of Estes Park through times of hardship offering a food pantry and emergency services in 1982. After the Lawn Lake Flood struck Estes Park in 1982, Crossroads Ministry became a vital resource to victims affected by the flood. Over the years, the organization has grown through an outpouring of local support and is now comprised of 15 local churches and eight affiliated service groups, as well as representation from many local businesses. Their mission is to provide human services to the community of Estes Park with unconditional love.

Stone’s dedication to Crossroads Ministry includes planning their annual fundraising event: a night of food, wine, and a silent auction. Under her leadership, the event raises $40K-$100K annually. “This fills my heart with joy and gratitude,” said Stone, who also serves as Vice President on Crossroad Ministry’s Board of Directors. “I am honored and take so much pride in being part of an organization [whose] sole purpose is to better the lives of others and let them know that everything is going to be alright.”

13

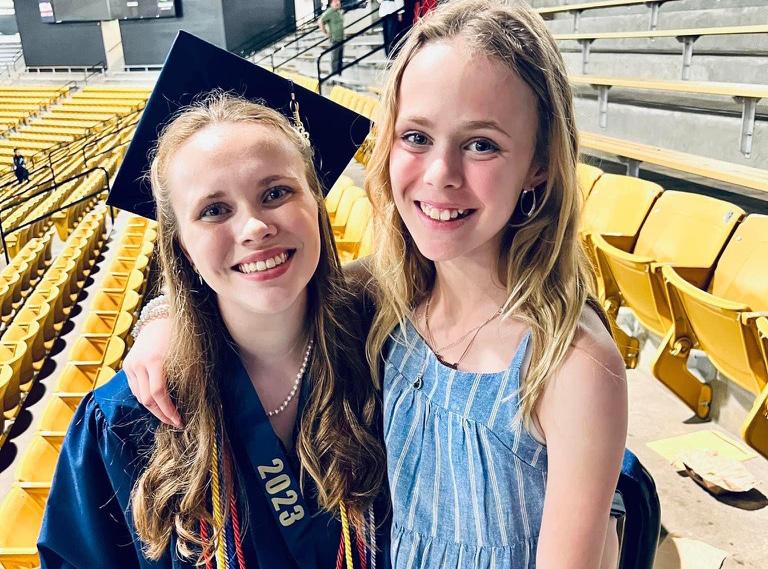

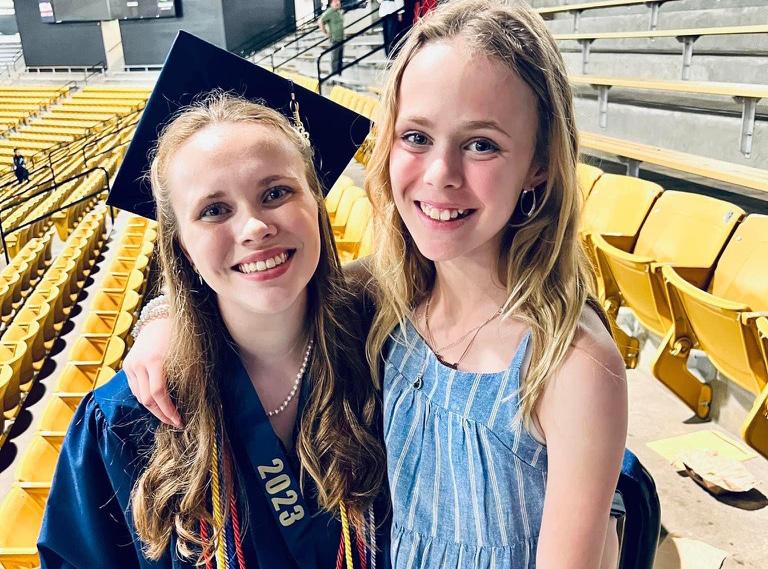

Congratulations to the Graduates of the CAR Leadership Academy!

Your dedication and hard work have paid off as you've completed an intensive program to cultivate and enhance your leadership skills. We're immensely proud of your commitment to personal and professional growth.

As you embark on your journey as leaders in our industry and communities, we have no doubt you'll achieve remarkable things. Well done, graduates! We look forward to witnessing your continued success and impact.

14

FUMNANYA CAMARA

KAYDEN HYSON

SARAH MORROW

LYNN ELLEN VERGIS

JESSICA CHARITON

ANN KIDD

MERRIDITH "BREEZY" OBLETZ

HEATHER WASHBURN

ANDREA COX

MARINA-JEANNE LEWALLEN

DON POTTER

NICOLE WHITE

PAIGE HADERLIE

DAVE MAURO

MICHELLE SCHWINGHAMMER

TROY WILLIAMS

REALTORS® Political Action Committee

CONGRATULATIONS to 14 of our members who got inducted into the National Association of REALTORS® RPAC Hall of Fame this past month at the NAR Realtor Legislative Meetings in Washington, D.C. This elite and passionate group of REALTORS® have invested $25,000 or more in their lifetime to help shape the future of the real estate industry. We THANK YOU for your generosity.

Amy Dorsey - $100,000

Linda Romer Todd - $100,000

Ron Myles - $75,000

Kay Watson - $75,000

Tyrone Adams - $25,000

Dale Carroll - $25,000

John Cooley - $25,000

Heather Hankins - $25,000

Janene Johnson - $25,000

Piper Knoll - $25,000

Melissa Maldonado - $25,000

Bobbi Price - $25,000

Tami Spaulding - $25,000

Brendan Bailey - $25,000

COLORADO RPAC HALL OF FAME

Thank you to the below dedicated members who have invested $10,000 or more to RPAC in their lifetime. Your continued support does not go unnoticed. THANK YOU!

Andrew Abrams

David Anderson

Brian Anzur

Okie Arnot

Barbara Asbury

Ann Bagwell

Windy Bailey

Sunny Banka

Ed Behr

Brandon Brennick

Michel Brossmer

Ted Bryant

Michael Burns

Vicki Burns

Cheryl Chandler

Kathy Christina

Carol Click

Natalie Davis

David DeElena

Amanda DiVito Parle

Chris Djorup

Chris Doyle

Holly Duckworth

Molly Eldridge

William Fandel

Amanda Fein

Micah Fritzel

Bob Fullerton

Nanci Garnand

Jace Glick

Heidi Greer

Ed Hardey

Kati Harken

Tyler Harris

Toni Heiden

Mary Ann Hinrichsen

Matthew Hintermeister

Deborah Howes

Justin Kalinski

Pamela Kiker

Kelly Kniffin

Justin Knoll

Cynthia Kruse

Dave Kupernik

Polly Leach-Lycee

Karen Levine

Cheryl Long

Alan Lovitt

Kevan Lyons

Mike MacGuire

Gary Maggi

Janet Marlow

Stew Meagher

Kristen Miller

John Mitchell

George Nehme

Jarrod Nixon

Mike Papatonakis

Kevin Patterson

Jason Peck

David Pike

Hank Poburka

Sally Puff –Courtney

Albert Roer

Gretchen

Rosenberg

Laura Ruch

Ulrich Salzgeber

Marcel Savoie

Todd Schuster

Richard Sly

Alan Smith

Lynn Snyder-Goetz

LaDawn Sperling

Mark Trenka

Scott Webber

Dean Weissman

Brad Whitehouse

Brenda Wild

Sandi Zimmerman

15

1031 Exchanges: A Practical Guide for Real Estate Agents and Their Clients

This article is written by 1031X.com, Inc., a qualified intermediary headquartered in Denver, Colorado, that has been conducting 1031 exchanges across the nation for almost 31 years. This article is intended to be a broad educational overview of some key aspects of 1031 exchanges which involve complex legal, tax, investment and real estate laws, concepts, and principles. Nothing in this article is intended to be, and should not be construed, used, or interpreted, as legal, tax, investment, or real estate advice. Please always consult your own legal, tax, investment and real estate advisors and professionals, as applicable, who are familiar with your own unique situation and facts. This article is not endorsed by and does not necessarily reflect the opinions of CAR.

It’s true that a lot of real estate agents know about 1031 exchanges, but the details and strategic applications can often be confusing and feel daunting. The most effective agents aren’t experts in the tax code, but rather they are knowledgeable enough to spot opportunities and provide actionable information.

In this article, we will break down several must-know rules, clarify common misconceptions, and show how 1031 exchanges can address real client challenges. Think of this as a cheat sheet to help better position yourself as a more knowledgeable 1031 exchange “conversationalist”.

Before diving in too far, let’s get some basics out of the way. First, 1031 exchanges are designed to help real estate investors with their investment properties; they are not a tool for buyers and sellers of primary residences or for (most) vacation properties (for help with primary residences, look to IRC Section 121) . Second, 1031 exchanges are intended for long-term investors, which means developers, dealers, and flippers may struggle to qualify. However, if you are working with a typical retail or institutional investor, the following knowledge could go a long way to impressing your audience.

THE ESSENTIAL 1031 RULES AND WHAT THEY MEAN FOR YOUR CLIENTS

• Defer Taxes to Fuel Growth: At their core, 1031 exchanges allow investors to defer taxes (including state taxes, capital gains taxes, depreciation recapture taxes, and NIIT taxes). If your client sells an appreciated investment property, they would normally pay taxes on the profit. However, with a successful 1031 exchange, your client can defer these taxes and reinvest the proceeds instead, allowing them to unlock greater return on their investment.

• Ticking Clock: 1031 exchanges operate on strict deadlines. Unless a qualifying natural disaster is declared, your clients have only 45 days from the sale of their property to identify potential replacements and only 180 days from sale to acquire their next property.

• Begin Your Exchange by Consulting With a Qualified Intermediary First: Except in the rarest of circumstances, your clients cannot start a 1031 exchange if they already sold their property or received their sale proceeds. That’s why clients need to find and retain a Qualified Intermediary (QI) before they close on a property that will be involved in a 1031 exchange. This is a simple but critical timing issue that is often overlooked and can disqualify a 1031 exchange.

• The Role of a Qualified Intermediary: A taxpayer transacting a 1031 exchange should engage a qualified intermediary (QI) prior to the sale of real estate. However, it is also very important to emphasize what the role of a QI is. A QI is not a law firm or legal advisor, not an investment advisor, not a real estate broker, and not a CPA or an accountant. The role of a QI is solely to facilitate, coordinate, and administer the exchange process. It does not provide legal, tax, investment, or real estate advice.

16 continued on next page

Your client should seek and obtain their own and separate and independent advice from applicable qualified advisors who are appropriately licensed in their specific respective professions; namely, lawyers, CPA’s, investment advisors, and real estate professionals. Think of the QI as the facilitator and the administrative quarterback of a 1031 exchange.

• Buy “Like-Kind” Property: When your client sells an investment property in a 1031 exchange, they have to replace it by buying property(ies) of “like-kind.” The term “like-kind” often leads to misunderstandings. Virtually all types of real property held for business or investment purposes can be “like-kind” to each other. It's not about swapping one property for an identical replica. Your clients do not need to exchange a condo for a condo, or an apartment building or another apartment building. They can sell a farm and buy a condo. Or sell a duplex and buy a single-family home, and so forth. The list of what qualifies as “like-kind” includes, but is not limited to…

• Residential rental properties (single-family homes, apartment buildings, etc.)

• Commercial real estate (office buildings, retail space, warehouses, etc.)

• Industrial property

• Farmland

• Raw land

• Certain mineral rights, easements, riparian and water rights, air rights above buildings, and other rights.

• and more.

The point here is that clients can mix and match different types of qualifying investment real

property. This flexibility allows real estate investors to strategically utilize 1031 exchanges to diversify their holdings, change or upgrade property types, change locations, or adapt their portfolios based on market conditions and personal goals.

BUSTING COMMON MYTHS & MISCONCEPTIONS

Navigating the complexities of 1031 exchanges can be daunting, and misconceptions about the process abound. As a real estate agent, understanding a few key rules and clarifying common misunderstandings will help you guide clients with confidence.

MYTH #1: “YOU ONLY NEED TO REINVEST THE NET CASH OR PROFIT FROM SALE”

This is a very common misunderstanding. It is true that the IRS requires that your client reinvest all net cash proceeds from their sale to receive full tax deferral in an exchange; the IRS also requires that your client acquire replacement property(ies) that are at least as valuable as what they sold. Suppose that your client sells a $500,000 property with $300,000 worth of net equity. In order to fully defer taxes in a 1031, the client would need to transfer all $300,000 into the new property, and the new property would have to be worth at least $500,000. To the extent that your client falls short of either reinvesting the $300,000 or failing to buy $500,000 of new property, the difference can become taxable.

17 continued on next page

MYTH #2: “YOU MUST TRADE EQUAL OR UP IN DEBT”

You will read this all over the internet: “You must replace the debt on your old property with equal or greater debt on the new property.” And while there is some technical basis for this claim, in a practical sense it’s not always true. Your client can replace some or all of the value of their old debt by bringing in more outside cash (or other consideration) on the new property.

MYTH #3: “REAL ESTATE MUST BE USED SIMILARLY TO BE ‘LIKE-KIND’”

Effectively, any real property held for investment can be considered “like-kind” to your client’s property. They can trade out of farmland into a commercial shopping center, or from residential rentals to a gas station. Your client can also (subject to certain rules and limitations) trade out of active management situations into certain passively managed real property, such as investment deal syndications.

MYTH #4: “VACATION HOMES ARE 1031-ELIGIBLE”

Unfortunately, no, not always. There are specific conditions and use limits. These types of homes only qualify for 1031 treatment if your client’s personal use is limited no more than 14 days per year, or 10% of the days that the property was rented out, whichever is greater. (For example, a property rented for 200 days per year would allow for 20 personal use days per year to remain eligible for 1031 treatment.) It’s also best if the property was owned for at least 24 months prior to sale and there were at least two weeks of rental income in each of the prior two years.

MYTH #5: “YOU MUST OWN YOUR PROPERTY 2 YEARS BEFORE SELLING OR 2 YEARS AFTER BUYING IN A 1031”

This myth causes a lot of confusion and can lead to poor decisions and outcomes. It is not true that every 1031 property must be owned for 24 months before/after an exchange. The IRS only requires that, for any property involved in an exchange, the intent is to hold it for longterm business or investment use. Many exchanges occur with properties owned less than 24 (or even 12) months prior to sale/purchase. That said, longer holding periods are a great way to demonstrate the correct intent, and the rules can change if you’re trading properties with

related parties. If your client is dealing with a property that has a short holding period, direct them to consult with a tax advisor.

MYTH #6: EXCHANGES ELIMINATE TAXES

It's essential to remember that 1031 exchanges defer taxes, not eliminate them entirely. However, strategic use throughout an investor's lifetime can have significant legacy planning benefits. Most notably, if properly structured, real estate passed on to your client’s heirs will receive a ‘step-up’ in tax basis at the time of the inheritance. This effectively eliminates all capital gains accrued up to that point, including capital gains taxes that were deferred in a series of multiple or successive 1031 exchanges. Some 1031 strategies may ultimately end with a tax bill; some won’t. It’s all about planning.

MYTH #7: “YOUR PURCHASE AND SALE AGREEMENT NEEDS TO INCLUDE 1031 LANGUAGE”

This is an extremely common misconception. The IRS rules state that the counterparty to any exchange transaction must be alerted about the exchange itself – but the rules don’t state how to deliver that alert. Many advisors suggest putting additional 1031-specific language in the purchase agreement or offer letter, but sometimes this can spook a seller or their agent if they mistakenly assume that the 1031 exchange will cost them money or add complexity to their sale. Consult with a QI for some thoughts and possible alternative notice methods allowable by the IRS.

1031 EXCHANGES IN ACTION: SOLVING REAL-WORLD CLIENT PROBLEMS

SCENARIO #1: THE OVERWHELMED LANDLORD WHO WANTS TO EXCHANGE INTO PASSIVE INVESTMENT

Are your clients tired of dealing with tenants, repairs, and the constant demands of hands-on property management? A 1031 exchange could allow your client to sell and reinvest in easier asset(s), such as a larger, professionally managed property. Doing this could mean more income, fewer headaches, increased free time, and freedom from restrictive legal jurisdictions.

18

continued on next page

SCENARIO #2: THE INVESTOR WHO WANTS TO DIVERSIFY THEIR PORTFOLIO

Are your clients worried about having too much of their investment portfolio tied up in a single market, property type, or geographical location? Your client may want to consider selling their appreciated property and use a 1031 exchange to diversify across multiple locations or property types. They could spread their investment across different states, ideally reducing risk exposure to local economic downturns or market fluctuations.

SCENARIO #3: THE CLIENT WHO WANTS TO RELOCATE TO A NEW STATE.

Clients relocating to a new state, with different tax rates and laws, may want to re-align their real estate holdings with their new location and lifestyle goals. A 1031 exchange lets them sell properties without incurring a tax hit, reinvest more proceeds in their desired market and keep their investment journey on track.

SCENARIO #4: THE AMBITIOUS INVESTOR WHO WANTS TO MAXIMIZE THEIR RETURN ON EQUITY

Clients may own highly-appreciated properties but desire a stronger cash flow to match their current needs. A 1031 exchange could allow them to unlock that equity by reinvesting in one or more incomeproducing properties that better suit their current investment objectives. This "leveraged exchange" strategy puts their equity to work, potentially boosting overall returns long-term.

SCENARIO #5: THE GENERATIONAL INVESTOR WHO IS SERIOUS ABOUT ESTATE PLANNING

A savvy investor is focused not just on their own wealth growth, but on legacy planning for future generations. 1031 exchanges, used strategically throughout their lifetime, can minimize the tax burden passed down to their heirs. By deferring capital gains taxes, and possibly benefiting from a "stepped-up" tax basis upon death, your clients can preserve more of their hard-earned wealth for their beneficiaries.

AGENT TAKEAWAY:

Agents and brokers don’t need to be experts in the tax code in order to leverage 1031 exchanges to help their

clients. Even a small amount of knowledge can reveal new opportunities or help avoid potentially costly mistakes. Also, keep in mind that every 1031 sale could lead to another 1031 purchase (or two), which could mean more business for the savvy agent. This article should better equip you, and we hope it helps make you a better 1031 exchange “conversationalist.”

AUTHORS:

Sean Ross, CEO: Before assuming his current role as CEO, Sean joined 1031X in 2016 to spearhead business development, technological development, and client servicing. Born and raised in Colorado, he earned a B.S. in Economics and a B.S. in Political Economy from Regis University. He spent the next 10 years working as an entrepreneur, retail banker, investment advisor, and editor for several financial publications. As an author, Sean has bylined more than 3,000 articles on the topics of investment, taxes, debt, real estate, and private capital.

Paul Hart, General Counsel & VP: Prior to joining 1031X, Paul was VP/EVP and General Counsel of several software, technology, and sports-media companies, several of which went on to be acquired. He has nearly a decade of "big law" firm experience in Silicon Valley as a corporate securities attorney doing venture capital financing deals, IPO’s, M&A, as well as contracts, licensing, and general corporate representation. He earned a JD and an MBA from UCLA.

Jeremy M.H. Fahl, Strategy and Implementation Manager: Jeremy cut his teeth in the real estate industry by representing banks at foreclosure sales while working through a Clevelandbased law firm in 2003. Jeremy pivoted to the title industry working mainly as a workflow analyst and product manager in residential and commercial title. Jeremy turned his attention to the 1031 exchange industry in 2012 to help streamline and simplify the process for taxpayers and their advisors. Since that time, Jeremy has successfully and personally facilitated over 5,000 exchanges nationally.

1031x.com, Inc. ("1031X") is a nationwide 1031 Qualified Intermediary. Over the course of the last 31 years, 1031X facilitated more than 12,000 exchanges representing more than $5 Billion in real estate value. Our staff includes real estate brokers, licensed attorneys, former financial advisers, and title officers, each dedicated to safeguarding your real estate investments from unnecessary tax burdens. Whether you're initiating forward exchanges or exploring the complexities of reverse and construction exchanges, or looking into the strategic advantages of a 721 UPREIT, 1031X offers tailor-made solutions to meet your needs. Member of the Federation of Exchange Accommodators. CES® (Certified Exchange Specialists) on staff.

www.1031x.com

888-899-1031

Free Consultation link

19

MAXIMIZE YOUR

CAR MEMBERSHIP

The ultimate guide to exclusive perks

Discover a world of exclusive perks and privileges! As a valued REALTOR® member, you gain access to a wealth of benefits designed to enhance your life and business in ways you never imagined.

BENEFITS LIKE...

• CTM ECONTRACTS

• VAULT HEALTH INSURANCE

• LIVEPAD

• EXODUS MOVING AND STORAGE

• KNOME HOME MAINTENANCE

• BUDGET CAR RENTAL

• AVIS CAR RENTAL

• KAYDOH VIDEO MESSAGING

• PITCHHUB VIDEOS

• RENTSPREE

• WILLIAMS UNDERWRITING GROUP

• ODP BUSINESS SOLUTIONS

• CONSTANT CONTACT

• KAPLAN REAL ESTATE EDUCATION

• MEMBER OPTIONS INSURANCE

• IXACT CRM

• LENOVO

• HOTEL ENGINE

• CAREFREE PET

• IT PLEASE

• LEGAL SHIELD / ID SHIELD

• UPS

• ONETAP CONNECT

• IDENTAVAULT

UNLOCK THE POWER OF MEMBERSHIP BENEFITS TODAY!

20

WWW.COREALTORMARKETPLACE.COM

21

Customer Service and What it Means to You

By Mathew Schulz, CVLS, CML President, Residential Loan Programs, CAR Foundation Board Member

Hello, my wonderful partners from the Colorado Association of REALTORS®. It is my pleasure to be bringing you my next edition of Notes from A Mortgage Professional. This quarter, I am going to change things up a bit. Most of my columns are around mortgage programs, rates, the rate environment, or predictions for the future (which, like most economists, I get it wrong more than I get it right it seems). Many of you likely yawn and turn the page – yeesh, I hope NOT!

This quarter, my mission is to inspire you. Inspire you to do better, inspire you to hold your business partners to a higher standard, and inspire you to change your outlook in business and how we interact with each other in general. But wait a minute Mathew, I thought we were discussing customer service, not listening to a Tony Robbins’ speech. I promise you, with the words and thoughts ahead of you in this article, not only will your business thrive, but if we were to approach life in this manner, I do believe we would be living happier and more peaceful lives.

Who among us has not had an awful customer service experience, and not just a bad one, but a horrible one, one that made you want to scream and lose your temper and jump out of your office window (on the first floor)? Personally, I think of being on the phone with a particular cable company, on my third call in to fix the same problem that still exists. I have taken two afternoons

off work so that a technician can come to the house between 12:00pm-7:00pm because scheduling messed up and nobody came on the first day. After being on hold for 23 minutes, the first call was disconnected going from the first operator to the second in the “appropriate department”. Now, I get to sit on hold the same amount of time, pray that the agent properly transfers me this time, and all of this after they refused my request to speak with a manager. Finally, once I am successfully transferred to the proper agent, they apologize and offer me a $5 credit on my monthly bill that tops $300 every month. I can feel your blood boiling right now as mine is.

Sit for a minute and ponder a situation like this that you have experienced. Think of all the ways you would’ve handled this situation differently had you been on the other side of the phone. Ask yourself these questions: Was I heard? Did I get the true feeling that those I was dealing with were sincerely listening to me? Did they have compassion and empathy, or defensiveness and sarcasm in their voice? Did I feel rushed to be pushed off on someone else or off the line altogether? Was I offered something in an effort to make a bad situation right? Did I come away from the experience feeling whole or dissatisfied and still working to resolve an issue that seemed like it will never end?

When I was in college, I worked in a fine dining restaurant

continued on next page

22

in Minneapolis where I experienced a customer service scenario that forever changed my life and my own expectations surrounding the customer service experience. I wish I could take credit for this incredible example; however, it was my manager at the time, Dale Peterson (who’s now one of my best friends and was a groomsman in my wedding) who took charge and made what could’ve been a bad experience into a glowingly positive one. It was at the very end of the night when we had an eight top show up almost an hour past their reservation time, with the kitchen already in the process of shutting down. We sat them without hesitation, as that was the type of organization we were. I don’t mean to throw the customers under the bus, but they also took almost 35 minutes to review the menu before placing their order. Again, as our mantra was all about service, not one employee batted an eye. We served them an amazing four course dinner with wine flight. The difficult part about serving a table after the kitchen had begun to shut down is that everything takes longer. We’re pulling ingredients out of the cooler, getting pasta water back to boil, and prepping everything as if we’ve just opened, yet the customers viewed the situation as nearly empty restaurant. Why was it taking so long? It drew our first complaint. Then, the customers complained that we did not give them enough time between courses, followed up with two people complaining about the quality of their entrées.

In stepped Dale. Anyone who has worked in a restaurant would understand the situation from the back of the house perspective, knowing things may take longer, and, at that time of night, we weren’t dealing with perfectly sober customers. Still, Dale was the ultimate professional. The first thing that he did was listen. I bet Dale stood there for twelve plus minutes listening to his staff, himself, and the restaurant that he loved working at get berated, relatively unjustly, with a legitimate, concerned and empathetic look on his face, taking a mental note of every grievance the customers brought up. He did not interrupt one time, he did not become defensive, he didn’t mention once how the customers were late for their reservation and how that can add undue and unexpected stress to a kitchen. He simply listened. When was the last time you felt truly listened to in a situation like this? After hearing all the grievances, he briefly reiterated the list back to the table to be sure he had everything accurate. Then he went

to work at making the situation right.

The first thing that Dale did was signal me, the bartender, to bring a round of drinks to the table as he could see that they were unhappy. As drinks were delivered, the customers looked up as though “we didn’t order these.” Dale just said, “As I can see your experience hasn’t been the best, this is just one small token of our appreciation for your business. I don’t want you to feel rushed in your telling me your experience, I just thought you looked thirsty.” This got a good chuckle out of everyone and was the first step in turning the tide of the experience. I do have to defend the team at the restaurant, we really had done a great job, but that didn’t matter. In almost any situation or relationship, intent doesn’t matter, what matters is perception. Dale then offered up a dessert tornado, bringing one of every dessert on the menu to the table, which they were also very grateful for.

As the evening was ending, Dale came back to the table with the check reiterating the complimentary drinks and desserts, but as he did so, his instinct told him that they were still a little begrudged. So, Dale, in his wisdom, told the table, “Folks, you have been so wonderfully patient with us and as it seemed we missed the bar in our delivery of our cuisine and service to you, we would like to take care of the bill for you entirely”. It was at that time that the customers said, “Oh no, that’s too much, you have already done so much. We were just grateful for your listening and those desserts were out of this world. We are fine covering the bill.”

That is the moral of the story - Correcting a negative situation so well that the customer is literally telling you that you have already done more than is necessary to make this situation right.

More times than not, I’ve been able to pull a positive review from a client that was unhappy at some point, and I have never received a negative review. Look us up on Google –knock on wood There’s an old cliché that a person will tell 2-3 people about a positive experience but will tell 7-10 people about a negative one. I would go a step further by adding a third category of a negative experience that was made right with over-the-top customer service. I would venture to say that more people would tell even more people about that experience.

Some of you are probably thinking, “Yeah, they just threw continued on next page

23

a lot of money at the situation.” And in my illustrative example, that is true. Yet, there are so many other ways you can make things right. Handwritten notes and thank you cards are all but extinct in our culture, but people value them as they know they take a little extra time. Get into the habit of giving clients personalized thank you gifts at closings and not just another bottle of wine. Volunteer to bring a manager to the situation and give their contact information to reassure your clients the rest of the experience will be better .

In conclusion, this way of thinking, of making things right but better than before the situation occurred, if utilized in all aspects of our lives and on both sides of any interaction (or transaction), could make all of our interactions and relationships truly great, with all of us living happier and more peaceful lives.

Mathew Schulz, CML, is the President of Firelight Mortgage Consultants in Greenwood Village, Colo., a mortgage company that he has owned for 15 years. He is also a board member of the CAR Foundation. You can reach him at mschulz@FirelightMortgage.com.

APPLY NOW

SERVE ON A CAR COMMITTEE IN 2025

The time has come to take an active role in shaping the future of our industry— committee applications are now open for the Colorado Association of REALTORS®!

As a professional dedicated to the real estate industry, this is your chance to lend your voice and expertise. Whether your passion lies in legislation, diversity and inclusion, international real estate, finance, professional standards, or strategic thinking, we have the perfect spot for you.

Don’t miss out on this opportunity to make a difference. Applications will be accepted until July 1st.

Ready to step up?

APPLY HERE:

https://wkf.ms/3tQb2A0

25

MARKET TRENDS

New Listings Jump in April Giving Buyers a Few More Options

A springtime jump in new listings across all property types helped deliver opportunities for buyers across the seven-county Denver metro area (+22.7%) and statewide (+18%) in April, according to the latest Market Trends Housing Report from the Colorado Association of REALTORS® (CAR) and analysis from the Association’s spokespersons across the state.

Although not at the same volume, sold properties and those pending/under contract also rose nicely in April, driving down the average days on market and keeping median pricing on the rise. Single-family homes in the Denver-metro area rose 3.1% from March to April to a median of $639,000 while condo/townhomes dipped slightly over the past month to $416,500. Statewide, median pricing for single-family homes rose 3.5% to $595,000 while condo/townhomes stayed flat at $425,000.

The inventory of active listings increased approximately 6% for all property types in the Denver-metro area, and around 5% statewide. Sellers continue to receive asking price for those homes in good condition and accurately priced.

Taking a more in-depth look at some of the state’s local market data and conditions, the Colorado Association of REALTORS® Market Trends spokespersons provided the following assessments:

BOULDER/BROOMFIELD

“Where did the buyers go? In Boulder and Broomfield counties, the tables are finally starting to turn. What has been a seller’s market for the past 5 years is showing signs of adjusting to the other direction. Sellers who waited for interest rates to come down have finally decided it’s time for a move, regardless of today’s rates.

“In Boulder County, we are relishing in 25% more listings on the market. The increased inventory is a welcome reprieve but buyers who so desperately wanted choices are still sitting on the sidelines. The lack of movement in the rates, the upcoming election, and other general areas of economic uncertainty have created a pause in the buyer demand. With few showings and longer days on the market, prices have been pressured down by 4% since the beginning of the year.

“In Broomfield County, listings are also up a more modest 8% but sales activity is sluggish with fewer homes selling than at this time last year. Due to decreased buyer demand, prices are 6.7% less than they were at this time last year. It’s taking about 60 days on average to sell and as those days increase, sellers become more motivated, and prices decrease. The savvy buyer will recognize the situation and hop in while this market is experiencing a shift. Sellers are willing to pay concessions to buy down the interest rate, lenders are offering free refinance opportunities when rates decline. With more homes on the market and motivated sellers, this is an opportunity for buyers we haven’t seen in years,” said Boulder/Broomfield-area REALTOR® Kelly Moye.

26

APRIL

SINGLE FAMILY TOWNHOUSE/CONDO 2,746 APRIL 2024 APRIL 2023 2,245 +17.1% APRIL 2024 APRIL 2023 7,833 9,176 +22.3% continued on next page

NEW LISTINGS STATEWIDE = 12,032

2024

COLORADO SPRINGS

“The market is giving us mixed signals. On one hand, values went up 5.2% in April which might lead you to believe things are great in the Pikes Peak region. But we need to address the elephant in the room. What is selling is upper end homes. This gives an appearance of price increases despite the 6.6% drop-in units sold and a 23.5% increase in active listings. I believe this is beginning to signal a market shift. One that, in other areas of the country, is also beginning to show up. Properties coming to the market and yet, not selling. Buyer demand remains low. We are seeing 2012/2013 levels of sales, based on units sold. There is really a disconnect now and the numbers are not showing what is really going on.

“If you purchased a home in 2022 prior to rate hikes, your home likely has declined in value since that time. We are seeing homes sold that year hit the market under the price it sold for two years ago. Most areas are below our peaks locally. A new listing that hit the market this week at $399,900 actually sold for $430,000 in the first quarter of 2022. This is happening across the region. Rates are a driving force in this area, along with rental prices being far more aggressive than buying the same home. Rentals also are sitting longer, and rental prices are continuing to soften. If we were in October, we would write this off as seasonal. But we are in the springtime market, and this does not feel like a springtime market.

The national economy is not as strong as what we continue to hear. But we are in an election year, and we would expect the fluff. The job market is probably not as strong as the Federal Reserve says. Inflation and daily costs continue to burden the consumer. Loan delinquencies continue to rise on credit cards, car loans and even nonQM loans. The average person does not feel comfortable and consumer confidence at the grass-root level shows this. Buyers are nervous, which shows in the loan application rates sitting at 1995 levels. Read the headlines and you start to see that April posted falling numbers for full time jobs, again. It isn’t that homes are not available, they are not affordable. And that continues to be an issue

locally. Until confidence and affordability come into the market, I expect that monthly we may see lower and lower sales and more housing inventory come into the market. Once something big goes wrong, the Fed will be lowering rates at breakneck speed. And if history rhymes, it will be too little too late,” said Colorado Springs-area REALTOR® Patrick Muldoon.

COLORADO SPRINGS

“The number of single-family/patio homes for sale in the Colorado Springs area in April 2024 was 2,139, representing a 14.5% increase month-over-month and a whopping 34.5% year-over-year, and the highest level of inventory in April since 2016. Overall months’ supply of active listings was at 2.2 months, for homes priced under $400,000 at 1.8 months, homes between 400,000 and $600,000 at 1.8 months, homes priced between $600,000 and $1 million at 2.8 months, and 5.2 months for homes priced over $1 million.

“There were 959 sales of single-family/patio homes in April 2024, compared to 941 in the previous month and 1,090 in April last year, representing an increase of 1.9% month-over-month and a 12.0% decrease year-over-year. The monthly and year-to-date sales volumes were down 6.7% compared to last year. However, looking back 10 years to April 2014, the monthly and year-to-date sales volumes are up 143.7% and 159.4%, respectively. The 40 average days on the market compared to 56 days last month and 39 days in April last year. Last month, 37.8% of the El Paso County active listings in the Pikes Peak MLS had price reductions.

“Last month, the average sales price was $564,715 compared to $527,629 in the previous month and $532,254 in April last year, representing an increase of 7% monthover-month and 6.1% year-over-year. The median sales price was $490,000 compared to $470,000 in the previous month and 459,000 in April last year, representing an increase of 4.3% month-over-month and 6.8% year-overyear. The average and median prices reached record high

27

continued on next page

levels in April 2024 compared to any April previously.

“From an analysis of the single-family/patio homes sold by price range, last month, 23.8% of the homes sold were priced under $400,000, 46% between $400,000 and $600,000, 24.4% between $600,000 and $1 million, and 5.8% over $1 million. Year-over-year in April 2024, there was a 24.4% drop in the sale of single-family homes priced under $400,000, a 15% decline in homes priced between $400,000 and $600,000, a 15.3% increase in homes priced between $600,000 and $1 million, and a 23% increase in homes priced over $1 million.

“So sadly, inconceivable affordability challenges due to a staggering combination of high-interest rates, recordhigh home prices, and inflated cost of living remain the most daunting barriers for Colorado Springs-area homebuyers,” said Colorado Springs-area REALTOR® Jay Gupta.

CRESTED BUTTE/GUNNISON

“The real estate market in the Crested Butte and Gunnison area in 2024 continues to outpace 2023. Through April, sales are up 8%, but dollar volume is up a whopping 75%. A lot of this activity is centered in the Crested Butte area with sales up 28% and dollar volume up 80%. The Gunnison area continues to remain steady with the number of sales actually down 25% and dollar volume up 11%. While better than last year, the number of sales remains historically low and at a level not seen since 2011. Given that the number of properties for sale is less than half of what was on the market in 2011, it is unlikely that we will exceed that year in the end.

“Looking ahead to our busy summer season, there will be more properties to choose from than last year. The number of properties for sale is up 38% from this time last year and the number of properties that have come on the market in the last month is more than double what we saw in April 2023. Historically, summer is when the most properties are for sale so it seems likely that this trend will continue.

“The stats above indicate prices are up overall. Some of

this is because we have more properties at the higher end of the market for sale and selling. Buyers continue to be cautious. Turnkey properties and those that have been updated are selling quickly if they are priced right. Properties that need work will linger on the market as buyers know it can be challenging to find people to do the necessary work. It is important for sellers to have information about recent sales when they are deciding to sell their property and what the asking price should be. Buyers need to consider the interest rates, housing needs and income potential as they move ahead with a purchase,” said Crested Butte -area REALTOR® Molly Eldridge.

DENVER COUNTY

“Elevated interest rates, rising insurance costs, and higher property taxes haven’t appeared to faze buyers and sellers here in the Mile High City. Last month, the Denver-metro area remained one of the hottest housing markets in the country, fueled by financial stability, economic resiliency, low housing supply, and an unwavering attraction to Colorado’s high quality of life. The significant mismatch between our limited supply and excess demand has continued to perpetuate a moderate-to-strong seller’s market so far this year.

“Sellers looked to capitalize on their advantageous market position in April, posting 1,500 new listings, a near-two-year high for Denver County. Median close prices also favored sellers, improving 15% year-overyear to $625,000, just shy of April 2022’s all-time record of $650,000. Sales pace has rapidly improved recently, with the median time listings spent on the market in April reaching a 10-month low of just 8 days. However, high levels of new listings have hindered overall market velocity. In April, the supply of inventory reached 2.2 months, a historically high figure compared to the previous 10-year April average of about 1.6 months.

“While sellers reap the benefits of a strong market, buyers aren’t necessarily flawed in remaining optimistic. Higher inventory will generate a more competitive environment, awarding homebuyers with negotiating power. I expect moderate movement towards a more balanced market as

28

continued on next page

the year continues, which could accelerate in the event of rate cuts. For now, consumers are still buying homes despite affordability challenges, and Denver’s real estate market earned a mostly clean bill of health for April,” said Denver County-area REALTOR® Cooper Thayer.

DOUGLAS COUNTY

“Encouraged by moderate price increases in 2024 thus far, long-time Douglas County homeowners are beginning to realize massive equity gains in their homes. Median close prices reached $700,000 in April, a 2.8% increase yearover-year. Buyers, however, have slowed down spending as they seek remodeled, high-quality listings to make their purchases worthwhile. The result is a split market, with ‘turnkey’ homes selling quickly and often receiving multiple offers, while homes requiring updates or repairs struggle to attract attention amongst higher inventory.

“Sellers can be stubborn on price, and understandably so. It’s difficult to accept offers that may be perceived as ‘below market value,’ especially as prices have slid down approximately 4% over the past two years. For the average single-family home in Douglas County, that’s around $30,000. Top dollar is still attainable but, differentiating a listing from the two-plus months of inventory on the market, has become a more daunting challenge and risky investment.

“The newest data shows homes are still receiving nearasking price offers on average, and the median time on the market last month was just 9 days. While activity is not outpacing the previous three years, the Douglas County real estate market is showing impressive resilience as economic and political uncertainty remains a prominent concern of the industry. Despite the unknowns, the underlying lack of supply compared to excessive demand will likely continue to provide this stability, regardless of challenges stemming from macroeconomic conditions,” said Douglas County-area REALTOR® Cooper Thayer.

DURANGO/LA PLATA COUNTY

“Amid evolving market conditions, the real estate landscape in La Plata County continues to demonstrate its resilience and adaptability. Year-to-date statistics reveal interesting trends shaping the housing market, offering a mix of challenges and opportunities for buyers and sellers.

“Key statistics in the single-family homes segment: New listings have increased by 16%, indicating a vibrant market for prospective buyers. However, the number of sold listings has slightly declined by 14%, reflecting some hesitancy in the selling process. Despite this, home prices have seen a significant uptick of 9.2%, with the median price now at $785,000, showcasing the value and desirability of properties in the region.

“Challenges have surfaced in rising inventory levels for sellers, with 84 townhouses/condos currently on the market. This is a 121% increase compared to the previous April but adding to the options available for homebuyers and investors. The monthly inventory supply for townhouses and condos has risen from 1.7 to 4.3 months. This shift reflects a changing market dynamic, potentially offering buyers more negotiating power.

“As the market prepares for a robust selling season in the coming months, the increased inventory is expected to provide local residents with more housing options. With historically low interest rates keeping sellers on the sidelines the previous few years, the hope is that those waiting will take advantage of the current market conditions and move within the locality.

“In conclusion, La Plata County's real estate sector remains dynamic and full of opportunities. Despite certain challenges, the market continues to evolve, presenting a fertile ground for those looking to invest, purchase, or sell properties in the area,” said Durango-area REALTOR® Jarrod Nixon.

29

continued on next page

FORT COLLINS

“The decision to sell a home is generally not one made on a whim. Experience has revealed that the decision to sell a home and uproot all the inhabitants (and their possessions) is made well in advance of the home being listed on the multiple listing service. The decision is borne out of the relationship (or gap) between a homeowner’s current situation and their desired situation. Evidently, many homeowners have decided their current situation is far less attractive than their desired situation and have decided to sell. All this is to say that the current data showing the number of homes coming on the market in April was up more than 24% is a lagging indicator of decisions made a month or more in advance.

“At the beginning of the year, it appeared mortgage interest rates were stabilizing and for a moment were coming down from the 8% highs of late 2023. This may have been enough for some homeowners and investor owners to take off their ‘golden handcuffs’ of an ultralow, fixed-interest rate and cash in on the equity they have built in the post-pandemic run-up in valuation. The additional inventory has been welcomed by buyers who are in urgent need of housing and have the wherewithal to navigate the current interest rate and loan qualification process. This shows up in the data with a year-over-year increase in home sales of more than 6% and pushing the median price in the Fort Collins area to over $627,000 – a level not seen since last June.

“Right now, however, with interest rates having crept back up over 7%, the housing market, now flush with new inventory, is falling a bit flat with buyers who aren’t as comfortable with the news that interest rates may not be coming down any time soon. Months’ supply of inventory is up over 2 months now and buyers have the luxury of not only shopping but actually negotiating with sellers who need to sell by securing seller cash concessions in the form of mortgage interest rate buy-downs, down payment assistance, or both. As mentioned in previous reporting, this concession is generally not illustrated in the list price to sale price ratio which for April was sitting just over 100% and since the appreciation trend in most market segments has been positive, appraisal issues have

not been as big an issue as they can be in a leveling or negative appreciation market.

“The decision to sell is generally not predicated on a single data point and turning back from deciding to sell is a bit more difficult than a buyer deciding to wait and see. Buyers are rarely in the driver’s seat during the height of the spring and early summer selling season but once again, due to the volatility in the mortgage rate market, we are quickly reaching parity where a near-balanced market also balances negotiation dynamics between seller and buyer,” said Fort Collins-area REALTOR® Chris Hardy.

FREMONT COUNTY

“The Fremont County real estate market for April of 2024 compared to April of 2023 shows new listings on the market increased 18.4% while new sales were down 36.8%. This gives current buyers a slightly higher number of listings to choose from. The median price range April 2023 vs April 2024 was down 2.5% at an even more affordable price of $314,000. The year-over-year median price weighs in at $317,000. Fremont County’s current inventory is up 11.3% from April of last year leaving us with a total of 4 months of inventory. Our average dayson-market is 89 days.

“Year over year, new listings are down slightly (0.6%) while sales are down 17.9%. Sellers are receiving an average of only 2.7% less than what they listed the property for in final sales contracts.

“Fremont County’s affordably low $300,000 median price range brings retirees from the Colorado metro areas and other surrounding states. In the higher end local market, a buyer can live happily ever after in a newer 3,200 squarefoot home with walk-out basement and mountain views all on public utilities with high-speed internet, half acre, or larger lots all for an affordable price in the low $600,000s. Local listings and sales increase from May through August each year. We anticipate this to be the case for the next few months,” said Fremont County-area REALTOR® David Madone.

30

next

continued on

page

GLENWOOD SPRINGS/GARFIELD COUNTY

“The real estate market in Garfield County has experienced a slight shift this April, with new listings showing a modest rise of 5.6% compared to the same period last year. This translates to an additional four homes entering the market. More notably, the number of sold listings has surged 63%, indicating a robust increase in sales activity with 54 homes sold compared to 33 in the previous April. Despite this uptick in sales, the median sale price has seen an unusual dip of 17.4%, settling at $640,000, down from $775,000 in April 2023. In contrast, the average sale price has edged up slightly by 0.7%, with this April's figure at $966,747 compared to $959,931 last year. The market also observed a lengthening in the days on the market, with homes now taking an average of 70 days to sell, up from 58 days. Concurrently, the inventory of singlefamily homes has contracted, decreasing to 141 homes from 153 at the end of last April, suggesting a continued tight market that could influence future pricing and sales trends.