The Colorado Automobile Dealers Association (CADA) is the voice of the automotive retail industry throughout the state. As the automobile dealer trade association, CADA advocates issues of importance to the auto industry, Colorado auto dealers and Colorado's driving public.

The Denver Automobile Dealers Association started in 1914 to operate the annual Denver Auto Show which dates to 1902. Colorado Automobile Dealers Association soon followed and both associations operated together with shared staff and a headquarters building. In 2010, after almost eight decades together the two associations became one. The history now dates over 108 years of high level automotive and mobility impact.

Today, our dealers range from small family-owned dealerships, to nationally operated, multiple franchise corporations. CADA represents a united front for over 300 new car, truck, motorcycle and RV dealers. From local, state and federal policymakers, to the public and the media, CADA is the voice for Colorado's auto industry.

Colorado Automobile Dealers Association 290 East Speer Blvd Denver, CO 80203 303 831 1722 info@colorado auto www colorado auto

Tim Jackson, CAE, CMP

President & CEO tim jackson@colorado auto 303 282 1448

Marsha Temple Chief Operating Officer marsha temple@colorado auto 303 457 5123

Matthew Groves

Vice President of Legal, Regulatory & Compliance matthew.groves@colorado.auto 303 282 1449

Beth Weir Controller beth weir@colorado auto 303 457 5120

Kim Jackson Marketing & Communications Director kim jackson@colorado auto 303 457 5115

Mark Zeigler

Clear The Air Foundation Director mark zeigler@colorado auto 303 457 5105

Khorrie Luther Business Manager khorrie luther@colorado auto 303 457 5122

Qiana Emery Member Services Coordinator qiana emery@colorado auto 303.831.1722

Brent Wood 2022 CADA Chair

Brent Wood 2022 CADA Chair

I was honored to serve as CADA’s 2022 chair The year was marked by COVID recovery, inventory shortages, a growing EV market, an ongoing war on driving, and surprisingly challenging election results, interest rate and gas price hikes. CADA’s accomplishments were numerous, including an outstanding Annual Convention and Colorado Automotive Hall of Fame Induction Dinner, successful Project DC visit, sold-out Annual Member Golf Event and more

No question, 2022 has been challenging and exhilarating It confirmed my natural optimism that the auto industry will not only survive, but thrive no matter what’s thrown at us

CADA began 2022 negotiating with the state legislature over proposed bills that purported to curb air pollution. We ultimately supported HB22-1026 which passed “Alternative Transportation Options Tax Credit” replaces employers’ existing income tax deductions for money spent offering workers alternative transportation options with 50% refundable income tax credits

The Front Range’s ozone problem – upgraded from “serious” to “ severe ” in March by the EPA, is still being blamed largely on automobiles. We’ve argued that new gas-powered cars are very clean, and identified wildfire smoke from elsewhere as a huge ozone contributor. Nevertheless we anticipate another attempt in the 2023 General Assembly to curtail employees’ use of cars to commute to work, with employers acting as enforcers

Colorado’s Dealer Breakfast at the Las Vegas NADA Show March 12th provided real food for thought. Our speaker lineup included veteran industry watcher Charlie Vogelheim; former Automotive News publisher Jason Stein; Colorado State Sen Robert Rodriguez and Rep Alex Valdez We also honored Colorado’s nominee for TIME Dealer of the Year, Phil Winslow We had a standing-room-only crowd

Bill Hellman chaired CADA’s Annual Convention and Colorado Automotive Hall of Fame Induction Dinner at the Broadmoor in May. We had tremendous speakers, good participation and excellent vendor sponsorships. Speakers included Heritage Foundation economist Stephen Moore, Bloomberg Intelligence writer Kevin Tynan, Asbury Group CEO Dave Hult, Canvas Credit Union CEO Todd Marksberry; former Bronco and entrepreneur Ray Crockett; and professional truth detector Traci Brown

The Colorado Automotive Hall of Fame inducted industry legends: former CADA President, Bill Barrow; Denver’s first Ford dealer, Al O’Meara, Sr.; the youngest Chrysler dealer in the U.S., Bill Crouch; the youngest VW dealer ever and Colorado TIME Dealer of the Year nominee, Phil Winslow; Elway Chevrolet “Ambassador” and former part-owner, A J Guanella; Leo Payne, who owned what was then Colorado’s largest auto chain; and the late Larry H Miller and his widow, Gail Miller The silent auction benefited CADAsupported Clear the Air Foundation (CTAF), which has

received far fewer vehicle donations this year due to dealer inventory shortages We had a tremendous turnout with more than 500 people. CTAF provides scholarship assistance to students studying to be automotive technicians which dealers badly need.

CTAF also benefited from the Annual Member Golf Event at Arrowhead Golf Club on October 3rd Peak Kia North’s Jeff Taylor and his committee set lofty attendance and fundraising goals and delivered in a big way – sold out with record attendance and financial results Sponsoring CTAF is one tangible way dealers show we support clean air and reduced pollution.

These events helped us financially in a year when there was no Denver Auto Show

Board members participated in CADA Project D C in midSeptember in conjunction with the NADA Washington Conference The impact of the Inflation Reduction Act, which included measures intended to accelerate the adoption of electric vehicles was a major issue NADA says that under the IRA, “70% of 72 U.S. electric, plug-in hybrid and fuel-cell EVs [would be] ineligible upon passage. ” Another big topic was new Federal Trade Commission regulations increasing paperwork involved in purchasing a car

During the trip we met with Colorado’s federal legislators and their staff to discuss industry-related concerns It’s important we ensure they understand our positions. Here in Colorado we do the same with Legislative Grassroots Meetings (LGMs) meeting with state lawmakers. Good relationships do pay off when the legislators consider issues affecting the auto industry

Unfortunately, the midterm elections did not fall out more like we’d hoped, producing a lopsided Democratic legislature instead of the balanced one we’d hoped for CADA has good relationships with both parties; we’ll just have to work a bit harder to educate and inform the lawmakers and continue communicating our positions to the governor and state regulators CADA’s effective Legislative Policy Committee is chaired by Tim Van Binsbergen

Finally, planning is underway for a new and improved Denver Auto Show – back at the Colorado Convention Center – in April, chaired by Eric Beutz Stay tuned for details

Thanks to everybody, on behalf of myself and the CADA staff, for your active support, involvement and hard work this year as we strive to make CADA America’s best automotive association and provide great leadership for all our Colorado new car dealers

Tim Jackson CADA President & CEO

Tim Jackson CADA President & CEO

CADA is in full planning gear for the 2023 Denver Auto Show, April 12-16, at the Colorado Convention Center. The Preview Gala on April 11th will feature the Colorado Automotive Hall of Fame dinner and induction ceremony

While much of the show will look familiar, this ain’t your father’s auto show We have a new show producer for the first time since 2007: Yoffe Expo Services, which has produced the Washington, D C Auto Show for two decades, the Auto Fleet Managers’ Conference, and many other largescale expositions, will work with the association to produce our show.

In the pro forma we did to determine whether to proceed, we considered how the financial viability of the show might be impacted with a smaller footprint and fewer manufacturers represented What we determined is that the Denver Auto Show is still likely to be a solid revenue success Moreover, CADA’s Denver Auto Show Committee, chaired by Eric Beutz (Mike Maroone Longmont Ford), has some visionary ideas, ensuring it will be a memorable exposition that the public – and dealers – will enjoy.

“The goal is to come back better than ever and to make it as good as and reserving the potential to be better than before,” according to Eric That idea was met with enthusiasm and excitement at a recent gathering CADA hosted of more than 50 members of the Rocky Mountain Automotive Press (RMAP)

The 2023 Denver Auto Show will definitely reflect the drastic changes in the industry over the last five years The concept of mobility now embraces Colorado’s growing focus on electrification The pandemic-heightened interest in camping and van conversions will also be reflected “There are more than 15 builders right here in Colorado It’s the epicenter for this new vehicle experience and Coloradans should be happy to see some of that at the show,” Eric says

Other personal transportation alternatives also will be highlighted There are plans for an area set aside where show attendees to try out electric skateboards, electric bikes and scooters “It will feel a little like a skatepark inside the auto show,” Eric jokes

Colorado is one of 13 states to adopt California’s Zero Emission Vehicle (Cal ZEV) standards, and the legislature has earmarked funding for electrification infrastructure

Colorado consumers are demanding more electric and hybrid vehicles. New models will be a major feature of the 2023 Denver Auto Show The auto show committee envisions at least one indoor track where people can ride in an EV

There also will be several ride and drive opportunities so attendees can take an EV for a test drive beginning and ending at the Colorado Convention Center’s launch area “It makes perfect sense to demonstrate to manufacturers that Colorado dealers are enthusiastic about electrified vehicles, and we are the best way to move them,” Eric says. We also hope to welcome back many of the most successful draws from past shows, such as Camp Jeep as well as plenty of aftermarket vendors

As the second-oldest auto show in America, the Denver Auto Show has displayed the best our industry offers for more than 100 years One key objective for the 2023 Denver Auto Show is to demonstrate its usefulness as the industry shifts toward direct sales – either from home or from dealers. The auto show may be the best opportunity consumers have to experience vehicles before purchasing Most dealers don’t have demonstrator models available and newly arriving vehicles have already been sold, particularly among traditional OEMs, according to Eric Beutz And the Denver Auto Show is still the only one-stop opportunity consumers have to sit in, kick the tires and compare vehicles

That’s a key selling point for attracting manufacturers and Colorado dealers to support the 2023 Denver Auto Show. Even with short inventories, the show can be a great place to take orders In this changed industry landscape, “Dealers don’t need inventory, they just need orders,” Eric Observed

“You can stand back with your arms folded and become irrelevant, or you can jump in and influence the outcome.” - Eric Beutz

With the start of the New Year just weeks away, the Cox Automotive Industry Insights team offers its expectations for the U S automotive market in 2023 By nearly all measures, 2022 was a difficult year for both the industry and the consumer, marked by historically low new-vehicle inventories, high prices, and stubborn inflation chipping away at monthly budgets. A relatively strong jobs market was a tailwind, but all the while, a hawkish Federal Reserve pushed rates higher, essentially riding the brakes as the auto industry struggled to gain momentum

“This past year was challenging not only to forecast but for the industry to manage, ” said Cox Automotive Chief Economist Jonathan Smoke “As we look forward into 2023, we see one set of challenges being replaced by another. We expect the year ahead to be one of transition, as both the consumer and the industry move past the remnants of a global pandemic and set a new course for mid-decade growth ”

Guided by recent research, intelligence capabilities powered by DRiVEQ, the largest breadth of first-party data in the automotive ecosystem, and an unmatched team of analysts and experts, Cox Automotive posits 10 trends that will shape the auto business in 2023

While the risk of recession in 2023 remains, Cox Automotive expects the economy to see at least slowing or very weak growth as the Federal Reserve tightens monetary conditions and consumers continue to wrestle with high interest rates. A job-wrecking recession is a worst-case scenario for the auto industry, but hope for an economic soft landing remains Either way, a sputtering economy will hold back the auto market in the year ahead

#2 New-Vehicle Inventory Levels Will Continue to Increase.

New-vehicle production challenges are beginning to ebb, and inventory levels are measurably improving While lingering supply chain and labor challenges will remain, and capacity will not return completely to pre-pandemic levels in the foreseeable future, stronger production levels and softer demand will lead to higher days’ supply and, ultimately, more vehicle options for shoppers in 2023.

#3: Total Retail Vehicle Sales Will Fall in 2023, as New-Vehicle Sales Grow, Used Sales Decline.

With new-vehicle inventory levels improving as demand slows, Cox Automotive forecasts 3% year-over-year newvehicle sales growth in 2023, with the market hitting 14.1 million units. Increasing fleet sales will help the absolute number A lack of nearly new supply, declining affordability, and a shrinking pool of buyers will challenge the usedvehicle market Overall retail sales will decline in 2023, adding competitive pressures to the market, especially in used

#4: Sales of Electric Vehicles in the U.S. Will Surpass 1 Million Units for the First Time.

The battery-electric vehicle market continues to outpace the overall market in sales, and a new milestone is on the horizon: 1 million EVs sold in the U.S. in 2023. With expanded product availability coming and a fresh round of government-backed incentives to motivate buyers, the Cox Automotive team is forecasting continued good news in the electrified vehicle market

As the Clock Winds Down on a Year Steered by Tight Inventory and Rising Loan Rates, Cox Automotive Offers 10 Predictions for 2023What the market gives, the market takes: After historic value increases in 2020 and 2021, followed by above-average depreciation for most of 2022, used-vehicle values are likely to see another year of above-normal depreciation, especially in the first half of 2023 Price trends should normalize in the second half of the year as constrained wholesale supply supports used values and used retail prices fall into a normal relationship with new prices

Elevated retail prices and high auto loan interest rates combined to produce record monthly payments in 2022, levels that increasingly pushed lower income and lower credit quality consumers out of the market More of the same is expected in 2023, as the automakers increasingly cater to the new-vehicle market with more expensive products for higher-income consumers, leaving less-affluent and subprime buyers struggling to find affordable vehicle payments that satisfy monthly budgets

With auto loan interest rates hitting 20-year highs, the rise in all-cash deals will continue More wealthy consumers will buy with cash rather than finance in 2023, placing downward pressure on dealership F&I profits This change will be felt more acutely in the new-vehicle market and will likely have lingering impacts on industry profit pools and future buying behaviors

#8:

As affordability issues lead more owners to maintain current vehicles, 2023 should see continued strong dynamics in the service lanes, with or without a recession. Fixed operations saw strong revenue growth in 2022 as pricing power and strong demand led to large increases in average ticket size despite total service volumes not yet recovering to 2019 levels With retail sales expected to be flat or down, fixed operations as a profit center will be more important than ever in 2023

The shift to eCommerce was accelerated by the pandemic and shows no sign of fading. In the year ahead Cox Automotive forecasts that half of all vehicle buyers will engage with at least one digital tool during the purchase process Importantly, fully digital vehicle purchases will continue to be only a small percentage of the business, as most buyers will pursue an omnichannel vehicle buying experience

A key element of the Inflation Reduction Act of 2022 was the reshaping of EV tax credits in the U.S. Within the new laws are incentives designed to entice fleet operators to consider electrified vehicles in the coming year Fleets have historically shown slow adoption of EVs, but recent research indicates 66% of fleet buyers are considering EVs, up from 43% in 2021 New incentives and investments in charging infrastructure will likely amplify the trend

Cox Automotive Inc. makes buying selling owning and using vehicles easier for everyone The global company ’ s more than 27,000 team members and family of brands, including Autotrader®, Dealer com®, Dealertrack®, Kelley Blue Book®, Manheim®, NextGear Capital®, VinSolutions®, vAuto® and Xtime®, are passionate about helping millions of car shoppers, 40,000 auto dealer clients across five continents and many others throughout the automotive industry thrive for generations to come Cox Automotive is a subsidiary of Cox Enterprises Inc., a privately-owned, Atlantabased company with annual revenues of nearly $20 billion. www coxautoinc com

The last couple of years have been among the most challenging ever for our industry After some record sales years, the global pandemic struck, bringing lockdowns, chip shortages, supply chain problems and more We cancelled the Denver Auto Show in 2020, our major revenue producer

Moreover, Colorado’s new car dealers were already facing multiple challenges, including shifting political winds, environmental pressures, manufacturer demands, industry consolidations and more The Colorado Automobile Dealers Association has been there to help throughout, representing all Colorado dealerships: 269 dealerships with 99 unique owners – from smaller, family-owned dealerships to large, corporate ownership groups

In response to these extraordinary challenges and to chart a course forward, CADA’s Board of Directors convened a twoday Strategic Planning retreat, December 6-7, at the Doubletree by Hilton in Greenwood Village Veteran industry facilitator Harrison Coerver led our sessions, which were attended by all but a couple of Board members

Under normal circumstances we would have waited until 2023 to perform a strategic plan review These are not normal circumstances The result of the Strategic Planning process was that we identified issues, set goals, and formulated and prioritized important action items.

Job #1 was to make a comprehensive assessment of recent industry trends/developments, financial situation, communications, programs, and organizational structure, and compare them with CADA’s mission:

CADA is the prominent voice of the automotive industry across Colorado, dedicated to advocating issues, educating, building environmental awareness, and serving as a resource for dealers, legislators, and Colorado’s driving public.

How effective are we? A pre-retreat Board survey indicated that on a five-point scale, the association gets a 4.2 overall performance rating That’s a tad lower than some other planning surveys CADA has done – at retreats in 2008, 2011, 2014 and 2017 Of the more than 1,400 facilitations that he’s done, Coerver said that CADA has earned the top four highest scores: 4 8, 4 8, 4 9 and 4 9 – the highest he’s seen during his career He said the average is usually around 3 2-

extraordinary circumstances we ’ ve witnessed recently

Board’s pre-retreat survey identified that:

CADA’s greatest strengths are its legislative advocacy and outstanding staff.

Areas that need improvement are finances, active dealer engagement and restarting and rethinking the Denver Auto Show CADA’s most pressing issues include the effects of electrification on the industry and franchise protections

3 6 The reason for the slip is because of the

The

"The secret of change is to focus all of your energy, not on fighting the old, but on building the new."

- Socrates

In general, CADA has a structure that works pretty well and a staff that is remarkably effective. Our work to increase the number of committees has paid off especially in some of our sold-out events such as the Annual Member Golf Event and the Colorado Automotive Hall of Fame induction dinner CADA still needs to strengthen member engagement We also need to get more active involvement from publicly owned dealerships who may be overseen not by a dealer principal but by a general manager reporting to a regional vice president

Do we serve Colorado’s driving public? Depending on how you look at it, the answer may be, “ no ” or perhaps “indirectly.” In a shifting regulatory landscape that increasingly de-emphasizes motor vehicles CADA is a voice for drivers through our legislative advocacy; our push-back against overeager regulators seeking to make driving harder by sponsoring organizations such as the Freedom to Drive Coalition; and by supporting the Clear the Air Foundation (CTAF), which works to improve Colorado’s air quality by removing high-emitting vehicles

Making plans for CADA’s next chapter depends on making a few assumptions around the market, politics/regulatory landscape technological developments and CADA itself.

Market Conditions and Environment for New Car Dealers – It’s likely the market will continue to be turbulent with compressed margins, more competition and increased dealer consolidation OEMs will continue to control pricing More consumers will opt for leasing The EV trend will slow Dealers will continue to experience qualified workforce shortages, especially among technicians

Political, Legislative and Regulatory Landscape –More turbulence here, too, as Colorado continues its leftward shift and love affair with California-style policies The EPA standards will eclipse NHTSA’s and CDOT’s policies will increasingly favor public transportation options There will be more efforts to weaken the Franchise Act that underpins our industry Technology – The traditional model of sales will continue to diminish as more consumers accept digital sales and paperless transactions Our products will offer more autonomous driving functions; receive remote repairs/software updates; and there will be more mobile services, apps and subscription options. Changes to CADA’s Membership – The torch is passing to a new generation. CADA members are getting younger and more tech savvy, leading to a

balance of veterans and NextGen members, including more women. At the same time, industry consolidation and corporatization has led to fewer dealer principals and more GMs with more rooftops per member

A Changing CADA – The association can and will change, continuing to remain relevant It will be more diverse and continue to represent 100% of Colorado new car dealers Healthy finances and a succession plan will be key, as will our ability to adapt and evolve

With these agreed-upon assumptions, the Board arrived at a new set of objectives that will guide CADA during 20232025 As Harrison Coerver pointed out in his report on our Strategic Planning sessions, objectives are “ a temporary but careful estimate regarding a future result which cannot be projected with accuracy, ” but are within our grasp with “CADA’s efforts and commitment of resources ” These objectives are grounded in “careful analysis of future development and potentials,” rather than what we ’ ve experienced in the past. And we must be able to quantify our efforts and measure our performance, so every objective here included measurements, resource requirements and a direction for implementation

"The only way to make sense out of change is to plunge into it, move with it, and join the dance."

- Alan W. Watts

Define CADA’s future financial strategy and direction – The Denver Auto Show’s revenues remain uncertain, so we need to make sure our dues structure makes sense, perhaps adjusting it annually based on CPI Our budget could still be trimmed and our vendor financial support maximized There is income potential in our real estate. We should ensure we communicate the financial benefit of our legislative wins.

Leverage staff and member dealers for LGMs to increase influence on both sides of the aisle – Colorado’s General Assembly will continue to be challenging with the expectation that Democrats will remain in control for the next six to eight years Our lobbying team is stellar, but our PAC is maxed out; dealers can influence legislators’ opinion about our industry especially through more dealer participation in LGMs, particularly in some districts We’ll need to pay more attention to advocacy with regulators

Communicate to the general public the value of dealerships and their collective contributions to their communities – The public sometimes views dealers in a less than positive light and does not understand the many contributions we make to our communities or the industry’s important economic and employment impact CADA will rely on members to help supply the information that can be pushed out and using some outside assistance, will craft messaging that resonates with consumers through social media and other opportunities, including the Denver Auto Show

Determine the optimum coalition structure to advocate for vehicle transportation infrastructure – It’s easy to call it “The War on Cars,” but it’s indisputable that personal vehicles are under attack If we determine this is our fight, we could support forming a Freedom of Mobility Coalition made up of stakeholders who have direct interest in vehicle transportation, including members of the group that fought the Employee Traffic Reduction Plan (ETRP), as well as motor carriers, ride-share operators, road builders, power sports dealers, oil and gas producers and agriculture interests. Our challenge is balancing our political efforts between franchise protection advocacy and vehicle transportation infrastructure.

There’s a single thread running through these objectives, and that is that success will depend on increased and ongoing dealer engagement Our membership is changing and we’ll need to make sure that the next generation of dealers understands the value of CADA and will step up to make their own contributions.

Change is hard, yet necessary Our association has a road forward and while we ’ re mixing metaphors, we have to engage the challengers while we “plunge forward and join the dance ”

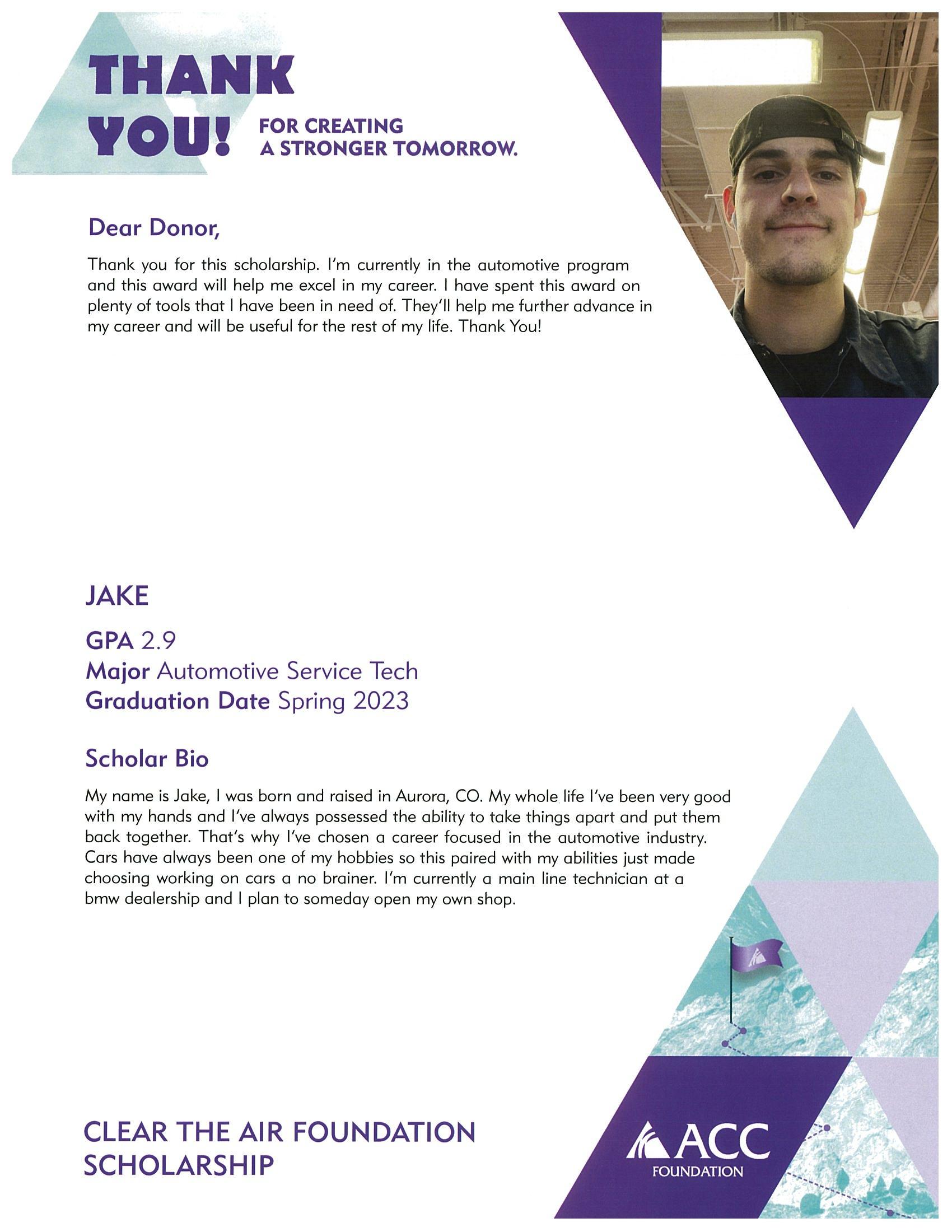

Did you know that the old, unsellable cars on your lot may be the key to someone's dreams coming true? By donating those old, high-emitting vehicles to the Clear The Air Foundation, you can help young aspiring service technicians secure a successful career path It's not just about making our air cleaner - it's also about getting service professionals trained for successful careers in rewarding technical fields at your dealerships Even better, those efforts will contribute towards scholarships for future technicians too!

So far this year, 13 lucky students have been awarded an incredible opportunity to jumpstart their career in automotive technology With these scholarships totaling $60,000, more students can now start down the path of a fulfilling and financially rewarding future! Keep your donations coming so we can continue making dreams come true for aspiring automotive technicians across the state.

Nate Miller

Deb Enoch

Brandon Molina

David Roman Cervantes

Josh Pryor

Alex Perez

Jake Boling

Erik Montiel

Tony Panza

Justin Bauer

Luis Santiago

Emily Ness

Roger Pfannenschmid

Technical College of the Rockies

Pikes Peak State College

Aims Community College

Aims Community College

Pueblo Community College

Arapahoe Community College

Arapahoe Community College Arapahoe Community College

Emily Griffith Technical College

Pueblo Community College Intellitec College

Pikes Peak State College

Pueblo Community College

Red Noland Infiniti Pueblo Community College

Mike Maroone Chevrolet South

Pueblo Toyota Dellenbach Motors

Pueblo Dodge Chrysler Jeep Ram The Faricy Boys The Faricy Boys Ford

O'Meara Buick GMC AutoNation Chrysler Jeep Arapahoe Hellman Motor Company O'Meara Ford Mile High Honda Mountain States Toyota Schomp Honda Stevinson Toyota West BMW of Loveland Johnson Auto Plaza

Perkins Motors

Phil Long Valucar Schomp Subaru Mike Maroone Honda Faricy Boys Automotive Salida O'Meara Collision Center O'Meara Volkswagen

Phil Long Ford of Chapel Hill Schomp Hyundai Schomp Nissan Stevinson Toyota East Berthod Motors

Markley Motors

Phil Long Honda of Glenwood Springs Phil Long Hyundai of Chapel Hills AutoNation Chrysler Jeep Broadway Emich Volkswagen

Emich Volkswagen of Boulder Foundation Chevrolet Freeway Ford Honda of Greeley Peak Kia North

Phil Long Lincoln Schomp Ford Schomp Mazda Shortline Buick GMC Sill-Terhar Motors Summit Ford Castle Rock Ford

Dave Solon Nissan Elway Chevrolet Emich Chevrolet Fisher Honda Foundation Hyundai of Boulder Foundation Kia

Fuoco Honda Hyundai of Greeley

King Chevrolet Buick GMC Longmont Mike Maroone Ford of Longmont Mountain Chevrolet

Phil Long Ford Chapel Hills

Phil Long Ford of Denver

Phil Long Glenwood Springs Subaru Planet Honda Schomp BMW Turner Automotive

Nominations are now being accepted for the 2023 class of the Colorado Automotive Hall of Fame, the industry’s most prestigious local award

We invite you to nominate industry standouts, including franchise new car dealers, executive managers and automotive industry affiliates who have made a difference in Colorado’s auto industry. Your nomination can include an icon who is no longer with us.

Please complete the form and nominate those leaders you think deserve the honor and permanent recognition as a Colorado automotive industry icon. Before you nominate someone who deserves this recognition, check the list of honorees to make sure he or she has not already been inducted into the Colorado Automotive Hall of Fame

William D. "Bill" Barrow

Florian Barth

Nate Burt

Jeff Carlson

Lloyd Chavez

Jay Cimino

J. William Crouch Christina Dawkins

Dick Deane

RW Dellenbach

Don Doenges

Harry Dowson

Dean Dowson

Fred Emich, III Scott Ehrlich

Bob Fisher Fletcher Flower

Tony Fortino Herrick Garnsey Dwight Ghent

Bob Ghent

AJ Guanella

Vern Hagestad Bill Hellman

Complete and return to CADA by 5 p.m. Friday, January 20, 2023. e-mail your nomination to CADA: coloautohof@colorado.auto OR complete and submit your nomination online: coloautohalloffame.com/2023-nominations

Don Hicks Joe Luby Russ Lyons Jack Maffeo

Gene Markley

Bob Markley

Todd Maul

George McCaddon

Doug McDonald

John Medved

Larry H & Gail Miller

Jim Morehart

Doug Moreland

Al O’Meara, Jr

Alfred O'Meara Sr. Mary Pacifico-Valley

Lee Payne

Leo Payne

Bob Penkhus

Roland Purifoy

Jim Reilly, Sr. John Schenden

Ralph Schomp

Lisa Schomp

Mike Shaw

Kent Stevinson

Jim Suss, Sr Jack Terhar

Hugh Tighe, Jr

Barbara Vidmar

Bud Wells

Gene Wilcoxson

Phil Winslow

Charlie Williams

Endorsed Provider of the

Matthew Groves

Endorsed Provider of the

Matthew Groves

Before we all wrap up the 2022 calendar year, there are a few things to keep in mind on the regulatory front.

All dealers must re-register each year as retailers under the Uniform Consumer Credit Code. Enforced by the Colorado Attorney General, this filing notifies the state that you facilitate credit deals for your customers The deadline is January 31, with a 30-day grace period After that, fines accrue at $5/day As of March 1, all 269 dealers were properly registered in 2022 Thus, this should just be a renewal for each of you

As a part of the emissions tampering bills run in the legislature last year, cars without catalytic converters or with tampered emissions systems may no longer be sold to consumers After January 1, 2024, it may no longer be wholesaled or dealer-traded Initially slated to take effect July 2022, this deadline was delayed until January 1, 2023 Dealers should now visually verify the presence of a catalytic converter before selling a used vehicle. As it has been named a major motor vehicle component (like a windshield or a seat belt), the car cannot be sold without it. Dealers selling outside the non-attainment zone are not required to get emissions tests done on their used inventory but will be required to fix cars that fail an emissions test and are brought back within 5 days – the new statutory limit The best way for dealers to protect themselves against bad trades on deleted vehicles is the use of a Form 895 – Trade in Affidavit If you need these, please contact CADA We heavily recommend their use, and the forms are made available electronically through nearly every DMS

As we are going back into the legislature on catalytic converter and motor vehicle theft in 2023, CADA is collecting base information If you are able, please e-mail Matthew Groves at matthew groves@colorado auto with a brief aggregation of 1) how many vehicles were vandalized/stolen from your dealership lots or service centers; 2) if you can estimate in round numbers the total dollar loss, insured or otherwise; and 3) was a police report filed – yes/no This data will be anonymized and aggregated to support our legislative efforts

When the Federal Trade Commission regulated the Safeguards Rule, under the authority of Gramm Leach Bliley, they initially set a compliance date of December 9, 2022 Through an effective lobbying effort by NADA and other industry partners, this date has also been delayed 6 months – until June 9, 2023 However, since onboarding a cybersecurity vendor can be a time-intensive process, we encourage dealers to act swiftly to evaluate their data privacy standards and come into compliance with this new sweeping series of standards

For those of you who have been closely tracking our electronic registration efforts, we are happy to say that four years in, the pilot program is up and running. For more information, please contact your Dealertrack representative This pilot program includes a partial work around for electronic signatures on secured paper

Otherwise, I hope you all enjoy your holiday and wish the very best for you and your families. Barring the unforeseen, this will be my last communication this year. I hope to see you in the new year!

All dealers must re-register each year as retailers under the Uniform Consumer Credit Code Enforced by the Colorado Attorney General, this filing notifies the state that you facilitate credit deals for your customers. The deadline is January 31, with a 30-day grace period. After that, fines accrue at $5/day. As of March 1, all 269 dealers were properly registered in 2022. Thus this should just be a renewal for each of you.

As a part of the emissions tampering bills run in the legislature last year, cars without catalytic converters or with tampered emissions systems may no longer be sold to consumers After January 1, 2024, it may no longer be wholesaled or dealer-traded Initially slated to take effect July 2022, this deadline was delayed until January 1, 2023 Dealers should now visually verify the presence of a catalytic converter before selling a used vehicle As it has been named a major motor vehicle component (like a windshield or a seat belt), the car cannot be sold without it Dealers selling outside the nonattainment zone are not required to get emissions tests done on their used inventory but will be required to fix cars that fail an emissions test and are brought back within 5 days – the new statutory limit. The best way for dealers to protect themselves against bad trades on deleted vehicles is the use of a Form 895 – Trade in Affidavit. If you need these, please contact CADA. We heavily recommend their use, and the forms are made available electronically through nearly every DMS

As we are going back into the legislature on catalytic converter and motor vehicle theft in 2023, CADA is collecting base information If you are able, please e-mail Matthew Groves at matthew groves@colorado auto with a brief aggregation of 1) how many vehicles were vandalized/stolen from your dealership lots or service centers; 2) if you can estimate in round numbers the total dollar loss, insured or otherwise; and 3) was a police report filed – yes/no This data will be anonymized and aggregated to support our legislative efforts

When the Federal Trade Commission regulated the Safeguards Rule, under the authority of Gramm Leach Bliley, they initially set a compliance date of December 9, 2022.Through an effective lobbying effort by NADA and other industry partners, this date has also been delayed 6 months – until June 9, 2023 However, since onboarding a cybersecurity vendor can be a time-intensive process, we encourage dealers to act swiftly to evaluate their data privacy standards and come into compliance with this new sweeping series of standards

For those of you who have been closely tracking our electronic registration efforts, we are happy to say that four years in, the pilot program is up and running For more information, please contact your Dealertrack representative This pilot program includes a partial work around for electronic signatures on secured paper

If you were unable to make our compliance training in December – hosted in conjunction with Fairfield & Woods, our newest version of the Guide is now available at wwwcoloradoauto/orders This year ’ s guide ranges 516 pages of compliance information, including 8 new sections These include the Colorado Privacy Act, Electronic Vehicle Registration, Low/Zero Emission Vehicles, Television Licensing, Records Retention, FTC Safeguards, Pay Equalization, Healthy Workplaces and Families Act, and Emissions Tampering It also includes updates to the state’s reversal of position on passing along credit card fees, and previews coming legislation on GAP and Warranty Reimbursement

The guide alone is available for $249 The compliance training seminar is available at our education on demand for $299 with the compliance guide and $179 as standalone training

All compliance guides ordered as a part of the compliance training have been shipped, so please contact Matthew Groves at matthewgroves@coloradoauto if you have not yet received your copy.