REPORT

PROGRESS

2021

OF CONTENTS

A ‘ normal’ year? What IS that, anyway?

2021 CADA Board of Directors

2021 Chair Letter: Along with challenges, year ended on a high note

2021 CADA Organization Chart

CADA President Letter: Looking back on 2021 in my rear-view mirror

Legislative

Pandemic-related issues persist, Colorado Privacy Act passes

Legislature passed bills to create special plates

12 Regulatory

CADA’s ‘normal’ scope of regulatory agency presence doubles

Dealership buy-sell transactions set all-time record

Colorado’s redistricting helps level playing field between parties

CADA concludes its more than 50-year relationship with Employers Council

Clear the Air Foundation Foundation partners with industry players, seeks other contribution sources

18 Advocacy Funding Mechanisms

First Colorado Automotive Hall of Fame a huge success

Annual Convention & CADA Golf Event score a hole in one

Employee Benefits boosts income 12%, boasts 100% dealer retention third year running

23 Member Services

CADA leans on non-dues revenue to advocate on behalf of dealers’

Forms gross sales gain over 2020

Bond sales close out year on high note

Endorsed Provider revenue shares continue growth

Dealership mergers affect F&I revenue shares

31 Charts

Forms Net Income - All

Total Bonds Income –Tokio Marine HCC Surety

Endorsed Provider Net Income — All

Endorsed Provider Net Incomeby Provider (partial list)

F&I Net Incomeby Provider (partial list)

CADA Annual Revenue Increase 2021 vs. 2007

CADA Assets Increase 2021 vs. 2007

CADA Assets Increase - 2020 vs. 2007 – including building & land valuation

CADA PROGRESS REPORT 2021 3 4

6

7

8

9

10

10

11

12

13

14

15

16

18

20

22

23

23

24

25

26

27

28

29

30

31

32

33

34

TABLE

As we close the book on this year, we wish you and yours robust health, great success and a return to normalcy in 2021.

Nor•mal•cy (Noun)

The state of being usual, typical or expected

After the year of hindsight, which changed so many facets of our lives, we fully expected business to return to normal. CADA was so sure of it, our New Year’s card proclaimed our collective hope for normalcy.

Yet it was anything but. Cautiously optimistic? Maybe. It was more like horses chomping at the bit to ‘get back’ to what we defined as our lives.

Microchip shortage changes ‘normal’

Then a strange thing happened. Suddenly, there was a microchip shortage. Inventory dried up. New vehicles became scarce. On the floor, sales associates became order takers. People bought vehicles sight unseen. There were no test drives. Online shopping and contracting dominated. Dealers delivered new vehicles to buyers’ homes. As the year progressed, used car inventory became scarce and prices climbed, because people still needed vehicles to drive to work, run errands, drop off and pick up the kids from school. You know, everyday life. And for the first time in decades, dealers were showing huge profits, very robust balance sheets.

2021 buy-sell market sets record

Then something else happened, first in ones or twos: Dealers sold their dealerships to other Colorado dealers. Then almost without noticing, large, out-of-state companies and public corporations began swarming the state.

The buy-sell market was scorching hot, so much so that the two-person licensing unit at the Auto Industry Division pleaded with dealers to allow up to 30 days to re-issue salesperson licenses, because they could no longer process them in the normal 72 hours. When the dust settled, a recordsetting 62 of Colorado’s rooftops changed hands.

It was a remarkable year for dealers: No inventory. Record profits. In a normal year, that wouldn’t compute. Yet for dealers, ‘normal’ may have forever changed in 2021.

Association seeks non-dues revenue sources

CADA watched in amazement from the sidelines. We hoped for our own return to normalcy early on in the year.

Member dues for a state trade association cover a portion of the organization’s operating expenses. A trade association counts on non-dues revenue to do important work, including protecting members at the state capitol and with regulators.

When Covid-19 forced the governor to abruptly shut down Denver Auto Show in 2020, CADA lost its biggest source of non-dues revenue. By the beginning of 2021, we were losing our financial ability to advocate for dealers at the state capitol. And there were some big bills going before the 2021

CADA PROGRESS REPORT 20214

Glad to see that one go!

Okay people, it’s a wrap. Get this year outta here!

Legislative Session that could have negatively affected how you do business. Something needed to be done. Fast.

Dues increased for first time in decades

After internal discussions, followed by conversations with the Board’s Executive Committee, CADA raised dealers’ dues at the start of the year. Necessary? You bet. Long overdue? Absolutely. After all, this was the first dues increase in more than 20 years.

By contrast, trade associations raise their dues every year to keep pace with inflation and the increasingly demanding legislative and regulatory pressures they face. Thanks to the Denver Auto Show, CADA was insulated from that annual dues-raising event.

Until 2021.

After sending a dues increase letter, we held our breaths, as this was a big deal for CADA. When you’ve been able to fight the good fight with the normal non-dues revenue mechanisms in place for decades, you don’t even think about going to members for more. With the exception of a couple conversations, you, our member dealers, understood and weathered the change.

Denver Auto Show goes outdoors

At the same time, we were discussing a 2021 Denver Auto Show. The Colorado Convention Center wasn’t an option, as it was still being used for overflow Covid-19 cases. So CADA began looking elsewhere.

Taking a page from the 2020 Detroit Auto Show’s success as an outdoor event, we searched, then landed on Denver’s Elitch Gardens in September, when we could count on great weather.

So we did what we’ve always done: Threw ourselves into creating the first outdoor Denver Auto Show in more than 100 years. We reached out to manufacturers and sponsors, negotiated vendor contracts, created an identity for and heavily marketed the event to the public .

We contacted our loyal sponsors for the 13th Annual Preview Gala, who were as excited as we were to bring people together for the elegant kickoff to the Denver Auto Show.

First Colorado Automotive Hall of Fame a spectacular success

Also, we launched the first Colorado Automotive Hall of Fame, where 50 dealers and one automotive journalist were inducted into the inaugural class. With more than 700 people under a star-filled sky, it was a resounding success. People were excited about getting together. Dealers commented how great it was to see dealers again, especially when for some, it had been many years since they had seen one another. Instantly, this event became the standard among other state auto dealer associations.

Denver Auto Show introduces EV Ride and Drives

When the ribbon to the Denver Auto Show was cut the next morning by our key sponsor of the event, AAA Colorado, the public was excitedly waiting to see what they’d been missing for two years: All those gorgeous cars, trucks and SUVs, along with electric vehicles. In fact, Xcel Energy sponsored EV Ride and Drives, so the public could see what EVs can do on the road and for the environment.

All told, it appeared to be on track as a smashing success. Then reality set in. The public was disappointed with only five manufacturers. It was hot. Really hot. And there was no shady place for people to cool off. What’s more, dealers didn’t have any inventory to sell when someone found just the right vehicle to buy.

Chalk it up to a teachable moment, as after the wrap-up discussion, we began looking for other non-dues revenue opportunities that can keep CADA financially strong to stand shoulder to shoulder with you at the Colorado Capitol and with regulators.

Our commitment to you is unwavering. CADA will always fight for you on the front line, so you can continue providing the well-paying jobs and quality of life that Colorado’s thousands of new car franchised dealership employees count on you to provide.

As ‘normal’ evolves for CADA, we continue examining opportunities in the pursuit of strong non-dues revenues sources to ensure your stores can continue offering the bestmade vehicles to your buying public.

CADA PROGRESS REPORT 2021 5

Colorado Automobile Dealers Association

2021 Officers and Board of Directors

Brent Wood Vice Chair

Larry H. Miller

Bighorn Toyota

Chrysler Jeep Dodge Ram

President/CEO Colorado Automobile Dealers Association

Director District

Larry H. Miller Ford Lakewood

Director District

Zach McCandless Director District 7 McCandless Truck Center

Ray Reilly

Director District 8

Larry H. Miller

Taylor Fuoco Director District 11 Fuoco Motors

Eric Beutz

Director District 12

Mike Maroone

Longmont Ford

CADA PROGRESS REPORT 20216 Colorado Automobile Association

Steve Zeder Chair

Mary Pacifico-Valley Treasurer Rickenbaugh Cadillac-Volvo

Carol Spradley Secretary Spradley Chevrolet & Hyundai

Jeremy Hamm Past Chair Solon Nissan

Tim Jackson

Rob Edwards Director District 1 Groove Toyota

Aaron Wallace Director District 2 Schomp BMW

Todd Hilleboe

3

Matt Marr

4

Fowler Jeep

Boulder

Mike Dellenbach Director District 5 Dellenbach Motors

Jeff Taylor Director District 6 Peak Kia North

Don Hicks NADA Director Shortline Automotive Group

Fletcher Flower DAS 2021 Chair Flower Motor Company

Tim Van Binsbergen Legislative Policy Committee Chair Mountain States Toyota

Bill Hellman Annual Convention Chair Hellman Motor Company

Steve Linger Clear the Air Foundation Chair Mike Maroone Longmont Ford

Tom Sellers Director District 10 TruWest Chrysler Dodge Jeep Ram Shawn Flynn Member Services Committee Chair Phil Long Ford of Motor City

2021 Officers and Board of

Directors

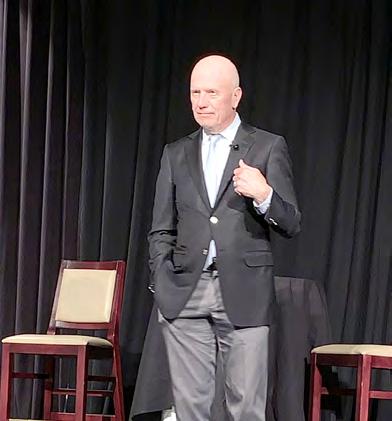

Steve Zeder

2021 CADA Chair

Chairing

the Colorado Automobile Dealers Association has been a fascinating and true learning experience. Even as a board member, I didn’t fully appreciate the behindthe-scenes activity at CADA. Serving provided me access I never had and convinced me that with our outstanding staff, and by any number of metrics, CADA is one of the best dealer associations in the country. My peek behind the curtain — beyond forms and membership services, and into legislative and regulatory efforts — revealed an impressive organization.

Nobody could have envisioned 2021. When you consider COVID, a reimagined Denver Auto Show, the launch of the Colorado Automotive Hall of Fame and what transpired with lawmakers and regulators, there was no ‘business as usual.’

Overcoming government roadblocks with more dialog

At the State Capitol, we had some notable success. We improved relationships this year with Governor Polis, state legislators and regulators at the Colorado Department of Transportation. We won’t always agree, but CADA cultivated increased dialog and better communication. Governor Polis now seems to see that while we don’t share the same vision for achieving them, we do share several common goals. Really, who doesn’t want clean air? We’re ready to sell electric vehicles and think he may pay more attention down the road in how that can be realized.

We expect to have better communication with CDOT’s Executive Director Shoshanna Lew. As CDOT formulates policy for reducing greenhouse gases, I hope that better connection will pay practical dividends.

Is ETRP the zombie rule?

The Employee Trip Reduction Program would have made employers responsible for getting workers to choose ways to commute other than personal vehicles. Thanks to our and other businesses’ vigorous opposition, ETRP was pulled before it was formalized as a regulation although we believe it will come back in other forms.

Also, we made some headway on tax issues and simplifying how vehicles are registered. Both will help us and our customers.

Ups and downs on the events rollercoaster

After COVID forced CADA to cancel and/or postpone major annual events in 2020 and earlier this year, we made some big changes. For one, the Board opted to reinvent the 2021 Denver Auto Show. Instead of hosting it in the Colorado Convention Center during its usual March/April timeframe, we instead planned an outdoor September show at Denver’s Elitch Gardens to see if this long-standing community event could adapt to major changes.

The Denver Auto Show wasn’t the financial success we planned. We expected stronger exhibitor participation and attendance. Inventory shortages cut into participation and hot-hot-hot weather cut into crowds.

The Denver Auto Show’s evolving future is up for total re-envisioning and futurescaping.

Conversely, the inaugural celebration of the Colorado Automotive Hall of Fame and Preview Gala were an unmitigated success. With more than 700 in attendance, the sellout crowd embraced this new and instantly iconic event. It was great to see dealers I haven’t seen

for years. Dinner was excellent, the presentation moved right along and we received some glowing reviews.

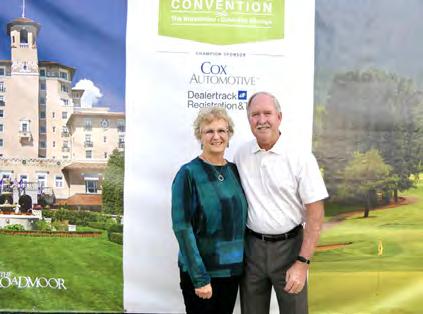

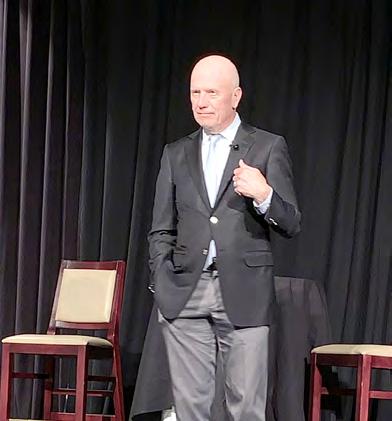

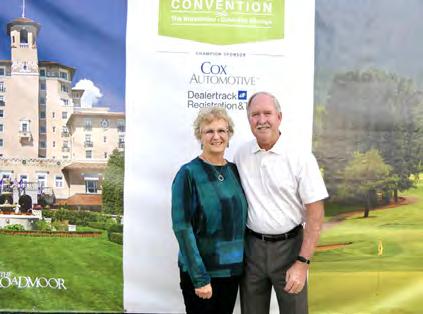

CADA’s Annual Convention and Golf Event at The Broadmoor was just wonderful. Attendance was down a bit from pre-pandemic times, but the weather and the 14th CADA Annual Golf Event were spectacular. Speakers were interesting and thought provoking. Overall, some good ideas were generated — and not just from the speakers. Again, seeing and being with fellow dealers was super.

I’m looking forward to assuming a consulting role as Past Chair. Key to CADA’s success is involvement, engagement and activation. Let’s continue to create greater results through expanded participation in our most important advocate — our association.

CADA PROGRESS REPORT 2021 7

While 2021 had some challenges, it ended on a high note

CADA PROGRESS REPORT 20218

Tim Jackson

President

& CEO

Marsha Temple Chief Operating Officer

Rachelle Rice Chief FInancial Officer

Craig Gordon

Sales Manager, Employee Benefits

Katie Buchanan

Member

Services

Coordinator

Matthew Groves Vice President of Legal, Regulatory & Compliance

Mark Zeigler Director, Clear the Air Foundation

Khorrie Luther

Business

Manager

Savannah Hatcher Member Services

Coordinator

Kim Jackson

Director,

Marketing &

Communcations

Laura Will

Account

Coordinator

Colorado Automobile Dealers Association Organizational Chart

Looking back on 2021 in the rear-view mirror

Renewal,

reinvention and rapprochement defined 2021 for the Colorado Automobile Dealers Association. With the pandemic ebbing, we came out of lockdowns and renewed in-person relationships with customers and colleagues.

We reinvented important CADA events

We negotiated hard with Colorado lawmakers and regulators to find where we could agree, where to compromise and when to fight policymakers’ attacks on us and our industry.

Jumping into the new year

Our 2021 Chair Steve Zeder adjusted well with John Medved’s surprise retirement. He quickly issued a call for members to oppose state and federal attempts to force dealers to change their business models, add more regulations on vehicles and impose stricter labor rules.

Among the year’s early challenges was deciding whether to mount a Denver Auto Show. Auto Show Committee recommended in March, and the Board approved, to a outdoor Denver Auto Show at Elitch Gardens in September.

The Preview Gala and the long-awaited inaugural celebration of the Colorado Automotive Hall of Fame were planned to coincide with the show. Fletcher Flower chaired the show and Preview Gala. Anthony Brownlee, who had long advocated a Colorado Automotive Hall of Fame, served as founding Chair for the dinner and induction ceremony.

Winning some, compromising on others

CADA spent most of 2021 on issues that I’ve come to think of as a “war on cars” based on the need to reduce greenhouse gases.

We reached an agreement with legislators and regulators on SB21260, a comprehensive, $5.3 billion

transportation bill. CADA held our noses but supported it because we knew funding was needed, although the plans didn’t really address congestion, emphasizing transit and bikes over new and better roads and highways.

The Employee Travel Reduction Plan (ETRP) was regulators’ proposal to force employers of more than 100 at a single location to plan and execute a radical reduction in employee commuting.

Over the next few months, CADA joined other business interests to oppose ETRP, committing $100,000 to the effort.

Ultimately, the opposition was so stiff that regulators pulled ETRP just before it went to the Colorado Air Quality Control Commission (AQCC) for a vote in August.

The assumptions we continue to battle are 1) Dealers don’t want to sell EVs and hybrids and 2) gas-powered vehicles are highly polluting. We have the data: BEV sales have grown by 53%, pure hybrids by 93% and PHEVs by 153% in 2021 versus 2020, while new ICE vehicles are 99% cleaner now than 20-30 years ago

A 12-dealer group met with CDOT Executive Director Shoshanna Lew late in the year. It was cordial but there are clear differences between CADA and CDOT. We couldn’t discuss the rulemaking process, which was frustrating. However, we agreed to keep meeting regularly.

September and October were CADA’s busiest months.

The reinvented Denver Auto Show was September 15-19, outdoors at Elitch Gardens and focused on electrification. Inventory shortages curtailed dealer/ manufacturer participation and weather hurt attendance.

The Preview Gala and Inaugural Colorado Automotive Hall of Fame dinner sold out and were well received. After a year’s delay, we inducted 50 dealers — past Colorado TIME Dealer of the Year

nominees — plus veteran automotive journalist Bud Wells in the inaugural ceremony.

On the heels of the 2021 Denver Auto Show, CADA’s Board of Directors left for CADA Project DC, our annual visit to meet with Congressional representatives and Senators and/or their staff members. Our focus this trip was to emphasize that Colorado dealers are on board with EVs and that franchised dealers are positioned best to sell them.

We headed to The Broadmoor for the CADA Annual Convention and Member Golf Event and, October 6-8. We enjoyed sparkling weather for golf and some outstanding speakers who covered automotive finance, new sales models, setting and executing goals, plus a 360-degree view of the industry from NADA Chair Paul Walser and a revealing look at Tesla’s founding and future.

Lucy in the sky with asteroids

A smaller group of dealers and CADA staff joined some policymakers to Cape Canaveral as guests of Lockheed-Martin. United Launch Alliance launched “Lucy,” its Atlas V-401 rocket on a 12-year exploration of asteroids near Jupiter. The launch was amazing, and we used the opportunity to informally meet the lawmakers.

Rounding out 2021, CADA continued an aggressive schedule of Legislative Grassroots Meetings with legislators as they prepared for the 2022 General Legislative Session.

CADA PROGRESS REPORT 2021 9

CADA President & CEO

Pandemic-related issues persist, Colorado Privacy Act passes

The2021 Colorado State Legislative Session was a busy one. Of the 623 introduced bills, 508 were passed. Most were not of interest to dealers, yet some bigger issues rose to the surface during the January through May session:

SB-21-076 – Fund Electronic Third-party Vehicle Transactions

After waiting two years for the state to kick off Electronic Vehicle Registration, Dealertrack, VITU and CADA lobbied for funding to finance a state system that can enable nearly instant titling and registration work — and saving consumers a trip to the DMV.

The legislation will provide $1.5 million in state funds to launch the program. It’s the first step in secure data transfer that will open the door for full electronic contracting. The governor signed this bill July 7, 2021.

Pandemic-related issues persisted throughout the year

When Congress passed the Economic Aid to Hard-hit Small Businesses, Nonprofits and Venues Act, an additional $284 billion was available in January for the Small Business Administration’s Paycheck Protection Program.

This was different from Congress’ first iteration of the PPP, as this bill was designed to benefit those small businesses that didn’t get any relief during the first round of funding. In this second round of funding, individual businesses received a maximum $2 million loan, while a corporate group could qualify for $4 million.

There were qualifiers for this second round of PPP loans, including dealers must show a reduction in gross receipts of at least 25 percent between 2019 and 2020. Like the first draw, NADA noted that dealers applying for a second draw must have been able to certify the funds were necessary to support ongoing business operations, in light of current

economic conditions.

HB-1191 – Prohibit Discrimination COVID-19 Vaccine status

As the state moved closer to opening vaccine eligibility to more Coloradans in March, there was very little guidance on the books about what employers could and couldn’t mandate their employees to do. Dealers could offer incentives for employees to get vaccinated. Yet it wasn’t clear whether employers could offer disincentives — such as suspension or termination — when employees refused to get vaccinated.

House Bill 1191 prohibits any action against an employee or applicant, based on his/her immunization status. The bill also covers adverse actions against customers based only on their vaccination status.

SB-190 – Colorado Privacy Act passes

The Colorado Privacy Act will provide Colorado consumers with additional protections for, and certain rights regarding, their personal data. The CPA imposes new obligations on companies holding that data, including dealerships.

Under the Act, personal data is defined as information that’s linked, or reasonably linkable, to an identified or identifiable individual. A consumer is limited to a Colorado resident acting only in an individual or household context.

The CPA will impose obligations on controllers and processors who process

personal data of Colorado consumers. The Act defines a controller as a person who determines the purposes and means of processing personal data. A processor is a person who processes personal data on behalf of a controller.

The CPA will go into effect July 1, 2023 and applies to all controllers who:

• Conduct business or produce products or services targeted to Colorado residents.

• Process personal data of more than 100,000 consumers a year

• Derive a financial benefit from the sale of personal data and control or process personal data of at least 25,000 consumers.

The CPA requires controllers to provide a host of additional services to consumers. Violators will be enforced by Colorado’s Attorney General and district attorneys, subject to an injunction and civil penalty of up to $2,000 for each violation, without a penalty cap.

While Colorado statutes requiring data security, data disposal and data breach reporting obligations are already on the books, the CPA dives deeper to protect Colorado consumers’ personal data.

Attorney General’s office reaches out to CADA to create catalytic converter legislation

In July, the Attorney General’s office reached out to CADA as a stakeholder for an anticipated emissions-tampering bill that would prohibit the tampering or removal of emissions control devices,

CADA PROGRESS REPORT 202110

Legislative Progress

including catalytic converters.

Where currently, law states deleted vehicles may not sell into the ninecounty Front Range non-attainment area, this law will prohibit buying, selling, leasing or renting emissionstampered vehicles statewide.

CADA convinced the Attorney General a separate bill is required to specifically address catalytic converter theft — or what we’ve termed involuntary emissions tampering.

We recommended classifying catalytic

converters as necessary equipment, similar to seat belts or air bags, along with possession of three or more converters as evidence of chop shot activity — a Class 4 felony under Colorado law.

By taking the profit motive out of the crime, we hope to slow the rate of converter theft.

SB-21-260 – Sustainability of the Transportation System

This bill addressed Colorado’s transportation system and created

Our legislators passed several bills that created special Colorado license plates!

Colorado Foster Care

Colorado Hospice and Palliative Care

Denver Fire Fighter

new sources of dedicated funding to preserve, improve and expand existing transportation infrastructure.

The measure develops a modernized infrastructure needed to support widespread adoption of electric vehicles.

Also, it is designed to mitigate environmental and health impacts of transportation system use, while expanding authority for regional transportation improvements and making an appropriation.The governor signed the bill June 17, 2021.

Protect our Pollinators

Electric Vehicle

Nurses Change Lives

CADA PROGRESS REPORT 2021 11

Special Olympics Colorado

CADA doubles its regulatory agency presence

Since2019, our ‘normal’ scope of regulatory agency presence has grown from primarily working with the Colorado Department of Revenue and the Air Quality Control Commission to include the Department of Public Health and Environment and the Department of Labor and Employment.

The Department of Revenue alone houses the Tax Division and the Small Business Group, where the Department of Motor Vehicles and the Auto Industry Division reside.

Our presence in each of these agencies ensures our ability to deflect the numerous regulations we continue to see aimed at new car franchised dealerships. These are key highlights from our efforts in 2021.

Motor Vehicle Dealer Board

In February, a manufacturer filed a request to review the rule around Advertising Rule 3, which would allow dealers to advertise vehicles for delivery that were still on the manufacturers’ site, and not the dealers’. The rule passed in December. The modification eliminated the requirement to wait to advertise a vehicle until it was assigned a dealer stock number, and created a just-in-time inventory model that has been so successful in other industries.

Department of Motor Vehicles

Air Quality Control Commission

Early March, we heard the first rumblings of a proposal for the Employee Traffic Reduction Program. Designed as a potential greenhouse gas reduction strategy, the ETRP rule would improve Colorado’s air quality and address climate change — and was considered by the Air Quality Control Commission as part of a greenhouse gas reduction package.

ETRP was a social engineering program where the state would have compelled businesses with 100 or more employees at one location to develop a plan that would reduce employees’ single-occupancy vehicle trips by 25 percent in one year and 40 percent in three years.

While enforcement mechanisms were thin, ETRP threatened commuters who relied on a personal vehicle to and from work, instead throwing the burden on employers to encourage them to take public transit, ride share or carpool to work. CADA Board Treasurer Mary Pacifico-Valley summed up dealers’ sentiment in two short sentences. “Oh, right. Try telling techs they can’t drive their trucks to work!”

Along with several other business groups, CADA vigorously opposed the rule, which ultimately was defeated.

After waiting more than two years for the state to kick off Electronic Vehicle Registration, the state funded $1.5 million to move the program forward. Also known as Electronic Registration and Title, electronic vehicle registration is the first step in ensuring a secure data transfer that will open the door for full electronic contracting down the road. It’s estimated the full program will be live around July 1, 2022.

DMV cracks down on out-of-state truck titles

Midyear, out-of-state used truck titles were increasingly being rejected at the DMV. A long-standing provision of law requires a paper weight slip on all out-of-state trucks between 4,501 and 10,000 pounds.

While it’s remained unchanged for 11 years, DMVs accepted electronic vehicle weights through a software program, VINtelligence, which had been programmed into the state titling system, DRIVES, to meet the requirement.

The DMV learned this common practice violated the statute and started cracking down on violators. It means dealers must now stop these trucks before they become commercially available. CADA and the Colorado County Clerks Association will approach the state legislature in January to reverse the requirement.

CADA PROGRESS REPORT 202112 Regulatory

New record set in 2021— Colorado dealership buy-sell transactions top 61 deals

While the persistent pandemic resulted in microchip shortages that caused low inventory supplies and staffing issues, new franchised dealership profits remained strong.

An estimated 350 closed dealership transactions took place across the country — a new industry high. And 62 — or 24 percent — of Colorado rooftops changed hands last year, a record in and of itself.

What’s driving these transactions?

According to industry authority on dealership valuation and buy-sell transactions Kerrigan Advisors, the biggest driver of these transactions is the month-over-month record profits that dealers enjoyed.

Those low inventories and fewer staff paved the way for dealers to re-engineer their business models, which led to those record profits.

Colorado dealerships that changed hands in 2021

• Gebhardt Volkswagen to Fred Emich IV

• Spradley Ford Lincoln Pueblo to Ivette Dominquez, Alpine Automotive

• Stevinson Chevrolet to Asbury Automotive

• Stevinson Toyota East to Asbury Automotive

• Stevinson Toyota West to Asbury Automotive

• Stevinson Lexus of Frederick to Asbury Automotive

• Stevinson Lexus of Lakewood to Asbury Automotive

• Stevinson Hyundai to Asbury Automotive

• Porsche of Littleton to Asbury Automotive

• Stevinson Jaguar to Asbury Automotive

• Ehrlich Toyota Greeley to McDonald Automotive

• Ehrlich Toyota Fort Morgan to McDonald Automotive

• Ehrlich Chrysler Jeep Dodge Ram Fort Morgan to McDonald Automotive

• Glenwood Springs Subaru to Phil Long Dealerships

• Summit Ford to Titon Automotive (Idaho)

• Mike Naughton Ford to Schomp Automotive

• Co’s BMW to John Elway Dealerships

• Mini of Loveland to John Elway Dealerships

• Grand Junction Subaru to Sonic Automotive

• Grand Junction Volkswagen to Sonic Automotive

• Glenwood Springs Volkswagen to Sonic Automotive

• Audi Glenwood Springs to Sonic Automotive

• John Robert’s Motor Company GMC to Town and Country Salida

• Town and Country Ford to The Faricy Boys

• Town and Country Chevrolet Buick GMC to The Faricy Boys

• Town and Country Chrysler Jeep Dodge Ram to The Faricy Boys

• Empire Littleton Nissan to Schomp Automotive

• AutoNation Hyundai 104th to Foundation Automotive

• Boulder Hyundai to Foundation Automotive

• Spradley Barr Ford Lincoln Fort Collins to Ken Garff Automotive

• Spradley Barr Ford Lincoln Greeley to Ken Garff Automotive

• Spradley Barr Mazda Fort Collins to Crossroads Automotive

• Greeley Subaru to Asbury Automotive

• Freedom Honda to Summit Automotive Partners

• These Larry H Miller stores to Asbury Automotive

• Toyota Boulder

• Nissan 104th

• CJDR 104th

• Ram Truck Center 104th

• Volkswagen Lakewood

• Ford Lakewood

• Nissan Highlands Ranch

• Nissan Arapahoe

• Jeep Havana

• CDRF Havana

• Liberty Toyota

• Colorado Springs South Toyota

• Ed Bozarth Chevrolet - From Ed Bozarth to Kent Bozart

• Ed Bozarth Chevrolet Park Meadows - From Ed Bozarth to Kent Bozarth

• Pollard Jeep to Fowler Automotive

• Arapahoe Hyundai to Asbury Automotive

• Ehrlich 1-25 Kia to Fowler Automotive

New franchise car openings

• Polestar Denver to McDonald Automotive

• Rolls Royce Denver to Mike Ward Automotive

New motorcycle powersports openings

• Powersports store in Colorado Springs to Don Hicks

• Powersports store in Loveland to John Elway Dealerships

• Motorcycle store in Greeley to John Elway Dealerships

CADA PROGRESS REPORT 2021 13

Redistricting

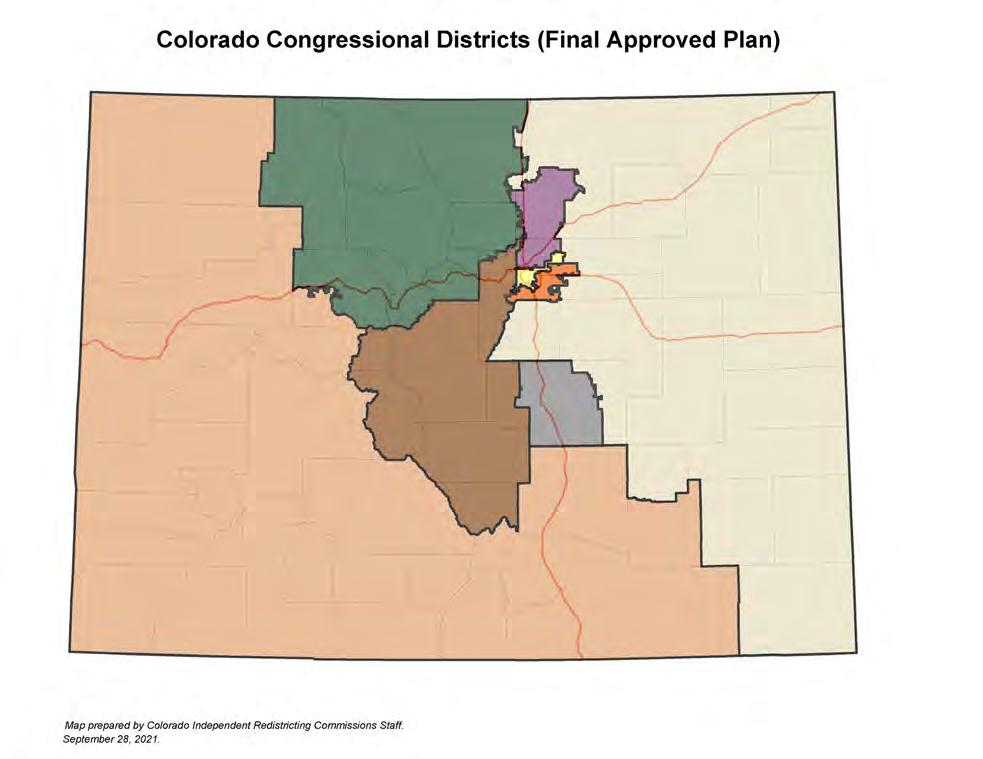

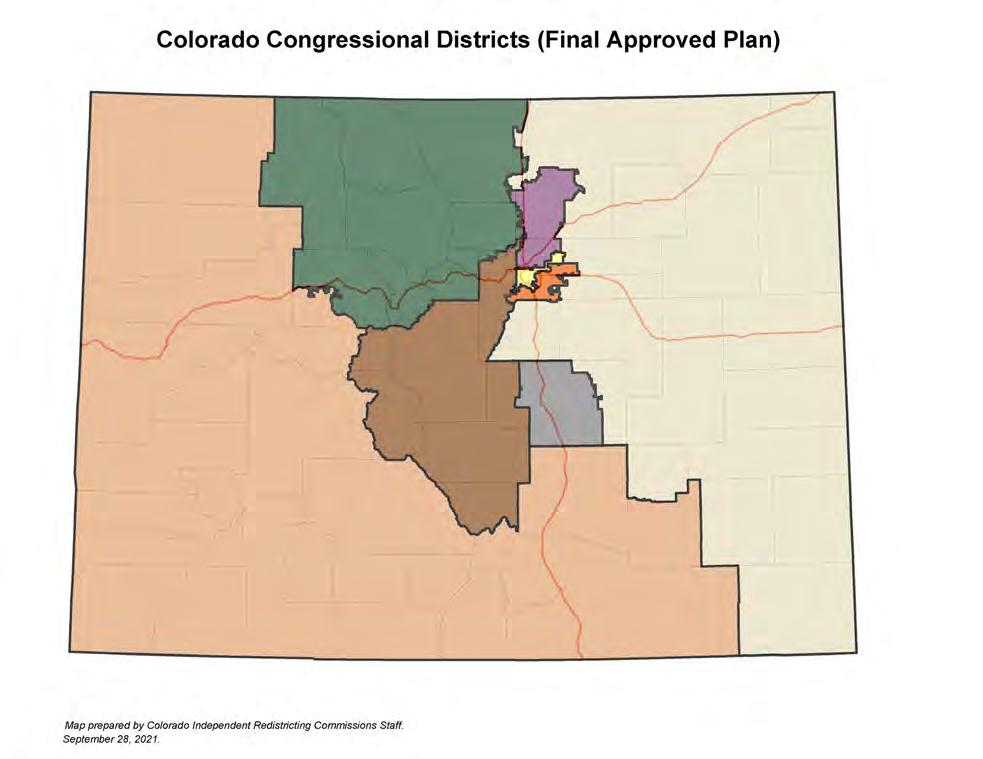

Colorado’s redistricting helps level the playing field between parties

Every10 years, the U.S. Census Bureau conducts its signature survey to determine how many people currently reside in the United States. From there, congressional districts are reshuffled, as representation in the U.S. House is governed by population in each state.

When each state redraws its congressional boundaries, each newly drawn district must be as nearly equal in population as practicable and districts can’t intentionally or inadvertently discriminate on the basis of race to have the effect of diluting the minority vote.

After the 2010 redistricting, Colorado was considered a gerrymandered state, which means the boundaries of our electoral consitutency were manipulated. So while statewide legislative race totals were often close in raw numbers, the legislature’s makeup was a supermajority for Democrats.

To prevent a similar, yet opposite reaction in favor of Republicans, Colorado voters passed Amendments Y and Z in the 2018 elections.

What Amendments Y and Z do for Colorado’s constitution

These amendments were written to end the practice of gerrymandering. To promote a healthy democracy and

create fair representation, Colorado’s citizens needed to have competitive congressional elections.

Amendments Y and Z created the 12-member Colorado Independent Redistricting Commission for state and federal reapportionment, evenly divided among Democrats, Republicans and those unaffiliated with any political party.

Candidates would be approved by a panel appointed by the Chief Justice of the Colorado Supreme Court. Paid lobbyists or anyone hyperactive in the political campaign process were excluded.

The guiding principles in district re-alignment stressed district compactness, emphasized competitiveness and kept communities of interest together as much as possible.

How it works

The Commission reviews several maps, including possibilities for new congressional districts. Eight Commission members must agree on the final map selected, including at least one who is unaffiliated with a political party.

It’s then approved by the Supreme Court, which must accept the map, unless it finds the Commission abused its discretion in meeting the agreed upon principles approved by voters.

CADA PROGRESS REPORT 202114 2 1 6 7 3 4 8 5

Colorado’s new districts

After the Supreme Court approved new plans — federally for the US House of Representatives and at the state level for the Colorado State Legislature — interactive maps were posted for public review.

Since the balance of power before redistricting was 20 Democrats to 15 Republicans in the Senate and 41 Democrats to 21 Republicans in the House, the likelihood of leveling out seems very realistic.

Regardless of whether Republicans take control of either chamber, the representation is likely to move closer toward a 50/50 split. Redistricting does not affect the races for

Governor, Lieutenant Governor, Attorney General, Secretary of State or Treasurer.

At the federal level, Democrats previously held four seats to Republicans’ three. With the redistricting, the prediction is that four will remain Democratic and three Republican, while the newly added 8th Congressional District is considered a toss up – with a separation of voter registration of roughly two percent.

All eight Congressional seats will be up for election in 2022. In the U.S. Senate, Democrats hold both seats, with only Senator Michael Bennet up for election in 2022.

CADA’s outlook

While CADA strives to maintain strong relationships on both sides of the political aisle, it’s generally accepted that the business community fares the best when the branches of government are split.

For the previous four years, Democrats have held the Governor’s office, House and Senate. While it’s unlikely the Governor’s office or the state house will flip, Republicans could take the Senate in 2022.

That said, we are preparing our legislative and regulatory agenda for the coming year blind to partisan makeup. We’ll continue to advocate for the best interests of dealers and our consumers as we have done for more than a century.

CADA concludes its more than 50-year relationship with Employers Council

CADA and Employers Council have offered employer resources through a relationship that dates back nearly five decades. Employers Council, long named Mountain States Employers Council, has provided employer-based services through a mutually beneficial relationship with CADA that allowed dealer access to consultation and web-based services through association membership.

Through strategic restructuring at Employers Council, along with an overhaul of its membership structure, CADA was informed that our long-standing relationship no longer fits with Employers Council new model.

With a sea change in Colorado’s labor and employment regulatory landscape, CADA has begun a greater participation in the labor and employment field. A large

portion of entry-level questions can now be handled in house through Matthew Groves’ office, in conjunction with our participation in legal advisory boards at state and local organizations.

We’re pursuing a new member services relationship for full-scale representational issues. Additionally, the 2022 version of CADA’s Colorado Dealer Compliance Guide, when completed, will cover recent Colorado labor and employment requirement evolutions for the first time.

CADA strives to offer the most comprehensive assistance to member dealers, accomplishing that in the most efficient way possible. The combination of our increased in-house capacity and new, more formalized external relationships, will continue to help us serve you in ways that meet the challenges of 2022 and beyond.

CADA PROGRESS REPORT 2021 15

Foundation

Sometimes,

you just have to push the ‘Reset’ button and change the way things have always been done. For the Foundation, 2021 was that year.

While the year started as 2020 ended — with strong dealership donations of old, high polluters — by second quarter, market conditions, combined with dealers opting to sell those high polluters instead, saw a big drop in donations. These conditions persisted through the rest of the year.

Foundation celebrates 10-year anniversary

In 2021, the Clear the Air Foundation celebrated its 10-year anniversary as a tax exempt, 501(c)3 nonprofit organization. Dealer donations have been the Foundation’s lifeblood since its inception.

The first year the Foundation accepted donations in 2011, 300 cars were recycled. Ten years down the road, nearly 5,600 vehicles have been forever silenced, never to pollute again.

After clearing title from those donated vehicles, the Foundation recycles every part possible, then crushes the engine and other non-recyclable parts.

From there, Clear the Air receives funds generated by the recycler to provide scholarships for auto technician students.

Foundation awards 21 scholarships to auto tech students

The Clear the Air Foundation received 580 vehicles and awarded 21 tool or tuition scholarships to auto tech students who want to make a career in franchised new car dealerships.

When added to the number of scholarships that have been awarded since 2015, 101 students received tuition or tool scholarships, valued at $325,000. That’s been made possible through the generosity of CADA member dealers.

Turning to dealers for donations has been the first part of an equation that’s always penciled out. Until 2021. Make that 2020, when dealer donations started to drop.

While considering options to boost numbers in second quarter 2021, The Foundation was approached by Fort Carson Army Base in Colorado Springs, where the base donated 158 vehicles, during a year where dealers contributed 695.

Fast forward to December 2021

With microchip shortages taking center stage by mid year, combined with revenues dealers were making by selling those vehicles they’d have otherwise donated, dealer donations were only down 11 percent from 2020. Because the Foundation had cleared most of the abandoned cars from the Army base, Fort Carson’s donations dropped to just 36.

CADA PROGRESS REPORT 202116 Clear The Air Foundation

$127,988 $98,595 $113,406 $128,342 $134,105 $147,207 $190,064 $0 $20,000 $40,000 $60,000 $80,000 $100,000 $120,000 $140,000 $160,000 $180,000 $200,000 2015201620172018201920202021 Vehicle Donations Revenue

partners with industry players, seeks other contribution sources Vehicle Donations Revenue

was

to

to be done. By late second quarter,

CADA energies were focused on the first outdoor Denver Auto Show in more than 100 years, where the 13th Annual Preview Gala ‘opened the doors’ to the Show.

may know, the Clear the Air Foundation is the Preview Gala’s beneficiary. To keep the scholarship machine going, the Foundation partnered with AmFund for a silent auction

several vacation packages during the Preview Gala. Thanks to dealers who bid — and won seven spectacular trips —

Foundation

more than $5,000.

a light bulb moment, one that jump-started ideas about revenue

be generated from additional sources,

reducing reliance on just vehicle donations.

CADA PROGRESS REPORT 2021 17 It

time

pivot Something needed

all

As you

of

the

netted

It was

could

while

So while the donation numbers may not be the best ever, we’re incredibly optimistic about the Foundation’s future in providing dealerships with well-trained auto tech students who can hit the pavement running. Tomorrow! That is, with your help, of course. 389 397 600 576 631 571 807 911 580 0 100 200 300 400 500 600 700 800 900 1000 201320142015201620172018201920202021 High-polluter Donations $27,500 $2,500 $16,358 $75,000 $103,000 $52,000 $44,000 $$20,000 $40,000 $60,000 $80,000 $100,000 $120,000 2015201620172018201920202021 Scholarship Value Awarded High-polluter Donations Scholarship Value Awarded Clear The Air Foundation

First-ever Colorado Automotive Hall of Fame a huge success

Witha sell-out crowd of nearly 700 people — including dealers, dealership staff, sponsors and family members — rarely has the old saying, “A good time was had by all,” been more true than when summing up the first Colorado Automotive Hall of Fame celebration.

As part of the re-imagined 2021 Denver Auto Show, outside at Elitches in September, the dinner and awards ceremony gathered under Colorado blue skies for cocktails and dinner to honor 50 past and present dealers to the charter induction of the Colorado Automotive Hall of Fame.

Event Chair Anthony Brownlee had been percolating the idea for several years, when it just seemed the time was right. Actually, the event was ready to launch with the 2020 Denver Auto Show, but we all know what happened then: Three weeks before the Denver Auto Show was to open its doors — through the Hall of Fame and Preview Gala — the governor shut down the state for eight weeks. There’s usually a silver lining with everything. Sometimes it’s tough to see, other times it’s quite obvious. The silver lining with an 18-month delay was CADA could take more time to put together Brownlee’s labor of love: the best first-time event in our 108-year history.

How inductees were selected

All named Colorado Dealer of the Year, the charter induction of 50 dealers were CADA’s nominees for the TIME Dealer of the Year Award.

The 50 dealer inductees dated back to 1970. There was close to 100 percent attendance among inductees or family members who represented inductees who are no longer with us.

Automotive journalist Bud Wells, who was the only nondealer inducted, said he was pleased to be part of such an elite group of Colorado business giants who made and continue to make important contributions to their communities.

Honoring 51 individuals in one night was ambitious, yet 9News emcees Ed Green and Claudia Garofalo kept things moving.

All told, the evening’s success was a combination of factors: The spectacular September weather goes without saying. Curiosity about what a Colorado Automotive Hall of Fame would look like. The opportunity to see a bit of Colorado history. And perhaps most important is the vision and hard work of CADA staff.

CADA PROGRESS REPORT 202118

Advocacy Funding Mechanisms

Advocacy Funding Mechanisms

“The night was an incredible celebration of the history of the automotive industry in Colorado. The positive emotion and family feel of the night was incredible. All things equal, I think this was a great way to get started.” — Anthony Brownlee, Chair, 2021 Colorado Automotive Hall of Fame

“What I liked best was reconnecting with many of theindustry people with whom I invested 43 years of mylife. I had lost touch with so many people. I’m gratefulfor this event and sharing it with my family.”

— Inaugural Inductee

“I don’t think I’ve ever been to any event where there were so many dealers of all brands, all having dinner together and socializing.”

— Inaugural Inductee

“I am humbled and delighted to have been included in the charter induction of the Colorado Automotive Hall of Fame, which included 50 other people, most of whom I knew, admired and wished to emulate in my business. We certainly have an industry with a remarkable array of outstanding businessmen and women through the hundred-plus years of automobiles in Colorado. Thank you all for establishing this great way to recognize business leaders who have significantly contributed to the economic welfare of Colorado.” — Inaugural Inductee

CADA PROGRESS REPORT 2021 19

THERE WERE REVIEWS!

Advocacy

Against the madeto-order backdrop of spectacular weather, The Broadmoor’s scenic views and great company, the 2021 CADA Annual Convention was fun, fun, fun!

From hitting the links Thursday on the West Course...

To the Opening Reception on the Lakeside Terrace Thursday evening...

To the Awards Lunch after golf...

CADA PROGRESS REPORT 202120

Photos courtesy Ambereen Ebrahm, unless otherwise noted.

Funding Mechanisms

The

and relax.

Annual

was a great time to reconnect,

CADA PROGRESS REPORT 2021 21

Savannah Hatcher

To terrific speakers on Friday....

2021 CADA

Convention

recharge

Advocacy Funding Mechanisms

Inthe ultra competitive Employee Benefits industry, rarely do you find an agency that keeps all its clients from one year to the next. We said that last year and we’re saying it again now, because for the THIRD year in a row, CADA Employee Benefits enjoyed 100 percent dealership retention in 2021 (except some dealerships that were sold).

Since 2016, Employee Benefits has steadily increased its client base, retention and revenue through the variety of plans it offers to dealers.

At a time when businesses readily jumped from one agency to another, dealers stayed with CADA Employee Benefits.

Why?

Dealers have learned they can trust the Employee Benefits team. With nearly 50 years’ combined experience in serving clients’ health insurance needs, Director Craig Gordon and Account Coordinator Laura Will have more than proven their commitment to providing the best coverage at the best price with the best service in the industry.

Employee Benefits offers exclusive health insurance options only available through the agency. The team increased the number of employees to the sponsored medical program through open enrollments — and medical insurance by far makes the greatest contribution to the bottom line.

Make no mistake: Employee Benefits offers all the health insurance options any other agency in Colorado can. Those

exclusive lines have been critical to the division’s success. No other Colorado agency can offer all of the benefit options CADA Employee Benefits does.

Revenues increased through added voluntary products and open enrollment. Voluntary products include Dental, Vision, Disability and Life insurance.

The division set a record for new quotes. This presented a significant opportunity to convert prospects to clients and increase income overall.

Gordon became licensed to sell individual coverage in 2021. Offering individual coverage presented opportunities that have never before been available to Employee Benefits. Lives change. People’s circumstances change. Individual coverage is an option that’s available to everyone, from a staff member to an independent contractor or even a supplier.

This additional license has opened doors that were previously firmly closed.Dealerships are what keep the division fueled. Craig and Laura will provide a comparison on all aspects of employee benefits, including type of coverage, voluntary products and employer statistics.

And when you choose CADA Employee Benefits, you’re helping CADA on the front lines with legislators and regulatory agencies.

CADA PROGRESS REPORT 202122

Employee Benefits boosts income 12%, boasts 100% dealer retention third consecutive year $194,398 $217,504 $205,609 $231,090 $170,000 $180,000 $190,000 $200,000 $210,000 $220,000 $230,000 $240,000 2018 2019 2020 2021 CADA Insurance Services Employee Group Benefit Commissions CADA Insurance Services Employee Benefits Commissions Advocacy Funding Mechanisms

Most

associations count on non-dues revenue to ensure a strong and stable financial organization. While dues are an important component of a successful association, non-dues revenues offer CADA a way to represent dealers at the Colorado State Legislature and before regulatory agencies.

Without these revenue streams, your Association is limited in what it can do on your behalf.

CADA Member Services include revenue from forms, bonds, Endorsed Providers and F & I revenue share.

By purchasing goods and services from CADA and our providers in these Member Service areas, you’re getting the best from the well-vetted providers AND ensuring our efforts can continue to defend your business model.

Forms Total

2021 forms sales were $1,225,974, versus $1,213,840 in 2020. This represents a 1 percent gain over 2020 form sales, or $12,134.

While gross sales were up, forms net income to CADA were $550,471, a 4 percent decrease from 2020. This was due to an increased cost of forms by nearly 3 percent, shipping expenses by nearly 30 percent and a 24 percent increase in legal commissions.

These expenses were offset by a 78 percent improvement in inventory obsolescence over 2020.

While electronic forms were a fraction of our printed forms sales, they continue to gain ground. Sales of electronic forms in 2021 were $146,287, compared to $121,958 in 2020 — or representing a nearly 20 percent increase. We expect to see that trend continue.

CADA PROGRESS REPORT 2021 23

Member Services CADA leans on non-dues revenue to advocate on dealers’ behalf $213,601 $289,239 $182,906 $430,884 $567,144 $617,720 $624,067 $573,217 $550,471 $$100,000 $200,000 $300,000 $400,000 $500,000 $600,000 $700,000 201320142015201620172018201920202021 Forms Net Income - ALLForms Net Income - All

5,536

bonds were sold,

to CADA of $226,657. This

from 2020, which is attributed to

often where new

a net

percent

CADA PROGRESS REPORT 202124 Despite a lack of inventory on site, dealers were busy and profitable throughout the year. In 2021,

surety

with

income

represents a 1.4

decrease

the spate of dealership consolidations,

corporate owners purchase their bonds elsewhere. When you purchase your bonds through CADA, you’re supporting our efforts to fight for you and your dealerships at the state legislature and with regulatory agencies. Bonds Many thanks to our Top 5 All Stars! 1. Durango Motor Company 2. Spradley Chevrolet 3. Foundation Chevrolet Cadillac 4. Colorado Springs Dodge 5. Tie: Mike Ward Infiniti Groove Toyota CADA bond sales close out year on a high note $270,310 $254,511 $265,073 $262,212 $261,879 $247,864 $246,790 $229,962 $226,657 $$50,000 $100,000 $150,000 $200,000 $250,000 $300,000 201320142015201620172018201920202021 Total Bonds Net Income - Tokio Marine HCC SuretyTotal Bonds Net Income - Tokio Marine HCC Surety

Endorsed

Throughthe record-breaking number of dealership buysells during 2021, Endorsed Provider revenue shares with CADA grew. It’s a remarkable fact, given that many dealership owners today are out of state. They don’t know or understand the long-standing valued relationships that have been formed between dealers and our Endorsed Providers.

Or when they get their products and services from these preferred providers, they’re supporting CADA’s efforts to continue defending their business model.

When you choose Endorsed Providers as your suppliers, you’re supporting CADA’s efforts to keep your store and business model safe at the state legislature and with regulatory agencies.

Revenue share from the top Endorsed Providers resulted in $220,100 net income to CADA during 2021.

For example, American Fidelity’s 2021 revenue share with CADA was up 7.3 percent over 2020, thanks to the robust suite of products it offers to dealers. In addition, CADA Insurance Services Employee Group Benefits and American Fidelity visited dealer groups together, which served to boost that revenue share even more.

Federated Insurance revenue share was up 2.2 percent over 2020. Market uncertainty, combined with buy/sells and persistent pandemic issues may have been a few reasons why dealers opted to more wisely insure their dealerships.

Similarly, LB Telecom revenue share was up 2.2 percent over 2020. It’s robust VOIP telecom services with added features contributed to its growth.

CADA PROGRESS REPORT 2021 25

Providers Endorsed Provider revenue shares continue growth pattern $92,679 $79,704 $112,071 $84,223 $91,391 $87,611 $92,018 $97,043 $105,143 $56,947 $59,519 $59,074 $45,199 $44,051 $48,904 $55,722 $57,083 $58,337 $24,840 $27,696 $36,141 $32,520 $38,694 $37,262 $42,091 $44,181 $45,144 $21,746 $45,302 $11,301 $11,486 $$20,000 $40,000 $60,000 $80,000 $100,000 $120,000 2013 2014 2015 2016 2017 2018 2019 2020 2021 Endorsed Provider Net Income By Provider (Partial List) American Fidelity Federated Insurance LB Telecom Armatus Endorsed Provider Net Income - By Provider (partial list) $284,879 $254,057 $331,228 $263,537 $253,246 $251,425 $281,438 $238,364 $246,869 $$50,000 $100,000 $150,000 $200,000 $250,000 $300,000 $350,000 201320142015201620172018201920202021 Endorsed Provider Net Income ALLEndorsed Provider Net Income - All

non-dues revenue sources, F&I providers have contributed to CADA’s income stream through commissions paid when dealers use their products or services.

In this category, CADA has two key F&I providers: PermaPlate and Allstate Dealer Services.

2016, F&I provider PermaPlate has contributed the lion’s share of F & I revenue in commissions paid to CADA, peaking at nearly $50,000 in commissions in 2019.

2021, PermaPlate revenues were down by 64 percent over 2020. Similarly, Allstate revenues were down by 62 percent, for an average revenue share drop of 63 percent over 2020.

shortfalls are attributed to a loss of one highly productive dealer group.

CADA PROGRESS REPORT 202126

Likeother

Since

In

These

F & I Providers $6,643 $7,411 $6,041 $7,355 $14,840 $20,698 $35,105 $49,369 $22,784 $8,238 $20,043 $9,634 $6,773 $20,916 $10,824 $16,241 $14,329 $12,842 $15,934 $6,008 $$10,000 $20,000 $30,000 $40,000 $50,000 $60,000 20122013201420152016 20172018201920202021 F&I Net Income - By Provider (Partial List) PermaPlate Allstate Dealer Services Dealership mergers affect F&I revenue share F&I Net Income - By Provider (partial list)

CADA PROGRESS REPORT 2021 27 CHARTS $213,601 $289,239 $182,906 $430,884 $567,144 $617,720 $624,067 $573,217 $550,471 $$100,000 $200,000 $300,000 $400,000 $500,000 $600,000 $700,000 201320142015201620172018201920202021 Forms Net Income - ALLForms Net Income - All

CADA PROGRESS REPORT 202128 CHARTS $270,310 $254,511 $265,073 $262,212 $261,879 $247,864 $246,790 $229,962 $226,657 $$50,000 $100,000 $150,000 $200,000 $250,000 $300,000 201320142015201620172018201920202021 Total Bonds Net Income - Tokio Marine HCC SuretyTotal Bonds Net Income - Tokio Marine HCC Surety

CADA PROGRESS REPORT 2021 29 CHARTS $284,879 $254,057 $331,228 $263,537 $253,246 $251,425 $281,438 $238,364 $246,869 $$50,000 $100,000 $150,000 $200,000 $250,000 $300,000 $350,000 201320142015201620172018201920202021 Endorsed Provider Net Income - ALLEndorsed Provider Net Income - All

CADA PROGRESS REPORT 202130 CHARTS $92,679 $79,704 $112,071 $84,223 $91,391 $87,611 $92,018 $97,043 $105,143 $56,947 $59,519 $59,074 $45,199 $44,051 $48,904 $55,722 $57,083 $58,337 $24,840 $27,696 $36,141 $32,520 $38,694 $37,262 $42,091 $44,181 $45,144 $21,746 $45,302 $11,301 $11,486 $$20,000 $40,000 $60,000 $80,000 $100,000 $120,000 2013 2014 2015 2016 2017 2018 2019 2020 2021 Endorsed Provider Net Income By Provider (Partial List) American Fidelity Federated Insurance LB Telecom Armatus Endorsed Provider Net Income - By Provider (partial list)

CADA PROGRESS REPORT 2021 31 CHARTS $6,643 $7,411 $6,041 $7,355 $14,840 $20,698 $35,105 $49,369 $22,784 $8,238 $20,043 $9,634 $6,773 $20,916 $10,824 $16,241 $14,329 $12,842 $15,934 $6,008 $$10,000 $20,000 $30,000 $40,000 $50,000 $60,000 20122013201420152016 20172018201920202021 F&I Net Income - By Provider (Partial List) PermaPlate Allstate Dealer Services F&I Net Income - By Provider (partial list)

CADA PROGRESS REPORT 202132 CHARTS $1,886,277 $3,800,957 $0 $500,000 $1,000,000 $1,500,000 $2,000,000 $2,500,000 $3,000,000 $3,500,000 $4,000,000 2007 2021 CADA Annual Revenue Increase 2021 vs 2007 Based on audited financial reports 102% + *In 2010, MDADA became part of CADA. * CADA Annual Revenue Increase 2021 vs 2007 Based on audited financial reports

CADA PROGRESS REPORT 2021 33 CHARTS $3,488,673 $5,603,231 $0 $1,000,000 $2,000,000 $3,000,000 $4,000,000 $5,000,000 $6,000,000 2007 2021 CADA Assets Increase 2021 vs 2007 Based on audited financial reports 61% + CADA Assets Increase 2021 vs 2007 Based on audited financial reports

CADA PROGRESS REPORT 202134 CHARTS $4,532,596 $10,321,160 $0 $2,000,000 $4,000,000 $6,000,000 $8,000,000 $10,000,000 $12,000,000 2007 2020 CADA Assets Increase - 2020 vs 2007 With building & land valuation included 128% + * ** *In 2010, MDADA became part of CADA. ** No broker opinion of value was received in 2021 for the CADA building and land, plus Grant Street Development. CADA Assets Increase 2020 vs 2007 Including building and land valuation

PHONE/FAX: Phone: 303.831.1722 Fax: 303.831.4205 info@colorado.auto COLORADO AUTOMOBILE DEALERS ASSOCIATION 290 E. Speer Blvd. Denver, CO 80203