BULLETIN

COLORADO AUTOMOBILE DEALERS ASSOCIATION

IN THIS ISSUE

THE IMPORTANCE OF PROJECT DC

TIPS FOR PROTECTING YOUR DEALERSHIP

THE BENEFIT OF CONTINUING EDUCATION

OSHA ACTIVELY AUDITING DEALERS FOR HEAT STRESS

THE IMPORTANCE OF PROJECT DC

TIPS FOR PROTECTING YOUR DEALERSHIP

THE BENEFIT OF CONTINUING EDUCATION

OSHA ACTIVELY AUDITING DEALERS FOR HEAT STRESS

The Colorado Automobile Dealers Association (CADA) is the voice of the automotive retail industry throughout the state. As the automobile dealer trade association, CADA advocates issues of importance to the auto industry, Colorado auto dealers and Colorado’s driving public.

The Denver Automobile Dealers Association started in 1914 to operate the annual Denver Auto Show which dates to back 1902. Colorado Automobile Dealers Association soon followed and both associations operated together with shared staff and a headquarters building. In 2010, after almost eight decades together, the two associations became one. The history now dates over 108 years of high level automotive and mobility impact.

Today, our dealers range from small family-owned dealerships, to nationally operated, multiple franchise corporations. CADA represents a united front for over 300 new car, truck, motorcycle and RV dealers. From local, state and federal policymakers, to the public and the media, CADA is the voice for Colorado’s auto industry.

Each September, CADA brings its board of directors to Washington, DC. Ostensibly, this is to participate in NADA’s Legislative Conference and attend CADA’s Q3 board meeting. However, if you speak to previous participants, they will tell you the gravity of the event comes from storming Capitol Hill and meeting your Congressional delegation.

If you’ve never seen the nine buildings that comprise the Capitol complex, it is a magical place. Set aside its classical architecture and enough marble to create a small city. The 7,000 people who report to work daily oversee how the United States spends 4 trillion dollars annually, oversees 438 federal agencies, and keeps the United States as the preeminent superpower, with a $26 trillion dollar economy and 1.4 million volunteer active duty military.

There is no question the political landscape of Colorado has shifted. 2018 was the last time we saw a statewide elected Republican or split control of either chamber. In 2020 and 2022, Republicans lost more ground, including a house seat in Douglas County. In 2023, Colorado Springs elected its first Democratic mayor this century.

Yet the ‘bluing’ of the state has lifted Colorado to prominence. Within the Biden administration, increasing numbers of federal appointees hail from Colorado.

Former House Speaker KC Becker serves as the EPA Administrator for Region VIII. Former Senate President Leroy Garcia is appointed to the Department of Defense. Former CDOT and CDPHE employees are now in senior staff positions at NHTSA and USDOT. Colorado even managed to retain the United States Space Command, undoing a politically motivated decision by Donald Trump.

For this reason, it’s imperative that we build relationships with our federal delegation. Not only have we had great success with Colorado Democrats in DC, but several in our delegation appear to have bright futures beyond their current roles. The louder the state’s voice gets, the more we stand to benefit from our nurtured alliances. The legislation we present at this conference is merely an icebreaker to a conversation we hope will last a decade.

One common criticism of the trip is that our meetings tend to get delegated to staff, many in their 20s and 30s. This is true and largely a product of our own planning.

Project DC happens in mid-September, two working weeks ahead of what is perennially considered “government shutdown time.” The federal government’s fiscal year begins October 1. However, this should not deter participation.

Developing relationships with legislative staff is equally as critical as with elected officials. There are 21 standing committees in the House of Representatives alone. Staff are the subject matter experts who tend to make decisions on behalf of members long before the votes happen. In fact, many elected officials cut their teeth in politics as staff members. Senator Michael Bennet was a Chief of Staff to then-Mayor John Hickenlooper. Ken Buck was a staff member for then-Congressman Dick Cheney. Former State House Speaker Alec Garnett previously worked for Congressman Ed Perlmutter. Increasingly, the path to elected office has a stop as a legislative staffer.

But I may have an observation bias, as I’m also a five-year veteran of the House of Representatives.

The point is this: they tell us the best time to plant a tree was 20 years ago. The second-best time is today. Whether we are successful in repealing the Federal Excise Tax, or extending the LIFO accounting deadline, the hands we shake and the stories we share are the foundation for our standing in 2030 and beyond. Our former Governor sits in the Senate; our present Governor came home from DC to serve. There is a good chance that our future governors are currently sweating it out in wool suits running between buildings, and standing in security lines like the rest of us. Your participation in Project DC acknowledges that it’s time to start planting trees for the future.

Khorrie Luther is a familiar face at the Colorado Automobile Dealers Association. She started working here as a temp ten years ago. She just began a new role as CADA’s Associate Vice President of Operations, recently promoted from her last CADA stint as Business Manager.

It’s fair to say that Khorrie is CADA’s institutional memory as the longest-serving staff member. Her first year was part-time, behind the desk. “I worked covering lunches and testing. Gradually, I started picking up a couple of hours a day,” she remembered.

Soon she was the full-time member services coordinator, and as CADA implemented new information technology, she “kind of became the systems guru…the IT person for the office. “ I never knew I would be part of a nonprofit, let alone anything in the auto industry,” she said, but it suited Khorrie.

After graduating from the University of California at Irvine in 2009 with a degree in political science, she moved to Denver. “I always knew I wanted to live here,” Khorrie stated.

She decided to join her father and brother, who already lived here. She put in her notice at the retail store where she worked and moved with a few suitcases and boxes but no job prospects. “Moving to Denver was the best thing I could do for myself,” she said.

Personally, Khorrie is “totally a 90s baby…all about movies, TV shows, and I love music.” Her latest interest is wellness, including fitness and nutrition.

“I’m a Leo,” Khorrie pointed out. “Personally, I can be a little stubborn. One of our positive qualities is that we tend to be leaders. But I’m different from a Leo in that I’m totally a team player, too,” she said. “I’m loyal, very positive, with lots of energy. “

Khorrie enjoys managing projects and has done a lot of that at CADA, a very useful quality that came in handy this past spring with the Denver Auto Show. “Nobody had ever been part of the auto show process except me.” When the show producer bowed out shortly before the show, “I was the only person here that could answer hard questions as far as how events – scope, timeline – all was put together. I knew my experience here was a big factor in its success,” she said.

The last several months have seen a big change in the association. “The culture has changed significantly, and it’s very conducive to honing in our goals. We can keep communications open and stay more connected with a more user-friendly and dynamic system ranging from bonds to member dues,” said Khorrie. Her ultimate goal is to be more connected to dealers. “We really want to change how dealers communicate with us, stay connected and get better dealer involvement.”

Khorrie is looking forward to the challenge of rebuilding. “We’re trying to reinvent ourselves. I’m all for the challenge and work well under pressure. We want bigger events and for dealers to be engaged,” she said. “We enjoyed where we were before COVID. We saw an increase in everything from 2014-16. Then we had a plateau and COVID impacted everything.”

Her years as Business Manager dealt with the Association’s core profit sector. The new position as AVP - Operations takes her away from accounts receivable, allowing her to work on building projects and giving her a bigger role in growing CADA’s for-profit business. She says there’s still a lot to learn, but it’s taking her previous experience, building on it, and learning more.

In some ways, changes at CADA reflect the changes that have been going on in Denver and Colorado. Khorrie lives in downtown Denver with her significant other, Michael and three cats and has seen up close all of the building projects and the steady influx of people. “I know how vital the automobile industry is to the overall Colorado economy,” she says.

The auto industry and the Colorado economy face many challenges, and Khorrie is happy to be part of navigating them in her new role at CADA. “It’s different now. This is a great time – the next year, the next five years. This is a really great time to be involved with the association. Change is good.”

When dealers stop to think about why our Association exists, it always comes back to one central theme: advocacy. As a smaller dealer, running a successful dealership is a round-the-clock job. And, sometimes it feels like even that is not enough. There are not enough hours in the day to sell cars and educate elected officials on how essential our industry is to Colorado’s economy. This year’s economic impact study shows that we are inching closer to 25% of the state’s sales and use tax market.

And while we occasionally break away from our offices to go to the Capitol and support major legislation, like warranty reimbursement or a franchise bill, it would not be possible to keep ahead of the hundreds of pieces of legislation that impact our industry each year. This is why we collectively created CADA – to be “the voice of the automotive retail industry throughout the state.”

We know that motor vehicles have been under attack for several years. Consumer groups and trial lawyers want to make it easier to sue us; labor advocates want to give union rights to our non-unionized workforces; environmentalists want our vehicles to stop burning gas. The sheer volume of impactful legislation has steadily increased year over year to bring the industry to a place we would not have even recognized before the pandemic.

This is where the Association’s second function comes in. When the legislative session winds down, CADA hosts training sessions on how to comply with the multitude of mandates that the legislature has handed down this year. These education sessions are critical lifelines to keep dealers out of court and free from the talons of our industry’s regulators and auditors. They cover topics as specific as the Pay Equalization Act and FTC Safeguards Rule, and as general as title training or what to do in case of an audit.

However, somewhere along the way these trainings became a revenue stream for the Association. Over time, the price of an individual class crept up to the point that it superseded the importance of getting the information to the dealer. In some cases, the price discouraged dealers from staying in tune with legislative and regulatory updates, taking on risk of non-compliance in the process.

This fall will be a turning point for education at CADA. With the promotion of Dan Allison from Member Services to the Director of Education, CADA is focusing on providing more concise, targeted, and frequent education sessions at a drastically lower cost to members. Building off the 2022 development of ‘free Friday’ regulatory zooms with Matthew, we will seek to divide our education into four categories: no cost updates from our endorsed providers, 30-minute sessions on targeted issues within one department of a dealership, 60-minute sessions on higher stakes issues that impact a dealer’s bottom line, and half- or full-day intensive workshops where multiple government actions center around one facet of the dealership.

We already have several trainings in the pipeline. The passing along of credit card fees (SB21-091), to paid family leave insurance alternative plans (Proposition 118), to raising the allowable GAP fee (HB23-1181), and a half day on EV Tax Credits (federal, state, vehicle exchange credit, IRS forms for assignability). We will also have insights on upcoming rules like the 2nd California Clean Car Rule, the FTC Motor Vehicle Regulation, and the POWR Act which lowers the bar for a workplace harassment lawsuit against an employer.

Training will be in person but also available digitally to those unable to make the trip. We don’t believe that your access to critical compliance information should be predicated upon your proximity to CADA headquarters. We also don’t believe that your level of preparedness should be based upon how many CADA trainings you can afford. Training will continue to include an Association representative and a government official or industry expert to relay the nature of the change and its proposed impacts.

With training resuming this fall, we hope that you will find the content useful and beneficial. We have been fortunate to fair well this legislature, even in the face of a progressive majority. These courses should represent the peacetime dividend of the battles we waged and won during the legislative term.

While much of your dealership’s banking business has probably gone digital, it’s possible that you still send and receive checks as part of normal everyday business. But is this traditional payment option secure?

Mail theft is a growing problem across the country, and many of these criminals are looking for checks to intercept. While concerning, you can take steps to help protect your dealership against mail theft and check fraud.

Most mail arrives at the intended destination without any issue. But thousands of scammers are arrested each year for targeting mail in transit — or taking mail right out of mailboxes (a practice known as mailbox fishing).

Check washing refers to scams where thieves use chemicals to remove ink from a check. In other instances, copiers or scanners are used to print fraudulent duplicates of the check.

Ways to help protect your dealership from check washing:

• Use a black gel pen. Certain types are resistant to chemical stripping since their pigments seep into the fibers of the check’s paper.

• Review images of checks online to ensure they appear as you wrote them.

• Limit how often you send checks in the mail. Instead, rely on digital tools to make and receive payments.

If you do need to mail a check, follow these tips to make sure it’s delivered safely:

• Follow your mail – the U.S. Postal Service provides resources to monitor your mail’s status and receive confirmation on arrival, as well as other secure options for businesses to receive mail.

• Mail directly from the post office – the mail slots inside are virtually tamper-proof, shielding mail from thieves.

The digital world has made banking simpler and safer. Most vendors offer online bill payment options. Additionally, your business may be able to utilize digital payment platforms like Dealer Pay, Stripe, Zelle or Venmo. For high-dollar payments, consider alternative methods like ACH or wire transfer. Your online banking site should offer these services.

When it comes to switching from paper registration and title processes to digital solutions, some dealerships have a hard time letting go of familiar workflows. Change can be hard. We say it often; we hear it often; and after a while, we may end up believing it.

However, with the right solutions partner, embracing digital registration and title solutions is a positive change. Especially when you consider that you’re saying goodbye to the expense, disruption, and inconvenience inherent in a paper-based process.

Dealers who’ve made the switch report consistent satisfaction in two key areas:

When you change to digital processes, completing deals is faster and more fluid for your back office. Title clerks can process in-state transactions in under 4 minutes1 while eliminating costly manual paperwork and processes that slow down deals. Crossborder deals are also simplified with RegUSA, our 50-state reg and title solution backed by professional deal audit services.

Electronic reg and title solutions enable documents to be completed online and submitted directly to the BMV. Integration with your DMS means much of the customer and vehicle information comes directly from earlier stages of the deal process. Pre-populated fields dramatically reduce data entry errors, eliminate re-keying that slows down your team, and help get customers out the door quickly.

Trade-in vehicles can be a reliable source of cash flow for dealerships. Yet, manual payoff processing and title release is time-consuming and steals valuable time away from your remarketing window of profitability. Holding costs for vehicles in title release limbo can add up quickly and tank your bottom line.

A digital payoff and title release solution like Accelerated Title allows you to gain insight into title details before you take

possession to avoid any potential ownership pitfalls, calculate a reliable payoff, and get the title released in as quickly as four to six days. That’s 70 percent faster2 than the standard payoff and release time. The result? Turn trade-ins faster, realize fuller profits, and help ensure they flow straight back to your bottom line.

Any operational change requires a partner, not a vendor. Dealertrack is a proven partner in providing unmatched solution support and training. Our implementation team will get your back office up and running fast with any new solutions, while on-site and online training are easily available whether a staff member is new to reg and title processing or just needs a quick refresher.

Change doesn’t have to be hard

Staying up to date with technology shouldn’t be an added burden. Digitizing your reg and title process helps maximize deal completion efficiency, fuel your bottom line, and allow your staff to focus on what matters most: your customers.

Schedule a no-obligation call with Rosey Patti, regional sales manager for Ohio, to discuss how Dealertrack solutions can help you make a positive change.

“ It’s very simple: if I’m paying for something and not getting the results I want, I’m ready to change – and I like change, especially if it’s positive.”

Frankie Arredondo General Manager, Delano Chevrolet Buick GMC

Registration for the annual CTAF golf tournament has opened, and you can register here. It will be held at Blackstone Country Club on Monday, October 9th and will be free to dealer members. This year’s tournament will be the best yet, with a great lineup of fun challenge holes including a $25,000 hole-in-one contest, an air cannon T shot, a beat the Pro hole, and of course some incredible sponsors who, thanks to their generous support, make this tournament possible. Speaking of sponsors, we have several sponsorship packages left so if you have someone you work with in the industry who might be interested in getting in front of 100 dealers for a day, please refer them to me at mark. zeigler@colorado.auto.

At the midpoint of the year, I’ve awarded twelve scholarships valued at $53,194 to auto tech students who work at dealerships. The goal is to award ten more by the end of the year. If you have a promising student working at your store, have them complete the scholarship application here so they can be considered for the next round. It really does make a difference!

Save the Date

WHEN: October 9, 2023

TIME: 9:00 am Shotgun Start

LOCATION: Blackstone Country Club in Aurora

Get the technology for faster, simpler registration and title transactions from trade-ins to vehicles sold.

• Colorado In-State Reg & Title: Prepare in-state transactions for the DMV in under 4 minutes,1 saving your dealership time and money.

• Dealertrack Accelerated Title ® : Streamline payoffs and gain title release up to 70% faster 2 on trade-ins.

• Dealertrack RegUSA ® : Simplify out-of-state registration and title process for customers in any state.

For more information or to schedule a demo visit us.dealertrack.com/COAHOF

1 Based on Dealertrack User Timing report through Google Analytics 9/30/21 to 9/30/22.

2 Based on average industry timeframe for vehicle title release and vehicle payoff process of 18+ days, as determined by 2022 Dealertrack data

Proud partner of

As we have become aware of increased OSHA activity in Colorado and surrounding states, we have invited our endorsed provider to give an update on their dealers’ experiences with audits.

The safety and well-being of your dealership employees are paramount, especially amid rising temperatures and increased heat-related risks during these summer months. The Occupational Safety and Health Administration (OSHA) has noted these concerns and recently intensified its focus on heat stress prevention at dealerships. In this article, we will delve into key topics surrounding OSHA’s audits and how ComplyAuto Safety can be your ally in achieving compliance and safeguarding your workforce against scrutiny.

OSHA has been actively conducting inspections at dealerships, and it is essential to be aware that these visits are happening. Being well-prepared will ensure a smooth process and demonstrate your commitment to maintaining a safe workplace. Some examples of workplace preparedness include:

• Hydration: Encourage employees to drink plenty of water throughout the day, especially during hot weather. Provide access to cool, potable water near the work area and remind employees to hydrate regularly.

• Rest and Shade: Schedule frequent rest breaks in shaded or cool areas to allow employees to recover from heat exposure. Along those lines, ensure that shaded or cool areas are close to exposed work

areas and easily accessible. Encourage employees to take breaks before they feel overly fatigued or experience symptoms of heat-related illnesses.

• Workload and Scheduling: Adjust workloads and schedules to avoid peak heat hours whenever possible. Consider limiting strenuous tasks to cooler parts of the day.

• Training and Education: Train employees and supervisors about the dangers of heat stress, how to recognize its symptoms, and the importance of prompt action when symptoms arise.

• Heat Illness Prevention Program: Develop a comprehensive heat illness prevention program tailored to your dealership. The program should include risk assessments, preventive measures, and guidelines for managing heat-related hazards.

Even though OSHA’s primary emphasis is on heat illness prevention, they may also scrutinize other areas that traditionally pose significant safety concerns while on-site.

Heat stress poses a significant risk to employees, particularly those working in outdoor areas or under extreme conditions. The National Emphasis Program (NEP) has defined “heat priority days” as days when the heat index is expected to be 80°F or higher. OSHA’s latest guidance on preventing heat-related issues at high-risk workplaces allows OSHA to inspect your dealership on these days. For more information, click here

To protect your employees from heat-related illnesses, it is crucial to have a well-developed and comprehensive heat illness prevention program in place. Such a program should include proper risk assessments, implementation of preventive measures, and guidelines for identifying and responding to heat stress-related symptoms. Dealerships are encouraged to review the heat illness requirements of their state to make sure that they are compliant with unique state requirements.

Regular training is a critical component of a successful safety program. Are your employees aware of the heatrelated risk factors that can impact the risk of heat illness? How about the types of heat illness and their symptoms? Providing your employees with annual heat stress training helps raise awareness and ensures they are equipped to identify and manage potential hazards effectively.

The Consequences

Recent instances of dealerships facing hefty fines, like the nearly $200,000 in penalties imposed on a New Hampshire auto repair facility for OSHA safety violations, underscore the importance of adhering to safety regulations. Although these fines were not related to heat stress, the inspection and ensuing fines should remind us that OSHA penalties can be very expensive and be the canary warning for dealers to review the safety of their workplaces. Additionally, OSHA has a fair amount of discretion under the general duty clause and typically uses it as authority for most citations relating to heat-related illnesses.

Our association has partnered with ComplyAuto Safety to bring an automated approach to streamline policy management, employee training, and much more to our dealers. Their comprehensive platform is designed to help you achieve compliance at your dealership effortlessly, ensuring that your employees are wellversed in safety protocols and that your dealership is a safe workplace.

To help dealers swiftly achieve compliance, we are delighted to inform you of an exclusive offer we have worked out with ComplyAuto. They are offering a FREE on-site inspection to identify potential areas for improvement for our dealer members. Additionally, they are providing a one-month free trial of their Safety software platform, empowering dealers to address safety requirements immediately. It is a limited-time offer for new ComplyAuto Safety clients and will be allocated on a first-come, first-served basis. If you would like to take advantage of this offer, email info@complyauto.com. For more information, you can visit complyauto.com/safety

As OSHA continues its audits and enforcement activities in the automotive industry, it is essential to be proactive in heat stress prevention and overall safety compliance. By utilizing the ComplyAuto Safety platform, you can stay ahead of regulatory demands and ensure the well-being of your workforce. Invest in the right tools and practices today to safeguard your dealership and employees for a safer tomorrow.

Colorado

Quarterly Registrations

Seasonally Adjusted Annual Rate, Converted to Equivalent U.S. New Vehicle Market SAAR (millions of

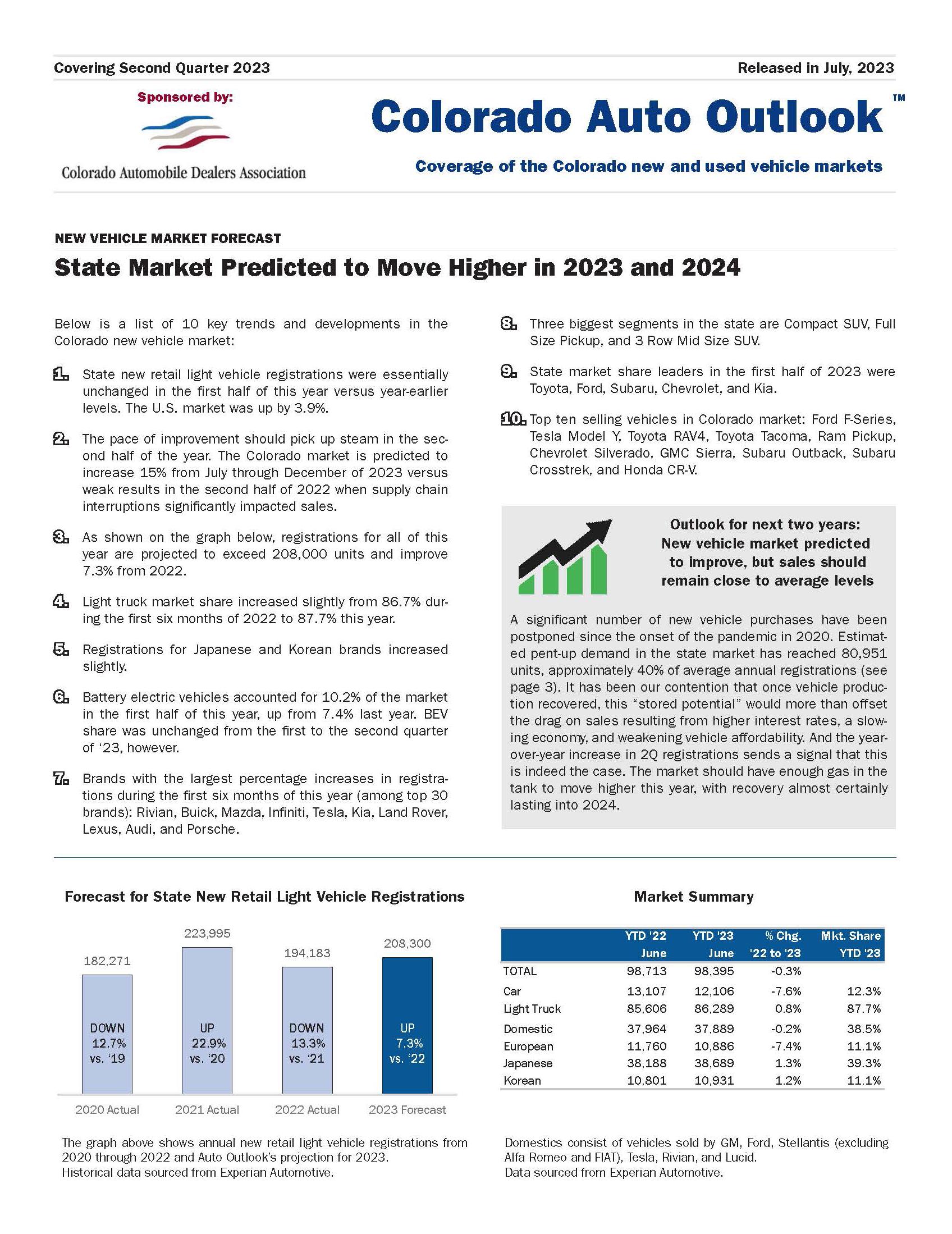

DOWN 0.3%

UP 3.9%

The graph on the left provides an easily recognizable way to gauge the strength of the Colorado market. It shows quarterly registrations based on a seasonally adjusted annual rate. These figures are then indexed to SAAR sales figures for the U.S. new vehicle market. So just like in the national market, when the quarterly SAAR is above 17 million units, the state market is strong, 15 million is about average, and below 13 million is weak. Equivalent SAAR levels in the state increased from 14.1 million in the First Quarter of this year to 15.2 million in the Second Quarter.

New retail light vehicle registrations in the state declined a slim 0.3% during the first six months of this year, versus the 3.9% increase in the Nation.

At Auto Outlook, we strive to provide sound and accurate analyses and forecasts based upon the data available to us. However, our forecasts are derived from thirdparty data and contain a number of assumptions made by Auto Outlook and its management, including, without limitation, the accuracy of the data compiled. As a result, Auto Outlook can make no representation or warranty with respect to the accuracy or completeness of the data we provide or the forecasts or projections that we make based upon such data. Auto Outlook expressly disclaims any such warranties, and undue reliance should not be placed on any such data, forecasts, projections, or predictions. Auto Outlook undertakes no obligation to update or revise any predictions or forecasts, whether as a result of any new data, the occurrence of future events, or otherwise.

Colorado Auto Outlook Published by: Auto Outlook, Inc. PO Box 390, Exton, PA 19341

Phone: 610-640-1233 EMail: jfoltz@autooutlook.com

Editor: Jeffrey A. Foltz

Information quoted must be attributed to Colorado Auto Outlook, published by Auto Outlook, Inc. on behalf of the Colorado Automobile Dealers Association, and must also include the statement: “Data sourced from Experian Automotive.”

80,951

The Colorado unemployment rate was less than 3% in May of this year. Wages were up versus year earlier. Consumer sentiment has stabilized and total household wealth moved higher in the First Quarter of this year.

Estimated

new vehicle purchases will be postponed between 2020 & 2023 representing 40% of sales in an average year

BEV market share was unchanged from the 1st to the 2nd Quarter of this year.

• Battery electric vehicle market share increased from 7.4% in the first half of ‘22 to 10.2% in 2023, but was unchanged from the First to the Second Quarter of this year.

• The industry is almost singularly focused on growth in BEV sales and market share. As a result, sales gains for hybrids have been largely ignored, which should not be the case. Hybrid vehicles provide a valuable “bridge” as the industry transitions to BEVs. They have better fuel economy than ICE vehicles, reduced emissions, and are less costly than BEVs.

• As shown above, hybrid vehicle market share in Colorado increased from 7.6% in the first half of last year to 9.1% this year. And 100% of hybrids were sold by franchised dealerships.

• The graph on the left shows new vehicle registrations for Hybrids, BEVs, and PHEVs broken down by type of selling dealership. Franchised dealerships accounted for more than 73% of combined sales for all three alternative powertrain types.

• Franchised dealership share of the BEV-only market decreased slightly to 40.5% in the first half of this year.

Data sourced from Experian Automotive.

The table shows new retail light vehicle (car and light truck) registrations in the Colorado market. Figures are shown for the 2nd Quarters of ‘22 and ‘23, and year to date totals thru June. The top ten ranked brands in each change category are shaded yellow.

The graph below provides a comparative evaluation of brand sales performance in the Colorado market. It shows the percent change in registrations during the first six months of this year versus year-earlier for each brand, organized by category (i.e., Domestic, European, and Asian). Although supply chain issues are easing, results for some brands have been impacted by restricted inventories during the past 18 months.

Data sourced from Experian Automotive.

Domestic

Largest percent increases in first half 2023:

Buick and Tesla

European Brands

Largest percent increases in first half 2023: Land Rover and Audi

Asian Brands

Largest percent increases in first half 2023:

Mazda and Infiniti

The graph below provides an indicator of brands that are popular in Colorado (relative to the National standard), and those that are not. Here’s how it works: For the top 30 selling brands, each brand’s share of the U.S. market is multiplied by retail registrations in the state during the first six months of this year. This yields a “target”

for the state market. Target registrations are subtracted from actual registrations to derive the measurement of sales performance.

Brands at the top of the graph (i.e., Subaru, Ford, Toyota, and Mazda) are relatively strong sellers in the state, with actual reg-

istrations exceeding calculated targets by large margins. For instance, Subaru registrations exceeded the target by 4,350 units.

Colorado Retail Market Performance based on registrations during YTD 2023 thru June

Actual registrations minus target (state industry registrations times U.S. market share)

Subaru, 4350

Infiniti, -62

Lincoln, -78

Genesis, -126

Lexus, -194

BMW, -249

Mitsubishi, -310

Buick, -316

Dodge, -393

Acura, -414

Mercedes, -433

Cadillac, -460

Hyundai, -714

Nissan, -963

Ford, 1624

Toyota, 1546

Mazda, 1045

Ram, 694

Rivian, 576

Audi, 506

Volkswagen, 469

Jeep, 197

Volvo, 184

Tesla, 129

Kia, 125

GMC, 88

Porsche, 26

Land Rover, 18

Honda, -2993

Chevrolet, -3695

Actual registrations minus target (state industry registrations times U.S. market share)

8,000

The two graphs below show brand market share for non-luxury and luxury brands during the first six months of 2018 (light blue dot) and 2023 (dark blue dot). Brands are positioned from left to right based on market share in 2023. Toyota was the best-selling non-luxury brand in the state during the first six months of this year (17.2%), up slightly from 2018. Tesla had big gains in the luxury segment, with market share increasing from just 4.8% in 2018 to 27.8% this year.

Kia share of the state nonluxury market increased from 2.6% in the first half of 2018 to 7.2% this year

Data sourced from Experian Automotive.

MODEL RANKINGS

The table below shows the top five selling models during the first six months of 2023 in 20 segments. In addition to unit registrations, it also shows each model’s market share in its respective segment.

The Colorado used vehicle market declined 6.1% during the first six months of this year versus a year earlier, compared to the less than 1% drop in new vehicle registrations.

As shown on the graph to the left, the three year old or newer market held up relatively well in the first half of this year. Used registrations of three year old or newer vehicles increased 1.1%. The 4 to 6 year old market declined 8.9% and the 7 to 10 year old market fell 3.9%.

Top five selling brands in the state market during the first six months of 2023 were Ford, Toyota, Chevrolet, Subaru, and Jeep. Ford F-Series, Ram Pickup, Chevrolet Silverado, Toyota RAV4, and Subaru Outback were the top five selling models. Rankings are for 8 year old or newer vehicles only.

USED VEHICLE BRAND REGISTRATIONS

Brand Market Share for Top 15 Selling Brands, by Vehicle Age (YTD ‘23 thru June)

Ford

% Change in Registrations

thru June vs. YTD ‘22

yrs. old or newer

to 8 yrs. old

We work with you to create a menu of F&I options to help protect your customers' vehicles and their budget. Because even if you’re selling your hundredth car, there’s nothing like giving someone the joy of their first car. We’re all better off with an ally.

ally.com/dealer