Otago Property Market Review and Outlook

QUEENSTOWN, WĀNAKA, DUNEDIN & CENTRAL OTAGO

Introduction

QUEENSTOWN

Property Market Overview

Tourism Market

Residential Market

Commercial Market

Industrial Market

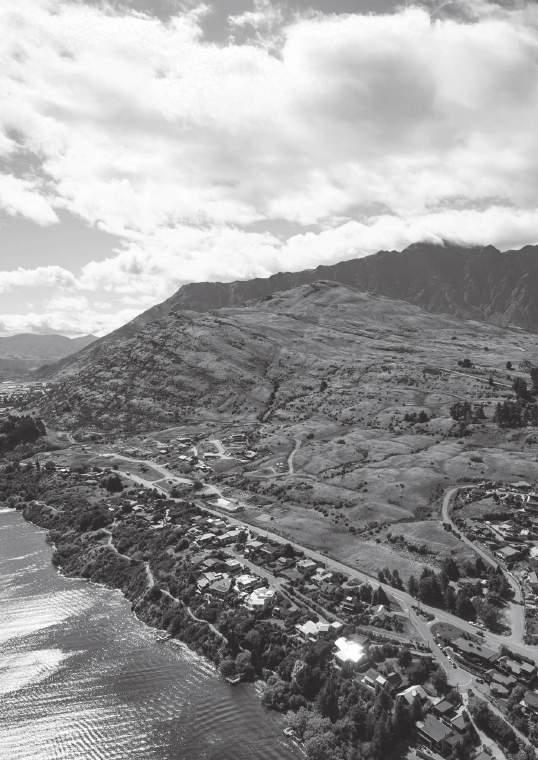

WĀNAKA

Residential Market

Commercial Market

Industrial Market

CENTRAL OTAGO

Cromwell Commercial & Industrial Markets

Lifestyle, Horticulture & Viticulture Markets

DUNEDIN

Residential Market

Commercial Market

Industrial Market

COLLIERS OTAGO

Disclaimer: Whilst all care has been taken to provide reasonably accurate information within this report, Colliers Otago cannot

the validity of all data and information utilised in preparing this research. Accordingly, Otago Valuations Limited (t/a Colliers) do not make any representation or warranty, expressed or implied, as to the accuracy or completeness of the content contained herein and no legal liability is to be assumed or implied with respect thereto. © All content is Copyright Otago Valuations Limited and may not be reproduced without express written permission.

Welcome to Colliers’ 2025-2026 Otago Property Market Review & Outlook -

our annual overview of the key factors affecting the property market across the region.

The cautiously optimistic sentiment that was emerging a year ago has become more widely established across market sectors in Otago and nationwide in 2025. Interest rate cuts are beginning to contribute to renewed buyer enquiry for investment property. The property market is showing more stability and resilience than in mid-2024 and there is more certainty around its expected recovery, now that we are past the cyclical low point and interest rates are on the decline.

However, global uncertainty around trade and geopolitical tensions is now considered the biggest threat to the ongoing market recovery, with a slowdown in Asia-Pacific regional economic growth expected. Increased market uncertainty could also prompt investors to pause their decision making until greater clarity emerges.

While investor confidence is returning as interest rates make bank deposits less attractive, buyers are still very value conscious and focused on asset quality. This, coupled with vendor reluctance to meet the market in some cases, is keeping transaction volumes relatively low. However, in high-demand sectors, including the firsthome market and lower-value industrial property, some surprisingly strong sale values have been achieved in recent months.

The increased accessibility of bank lending is a further indicator of renewed confidence and expected market growth. This has prompted some development activity to come back online, with developers of small to mid-sized projects becoming more active in 2025.

The ongoing tourism recovery is positive for local businesses and provides a strong long-term economic driver across the region. However, the high cost of living and housing affordability will continue to challenge household budgets. This will continue to be a drag on the property market, until sufficient wage growth occurs and interest rate cuts begin to have a meaningful impact on buyer demand.

PROPERTY VALUE AND OFFICIAL CASH RATE (OCR) CORRELATION

As of July 2025, New Zealand’s Official Cash Rate (OCR) stands at 3.25%, following a series of rate cuts by the Reserve Bank of New Zealand (RBNZ) in response to subdued economic growth and easing inflation pressures. Looking ahead, most major banks and economic analysts forecast that the OCR will continue to decline over the remainder of 2025, with projections generally ranging between 2.5% and 3.0% by year-end. These forecasts are based on expectations that inflation will remain within the RBNZ’s target range of 1–3%, with only a temporary uptick due to higher electricity and food prices. Overall, the RBNZ is expected to maintain an accommodative stance through 2025, with further OCR reductions possible if global economic risks persist.

Queenstown Property Market Overview

Queenstown’s GDP and population continue to increase at above average rates compared with the rest of New Zealand.

Alongside this growth are ongoing frustrations with traffic and roadworks, sharp increases in local body rates and well-publicised debate around the inability of local infrastructure to keep pace with development. The growth of satellite/outlying towns and suburbs such as Cromwell, Kingston and Homestead Bay can only be fully successful if adequate transport infrastructure is developed in tandem when planning the subdivisions.

The tourism sector has demonstrated a full recovery, as evidenced by domestic passenger volumes at Queenstown Airport approaching pre-Covid levels. Furthermore, international passenger numbers for the year 2024 surpassed those of 2019 by 26.4%.

The trophy value of property ownership in Queenstown also helps create a ‘bubble’ effect for the local market that is somewhat less affected by international factors than other centres around the country. Constrained supply of land in the residential and commercial/industrial property sectors is another factor supporting long-term value growth in the property market, with a supply and demand imbalance across most asset classes expected to continue to varying degrees.

FAST-TRACK APPROVALS ACT

The government’s Fast-Track Approvals Act, which came into force on 23 December 2024, aims to streamline consent approvals for projects of regional significance. Several local projects have been approved to put forward substantive applications; however, the timeframes for this are unknown. Projects approved for fast-track to date include:

• Homestead Bay: 2,800 residential units neighbouring Jack’s Point

• Expansion of The Remarkables Ski Area into Doolans Basin

• Silver Creek: Over 1,000 homes on a 32-hectare site at the top of Queenstown Hill

• Cardrona Valley Ski Development: On-mountain visitor and worker accommodation and gondola to the Cardrona and Soho ski areas from Cardrona Valley

• Coronet Village: A new village at the base of Coronet Peak with 780 houses, roading and wastewater infrastructure, mountain biking, school and a gondola accessing the ski area

• Gibbston Village: 900 houses, a commercial area and a primary school

• Flint’s Park urban intensification: 500 houses on the north side of Ladies Mile, a neighbourhood mixed-use centre and a cableway to access residential development on Slope Hill

• The Hills Resort: A golf resort, 18-hole championship course, visitor accommodation and residential development

• Bendigo-Ophir Gold: Gold mining on Bendigo and Ardgour Stations

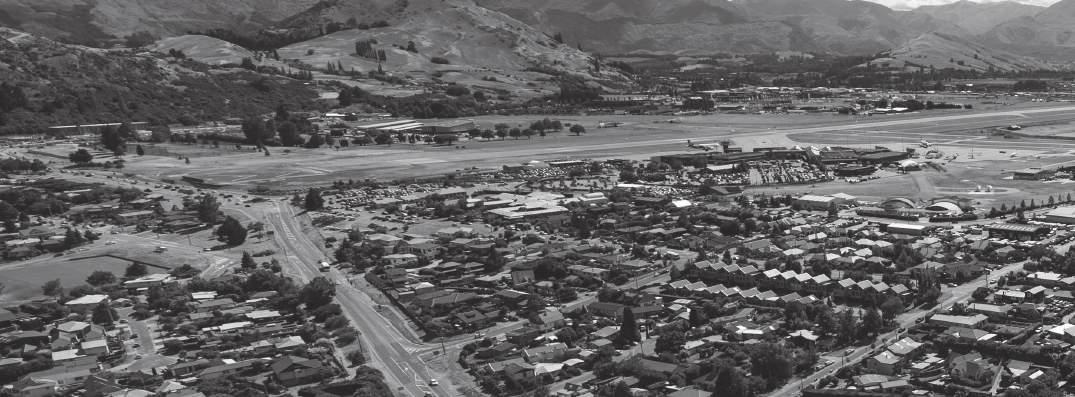

Queenstown Tourism Market

The Queenstown tourism market in 2025 is characterised by strong visitor demand and significant economic contribution, as evidenced by recent airport and employment statistics.

To the year ended May 2025, Queenstown Airport recorded a 10.3% year-on-year increase in international passenger numbers, while domestic passenger movements remained stable during the same period. This growth in international arrivals reflects sustained strong demand, with total passenger throughput reaching 1,084,768, comprising 714,461 domestic and 370,307 international passengers. The airport’s robust performance continues to be a critical driver of Queenstown’s tourism sector, which supports 33.5% of local employment - significantly higher than the national average of 6.5%.

Accommodation supply is under pressure, with hotel room shortages projected over peak periods and increased competition for private housing between tourists and local workers.

Queenstown is implementing a regenerative tourism strategy targeting carbon zero status by 2030 and prioritizing high-value, longer-staying visitors to address sustainability challenges. The plan proposes rapid decarbonisation as a catalyst for innovation and has had strong buy-in from tourism operators in the region, with plans afoot for the world’s first electric jet boats, conversion of the TSS Earnslaw to hydrogen, electric chairlifts for the ski fields and ambitious gondola plans (noted adjacent). Overall, the tourism sector continues to drive economic activity, but future growth is contingent on infrastructure investment and sustainable planning.

GONDOLA DEVELOPMENT

Queenstown is set for significant proposed gondola development, with multiple projects advancing that aim to enhance both tourism and urban transport.

Skyline Queenstown recently completed a major upgrade of its iconic Bob’s Peak gondola, replacing the original four-seat cabins with new 10-seat cabins, to accommodate anticipated growth in visitor numbers.

Two new urban gondola projects are in planning and early development phases.

The first project, backed by Southern Infrastructure and Doppelmayr New Zealand, proposes a cable car system connecting downtown Queenstown with Frankton and Queenstown Airport, capable of transporting up to 3,000 passengers per hour per direction. This fully electric, zero-emissions system is targeting a late 2028 opening for its first stage, with construction potentially starting in 2027.

The second project, led by Kiwi company Whoosh in partnership with Remarkables Park, is expected to begin construction in the second half of 2025. The Whoosh “Frankton Connector” will initially link the Remarkables Market to the Kawarau River, with plans to extend the loop around retail areas and eventually up to The Remarkables Ski Field, Shotover Country and Lake Hayes Estate. The estimated cost is $5m per kilometre, with the initial phase projected to cost $10–20m.

Both the Doppelmayr and Whoosh projects are privately funded, aiming to address Queenstown’s transport challenges and support sustainable urban growth.

Queenstown Residential Market

Initial optimism across many developed property markets throughout the country at the start of 2025 waned somewhat due to the global economic market uncertainty caused by ongoing conflicts in the Middle East and broader geopolitical tensions. As an international destination and resort town, Queenstown is not exempt from this sentiment, with the uncertainty causing many buyers to adopt a ‘’wait and see’’ approach before committing to a sale or purchase. This buyers’ market has remained in place through the middle of 2025. Buyers are aware that they have the negotiating advantage and are taking longer to commit, assessing the multitude of options, and displaying high price sensitivity. Despite this, the Queenstown residential market maintains a gentle upward momentum with a gradual, more stable period of value growth occurring.

There are several conflicting forces at play affecting the residential market. These include:

• reduced interest rates helping affordability,

• an ongoing surplus of listings,

• international perception as a property safe haven,

• continued restricted household spending as wages fail to keep pace with inflation, and

• an undercurrent of uncertainty stalling property decisions.

Queenstown’s economic growth has prompted higher than the national average increases in house values for the district and more building consents issued. Construction cost growth stabilised in 2024 and shows modest growth in 2025. A shortage of titled, entrylevel land prevails in Queenstown, which has resulted in a sharp increase in land values since 2024. In contrast to this, there remains a surplus of high value lifestyle land for sale, with buyers spoilt for choice at this end of the market.

In 2025, residential property listings in Queenstown have increased significantly compared with 2024. First-home buyers continue to be the dominant market segment, with properties under $1.5m in strong demand. Consequently, entry-level suburbs like Fernhill, Sunshine Bay, Hanley’s Farm, Shotover Country and Frankton have continued to see good demand for listings. Numerous townhouse developments offered for sale ‘off plans’ continue to absorb much of the sub-$1m first-home buyer market. Units in some multi-unit developments are being offered on smaller individual freehold titles, as opposed to strata or unit titles with body corporates in place. Given the freehold ownership structure, buyers should consider insurance ramifications and a longer-term maintenance plan of common areas.

SECTION MARKET

A shortage of titled, flat, entry-level land in Queenstown has resulted in a sharp increase in values in this part of the market since 2024. The final Hanley’s Farm sections were sold in February 2025 with prices per square metre ranging from $1,000 for larger sites to $1,400 for smaller sites. Subsequently, sites in the neighbouring Park Ridge subdivision were first released in February 2025 with sale prices from $1,394 to $1,566 per square metre for a 371-square-metre site. In contrast, Jack’s Point has arguably superior value for money at present with larger, higher value sites selling for between $1,000 and $1,300 per square metre, albeit at higher quantum levels.

As land in Queenstown becomes increasingly scarce, subdivisions with more challenging topography are being developed. Steeper, more elevated sites that usually require costlier earthworks are being sold in subdivisions such as Silver Creek and Remarkables View. The average section size has also reduced substantially from 700 square metres in the early 2000s to 350 square metres in 2025.

Several subdivisions are being considered under the Fast-Track Approvals Act which came into force in December 2024. If these proceed, a renewed influx of level sites should come online in the next 18-24 months. Much of this land is in Te Tapuae Southern Corridor, an area south of the Kawarau River, with 2,800 sites planned by RCL, the developers of Hanley’s Farm and Homestead Bay. Also being considered are 501 sites at Flints Park on Ladies Mile and 1,050 homes at Silver Creek on Queenstown Hill. However, difficulties with infrastructure development may delay some of these projects.

Further afield, sections in Kingston Village have sold out at each release and are priced from $299,000.

LIFESTYLE MARKET

2025 has seen a slight upswing in activity levels for lifestyle property following a quiet 2024. There remains a higher than average number of lifestyle properties for sale, particularly lifestyle sections. Buyers have considerable choice in the top end of the market and many properties are sitting on the market for extended periods of time. However, lifestyle properties have seen continued steady value growth and there are healthy enquiry levels, including from Australian buyers. Several Queenstown addresses are among the country’s highest value streets, with Arrowtown-Lake Hayes Road being the sixth most expensive in the country.

TOWNHOUSE MARKET

A substantial number of off-plan townhouse developments are available in Queenstown, offering buyers considerable choice in this segment of the market. Many of these townhouse developments offer visitor accommodation consent in some form.

Current developments include:

• Five Mile Villas, Frankton: 226 freestanding, two-bedroom, one-bathroom dwellings on freehold titles with a floor area of 63 square metres and a site area of 67 square metres. Asking price from $869,000.

• Kawarau Villas, Frankton: 39 terraced townhouses for sale in stage one, providing two and three-bedroom options with 86 square metres of floor area. Two-bedroom townhouses are priced from $850,000.

• Waipuna Rise, Frankton: Two and three-bedroom apartments as well as three and four-bedroom terraced townhouses. Two-bedroom dwellings are priced from $845,000.

• The Crest Chalets, Frankton: 100 one-bedroom freehold chalets and cabins priced from $669,000.

• Lakehouse Villas, Frankton Road: 63 freehold, two, three and four-bedroom homes. Construction has yet to begin and prices range from $699,000 to $2,350,000.

• Te Pā Tāhuna, Central Queenstown: Construction is underway on Stage 2, which provides 66 one and twobedroom apartments.

LADIES MILE DEVELOPMENT

The rezoning of the Te Pūtahi Ladies Mile land on the north side of Frankton-Ladies Mile Highway provides capacity for up to 2,400 new homes on one of the last remaining tracts of land suitable for residential development in the Whakatipu Basin. The master plan includes a wide range of residential development densities, a town centre, supermarket, primary school, high school and a sports and recreation centre.

GOLDEN VISA

Formerly known as the Active Investor Plus (AIP) visa, the ‘golden visa’ has been updated, effective 1 April 2025, to attract more investment and offer greater flexibility to investors seeking residency. Since the 1 April changes, and as at 23 June 2025, Immigration New Zealand reportedly received nearly 200 applications for the ‘golden visa’. This is considerably more than the 116 applications received over more than two and a half years under the preceding settings. The current coalition government is also looking at easing its ban on foreigners purchasing residential property in New Zealand. Anecdotally, there has been a recent surge in interest in purchasing property in New Zealand, from Americans in particular.

VACANT HOLIDAY HOMES

Census data on the number of unoccupied dwellings gives an indication of the very high proportion of residential properties used as holiday homes in the Queenstown Lakes District, compared with New Zealand as a whole. 39.6% of homes in the Queenstown Lakes District were unoccupied on census night (Tuesday 7 March) in 2023. This compares with 12.3% of homes unoccupied in New Zealand on the same night.

TRENDS & PROJECTIONS

Continued slow but steady value growth

Buyers’ market continuing for some time until the overhang of supply clears

Shortage of entry-level land for construction of new properties prompting a shift toward renovation of older properties on good sized sites

57 DRYSDALE ROAD, HANLEY’S FARM

A 2021-constructed, single-level, three-bedroom, two-bathroom modern dwelling with an attached, one-bedroom, one-bathroom, self-contained flat located to the rear. The 197 sqm dwelling is located on a 448 sqm section. The main house includes an open plan kitchen, dining, and living area which opens out onto a patio and rear lawn area. Sold May 2021

$1,165,000

November 2024 $1,568,888

RENTAL MARKET

The rental property market in Queenstown has experienced some softening towards the end of 2024 and into 2025. The median vacancy period has extended to 21 days and demand is subdued. While the winter season typically brings some increase in prospective tenant numbers, tourism and ski operators’ purchases of former backpackers’ hostels in recent years has taken some of the heat off this seasonal spike. This shift has contributed to a more balanced rental market during peak periods.

Additionally, a significant number of home-and-income properties in the later stages of the Hanley’s Farm subdivision have entered the rental market, increasing supply and contributing to the current market conditions. The anticipated slowdown in residential construction, driven by infrastructure constraints, is likely to help alleviate the current oversupply in the rental market.

Continuing increase in townhouse construction and higher density projects due to land supply shortage

Affordability challenges due to large increases in rates and insurance, making the market less appealing to investors

Further subdivision of larger sites with older dwellings due to land demand expected – this trend is already happening in suburbs such as Arrowtown, Lake Hayes Estate and central Queenstown

Queenstown Commercial Market

QUEENSTOWN CBD COMMERCIAL MARKET

Demand for town centre retail space remains strong. Recent vacancies have seen take up from new tenants with the international and chain retail stores still showing interest, particularly from the premium fashion and concept store retail brands. Accordingly, some new entrants to Queenstown have paid higher rents than previous tenants, particularly in the recently upgraded Beach Street corridor accessing the lakefront. Investor appetite for prime CBD assets is high, and retail vacancies have returned to minimal levels. Town centre properties have historically changed hands at very low yields (<4.5%). This is sharper than in most other main centres and reflects the premium placed on central Queenstown property and the growth it has consistently experienced over time. There have been no investment sales so far in 2025 in the CBD and none in the +$10m price bracket since mid-2022.

In contrast, the CBD office market has softened since 2021, with increased vacancy emerging as a number of the larger occupiers have moved or transitioned to Frankton, which offers newer buildings and now has a mature retail and hospitality market to support occupiers. This together with traffic and accessibility issues to/from the town centre has made Frankton an attractive alternative. The Queenstown Lakes District Council continues to deliberate over whether to host their staff in Frankton or Queenstown, which could have wide ranging ramifications for either location in either scenario.

Town centre hospitality operators are increasingly reliant on a tourist customer base. This trend, along with increasing rents, is resulting in some independent/locally run hospitality businesses selling to larger operators who can achieve economies of scale on expense line items and staff.

QUEENSTOWN CBD COMMERCIAL MARKET KEY INDICATORS

Source: Colliers Otago

CARPARKING WOES

The well-publicised shortage of carparking in central Queenstown is a source of frustration for business, locals, workers and visitors. Despite council and government efforts to invest in improvements to walking, cycling and bus networks, The Queenstown Lakes District Council has acknowledged the high value placed on adequate parking among locals and visitors in its Draft Parking Strategy Report. The geographically-dispersed nature of large subdivisions

QUEENSTOWN CBD TRENDS & PROJECTIONS

Prime CBD retail assets remain in high demand with no recent sales to benchmark any movement in yields

Despite a softening office market, the CBD still remains a strong part of the retail, hospitality and tourism sector for the region with hotel occupancy and room rates continuing to strengthen

around central Queenstown means locals rely on car ownership, resulting in congestion and very high demand for the limited parking that is currently provided. While the Frankton commercial centre appears to be relatively well served by customer parking from a retail perspective, the limited availability and/or affordability of staff parking in and around Frankton is becoming a greater issue for many businesses operating there.

Prime and secondary retail location rents remaining divided until consumer spending recovers

Office space dynamics hinged on large occupier demand in the town centre – elevated vacancies could persist with softer rental in Queenstown CBD compared to Frankton/Arrowtown, which may begin to support a change in use for that vacant space

FRANKTON COMMERCIAL MARKET

Frankton remains the preferred office and retail precinct for large format and chain retail stores, with high occupancy levels and a relatively stable market that is well supported by locals and regional visitors. Queenstown’s suburban expansion and the growth of Cromwell and Kingston have contributed to the appeal of the Frankton commercial centre, with its location and relative ease of access and parking being key attractions for occupiers, staff and customers. Frankton’s newer buildings and lower operating expenses for tenants than those of the town centre are also contributing to the strong demand for office and retail space.

FRANKTON COMMERCIAL MARKET INDICATORS

Source: Colliers Otago

ARROWTOWN

As more and more international retailers open in Queenstown, the ripple effect is now reaching Arrowtown’s commercial core, which is centred around Buckingham Street and Ramshaw Lane. The recent completion of two substantial developments on Arrow Lane has extended the boundaries of Arrowtown’s commercial and hospitality precinct. Rents in Arrowtown’s town centre have continued to show a

FRANKTON TRENDS & PROJECTIONS

steady increase over the past 12 months (to mid-2025), with further increases expected in the short term. The question now is whether Arrowtown’s commercial centre can retain its unique character and charm, or whether generic commercial expansion and retail chains will overtake locally owned businesses.

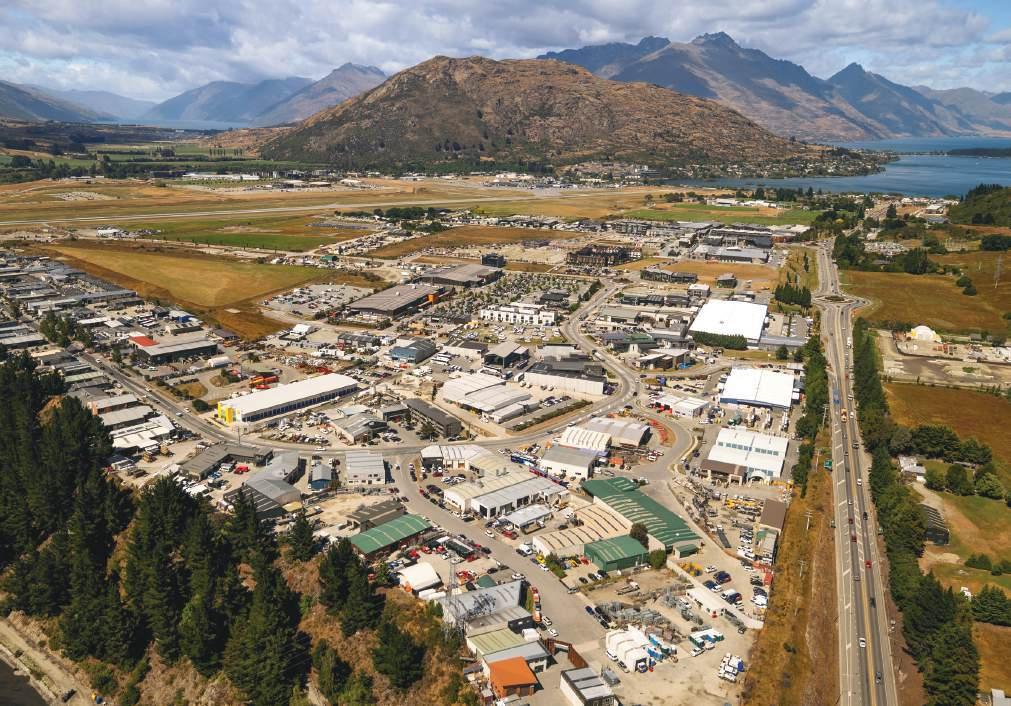

Queenstown Industrial Market

Industrial property across Queenstown has shown its resilience, in contrast to trends in many other centres around New Zealand.

The limited supply of industrial premises available for lease in Queenstown is pushing rents up as tenants compete for space. This scarcity means that the Frankton industrial market is at virtually zero vacancy and likely to remain so for the immediate future. Rents are reaching very high levels under strong demand in comparison with similar industrial areas throughout the country.

A number of industrial tenants, owner-occupiers and investors are looking for a foothold in Frankton but are facing limited availability of space to lease or purchase. Current market dynamics are appealing to a growth-focused investor pool, who are familiar with Queenstown’s regional peculiarities.

As well as the shortage of existing facilities, a lack of available industrial land is restricting further development and this situation is unlikely to be alleviated in the immediate future. The upcoming Coneburn industrial area may provide some relief, although sites will not be available for some time. The release of land to the south side of Queenstown Airport will accommodate some niche users permitted within the Remarkables Park Zone.

TRENDS & PROJECTIONS

A series of land transactions in 2024 and 2025 demonstrate the value appreciation that has continued in the Frankton industrial sector, despite the challenging development environment. Yields have generally been maintained in a relatively tight range of around 4.5% to 5.0% over the medium term, despite a less favourable national economic backdrop. The relatively small size of buildings in Frankton, compared with those of industrial precincts in larger centres, is keeping transactions in the sub-$5m bracket and within reach of locally-based, high-net-worth investors. The market is generally untested above this level, where trends seen on a national context may prevail and an alternate buyer pool may be more active.

The Gorge Road corridor remains a less preferred destination for industrial occupiers and investors. Businesses which benefit from close proximity to the Queenstown town centre generally favour premises in this precinct. Increasing congestion along Frankton Road is also a deterrent to occupiers who have the choice of locating elsewhere. Market conditions in this sub-sector remain relatively stable with occupancy levels high. Investor demand is lower due to the older building stock, which requires a higher degree of management, and the perception of superior rental growth prospects in Frankton.

18 SUTHERLAND LANE, FRANKTON

Modern, corner-positioned, mixed-use building of 203 sqm, located on a 412 sqm section with frontage to Glenda Drive and Sutherland Lane.

Sold June 2018 $1,180,000 Sold March 2025 $1,600,000

Growth 4.63%

Vacancy levels to remain low with upward pressure on industrial rents persisting in Frankton - tenants may look to relocate out of the precinct if able to do so

Perception of market rent ceilings may jump higher in the event of a limited number of overly strong leasing deals for vacant premises being negotiated

FRANKTON INDUSTRIAL MARKET KEY INDICATORS

Source: Colliers Otago

*analysed apportionment excl. yard areas/parking

Yields to persist at low levels, which have been rarely achieved in most other centres since the 2021/2022 market peak

Continued lack of vacant industrial land supply - despite large areas of undeveloped land held by a small number of owners that are not releasing it for development

The further release of land on the south side of Queenstown Airport will be able to accommodate only a handful of user groups due to restrictive covenants and zoning

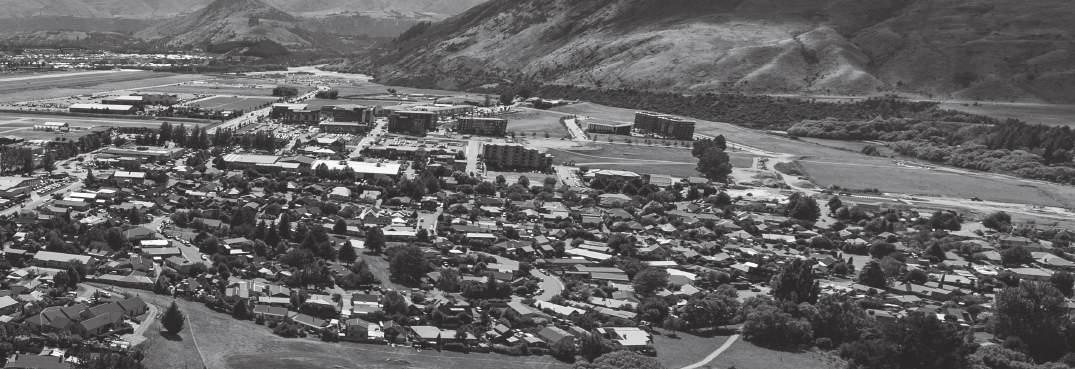

Wānaka Residential Market

The rebound in the Wānaka residential property market that was expected to take hold in 2025 has not eventuated yet, with market uncertainty holding values fairly static.

Despite this, the Wānaka residential market has shown good stability and resilience compared with other centres in New Zealand during the challenging conditions of the past few years. However, the number of listings on the market has been persistently high in 2024 and the first half of 2025. This elevated listing volume is giving buyers plenty of choice, lessening competitive tension and time pressure on purchasing decisions.

Online enquiry levels appear to be increasing in 2025, but the buyers’ market dynamic persists. There is also a gap between vendors’ and purchasers’ price expectations in many cases, which is contributing to properties remaining on the market for extended periods. We are seeing owners that are under no financial pressure to sell holding firm on price, hopeful that conditions will improve or a purchaser is identified who sees value at their level.

SECTION MARKET

Section sale volumes have increased in the past 18 months; however, this is primarily due to issue of titles in the Northlake, Orchard Park, Peak View, Pembroke Terrace and Studholme Rise developments. Some buyers, having signed up for sections two to three years ago, have now found themselves financially unable to build on their lots. A number of these sections are now being put back on the market before or shortly after title issue at similar prices to their initial release. Current supply volumes mean that people on-selling sections are not usually making a significant value gain (and in some cases are realising a loss). Less than 20% of the total section sales in Wānaka in 2024 were for existing sites, as opposed to sections in new subdivisions requiring title issue.

ENTRY-LEVEL MARKET

The first-home/entry-level price bracket is the most active part of the market in terms of transactional activity. The increased activity and buyer demand in this price bracket in Wānaka and Lake Hāwea is an early sign of interest rate reductions taking hold. There is also a good level of stock availability and more choice for buyers at this end of the market. For example, there are a number of house and land packages currently being advertised for sale between $750,000 and $1m for two to threebedroom homes in the 2,500-lot Longview subdivision at Lake Hāwea. Transactions of larger, four-bedroom homes in other recent subdivisions in Lake Hāwea have occurred between $1.5 to $1.6m in 2025. In Wānaka, particularly in the Northlake subdivision, entry-level transactions have been occurring between $980,000 to $1.25m.

MID-TO-HIGH VALUE MARKET

The mid-range value bracket (around $2m to $4m) has been met with lower buyer demand, resulting in less activity. This has in part been due to less favourable market conditions in other locations creating more caution and reluctance to purchase holiday/retirement homes in Wānaka at present. It is also partly due to owners already in the market being unable to trade up, instead choosing to stay where they are for the time being. Although these sectors have been soft, they are stable. Since the beginning of 2025, there have been six to seven properties per month changing hands at over $3m, which includes a mix of premium sections, high-end homes and lifestyle properties.

HIGH-END/LUXURY PROPERTY MARKET

Wānaka’s prime lakefront and superior lifestyle properties remain highly desirable, although purchasers in this value range are usually very discerning and also willing to look at other locations around the country. As there is only a limited number of luxury properties on the market at any one time in Wānaka and the Upper Clutha region, flagship properties have been known to attract a premium if a purchaser is highly motivated to secure the property.

6 PETALITE LANE, WĀNAKA

An architecturally designed, 322 sqm home built with passive home principles, featuring high-end finishes and features. Three bedrooms, three bathrooms (two ensuites), an open plan kitchen, dining and living area, plus media room. Separate double garage with an attached office, toilet and drying room. Features outdoor living spaces and attractive grounds development. Set on an elevated, 1,502 sqm site with outstanding lake and mountain views.

Homes in major subdivisions such as Longview (Lake Hāwea) and Northlake remain popular among entrylevel/first-home buyers - with good stock availability and accessible pricing resulting in more transactions than in higher-value brackets

RENTAL MARKET

The supply of residential rentals in Wānaka increased in 2024, following an extreme rental property shortage in previous years. Renters now have more choice and rents have stabilised in response to the increased supply. In recent years, large employers in Wānaka have either purchased or taken leases on accommodation premises to help with staff and seasonal worker accommodation. This has also contributed to the greater availability of residential rental homes.

Section sale volumes, although increasing, are expected to remain low

Wānaka Commercial Market

The small size and very tightly held nature of Wānaka’s CBD commercial market means there are few transactions.

Those that do occur reflect very low yields compared with the rest of the country and are on par with the Queenstown town centre, although generally at lower value quantums. The market is largely held by individual investors and family trusts.

Many CBD buildings are becoming dated and some of the sites are under-utilised. However, current build costs mean rents would need to increase to make redevelopment projects feasible. While rents have generally increased over the past year, there is limited potential for any meaningful increases to occur in the foreseeable future.

Construction and leasing activity continues in Three Parks, with this market yet to mature. However, growth may slow in response to subdued tenant demand and rents reaching affordability ceilings, particularly in retail. Rents on office premises in Three Parks are at similar levels to the town centre. Retail rents have been lower, but are increasing to meet construction feasibility requirements.

Current development plans in Three Parks include a town square with a cinema, food and beverage tenants, and retail. A Woolworths supermarket is also planned. A proposed private hospital and healthcare precinct at Three Parks is currently progressing through the consenting process. The proposed five-level hospital would have a footprint of 6,300 square metres and be surrounded by a purposebuilt healthcare precinct.

WĀNAKA COMMERCIAL MARKET KEY INDICATORS

Source: Colliers Otago

COMMERCIAL TRENDS & PROJECTIONS

45 ARDMORE STREET, WĀNAKA

A single-level building, built in approximately 1965, that was originally the Wānaka Fire Station. Extensively renovated and earthquake strengthened in 2018 for the current national tenant. The building has a gross floor area of 237 sqm, being situated on a 511 sqm freehold site on the southern side of Ardmore Street. Property sold at auction.

Wānaka Industrial Market

The industrial market in Wānaka is stable, with good demand from investors who are willing to enter the market if pricing is right.

Vacancy remains very low and limited new development is expected, owing to the restricted supply of new land. Most new development land in Enterprise Drive, off Ballantyne Road, is spoken for. However, title issues in the next stage of Three Parks in 2025 could ease the situation somewhat.

In line with national trends, investors still prefer modern, highquality industrial properties with long leases in place, but stock availability is limited as assets are tightly held. Rental growth has slowed as tenants continue to face challenging operating conditions and tighten their rental budgets.

As is the case in other sectors and markets nationwide, construction costs and rent levels continue to challenge the viability of development projects in the Wānaka industrial market.

WĀNAKA INDUSTRIAL MARKET KEY INDICATORS

Three Parks Showroom

Source: Colliers Otago

17 ENTERPRISE DRIVE, WĀNAKA

A modern, 2021-constructed, single-level industrial building comprising two separate tenancies, each with dedicated warehouse space, associated office/amenities, and carparking. The property sold fully leased with an international and a local tenant in place. The building has a total gross floor area of 666 sqm and is positioned on a 1,127 sqm freehold site on Enterprise Drive, within the Ballantyne Ridge Industrial Park. The transaction was completed via a Price by Negotiation campaign.

Cromwell Commercial & Industrial Markets

OFFICE / RETAIL MARKET

The retail and office sectors in Cromwell have remained subdued. Both tenants and owner-occupiers are facing increased council rates and insurance costs, while challenging trading conditions persist across many retail and service industries. Current construction costs indicate that office rents would need to rise to a base rate of at least $350 per square metre for new office developments to be financially viable. However, prevailing office rents remain well below this threshold. Combined with stringent financing requirements and high development costs, this has limited the feasibility of new office projects. In the absence of new office construction, Cromwell has continued to convert retail space for office use in the short term, which has further diluted the retail offering available to local residents. Should population growth continue at its recent pace, it is anticipated that the town centre will either reverse this trend or halt the conversion of retail to office space within the next three to five years.

The council’s substantial investment in the new Memorial Hall and Events Centre is positive for the town in general; however, with the facility being located on the riverfront, on the opposite side of town from The Mall, it will have limited impact on generating more favourable trading for current retailers. The nearby development of Wooing Tree Estate continues to see a steady stream of new houses close to the town centre, which does offer the potential for increased foot traffic in The Mall.

INDUSTRIAL MARKET

A number of high value transactions in late 2024 and early 2025 in the Cromwell industrial precinct indicate the increasing regional significance and growing investor appeal of industrial property in the town. Cromwell industrial property now presents a value proposition that is attractive enough to catch the attention of investors who were previously focused on Queenstown and Wānaka. Modern, high-quality buildings with long-term lease agreements are in highest demand, in line with national trends, and yields have sharpened for these assets. Older stock is lagging behind, resulting in a two-tier market. Yields from recent sales have been as low as 5% for new properties with long leases and good tenant covenants.

TRENDS & PROJECTIONS

High quality assets with strong tenancy fundamentals are offering investors alternative options to Frankton, Queenstown

Land values remaining generally stable over the medium term

Vacancy rates for industrial buildings to remain low, with construction costs staying high

Relative affordability of both land and rents appealing to owner-occupiers and tenants compared with Queenstown and Wānaka

The nationally significant gold discovery at nearby Bendigo could spur further local economic growth

31 MCNULTY ROAD, CROMWELL

A contemporary, purpose-built industrial facility of some 1,064 sqm, located on a 5,618 sqm section with McNulty Road frontage and exposure.

Sold July 2017

$1,945,000 Sold November 2024 $3,850,000

Industrial land values are relatively stable, with a long-term supply pipeline of industrial land likely to meet foreseeable upcoming demand. Persistently high development costs and a relatively limited pool of potential tenants continues to result in moderate growth, as opposed to the boom-and-bust cycles of larger property markets. With limited speculative development occurring, enquiry for large industrial premises development usually results in designbuild outcomes for those already holding land. Occupancy levels remain high, with the town acting as a regional hub. Cromwell is also an attractive alternative for Queenstown tenants who are no longer willing or able to pay the high rents required for facilities that are often of lower quality or lacking in sizeable yard space, in a congested industrial precinct.

Central Otago Lifestyle, Horticulture & Viticulture Markets

LIFESTYLE MARKET

Sales activity in the Cromwell Basin has declined slightly. From January to May 2025, there were 21 transactions of lifestyle sites between one and ten hectares, compared with 23 during the same period in 2024. At the same time, the average sale price has risen slightly from $1.54m in 2024 to $1.58m in 2025.

Interest rate cuts were expected to have a positive impact on the lifestyle sector; however, the market response has been subdued. There is significant enquiry from potential buyers, as current price levels are perceived as attractive. This has translated into longer decision-making times for buyers. Vendors are currently more willing to sell and are receptive to market pricing, resulting in a buyers’ market in the Central Otago area.

HORTICULTURE MARKET

VITICULTURE MARKET

The viticulture sector in Central Otago has been significantly impacted by several factors, including increased production costs, supply chain challenges, climate change effects and market demand fluctuations. These challenges have led to a rise in the number of vineyards being listed for sale. Enquiries have been low as buyer caution persists due to the sector’s uncertainties. Consequently, the time from initial listing to sale has extended compared to previous periods. For the year ending April 2025, there were five viticulture property sales in the Central Otago area, with the most recent sale recorded in February 2025.

The horticulture sector in Central Otago is experiencing diverse impacts across different areas. Despite economic pressures, enquiries for horticulture properties have remained relatively stable over the last 12 months. The apple market remains robust and continues to play a vital role in the region’s economy. Some orchardists, particularly summer fruit growers and owners of older orchards, are considering removing trees to sell their land as lifestyle properties. This shift is driven by rising costs, fluctuating market prices and the ongoing demand for lifestyle properties in Central Otago. Given that lifestyle properties often have higher values than some horticultural properties, this conversion is viewed as a financially attractive option among growers. Sold February 2025 $3,000,000

TRENDS & PROJECTIONS

Local tourism offering increasing with more high-end attractions such as the Scapegrace Distillery, winery cellar doors/restaurants and expanded bike trail infrastructure

Lifestyle sector has been subdued - resulting in a buyers’ market

27 MCNAB ROAD, CROMWELL

A 6.7769-hectare land holding with a cellar door and renovated, villa-style home. 4.68 hectares planted in two varieties (pinot noir and chardonnay).

Vineyard sales remaining slow due to the global oversupply of wine; however, the Central Otago region does have the potential to recover more quickly due to lifestyle appeal

Continuing trend of people moving from main centres to Central Otago for lifestyle reasons

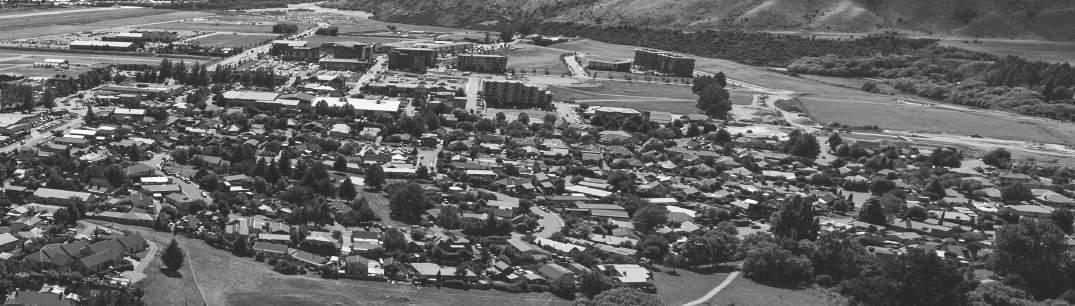

Dunedin Residential Market

Buyer activity appears to be cautiously returning to the Dunedin residential market in 2025, influenced by interest rate cuts and more stable market conditions.

However, the subdued economic climate nationally is still challenging household budgets and holding buyer confidence back in Dunedin.

While there has been some buyer demand across all sectors of the residential market in the first few months of 2025, values have remained fairly static, with dwelling median sales prices slightly up (5.3%) as of May 2025, compared with May 2024. After a quieter start to 2025, a high number of listings, particularly in the entrylevel/first-home price bracket, is being met with higher enquiry levels. Sales volumes have increased by around 10.2% for the January-May 2025 period compared with 2024. However, many properties still appear to be sitting on the market, despite good numbers being reported at open homes. The higher-value end of the market also offers buyers some choice, with most showing a general lack of urgency when making purchasing decisions.

Student investment properties have begun to change hands in increased volumes, with gross yield levels generally appearing in the high 6% to mid-7% range for well-located accommodation. There is good demand from students for flats, with the University of Otago forecasting roll growth in upcoming years; and rents are predicted to increase. Dunedin student flats are being targeted as an area of concern under government healthy homes standards, with properties being inspected and non-complying landlords spoken to by the Ministry of Business, Innovation and Employment (MBIE) ahead of the healthy homes compliance deadline on 1 July 2025.

Smaller-scale, infill townhouse developments are continuing in different locations throughout the city, although there are few larger housing developments planned or underway, owing to the shortage of suitable vacant land. The largest proposed development is Universal Developments’ planned 600-lot subdivision off Bush Road on the western edge of Mosgiel. The 38-hectare site was rezoned for residential use in 2022. While resource consent had not yet been lodged, as at mid-2025, the developers have indicated they hope to offer the first release of sections to the market in early 2026. There will likely be some increased interest for these sections given the level contour and ease of access relative to other locations around Dunedin. However, section sales in the city continue to be slow as this sector remains affected by high building and development costs. A proposed 260-unit Summerset retirement village, also in Mosgiel, has received government fast-track consent approval.

SOUTH DUNEDIN FLOOD PROTECTION

MEDIAN MARKET RENT PER WEEK

Dunedin Central - 6 months to 30 April 2025

Half of all buildings in South Dunedin, including a large residential area, as well as the South Dunedin industrial and retail precinct, are at risk of flooding. This is expected to rise to nearly 70% by 2100. South Dunedin Future, a joint Dunedin City Council and Otago Regional Council programme, has released several adaptation scenarios, ranging from construction of flood control systems to a full retreat of residential and commercial activities from the area.

PROPOSED DUNEDIN CITY COUNCIL DEVELOPMENT CONTRIBUTIONS

Source: tenancy.govt.nz

Dunedin City Council proposals to dramatically increase development levies in mid-2025 have been met with widespread criticism among property developers and the business community. Some major local businesses have raised their concerns in the media about the impact of the proposed changes on development feasibility and Dunedin’s growth. It is feared that the proposals will increase housing unaffordability if smaller developers are unable to absorb the higher costs and need to pass them on to buyers. It is also suggested that the high costs will cause developers to land bank sites instead of developing them, or close up operations in Dunedin and focus on lower-cost markets such as Christchurch. House 1-BEDROOM

TRENDS & PROJECTIONS

Buyers’ market dynamic persisting across most parts of the market

Lower-value price bracket expected to be the first market segment to recover

Values holding fairly steady, although properties are sitting on the market for longer

Buyers in the mid-value price range continuing to face affordability challenges

Dunedin Commercial Market

RETAIL MARKET

Following a flurry of new leases, store openings and tenant moves on George Street, leasing activity has levelled off in 2025, with rents and vacancy rates stable. The central city retail precinct is well placed to capture the recovery in consumer spending, with the recent council streetscape upgrade project complete and low vacancy in the core precinct. The addition of Les Mills gym and Chemist Warehouse in the Meridian Centre has continued to benefit the surrounding retailers, drawing increased pedestrian numbers. High quality investment stock in the core retail precinct is scarce and properties that do come up for sale often require substantial investment into improvements.

The large format retail market in Dunedin is stable, in line with trends nationwide. Smiths City has invested in a significant refurbishment project on Crawford Street, near several other national retailers. This central, large format retail precinct is under high tenant demand and prospective occupiers face difficulties in securing premises. Large format retail on Andersons Bay Road is also in strong demand, with Kmart the most recent opening. In contrast to other cities, such as Christchurch, where greenfield land availability permits the construction of new large format centres alongside residential development; retail space in Dunedin is limited to existing brownfield sites, which are in short supply.

DUNEDIN RETAIL MARKET KEY INDICATORS

Source: Colliers Otago

RETAIL TRENDS & PROJECTIONS

OFFICE MARKET

Dynamics in the Dunedin CBD office market are changing, with the addition of a significant amount of new office space to the market following several years of limited supply and rent increases. This additional space is across three projects: the ACC/ Ngāi Tahu joint venture development, the Otago Regional Council headquarters (redevelopment of the former Dunedin Warehouse building) and the new Mataukareao building on Great King Street.

As tenants move into these new developments, notably ACC, a large amount of office space is being left vacant. Some of the buildings most affected by these vacancies are Otago House and Philip Laing House, which will have large floor plates available for lease. This space is entering the market at a time when

tenant preferences are for modern, high grade office space in good locations. The post-Covid downsizing trend is also still evident in Dunedin.

Space in the new buildings has been offered for lease at much higher rates than current market levels, with some new offices advertised at $450 per square metre and over (on a net basis). The excess supply entering the market in 2025, combined with ongoing economic pressure prompting occupiers to downsize their office space, may have a dampening effect on rental growth. SECTOR GROSS

Source: Colliers Otago

BUILDING CONVERSION MAY HELP ADDRESS SECONDARY VACANCY

Conversion projects to repurpose older office buildings in the Dunedin CBD into alternative uses such as visitor or student accommodation may re-emerge in the medium term as a viable option for landlords facing limited tenant demand for office space. With larger floors in some buildings becoming redundant as offices, building repurposing projects may once again become a feature of the market, when economic conditions and demand for accommodation reach a level which makes such projects feasible.

OFFICE TRENDS & PROJECTIONS

Dunedin Industrial Market

The shortage of central Dunedin industrial property has prompted growth in outlying locations, notably North Taieri, where property is also in limited supply.

However, development activity has become more subdued recently, with no new projects over the past year. This reflects elevated build costs and the higher rent levels that need to be achieved to make developments financially viable.

In central Dunedin, industrial property is hard to come by and vacancy rates have remained historically low. A move by Port Otago subsidiary Chalmers Properties to sell underlying Lessor Interests to sitting lessees is slowly changing the makeup of the Dunedin southern endowment industrial areas. This is increasing the attractiveness and potential development feasibility of those former leasehold sites, and may eventually boost values in the area.

Investor demand for modern, well-located facilities with long leases continues, in line with national trends. There has been consistent turnover of lower value properties, which are popular among individual investors and owner-occupiers. Transactional activity is expected to increase in other value brackets as interest rate reductions prompt buyers to return to the commercial property market in search of attractive yield returns.

DUNEDIN INDUSTRIAL MARKET KEY INDICATORS

Source: Colliers Otago

TRENDS & PROJECTIONS

Industrial sector has remained resilient through the downturn and growth is expected as buyer demand gathers strength

Consistent demand from investors - in line with national trends

PROPOSED INLAND PORT DEVELOPMENT PLANS

Port Otago and Dynes Transport’s proposed Southern Link Logistics Hub in Mosgiel has received an $8.2m government loan to upgrade the rail link with Port Chalmers, reducing truck volumes on the roads. The first stage of the development (container storage) is expected to open in late 2025 and stage two construction will commence in mid-to-late 2026. The development will allow Port Otago to consolidate its two existing inland depots at Dunedin and Ravensbourne into the new site, freeing up four hectares of industrial land for future development. Calder Stewart has also announced plans for a $3b solar-powered inland port north of Milton. The Milburn Quadrant development would cover over 200 hectares of land and include an inland port connected directly with State Highway One and the South Island main trunk rail line.

Geographical constraints restricting industrial development in central Dunedin - increasing the demand for property in Kaikorai Valley Road and North Taieri

Freehold conversion of some central Dunedin industrial properties may encourage owners in this area to undertake development and/or refurbishment activity

Colliers Otago

Colliers Otago offers a broad range of specialist property services, with a knowledge-driven approach and global reach. Our combined team of experts provides clients with arguably the largest and most experienced group of property professionals in the region, with offices in Queenstown, Wānaka, Cromwell and Dunedin.

OUR FULL SERVICE OFFERING

• Property valuations - commercial, industrial, lifestyle, tourism-related and residential

• Project developments - feasibility, advisory and management of the property development

• General consultancy - property acquisitions and sales, developments, subdivisions and syndications

• Research - retail pedestrian traffic counts, sales research and analysis, subdivision supply and demand, commercial vacancy and leasing supply and demand

• Commercial / industrial / tourism sales and leasing

• Development land sales

• Residential real estate sales

• Investment property sales

• Rural and lifestyle sales

• Project marketing professionals

Our Offices

QUEENSTOWN (VALUATION)

Top Floor, 10 Athol Street, Queenstown 03 441 0790, queenstown@colliers.com

FRANKTON (REAL ESTATE)

Five Mile, Building 8, Level 1/36 Grant Road, Frankton 03 441 0790, queenstown@colliers.com

FRANKTON (RURAL REAL ESTATE)

A1-03, 19 Grant Road, Frankton admin.rural@colliersotago.com

WĀNAKA (VALUATION)

Level 1, 93 Ardmore Street, Wānaka 03 443 1433, wanaka@colliers.com

WĀNAKA (REAL ESTATE)

38 Helwick Street, Wānaka 03 443 4040, wanaka.realty@colliers.com

CROMWELL (VALUATION & REAL ESTATE)

2/24 McNulty Road, Cromwell 03 445 4010, cromwell@colliers.com

DUNEDIN (VALUATION & REAL ESTATE)

Level 4, ASB House, 248 Cumberland Street, Dunedin 03 474 0571, dunedin@colliers.com

GORE (REAL ESTATE)

145 Main Street, Gore 03 280 2212, admin.rural@collierssouthland.com

Meet our Team

VALUATIONS & ADVISORY TEAM

Heather Beard - Director

Registered Valuer / Consultant

Queenstown

Cara McMeeken

Valuations Team Leader

Queenstown

Tom Jarrold - Director

Registered Valuer / Consultant

Wānaka

Laurette Young Valuer

Wānaka

Joe Chapman

Registered Valuer / Consultant

Dunedin

Isabella Smith Valuer

Dunedin

COMMERCIAL TEAM

Mark Simpson - Director

Commercial Broker

Queenstown

James Valentine

Commercial Broker

Queenstown

Sharee Aitken

Commercial Broker

Queenstown

Geoff McElrea

Commercial Broker Wānaka

Dean Collins - Director

Commercial Broker

Dunedin

Matthew Crowther

Registered Valuer / Consultant

Queenstown

Max Sinclair

Valuations Assistant

Queenstown

Jodi Todd

Valuation Practice Manager

Wānaka

Lynette Bailey Valuer

Wānaka

Duncan Jack Registered Valuer / Consultant Dunedin

Lisa Pond

Registered Valuer / Consultant Queenstown

Tim Welsh

Registered Valuer / Consultant

Wānaka

Kayla James

Registered Valuer / Consultant Dunedin

Alastair Wood

Commercial Broker

Queenstown

Mary-Jo Hudson

Commercial Broker

Queenstown

Steve McIsaac

Commercial Broker

Queenstown

Tyler Dickison

Commercial Broker

Dunedin

Anna Rawling

Commercial Broker

Queenstown

Rory O’Donnell

Commercial Broker

Queenstown

Tim Thomas

Commercial Broker

Queenstown

RESIDENTIAL TEAM

Fred Bramwell - Director Sales Consultant

Queenstown

Brendan Quill Sales Consultant

Queenstown

Eoin Miles Sales Consultant

Queenstown

Maria Wyndham Sales Consultant

Queenstown

Paula Gilmartin Sales Consultant

Queenstown

Stephen Hebbend Sales Consultant

Queenstown

Zach Hylton

Sales Consultant

Queenstown

Craig Myles - Director Sales Consultant

Wānaka

George Wallis Sales Consultant

Wānaka

RURAL & LIFESTYLE TEAM

Ruth Hodges - Director

Rural Sales Advisor

Otago/Southland

Helen Flintoff

Rural Sales Advisor

Otago

Georgia McKenzie

Rural Sales Associate

Otago/Southland

Raylene McQueen

Residential Business Manager

Queenstown

Candice Buchanan Sales Consultant

Queenstown

Hugh Clark Sales Consultant

Queenstown

Mei Chen Sales Consultant

Queenstown

Poppy Jefferies Sales Consultant

Queenstown

Vera Stewart Sales Consultant

Queenstown

Rich Norris

Residential Business Manager Wānaka

Roger Ellis Sales Consultant

Wānaka

Anna Wang Sales Consultant

Queenstown

Doug Reid Sales Consultant

Queenstown

Jesse Johnston Sales Consultant

Queenstown

Nicole Bell Sales Consultant

Queenstown

Richie Heap Sales Consultant

Queenstown

Vicky Tomich Sales Consultant

Queenstown

Debbie Forrest Sales Consultant

Wānaka

Mark Wilson - Director Rural Sales Advisor

Otago/Southland

Wes Flannery

Rural Sales Advisor

Otago

Mike Eyles Rural Sales Advisor

Otago/Southland

Fiona Scobbie Sales Advisor

– Residential & Lifestyle Southland