Market Review & Outlook

2020/21

Colliers International’s Market Review and Outlook 2020-2021 covers our key projections for the principal Otago property markets of Queenstown, Wanaka, Cromwell and Dunedin.

2020/21

Colliers International’s Market Review and Outlook 2020-2021 covers our key projections for the principal Otago property markets of Queenstown, Wanaka, Cromwell and Dunedin.

Since our 2019-2020 Market Review and Outlook was released in June 2019, the Queenstown property market has changed significantly in the wake of the global Covid-19 pandemic.

Over the past decade, the fundamental driver of the Queenstown property market’s growth has been the tourism market, which in turn stimulated economic and population growth and fuelled our second-largest industry – construction.

From the time New Zealand went into alert level 3 and 4 lockdown in late March, through to October 2020, the property market has been impeded by economic uncertainty. Factors affecting this include ongoing government fiscal stimulus, decreasing interest rates (with the RBNZ signalling the possibility of a negative Official Cash Rate) and questions around when international tourism may resume. The silver lining of this challenging time is government investment in much-needed infrastructure projects in the region. This will assist in recovery and further growth following the international border re-opening.

The Queenstown property market has proved to be remarkably resilient with current market sentiment and Queenstown Lakes District Council population growth projections showing confidence in Queenstown’s longer term prospects. In the short term, reliance on domestic travel and related spending levels, plus a tightening on funding, will likely continue to create a degree of uncertainty in the property market.

In June 2020, the government announced $85 million in funding for ‘shovel ready’ projects in Queenstown, with a view to this stimulus unlocking further infrastructure developments in the short term.

The $57m Queenstown Town Centre upgrade project received $35m. Construction started on lower Beach Street in September 2020 and is projected to take a year to complete.

A further $50m is earmarked for the first stage of the town centre arterial bypass project, which involves an upgrade of Melbourne and Henry Streets into a new link road, which will bypass Stanley St.

Further proposed projects include Project Manawa – a community precinct comprising community and arts spaces, library, town square and QLDC administration building, plus a $25m town centre Public Transport Hub.

Source: Beehive.govt.nz (New Zealand Government)

Consolidating domestic tourism forecast for summer, centred around activities such as golf and mountain biking

Consolidation of residential property values in the sub $1.5m bracket

Relocation for lifestyle purposes and working from home. Relative affordability compared with Auckland

Tourism and Airbnb accommodation experiencing reduced occupancy and tariffs

Structured commercial rental deals reflecting lower average rental rates over initial term

Low interest rates driving property investment as investors seek returns

Negative OCR predicted from early 2021

High-end residential sales show strong growth as high net worth purchasers enter the Queenstown market

Post lockdown, the Queenstown residential market as a whole has not behaved consistently.

By mid-2020, market sentiment indicated an impending residential market downturn, but this has not materialised – at least not to the extent predicted. The market has been buoyed by low interest rates and pent-up demand, particularly from first home buyers, holiday home investors and people relocating for lifestyle reasons.

Headwinds in the lower to mid range residential sector include high deposit requirements for buyers, falling rental rates and the mortgage holiday scheme ending in March 2021, affecting an estimated 12% of mortgages in Queenstown. In contrast the upper end of the market has shown strong growth with 20 sales over $3m from June to October 2020.

Subdivision development activity

Significant section supply is planned for the land located between Kawarau Falls and Jack’s Point (Coneburn Valley). A total of 2,654 sections are expected to be developed in Hanley’s Farm, the Woolshed Road subdivision and Coneburn Special Housing Area (SHA). However, there will be a significant delay before these sites come to market, with the latest release in Hanley’s Farm due for title issue in 2022.

Source: QLDC E-Docs

Residential rentals have come off their peak as demand has dropped significantly and supply has increased, initially due to short-term accommodation providers entering the rental pool and subsequently due to lower demand as transient workers leave Queenstown.

Further vacancy and rental decreases are possible if unemployment worsens, however additional demand may come from people working from home or young professionals who now consider Queenstown an affordable option. Longer-term property investors expect rental values to return to previous levels.

Trends

• Sub $800,000 market strong for first home buyers and investors

• Sales volumes down for the year due to periods of inactivity –market transactions picking up significantly post lockdown

• Ongoing risk in the home and income market where rentals have declined and higher interest rates are locked in for a longer term

• Values holding in the $1.5m + sector, with strong demand

• Continued growth expected in the high end market as expats return and OIO approved international buyers seek ‘bolt holes’

• Lifestyle market constrained by land availability and zoning, prompting increasing values in this sector including outlying areas such as Gibbston Valley, Glenorchy and the Crown Range

• Managed apartments seeing low transaction volumes, with owners confident in the market returning to strong levels and debt servicing remaining manageable with current low interest rates.

With the absence of international tourists in the Queenstown CBD, rental affordability is a hot topic and rental abatements have become commonplace over the short term. New leasing activity to date appears to be at pre-Covid levels, however incentives are reflecting lower effective contract rentals and there could be further downward pressure in this sector. Demand in the prime retail area is continuing, with some tenants taking the opportunity to reposition or enter the market. Secondary retail areas have seen a decrease in both demand and rental levels, as well as a trend towards shorter leases. Office space is currently steady, but we expect reduced take-up of lease renewals and some vacancy to come through as businesses downsize tenancies with more people working from home.

The industrial sector remains a soughtafter investment in Queenstown and nationwide, as investors gravitate towards ‘essential business’ tenants.

The Queenstown industrial area is seeing some vacancy flowing through from businesses servicing the CBD, as well as tourism operators. Generally, this area is characterised by lower rentals and older stock. Frankton industrial rentals are experiencing some downward pressure, but capital values appear to be holding. Industrial projects under construction include Bunnings Warehouse and Kennards Hire.

Frankton retail appears to be steady, with a strong local customer base and relative rental affordability compared with Queenstown CBD. However, there has been some consolidation of premises. The Frankton office market has an excess of supply and we expect a level of vacancy to

persist in the short term. Further development continues at Five Mile with the final building comprising ground level retail and a further three levels of tourist accommodation due for completion in mid 2021.

MBIE visitor spending data for the year to August 2020 show that visitors to Queenstown spent $1.913 billion, 23% less than in the year to August 2019. By comparison, visitor spending was $2.343 billion in the year to February 2019.

International visitor spending in Queenstown fell to $1.038 billion in the year to August 2020, from $1.633 billion in the year to August 2019. At the same time, domestic visitor spending rose slightly to $875m in the year to August 2020, from $837m the previous year.

Over the 10-year period from June 2009-2019 Queenstown airport experienced strong growth with annual passenger numbers increasing from 730,000 to 2,393,000. As at July 2020 YTD, there were 737,542 passenger movements, with the Queenstown Airport Corporation projecting a total of 1,240,000 for the 2021 year – a projected decrease of 51.8% compared with the 2020 year.

Nationally in the hotel sector, 29 hotels comprising approximately 6,000 rooms are being utilised as managed isolation facilities, but to date there are none located in Queenstown. Domestic travel appears to be concentrated around weekends and school holidays. Occupancy for the year ended September 2020 for Queenstown was at 53.3% compared with 82.0% for the previous year, noting however there are some periods of lockdown contributing to these statistics. Average daily rates (tariff levels) for Queenstown appear to be holding at around $250 per night, comparable to the average daily rate recorded for the year ended March 2020 of $248.

Situated on a high profile 7,823sqm site located on the corner of Glenda Drive and Hawthorne Drive. The property comprises a purpose built retail/trade facility, providing a mix of retail/showroom, office, warehousing and storage areas with a total floor area of 2,592sqm and a sealed yard area of 4,510sqm.

Sold July 2020:

$9,925,000 + GST (if any)

The Ramada Queenstown and Holiday Inn Express have recently been completed adding 368 rooms to the Queenstown CBD hotel supply. The 61 room Radisson managed Hotel being built by Augusta in Man Street was put on hold after getting to foundation stage.

There are a further 435 rooms across four hotels currently under construction at Remarkables Park/Five Mile at Frankton, which will bring the total number of rooms in this precinct to 564.

Queenstown hotel supply of 3,831 rooms is currently being boosted by an additional 569 rooms under construction while there are 2,460 rooms consented and a further 1,481 in the consent process.

The Wanaka property market has experienced significant growth over the past five to seven years and appears to be maintaining value levels post-Covid, despite recent predictions.

Anecdotally, Wanaka appears to be attracting a number of expats and people working from home, moving for lifestyle or purchasing holiday homes, with a record number of sales reported in August. The Wanaka commercial market remains steady, with some consolidation of ‘off prime’ retail as well as some office consolidation. QLDC’s Wanaka Lakefront Development Plan, a five-stage project to enhance the town centre and lakefront area, is currently underway. Some industrial areas are experiencing a softening in land values.

QLDC revised population projections in July 2020 have forecast further population and visitor growth for Wanaka. The usually-resident population is expected to more than double in the 30 years from 13,640 in 2021 to 28,240 in 2051. Total average-day visitor numbers are also projected to increase by over 400% during this period.

Student numbers at Mount Aspiring College have doubled since 2012, with the roll now at 1,139. Funding of $46.5m for a two-stage redevelopment project will increase capacity to 1,800 students, with work planned to begin in late 2020.

Source: QLDC Population Projections July 2020

An initial decrease in sales volumes ‘post-Covid’ which has now stabilised as confidence returns to market

Entry level and first home buyers remain active particularly in outlying areas including Lake Hawea, Albert Town and Luggate

Lifestyle and higher-end property ($2m+) remains highly sought after

Limited new greenfields developments coming to market, with the residential construction sector still performing strongly. Stage 1 of Alpine Meadows will have approximately 100 sections ranging from 600 – 1,100 sqm with a further 300 sections planned for future releases.

Wanaka Median Section & Dwelling Sales Prices & Volume

Information used in this graph does not include section sales in developments where Freehold Record of Title Identifiers (titles) have yet to be issued or section sales where lots have been sold directly from the developer. Please note that the median section price is skewed due to the number of titles issued during 2018 that sold off plans in late 2016 and 2017.

Source: Colliers International

Rental Market

Market rental levels have decreased, with an influx of long term rental supply coming from the short term accommodation market. The spring shoulder season could trigger further downward rental pressure and vacancy.

Median Weekly Rent 1 Apr - 30 Sept 2020 Key Indicators

Source: tenancy.govt.nz

An elevated 1,214sqm rear site with expansive lake and mountain views.

Sept 2017: $895,000

Sept 2020: $1,292,500 Annualised Growth: 2.7%

Wanaka commercial property is primarily underpinned by the local market, with a limited number of tourism operators in the town centre.

The withdrawal of international tourism and ongoing border closures appear to be causing a less significant impact on Wanaka than they have on Queenstown.

Retail and hospitality property market activity in the town centre appears to be cooling, with newly-agreed leases at slightly lower rental levels than pre-Covid-19. However, there has been minimal market activity to date. The office market is experiencing a minor recalibration as some occupiers shift to working from home or downsizing their premises. Given the limited availability of office supply, we expect this will correct in the medium term.

There has been consolidation of rental levels in the Ballantyne Ridge industrial area, along with a recalibration of land values in industrial areas. To date, there has been limited market activity of commercial/ industrial buildings post-Covid.

Continuing construction pipeline activity in the Three Parks area will be a key economic driver in the short to medium term. The 9,000sqm Mitre 10 Mega development is due for completion in late November.

Capacity and growth constraints based on forward projections at Queenstown Airport appear to be key drivers for developing further airport infrastructure in Central Otago.

The Wanaka Stakeholders Group is currently involved in a judicial review over QLDC/QAC consultation of a 100-year lease at Wanaka Airport, which would allow for significant airport expansion and, potentially, wide-body aircraft into Wanaka.

Further plans are centred around Tarras where Christchurch International Airport has acquired 750ha of land with the intention of building an international airport.

Wanaka Commercial Market Key Indicators

Two 1,079sqm separately titled industrial sections located in Ballantyne Ridge sold to a single investor.

Sold August 2020: $900,000 (two sections) $ / sqm: $417

The Cromwell market has experienced sustained growth over an extended period of time, underpinned by population growth, the town’s geographical location in the Otago supply chain and relative affordability.

The residential and lifestyle property markets are performing strongly, fuelled by growth in the rural/agribusiness, viticulture, horticulture and commercial sectors.

Recent government investment in Cromwell includes $8m for upgrades to State Highway 8B through the Provincial Growth Fund. The Fund is also making a $600,000 loan to a new Cromwell-based company, Hector Egger New Zealand, which will manufacture high-tech prefabricated timber buildings for residential and commercial use. The company’s innovative prefabricated building process will increase options in the construction market, provide cost certainty and offer faster construction timeframes than traditional building methods.

Shannon Farm - a new lifestyle development located on the eastern side of Ripponvale Road, comprising 160 large lifestyle sections over 142 hectares alongside an expansion of the existing cherry orchard.

Wooing Tree - a 25ha development site situated on the corner of SH8B, LuggateCromwell Road. The proposed master plan provides for 309 residential lots plus a boutique commercial precinct. Stage 1 sites range from 501sqm to 1,002sqm.

• Continuing demand for larger sections in the Golden Rectangle/old Cromwell area, with infill development increasing

• Average section sizes are reducing, with sites available in Stage 5 of the Gair Avenue subdivision at around 350sqm, and in Prospector’s Park at 450sqm - 500sqm

• The average rental rate for residential property has increased from last year, with an average increase of around 10%. Well-located properties in close proximity to amenities continue to be in demand

• Sales volumes of rural and lifestyle property are strong, with 41 sales to date in 2020 (Jan-Sept) compared with 28 for the same period last year. Median price has increased to $1.97m, up from $1.10m in 2019.

Horticulture and Viticulture

• In the horticulture sector, approximately 300ha of new cherry orchards are in the pipeline although labour and freight issues could provide headwinds to growth in this sector

• The viticulture market remains strong, with substantial demand from overseas buyers although this has been hampered by Overseas Investment Office restrictions.

Commercial and Industrial

• Significant new commercial supply is in the pipeline including a small commercial precinct at Wooing Tree Estate, as well as The Gates commercial building on Barry Avenue, comprising around 1,620sqm over three levels

• There is a shortage of good quality industrial space, with owner-occupiers leading the market

• There is currently a good supply of vacant industrial sites, but a lack of design-build sites under 2,000sqm in size.

229 Ripponvale Road

Six bedroom, four bathroom dual-level home incl. self-contained unit. Positioned on 4,018sqm.

Sold Nov 2020: $1,550,000

Case Study

8 McNulty Road

Workshop and yard based industrial property set on a 2,482sqm prime corner site.

Sold June 2020: $1,330,000 + GST (if any)

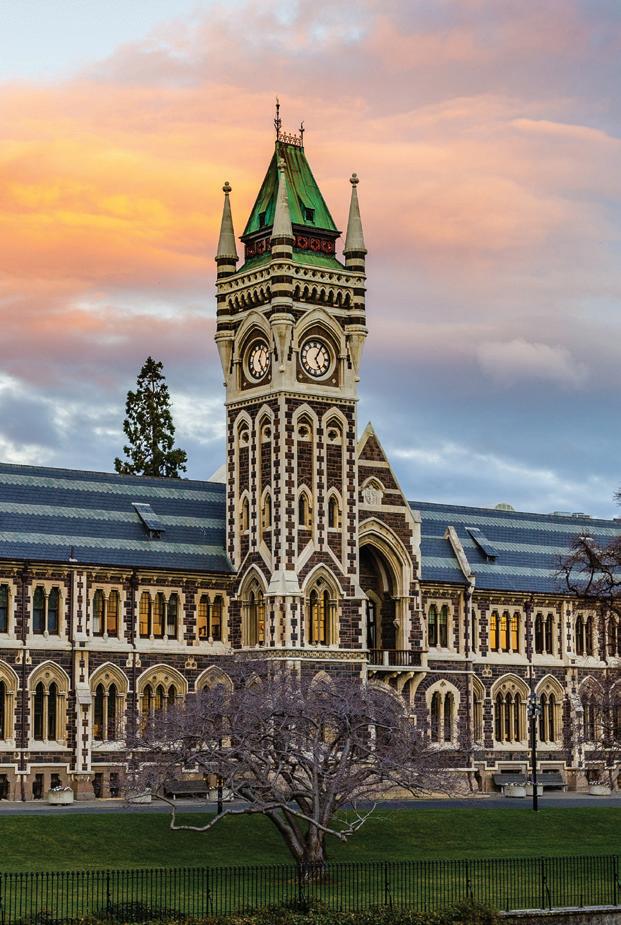

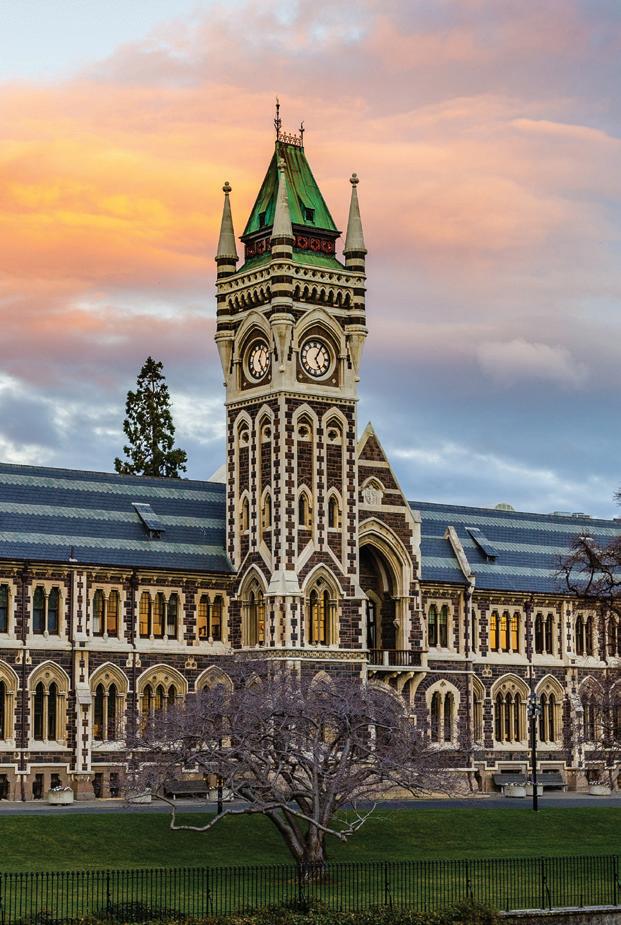

The Dunedin property market continues to grow at a moderate pace with some sectors in a holding pattern following the Covid-19 lockdown.

Residential property market values are holding at a high level with limited volume of stock available. A trend of yield compression is continuing in the residential investment market, as investors seek higher returns through acquiring property assets.

This trend is also present in the commercial property sector, where there is still good demand for office stock and strong investor demand. With cruise ship activity down due to border closures, limited upcoming events and subdued domestic tourism, the tourism and retail / hospitality markets may see some consolidation in the short term.

Dunedin is in line to receive $57.68m of investment from the Government’s Provincial Growth Fund. Major projects include $19.9m towards the city’s waterfront redevelopment, including wharf infrastructure, public spaces and a pedestrian/cycle bridge connecting the waterfront to the city. A $19.97m project will re-establish Kiwirail’s Hillside engineering workshop and rail infrastructure, while $10m is earmarked to help establish Otago as the centre of New Zealand’s digital creative industry. $8m will go to the engineering and manufacturing sectors.

Source: Beehive.govt.nz (New Zealand Government)

Residential

• Sales volumes at lower levels than previous years due to lack of supply

• Record high median dwelling sales price in September 2020 of $568,000 now at a higher level than Christchurch

• Limited stock available in the sub $500,000 market with strong buyer interest from both owner occupiers and investors

• First home buyers a key driver of the owner occupier market

• Investors have returned to the market showing strong interest after some initial caution post lockdown

• Rental levels continuing to increase following five years of consistent growth

• Student investment property yields of 5% to 6% becoming more common

• Developers active, with good demand for land with subdivision potential.

Future supply of student accommodation through the University of Otago of over 830 rooms (including a 450-bed hall of residence) could be deferred due to lack of government funding. The university had $180m in the construction pipeline.

Despite the potential delays of new residential halls, the University of Otago and Otago Polytechnic will continue to be key drivers of the Dunedin economy, and both are

currently undertaking significant capital upgrades and investment into new building projects.

Some of these projects are now underway at various stages of construction, including the newly-completed stage one of the new university dental school facility.

Source: Colliers International

Commercial Trends

Commercial investment property in Dunedin has historically displayed strong returns compared with other main centres.

However, more recently, strong underlying fundamentals and an influx of investors seeking better returns than those available in other cities have resulted in further yield compression.

This has also been fuelled by low interest rates, resulting in strong competition on available properties.

Another strong driver of the Dunedin property market is the hospital rebuild, which includes the construction of 89,000sqm of space over two buildings. The budget for the project is expected to exceed $1.4bn and is due for completion by 2028.

The retail and hospitality sectors may see some consolidation as strained tenants downsize and rental abatements cease

Continuing demand for office property, with no immediate new supply planned

Office rents increasing on review or upon entering new leases

Yields reducing in line with national trends

Lack of industrial land supply in central Dunedin has resulted in industrial occupiers and developers showing interest in North Taieri greenfield sites. These have traditionally offered a significantly lower entry price point but are now commanding higher values owing to increased demand and limited alternative options.

CBD Office Market

Key Indicators

Freehold central city commercial property with land area of 112sqm. Features a modernised and strengthened two level building, tenanted by Flight Centre.

Freehold industrial property with land area of 3,546sqm. Features a recently extended and upgraded office portion, sold with a 7 year lease in place to the existing occupier.

Sep 2020:

Valuation and Advisory Team

John Scobie

Registered Valuer / Consultant Queenstown

Barry Murphy

Registered Valuer / Consultant Queenstown

Jodi Todd

Registered Valuer / Consultant Wanaka

Lynette Bailey Valuer Wanaka

Duncan Jack

Registered Valuer / Consultant Dunedin

Commercial Sales and Leasing Team

Alastair Wood

Commercial Broker Otago / Southland

Mary-Jo Hudson

Commercial Broker Queenstown

Barry Robertson

Tourism / Development Broker Queenstown

Tyler Dickison

Commercial Broker Dunedin

Heather Beard

Registered Valuer / Consultant Queenstown

Kate Boe Valuer Queenstown

Lisa Scott

Registered Valuer / Consultant Wanaka / Cromwell

Laurette Young Valuer Wanaka

Tony Chapman

Registered Valuer / Consultant Dunedin

Doug Reid Registered Valuer / Consultant Queenstown

Geoff McElrea

Registered Valuer / Consultant Wanaka / Cromwell

Tom Jarrold

Registered Valuer / Consultant Wanaka

Joe Chapman Registered Valuer / Consultant Dunedin

Jaden Hareb Valuer Dunedin

Mark Simpson

Commercial Broker Otago / Southland

Tim Thomas

Commercial Broker Queenstown

Steve McIsaac

Tourism / Commercial Broker Queenstown / Cromwell

Rory O’Donnell

Commercial Broker Otago / Southland

Luke Baird

Commercial Broker Queenstown / Cromwell

Dean Collins

Commercial Broker Otago / Dunedin

Residential Sales Team

James O’Hagan Managing Director Queenstown

Stephen Hebbend Sales Consultant Queenstown

Emma Lups Sales Consultant Queenstown

Richie Heap Sales Consultant Queenstown

Nicole Bell Sales Consultant Queenstown

Zach Hylton Sales Consultant Queenstown

Andy Connelly Sales Consultant Dunedin

Marie Hendren Sales Manager Queenstown

Brendan Quill Sales Consultant Queenstown

Maria Wyndham Sales Consultant Queenstown

Jesse Johnston Sales Consultant Queenstown

Raylene McQueen Sales Consultant Queenstown

Jannette Highsted Sales Consultant Queenstown

Fred Bramwell Sales Consultant Queenstown

Hugh Clark Sales Consultant Queenstown

Rowan McDonald Sales Consultant Queenstown

Sophie James Sales Consultant Queenstown

Damo Yorg Sales Consultant Queenstown

Matt Morton Sales Consultant Dunedin

Rural and Lifestyle Team

Ruth Hodges National Co-Director Otago / Southland

Mike Eyles

Rural / Lifestyle Sales Consultant Otago / Southland

Rebecca Turley

Rural / Lifestyle Sales Consultant Otago / Southland

Colliers International’s Otago business offers a broad range of specialist property services with a knowledgedriven approach and global reach. Our combined team provides clients with arguably the largest and most experienced group of property professionals in the region, based in offices in Queenstown, Wanaka, Cromwell and Dunedin.

• Property valuations - commercial, industrial, lifestyle, tourism-related and residential

• Project developments - feasibility, advisory and management of the property development

• General consultancy - property acquisitions and sales, developments, subdivisions and syndications

• Research - retail pedestrian traffic counts, sales research and analysis, subdivision supply and demand, commercial vacancy and leasing supply and demand

• Commercial / industrial / tourism sales and leasing

• Development land sales

• Residential real estate sales

• Investment property sales

• Rural and lifestyle sales

• Project marketing.

Queenstown Office

Top Floor, 10 Athol Street

Queenstown 03 441 0790

queenstown@colliers.com

Wanaka Office

Level 1, 93 Ardmore Street

Wanaka 03 443 1433

wanaka@colliers.com

Cromwell Office

2/24 McNulty Road

Cromwell 03 441 0790

cromwell@colliers.com

Dunedin Office

Level 4, ASB House

248 Cumberland Street Dunedin 03 474 0571

dunedin@colliers.com