Issue 6 Colliers Portfolio

301 Market Street North, Hastings, Hawke's Bay

2022 Nov/Dec

Accelerating success.

More on page 04

485C Rosebank Road, Avondale Sold by Benson Tarm and Caroline Cornish Recent Deals 20 Constance Street, New Plymouth Sold by Benet Carroll SOLD 2805 State Highway 30, Rotomā Sold by Warwick Searle SOLD 49 Third View Avenue, Beachlands Sold by Logan Roach and Ronal Prasad SOLD 253 Ihumatao Road, Māngere Sold by Tom Peterson and Josh Franklin SOLD 164 Courtenay Street, New Plymouth Sold by Benet Carroll SOLD 11-12 A & B Marken Place, Wairau Valley Sold by Matt Prentice and Janet Marshall SOLD 29 Queen Street, Te Puke Sold by Rob Schoeser and Simon Clark SOLD 189a South Road, New Plymouth Sold by Benet Carroll SOLD SOLD 2 Colliers Portfolio

New Zealand Research Report November 2022 Key Listings

Otago Market Review & Outlook 2022 - 2023

Welcome to our last edition of the Colliers Portfolio for 2022.

We are seeing more positive news emerging in the global economy, which looks promising for the year ahead.

The commercial property sector remains active with good quality, well-located properties in demand and investors making the most of the opportunities in the market.

We are now well and truly in the run-down to Christmas, and now is the time to make any property decisions before the year-end.

Thank you for your ongoing interest in Colliers Portfolio. This edition features a collection of premium properties, including a portfolio of childcare centres, large-format retail, and commercial investments. Our team of experts looks forward to hearing from you.

Contents

Gareth

Fraser Auckland Director | Investment Sales Colliers Portfolio Issue 6

Premium Listings 04 Countdown Orewa offers premier beachside investment 09 Nine childcare properties present compelling purchasing 11 North Harbour industrial property with development potential 16

17 22

3 Colliers Portfolio

20

Boundary line indicative only

Bunnings Warehouse - Hastings

301 Market Street North, Hastings, Hawke’s Bay

For sale by Deadline Private Treaty closing 2pm, Friday 9th December 2022 (unless sold prior)

Land Area: 9,080m2 Long-standing Australasian tenant Floor Area: 4,600m2 High profile site Net return $521,551 pa + GST

Occupied by Australasian tenant Bunnings, the leading retailer of home improvement and outdoor living products in Australia and New Zealand, the 9,080m² site offers investors a rare opportunity to secure a large land holding in the Hastings CBD.

The asset is strategically positioned in Hastings with Bunnings occupying the site since 2016, the high profile corner site offers excellent exposure to traffic and easily accessible with approximately 100 onsite customer car parks.

Bunnings have recently signed a new five year lease with a right of renewal for a further five years, final lease expiry December 2031. Returning $521,551 net pa + GST, the lease offers 2.5% annual increases, with market rent reviews on renewal.

This property offers the astute investor a premium trade retail investment in Hastings, Hawke’s Bay. Danny Blair 021 826 496 Greg Goldfinch 021 537 682 colliers.co.nz/p-NZL67021390

4 Colliers Portfolio

Image is

Strategic Occupier/Added Value Opportunity

367 Blenheim Road, Middleton, Christchurch For Sale by Deadline Private Treaty closing 4pm, Thursday 8 December 2022 (unless sold prior)

6,516 sqm (more or less) commercial mixed use site

3,900 sqm approx. floor area

67% NBS Prime corner site with good vehicle access

Exposure to 46,249 vehicle movements per day

Colliers are pleased to present this strategically located property on the corner of Blenheim and Annex Road, Middleton, Christchurch. This property provides a great opportunity for intending occupiers or added value investors/developers.

The property boasts a generous 6,516 sqm site area with a net lettable area of approximately 3,900 sqm serviced by 72 onsite car parks future proofing this site for intending owner occupiers providing plentiful and convenient parking to a high volume of potential customers.

Superbly positioned with ease of access from all directions, the offering presents a unique opportunity in tightly held Blenheim Road.

Nick Doig Director Of Retail 021 944 722

colliers.co.nz/p-nzl67021272

digitally

Established large format retail location 5

enhanced

Colliers Portfolio

Trophy North Shore Investment

145 car parks (including 82 basement) 6 Colliers Portfolio

Units A, B, C and E, 17-19 Croftfield Lane, Wairau, Auckland

For Sale by Deadline Private Treaty closing at 4pm Tue 29 November 2022 (unless sold prior)

Returning $885,067 pa net + GST

Five established tenants

3,276m² net lettable area (approx.)

Strategically positioned in one of North Shore’s most tightly held commercial precincts is this unbeatable investment opportunity that must be seriously considered.

Anchored by listed covenant The Warehouse Group, the offering is underpinned by five established tenants returning $885,067 pa net, occupying 3,276m square of net lettable area (approx.) and 145 car parks (including 82 basement).

Featuring excellent motorway exposure, the site also benefits from easy access off the Tristram Ave interchange via Croftfield Lane and is surrounded by well known National and International brands including Harvey Norman, Resene, JB Hi-Fi , Placemakers, Briscoes, Noel Leeming to name a few.

Investments of this calibre are rarely offered to the market anywhere in Auckland. To register your interest, contact either of the sole agents, Shoneet Chand or Matt Prentice today.

*The last remaining unit (Unit D - 12 basement car parks) is not included in this offering.

Shoneet Chand 021 400 765 Matt Prentice 021 464 904 colliers.co.nz/p-NZL67021296

A+ NBS seismic rating (2014) BOUNDARY LINES INDICATIVE ONLY UNIT D (12 BASEMENT CAR PARKS) IS EXCLUDED FROM THE OFFER

Brand New Central Westgate Investment

3 Pua Street, Westgate, Auckland

For sale by Deadline Private Treaty closing at 4pm Wed 7 December 2022 (unless sold prior)

Returning $368,160 pa net + GST

Lease term 15 + 10 + 10 years

2% annual increases + market reviews

Land area 2,402m²

Completion Q1 2023

Centrally positioned in one of New Zealand’s fastest growing locations, is this brand new investment opportunity with excellent fundamentals.

Returning $368,160 pa net, this high quality childcare investment features a new 15 year lease + further ROR’s and 2% annual rental growth with market reviews every 5 years. Positioned on a road front 2,402m² freehold title, the centre is consented for 120 children with an additional family healthcare component as part of the overall offering.

Metres from the new Costco, PAK’nSAVE, Bunnings, NorthWest Shopping Centre and over 15,000 proposed new dwellings, long term investment opportunities of this calibre are very sought after – call the Sole Agents now to register your interest .

Shoneet Chand 021 400 765

Matt Prentice 021 464 904

colliers.co.nz/p-NZL67021397

Josh Coburn 021 990 691

ARTISTS IMPRESSION

7

Colliers Portfolio

3 Moenui Avenue, Orewa, Auckland

For Sale by Deadline Private Treaty closing at 4pm Tue 29 November 2022 (unless sold prior)

Returning $1,241,392 pa net + GST

10 Year Lease from April 2021 + ROR’s

ASX & NZX Listed Tenant Covenant

9,380sqm Town Centre Zoned Extensively refurbished in 2014

Featuring an ASX and NZX listed tenant covenant on a new long term lease, Countdown Orewa really is the perfect bottom drawer, passive investment.

Returning $1,241,392 pa, with approximately 9 years remaining on the current term and rights of renewal to 2081, Countdown Orewa is one of the most secure, long term investment opportunities currently available in New Zealand. Countdown is a fully owned subsidiary of the Woolworths Group who have over 1,064 stores across Australasia and employ over 190,000 staff. In FY21, they generated over $55.7 Billion in sales which was an 11.1% increase from FY20.

Positioned on a large, 9,380sqm Business Town Centre Zoned block, spread over nine freehold titles, the site is metres away from popular Orewa Beach and centrally located within an established catchment. Do not miss out on this incredible opportunity - call either of the Sole Agents now for further detail, or to register your interest.

Shoneet Chand 021 400 765 Matt Prentice 021 464 904 colliers.co.nz/p-NZL67020497

Countdown Orewa - The Ultimate Passive Investment!

Countdown Orewa - The Ultimate Passive Investment!

BOUNDARY

ONLY

LINES INDICATIVE

8 Colliers Portfolio

Countdown Orewa offers premier beachside investment

Supermarkets have long been considered one of the premier passive investment opportunities in New Zealand and Countdown Orewa has been placed on the market for sale, presenting buyers with the chance to purchase a high-quality asset with a strong tenant covenant.

Located in a prominent position at 3 Moenui Avenue in Orewa, the property offers 4,089sq m of total net lettable area and 145 car parks on a 9,380sq m site that is spread across nine freehold titles and is zoned Business – Town Centre Zone under the Auckland Unitary Plan.

Extensively refurbished in 2014, the highly visible property has a 100 per cent seismic rating and more than 200m of road frontage.

Countdown’s current 10-year lease began in April 2021 and there are 10 further rights of renewal for five years each leading to a final expiry of April 2081. The net passing income from the property is $1,241,393 plus GST per annum.

The subject property services the local catchment of Orewa, as well as coastal towns further north, including Waiwera and Hatfields Beach, and secondary catchments such as Silverdale, Red Beach, and the lower parts of the Whangaparāoa Peninsula.

Orewa is an accessible location that is just 25 minutes from Takapuna, five minutes from State Highway 1, and 30 minutes from Auckland’s CBD.

Colliers Directors Shoneet Chand and Matt Prentice have been exclusively appointed to market the property for sale by deadline private treaty closing at 4pm on Tuesday 29 November, unless sold prior.

General Distributors Limited, trading as Countdown, is part of Woolworths New Zealand, a subsidiary of the publicly listed Australian company, the Woolworths Group.

Woolworths has more than 1,050 stores in Australia and New Zealand, including its supermarkets, liquor, hotel, and retail divisions and has been in operation for more than 80 years.

Chand, Director of Investment Sales at Colliers, says this blue-chip property provides a strong tenant covenant.

“Supermarkets are keenly sought among buyers given they offer a range of key investment fundamentals such as an established tenant with a long-term lease on a highprofile site,” Chand says.

“They also have the ability to trade through a wide array of conditions and proved incredibly resilient throughout the Covid-19 pandemic as they adapted quickly to the changing retail environment.

“This property serves as the ultimate passive investment for prospective purchasers who will have the opportunity to secure an asset with an ASX-listed tenant that is a household name in New Zealand.”

Prentice, Director of Sales and Leasing at Colliers, says the property benefits from an outstanding location in Orewa, only moments from the beach.

“Surrounding properties are composed of some lowrise strip retailing and convenience retail blocks, with significant residential areas situated to the north, south, and west,” Prentice says.

“Investment from the council to upgrade the main road and widen the footpaths has reconnected the town centre to the beach and has proven to be a catalyst in growing the hospitality sector in Orewa.”

To continue reading and find out more, scan the QR Code

colliers.co.nz/real-estate-news

News

•

•

•

NATIONAL CHILDCARE INVESTMENT PORTFOLIO Shoneet Chand +64 21 400 765 shoneet.chand@colliers.com Ronal Prasad +64 21 232 1192 ronal.prasad@colliers.com Matt Prentice +64 21 464 904 matt.prentice@colliers.com • Buy one or buy all! • Nine established childcare properties • Annual returns between $124,800 to $382,200 pa + GST • $2,049,060 pa + GST total portfolio income

Market

tenant –BestStart Educare Ltd

leading

12

lease

year

+ ROR’s. Final Expiry in 2052

rental

+ market reviews

Annual

growth

diversified portfolio Licensed REAA 2008 For more information visit childcareportfolio.co.nz Boundary lines indicative only For Sale by Deadline Private Treaty 30 November 2022 (unless sold prior) 150 Salisbury Street, Christchurch Central 162 Hutt Road, Wellington 504 Porchester Road, Randwick Park 10 Colliers Portfolio

• Nationally

Nine childcare properties present compelling purchasing opportunity

The land and buildings of nine fantastic childcare properties across major cities in New Zealand are being presented to the market for sale.

The properties can be purchased either individually or as a nationally diversified portfolio, opening the opportunity to all levels of investors.

The portfolio of properties includes one centre in Whangārei, four in Auckland, one in Hamilton, one in Wellington, and two in Christchurch.

BestStart Educare is the tenant and the company’s nationwide network of more than 270 early childhood education centres cares for more than 15,000 children each day.

The total net annual rental income from the combined portfolio is $2,049,060 plus GST with each individual centre producing between $124,800 to $382,200 plus GST per annum.

There is 16,317sq m of total combined land area underpinning significant value for these investments, while the portfolio is licensed for 763 children.

The sale and leaseback of the properties will include a brand new 12-year lease with multiple rights of renewal and a final lease expiry of 2052. This portfolio of centres also includes fixed annual rental growth of 2 per cent and market reviews every four years.

Colliers Brokers Shoneet Chand, Matt Prentice, and Ronal Prasad have been exclusively appointed to market this portfolio of childcare centres for sale by deadline private treaty closing at 4pm on Wednesday 30 November, unless sold prior.

The property at 460a Maunu Road in Whangārei comprises two separately licensed, purpose-built childcare centres that are held under a single Record of Title.

To the rear of the property is a structure built in the late 1990s that is licensed for 80 children. Adjoining is a separate new building that is licensed for 70 children.

The four properties in Auckland are located at 2 Coronation Road, Papatoetoe (licensed for 50 children), 174 Ridge Road, Howick (47 children), 2 Barrels Close, Kumeu (91 children), and 504 Porchester Road, Takanini (110 children).

The Hamilton centre is at 48 Powells Road, Fairview Downs and is consented for 50 children. The Wellington property is located at 162-168 Hutt Road, Kaiwharawhara and is licensed for 100 children.

The Christchurch centres are at 150 Salisbury Street in the city centre and 95-99 Wainui Street, Riccarton and are consented for 66 and 99 children, respectively.

Chand, Director of Investment Sales at Colliers, says early childhood education centres are an attractive asset class for buyers.

“These properties are all strategically located in key hubs in their respective towns and cities meaning there will be continued demand for their services. Each property is also underpinned by strong land values,” Chand says.

“With built-in rental growth through annual increases and market reviews, these properties are highly compelling purchasing opportunities in a sector that remains keenly sought among investors.”

Prentice, Director of Sales and Leasing at Colliers, says the portfolio offers a strong tenant covenant through a market-leading provider in the sector.

To continue reading and find out more, scan the QR Code

colliers.co.nz/real-estate-news

News

Why Lease, When You Can Own?

Level 2, 128 Lichfield Street, Central Christchurch For Sale by Deadline Private Treaty: 4pm, Thursday, 8 December 2022 (unless sold prior)

Strategically positioned in the heart of Central Christchurch

Within walking distance of all city amenities

Post-earth quake built building

Northern outlook over Rauora Park

Z

Zoned Central City Mixed Use (South Frame)

Architecturally designed

This comprises a unique opportunity to secure a post-earthquake constructed office suite forming part of a mixed use development, supremely well located with a north facing aspect over Rauora Park, Christchurch CBD.

Astute occupiers and investors alike should act quickly to secure this immaculate office level which is strategically situated one block west of the Te Kaha/Canterbury Multi Use Arena, now underway.

There are limited options to secure office in this tightly held locality - so don’t delay, this office suite won’t last - call the sole listing agent to arrange your inspection.

Courtney Doig 021 991 251

colliers.co.nz/p-nzl67021398

12 Colliers Portfolio

Breckenridge Lodge

Luxury lodge, ultimate lifestyle, multiple options

1 Breckenridge Lane, Puketapu, Hawke’s Bay For Sale

Asking price of $3,900,000 plus GST, if any Exceptional properties such as this are usually offered only once in a lifetime, and that time is now. Motivated by the lure of family in the South Island, the owner is selling this special slice of the Hawke’s Bay luxury accommodation sector. Creatively designed and lovingly maintained with meticulous attention to detail and craftsmanship, Breckenridge Lodge embraces country-style elegance throughout the guest accommodation and owner’s residence and is set to capture maximum sun and pictureperfect vineyard views. This outstanding property must be viewed to appreciate all it offers, including an extensive number of chattels, and clever configuration that provides for multiple living and income options. This is a truly exceptional lifestyle property that the discerning new owner will delight in owning.

Gary Brooks 027 444 3756

13 Colliers

Hamish Goodwin 027 291 2156 colliers.co.nz/p-nzl67020903 Land area 1.5290 ha Multi-use options 630sqm (approx.) 8 bed | 7 bath Stunning views Excellent returns Close to Napier

Portfolio

The ultimate passive investment in Orewa

Located in a prominent position at 3 Moenui Avenue in Orewa, the property offers 4,089sq m of total net lettable area and 145 car parks on a 9,380sq m site.

Details on page 8

14 Colliers Portfolio

15 Colliers

Portfolio

North Harbour industrial property with development potential

Located in the tightly held North Harbour Industrial Estate, a highly functional office and warehouse building that is home to an established tenant offers buyers the opportunity to purchase a high-quality asset with future development potential.

The 1,207sq m property at 11 William Pickering Drive, Albany sits on a 3,158sq m freehold site that is zoned Business – Light Industry Zone under the Auckland Unitary Plan.

The property offers multiple access points from the street, as well as dual roller door access to the building and an abundance of car parking and yard space.

Landscape Solutions is the current occupant, and they recently began a new five-year lease that includes two further rights of renewal for five years each leading to a final expiry of June 2037.

The lease agreement provides $278,000 plus GST in net annual rental income and includes annual CPI rent reviews except on the renewal dates when market reviews will take place.

The property benefits from excellent access to the nearby Northern Motorway. Auckland’s CBD is approximately 15 minutes away under normal driving conditions, whilst Takapuna can be reached in 10 minutes.

To the north, the Albany commercial hub is approximately five minutes away, featuring key landmarks such as Westfield Albany, Massey University, and a range of prominent businesses.

Colliers Directors Matt Prentice and Shoneet Chand have been exclusively appointed to market the property for sale by deadline private treaty closing at 4pm on Tuesday 22 November, unless sold prior.

The building comprises a 721sq m warehouse, a front office that spans 401sq m, and a rear office measuring 126sq m. The rear mezzanine area is 76sq m and the

office lightwell measures 35sq m. With 550sq m of yard space, there’s also ample room for containers to be dropped off.

Prentice, Director of Sales and Leasing at Colliers, says the property presents buyers with options for the future.

“Passive investors will be happy to enjoy the steady rental stream on offer and the strong tenant covenant that comes with having an established occupant on a longterm lease with built-in rental growth,” Prentice says.

“But ultimately, the true value may lie in developing the property further and an add-value investor could maximise the potential of the site by extending the northern end of the warehouse facility.”

Chand, Director of Investment Sales at Colliers, says the North Harbour industrial precinct remains sought-after among buyers and occupiers.

“The area provides a high standard of development and benefits from a number of top-quality buildings and national brand occupants,” Chand says.

“With favourable proximity to the motorway network and surrounding amenities, the area is also well connected to the neighbouring suburbs.

“Recent research from Colliers notes there is a 0.4 per cent vacancy rate for prime industrial property in the North Harbour region, which is lower than the Aucklandwide figure of 0.6 per cent. This suggests the area continues to experience ongoing demand for properties of this nature.”

The Business – Light Industry Zone anticipates industrial activities that do not generate objectionable odour, dust, or noise. This includes manufacturing, production, logistics, storage, transport, and distribution activities.

News

colliers.co.nz/real-estate-news 16 Colliers Portfolio

Standalone Mt Eden gold - this has it all 237 Dominion Road, Mount Eden Auction taking place 11am, Wednesday 30 November (unless sold prior) Rare high profile freehold 536m2 site with a 325m2 building Allowing for owner occupiers to gain access from March 2023 Fantastic access, 10 car parks, rear entrance point Jonathan Lynch 021 900 611 Ben Jamieson 021 520 884 Ned Gow 021 122 2731 colliers.co.nz/p-NZL67021278 Corner Bank & Vine Street, Whangārei Deadline Private Treaty closing Thursday, 1st December 2022 at 4pm (unless sold prior) 402m² Freehold Title High profile corner site Split risk - 6 tenancies Nigel Ingham 021 562 919 Daniel Sloper 021 0221 0339 colliers.co.nz/p-nz667021046 High profile split risk investmentWhangārei CBD Industrial with award winning tenant 54 & 68 Evolution Drive, Horotiu For Sale by Deadline Private Treaty closing Thu 24 November at 4pm (unless sold prior) Well located industrial with surplus land High Quality Tenant New 8-year lease Alan Pracy 021 623 089 colliers.co.nz/p-nzl67020985 Add Value Industrial Investment 11 William Pickering Drive, Albany, Auckland For Sale by Deadline Private Treaty closing Tue 22 November 2022 at 4pm (unless sold prior) Matt Prentice 021 464 904 Shoneet Chand 021 400 765 colliers.co.nz/p-nzl67021105 BOUNDARY LINES INDICATIVE ONLY 3,158m² Freehold site (Huge yard) Returning $278,000 pa net + GST New 5 year lease term Guaranteed rental growth 17 Colliers Portfolio

Attention Occupiers, Add-Value Investors & Developers 8 Freehold Titles on Great South Road, Saleyards Road & Portage Road, Ōtāhuhu For Sale by Deadline Private Treaty closing Wednesday 7 December 2022 at 4pm (unless sold prior) Ben Cockram 021 245 5855 Hamish West 021 882 737 Josh Franklin 021 990 714 colliers.co.nz/p-nzl67021283 Gateway to Ōtāhuhu Boundary lines are indicative only Boundary lines are indicative only 10,409m² freehold land in total Various purchase options Light Industry zoning Huge street frontage276m in total Holding income High profile Z 60 Don McKinnon Drive, Albany, Auckland For Sale by Deadline Private Treaty closing Tue 29 November 2022 at 4pm (unless sold prior) Josh Coburn 021 990 691 Shoneet Chand 021 400 765 colliers.co.nz/p-NZL67021158 Albany Freehold Land – Develop or Landbank Z 4,069m² Freehold Title Dual street frontage Zoned –Metropolitan Centre “A” Grade Location Vacant, flat & regular shape Motivated vendor says “sell” Matt Prentice 021 464 904 BOUNDARY LINES INDICATIVE ONLY 18 Colliers Portfolio

Long term, passive investment

New 20 Year Lease

19 Cloten Road, Stratford, Taranaki

For Sale by Deadline Private Treaty closing: Wednesday 7 December 2022 (unless sold prior)

Est. tenant in robust industry

Benet Carroll

Constructed in 2021 Net annual rental: $157,560 + GST

Lease term: 20 years from 2021

021 0289 4537 colliers.co.nz/p-nzl67021262

2 Years CPI rental increases

Tightly held location

Featured Brokers

Matt Prentice

Director | Investment Sales North Shore

M: 021 464 904 matt.prentice@colliers.com

Matt joined Colliers in 2006 and for the past 6 years has been a director of the industrial sales and leasing team, with a focus on mid to upper end industrial sales and leasing transactions. He is considered a trusted source and wealth of knowledge to both vendors & purchasers, with over 15 years in the industry and hundreds of transactions completed.

Shoneet Chand

Director | Investment Sales North Shore

M: 021 400 765 shoneet.chand@colliers.com

Shoneet has been involved in selling investment property for over 13 years and since 2015 he has been a director in the investment sales team at Colliers, specialising in investment and development sales across the wider Auckland region.

19 Colliers Portfolio

New Zealand Research Report

November 2022

Metropolitan Office Market Outperforms CBD

The ongoing appeal of high quality office space located in proximity to high levels of amenity has limited the impact of changes in work practices New properties have attracted high levels of tenant precommitment and underpinned upward pressure on rentals.

Demand for metropolitan office space stronger than CBD

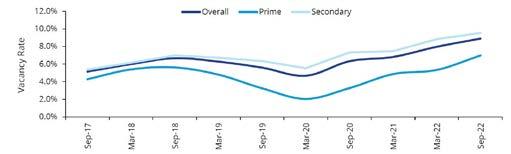

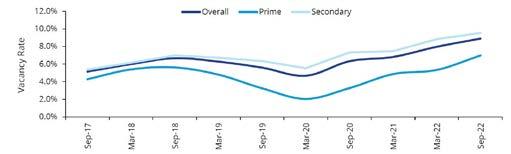

Auckland’s metropolitan (non-CBD) office market continues to exhibit resilience in the face of a cooling economic backdrop and changing work patterns. Overall vacancy across the city fringe and suburban markets of Auckland was little changed between our March and September 2022 surveys, increasing by just 1 percentage point to 8.9%. The latest figure contrasts with the CBD’s overall vacancy rate which has increased from 11 1 to 12 5 between surveys. The latest metropolitan vacancy result is only 110 bps ahead of the metropolitan market’s long term (14 years) average rate of 7.8%. The CBD is currently above the average, for the same period, of 8.3%.

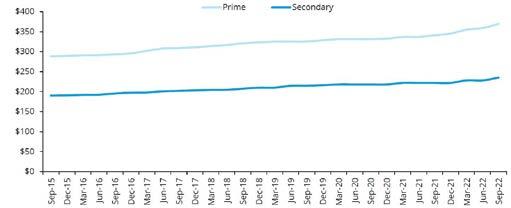

What was comparable to the CBD’s underlying demand profile is the flight to quality trend Metropolitan prime grade office vacancy in September stood at 7.1% compared with a figure of 9.5% for secondary grade properties.

Differing precincts provide differing results

While there was little movement in the overall vacancy figures, there was variation across precincts. Vacancy within the City Fringe and West Auckland precincts increased while a reduction was recorded in the South Auckland precinct. On a similar theme, there were mixed results for the metropolitan area’s largest sub markets The net uptake of approximately 1,800 sqm of space within Ellerslie/Greenlane saw vacancy decline from 11.2% to 10.4%. By contrast, vacancy within the North Shore’s largest market, Takapuna, which comprises approximately 215,000 sqm, increased to 12.0% from 10.8% six months earlier. A grade leasing options, however, remained in short supply with just 2,680 sqm vacant.

Newmarket, which has an inventory of 191,000 sqm, experienced a lift in the overall vacancy rate to 9.3% from 5.0%. This spike in vacancy is, however, likely to be short lived due to a number of leases negotiated subsequent to the September vacancy survey. Examples include space leased at 139 Carlton Gore Road, while Waka Kotahi have agreed a lease at 79 Carlton Gore Road.

The leasing market in 2023 is likely to remain active as businesses review their office space requirements. The heightened emphasis on issues such as how best to attract workforces back to the workplace, ESG requirements and the appeal of prime locations will be weighed against costs. For landlords, tenant retention will be the prime consideration.

Development pipeline attracts strong tenant pre-commitment

While the introduction of new supply will have an impact on vacancy, the high levels of tenant pre-commitment secured for high quality environmentally sustainable buildings located within amenity rich areas points towards the increases in vacancy being limited and short term in nature.

Auckland Metropolitan Office Vacancy

20 Colliers Portfolio

Source: Colliers Research

To view the full report and find out more, scan the QR Code

A number of new office developments and refurbishment projects are currently underway which will increase A grade supply across metropolitan Auckland by approximately 65 000 sqm by mid-2023.

The largest of the projects is 6-8 Munroe Lane in Albany which will have a total floor area of 15,900 sqm. The building has obtained a 5 Green Star - Design As Built NZv1.0 Certified Design Review rating. Auckland Council have agreed a lease over 68% of the floorspace and it is anticipated that the property will be completed by mid-2023.

In Newmarket, high levels of tenant uptake at 110 Carlton Gore Road have occurred through leases toMetlifecare Limited, Vector Limited and Aurecon, accounting for 74% of the 13,620 sqm of total space.Purchasers Stride Property Group have also advised that negotiations are well advanced with other parties which would lift the tenant commitment to 88%. Upon completion, the property is expected to achieve a 6 Star Green Star Design & As Built (v3.2) rating, and a 5 Star NABERSNZ rating.

Kiwi Property’s 3 Te Kehu Way project at Sylvia Park is well advanced with completion expected in the first quarter of 2023. This will add just over 7,230 sqm of office space to the multi use development. Once again, strong preleasing activity has occurred with a combination of tenants including IWG, Tamaki Health, Horizon Radiology and Geneva Finance all having agreed lease terms. The tenant appeal has been strongly underpinned by the building’s environmental credentials designed to a targeted 6-star Green Star rating for sustainability and 5-star NABERSNZ certified rating for energy efficiency.

The timing of the announcements of new additions to the development pipeline will be reliant upon tenant precommitment. A number of property owners however, have development plans at an advanced stage.

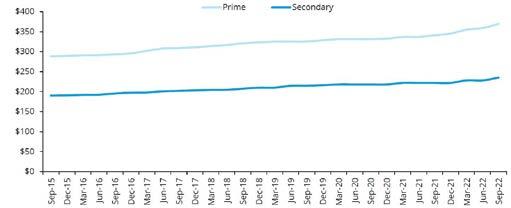

Auckland Metropolitan Office Net Face Rents ($/SQM)

Source: Colliers Research

Prime grade rents increase but so do costs

The combination of the flight to quality, an inflationary economic backdrop and the introduction of new supply isplacing upward pressure on prime grade office rentals.

Across the metropolitan area, average prime grade net face rents increased from $341 per sqm in the September 2021 quarter to $367 per sqm in September 2022. The rate of increase clearly varies across precincts and is significantly impacted by the development of new high-quality space.

Incentives remain in play, but these too have stabilised after rising sharply in early 2020. For prime grade offices, average incentives range from 8% to 16% of the initial lease term.

The inflationary environment is, however, driving an increase in operating costs with average outgoings for prime grade space, increasing by $6 per sqm to $86 per sqm over the year to September 2022.

21 Colliers Portfolio

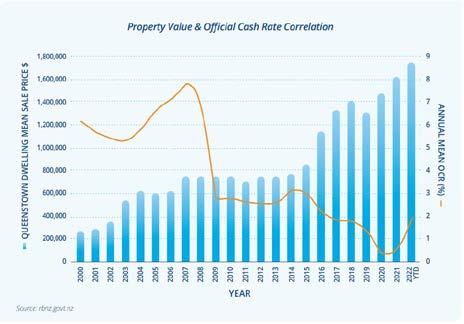

Otago Market Review & Outlook

2022 - 2023

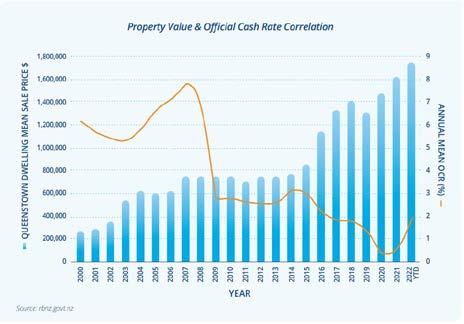

During production of this report in the third quarter of 2022, the threat of economic recession, despite being fuelled by media speculation, was not yet significantly impacting the regions outside Auckland. With many commentators pointing to economic headwinds, buyer sentiment has shifted from ‘fear of missing out’ to ‘fear of over-paying’. The dual pressures of interest rate increases and high inflation may lead to a softening in the residential sector with potential for forced sales going forward.

Commercial prime property is expected to perform best, with secondary property generally more exposed to sentiment fluctuations. We expect the margin between prime investment property and secondary stock to widen as the potential economic fall-out from inflation and mortgage pressure becomes reality.

A reduction in the number of investors in the residential market is evident, with many switching to commercial property which continues to provide favourable growth and consistent returns. Many residential investors are now adopting a wait and see approach pending Election 2023 results and the potential repeal of legislation phasing out interest deductibility on residential property investments.

The reopening of New Zealand to tourism is expected to provide a welcome economic boost. However, the risk remains that the government’s current immigration settings, along with an exodus of young Kiwis leaving the country for their Covid-delayed OEs and working holidays, will exacerbate the existing worker shortage, diminishing the quality of the tourism experience we are internationally renowned for.

To continue reading and find out more, scan the QR Code

22 Colliers Portfolio

At Colliers, we maximise the potential of property to accelerate the success of our clients and our people. We are committed to attracting and developing industry leaders, empowering them to think and act differently to drive exceptional results. What’s more, our global reach maximises the potential of property wherever our clients do business.

Learn more about our experts and how they can help you get the most out of your next property decision.

Colliers.co.nz

Expert solutions to accelerate our clients’ success. Experts choose experts.

Licensed REAA 2008

HSBC Tower, Level 23 188 Quay Street Auckland 1010

portfolio.colliers.co.nz

This document has been prepared by Colliers New Zealand for advertising and general information only. Colliers New Zealand does not guarantee, warrant or represent that the information contained in this document is correct.

November 2022

Countdown Orewa - The Ultimate Passive Investment!

Countdown Orewa - The Ultimate Passive Investment!