FINDING YOUR home

Teresa Munguia, of Coldwell Banker West, is a 20+-year veteran of the real estate industry. She has proudly represented many families and clients throughout Southern CA. She has achieved this through her dedication, attention to detail, strong work ethic and putting her client’s needs first! She is the Realtor® you want to hire as your advocate, negotiator and trusted advisor.

Teresa studied Real Estate at Southwestern College and afterwards began work in “real estate”. Passionate about the closing and handing the keys over to her clients. Teresa Munguia has continued to leverage her know-how and experience to exceed her client’s expectations. As a small business owner, she prides herself on providing exceptional quality service. Teresa has grown her business throughout the years, through grassroots efforts because of clients supporting her and trusting her enough to send her consistent referrals. She is always grateful for this act of kindness and doesn’t take it for granted.

Active in the community, Teresa Munguia plays an instrumental role as part of the Member of Graffiti Abatement in San Diego, she enjoys seeing her neighborhood, as well as the city clean of graffiti and debris. Teresa is also a committed member of the Coldwell Banker Foundation, this foundation is focused on helping others, especially children in need. To see a child happy smile is priceless!

In her free time, Teresa Munguia is an avid walker at the Coronado Island Beach and you might catch her dancing on the streets, since this too is a passion. Spending time at the beach together with her children, grandchildren and with her pug, named Tubby is never something she takes for granted.

“Life passes by to quickly and work takes a majority of time, therefore making the time to spend at the Coronado beach with love ones are priceless moments’ have to make the time life to short”!

Buying a home is one of life’s most important investments and exciting adventures. As your Coldwell Banker West sales associate, I will guide you every step of the way by:

• Helping you get pre-approved and establishing your purchase power.

• Helping you articulate actionable home preferences.

• Helping you determine your offer.

• Negotiating the offer and contract.

• Facilitating the financing process.

• Initiating the property evaluation and inspection process.

• Explaining the title search process.

• Preparing you for the close of escrow.

When you partner with a professional REALTOR® home that meets your needs,

The term REALTOR® is a registered trademark that identifies a real estate professional who is a member of the National Association of REALTORS® and subscribes to its strict code of ethics. On the next few pages are some important reasons why it pays to work with a REALTOR®.

Buying or selling a home requires disclosure forms, inspection reports, mortgage documents, insurance policies, deeds, and multi-page settlement statements. A knowledgeable expert will help you prepare the best deal and avoid delays or costly mistakes.

REALTORS® can provide local community information on utilities, zoning, schools, and more. They will also be able to provide objective information about each property. A professional can help you answer these two important questions: Will the property provide the environment I want for a home or investment? Will the property have resale value when I am ready to sell?

Sometimes the property you are seeking is available but not actively advertised, and it will take some investigation by your REALTOR® to find all available properties.

There are many negotiating factors, including but not limited to price, financing, terms, date of possession, and inclusion or exclusion of repairs, furnishings, or equipment. In addition, the purchase agreement should provide a period of time for you to complete appropriate inspections and investigations of the property before you are bound to complete the purchase. Your agent can advise you as to which investigations and inspections are recommended or required.

REALTOR® who is dedicated to finding you a needs, you free up your time!

If you don’t know a CMA from a PUD, you can understand why it’s important to work with a professional who is immersed in the industry and knows the language.

Most people buy and sell only a few homes in a lifetime, usually with quite a few years in between each purchase. And even if you’ve done it before, laws and regulations change. REALTORS®, on the other hand, handle hundreds of real estate transactions over the course of their career. Having an expert on your side is critical.

A home often symbolizes family, rest, and security — it’s not just four walls and a roof. Because of this, home buying and selling can be an emotional undertaking. And for most people, a home is the biggest purchase they’ll ever make. Having a concerned but objective third party helps you stay focused on both the emotional and financial issues most important to you.

Every member of the NATIONAL ASSOCIATION of REALTORS® makes a commitment to adhere to a strict Code of Ethics, which is based on professionalism and protection of the public. As a client of a REALTOR®, you can expect honest and ethical treatment in all transaction-related matters. It is mandatory for REALTORS® to take the Code of Ethics orientation and they are also required to complete a refresher course every four years.

As your representative, your agent prefers to work as your buyer-broker. I will work in your best interest. All Coldwell Banker West REALTORS® have completed an advanced course in buyer-broker agreements.

These are just a few of the many things a REALTOR® can do as a buyer-broker:

• Prepare and interpret market analysis for the property you are buying (determines if the price and terms of the listed property are correct).

• Analyze and compare pluses and minuses of different properties you are considering.

• Discuss the value variables of different neighborhoods (what neighborhoods hold their property values).

• Provide you with information that is conveyed about the seller’s motivation.

1. Your income.

2. Your available assets for the down payment, closing costs and any cash reserves required by the lender.

3. Your outstanding debts.

4. Your credit history.

5. The type of mortgage you select.

6. Current interest rates.

Your buyer-broker can provide you with a list of the best lenders in the business who can help determine your pur chasing power by analyzing your financial strength. Before you begin searching for the home of your dreams, this analysis and your loan preapproval will help you focus your house hunting efforts.

A REALTOR® should provide you with a Buyer’s Net Sheet, which will include down payment money, title search, recording fees, etc. This should give you a good idea of your money outlay. Each home purchase/ sale is different.

Normally the seller pays the REALTOR®’s fees associated with selling the home. The seller pays the REALTOR®’s brokerage and the brokerage distributes the earned commission to all the parties involved, which generally includes the buyer’s agent.

Coldwell Banker West is committed to guiding buyers to Buying process assures that you experience one of life’s biggest Banker West REALTOR®, I will

Getting to know you via video chat is our first step in finding your home.

After determining your home preferences and budget, I will continually check

I will walk you through the home(s) virtually, share market data, and provide

You will electronically sign all documents, offers, and disclosures front he

Once you have signed the necessary documents, you will wire your earnest

The inspectors will send you a detailed inspection report with specific photos

Closing documents will be signed with a mobile notary and all access materials

It’s time for you to move in! Once escrow is finalized, I will transfer keys and

to their perfect home, wherever that may be! Our Virtual Home biggest milestones in a convenient and safe way. As your Coldwell will guide you every step of the way.

This helps me better understand what is important to you in a home. check the market and send you potential homes that meet your criteria. provide expertise to guide your analysis. comfort of your own home. earnest money digitally and securely. photos and descriptions, so you will get to know every inch of the property. materials and information will be transferred safely and remotely. and any necessary access information.

AMENDMENTS: A change—either to alter, add to, or correct—to part of an agreement.

APPRAISAL: An estimated property value resulting from analysis of facts about the property; an opinion of value.

ASSUMPTION: When the buyer accepts responsibility for liens or other obligations attached to the property title. In some cases, this means the new buyer takes over the old mortgage.

BENEFICIARY: The recipient of benefits, often from a deed of trust; usually the lender.

CLOSE OF ESCROW: The date when documents are recorded and title passes from seller to buyer. On this date, the Buyer becomes the legal owner, and title insurance becomes effective.

COMPARABLE SALES: Sales that have similar characteristics as the subject real property, used for analysis in the appraisal. Commonly called “comps.”

DEED OF TRUST: An instrument used in many states in place of a mortgage.

DEED RESTRICTIONS: Provisions contained in deeds to limit the use of the property.

EARNEST MONEY DEPOSIT: Down payment made by a purchaser of real property as evidence of good faith; a deposit or partial payment.

EASEMENT: A right, privilege, or interest, limited to a specific purpose that one party has on land owned by another.

HAZARD INSURANCE: Real estate insurance protecting against fire, some natural causes, vandalism, etc., depending upon the policy. Buyer often adds liability insurance and extended coverage for personal property.

IMPOUNDS: A type of trust account established by lenders for the accumulation of the borrower’s funds to meet periodic payments of taxes, mortgage insurance premiums; and/or future insurance policy premiums.

LEGAL DESCRIPTION: A description of land recognized by law, based on government surveys, spelling out the exact boundaries of the entire parcel of land. It should thoroughly identify a parcel of land that cannot be confused with any other.

LIEN: A form of encumbrance that usually makes a specific parcel of real property the security for the payment of debt or discharge of an obligation for example, judgments, taxes, mortgages, deeds of trust.

MORTGAGE: The instrument by which real property is pledged as security for repayment of a loan.

PITI: A payment that combines principal, interest, taxes and insurance.

POWER OF ATTORNEY: A written instrument whereby a principal gives authority to an agent. The agent acting under such a grant is sometimes called “attorney-in-fact.”

PURCHASE AGREEMENT: The purchase contract between the buyer and seller. It is usually completed by the real estate agent and signed by the buyer and seller.

QUITCLAIM DEED: A deed operating as a release, intending to pass any title, interest, or claim which the grantor may have in the property, but not containing any warranty of a valid interest or title by the grantor.

RECORDING: Filing documents affecting real property with the County Recorder as a matter of public record.

Selects a REALTOR®

Gets pre-approved by lender if new loan needed

Views homes with Real Estate Professional

Selects home and submits contract with Loan Status Report (LSR)

Inspection reports sent to applicable party, reviewed and notified

Appraisal ordered and completed

Deposits required funds

Loan documents returned to lender for review

Receives key from real estate professional

Selects a REALTOR®

Prepares house for showing & selling

Reviews and accepts contract from buyer

Inspections ordered

Advises escrow of home insurance policy

Escrow opened and preliminary report ordered

Receives final loan approval from lender

Closing documents compiled by escrow

Loan Documents prepared by lender and sent to escrow

Escrow ensures all contract conditions have been met

After recording, confirmed escrow disburses funds

Final documents sent to interested parties

Lender “funds loan” (sends funds to escrow)

Documents recorded and escrow closed

Two or more persons Two or more natural persons

Ownership can be divided into any number of interests equal or unequal

Ownership interests must be equal

Spouses or domestic partners Spouses or domestic partners

Ownership interests must be equal Ownership interests must be equal

One or more conveyances (law presumes interests are equal if not otherwise)

Single conveyances (creating identical interests; vesting must specify joint tenancy)

Presumption from marriage or domestic partnership or can be designated in deed

Single conveyance and spouses or domestic partners must indicate consent which can be on deed

TRANSFERABILITY Each co-owner may transfer or mortgage their interest separately

Unless married or domestic partners, co-owner’s interest not subject to liens of other debtor/ owner but forced sale can occur

Each co-owner may transfer his/her interest separately but tenancy in common results

Co-owner’s interest not subject to liens of other debtor/ owner but forced sale can occur prior to co-owner’s/ debtor’s death

Decedent’s interest passes to his/her devisees or heirs by will or intestacy

Decedent’s interest automatically passes to surviving joint tenant

Both spouses or domestic partners must consent to transfer or mortgage

Entire property may be subject to forced sale to satisfy debt of either spouse or domestic partner

Both spouses or domestic partners must consent to transfer or mortgage

Entire property subject to forced sale to satisfy debt of either spouse or domestic partner

Decedent’s 1/2 interest passes to surviving spouse or domestic partner unless otherwise devised by will

Decedent’s 1/2 interest automatically passes to surviving spouse or domestic partner due to right of survivorship

Co-owners interests may be separately transferable

Right of survivorship (avoids probate); may have tax disadvantages for spouses

Qualified survivorship rights; mutual consent required

Right of survivorship; mutual consent required for transfer; surviving spouse or domestic partner may have tax advantage

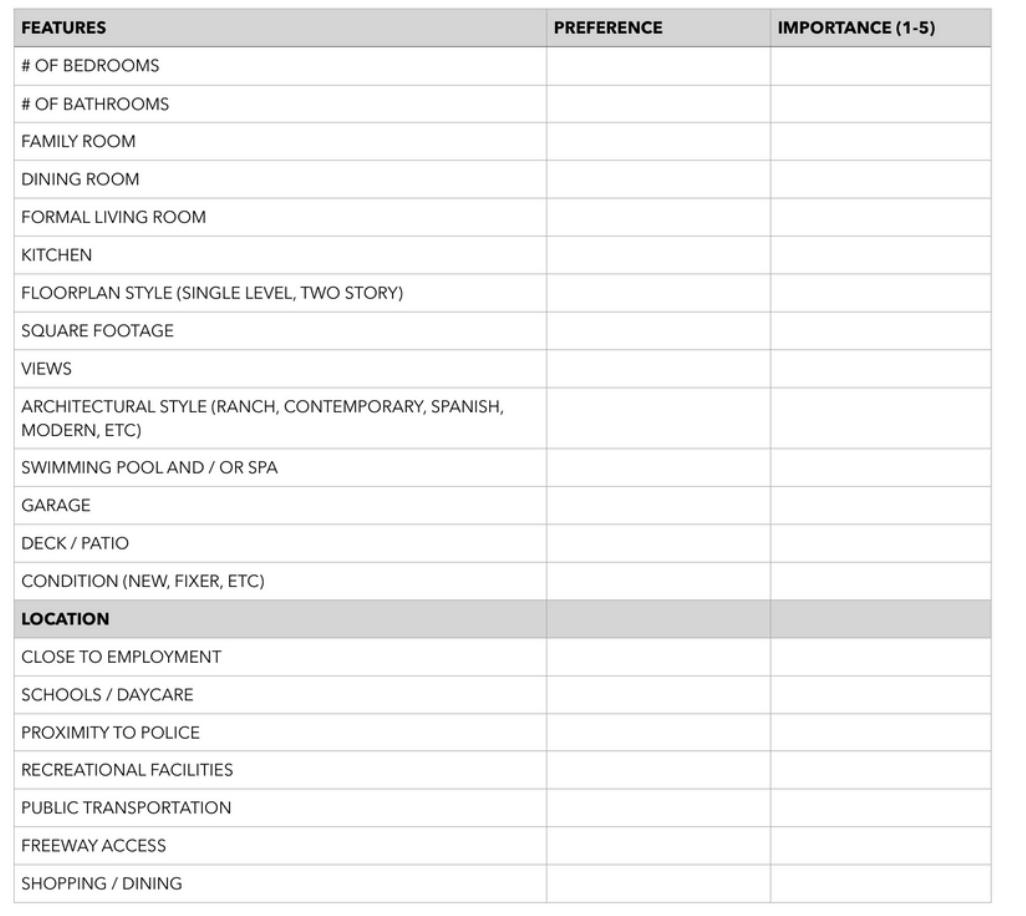

The more I know about your preferences, needs, and priorities, the better I will be able to focus our search on properties that most closely match your criteria.

Remember, unless you are building your dream home from the ground up, there are often compromises to consider when deciding whether or not you will be satisfied with a given property.

Please write down your preference to each feature then rate from 1 -(No Importance) to 5 - (Must Have)