OUTLOOK 2023

Q&A with Pattie Lovett-Reid p.26

NON-CANADIAN CLIENTS

VARIABLE MORTGAGES

Rates, risk and the role of the broker p.30

EXPERT SOLUTIONS

Restrictions on residential property sales p.20 OSFI SEEKS INPUT

A toolbox of financing options mainstream lenders can’t match p.34

Tightening mortgage underwriting rules p.10

CMBA-ACHC.CA PM No. 41297283

WINTER 2023 $6.95 THE MAGAZINE FOR PROFESSIONAL MORTGAGE BROKERS +

COMMERCIAL MORTGAGE LENDING CRITERIA Mortgage Type Loan to Value (up to) Loan Amount Range Interest Rate Starting at Retail/Office/ Industrial 70% $1.5 M - $75 M 8.50% Land (urban infill) 65% $1.5 M - $75 M 9.50% Apar tments 70% $1.5 M - $75 M 8.50% Res. Condo Inventory 70% $1.5 M - $65 M 9.00% RESIDENTIAL MORTGAGE LENDING CRITERIA Mortgage Type Loan to Value (up to) Loan Amount Range Interest Rate Starting at Single Family 70% $1.5 M - $5.0 M 8.50% Luxury Condos 65% $1.5 M - $3.5 M 9.25% Vacation 65% $1.5 M - $3.5 M 9.25% Sam Fogell sfogell@lanyardgroup.com 604-688-5388 x103 Golden Ma - B.C. Commercial gma@lanyardgroup.com 778-869-4653 Phone 604.688.5388 www.lanyardgroup.com WE CAN HELP YOU GRAB MORE IN A TOUGH MORTGAGE MARKET Make the move to more... more money, more flexibility, more control.

10

RATES, RISK AND THE ROLE OF THE MORTGAGE BROKER

Client service agreements can be golden when arranging variable rate mortgages BY RAY

BASI

BASI

OSFI SEEKS INPUT ON MORE STRINGENT MORTGAGE UNDERWRITING RULES

BY KOKER CHRISTENSEN AND KATHLEEN E. BUTTERFIELD

GIFT, LOAN OR INVESTMENT

Does the purchase money advanced come with strings attached? BY RAY BASI

BLIZZARDS, BANKS AND BROKERING

Whether in food or finance, mortgage agent Matt Shaw is drawn to new challenges

BY LISA GORDON

MORTGAGE AND REAL ESTATE OUTLOOK FOR 2023

Q&A with financial commentator Pattie Lovett-Reid BY

CHRIS FREIMOND

STRESSFUL TIMES REQUIRE EXPERT SOLUTIONS

2023 is a year of opportunity for mortgage brokers, whose toolbox of customized financing options can’t be matched by mainstream lenders

BY LISA GORDON

GORDON

CMB MAGAZINE CMBA-ACHC.CA WINTER 2023 I 5 VOLUME 8 ISSUE 1 WINTER 2023 departments columns Editorial Advertisers’ Index Off the Clock: Derek Diener applies the lessons he’s learned from sports to his successful career as a mortgage broker BY LISA

Legal Ease: New responsibility for mortgage brokers regarding non-Canadian clients BY RAY BASI 8 38 16 20

26 34

24

30

12 16 features

VOLUME 8 ISSUE 1 WINTER 2023

THE CANADIAN MORTGAGE BROKERS ASSOCIATION

DIRECTORS

Terry Kilakos (CMBA-Quebec)

Sadiq Boodoo (CMBA-Ontario)

Jim DeCoste (CMBA-Atlantic)

Sachin Varma (CMBA-BC)

EXECUTIVE DIRECTORS

Carla Giles

Petra Keller

CMBA - ATLANTIC Mortgage Brokers Association of Atlantic Canada

12 M - 7095 Chebucto Road, Halifax, NS B3L 0A1

CMBA - BC

Mortgage Brokers Association of British Columbia 2025 Willingdon Ave, Suite 900, Burnaby, BC, V5C 0J3

CMBA - ONTARIO

Independent Mortgage Brokers Association of Ontario

7 - 40 Winges Road, Woodbridge, ON L4L 6B2

CMBA - QUEBEC

L'Association des courtiers hypothecaires du Québec

5855 Taschereau #202, Brossard, QC J4Z 1A5

CANADIAN MORTGAGE BROKER magazine is produced by the Canadian Mortgage Brokers Association (CMBA)

EDITOR

Carla Giles

STAFF WRITER

Ray Basi

MANAGING EDITOR

Kathleen Freimond

ART DIRECTOR

Scott Laing

BILLING AND SALES

Debra Hiller

CONTRIBUTORS

Ray Basi

Kathleen E. Butterfield

Koker Christensen

Chris Freimond

Carla Giles

Lisa Gordon

IMAGES Adobe iStock

CANADIAN MORTGAGE BROKER © All rights reserved. The views expressed in CANADIAN MORTGAGE BROKER are those of the respective contributors and are not necessarily those of the publisher or staff.

PUBLICATIONS MAIL AGREEMENT 41297283

Please return undeliverable Canadian addresses to 2025 Willingdon Ave, Suite 900, Burnaby, BC V5C 0J3

Printed in Canada by Hemlock Printers Ltd.

RESIDENTIAL COMMERCIAL CONSTRUCTION DEVELOPMENT LAND

30 Years of Experience You Trust Contact us 1-866-907-5407 deals@vwrcapital.com Pratheesan Rathnapala Ontario Business Development Manager 416-629-2219 pratheesan@vwrcapital.com Paula Hutton Prairies Business Development Manager (AB, SK, MB) 780-370-7430 paula@vwrcapital.com Jennifer Peters British Columbia Business Development Manager 604-803-7430 jennifer@vwrcapital.com Save Money Low • Basic • Simple Fee Structure 2nd Mortgage 1 year Closed Fee starting at only $500 1st Mortgage 1 year Closed Fee starting at only $750 • No Income Qualification • No Minimum Beacon Score • 1st and 2nd Mortgages • Purchase and Refinance • Residential Financing Visit us at vwrcapital.com Submit applications through Filogix, Velocity and Lendesk

BE AT THE TOP OF YOUR GAME

BY CARLA GILES, CHIEF EXECUTIVE OFFICER, CMBA-BC AND MBIBC; CO-EXECUTIVE DIRECTOR CMBA

This past January, the mortgage community breathed a sigh of relief with the news that the Bank of Canada is holding its policy rate at 4.5 per cent while it assesses the impact of the cumulative rate increases on inflation.

The second half of 2022 was not kind to the mortgage sector. While the year started with an overheated housing market, fueled by low interest rates and investor confidence, it gradually shifted to one of uncertainty as inflation shot to 8.1 per cent by June.

To curb inflation, the Bank of Canada halted quantitative easing in March and rapidly raised interest rates in just 10 months. The Bank’s reasoning behind rapid adjustments to the policy rate was grounded on the need to cool the economy and keep inflation expectations anchored.

Prospective homebuyers delayed their entry into the market, waiting to see what would happen with mortgage rates and hoping prices would come down with the housing market cooling. At the same time, sellers adopted a similar posture, waiting to see when and if the market settled before listing their properties. By the end of 2022, housing sales dropped significantly to just below the 10-year average.

In addition, the rapid rise in interest rates impacted housing affordability more significantly than the rest of the economy, making homeownership more expensive for Canadians. On a year-over-year basis, the mortgage interest cost index rose to 18 per cent in December, as per Statistics Canada. Homeowners holding variable-rate mortgages felt the immediate impact of each rate hike. They saw their principal payments reduced or saw

increases in their monthly payments. A recent survey conducted by Habitat for Humanity Canada on attitudes of Canadians on homeownership and the housing affordability crisis revealed that 40 per cent of those surveyed are concerned about paying rent or mortgage over the next year.

The Bank’s response to rising inflation has been criticized for ignoring the early warning signs in 2021 and failing to act quickly to

8 I WINTER 2023 CMBA-ACHC.CA CMB MAGAZINE ISTOCK.COM

This is the time for mortgage brokers to broaden their knowledge and remain confident about the future

editorial Sources: Survey of Non-Bank Mortgage Lenders, CMHC NHA MBS mortgage reporting, CMHC calculations, second quarter of 2022 Market shares shift slightly with the changing interest rate environment Credit Unions Mor tgage Investment Entites Other Non-Bank Mor tgage Lenders Big 6 Banks Other Char tered Banks Non-bank OSFI regulated Market Share of Newly Extended Mor tgages Market Share of Outstanding Mor tgages Credit Unions Mor tgage Investment Entites Other Non-Bank Mor tgage Lenders Big 6 Banks Other Char tered Banks Non-bank OSFI regulated Market Share of Newly Extended Mor tgages Market Share of Outstanding Mor tgages Credit Unions Mor tgage Investment Entites Other Non-Bank Mor tgage Lenders Big 6 Banks Other Char tered Banks Non-bank OSFI regulated Market Share of Newly Extended Mor tgages Market Share of Outstanding Mor tgages Credit Unions Mor tgage Investment Entites Other Non-Bank Mor tgage Lenders Big 6 Bank s Other Char tered Non-bank OSFI regulated Market Share of Newly E xtended Mor tgages Market Share of Outstanding Mor tgages Credit Unions Mor tgage Investment Entites Other Non-Bank Mor tgage Lenders Big 6 Bank s Other Char tered Bank s Non-bank OSFI regulated Market Share of Newly E xtended Mor tgages Market Share of Outstanding Mor tgages

control inflation. Back then, the Bank believed that inflation was transitory and would be resolved independently. Throughout that year, the Bank indicated it would keep interest rates low until at least 2023. The mortgage community operated under this belief, offering mortgage options to clients that in most cases did not consider a rapid rise in interest rates.

As for 2023, the Bank expects Consumer Price Index inflation to be around 3 per cent in mid-2023 and back to the 2 per cent target in 2024. There are signs that restrictive monetary policy is slowing activity, especially in household spending.

However, this time, the industry is treading with caution as inflation may prove to be sticky and not fall as quickly as expected by the Bank. The labour market remains tight, with an unemployment rate of 5 per cent in December, just above the record low of 4.9 per cent in June, according to the latest data released by Statistics Canada.

What seems to be clear is that we are still in a period of unknowns and that a shift in mindset is needed. Housing market participants need to get used to interest rates remaining higher than what we experienced in 2021 and early 2022. Higher net migration will almost certainly continue to put upward pressure on housing demand against an already limited housing supply. As well, the rental market may not be an option for many Canadians – as demand has outpaced supply and rent costs have gone up across Canada at an unprecedented pace in the last year.

Within this economic landscape lies a massive opportunity for the mortgage broker channel to grow as homebuyers’ affordability has taken a hit. It has become more difficult for potential borrowers to get qualified for loans. According to CMHC’s Residential Mortgage Industry report, there was a decline in the ratio of mortgage loans to applications in the second quarter of 2022.

Mortgage brokers are best positioned to assist homebuyers entering the market and mortgage holders needing help when it comes time to refinance their mortgage. They can provide options that are best suited to their specific circumstances and needs.

It is essential to recognize that this level of service requires more effort from mortgage brokers, who are already pressured to be at the top of their game. They need to be abreast of changing regulations and market trends. For example, as per data released by CMHC, the market share of newly extended mortgages by mortgage investment entities (MIEs) is increasing, signaling a trend where borrowers find it harder to qualify with a conventional lender.

This is also the time for brokers to broaden their knowledge and remain confident about the future through increased opportunities for education and networking. They must learn about new products and financing options available through different lenders. They may also want to revisit their client management and engagement tools and practices, as the digitalization of processes can help tailor messages to various segments and support lead generation. Those best equipped to understand their clients’ needs and offer products most suitable for their unique situation will be positioned to be the most successful.

CMB MAGAZINE CMBA-ACHC.CA WINTER 2023 I 9

OSFI SEEKS INPUT ON MORE STRINGENT MORTGAGE UNDERWRITING RULES

On January 12, 2023, the Office of the Superintendent of Financial Institutions (OSFI) launched a public consultation regarding changes to Guideline B-20 Residential Mortgage Underwriting Practices and Procedures that would further tighten mortgage underwriting rules and possibly related rules that apply to federally regulated lenders.

BACKGROUND

OSFI views lending risks as having significantly increased due to a combination of high interest rates, high levels of indebtedness, and the risks of an economic downturn. The consultation was telegraphed in OSFI’s Annual Risk Outlook 2022-23. It reflects the Bank of Canada’s latest Monetary Policy Report in October 2022, noting that inflationary pressures remain elevated, the pace of economic growth in Canada is slowing and there is potential for a sharp slowdown in the global economy in an era of combined tightening by central banks.

To mitigate these risks, OSFI is proposing several debt serviceability measures with a view to enhancing the credit quality of residential mortgage assets and underwriting practices of federally regulated lenders. Further, any new measures are intended to reinforce Principle 3 of Guideline B-20, which provides that FRFIs

should adequately assess a borrower’s capacity to service their debt obligations on a timely basis. This assessment should account for varied financial and economic conditions and/or higher interest rates.

The Minimum Qualifying Rate, commonly referred to as the “mortgage stress test” was introduced in 2018 to ensure a minimum threshold in this respect. The consultation document states that the stress test has helped, but additional measures may be needed. Accordingly, OSFI is seeking feedback on three measures: (1) possible restrictions on mortgage size (loan-to-income (LTI)) and debt load (debt-toincome (DTI)); (2) debt service coverage restrictions, in relation to a borrower’s gross income and total debt; and (3) interest rate affordability stress tests, to gauge a borrower’s ability to afford higher debt payments in the event of financial shocks.

MORTGAGE SIZE (LTI) AND DEBT LOAD (DTI) POSSIBLE CHANGES

To make borrower payments more manageable and to limit lenders’ potential losses upon default, limits may be placed on mortgage debt relative to borrower income (loanto-income or “LTI”) or total indebtedness relative to borrower income (debt-to-income or “DTI”).

OSFI is also considering a lender-level volume restriction on high LTI lending (often called a “flow limit” or speed limit”). These restrictions would give lenders discretion to underwrite a certain number of loans that exceed a reasonable threshold, but which may be allowed currently under residential mortgage underwriting policies (RMUPs) based on other criteria. For such restrictions to function effectively, OSFI is considering a consistent definition of “income” for calculating LTI, a “high” LTI threshold, and an industry-wide LTI volume limit.

As part of the consultation, OSFI is seeking input on a specific proposal to adopt a “high” LTI threshold of 4.5x with a 25% quarterly volume limit on originations that exceed the threshold.

Over the last several quarters, all of the D-SIBs have reported increases in their provisions for credit losses. Although the latest data available shows that mortgage arrears remain at record-low levels, with rising interest rates and dropping housing prices1, some Canadians will face a different borrowing scenario when their mortgage terms expire; and there are further implications for variable rate mortgages. By proposing changes to Guideline B-20 now, OSFI may help FRFIs work with borrowers to anticipate challenges the will face on renewal or if monthly payments become insufficient.

DEBT SERVICE COVERAGE RESTRICTIONS

OSFI’s related news release emphasized the heightened risk of debt serviceability.

FRFIs currently use debt service coverage ratios in reviewing a borrower’s creditworthiness, including Gross Debt Service (GDS) and Total Debt Service

10 I WINTER 2023 CMBA-ACHC.CA CMB MAGAZINE

ISTOCK.COM public consultation

BY KOKER CHRISTENSEN and KATHLEEN E. BUTTERFIELD

1Robert McLister, “How new mortgage rule proposals could affect housing financing”, The Globe and Mail (12 January 2023).

(TDS), but existing limits are only prescribed by the Minister of Finance for insured mortgages. Guideline B-20 currently allows FRFIs to establish debt serviceability metrics for uninsured mortgages, although they are expected to assure OSFI that GDS and TDS average scores for all mortgages underwritten and/or acquired do not exceed their stated maximum.

OSFI is proposing a new lender-level volume restriction on loans with high debt service ratios. As outlined in its consultation paper, for this measure to operate effectively OSFI is specifically considering:

n Formulas and definitions for GDS and TDS, and whether to adopt those that currently exist for insured mortgages;

n Appropriate GDS and TDS thresholds for uninsured mortgages, which could involve graduated or tiered limits; and

n An explicit amortization limit used for qualification in the Guideline that, in combination with debt service ratio restrictions, would limit excessive leverage. This proposal could further limit how much a borrower’s mortgage payment or other obligations can be as a percentage of income, in order for FRFIs to meet any new thresholds.

INTEREST RATE AFFORDABILITY STRESS TESTS

The MQR is a minimum interest rate applied to debt service calculations to test the borrower’s ability to service higher debt payments if in the case of negative shocks to income or increases in interest rates or expenses. This stress test is currently applied in the GDS calculation at underwriting.

OSFI is considering introducing a minimum affordability test. Per its consultation paper, OSFI

is specifically considering the following elements:

n The creation of an explicit principles-based expectation that lenders establish, monitor and report on different MQRs (in addition to the current MQR) according to various risk characteristics and product types;

n An expectation that the MQR be applied to a borrower’s total debt service (i.e., any other debt obligations) in addition to gross debt service; and

n Tests of affordability and other debt serviceability measures for non-mortgage retail lending outside of Guideline B-20.

Reporting requirements for different MQRs could give OSFI greater insight on emerging vulnerabilities, building on FRFI financial statements reflecting any defaults in previous quarters and IFRS 9 credit loss projections. Actual arrears are a lagging indicator, sometimes requiring at least several months of missed payments.

Tests tied to total debt serviceability could link the inter-related risks of products like home equity lines of credit (HELOCs) that exist alongside mortgages and have grown in popularity. If interest rates continue to rise, debt-service calculations based on total debt serviceability would offer another way to mitigate Canadians’ record level indebtedness.

IMPLICATIONS AND NEXT STEPS

OSFI is seeking feedback on the proposed changes, including whether these will achieve OSFI’s policy objectives and whether there are alternatives that OSFI should consider. One question raised is whether the proposed lender-level volume restriction should allow FRFIs discretion to underwrite a certain

number of loans that exceed any new thresholds, provided they are still permissible under their RMUP policies, and therefore potentially reduce the number of borrowers looking to provincial credit unions or less-regulated private lenders in response to the more restrictive federal rules.

The consultation paper notes several times that alternative measures available to OSFI could involve increasing capital requirements for FRFIs. It provides statistics on the higher volume of high LTI loans held by smaller and medium-sized FRFIs, noting that these risks could be addressed through the capital framework. OSFI recently raised the Domestic Stability Buffer applicable to the D-SIBs by 50 basis points to 3% of risk-weighted assets effective

February 1, 2023, while also increasing the range in which it can set the buffer to between 0% to 4%.

Comments are to be provided by April 14, 2023 to B-20@osfi-bsif.gc.ca. A draft revised Guideline B-20 will subsequently be issued for further public consultation. OSFI has also indicated that it may publish interim guidance based on the consultation

This article is republished with the permission of Fasken, a leading international law firm. Koker Christensen is partner, co-leader, Financial Services; Kathleen E. Butterfield is partner, co-leader, Financial Services. The authors acknowledge the contribution of Brittany Vanword, articling student. Information: fasken.com

CMB MAGAZINE CMBA-ACHC.CA WINTER 2023 I 11

GIFT? LOAN? INVESTMENT?

Does the purchase money advanced come with strings attached?

BY RAY BASI, J.D., LL.B., DIRECTOR OF EDUCATION FOR CMBA-BC AND MBIBC

BY RAY BASI, J.D., LL.B., DIRECTOR OF EDUCATION FOR CMBA-BC AND MBIBC

12 I WINTER 2023 CMBA-ACHC.CA CMBMAGAZINE

Ayoung couple is purchasing their first home. The husband’s parents are advancing $250,000 and you, as their mortgage broker, have arranged a loan for the $750,000 balance. The lender required – and the parents signed – a gift letter regarding the $250,000. You heard the parents and the couple discussing that the gift letter will satisfy the lender’s requirement but that they will sort out the $250,000 among themselves later. The purchase closes.

Fast forward three years and the couple is in the midst of a divorce. They are arguing about how their matrimonial property is to be divided. The wife says the parents gifted the $250,000 to them and so there is no debt that needs to be addressed as part of the property division. The husband says the advance was a loan that needs to be addressed as part of the property division. The parents say the advance was an investment in the property and they are entitled to a quarter interest in the value of the property. Each of the three characterizations of the $250,000 advance of course would net the parties different amounts.

Unfortunately, once the purchase had closed, the topic of the $250,000 was never raised. The parents had advanced the money from their line of credit and since then had made all of the required monthly payments. They never asked for nor received any acknowledgement of the debt or any payment toward it from the couple.

Scenarios such as this have become common as more young couples need financial assistance from the ‘bank of Mom and Dad’ to make their first real estate purchase. Unfortunately, families often fail to confirm the nature of the assistance provided. Was the assistance a gift, loan or investment? Some of the later disputes as to the correct categorization arise due to true misunderstandings, failing memories or matters of convenience following marriage breakups or family feuds, but all could be assisted with some appropriate discussion, notes and agreements. Understanding the approach courts have taken can help a mortgage broker assist their clients to avoid such disputes.

determines whether it is or is not a gift. This approach takes into account that people might later state their intention differently if circumstances change (such as the pending divorce of the couple to whom they advanced the money). They might then state their intention according to what benefits them or their favoured people in the new reality.

To determine the intention of the person making the advance, the court starts with the applicable presumption and then considers all of the evidence to see if it needs to be set aside. Among the evidence that is often relevant are oral statements made by the parties, written statements made by the parties (such as emails, texts, notes, correspondence and agreements), and the conduct of the parties before and after the money is advanced. How a party conducts themselves after the advance is made can be very telling about their intentions when they made the advance.

Some examples of factors courts have reviewed in determining the transferor's intention include:

n Whether there were any contemporaneous documents evidencing a loan;

n Whether the manner for repayment is specified;

n Whether there is security held for the loan;

WHAT IS THE DIFFERENCE BETWEEN A GIFT, LOAN AND INVESTMENT?

A gift is a transfer of funds/property in which there is no expectation of the person who advanced the funds/property being repaid. (For the sake of simplicity, we will refer to the funds/ property as “money.”)

A loan involves the person who received the money being obligated to repay the principal amount (or any part of it, as agreed), repay any interest agreed upon, and abiding by any other terms of the agreement (such as keeping the property taxes paid, the property insured and the property reasonably maintained).

An investment involves the person who advanced the money taking an ownership interest in the property, either proportionate to the amount of the advance or some other agreed proportion. This can be done by being directly registered on title or having the person registered on title hold the proportionate share on their behalf.

PRESUMPTION – AN ADVANCE IS NOT A GIFT

The Supreme Court of Canada in Pecore v. Pecore, 2007 SCC 17, (2007) 1 S.C.R. 795 2007 established presumptions in determining whether an advance of money is a gift.

Courts presume that where the advance was made for nothing in return, the person who made the advance did not intend it to be a gift. This presumption can be set aside by sufficient evidence indicating the advance was intended as a gift.

However, where the person receiving the advance is a dependent, minor child of the person who made the advance, the advance is presumed to be a gift. This presumption can be set aside by sufficient evidence indicating the advance was not intended as a gift.

INTENTION OF TRANSFEROR DETERMINES

It is the intention of the person making the advance, at the time the advance was made, that

n Whether there are advances to one child and not others or advances on equal amounts to various children;

n Where there has been any demand for payment before the separation of the parties;

n Whether there has been any partial repayment, and

n Whether there was an expectation or likelihood or repayment.

(Source: Kuo v. Chu, 2009 BCCA 405; Locke v. Locke, 2000 BCSC 1300)

The list is not exhaustive, and no factors alone determine the decision. The court looks at the entire picture to determine the person’s intention in advancing the money.

As indicated by the Supreme Court of Canada in the Pecore case, the party who wants to set aside the presumption does not need absolute proof of the intention of the advance. They need to prove it on the balance of probabilities; that is to say they need to persuade the court that it was more likely than not that the party had the intention the party claims.

CMB MAGAZINE CMBA-ACHC.CA WINTER 2023 I 13

determine the difference ADOBESTOCK.COM

determine the difference

WHAT HAPPENS IF THE TRANSFEROR IS NOT COMPETENT TO FORM THE INTENTION?

Stress

Equity Lending up to 1,500,000 1st and 2nd Purchase / Refinance, ETO up to 75% LTV Special offers for 600+ Beacon Scores in large urban centres Still waiting for Bank Approvals?

BRITISH

Greg Kakuno

Business Development Manager

604-430-1498

gkakuno@capitaldirect.ca

ALBERTA

Donna Hunter

Business Development Manager

403-874-6348

dhunter@capitaldirect.ca ONTARIO

Cheryl Smith

Business Development Manager

905-299-1706

Sometimes the person making the advance is mentally compromised, either due to age or other reason. The person who makes the advance needs to have sufficient mental capacity to have formed the intention to make the gift. They need to be able to understand substantially the nature and effect of the transaction [Royal Trust Co. v. Diamant, (1953) 3 D.L.R. 102 (B.C.S.C.)]. In other words, they need to be able to understand they are advancing money to the person and they will not be getting it back.

(For considerations as to how a broker might address a situation where there is concern as to a person’s mental capacity to make a gift, please refer to the Spring 2014 edition of Canadian Mortgage Broker, Capacity to Gift, p.39.)

GIFT OR INVESTMENT?

If the court decides the advance was not a gift, it still must decide whether it was a loan or an investment in the property. If it was a loan, the children can satisfy the debt by paying back the principal and meeting the terms of the loan. If it was an investment, the parents own a proportionate share of the property. The argument would be that while the children are registered as the owners of the property, they hold the proportionate share in trust for the parents.

This again comes down to the intention of the parent as indicated by all of the circumstances. Similar considerations apply as indicated above in determining whether a loan was intended. The court will look at all of the circumstances to determine whether the parties intended a loan or an investment by looking for evidence supporting one or the other. It may also look at the conduct of the parties, such as whether the parents contributed to the monthly mortgage payments, taxes, and maintenance and upkeep of the property.

TAKEAWAYS: WHAT CAN MORTGAGE BROKERS DO?

Mortgage brokers are advisors. They would be of service to their clients by drawing to their attention the pitfalls that can be avoided by having frank conversations as to the nature of the advance and the parents’ intentions. They can recommend the parties document the

intention of the persons making the advance and perhaps having a lawyer draw up an appropriate agreement.

The mortgage broker should advise the clients as to the requirements of the lender. For example, the lender may not be willing to commit to the loan unless the parents sign a gift letter form provided by the lender. That form will likely include having the person confirm they are making the advance as a gift to the clients without any expectation of repayment. The dilemma of course is that the parents signing the gift letter makes it more difficult for them to later, such as on the pending divorce of the children, deny the in-law child the benefit of the gift.

The other possibilities can also be problematic. If the parents confirm the advance as a loan, the children may not be able to secure financing for the balance of the purchase price because their total debt service will have increased.

If the parents confirm the advance as an investment, they may hamper the children from obtaining the full benefit of first-time home buyer programs, the parents may attract capital gains tax concerning their share of the property, and they take on obligations regarding maintaining the property and its associated costs. Importantly, if the parents ignore the issue and raise it only when it becomes a problem, they may be left with an uphill battle to convince the court of their true intention at the time the advance was made.

It is not for the mortgage broker to decide for the client, but it is for them to identify the issue and provide advice appropriate for their position. Where the matters require greater expertise, they should recommend that the clients obtain legal advice.

14 I WINTER 2023 CMBA-ACHC.CA CMB MAGAZINE

This article is not intended as legal advice. You are advised to obtain legal advice in specific instances. COLUMBIA

Test killing your deals? Your clients need you now, more than ever as the banks are tightening up! We offer 24 Hour turnaround on commitments – allowing you to present solutions for your clients sooner rather than later.

csmith@capitaldirect.ca

Derek Diener applies the lessons he’s learned from sports to his successful career as a mortgage broker

BY LISA GORDON

erek Diener loves running on Kootenay time. As a mortgage broker in the town of Nelson, British Columbia, he encounters a wide variety of clients who need different financing solutions. Passionate about living and working in B.C.’s southern interior, Diener especially enjoys working with first-time buyers and those who are relocating to the area.

Over the last 12 years in the mortgage business, Diener has built up an extensive network in the town of 10,000. But when he’s not writing deals, the 46-year-old mortgage broker with Dominion Lending Centres Blue Tree Mortgages West admits he’s obsessed with sports.

From his lakeside home just outside Nelson, Diener can jump into his side-by-side ATV, equipped with tracks for the winter, and follow access roads into the wilderness. There, he can pursue his biggest passion: earning his turns in B.C.’s breathtaking backcountry.

Also called “ski touring,” his favourite sport is all about getting off the beaten path. Diener uses a splitboard – basically a normal snowboard that splits into two skis – and attaches “skins” that help him climb uphill. Once he’s crested a mountain, he removes the skins, reconfigures back

Opposite: Derek Diener doing what he loves best, venturing off the beaten path on a splitboard.

to a snowboard, and savours the experience of boarding downhill.

“I love sports and being outdoors,” Diener told Canadian Mortgage Broker. “Ski touring is my thing right now. I could talk to you all day about it. Splitboarding was relatively new when I moved to Nelson 15 years ago, but the sport has exploded.”

A great deal of planning leads to that moment of triumph on the mountaintop. Usually, Diener begins mapping an excursion days before, figuring out which mountain to summit, monitoring avalanche reports, gathering up people to accompany him, and route-finding the best way to the top.

“Once you summit, you see all sides of that mountain,” he said. “It’s an exhilarating feeling. The hard part is over and now you get to snowboard this line you’ve scoped out.

“I also love the social part of it, and the fun going down the mountain. I integrate that into my business, too. This morning, I was snowboarding with a Realtor and three of my clients.”

16 I WINTER 2023 CMBA-ACHC.CA CMB MAGAZINE brokers off-the-clock

D

TURNS

HIS TURNS

brokers off-the-clock

Growing up in Saskatoon, Sask., the mountains were out of reach. Back then, Diener spent most of his time at the hockey rink. He was eventually drafted by the Philadelphia Flyers and later played professionally with the St. Louis Blues farm team, before suffering a serious injury with the Vancouver Canucks.

“That was my life to age 23. Hockey was everything. Then, I had an injury on the first day of training camp with the Canucks. It ended my career.”

After that, Diener went back to school to study business administration and began to focus on another sport he’s passionate about: golf.

“I was a club golf professional for about seven or eight years and ran the golf shop and taught the game,” he recalled. “Then, I moved out to Nelson for some real estate endeavours and eventually reinvented myself in mortgage brokering.”

Although his background is diverse, the one common thread is a love of sports. Diener said there is a social component to sports and people want to work with those who share common interests.

“I started to leverage that in the mortgage business,” he said. “It really worked, because people liked to hear me talk about sports as well as fixed or variable rate mortgages.”

Besides snowboarding, ski touring and golf, Diener plays with an informal hockey league once a week. He supports associated charity events whenever possible, and has volunteered with the Rotary Club of Nelson.

It hasn’t been easy pivoting into new sports or new careers, he reflected.

“For me, nothing came easy. To excel in sports, you have to put time in. You don’t just go right to the top. I’ve always had that mentality; I always humble myself and learn from the bottom up. That’s a big thing for me and that’s what helped me get started in the mortgage broker business. It still helps me, because I get in there to understand

“what’s happening with my clients and then I work hard for them. I always scale it back to learn the nuts and bolts of my clients’ unique situations, and then use my experience and expertise to get them the best mortgage product possible.”

Just as he prepares to summit a mountain, Diener researches the mortgage market daily, so he can best understand the current landscape.

As 2023 unfolds, Diener expects it to be a slower year where the emphasis will be on customer service, as well as keeping up with economic developments and changes with lending partners.

“Be available for my current and future clients and stay informed: That is my focus as we move into 2023 – it will be crucial for my book of business moving forward.”

Left: Derek

Right: Nowadays Derek plays in an informal hockey league about once a week.

“I think as the world gets more complex, our job as mortgage brokers becomes more important,” he concluded. “Everyone has a unique situation and their own complex considerations. As mortgage brokers, we have a lot of knowledge and connections with multiple lenders, and the trend is that more and more people are using us. Having someone experienced in mortgages who can give you options is very important.”

This interview with Derek Diener continues our series Brokers off the Clock. In every issue, we ask a mortgage broker to tell us what they like to do when they’re not behind a desk. Be it working with animals, travelling to exotic places or researching your family roots, we want to know how you unwind. Would you like to be profiled in a future edition –or suggest a fellow mortgage broker? Contact info@cmba-achc.ca

18 I WINTER 2023 CMBA-ACHC.CA

As the world gets more complex, our job as mortgage brokers becomes more important.

was drafted but his hockey career was cut short by an injury;

CMB MAGAZINE CMBA-ACHC.CA WINTER 2023 I 19 DATE: LIVE: TRIM: BLEED: JANUARY 9, 2023_2PM 8.375” x 10.75” NA NA Ensuring our borrowers see a clear path to success is our unique specialty. We’re one of North America’s leading commercial non-bank mortgage lenders with over $3 billion under administration. We specialize in bespoke lending solutions for commercial real estate financing in amounts from $10M to $400M. We’ll share your vision, and your entrepreneurial mindset, to provide time-sensitive lending and financing solutions. Let’s talk. 800 494 0389 | romspen.com License # 10172 Your lender should remove obstacles, not be one. Investment Corporation LAWRENSONWALKER.COM VANCOUVER · VICTORIA · OKANAGAN PEACE REGION · CALGARY · EDMONTON Guiding You Through The Storm

Steep penalties for those found guilty of violating the Prohibition on the Purchase of Residential Property by Non-Canadians Act

BY RAY BASI, J.D., LL.B., DIRECTOR OF EDUCATION FOR CMBA-BC AND MBIBC

NEW RESPONSIBILITY FOR MORTGAGE BROKERS REGARDING NON-CANADIAN CLIENTS

As of January 1, 2023, under the provisions of the Prohibition on the Purchase of Residential Property by Non-Canadians Act*, non-Canadians are prohibited from purchasing, directly or indirectly, any residential property in Canada. A mortgage broker who attempted to or did counsel, induce, aid or abet a non-Canadian to violate the prohibition would be guilty of an offence and subject to a fine of up to $10,000.

The following will help mortgage brokers understand the new law.

WHY THE PROHIBITION?

The federal government indicated the Act supports its intention to address prevailing housing affordability concerns experienced by Canadians.

WHAT PROPERTY IS INVOLVED?

The prohibition applies to “residential property.” The Act defines the term very broadly and includes any property located in Canada that is:

n A detached house or similar building, containing not more than three dwelling units; or

n A part of a building that is a semi-detached house, rowhouse unit, residential condominium unit or other similar premises that is a separate parcel owned apart from another unit in the building.

However, land that meets the following requirements is exempted from the definition of “residential property” and thus from the application of the prohibition:

n does not contain any habitable dwelling;

n is zoned for residential use or mixed use; and

n is located in a community no larger than permitted by the Regulations (as the permitted community size is specific and technical, you are encouraged to refer to the wording in the Regulations).

This exemption is intended to exclude certain recreational properties from the application of the prohibition.

CMB MAGAZINE CMBA-ACHC.CA WINTER 2023 I 21 legal ease

ISTOCK.COM

legal ease

WHAT AMOUNTS TO A PURCHASE?

Essentially any acquisition of an interest in residential property, with or without conditions, amounts to a purchase under the Act. However, the following are excluded:

n Acquisitions by an individual resulting from death, divorce or separation, or a gift

n A tenant renting and occupying a dwelling unit

n A transfer under a trust that was created before January 1, 2023

n Foreclosures

On its face, it would appear that a nonCanadian lender secured by residential property would be acquiring an interest in property that would be prohibited by the Act.

WHO IS A NON-CANADIAN?

A non-Canadian is defined as:

n An individual who is not a Canadian citizen, a permanent resident of Canada, or registered as an Indian under the Indian Act;

n A foreign corporation;

n A private corporation incorporated in Canada but controlled by a non-Canadian;

n A foreign entity; or

n A private entity incorporated in Canada but controlled by a non-Canadian. In effect, a non-Canadian cannot purchase the property themself, or through a corporation, trust or other legal entity. However, the following are exempted from the prohibition provided they meet criteria specified in the Act and its regulations:

n A temporary resident who is a foreign student

n A temporary resident who holds a work permit

n A refugee

n Consular staff and members of international organizations residing in Canada

n Where the prohibition would conflict with Indigenous rights recognized and affirmed by the Constitution

WHAT ARE THE PENALTIES?

A mortgage broker who attempted to or did counsel, induce, aid or abet a non-Canadian to violate the prohibition is guilty of an offence and subject to a fine of up to $10,000.

Every non-Canadian who is found guilty of violating the Act is guilty of an offence and subject to a fine of up to $10,000.

A corporation, director, officer, manager or other who directed, authorized, assented to, acquiesced in or participated in the offence may also be liable, regardless of whether the corporation was prosecuted.

IS THE TRANSACTION INVALID?

A transaction that violates the Act remains legally binding; however, a court may order that the property be sold and the proceeds distributed in the following order:

n To the government to cover its costs of the court process, the sale, and any fines owed by the non-Canadian under the Act

n To others to cover their debts in the amounts and priority determined by the court

n To the non-Canadian (the amount is to be no greater than they paid for the property)

n To the Receiver General for Canada, the balance remaining

IS THE LEGISLATION PERMANENT?

The legislation is set to be automatically repealed in two years. Of course, this does not mean the government cannot change its mind and extend the two-year period or even make the prohibition permanent.

WHAT ABOUT EXISTING CONTRACTS?

The prohibition does not apply to contracts of purchase and sale entered into or assumed before

January 1, 2023, provided the non-Canadian became liable or assumed liability under the contract prior to this date. This could be interpreted to mean that any Agreement of Purchase and Sale signed by a non-Canadian by December 31, 2022, would be exempt from the prohibition. Given the amounts of money involved in these transactions, it is recommended that legal advice be obtained regarding any specific Agreement.

TAKEAWAY: CHANGES TO MORTGAGE BROKERING PRACTICE

The Act does not impose any additional compliance requirements (such as related to collection, processing or reporting) on mortgage brokers. However, mortgage brokers should establish prudent business practices to collect, review and document information provided by non-Canadians in the course of a business transaction, particularly regarding any claim that the non-Canadian comes within an exception/exemption. ‘Know your client’ practices, due diligence and retaining of thorough documentation (including notes) are suggested. The due diligence should include but not be limited to a signed statement from the client in the client services agreement that that they are not a nonCanadian under the Act.

This article is not intended as legal advice. You are advised to obtain legal advice in specific instances.

22 I WINTER 2023 CMBA-ACHC.CA CMB MAGAZINE

ADOBESTOCK

The legislation, the Prohibition on the Purchase of Residential Property by Non-Canadians Act, can be found at https://laws-lois.justice.gc.ca/eng/acts/P-25.2/page-1.html and the Regulations at https://canadagazette.gc.ca/rp-pr/p2/2022/2022-12-21/html/sor-dors250-eng.html.

*

CMB MAGAZINE CMBA-ACHC.CA WINTER 2023 I 23 BMI Advisory Services offers every client a fully personalized plan to best meet their insurance needs We offer Life Insurance, Disability Insurance, Critical Illness, Travel, Health & Dental and more Rosy Jallad 778-893-0510 rosy@bmiadvisory ca Jessey Camara 604-761-1552 jessey@bmiadvisory ca To work with BMI Advisory Services Contact: BMIAdvisory ca

BLIZZARDS, BANKS AND BROKERING

BY LISA GORDON

“I had a fairly strong presence in London and the surrounding area, with a large network,” recalled Shaw. “So, in April 2014, I began as a mortgage specialist at one of the big banks, with no prior experience. I consider myself a quick learner, but I learned that a commission sales role has an entrepreneurial foundation. The bank gives you tools and resources, but it’s on you to use them and ask questions, and use everything in your tool box.”

Shaw realized his new job was sink or swim.

“When I got in there, I had a huge network. My reputation was good. I had trust from people off the hop, but my knowledge needed brushing up.”

That’s when he began shadowing one of the top mortgage specialists in the country, who happened to live in London.

Growing up in London, Ont., Matt Shaw was steeped in an entrepreneurial environment, learning lessons about hard work and responsibility at a young age.

“My mom owned some restaurants, so I grew up around it. It was second nature,” Shaw told Canadian Mortgage Broker. “I worked three jobs while going to school, on and off campus. One of them was managing a Dairy Queen store. That led me to the opportunity to buy into a Dairy Queen – and that’s what got me into franchising.”

He admits that it wasn’t everything he had expected. As much as he was running his own business, he still had to operate within the guidelines set out by Dairy Queen.

“You’re really confined as far as what you can do when you work for a big conglomerate.”

Shaw quickly realized that earning a good income meant scaling up with multiple locations, so he got a second store within 18 months, and a third just a year after that.

“I built the third store from scratch, which fuelled the entrepreneurial desire and led into a real estate mindset,” he said.

At that point, Shaw was approached by his commercial account manager at the bank. They were leaving to go to another bank and wanted Shaw to join their mortgage team. It was an intriguing offer for someone who has always liked a challenge.

“I’d show up at his house in the morning and literally follow him all day, just listening to him. It was the best learning experience I had. I was able to take that learning and apply it to my business and my network. From then on, I was in the top 10 per cent in Canada.”

But even though he was excelling in his new role, Shaw was also learning something else: Many of his clients, like him, were self-employed. The bank didn’t have many mortgage solutions for them.

“I was one of the top mortgage specialists referring deals to our alternative lending channels,” he recalled. “I realized then that maybe I was in the wrong place. I needed a bigger tool box –something that had more than one product to provide my clients with other solutions.”

So, in March 2019, Shaw teamed up with two colleagues at the bank – Aly Jamal and Andy Jia – to form BNB Financial Group with Mortgage Alliance.

Once again, Shaw found himself confronting a steep learning curve.

“We were humbled very quickly in the broker space. I think we took a lot of things for granted that we had had at the bank. They have vast resources. You get an assistant, opening/closing solutions, back-end support, etc. When you’re a broker, you are that person for the entire journey with the client, from submission right through to closing.”

The bank and broker spaces are vastly different, added Shaw.

“I would say I’m a better mortgage agent now because of my broker experience. Here,

24 I WINTER 2023 CMBA-ACHC.CA CMB MAGAZINE

industry profile

Whether in food or finance, mortgage agent Matt Shaw is drawn to new challenges that exercise his entrepreneurial spirit

you definitely get to run a business, whereas at the bank you’re a salesperson selling the bank’s products. When you’re a broker, you’re looking at all the options and constantly looking for solutions for your clients.”

Shaw and his partners had to “relearn” the business while transitioning from bank to brokerage.

One of their biggest innovations was to create a “hub” – run by Shaw and one other employee – that streamlined all mortgage transactions by handling administrative tasks for the company’s eight agents.

“We’d send a deal in on their behalf to a lender that they wanted, and we’d handle lender questions on the agent’s behalf,” explained Shaw. “These are all tedious tasks. It was a real benefit for me to go in and create the hub and build relationships with the lenders. I took that time to learn everything and apply it to my own book of business and provide support to the other agents on our team.”

Just as he was transitioning out of the hub and back into a full-time mortgage agent role, the COVID-19 pandemic hit. Within 30 days, the team was disconnected, sequestered in their homes. Momentum slowed and collaborative chatter ceased.

“The big thing with brokering is that it can be really lonely,” reflected Shaw. “Having a cohesive team atmosphere is a big plus, so we made a real effort to have regular Zoom calls to keep people connected.”

Now that business is returning to normal, he predicts that 2023 will be a year of solutions-based lending.

“A lot of Canadians out there are trying to navigate this interest rate market, whether they are in a variable mortgage or coming up for renewal this year. It’s going to be about giving advice and finding solutions to fit people’s needs. Mortgage brokers will be challenged to show their value.”

A self-proclaimed “people person,” Shaw, now 41, believes the most important thing is being there to provide clients with good advice. Even if that doesn’t result in a transaction, he thinks clients will eventually return to him when they do need a mortgage. In the end, it’s all about the relationship.

“Clients, lenders, back office support, appraisers, vendors... There is a ton of relationships to be had here, and you really need to take care of them. At the bank, it really was transactional. In this space, relationships are everything and it’s not about a one-time transaction.”

CMB MAGAZINE CMBA-ACHC.CA WINTER 2023 I 25

“

I was one of the top mortgage specialists referring deals to our alternative lending channels. I realized then that maybe I was in the wrong place. I needed a bigger tool box –something that had more than one product to provide my clients with other solutions.

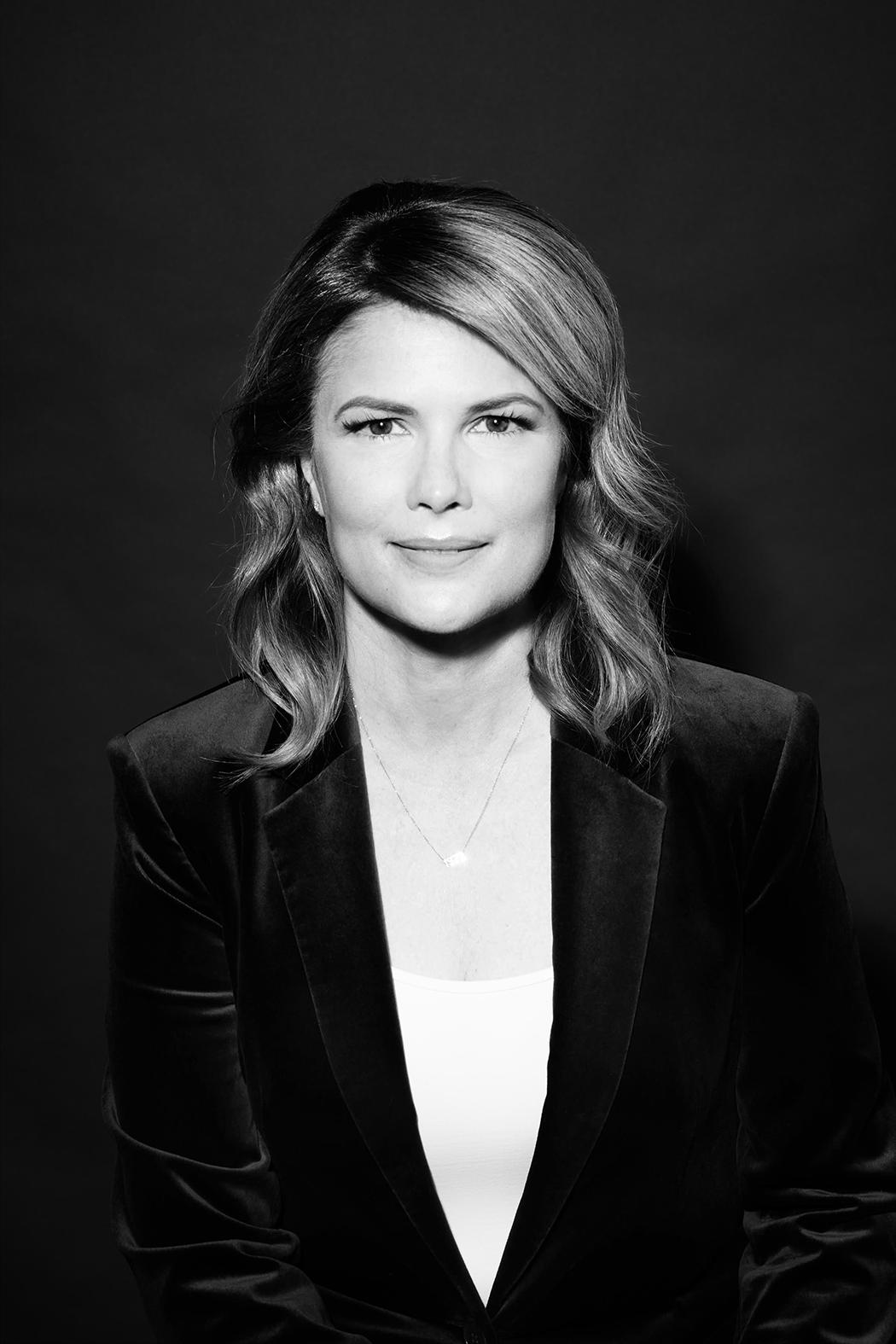

Q&A WITH FINANCIAL COMMENTATOR PATTIE LOVETT-REID

The Bank of Canada’s latest interest rate hike has put further pressure on an already stressed housing market. While pent-up demand continues to outstrip housing supply, the coming 12 months could be a crucial time for the mortgage industry as the economy slows and unemployment rises in some sectors.

2023 MORTGAGE AND REAL ESTATE OUT LOOK

BY CHRIS FREIMOND

To find out what the future holds, Canadian Mortgage Broker asked financial commentator Pattie Lovett-Reid to share her outlook for real estate and mortgages over the next year.

Lovett-Reid was previously a senior vice president at TD. She is also a Certified Financial Planner, best-selling author and former chief financial commentator at CTV. She became a household name through her

market outlook

26 I WINTER 2023 CMBA-ACHC.CA CMB MAGAZINE

time as a regular guest on BNN Bloomberg and as host of the Pattie Lovett-Reid Show on CTV.

Lovett-Reid is currently chief financial commentator at HomeEquity Bank, provider of a range of reverse mortgage solutions including the flagship CHIP Reverse Mortgage™ product for Canadians aged 55 and older.

CMB: What are currently the primary economic issues impacting the housing sector and mortgages?

Pattie L-R: For the average Canadian on the street, higher interest rates sure are an issue, but I’m not sure affordability is front and centre. I think it’s more about lack of supply out there, which means there is still pent-up demand.

We are seeing many first-time home buyers – and many home buyers in general – amass more of a down payment than we’ve seen in a long time. But they can’t deploy it. They can’t find the right house at the right price.

We don’t know for sure that it’s the last increase. It takes time for these interest rate hikes – eight of them in a row – to work their way through the system. It appears to be working, but we don’t know with absolute certainty yet, nor does the Bank of Canada. Was the recent increase an insurance policy? A bit of one. Some would suggest that the Bank was a little too slow in starting to raise interest rates then was in catch-up mode.

So, the fear of missing out has been overtaken to some extent by the joy of missing. Many buyers are now saying maybe it’s better to wait and see if more supply comes onto the market in the spring selling season, and maybe prices will continue to move a little lower.

CMB: What is causing the lack of supply?

Pattie L-R: There’s pent-up demand driven in part by immigration. We have one of the fastest growing populations – if not the fastest growing – in the G7 nations. We simply don’t have the supply. Also, I think many Canadians are opting to stay in their homes longer, so they are not putting them up for sale, adding to the shortage. Many are instead turning to CHIP Reverse Mortgages, which were once probably the most disliked product on the market because in many cases they were misunderstood.

But you can’t eat a brick in retirement. The economic slowdown is prompting many homeowners to use the equity in their homes to create a little financial wiggle room and allowing them to stay in their home longer.

The supply crunch is also exacerbated by millennials who have been living under their parents’ roof, but neither they nor their parents want it to go on forever, so they are looking for homes of their own.

CMB: Other than homeowners who want to stay in their homes longer, to what extent is the supply shortage caused by those who don’t want to sell when prices are falling and are waiting for prices to recover?

Pattie L-R: I think there may be some of that, but I also think people need to look in absolute numbers. What actually is your principle gain on this residence? What did you buy in at?

For many Canadians, a house is their largest asset, but it’s also their most emotional asset. Regardless of whether the market is up or down, they need to do a reality check before putting their house up for sale: Why are you selling? Do you need to sell? Are you pricing yourself out of this market?

And even those who tell me that they want to downsize, I often think, are you really downsizing in terms of just dollars? If so, where are you going to go and what are the lifestyle considerations?

The shortage has also in part been induced by the Bank of Canada with interest rate hikes to slow down the one thing that propped up the economy, which was the housing market during the pandemic. The Bank is now trying to reverse course so that we can beat down inflation and put more money in the pockets of Canadians and allow the economy to continue growing.

So I do think we’re at an inflection point, a bit of a reset, and households are assessing what that means for them.

CMB: It seems counterintuitive that there is still such pent-up demand in spite of rising interest rates. Why is that?

Pattie L-R: I think what’s happened is that people who went through the qualifying process for mortgage loans and had their deposit ready, pulled back when the market was stronger and refused to get into a bidding war. They still have their deposit and still dream of owning a home and will continue to look for it.

CMB: Do we need to change the requirements of qualifying for a mortgage?

Pattie L-R: I think our banks have been very prudent. If you look at our delinquencies right now, people may not be happy with high inflation and interest rates going higher, but our delinquencies are still very low.

CMB MAGAZINE CMBA-ACHC.CA WINTER 2023 I 27

“

market outlook

The housing market has proven to be very resilient. We could see prices drop further in the spring and not get the usual uptick that we’ve seen before, but I think it’s going to be temporary. The dream of home ownership is still there for a lot of people who missed it on the last round.

CMB: It has been suggested that the latest Bank of Canada interest rate increase may be the last for a while. How do you think that’s going to affect the real estate market and the mortgage industry in particular?

Pattie L-R: We don’t know for sure that it’s the last increase. It takes time for these interest rate hikes – eight of them in a row – to work their way through the system. It appears to be working, but we don’t know with absolute certainty yet, nor does the Bank of Canada. Was the recent increase an insurance policy? A bit of one. Some would suggest that the Bank was a little too slow in starting to raise interest rates then was in catch-up mode.

And when I look at what the market is pricing in 2023 to 2024, if the economy lapses into this slowdown, which is expected by just about every economist on Bay Street, the Bank may be in a position or even forced to cut rates by as much as 200 basis points.

As far as mortgages go, there are many savvy people out there saying that if you find your dream home and it’s in the right location and you have the deposit and can afford the payments and you believe rates will be coming down, then variable products may be suitable for you.

Whether to opt for fixed or variable rate products is a personal choice. I know people who have had variable rates during the time that rates have been rising. They have altered their lifestyle, are still making their payments and are comfortable with where they are at. But I know others with fixed rates who say they would not sleep at night if they were stuck with a variable rate product.

There’s the right product out there for the right person, and everyone has their own view on the economy. However, the job market is the wild card. Do you have a job? Will you be able to maintain your job through this?

And yes, jobs have been very strong, which is why some are saying this is going

There’s a lot of talk about prices maybe being down 25 per cent over the next year. There’s no doubt that prices have come down. But the housing market has proven very resilient, and it is a far cry from where you see a pullback from a bubble that has burst. We have demand here in Canada, and it is a sector that has served us well through the pandemic.

to be a mild recession because we still have a labour shortage, but we don’t have a labour shortage in every sector, technology and financial services for example.

If you have a job, you don’t worry about a recession. If you find the right home and you can afford it and you have the down payment, you don’t worry about making your mortgage payment. It’s the minute you don’t have a job that you start to worry.

CMB: Other than interest rates and employment security, are there any other significant factors that you think will influence home buyer or home seller decisions in the next year or two?

Pattie L-R: I think the employment landscape will play a role. During COVID-19 when people could work from home, many moved out of urban centres to more rural locations. They believed they would never have to return to the office.

Initially, employers were happy to see that happen, but many are now realizing that 100 per cent remote is not working for them and they are calling employees back into the office. It still has to be played out, so we don’t know how it will impact the housing market or how much flexibility employers are prepared to allow.

CMB: What advice would you give to help mortgage brokers navigate the current market conditions, particularly with interest rates having risen yet again?

Pattie L-R: The mortgage brokers I know do a fabulous job at this already. I think it’s about putting it into perspective. Drilling down on what a client may need versus what they think they want or would like to see. What may appear attractive in mortgage terms and conditions for one person is not attractive for the next. They need to ask their clients how long they expect to stay in this

location and look at their life as a whole.

It’s about taking that hand-holding step further and it becomes more of a partnership based on: “I’m going to get the best deal for you,” which doesn’t always mean it’s the best rate, but rather the best package.

CMB: With the real estate market having changed to the extent that it has, do you see any new types of mortgage products coming onto the market to deal with the new circumstances?

Pattie L-R: I am not an expert on all of the mortgage products available and, at least from my perspective, if I don’t fully understand them, does the end consumer?

Maybe there are opportunities for changes such as moving away from the conventional five-year and three-year fixed mortgages. Maybe we could have a longer amortization period and different pay down methods, more tailored to the individual consumer.

I appreciate that a bank’s funding commitment is a business decision, but they may need to look at new products to maintain or grow market share as the lending landscape alters.

CMB: Finally, what is your outlook for the housing market as a whole?

Pattie L-R: There’s a lot of talk about prices maybe being down 25 per cent over the next year. There’s no doubt that prices have come down. But the housing market has proven very resilient, and it is a far cry from where you see a pullback from a bubble that has burst. We have demand here in Canada, and it is a sector that has served us well through the pandemic.

In my opinion, as we enter into an economic slowdown and even as we come out of it, it will be a sector that continues to serve this country well.

28 I WINTER 2023 CMBA-ACHC.CA CMB MAGAZINE

“

CMB MAGAZINE CMBA-ACHC.CA WINTER 2023 I 29

RATES, RISKand the ROLE of the MORTGAGE BROKER

30 I WINTER 2023 CMBA-ACHC.CA CMB MAGAZINE client relationships ADOBESTOCK

Client service agreements can be golden when arranging variable rate mortgages

BY RAY BASI, J.D., LL.B., DIRECTOR OF EDUCATION FOR CMBA-BC AND MBIBC

THE PROBLEM

Is a mortgage broker responsible for losses or damages suffered by a client who entered into a variable rate mortgage? If the mortgage broker established the client relationship appropriately and conducted themself accordingly, no; otherwise, possibly.

A variable rate mortgage often provides a client with a more favourable initial interest rate than other products. It comes with the ongoing benefit that if mortgage rates decrease more of the client’s payment will be applied to the outstanding mortgage principal. However, it also comes with the ongoing risk that if mortgage rates increase less of the client’s payment will be applied to the principal.

As well, if the mortgage interest rate increases significantly, the initial payment amount may not be enough to cover the increased interest charges. In such cases, most variable rate mortgages allow the lender to require an increase of the payments amount or call the mortgage due.

Indeed, this latter situation has arisen for many variable rate mortgage borrowers in the past year due to the steep rise in interest rates. Some clients accept that the risk came with the mortgage product for which they signed up; others may claim surprise at not having been advised of the risk by their mortgage broker.

CMB MAGAZINE CMBA-ACHC.CA WINTER 2023 I 31

MORTGAGE

What can a mortgage broker do to reduce the chances of a client legitimately making such a claim? In answering this question, we will consider whether the mortgage broker has an obligation to discuss the risks by virtue of their position or pursuant to an agreement. We will end by suggesting some practical considerations for a mortgage broker when arranging a variable rate mortgage.

ARE THERE FIDUCIARY OBLIGATIONS?

Is a mortgage broker a fiduciary of the client? Would being a fiduciary of a variable rate mortgage client automatically make the client responsible for loss and damages suffered by the client?

No law makes a mortgage broker automatically a fiduciary of their client. No broker should, barring extenuating circumstances, enter into an agreement to become a fiduciary of their client. No broker should conduct themselves in a way that makes them a fiduciary of their client. A broker should avoid exercising discretion or making decisions for their client. They should make complete and candid disclosure to their client of all material information, provide competent advice for the client to consider, educate/ equip the client to provide informed instructions, and they should follow the instructions provided. A mortgage broker who unilaterally decides that a variable rate mortgage is best for a client or acts on uninformed instructions to arrange such a mortgage takes a step down the undesirable path of being a fiduciary.

A mortgage broker who is found to be a fiduciary of a client is more likely to be responsible for loss and damages suffered by the client due to the mortgage broker’s actions. I say more likely because it is possible the mortgage broker could be found to have been a fiduciary for some purposes but not for others. A mortgage broker who avoids being a fiduciary at all avoids having to make nuanced arguments concerning this finer distinction.

PROFESSIONAL STANDARD OF CARE

A broker who fails to meet the standard of care expected of mortgage brokers may be found to be negligent and responsible for a client’s loss and damages. This begs the question: what is the standard of care expected of a mortgage broker?

In discussing the standard of care expected of professions/occupations, courts use varying language such as requiring the person to have and exercise the degree of skill of an average practitioner in the field or that of a reasonable and prudent practitioner in the field. The fine differences in language do not matter for our purposes. As indicated in more detail when discussing fiduciaries, a broker should not exercise discretion, should not make decisions for the client, should make complete and candid disclosure of all material information, should provide competent advice, and should take only informed instructions. Taking that approach would appear to satisfy the standard, regardless of its specific wording.

I do note that courts in considering whether the applicable standard was met in a certain case will take note of legislative and regulatory standards and industry practice, but in the end, it is the court that sets the standard in terms of determining whether the broker was negligent. It is not a bullet-proof defence for the broker to say that everyone in the business does it that way. It is open for a court to conclude that the industry’s standard is too low and hold the specific broker responsible for the client’s loss and damages.

CLIENT SERVICE AGREEMENTS

Every broker should have a client service agreement (CSA) with every client. It should establish the relationship between the broker and the client, including setting out what the broker is committing to doing and what they will not be doing. The CSA can be a valuable tool if the client later wrongly seeks to impose an obligation on the broker.

The CSA should be reasonable in setting the list of included and excluded duties. It should reflect the industry’s general practices and what a usual client would expect of a broker. Any exceptions should be highlighted for the client. While it might be tempting to try, a CSA is unlikely to be successful in negating a standard of conduct required by the court or a duty imposed by legislation or regulation. As well, it is highly unlikely a CSA would be effective in allowing the broker to contract out of negligence. For example, it would almost certainly not be effective for the CSA to state that the

client is agreeing to not hold the mortgage broker responsible for any losses or damages the client suffers whether or not they arise because of an act or omission of the mortgage broker.

The CSA should be clear in stating that everything the broker does or says should be understood as the broker maintaining their role as an advisor. Anything that could be understood otherwise is to be understood as being only advice and not a decision. It should include that the broker will: disclose all material facts to the client, provide their best advice, inform the client to equip them to make decisions and instruct the broker, and will act on instructions and not make decisions for the client.

THE CURRENT VARIABLE RATE MORTGAGE ISSUE

Having an appropriate CSA in place, it only remains for the broker to conduct themself accordingly. Specifically, with regard to arranging a variable rate mortgage, they should:

n Not decide for the client that a variable rate mortgage is best for the client;

n Advise the client of the benefits (including generally a lower interest) of the variable rate mortgage;

n Advise the client of the risks (including those related to the interest rate increasing as discussed previously and as stated in the lender’s documentation);

n Advise the client of the benefits and detriments of possible alternatives;

n Equip the client to decide whether to instruct the broker to proceed with the variable rate mortgage; and

n Not limit the information to the client so they are unable to decide that they do not prefer a variable rate mortgage.

TAKEAWAY

An appropriate CSA coupled with a mortgage broker conducting themselves accordingly can assist a broker from claims concerning variable rate mortgages, particularly that the broker did not explain the benefits and risks involved.

The CSA and the broker's conduct should make and keep clear that the broker is, in relation to the client, only an advisor and not a decision-maker.

This

32 I WINTER 2023 CMBA-ACHC.CA CMB MAGAZINE client relationships

article is not intended as legal advice. You are advised to obtain legal advice in specific instances.

With uDrive, you’re in control.

As an alternative MIC mortgage lender, we focus on being a good business partner to our broker community. We work diligently to find creative solutions for your clients who don’t qualify for traditional financing.

• uDrive: No Fee or Lower Rate

• Residential 1st and 2nd mortgages

• Fully open options available

• Lending in BC, AB and ON

• Maximum LTV of 75%

• Submissions can be made via Expert, Velocity or Lendesk

CMB MAGAZINE CMBA-ACHC.CA WINTER 2023 I 33 WELCOME ABOARD! BECOME A MEMBER TODAY! LEARN MORE AT: www.cmba-achc.ca/membership 604.408.9989 CMBA’S PROVINCIAL MORTGAGE BROKER ASSOCIATIONS REPRESENT MEMBERS IN: • British Columbia • Ontario • Quebec • Atlantic Canada MEMBERSHIP HAS BENEFITS: • JOIN A GROUP OF LIKE-MINDED PROFESSIONALS • COURSES & WEBINARS TO CONTINUE YOUR EDUCATION IN THE INDUSTRY • NETWORK WITH LEADING INDUSTRY EXPERTS INVEST. LEND. GROW. threepointcapital.ca uDrive@threepointcapital.ca | 1.800.979.2911

NOW YOU’RE IN THE DRIVER’S SEAT. FSRA #13070

STRESSFUL TIMES REQUIRE EXPERT SOLUTIONS

2023 is a year of opportunity for mortgage brokers, whose toolbox of customized financing options can’t be matched by mainstream lenders

BY LISA GORDON

ince the Bank of Canada began hiking interest rates in March of 2022, mortgage broker Denise Laframboise has noticed a growing trend: bank clients are reaching out to her more often because they aren’t getting customized financial advice.

“This is the type of market that creates a need for experts,” said Laframboise, who operates LaframboiseMortgage.ca – Mortgage Architects in Whitby, Ont.

“If you’re dealing with someone (at the bank) who has never owned a home or doesn’t know their stuff, that’s not going to fly now. It’s a stressful time for people, and they really need good advice.”

Throughout 2022, the Bank of Canada steadily raised the overnight lending rate from 0.25 per cent in January to 4.25 per cent in December. In January 2023 the rate was raised to 4.5 per cent.

Laframboise, who has been in the mortgage industry since 2016, said she is passionate about helping clients pay less interest while building net worth through strategic real estate investing.

“Right now, homeowners may be facing the perfect storm,” she told Canadian Mortgage Broker. “The Christmas bills are coming in. If you’re part-time, you may have been off work for the holidays. And now, they’re talking about another rate increase.”

34 I WINTER 2023 CMBA-ACHC.CA CMB MAGAZINE financing options

S

Some variable rate mortgage holders have already received trigger rate notices from their banks. This means that the prime rate has risen to a point where their static monthly payments are barely covering the interest owed – without paying down any principal. At that point, the bank may increase their payments.

In this kind of financial climate, Laframboise takes a holistic approach with her clients. With inflation driving up the prices of groceries, gas and other commodities, it’s not just about variable rate mortgage payments.

“Strategic restructuring is best for clients with higher

debt and higher expenses outside the mortgage,” she said. “What about cash flow? I do think in this market, the days are gone when you can give a five-year fixed to everybody with no strategic assessment.”

This is the chance for mortgage brokers to shine, believes Laframboise.

“They will have the ability to give advice that will change people’s lives. Bad advice will really hurt people right now.”

She described one client’s situation, where switching to a five-year fixed rate was not the best option.

“The clients had a variable rate mortgage and asked us about locking in. They had just over $90,000 of debt outside their mortgage. Instead of saying here is the lock-in option for their mortgage – which would save them only

about $100 per month while tying them in for five more years – we are doing a refinance instead. We are extending their amortization and paying out all their higher-interest debts, saving them about $1,463 per month. They are now in a two-year fixed, so if rates come down a bit, they will have the chance to take advantage of it. We’ve improved their monthly cash flow and paid off the debt that was beginning to tank their credit rating. If this client had gone directly to the bank, they wouldn’t be presented with any other option (than a five-year fixed). But locking in isn’t always the best answer.”

Mortgage brokers can offer their clients so many options, which becomes even more critical in this financial climate.

CMB MAGAZINE CMBA-ACHC.CA WINTER 2023 I 35

This is the opportunity to eat the bank’s lunch.

Truly, there is so much we have access to that they can’t.

“

Denise Laframboise

financing options

“It’s extremely important to work with someone who has your best interests in mind,” said Laframboise, who works with 58 lenders. “We have investors flipping into interest-only lines of credit (LOCs) to remain cash flow positive, or stretching out amortizations even longer by going to B lenders. Are other debts costing you more? Can we refinance a car payment into an LOC?

“This is the opportunity to eat the bank’s lunch. Truly, there is so much we have access to that they can’t.”

For homeowners who are facing bigger payments on their variable rate mortgage or LOC, Laframboise has some advice: “Don’t call up the bank and ask them if you can lock in. Instead, tell them, ‘These increased payments and the higher cost of living are hurting us. How many different options can you give me to solve this?’