FINDING THE GROOVE

How

niche p.24

STRENGTH THROUGH NUMBERS

Cross-country update from CMBA provincial associations p.10

ACTION AND IMPACT

Removing subject-to-financing clauses p.18

FINTRAC REPORTING

How to address new requirements p.42

TECHNOLOGY TRENDS

AI in Canadian financial institutions p.36

CMBA-ACHC.CA PM No. 41297283

develop your industry

to

WINTER 2024 $6.95

+

THE

MAGAZINE FOR PROFESSIONAL MORTGAGE BROKERS

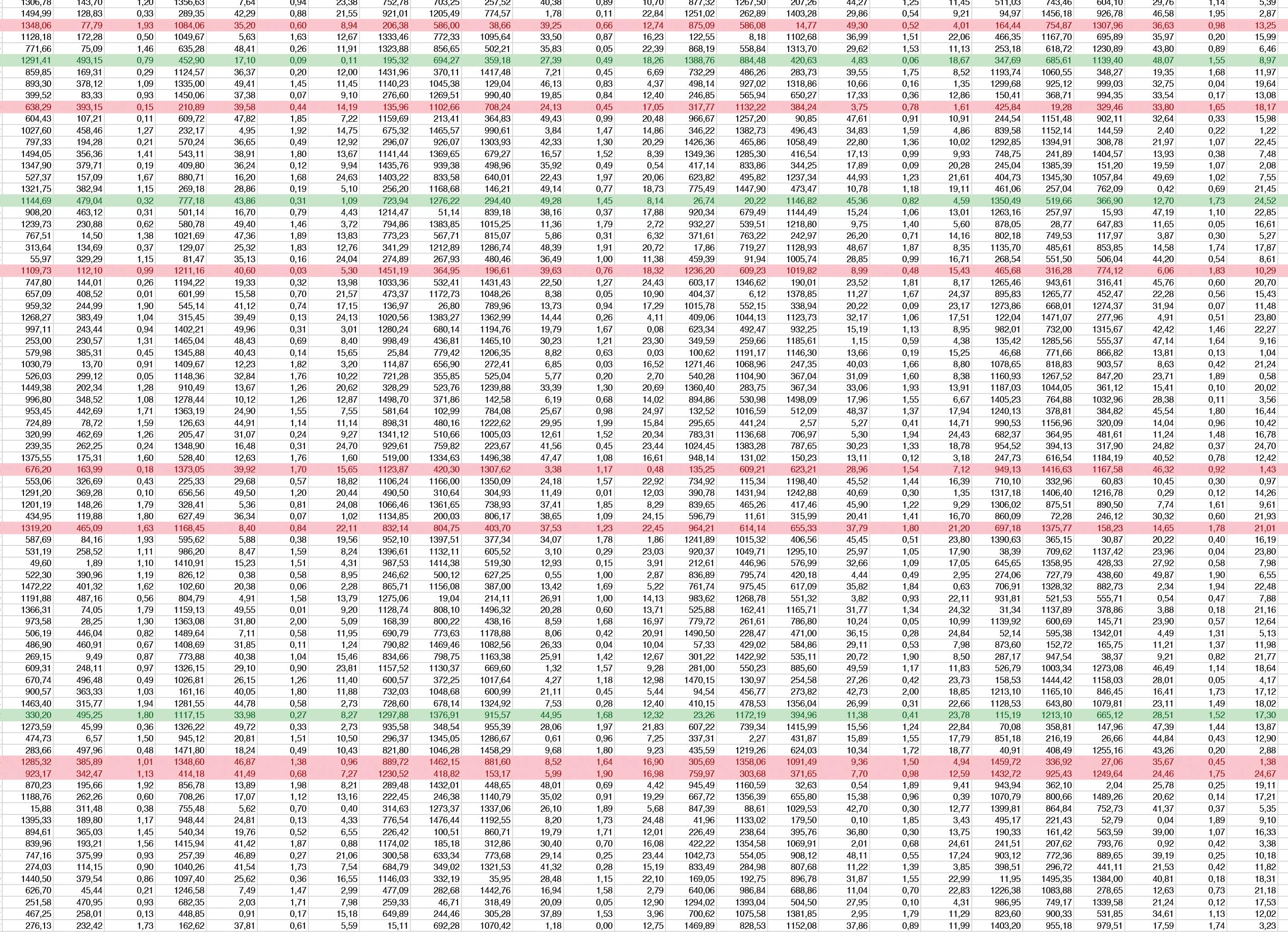

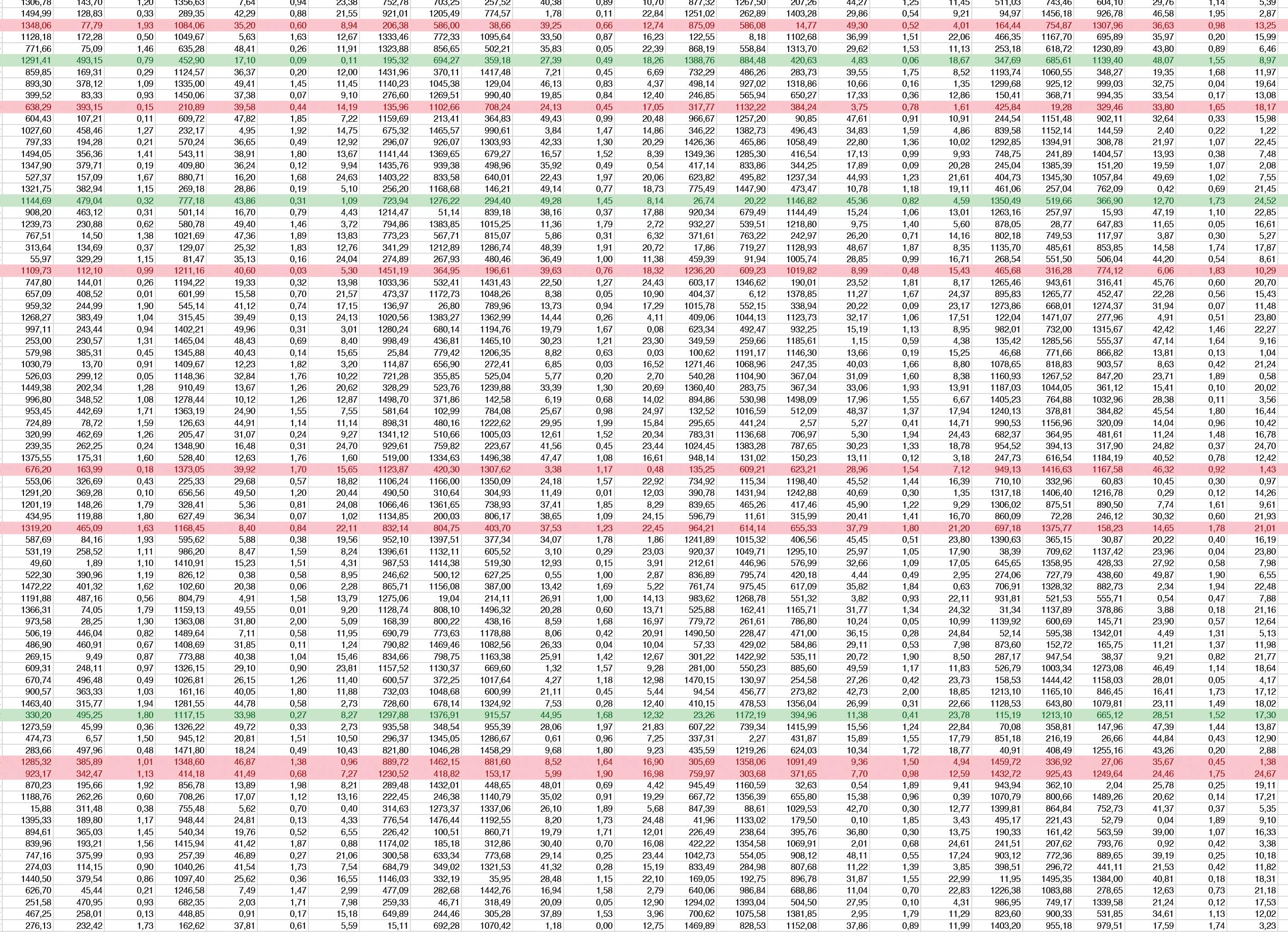

COMMERCIAL MORTGAGE LENDING CRITERIA Mortgage Type Loan to Value (up to) Loan Amount Range Interest Rates Starting at Retail/Office/Industrial 70% $1.5M -$75M Prime + 2.0% Land (urban infill) 65% $1.5M -$75M Prime + 3.0% Apartments 70% $1.5M -$75M Prime + 2.0% Res. Condo Inventory 70% $1.5M -$65M Prime + 2.5% RESIDENTIAL MORTGAGE LENDING CRITERIA Mortgage Type Loan to Value (up to) Loan Amount Range Interest Rates Starting at Single Family + Condo 70% $1.5M -$5.0M Prime + 2.0% Luxury Condos 65% $1.5M -$5.0M Prime + 2.5% Rentals/Vacation 65% $1.5M -$5.0M Prime + 2.5% EXPERIENCE THE DIFFERENCE MORE EXPERTISE MORE OPTIONS MORE... Lanyard specializes in providing mortgage brokers and their clients with More options for short to medium term financing solutions. More … money (up to $75m). More … loan payment options (including interest reserves). More … flexible repayment provisions. More … extension privileges. More … happy clients! Sam Fogell - Commercial (National) sfogell@lanyardgroup.com 604-900-3669 Golden Ma - Commercial (B.C.) gma@lanyardgroup.com 604-648-7850 Brian Chelin - Residential (National) bchelin@lanyardgroup.com 604-293-2626 Phone 604.688.5388 www.lanyardgroup.com

Flexible lending when you need it

cus tom mor tgage solutions your client s require

We

tgages tailored to the needs of your self- employed, stated income, and low beacon client s . Fur thermore, a common sense lending approach allows us to approve and fund deals fas

At Antrim, being flexible allows us to create the custom mortgage solutions your clients require. We provide a broad range of residential 1st and 2nd mortgages tailored to the needs of your self-employed, stated income, and low beacon clients. Furthermore, a common sense lending approach allows us to approve and fund deals fast. • Residential Mortgages • LTV Sliding Scale of 75% on the first $1M, 60% on the balance • OPEN Terms Standard • BC, Alberta and Ontario antriminvestments.com Flexible lending when you need it. FSCO #13198 T 604.530.2301 (BC) | T 416.898.5692 (ON) | TF 1.888.550.6039 applications@antriminvestments.com Private Lender – Filogix, Velocity and Lendesk cus tom mor tgage solutions your client s require. We provide a broad range of residential 1s t and 2nd mor tgages tailored to the needs of your self- employed, stated income, and low beacon client s Fur thermore, a common sense lending approach allows us to approve and fund deals fas t. • Re sidential Mor tgages • LT V Sliding Scale of 6 0% on the balance • O PEN Terms Standard • B C , Alber ta and Ontario a nt ri mi nve s tme nt s . c o m Flexible lending when you need it . F S C O # 1 3 1 9 8 T 60 4 . 5 3 0 . 23 0 1 (BC) | T 4 1 6 . 89 8 .56 9 2 (ON ) | T F 1 . 8 8 8 . 5 5 0. 6 0 3 9 applicati o ns @ a n t r imi n v e st m ents . c o m P r i v a t e L e n d e r – F ilogix, Vel o ci t y a n d L e n des k

1s t and

Re sidential Mor tgages • LT V Sliding Scale of 6 0% on the balance • O PEN Terms Standard • B C , Alber ta and Ontario a nt ri mi nve s tme nt s . c o m

provide a broad range of residential

2nd mor

t. •

. F S C O # 1 3 1 9 8 T 60 4 5 3 0 23 0 1 (BC) | T 4 1 6 89 8 .56 9 2 (ON ) | T F 1 8 8 8 5 5 0. 6 0 3 9 applicati o ns @ a n t r imi n v e st m ents . c o m P r i v a t e L e n d e r – F ilogix, Vel o ci t y a n d L e n des k

FEDERAL GOVERNMENT DENIES EXPENSES ON SHORT-TERM RENTALS

New proposed measures to disincentivize short-term rentals which are non-compliant with local jurisdiction

BY CLARA PHAM, FARRYN COHN AND JIM NIAZI

40

10

15

BUILDING STRENGTH THROUGH NUMBERS

CMBA’s provincial association presidents aim to grow their ranks by delivering member programs and services that matter BY LISA GORDON

EMPOWERING MORTGAGE BROKERS

CMBA National's compelling value proposition

FINDING YOUR GROOVE

Work hard and your mortgage industry niche will naturally develop over time, say brokers BY

LISA GORDON

CHANGING THE STRESS TEST

Not fully stressed – further announcements expected BY RAY BASI

36

BANKING TECHNOLOGY TRENDS

The use of AI in Canadian financial institutions

CINDY ZHANG IN CONVERSATION WITH PHILL MORRAN

42

FINTRAC REPORTING REQUIREMENTS ON THE HORIZON

Steps to address money laundering and terrorist financing risks and activities BY RAY BASI

CMB MAGAZINE CMBA-ACHC.CA WINTER 2024 I 5 VOLUME 9 ISSUE 1 WINTER 2024 departments columns Editorial Advertisers’ Index Off the Clock: Mortgage broker Daniel Cox wears many hats, all of them designed for community service BY LISA GORDON

Ease: Consider the potential impact of removing subject-to-financing clauses BY RAY BASI Industry profile: Deb White’s client-centric service model BY LISA GORDON 8 46 16 18 28

Legal

24 30

features

No mortgage stress test. Oh, the places your clients can go!

While most lenders have to qualify clients with the stress test, we don’t. We qualify at contract rate, so your clients may be approved for a higher mortgage with us.

Learn more at www.icsmb.ca

FIRST MORTGAGES, PURCHASES & REFINANCES* | RESIDENTIAL & COMMERCIAL

24-HOUR TURNAROUNDS | NO MINIMUM BEACON SCORE

*Considers income, affordability, LTV. property type and more.

CONSTRUCTION

THE CANADIAN MORTGAGE BROKERS ASSOCIATION

DIRECTORS

Terry Kilakos (CMBA-Quebec)

Jim DeCoste (CMBA-Atlantic)

Deb White (CMBA-BC)

Taylor Lewis (CMBA-Ontario)

EXECUTIVE DIRECTOR

Carla Giles

CMBA - ATLANTIC

Mortgage Brokers Association of Atlantic Canada

12 M - 7095 Chebucto Road, Halifax, NS B3L 0A1

CMBA - BC

Mortgage Brokers Association of British Columbia

2025 Willingdon Ave, Suite 900, Burnaby, BC, V5C 0J3

CMBA - ONTARIO

Independent Mortgage Brokers Association of Ontario

7 - 40 Winges Road, Woodbridge, ON L4L 6B2

CMBA - QUEBEC

L'Association des courtiers hypothecaires du Québec

5855 Taschereau #202, Brossard, QC J4Z 1A5

L

L

RESIDENTIA

COMMERCIA

ND

DEVELOPMENT LA

CANADIAN MORTGAGE BROKER magazine is produced by the Canadian Mortgage Brokers Association

EDITOR

STAFF WRITER

Basi MANAGING EDITOR Kathleen Freimond ART DIRECTOR Scott Laing BILLING AND SALES Debra Hiller CONTRIBUTORS

(CMBA)

Carla Giles

Ray

Ray Basi Farryn Cohn Carla Giles Lisa Gordon

IMAGES Adobe iStock VOLUME 9 ISSUE 1 WINTER 2024 PUBLICATIONS MAIL AGREEMENT 41297283 Please return undeliverable Canadian addresses to 900-2025 Willingdon Ave., Burnaby, BC V5C 0J3 Printed in Canada by Hemlock Printers Ltd. CANADIAN MORTGAGE BROKER © All rights reserved. The views expressed in CANADIAN MORTGAGE BROKER are those of the respective contributors and are not necessarily those of the publisher or staff.

Jim Niazi Clara Pham Cindy Zhang

Challenges and strategies for mortgage brokers

NAVIGATING CANADA’S HOUSING MARKET

BY CARLA GILES, MBA, CAE, CEO OF CMBA-BC, MBIBC, EXECUTIVE DIRECTOR, CMBA NATIONAL

The Canadian housing market has been abuzz with activity in recent months, showcasing notable increases in residential unit sales across major markets.

According to the British Columbia Real Estate Association (BCREA), January 2024 saw a 29.4 per cent surge in sales in British Columbia compared to the same month in the previous year, while Ontario experienced a 21.4 per cent rise as reported by the Ontario Real Estate Association (OREA). Nationwide, the upswing in home sales activity reached an unexpected 22 per cent compared to the same period last year.

“A sharp decline in fixed mortgage rates and expectations for future Bank of Canada rate cuts is driving sentiment in the market and bringing pent-up demand off the sidelines,” says BCREA’s Chief Economist Brendon Ogmundson, noting a clear uptrend in the real estate market in B.C.

This recent increase in home sales activity is a positive development for mortgage brokers across the country. However, it is important to recognize that market imbalances are still impacting Canadians, potentially limiting the overall volume of home sales transactions.

The demand for housing in Canada has been steadily rising, driven by factors such as population growth, shifting demographics and historically low interest rates. Nonetheless, the

housing sector continues to grapple with a persistent shortage of supply, reflecting decades of under-investment.

Despite various initiatives and policy adjustments aimed at stimulating housing supply and promoting innovative housing solutions, affordability challenges persist, especially for firsttime homebuyers and low-to-middle-income households. Efforts to incentivize densification and promote more affordable housing solutions such as laneway housing and micro-units are underway. But questions linger about the adequacy of these measures to address the diverse needs of Canadians, particularly in major urban centres in the short and medium term.

Moreover, the scarcity of housing options catering to middle-income families and multi-generational households further compounds the challenge. While single-family homes continue to dominate the market, there is a growing demand for alternative options such as townhouses, duplexes and condominiums – as well as mortgage products to support the increased interest for co-ownership.

As the dream of homeownership becomes elusive for many Canadians, there is a growing sentiment among politicians and policy-makers that Canadians should consider renting rather than owning a home. However, the rental market is not without its challenges. A recent report released by the Canada Mortgage and Housing Corporation (CMHC) indicates historic lows in rental vacancy rates nationwide, hitting

a 35-year low of 1.5 per cent. This scarcity of housing options further complicates the housing crisis and impacts many facets of the Canadian economy.

In this evolving landscape, mortgage brokers play an important role in assisting homebuyers as they navigate the intricate process of mortgage financing and helping mortgage holders facing renewal challenges by identifying viable solutions.

Successful mortgage brokers are adapting to better serve their clients. They are focusing on staying informed about new regulatory requirements; utilizing advanced technology to improve communication with clients, lenders and partners; and strengthening connections within their communities. By adopting these proactive measures, mortgage brokers are not only responding to industry shifts but also ensuring they are better equipped to meet the evolving needs of homebuyers.

EDUCATION AND NEW PRODUCTS.

To remain competitive, mortgage brokers are actively seeking educational and networking opportunities. This involves improving marketing skills, staying updated about new lending products as well as government programs to support affordability, and keeping abreast of evolving regulatory and compliance requirements.

This proactive approach ensures compliance with evolving regulations and equips brokers to

8 I WINTER 2024 CMBA-ACHC.CA CMB MAGAZINE ADOBESTOCK

editorial

provide comprehensive support to clients navigating homeownership considerations or seeking assistance with mortgage renewals. As they actively engage in educational opportunities, brokers enhance their ability to guide clients through the complexities of the ever-changing housing landscape.

BUILDING A STRONG REFERRAL NETWORK.

Establishing a robust referral network is indispensable for mortgage brokers seeking to expand their client base. For example, real estate agents, as pivotal players in the homebuying process, can serve as valuable partners in generating new clients.

Building a strong referral network necessitates proactive networking and relationship building. Participation in industry events, networking functions, and engagement with industry professionals both online and offline can aid mortgage brokers in establishing and nurturing these relationships. Clear and timely communication is key in maintaining strong referral partnerships, showing appreciation for their referrals and delivering excellent service to their clients, thus enhancing the overall client experience.

INNOVATION AND ADAPTATION.

In the mortgage industry, embracing digital technology as well as leveraging industry data are crucial for future success. Companies investing in innovation by leveraging digital technologies are better positioned to compete for top talent in what is already a very competitive space. This allows for streamlined operations, improved security and compliance, and enhanced broker and client experiences. By maintaining a clear focus on core strengths, technology investments can be targeted effectively, boosting productivity and empowering brokers for success.

At the same time, strategic partnerships will play an increasingly crucial role in the broker channel and allow brokerages to access new capabilities, accelerate expansion and better allocate resources. By embracing these approaches, companies can stay ahead in an evolving market landscape.

ADVOCACY ROLE. Mortgage brokers have a unique opportunity to provide a nuanced perspective on the impact of housing policies in the communities they serve. Their unique vantage point enables them to identify the intricacies of local housing markets and offer vital perspectives to support a more nuanced approach to housing affordability issues. Their invaluable insights, channelled through mortgage broker associations, can be instrumental in promoting policies that not only support and enhance professionalism within the mortgage industry but also address the obstacles to homeownership, contributing to a more balanced housing market.

In conclusion, the recent surge in home sales activity reflects the dynam ic nature of the real estate market. While the increased demand is positive for mortgage brokers, there are underlying market imbalances that impact the overall volume of transactions. Affordability challenges persist, as the housing sector grapples with a persistent shortage of supply. Initiatives to stimulate housing supply and promote affordable solutions are underway, but questions linger about their adequacy.

As the housing landscape evolves, mortgage brokers play a crucial role by adapting to industry shifts, focusing on education and new products, building strong referral networks, embracing innovation and supporting advocacy efforts. By actively engaging with these strategies, mortgage brokers are not only responding to current challenges but also positioning themselves to meet the evolving needs of homebuyers in a dynamic and complex housing market.

CMB MAGAZINE CMBA-ACHC.CA WINTER 2024 I 9

BUILDING STRENGTH THROUGH NUMBERS

As they reflect on 2023 and focus on the year that lies ahead,

CMBA-British Columbia ,

CMBA-Ontario , CMBA-Quebec , and CMBA-Atlantic aim to grow their ranks by delivering member programs and services that matter.

BY LISA GORDON

BY LISA GORDON

10 I WINTER 2024 CMBA-ACHC.CA CMB MAGAZINE

cross-country update

ADOBESTOCK

From soaring interest rates to plunging affordability, it was a challenge helping Canadians get into homes in 2023.

While home ownership remained a goal for many, it was a year to pause, take stock and adjust expectations. Mortgage brokers across the country found themselves crafting innovative and sometimes shortterm solutions to help clients realize the dream of home ownership – or, sometimes, to help them stay in their homes in the face of rising mortgage payments and inflation-fueled household debt.

As 2024 dawned, there was more optimism in the air. Overall, mortgage brokers believe we will soon see much-needed interest rate cuts and that, by mid-year, the cyclical mortgage market will begin to accelerate once more. At the same time, CMBA and its provincial associations are working hard to provide value for membership, including educational opportunities, networking events and effective government relations.

In early January, Canadian Mortgage Broker connected with the presidents of CMBA’s four regional associations – Atlantic, Quebec, Ontario and British Columbia – to find out how they fared last year and what’s in the cards for 2024.

CMBA-ATLANTIC

In 2023, CMBA-Atlantic hosted successful professional development and networking events for mortgage brokers and industry partners in Nova Scotia, New Brunswick, Prince Edward Island and Newfoundland and Labrador.

Association president Jim DeCoste highlighted several industry webinars that forged connections between the region’s mortgage brokers and the industry partners that support them. The live webcasts included featured guests who shared information on various mortgage products and services, followed by real-time Q&As with brokers.

September was also a big month for CMBA-Atlantic, said DeCoste. On September 18, the association hosted a trade show and lender networking reception. The following day, mortgage professionals hit the links for the inaugural Donald MacMillan Memorial Golf

Tournament, in memory of CMBA-Atlantic’s past president.

“It was very well attended and received by the industry, and we’re looking forward to building off that in 2024,” said DeCoste.

CMBA-Atlantic marked several other accomplishments in 2023, including adding three new regionally-based directors to its board, and ongoing relationship-building with provincial governments and regulators.

“Last spring, the association partnered with PROLINK to offer our members Guaranteed Acceptance Critical Illness Insurance,” he said. “We plan to once again partner with PROLINK in March for another special offer, this one for Guaranteed Acceptance Term Life Insurance, delivered by Industrial Alliance. Our members can also get Errors & Omissions insurance through PROLINK.”

CMB MAGAZINE CMBA-ACHC.CA WINTER 2024 I 11

Jim DeCoste

cross-country update

As he looks ahead to 2024, DeCoste listed the priorities for CMBA-Atlantic:

n Growing the membership through education, advocacy and awareness of the value of belonging to the association;

n Increasing association exposure through in-person visits, local activities run by CMBA-Atlantic’s provincial directors, and a variety of outreach initiatives to connect with Atlantic brokers;

n Hosting a symposium in February, focusing on the market challenges Atlantic brokers may face in the coming year; the impact of AI on the mortgage industry; how to manage the volume of renewals expected in 2024-2025; and a review of the anticipated increase in new construction to meet inventory shortages;

n Hosting the second annual Donald MacMillan Memorial Golf Tournament; and,

n Continuing to build relations with provincial regulators and promoting programs offered through different provincial government departments, including Down Payment Assistance, First Time Home Buyers and Rent-toOwn, to name a few.

When asked how CMBA-Atlantic will measure its success over the coming year, DeCoste said membership numbers, event attendance, government interactions and industry partner participation will tell the tale.

For this year and beyond, he predicted the Atlantic provinces will see an increase in mortgage applications from those who are new to Canada; an uptick in renewal and transfer activity as clients shop around for the best terms; and continuing concern about housing inventory in the face of sustained demand.

CMBA-QUEBEC

Even though Sylvain Poirier is preparing to hand the torch to his successor sometime this year, the current president of CMBA-Quebec is laser-focused on increasing membership by delivering concrete value.

“We have a new transactional website in development that will allow people to renew their memberships online; the system will provide them with a billing and membership number,” he explained. “With that number, they will have access to member privileges through our partners, including special rates on liability insurance, training sessions, phone plans and office supplies. We are developing partnerships with other organizations to provide additional rebates.”

Poirier said 2023 was a tough year for mortgage brokers in Quebec, as it was across the country.

“Ballpark, I’d say business decreased between 40 to 50 per cent from the peak,” he told Canadian Mortgage Broker. “The lenders are experiencing the same figures. When it went down like that, many brokers left the business. But I can say, being in this business for 25 years, that it’s a cycle. I’ve gone through four major decreases in the market, but as soon as the Bank of Canada decreases its rates once or twice, you will see the markets going up.”

Looking ahead at 2024, Poirier said he will assist with finding the next association president and helping them acclimate to the position.

“I hope that person will take the association to the next level,” he shared. “They will bring their own unique experience to the job.”

When the new CMBA-Quebec website is finalized, he also hopes to host some online events focused on broker education, seminars and industry communications.

Mainly, Poirier said the goal will be to increase association membership. The way to do that, he added, is to be the real voice of the broker.

“On the board, we’re focusing on how we can represent all the brokers in this province – not just on what membership dues we collect. You have to give first. We must be the voice of every broker, even those who are not members, to build the value before collecting the money.”

Shifting gears, Poirier said artificial intelligence (AI) and its application in the mortgage industry will be a critical component of how modern brokers do business.

“All brokers must work with AI – and if they don’t, they won’t be in the business over the next three years,” he predicted. “You will see some very productive brokers decreasing their business, while new brokers who are good with technology and social media will skyrocket. You will see that in 2024 and 2025.”

Poirier said he uses AI applications for automated client communications, entering their information into his CRM system at the very beginning of the relationship.

“They receive a welcome message immediately to confirm their information and it begins to develop the relationship. Every step of their mortgage process will be sent to them; you keep them alive, keep them connected. Twenty years ago, brokers had to go where the clients were. Today, the clients are in front of the computer. If you’re not there, unfortunately you won’t be successful.”

Similar to his mortgage industry peers across Canada, Poirier believes the market will take a turn for the better by mid-2024.

“When it rains, it never rains for all time,” he concluded. “The past two or three years were uncomfortable for the business. But as soon as the consumer feels a bit less pressure, you’ll see the rainy days in the past.”

Sylvain Poirier

CMBA-ONTARIO

CMBA-Ontario had another busy year, full of educational and entertaining events that brought the provincial mortgage industry together.

Association president Taylor Lewis said the big entries on the 2023 calendar included CMBA-Ontario’s annual conference, gala and trade show at the end of March, as well as the Summerfest golf tournament in Niagara Falls.

In addition, the association rolled out a series of educational symposiums and trade shows across the province, including in Ottawa, Southwestern Ontario and the Greater Toronto Area (GTA). Golfers took to the links at tournaments in Ottawa and Kitchener, enjoying the chance to practice their games while networking with industry peers.

Lewis said a highlight of the year was a charity casino night that raised money for Toronto’s SickKids Hospital. “We raised enough over the past three years to be awarded a plaque at SickKids in recognition of CMBA-Ontario and our donations,” he said.

While programs are often held in the GTA, Lewis said CMBA-Ontario is committed to holding events across the province.

“As an association, our responsibility is to include our members across the province, and not to isolate them, and that is a responsibility we treat with the utmost importance,” he said.

In total, CMBA-Ontario represents about 1,000 members who fall into these categories: licensed members, non-licensed members, licensed lenders, student members and partner members.

Lewis said all industry members faced a challenging year in 2023.

“Last year called on the expertise, creativity and intelligence of mortgage brokers more than the preceding years,” he explained. “Since the pandemic, we have seen mortgage rates fluctuate, employment rates fluctuate, and housing prices fluctuate. This has resulted in increased pressure on mortgage brokers to come up with creative and brilliant solutions for borrowers, no matter the circumstances.”

CMB MAGAZINE CMBA-ACHC.CA WINTER 2024 I 13 With uDrive, you’re in control. We work diligently to nd creative solutions for your clients who don’t qualify for traditional nancing. • uDrive: No Fee or Lower Rate • Residential 1st and 2nd mortgages • Fully open options available • Lending in BC, AB and ON • Maximum LTV of 75% INVEST. LEND. GROW. threepointcapital.ca uDrive@threepointcapital.ca | 1.800.979.2911 NOW YOU’RE IN THE DRIVER’S SEAT. FSRA #13070

Taylor Lewis

That’s why CMBA-Ontario chose to launch four new educational offerings in 2023, to equip brokers and agents with the tools they need to serve their customers.

As 2024 unfolds, Lewis said CMBAOntario’s priority will be to give the broker channel what it needs to navigate a perpetually evolving market. This includes networking opportunities and educational opportunities for all members of the mortgage industry –whether they are brand new or highly experienced.

“Ultimately, our team wants to be of value to mortgage professionals and their careers,” said Lewis. “Their successes are CMBAOntario’s successes, and those of the industry as a whole. We will continue to take careful measure of how members and other attendees respond to our courses and events.”

As for the 2024 market, he added that if interest rates do begin to drop, as predicted, it should stimulate the housing market to surpass 2023 numbers.

“With that being said, brokers will continue to be in higher demand than previous years,” concluded Lewis. “It will take experts with access to a variety of lenders to put borrowers in homes, and in mortgages that fit their unique situations.

“In 2024, I expect the mortgage industry to continue to do what it does best, which is find solutions for Canadians to put roofs over their heads. One thing that the mortgage industry has consistently proven, year after year, is that we are adaptable. We will always find new ways to solve problems that Canadians face every day.”

CMBA-BRITISH COLUMBIA

CMBA-BC is still three months away from hosting its annual conference from April 15-16, 2024, but as of early January, sponsorships were nearly sold out and there were only a couple of booths left for the trade show.

“We’re on a good roll right now,” commented Marci Deane, association president. She said CMBA-BC’s 1,200 members – who represent the province’s managing brokers and sub-brokers, plus associated product and service providers –have been supportive of industry events.

“In 2023, we held our first big in-person event since 2020, our annual conference and

trade show. We were excited to host 500 people at the Park Hotel in Vancouver. We also updated our association by-laws at our AGM in May.”

Deane said she participated in the CMBA-BC Roadshow, with industry events held in Langley, Kelowna and on Vancouver Island.

“It was a chance for me to go around and meet brokers from different parts of the province,” she said. “Kelowna and Victoria were in November; they were both really well attended by brokers and lender partners. We’ve also had an ongoing series of great webinars and educational content. Plus, we have our two main courses for newer brokers and managing brokers. Those are always fully sold out and well attended.”

From an association perspective, Deane said the goal is always to get the word out to increase membership.

“It’s not a requirement under our licensing to be a member of our professional association – it’s voluntary,” she explained. “So, our challenge is to get the word out that we add value, that we’re important. For me, my message across the province is that there is power in numbers. We meet with BCFSA (the B.C. Financial Services Authority, the provincial regulator) and government regularly, but we can have a bigger voice if we’re speaking for all mortgage brokers in B.C.”

Deane estimated there are about 5,000 mortgage brokers in B.C., so there is lots of opportunity to expand the association – “and that’s our biggest goal for 2024. We have a big membership of established brokers, but it’s getting the new brokers to understand the importance of joining their professional association.”

The CMBA-BC board works to keep member education offerings relevant. In 2023, events included frequent economic updates from top industry economists, a fireside chat with one of the top conveyance lawyers in B.C., and a session on AI in the mortgage industry, which included tips and tricks to maximize time and productivity.

Looking ahead to 2024, CMBA-BC will continue its conversations with BCFSA, which will be rolling out the new Mortgage Services Act sometime during the year. Deane said the law has been in the works for a number of years and there will be a great deal of consultation happening as it is rolled out.

Webinars and road shows will also continue this year, she revealed.

“We’re working hard on all kinds of initiatives to make sure there’s a lot of value in being part of CMBA-BC. Our success will be measured in membership numbers, attendance and also just the buzz in the industry. I feel like we really have a positive vibe and talk around CMBA-BC right now, in general.”

Reflecting on the next few months, Deane thinks the first quarter of 2024 will continue to present challenges for the mortgage industry. However, by mid-year things will start to improve, and then “things will be great” heading into 2025.

Deane concluded by tipping her hat to Carla Giles, CMBA-BC CEO and CMBA National Executive Director, who joined the association at the beginning of 2022 and has accomplished much in just two years.

“We have a great, hardworking board and we’re getting a lot done.”

Across the country, CMBA’s provincial associations are heading into the new year with renewed optimism and a commitment to delivering solid member value. From educational offerings to valuable networking opportunities in-person and online, association membership delivers proven advantages in any kind of market.

For more information, visit the CMBA National website at cmba-achc.ca/membership

14 I WINTER 2024 CMBA-ACHC.CA CMB MAGAZINE

cross-country update

Marci Deane

EMPOWERING MORTGAGE BROKERS

CMBA National’s compelling value proposition

The Canadian Mortgage Brokers Association (CMBA National) stands as a unifying force for provincial mortgage broker associations across Canada. Through collaboration and resource-sharing, CMBA National empowers these associations to focus on delivering tailored services to their members while advocating for industry-wide initiatives on a national scale.

ORIGINS AND PURPOSE

Established in 2014, CMBA National was created to fortify the network of provincial mortgage broker associations (CMBA-BC, CMBA-ON, CMBA-Quebec, and CMBA-Atlantic), allowing them to concentrate on providing region-specific services. By offering a collaborative platform, CMBA National facilitates the exchange of resources, branding initiatives, and industry insights essential for growth. Through coordinated efforts, members identify trends and develop collective solutions to address common challenges in the industry.

ROLES AND RESPONSIBILITIES

CMBA National plays a pivotal role in shaping Canada's mortgage broker industry:

n Advocacy: Representing mortgage brokers' interests at the federal level, CMBA National champions legislative agendas that support the vibrancy of the sector nationwide.

n Umbrella Support: Providing resources, advertising materials, and brand awareness initiatives, CMBA National supports provincial associations in delivering exceptional services to their members.

n Professionalism and Ethics: CMBA National upholds member professionalism and ethics by establishing national standards such as the Mortgage Broker Regulators’ Council of Canada's (MBRCC) Code of Conduct, ensuring quality and integrity.

Provincial associations also have significant responsibilities within their jurisdictions:

n Representation and Advocacy: Advocating for members' interests at the provincial level, these associations engage with government bodies, licensing bodies, and regulators on local issues. They also work with industry partners to elevate the profile and market position of mortgage brokers at the provincial level.

n Education and Networking: Delivering licensing courses and continuing education programs to members, provincial associations ensure they stay informed about industry developments. They also provide networking opportunities through webinars, networking events, trade shows, and conferences, fostering a vibrant community of mortgage brokers.

LEADERSHIP AND GOVERNANCE

CMBA National is governed by a Board of Directors nominated by the provincial associations' respective Boards and supported by Executive Director Carla Giles. Current Directors include Terry Kilakos

Jim DeCoste (Vice President and Secretary), and Deb White (Treasurer). A fourth director position, to be filled soon by a director from CMBA-ON, completes the leadership team.

CMBA National serves as a cornerstone of unity and collaboration within Canada's mortgage broker industry. By empowering provincial associations and their members, CMBA National fosters a robust, ethical, and consumer-focused mortgage ecosystem nationwide.

To learn more, visit cmba-achc.ca.

CMB MAGAZINE CMBA-ACHC.CA WINTER 2024 I 15

(President),

BRITISH COLUMBIA Greg Kakuno Business Development Manager 604-430-1498 gkakuno@capitaldirect.ca ALBERTA Donna Hunter Business Development Manager 403-874-6348 dhunter@capitaldirect.ca ONTARIO Cheryl Smith Business Development Manager 905-299-1706 csmith@capitaldirect.ca Equity Lending up to 1,500,000 1st and 2nd Mortgages Purchase / Refinance, ETO up to 75% LTV Special offers for 600+ Beacon Scores in large urban centres Still waiting for Bank Approvals? Stress Test killing your deals? Your clients need you now, more than ever as the banks are tightening up! We offer 24 Hour turnaround on commitments – allowing you to present solutions for your clients sooner rather than later.

East Coast mortgage broker Daniel Cox wears many hats, all of them designed for community service

BY LISA GORDON

PASSION

W FOR THE COMMUNITY

hen Daniel Cox finished a 10-year deployment with the Canadian Navy, he immediately navigated toward an industry where he could still help others. In 2010, he embarked on what would be a six-year transition from the military into full-time financial services, specializing in middle-income families. In 2019, Cox added mortgage brokering to his offerings, focusing on current homeowners and first-time homebuyers.

Today, Cox is based in Lower Sackville, N.S., where he enjoys dual roles as team leader, mortgage broker and brand ambassador with Mortgage Alliance, as well as branch manager for PFSL Investments Canada Ltd., a financial advising firm.

“I joined the military to protect my country and serve the people within it,” he told Canadian Mortgage Broker during a recent interview. “I do have that servant’s heart, so I am the guy who runs toward fire rather than away from it.”

Cox stepped into the breach for local communities during the pandemic, when he and his wife, Jennifer, purchased three Premier Sports Leagues franchises in Halifax, Dartmouth and Sackville. The organization introduces kids to a variety of fun recreational and competitive sports, with floorball – a type of co-ed floor hockey with playing levels from under seven to adult – being the anchor sport.

The Coxes have five children of their own, aged three to 20, and prioritize family ties – so much so that Jennifer also works at Cox’s office as an administrator and his mother lives on his property.

“We bought a large property in order to host events for family, business associates and clients,” he said. “I even built a home for my parents with my own two hands on our property.”

The importance of organized sports and the camaraderie it builds is not lost on the Coxes.

“

This is our way to give back to kids in the community who may be a little less fortunate and maybe couldn’t afford to play a sport otherwise.”

“We have a huge passion for the community and, in particular, helping all children to feel they are part of the group,” said Cox.

If a family cannot afford to have their child participate, he said his Mortgage Alliance office sponsorship helps to cover the costs.

“This is our way to give back to kids in the community who may be a little less fortunate and maybe couldn’t afford to play a sport otherwise,” he explained. “We do this so that kids can wake up Christmas morning with a smile on their face and possibly even a [floorball] stick in their hand.”

While his wife is owner/administrator for the sports franchises, Cox himself looks after operational roles, including coaching, refereeing, managing equipment and acting as convenor.

He’s happy to donate his time to the three franchises, where the kids refer to him as “Coach Dan.” At least once a year, Cox and his floorball travel team head to Ontario for tournaments in Cambridge and Guelph.

“Giving a child even one hour a week means that child gets positive, encouraging words poured into them, with a pat on the back and a can-do attitude to let them know they have what it takes,” he said. “I’m impact-driven, not money motivated, and that helps to fulfill my drive to impact families.”

brokers off-the-clock

16 I WINTER 2024 CMBA-ACHC.CA CMB MAGAZINE

Right: The Cox family all sporting Premier Floorball kit. Daniel is holding daughter Isabella while Jennifer has her hands on the shoulders of Emerson and Grayson for this family photo.

“Coach Dan” is also advocating to build a new, publicly owned multiuse sports and community centre in Sackville. He is currently working with local politicians and business leaders to see the idea to fruition, explaining that the facility would include an NHLsized ice rink and a gym that could be used for many sports, including a regulation-size floorball surface.

Cox believes a personal approach works best, whether for building sports teams, businesses or relationships.

He often chooses a ‘kneecap-to-kneecap’ service model when meeting with his clients – offering in-person or remote service, often after-hours, for those who are not available during the day.

Cox’s Mortgage Alliance office was busy in 2023, growing from three brokers in January to 32 just a year later. He expects to expand into Newfoundland as early as next year, adding to existing offices in Nova Scotia and Prince Edward Island, and one that is opening in New Brunswick. By the end of 2028, he is projecting the brokerage will have 100 licensed mortgage brokers – responding to a massive demand for their services in the eastern provinces.

Cox’s secret to success? He’s not afraid to fail.

“As long as you do everything legally, morally and ethically, don’t be afraid to fail,” he concluded. “If you keep doing the right things long enough, you will succeed. If anything, failing is the best teacher in life.”

This interview with Daniel Cox continues our series Brokers off the Clock. In every issue, we ask a mortgage broker to tell us what they like to do when they’re not behind a desk. Be it working with animals, travelling to exotic places or creating an awardworthy garden, we want to know how you unwind. Would you like to be profiled in a future edition – or suggest a fellow mortgage broker? Contact info@cmba-achc.ca

CMB MAGAZINE CMBA-ACHC.CA WINTER 2024 I 17

The need for an educated, careful and thought-out practice

BY RAY BASI, J.D., LL.B., DIRECTOR OF EDUCATION FOR CMBA-BC AND MBIBC

REMOVING SUBJECTTO-FINANCING CLAUSES

18 I WINTER 2024 CMBA-ACHC.CA CMB MAGAZINE

TO-FINANCING

BACKGROUND

Apurchaser often enters into contracts to purchase real estate which contain a clause that their obligation to complete the purchase is binding only if they secure the mortgage financing they need. Many seek the assistance of a mortgage broker to secure this financing. On being satisfied that the financing has been arranged the purchaser removes the financing condition and the contract becomes binding on both the purchaser and seller.

What if the financing appears to have been arranged and the purchaser removes the financing condition only to have the financing later fall through? Can the purchaser sue the would-be lender for breaching its agreement to lend? If the mortgage broker advised the buyer that the financing was in place, can they sue the broker for the loss they suffer?

Consider Whittome v. Bains, 2023 BCCRT 974 when evaluating the risk involved. The case is from British Columbia’s Civil Resolution Tribunal (CRT). The CRT has jurisdiction over small claims brought under section 118 of the Civil Resolution Tribunal Act (CRTA). Section 2 of the CRTA states that the CRT’s mandate is to provide dispute resolution services accessibly, quickly, economically, informally, and flexibly. However, the principles set out in the case are applicable far more generally.

WHAT HAPPENED?

The purchasers arranged to purchase real estate subject to being able to arrange the financing needed to complete the purchase. Their real estate agent referred them to a financing consultant who referred them to a specific mortgage broker. The broker arranged a financing commitment letter. The purchasers claimed that on the strength of their financing consultant and mortgage broker each having told them the financing had been secured, they removed the subject-to-financing condition in their contract and thus made the contract binding.

However, days before the purchase was scheduled to complete, the lender advised they would not be proceeding with the mortgage. This was because it had been discovered the security property was a mobile home and not, as it had understood, real estate. It did not lend on the security of mobile homes.

The purchasers then paid $5,000 to the sellers to obtain an extension and, on their own, arranged the needed mortgage from another lender.

THE ISSUES

Who is to incur the $5,000 cost for the extension? Was the loss the purchasers’ own fault and therefore not recoverable from others? Was the mortgage broker negligent and responsible for having advised the purchaser that the financing was secure when it was not? Was the financial consultant negligent and responsible for having advised them that the financing was secure when it was not? Did the lender breach the terms of the commitment letter by failing to complete the transaction?

THE POSITIONS

The purchasers of course did not blame themselves, otherwise, a court case would not have ensued. They claimed they relied on the advice of the financial consultant (who they said they understood to also be a mortgage broker) and on the advice of the mortgage broker in removing the subject-to-financing clause.

The mortgage broker argued he had completed all necessary steps to secure the financing and placed the blame on the lender for withdrawing financing

CMB MAGAZINE CMBA-ACHC.CA WINTER 2024 I 19

legal ease

ADOBESTOCK

upon discovering the property had a mobile home.

For the hearing, the mortgage broker provided the commitment letter received from the lender, which was subject only to an appraisal confirming the property's worth. The purchasers provided a letter from their realtor stating that the MLS listing for the property showed the building on the property to be a mobile home. The copy of the MLS listing supported the realtor’s statement. The realtor’s view was that the MLS listing had not been read carefully. The mortgage broker claimed, as he had provided all required information and documents to the lender, it was the lender's own error in not noting that the property was a mobile home that had caused the withdrawal of financing. The purchasers contended that all of that aside, the mortgage broker failed to consider crucial factors in securing a mortgage for a property with a mobile home. In effect, the financing was not secure when the mortgage broker told them the subject-to-financing clause could be removed.

The financial advisor argued that he simply made a referral to the mortgage broker and was not otherwise involved in the transaction. Also, he agreed with the broker’s position.

The lender did not have to take a position as no one brought it into the lawsuit. The purchasers did not sue the lender and neither the mortgage broker nor the financial advisor brought it in as a third party. (A third party is not an original party to the lawsuit but is brought into the case by a defendant who seeks to shift some or all of the liability onto that third party. The claim is generally in the form of ‘if I am to blame for the plaintiff’s loss it is because of the conduct of the third party and the third party should be made to pay all or some of the amount.’)

THE DECISION

The financial advisor was not negligent as his relationship with the purchasers was only that he referred them to the

mortgage broker, he was otherwise not involved in the transaction. The claim against him was dismissed.

The mortgage broker owed a duty of care to the purchasers because his role as their mortgage broker was sufficiently close to know that carelessness on the mortgage broker’s part could result in harm to the purchasers. The standard of care for a mortgage broker does not require perfection but the exercise of reasonable care. The mortgage broker should have known there were additional considerations when securing a mortgage where the property has a mobile home. The approval letter did not address the mobile home issue and the mortgage broker breached the required standard of care by failing to make further inquiries with the lender about how to secure a mortgage on a property with a mobile home. That failure led to the purchasers suffering damages the mortgage broker could have foreseen. The mortgage broker was ordered to pay the purchasers the $5,000 extension fee, plus prejudgment interest of $253.23, and hearing fees of $175.

The mortgage broker was free to pursue the lender for the amount it was ordered to pay the purchasers, but no order was made in this decision regarding that matter as the lender had not been brought into the action.

TAKEAWAYS

A mortgage broker takes some risk when advising a client as to whether a subject-to-financing clause should be removed from a purchase agreement. Whether a lender can back out of a commitment letter depends on the wording of the specific commitment letter. Some contain specific language as to when a lender can back out of the commitment, such as stating that if the borrower’s financial circumstance significantly changes between the date of the commitment letter and the date of funding the lender can decline to fund the transaction. Some even seemingly binding commitment letters leave wriggle room for the lender to argue they can back out of the commitment. This puts a mortgage broker in a difficult

How a broker navigates a specific circumstance involves a careful assessment of risks in the particular transaction. The mortgage broker might want to craft how the advice to the client is to be provided, such as starting with “I cannot foretell the future but, in most cases, …”

position when a client seeks advice as to whether the subject-to-financing clause in their purchase agreement can be removed.

If the mortgage broker does not provide an unequivocal yes, the client may find another broker or may not remove the condition and cause the purchase agreement to lapse. If the mortgage broker provides an unequivocal yes, the broker may take on liability if the transaction does not close and the client suffers losses. How a broker navigates a specific circumstance involves a careful assessment of risks in the particular transaction. The mortgage broker might want to craft how the advice to the client is to be provided, such as starting with “I cannot foretell the future but, in most cases, …” or "I cannot make the decision for you but here are things for you to consider.”

The above case does not include a discussion of the bigger risk to the mortgage broker. What if a mortgage broker advises the client that the subject-to-financing clause can be removed, the lender later fails to fund, and the seller does not extend the date (for or without a fee) and instead sues the purchaser for noncompletion. The purchaser could then be responsible to the seller for losses suffered by the seller and might look to the mortgage broker for recovery. The dollars involved could be a lot more than the amounts involved in this case.

If a mortgage broker is sued for having advised the client that the subject-to-financing clause should be removed, the mortgage broker should consider whether the lender improperly caused them to provide that advice and could be responsible.

And the final takeaway to be provided – yes, all businesses involve some risk but educated, careful, thought-out practice is a preferred option.

This article is not intended as legal advice. You are advised to obtain legal advice in specific instances.

20 I WINTER 2024 CMBA-ACHC.CA CMB MAGAZINE legal ease

CMB MAGAZINE CMBA-ACHC.CA WINTER 2024 I 21 • Innovative lending solutions since 1982 • 1st and 2nd Private Mortgage Funds • British Columbia, Alberta, Manitoba • Experienced Under writers • Fast straightfor ward approvals SUBMIT@BAYFIELD.CA | T 604.533.4478 Lending a Helping Hand to You and Your Clients for Over 30 Years. Bayfield Mortgage Professionals Our online portal system gives you access to our services 24/7/365 GREATER VANCOUVER · VANCOUVER ISLAND FRASER VALLEY · SEA TO SKY · OKANAGAN · KAMLOOPS PEACE REGION · CALGARY · EDMONTON LAWRENSONWALKER.COM

Unlock your potential in the mortgage industry with our comprehensive professional education

Live Interactive Courses

Get hands-on experience, industry insights, and personalized guidance from experts

Educational Webinars

Stay updated on trends and best practices with dynamic webinars.

On-Demand Learning

Learn at your pace with on-demand courses that will help you prepare for licensing exams.

Explore our diverse educational offerings through your CMBA industry association in BC, Ontario, Quebec, and Atlantic region. They're committed to your success!

22 I WINTER 2023 CMBA-ACHC.CA CMB MAGAZINE

Free or reduced fees for members

courses.cmba-achc.ca cmbaatlan�c.ca cmbabc.ca/event/courses-webinars cmbaontario.ca/educa�on

FOCUSED ON

EDUCATION

BROKERS

CMB MAGAZINE CMBA-ACHC.CA WINTER 2024 I 23 Earn More Low • Basic • Simple Fee Structure 30 Years of Experience � No Income Qualification � No Minimum Beacon Score � Set your Own Broker Fee � Residential Financing � Purchase and Refinance � Up to 75% LTV Contact us 1-866-907-5407 deals@vwrcapital.com Pratheesan Rathnapala Ontario 416-629-2219 pratheesan@vwrcapital.com Paula Hutton Prairies (AB, SK, MB) 780-370-7430 paula@vwrcapital.com Jennifer Peters British Columbia 604-803-7430 jennifer@vwrcapital.com vwrcapital.com 1 year Closed Fee starting at only $750 1 year Open Fee only 1% VWR Capital Print Ad - CMB - Winter 2024 - 7.25” x 4.71” Colour(s) AD SIZE: 7.25” X 4.71” PRESS / STOCK: US SWOP V2 RES ARTWORK: 400 PPI BLEED: N/A ARTWORK SCALE: 1 : 1 FILE FORMAT: PDF/X-1A December 18, 2023 12:23 PM VWR_Capital_CMB_7.25x4.71_Ad_01.10.2024_FNL.PDF NOTE: Trap at Output CYAN MAG YELLOW BLACK 604-224-3757 1st & 2nd Mortgages

FINDING YOUR GROOVE

Work hard and your mortgage industry niche will naturally develop over time, say brokers

BY LISA GORDON

Jamie Ushko prefers to work with clients who don’t fit into a banker’s box.

She loves the challenge of placing an alternative mortgage for a self-employed entrepreneur, someone who has put their heart and soul into their business –just like Ushko herself.

“They work hard and they go to the bank and they are told no,” said the Kamloops, B.C.-based mortgage broker. “I feel like they are penalized for taking a less traditional approach to earning. I love being a warrior for those people.”

Ushko knows what it’s like to invest countless hours into your own business. She joined Mortgage Architects in 2021, making the jump from a sciencebased career as a researcher. At first glance, the two jobs are worlds apart. However, Ushko said there are many similarities.

“To be a good broker, you have to be resourceful and use the tools at your disposal to come up with solutions, like in the lab. Understanding the policies and where a file will best fit is important, and it’s important to be detail-oriented and methodical so every client has the same awesome experience.”

When she first became a mortgage broker, Ushko – like everyone else – took every file that came her way. She started with referrals from family and friends, and then began to develop

client referrals and then Realtor partnerships. In her first six months, she had a mixed bag of 15 files, including a reverse mortgage, four alt files, a private file and an assortment of more straightforward deals.

“As a broker, you have to be open and stay well-rounded in your skills,” she told Canadian Mortgage Broker. “You never know what will come at you. You have to be willing and able to do all of it.”

But even as she was doing all of it, Ushko realized that she really enjoyed working with self-employed homebuyers. Before she knew it, she had developed a niche and a reputation for getting difficult deals done.

“I’m known for picking up my phone,” she explained. “Most people are looking for someone who always answers and communicates well with clients and Realtors. Since I was picking up the phone, I was getting the calls on the emergency files that were failing at the bank or branch. You do that a number of times and Realtors and clients never forget you. I would say I am known for being reliable and getting things done.”

Ushko’s remote business model doesn’t prevent her from adding a personal touch to her deals. She uses Zoom, phone, email and text to communicate with her clients, adding customized videos to explain important concepts.

“I communicate complex commitment packages on BombBomb (a platform that embeds custom video into email messages). The video I send is personalized for the client. They can watch it on repeat and I find that people do replay it. I have never sent a mortgage commitment to anyone without an instructional video.”

Ushko, who said her clients tend to be between 30 and 60 years of age, adds them to her social media accounts after their deal funds. She uses Instagram and Facebook and a bit of TikTok, adding that it’s really a way for people to get to know her and stay in touch.

“I try to do a mix of educational and personal posts to keep it interesting. If you think about the problems your niche market has and try to answer them, Realtors will share your post if it’s useful.”

24 I WINTER 2024 CMBA-ACHC.CA CMB MAGAZINE

niche markets

ISTOCK

“

You can do fancy ads, but if you’re not picking up the phone, you’re done. If I can’t get to my phone, my voicemail tells people I will call them back within an hour – and I do.”

Jamie Ushko, Mortgage Architects

So far, Ushko’s business has been growing quickly and organically via word of mouth and referrals.

“It hinges on personal relationships. You can do Realtor pitches, but if they don’t like you, they’ll forget about you. You have to build that loyalty. Follow through, be professional and consistent.

“Communication is the No. 1 thing,” she continued. “You can do fancy ads, but if you’re not picking up the phone, you’re done. If I can’t get to my phone, my voicemail tells people I will call them back within an hour – and I do.”

For brokers who are thinking of “niching,” Ushko said there’s no rush. She recommends they build their skills doing a variety of files to identify the market where they excel.

“Who is coming to you most, who are you helping? Find that out and then amp up those skills,” she advised.

Ushko is also a believer in lifelong learning. She often taps into the collective expertise of her broker team, let by Tara Borle at Mortgage Architects.

“There are so many experienced agents on our team. I can access expertise from all of them to get things done. I also take courses and talk with other brokers. Don’t be afraid to run a file by one of your contacts to see how they would do it.”

She also said brokers should not be afraid to consult the business development managers (BDMs) working for their lender partners.

On the positive side of the ledger, niching allows brokers to gain confidence in a particular skill set, developing solid relationships along the way with Realtors, BDMs and underwriters.

However, specializing in one area might mean that you forget how to handle other types of mortgage deals.

“We need to be versatile in our skills, so stay well-rounded,” said Ushko.

While she uses artificial intelligence (AI) every day for rewriting emails and scheduling social media posts, she’s not worried about a computer taking her job.

“As long as we’re niching on things that are more complex, it will be harder for AI to get in there. And, I think you never stop developing your niche. Keep an open mind, never think you’ve got it figured out. Keep plugging away.”

‘YOUNGER BUYERS IDENTIFY WITH ME’

Three years ago, Jarrett White was working as a Red Seal automotive painter in Langley, B.C. When Covid-19 hit and there were fewer cars on the road, his work dried up.

“At that point, I was 22,” he recalled. “My friends were just finishing school and going into their careers. I had a Red Seal ticket, but it didn’t transfer to anything else. So I decided to sign up to be a Realtor.”

“I have tried everything as far as marketing – paid ads on Google, Facebook, SEO. SEO is expensive because you’re constantly trying to update it. The most cost effective way is referrals, by cultivating relationships with Realtors. The next source is your inner circle, so stay top of mind with them through social media.”

Jarrett White, Whiteridge Mortgage

When he went online to register at UBC’s Sauder School of Business, he noticed the mortgage brokering course alongside the real estate program.

“Instead of competing with everyone I knew in real estate, I decided to partner with them,” said White. “We (brokers) have much more flexibility with our schedule and the volume is higher than a Realtor can bring in. Brokers can intake 20 to 30 files a month and still have time to do other things with their life.”

Today, White runs Whiteridge Mortgage in Langley, part of the Valley Financial Specialists brokerage. As he reflected on the last two-plus years in the mortgage industry, he admitted the first months were rough.

“Luckily, I was still living with my parents and had money saved up from working in the trades,” said White, who recently purchased his first home. “I started out by marketing and networking with Realtors, and it took three to four months before I had a dollar in my pocket.”

Like Ushko, White accepted every file he could get in the beginning. Over time, as he worked to get his name out through various social media channels, he realized that most of his clients were young first-time homebuyers and new permanent residents.

“If you were to ask most brokers and Realtors that know me, I have a pretty big presence within the industry on social media. Younger buyers identify with me,” he explained. “For me, it’s not necessarily that I chose to do those files, it just developed that way. I relate to them really well, think of them as friends rather than clients.”

White said a lot of his business now comes from repeats and referrals. He has a knack for working with young buyers and their parents, who are often gifting part of the down payment: “I have a really good process for talking with clients’ parents. Once they trust you, they refer you to every person they know.”

Along those same lines, he said that once a broker has handled enough first-time homebuyer files, including the really tricky ones, they understand what can be done to make it work.

When he’s communicating with clients, White said the

26 I WINTER 2024 CMBA-ACHC.CA CMB MAGAZINE

niche markets

first contact is usually by phone. After that, he connects with them by text and email, too. He also embeds customized BombBomb video into his emails when he needs to explain complicated documents or processes.

“When it comes to signing packages where you’re going through important details, you’d think people would want to talk – but if I’m thorough enough (in the video), they can do it on their own time,” he said. “If they need to hear something again, they can replay it and review.”

Every day, White spends one and a half to two hours on Instagram and TikTok, where his account name is “thatguythatdoesmortgages.”

“I’m messaging and talking with as many people as possible, working my way in, prospecting through social media to earn trust.”

He posts at least once a day to his 4,000 followers, about half of whom are Realtors. Most of his videos are educational and contain valuable information for young

people trying to become homeowners. Topics include tips for boosting their credit rating or an explanation of the co-signing process.

“I have tried everything as far as marketing – paid ads on Google, Facebook, SEO,” recounted White. “SEO is expensive because you’re constantly trying to update it. The most cost effective way is referrals, by cultivating relationships with Realtors. The next source is your inner circle, so stay top of mind with them through social media.”

For every 20 first-time buyers who reach out to White, he said about four or five are in a position to get a mortgage. Of those, it’s mainly because there are dual incomes and a parent with little to no debt who is willing to co-sign.

White said a mortgage broker’s niche will eventually develop over time, and there’s no point rushing it.

“You’ll get these one-off deals that are really tough, but now you know you can help them in that situation,” he said. “I had people in my brokerage telling me I take on the files that seem impossible and take a lot of time. That is how your niche develops. People refer other people who are similar to them.”

White believes niching is a good way to reduce competition.

“If you’re someone that does commercial mortgages, for example, you have much less competition from other brokers. First-time buyers is still a bit broad, but if you’re that person that does construction mortgages, you could do so well if you were getting a large chunk of that market.”

Most importantly, White said new brokers need to work hard and give it time.

“At month four, I was getting pretty discouraged. I was trying as hard as I could and nothing was happening. I wasn’t doing anything wrong; I just didn’t give it enough time. Now, my business has more than doubled each year and is continuing on that trend.

“If you’re doing a good job, the business will come. Give it time.”

CMB MAGAZINE CMBA-ACHC.CA WINTER 2024 I 27

CLIENT-CENTRIC SERVICE

Mortgage industry veteran Deb White founded her successful business on three pillars: establishing relationships, personalized attention and tailored solutions. It’s a recipe that has kept her clients coming back to White House Mortgages for nearly 20 years.

BY

LISA GORDON

It’s game day. Deb White, owner and mortgage expert at Dominion Lending Centres – White House Mortgages, sits in her office on a Monday afternoon in December sporting her Seattle Seahawks jersey.

This is not an unusual practice for the Vernon, British Columbia-based entrepreneur. Not only is she a big Seahawks fan, but she also believes wholeheartedly in the value of a positive, more relaxed work atmosphere.

She says that her business beliefs align with her personal convictions, summing it up this way: “If you wouldn’t do it or act that way in front of your mother, don’t do it.”

Mortgage brokers play a pivotal role helping individuals navigate the complex journey to homeownership. For White, her own journey to B.C. began when her father accepted a work opportunity in Kelowna. The family packed their belongings and left their hometown of Windsor, Ontario, heading west for new opportunity.

As an adult, White opted for a quieter life in Vernon, establishing an interior design career until a 1993 car accident ultimately led her to change direction.

“The accident hindered my arm in a way that I could not lift my arm properly in order to do construction drawings,” she explained.

She then took a job as a realtor’s assistant in 1995; but after two years, she realized it was not for her.

As she worked to ‘find herself,’ White tried her hand as a real estate agent and then as a financial adviser’s assistant. It was the latter role that helped her discover her niche as a mortgage broker.

“When I was working for the financial adviser, he placed a mortgage through his company. I assisted him with some documents and I thought, ‘Wow, that was fun!’”

White landed a job with a private lender who needed a mortgage broker in Kelowna, launching her mortgage industry career. Twenty-five years later, she’s never looked back.

At the time, White was a single mother of four who felt like she was just starting to get ahead with her job in Kelowna. She was commuting to work every day from her home

28 I WINTER 2024 CMBA-ACHC.CA CMB MAGAZINE industry profile

in Vernon. Then, a second tragic car accident changed her life yet again.

“One of my children was hit head-on by a drunk driver; so at that time, I had to stop working, help my child heal and find something closer to home,” she explained.

White found a job as a mortgage broker with a nearby firm; but after a while, she realized she could no longer work for others whose visions did not align with her own.

In January 2005, she took the bold step of founding White House Mortgages, driven by the desire to create a transparent, personalized and client-centric mortgage service. She believed

that really getting to know her clients would allow her to fully understand their situation –then, she could offer them tailored solutions.

“I think because of what I have gone through in my past, I have true empathy for what others are going through,” she reflected.

White has helped many clients over the years, but certain situations stand out in her mind. She recalls one couple in particular who faced a challenging and heartbreaking situation: “The husband was suffering from dementia and the medication was very expensive; debt was accumulating and the wife was getting behind on the mortgage.”

“

This is an amazing and wonderful career ride that I am on. If you can embrace it and just stay true to yourself and who you are, you will have a wonderful ride, too.”

White steered those clients into an alternative MIC-based mortgage for one year, which bought them time to get their finances back under control. She’s proud to have helped many clients avoid bankruptcy over the years.

“As mortgage brokers, we make sure we look at their entire financial situation and suggest a product that best suits their needs.”

White said her business model is an amalgamation of her experiences, both professional and personal.

“I learned through my numerous job experiences how to treat people and how not to treat people – whether clients, fellow brokers or employees,” she said.

When she’s not assisting mortgage clients, White can be found helping in her community. Volunteering is important to her; she feels it’s a priority to give back to the community that has always supported her.

She and her husband of 20 years, Doug, also enjoy spending time on the water – either on their boat or on White’s newly acquired Sea-Doo.

Nothing tops family time. “I have four grown children and their spouses, and seven grandchildren. I have a special bond with my children and grandchildren and love spending time with them.”

As CMBA’s national treasurer and the former president of CMBA-BC, White stays connected with industry happenings.

“I think 2024 is definitely going to be a switch year with the prime rate expected to come down. I think it is going to be a very busy year for mortgage brokers,” she predicted.

She also told Canadian Mortgage Broker that she speaks with many people who are holding off on buying, in hopes of getting a good deal following a rash of foreclosures. However, White’s own research and discussions with her lender partners point to this being an unlikely scenario. Instead, White feels some sellers may be downsizing, while others will look to refinance through their mortgage broker.

Through perseverance, commitment and a passion for helping people become homeowners, White has carved out an incredible career.

“This is an amazing and wonderful career ride that I am on,” she concluded. “If you can embrace it and just stay true to yourself and who you are, you will have a wonderful ride, too.”

CMB MAGAZINE CMBA-ACHC.CA WINTER 2024 I 29

30 I WINTER 2024 CMBA-ACHC.CA CMB MAGAZINE

CHANGES TO THE STRESS TEST

BY RAY BASI, J.D., LL.B., DIRECTOR OF EDUCATION FOR CMBA-BC AND MBIBC

INTRODUCTION

The Office of the Superintendent of Financial Institutions (OSFI) is exploring additional modifications to the stress test, which may involve adjustments to allowable Gross Debt Service (GDS) and Total Debt Service (TDS), reconsideration of whether borrowers need to requalify for the stress test upon mortgage renewal, and the imposition of limits on the borrowing amount relative to the borrower's income. What is the context for these considered changes, how did we get here? What changes are being contemplated? When are the changes expected to be announced?

WHAT IS THE STRESS TEST?

The stress test is required to be applied by federally regulated banks, other lenders such as provincial credit unions may apply it voluntarily. It requires a borrower to qualify for their mortgage at a prescribed higher interest rate than the one provided in their mortgage agreement. This helps to protect consumers from taking on more debt than they can reasonably manage and to safeguard the Canadian housing market from potential economic downturns. Additionally, it limits the risk government (and hence the public) takes on in insuring covered lenders from mortgage defaults.

CMB MAGAZINE CMBA-ACHC.CA WINTER 2024 I 31 stress test ADOBESTOCK

SOME KEY HISTORICAL CHANGES

To understand the currently contemplated changes to the stress test, one has to understand the historical context in which they occur.

Regulatory control of the mortgage environment has increased significantly in the last decade and a half. Prior to the 2008 financial crisis, Canada had a more lenient approach to mortgage lending. In the aftermath of the financial crisis, global regulators and policymakers began to reassess financial regulations to prevent a similar crisis in the future. The Office of the Superintendent of Financial Institutions (OSFI), Canada's federal financial regulator, started implementing measures to strengthen the resilience of the financial system.

These measures included reducing the maximum amortization period for high ratio insured mortgages from 40 to 35 years; establishing a 5 per cent minimum down payment requirement; mandating lenders to obtain sufficient evidence of property value, the borrower’s amount of income, and borrower’s income sources; and requiring borrowers, with limited exceptions, to have a minimum credit score of 620.

In 2010, the maximum amount for insured refinance mortgages was reduced from 95 to 90 per cent of loan-to-value.

In 2011, the maximum amortization for a high ratio insured mortgage was reduced from 35 to 30 years. For refinance mortgages, the maximum was reduced to 85 per cent loan-to-value.

In 2012, the maximum for refinances was reduced further to 80 per cent loan-to-value; a $1 million limit was established for the value of a property that secured a high-ratio mortgage covered by default insurance; the maximum amortization was reduced from 30 to 25 years; and the gross debt service (GDS) and total debt service (TDS) were limited to 39 per cent and 44 per cent respectively for high ratio borrowers.

In 2016, OSFI implemented a stress test for all insured mortgages. To be insured, a mortgage had to have been stress tested (that is that borrower had to qualify for it by using the Bank of Canada’s benchmark rate). As well, a new policy required a high ratio mortgage borrower was required to make a 10 per cent, rather than the previous 5 per cent, down payment for the part of the value of the security property in excess of $500,000.

In 2017, OSFI released the B-20 guidelines federally regulated financial institutions must follow in underwriting all residential mortgages, including uninsured mortgages. Significantly, borrowers had to qualify for their mortgage at the greater of the Bank of Canada's 5-year benchmark fixed rate and the contracted mortgage rate plus 2 per cent.

In January 2018, the B-20 guidelines took effect. As well, lenders were required to be more diligent with regard to how the loan funds were to be used (such as for purchasing the subject property) and how the property was to be used (such as owner-occupied, investment or recreational).

In June 2020, underwriting requirements for CMHC-insured mortgages included lowering the maximum GDS ration from 39 to 35 per cent, lowering the maximum TDS from 44 to 42, raising the minimum permitted credit score from 600 to 680 (for at least one household borrower), and banning several types of borrowed down payment.

In June 2021, the minimum qualifying rate for uninsured and insurance mortgages was increased from 4.79 to 5.25 per cent, so that the borrower had to qualify at the greater of 5.25 per cent and the contract rate plus 2 per cent.

CHANGES UNDER CONSIDERATION

This decade and a half evolution of ever-increasing restrictive regulatory requirements brings us to the currently contemplated changes to the stress test. In January 2023, OSFI began consultations on changes it proposed to the B-20 guideline, including more stringent income requirements. It’s response to the feedback indicate it has decided/considered at least the following.

On December 12, 2023 OSFI announced that the minimum qualifying rate for uninsured resident mortgages would remain at the greater of 5.25 per cent or the mortgage contract rate plus 2 per cent.

OSFI announced that TDS and GDS ratios are to be left unchanged for uninsured mortgages The federal finance department announced the same in relation to insured mortgages. The TDS and GDS are 39 per cent and 44 per cent respectively.

Insured borrowers are to be exempt from having to again qualify under the stress test when switching to a new lender. OSFI says that is because the borrower’s credit risk had been transferred for the life of the loan to the mortgage insurer. To be exempt, the loan amount cannot increase and the mortgage amortization cannot change. This exemption allows these mostly high ratio borrowers a freer hand when negotiating renewals of their mortgages, otherwise the very fact that they are in a high-ratio mortgage would likely make it difficult for them to requalify with a new lender and would give the existing lender a tremendous upper hand in negotiations.

Uninsured borrowers who renew with their same lender will not need to satisfy the stress test again.

Uninsured borrowers who renew with a new lender will need to satisfy the stress test again. OSFI said that when a borrower switches lenders, a new loan is created and so it must be underwritten afresh. The new lender must do its own due diligence as it will own the credit risk for an uninsured loan. One can easily imagine that these borrowers will have little power when negotiating their renewal terms.

OSFI is considering making new loanto-value requirements. Regardless of the size of their down payment, borrowers would be capped at a mortgage of no more than 450% of their income. OSFI notes that industry does not support this change. OSFI notes that GDS and TDS focus on affordability whereas as loan-to-income and debt-to-income focus on limiting exposure to high indebtedness.

ANNOUNCEMENT EXPECTED

At the time of publication, OSFI was overdue in confirming with which considered changes it intends to proceed. While the above provides a good indication of the changes to expect, we need to stay tuned. To quote the late, great Yogi Berra, “It ain’t over ‘til it’s over.”

This

32 I WINTER 2024 CMBA-ACHC.CA CMB MAGAZINE stress test

advice in specific instances.

article is not intended as legal advice. You are advised to obtain legal