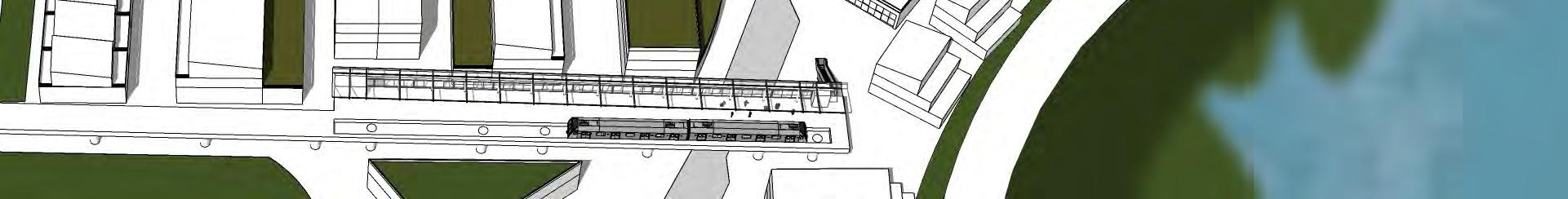

New pedestrian bridge takes place of old railroad bridge

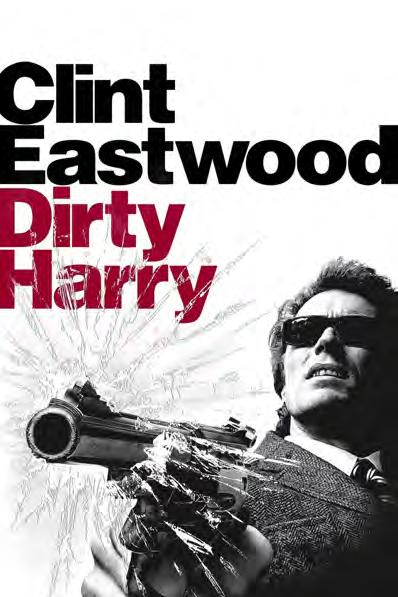

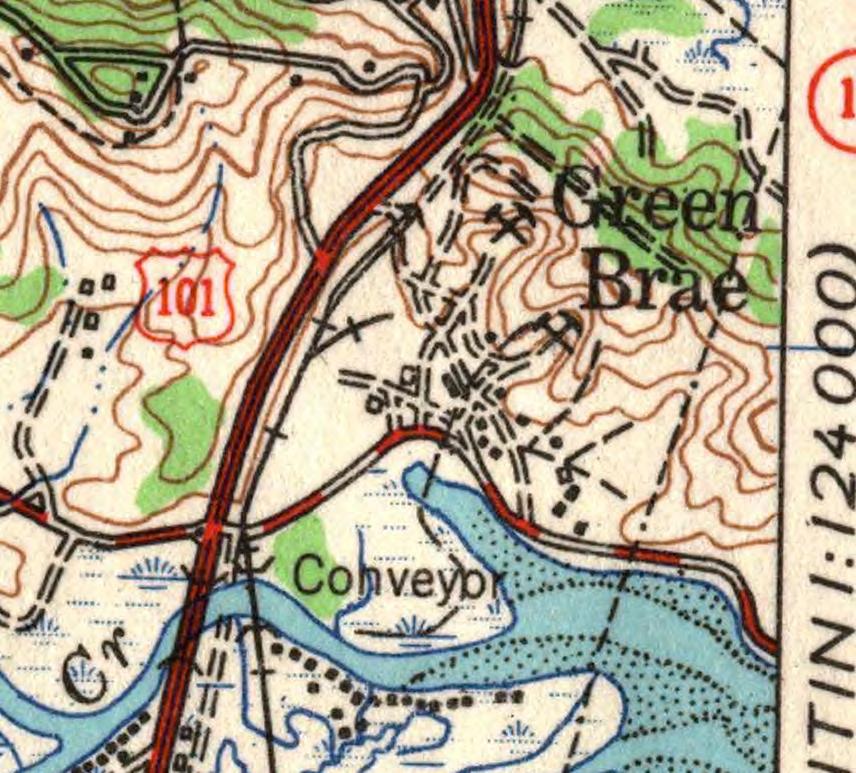

Some initial structures and railroad

Site acting as rock quarry, with conveyor through marsh to deposit on ships

Site Development (1980s)

Larkspur Landing developed in 1970s with shopping mall and ferry terminal with surface parking

Condos developed behind site, full parking lot, expansion of bikepath through site and new pad ready for development

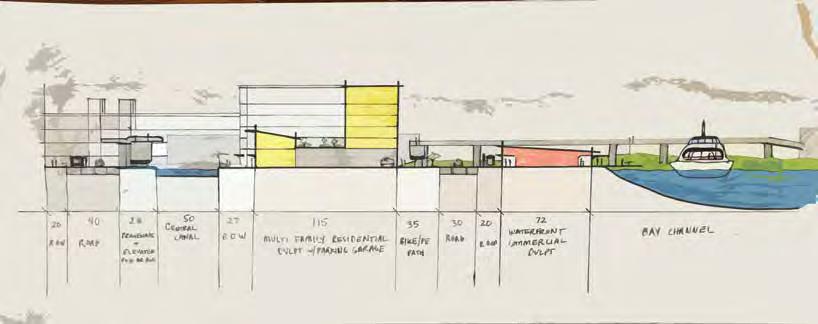

The Preferred Option is a combination of the Option 1 and Option 3, combining the parking lot layout offered in Option 1 and the Train Station layout used in Option 3

- Maximizes developable land on site

- Keeps existing structures in place

- Incentivizes train/bus transit over driving

- Activates site by forcing train goes to walk through site

Dark Red Freeway

Red 6-lane Street

Orange 3-lane Street

Yellow 2-lane Street

Blue Car-tolerant Pedestrian Lane

Green Bike & Pedestrian Way

Purple Pedestrian Way

Black Transit (Train & Bus)

Ovals Bus Stops

ENERGY CENTER: human and food waste provides biogas for electricity, water & air heating, and treats gray water for irrigation & toilets

SOLAR: panels on majority of developments

WATER: microhydro power stations at canal/Bay nexus points

- Water renention on roofs and low-flow fixtures

- Energy-efficient & no-gas appliances

- Preserving and expanding greenbelt

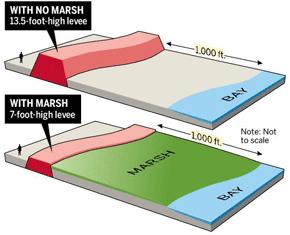

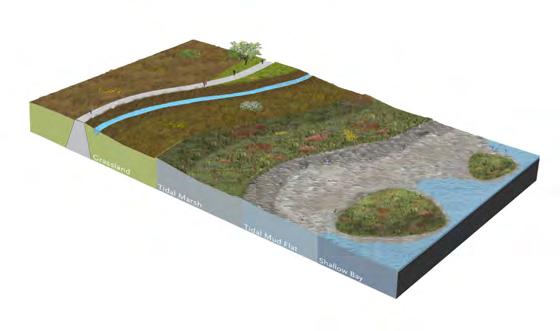

CANAL SYSTEM: sea level rise and absorb groundwater rise

GREEN ROOFS: urban heat island effect

Phase 0 - Grading, Infrastructure, Parking

Phase 1 - 69 Rental, 94 For-Sale, 50,065 NSF Retail, Additional Parking

Phase 2 - 23 Rental, 30 For-Sale, 7,395 NSF Retail, 8,925 NSF Office, 10,838 NSF PDR

Phase 3 - 71 Rental, 100 For-Sale, 26,410 NSF Retail, 53,210 NSF Office, Power Station

TOTAL COSTS: $346 Million

Estimated Costs: $94 Million

Estimated Costs: $81 Million

Estimated Costs: $36 Million

Estimated Costs: $134 Million

Phase 1 Phase 2 Phase 3

$200,000 $400,000 $600,000 $800,000 $1,000,000 $1,200,000 $1,400,000 $1,600,000 $1,800,000

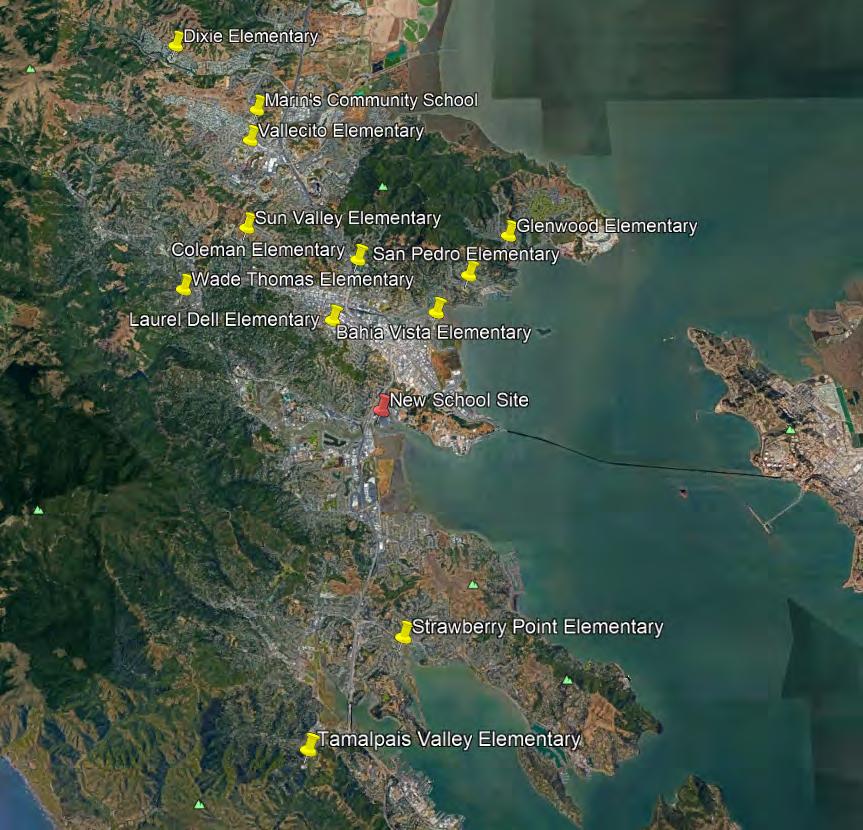

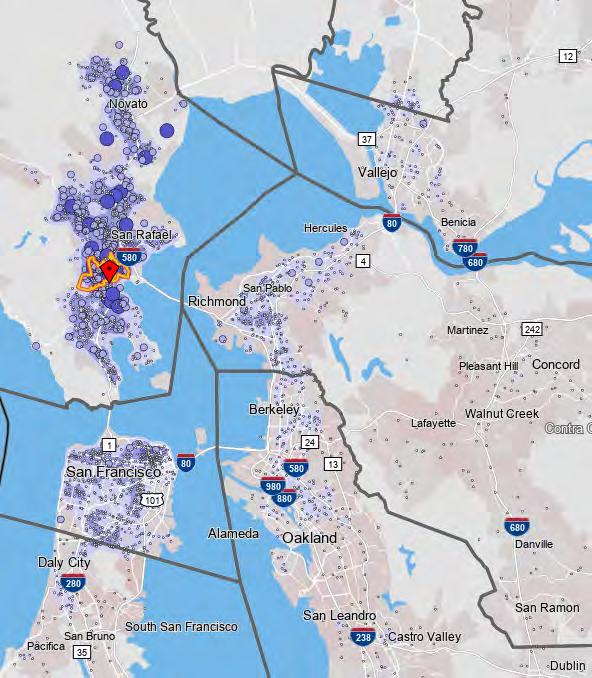

Student to Pupil Ratio has increased 8% since 2000 The most overcrowded schools are in San Rafeal and are Elementary

Employed in Larkspur but Living Outside: 94.60%

Living in Larkspur but Working Outside: 93.20%

$1,250 per month or less: 13% vs. 11%

>$1,251 but < $3,333 per month: 26% vs. 21%

More than $3,333 per month: 61% vs. 68%

Health Care and Social Assistance: 24.20%

Professional, Scientific, and Technical Services: 13.00%

Accommodation and Food Services: 11.00%

Less than 10 miles: 37.10%

10 to 24 miles: 31.80%

Greater than 24 miles: 31.10%

Source: On the Map Census

Household % Family: 70.11%

Family % No Children: 54.72%

Household Increase 2000-2019: 1.8%

Housing Units Added 2000-2019: 5.0%

Housing, Vacant Units: 6.83%

Average Sale Price PSF (TTM): $674

Average Condo Unit Price (TTM): $830k

Source: Simply Analytics, Redfin

Townhome/Condo Market

Average Price: $830k

PSF: $674

Average Size: 1,213 SF

Residential Rental Market

Vacancy Rate: 3.9%

Rent per Unit: $2,928

Central Marin Office Market Vacancy Rate: 7.4%

Asking Rent PSF: $5.36

Class A Office Central Marin Vacancy Rate: 9.4%

Asking Rent PSF: $5.84

Source: Redfin, Newmark Knight Frank (Q4 2019), CBRE (Q4 2019, Q2 2019)

Vacancy Rate: 2.6%

Asking NNN PSF: $2.50