WEALTH WEALTH COLLECTIVE MAGAZINE SEPTEMBER 2023 www.clime.com.au @clime australia COLLECTIVE THE

This information constitutes general financial product advice. The advice has been prepared without taking into account your objectives, financial situation or needs. You should, before acting on the advice, consider the appropriateness of the advice having regard to your objectives, financial situation and needs. Before making a decision about whether to acquire a financial product, you should obtain and consider the Product Disclosure Statement (or other disclosure document). We encourage you to obtain professional advice before deciding to invest in a financial product.

2

© Clime Investment Management Limited

3 Contents 04 Letter from our CEO by Annick Donat 05 Upcoming events 06 Letter from our CIO by Will Riggall 07 Our services 08 A journey of wealth across generations by Garth Curry 10 Macro Update by Paul Zwi 12 Conversations with AI: The Revolution we never saw coming by Dr. Michael Kollo 14 Get to know Quilla by Andrea Theouli 15 Private Wealth spotlight 16 Our people 18 Contact us 19 Key dates 20 About the contributors

Letter from our CEO

Annick Donat

Re-introducing The Wealth Collective: a quarterly magazine for our Private Wealth clients.

Welcome all,

I hope this message finds you well. It’s with great excitement that I re-introduce to you our refreshed quarterly magazine tailored exclusively for our Private Wealth clients: The Wealth Collective. As the CEO of Clime, I’m delighted to share the wealth of knowledge and insights our team has gathered to help you make the most informed financial decisions.

We believe in transparency and personal connection. That’s why I’d like to begin by introducing myself, and our dedicated executive team. With decades of combined experience, we are committed to guiding you through the intricate world of private wealth management. We understand that each of you has unique financial aspirations, and it’s our privilege to be your trusted partners on this journey.

The Wealth Collective is designed to share knowledge, showcase our community, and keep you informed about events and investment ideas that you may find of interest. Here’s a glimpse of what you can expect:

Investment Insights: In every issue, our team of experts will provide you with exclusive insights into the ever-evolving investment landscape. Whether it’s market trends, asset allocation strategies, or specific investing ideas, our aim is to keep you informed about the investment landscape.

Spotlight on our team: We have a great team of people dedicated to supporting our Private Wealth clients. Each edition will feature a team member who plays a pivotal role in ensuring your financial well-being. We believe in the strength of community and it’s important to us that we build quality long term relationships with our clients. This edition features three of our Private Wealth Advisers sharing a little more about themselves.

Events: A way to keep you informed about upcoming events, seminars, and webinars. These gatherings are excellent opportunities to deepen your knowledge and interact with our experts and other clients within our community. We’ll also share with you events that may have miss, providing an opportunity to speak to your adviser and catch up on any past events that may be of interest.

Community Activity: We understand that wealth management goes beyond numbers. Our magazine will also highlight the philanthropic activities and community involvement that make us proud to serve you and our local communities.

In this edition you’ll find an article from Dr. Michael Kollo, CEO Evolved Reasoning about Artificial Intelligence (AI) and how it’s shaping the future in all aspects of life. Ethical AI and transparency are gaining importance in AI development. Additionally, AI is playing a pivotal role in addressing global challenges like climate change and cybersecurity. As AI technology becomes more integrated into our lives, staying updated on these trends is important for businesses and individuals alike. We hope you find the article informative.

Your Wealth, Our Commitment

I trust you will discover valuable insights, knowledge, and a strengthened connection to our Private Wealth community. We consider ourselves not merely your financial advisers but dedicated partners in the pursuit of your wealth creation and preservation goals. Thank you for entrusting us with the management of your financial future. We look forward to providing you with the utmost in professional guidance and support.

Sincerely,

Annick

4

Join us for our upcoming events

Our end of year Investor Briefings are fast approaching & the Private Wealth team is thrilled to invite you to the below events. Hear from John Abernethy as he provides a macroeconomic update and Will Riggall for a market update at a location near you.

Register now for an Investor Briefing below.

31 Oct - Perth

End of Year Investor Briefing

with John Abernethy & Will Riggall

29 Nov - Sydney

End of Year Investor Briefing

with John Abernethy & Will Riggall

7 Dec - Melbourne

End of Year Investor Briefing

with John Abernethy & Will Riggall

Letter from our CIO

Will Riggall

Atthe start of 2023 investment markets were challenged by the prospect of near-term recession, surging inflation, and the collapse of several regional banks in the US. Early in my career I was reminded that for markets to rally they often need to “climb a wall of worry”, fast forward to today this is precisely what has occurred with the globe yet to fall into a recession, credit markets functioning, and inflation having peaked. The “not as bad as feared” trade has driven equity market returns with both the ASX and US markets only just falling short of the all-time highs reached in 2022 despite bond yields having been reset higher following a relentless period of interest rate increases by central banks. Valuations have bounced back to be largely in line with long term averages, so what are the key drivers for the range of asset classes we invest in going forward?

In the formation of Clime’s house view and subsequent portfolio positioning, we constantly review the outlook for each asset class, taking into consideration a range of data across valuations, sentiment and broad macro indicators. While current valuations have returned to fair value, economic and company earnings sentiment remains robust and as we close in on the end of the rate hiking cycle, macro conditions look set to be incrementally support of returns. A key component that we watch closely is liquidity and at this point there is no indication of tightening conditions that would pre-empt a material drawdown in markets.

Looking across equity markets, the US market has been a stellar performer which can be largely attributed to the performance of large tech names, however no doubt the resilience see in the US consumer has supported the broader market. The Australian market too has performed strongly, with the ASX300 Accumulation Index rising +8.96% to the end of August.

Taking the US 10-year yield as a proxy for fixed interest markets, rates have surged higher from 3.81% at the end of June to 4.31% at the time of writing. Higher yields have weighed on traditionally defensive assets such as property and infrastructure but have also seen defensive sectors such as telecommunications, healthcare and staples underperform technology and consumer sectors.

The apparent divergence in returns within and across asset classes is starting to deliver a greater range of opportunities that we will look to take advantage of. While we do not expect to see major changes to long term return expectation that underpin the formation of risk profiles set within the newly structured Madison Investment Committee, the opportunities are prevalent at the strategic asset allocation level through to stock selection with our equity portfolios.

With the material change in bond yields, we are increasingly attracted to the potential 5-6% returns now available through exposure to credit at the shorter end of the yield curve, however with high inflation we are hesitant to take too much duration risk at this point. Turning to equity markets, despite the clear benefits that AI will bring the tech leaders, valuations look stretched, and we expect to see a broadening of returns to industrial sectors, a trend that should see the Australian market perform more in line with global equity markets. For Australia, the weakness seen within the Chinese economy is a key risk, however with Iron Ore currently trading at over US$120 and Crude Oil now over US$90, commodity markets appear to be much more sanguine.

Within our equity portfolios, we look to invest in companies that have invested in a strong competitive position, our key indicator of “quality”, have an identifiable “thematic” tailwind and have fundamental “valuation” support.

6

Having come to this conclusion through a series of stages of review, we look to build a meaningful portfolio position whereby investors will get the full benefits of the insight gained and team conviction. A great example of this process has been our belief in the long term growth available for those involved in the energy transition, a key portfolio thematic. Across the supply chain we continue to invest within the Lithium sector, however for investors the position in Worley (WOR.ASX) has proven to

be lucrative. The group has always rated highly within our quality screening process, but it was their unique position as a global leader in the design and construction of a new generation of energy projects that was set to deliver Worley a huge market opportunity. Pleasingly, given the increased disparity in market returns, we are excited about the enhanced opportunity set now available for active managers.

WEALTH COLLECTIVE

A Journey of Wealth Across Generations

A Personal Case Study in Comprehensive Financial Planning

by Garth Curry

For over three decades, I’ve had the privilege of knowing and working closely with the Jones* family. We’ve watched as the world around us evolved, from a space where we had to create what we wanted to a digital age overflowing with information and technology. This transformation has been nothing short of exciting as we’ve adapted to think like the new generation and anticipate their needs, having made some mistakes so having to adapt, but all while safeguarding the family’s wealth.

The Jones family spans four generations, each with its own set of financial needs and aspirations. Our shared goal has always been to ensure their financial security, provide for the education of our children and grandchildren, and explore opportunities for philanthropy that transcend generations.

To truly serve each generation effectively, understanding their distinct financial goals, special needs and values was paramount. The younger generation was deeply immersed in AI, technology, and digitalisation, while the older generation cherished capital preservation and life experiences. Through ongoing meaningful conversations with each family member, we delved into their individual financial circumstances, risk tolerance and deeper aspirations. Building personal connections was the bedrock on which we built trust across the generations.

Our journey began with crafting a comprehensive financial plan that embraced the family’s history, mission, goals and objectives. This plan laid out a straightforward roadmap that addressed the complexities of each generation’s financial life, something they all could embrace together. Key components included:

• Investment Strategy: We embarked on an educational journey with the Jones family, enlightening them about the advantages of diversification. We then tailored investment portfolios for each generation, aligning them with their unique risk profiles.

• Income vs. Capital: Encouraging each generation to prioritise income over capital was crucial for maintaining financial stability while meeting their objectives.

• Investing for the Long Term: We emphasised the significance of long-term investment horizons, aligning their investments with multi-generational goals like securing education funds for children and ensuring a comfortable retirement for grandparents. Throughout, we accommodated evolving family dynamics, fostering transparency and open communication.

• Philanthropic Legacy: Acknowledging the family’s desire to create a lasting philanthropic legacy, we structured their charitable giving to resonate with each generation’s values while optimising tax benefits within their financial plan.

8

A journey of wealth across generations

• Regular Family Meetings: Encouraging regular family meetings allowed us to come together, reevaluate values and adapt the financial strategy as circumstances changed.

Over 34 years, the Jones family remained dedicated to their multi-generational financial plan. By steadfastly adapting & adhering to the plan, they experienced the rewards of long-term investing, providing stability and growth for education funds, retirement savings, family unity and their philanthropic legacy.

Their financial wellbeing was secured, and their collective impact on the community grew, even as some members lived on different continents.

The Jones family’s journey is a testament to the power of holistic financial planning across generations. I learnt a lot in assisting the Jones Family & this assisted me in looking after my own family & other families by starting with a comprehensive approach, understanding the values and goals of each generation, and incorporating every facet of their financial lives, to achieve not only financial objectives but also fostered a lasting and, most importantly, trusting relationship within each family.

Financial planners have a unique opportunity to make a profound impact on multi-generational families. By aligning strategies with values, educating on sound financial principles, and helping navigate special circumstances through external professional expertise, planners can

guide families in creating lasting financial legacies that benefit generations to come. The Jones family’s journey reminds us that financial planning isn’t just about wealth accumulation; it’s about crafting a legacy that leaves a positive impact on our world.

*Please note: To protect the identity of the client, an alias has been used throughout this article.

9

WEALTH COLLECTIVE

“Financial planning isn’t just about wealth accumulation; it’s about crafting a legacy that leaves a positive impact on our world.”

Macroeconomic Update

by Paul Zwi

Global real GDP growth (inflation adjusted) is expected to average 2.5% in 2023, although the average hides wide variations amongst countries and regions.

This is lower than normal growth and it reflects:

1. The diminishing effect of the post-lockdown bounce back,

2. The drag from widespread monetary policy tightenings, and

3. Softer than anticipated growth in China.

We expect global inflation to continue to fall back towards 3% in 2024, reflecting supply chain improvements. However, the recent surge in oil prices is becoming an issue that could upset inflation readings.

The US economy remains a bright spot against forecasts of a slowdown. Resilience in consumer spending and strong labour markets are observed. The US is expected to achieve positive real GDP growth of slightly more than 2% this year, belying higher interest rates and supported by continued strength in real disposable income growth. Labour markets and the unemployment rate will probably remain resilient for the next year or two.

While the Federal Reserve’s 2% target for consumer price inflation will remain unmet for some prolonged period, it is likely that core PCE inflation, the Fed’s preferred gauge, will be close to 3% by year end. Falls in inflation will benefit from the continued supply chain recovery, a decline in shelter inflation, and slower non-housing services inflation as wage growth continues to moderate. However, as noted above, the cost of oil and therefore gasoline needs to be watched.

We believe the Fed’s hiking cycle is now largely complete, and this is probably the case for most other major central banks as well. However, high rates (compared to 2 years ago) will remain at elevated levels for some time, and it is possible that market expectations of rate cuts by mid2024 will be disappointed.

In the Euro area, we expect a continued period of stagnation reflecting a range of difficulties, including high energy prices, the effect of weaker Chinese import markets and the drag of the ongoing European Central Bank hiking cycle. The Eurozone will struggle to pass a modest 0.5% GDP growth target. Core inflation remains relatively high in Europe, reflecting the pass-through from energy (Ukraine war), food prices and wages growth. Inflation will likely remain above 4% through to mid 2024.

In China, a deluge of weak economic data has started to improve in recent weeks, perhaps reflecting a series of somewhat small policy easing measures. That said, continuing stress in the real estate market, ongoing structural demographic challenges, local government and shadow banking debt problems and falls in trade numbers suggest real challenges ahead in China is to reach its target GDP growth level of 5%.

In Australia, the ASX reporting season passed without too many negative surprises, but consumer sentiment remains depressed. The Australian dollar has steadied around US$0.64, given slightly better data out of China. The AUD appears to be trading as a proxy for weaker growth in China amongst currency speculators, and fundamental factors should see it recover in time. A key issue remains the comparison of reported inflation to cash rate settings by the RBA. The current “negative” real interest

10

Macroeconomic Update

rate (compared to the US) will continue to hold the AUD down. Inflation needs to sustainably pull back below 4% for the AUD to appreciate based on relative real interest rates.

Based on international central bank guidance, the RBA is surely very close to ending its tightening program. At its September Meeting, the RBA held interest rates steady for the third consecutive month and the Board said that inflation had passed its peak (around 7%) despite remaining elevated.

The Australian economy is and will continue to experience a period of below-trend growth and unemployment is forecast to rise gradually (currently 3.7%). Against this, a lagged wages push as cost of living expenses remain intense (mainly energy), suggests that both inflation and therefore cash rates will remain above 4% through FY24.

In conclusion, a key issue remains the observed resilience of world bond markets as central banks adopt programs to reduce the size of their balance sheets that swelled during COVID. Developed economy bond yields, in the key 5-to-10-year maturity range, have settled around the 4% level. This level, that measures the “risk free” rate of return, suggests that most asset classes are fairly priced for moderate economic growth with elevated inflation.

11

“We expect global inflation to continue to fall back towards 3% in 2024, reflecting supply chain improvements.

WEALTH COLLECTIVE

However, the recent surge in oil prices is becoming an issue that could upset inflation readings.”

Conversations with AI: The revolution we never saw coming

Conversations with AI: The revolution we never saw coming

by Dr. Michael Kollo

Until recently, AI was a one-trick pony, lost in a sea of numbers, metrics, and equations. The narrative was set; technology had put the arts and humanities on the back burner, fueling a world obsessed with STEM. Even the term ‘technology’ had become synonymous with circuits and silicon, leaving language and literature as relics of a bygone era.

Then, as if flipping a switch, November of last year marked a tectonic shift. Enter ChatGPT, the linguistic AI, a kind of virtuoso, with the conversational depth of an Oxford scholar and a measured linguistic IQ of 140. Picture a quantum shift, akin to discovering Einstein’s theory of relativity in a world stuck on Newton’s laws. This was no mere update; it was a complete overhaul and a change of direction. ChatGPT didn’t just add a splash of linguistic colour to a monochrome technical canvas of AI —it introduced an entirely new palette, reshaping our very understanding of what AI could be.

When ChatGPT was launched in November of last year, it achieved an adoption rate that dwarfed all preceding technologies in software history, reaching a user base of 100 million within its first month. This was not simply another step on the ladder of technological evolution; it was a quantum leap. It made high-end AI functionality not only understandable but immediately applicable, reminiscent of how the Internet transformed from a specialised military network into a global communication fabric.

Simplifying Adoption: The Plug-and-Play Paradigm

What makes this generation of AI especially transformative is its accessibility. Previously, AI deployment necessitated substantial investment in cloud infrastructure and specialised machine learning talent—akin to needing an entire laboratory to conduct basic experiments. Now, these AI models are more like compact, portable scientific kits. They can be directly adopted “off-the-shelf,” and implemented without a prohibitive cost or learning curve. This ease of adoption democratises the technology, akin to how personal computers made computational power accessible to the masses, changing the landscape of possibilities in work, education, and beyond.

Confluence of Competence: A Reimagined Workforce

This new model of immediacy in AI adoption interlocks seamlessly with a shift in the professional ecosystem. The need for AI specialists and data scientists—once considered the gatekeepers of this domain—becomes less pressing. It’s similar to how the advent of user-friendly software suites reduced the demand for specialised programmers for basic tasks. Organisations can now rely on a more diversified array of employees to harness AI, widening the net of competence and thus speeding the rate of AI integration across sectors.

12

A Tidal Wave of Change: Beyond Finance

We should resist the temptation to think that this revolution is confined to Wall Street. It’s more like the Internet—a transformative technology affecting multiple facets of life and work. According to estimates by Goldman Sachs, this technological wave will touch approximately 300 million workers worldwide. This isn’t about replacing human labour but enhancing it, akin to the way power tools revolutionised craftsmanship.

The Social Fabric: A New Element in Our Lives

At the horizon lies perhaps the most intriguing potential: the rise of a new type of digital agent, a kind of human-like algorithm. This is a development without precedent, as disruptive and novel as the introduction of smartphones. Former Secretary of State Henry Kissinger suggested that language models represented a meteoric advancement in our development as a species: seeking to alter human cognition on a scale not seen since the invention of printing.

The use cases are in abundance: we need more teachers, mentors, companions and assistants all around the world. Ones that never tire, that understand your needs through context and memory, and most importantly, those that are not trying to manipulate you, driven by marketing desires, but ones created to help and develop our humanity.

These language models are more than just computational tools; they bring us closer to a future where AI integrates seamlessly with human life, understanding and even generating our most essential form of expression— language.

13

WEALTH COLLECTIVE

Get to know Quilla

by Andrea Theouli

Proactive Portfolios (Proactive) is a wholly owned subsidiary of Clime Investment Management Limited. Under the Proactive banner we have developed a robust and collaborative approach to building investment portfolios to help investors achieve long term wealth growth while managing market volatility.

Proactive’s approach is enhanced by its partnership with external experts like Quilla Consulting (Quilla). The collaboration with Quilla, a distinguished investment consultant, is a cornerstone of Proactive’s methodology which aims to elevate the overall investment experience for both advisers and clients by harnessing partners expertise in constructing investment strategies.

At its heart, the portfolio investment solutions offered by Proactive emphasise several key principles:

1. Diversification and wealth preservation: by providing investors with access to a diverse array of investments within well-rounded and resilient portfolios. This diversity is designed to prioritise wealth preservation, ensuring that clients’ assets are safeguarded against market volatility.

2. Rigorous research: this involves conducting thorough research to identify investment opportunities and strategies that are most likely to meet the needs of investors. This research-driven approach underpins the selection of investments held within the portfolios.

3. Innovation and independence: Both Proactive and external experts, Quilla, maintain an independent mindset that encourages innovative thinking. Enabling the exploration of new ideas by fostering a continuous drive for excellence via implementable investment solutions.

By leveraging external expertise, Proactive ensures that its investment strategies are at the forefront of industry best practice and are tailored to meet evolving market dynamics.

Proactive’s approach is implemented through a systematic and disciplined investment process:

1. Assessment of investment market returns: this involves the evaluation of expected market returns across various asset classes over the long term. This assessment serves as the foundation of the decision-making process.

2. Strategic Asset Allocation (SAA): portfolios are constructed with an allocation to different asset classes based on ten-year asset class return forecasts. Longterm benchmarks and allowable ranges for asset allocation are established during this phase.

3. Dynamic Asset Allocation (DAA): the actual asset allocation of portfolios is managed dynamically over shorter time frames, typically one to five years. Inputs from experienced sources, including Quilla, play a crucial role in making timely adjustments based on changing market conditions.

4. Asset selection: individual assets within each asset class are meticulously selected. Criteria such as yield, stock ratings, and risk management assessments are applied for securities listed on the ASX. For managed funds, quantitative metrics and qualitative assessments from independent research sources, guide selections.

Proactive has created investment solutions designed to meet clients’ requirements. By tapping into external expertise and maintaining commitment to excellence, Proactive strives to provide excellent outcomes and an enhanced investment experience for advisers and clients alike.

For more information on Proactive’s investment solutions, please reach out to us.

14

Get to know Quilla Consulting

Private Wealth Team Spotlight

What makes you passionate about providing financial advice?

I enjoy working closely with clients, understanding their goals and formulating strategies that have a positive impact on a client’s financial position.

When I’m not at work, I am…

Enjoying the great outdoors, playing basketball, studying or spending time with friends!

What makes you passionate about providing financial advice?

I enjoy the challenge of solving complex financial puzzles and tailoring strategies to meet my clients’ unique goals. I relish the opportunity to educate clients about financial matters and build lasting relationships.

When I’m not at work, I am…

Fanoula Stathatos Private Wealth Adviser

Spending time with my family, catching up with friends over dinner and planning my next travel adventure.

What makes you passionate about providing financial advice?

I enjoy freeing people of their day-to-day concerns about their finances and working with them to maximise the return on the hard work they put into their lives. I enjoy discovering their goals and the best path to achieve those goals.

When I’m not at work, I am…

Stephen Wilson Private Wealth Adviser

Helping my wife wrangle our kids. We all enjoy spending time outdoors together, especially when it includes animals.

15 WEALTH COLLECTIVE

Harley McDermott Associate Adviser

Our people

James Trude

Chief Client Officer

E: jtrude@clime.com.au

Anna Garuccio Financial Adviser

E: anna@mtis.com.au

Garth Curry

Private Wealth Adviser - NSW

E: gcurry@clime.com.au

Sean Cummins

Private Wealth Adviser - VIC/ WA/TAS

E: scummins@clime.com.au

Stephen Wilson Private Wealth AdviserNSW

E: swilson@clime.com.au

Matt Rencken

Private Wealth Adviser - QLD

E: mattr@clime.com.au

Harley

E: harley@mtis.com.au

Amanda Brain Senior Associate Adviser

E: amanda@mtis.com.au

Boban Petreski

Private Wealth AssociateNSW/QLD

E: bpetreski@clime.com.au

16

McDermott Associate Adviser

Fanoula

E: fstathatos@clime.com.au

David

E: david@mtis.com.au

Pauline

E: pauline@mtis.com.au

E: tabeywickrama@clime.com.au

E: cschonfeldt@clime.com.au

E: dallass@clime.com.au

E: jo@mtis.com.au

E: bgalbavy@mtis.com.au

17 Want to speak to a Private Wealth Adviser?

Stathatos Private Wealth AdviserVIC/SA/NSW

Hammer Financial Adviser

Novotny Financial Adviser

Tara Abeywickrama Private Wealth AssociateVIC/WA/SA/TAS

Catherine Schonfeldt

Private Wealth Associate - NSW

Jo Shi Associate Adviser

WEALTH COLLECTIVE

Dallas Sinclair Associate Adviser

Bea Galbavy Team Coordinator

Email us at associatesupport@clime.com.au or call us on 1300 788 568.

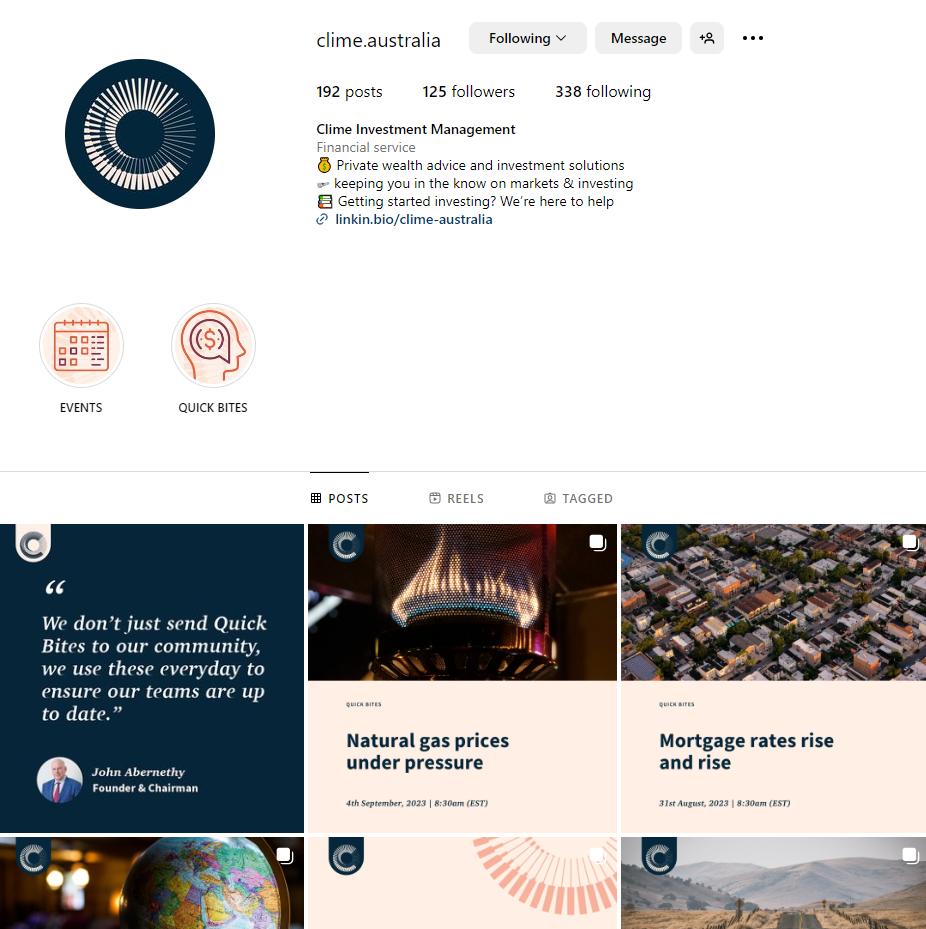

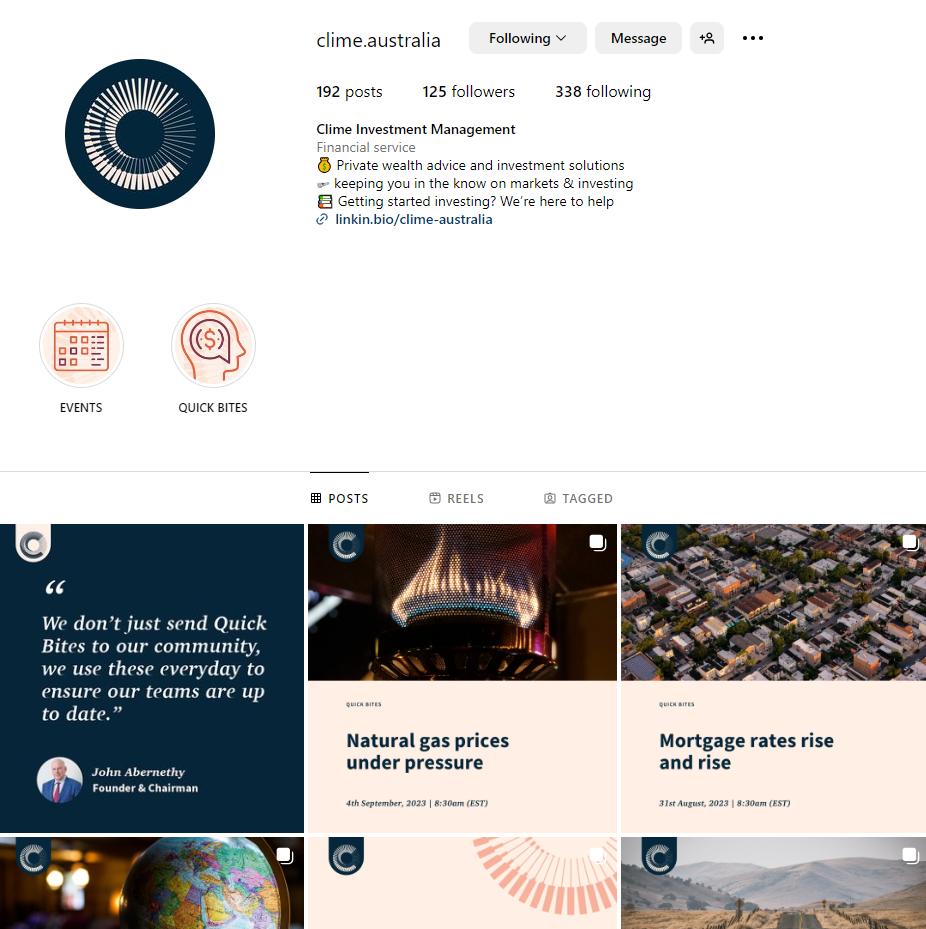

18 Contact Us Have any questions about this edition of the Wealth Collective? Contact your Adviser now or get in touch with us via email at associatesupport@clime.com.au. STAY IN TOUCH Clime Investment Management @clime.australia @clime.australia SCAN here to access more of our resources

Key dates for SMSF Trustees

30 September

SMSF trustees should start collecting information relevant for any transfer balance account event that has occurred since 1 July 2023 or any other transfer balance account event that has occurred and not yet reported. The first quarters transfer balance account report is due on 28th October and these events must be included.

28 October

Is your fund paying any pensions? Do you have a transfer balance account? Have there been any transfer balance events?

Remember, the requirement to report transfer balance events no longer depends on the size of your members’ super balances. All unreported events that occurred before 30 September 2023 must be reported by this date. This means you cannot report at the same time as your SMSF annual return for the 2022–23 income year.

If your fund is registered for GST, your BAS is also due on 28th October.

31 October

You need to lodge your annual return and auditor’s report by this date if you are a first timer or were a late filer last year.

1 December

If you are lodging your annual return on 31 October, you must pay your SMSF’s annual supervisory levy by this date. This must now be paid in advance so if your SMSF was only established last financial year you will have to pay double. That is, twice the annual amount of $259 or $518.

Source: Super Guide

19

This quarter’s contributors

About Annick Donat

Chief Executive Officer

With over 30 years’ experience in financial services, Annick has been active in her advocacy of financial planning and technology, often supporting and mentoring emerging entrants to financial services. Her expertise spans across governance, strategy, distribution, business and practice development, licensee services and operations management. Annick Donat was appointed CEO of Clime Investment Management Limited on 1 May 2021. With a predilection and curiosity for innovation, Annick believes great advice can change lives. It’s these values that led her to become Chief Executive Officer of Madison Financial Group in 2017 where she strived to empower consumers through great advice. Annick sits on various industry advisory boards including, but not limited to, Advisory and Director roles with Not-for-profit organisations.

About Will Riggall

Chief Investment Officer

Will has been building wealth for Australian investors for more than 20 years. He has a proven track record managing market-beating portfolios and a stellar reputation as an astute analyst. Will’s experience spans the full market-cap range, and his analysis skill is both quantitative and fundamental. Will is proud of his skill at managing investments through the cycle and his ability to create and protect wealth through equity booms and busts. Will is a keen communicator and regularly presents at seminars, webinars and portfolio updates. In addition, he ensures his portfolios are structured to provide advisers and clients with optimal transparency.

About Garth Curry

Senior Private Wealth Adviser

Garth has over 33 years’ experience as a investment manager looking after investor portfolios in the South African and global markets. Before joining Clime in September 2022, Garth was a Senior Portfolio Manager at Sanlam Private Wealth. Prior to that he was the Managing Director of Merrill Lynch Private Client division in South Africa.

20

About Paul Zwi

Macro Analyst

Paul Zwi has worked in the investment and financial services industry for over 20 years, with a key focus on equity research and wealth management opportunities. Prior to Clime, Paul was the Head of Equity Research and Senior Research Analyst at Centric Wealth and Head of BT’s Private Client business.

About Andrea Theouli

Deputy

Chief Investment Officer

Andrea has a demonstrated history in financial services across trading, investment governance, portfolio construction and product research. Andrea chairs the Clime Managed Account Investment Committee and has been the research lead for managed funds, ETFs and other investment products across the group for several years.

About Dr. Michael Kollo

CEO of Evolved Reasoning

Dr. Michael Kollo is the CEO of Evolved Reasoning and is a senior investment professional with extensive academic and private sector experience globally, more recently speaking on the application of machine learning and AI in the financial services sector. Dr Kollo gained his PhD in Finance from the London School of Economics, and has lectured at the London School of Economics, Imperial College and at the University of New South Wales.

He is a strong thought leader who has worked closely with sales teams to transform research insights into marketable service and products. Michael has led experienced global research teams at Blackrock, Fidelity, Axa Rosenberg to more recently, at HESTA a $50bn superannuation industry fund in Australia.

21

WEALTH COLLECTIVE

22