Beyondsustainabilityreporting:

BY CLIMATE & COMPANY AND GERMANWATCH E.V.

Climate&CompanyisGermany’sleadingSustainableFinanceThinkTank.Beitforbiodiversityprotectionand the restoration of ecosystems, tackling the climate crisis, or halting deforestation - with sound data evidence, solidregulatoryanalysisandstrategicpolicyrecommendationswehelpdecision-makersinconnectingthedots andbridgingthegapsbetweenfinance,policyandtheenvironment.

EXECUTIVE SUMMARY

• Financialinstitutions(FIs)areapartnerinenablingthemajorityofcorporateandhouseholdinvestments. Through their investment strategies and their engagement with clients and investee companies, they can haveasayinhowgreenorsustainabletheseinvestmentsneedtobe.

• FIs also face increasing risks from financing clients or investing in assets with impacts on the environment and exposure to environmental risks, such as financing actors along deforestation-linked supply chains These risks can add up to systemic risks at market level, thus representing stability risks for Member States’andtheEU’seconomy.

• So,whetherthefocusisonachievingpositiveimpactsormanagingfinancialrisks,FIswillneedtogobeyond theirestablishedduediligencepatternstoincludesustainabilityobjectives.

• Yet, no harmonised sustainability due diligence framework across all EU Member States is available to supportFIsinthisendeavour.

• TheCorporateSustainabilityDueDiligenceDirective(CSDDD)hasthepotentialtofillthisgap.However, itsinclusionofFIsinthecurrentdraftsisnotsufficienttoaddressthebulkofenvironmentalimpact.

• We have five recommendations to adjust the CSDDD during the negotiations to serve its purpose more effectively:

o IncludeallFIsinthescopeofmandatorysustainabilityduediligenceprovisionsintheCSDDD, andavoiddistortionofcompetitionandadditionalburdenthroughdivergentnationallegislation.

o IncludeFIs’entirevaluechainbeyonddirectclients/investeesinthescope,toaddressthevast majority of environmental and social impact (such as deforestation) hidden upstream in their clients’andinvestees’valuechain.

o Requireregularidentificationofimpacts,assupplychainsandenvironmentalconditionschange overtime.

o Require divestment or disengagement as back-up strategies, if actions are not taken by investeesandclients.

o Provide specific guidelines for the financial sector to recognize the specific structures and proceduresofdifferenttypesofFIs,clarifyexpectationsandprovidethenecessaryguidance.

1

Whyastandardisedduediligenceframework forthefinancialsectorwillsteersustainable developmentalongtheEU'ssupplychains.

THIS IS THE PROBLEM

Environmentaldestructionandprotectionare,ultimately,drivenbyspecificinvestmentdecisions.Let’squickly considertheexampleofforestsanddeforestationtoillustratethispoint,butalsorecallthescopeandurgency of the challenge. Addressing deforestation is key to delivering the targets of globally agreed environmental commitments such as the Paris Agreement and the 2022 Kunming-Montreal Global Biodiversity Framework (GBF).ForestsharbourmostoftheEarth’sterrestrialbiodiversityandprovidenumerousecosystemserviceson which we depend. They are home to many Indigenous communities, where the traditional use of forests is an integralpartoftheircultureandlivelihoods.ForestsareessentialCO2sinks,andtheirdepletionreducescarbon absorption capacity and contributes to greenhouse gas emissions. Between 1990 and 2020, an estimated 420 millionhectaresofforest(morethan10%oftotalforestarea)werelostthroughconversiontootherland-uses1 , threatening numerous species. In most high-impact sectors, the bulk of environmental impact, such as deforestation,istakingplaceupstream,hiddeninthesupplychain(98%forthefoodandbeveragesector2).

With the EU Green Deal as its new economic paradigm, EU and national policymakers are shaping the EU regulatory framework to address environmental impacts and dependencies. Two very important measures in this context are the EU Deforestation-free Products Regulation (EUDR), which entered into force in June 2023,andtheCorporateSustainabilityDueDiligenceDirective(CSDDD),currentlyundernegotiation.Those regulatory measures have the potential, when implemented in close cooperation with the EU’s partner countries, to transform the production of raw materials, commodities and intermediate goods in our supply chainstominimisedeforestationandothersignificantenvironmentalandsocialimpacts.

What role does the financial sectorplayinallofthis?

Financial institutions (FIs) indirectly support deforestation by providing financing to companies in sectors such as beef and soy production. Additionally, they have an indirect influence by offering financial support to wholesale and retail operators whose supply chains involve high-risk commodities associatedwithdeforestation Figure1showssomestrikingnumbers.Thesenumbersarenotonlyalarmingfor thoseconcernedwithhumanprosperityandsurvival.Theyarealsodeeplydisconcertingforeveryonewhocares aboutthestabilityoffinancialmarketsandtheprofitabilityoffinancialinstitutions.

Theroleofthefinancialsectorneedstobeclarifiedurgently:theEUDRdoesnot(yet)includeFIsinitsscope3 and it is still unclear whether and how the CSDDD will require FIs to exercise sustainability due diligence throughouttheirvaluechainsandforalltheirclients/investees.

2

1 FAO(2022),Thestateoftheworld’sforests,link

2 UNPrinciplesforResponsibleInvestment(2017),link

3 SubjecttoanimpactassessmentontheroleofFIsandthepotentialneedforadditionalrequirementsinEUlegislationaspartofthe secondreviewprocessoftheEUDRinSpring2025.

Figure 1: How financial institutions are financing deforestation (Sources: Forests & Finance (2022), link ; Forest500 (2023), link)

WHY FINANCIAL INSTITUTIONS ARE KEY FOR DELIVERING THE EU GREEN DEAL

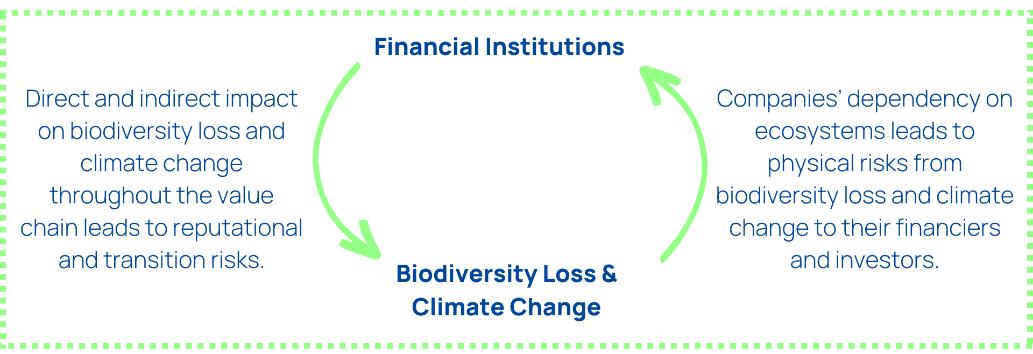

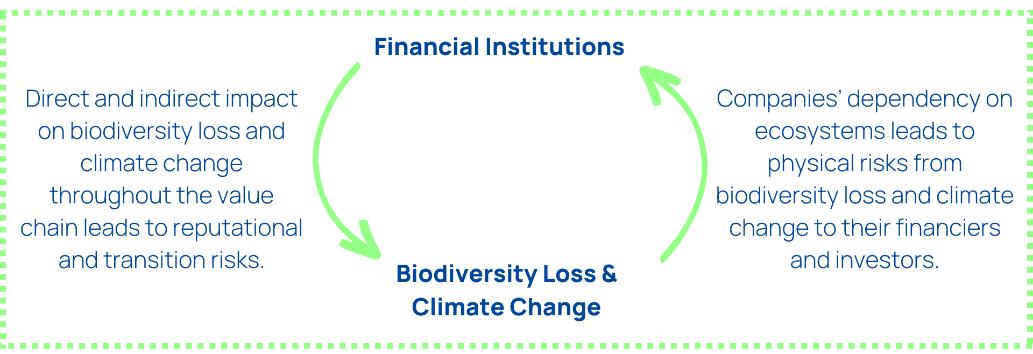

FIs face financial risks from (1) their investees’ and clients’ dependency on nature and exposure to climate change impacts,and(2)theirimpacton environmentalandsocialissues throughout their value chain (Figure2).

Financial risks at firm (i.e. individualFI)levelcanaddupto systemic risks at market level, with potentially significant ramifications for entire economies and societies. Environmental impacts could have significant macroeconomic consequences, and failure to account for, mitigate,andadapttotheseisasource ofriskfor FIsindividually,aswellasforthe long-term stabilityofour financialmarketsoverall 4

TheEUaimstotransitiontoaclimate-neutraleconomy5,anddeliveringtheEUGreenDealwillrequire‘shifting trillions[ofEUR]’.Each MemberStatealsohasitsowninvestmentneeds.Deliveringthesetargetswillrequire a coordinated effort across Member States to implement structural reforms that channel resources into sustainable investments. While both public and private resources are needed, the majority will need to be supplied by the private sector6. For this, FIs play a key role in providing the right incentives for companies to address their impacts, either through their financing and investment decisions and/or by engaging with clients and investees about their ESG performance along their entire supply chain. For SMEs in particular, the engagementbybanksoftengoesbeyondexpressingconcernstotakingamoreactive,supportiverolevis-à-vis theSME,helpingitintacklingtransitionchallenges.

WHY THE EU INSTITUTIONS SHOULD INCLUDE MANDATORY VALUE CHAIN DUE DILIGENCE FOR FINANCIAL INSTITUTIONS

TherearefiveissueswhichcouldberesolvedbymandatorysustainabilityduediligenceforallFIsintheCSDDD:

1. FIs and their investees/clients need a level-playing field across EU Member States. The General ApproachtotheCSDDDadoptedbytheCounciloftheEU7 wouldleadtodivergentobligationsforFIsin each Member State. This would increase the burden for FIs active in different countries. Additionally, divergent obligations would distort competition within the EU. Investee companies and clients (particularly SMEs) would also suffer from a plethora of incoherent and unharmonized disclosure and duediligencerequirementsfromtheirinvestorsandbanksacrosstheEU.SMEsin particularoftenlack the resources and expertise to navigate through varying sustainability-related demands from their banks and investors. They need a harmonized set of due diligence requirements from FIs, to provide themwithclarityandconsistencyandreducetheiradministrativeburden.

4 NGFS(2022),Statementonnature-relatedfinancialrisks,link

5 EuropeanCommission(2018),Communication:ACleanPlanetforallAEuropeanstrategiclong-termvisionforaprosperous,modern, competitiveandclimateneutraleconomy,link

6 ClimatePolicyInitiative(2022),GlobalLandscapeofClimateFinance:ADecadeofData2011-2020,link IEA(2022),WorldEnergy Outlook2022,link

7 CounciloftheEuropeanUnion(2022),GeneralApproachtotheCSDDD,adopted1st December2022,link

3

Figure 2: Financial risks from dependencies and impacts on the environment

2. A harmonized set of obligations reduces the burden on international partners and supports global regulatory initiatives. EU unilateral environmental policy is reaching an upper ambition limit. Any further progress necessitates cooperation from our partner countries. However, they are already facing different requirements from EU disclosure, due diligence and market access legislation. The burden caused by divergent demands on companies upstream the value chain could de-facto lead to theirexclusionfromthemarket.Thiswouldbedetrimentaltothesustainabletransformationofsupply chains.Therefore,clearrulesandstandardstofollowstemmingfromaharmonisedsetofrequestsfrom FIs would facilitate the collaboration and effective contribution of international partners to delivering theEUGreenDeal.

Additionally, the future of the global financial system will be determined by conversations in the G20, G7, the United Nations and bilaterally, fed notably by the benchmark that the EU could set on due diligence regulation for FIs. Leaving the shaping of the financial sector due diligence on sustainability risks and impacts up to each EU Member State would be counter-productive to global initiatives towardsharmonisation.

3. Lackofpolicycoherenceincreases the burden,uncertainties,andliabilityrisksforFIs.Excluding FIs from the CSDDD also leads to considerable legal uncertainties for them. FIs are implicitly already requiredtocomplywithcertainsustainabilityduediligencedutiesthrough,forexample,deforestationrelatedstandardsandindicatorsintheCSRDandSFDR.However,theseprovisionslackclearguidance andspecificityonwhatisexpectedofthemandhowtodealwithidentifiedrisksfromandimpactson, forexample,deforestation.Thisincreasestheirliabilityrisks.Guidanceonhowtoexercisesustainability due diligence would be facilitated if obligations for the financial sector across the EU were prescribed in law. Considering the specific structures of FIs and their distinctive position along the value chains, attention should be placed on making those requirements feasible, such as by specifying their role in checking thesoundnessandsolidnessofduediligencestatementsmadeavailablebytheirclientsand investees. This is particularly important for small and medium-sized FIs, who have more limited capacities and resources but also play a major role in advancing sustainable investments and supply chains.

4. Voluntary actions have not been enough to counter deforestation throughout value chains. DespiteseveralcommitmentsfromFIstoeliminatedeforestationintheirportfolios8,theneededlargescale and timely shifts of financial flows to deliver theEU Green Deal will only happen with regulation FIshavelackedincentivestoconsiderenvironmentalimpactthroughouttheirvaluechainasfinancially material. Legislation (such as the CSDDD) could provide the incentive, guidance and data which have beenlackingsofarandresultedintoofewdeforestation(andotherenvironmentalimpacts)mitigation measuresbyFIs.9

5. Lack of policy coherence leads to risks of not delivering the objectives of the EU Green Deal. OmittingFIsfromtheCSDDDorincludingthemwithoutconsideringtheirwholevaluechainwouldlead to significant incoherence in the EU legal framework for corporate sustainability due diligence and sustainable finance. This would be detrimental to the EU’s ambition to steer financial flows into sustainable business activities, due to the crucial role of FIs here. Institutional investors and asset managersareofhighimportancehere.TheSFDR,whichtargetsthem,doesnotrequireandprovidethe necessary enabling framework for themto exercise sustainability due diligence, leading to substantial uncertaintiesandrisksnottofullyleveragetheroleofallfinancialinstitutionsinclosingoursustainable investmentgap.

4

8 Mostpopular:Financialsectorcommitmentletteroneliminatingcommodity-drivendeforestation,link 9 Traseinsights(2023),Newguidancehelpsfinancialinstitutionsgrapplewithdeforestationduediligence, link

OUR RECOMMENDATIONS

MandatoryduediligenceforthefinancialsectoracrosstheEUregardingsustainabilityimpactsthroughouttheir value chain, such as deforestation, will ensure (1) that FIs take action to mitigate deforestation (beyond voluntary commitments), (2) that FIs are provided with a level-playing field and (3) that policy coherence is improvedtodelivertheobjectivesoftheEUGreenDeal

However,thecurrentproposals10 oftheCSDDD do noteffectively include allFIstopreventdeforestation (andotherenvironmentalandsocialissues)throughoutvaluechains

We have five recommendations to improve the inclusion of FIs in the CSDDD, which we encourage the EU institutionsandMemberStatestoconsider:

1) Include all FIs in the scope of mandatory sustainability due diligence provisions in the CSDDD WhiletheEuropeanCommissionandEuropeanParliamenthaveagreedintheirproposalthatFIsshould be part of the scope of the CSDDD, the proposal by the EU Council to leave it up to Member States to decidewhethertoincludeFIsintheirnationaltranspositionisaveryriskyapproach,asexplainedabove. FIs need harmonized due diligence requirements across the EU, to be provided by the CSDDD. This means that institutional investors and asset managers should also be included in the scope of the Directive.

2) Include FIs’ entire value chain beyond direct clients/investees in the scope Impacts such as deforestationareusuallyhiddenupstreaminthevaluechainofclientsandinvestees.LimitingFIs’due diligence requirements to only the activities of their direct clients and investee companies (i.e. more likely downstream companies) means that the bulk of environmental impact is not considered or addressed.FIsshouldconsidertheresultsoftheirclientsandinvestees’valuechainduediligence.The inclusionofSMEsandtheirvaluechainsisparticularlyvaluabletomitigateenvironmentalimpact.

3) Requireregularidentificationofimpacts Alimitationtoonlypre-contractualidentificationofimpact forFIsisincoherentwiththeconceptofdynamicmateriality(=whatisconsideredmaterialcanchange over time due to numerous factors), as well as the core purposeof sustainabilitydue diligence. In this context, the Directive should specify the points in time during a contract or the provision of financial services when due diligence must be performed, as per the European Parliament report. This would helpavoidfurtheruncertainties.

4) Require divestment or disengagement as back-up strategy if actions are not taken by investees andclients FIs’leveragewith regardtomitigatingadverseimpactsisseverelyweakenedifthereisno credible threat of terminating a business relationship or selling assets (“divesting”) if needed. Engagement and divestment are complementary strategies. The EU Commissionproposed to exempt FIsfromdivestingordisengagingwithacompanyifitisexpectedtocausesubstantialprejudicetothe company.ThisisavagueprovisionandcouldleadtomoreliabilityrisksforFIs.

5) Definespecificguidelinesforthefinancialsector.Definingthespecificstepsthatthedifferenttypes of FIs should take to properly exercise sustainability due diligence would clarify expectations and providetheadditionalguidanceneeded.TheOECDGuidelinesalreadyconsiderthedifferentstructures ofFIsbydistinguishingbetweeninstitutionalinvestorsandbanks.TheEuropeanCommissioncoulddo the same through sector-specific guidelines. These should recognise the increased complexity of conductingduediligencefromtheirpositionwithinthevaluechain,thedifferenceinclientrelationships andthedifferencesintheirestablishedduediligencesystemscomparedtonon-financialcorporates.

5

10

ByEUCommission,EUParliamentandEUCouncil

HOW WE CAN SUPPORT YOU

OurteamatClimate&Companyanditspartnerorganisationswouldbeveryhappytogointodetailaboutand discusswithyouthecontentofthisbriefandanycomments/questionsyoumighthave.Weinviteyoutohavea lookatthefullanalysisonourwebsite Wewouldbedelightedtoplanameetingwithyouandexplorewithyou how we can best support your efforts and work in this context, ahead of the technical and political Trilogue meetingsinSeptember,Octoberandbeyond.

Contact:LouiseSimon–louise@climcom.org

Climate & Company is also working on data solutions. We are implementing a pilot study with a pension fund todemonstratethefeasibilityofmappingdeforestation-relatedriskswithexistingdataandavailabletools.We wouldbehappytopresentyouourcurrentfindingsduringaworkshoporsimilarclosed-doorevent.

Contact:MalteHessenius–malte@climcom.org

Thisbriefingispartofourprojectonpreventingsupply-chain-drivendeforestationfundedbytheGordonand BettyMooreFoundation

6