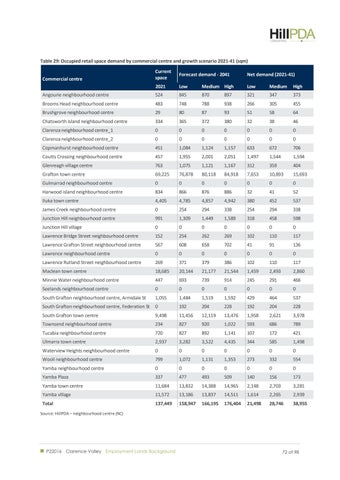

Table 29: Occupied retail space demand by commercial centre and growth scenario 2021-41 (sqm) Current space

Forecast demand - 2041

Net demand (2021-41)

2021

Low

Medium High

Low

Medium

High

Angourie neighbourhood centre

524

845

870

897

321

347

373

Brooms Head neighbourhood centre

483

748

788

938

266

305

455

Brushgrove neighbourhood centre

29

80

87

93

51

58

64

Chatsworth island neighbourhood centre

334

365

372

380

32

38

46

Clarenza neighbourhood centre_1

0

0

0

0

0

0

0

Clarenza neighbourhood centre_2

0

0

0

0

0

0

0

Copmanhurst neighbourhood centre

451

1,084

1,124

1,157

633

672

706

Coutts Crossing neighbourhood centre

457

1,955

2,001

2,051

1,497

1,544

1,594

Glenreagh village centre

763

1,075

1,121

1,167

312

359

404

Grafton town centre

69,225

76,878

80,118

84,918

7,653

10,893

15,693

Gulmarrad neighbourhood centre

0

0

0

0

0

0

0

Harwood island neighbourhood centre

834

866

876

886

32

41

52

Iluka town centre

4,405

4,785

4,857

4,942

380

452

537

James Creek neighbourhood centre

0

254

294

338

254

294

338

Junction Hill neighbourhood centre

991

1,309

1,449

1,589

318

458

598

Junction Hill village

0

0

0

0

0

0

0

Lawrence Bridge Street neighbourhood centre

152

254

262

269

102

110

117

Lawrence Grafton Street neighbourhood centre

567

608

658

702

41

91

136

Lawrence neighbourhood centre

0

0

0

0

0

0

0

Lawrence Rutland Street neighbourhood centre

269

371

379

386

102

110

117

Maclean town centre

18,685

20,144

21,177

21,544

1,459

2,493

2,860

Minnie Water neighbourhood centre

447

693

739

914

245

291

466

Seelands neighbourhood centre

0

0

0

0

0

0

0

South Grafton neighbourhood centre, Armidale St

1,055

1,484

1,519

1,592

429

464

537

South Grafton neighbourhood centre, Federation St

0

192

204

228

192

204

228

South Grafton town centre

9,498

11,456

12,119

13,476

1,958

2,621

3,978

Townsend neighbourhood centre

234

827

920

1,022

593

686

789

Tucabia neighbourhood centre

720

827

892

1,141

107

172

421

Ulmarra town centre

2,937

3,282

3,522

4,435

344

585

1,498

Waterview Heights neighbourhood centre

0

0

0

0

0

0

0

Wooli neighbourhood centre

799

1,072

1,131

1,353

273

332

554

Yamba neighbourhood centre

0

0

0

0

0

0

0

Yamba Plaza

337

477

493

509

140

156

173

Yamba town centre

11,684

13,832

14,388

14,965

2,148

2,703

3,281

Yamba village

11,572

13,186

13,837

14,511

1,614

2,265

2,939

Total

137,449

158,947

166,195

176,404

21,498

28,746

38,955

Commercial centre

Source: HillPDA – neighbourhood centre (NC)

P22016 Clarence Valley Employment Lands Background

72 of 98