DESIGN PORTFOLIO

UX/UI DESIGN

Chigozie Ofor By

Chigozie Ofor By

I am an excellent and adaptable designer with extensive experience in UX/UI Design as well as User Research and Service Design.

I am passionate about creating engaging user experiences and exceeding business/customer satisfaction. I also aspire to advance the field of user experience and satisfaction for the customers' and business' benefit.

On a free day, I'd usually be cycling in the countryside where I reside, or taking a nature walk with friends/family. I love to read books related to design, and life as well as some fiction.

chigofor2015@yahoo.com

+44 7707405562

London, UK

https://www.linkedin.com/in/chigofor/

for

Duration: Two (2) months

Exact Role:

Conducted interviews with employees, analysed feedback and implemented insights into design work, designed screens and prototypes.

Team size:

The project sought to improve the way employees of a DIY store access staff discounts for items they purchase from the store. The key pain points identified were lack of information on the discount, bottlenecks with the discount service, and low employee morale. I conducte interviews with employees and also realised that digitising the process migh exclude less tech-savvy employees.

The design solution was an employee app that contained the discount card a ID details so the employee checks out at the till. The app also allows the emp to add the discount card to their E-wallet.

The overall impact to the business/employees were low turnover rate, boosted the employee morale and a better user experience for the staff.

• Employee might not always carry ID for authentication

This is needed to redeem discounts at the till

Employee can lose paper slip for discount

• Business loses money and time with current discount system. Employees spend a lot of time validating discounts manually when checking out at the till

• Inadequate information about discount

No information during onboarding

Employee has to check discount expiry at the till

Problem Space for the business

•

• High employee turnover

Some employees do not know about the discount scheme

Employees using discount do not feel they get cost savings

To gain insights, I conducted semi-structured qualitative interviews with about 50 employees mainly on the floor department.

The main research question was "What is the impact of the employee discount scheme on your employee experience and how can this be improved?"

The two (2) major personas identified were

Tech-savvy employees usually younger who felt the process was cumbersome,

Less tech-savvy employees usually older in age who felt that the employee welfare is not prioritised especially with the discount scheme.

60% of employees suggested the discount process can be digitised with scannable QR codes and ability to add to E-wallet.

30% of employees opted to receive a physical discount card especially during onboarding as a new staff. This can be used alongside the digital discount card.

Some employees feel the business does not care about their welfare, because they are either not aware of the discount or struggle to use it.

40% of employees interviewed are not aware that there are discounts available to them.

Once the discount paper slip is lost, it cannot be retrieved and employee misses out on cost savings.

40% of employees interviewed are not aware that there are discounts available to them.

The opportunities identified came from synthesising the research findings and drawing out common themes and patterns.

All four identified opportunities for improvement were addressed through the design solutions in the subsequent slides. Please see corresponding colour code.

Embed the discount card (both physical and digital forms) into the employee's welcome pack during their onboarding process.

Let employees have their ID details within the discount card (whether digital or physical) so it serves an added purpose of authentication

Employees can have their physical discount card in form of a card to be kept in their wallet or as a tag attached to their bunch of keys.

Within the staff app, employees can easily view their discount allowance, amount spent and remaining as well as expiry and renewal dates.

Scan discount as barcode or QR code and add to E-wallet

Employee has the option to scan discount as barcode or QR code and can also add to Google wallet

View discount details

Employee can view discount limit and key dates at a glance

Mockup of physical discount card in wallet

Discount card can be carried in wallet for easy and quick use when employee wishes to purchase an item in-store.

ID details on Discount card

Discount card shows employee ID details such as photo, name and designation. This is useful for quick and easy authentication.

Some employees who are less tech-savvy can opt for physical discount cards. This will enable them enjoy the unique experience of cost savings on items purchased as employees

Physical Discount card as key tag

Employee can have the discount card in a physical form as a keytag to attach to their bunch of keys.

Physical Discount card ndard cards)

loyee can have the discount in a physical form as a card to ored in their wallet or dbag.

Reduced employee turnover by 20% in the subsequent 6 months

Less tech-savvy employees are designed for and feel included

Quicker and Easier discount checkout process for employees. This also saves time and money for the business

Employee processes are transformed from manual (paper slips) to digital.

for a UK Building Society in the Banking and Finance Industry

Duration: Two (2) months

Exact Role:

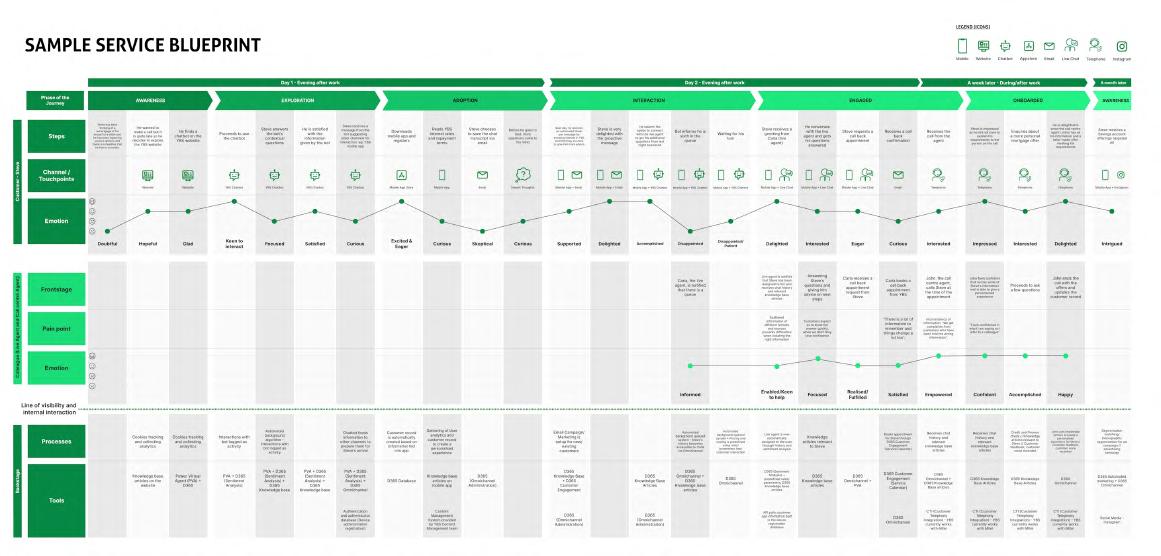

Refined user personas, mapped Service blueprints and prototypes.

Team size:

The project sought to improve the way a customer with a popular UK building society receives remortgage offers and advice and eventually applies for the mortgage deal of their choice.

The key pain point identified was limited range of online services especially for customers with busy schedules who cannot come into a branch. Another painpoint was a non-personalised service causing customer to remember their details per each visit to the branch, this was due to the supporting technology that the bank used to offer mortgage services.

The design solution was to consult with subject matter experts and analyse existing research before mapping a service blueprint for implementation.

The overall impact to the business/customers was a smoother and enjoyable experience for both the customer and the front stage employees. The updated supporting technologies also incorporated omni-channel experience across web, app, and in-person channels and this improved the business's reputation and increased customer retention by 30% within 4 months.

ServiceI do not have the time to visit the bank branch each time through the process of my remortgaging.

While remortgaging, I want to have a seamless experience across channels such as mobile, email, web, in-person branch visits, and customer phone calls.

The problem space was derived from customer and business research findings that an external team gathered prior to when my phase of the project started. These formed the starting point for my UX and Service Design work.

I am not able to explore remortgage offers online via my mobile phone

Business loses customers (especially busy professionals) as their processes are manual and cumbersome.

Problem Space for the Business (Building Society)

I have to recall my details each time I visit the branch, I want the service to remember my details on subsequent visits.

Business' supporting technologies do not have an omnichannel experience for the customers and this is frustrating for the employees (customer care colleagues)

Opportunities identified stemmed from the synthesis of research findings. The research conducted included interviews with customers and customer care colleagues. The artefacts gathered included user personas from qualitative insights, as well as quantitative findings on volume of incoming customer care calls and its negative impact on the business.

Provide customers with personalised remortgage deals via mobile app/website based on their financial situation and preferences. This reduces the burden on the customer care colleagues and the frequency of in-branch visits

Highest priority and impact for the business and the customer

Embed an omni-channel supporting technology that enables customer care colleagues and customers communicate seamlessly across channels such as mobile app, website, phone calls, etc.

Second in priority and impact for the business and supporting the service provision of personalised deals for the customer

Authenticate users quickly through single sign-on, or biometric features as this saves time and money during customer care calls, or live chat sessions.

Third priority and least impact on customer experience.

Design artifact of Service Blueprint, developed and presented to the clients with positive feedback and implementation

Service

Improved business operations by 30% in 6months as omnichannel supporting technologies reduce customer call frequencies and enabled business to channel improvements to other aspects.

Opportunity for business to rebrand and appeal to target customer demographics such as young and busy professionals.

Increase customer retention by 40% and attraction of about 500 new customers within the first month of implementation.