2021 annual report

Kelowna, British Columbia, Canada

For the year ended December 31, 2021

city of kelowna

2021 annual report for the year ended december 31, 2021

The Annual Report is produced by the Communications and Financial Services departments of the City of Kelowna, in cooperation with all civic departments and agencies.

Kelowna, British Columbia, Canada

introduction A Message from the Mayor 4 A Message from the City Manager 6 Our Community 9 Mayor & Council 10 Our Organization & Organizational Chart 11 Financial Strategy 12 Civic & Community Award Winners 14 Awards & Recognition 15 council priorities Council Priorities 2019 – 2022 17 2021: From Resilience to Momentum 18 Community Safety 20 Social & Inclusive 21 Transportation & Mobility 23 Vibrant Neighbourhoods 24 Economic Resiliency 26 Environmental Protection 29 corporate priorities Financial Management, Clear Direction, People 31 financial information Index to Financial Statements Financial Services 33 Provision of Services & Support for Growth 33 City Reserves 34 Development Cost Charges 35 Financial Management Strategies 37 Top 10 Principal Corporate Taxpayers 38 Permissive Tax Exemptions 39 Revitalization Tax Exemptions & Heritage Building Tax Exemptions 43 Consolidated Financial Statements Report from the Divisional Director, Financial Services 44 Independent Auditor’s Report 46 Consolidated Statement of Financial Position 48 Consolidated Statement of Operations and Accumulated Surplus 49 Consolidated Statement of Changes in Net Financial Assets 50 Consolidated Statement of Cash Flows 51 Notes to the Consolidated Financial Statements 52 Schedule 1 – Tangible Capital Assets 70 Schedule 2 – Segmented Information 72 Schedule 3 – Long Term Debt 76 Schedule 4 – COVID-19 Safe Restart Grant for Local Governments 79 statistical review Statistical Review for the Years of 2017 – 2021 80 table of contents

a message from the mayor

We’ve gone through a lot the past two years and I’m sure we will have many challenges to navigate as we move forward, but we also have a lot to be optimistic about. Our collective vision—developed through Imagine Kelowna—will be more important than ever. Building community connections and creating a caring, smart, inclusive city that puts people first will be our way forward.

As we lean into our community’s vision—one that encourages curiosity and creativity, and where everyone does their part to seize opportunities for improvement—we are reassured by the fact that confidence in our city has never been greater. We are seeing record breaking investment and, with some of the strongest growth in the country, there is a clear signal that people want to live and do business in Kelowna—and we are more than ready to take advantage of our opportunities.

To shape this growth in a way that aligns with our community values and respects the natural wonders that contribute to our identity, a key focus in 2021 was completing the new Official Community Plan and Transportation Master Plan. These plans, working alongside others such as the Regional Transportation Plan, Community Climate Action Plan, Cultural Facilities Master Plan, and Healthy City Strategy, are the building blocks to our city’s continued prosperity. Strong integrated planning lays the foundation to not only be able to respond effectively to our community’s challenges, but also use them as an opportunity to innovate, and become a better city because of them.

As co-chair of the BC Urban Mayors’ Caucus, I can tell you we have made excellent progress turning advocacy into action with the provincial and federal governments on four critical issues facing our communities: mental health, substance use and treatment; affordable housing; public transit; and the development of a new fiscal relationship with both levels of government.

City of Kelowna 2021 Annual Report 4

This along with our diverse economy, thoughtful policy development and enviable quality of life will see us emerge from the last two years stronger in so many ways. But it will take all of us pulling in the same direction on things like climate action and community safety, two of our community’s most pressing priorities.

Building community connections and helping ensure Kelowna reaches its full potential begins with Truth and Reconciliation. Many of us are just beginning to understand what we didn’t know, or chose not to know, about our history. We need to take the steps necessary to reconcile our country’s past with a new relationship with First Nations in the Okanagan.

As we embark on the work ahead, it will be a period of positive transformative change for our city. I encourage our citizens to get involved by learning more about the Council Priorities 2019–2022 and visiting Get Involved Kelowna to find timely public input opportunities and help shape our city of the future.

5 A message from the Mayor

Mayor Colin Basran City of Kelowna

a message from the city manager

Each year the Annual Report provides our citizens and other stakeholders with detailed information about the City’s operating and financial activities for the fiscal year. It provides a permanent public record of the dollars spent, and results achieved across our various departments. It keeps our citizens informed and involved, while holding us accountable for ensuring the financial integrity of the organization and efficient delivery of services that touch the day-today lives of our citizens.

The ability to be flexible and nimble is an important aspect of any successful organization. However, responsible financial management is grounded in having a strong vision and clear set of priorities. They are the guideposts that drive decision-making and enable organizations to strategically and efficiently embrace opportunity, tackle challenges and deliver on promises.

Our city’s vision to 2040, Imagine Kelowna, was created by our community, for our community. It is built on four key principles of being responsible, smarter, collaborative and connected, and it outlines 14 goals to help us thrive in the face of unprecedented growth and change, and unexpected bumps—such as a global pandemic—along the way.

When a crisis hits, it’s more important than ever to pay close attention to our values, vision and goals. In a time of uncertainty, they will always reveal what is most important and where attention and resources need to focus. They underpin an organization’s ability to be resilient and responsive, which helps ensure recovery is swift and the organization ends up stronger because of it.

The following pages outline the incredible achievements that were made over the past year, despite the various obstacles and challenges— proof that our community’s vision and values are leading us in the right direction. We have become more technologically adept, more agile and we have adapted and diversified services to meet demand and improve quality of life.

City of Kelowna 2021 Annual Report 6

I want to commend our staff for their many long hours and dedication to innovation over the past year to better serve our residents. Your passion for public service and commitment to our community’s shared vision and influencing positive change is building a city of the future. As we round the corner on the current four-year council term, I would also like to acknowledge the work of our current Council and the continuous advancement of the 2019–2022 council priorities through unprecedented times. Council’s bold decisions this term have set up our community for success and ensured that we are taking actions that serve our community as a whole.

Finally, I thank our citizens, community partners and service providers. The past year has confirmed what we learned through the Imagine Kelowna vision process: to flourish in the future, we need to be agile, resilient, and unafraid to do things differently and, as we grow, we need to continue to take care of one another and protect the environment that sustains us. That is what we did throughout 2021, and will continue to do, because Kelowna is more than just a beautiful city; it’s our home.

Doug Gilchrist City Manager, Kelowna

Doug Gilchrist City Manager, Kelowna

7 A message from the City Manager

territory acknowledgement

We acknowledge that our community is located on the traditional, ancestral, unceded territory of the syilx/Okanagan people.

8

our community

Kelowna is located along the beautiful shores of Okanagan Lake, in the heart of the stunning Okanagan Valley. With a four-season lifestyle, the lake offers opportunities for boating, swimming and fishing, while nearby mountains attract hikers, skiers and outdoor enthusiasts. From scenic golf courses to bustling urban centres with delectable restaurants, awardwinning wineries and breweries, local shopping, museums, live entertainment and cultural festivals, residents and visitors enjoy it all in Kelowna.

Nearly all citizens (92 per cent) rate the quality of life in Kelowna as good or very good thanks to recreational opportunities, safety, its accessible location, job opportunities, stunning landscape and the great weather.

The technology sector has seen us dubbed as the Silicon Valley of the north and is a pillar of the regional economy. Dynamic tourism, post-secondary education, construction, real estate, healthcare and deep-rooted agriculture sectors are drivers of our economy.

As a highly desirable place to live, Kelowna remains one of Canada’s fastest growing cities. By 2040, we expect a growth of more than 45,000 new residents who will call Kelowna home.

citizen survey

The most recent (2020) City of Kelowna Citizen Survey gauged public satisfaction with municipal programs and services. According to the survey:

9 Our Community

mayor & council

The City of Kelowna is governed by an elected Mayor and eight Councillors for a four-year term (2018–2022). Led by Mayor Colin Basran, Kelowna City Council is committed to building on the momentum of past Councils and being open for opportunity through community engagement and partnerships. It is consistent and transparent in decisions, creating a favourable

environment for customer service, development and business in Kelowna. Council meets regularly and the public is welcome to attend any open meeting or provide feedback in writing via mail or email.

Learn more at kelowna.ca/council

City of Kelowna 2021 Annual Report 10

colin basran Mayor

gail given Councillor

mohini singh Councillor

maxine dehart Councillor

charlie hodge Councillor

luke stack Councillor

ryan donn Councillor

brad sieben Councillor loyal wooldridge Councillor

our organization

The organization is led by our dedicated City Manager, Mayor and Council. More than 1,000 employees deliver quality services to ensure our city is safe, vibrant and sustainable. Strong financial management allows us to provide core services to the citizens of Kelowna, introduce new amenities and maintain valuable infrastructure.

Council Priorities 2019–2022 identifies the strategic shifts, improvements and changes that are important to Council, the community and organization. Our annual Action Plan identifies the strategic and operational work required to deliver results on these priorities.

The annual Progress Report on Council Priorities 2019–2022, released each spring, is an interactive online report showing how the City is taking action and making progress,

demonstrating Council’s commitment to transparency and accountability.

The Financial Plan provides the most comprehensive view and plans for how we deliver the core services that residents rely on like emergency services, clean drinking water and roads.

Working together with the Annual Report to keep the public informed of City projects and progress, are the kelowna.ca website, City Views newsletter and a variety of social media channels designed to spark conversation and connections with our community. Citizens can also provide input and be involved on key projects through the City’s online engagement platform getinvolved.kelowna.ca. Engaged citizens help build strong neighbourhoodsz and create a city that is welcoming and inclusive.

organizational chart

11 Our Organization office of the city clerk Stephen Fleming City Clerk

kelowna residents city council city manager Doug Gilchrist partnerships & investments Derek Edstrom Divisional Director corporate & protective services Stu Leatherdale Divisional Director infrastructure Mac Logan General Manager corporate strategic services Carla Weaden Divisional Director planning & development services Ryan Smith Divisional Director kelowna international airport Sam Samaddar Airport Director active living & culture Jim Gabriel Divisional Director financial services Genelle Davidson Divisional Director

financial strategy: strength & stability

Sound financial strategy is the ability to acquire and manage a portfolio of financial and physical assets that meet the current and future needs of our community. Read more about our Financial Management Strategies on page 37.

financial strategy

• Assets – New

• Assets – Renew

• Debt

• Development Financing

financial principles

plans that influence financial decisions

• Sufficient

• Pragmatic

• Council Priorities

• Official Community Plan

• Imagine Kelowna vision

• Grants

• Operations

• Partnerships and Enterprise

• Property Taxation

• Flexible

• Transparent

• 10-year Capital Plan

• 2030 Infrastructure Plan

• 20-year Servicing Plan

• Reserves and Surplus Funds

• User Fees and Charges

• Balanced

• Community Trends Report

residents’ top 5 priorities for investment

budget revenues by type (%)

City of Kelowna 2021 Annual Report 12 Financial Strategy

ADDRESSING SOCIAL ISSUES IN THE COMMUNITY DRINKING WATER PROVIDING DIVERSE HOUSING OPTIONS FIRE AND POLICE SERVICES TRAFFIC FLOW MANAGEMENT

2021 FINANCIAL PLAN FINAL BUDGET VOLUME 3

SOURCE:

did you know?

City of Kelowna has a diverse portfolio of operations, some of which are run as self-funded business units that have no impact on property taxes (example: water utility, wastewater utility, parking services, and Kelowna International Airport). The City provides corporate services to these business units and uses internal allocations to recover these costs. This prevents these costs from being included in the annual property tax levy and allows the fees charged by the self-funded business units to encompass the full cost to deliver their service.

civic & community award winners

47th Annual Civic & Community Award Recipients

Honouring individuals and organizations for outstanding contributions and achievements in 2021 that directly benefited the community, making Kelowna a great place to live, work and play.

edna terbasket

Anita Tozer Memorial Award

lloyd nelson

Sarah Donalda Treadgold & Fred Macklin Memorial Award –Citizen of the Year

don dobson

Champion for the Environment Award

toyota kelowna

Corporate Community of the Year Award

canadian mental health association – kelowna

Central Okanagan Foundation –Volunteer Organization of the Year Award

david withler

Young Citizen of the Year Award

jennifer money

Honour in the Arts Award

dryden bennett

Teen Honour in the Arts Award

malindi elmore

Female Athlete of the Year Award

jerome blake

Male Athlete of the Year Award

tatum wade

Augie Ciancone Memorial Award –

Top High School Female Athlete

tie: everett schmuland & nathan loo

Augie Ciancone Memorial Award –

Top High School Male Athlete

kelowna secondary school owls boys

volleyball team

Bryan Couling Memorial Award – Athletic Team of the Year

mike sodaro

Bob Giordano Memorial Award – Volunteer Coach or Sport

Administrator of the Year

14

awards & recognition

The City of Kelowna received a number of awards and recognition in 2021 including:

government finance officers association

canadian award for financial reporting

2020 Annual Report

This is the 19th consecutive year the City has received the award recognizing excellence in governmental accounting and reporting.

government finance officers association

distinguished budget presentation award

2021 Financial Plan

This is the 20th consecutive year the City has received the highest form of recognition for governmental budgeting.

southern interior construction association (sica)

building award – civil

Kelowna Integrated Water Project – Phase 1

Emil Anderson Construction

southern interior construction association (sica)

building award – project of the year

Kelowna Integrated Water Project – Phase 1

Emil Anderson Construction

share the road cycling coalition

Bicycle Friendly Community Designation

Canadian Award for Financial Reporting

Presented to City of Kelowna

British Columbia

For its Annual Financial Report for the Year Ended

December 31, 2020

Executive Director/CEO

15 Awards & Recognition

Government Finance Officers Association

council priorities

16

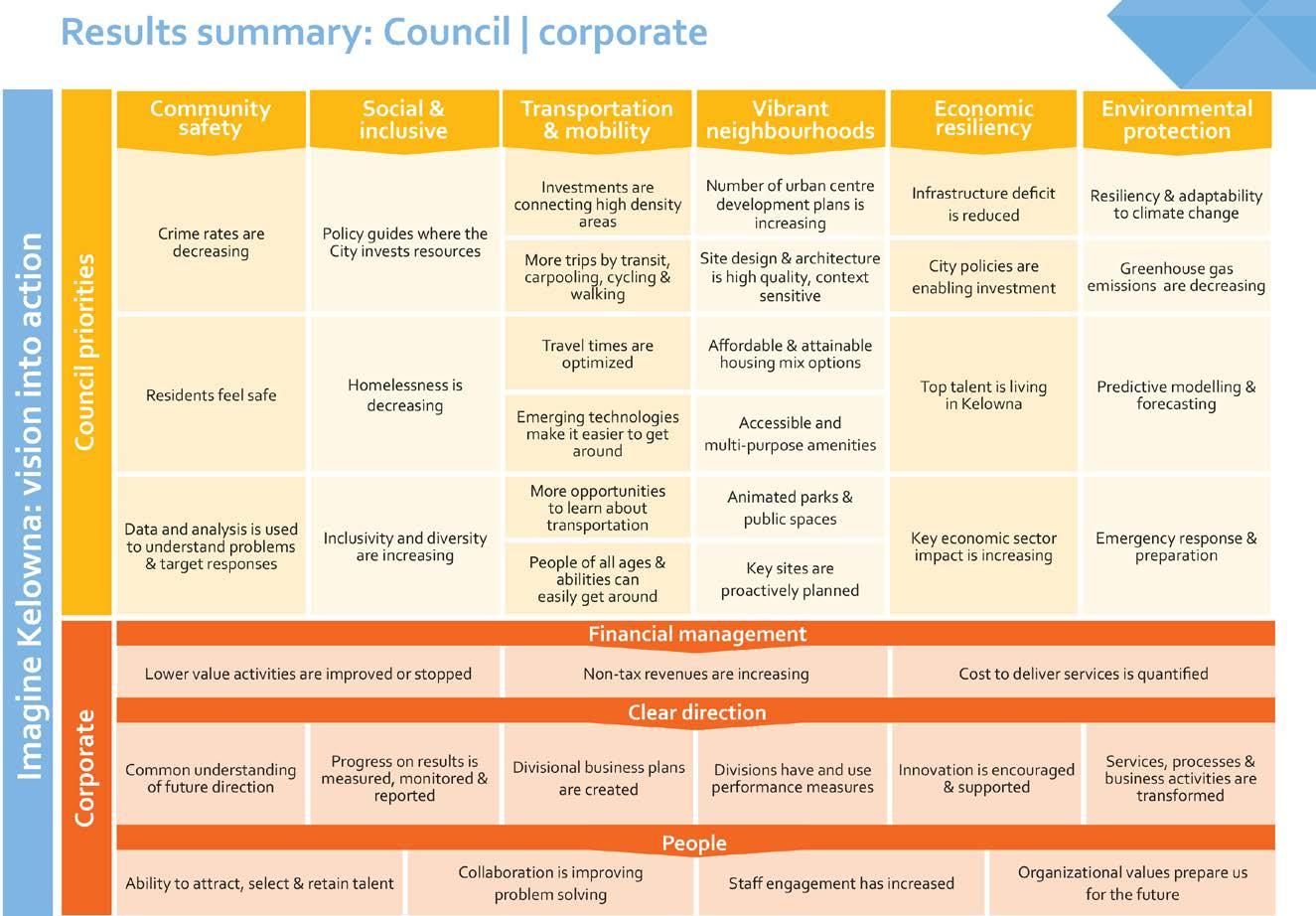

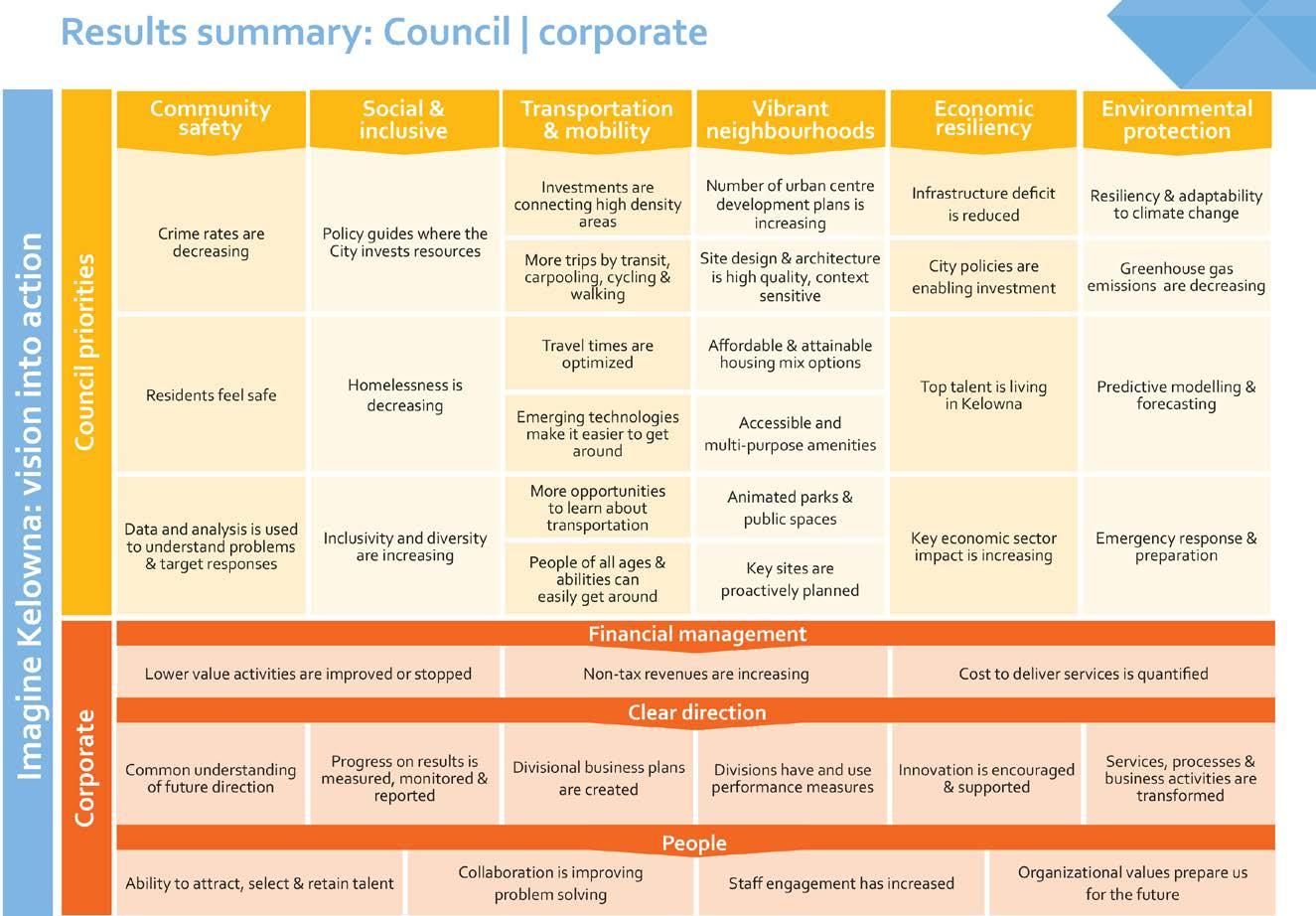

council priorities 2019 – 2022

imagine kelowna: vision into action

Council Priorities 2019–2022 identifies the strategic shifts, improvements and changes that are important to Council, the community and organization. It is an open and accessible commitment to how we will advance the Imagine Kelowna vision within this Council’s term. It will focus the work we do to become the Kelowna residents told us they want to see. Reporting on its progress each year is part of Council’s commitment to working in a way that is citizen focused, balanced and embraces continuous improvement. The interactive progress report can be found at kelowna.ca/councilpriorities

breakdown of 2021 council priority action plan projects

2021 progress results

• 29 results are trending in the right direction

• 5 results show no change or it is the first year that data is available

• 5 results are not trending in the right direction

Learn more at kelowna.ca/councilpriorities.

17 Council Priorities 2019–2022

SOURCE:ACTION PLAN 2021

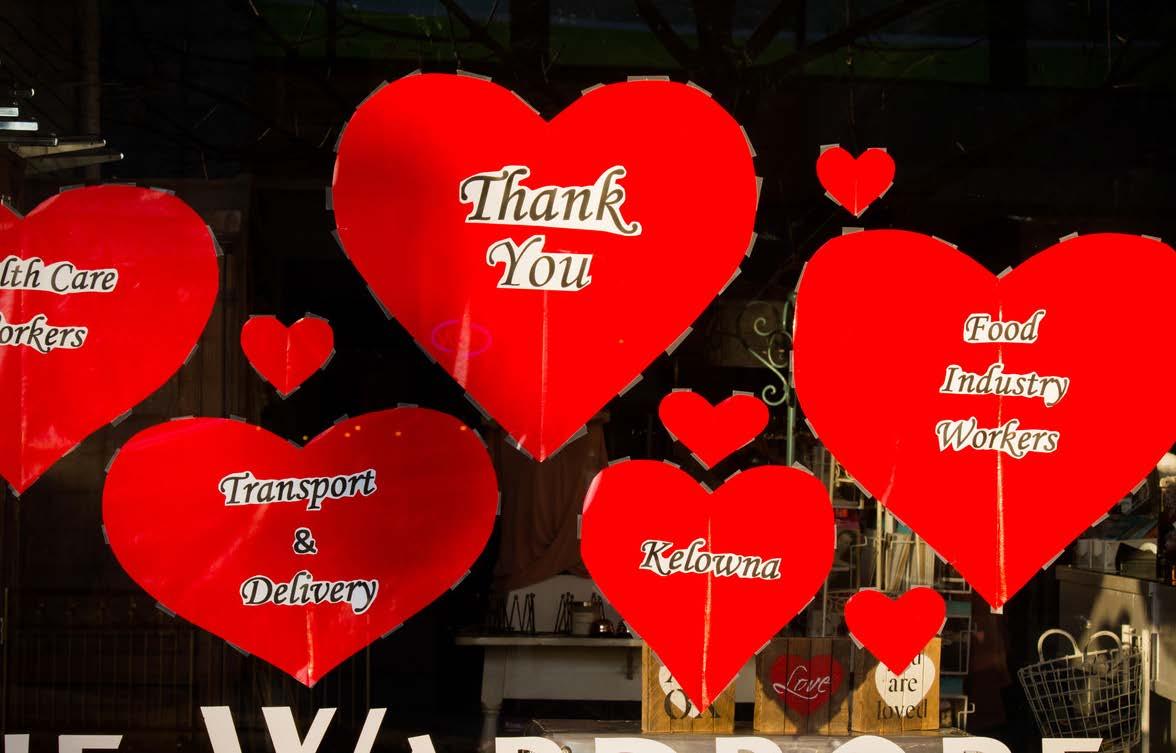

2021: from resilience to momentum

setting the stage for an inclusive, prosperous and sustainable future

While 2020 demonstrated our community’s resilience, 2021 was a story of response and, despite a global economic downturn, substantial progress. Alongside the completion of pivotal strategies and the realization of recordsetting milestones, key economic indicators are showing Kelowna is heading into 2022 with momentum—and living up to its promise of becoming a City of the Future.

Between 2016 and 2021, our city’s population increased 13.5 per cent, making it the fastest growing city in B.C. while having the third-fastest growing downtown in Canada (behind Montreal and Halifax). For the first time, building permit values exceeded $1 billion and Kelowna International Airport (YLW), one of the largest economic drivers in the Southern Interior, continued to be one of the top 10 busiest airports in the country, and was one of the fastest recovering airports in Canada.

Though restrictions and the biggest wave of the pandemic yet continued to touch many aspects of our lives, 2021 offered an opportunity to innovate, optimize and streamline, revealing new—better and more efficient—ways of doing things. New economic opportunities were generated through a focused approach to community partnerships, and key foundational plans to shape our city’s growth and respond to complex social and community safety issues were pushed over the finish line.

Of the many projects and initiatives completed in 2021, arguably none could be more important than the 2040 Official Community Plan (OCP) and 2040 Transportation Master Plan (TMP)

The OCP sets a strategic course for the next 20 years as to how our city should grow, prioritizing areas, decisions and policies that our citizens have told us they want to focus on through Imagine Kelowna and OCP engagement opportunities. The 2040 TMP sets the direction for a vibrant city where people and places are conveniently connected by diverse transportation options. Working together, the two plans will help achieve the vibrant, sustainable and inclusive future residents envisioned through the creation of our city’s Imagine Kelowna community vision.

Throughout the year, staff also worked diligently to advance City of Kelowna’s Action Plan 2021, which identifies the organization’s most notable strategic and operational work for the year. This included developing Kelowna’s first Community Safety Plan, a comprehensive, systems-based, five-year action plan to generate shared ownership, vision and action among government ministries and community organizations that contribute to community safety.

As these and many more projects throughout 2021 taught us, flexibility, adaptability, innovation and a shared vision are the cornerstones of a vibrant, resilient city. It is through this that we generate valuable new ideas and approaches to support our community’s vision and turn progress into the results that create the Kelowna we want to live in and leave for the next generation.

To learn more and view the interactive 2021 progress report on Council priorities 2019–2022, visit kelowna.ca/councilpriorities

18 City

of Kelowna 2021 Annual Report

an historic agreement Paving the Way for Important Improvements

As a result of months of discussions throughout 2021, the Okanagan Indian Band, District of Lake Country and City of Kelowna reached an agreement on a Memorandum of Understanding (MOU) that will pave the way toward building important health, safety and infrastructure improvements, including completion of the Okanagan Rail Trail. The historic agreement will provide many improvements, not only to residents and businesses in the area but have positive cultural and economic spin-offs for the entire region.

a time to learn and listen

National Day for Truth and Reconciliation

On September 30, 2021, City of Kelowna marked the first annual National Day for Truth and Reconciliation with ceremonial acknowledgments of the new relationship emerging between Canada and Indigenous Peoples—one based on the recognition of rights, respect, co-operation and partnership. City flags were flown at half-mast to remember the lost Indigenous children who died in residential institutions and to express condolence and respect to survivors and local First Nations.

meet me on bernard

Creating Vibrant Urban Spaces while Stimulating Economic & Social Recovery

The City, in partnership with the Downtown Kelowna Association and Tourism Kelowna, launched Meet Me on Bernard, opening Bernard Avenue to pedestrian-only traffic over the summer. The open-streets initiative allowed 23 businesses to extend patios to create more space, and also featured seven parklets designed and created collaboratively by more than 20 local landscaping and architect firms, daily and nightly performances from local artists and buskers, and numerous art installations woven through the four blocks of Bernard.

19 2021 in Review

community safety

goal: crime is reduced and residents feel safe

Community safety remains a top priority for Kelowna citizens and City Council. The City and its partners are using data and analysis to better understand the root causes of crime and our specific local problems so we can deliver targeted responses. What contributes to a family in a suburban neighbourhood feeling safe might be different than that of a university student travelling from downtown to campus at night.

As crime is intrinsically linked to societal conditions, the safety and well-being of a neighbourhood is achieved when we all pull together on a clear set of goals. Throughout 2021, the City worked with many partners to develop Kelowna’s first collaborative Community Safety Plan. Generating shared ownership, vision and action among government ministries, community partners and Kelowna residents, it is a comprehensive, systems-based, five-year action plan designed to deliver community safety strategies and outcomes, and build governance structures for ongoing coordination and integration among systems leaders.

Alongside the Community Safety Plan, Kelowna RCMP launched its 2021–2024 Strategic Plan, which focuses on achieving measurable differences in public safety outcomes, while maintaining other critically important services including: frontline policing, traffic enforcement, drug enforcement and youth engagement. It also significantly expanded its Community Safety Unit to increase visibility and responsiveness in the downtown area, Rutland, and parks, as well as enhanced collaboration with cross-sector partners in response to those who experience mental health and substance use issues.

additional highlights

• Supported the launch of Kelowna Community Court, an integrated court to more effectively address offenders concurrently experiencing mental health, substance use disorder and/or homelessness.

• Strengthened RCMP contract management practices, including establishing policing priorities and outcomes to enhance police visibility, responsiveness, efficiency and effectiveness.

• Enhanced services at the Rutland Community Policing Office and restructured the Crime Prevention Branch.

• Expanded the Safety Education Ambassador Program to increase the safety of our local parks, beaches, and waterfronts from the May long weekend to the September long weekend.

• Received funding from the Union of B.C. Municipalities (UBCM) for an update of the Community Wildfire Resiliency Plan, which involves multiple departments and intended to guide wildfire risk reduction activities.

• Completed a comprehensive review of crime prevention programs and services, including bylaw services.

• Received Airport Health accreditation from Airports Council International recognizing YLW’s commitment to prioritizing health and safety.

City of Kelowna 2021 Annual Report 20

social & inclusive

goal: fewer people will experience homelessness and inclusion and diversity are increasing

The City is playing an increasingly active role to address social issues—as many cities are. Our community puts people first and welcomes people from all backgrounds. We all benefit when everyone in the community has access to economic, recreational and social opportunities.

As a Built for Zero Canada community, progress was made in 2021 towards gaining a better understanding of how people flow in and out of homelessness, which will support the data-driven goal of optimizing the local homeless serving system through continuous improvement practices. Key achievements included the development of a coordinated governance model, access system, and a road map for achieving integrated data system among community partners.

The City received a $3.2 million grant from the Union of BC Municipalities (UBCM) Strengthening Communities’ Services Program funded by the Government of Canada and the Province of BC to support implementation of the City’s Outdoor Sheltering Strategy. The strategy is designed to support unsheltered people experiencing homelessness and address related community impacts. A Community Emergency Shelter Strategy is currently in development and will provide a system-wide approach for the delivery of shelter services, which is founded on the four core principles of choice, healing, community and safety.

Through partnerships with BC Housing and the Journey Home Society, 49 units of housing with supports opened in 2021. A total of 318 units of housing with supports have been added since the onset of the Journey Home Strategy, surpassing the five-year goal. Although significant investments have been made by all levels of government to address homelessness in Kelowna, the City and its partners still have work to do to decrease the number of people experiencing homelessness in our community.

additional highlights

• Engaged Urban Matters to develop a Youth Services Framework that will guide the creation of programs and services designed to build resilience in youth.

• Implemented mandatory training for all front-line employees at YLW on how to provide assistance to people with disabilities.

• Added additional infrastructure at YLW to help improve accessibility for all guests. This included a new relief area for service animals, visually contrasting stair tread to the second level of the Air Terminal Building and visually contrasting colours to the front curb pillars.

• PEOPLE Peer Navigators and Capacity Building Program, in its second year of the three year $691K Health Canada funded project, demonstrated strong results. Local capacity to train and host peers has significantly increased with two cohorts of Peer Navigator graduates placed in seven different local social serving organizations to meaningfully improve experiences of people with lived and living experience of substance use and other vulnerable circumstances.

21 Social & Inclusive

Community Safety (9%) Social & Inclusive (10%) Transportation & Mobility (20%) Vibrant Neighbourhoods (40%) Economic resiliency (8%) Environmental protection (13%) 6 9 6 28 14 7

22

transportation & mobility

goal: fewer trips are made by car and solutions are innovative

Following a four-year planning process and more than 12,000 community inputs from citizens and stakeholders, 2021 marked the completion of the 2040 Transportation Master Plan (TMP).

The pivotal long-term, citywide plan sets the direction for a vibrant city where people and places are conveniently connected by diverse transportation options.

Outlining improvements that will help keep Kelowna moving, now and into the future, it includes 100 recommended actions that will help us maintain and renew our existing infrastructure, create fast and reliable transit, improve road connections, develop comfortable bicycle routes, create walkable neighbourhoods, and help people use and enjoy new ways of getting around.

Supporting the TMP goals to double transit ridership, quadruple the number of trips made by bicycle, and reduce the average distance each person drives by 20 per cent, in 2021, the City opened the latest phase of the Ethel Street Active Transportation Corridor (ATC) between Rose and Raymer avenues, providing residents with access to a dedicated pedestrian and bike route separate from vehicle traffic all the way from Cawston Avenue to Raymer Avenue.

The year also saw the introduction of shared e-scooter and e-bike programs, offering flexible, affordable and accessible mobility options to residents.

additional highlights

• Launched pilot artificial intelligence tool that automatically maps potholes.

• Received a $2.4 million provincial/federal government grant to extend the Houghton Road Active Transportation Corridor (ATC) from Rutland to the Okanagan Rail Trail.

• Widened Lakeshore Road bridge over Bellevue Creek to two lanes of vehicle traffic, buffered bike lanes in each direction and added a multi-use pathway.

• Completed Taxiway D rehabilitation at YLW.

• Launched a new transit orientation video that aims to help youth and older adults feel confident taking public transit. The video is part of a suite of public education materials.

• Repaved Taxiway E and finalized design for Air Terminal Building expansion

Transportation & Mobility 23

vibrant neighbourhoods

goal: affordable housing and higher density neighbourhoods

By 2040, Kelowna’s population is expected to grow by more than 45,000 citizens. This growth will bring both opportunities and challenges, and strategic planning is essential to ensure Kelowna can continue to be prosperous, vibrant and resilient in the years to come. Following a multi-year planning process alongside the development of the 2040 Transportation Master Plan (TMP), the new 2040 Official Community Plan (OCP), a high-level policy document that guides how and where our city grows, was completed in 2021.

Developed with participation from more than 2,000 citizens and stakeholders, the new OCP will shape how our city looks and feels. It includes updated land uses, mapping and policies to reflect the community’s vision and clearly signal where development will be prioritized and supported with infrastructure and amenities. The OCP provides a framework for Council by addressing issues such as housing, transportation, infrastructure, parks, economic development and the natural and social environment.

In support of a strong OCP, recreation, arts and culture play key roles in vibrant neighbourhoods, as do special events and activities that connect the community. In 2021, the City—in partnership with the Downtown Kelowna Association and Tourism Kelowna—launched Meet Me on Bernard, an open-streets initiative designed to generate more vibrant urban spaces while stimulating economic and social recovery. Returning for a second season in 2022, the popular attraction will again feature extended patios, free community programming, musical entertainment, public art and unique animations woven throughout the four blocks of Bernard leading to the waterfront.

Inclusive, vibrant neighbourhoods also know the value of sport in creating strong, connected communities. Throughout 2021, the City developed a provincially endorsed Quality Sport Framework to guide local sport organizations in creating experiences that are safe, inclusive and meaningful for all participants at every stage of their sport pathway. Sport is also a major economic driver and in July the City, in partnership with over 20 partners including Tourism Kelowna, School District 23, and PacificSport Okanagan, celebrated winning the bid to host the 2026 BC Summer Games. The games are expected to generate over $2 million in economic impact for Kelowna and the Central Okanagan.

• Finalized the long-term land lease of 350 Doyle Avenue and worked with arts organizations on a Creative Hub Feasibility Study to understand the opportunities in the proposed 6,000 square feet of new cultural space.

• Conducted a programming review of Kelowna Community Theatre to identify and evaluate different programming models and ways to improve audience experiences. Significant renovations were made to the lobby and washrooms.

• Opened Phase 3 of Glenmore Recreation Park featuring two sport fields and an off-leash dog park.

• Completed final phase of Rutland Centennial Park featuring a basketball court, ping pong tables, new landscaping, and lighting.

• Completed public engagement on designs for Tallgrass and Ballou neighbourhood parks in Tower Ranch and Glenmore respectively.

• Unveiled designs and construction schedule for the future of City Park.

• Improved the Cook Road boat launch, including parking lot upgrades.

• Conducted community engagement and consultation (including two “Get Eventive” weekends) as part of the planning and development of a Strategic Event Plan and future “signature” event for Kelowna.

• Endorsed a two-year pilot period for vehicle access on Knox Mountain Drive with input from more than 8,000 survey respondents.

City of

2021 Annual Report 24

Kelowna

additional highlights

25 Vibrant Neighbourhoods ESTIMATED PER CAPITA INVESTED ARTS, CULTURE & HERITAGE BUILDING PERMITS ISSUED MULTI-FAMILY UNITS 835 SINGLE DETACHED UNITS NEWPURPOSE-BUILT RENTAL UNITS OCCUPIED 716 $24.96 2,116

economic resiliency

goal: the infrastructure deficit is reduced, and kelowna is investment friendly

Economic resiliency is the ability to adapt to changing market conditions and recover and reconstruct after a shock. While the effects of COVID-19 provided some positive outcomes, such as the development of new technologies and services, reduced economic activity and revenue loss were a challenge for many organizations locally and beyond.

Building in economic resiliency strengthens our capacity to adapt and thrive in the face of challenge, including emergencies like a global pandemic. Throughout 2021, we focused on business continuity planning for essential services such as roadways, water and wastewater; reducing infrastructure deficit; enhancing online service delivery; and continuing to nurture a culture of entrepreneurship and collaboration.

Economic resiliency also means making our city attractive to investors, a key component of our ability to weather,

bounce back from and thrive after a crisis. One of the strongest examples of economic resiliency in 2021 was YLW, one of the largest economic drivers in the Southern Interior. Serving more than 830,000 passengers in 2021, it was one of the fastest recovering airports in Canada, capturing 41 per cent of its 2019 passenger numbers (2,032,019). Increasing domestic flight destinations to 14, which is five more than it has ever had, it operated as one of the top 10 busiest airports in Canada in 2021.

2021 provided yet another year of strong growth in the city’s urban centres, demonstrating the market’s confidence in the city’s direction.

Maintaining quality infrastructure, delivering a skilled workforce and high level of livability, and streamlining processes to welcome investment that supports our community vision, remain keys to Kelowna’s continued prosperity.

City of Kelowna 2021 Annual Report 26

Grow vibrant urban centres & limit sprawl Build a fair and equitable community Nurture entrepreneurship Foster residentdriven solutions Protect land, water & air Protect agricultural land Preserve Okanagan Lake as a shared resource Support innovation Take action in the face of climate change Build healthy neighbourhoods for all Embrace transportation options Create great public spaces Provide opportunities for all Cultivate an engaging arts & culture scene

additional highlights

• Introduced a more streamlined new Business Licence System enabling residents to apply for and manage licences online.

• Completed a Central Okanagan Music Strategy to support the growth and sustainability of the local music industry. Among the highlights are recommendations for a purposebuilt venue and affordable and accessible spaces for music education and practice.

• Developed market sounding and expressions of interest for destination retail and hotel development at YLW to drive community and economic benefits.

• Launched the new Recovery and Sustainability Grant Program, a one-time funding initiative to support nonprofit organizations in the sport, event and cultural sectors who continue to be significantly impacted by lost earned revenue due to the COVID-19 pandemic.

• YLW received $3.1 million in operational grants from Federal Airport Relief Fund program, and $0.7 million in operational support from the BC Provincial COVID-19 Airport Relief Fund to help mitigate the financial impact of COVID-19.

• Streamlined development permit and public hearing processes.

27 Economic Resiliency

28

environmental protection

goal: adaptable in the face of climate change

The scientific community warns that global warming needs to be halted within the next few decades to reduce the risks of extreme and irreversible climate change. Kelowna is already experiencing floods, fires and drought and changes in climate, creating a new normal every year. From disruptions in food security and pricing, water availability and energy supplies to local infrastructure and personal property damage, climate change is no longer a future trend, but instead requires our community to respond today.

In 2021, the Okanagan experienced a four-month pronounced drought, compounded by a nine-day extreme temperature period referred to as the Heat Dome, the unease of constant threat of fire, critically low creek flows, and a low runoff year resulting in very low water levels in Okanagan Lake. The result was a number of stresses from a social, financial and environmental perspective.

As a municipality we need to be a leader in environmental protection and addressing climate change, because the investments we make today will impact the quality of life of our future generations. While the City cannot control the occurrence of extreme weather events, we continue to integrate climate adaptation into policies and projects, and ensure our community is prepared for and resilient to the impacts of climate change.

Our strategic direction for how our community will grow, commute, interact and protect natural assets is intricately related to how we will reduce greenhouse gas (GHG) emissions and adapt to anticipated climate changes and those changes we are already experiencing. In September 2021, Council endorsed the Community Electric Vehicle and E-Bike Strategy which recommends actions we can take to achieve the vision that Kelowna is a city where charging an EV and riding an E-bike is easy, convenient and affordable. The City also pledged to convert 10 per cent of the light duty corporate fleet to Electric Vehicles (EVs) by 2023 and we received funding from PluginBC to complete a new “Green Fleet Strategy” as well as an assessment of electrical infrastructure needs to support EV charging over the next 10 years. The report estimates that the City can reduce fleet greenhouse gas emissions by 49 per cent by 2031, based on the current availability of EV technologies.

Local governments are uniquely positioned to influence the shift towards a low carbon lifestyle and to respond to the impacts of climate change. However, it will take all of us working together to protect our environment and affect change.

additional highlights

• In 2021, the City completed the Official Community Plan and Transportation Master Plan, highlighting targets, policies and actions for the reduction GHG emissions.

• The City offered top-up rebates for electric vehicle chargers in multi-family buildings and electric heat pumps that complement provincial rebates.

• Continued early adoption of Energy Step Code by moving to Step 3 for Part 9 Buildings, which requires all new buildings to be 20 per cent more efficient than the base BC Building Code.

• Maintained Airport Carbon Accreditation Level 1 at YLW.

• Transitioned fire fighting foam used at YLW to a fluorinefree foam.

• Transitioned irrigation of the wastewater treatment plant property from the potable water supply to reclaimed water from the treatment process. The system will save energy, fertilizer and reduce effluent going into the lake.

• Awarded $9 million Environmental Quality Grant from the Government of Canada and Province of BC for the Kelowna septic system elimination and sewer connection project, which includes eliminating over 600 aging septic fields from Central Rutland, Rio/Rialto, and a creek crossing for future servicing of the Hall Road connection area.

29 Environmental Protection

corporate priorities

City of Kelowna’s leadership team has identified the following three corporate priorities during the 2019–2022 Council term. A list of projects and initiatives that will advance the results in each of these areas is published each January at kelowna.ca/actionplan. Citizens can view a detailed progress report on action plans—including 2021 council and corporate priorities—at kelowna.ca/councilpriorities.

30

financial management clear direction

desired results

• Lower value activities are being improved or stopped

• Non-tax revenues are increasing

• The cost to deliver services is quantified summary:

In 2021, 29 projects aligned with our goal to ensure that every touchpoint with citizens and our customers is of good value and achieving its intended outcome. Non-tax revenues increased in 2021 with the largest increase coming from fees and charges ($24 million) driven by increased development, air travel and parking, as well as a one-time additional payment of $5.4 million from the Federal Community Works Fund used to fund eligible infrastructure projects. Government contributions also increased in comparison to 2020 with grants being received for: COVID-19 pandemic relief at the Kelowna International Airport, unsheltered populations and related community impacts, and provincial gaming revenue.

people

desired results

• The ability to attract, select and retain the right people is improving

• Collaboration within the organization, and with external stakeholders, is improving problem solving

• Staff engagement has increased

• Organizational values have shifted to prepare us for the future

summary:

Collaboration has been identified as both a corporate priority and as an organizational value. As such, it is receiving more intentional focus and action both with internal partners and external partners. In 2021, we formed a culture committee to bring this and other priorities and values to life across the organization. Corporate Communications and Human Resources led and completed work to align a number of business practices, tools and policies to the refreshed values. We introduced Principles of Conduct Guidelines and updated our training and development strategy as well as culture and values content in touchpoints across the organization. At the end of the year, 95 per cent of managers had introduced organizational culture content to 80 per cent or more of their staff. The full-time employee turnover rate was 10.3 per cent in 2021 which is a significant increase over the 2020 rate of 5.6 per cent. The higher rate is consistent with 2021 labour market trends. However, the turnover with new full-time employees with less than one year of service dropped in 2021, signaling improvements in the selection of the right candidates.

desired results:

• Common understanding of where the organization is going in the future

• Progress on Council and corporate results is measured, monitored and reported

• Divisional/departmental plans show how we are advancing the Council and corporate results and outline key operational initiatives

• Divisions and departments have meaningful performance measures that are reviewed regularly

• Innovation is encouraged and supported throughout the organization

• Services, processes and business activities are being transformed

summary:

The model of Council and corporate priorities and more consistent divisional-level planning, paired with our organizational vision and values introduced in 2021, has helped evolve our culture and deepen a common understanding of where the organization is going. In 2021, we continued to shift more services, including business licensing, online and promoted increased use of the automated chatbot to answer customer questions. A total of 6,916 business licenses (81 per cent ) were processed through the new system, 1,000 building permit applications were received online, and over 50 per cent of chatbot interactions took place outside regular business hours.

31 Corporate Priorities

financial information

City of Kelowna 2021 Annual Report 32

financial services

The City of Kelowna is committed to financial strength and stability. The City defines this as the ability to acquire and manage a portfolio of financial and physical assets that meet the current and future needs of our community. This commitment to excellence was recognized again by the Government Finance Officers Association. In 2021 and for the nineteenth year in a row, the City was awarded the Canadian Award for Financial Reporting and for the twentieth year, the Distinguished Budget Presentation Award.

canadian award for financial reporting

The Government Finance Officers Association of the United States and Canada (GFOA) awarded a Canadian Award for Financial Reporting to the City of Kelowna for its annual financial report for the fiscal year ended December 31, 2020. The Canadian Award for Financial Reporting program was established to encourage municipal governments throughout Canada to publish high quality financial reports and to provide peer recognition and technical guidance for officials preparing these reports.

In order to be awarded a Canadian Award for Financial Reporting, a government unit must publish an easily readable and efficiently organized annual financial report, whose contents conform to program standards. Such reports should go beyond the minimum requirements of generally accepted accounting principles and demonstrate an effort to clearly communicate the municipal government’s financial picture, enhance an understanding of financial reporting by municipal governments, and address user needs.

A Canadian Award for Financial Reporting is valid for a period of one year only. We believe our current report continues to conform to the Canadian Award for Financial Reporting program requirements, and we are submitting it to the GFOA.

provision of services & support for growth

In December of 2020, Council approved the 2021 Financial Plan – Preliminary volume with a tax increase of 4.04 per cent, followed by the addition of the 2021 Carryover budget in March 2021. As the COVID-19 pandemic had already been present in our community since early 2020, staff were able to plan for 2021 with the knowledge that there would be financial impacts. However, the impacts from the pandemic were numerous and conditions changed frequently as the year progressed.

The COVID-19 pandemic was a health crisis without precedent in our recent history. The pandemic continued to create challenges for Kelowna as the public health challenges impacted our community at large, as well as our City operations. In addition, British Columbia experienced a significant heat-dome, wildfires and flooding during 2021. The combined impacts of these events created supply chain challenges and significantly higher levels of inflation.

To recognize the complex financial challenges faced by our residents, the 2021 Financial Plan was used as a financial response as the City worked to maintain the essential services we provide, while also keeping taxation as low as possible. The 2021 Final Budget, as approved by Council in April of 2021, kept the tax increase at the same rate as the Preliminary Budget tax requirement of 4.04 per cent.

The City budgeted to collect a total of $274.9 million in taxation revenues, 57 per cent of which was retained for municipal purposes. The remaining 43 per cent is levied on behalf of other governments and agencies to provide funding for schools, the Regional District of Central Okanagan shared services, libraries, regional hospital, Kelowna business improvement areas, and for BC Assessment to cover the City’s share of costs associated with providing assessment information.

The City has historically relied on pay-as-you-go rather than debt financing for infrastructure needs wherever possible in achieving strategic servicing goals. Pay-as-you-go capital project funding represented 7.7 per cent of the 2021 taxation requirement. The service area with the highest cost with funding from municipal taxation is Community Safety, including RCMP, at 30.4 per cent, followed by the Fire Department at 14.3 per cent and Parks Services at 12.8 per cent.

Financial Information | Financial Services 33

5.0% Active Living & Cultural Services

3.1% Debt

2.2% Grants

2.0% Utility Services

30.4% Community Safety

4.7% Transit/Regional Services

5.2% Planning & Development Services

7.2% Building Services

12.8% Parks Services

13.1% Transportation Services

14.3% Fire Department

city reserves

City Council approved policy 384 Financial Reserves in July of 2021. Reserves form an integral component of the City’s budget and strategic financial plan to help ensure equity between current and future taxpayers. The City maintains reserves to achieve the following policy objectives:

• To acquire, replace and renew major capital assets;

• To ensure stable, predictable tax and utility levies;

• To minimize the financial impact of unusual and unexpected events including but not limited to law enforcement, weather events, insurance claims, tax assessment appeals, environmental hazards and other significant unexpected or emergent issues;

• To achieve long-term financial stability;

• To balance the costs of maintaining sufficient Reserve levels to current and future taxpayers;

• To fund asset retirement obligations;

• City reserves are established, maintained and used for specified purposes as mandated by statute, City bylaw or Council policy.

$139 $71 $54 $254 $267 $280 $310 $84 $88 $97 $116 $54 $106 $93 $82 $119 $137 2017 2018 2019 2020 2021 2017 2018 2019 2020 2021 $59 $65 $69 Breakdown of Municipal Tax for 2021 City of Kelowna 2021 Annual Report 34 Financial Information | City Reserves

Reserve for future General Natural Gas Statutory Wastewater Water Surplus Airport 0 $40 $80 $120 consolidated reserves & surplus millions long term debt millions

development cost charges

Development cost charges (DCCs) are fees that municipalities collect from new development to help pay the cost of infrastructure services that are needed for growth. Imposed by bylaw pursuant to the Local Government Act, the charges are intended to facilitate development by providing a method to fund capital projects related to roads, drainage, sewer, waterworks, and parkland.

The City’s DCC program supports community development and integrates with longer-term plans. Infrastructure requirements are based on the Official Community Plan that estimates a resulting population of 161,701 by the end of 2030. The 20-Year Servicing Plan and Financing Strategy provides the infrastructure requirements to 2030 along with the cost sharing for various projects. Cost sharing methodologies reflect the level of benefit to existing taxpayers and new growth. Charges are based on the demand placed on services by different residential types, commercial, industrial, and institutional growth.

The current plan, updated in February 2020 to include park development and linear park acquisition, reflects a total program cost of $993 million. The funding for the program is 66 per cent from Development, 29 per cent from City funds, and 5 per cent from senior levels of government. Arterial Roads maintain the largest share of the program at $518 million; followed by Park Development and Land Acquisition at $278 million, Wastewater Treatment at $88 million, Water Distribution at $64 million, and Wastewater Trunks at $45 million.

Local governments are permitted to temporarily lend available money from one DCC reserve fund to another. The money, along with appropriate interest, must be returned to the original reserve fund. For 2021, a deficit in Water Sector B reserve fund was covered from Water Sector A and a deficit in the Wastewater Treatment reserve was covered by Water Sector A and Roads Sector A reserve fund.

35 Financial

| Development Cost Charges

Information

municipal assist factor

The Local Government Act requires local governments to assist in the cost of growth-related infrastructure. The municipal assist factor is separate from costs allocated between growth and the existing users on the basis of benefit. The level of the assist, determined by City Council, reflects the community’s desire to encourage development by reducing the DCC rates by the level of assist adopted.

of Kelowna Municipal Assist Factor

major project expenditures in 2021

Parks Acquisition

$3.8 million – Parkland Acquisition at 3684 Lakeshore Road.

Parks Development

$1.8 million – Pandosy Waterfront Park, Rutland Centennial Park, and Ponds Community Park.

Roads

$2.5 million – Lakeshore 1 (Bridge, ATC, and Road) and Ethel Active Transportation Corridor (ATC).

Water

$250k – Skyline Pump Station – Electrical Building Upgrade.

Wastewater Trunks and Treatment

$800k – Water Street Force Main and Gyro Force Main.

future plans

Total 2022 program expenditures are projected at $37.4 million made up of the following major projects:

Parks Acquisition

$12.5 million – Parkland acquisition.

Parks Development

$13.3 million – DeHart Park, Pandosy Waterfront Park, Mission Recreation – Softball Diamonds, Mission Creek Linear Park and Ballou Park.

Roads

$6.4 million – South Perimeter Road, Hollywood Road, Stewart Road West, Houghton ATC and McCulloch Area Roads.

Water

$780k – Poplar Point to Dilworth Mountain Transmission Upgrade.

Wastewater Trunks and Treatment

$650k – Guy Street Lift Station Renewal.

Development Cost Charge Reserve Funds (thousands of dollars)

*Waivers are for Affordable Rental Housing Grants and are funded through taxation.

On April 18, 2016 Council approved the 2030 Infrastructure Plan, which identifies all the City’s infrastructure investment needs for the next 15 years (2016 – 2030).

City of

2021 Annual Report 36

Kelowna

Opening Transfers Closing Reductions/ Balance Receipts Interest Out Balance Waivers* Parks Land/ Development $ 21,344 $ 22,176 $ 473 $ 7,528 $ 36,465 $ 97 Roads 57,647 18,604 1,083 3,143 $74,191 78 Water 14,842 1,289 256 263 $16,124 7 Wastewater (10,079) 8,771 (115) 772 ($2,195) 38 Total $ 83,754 $ 50,840 $ 1,697 $ 11,706 $ 124,585 $ 220 City

Roads 15% Parks 8% Water 1% Wastewater 1%

financial management strategies

Principles and Strategies for Financial Strength and Stability have been adopted by Council establishing guidelines for how the City will acquire and manage a portfolio of financial and physical assets that meets the current and future needs of our community.

The 10 financial management strategies are:

assets – new

Expenditures for new assets will be prioritized based on social, economic and environmental factors and life cycle cost implications. Emergent opportunities will be evaluated against existing priorities. Investment in new assets should follow the long-term capital plan. The decision-making process for new asset investment will be documented, transparent and clearly communicated to Council, staff and the community.

assets – renew

The City will invest in existing infrastructure renewal in accordance with the long-term capital plan. Funding for asset renewal will be balanced against service levels and risk tolerance. Life cycle costs should be managed through preventative maintenance and renewal strategies.

debt

General Fund debt servicing costs will be maintained at or below a targeted level of annual taxation demand. The City’s debt capacity will be preserved by limiting the use of debt to fund only one-time major capital projects. If possible and when beneficial, debt will be paid down earlier. Financing for less than a five-year term will be completed through internal financing. Impacts on overall City debt levels from “self-funded” cost centres and Funds will be reviewed and understood.

development financing

Developers will pay their fair share for growth-related infrastructure through DCCs and other tools. Where appropriate, other funding can be used to provide additional capacity over and above the current OCP horizon. Taxation- funded DCC’s through grant programs may be used to encourage economic development and community projects.

grants

Grants will only be pursued for the City’s priority projects. Grant funding will not increase the scope of a project without Council endorsement. Annual project funding must be sufficient without conditional grants. Long-term financial planning will rely on unconditional grant opportunities only.

operations

All services, including new services, must be aligned with the City’s priorities and reviewed regularly. The full financial cost of service and staff requirements will be understood by Council and administration. Future changes in operating costs, including personnel resourcing requirements, will be considered in long-term capital and financial planning. Ongoing operating activities will only be funded through taxes, fees and charges.

partnerships and enterprise

The City will pragmatically partner with other entities to deliver community services and amenities. The City will explore access to new sources of capital and revenue streams. The City will leverage existing assets to attract private sector involvement. The City will leverage the expertise of outside partners. Services from partnerships will be reviewed regularly to ensure the needs of the City continue to be met. The City supports organizations within the community that enhance the quality of life.

property taxation

Property taxes will remain as stable as possible over time. Property taxes will be comparative with similar communities. Increases to property taxes will be balanced among assessment classes. Property tax information will be transparent and easy to understand. Property taxes will reflect the infrastructure, services and service levels that the community believes are important.

reserves and surplus funds

The purpose of each reserve will be documented and reviewed regularly. Ongoing operating requests will not be funded from reserves. Accumulated surplus will only be used as an emergency funding source.

user fees and charges

Everyone will pay a fair amount for the services they receive. Services will be reasonably accessible by all citizens. User fees will be transparent and easy to understand.

37 Financial Information | Financial Management Strategies

top 10 principal corporate taxpayers

City of Kelowna 2021 Annual Report 38 Financial Information | Top 10 Principal Corporate Taxpayers

2021 Legal Name Type of Property 1 Al Stober Construction Ltd Commercial Building 2 FortisBC Inc Electrical Utility 3 Orchard Park Shopping Centre Shopping Mall 4 Victor Projects Ltd Shopping Mall 5 McIntosh Properties Ltd Shopping Mall 6 Inland Natural Gas Co Ltd Gas Utility 7 Callahan Construction Company Ltd Multiple Types 8 3752 Investments Ltd Multiple Types 9 Midwest Ventures Ltd Multiple Types 10 RG Properties Ltd Shopping Mall 2020 Legal Name Type of Property 1 Orchard Park Shopping Centre Shopping Mall 2 FortisBC Inc Electrical Utility 3 Inland Natural Gas Co Ltd Gas Utility 4 Al Stober Construction Ltd Commercial Building 5 DHL No 48 Holdings Ltd Hotel & Convention Centre 6 McIntosh Properties Ltd Shopping Mall 7 RG Properties Ltd Shopping Mall 8 4231 Investments Ltd Shopping Mall 9 Tolko Industries Ltd Lumber Mill 10 Victor Projects Ltd Shopping Mall

Source: City of Kelowna Financial Services Department.

permissive tax exemptions

39 Financial Information | Permissive Tax Exemptions

Art Gallery, Museum, Heritage, Cultural Purpose Central Okanagan Heritage Society $7,352 Centre Culturel Francais De L’ Okanagan $3,724 German - Canadian Harmonie Club $5,983 Kelowna Art Gallery $105,189 Kelowna Canadian Italian Club $4,036 Kelowna Community Music Society $4,407 Kelowna Museums Society - Kelowna Centennial Museum $82,267 Kelowna Museums Society - Okanagan Military Museum $55,687 Kelowna Museums Society (Laurel Packing House) $44,094 Kelowna Visual and Performing Arts Centre Society $88,201 OCCA Communities Association $1,394 Okanagan Symphony Society $14,825 Roman Catholic Bishop of Nelson Pandosy Mission $2,821 Westbank First Nation $8 Athletic or Service Club Central Okanagan Land Trust $9,923 Central Okanagan Small Boat Association $27,530 East Kelowna Community Hall Association $2,414 H2O Adventure & Fitness Centre $219,904 Kelowna & District Fish & Game Club $4,748 Kelowna Badminton Club $8,365 Kelowna Cricket Club $475 Kelowna Curling Club $23,426 Kelowna Lawn Bowling Club $12,827 Kelowna Major Men’s Fastball Association $19,532 Kelowna Minor Fastball Society $1,912 Kelowna Outrigger Racing Canoe Club Association $22,109 Kelowna Riding Club $4,853 Kelowna United Football Club $299 Kelowna Yacht Club $8,750 Nature Trust of BC $47,472 Okanagan Gymnastic Centre $14,550 Okanagan Mission Community Hall Association $6,191 Rutland Park Society $8,839 Scouts Canada $10,339

City of Kelowna 2021 Annual Report 40 Financial Information | Permissive Tax Exemptions Charitable or Philanthropic BC Society for Prevention of Cruelty to Animals $13,729 BHF Building Healthy Families Society $2,052 Big Brothers Big Sisters of the Okanagan Society $3,736 Bridges to New Life Society $4,135 Canadian Mental Health Association $7,843 Central Okanagan Community Food Bank Society $22,393 Central Okanagan Emergency Shelter Society $4,505 Daycare Connection Childcare Society $906 Kalano Club of Kelowna $6,107 Kelowna & District S.H.A.R.E. Society $9,857 Kelowna & District Safety Council Society $3,000 Kelowna Centre for Spiritual Living Society $2,308 Kelowna Child Care Society $3,386 Kelowna Community Resources $21,379 Kelowna Gospel Mission Society $14,262 Kelowna Senior Citizens Society of BC $8,472 Kelowna Yoga House Society $8,765 Kelowna(#26) Royal Canadian Legion $5,780 KGH - Rutland Auxiliary Thrift Shop $9,522 Ki-Low-Na Friendship Society $21,175 MADAY Society for Seniors $2,907 National Society of Hope $5,083 New Opportunities for Women (NOW) Canada Society $2,890 Okanagan Boys & Girls Clubs $95,039 Okanagan Halfway House Society Inc $7,845 Okanagan Mental Health Services Society $1,825 Pathways Abilities Society $22,486 Reach Out Youth Counselling & Services Society $5,243 Resurrection Recovery Resource Society dba Freedom’s Door $14,840 Salvation Army Community Resource Centre $24,758 Society of St. Vincent De Paul of Central Okanagan $4,797 Starbright Children’s Development Centre Assoc. $28,653 The Bridge Youth & Family Services Society $8,296 Tourism Kelowna Society $13,879 Hospital Licenced Under Community Care Facility Act Canadian Cancer Society $19,736

41 Financial Information | Permissive Tax Exemptions

Capital News Centre $73,301 Prospera Place $257,029

Schools Aberdeen Hall Preparatory School Society $43,573 Immaculata Regional High School $67,766 Kelowna Christian Centre School $10,393 Kelowna Christian School $16,368 Lakeside School Kelowna $12,164 Lutheran Church - Private School $11,932 Okanagan Montessori Elementary $9,750 Seventh Day Adventist Church (Private School) $44,451 St. Joseph Elementary School $35,344 Studio9 Independent School of the Arts (Private School) $4,693

Worship

Resource Centre Society

$28,971 BC Assn of Seventh Day Adventist $1,829 C3 Church $4,235 Christ Evangelical Lutheran Church $6,625 Church of the Nazarene $4,215 Corpus Christi Roman Catholic Parish (formerly

$5,383 Dormition of the Mother of God (formerly Assumption Of Blessed Virgin Mary’s Parish) $5,402 Evangel Tabernacle Church $5,639 Faith Lutheran Church $5,932 First Baptist Church $7,628 First Lutheran Church of Kelowna $11,932 First Mennonite Church $6,178 First United Church $8,464 Glenmore Congregation of Jehovah’s Witnesses $6,366 Grace Baptist Church $13,110 Gurdwara Guru Amardas Darbar Sikh Society $3,758 Immaculate Conception Parish $8,825 Kelowna Bible Chapel $9,140 Kelowna Buddhist Society $5,969 Kelowna Christian Centre Church (School) $10,393 Kelowna Christian Reformed Church $8,391 Kelowna Congregation of Jehovah’s Witnesses $3,988 Kelowna Full Gospel Church $4,603

Partnering

Private

Public

Apostolic

(formerly New Life Vineyard Fellowship)

St. Theresa’s Parish)

City of Kelowna 2021 Annual Report 42 Financial Information | Permissive Tax Exemptions Kelowna Gospel Fellowship Church $7,040 Kelowna Tabernacle Congregation Church $1,358 Kelowna Trinity Baptist Church $30,329 Mennonite Brethren Churches (Willow Park Church) $9,489 Mennonite Brethren Churches (Metro Community Church) $6,550 Mission Creek Alliance Church $16,256 Mission Springs Church of God (formerly German Church of God Dominion of Canada) $3,771 New Apostolic Church $3,627 Okanagan Chinese Baptist Church $3,574 Okanagan Jewish Community Association $3,864 Okanagan Sikh Temple & Cultural Society $8,105 Providence Baptist Church $3,656 Ridgeview Evangelical Missionary Church $4,725 Rutland United Church $6,431 Salvation Army Community Church $10,331 Serbian Orthodox Par-Holy Proph St Ilija (Parish) $935 Seventh Day Adventist Church $23,241 Spring Valley Congregation of Jehovah’s Witnesses $7,234 St. Andrew’s Church $8,220 St. Charles Garnier Parish $1,950 St. David’s Presbyterian Church $8,704 St. Mary’s Anglican Church $941 St. Michaels Anglican Church $10,237 St. Peter & Paul Ukrainian Greek Orthodox Church $5,343 St. Pius X Parish $6,418 Synod of the Diocese of Kootenay $4,005 The BC Muslim Association $3,248 The Church of Jesus Christ of Latter-Day Saints $9,193 The Congregation of Bethel Church $5,675 The Embassy Church $4,225 The Union of Slavic Churches of Evangelical Christians $1,397 Truth Now Tabernacle United Pentecostal Church $1,628 Unitarian Fellowship of Kelowna Society $2,972 Total Municipal Portion of Permissive Tax Exemption $2,294,447

revitalization tax exemptions

43 Financial Information | Revitalization Tax Exemptions & Heritage Building Tax Exemptions Revitalization Tax Exemptions Tax Incentive Area #1 1775 Chapman Pl $29,657 269 Lawrence Ave $18,087 Tax Incentive Area #2 596 Leon Ave $4,186 552 – 554 Leon Ave $21,071 Tax Incentive Area #3 110 Highway 33 W $33,369 1350 St Paul St $9,840 1759 Highway 33 E $5,863 200 Nickel Rd $17,233 225 Rutland Rd S $31,099 460 Doyle Ave $94,095 Purpose-Built Rental Housing 1155 Brookside Ave $29,683 125 Dundas Rd $28,223 1469 KLO Rd $206,500 1525 Dickson Ave $43,514 1545 Bedford Ave $34,134 165 Celano Cres $3,115 1745 Chapman Pl $17,883 1975 Kane Rd, 420 Valley Rd $85,580 2065 Benvoulin Ct $16,624 2075 Benvoulin Ct $16,884 2127 Ethel St $5,991 305 Homer Rd $6,332 598 Sutherland Ave $8,325 678 Richter St $4,336 720 – 724 Valley Rd $137,355 755 Academy Way $85,246 800 Academy Way $142,769 805 Academy Way $52,814 955 Leon Ave $19,401 Total Revitalization Tax Exemptions $1,209,208

Copeland House 784 Elliot Ave $8,624 Total Heritage Building Tax Exemptions $8,624 Total Value of Municipal Taxes Exempted $3,512,279

heritage building tax exemptions

report from the divisional director, financial services

June 10, 2022

mayor basran and members of council, I am pleased to present the City of Kelowna’s 2021 Annual Financial Report for the year ended December 31, 2021. The purpose of this report is to publish the City of Kelowna’s Consolidated Financial Statements, Auditor’s Report and to provide an update on City services and projects, pursuant to Sections 98 and 167 of the Community Charter.

Preparation of the Consolidated Financial Statements is the responsibility of City Council and City of Kelowna management. These statements are prepared by City staff in accordance with Canadian public sector accounting standards. Management is also responsible for implementing and maintaining a system of internal controls for the safeguarding of assets and to provide reasonable assurance that reliable information is produced.

The external auditor, Grant Thornton LLP, conducted an independent audit of the Consolidated Financial Statements in accordance with Canadian auditing standards and, in their opinion, determined them to be presented fairly and not materially misstated. The City received a clear audit opinion. The City’s Audit Committee also reviewed the Consolidated Financial Statements to ensure they are comprehensive, reliable, and understandable.

The information presented in this document reflects the results of the past year’s work on Council Priorities 2019–2022, which help guide how the City will acquire and manage a portfolio of financial and physical assets that meet the current and future needs of our community. The City also continues to monitor and report financial health indicators as part of the annual financial reporting to the Audit Committee and Council. The financial indicators show that the City continues to be well positioned to meet current and future financial obligations and has once again shown resiliency while navigating through the unprecedented challenges of the past two years.

The ongoing COVID-19 pandemic showed a recovery trend compared to the prior fiscal year for the world, our community, as well as our City of Kelowna operations. However, in 2021 our community also experienced a significate heat-dome, wildfires, and flooding. Consequences of all these events in the year have created additional challenges with supply chain disruptions, higher levels of inflation, and labour shortages. These outcomes have impacts for families, businesses, and many other organizations in our community, including the City of Kelowna.

City of Kelowna 2021 Annual Report 44

For the City, we had record building permit and construction activity in 2021; aiding recovery from the pandemic with increased revenues. The increased development in the City resulted in the total value of building permits exceeding $1 billion for the first time. The COVID-19 public health order restrictions and travel advisories were lifted during the year and the City saw substantial recovery in revenues for our airport and to a lesser extent for public transit, recreation facilities, and parking. The City also received onetime additional funding in 2021 from the Community Works Fund which led to higher revenues compared to 2020.

In 2020, expenses decreased by $10 million in response to COVID-19. 2021 was a recovery year as the City saw overall revenues increase by $29 million while the expenses were returned to a pre-pandemic level. The normalization of expenses resulted in a $23 million increase mainly due to the return to a full staff complement and increased use of contract and professional services. The City also saw additional costs for the RCMP contract in 2021.

The General Fund ended 2021 with an $8.8 million unappropriated surplus from operations with $8.7 million put into reserves and $0.1 million added to accumulated surplus. The General Fund accumulated surplus balance of $4.9 million adheres to financial best practices and is to be used only for extraordinary events. The City ended the year with an increase to accumulated surplus, which now sits at $2.2 billion. The accumulated surplus is an indicator of the City’s overall financial viability and is equal to the sum of the net financial assets and non-financial assets representing resources (both financial and non-financial) that may be used to provide future services.

In 2021, the City completed various capital projects including parkland acquired at 3684 Lakeshore Road and property acquisitions at 1144 Pacific Avenue and 1749 Abbott Street. Capital projects also included parks development at Pandosy Waterfront Park, Rutland Centennial Park, and Ponds Community Park. Infrastructure capital expenditures had some significant projects in 2021, including the Ethel 3 (Rose-Raymer) Active Transportation Corridor, Glenmore Recreation Park (Phase 2 and Phase 3), the landfill liner design and construction, and Lakeshore 1 Bridge at Bellevue Creek. The Water Fund capital expenditures were primarily dedicated to water meter replacements, Adams Reservoir, Skyline Pump Station, and other improvements.

The City’s net financial position continued to grow in 2021, demonstrating the City’s ongoing strength to meet financial obligations despite the changing economic environment we are facing. Under the direction and guidance of City Council, the City of Kelowna is well positioned to continue supporting the community and delivering quality services as we overcome the COVID-19 pandemic, face new economic and environmental challenges and continue to achieve our vision to be a city of the future.

Respectfully submitted,

– Genelle Davidson, CPA, CMA Divisional Director, Financial Services

– Genelle Davidson, CPA, CMA Divisional Director, Financial Services

45 Report from the Divisional Director, Financial Services

3�$�4��$�����#$����5

��4���

����+��0�01��

��2��+����#�6����2��+�����(��2��������7

�

�4�����2�����#$�������66��$��6�����+�����$����>�������(��66�4��$��#$����>�

���$��$

������&��6�

�� 4��2�

������A#$>0������$�0��������4��2�

������

C�4��6�

0��+��#>+�#���+���#$��. 8����

�7�

�������

As part of an audit in accordance with Canadian generally accepted auditing standards, we exercise professional judgment and maintain professional skepticism throughout the audit. We also:

� 3$����2(���$��

�

��+����

C

��2�0��������0�

����0�����2��+��6��

���$���$�2����6����

����0���

� �+��+���$#�����2��#$�����������$�

�>����$�4��2��0��#$���4��6�$#��

���

4��

�'������+�

����

C

����$ �1������#$����'�$��6���+�� �

�

#22�6�������$��44��4���������4��'�$����1�

�

�2����#���4�����.��+����

C �2�����$���6���>���0��������0�

����0������

#����>�2��0�2��#$��

�+�>+����+���2���������

#����>�2��0 ��������

�2��#$�0�(���'��'��6���#

�����2��>��(���������������0�

���

��0�

��4��

��������

������+� �'����$���2����������6������.

• Identify and assess the risks of material misstatement of the consolidated financial statements, whether due to fraud or error, design and perform audit procedures responsive to those risks, and obtain audit evidence that is sufficient and appropriate to provide a basis for our opinion. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control.

8��+�'���#$���$��+��6��

���$���$�2����6����

����0���

��2��+�����(��2�������� 9:�+�����(;<���+�6+� 6�04��

���+��6��

���$���$

����0�����2�2����6����4�

�������

����=�6�01�� �����������$��+�� 6��

���$���$

����0���

��2��4�������

��$��66#0#����$�

#�4�#

��6��

���$���$�

����0�����2�6+��>�

��� ����2����6�����

��

��$ 6��

���$���$�

����0�����2 6�

+�2���

2����+��(�����+�����$�$����$ ��

#00��(� �2�

�>��2�6�����66�#����>�4���6��

��$���+����&4�������(���2��0�����