1 minute read

Credit

PREPARING YOUR FINANCES Credit

How your Credit Score is Calculated

Advertisement

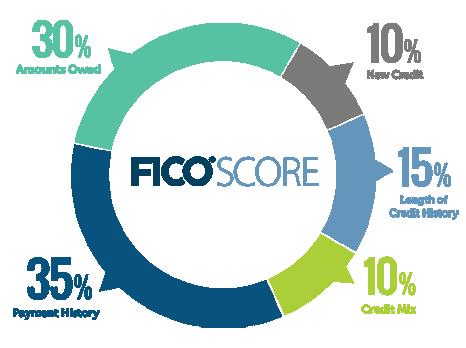

Your credit score is made up of five different elements: payment history, amounts owed, length of credit history, credit mix, and new credit.

Payment History Your payment history makes up of 35% of your credit score. This element has the biggest impact on your credit score because it shows your lender how trustworthy you are and how likely you are to repay the money you borrow.

Amounts Owed Your amounts owed makes up 30% of your credit score. This element makes up a large portion of your score because your lender wants to make sure you are using your credit cards and loans as a tool. As a rule of thumb, we recommend you use 30% or less of your total credit card limit each billing cycle.

Length of Credit History The length of your credit history makes up 15% of your credit score. A longer credit history has a positive impact on your credit score because it give your lender a clear picture of your payment history. Tip: Keep your first credit card open as long as possible because it is the longest piece of your credit history!

Credit Mix Your credit mix makes up 10% of your credit score because your lender wants to see that you have experience with the two types of credit: installment and revolving. The difference between installment & revolving credit is payment terms. With installment credit, your lender sets the monthly payment amount (i.e. mortgage, auto loan, etc.). With revolving credit, your lender will give you a total monthly limit, but you decide how much of the limit you plan to use (i.e. credit cards) and it’s your responsibility to track how much you spend each month.

New Credit Any time you apply for new credit, your credit score will drop by a few points. It’s important to make thoughtful decisions about how often you borrow or open new lines of credit because applying for new credit make up 10% of your credit score