BUSINESS WITH PERSONALITY

KNOCKOUT PUNCH MEET THE APPRENTICE WINNER BOXING CLEVER IN CAMBERWELL P22

SQUARE MILE AND ME JIM WOODSMITH ON A LONG CITY CAREER P16

BUSINESS WITH PERSONALITY

KNOCKOUT PUNCH MEET THE APPRENTICE WINNER BOXING CLEVER IN CAMBERWELL P22

SQUARE MILE AND ME JIM WOODSMITH ON A LONG CITY CAREER P16

JACK MENDEL AND STAFF

THE HEADLINE rate of inflation fell below the seven per cent mark yesterday but analysts warned it was too early to declare victory in the fight against rising prices.

July’s year-on-year inflation figure sat at 6.8 per cent, according to official data released yesterday, down from 7.9 per cent in June.

The rise was in large part driven by lower energy costs, with wholesale prices falling and a new,

lower energy price cap kicking in.

The read-out marked the first time wage growth has outpaced inflation for more than a year.

However, any optimism was checked by news that core inflation –which strips out energy, food, alcohol and tobacco prices –had stayed at

That implies wage growth has embedded itself into the wider economy forcing

up prices, in what is called a wage price spiral.

Services inflation also crept up from 7.2 per cent year on year to 7.4 per cent. Analysts yesterday were forming a consensus that the Bank of England would hike rates at their September Monetary Policy Committee, but that could mark the end of a 15-in-a-row ratchet.

ING economist James Smith said “stubbornly-high” wage growth would cement a September hike but “the committee appears to be laying the ground for a pause”.

EVERYTHING’s going up, they cry. Well, almost everything. The price of a ticket to watch Arsenal’s women’s team at the Emirates last year was £12. This year it’s come down to £7 or £9, depending on how many games you buy for. Who said you can’t find value in 2023.

The story of women’s football’s growth in this country is a long one littered with misogyny, sexism and underinvestment. The first two have been dealt with by the

players; pity the man who confidently pronounces he could have stopped Ella Toone’s topcorner strike in yesterday’s semi final. The latter has been a joint effort from clubs, league football and commercial partners, including most notably TV.

That investment was, naturally, criticised. But in the medium- and long-term it seems an absolute no brainer it will pay off. Crowds continue to tick upwards; playing numbers are on the up, too. It’s highly likely the next broadcasting deal for the super league, the top level of the women’s game in the UK, will be some way larger than the already ‘multimillion’ deal signed last time. Investment has bred success, success has bred commercial opportunities.

Can you see where we’re going with this column? Investment is sorely lacking in the British economy, and therefore it’s not necessarily a surprise that the UK lags in medium- and long-term growth tables. Ironically, investors are amongst those who don’t always reward investment; witness the share prices of firms like BT, whose big spending plans today have not been given the thumbs up by short-term-focused institutional investors. The government have

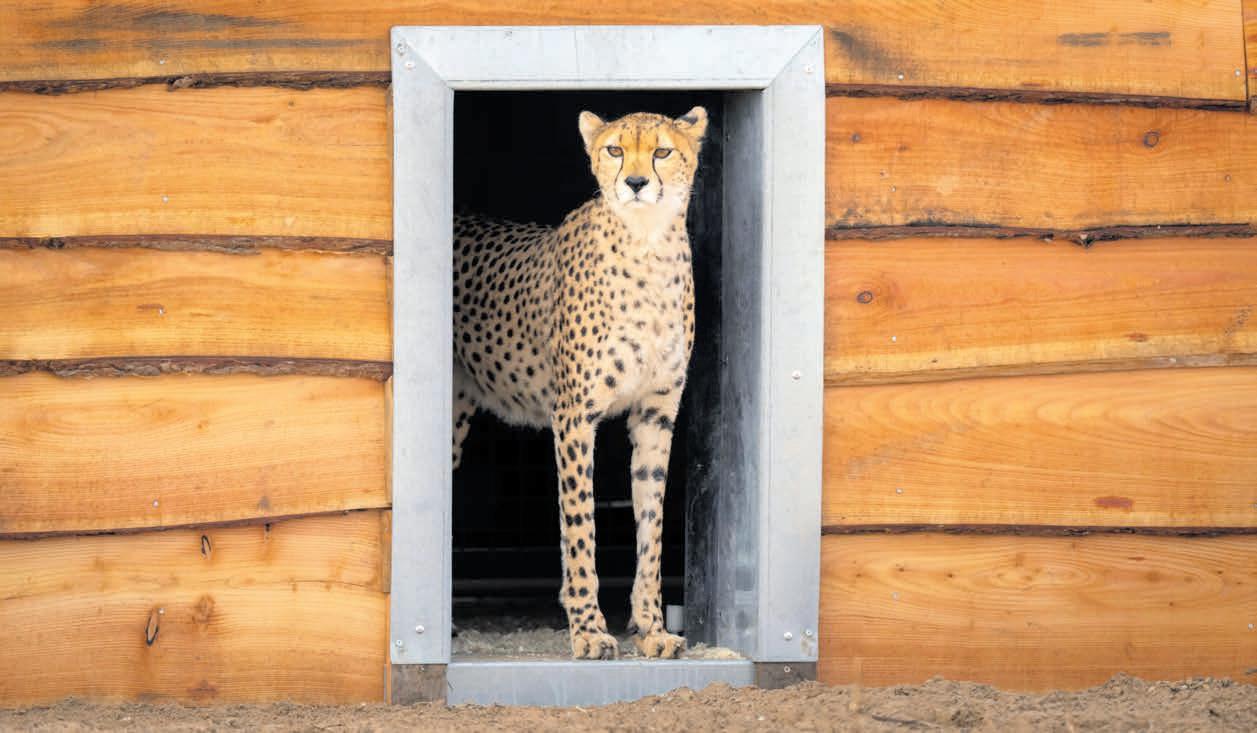

MATCHMAKING Darcy the cheetah yesterday surveyed Yorkshire’s new wildlife reserve, where she is set to be joined by suitor Brooke as part of an endangered species programme

also done their damnedest to give firms reasons not to invest.

Corporation tax in the UK has been a in recent years, and become stuck at the highest point. Our energy policy resembles a guessing game that even Mystic Meg in her pomp would struggle to predict. Moves to encourage insurance giants and pension funds into the equity markets will help. But more is to be done before the UK economy is in any danger of winning a trophy.

WHAT THE OTHER PAPERS SAY THIS MORNING

Rishi Sunak has pledged to keep to the pension triple lock despite signs the guarantee to older people will cost the Treasury an extra £10bn next year –£2.5bn more than was estimated in the spring budget.

THE FINANCIAL TIMES FED SCEPTICAL OVER NEED FOR FURTHER RATE RISES Federal Reserve officials have become more wary about the need to keep raising interest rates despite fearing it has not won its battle against inflation, according to minutes from its July meeting.

THE TELEGRAPH FRANCE OVERTAKES UK WITH NUMBER OF ‘DOLLAR MILLIONAIRE’ RESIDENTS France has edged the UK out of the top five countries with the biggest number of ‘dollar millionaire’ residents. taking the third spot behind America and China, a global wealth report has found.

NICHOLAS EARL

OVO HAS supported Ofgem’s calls for the current set-up of the energy price cap to be reconsidered, with household bills set to stay ultra-high over winter.

Ovo chief executive Raman Bhatia told City A.M. that the mechanism needed to be reassessed following instability across the energy sector which had seen 30 suppliers collapse –and provoked the de-facto year-long nationalisation of Bulb Energy.

“We support the principle of price protection in general but we must accept that the energy market of today is vastly different from what it was pre-

energy crisis. In this new era of extreme volatility we need a social tariff for households who need most support and [we need to] redesign the price cap radically to ensure it is fit for the rest of the market,” the Ovo boss said.

His comments put growing pressure on ministers to reconsider the price cap, following criticism from other suppliers this week, including Good Energy boss Nigel Pocklington – who is also in favour of a social tariff for households this winter.

This comes after Ofgem boss Jonathan Brearley urged ministers to consider whether the “very broad and crude” price cap is still fit for purpose following the domestic energy crisis.

“The price cap was designed for a market that was much more stable –so, pre-2020 – and it worked quite well. But in this volatile market, the price cap has costs as well as benefits, so we would welcome a debate on the future of pricing regulation,” he told The Guardian earlier this week.

London-based think tank the Centre for Policy Studies recently published its own findings on the mechanism –and warned that the cap was resulting in higher minimum prices for customers.

Cornwall Insight expects the price cap to remain near £2,000 per year, almost double pre-crisis levels, up until next winter at the earliest.

CITY A.M. REPORTER

EY HAVE said no to an attempt by a private equity firm to resuscitate the Big Four giant and spin off its consulting wing, according to reports.

TPG, a US private equity giant, had proposed a debt-and-equity deal to spin off EY’s consultancy arm in a letter to the firm’s partners, the Financial Times first reported.

That came after EY was forced to shelve its own plan to spin off, and float, the lucrative division.

US partners nixed the project, which was known internally as Operation Everest.

But in a note to partners seen by the Financial Times yesterday afternoon, EY’s global chair and chief executive Carmine Di Sibio said “we frequently receive inquiries from private equity firms and other investors expressing interest in parts of EY’s businesses”.

“The TPG approach was a preliminary expression of interest and there

has not been further engagement,” he said.

“We are not actively engaging in any transactions.”

Each of EY’s national firms are owned by local partners, making the sign-off on any deal a complex and political process.

The logic for a split includes the removal of conflict of interest concerns over the Big Four giant’s ability to supply both audit and accountancy services, as well as consultancy.

The US buyout firm’s move came at a tricky time for EY.

After the failure of Operation Everest in April Di Sibio –who became CEO in 2019 and was the driving force behind the project –said he would retire in June next year.

The search for his replacement is ongoing.

Insiders told the Financial Times that it could be difficult for a the firm to commit to pursuing a deal before a new successor is chosen.

GUY TAYLOR

BOSSES at three leading UK airports have warned the government that its so-called ‘tourist tax’ is already making Britain a less appealing tourist destination.

Senior figures at London City, Heathrow and Gatwick argued the return of airside VAT-free shopping would be critical for the sector to finally shake off Covid and keep pace with international competition. VAT-free shopping for international

GUY TAYLOR

LONDON business groups have slammed a significant government hike in rail ticket fares set to hit commuters next March.

The Department for Transport (DfT) has committed to ensuring any fare increase falls below the nine per cent rise in the Retail Price Index inflation rate.

Regulated rail fares have previously risen in line with that figure and the DfT has yet to confirm how next year’s change in fare price will be calculated.

A similar rise to last year’s would see commuters face an average £300 hike in the cost of annual travel in and out of London, according to the pressure group Campaign for Better Transport.

Adam Tyndall of BusinessLDN told City A.M.: “Increasing rail ticket prices

without any clear plan to improve services is the last thing commuters need amidst a cost of living crisis.” Politicians, unions and pressure groups echoed the business groups’ concerns and called for the government to freeze rail fares. A DfT spokesperson said: “We’ll continue to protect passengers [and] will not increase next year’s rail fares by as much as the July RPI figure.”

tourists was removed in 2021 when Rishi Sunak was Chancellor. Concerns are growing that moneyed shoppers are now spending their money in other cities like Paris.

Speaking exclusively to City A.M., London City Airport chief executive Robert Sinclair said the removal of VAT-free shopping was a particularly egregious example of government policy harming UK airports.

Asked to note the government’s most damaging policy decisions in recent years, Sinclair said “one which

I would raise is the removal of VAT shopping [which] is something we find… and the whole industry has found very, very disappointing.”

Heathrow’s chief commercial officer Ross Baker told City A.M. the 2021 decision was “disastrous for UK competitiveness as tourist spend in the UK is now eclipsed by our European neighbours, where goods are up to 20 per cent cheaper.”

Campaign group BusinessLDN said reversing the measure could generate £4.1bn annually for the UK.

AVERAGE UK house prices continued to grow in June despite pressure from interest rate rises, but property experts are warning this won’t continue for long.

New figures from the Office for National Statistics (ONS) show UK house prices climbed 1.7 per cent in the 12 months to June, bringing the average cost of a home to £288,000.

While marking a slowdown in the pace of growth, the increase shows a surprising resilience in a market which has been hit with 14 consecutive interest rate rises, pushing up mortgage prices.

London bucked the trend, however, with prices in the capital dropping 1.2 per cent over the year, the only region to see a drop.

The fall saw the average London house price come in at £528,000, meaning the capital remains the most expensive region in which to buy a home.

“This is the first negative annual inflation for London since November 2019, when average house prices decreased by 1.2 per cent,” the ONS said in its report. Mortgage rates have been cooling over

LAURA MCGUIRE

the past few weeks, with many lenders cutting the price of their deals after an unexpected fall in inflation.

While this may be a signal of hope for many prospective buyers, commentators appear to be more cautious about the outlook for the market.

“It’s written in the stars that house prices are declining and will continue for some time yet. Don’t be misled by the data about price rises in certain areas,” Lewis Shaw, mortgage expert at Shaw Financial Services, said.

Shaw cited the lag between the time when buyers agree to buy a property and the time the transaction is completed and reported for affecting the relevance of the data.

Ross Boyd, chief of mortgage platform Dashly, said he expects “downward pressure” on house prices to continue.

“This latest house price data shows the complete reversal in momentum in the property market compared to a year ago.

“With core inflation remaining sticky, another base rate hike is now likely, so the downward pressure on house prices looks set to continue throughout 2023.”

RISING revenues were not enough to impress investors in Balfour Beatty yesterday, whose shares took a hammering after the construction firm’s half-year results. The FTSE 250 company reported a nine per cent jump in revenues to £4.7bn for the first six months

BUILDING products supplier Marshalls reported a 26 per cent slide in profit in its half year results yesterday as a slowdown in the UK house building market ate away at its earnings.

The London-listed firm saw adjusted profit before tax drop 26 per cent in the first six months of the year, slumping to £33.2m.

The firm blamed a difficult trading environment for the fall amid high

inflation and poor consumer confidence, and warned it expected these challenges to persist in the second half of the year as well as into 2024.

The business has made efforts to streamline costs including cutting some 250 jobs earlier this year, as well as closing a factory in Scotland and exiting the Belgian market.

The bleak outlook for the UK residential sector has hindered Marshalls’s share price, which is trading no higher than it did in 2015.

of the year, with the group hailing its “diverse portfolio” for the lift.

The business, which works on trackwork and power supply builds, hailed its “diverse portfolio” for the lift, which protected it against some of the slowdown seen by construction firms which focus on the residential sector.

However, it was not all rosy, with the group reporting a contraction in

its order book, which fell from £17.7bn to £16.4bn.

The group blamed tough economic conditions in the US which delayed office projects.

Investors took note, with shares falling over 10 per cent, which CMC Markets analyst Michael Hewson attributed to lower margins and unchanged guidance along with the £1bn order book decline.

HOLLY WILLIAMS

FRESH data on the Chinese economy suggests the country’s property market is in bad shape –threatening growth in what has become the engine of the global economy since the financial crisis.

The price of a new home in China reverted back into negative growth in July, after a brief uptick in June had raised hopes that the economy was moving in the right direction.

Analysts have warned that should

China’s property market slowdown, confidence in the wider economy would be hit.

Barclays cut their forecasts for 2023 Chinese growth on Tuesday, forcing the central bank into surprise interest rate cuts.

The National Bureau of Statistics showed a fall in the price of new homes in the 35 smallest cities it surveys for the 17th straight month, with only megacities like Shanghai and Beijing providing a gloss on the overall figures.

“The good news is that regulatory vigilance means a rerun of the 2008 US crisis is unlikely,” Gavekal Dragonomics’s Xiaoxi Zhang wrote in a note seen by Reuters. “The bad news is that debt strains from property developers and local government financing vehicles are spreading across China’s economy."

China’s economic growth has done much of the world’s heavy-lifting in recent years, with higher median incomes and rapid urbanisation powering a consumer, services and commodities boom.

UK BUSINESSES reportedly face being ‘debanked’ over trading relationships with Ukraine, business leaders have warned.

Firms are increasingly “afraid to trade with Ukraine from the UK” due to the risk of having their accounts forcibly closed by overly risk-averse financial institutions, it has been claimed.

According to Politico, both the BritishUkrainian Business Council and the British-Ukrainian Chamber of Commerce (BUCC) have cited multiple examples of firms being debanked or having transactions cancelled in relation to dealings with Ukraine.

Writing to City minister Andrew Griffith last month, BUCC co-chair Bate Toms warned: “Conducting even one Ukrainian transaction can lead to an account being closed. UK banks generally refuse to open accounts if any Ukrainian

Intel and Israeli chipmaker Tower Semiconductor have “mutually agreed” to call off their $5.4bn (£4.2bn) deal due to regulatory hurdles from China. In a statement yesterday, leading semiconductor manufacturer Intel said it will pay a termination fee of $353m to Tower after the merger failed to get approval from regulators by its 15 August deadline. Intel, which has held operations in China since the mid-1980s, successfully got its merger past US and European regulators but it ran into trouble in China, which failed to give a ruling on the deal in time. The specifics of the regulatory issues were not disclosed by either company.

OFFICIALS from foreign countries have urged the UK to hurry up in its planning of the global AI summit, with details yet to be released for the autumn event.

trade is contemplated.”

He warned: “If trade from the UK is not possible… Ukraine’s economy will suffer, harming its ability to fund defence and making it even more dependent on foreign assistance.”

It comes after a wider debanking scandal emerged after former UKIP leader Nigel Farage became embroiled in a row with Natwest-owned Coutts, which closed his premium account. However, banks have had to comply with legal and regulatory obligations and that Western and UK sanctions against Russia had complicated matters.

A UK Treasury spokesperson said the issue was “not in scope” of the PEP review which was about individuals rather than businesses.

“We continue to stand firm in our support for Ukraine,” the spokesperson added.

Royal Mail’s electric lorry supplier Tevva Motors will move its headquarters to the US after announcing a merger with a New York-listed electric carmaker. Tevva Motors, whose headquarters are in Tillbury, Essex, said it would merge with Canada-based Electrameccanica and relocate to Delaware. The startup firm –which manufactures a range of medium and heavy duty electric vehicles for Royal Mail – had struggled with significant cash flow problems and had been in talks with private investors to raise extra capital. The company will maintain its manufacturing centre in Tillbury, while taking advantage of Nasdaq-listed Electrameccania’s 235,000 sq ft facility in Arizona.

Ukraine last year

THE CHIEF executive of Carlsberg has described his “shock” over Russia’s seizure of its business after the brewer left the territory.

Last month, Russia took control of the beer maker’s eight breweries and 8,400 employees in the country after it closed a sale of the business to an undisclosed buyer.

Jaguar Land Rover has announced plans to create hundreds of new jobs in the West Midlands after the marque swung into the black earlier in the year. The luxury carmaker yesterday said it will employ 300 new technicians and test engineers at its plants in Solihull, Gaydon and Whitley. It said the recruitment push would help its drive to increase production of Range Rover and Range Rover Sport models by 30 per cent in future quarters. Andy Street, mayor of the West Midlands, welcomed the investment. It comes after the luxury marque swung into profit for the first time in nearly two years in January, as the easing of the global chip shortage caused a surge in production volumes.

“We have known from the beginning, since announcing the intention to leave Russia in March of last year, that there was huge interest in the business from people inside Russia. But still, this is an unprecedented development,” Carlsberg CEO Cees ‘t Hart said on a media call, according to reports in Reuters. “Technically, this is not a nationalisation, but how it will unfold is unclear for us at this point in time.”

In June, Prime Minister Rishi Sunak announced the UK’s plans to host the first major global summit on AI safety in autumn this year.

However, crucial details such as an exact date and a list of invitees are still missing.

Officials from four countries have urged the UK to hurry up as autumn approaches, according to Politico, with a senior European diplomat saying the UK needed to “step up its summit planning to ensure that substantive outcomes can be achieved”.

One embassy official said:“We haven’t been given much information yet and we’re getting quite close to the date now.”

The provisional date of “early November” for the summit was “pretty vague”, they added.

THE MISSION to get the UK’s fleet of trucks to go green is failing to take off, new SMMT figures have revealed, with electric and hydrogen models representing just 0.4 per cent of all HGVs sold in the second quarter.

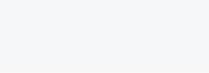

JOE BIDEN’s Inflation Reduction Act is now a year old, and energy experts have warned Britain risks falling behind the pack if it doesn’t catch up.

The UK has been urged to stump up more cash in vast subsidy packages for low carbon projects, and implement regulatory reform, in a bid to rival markets on the first anniversary of the US act, dubbed the IRA.

Emma Pinchbeck, CEO of Energy UK, warned Britain has no “divine right”

to its frontrunner position as a developer of clean energy.

She regarded President Joe Biden’s vast £290bn ($369bn) subsidy package for green energy as a “game changer” for the investment landscape.

Prime Minister Rishi Sunak has opted against entering a full-on subsidies race with the US, which has a considerably larger economy and more spending power than the UK. Instead, it has focused new funding announcements on specific technologies such as carbon capture

THE BOSS of Aviva yesterday doubled down on a decade-long investment splurge in the UK and looked to ease concerns that some cash would flow overseas, as the insurance industry gears up for new regulation designed to free up billions in investment.

The FTSE 100 firm has previously committed to investing £25bn in the UK after EU-era Solvency II rules were ditched last year in sweeping deregulatory reforms by the government.

Boss Amanda Blanc said the firm would be pumping cash into UK infrastructure.

“Aviva has said that we will invest £25bn over the next 10 years as a consequence of the reforms, and the commitment that we have made is that that focus will be on the UK,” she said.

“Obviously, one of the commitments of the Solvency II reforms, when the government and the regulator is building those reforms, is that that investment does go back into the UK.”

Areas including “green energy, infra-

structure, social housing, science and university parks” were all being weighed up as potential investment targets, she added.

Ministers have been looking for ways to unlock capital stored away in the UK’s insurance firms and have announced plans to replace Solvency II with a new Solvency UK regime, which would allow firms to hold a smaller cash buffer on their books.

Last month’s proposals included plans to move towards a more principlesbased system for assessing firms’ internal models, taking away some of the more onerous requirements.

Blanc’s comments on the investment boost came as Aviva beat profit expectations in the first half of the year on the back of growth across the group.

In its half year results yesterday, Aviva said operating profits had grown eight per cent to £715m in the first half of the year on the same period last year.

The firm bumped its dividend by eight per cent, with news too of earlier-than-expected success on a costcutting programme.

and small modular reactors, amid two rafts of energy pledges this year. Big players like energy storage specialist Zenobe and hydrogen firm Sunfire told City A.M. this year they would consider expansions in the US over other markets following the IRA. A Department for Energy Security and Net Zero spokesperson said: “We won’t apologise for moving faster and earlier on clean energy than many other countries, and last year renewables accounted for over 40 per cent of our electricity.”

President Biden’s act was crafted to hit climate targets and boost productivity

CHARLIE CONCHIE

ADMIRAL ramped up its prices by 20 per cent in the first half of the year to stave off the impact of rampant inflation on its profits margins.

In its half-year results yesterday, the London-listed insurance firm posted a four per cent bump in profits in the six months to the end of June.

In its core motor insurance business, Admiral saw revenues rise to £1.5bn from £1.3bn while turnover rose 21 per cent to £2.24bn.

Arecent meeting with an insurance exec revealed the lengths the industry goes to in order to price claims up properly. His team was measuring the relative decibel levels of electric vehicles to work out if the quiet ones were more likely to get into mischief than their louder, but less safety-conscious, forebears. It’s a numbers-driven game these days, even if some of the old-school brokers might pine for the lunchtime Leadenhall sessions.

It’s been a numbers game for Amanda Blanc at Aviva, too: specifically, upping shareholder returns. Having taken over a sprawling business she’s focused her efforts on three core markets and now shareholders are reaping the

rewards, perhaps benefitting from a now-well-beaten but worthwhile activist campaign from Cevian.

As is traditional, a strong set of results, long-term investment plans and a shareholder stocking-filler failed to significantly move the dial on Aviva’s share price, up only 1.6 per cent on the day. Yet analysts, including Abid Hussain at Panmure, struggled to find much to disagree with in the results.

Perhaps Blanc will join the list of City CEOs private grousing about investors’ unwillingness to splash the cash on London’s equity markets.

Milena Mondini de Focatiis, group chief of Admiral, said inflation was continuing to impact the business but it had “navigated the cycle well”.

The firm said it had increased prices by some 20 per cent across new business and renewals in the six month period to reflect continued above-expectation claims inflation. Prices would remain lofty “if the current level of claims inflation persists”, Admiral warned.

The Bank of England recently warned insurers must rigorously assess the impact on their solvency of the rising cost of settling car, property and other claims and ensure they have sufficient reserves.

Matt Britzman, equity analyst at Hargreaves Lansdown, said Admiral’s seven per cent dip in customer numbers was “a loss worth taking”.

NIGELFARAGE recently laid into Natwest for trying to “force a cashless society” on the UK by limiting cash withdrawals and deposits for current account holders. Now, Farage and the bank may have a contentious relationship for other reasons, but the exUKIP leader could be speaking to a real anxiety here.

There could, however, be a commercial logic to de-emphasising hard currency. Looking at YouGov data from July 2019 – July 2023, we can see that the proportion of Britons who said they never made payments in cash rose from two to eight per cent, with the proportion who said they only make payments in cash if they have to rising from 42 to 55 per cent. Combined, a majority (63

per cent) appear to be using cash begrudgingly, if at all.

The proportion of Britons who make cash payments “fairly often” fell from 40 to 28 per cent over this period. Those who say they exclusively make payments in cash stayed stable – at two per cent – but the proportion who said they “almost always” make payments in cash fell from 10 to six per cent.

YouGov Profiles data also suggests a majority of Britons don’t enjoy making cash payments. When asked if they like to use cash for purchases, just a third agree, while nearly half disagree. Brits aged 18 to 34 are less keen on cash (32 per cent agree that they like using it; 53 per cent disagree) and over-55s slightly more (36 per cent agree; 42 per cent disagree) but only a minority of all ages enjoy using hard currency.

Covid may have accelerated the cashless tendency. The number of Brits using cash regularly has not reached its prepandemic levels. But if the public mourn using cash, the reasons might be more sentimental than practical.

Stephan Shakespeare is the co-founder and CEO of YouGov

The countdown has officially begun for City Giving Day, the City's biggest annual celebration of charity, philanthropy and giving. With just under six weeks to go until the big day, a host of exciting events have been announced, hosted by City businesses across the Square Mile these include a brand-new live online auction to “Knit for the Community” being supported by the Lady Mayoress, Felicity Lyons and an event hosted by City Bridge Trust.

Coming into its 10th year, City Giving Day is an annual event hosted by The Lord Mayor’s Appeal uniting the City to celebrate and promote the positive impact of philanthropy. Taking place on Tuesday 26 September 2023, it gives companies the chance to showcase their charitable work – collectively sharing their community outreach via the City Giving Day webpage and social media. Whether City businesses support The Lord Mayor’s Appeal, or their own chosen charities – it provides a platform to tell corporate fundraising and volunteering stories and facilitates collaboration between businesses.

For those that don’t want to host or promote their own philanthropy this year, but are keen to take part, there are a host of City Giving Day events open to all City businesses. New for 2023, the Appeal has partnered with Jumblebee to host a City Giving Day Online Auction. Opening on 12 September and closing at 8pm on City Giving Day, businesses are invited to donate one or more auction lots such as cakes, honey, wine, sports tickets, dining, theatre, concert tickets, sports tickets or anything else you can think of with funds raised from the auction going directly to The Lord Mayor’s Appeal.

Another new event this year is hosted by City Bridge Trust. Taking place at the Guildhall on 26 September, the free event will focus on how EDI considerations have helped to shape funding priorities, processes and commitments and the emerging learning from this work.

Speakers will include James Banks, CEO, London Funders, Caroline Rowley, Head of Corporate Philanthropy, Bloomberg, Sarah Denselow, Principal, Effective Philanthropy, New Philanthropy Capital, Sarah Benioff, CEO, Islington Giving, and young grant-makers Izzy Petriti and Freya Johnson and Sam Grimmett-Batt, Funding Director, City Bridge Trust. Having launched their ‘Knit for the Community’ initiative in 2020 with the aim of creating 20-30 blankets and ending up with over 900, this year The Worshipful Company of Framework Knitters are asking City businesses to join in the fun by knitting squares in The Lord Mayor’s Appeal’s pillar colours – yellow, green, blue and red – from now until September. The results will be knitted together into lap blankets and distributed to deserving causes around the City.

Events taking part on City Giving Day itself include The Worshipful Company of Chartered Surveyors annual takeover of Browns in Old Jewry. From breakfast time to dinner time on 26 September, the company invite City workers to book in for breakfast, morning coffee, lunch, afternoon tea, dinner or just a quick drink to come together – with a percentage of the total spend on the day will be donated to the Appeal. When booking please quote City Giving Day. Free to join, with the bonus of learning a new skill, another event on the day will be the Big City Sing hosted by wellbeing company, Music in Offices at the historic Guildhall Yard and sponsored by Culture Mile Business

Improvement District. Vocal leader, Naveen Arles will be leading voluntary singers through a repertoire of uplifting tunes including ‘Celebrate’, ‘Higher and Higher’ and ‘Bring me Sunshine, giving colleagues the chance to have fun and sing together. Before the performance, Music in Offices will be holding lunchtime rehearsals in the City on the 7, 14 and 21 September. These rehearsals are an opportunity to fine-tune performances, ready for the 26.

Since its launch in 2015, City Giving Day has grown year on year with 526 companies involved in 2022. Set at the City Giving Day launch breakfast in March, the target for 2023 is to inspire organisations to get involved, not only in London but in other cities around the UK. An estimated £510,000 was raised for charities and good causes in 2022, while 64% of the organisations that took part said that City Giving Day helped to promote and celebrate their charitable activity and 72% said that City Giving Day inspired their employees to fundraise or volunteer.

The Lord Mayor’s Appeal also hosts

several annual City Giving Day events which companies are also welcome to join. These include Tour de City, a static Wattbike challenge sponsored by EC Business Improvement District and supported by Third Space where company teams of up to five people compete against each other in a thrilling 40 minute static bike race, divided into five eight-minute slots; City Walks – a one hour lunchtime walking tour taking place around the City hosted by expert City of London Guides; a Treasure Hunt, sponsored by The Investment Association, inviting teams of up to six people to solve a series of clues discovering some little known facts about the City of London; and a Quiz Night challenging teams of up to six to test their general

knowledge and compete with the greatest minds on the Square Mile, hosted at various locations around the City.

The City of London is a global leader in financial and professional services, but not everyone knows that is also invests significant sums in communities and causes to change lives and make a wider positive impact on society. Funds raised by The Lord Mayor’s Appeal on City Giving Day will be used to support the work of their three charity partners National Numeracy, MQ Mental Health Research and The Duke of Edinburgh’s Award. Find out more about City Giving Day events here: https;//www.thelordmayorsappeal.org/events

With just under six weeks to go until the big day, a host of exciting events have been announced, hosted by City businesses across the Square Mile

AS A decade-spanning serial entrepreneur, it seems only too on the nose that Sherry Coutu likes to spend her spare time climbing mountains.

When we speak, the founder of the retail investment stalwart Interactive Investor has just returned from a jaunt up Rinjani volcano in Indonesia for the third time. She’s gearing up to take on Kilimanjaro for the fourth time in February and when we tried to arrange a chat previously she was busy taking on the Great Ocean Walk Down Under.

“I just love it,” she says in an interview. “You know, climbing up a mountain you get to the top and you can see forever and you just feel free and alive.

“I think for those of us who are complete workaholics, the fact that you need to focus and it gets you out of everything else is also a release.”

Climbing mountains, she says, is also a “learned activity”. “You can get better over time and learn how to do well if you study them”.

While Interactive Investor might be the best known of her endeavours, the outlook of learning one’s way to the top has dominated the latter stages of Coutu’s career. These days her workaholicism is channeled into tackling a new peak: boosting entrepreneurial learning and education.

The root of that new goal might lie in her background. Coutu grew up in an isolated lumber town on the West Coast of British Columbia and still speaks with her native Canadian twang. She credits education and access to teachers as the sole reason for her journey from a sleepy hometown to the upper echelons of British business.

“I’m the first person in my family that went to university and it wouldn’t have been a pathway except for the urging and encouragement of some teachers, both at school to tell me that I should go to university, and then at university to tell me that I should go further,” she says.

It was at the London School of Economics, when she began to rub shoulders with professors of entrepreneurship and future business builders, that the idea of becoming one began to fully form.

“When I read about [entrepreneurs], and when I met them, it felt like they were like me,” she says. “It just felt like I belonged.”

The benefits of the education went beyond just teaching as well. After founding Interactive Investor in 1995, she counted one of her LSE professors as one of her first backers.

Since then she has gone on to both found and back scores of firms as an angel investor, winning gongs aplenty including a CBE in 2013 for services to entrepreneurship. Now, her aim is to build businesses that can help develop the next crop of entrepreneurs.

While Coutu speaks of entrepreneurs in almost mystical terms –a “tribe” –she insists it is something that can be taught and learned. And the UK, she argues, is falling well behind the pack.

England specifically is a major straggler. It is one of the few nations in Europe that has failed to publish an entrepreneurial strategy for education, while Scotland, Wales and Northern Ireland all rolled out their own in the early 2000s.

At a more basic level, the fundamentals of numeracy needed to succeed in business are also lacking in UK education, she argues.

“There is a cultural bias that makes it okay here to say ‘I’m rubbish at maths’, or ‘I’m not interested in maths’,” she says.

“I don’t want to get into school policy, but I think the narrowness of the way the curriculum is taught in this country… means that people who are risk averse –and there’s lots of people who are risk averse –would choose to not do maths because they’re terrified of it.”

By the government’s own numbers,

economy around £20bn a year.

The issue has since been taken on with some vim by Rishi Sunak, who has rolled out a pledge that mandatory maths should be taught until 18. But Coutu sees it as righting a wrong rather than any great revolutionary policy.

“I was a bit surprised when they introduced it that they didn’t mention that every other OECD nation has

For her part, Coutu has founded a number of ventures to try and close the entrepreneurial and numerical skills gap in schools. Founders4Schools gets entrepreneurs in front of pupils to speak about building businesses as a viable career path, and a new offshoot, Maths4Girls brings in female entrepreneurs to talk about the practical application of their lessons to later life.

The former venture she says was formed in part as a reaction to Speaker for Schools, which gets big corporates and employees in to speak to pupils about career paths. She argues the corporate route –“large shrinking companies where everybody is miserable” –is not always the best thing to promote to mouldable minds.

She does, it should be said, also sit on the board on a number of big educational players, including the listed pub-

power and Workfinder, which specialise in recruitment and training in the workplace, and is betting on the sector to put an end to the need for lengthy and disruptive need for education breaks while in work.

“If I think about what’s going to keep me on fire and excited for the next five to ten years, it’s going to be making it easy for people everywhere in the world to acquire skills with no friction and at speed,” she says.

The ultimate aim is to help people of all ages quickly skill their way up any mountain they please. And while there are some easy and cringe-inducing comparators to reach for when discussing scaling great peaks and building great careers, in a nod to the belief that anyone can do it, she points back to her beginnings.

“Well, I’m Canadian. We do like getting out and about.”

Coutu speaks of entrepreneurs in almost mystical terms – a ‘tribe’

Charlie Conchie interviews the biggest movers and shakers in tech, fintech and financial services

public to judge him on five pledges. Our traffic light system doesn’t make for cheery reading, writes Jessica Frank-Keyes

IN JANUARY, Rishi Sunak unveiled the vision for his government. Five pledges; five clear goals; five ambitions for his ministers. His aim was clear: be seen as an effective, solutions-focused administration and, hopefully, reap the electoral rewards.

“No tricks, no ambiguity; we’re either delivering for you or we’re not,” he vowed.

Eight months in, and Sunak appears deep in the weeds. This week, YouGov found 60 per cent of UK adults – and 53 per cent of Leavers – think he’s doing badly.

With a widely anticipated reshuffle and October’s party conference fast approaching, ahead of a likely autumn 2024 general election, No 10 will be hoping to turn things around by Christmas. But how well is the programme really going?

City A.M. takes you through Sunak’s scorecard.

HALVING INFLATION RATING: AMBER

When the PM promised to halve it in January, inflation had been 10.7 per cent in the three months from October to December 2022 – making his target 5.3 per cent by the end of 2023.

While that is now looking increasingly achievable, experts agree it’s still far from guaranteed.

Heidi Karjalainen, research economist at the Institute for Fiscal Studies (IFS), warned “the stubbornly high rate of price inflation for goods and services other than food and energy has put the target in jeopardy.

“With only four months to go, it no longer seems at all clear that inflation at the end of the year will have fallen by enough to achieve it.”

Of course, there’s one other factor: there’s precious little the Treasury or the Prime Minister can actually do to

bring down inflation.

GROWING THE ECONOMY RATING: AMBER

It’s no surprise the Stanford grad and former Goldman Sachs man’s second (and third) pledges are also focused on UK plc’s bank balance.

But in terms of economic growth it’s a similar tale: if not one of woe, then far from joyous.

IFS deputy director Carl Emmerson describes the latest figures as “not anything worth shouting about”. GDP in the second quarter of 2023 was 0.4 per cent higher than the same quarter last year.

We’ve dodged a recession, yes, but productivity is stagnant, and forecasts remain drab. Economists speak of the four big shocks: the financial crisis, Brexit, Covid and the cost of living crisis.

AJ Bell’s Russell Mould is similarly measured, dubbing the last five quarteron-quarter GDP growth numbers [+0.1 per cent, -0.1 per cent, +0.1 per cent, +0.1 per cent, +0.2 per cent] as “not very exciting stuff”.

This is a simple one to judge – debt has gone up, though Downing Street may insist that Sunak never pledged it would fall this year, as Emmerson notes.

3 LISTS The Prime Minister told the

“Debt was only forecast to fall as a share of national income in 2027-28,” he said. “It has continued to rise, but presumably the PM did not intend to commit to debt falling this year.”

However, aggregate government debt is growing, Mould highlights, now at £2.6trn “and rising… equivalent to around 100 per cent of GDP”, even if annual borrowing falls, helped, he predicts, by a VAT spending boost, wage growth and aforementioned economic resilience.

NOT MUCH GREEN...

This rating is also easily decided, as the PM himself publicly acknowledged yesterday.

Speaking at a hospital visit in Milton Keynes, he admitted progress on his fourth pledge had ground to a halt, despite insisting an initial drop in longterm waits had taken place.

“We’ve practically eliminated the number of people waiting two years. Earlier this year, we practically eliminated the number of people waiting one and a half years,” he told media.

“Unfortunately, the progress we were making has stalled because of the industrial action.” That’d be a red, then.

Arguably, progress on this pledge is a somewhat more nuanced picture.

The government has introduced new policies aimed at achieving this aim, but both the Rwanda deportation scheme and the Bibby Stockholm migrant barge have been beset by delays, controversy, and, now, Legionella bacteria.

4 5

Sunak and home secretary Suella Braverman’s hopes are pinned on another High Court appeal and, presumably, a thorough deep clean and successful health and safety inspection.

In the meantime though, 1,719 people made their way across the Channel in 32 small boats in the last seven days, and six asylum seekers drowned after their vessel sank on Saturday.

The Prime Minister can, rightly, bemoan the cards he was dealt when he took the job.

But there will be precious little sympathy at the ballot box if there’s still more red than green on the board come polling day.

THE LONG, hot summer we all hoped for hasn’t exactly materialised. Politically, the temperature seems equally mild.

Rishi Sunak and Sir Keir Starmer disagree widely, but you get the distinct feeling a base level of respect exists between the two men. Putting politics to one side, they could feasibly sit and chat over a few Mexican cokes. This is in marked contrast to the United States, where the political temperature feels higher than ever. Legal questions swirling around the President’s son are set to become a central feature of the next election. Allegations of “WITCH HUNTS”, “HOAXES” and “THE BIG LIE” have become normalised. Candidates for the Republican nomination for president of the United States are facing a tsunami of personal attacks; Chris Christie has been mocked for his weight, while the Florida governor has been nicknamed “Ron DeSanctimonious”.

Negative campaigning the other side of the pond is priced in, with hundreds of millions of dollars of PAC money poured into TV, radio and Facebook advertising to great effect.

Meanwhile, closer to home, guests are made to squirm at 08:10 on the radio be it because of worsethan-expected full year results or disappointing government data. It might be optimistic to think that the cordial undercurrent that exists between the two main political party leaders will continue. As we slowly saunter towards a general election, signs are beginning to emerge that the gloves are already coming off, but even when recess is over, few expect a bruising scrap akin to Trump/Biden.

Whereas the tenures of Boris Johnson and Jeremy Corbyn were defined by the individual, it is welcome that our national politics has become less personal and more professional. A lower political temperature is good for us all – even if the August weather matches it.

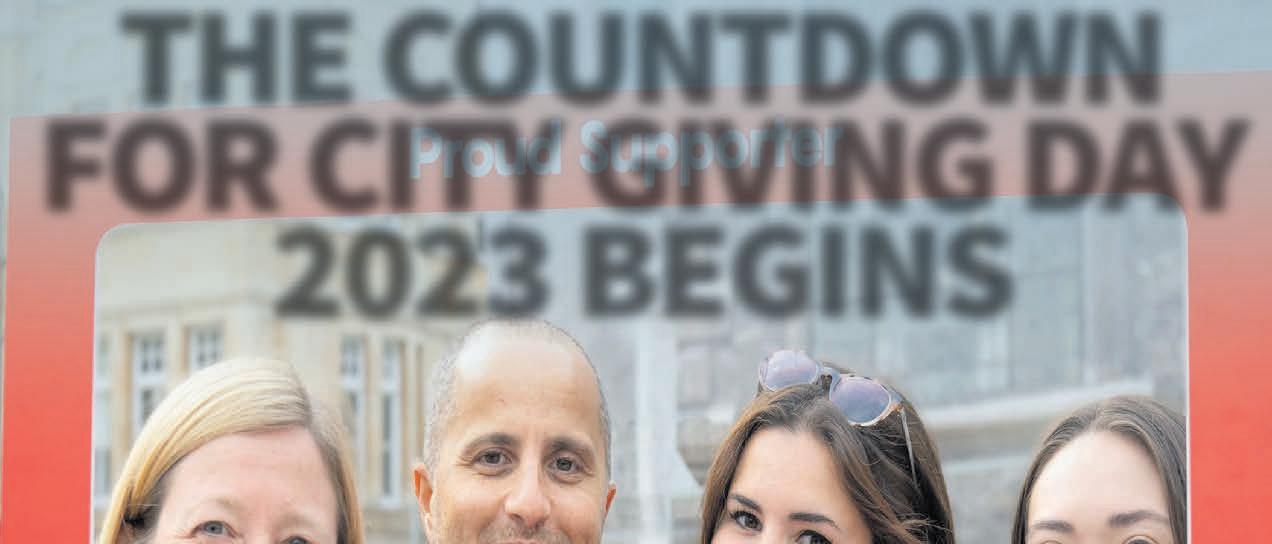

It was an unusually slow start to the new Premier League season for Arsenal on the pitch, with matters worse off it. Issues with the new eticket system left tens of thousands of fans stuck stationery outside the turnstiles while the system was reset and kick off was delayed.

It was a calamity that absolutely everyone saw coming minus anyone who works at the football club.

The clue? Arsenal’s digital ticketing FAQ page has 25 questions about the new process. To their credit, the club has spent months emailing season ticket holders about the changes but to little demonstrable effect.

Initiatives to clamp down on ticket touts and forfeits are of course to be admired, but the justification that it’s “an easier way to go green” by printing less feel like a stretch for a football club that once flew 14 minutes by private plane for an away game at Norwich. Let’s hope both the ticket system and central midfield work better in time for Fulham at home next Saturday.

…TO E-WASTE The buzz around AI and machine learning is the exciting face of technology, but e-waste is at the ugly end of it. The United Nations Environment Programme estimates 54m metric tonnes of e-waste is produced a year. That makes the work of charities like Community Techaid, based in Oval, even more important. Working with individuals and corporates, they have connected over 2,250 people with one of the 4,000 wiped and refurbish.

It’s the sort of place locals and regulars might not talk about in case it gets too popular. Divers Cove in Godstone was once used for sand extraction, but now the hidden venue hosts outdoor swimmers into its welcoming and surprisingly warm water. There’s an inherent risk in using a London paper to recommend getting out of London, but this small slice of Surrey is too good to miss. Wet suits not required.

Today, Ben Roback, managing director at advisory firm FGS Global, takes the notebook pen to talk politics, tech and Arsenal

It seems strange to think that as recently as the 1970s, ambulance drivers weren’t trained paramedics: they simply picked you up from the site of your emergency and drove you to the hospital – if you required triage on the way, you were generally out of luck. Today, of course, they’re highly trained professionals, your first lifesaving point of contact and a vital part of the medical network.

We can think of reception staff at your General Practice surgery in the same way: trained professionals who can guide you towards the care you need and ensure you’re seen as soon as possible.

Like all great institutions, the NHS is always evolving. We no longer live in a world where a single man or woman acts as a one-stop shop; now a multitude of specialists work as part of your GP surgery team. The introduction of new health and care staff – more than 29,000 in total –means more patients will get the right help quicker from the right health professional first time, as it’s not always necessary to see a GP for certain conditions. This also has the benefit of freeing up more GP appointments for those who really need them, helping to tackle the ‘8am rush’.

When you need an appointment, advice or other help, the information you provide to staff in your GP surgery helps them to link you up with this growing team of professionals, from Care Coordinators to Physiotherapists, Mental Health Practitioners to Health and Wellbeing Coaches, Pharmacists to Nurses.

And if you get to see and be treated by these expert clinicians first and often sooner than you might see your GP, what’s not to like? After all, if you need physiotherapy for a sports injury, it’s probably a physio you need to speak to, not a GP.

This more modern way of thinking sits alongside a wider change taking place throughout the NHS, which has moved on from analogue to smarter, more digitally connected systems.

Using a form on the website of your GP surgery enables you to request an appointment from your laptop or mobile. Just complete the details, click send and one of the surgery’s team of health professionals will get back to you with the help you need. For millions of users, it’s already a convenient way of getting in touch.

And however you do so – online,

by phone or by visiting the practice –your request will always be carefully assessed so you get the care you need. You may have a consultation by phone or over a video call, they may text or email you, or offer a face to face appointment. However you get in touch, the surgery’s growing team of professionals will respond with the care that’s best for you.

Covid put an unprecedented strain on every aspect of the NHS, but it also led to innovation and a more joined-up approach to healthcare. Here’s an introduction to some of the professionals you can be linked with through the staff at your GP surgery:

CARE COORDINATORS

Care Coordinators work with people who may need extra support to navigate the health and care system, helping to connect them to the right services or professionals at the right time. Care Coordinators act as a central point of contact to ensure support is available to help people manage their care.

Clinical Pharmacists are experts in medicines and can help people stay as well as possible. They can support those with long-term conditions like

asthma, diabetes and high blood pressure, or anyone taking multiple medicines, to make sure their medication is working. Many Clinical Pharmacists can also prescribe medicines.

Health and Wellbeing Coaches support people to take steps to improve their physical and mental health conditions, based on what matters to them. They help people develop their knowledge, skills, and confidence in managing their health, to prevent long-term illness, and any existing conditions from getting worse

Nursing Associates work under the guidance of a nurse or another health professional. They help with routine health checks, wound care, and provide patients with general health and wellbeing advice.

Paramedics work in a variety of roles within general practice. Their training means that they are used to working with people with a range of health conditions from minor injuries to more serious conditions

The information you give to staff in your GP surgery helps them to link you up with this growing team of professionals, from Care Coordinators to Physiotherapists

such as asthma attacks. They help manage routine or urgent appointments and carry out home visits.

PHYSICIAN ASSOCIATES

Physician Associates diagnose and treat a wide range of health conditions. They work alongside GPs and the wider practice team to provide care to people, including those with long-term conditions.

Physiotherapists are experts in musculoskeletal conditions. They can assess, diagnose and treat a range of complex muscle and joint conditions, reducing the likelihood of needing a referral to a hospital team.

Social Prescribing Link Workers help people to focus on their social, emotional, and physical wellbeing, working alongside their medical team. They give people time to focus on what matters to them, helping to connect them with local groups and services for a range of practical and emotional support. This could include physical activities and social groups, volunteering and gardening, or even debt and housing advice.

I’ve been at Kingswood Health Centre for nearly seven years and worked as a manager there for just over a year – before that I was a receptionist and a healthcare assistant. The practice serves approximately 12,000 people with a real mix of ages and ethnicities.

There are lots of ways to make appointments. We encourage people to use online forms on our website, where patients can request care, or they can call us or visit us if they prefer. If they turn up at the desk, we have a tablet in the reception area with the app on it; we’re happy to show them and explain how it works.

We [receptionists] spent a couple of months training and going through the system.

Before appointments were on a first come, first served basis.

The new system allows receptionists to

look at the information and book appointments appropriately, with the right member of our team, freeing up appointments of some of our busiest team members. When the forms come through to us a lot of the patients would like to have a GP appointment but when we look at the information and their history we can signpost patients to other clinicians that are more suitable for their symptoms (or condition), like paramedics, physios and nurses.

We have fewer phone calls to deal with and more time to assess the patients’ information and discuss with clinicians what help they need. Around 70-80 per cent of patients are using the online forms to request appointments and most are happy to do it that way.

I have14 receptionists and we’ve all been trained to book appointments appropriately based on clinical need, assessing and directing patients to the right care. The online forms come through and we have an urgent inbox and a routine inbox. A care coordinator or care navigator

assesses whether it’s urgent and requires a same day appointment or a routine appointment that we would book within a week.

We get quite a lot of patients with muscular pain. So if a patient sends us an online form for leg pain, we would refer that to our physio. We get a lot of rashes, which we can refer to community pharmacies or our paramedics. Patients with warts and moles go to the community pharmacist. There is a whole list of conditions that the team has been trained to assess, following guidelines set by the GP and clinical team, and direct patients to the right care – if it’s not on there, then we ask a GP.

Sometimes we need to reassure patients who want to see a GP. We encourage them and say to them we have paramedics and nurse practitioners who have been trained to deal with their problems.

I say to them a GP is always on hand if the nurse practitioner is unsure, but they are trained to do these roles... It’s just encouraging people – they deal with these things all day long.

The chances are they will be able to resolve the problem and if they can’t, the patient will be referred to somebody who can.

WHAT WAS YOUR FIRST JOB?

I never did the Saturday paper round or the gap year saving-the-sloth thing. I was classically middle class and went to work for Barclays Trust Company after graduating. In the mid 80s those with a Desmond in Politics from Hull couldn’t afford to be to too choosey.

HOW WAS YOUR FIRST ROLE?

Despite my derogatory remarks above, it was tremendous fun, gave unbelievably good training and was a very fortunate place to start my career. I then worked out how difficult actual clients are and transferred into the head office research department in Farringdon Street to escape about five years later.

WHEN DID YOU KNOW THE CITY WAS THE PLACE FOR YOU?

Very quickly after moving to the City. The atmosphere, aura and history were intoxicating (in a different way to my next answer). To balance that, I guess that like a lot of people I have long had imposter syndrome and am not sure it ever was the right place: I am in awe of people who do what I consider to be real work and are paid a pittance for so doing.

The thing with memorable lunches is that one’s memories of them tend to be rather fuzzy. I would say that the worst was actually a black-tie Christmas breakfast in a Smithfield pub, which turned into a Leo Sayer and a cry of ‘dead ant’ on the zebra crossing at the top of Northumberland Avenue in the evening rush hour. One participant, and subsequent eminent fund manager, didn’t realise the rest of us had got up and gone, staying alone in the middle of the road waving his/her arms and legs in the air.

Fortunately I never vomited in the chief executive’s top drawer or peed in the bin in the Datastream room. Most of my career-threatening fatfingeredness has come courtesy of email; I went through a terrible phase of apparently being unable to distinguish between ‘forward’ and ‘reply’. Sorry Mark.

The City is genuinely at the forefront of our response to decarbonisation and climate change, and miles ahead of both the government and regulation. This is something that we should be very proud of and should champion. I do hope though that we are not in the early stages of following America’s lead in politicizing the climate, but I suspect I am wrong.

Bring back all-day breakfast.

I probably have three lifetime heroes, with a little licence. Seve Ballesteros.

Second is Robert Fisk, whose writing and ceaseless exposure of the truth I miss terribly. And third is the Monty Python team, whose scripts should be compulsory reading for everyone in financial services. I have no investment heroes.

ARE YOU OPTIMISTIC ABOUT THE UK’S FINANCIAL SERVICES FUTURE?

I am really not sure. Our greatest challenge in broader financial services is attracting joiners out of schools and universities, and I don’t see this changing for the better until financial planning is taken seriously in education. With regard to the City, we have to concentrate on climate, not crypto, leaders.

WHAT’S OUR WORLD’S BIGGEST CHALLENGE?

FAVOURITE...

FILM: ANY OF THE PYTHONS, BUT PROBABLY THE HOLY GRAIL BAND/ARTIST: STEELY DAN

BOOK: ANY OF MARK FORSYTH’S BOOKS ABOUT ENGLISH LANGUAGE, OR PETER WOHLLEBEN’S THE HIDDEN LIFE OF TREES

DRINK: COFFEE OR TEA TEA (PREFERABLY CORNISH). COFFEE GIVES ME INSOMNIA AND INCONTINENCE

Other than recruitment, the retail financial services industry’s greatest challenge is the same now as it was 37 years, which is that we have never dealt with the dynamic between independent and restricted advice. We have spent four decades staring up our own posteriors and have made zero progress.

WHEN DID YOU MOVE OUT OF LONDON?

My big bank employer at the time apparently believed the ‘life begins at...’ truism and duly made me redundant on my 40th birthday in 2005. It took all of a fortnight to work at that this was the best thing that could have possibly happened, and I found a role in Christows (before this became Williams de Broe) that split my time between the City and Devon. And I’ve never looked east since.

WHAT’S THE ONE THING YOU LOVE MOST ABOUT YOUR JOB RIGHT NOW?

There’s three things. One, I live in Cornwall and work from home. Two, I still write what I feel to be right and am not crowbarred into regurgitating corporate platitudes. Three, I am steering Hawksmoor’s ESG and climate policies, which is genuinely rewarding work.

IT’S A SATURDAY AFTERNOON –WHERE DO WE FIND YOU? Usually fighting to keep the garden from being engulfed by the triffids of Bodmin Moor.

YOU’VE GOT A WELLDESERVED TWO WEEKS OFF–- WHERE ARE YOU GOING, AND WITH WHO?

We have a place in Thailand, so it is away for some sunshine, cold beer and panang gai with steamed rice.

We dig into the careers of the City’s great and good: this week, Hawksmoor Investment Management’s Jim WoodSmith takes us down a most eventful memory lane

STOCK markets in the UK fell further yesterday as investor sentiment remained on shaky footing amid fresh recession fears.

UK Consumer Prices Index (CPI) inflation fell to 6.8 per cent in July, the lowest rate in 17 months, driven by a fall in energy bills.

But eagle-eyed economists noticed core CPI inflation, which strips out energy and food prices, remained unchanged last month, while services inflation edged higher.

Looking beyond the headline figure it could mean that the Bank of England faces ongoing pressure to tighten monetary policy.

The IPPR think tank said it indicates a “very real risk” of recession with high interest rates squeezing households and businesses.

London’s FTSE 100 was weighed down

by losses for banks like Natwest and HSBC, and property-related stocks including Rightmove. It closed 32.76 points lower, or 0.44 per cent.

Chris Beauchamp, chief market analyst at trading platform IG, said: “Inflation data from the UK has lifted sterling but put UK-focused stocks on the back foot.

“While headline inflation numbers may look better, the resilience of core CPI means the Bank of England may have to work harder to fight inflation, risking a bigger downturn in the UK economy.

“This has weakened the FTSE 100, which has underperformed against other European indices today as UK housebuilders and banks, among others, fall back.”

The biggest risers on the FTSE 100 were Admiral, JD Sports Fashion, B&M European Value Retail, Ocado Group and 3I Group.

Balfour Beatty said yesterday that its order book lost £1bn in the first six months of the year, but it remained upbeat about the year ahead. Analysts at Peel Hunt agreed with the infrastructure specialist’s outlook, arguing that its shares “offer good value” after falling from recent highs. Peel Hunt maintained its ‘buy’ rating and target share price of 400p.

“It’s been another disappointing session for the FTSE 100, with weakness in real estate as well as the basic resource sector as it heads for its fourth successive daily decline, and its worst run of losses since early July.”

MICHAEL HEWSON CMC MARKETS

The motor insurance firm yesterday reported a four per cent bump in profits in the six months to the end of June after having rapidly hiked its prices. Admiral said it expects its insurance policy volumes to pick up again going forward. Peel Hunt advisors have reiterated a ‘hold’ rating and slapped down a target share price of 1,945p.

Powerful real-time thought leadership, insights and news delivery mechanism fuelling the most up-to date reporting, adding critical context for decisions that require consciousness, education and thought leadership.

in real-terms, funding is now at a level not seen since the dark days of the 1990s.

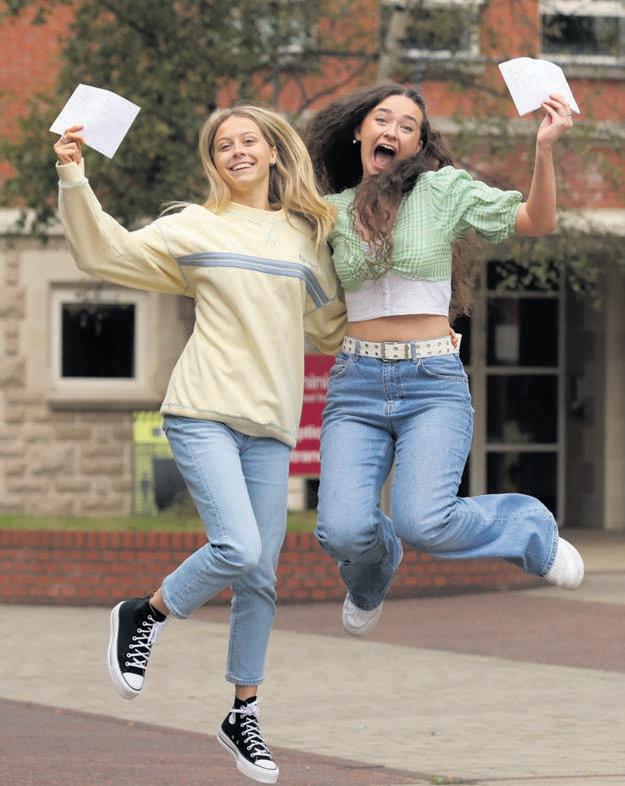

AS STUDENTS across the UK collect their A-Level results, few will be aware that the universities many will be entering in the autumn are already struggling to meet the grade.

British higher education is on its knees. Academics are being asked to stretch themselves ever thinner as not just staff to student ratios increase, but their working conditions worsen. The range of subjects being taught and studied continues to narrow as desperate institutions try to focus their offer on the most popular subjects. And students struggle to both study and live well, as the costs of student life continue to grow beyond the support available to those with no access to the “Bank of Mum and Dad”.

At the heart of this problem is the same issue currently affecting all public services; the lack of sufficient funding. Theresa May’s decision to deny universities an increase in tuition fees to keep pace with inflation was a painful blow; since 2020, it has become an existential one.

We are now at the point where a £3000 increase is necessary to restore tuition fees to their 2012 value, in real terms. And that’s before considering that universities have endured additional cuts to the funding they receive

directly from the government over the past decade.

It is possible that universities may have been able to limp along, gradually becoming worse in ways that while unpleasant and self-defeating, would not be immediately apparent. But the surge in inflation has brought things to a crisis point, with more and more universities sliding closer to bankruptcy. In 2016 only 5 per cent of universities were running

at a loss. As of 2022, that figure had risen to 55 per cent. Worse is to come as the noughties baby bulge hits higher education at full force, with more eighteen-and nineteen-year-olds looking to enter university. Unable to afford the investment to make such expansion sustainable, this surge in applicant numbers risks either fiercer competition for places or a degraded student experience as institutions take on

more students than they can afford to teach.

It should come as no surprise that thirteen years of Tory-led government has so thoroughly trashed higher education. Clement Attlee, Harold Wilson and Tony Blair all had to push through major reforms of the sector due to the failure of their predecessors to fund and develop universities to meet the demands placed on it by wider society. It is no coincidence that

IN 1925, the English writer Aldous Huxley described Los Angeles as “nineteen suburbs in search of a metropolis”. What would he say if he could see it today? Los Angeles is often quoted as the worst example of urban sprawl, the scattered outwards development of cities.

The term was coined by The Times in the fifties to describe London’s outskirts. Fast forward more than seventy years, and Londoners still live in fear that the city will become Los Angeles 2.0.

Urban sprawl is considered a negative model of development because it is fundamentally unsustainable. It involves low density areas with high commuting times, and it’s bad for the environment because it forces people into cars. Los Angeles, as a city, works on the premise that everyone has a car, making it very hard to move around in any other way.

Solutions like the green belt were invented to prevent urban sprawl. But according to the OECD, urban growth

Elena Siniscalco

boundaries and greenbelts can backfire “by causing fragmented, leapfrog development”. People are then forced to leapfrog - via car - between where they live and the city they need to reach, with a big green gap between the two. That’s not sustainable either.

With the housing crisis plaguing London, the risk of its outskirts becoming just a series of commuter cities is more acute. People young and old have already moved out of the city after the pandemic. Many more, who are not willing to give up on London, are being forced on its periphery by unaffordable rents.

A Centre for London report out today

provides some useful - but disheartening - context. The average rent in London has skyrocketed to over £2,500 in April, according to Rightmove. But the numbers are even starker when comparing central areas to outer London ones. According to the report, a two-bedroom home in Westminster goes on average for £2,925 per month. In Barking and Dagenham, the average is £1,250. When comparing different types of properties, it gets worse. The median rent for a onebedroom room in Westminster is £2,102; for a home with over four bedrooms in Bexley, it’s £1,600.

Living in the centre of a city has always been more expensive, but inflated rents have made it untenable. This pushes people further out and changes the character of a city. Restaurants and bars lose customers, the skyline changes, neighbourhoods lose their personality and London becomes less diverse and dynamic.

Jon Tabbush, senior researcher at Centre for London, said London is saved from Los Angeles status thanks to the

green belt. There are 14 London boroughs with more land designated for the green belt than for housing - keeping urban sprawl at bay. The catch of course, is that this fuels the housing crisis: it is a blanket rule even when bits of it are petrol stations and car parks.

The best counter strategy for urban sprawl is building high density inside the city. But in many areas of London there’s simply not enough space. The other option is building more in the suburbs, making space through things like land swaps - where you take a bit of the greenbelt out for building but you give back some actual green land.

The most important thing, says Tabbush, is avoiding the car dependency plaguing Los Angeles. “You need to plan public transport and housing together to densify the suburbs in a green way”, he says.

With Labour comfortably admitting it would build on the green belt, the tide might be turning. London could be safe from Huxley’s nightmare for just a little while longer.

Rishi Sunak’s only idea to mitigate the crisis is a poorly thought out gimmick about denying funding for courses that fail a simplistic statistical test for employability. So Sir Keir Starmer will undoubtedly have to make an intervention as dramatic as his Labour predecessors, if British universities are to survive let alone thrive.

While there are undoubtedly areas where higher education would benefit from some structural reform, what the sector needs right now is emergency funding to plug the gaping hole left in university budgets.

But it’s hard to see a new Labour government spending much more on higher education when more broadly used services such as hospitals and schools are at breaking point. The party is also terrified that voters won’t tolerate higher taxes.

Vice-Chancellors have an answer to this problem; just restart increasing tuition fees. But the scale of the raises required, especially if they were tasked with also funding a return of maintenance grants and a more equitable repayment structure, would be a bitter pill to swallow for even the most committed believer in co-payment models.

Starmer only recently abandoned his leadership manifesto pledge to retain Jeremy Corbyn’s policy of abolishing tuition fees. Even this Labour leadership may think increasing them substantially is just a fight too far with its left-wing.

£ Will Cooling writes about politics and pop culture at It Could Be Said substack

Davey did a brilliant rendition of an angry villager shaking his fist at the incoming housing developers in a press pic published by the Lib Dem leader. The only hitch is that he was supposed to be cheering on the Lionesses in the semi final - not grimacing at Big Housing.

[Re: Google and Universal in talks to license music to be use by AI, Aug 8] As Google and Universal Music look to licence artists' voices for songs generated by artificial intelligence, it’s great to hear of progress being made. The impact of generative AI on the business model of the content industries is probably greater than the advent of the internet itself. When Fake Drake emerged a few months ago, the original artist’s label rushed to have it banned from streaming platforms. That kind of knee-jerk reaction characterised the music industry’s response to the internet’s arrival, whereas a more constructive approach is being adopted now - or at least let’s hope so. Generative AI raises all kinds of questions about the adequacy of

copyright law in the face of new technological capabilities. What measures can really be implemented to stop AI algorithms from being trained on existing music? When Google recently published its first text-to-music algorithm, it was said to have been trained on 240,000 hours of recordings. But the majority of the rights to reproduce that music would be held by music labels and publishers. So while the negotiations currently underway might be about the right to publish something that purports to be Drakelike, the music industry will be keen to assert its right to licence the act of AI training in the first place.

Encouragingly, some musicians like Grimes are exploring collaborations, actively licensing their voiceprints for AI apps, and encouraging creatives around the world to generate music using their voice and sound. These choices become ethical as well as creative.

Jeremy Silver Digital Catapult

Chris Hirst

Chris Hirst

IHAVE only one recurring nightmare and though thankfully infrequent I emerge each time with the same sense of relief. So much so that it always takes a moment of unblinking wakefulness before I am reassured it has receded. The dream has its variations, but the theme is always the same – that I haven’t revised for the following morning’s exams and therefore failure, nay humiliation, await.

Another row about Ukraine’s future exploded this week, after a senior Nato official said Ukraine could relinquish parts of its territory to Russia in exchange for Nato membership.

Stian Jenssen, chief of staff of Jens Stoltenberg, suggested it as a possible way to end the conflict. He was at pains, however, to stress that every solution would have to be approved by Ukraine. Predictably, Ukraine didn’t take to the idea. A senior adviser to President Zelensky, Mykhailo Podolyak, called the proposal “ridiculous”.

This is not the first misunderstanding between Ukraine and its Western allies. Another row broke out earlier this summer, when UK defence secretary Ben Wallace suggested Ukraine should be more grateful for the weapons it receives from its allies.

Ukraine is wary of how faltering support from the West could change the course of the war. The Ukrainian government has tried to combat war fatigue, with Zelensky touring European capitals and meeting global leaders.

My A-levels were a very long time ago, yet so profound was their effect that I’ve come to consider their echoes through my subconscious as a kind of PTSD-lite. I therefore have full sympathy with those who await their results this morning and disdain for the annual humble-brag (at most charitable) postings from the “I screwed up my A -levels and look at me now” crowd. Qualifications matter. If you want to be a jet engine designer, you need to know something of thermodynamics. Nobody would argue with the principle of a doctor needing to have passed a few exams along the way. This is a perfectly reasonable position for employers to take. However, neither candidates nor employers should regard them with the gravity with which they are commonly treated. Good Alevel results are no more a measure of an individual’s suitability for a particular career than bad suggest unsuitability - even in very vocational roles such as the sciences. Einstein was a famously unsuccessful student.

For employers exam results are essentially a proxy, a means of making a judgement about a potential employee when nothing else exists. Qualifications are useful to employers, but mostly because at that early stage in our careers no other information is available. This is understandable, but there is also an increasing recognition that they are a blunt tool and this mindset serves to exclude many otherwise excellent candidates. It is for this reason that there is a growing desire by talent-starved employers to widen their net by questioning the primacy of qualifications when selecting candidates. In my own case for example, in a previous role we went as far as removing all reference to school, university and qualifications from the application process with

very successful results.

Irrespective of how good we are at exams, what we all need to succeed in our careers is a balance of aptitude and attitude. Aptitude can, and usually must, be gained over time and on the job - even the most highly qualified new joiner will possess only the most rudimentary of directly relevant skills when they begin work. Attitude however, is all us.

Therefore, the ideal candidate for any job is not simply the person who knows the most. Skills, even difficult skills, can be taught. In all jobs learning is a prerequisite for success and those who feel they do not need to do so are a hazard. The most successful people I have ever worked with have been those most willing (I use that word deliberately) to learn. And the primary determinant is attitude. But while attitude drives aptitude, it does not always work in reverse. Indeed in some instances a perception of established competence constrains willingness to learn and grow.